Are you looking for Products, Equipment or Services for your business? If so, check out these leading companies advertised inside:

AutoMAtIC Floor SySteMS

Keith Manufacturing Co – pg 14

BAggINg/PAlletIzINg equIPMeNt

Amadas Industries – pg 8

Premier tech – pg 10

CoMPoSt turNer

resource Machinery & engineering – pg 5

CoNVeyorS & CoNVeyor PArtS

Amadas Industries – pg 8

Smalis Conveyors – pg 3

equIPMeNt SAleS grindertrader.com – pg 8

grINDerS, ChIPPerS & SCreeNINg SySteMS

Action Vibratory equipment – pg 12

Amadas Industries – pg 8

Bandit – pg 19

Diamond z – pg 9

hogzilla – pg 5

Maverick environmental equipment – pg 16

Precision husky – pg 17

rawlings Wood hogs – pg 22

rotochopper – pg 21

Sundance grinders – pg 10

Viably – pg 7

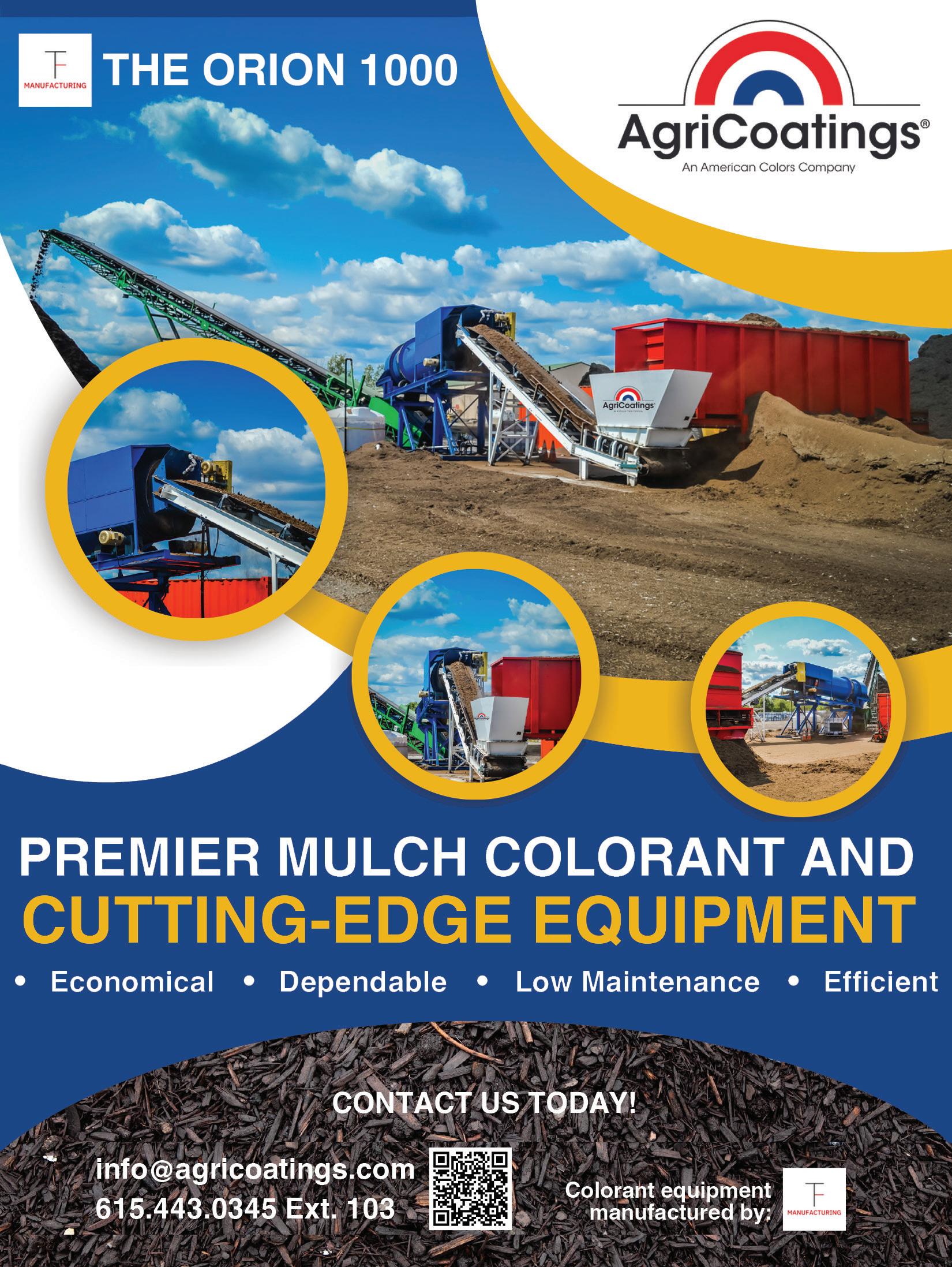

MulCh ColorINg equIPMeNt/ ColorANtS

AgriCoatings – pg 15

Amerimulch – pg 23

Britton Industries – pg 18

CMC – pg 13

Colorbiotics – pg 2

Faltech – pg 6

Milagro rubber Inc – pg 4

t.h. glennon Co – pg 24

MulCh SuPPlIerS ohio Mulch – pg 16

PAyloAD WeIghINg & MeASurINg SySteMS

Walz Scale – pg 11

trAIlerS Weaver Systems – pg 20

troMMel BruSheS

Power Brushes Inc – pg 8

WeAr PArtS

Armorhog – pg 12

By P.J. Heller

When Zach Brooks took a midlife sharp U-turn change in careers, he had a unique goal in mind.

“We set out to create a fully off-the-grid sustainable farm where we turn sunshine, rainwater and other people’s garbage into food and shelter and improvements to the planet,” he says. “That was kind of our North Star.”

Brooks laid out a 10-year plan to achieve those goals, but notes, “it did not include becoming a full-blown worm farm, that kind of evolved.”

Today, roughly seven years since he gave up his job as a partner in a management consulting firm, Brooks is believed to be one of the top 10 worm producers in the nation.

The Arizona Worm Farm, located on a 10-acre site in south Phoenix at the base of South Mountain, sells approximately 4 million red wiggler worms a year, 700-800 yards of worm castings, compost, raised bed mix, seed starter mix, vegetable starts and small trees. On Fridays and Saturdays, the company produces and sells an active worm-casting tea.

His vermiculture/vermicomposting business is also developing black soldier fly larvae products, including a rich organic soil amendment made from the frass (poop).

Brooks’ goal is to take food and landscape waste, divert it from the landfill by feeding

it to worms and larvae that then turn it into high-protein feed and fertilizer. The insects and their byproducts are then fed to the farm hens and spread on gardens to produce sustainable food and growing products.

“We’re determined to use this circular process to combat ‘climate change’, divert waste from landfills, and use regenerative soil efforts to put carbon back in the ground where it belongs,” Brooks says.

The Arizona Worm Farm, started in 2017 on what was an old cotton farm, has grown from $80,000 a year in revenue to more than $2 million. It employs 11 people fulltime as well as about a half dozen part-time staffers and interns. It targets predominantly backyard gardeners and small farms. The vast majority of the company’s products are sold from its facility, with garden centers accounting for only a tiny percentage of sales.

“What we’re trying to do for ourselves and our community is to create mechanisms whereby people can recycle their own [food and landscape] waste and can turn their garbage into food and soil in their yards,” Brooks explains. “We think we can have a positive impact on the earth and we can help you have a great backyard garden.”

He says compost producers would also benefit from adding worms to their mix.

The magic of Mulch Magic ® colorant is actually a lot of science. Only a microscope can see the little things, like particle dispersion and spectral analysis, that go into every tote. But anyone can see the difference in brilliance on each piece of mulch. And if you do want to see all that science, visit colorbiotics.com/magic

Continued from page 1

“If they would run some of it through a worm, they would increase the value of their compost from $50, $60, $70 a yard to $400, $500, $600 a yard,” he says. “It’s an interesting value-add that they really ought to consider. It’s not hugely complicated. It dramatically increases the value of their compost. And it’s highly desirable in the marketplace.

“Anyplace where somebody is selling compost or raised bed mix, adding a worm program to that product list is probably going to be a very profitable addition,” Brooks says.

Using worms to reduce food waste and keep it out of landfills helps to reduce the impact of “climate change”, since food waste is a major source of methane emissions. The U.S. Environmental Protection Agency says food waste is responsible for 58 percent of methane emissions from landfills.

Food waste is the biggest component of U.S. landfills, accounting for about 24 percent of all landfill waste, according to the National Environmental Education Foundation. The U.S. Department of Agriculture says food waste is estimated at between 30 to 40 percent of the food supply.

“The United States discards more food than any other country in the world: nearly 60 million tons—120 billion pounds—every year,”

STAFF

Publisher / Editor

Rick Downing

Contributing Editors / Writers

P.J. Heller • Robert LaGasse

Andrew Mollenbeck • Sandy Woodthorpe

Production & Layout

Christine Mantush

Advertising Sales

Rick Downing

Subscription / Circulation

Donna Downing

Editorial, Circulation & Advertising Office 6075 Hopkins Road, Mentor, OH 44060

Ph: 440-257-6453 • Fax: 440-257-6459

Email: downassoc2@oh.rr.com

Subscription information, call 440-257-6453.

Soil & Mulch Producer News is published bimonthly by Downing & Associates. Reproductions or transmission in whole or in part, without written permission of the publisher, is prohibited.

Annual subscription rate U.S. is $19.95. Outside of the U.S. add $10 ($29.95). Contact our main office, or mail-in the subscription form with payment. ©Copyright 2024

according to sustainability company Recycle Track Systems.

That, it says, equates to 325 pounds of waste per person.

“That’s like every person in America throwing 975 average sized apples right into the garbage—or rather right into landfills, as most discarded food ends up there,” it says. “All told, the amount of food wasted in America has an approximate value of nearly $218 billion—the equivalent of 130 billion meals.”

Phoenix has no program or rules and regulations to divert food waste from the landfill, Brooks says.

“We don’t even believe in daylight saving time,” he laughs. “In Arizona, we don’t make rules like that.”

Brooks has stopped keeping track of how much food waste the Arizona Worm Farm has diverted from the Phoenix-area landfill but estimates it’s in the thousands of yards.

The worm farm takes in 120 to 180 cubic yards a week of brown and green landscape waste from the city and landscapers, horse manure, plus food waste from a catering company and from bagged salad producers. Those materials are composted based on a recipe the company developed and refined over five years.

“The volume of waste is just enormous,” Brooks says. “We don’t have trouble getting the waste we need. Our problem is slowing it down.”

Brooks is doing what he can to encourage the public and businesses to think about dealing with their waste.

“There’s a pretty common saying that there’s ‘no away,’” he says. “So when people want to throw things [such as food and green waste] away, there’s no such place. There’s no place you can put stuff where it magically disappears. So one of our goals is to get people to use worms and our composting approaches to reprocess all of their waste. If the worm won’t eat it or you can’t process it in composting, we’re trying to convince people not to buy it.

Brooks also holds an annual Worm Business Conference for 50 farms, teaching them how to breed and raise worms, how to grow castings, how to make worm teas and how to sell worms into the marketplace.

“I’m a giant fan of worms and worm castings . . . I think it’s the best gardening product you can buy, period,” Brooks says.

Classes are also frequently held at the Arizona Worm Farm to educate the public about vermiculture, vermicomposting, reducing waste, how to have a successful garden, and pruning, watering and fertilizing trees. About 200 people attend the Saturday classes.

“We have a breadth of customers, many of whom are sustainability-focused and really want waste reduction as a key part of what they’re doing,” he says. “But we also have a lot of customers who just want to grow food in their backyard.”

By Andrew MollenBeck

Bruce Reuser built a business from dust — sawdust, to be precise. The father of four was raising his children on his own in Santa Rosa, California when the need to provide for them led to a new venture, one whose humble beginning in 1978 eventually led to the innovative landscape materials company that continues to bear the family’s name: Reuser Inc.

In the late 1970s, disposal methods for wood by-products were changing in the timber business. No longer could they be burned or taken to a landfill. At that time, an acquaintance asked Bruce if he wanted free sawdust. The budding businessman owned a truck, and his character and work ethic ensured a “yes” response. He took the sawdust and figured out how to sell it.

“He couldn’t afford to lose,” says Merle Reuser, Bruce’s son and current president of Reuser Inc. “Everything he did had to be very careful, very thought out.”

That DNA permeates the operation to this day, which has since relocated to Cloverdale and now includes the third generation of the Reuser family. The 13-acre facility along the 101 Freeway in Northern California continues to set itself apart not only for its product but also for its methods.

“We’re always focusing on the horizon as far as environmental constraints and regulatory things that are coming our way, and we build them into our business plan early instead of having them dropped in our lap late in the game,” says Merle, whose home state is often at the forefront of issuing new regulations. “Whether you agree with them or not, it is the reality of the business.”

Among Reuser Inc.’s many distinctives, none shines brighter than its solar panels. Seven years ago, the business installed them on top of its processing facility, and they now generate 80% of the operation’s power demands.

“We have 500 electric horse power that’s running inside that facility most of the time,” Merle says. “Instead of relying on power generated somewhere else, this makes us more independent and helps offset expenses.”

The grid tie system works especially well with the wood grinders, which were all converted from diesel to electric to coincide with the installation. That switch also resolved concerns about dust, fire risk and noise at the facility.

Continued from previous page

Streamlining the power supply reveals another hallmark of the operation: the pursuit of efficiency.

Mulch production is done entirely inside the operation’s 140,000 square feet of industrial buildings. That enables work to continue throughout the year regardless of weather conditions. In November of 2024, a weather system known as an atmospheric river dumped more than 10 inches of rain in the region over two days. Reuser Inc. continued work as usual.

“We’re in a Mediterranean climate, so we don’t get rain six to nine months out of the year,” Merle says. “Then our spring market can be very wet when our customer base is really clamoring for material. So, if we’re handicapped by weather early in the year, it’s problematic for us. That’s why we put up the industrial buildings.”

Inside the facility, Reuser Inc. custom-built all its machines to align with the unique indoor configuration. Over the past four years, Merle has worked closely with colorant manufacturer Colorbiotics to tailor the production to the specifics of his operation.

Efficiency and consistency are well-worn words around the operation. The business takes in three or four raw product codes, and it ships 250 product codes. Uniformity is essential. What started with two color offerings — bright red and black — has expanded to include shades of brown, cinnamon and others at the request of customers.

“I know that I can hit the same numbers every single time with the product,” Merle says. “The thing about consistency is if you have the same product every time it comes in, you can adjust your operations, you can adjust your machinery, you can adjust your crew and your equipment to that product. If I deliver a hundred yards and the next hundred yards looks different, that’s going to create a problem for my customers with homeowners or landscapers.”

HContinued on page 6

Continued from page 5

While dialing in the appropriate pounds per yard is a key component of an effective operation, the full scope includes thinking through every aspect of the business, just as Bruce established from the beginning. To that end, Reuser Inc. keeps its material covered to make it light. The site is paved to extend the life of its equipment. Trucks are loaded to 80,000 pounds on axle scales inside the buildings. Procurement and deliveries are scheduled during off hours to avoid California’s notorious traffic. Even the location right next to the 101 Freeway was intentional to expedite time in transit.

Coil to safeguard against the impact of a spill.

“Instead of fighting regulations or hiring lawyers or engineers or any of that stuff, we just buy the truck. We buy the loader. We make the improvement to our facility, and then it’s ours,” Merle says.

About 15 years after relocating to Cloverdale, Reuser Inc. truly put down roots in the community. Ever since it arrived, the business kept buying pieces of property to expand whenever possible. In the early 2000s, it annexed itself into the city, built the city street around the operation and helped establish the industrial park on the southeast edge of town. Its investment in the community and consideration of its neighbors led to a Spirit of Sonoma County Award, which recognizes those who contribute to the economic development and enhancement of communities.

urrently, Reuser Inc. moves about 1,500 tons of landscape materials every day at its facility. The business procures wood by-products — chips, sawdust, bark — primarily from local sawmills. After processing, a fleet of 16 company-owned trucks delivers the finished product to retail yards and landscapers in the San Francisco Bay Area and as far away as Colorado.

The truck fleet also reflects the company’s pillars of sustainability and efficiency. Since 2015, the entire fleet has run on renewable fuel. The change preceded state regulations and ultimately met the rules of the California Air Resources Board (CARB) well before they took effect. More recently, Reuser Inc. started using vegetable oil instead of hydraulic

Reuser Inc. has developed a reputation in the business for doing a good job for a good price, with customer service as the driving force. If a customer calls the office, they’ll get a real person on site. Merle doesn’t like to reach an automated voice, and he assumes his customers feel the same.

When asked about what makes him most proud of the operation, Merle doesn’t hesitate in the slightest with his response: it’s the 34 employees who make it all happen. It is not an attempt at flattery when he says any one of them could be the lead in most operations.

“We really value people, whether it’s our customers, our employees and their families, the public — we work very hard to do a good job,” Merle says. “That sounds very simple, but it’s very complicated to accomplish.”

The Komptech Lacero 8010 is a powerful, high-speed, horizontal grinder purpose-engineered for the demanding North American wood waste, biomass, mulch, orchard/land clearing, and organics markets.

/ Feed large waste volumes into the versatile 7'10" open-front hopper / Leverage all-day grinding with the huge 41" diameter downswing drum / Track chassis with optional 3-axle dolly for quick on-road transport

Explore Your Next Opportunity In Wood and Green Waste Grinding thinkviably.com/lacero

www.thinkviably.com/lacero

The U.S. Energy Information Administration (EIA) predicts that biomass electricity generation will see slight increases over the next few years, even as its share of renewable energy production declines, reports biomassmagazine.com. These projections are part of the EIA’s latest ShortTerm Energy Outlook, which provides insights into the evolving energy landscape.

Renewable energy is expected to account for a growing portion of U.S. electricity generation, rising from 22% in 2023 to 23% in 2024 and 25% in 2025. Biomass, a smaller component of the renewable energy sector, is projected to see modest growth in electricity output despite a reduction in its overall share of renewable energy.

Biomass electricity production is expected to increase slightly, from 20.7 billion kilowatthours (kWh) in 2024 to 21.1 billion kWh in 2025, though it will remain below the 21.4 billion kWh generated in 2023. However, biomass’ contribution to renewable electricity generation is expected to decline from 2.47% in 2023 to 1.99% by 2025.

The electric power sector’s biomass capacity is projected to remain stable, with 2.7 gigawatts (GW) of waste biomass and 2.3 GW of wood biomass through 2025. Industrial and commercial sectors will also maintain 5.4 GW of wood biomass capacity, though waste biomass capacity is expected to decrease slightly, from 1.4 GW in 2023 to 1.3 GW by the end of 2025.

Biomass energy consumption patterns vary across sectors:

• electric Power: Consumption of wood and waste biomass is expected to remain steady or slightly decrease through 2025.

• Industrial Sector: Wood biomass consumption is forecast to grow, from 1.224 quadrillion British thermal units (quad) in 2023 to 1.347 quad in 2025, reflecting its continued use in manufacturing and energy-intensive industries.

• Commercial Sector: Biomass consumption will remain relatively stable, with minor declines in waste biomass use.

• residential Sector: Residential wood biomass use is expected to decline slightly, from 0.45 quad in 2023 to 0.423 quad in 2025.

Across all sectors, total wood biomass consumption is projected to rebound to 2.011 quad in 2025 after a slight dip in 2024, while waste biomass consumption will see a small, steady decline. These trends reflect the changing role of biomass in the renewable energy mix as other technologies like wind and solar continue to grow.

Continued from page 3

He ticks off the benefits for those backyard gardeners.

“Your mental health will be better if you get off social media and go out in the backyard and garden,” Brooks says. “Your physical well-being will be better if you get up off the couch and stop watching TV and garden once in a while. And your diet will be better because you’ll be eating stuff out of your backyard.”

Political persuasions make no difference.

“We get customers from the far left all the way to the far right,” he says. “No matter where you are politically, no matter what your views are, there are reasons why you want to grow your own food. It’s delicious. It’s healthier. It’s accessible. It’s not at the mercy of tariffs or drought or things like that.”

Brooks confesses that before launching the Arizona Worm Farm, he was a “terrible” backyard gardener.

“I would spend hundreds of dollars and get three or four sickly tomatoes and be so proud of those tomatoes,” he recalls. “My garden is hugely successful now because I got out of the way. I just let the worms and microbes and organic decomposition drive that.

“The most fascinating thing to me is that nature has this right. If we just emulate nature and get out of the way, everything works fine,” Brooks says. “That has increasingly become our philosophy, to emulate nature to the extent that we can in the urban environments where we live.”

Brooks admits he never envisioned a career as a “worm farmer.”

“I can tell you that none of my friends, and very few of my acquaintances, have ever met somebody who’s really got a worm farm. They may have seen a profile in a movie or TV show . . . what we do on a commercial scale is hard for people to imagine.”

Arecent decision by the U.S. Court of Appeals for the D.C. Circuit has overturned decades of environmental regulatory practices, fundamentally altering how federal agencies implement environmental laws, according to an opinion article on redState.com . The case, Marin Audubon Society, et al v. FAA, et al , challenges the authority of the Council on Environmental Quality (CEQ), a body within the Executive Office of the President tasked with overseeing compliance with the National Environmental Policy Act (NEPA).

The court ruled that the CEQ exceeded its authority (ultra vires) by issuing regulations treated as binding for nearly 50 years. Judges Karen LeCraft Henderson and A. Raymond Randolph wrote the majority opinion, while Chief Judge Sri Srinivasan dissented.

The CEQ’s guidance had been used as a uniform standard for federal agencies to comply with NEPA. However, the court found that the CEQ, as an advisory body, lacked the legal authority to issue binding regulations.

Implications of the Decision:

1. regulatory Framework in Flux: The ruling invalidates much of the CEQ’s regulatory guidance. Agencies must now reevaluate how they comply with NEPA without relying on the CEQ’s framework.

2. Impact on environmental law: The decision could disrupt environmental regulations across the federal government, as agencies may need to issue new rules to replace those previously based on CEQ guidance.

3. A Changing legal landscape: This case reflects a broader trend of limiting federal agency authority. The Supreme Court’s recent decision in Loper Bright Enterprises v. Raimondo weakened the “Chevron deference,” which allowed courts to defer to agency interpretations of ambiguous statutes. Together, these rulings signal a shift toward stricter judicial scrutiny of administrative actions.

The lawsuit stemmed from a challenge by environmental groups against the Federal Aviation Administration (FAA), arguing that it had used the wrong standards when approving sightseeing flights near national parks. While the court ruled against the CEQ’s regulatory authority, it indirectly validated concerns about federal agencies’ reliance on improperly issued guidance.

The decision opens the door to changes in environmental regulation. It is expected that federal agencies will work to reissue or revise regulations to address the court’s concerns.

This landmark ruling marks a pivotal moment in the evolution of federal environmental governance.

By RoBeRt LaGasse, executive DiRectoR

Without doubt, the Covid-19 pandemic years of 2020 & 2021 set records in product sales growth for horticultural mulches and soils. Consumer demand increased by 25%-40% nationally as the entire nation was homebound and gardening became an essential activity in the greatest number of American households ever.

Since 2021, gardeners across the United States have continued to shape their home, garden and landscape lifestyles while the mulch market has experienced some notable shifts over the past few years. The Mulch & Soil Council’s annual surveys for 2022, 2023, and 2024 provide valuable insights into consumer behavior and purchasing trends for mulch, focusing on both bagged and bulk purchases. By analyzing these trends, we can gauge the current state of the mulch market and make informed predictions for its future.

Number of Mulch Purchasers

The consumer mulch market has seen a slight decline over the past few years. In 2022, 49% of gardeners reported purchasing mulch, with the highest concentration of buyers in the Northeast and South. In 2023, this figure decreased to 43%, and it remained steady at 43% in 2024. Despite this decline, mulch remains an essential product for many gardeners, with over 40% of households continuing to make purchases.

In terms of specific regions, the Northeast and South have consistently led mulch purchases. In 2022, 59% of Northeastern gardeners bought mulch, while 50% of those in the South followed closely behind. These

regions continued to dominate in 2023 and 2024, with 66% of Northeastern gardeners and 58% of Southerners purchasing mulch in 2023. The trend shows regional preferences that influence both the volume and frequency of mulch purchases, with the Midwest and West lagging behind in both years.

Stable buyers, defined as those who purchase mulch in consecutive years, account for a significant portion of the market. In 2022, 43% of gardeners bought mulch in both years, and this percentage decreased slightly in 2023 and 2024 to 35%. The decline in stable buyers may reflect a broader trend of gardeners purchasing less mulch or opting for other alternatives for discretionary use of time and money. The Northeast and South maintain the largest shares of stable buyers, while the West and Midwest show lower percentages of regular mulch buyers.

Bagged mulch continues to be the preferred method of purchase across the United States. In 2022, 63% of mulch buyers purchased bagged mulch, while 14% opted for bulk mulch. In 2023, the percentage of bagged mulch buyers increased to 69%, and it remained stable in 2024 at 69% This preference for bagged mulch can be attributed to its convenience, ease of handling, and the ability to purchase in smaller quantities suitable for various garden sizes.

On the other hand, bulk mulch remains a popular option for larger gardens and professional landscapers. In 2022, 14% of mulch purchasers

Continued on page 16

Continued from page 14

bought bulk mulch, and this percentage remained stable at 15% in 2023 and 2024. Although bulk mulch purchases are less common, they represent a significant portion of the market for larger-scale gardening projects.

For bagged mulch, the average number of bags purchased was 12 in 2022 and 2023, with a slight decline to 11 bags in 2024. The average bulk purchase was 11 cubic yards in 2022, with a slight decrease to 10.9 cubic yards in 2023 and 10 cubic yards in 2024. These small shifts indicate that consumers are purchasing slightly fewer bags and cubic yards of mulch over time.

To better understand the economic impact of these trends, we can estimate the market value of mulch based on the number of households purchasing mulch and the average price for bagged and bulk mulch. The prices for mulch are assumed to be:

• Bagged mulch: $4 per bag

• Bulk mulch: $28 per cubic yard

2022:

• Bagged Mulch

• Number of purchasers: 48.3 million households

• Average purchase: 12 bags

• Total bags purchased: 579.6 million bags

• Market value: 579.6 million bags × $4 = $2.32 billion

• Bulk Mulch

• Number of bulk purchasers: 6.76 million households (14% of 48.3 million)

• Average purchase: 11 cubic yards

For sixty years, the industry has relied on Precision Husky Corporation to produce the highest quality, most rugged equipment. Today’s products are ready to lead the way for the next sixty years.

Our horizontal and tub grinders are just one example. They are the most powerful, easiest to use grinders in the industry, designed with innovative

features and advanced technologies to give you the power and production needed to tackle the most demanding grinding operations.

You can invest in our equipment with confidence, and know it will do the job for many years to come. Call us today to discuss your needs and learn more about our high-performance products.

• Total cubic yards purchased: 74.36 million cubic yards

• Market value: 74.36 million cubic yards × $28 = $2.08 billion

• total Market Value for 2022: $2.32 billion (bagged) + $2.08 billion (bulk) = $4.4 billion

2023:

• Bagged Mulch:

• Number of purchasers: 42.4 million households

• Average purchase: 12 bags

• Total bags purchased: 508.8 million bags

• Market value: 508.8 million bags × $4 = $2.04 billion

• Bulk Mulch:

• Number of bulk purchasers: 6.36 million households (15% of 42.4 million)

• Average purchase: 10.9 cubic yards

• Total cubic yards purchased: 69.4 million cubic yards

• Market value: 69.4 million cubic yards × $28 = $1.94 billion

• total Market Value for 2023: $2.04 billion (bagged) + $1.94 billion (bulk) = $3.98 billion

2024:

• Bagged Mulch:

• Number of purchasers: 44.4 million households

• Average purchase: 11 bags

• Total bags purchased: 488.4 million bags

• Market value: 488.4 million bags × $4 = $1.95 billion

• Bulk Mulch:

• Number of bulk purchasers: 6.66 million households (15% of 44.4 million)

• Average purchase: 10 cubic yards

• Total cubic yards purchased: 66.6 million cubic yards

• Market value: 66.6 million cubic yards × $28 = $1.86 billion

Continued from page 16

• total Market Value for 2024: $1.95 billion (bagged) + $1.86 billion (bulk) = $3.81 billion

Survey Methodology and Demographics

The data presented in this article comes from consumer surveys conducted by the Mulch & Soil Council , an industry group representing the mulch and soil sectors, with research provided by technoMetrica Market Intelligence, a leading national polling and research firm. These surveys aimed to understand Americans’ mulch and soil buying behaviors and track changes over time.

• Survey Dates:

• 2022 : Survey data for 2022 is not explicitly dated but was gathered as part of general trends discussed in the reports.

• 2023 : The survey for 2023 was conducted between March 31 and April 4, 2023 (5†source).

• 2024 : The most recent survey was conducted between September 11 and September 13, 2024 (6†source).

• Survey Methodology:

• Sample Size: The surveys involved a sample of adults aged 18 and older. In 2023, the survey had 1,414 respondents, with a margin of error of ±2.8 percentage points (5†source). The 2024 survey involved a larger sample of 2,034 respondents, with a margin of error of ±2.2 percentage points (6†source).

• Data Collection: Both surveys were conducted online using TechnoMetrica’s Panel Network, a national panel of respondents. This ensures that the sample reflects a wide range of demographic characteristics and geographic distribution across the United States.

• Demographics of respondents:

• Age: Respondents varied in age, with a distribution across different age groups: Continued on page 20

» 40” diameter capacity

» Heavy-duty 50” diameter x 66” wide hammermill

» 20 hammer inserts

» Caterpillar C32, 1,200 horsepower engine

» Standard impact detection system

If you haven’t tried a Bandit unit for your operation, please contact a local Bandit dealer, email marketing@banditchippers.com or visit our website www.banditchippers.com and we will be happy to assist you!

18-24: 11% (2024)

25-34: 14% (2024)

35-44: 19% (2024)

45-54: 17% (2024)

55-64: 15% (2024)

65 or over: 24% (2024)

• gender: The surveys had a balanced gender distribution, with 52% of respondents identifying as female and 48% as male (6†source).

• Income: Income levels varied across the sample:

21% reported incomes under $20,000 (2024)

16% between $20,000 and $30,000 (2024)

19% between $50,000 and $75,000 (2024)

11% over $100,000 (2024)

• geography: The respondents were distributed across four major U.S. regions:

South: 38% (2024)

Midwest: 21% (2024)

West: 24% (2024)

Northeast: 17% (2024)

• Credibility and Accuracy:

• The credibility interval for the 2023 survey is ±2.8 percentage points, meaning that the results can vary by this margin in either direction. For the 2024 survey, the margin of error is ±2.2 percentage points. These margins are typical for surveys of this size and ensure that the results are reasonably reliable.

• The sampling method and the survey’s large sample size ensure that the findings accurately represent the U.S. population’s views and behavior, though slight variations in results due to sampling error are possible.

Continued from page 18

The consumer mulch market, while still substantial, has seen a stable or slight decline in recent years. From 2022 to 2024, the total market value for mulch dropped from $4.4 billion to an estimated $3.81 billion. This decrease is due to fewer consumers purchasing mulch and a reduction in the average quantity bought. Despite these shifts, bagged mulch remains the dominant product, with a clear preference for it across all regions. Bulk mulch purchases have remained relatively steady, primarily driven by larger gardening projects.

These trends suggest that there is a slight decline in both consumer volume and purchasing behavior. The steady dominance of bagged mulch and regional preferences, particularly in the Northeast and South, will continue to shape the market in the years to come. Factors such as economic conditions, shifting gardening practices, and regional preferences for alternative landscaping materials could further influence these trends in the future.

The Mulch & Soil Council has announced an open comment period for a proposed: Product Guidelines for Certified All-Natural Horticultural Mulches

The purpose of the guidelines is to define terms and requirements for a voluntary, industry-supported, national certification program for all-natural horticultural mulch products. A copy of the draft guidelines is available for review on the Council’s website at www.mulchandsoilcouncil.org. Follow the link under “Special Announcements”.

The comment period is open to any interested parties until January 31, 2025. Send responses to MSC Executive Director Robert LaGasse at execdir@mulchandsoilcouncil.org or by USPS to MSC Certification, 7809 N FM 179, Shallowater, TX 79363-3637.

Seamlessly

According to a recent article on theepochtimes.com , the U.S. manufacturing sector displayed early signs of recovery in November, as new orders expanded for the first time in eight months, according to data from the Institute for Supply Management (ISM) and S&P Global. While the sector remains in contraction overall, the pace of decline has slowed, buoyed by easing inflation and improved business sentiment following the U.S. presidential election.

The ISM Manufacturing Purchasing Managers’ Index (PMI) increased to 48.4 in

November, up from 46.5 in October, marking a five-month high. Although the index remains below the 50-point threshold that separates contraction from expansion, the reading exceeded market expectations. New orders showed particular improvement, rising to 50.4, signaling slight growth after seven consecutive months of contraction.

Similarly, S&P Global’s U.S. Manufacturing PMI edged up to 49.7 from 48.5, reflecting a milder contraction in activity. Both reports highlighted improving demand conditions, with ISM noting an expansion in new orders and

S&P Global reporting the smallest decline in domestic demand in five months.

Feedback from industry executives revealed mixed sentiments. Some noted ongoing challenges, such as changing consumer purchasing behaviors and uncertainty in demand forecasts, while others expressed optimism about the coming year:

• Food and Beverage Industry: Executives cited inflation-driven shifts in consumer behavior, with many prioritizing valueoriented purchases.

• textile Mills: Businesses reported improved sales forecasts for early 2025 and an optimistic outlook for the year ahead.

• Fabricated Metal Products: Companies observed slower demand as customers adjusted inventories but expressed hope for post-election stability.

Several factors contributed to the sector’s improved performance in November:

• easing Inflation: Cost pressures declined to their lowest levels in a year, providing relief for manufacturers.

• Employment Growth: Hiring rebounded as business optimism increased, offsetting the prior month’s job losses caused by labor strikes and natural disasters.

• Political Outlook: Anticipated pro-business policies under the incoming Trump administration, including potential tariffs and tax cuts, boosted confidence. However, concerns about trade retaliation and supply chain impacts remain.

Looking ahead, the manufacturing sector’s prospects appear cautiously optimistic. Improving demand and easing inflationary pressures could support a gradual recovery in 2025. However, uncertainties surrounding trade policies and global competition are likely to temper growth in the near term.

Economists predict stronger job growth and increased production activity as manufacturers adapt to changing market conditions and policy shifts. While challenges persist, the sector’s recent performance offers hope for a more stable and resilient future.

Colorbiotics®, a Sika® Company, has introduced the Sahara® XP Mobile. The latest mulch coloring system draws from design features of the industryleading Sahara XP — and literally takes them farther with its unique mobility.

“Our Sahara line has helped producers eliminate water waste and maximize color efficiency at the job site, but sometimes there’s more than one job site,” said Kent Rotert, vice president of Colorbiotics. “The XP Mobile gives them the ability to move with eight wheels and a generator.”

The machine is road-ready with a purpose-built

trailer that meets oversize and wide load regulations. In addition to the on-board generator, the XP Mobile comes with three-phase plugs to make it easy to switch between shore and generator power.

According to Dave Roller, colorant systems manager at Colorbiotics, you no longer need to worry about power supply or hauling truckloads of mulch to your permanent location. The XP Mobile gives you flexibility with all the performance of the Sahara XP.

The XP Mobile does not require a pilot car or special license plate for the road. With the touch of a couple of buttons, it unfolds for work. Once on

Arizona Worm Farm Turns Trash to Treasure PAGE 1

From Sawdust to Sustainability: How Reuser Inc. Built a Thriving Family Business PAGE 4

Biomass Electricity Generation: Modest Growth Expected Through 2025 PAGE 8

Court Ruling Reshapes Environmental Regulation Framework in the U.S. PAGE 12

News From The Mulch & Soil Council PAGE 14

Signs of Improvement Amid Easing Challenges for U.S. Manufacturing PAGE 22