AFFORDABLE HOUSING

THE VALUE OF COMMUNITY

As the call for affordable housing increases, so does the complexity and competition across the market.

Berkadia Affordable Housing brings a balance of drive, versatility and focus that comes only from deep experience in local, state and federal regulatory and financing environments.

Partnering with Berkadia Affordable Housing comes with our promise to provide clear and steady guidance from start to finish. Whether you’re looking to preserve and enhance existing affordable homes or create beautiful new properties, we look forward to partnering with you on this vital mission.

There’s no greater need in the marketplace, and no more important mission for our partners, than strengthening communities by creating affordable housing opportunities for families across the nation."

DAVID LEOPOLD SVP - Head of Affordable Housing Berkadia

IT'S IN OUR DNA.

Our mission is inspired by our two shareholders who created Berkadia— Berkshire Hathaway and Jefferies Financial Group. Both firms are renowned for their capital strength, sophisticated investment strategies and exacting attention to their clients’ diverse needs.

We’re honored to infuse our Berkadia values into everything we do. When you work with us, you’re more than a client, and more than a partner. You’re a member of our family.

Mortgage Banking

Your projects, of any size and location, benefit from best‑in‑class financing partners and unparalleled access to capital.

Servicing

Get customized solutions and seamless service with our established resources and proven expertise.

Investment Sales

When you equip the right professionals with industry leading insights and tools, the result is better investment outcomes.

Technology

Advanced decision‑making with actionable insights backed by our powerful data.

SUCCESS IS NOT PURELY MEASURED BY NUMBERS.

But, they help tell our story:

#1

GSE Affordable Housing Lender by Volume in 2024.*

$1.6 billion

Investment Sales and Advisory Services in 2023 and 2024. 2024 Rankings

Freddie Mac

#1 Low-Income Housing Lender

#1 Very Low-Income Housing Lender

$5.7 billion

Affordable housing loans financed in 2023 and 2024.

$671 million

LIHTC equity placed in 2023 and 2024.

#1 Targeted Affordable Housing Lender

Growing The Future Of Financing

• Provides tax credit equity solutions for for profit and non profit developers

• LIHTC equity

• Proprietary and multi fund investment structures

• Fund and asset management services

$2.4 billion Equity syndicated Tax Credit Syndication

14,160 Affordable housing units

41 Funds

132 Transactions

Traditions at Bloomington

Bloomington, Illinois

$39 million

• Garden style property consists of one bedroom floor plans

• Amenities include a fitness center, business center, conference room, two pools, community playgrounds and an outdoor grilling area

396 Units 2004 Built

MORTGAGE BANKING

Sunset Ridge Apartments

Lancaster, California

$108.8 million

• 15 year, fixed rate Freddie Mac acquisition loan, with eight years interest only through the Targeted Affordable Housing program

• Uniquely positioned to satisfy demand for affordable and market rate housing

• Qualified for tax credits in a market with strong demand drivers, creating a compelling investment opportunity

800 Units 1986 Built

INVESTMENT SALES

Park Western Estates

Los Angeles, California

$62.9 million

• 2.72% cap rate on annualized in place operations

• Partial project based HAP contract subsidizing 104 units (48%)

• 112 units were subject to LA City Rent Stabilization Ordinance (RSO)

216 Units 1969 Built

MORTGAGE BANKING

Goodlette Arms

Naples, Florida

$64 million

• Affordable community serving seniors and people with disabilities

• The asset’s affordability will be preserved for at least 40 more years, due to the new financing structure

• The debt includes tax exempt bonds purchased by Berkadia and backed by Freddie Mac, as well as low income housing tax credits

250 Units 1970 Built

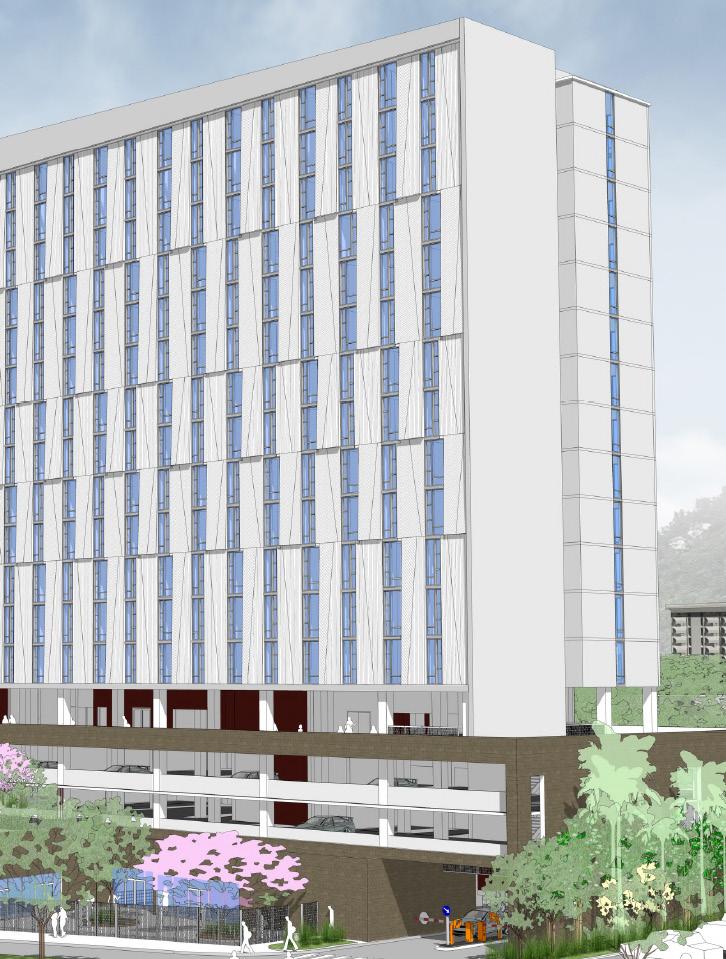

HŌM Flats at 28 West – Phase 2

Wyoming, Michigan

$6 million

• Under construction

• Mixed income, 132 units of high quality, affordable workforce housing and 28 units of market rate housing

• Financing for 28 West includes equity generated from the syndication of 4 percent Federal Low Income Housing Tax Credits

160 Units

TAX CREDIT SYNDICATION

Halewai’olu Senior Residences

Honolulu, Hawaii

$45 million

• 156 units for seniors age 62+ earning between 30% 80% AMI

• Halewai’olu Senior Residences is being developed by The Michaels Organization Financed by a construction loan, a RHRF loan, a Freddie Mac TEL perm loan, as well as 4% LIHTC credits and Hawaii State Tax Credits

156 Units

CLOSING IS JUST THE END OF THE BEGINNING.

We’re in this for the long haul. To us, every deal is the start of a new relationship or the continuation of one built on performance and trust.

Our clients are family, and we’re relentlessly focused on your long term success.

Affordable Housing Offices

Atlanta

3550 Lenox Road

Suite 2600

Atlanta, GA 30326

Boise

6255 N.Meeker Place Suite 210 Boise, ID 83713

Brentwood

5115 Maryland Way Office 210 & 211

Brentwood, TN 37027

Columbus

6555 Longshore Street Suite 280 Dublin, OH 43017

Detroit

28411 Northwestern Highway Suite 300

Southfield, MI 48034

New Orleans

One Galleria Blvd

Suite 1900, Office 1921 & 1920

Metairie, LA 70001

Portland

760 Southwest 9th Avenue

Suite 2380

Portland, OR 97205

OFFICES

Austin

2500

Building 3, Suite 550 Austin, TX 78746

Boston

10 Milk Street Suite 720

Boston, MA 02108

Charlotte

6000 Fairview Road

Suite 1200

Charlotte, NC 28210

Dallas

5960 Berkshire Lane Suite 1000 Dallas, TX 7522

Irvine

2020 Main Street Suite 200 Irvine, CA 9261

New York

521 Fifth Avenue

16th Floor

New York, NY 10175

San Francisco

1 Post Street

Suite 1000

San Francisco, CA 94104

Boca Raton

5100 Town Center Circle Suite 550

Boca Raton, FL 33486

Bozeman

895 Technology Blvd Suite 102

Bozeman, MT 59718

Chicago

125 South Wacker Drive

Suite 400

Chicago, IL 60606

DC Metro 4445 Willard Avenue

Suite 1200

Chevy Chase, MD 20815

Los Angeles

11111 Santa Monica Boulevard

Suite 400

Los Angeles, CA 90025

Philadelphia

Two Liberty Place, 50 S 16th St

Suite 2825

Philadelphia, PA 19102

Seattle

601 Union Street

Suite 3909

Seattle, WA 98101

David Leopold

EVP Head of Affordable Housing 301.202.3547 david.leopold@berkadia.com

Investment Sales

Brandon Grisham

Senior Managing Director 253.653.3313 brandon.grisham@berkadia.com

Mike Canori

Senior Managing Director 949.622.9215 mike.canori@berkadia.com

Jordan Baird Director 208.296.2073 jordan.baird@berkadia.com

Tax Credit Syndication

Chris McGraw

SVP Head of Acquisitions 980.208.1667 chris.mcgraw@berkadia.com

Andrew Anania

Managing Director 215.328.3817 andrew.anania@berkadia.com

Justin Sigmon

Senior Director 980.392.9447 justin.sigmon@berkadia.com

Jordan Skyles

Senior Director 208.631.4981 jordan.skyles@berkadia.com

Mike Terry Associate 425.761.1640 mike.terry@berkadia.com

Adam Tomberg

Senior Director 206.521.7218 adam.tomberg@berkadia.com

Marge Novak

SVP Capital Markets 248.208.0526 marge.novak@berkadia.com

Susan Moro

Managing Director 914.500.9387 susan.moro@berkadia.com

James Grande

Associate Director Acquisitions 215.328.3826 james.grande@berkadia.com

Zenzi Reeves

SVP Asset Management 267.760.3691 zenzi.reeves@berkadia.com

Melissa Smith

Managing Director 781.990.0157 melissa.smith@berkadia.com

Mortgage Banking

Liz Diamond

SVP, Head of Affordable Originations 415.646.7704 liz.diamond@berkadia.com

Jay Abeywardena

Managing Director 310.209.3244 jay.abeywardena@berkadia.com

Lloyd Griffin

Managing Director 512.226.8710 lloyd.griffin@berkadia.com

Franklin Brown

Senior Director 615.377.7676 franklin.brown@berkadia.com

Joseph Mandeville

Associate Director 614.468.5785 joseph.mandeville@berkadia.com

Matt Byrd

VP – Product Originations 972.801.3060 matt.byrd@berkadia.com

Tim Leonhard

Senior Managing Director 214.360.3849 tim.leonhard@berkadia.com

Matthew Baptiste

Managing Director

404.654.2608 matthew.baptiste@berkadia.com

Jeff Lawrence

Managing Director 404.201.0693 jeff.lawrence@berkadia.com

Melissa Koppel

Senior Director

423.863.1957 melissa.koppel@berkadia.com

Emily Pope

Associate Director 413.522.8530 emily.pope@berkadia.com

Anne Stephenson

VP – Originations

978.810.1060 anne.stephenson@berkadia.com

Matthew Napoleon

Senior Managing Director 614.468.5805 matthew.napoleon@berkadia.com

Chris Crump

Managing Director 504.322.1196 chris.crump@berkadia.com

Heather Olson Managing Director 770.286.6446 heather.olson@berkadia.com

Jerry Getant

Associate Director 617.470.7388 jerry.getant@berkadia.com

Jeff Radcliffe

SVP Chief Underwriter 214.960.9860 jeff.radcliffe@berkadia.com