BELL WEALTH

Bell’s Wealth Management Team Expands into Arizona

From pine-covered mountains to unique desert landscapes, Arizona – with its winter warmth, amazing sunsets, thriving businesses and more – is a place many people enjoy.

Today, loyal Bell Bank customers in Arizona include not only snowbirds who make Arizona home, but also an increasing number of year-round residents who have noticed “what’s different at Bell.” We’re proud to now offer Bell Bank Wealth Management services in Arizona, with a dedicated team providing in-person expertise and guidance.

2023 Q3

Meet Our Arizona Team

AND THEIR KEYS TO LOOKING FORWARD

As we continue to add full-service banking locations and offices in Arizona, we are also building our wealth management team in the state. Our Arizona group is led by senior wealth advisor James Dufresne, wealth and fiduciary associate Robert Colace and senior retirement plan consultant Matt Gromek. Let’s briefly meet each of them:

A Maine transplant, James Dufresne, CFP®, has worked in wealth management, investments and financial planning since 2008. He specializes in working with business owners on succession or transition planning, and those who have excess cash in their business and would like to maximize their investment, tax and estate plan to work toward their family’s goals. James enjoys helping solve the “financial puzzle,” making the investment, tax and estate planning pieces fit together to maximize net worth.

Robert Colace is a graduate of North Dakota State University who now lives in Phoenix. He helps wealth management advisors with investment operations and administration – and since he often supports clients with account requests, he really focuses on building trust when it comes to managing their assets.

It’s important to diversify your investment portfolio across different asset classes to spread risk and potentially increase returns. Researching options and understanding your risk tolerance can help you make informed decisions aligned with your financial goals and time horizon.

-Robert Colace, Wealth & Fiduciary Associate

Matt Gromek holds several certifications – as a CPFA (Certified Plan Fiduciary Advisor), CRPS® (Chartered Retirement Plans SpecialistTM) and QKA® (Qualified 401(k) Administrator) – that pertain to his extensive background in helping companies and organizations with retirement programs for their employees. Matt works with clients’ administrative, human resources and finance leaders to enhance retirement benefits for employees, focusing on 401(k), 403(b) and 457 plans.

For the majority of our clients, their business is their largest asset, and it’s crucial to plan for the eventual sale or succession. Given the complexity and changing nature of tax and estate laws, we advise clients to start simple and plan the next chapter of their business with flexibility in mind.

-James Dufresne, CFP® VP/Senior Wealth Advisor

Company-sponsored retirement plans are great benefits – and can be complex. It’s important to review provider services annually – in addition to reviewing the plan’s total cost every two to five years. We offer our clients this benchmark and review at no cost, whether or not we currently service the plan.

As a reader of this newsletter, you may be well aware of the services we offer at Bell. We hope you’ll take full advantage of all the guidance, management, planning and expertise that can help you manage your financial life, including:

• Financial planning

• Investments

• Trust and estate planning

• Retirement

• Private banking

Don’t forget, we also offer full-service banking, mortgage and insurance services at our locations in Arizona as well as in eastern North Dakota, west central Minnesota communities, the Twin Cities and Duluth. Contact us, so we can match you with a local expert and the services you need.

A RANGE OF FINANCIAL SERVICES

-Matt Gromek, VP/Senior Retirement Plan Consultant

2

THE IMPORTANCE OF GOALBASED RETIREMENT PLANNING

-Mike Kobbervig CFA®, CEBS. SVP/Retirement Plan Services Division Manager

Our time and attention are constantly pulled in different directions by the decisions we make. It can be overwhelming – and one way to simplify saving and investing decisions for retirement is to take the time up front to determine your goals!

Unfortunately, many of us make quick saving and investing decisions at initial retirement plan enrollment, or in education meetings, based on questions like these:

• What can I spare to save without changes to my spending patterns?

• What is the match formula?

• What investment is performing the best this year?

You should take advantage of a group retirement plan at work, but sometimes those initial decisions become limiting. In our rush to enroll, we ignore the basic premise of setting goals that can help guide future decisions, especially when downside volatility arises.

Quick enrollment “wizards” are great for making decisions faster and easier, but have an unintended consequence: there’s little foundation for decision-making. A better approach might be to use the forecasting tools available on participant web portals. Various plans may have a different look to their forecasts, but the engines are similar. These forecasting tools allow you to quickly customize goals based on savings rate, expected returns, anticipated retirement age and required retirement income. Once the data is populated, you can evaluate scenarios based on projec-

tions, then refine inputs (such as how much you save) to more closely align with retirement goals.

Unfortunately, most retirement plan participants just set a savings rate and pick an initial investment. After that, they check their quarterly statement to see if the account has increased in value recently. Worse yet, they may make decisions detrimental to their overall goal, relying on input from others that may have no bearing on their retirement.

To analyze your approach, and how you could improve it, ask yourself:

• Have I ever compared my investment performance to a co-worker’s or friend’s statement?

• Have I ever decided to change investments without considering long-term expectations?

• Have I ever compared my investment performance to my partner’s statement without regard to their risk/ return profile?

Planning for a retirement goal, especially with your partner, is important – and takes time. Spending time up front, with annual tracking toward your goal, will save you time in the long run and help you avoid the pitfall of overreacting to daily market movements. A consistent approach, with the ability to make minor adjustments along the way, can give you more confidence in your plan and likely increase the chances that you attain your retirement goal!

3

Exploring the Many Options for College Funding

Assisting your beneficiary – your child, grandchild, relative or friend –with funds for education is fulfilling and rewarding … but it may take some research to determine the best method for you and the recipient. There are a number of avenues that can accomplish the goal of helping someone pay for their education, including setting up a 529 plan, making a gift directly to the student or a qualified educational institution, establishing an educational trust or using Roth IRA funds. Let’s explore these options.

529 PLANS

Every state offers a 529 plan, and some states offer more than one type of plan to consider. 529 plans, legally known as “qualified tuition plans,” are sponsored by states, state agencies or educational institutions and are authorized by Section 529 of the Internal Revenue Code. Plan criteria, including contribution funding, maximum account balance limits and fees, vary from state to state.

Each state plan may offer different advantages. For example, North Dakota’s plan offers up to a $300 match for North Dakota residents, a new-baby match up to $200 when opening an account for a baby up to 12 months old and a kindergarten kickoff match up to $100 for children of kindergarten age. Check with your state to learn about possible matches or tax credits.

Funds from a 529 plan can be used for college tuition, fees, applicable room and board, required course supplies or student loan repayment, as well as tuition expenses up to $10,000 annually for K-12 public, private or parochial schools.

Gail Jacobson Blair CFP®, CTFA® VP/Senior Wealth & Fiduciary Advisor

If your beneficiary decides not to attend a qualified school, the account owner can name another beneficiary (subject to the individual plan) or take a non-qualified withdrawal, which is subject to 10% federal penalty and applicable federal, state and local taxes (some exceptions apply, including for a student attending a U.S. military academy or receiving a scholarship). The account owner has control of the 529 account until funds are withdrawn.

4

With you as the account owner of a 529 plan, the assets have relatively little impact on the beneficiary’s federal financial aid eligibility. Tax benefits vary depending on the state, with a number of states offering a state income tax credit. The 529 plan earnings grow tax-free over a period of time.

While there is no annual contribution limit, contributions are considered gifts for federal gift tax purposes. For 2023 the annual gift tax exclusion is $17,000 per year ($34,000 if married, filing jointly) per beneficiary. You can contribute more, but additional amounts may have gift tax implications. There is no limit to the number of accounts a beneficiary may have – they can have multiple accounts in multiple states.

GIFTING DIRECTLY TO A STUDENT

Funds can be gifted directly to the student for use toward educational expenses. This gift would be included in the annual gift tax exclusion amount of $17,000 per year ($34,000 given by a married couple) and may impact the student’s federal financial aid eligibility.

DIRECT PAYMENTS TO AN ACCREDITED EDUCATIONAL INSTITUTION

Payments made directly to an accredited educational institution are not included in the annual gift tax exclusion or an individual’s estate and gift tax exclusion and therefore are unlimited. For grandparents, payments are not subject to the generation-skipping tax limitations.

ESTABLISHING A TRUST TO GIFT FUNDS FOR EDUCATION

A parent or grandparent could work with their attorney to establish an irrevocable trust to cover education expenses. An advantage of this is the trust can be established for multiple beneficiaries and generations. A disadvantage for the beneficiary is that they will have to report this trust as their own money when applying for financial aid, and potentially limiting their eligibility. Also, earnings are taxable.

ROTH IRA WITHDRAWALS

Contributions to a Roth IRA can be withdrawn without penalty to pay for college expenses. Withdrawals can be made to fund expenses for yourself, a child or grandchild. Income limitations apply for contributions to a Roth, so you should visit with your CPA to determine your eligibility. Using Roth dollars to cover tuition may take planning if the child would otherwise be eligible for financial aid, as Roth IRA withdrawals are included in the financial aid calculation.

CONTACT US

With the number of options available to fund education, those with a desire to do so should be able to find a plan that fits their situation. Because gifting and tax rules are complex, you should seek advice from your financial advisor, attorney or CPA. Please contact us at 701.451.3000 to review options for educational funding.

2023 Tuition and Living Costs Summary By States

Table compares the average college costs for the academic year 2022-2023.

5

TUITION

State Number of schools Public In-State Public Outof-State Private On-Campus Off-Campus Arizona 106 $4,898 $12,619 $17,973 $14,669 $16,665 Minnesota 105 $8,387 $8,995 $27,674 $13,015 $13,895 North Dakota 26 $7,949 $8,589 $12,794 $11,174 $12,619 Average $7,134 $10,168 $21,405 $13,553 $14,994 Data source: NCES (National Center for Education Statistics).

with 2022-2023 tuition (Last update: February 27, 2023)

& FEES LIVING COSTS

Updated

Creating a Digital Plan

With guidance from your advisor, these are the basic steps for creating a digital plan:

1. Create a detailed inventory of all digital assets, including your username, password and security answers for each. By law, online providers can’t share your electronic communications without your consent, so you need to identify who will access these assets and how.

2. Determine which digital assets have value and your desired recipients. You may think you own a digital asset, but you may have purchased a nontransferable license to use the asset, with no ownership rights established. You need to review the terms of the agreement so you know.

3. Appoint an individual responsible for handling your digital assets/online ac counts. For example, your Facebook account can be deleted or changed to a “memorialized” site. Appoint a “legacy contact” to notify Facebook of your passing and monitor the memorialized site.

4. Consult your estate planning attorney and tax advisor to determine what digital assets need to be included in your estate and tax planning provisions. You may need to give consent for people to access the contents of your digital communications.

5. Position trusted individuals to administer digital assets during incapacity and after death, especially since most financial firms that provide corporate fiduciary services are not yet able to administer digital assets.

Having your wishes incorporated into strategic estate planning not only gives you peace of mind, but also helps eliminate potential discord among your beneficiaries. Appointing trusted advisors for digital assets can reduce stress and conflict among family members as the digital revolution races forward.

Planning for Digital Assets and Information in Your Estate Plan

By Shara Fischer, CRPC VP/Wealth & Fiduciary Advisor

New technology heightens the need to review and update estate plans, providing for all important matters that need attention following incapacity and death – including digital assets and information. In today’s world, alongside the property typically addressed in estate plans, digital assets and information should also be incorporated.

INVENTORYING DIGITAL ASSETS AND INFORMATION

Digital assets are any identifiable representation of value recorded and stored digitally. Examples include cryptocurrencies, software code, digital music and film, non-fungible tokens (NFTs) and valuable data or code. Digital information encompasses data that is stored, transferred and used by networks, computers and other technology. Examples include software, digital videos and photos, video games, web pages, social media, digital data, audio and electronic documents, and electronic books.

Preparing an inventory is the first step to identifying digital assets and information and their current or future value. Most estate planning attorneys use detailed checklists to delve into how to access, preserve and determine the disposition of digital property. Some digital assets may not pass through your estate – for example, if there is no monetary value at the time of your death, or if right-to-transfer-ownership restrictions are limited to the owner’s lifetime.

Your advisors can guide you in the legal and tax planning steps to address digital assets. Digital assets with high appreciation potential may offer tax advantages if they are transferred as lifetime gifts. Specific steps in case you are incapacitated may need to be addressed with the digital platform and in your estate plan.

Even though your digital assets may not have value, your fiduciary or representative may need access to sites including email, social media, financial accounts and online/cloud file storage. You may wish to plan how digital photos and similar heirloom items can be accessed and distributed. If you have an e-commerce business that uses eBay or Etsy, a successor may need to be positioned to run the transactional account or process closure. People who hold a website domain name should review the licensing agreement to determine if it is transferrable at death. Other digital areas to consider are mobile apps, loyalty accounts such as credit card rewards, commerce transactions via social media accounts and online gaming/gambling accounts.

6

Cryptocurrency Regulatory Update for an emerging asset class

As we mentioned in our cryptocurrency article in in the second quarter of last year, the regulatory environment surrounding pooled investment vehicles for cryptocurrencies is murky. Many retail and institutional investors are waiting for an exchange traded fund (ETF) or mutual fund option as a way to gain cryptocurrency exposure inside a wealth account. Doing so would offer investors the ability to buy and sell cyrptocurrencies, like Bitcoin, as easily as a share of stock. Today, no ETF or mutual fund exists that invests directly in cyptocurrency. There are a few closed-end funds available, as well as an ETF that invests in future contracts, but there is no direct exposure that is easily accessible.

Asset managers continue to file applications with the SEC to create “spot” Bitcoin ETFs, but have been unsuccessful in gaining approval. This summer, Blackrock, Fidelity, WisdomTree, VanEck, Invesco and Ark Investment Management have all applied, with no success. Although it does appear that a crypto option is getting closer, the main obstacles are surveillance and ways to combat fraud and market manipulation.

By Nathan Erickson SVP/Director of Investment Strategy

Bell Bank Wealth Management will continue to monitor this emerging asset class and its impact on investment markets.

7

Inside this issue:

s Arizona Snowbirds, Year-Round Residents Finding ‘What’s Different at Bell’

s 529 Plans Offer Varying Options for Education Funds

s Have You Considered Digital Assets in Your Estate Planning?

s The Latest on Regulating Cryptocurrency

s Why Goal-Based Retirement Planning Is Important

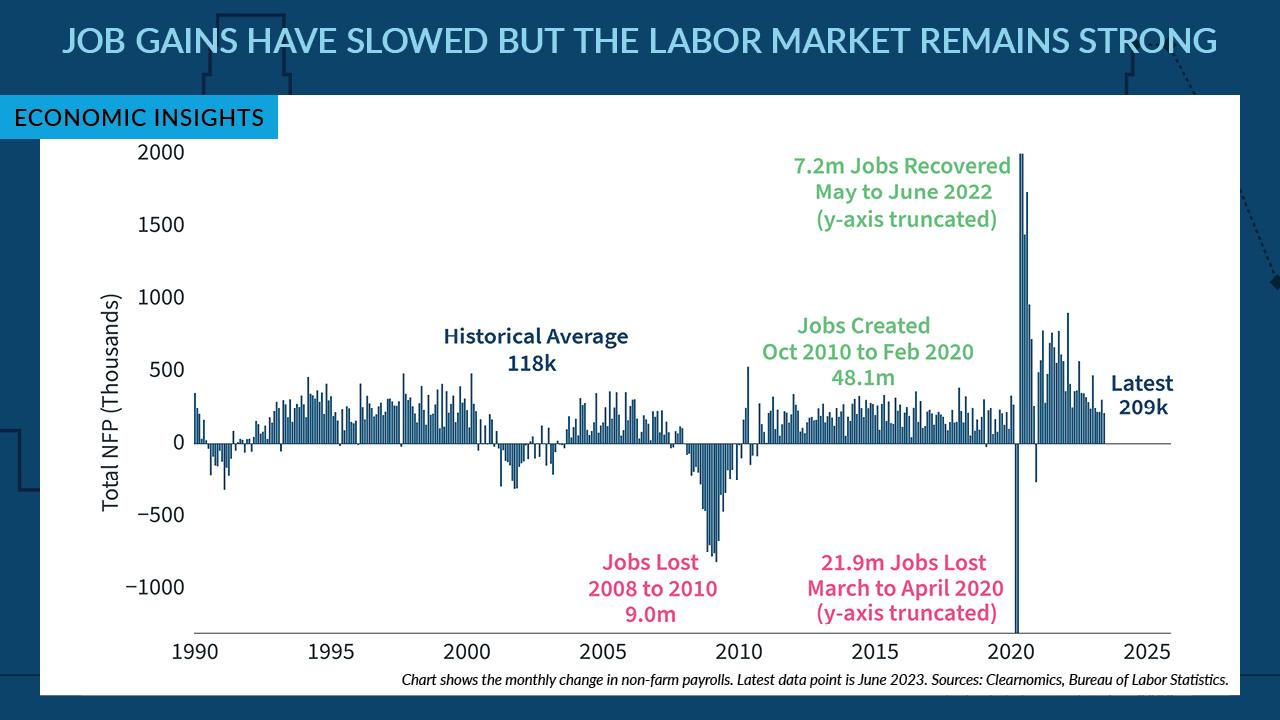

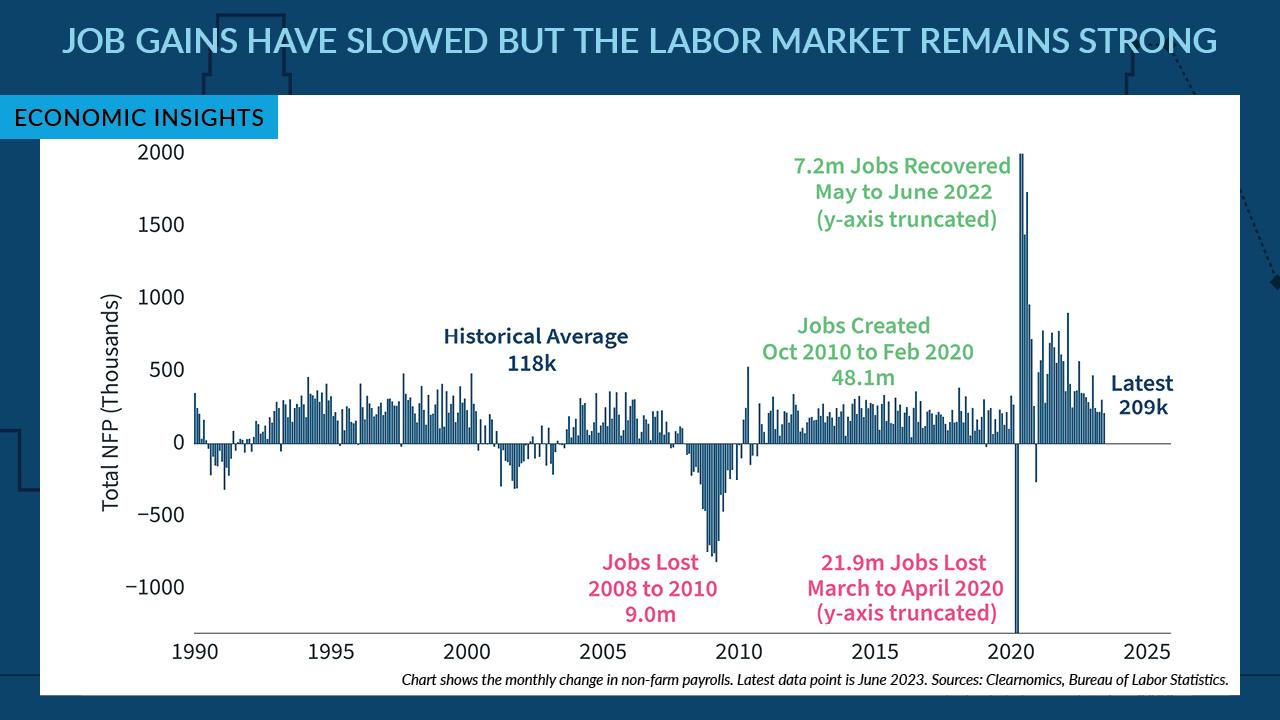

Economic Insights: Job Growth & Labor Market

While the U.S. added 209,000 new jobs in June, the number was lower than anticipated – the first time in 15 months jobs did not meet expectations.

Although hourly earnings surprised economists by growing 0.4% month over month, June payroll data continued to show slowing labor market growth over the past year. Inflation continues to be stubborn –a reason the Fed increased interest rates in July and may do so later in 2023.

701.451.3000 | 800.709.5781 15 Broadway | Fargo, ND 58102 www.bell.bank Deposit and loan products are offered through Bell Bank, Member FDIC. Bell Insurance Services, LLC is a wholly owned subsidiary of Bell Bank. Products and services offered through Bell Insurance or Bell Bank Wealth Management are: Not FDIC insured | No Bank Guarantee | May lose value | Not a deposit | Not insured by any federal government agency. This newsletter has been written for the general information of clients and friends of Bell Bank. It is not intended, nor may it be relied upon, as tax or legal advice with respect to any matter. This newsletter also cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by the Internal Revenue Service or other taxing authority.

Get LinkedIn Follow Bell Bank on LinkedIn for regular commentary and market insights. 8