U.S. MEDICAL & LIFE SCIENCES REPORT

SUMMER 2024 | BERKADIA RESEARCH

The medical and life sciences industries encompass a broad range of sectors involved in the research, development, manufacturing, and delivery of healthcare products, services, and technologies.

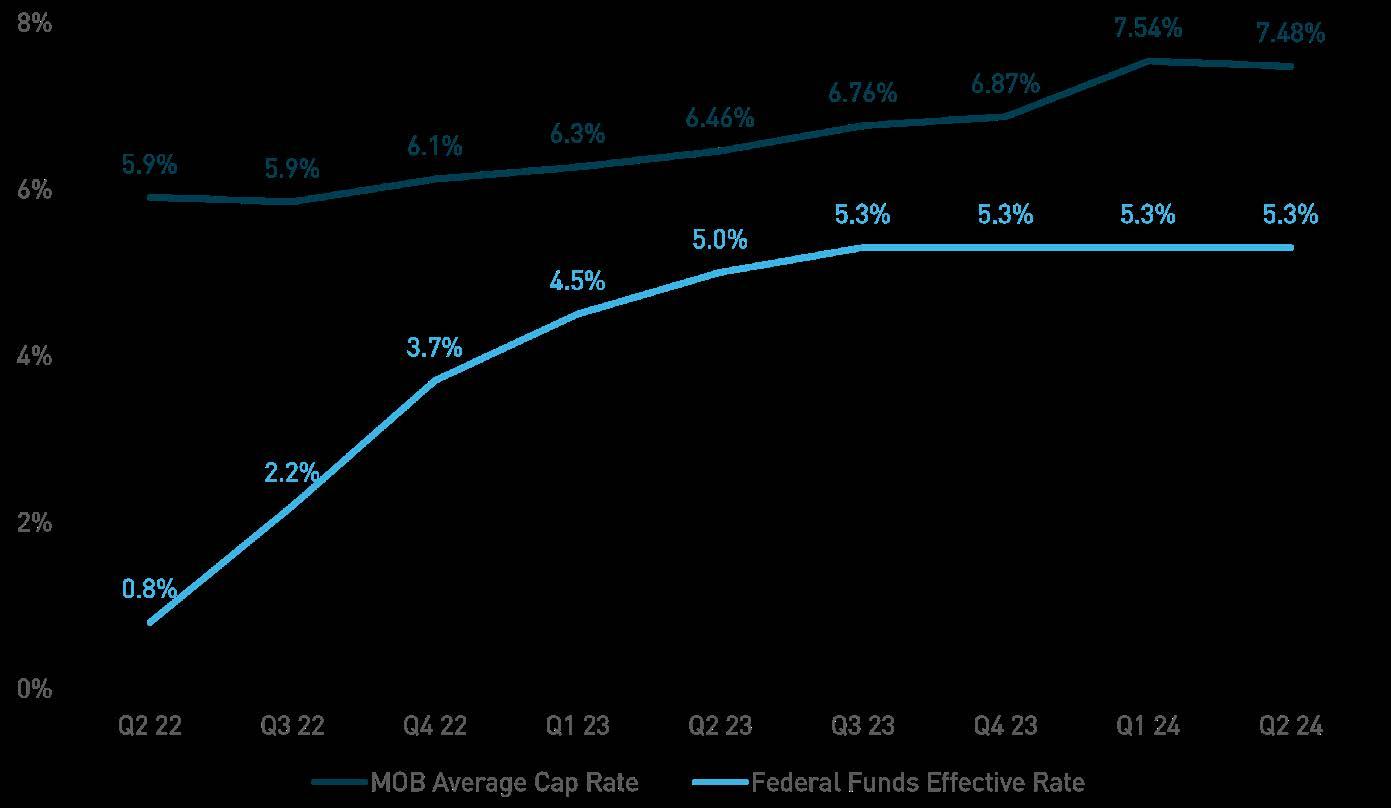

Overall, high interest rates and uncertainty around when they will fall has continued to set the tone for medical and life science real estate developments, transactions, and investments. It is expected that once interest rates normalize, dirt will move on planned projects. The brief slowdown in new starts will benefit occupancy rates in the long run and allow landlords to continue to capitalize on rent gains and drive up future sales prices.

• THE VOLUME OF NEW CONSTRUCTION STARTS CONTINUED TO DOWNSHIFT

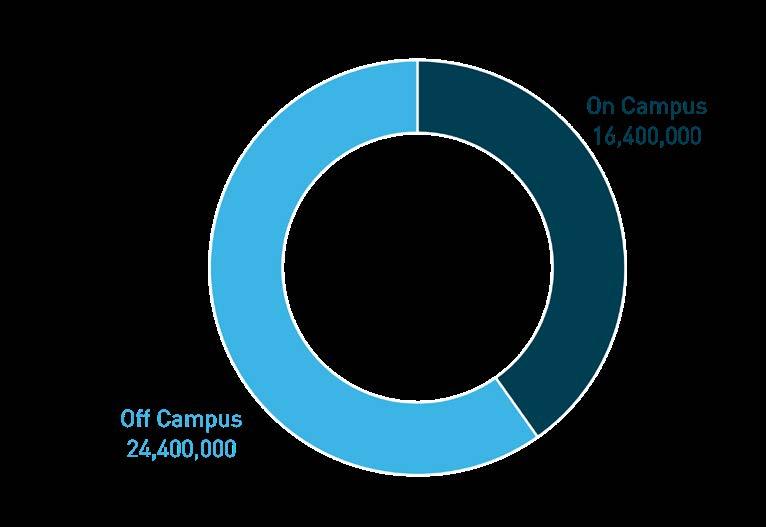

• OFF-CAMPUS CONSTRUCTION DOMINATED ON-CAMPUS

CONSTRUCTION AS PROVIDERS

CAPTURE SUBURBAN POPULATIONS WITH OUTPATIENT FACILITIES

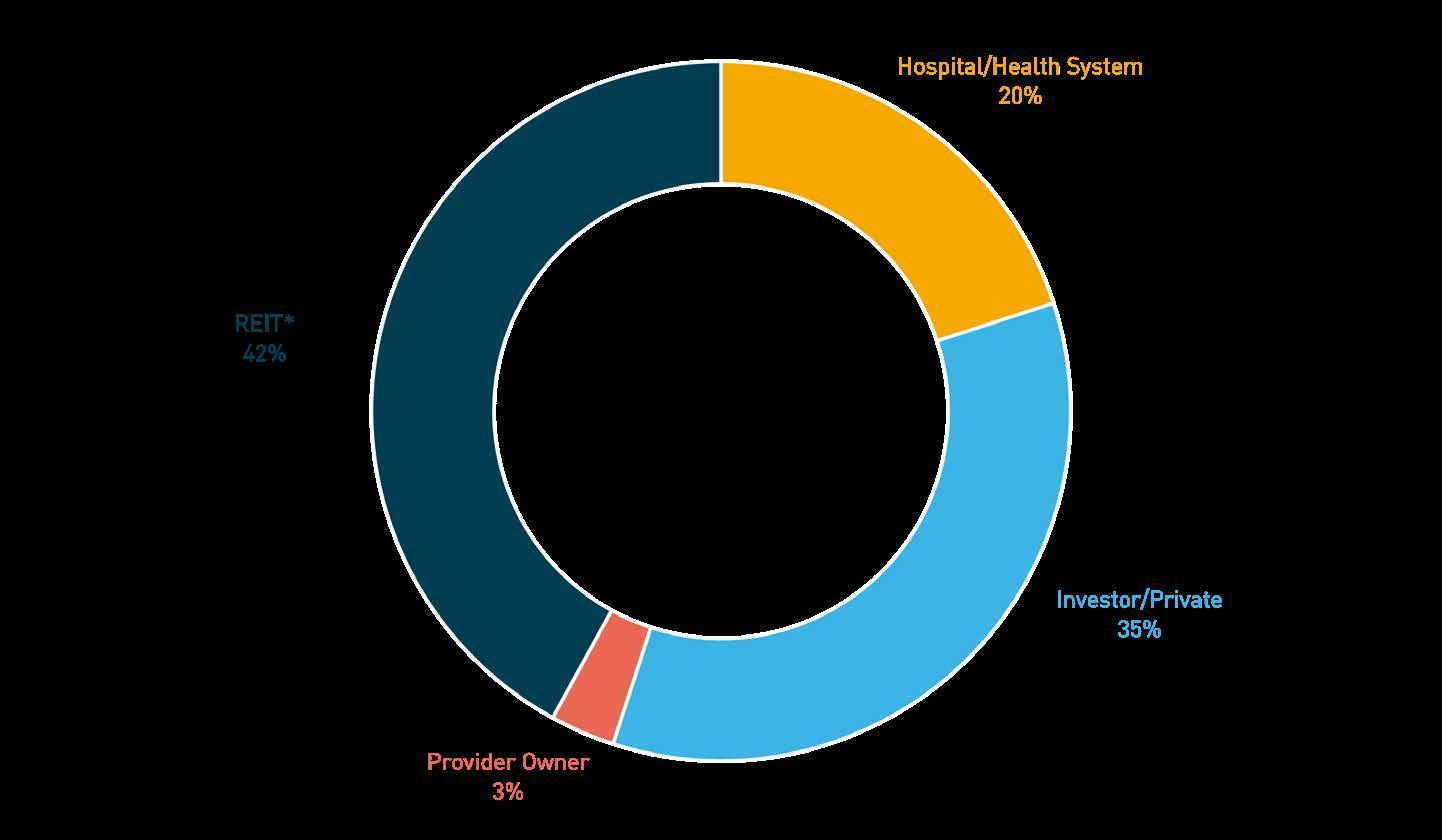

• REITS CONSTITUTED MOST OF THE TRANSACTION ACTIVITY OVER THE FOUR QUARTERS THAT LED TO Q2 2024, AND BUYERS TARGETED

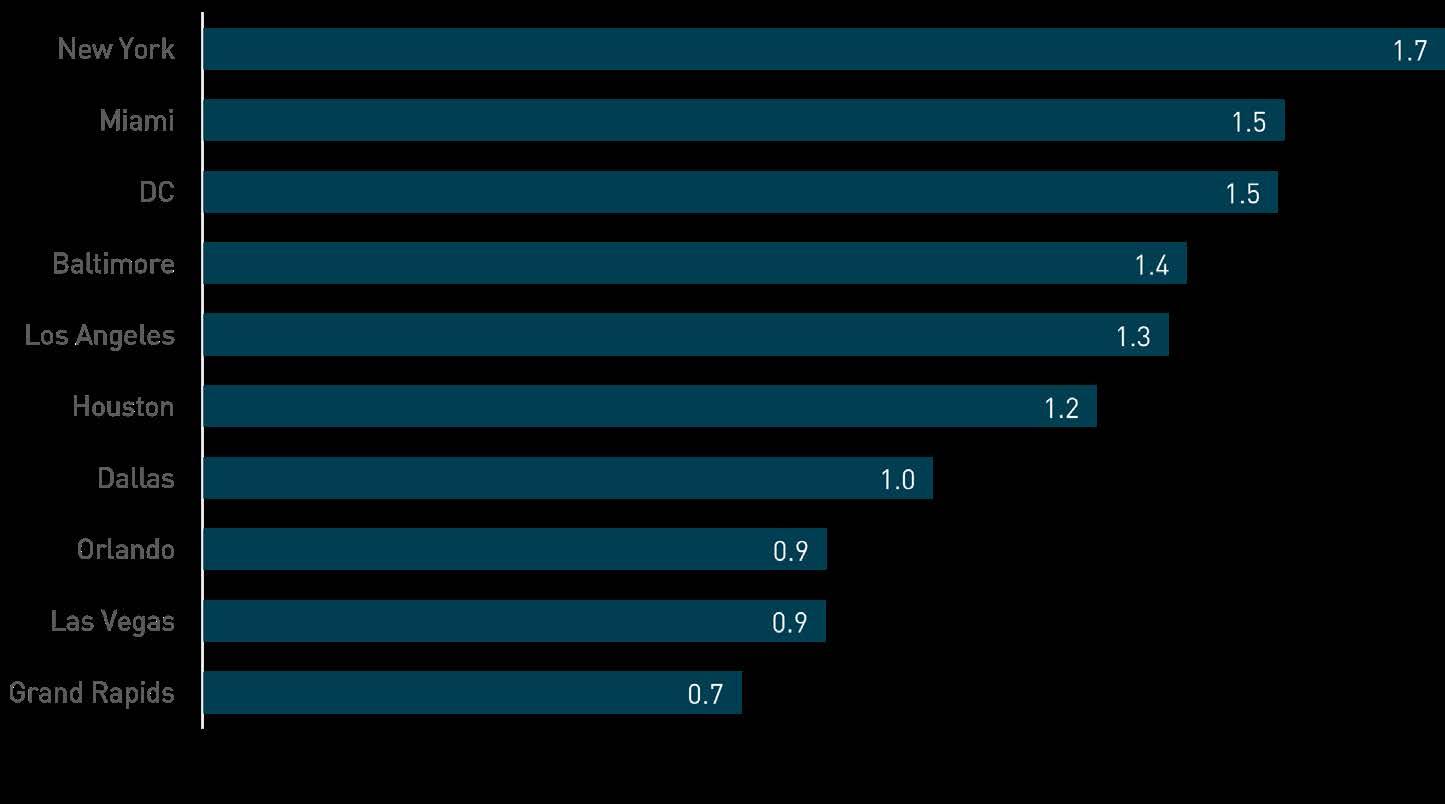

SMALLER OPPORTUNITIES IN ESTABLISHED MARKETS

• HOSPITAL SALES VOLUME REBOUNDED FROM 2023 IN LARGE

PART DUE TO TENET HEALTHCARE’S SIX-HOSPITAL PORTFOLIO SALE IN CALIFORNIA

As of 08/06/2024

As of 08/06/2024 CURRENT SOFR 5.3%

As of 08/06/2024

CURRENT 5Y TREASURY 3.7%

As of 08/06/2024

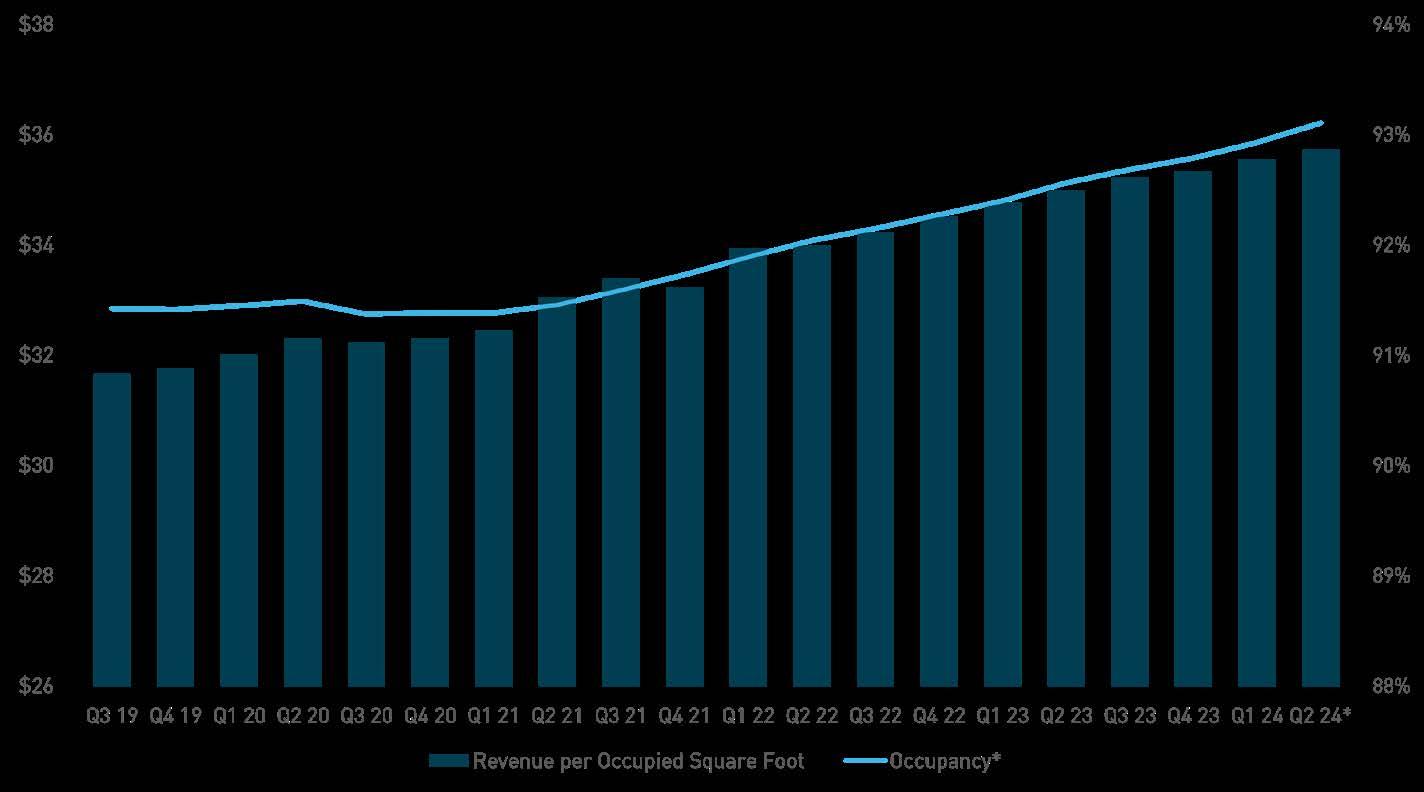

The average occupancy rate for MOBs in the top 100 markets rose 59 basis points annually as trailing 12-month completions were largely absorbed in the second quarter of 2024. Furthermore, the rate increase from the preceding quarter is expected to continue to rise over the next 24 months as construction starts to ween off. The average retention rate increased 63 basis points annually to 84.1% during the same period. Additionally, the revenue per occupied square foot is projected to rise to $35.74 based on the prior period’s trailing 12-month average growth rate of 2.2%.

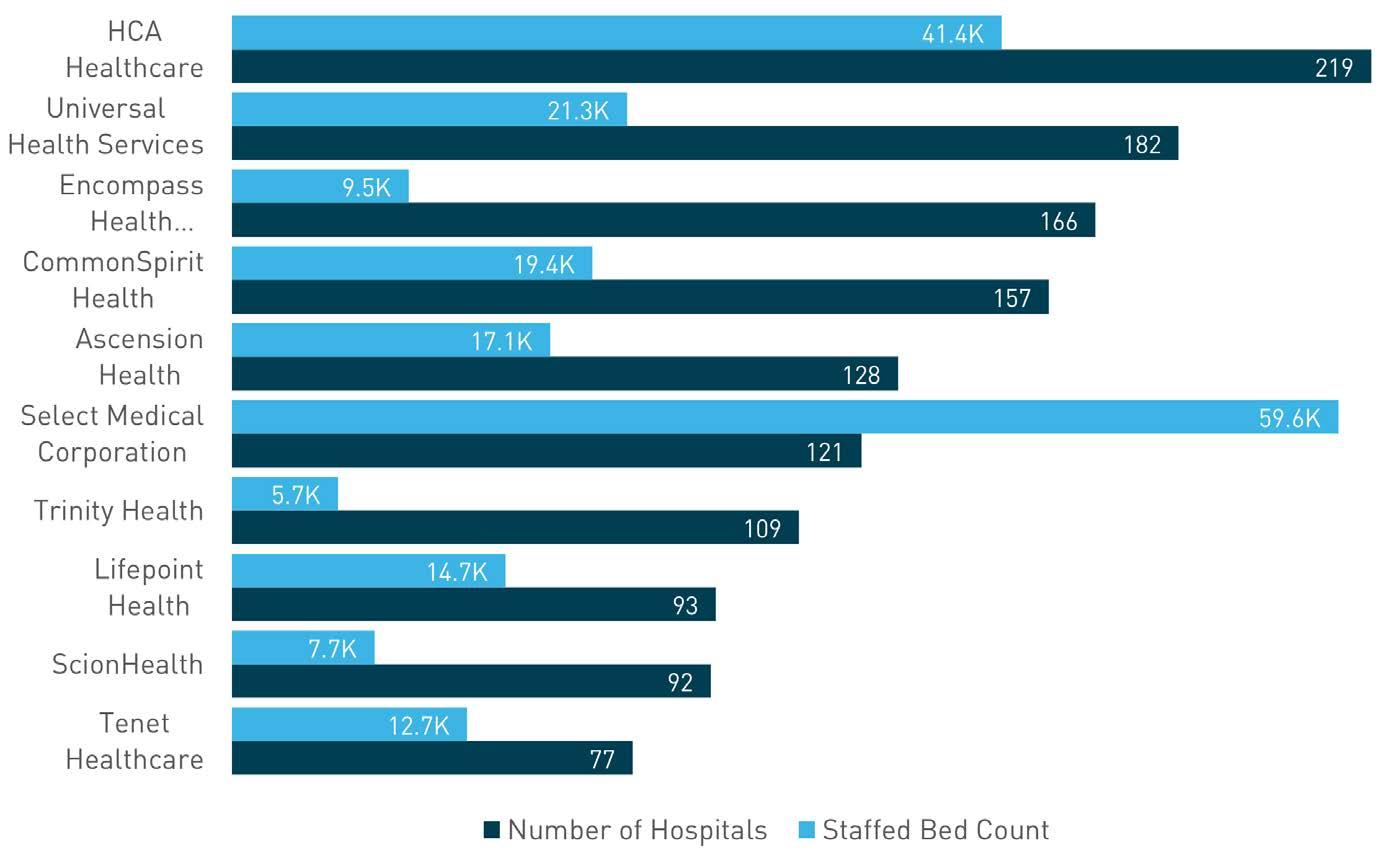

During fiscal year 2023, the 10 largest health systems (by number of hospitals) performed better than the national benchmarks for net operating profit margin and net income margins. Half of the largest systems had positive net operating profit margins during fiscal year (FY) 2023; however, at an average of 3.2%, it is 40 basis points lower than FY 2022, and 270 basis points lower than the average from the past five years. Furthermore, the average net operating margin for all systems nationwide was -3.3%, which may indicate that many hospitals in the U.S. are still re-balancing budgets, staff levels, and wages from the pandemic. The only system that consistently improved net operating profit margins over the past 10 years was the largest system, HCA Healthcare. The average net income margin for the top health systems remained at 6.1% during FY 2023, compared to the national net income average for all health systems at 2.9%.

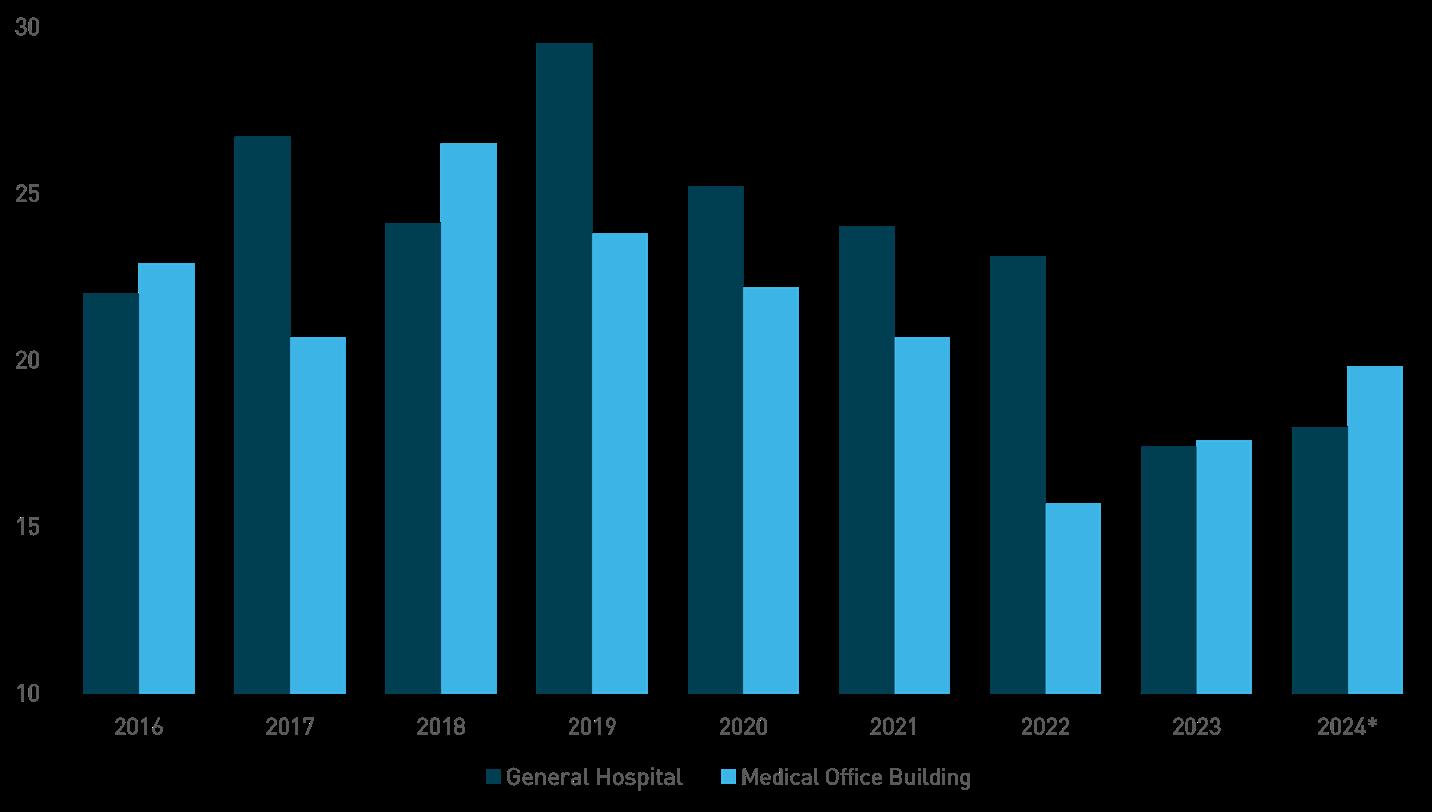

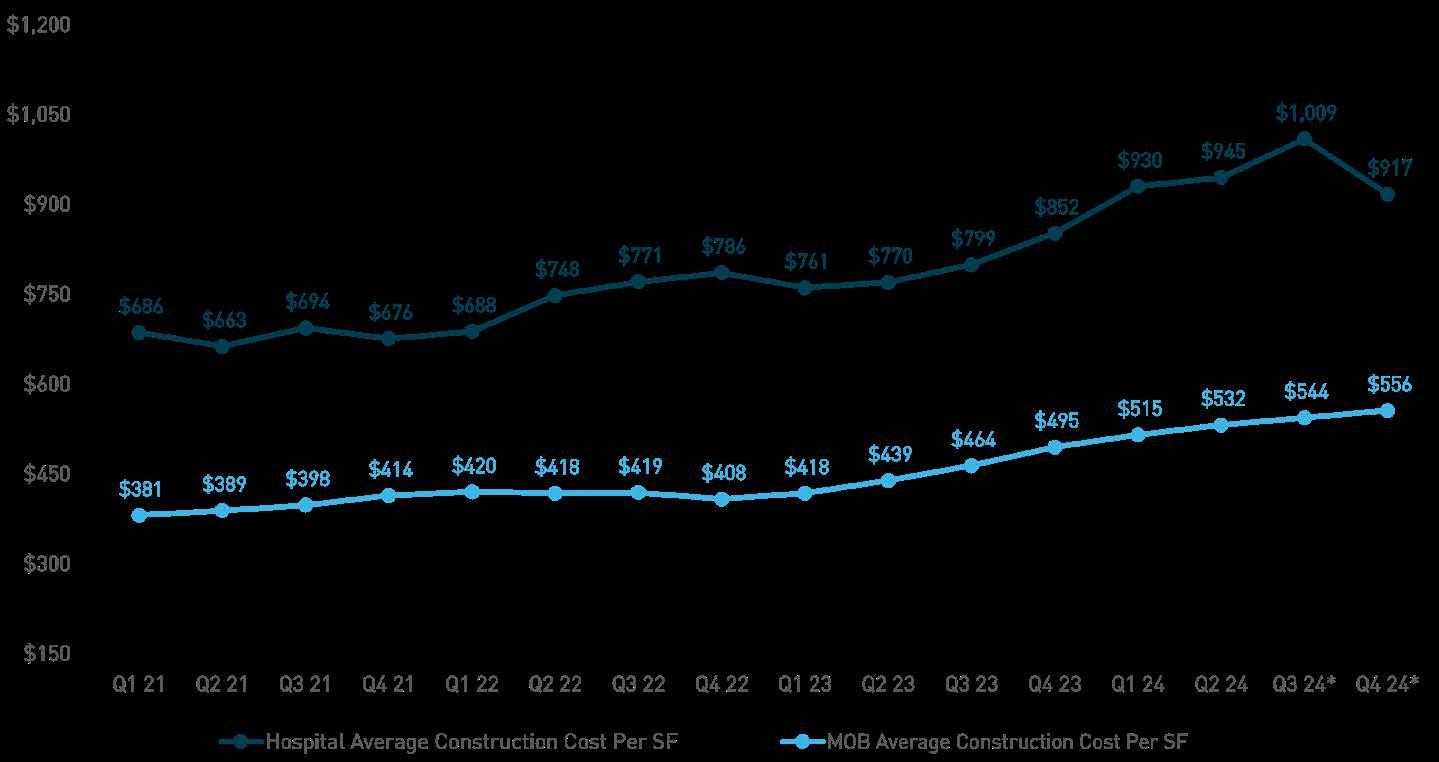

While the fundamental demand for medical services continues to put pressure on healthcare providers, high construction costs and interest rates continued to moderate the development of new hospitals and medical outpatient buildings. The volume of new supply delivered on a trailing 12-month basis was higher than one year ago, while total starts dropped 57.2% for MOBs and 4.0% for hospitals, annually. The majority of emerging supply consists of new buildings that require more time to complete. This diminished new supply will boost occupancy rates and further the current demand imbalance while supporting high rents.

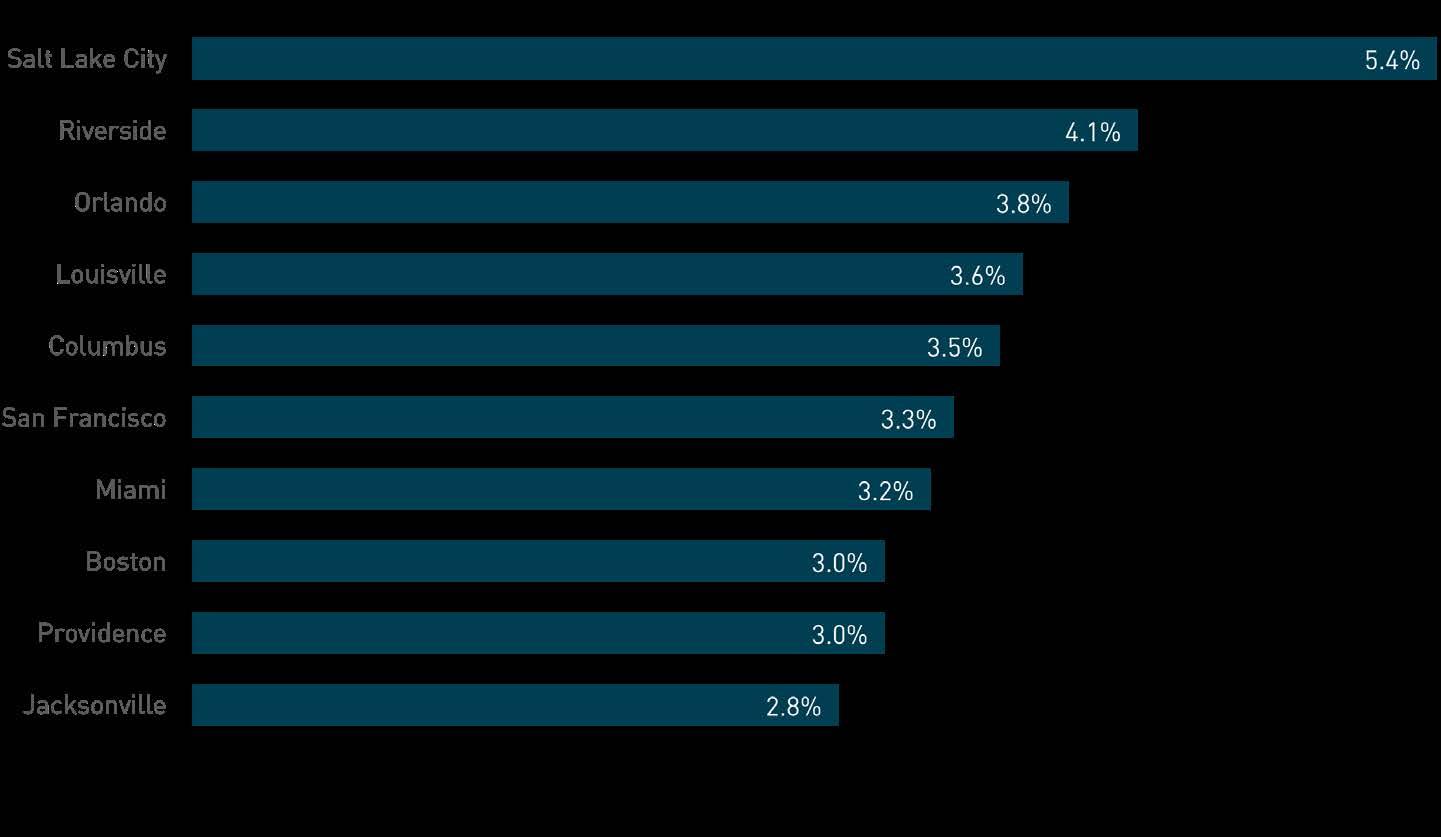

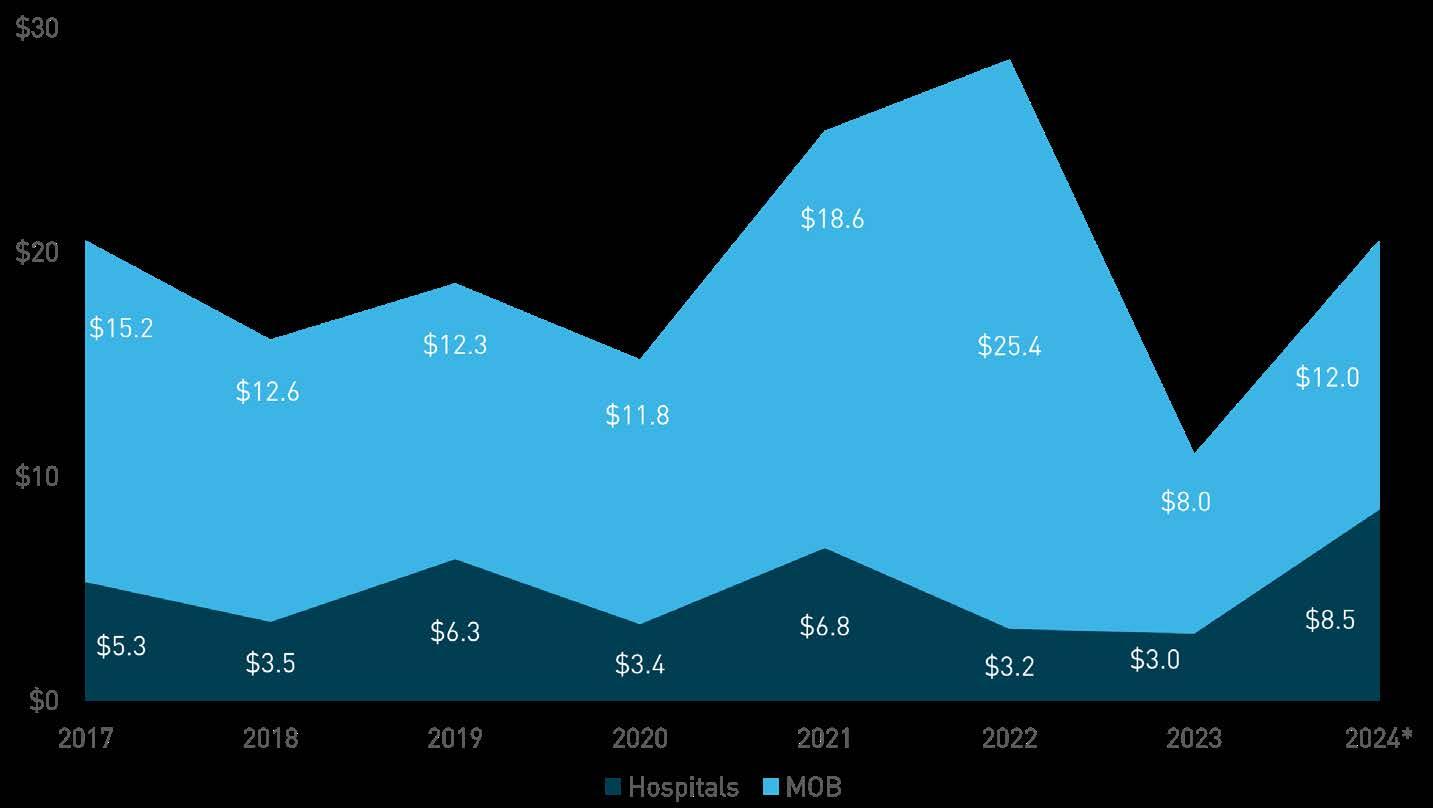

The 12-month transaction volume returned closer to the pre-pandemic average in the second quarter of 2024, with just over $20.5 billion in medical outpatient buildings and hospitals trading hands. The largest headwind for investors continues to be high interest rates and the uncertainty of when they may drop, as securing capital remained difficult through mid-year. Buyers preferred established markets and buildings with a diverse tenant mix were valued higher. Cap rates have also grown in the wake of less competitive pricing.

Life sciences building inventory increased to 379 million square feet in the first quarter. Though new supply continued to outpace demand, net absorption continued to incline from the low in the third quarter of 2023. With construction starts receding, occupancy levels should begin to rise assuming the upward trajectory of demand persists.

Life sciences transaction volume remained suppressed in the first quarter at $5.1 billion. Private firms and investors acquired the most square footage.

Venture capital investors in the life sciences sector took a flight to quality approach, preferring late-stage deals to all others. For example, biotechnology lenders sought out companies that are further along in clinical trials, as it is expensive to get them off the ground in initial phases. Meanwhile, medical technology investors, such as hospitals, are still re-staffing from the pandemic and reconfiguring profit margins to afford new advancements.

During 2023, the National Institute of Health (NIH) increased funding for Research Centers 1.1% annually but decreased the amount of biotechnology funding 11.0% so that biotechnology comprised 1.1% of total Research Center funding. Research Center funding is the budget mechanism term that covers five sub mechanisms: Specialized / Comprehensive Centers, Clinical Research, Biotechnology, Comparative Medicine, and Research Centers in Minority Institutions. The Biotechnology sub mechanism includes grants that “support biotechnology resources without regard to the scientific disciplines or disease orientations of their research activities or specifically directed to a categorical program area.”

The $1.7 trillion Consolidated Appropriations Act for the 2024 fiscal year includes provisions related to healthcare. Division FF of the Act:

• Reduced the pay-as-you-go (PAYGO) cut by 2.5% through 2023 and by 1.25% in 2024

• Extended public health emergency (PHE) flexibilities for telehealth / hospital at home through December 2024

• Phasing out of state-required Medicaid coverage and funding bumps

• Eliminated Medicaid disproportionate share hospital (DHS) cuts for FY 2024 and delayed FY 2025 DSH cuts

• Allocated $4.27 billion to support community health centers

• Established billions of dollars to address mental and behavioral health issues along with substance abuse

In August 2022, the U.S. Departments of Health and Human Services, Labor, and the Treasury released the final rules for the No Surprises Act. The act requires private health plans to cover out-of-network claims and apply in-network cost sharing, and prohibits doctors, hospitals, and other covered

providers from billing patients more than innetwork cost sharing amounts.

As of this year, 38 states and Washington, D.C., operate certificate of need (CON) programs. These regulations are required for approving major capital expenditures and projects for certain health care facilities. Arizona, Minnesota, and Wisconsin do not officially operate a CON program, but these states have approval processes similar to CON. Thus far in 2024, Georgia and Tennessee have modified their CON laws. Georgia’s (HB) 13391 modified two major exemptions for single specialty and joint venture ambulatory surgical centers (ASCs), among other items. Key changes in Tennessee’s HB 22692 removed the need for CONs to establish satellite emergency departments with restrictions and removed the CON requirement for ASCs so long as they participate in TennCare and charity care.

1.

with no more than two operating rooms. Additionally, definitions of single-specialty and joint-venture ASCs have been revised. Single specialty and joint venture ASCs allow physicians who aren’t members of the practice that owns or partially owns a facility to perform surgeries if they are of the same specialty of the owner or joint owner.

2. HB 2269: Starting in July 2025, hospitals will not need to obtain a certificate to establish a satellite emergency department as long as it is within 10 miles of the main hospital campus and 10 miles from any other actively licensed acute care hospital. Another key change is that Tennessee removed the requirement for ambulatory surgery centers (ASC) to obtain a CON, but a new licensing requirement was added. Starting in December 2027, ASCs need to participate in the TennCare medical assistance program and provide care to patients the same as hospital-based ASCs would. Additionally, ASCs must also provide a comparable amount of charity care to hospital-based ASCs.

State Legislation Year

Arizona HB 2609 2022

Connecticut

HB 5001

HB 5506

SB 9 2022 2022 2023

Georgia HB 1339 2024

Iowa SF 75 2023

Kentucky

Louisiana

HB 777 2022

SB 30 2022

Main HB 168 2023

Maryland HB 972 2022

Michigan SB 183 2022

Mississippi SB 2820 2022

New York SB 7885 2022

North Carolina

HB 259

HB76

SB 115 2023 2023 2023

Ohio HB 371 2022

Oklahoma HB 3867 2022

South Carolina B 164 2023

Tennessee

Vermont

Virginia

SB 267

HB 2269 2023 2024

HB 654

S 89 2022 2023

SB 130 SB 1452 2022 2023

Washington SB 5569 2023

Washington, D.C. B 889 2022

West Virginia SB 613 2023

Source: National Conference of State Legislatures

U.S. CON LEGISLATION BY STATE

CON Enacted

Modification of CON

No CON

Source: National Conference of State Legislatures, Berkadia Research