“The difficulty lies, not in the new ideas, but in escaping from the old ones."

John Maynard Keynes (1883-1946)

Heads’ Foreword …......................................................................................................................

Session Summary ............................................................................................................. ............

India's Gig Economy ............................................................................................ …Raghav Jasuja

Exchange Rate on Turkey's Inflation......................................................... …..........Mustafa Alp Ata

Taylor Swift: The Billion-Dollar Economics of a Mega-Star..........................................Aryav Odhrani

Foreign Aid ….......................................................................................................... Sanaaya Patel

Economics in the News........................................................................................................

Book Review: The Bottom Billion and Dead Aid ................................................ …..Mr. Christopher

Manipulating Globalisation ....................................................................................... ..Dhruv Arora

Economics of Luxury …............................................................................................ .Inaya Bhasin

Trump’s Tariffs …......................................................................................................Simar Bhasin

The Decoy Effect...................................................................................................... .Derin Conroy

Economics of Sneaker Culture.................................................................................... .Aarav Dave

The Number Behind Debt Relief..........................................................................Yorgen Engmann

The Rise of BRICS................ .........................................................................................RykaGehi Effects of a Maximum Wage ...................................................................................Anika Jethwani

The 2008 Financial Crash and Policy responses......................................................Rania Jethwani

Trump's Ukraine Policy .....................................................................................Ali Mansur-Valiyev

To What Extent Does Protectionism Strengthen an Economy in the Long Run?...............Aman Nair

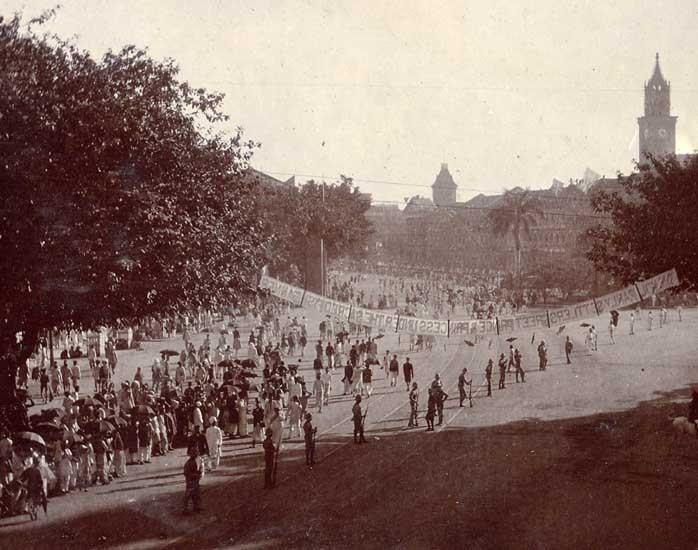

The British Raj: Prosperity or Poverty?.......................................................................Angela Philip Trump's Congress Kickoff.................................................................................... .Harihar Rengan

Market Failure in the 2008 Financial Crisis......................................................................Aadit Sen

Quantitative Easing: A Necessary Policy or An Avoidable Risk?..........................................Adi Siraj

High Frequency Trading …........................................................................................Aditya Tomar

Can Productivity Always be Measured Accurately...........................................................Aarush Vij

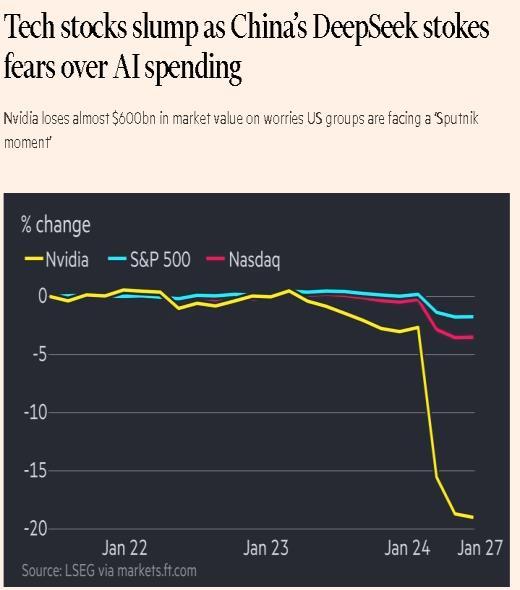

The rise of DeepSeek AI…...........................................................................................Sara Whabi

The Rise of the Gig Economy........................................................................................Jiawen Zhu

Beach Clean Up …......................................................................................................Zara Ansari

Japan Trip…..................................................................................................................

Year 12 Patchi Trip….........................................................................................................

As we approach the Easter break, we can look back on DKS's most successful term, despite only having 6 uninterrupted weeks. We have had an assortment of sessions, ranging from a mock revision session for Year 10 and 11 students to Shaheeda Abdul Kader's session on investment and startup advisement. We also hosted our annual DKS Beach Clean Up with Goumbook, an exceptionally fun day out for all students taking part.

We are excited to announce that we received more articles this term than ever before, beating out last term's record number too! A massive thanks to everyone involved in this achievement. Moreover, we must thank Mr. Christopher, whose unwavering support for the cause of DKS cannot be undermined.

Wishing everyone a restful break. Be prepared to return for another jam-packed term and make sure to stay committed to sessionsyour dedication keeps our society running!

- Raghav, Alp, Aryav, and Sanaaya

08/01/25

15/01/25

GCSE Revision Session

Shaheeda Abdul Kader

22/01/25

Ali Mansur-Valiyev

29/01/25

Mo Tanwir Exclusive Video Content

05/02/25

Save the Butts Goumbook

19/05/25

Welcome back from the Winter Break! The DKS Team offered a GCSE Revision session, focused on the Economics GCSE, directed at year 11s and Year 10s We hope the session was helpful for those going into their exam season, as we provided revision strategies and advice drawn from our own experiences

This week, we were honoured to have Ms Shaheeda Abdul Kader deliver an engaging talk Ms Abdul Kader, is an experienced trader and a regular guest lecturer at universities She imparted some valuable advice on our students, on her experience in the industry.

We were excited to welcome Ali Mansur-Valiyev, from year 11 Ali gave a talk about crypto currency and digital money, explaining in great detail how crypto operates, and how it is revolutionising transactions, transparency and trust in the global economy This was an extremely insightful lecture on the benefits and drawbacks of crypto and where it is heading in the future Thank you Ali!

Following the return of Trump as President in January, there has been many developments and much turbulence DKS students were lucky to have access to Mo Tanwir's , a regular lecturer at the society, discussing Trump's first 100 hours in office, rather than the customary 100 days analysis This was followed by a student led discussion where thoughts about the word economy and Trump's impact were shared.

We welcomed Ms Omaima Ahmed from Goumbook, who discussed the importance of sustainability and provided the students with greater detail and key information about the Friday 7th February Beach Clean Up with DC Sustainability Club Her company, Goumbook leads climate initiatives in the UAE, including air quality improvement, plastic reduction, and mangrove planting.

Tucker Highfield Gensis Digital Assets

This week we were delighted to host Mr Tucker Highfield, the CFO and manager of the renowned Genesis Digital Assets, bitcoin mining company. Mr Highfield is highly experienced in the field of banking and cryptocurrency, especially in the Middle East. This session was extremely insightful in shedding light on the industry.

Ramadan Annual Ramadan Essay Announced!

We were excited to announce the return of the DKS Ramadan Essay Competition. Submissions are due on Sunday 30th of March. We are looking forward to reading all of your essays!

Raghav Jasuja

The gig economy is defined as a labour market characterized by short-term contracts and freelance work. In India, the platform economy accounts for 1 3% of the workforce, projected to rise to 4 1% by 2029-30 However, there are shortcomings in this labor market, making gig workers devoid of rights that standardemployment employees possess

The very reasons why the gig economy boomed initially have led to concerns for both its workers and future. In India, gig workers are classified as ‘individual contractors’, severing their social security access The Code on Social Security, 2020 defines a gig worker as ‘a person who participates in a work arrangement and earns from such activities outside of traditional employer-employee relationship[s]’ The lack of a clear definition opens the door for exploitation, and the informal economy situation causes gig workers to struggle to find wage regularity or job security

Moreover, the lack of clarity within firms’ operating systems has been a point of concern Firms are not required to publish information regarding worker task allocation, driver rating systems, or distance-based fees calculations, potentially leading to further exploitation. Similarly, a major concern arising from the lack of regulation is discriminatory social structures based on identities such as caste, gender and religion, which serve to alienate workers belonging to disadvantaged groups.

The gig economy is seen as an opportunity where work is distanced from labor market barriers However, the discrimination pervasive in the platform economy is a concern, as it has an associated market failure: rising social inequality. Discrimination exists against female gig workers, who are concentrated in jobs that are low paid and devoid of social security, which can lead to workers feeling despair as their efforts fail to yield reward, decreasing work productivity. This is impactful in the gig economy, where each task yields income.

Politically, the lack of social security also raises concerns for India: is it equitable for gig workers in the world’s largest democracy to be denied access to public aid that protect otherwise similar standardemployment workers?

The first part of my proposition is to legally redefine the gig worker-aggregator relationship Countries like the UK, Italy and Spain have a status where gig workers are defined as ‘economically dependent self-employed’ persons with social protection provisions I propose the Indian legislative definition be changed to ‘an individual who performs work through platforms, including for multiple entities simultaneously, regardless of contract agreements between gig worker and platform owner’ This definition is more formal, allowing for a clear paper trail from firm to government This would also make the gig economy subject to the Employees’ State Insurance (ESI) scheme, where platform owners contribute ‘4 75% of the wages payable to employees’

Secondly, gig workers need to be eligible for more social security schemes. Countries like the UK have employment protections for gig workers, including coverage under ‘the National Minimum Wage…employer pension enrolment’ However, these policies would not work in the social setting of India, as pensions are smaller and there is no National Minimum Wage, due to large regional inflationary fluctuations, ranging from 6 05% in Odisha to 2 56% in Jharkand

Still, social protection for gig workers is a requirement The scheme I have in mind is Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (ABPMJAY), India’s health insurance scheme. This scheme provides health assurance to the poorest households in India, a solution to the Telanganga Gig and Platform Worker’s Union’s concerns over safety hazards of delivery drivers. Ayushman cards are issued to beneficiaries of the scheme, which could be adjusted to include gig workers. Access to ABPMJAY would increase gig worker access to secondary and tertiary healthcare, including life-saving complex diagnoses and specialized medical care

To further the positive impact of healthcare for gig workers, a Conditional Cash Transfer (CCT) scheme could be implemented Workers would receive a monetary payment regularly if they invest a proportion of this cash into healthcare checks and vaccinations CCTs have already been implemented in India with the intention to improve healthcare access, however, these schemes have not been implemented optimally For instance, the Bhagyalakshmi scheme failed to provide health insurance for female children due to lump-sum payouts A PAIGAM report found that close to 95% of gig workers earn less than 1000 rupees a day (estimated from page 25 table), equating to around $11.50. In many of these instances, a CCT lumpsum provision may be insufficient to encourage participation in the scheme, whilst staggered bi-annual payments may be attractive.

The final part of my policy provision relates to the power that firms currently exercise over gig workers As mentioned earlier, firms do not have a legal obligation to publish information regarding grievances, leaving room for exploitation By implementing legal measures where firms are required to address worker challenging of unfair decisions such as contract termination like that mentioned in Rajasthan’s Platform Based Gig Workers (Registration and Welfare) Bill, 2023: ‘[firms must] ensure time bound redressal of grievances related to platform-based gig workers’ (pg 27), this issue could be mitigated

My policy solutions are not without flaw Redefining the gig worker-aggregator relationship legally requires care to ensure gig workers do not lose autonomy Moreover, creating a CCT scheme requires compliance, which has a large cost to the government

However, these issues are trivial when compared to the benefit the policy would bring about for the government: reduced social inequality, causing less expenditure on welfare benefits.

It is also important to note that the gig economy employs 7.7 million workers as of 2024, which is expected to rise to 23.5 million by 2030. Admittedly, the expenditure required would be large, however, India has an opportunity to establish a comparative advantage in gig economy social protection, the impact of which should not be understated, given the forecasts of the platform economy’s expansion

Mustafa Alp Ata

10 years ago, one US dollar could get you 2.6 Turkish liras; now a dollar is worth 35.5 liras. The Turkish lira has depreciated significantly in the forex markets, while consumer prices have soared Türkiye's recent hyperinflation is tied to the unconventional use of expansionary monetary tools during a period of instability and high inflation Recently we have seen an interplay between the USD to TL exchange rate and the Turkish inflation rate, both rising drastically Through regression analysis, determine the strength of this correlation between these variables and observe if this is a new trend or a historic relationship

The US dollar is the most influential currency in the world and therefore is prominent in the foreign currency reserves of central banks. Countries rely on the dollar for international trade deals due to its function as a standard for pricing essential commodities like crude oil. As Türkiye is an emerging economy with an unstable currency, the exchange rate against the US dollar has a severe impact on society. Türkiye holds a lot of debt in USD; therefore, depreciations of the lira increase debt repayments Furthermore, as the USD is critical for international trade, the cost of imports like raw materials and energy will increase in Türkiye This can lead to increased cost-push inflationary pressures in Türkiye As a result of the association of the US dollar with stability and economic prosperity, the exchange rate of the lira and the dollar plays a key role in consumer confidence levels, financial stability, and price fluctuations in the economy

Null Hypothesis (H₀): Change in the exchange rate has no effect on the inflation rate

Alternative Hypothesis (H₁): A change in the exchange rate leads to a positive effect (increase) in the inflation rate.

These hypotheses will be used to perform regression analysis I have collected annualised inflation data and the annual change in the USD to TL exchange rate in Türkiye for every month since January 2001 This dataset consists of 289 data points, allowing for robust regression analysis that considers long-term trends rather than short-term fluctuations This can be used to plot a line of best fit and find the correlation coefficient between the two variables This can be used to assess the strength of the relationship between inflation and the USD to TL exchange rate Using a strict significance level of 1%, R=0 135 is determined to be the critical value for a hypothesis test with 289 data points For there to be a positive correlation, the test's R value must be higher than 0 135 to reject the null hypothesis that the USD to TL exchange rate and the inflation rate are not correlated.

This graph represents the relationship between the change in the USD to TL exchange rate and the annual inflation rate (change in the average price level in the economy) Therefore, this graph is comparing the rate of change in price level with the rate of change in the exchange rate with the US dollar The line of best fit has a gradient of 0 544, which indicates that every time the lira depreciates 1 percent against the dollar, the inflation rate increases by more than half a percent This displays that there is a significant exchange pass-through in the Turkish economy.

Regression analysis of the data provides a correlation coefficient of 0.79, which is close to 1, suggesting a strong positive correlation As 0 79 > 0 135, there is sufficient evidence to reject the null hypothesis The R² value is 0 6296, meaning that 62 96% of the variation in the inflation rate is due to the USD to TL exchange rate This suggests that the exchange rate has a major influence on inflation in Türkiye

Although this regression analysis provides some meaningful observations about the relationship between the USD to TL exchange rate and the inflation rate in Türkiye, there are many limitations of this model that need to be considered Other variables like interest rates, global inflation levels, and fiscal policy are not factored into the calculations. As R²=0.6296, 37.04 percent of variance in price levels is caused by other factors and is not explained by the model. Additionally, there have been many shocks and unorthodox policy implementations in Türkiye during the last 25 years, which are unaccounted for by the model. This limits how well the model can depict this relationship across time periods with radically different economic conditions

Overall, this data represents how there is a strong correlation between the USD to TL exchange rate and the inflation rate in Türkiye The regression analysis displays evidence of this relationship as the null hypothesis is rejected As R²>0 5, this proves that this exchange rate is the primary factor that accounts for variations in the Turkish inflation rate along with other minor factors Despite limitations with the data and the model, this proves that the Turkish government and central bank should work to stabilise and control the USD to TL exchange rate, as further depreciation of the lira can reaggravate currently cooling inflationary pressures in the economy.

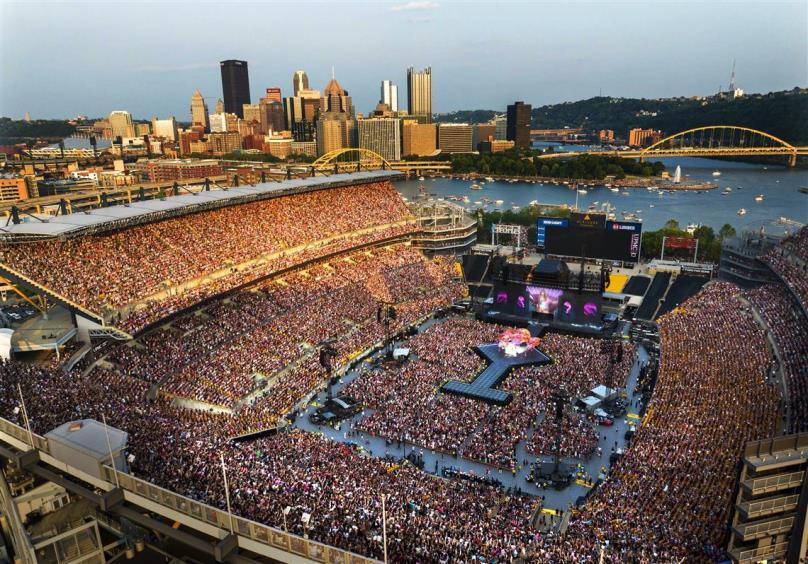

Taylor Swift needs no introduction The American music artist’s recent Eras Tour (March 2023 to December 2024) was a global phenomenon spanning 5 continents and 21 countries, grossing over $2 billion in ticket sales Apart from being the highest-earning concert in history, the tour strengthened the pop sensation’s fanbase with traditions like exchanging friendship bracelets and dressing up in erathemed outfits.

In addition to the music and spectacle, Taylor Swift extends her influence far beyond the stage; indeed, many recognise that the Eras Tour left a ‘lasting impact on the global economy’ (CNN, 2024), boosting the economies of dozens of cities This raises the question: how has Swift grown to wield such cultural and socioeconomic power?

Throughout 2023 and 2024, Taylor Swift travelled the world on her record-breaking Eras Tour The effect on cities hosting her tour is massive: Swift’s 3-day stop in Melbourne generated $766 million of economic value (Forbes, 2025) Each stop, whether 8 shows in London, 6 in Los Angeles, or 6 in Singapore, boosted the economies of host cities by $100s of millions. This effect is because of the mass influx of Swifties, Taylor Swift superfans, that flock to her concerts worldwide. Across the 21 countries Swift visited, the singer attracted an average of 72,500 fans per show.

Since these attendees often travelled long and far to watch the concerts, they would have been likely to stay at the destinations beyond the show Inflows of visitors lead to increased flight and hotel bookings in cities, and additional revenue for taxis like Uber, restaurants, sightseeing spots, and other small businesses

Chicago’s tourism bureau announced a record hotel room occupation (97%), Colorado’s GDP boosted $140 million with increased consumer spending, and Philadelphia and Los Angeles faced the highest post-pandemic hotel revenue and tourism spending due to Swift’s presence. With the average fan spending over $1,300 on travel, food, and merchandise, it is unsurprising that the Eras tour generated around $5 billion for the US economy.

Taylor Swift’s tours exemplify the multiplier effect The initial spending by fans is an injection into each city’s economy, stimulating further spending in other sectors This economic activity especially benefits the hospitality, dining, tourism, and retail sectors Increased demand for these goods and services leads to increased business activity and increased derived demand for labour, causing firms to hire more workers

Boston noted a 1000% increase in the demand for part-time workers near Swift’s show The massive spike in demand for hotels and restaurants, as concertgoers converged to the show’s locality, led to many businesses increasing employment. The California Center for Jobs and Economy estimated that the Los Angeles County’s employment increased by 3,300 due to Swift’s six shows there.

In the short-run, the tour catalysed consumption and GDP growth of cities Singapore reportedly paid Swift up to $18 million to be the singer’s sole stop in the region, leading an influx of 300,000 fans who injected up to $375 million into the country’s economy More than this, in the long run, the Eras Tour boosted the reputations of destinations as cultural and entertainment hubs Singapore would have gained increased visibility on the global stage, potentially receiving increased foreign direct investment from infrastructure and tourism investors

Taylor Swift recently joined the ranks of billionaires, with Forbes estimating her net worth to be $1 6 billion as of 2025 At just the age of 34, Swift became the first musician to become a billionaire solely due to music

Most of Swift’s wealth has been generated from her music catalogue and the sales of her records and tours Her music catalogue is worth $600 million, and her tours and royalties have earned her another $600 million (Forbes). Real estate is her third largest asset, being worth an estimated $125 million.

This demonstrates her mastery of the industry. Her strategic decisions in ownership, distribution, and marketing have maximized her earnings, allowing her to generate immense wealth and success In particular, the genius of Taylor’s Version must be noted: Swift turned her legal battle over her master recordings into a massive business opportunity At 16, Swift signed a record deal with Big Machine Records, giving them copyright to all her albums recorded with them When she departed from Big Machine, Swift was denied the ability to buy the copyrights to her own recordings, which were then sold to another executive Scooter Braun Taylor retaliated by embarking on a massive project to re-record her own Taylor’s Version of the albums

Swift’s innovative storytelling – portraying herself as a victim exploited by the music industry – gained the support of millions. Today, as a result of Swift’s marketing efforts and appeal to consumers, fans exclusively stream her versions, giving her all the credit and revenue. Swift’s original song “All Too Well” (2012) has been streamed around 40 million times (as of June 2024), while her new version has been streamed over 440 million times in just 4 years This is despite it being a much longer, ten-minute version

When it comes to Taylor Swift-related sales, scarcity is a significant factor Demand for her tickets far exceeds the fixed supply of tickets, determined by the capacity of concert venues As Tim Harford said in the Undercover Economist: strength comes from scarcity, and the excessive demand for Swift (relative to the supply of her ticket) gives her immense earning power. In fact, Taylor Swift makes approximately $13.6 million per concert (Forbes) – a result of the high ticket prices created from a combination of perfectly price-inelastic supply and high demand.

Despite this, secondary market sales are even higher While the average original Eras tour ticket sold for $204, resale prices averaged $1600 (or even $4000 according to some sources)! Some tickets were listed for upwards of $20000, demonstrating the power of scarcity that surrounds Taylor Swift

Several key business lessons can be learned from Taylor Swift’s rise to stardom

First, ownership matters Whether it’s music, patents, or proprietary technology, controlling your intellectual property ensures long-term profitability and leverage in negotiations Taylor Swift’s significant move to reclaim her master recordings created an entirely new revenue stream, leading to her success today

Second, build a direct-to-consumer model. Many artists rely on record labels and third-party distributors. Swift has a direct, close relationship with her fanbase via social media, surprise drops, and exclusive releases Her website minimises middlemen by being a hub for merchandise and event presales Cutting out intermediaries while maintaining effective marketing can lead to increased profit margins

Finally, engage your consumers Swift’s fanbase is not a regular audience but is arguably one of the world’s most closely-knit communities From friendship bracelet traditions to the gifting of her 22-song hat, Swift nurtures immense loyalty from her fans This cultivates a strong brand that markets for itself

“If she were her own economy, she would be bigger than 50 or so of the poorest nations in the world,” said Professor Gustafson at Penn State Harrisburg. Swift’s success is more than just talent: it’s masterclass branding, demand creation, and consumer engagement. Ultimately, it’s this business astuteness that has made her the billion-dollar industry she is.

A few weeks ago, the news was filled with announcements that one of the first things that Donald Trump did, upon taking office, was to suspend all of the US's foreign aid Shortly after, Elon Musk, his political sidekick and billionaire, said that the US Agency for International Development, set up in 1961 by J F Kennedy, needed to be fed “through the woodchipper” This rhetoric doesn’t only stem from the US; other countries have followed suit, notably the UK, as Sir Keir Starmer slashed the aid budget to 0 3% Meanwhile, rising global powers like Saudi Arabia, India and China have increased their financial overseas investments This raises the question of the future of the fragile industry in an uncertain geopolitical climate

In the early 2000s, an era for globalisation, international cooperation, optimism and diplomacy, global aid and its capacity were rising significantly. The US was spending 3% of its GDP on its development budget as the UN’s development goals were introduced. However, the world is a very different place now People no longer share the positive-sum view; as they have become more concerned about domestic issues, the appetite for aid has waned While a couple of decades ago, there was a strong drive to provide aid for the benefit of the recipient, the motive has now shifted to self-interest The world has become too political, which has meant that development agencies have been merged into other departments, such as the UK’s Department for International Development, and their capacity has fallen with that

Aid takes its form through ‘humanitarian relief, long-term development and power projection’ As a result, it is highly unlikely that we will ever return to a place where the desire for aid is as strong Minouche Shafik, speaking to the FT, argued that this stemmed from the financial crisis which highlighted the ‘winners and losers of globalisation’, as well as the building up of pressures for defence and public spending. Though while the traditional aid donors of the Western world have decreased their spending due to slow growth and domestic priorities, total aid continues to rise with the composition of the benefactors changing

In general, despite the cuts to aid, most people would say that the main reason behind giving aid ‘is to do good’ but want to know that the money has been effective In the US, Americans believe that most aid doesn’t achieve its goal The last 100 years have seen a level of progress far greater than it has ever achieved; there is wider access to education and healthcare, and as a result, less than 10% of the world lives in poverty. But we can never know whether this was directly due to aid. Though controlled trials and studies have shown that well-executed aid has generated positive outcomes, particularly in South Asia, Latin America and Africa. It has had an immediate impact on the world’s poorest in providing greater access to education, health and safety, which in turn has had huge consequences for higher productivity and life expectancy. Currently, US assistance constitutes almost 30% of global funding These cuts will disrupt essential services to the world’s poorest, from HIV to providing social care – many will die Abhijit Banerjee says while not all aid delivers success, “we will be left in a world with more misery” if the richest nations decide to turn their backs on aid

Another implication for the reduction in aid by Western nations is the reduced soft power influence in the developing world, especially with the growth of other countries that see this as an opportunity to increase theirs There has already been a shift in the way aid is spent In the past, reducing poverty was the main aim, which involved ensuring early school and vaccine care access Whereas now in a polycrisis world, in which developing nations are unfortunately affected disproportionately, aid is being spent on humanitarian aid in response to the rise in crises Moreover, the aid that has come out of countries like China, which has set up its Asian Infrastructure Investment Bank, tends to be heavily focused on commercial infrastructure rather than human development An example would be China’s Belt and Road Initiative While some may argue that the fact it is tangible may be more beneficial than receiving aid that only yields long-term results, it has not delivered the same impacts Many projects have been credited as white elephants and have led to huge debt overhangs for developing nations, who are now faced with servicing their often-unsustainable debts rather than spending on domestic health and education. In turn, the cuts will further pressurise the countries to find more resources to support the programmes like HIV that were in place before.

The opportunity costs of aid for Western nations are rising At the same time, it marks an opportunity to reform aid Nations are now forced to address their dependence on overseas money As Dambisa Moyo argues, Africa is “addicted to aid”, which should be scrapped altogether Malawi has greater foreign aid spending than domestic Abhijit Banerjee suggests that this is the moment for the rest of the world and for private philanthropists to take the lead The world’s 3,000 richest would cover the budget of the five largest donors with only 1% of their wealth The new donors that are filling in the vacuum are likely to have greater political interests in developing nations than driving living standards higher. Ultimately, the world is no longer the same as it was, and governments must improve their reforms and governance to achieve growth on their own terms.

You may have heard me referring to these two books in class and for good reason If you’re interested in global affairs and the study of international development, The Bottom Billion by Paul Collier and Dead Aid by Dambisa Moyo are two of the most thought-provoking books you could pick up Both are short, highly readable, and challenge conventional wisdom on how to tackle poverty perfect if you want to engage with big debates without wading through dense academic texts

At first glance, these books seem to be tackling the same problem: why do some countries stay poor while others grow? But their approaches couldn’t be more different. Collier, an economist with years of experience advising governments and institutions like the World Bank, argues that around a billion people worldwide are trapped by four key obstacles: conflict, bad governance, natural resource dependence, and geography His book is filled with eye-opening statistics and case studies that highlight just how difficult it is for some countries to break free from these traps

One of the most memorable examples he gives is that of Sierra Leone, a country that was rich in diamonds yet plunged into a brutal civil war in the 1990s Rather than fuelling development, its resources funded armed groups like the Revolutionary United Front, who used diamond profits to buy weapons and sustain conflict. Collier describes this as the “resource curse”, where natural wealth ironically makes a country more vulnerable to corruption and violence rather than economic progress. The problem, he argues, isn’t just poverty it’s that some countries are actively stuck in cycles that prevent them from escaping it

Moyo, however, takes a very different stance In Dead Aid, she argues that traditional foreign aid has done more harm than good, encouraging corruption and dependency rather than genuine economic progress She pulls no punches, writing: “No nation has ever attained economic development by relying on aid to the degree that many African countries do today ” Instead, she champions free-market solutions, foreign investment, and microfinance as the real paths to prosperity.

One particularly powerful example she highlights is how Zambia’s economy collapsed after it became heavily reliant on aid in the 1970s and 1980s With Western governments providing endless financial support, Zambian leaders had little incentive to implement economic reforms Meanwhile, neighbouring Botswana one of the few African nations to reject largescale aid pursued prudent economic policies, encouraged private sector growth, and is now one of Africa’s most successful economies Moyo argues that this isn’t a coincidence: Botswana thrived because it wasn’t trapped in an aid dependency cycle

Reading these books together is fascinating because they constantly challenge each other’s perspectives. Collier doesn’t reject aid entirely he argues it should be smarter, focused on specific areas like peacekeeping in war-torn regions or infrastructure investment. He cites Uganda as an example of where aid has worked when donors directly funded the building of primary schools, literacy rates rose significantly. However, he warns that too often aid is given to the wrong places countries with corrupt leaders who siphon it off for personal gain

Moyo, on the other hand, would rather shut off the tap completely, believing that only when governments stop relying on external funding will they take real responsibility for their economies She’s particularly critical of celebrity-led aid campaigns, such as Bob Geldof’s Live Aid or Bono’s advocacy for increased development funding, arguing that these well-intentioned efforts ignore the deeper structural issues at play

Neither book is without flaws. Collier sometimes appears overly optimistic about interventions like military action to stabilise failing states ideal in theory but far messier in practice. He suggests that in extreme cases, Western military forces should help restore order in failing states, but history has shown that outside intervention often backfires (think of the disastrous US-led interventions in Iraq and Afghanistan) Meanwhile, Moyo’s belief in market-led solutions can seem naive, given the risks of exploitation and the challenges of attracting investors to fragile economies

Despite these criticisms, both books are essential reading for anyone interested in how economics shapes the world’s poorest nations They bring abstract concepts like government failure, market failure, and globalisation to life with real-world examples, making development economics feel far more tangible than a textbook ever could. More importantly, they force you to question conventional wisdom whether it’s the assumption that aid is always helpful or the idea that free markets alone can solve deep-rooted problems.

So, if you’re looking for books that will challenge your assumptions, spark debate, and help you understand the global economy in a deeper way, The Bottom Billion and Dead Aid are well worth your time They might just change the way you see international development

“Economic hitmen are highly paid professionals who cheat countries around the globe out of trillions of dollars. They play a game as old as Empire but one that has taken on terrifying dimensions during this time of globalization ” (Perkins, 2004) This statement refers to the actions of international consulting firms that convince developing countries to accept enormous loans and to funnel that money to U S corporations, this form of manipulation has been dubbed as “neo-colonialism” by many, and this is why.

In the 1970’s, professional consultants in different fields were tasked with the job of convincing leaders and organization at underdeveloped countries to accept significant loans that would serve the purpose of funding large construction projects in the country The countries were convinced that their GDP will grow, unemployment will improve and that the country will develop based on detailed reports prepared by consultants These substantial projects would be contracted out to U S companies, essentially putting money from the loan back into the hands of corporations, with the loan still there to repay which these economic hitmen knew would be impossible for poorer countries to cover This provided immense political influence for the US and access to a plethora of natural resources for American companies, making the rich richer and the poor poorer.

Additionally, the presidents of these countries that accepted such loans knew that they were putting their country into deep debt but as a result of their corruption, accepted the loans regardless. This is because these presidents were also going to boost their wealth through this as they own the businesses involved, but there was another incentive for them. There were often CIA “assets” or spies in the background that were used to overthrow governments or assassinate their leaders, essentially forcing some of these presidents into accepting the loans (Perkins, 2020)

The drivers of this, the bankers proposing and closing the deals with these countries know that if they can work a couple of large deals in a year, they will be promoted to president of the bank or another powerful position; that's how they succeed in the bank, by getting these loans done If these bankers don’t complete these deals because of their morals and honesty, they are essentially shooting themselves in the foot, destroying their own career. More often than not, these bankers, when asked, will say that they have no choice, hence this problem is a systemic problem

These acts committed by U.S corporations as a means of gaining power has transformed into a blueprint for others to follow in the footsteps, particularly China China have recently begun an initiative known as the “Belt and Road Initiative” or BRI for short (McBride, J., Berman, N. and Chatzky, A., 2023) The BRI is one of the largest infrastructure projects in history and the main idea is to act as a silk road, stemming from China, to make it easier for the world to trade with China by funding roads, railways, pipelines, ports and other facilities across Asia and Africa. China is loaning billions of dollars to countries willing to participate with the vision of China becoming the world's next superpower China’s goals are not strictly economic, but largely geopolitical. The blueprint painted by the U.S in the late 20th century is the formula China is using for the BRI to come to fruition

A prime example of this is Sri Lanka In Sri Lanka, China loaned about $307 million to the government for construction of a new port (Shackle, S 2018), which would be a key stop on China’s maritime silk road It soon became clear that Sri Lanka would be completely unable to pay back the loan, so instead they gave China control of the loan as part of a 99-year lease (Stacey, K 2017)

A similar thing happened in Pakistan, where China controls a strategic port as part of a 40-year lease (Theasset com 2017) China is pushing for a similar agreement in Myanmar, and they have also opened a Chinese naval base in Djibouti. Essentially, China is trying to establish a string of naval bases in the Indian Ocean, allowing China to station ships and guard important shipping routes in the region Furthermore, like the U.S had done, all the infrastructure projects are contracted out to Chinese firms. Chinese construction companies that had fewer opportunities within China saw a huge boost in their growth through the BRI contracts, developing the Chinese economy and furthering their status as a global superpower Additionally, China cleverly used prison inmates as labor to solve 2 problems: prisons in China became empty and their cost of maintaining prisoners went down, as well as the countries where they were deployed paid the wages to these laborers, significantly boosting the Chinese economy. China effectively uses the neo-colonialism strategy to kill two birds with one stone: forming their silk road to cement themselves permanently in global trade and to boost their own economy at the expense of other economies

This is a classic display of free market capitalism that produces excessive inequality, a handful of elites get richer at the cost of millions of poorer people The strategy employed by economic hitmen in the 1970’s has done immense damage to underdeveloped countries and likely will do so for many years to come through China, the world's next superpower.

How In a world where the price of a luxury handbag can surpass the annual salary of an average worker, luxury brands are more than just providers of high-value goods; they are shaping global consumer behaviour. Luxury has always been synonymous with exclusivity, status and fine craftsmanship, but in recent years the concept of luxury has evolved with cultural advancements, influencing consumer behaviour far beyond their original markets. Brands such as LVMH and Hermès are leaders in this change in transformation, using price strategies and illusions of scarcity to create an environment of exclusivity that drives demand

Unlike typical consumer goods, which have fluctuating demand and supply in more standardised markets, luxury goods often follow more unique principles One principle is the Veblen good, a type of luxury good named after American economist Thorstein Veblen Usually, the law of demand states that when the price of a good increases, demand decreases However, the Veblen good is an exception whereby it will see an increase in demand when price rises The abnormal demand for Veblen goods is influenced by the “snob effect”, a situation where consumers prefer to own exclusive products that are different from commonly preferred ones, leading to higher demand for goods when price increases. The graph below shows this effect of the Veblen good. Luxury brands, particularly those under LVMH, maintain high prices and restrict supply to take advantage of this psychological effect, ensuring the products are still desirable

Apart from pricing, the illusion of scarcity is critical in reinforcing the exclusive nature of these goods On the contrary, for mass-market brands, that aim is to maximise profit by maximising revenue and production; companies like Hermès deliberately restrict the quantity of certain products to maintain the products' rarity Whilst the craftsmanship of a Birkin Bag takes up to a minimum of 18 hours as it is handcrafted, Hermès instils a quota system for its most popular bags: the Birkin, Kelly and Constance Clients can only purchase two quota bags per year However, customers cannot simply walk in and purchase a Birkin or Kelly on demand. Instead, they must establish a purchase history with the brand by purchasing belts, shoes, homeware and scarves before they are considered for the extremely popular handbags. This tactic is often referred to as “Birkin Bait”, where customers are incentivised to spend thousands on non-desired products in hope of being offered a quota bag. This system ensures that Hermès is highly profitable, generating a lot of revenue before offering a quota bag. Furthermore, this exclusive nature creates a sense of status and accomplishment, ensuring only the most brand-loyal customers can obtain these rare bags, reinforcing the desirability on a global scale

Similarly, this strategy is also seen in the luxury watch market, particularly those with Rolex and Patek Philippe Similar to Hermès with the “quota bag”, these brands also control supply by limiting the availability of their most iconic pieces, such as the Rolex Daytona and Submariner as well as Patek Philippe’s Nautilus and Aquanaut These watches are not offered to walk-in customers; instead, a relationship must be built with the retailer for those interested in purchasing, with prior purchasing of lower-demanded jewellery. This strategy forces customers to increase their overall spending, even if they had no initial intention of purchasing multiple watches. Moreover, by making these products seem inaccessible, luxury brands manipulate consumer perception, making customers and shoppers view these purchases as worthy investments rather than simple consumer goods It has been a key strategy, as in 2023, Rolex produced 1 24 million timepieces with sales of $11 5 billion, as reported by Morgan Stanley's annual watch report

Whilst historically associated with European elites, luxury brands have successfully tapped into emerging markets in Asia and the Middle East, where the rise of HNIs has increased the demand for high-value goods Through the global expansion of luxury goods, companies such as LVMH have adapted strategies to enter these new markets. China, which has a luxury market valued at $57 billion annually and is a significant player on the global stage. To capture markets like these, companies such as Chanel, LVMH and Hermès have heavily invested in flagship stores with exclusive marketing tailored to national and regional preferences. One of the most significant annual events in the luxury market is Chinese Lunar New Year, which is associated with prosperity, family and giving Brands such as Louis Vuitton, Dior and Rolex often launch limited-edition Lunar New Year collections to celebrate this festival and appeal to Chinese cultural traditions In India, which was reportedly the most dynamic luxury market, recording greater relative growth than other emerging countries and established markets worldwide, Diwali is a significant festival where brands such as Cartier and Bvlgari launch special collections catered to this audience This often includes gold and stone embellishments to align with the themes of prosperity and wealth By tailoring luxury to specific cultural events, brands influence consumers to make impulse purchases to avoid missing out on limited collections.

In summary, luxury brands shape consumer behaviour by using high prices, the illusion of scarcity and cultural exclusivity to drive demand. Strategies like the Hermès quota system and Rolex’s restricted supply force consumers to spend more, reinforcing luxury as a symbol of status and investment. Through tailoring products to regional markets and cultural festivals such as Lunar New Year and Diwali, luxury brands create urgency and reinforce exclusivity to ensure long-term desirability Ultimately, luxury brands do more than sell goods – they hold the power to dictate how and why consumers buy

Simar Bhasin

Recently, Trump imposed import duties that primarily impact goods from China, Mexico, and Canada. According to Trump, these tariffs will address the significant fentanyl drug trafficking and immigration problems on the US borders while also protecting domestic companies and workers These tariffs consist of a 10% tax on Chinese goods and 25% tariffs on imports from Canada and Mexico. In addition, Canadian energy exports like gas and oil are subject to a 10% tax

In retaliation, Canada has responded with direct tariffs targeting US goods for example a 100% tariff on rapeseed oil and pea imports as well as 25% tariff on seafood and pork products. Moreover, Mexico has spoken on possible responses which targets agricultural exports like corn and wheat Likewise, China has escalated its response, drastically impacting farmers whose income heavily rely on exports, by increasing tariffs on products like soybeans and pork Many argue that Trump tariffs are hurting the US These reactions demonstrate the growing tensions between these countries which raise further concerns on the effect on global market and economies.

The tariffs have created many negative effects and challenges to many sectors of the economy. One of the main stakeholders are farmers, as they heavily rely on exported goods however since China, a major consumer of soybean and porl, imposed tariffs has increases prices for farmers. According to the Financial Times, the US agricultural exports to China has dropped by 20% in 2025 Farmers have expressed concern on the impact of the retaliatory tariffs because it restricts access to the US’s important export markets inclusive soybeans, pork and corn and have urged Trump to quickly end this ongoing conflict

Another impacted stakeholder are Grocery stores such as Target and Walmart whose aim is to provide affordable goods for all however warned that the tariffs are drastically increasing the price of imported goods, fruits, vegetables and electronics. Furthermore, these effect the customers as the price increases there are financial strains and budgets that reduce purchasing goods

Despite this, domestic industries like steel and aluminium have seen significant growth due to the reduced competition of foreign imports As of the Financial Times, US steel production has increased by 5% in 2025, generating over 2000 new jobs As a result of this, it provided stability for workers in manufacturing has stayed stationary over the years.

The new tariffs which trump has introduces have creates both negative and positive impacts. Due to the retaliatory tariffs, domestic industries have seen expansion and growth with increased production rate and generating new jobs. However, majority of the consumers, farmers and businesses are struggling with this trade war duw to the reliance on both imported and exported goods and the struggle with the higher costs In the future, balancing the needs of domestic workers, consumers, businesses and international relations is critical to ensure economic growth and decreased tension between countries

The decoy effect is a pricing technique that takes advantage of consumer’s cognitive bias in order to make targeted products seem more appealing to them

When deciding between two differently priced products (e g popcorn boxes at a cinema) consumers may often select the smaller size that comes with a cheaper deal – however, the consumers preferences often changed when they are presented with a 3rd inferior option.

As consumers, we rarely evaluate choices individually; instead, we naturally compare them to other options The decoy effect exploits this tendency through the introduction of a tactically placed ‘bad’ option that anchors our perception of value By offering a choice with lower value businesses can guide consumers towards a preferred (more profitable) option that suddenly seems much more appealing by comparison.

Also, when faced with three options, many consumers – especially those unsure of what to choose – will gravitate toward the middle option as a compromise between cost-effectiveness and enjoyment, a wellplaced decoy makes the targeted option appear obviously more valuable, nudging uncertain consumers towards the selected choice.

Additionally, if consumers feel that they are being deceived or tricked into a choice, they may reject all options out of principle, the subtleness of the decoy effect allows the consumers choice to feel natural rather than forced and maintains the consumer’s perception of free choice

The main function of the decoy effect relies on our instincts as consumers to judge our options through comparison rather than assessing their true value individually. When making every day purchasing decisions avoid immediately comparing options to one another Instead, evaluate each option on its own Consider whether the price, quality and features justify the products cost without the influence of surrounding options Only after evaluating the options true value individually should you compare them to make a judgement This ensures that your decision is based on the options actual value rather than the artificial contrast manufactured by businesses.

The decoy effect is useful as it allows businesses to increase sales of a certain product This means they can specifically target products that are more profitable or aligned with their sales targets

To apply the technique the business needs to create a strategic product line up featuring low-end, middle and high-end (decoy) options The low-end option should be priced attractively but offer minimal features/benefits signalling that it is a clear budget choice. The middle option is where business should position their targeted product, it needs to appear the best value by comparison –offering more benefits than the budget option whilst being considerably cheaper than the decoy. The decoy option should be the most expensive choice, offering only slightly better features than the target product but being disproportionately more costly. This anchors the consumer’s sense of value and makes the target product seem far more appealing

Whilst the decoy effect is a powerful tool, if abused or made too obvious, consumers may feel forced to make a choice which harms the brand’s reputation and their customers loyalty It is important that each option provides fair value even if the decoy’s entire purpose is to make the target option more appealing.

Sneaker culture has grown from a niche interest to a multi-billion-dollar, worldwide industry No longer seen as athletic footwear, sneakers – particularly high-end brands such as Air Jordan and Yeezy – have become status symbols, investment products and a highly profitable sector within the resale economy. For instance, a pair of Air Jordan 1 “Chicago” shoes that originally retailed for $160 in 2015 can resell for more than $2000.

The high cost of these sneakers is not only due to production expenses but also to the economic principles of scarcity, marketing and the secondary market where these sneakers are resold This article provides a thorough analysis of these factors and determines how sneaker pricing reflects broader notions of supply and demand, consumer behaviour in marketing and speculative investment

One of the primary drivers of high sneaker prices is artificial scarcity Brands like Nike and Adidas release limited numbers of highly sought-after models with the intention of creating exclusivity and maintaining consumer demand. This is a classic example of supply and demand, as the perceived supply decreases, the perceived value increases. Nike and Adidas use ‘drop culture’, where there are limited releases, creating “hype”. Nike’s Travis Scott x Air Jordan 1 Low, launched in 2023, had just 150,000 pairs globally. With a retail price of $150, resale prices inflated to over $1500 within hours of the launch The brand-induced scarcity turns these sneakers into collector’s items, which inflates secondary market prices

The high demand for premium sneakers exceeds their intrinsic value The cultural relevance and history of Air Jordans, along with Kanye West’s impact on fashion through Yeezy, have propelled these brands into the luxury space Similar to luxury handbags or watches, the possession of a limited-edition sneaker signals wealth, status and cultural cachet

Psychologically, consumers tend to equate limited-edition products with prestige and superior quality Business Insider found in a study that 67% of sneaker consumers acknowledged that the exclusivity factor influenced their purchasing decisions Moreover, Nike and Adidas employ celebrity endorsement, collaborations and storytelling strategies that create perceived value. Specifically, the Air Jordan brand brings $5 billion annually in revenue for Nike

The Resale Market: Sneakers as an Investment.

The sneaker resale market has evolved into its own industry The global market was worth $6 billion in 2019 and is projected to reach $30 billion in 2030 (1) The growth has created sneaker reselling sites such as StockX, GOAT, and eBay that operate in the same manner as stock markets, with the prices of the sneakers changing in accordance with demand from buyers

For example, Kanye West's Adidas Yeezy Boost 350 "Turtle Dove" retailed for $200 in 2015 but now retails for resale values of more than $2,500 Some sneakers have even been referred to as alternative investments, the same as pieces of fine art or cryptocurrencies. Sneakercollectors and resellers purchase limited-release models strategically, hold them, then resell when the market is at its peak.

The sneaker resale market has transformed conventional retail business models. While Nike and Adidas, among other brands, profit from initial sales, resellers exploit the shortage, selling the shoes for massive profits This has resulted in an expanding sneaker economy in which young entrepreneurs have established companies focused on trading in the resales of the most sought-after models

According to research by StockX, over 50% of sneakers resold on their platform appreciate in value within six months Limited edition sneakers, in particular, have an average resale markup of 300% In some cases, "sneaker bots" automated software programs are used by resellers to buy large quantities of exclusive drops, exacerbating market shortages and further inflating prices

The inflated prices of sneakers are evidence of some fundamental economic principles:

1. Elasticity of Demand – Where others face declining demand when prices go up, luxury sneakers defy this principle. The effect of exclusivity presents the opposite response to prices: increasing prices can induce demand.

2. Market Speculation – Similar to stocks, sneaker consumers speculate on future value. Speculating on scarcity-driven appreciation, consumers keep sneakers as long-term investments

3 Consumer Psychology – Brand image, celebrity endorsements and marketing stories create an effective bond justifying premium pricing

While the sneaker business continues to thrive, it faces numerous challenges:

1 Counterfeits – The rise of sneakers’ counterfeits in the resale market constitutes a major threat Current estimations project the world market for counterfeit sneakers to have an approximate value of $450 billion a year

2. Manufacturer and Retailer Control – Brands are pushing back against the practices of resellers. In 2022, Nike implemented tighter buying regulations to restrict reselling, in the hope of getting sneakers to actual consumers instead of speculative purchases.

3. Sustainability Concerns – The faster sneaker business leads to environmental concerns due to high production volumes and non-sustainable materials Brands such as Adidas have introduced green initiatives, such as producing sneakers from recycled plastic, but the impact is still low

The astronomical prices of sneakers are the result of a brilliantly engineered economic ecosystem Artificial scarcity, prestige branding and resale speculation all contribute to their exorbitant prices While we still wear sneakers everywhere, these “limited edition” shoes have transcended their original purpose, morphing into status symbols, investment opportunities and cultural icons As the resale market expands, so will the battle over moral arguments, accessibility and the evolution of sneaker culture It remains uncertain if sneaks will remain a collector’s indulgence or once again become mass-accessible mainstays, but at present, they embody the tumultuous convergence of economic imperatives, cultural movements and buyer mindset.

Zambia became the first country in Africa to default on debt during the COVID-19 pandemic in 2020 The country owed more than $12 billion to overseas creditors and was left with the difficult choice between continuing to pay creditors or diverting resources towards poverty alleviations and healthcare But how do we actually calculate the actual impact of debt relief on economies like Zambia?

The answer lies within the power of mathematics Poor countries are typically in debt The 12% government expenditure by poor countries on debt servicing last year was higher than the 7% the same countries spent a decade ago on servicing debt. The opportunity cost of this is that it leaves no room for the investment required in infrastructure, education, and medicine. For instance, debt repayment eats up more than expenditure on healthcare alone in more than 15 countries in Sub-Saharan Africa. Additionally, debt also chases away foreign investment and thereby stifling economic growth. Mathematics supplies the means for assessing the poverty-reducing effect and economic growth induced by debt relief Dynamic modeling is one of the major methods employed here, replicating the development of economies over time by simulating the relationship between key variables such as debt, investment, and GDP growth A model, for example, may trace how the GDP level changes with time as a function of the level of investment and the debt service burden

Debt Servicing and Investment - A country which spends the majority of its expenditure on debt servicing does not have much left with which to invest in productive sectors like the constructing roads, schools, or hospitals Dynamic models capture this trade-off by establishing a direct relationship between debt servicing and the amount of investment a country can make

GDP Growth Through Investment - When nations do not owe debts, they are able to spend and thus produce a higher GDP over time. Dynamic models illustrate this relationship through the process by which higher investment is translated into higher output.

Feedback Loops - Dynamic models also consider feedback loops. For example, faster GDP growth may imply the collection of higher tax receipts, which can be reinvested back into the economy, leading to a cycle of expansion Conversely, excessive debt can create a vicious cycle where poor investment triggers poor economic expansion, further reducing the ability to service the debt

By simulating such behavior, dynamic models allow economists to predict the long-term impact of debt relief For instance, studies with such models have found that debt servicing can be reduced by 10% and increase GDP growth by 1 5% per annum for poor economies This is because the money saved through the debt servicing can be channeled back into the economy, leading to the creation of new jobs, infrastructural developments, and enhanced productivity. Cost-benefit analyses are also a useful tool, weighing the expense of debt relief (e.g., costs for creditors) against its advantages (e.g., increased GDP and poverty alleviation). The Heavily Indebted Poor Countries (HIPC) Program, launched in 1996, used such analyses for debt relief eligibility and impact assessment. Through 2019, HIPC had provided debt relief totaling $76 billion to 36 countries and enabled them to increase expenditure for education and health by 3% GDP

Case Study: Debt Relief in Action Uganda offers a striking illustration of the potential for liberation through debt relief With the release of $2 billion of debt relief under the HIPC program, the country increased expenditure on education by 50% and saw a revolutionary increase in the school enrollment rate Similarly, Mozambique used debt relief for a national immunization program reducing child mortality by 20% within a decade Examples such as these prove how rational policy decisions can be made with the aid of mathematical modeling Despite all the potential, debt relief is not a surefire solution

Math modeling depends upon assumptions e g , the assumption that resources made available through debt relief will be invested productively Those assumptions may prove to be wrong in some instances For example, if corruption diverts resources from productive investment, the payback from debt relief will be zero. Additionally, external factors such as world economic trends and political unrest can also complicate the process. Economist Joseph Stiglitz has captured the point well: "Debt relief must be accompanied by governance reforms to ensure sustainable development".

In the future, mathematics involving machine intelligence and big data analytics opens the door to new opportunities for refining debt relief models. Machine algorithms can sort through historical debt outcomes and economic indicators to better predict the impacts of relief schemes As well as that, debtfor-nature swaps whereby debt relief is exchanged for conservation can also be made economically and environmentally efficient with the aid of mathematical frameworks Debt relief isn't loan forgiveness it's unlocking the potential of nations With the predictability of mathematics, we may be able to translate every dollar of debt relief into tangible, measurable benefits for the world's most vulnerable economies With the global threats of climate change and pandemics now facing us than ever before, the need for results-based, equitable solutions could not be stronger

Ryka Gehi

BRICS is an intergovernmental organisation of ten countries (Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran and the United Arab Emirates), which aims to promote economic growth, development and cooperation among its member countries while aiming to reform the international financial and political system to better reflect the interests of emerging economies (East Asia Forum, 2021) The creation of BRICS was a response to the growing influence of these nations in global economics and politics, providing them with a stronger collective voice and influence in international affairs. Due to the increasing influence that BRICS continues to possess, many wonder if their power will have the ability to challenge traditional Western economic dominance.

The BRICS nations have emerged as key players in the global economy due to their rapid economic expansion and economic cooperation among its members. It is important to note that these countries are extremely diverse in their economic strengths, however they share a desire to reduce their dependency on Western financial institutions and currencies The BRICS economies also account for an estimated 37 3% of global GDP, and China alone represents 19 05% while India accounts for 8 23%, in comparison to the G7’s 30% (the world economic forum, 2024) Of February 2025, BRICS is a potentially high volume of global GDP, about 35% and continues to get bigger every year Russian deputy prime minister Alexander Novak expects that in the next 10-15 years the share of BRICS countries’ GDP will be more than half of the entire global economy This clearly depicts the increasing economic influence of these emerging economies, showing how they are a challenge to the west. Furthermore, China, the largest economy within BRICS has experienced consistent economic growth due to its continued industrialization and technological growth, positioning itself as the world’s second largest economy. Along with India, which has surpassed the UK as the fifth largest economy. Moreover, Russia and Brazil excel in agriculture whilst south Africa serves as a gateway to African markets Due to the diversity and the collective economic momentum, BRICS clearly challenges western dominance however internal challenges raise questions about its long-term influence

It is without a doubt that BRICS has not only established itself as a growing economic power but has also altered and influenced global trade and finance For example, by promoting alternative mechanisms like the New Development Bank as well as bilateral trade agreements, the provide options for member countries and contribute to the diversification of the global economic system The New development bank was established in 2015 to mobilize resources for infrastructure and sustainable development projects in BRICS and other emerging market economics and developing countries (World economic forum) Removing the dollar as a global reserve status will be detrimental to the US economy and would likely impact the US dollar, potentially leading to a decline in demand (de – dollarization) Therefore, it is evident that the BRICS are slowly trying to move away from western dominance, weaking the power of the US especially, by proving alternatives to the World bank and the IMF.

Despite the significant growth and influence of BRICS in global politics and economics, the organization does face a myriad of challenges internally and because of external factors This is because of divergent interests among member countries, differences in political systems and ideologies, as well as the need to maintain sustained economic growth The bloc has sought to coordinate its members’ economic and diplomatic policies but has struggled with internal division on a range of issues, including relations with the United States and Russia’s invasion of Ukraine Furthermore, achieving consensus among its diverse members is the largest problem it faces, as each country has different viewpoints Overall, to maintain their influence on a global platform, the countries in BRICS need to have consistent economic growth, which might not always be possible due to the everchanging global economy

In conclusion, there is a lot of evidence that supports the increase in global influence that BRICS has through the establishment of the new development bank as well as increasing the number of members as of 2024. This allows BRICS to reduce its dependence on the Western countries, such as the US, as well as challenge the traditional dominance of Western powers However, it is also vital to take into consideration the challenges that are posed to BRICS that prevent the organisation from becoming more dominant than western powers For example, internal disagreements and the impact of geopolitical events which result in discrepancies, limiting their influence Therefore, one could argue that even though the dominance of BRICS is increasing on a global level, there are a variety of factors that prevent them from overtaking traditional Western dominance

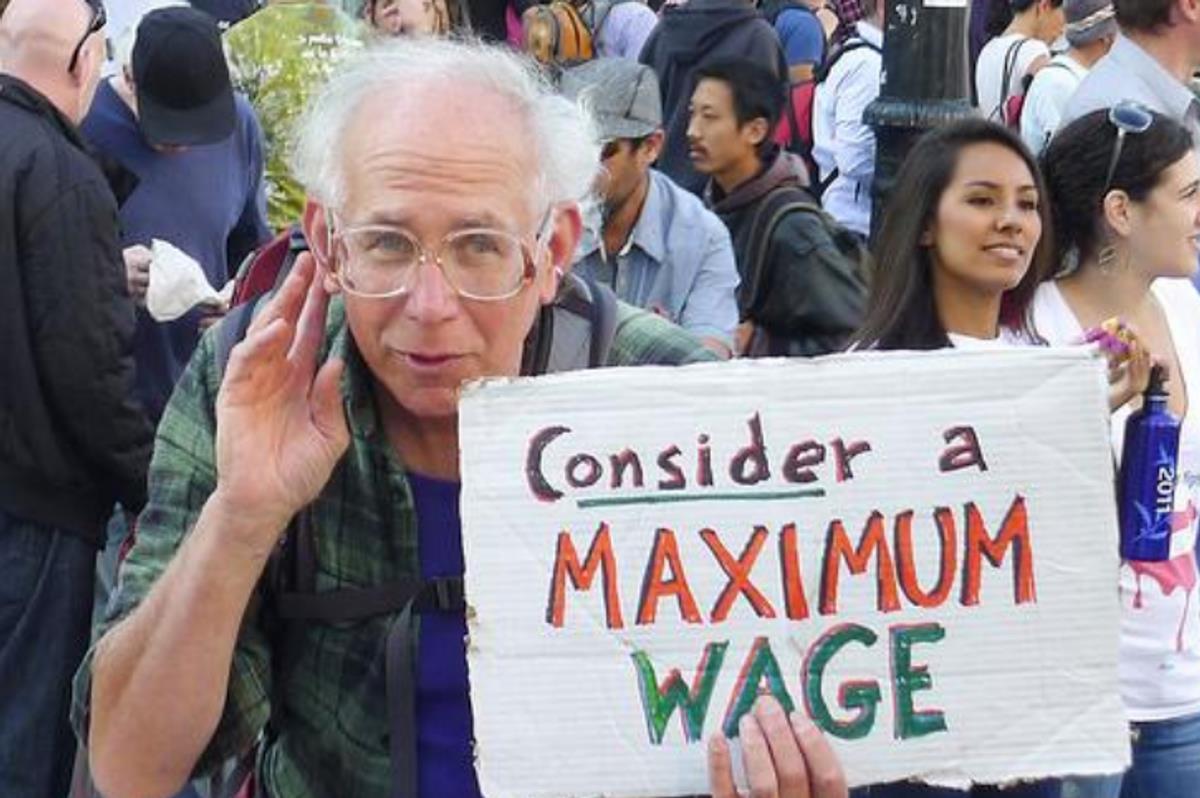

Anika Jethwani

A maximum wage is a price ceiling and legal limit on how much an individual can earn. In order for this to be effective, it should be placed below the equilibrium wage rate, as shown in the graph below This would mean that salaries are capped at a certain level, preventing a higher level of disparity between workers who earn a vast amount of money in comparison to others, aiming to lead to reduced income inequality in the world of work Income inequality is the difference of how income is distributed across a population and is measured through the GINI index, where the closer the value is to 0, the more equal the society is

A maximum wage can be beneficial to the economy by reducing income inequality While there has not necessarily ever been a proper maximum wage, America has been close, having implemented similar policies. In 1942, the president Franklin D. Roosevelt proposed a marginal tax rate of 100% on incomes over $25,000 per year – equivalent to about $375,000 today. During the time that this tax evolved and was in place, Does a maximum wage reduce income inequality or harm the economy?America became a much more equal society, as in 1913, 18% of incomes were going towards the top 1% of people, whereas in 1970, the top 1% was only a tenth of America’s income Their GINI index was at the lowest ever between 1970 and 1980, reaching a low of 34 7 Now, income inequality in the US has since increased, with the Gini index in 2022 being at 41 3 On average, CEOs in America earn over 300 times the amount an average worker does Therefore, there is no doubt that a maximum wage has the capability and potential to reduce income inequality

Furthermore, there are also other benefits of introducing a maximum wage on some of an economy’s key objectives, such as reducing inflation and unemployment. By capping salaries, workers are less able to negotiate for higher wages past the limit, therefore preventing a wageprice spiral where workers ask for higher wages, receive a greater income, spend more and lead to higher prices, then need higher wages again to compensate. Furthermore, because wages are capped, it costs less to employ workers This incentivises firms to hire, potentially increasing the rate of employment The quality of labour employed will also improve as wages play less of a role in determining whether someone is hired Firms can choose the most qualified and skilled worker for a job without spending more than the capped amount, thus improving their productivity

However, implementing a maximum wage also has several limitations Firstly, as the maximum wage is set below equilibrium, this will result in a shortage of workers and excess demand for labour – an example of government failure This is because at lower wages, skilled workers are less incentivised to work because they are not compensated based on their value This can lead to a lack of motivation, absenteeism and brain drain This is when qualified, highly skilled workers leave the country to work somewhere else. Furthermore, George Akerlof’s lemon theory can also be applied here. A maximum wage for a highly skilled job signals that the job does not require highly skilled applicants, caused by misinformation. This can result in firms hiring lower-skilled workers who are less productive. Therefore, while this may reduce inequality, it may slow down economic growth and lead to a less productive economy

There are several other methods which may be more effective in reducing income inequality with fewer trade-offs, such as progressive taxation or universal basic incomes Progressive taxation is a system where the more you earn, the more you pay in income tax The money the government earns can then be used to redistribute wealth to the lower-income individuals in the form of benefits, programmes or other schemes A universal basic income would mean that everyone has a fixed income, meaning that it could prevent extreme poverty but also does not cap how much an individual can earn, reducing the likelihood of things like brain drain occurring.

Overall, a maximum wage has the potential to significantly reduce income inequality by limiting higher earnings and has proved to be effective through improving the US GINI index However, no economies have ever properly implemented this policy, as the potential costs, like reducing economic growth, innovation and potential brain drain, are big risks for economies to take Its effectiveness as a policy may depend on whether it is combined with other policies

Rania Jethwani

The financial crash of 2008 was the most severe financial crisis since the Great Depression of the 1930s It triggered a global contraction in liquidity and credit, leading to the failure of major investment and commercial banks, mortgage lenders, insurance companies, and savings and loan associations as a result of the crash of the US housing market.

In 2001, in the US, the Federal Reserve anticipated a mild recession and therefore significantly lowered interest rates from 6 5% to 1 75% This led to an increase in consumer credit and consequently led to higher borrowing levels Due to lower interest rates, banks were able to lend subprime loans, loans which carried higher interest rates than prime loans, to 'high-risk consumers' These subprime mortgages were often structured as balloon payments, where large payments are only due at the end of a loan period Therefore, consumers were able to take advantage of the cheap credit to purchase larger assets, such as houses As long as house prices continued to rise, borrowers were able to protect themselves from high mortgage payments by selling their homes at a profit and paying off their mortgages

Many banks marketed subprime loans to borrowers with poor credit, assuming that house prices would rise. Therefore, to increase securitisation, banks bundled prime and subprime mortgages into mortgage-backed securities (MBS) to sell to investors. Credit rating agencies misclassified many of these as low-risk AAA bonds despite their exposure to risky subprime loans The purchases that investors made entitled them to a share of interest payments on the loans Selling MBSs was considered a good way for banks to increase liquidity and reduce riskier loans This is because if homeowners are unable to pay their loan, the burden of unpaid loans would fall on the investor

Furthermore, the housing boom led to more people taking out mortgages they could not afford, often under the assumption that rising home values would allow them to refinance or sell at a profit. Lenders, incentivised by high profits from MBS sales, continued issuing risky loans with minimal oversight. However, when the housing market reached unsustainable levels, prices of houses began to fall, and homeowners with subprime loans found that they owed more on their mortgage than their home was worth. This led to homeowners selling their homes with unpaid mortgage balances With these falling home prices, the value of MBSs dropped as well, so investment banks which held a large amount of securities suffered significant losses as their assets became devalued This situation led to a credit crunch as banks stopped lending to each other Since banks were unable to loan to each other or consumers, there was less spending and investment in the economy, which led to companies making workers redundant, leading to unemployment and less spending in the economy, deepening the recession