BTCHITSNEWATHASOCTOBER STARTSSTRONGLY

MARKETSIGNALS

BitcoinSurgestoATHs

MACROUPDATE

JobsSlow,GovernmentShuts Down:MountingStrainsontheUS Economy

BitcoinSurgestoATHs

JobsSlow,GovernmentShuts Down:MountingStrainsontheUS Economy

Bitcoin successfully defended the lower end of the July air gap near $107,500, repeatedly rebounding from this support as selling pressure eased in line with expectations. This resilienceculminatedinafreshall-timehighonBitfinexat$125,710,a17.08percentrecovery from Septemberʼs correction lows. The broader market also opened October on a strong footing.

Seasonalitynowsupportsa bullishoutlookforBTC.Historically,October,knowncolloquially as “Uptoberˮ,hasdeliveredpositivereturnsinnineofthepastelevenyears,averaginggains of roughly 21 percent. Q4 has also consistently been Bitcoinʼs strongest quarter, with averagereturnsofnearly80percent.

A major factor behind Bitcoinʼs rebound has been a sharp reduction in sell pressure. The late-summer correction was primarily driven by Short-Term Holder capitulation and heavy whaledistribution,coincidingwithprofit-takingaftertheFedʼsfirstratecut.Withleveraged positions flushed and the $110,000$112,000 zone reclaimed, fresh demand has absorbed supply,reignitingmomentum.Macrotailwindshavestrengthenedinparallel.USspotBitcoin ETFshavereversedoutflows,recordingover$647millioninaveragedailyinflowslastweek, while whale distribution has slowed materially. The setup remains favourable: a dovish FederalReserve,easinginflation,renewedETFinflows,andstableon-chainsupportsuggest thecorrectivephaseislikelybehindus.

The US economy is showing renewed strain as labour market data signals slowing momentum and rising uncertainty. Augustʼs JOLTS report showedjobopeningsholdingsteadyat 7.2 million but hiring falling sharply, while the quits rate declined for a third straight month, reflecting weaker workerconfidence.

ADPʼs September data confirmed job losses across small and mid-sized firms, pointing to fragility despite the Federal Reserveʼs rate cut in mid-September. That weakness has been compounded by the government shutdown that began on October 1st, threatening to push unemployment higher and weigh on consumer sentiment, which was already sliding by late September.

Global momentum toward digital asset integration accelerated this week. The European CentralBankfinalisedagreementswithseveraltechfirmstodevelopcoreinfrastructurefora potential digital euro, though progress remains subject to EU legislation. In the US, CME Group announced plans to introduce 24/7 crypto futures and options trading by early 2026, aligning traditional markets with the nonstop nature of crypto and eliminating the long-standing “CME gapˮ, that has been created as a result of no weekend trading. Meanwhile,theSECsawasurgeofovertwodozennewcryptoETFfilingsfromissuerslike REXShares,OspreyFunds,andDefianceETFs,takingadvantageofnewlistingstandardsthat streamline approvals. However, the US government shutdown has temporarily stalled progress, delaying potential launches. Together, these moves underscore rapid institutional expansionintodigitalassetsamidongoingregulatoryuncertainty.

● USLabourMarketStagnatesasHiring Slows ● GovernmentShutdownDeepens EconomicUncertainty ● ECBSelectsTechProviderstoBuildCore InfrastructureforPotentialDigitalEuro

CMEGroupExpandsto24/7Tradingin CryptocurrencyFuturesandOptions

BitcoinsuccessfullydefendedthelowerendoftheJulyairgapnear$107,500, andafterrepeatedlyholdingtherecentlowsassellingpressuresubsided,hit twonewalltimehighsovertheweekend,peakingat$125,710onBitfinexon5 October. This was a 17.08 percent recovery from the September correction lows.

The broader market has also now begun October on a positive footing, recapturing much of its earlier lost ground. The rebound coincides with BTC reclaiming a key on-chain support and resistance level, the short-term holder STH) cost basis, which is currently positioned at $113,040. Short-term holders representnewBitcoinholderswhohavebeenholdingforaperiodof155daysor less, and the metric changes dynamically as coins are moved on-chain. The typicalrelationbetweenpriceandtheSTHRealisedPriceRP)isthatnewholders tendtokeepincreasingtheiraveragecostbasisbybuyingonthewayup(which includes and is now dominated by ETF buying), but stop when the BTC price tradesundertheSTHRP.

Sustainingthislevelreinforcesthestructuralstrengthoftherally,suggestingthat dip absorption and renewed demand are providing the foundation for continued upside as October and Q4 begins - typically the most bullish quarter for crypto fromaseasonalityperspective.

Owingtoitsstrongcorrelationwithtraditionalfinance,thebroaderliquiditycycle, andoptionsmarketseasonality,thecryptocurrencymarkethashistoricallytended torallyinOctoberfollowingweakSeptembers.

This pattern, often dubbed “Uptober,ˮ stems from consistent seasonal trends. Since 2013, BTC has posted positive October returns in nine of the past eleven years,withanaveragegainofapproximately20.74percent,thesecond-highest of any month. October also boasts Bitcoinʼs highest median return at 14.71 percent, supporting our view over the past several weeks that the corrective phase would give way to a renewed Q4 rally and a move toward new all-time highs.

From a seasonality perspective, Q4 is historically the most bullish quarter for Bitcoin,withaveragereturnsof79.3percent.Thisstrengthtypicallyspillsoverto the broader market, though altcoins often exhibit shorter life cycles, making long-termcomparisonslessconsistent.Amongmajorassets,Etherhasdelivered an average Q4 gain of 22.29 percent since 2016. Together, these trends reinforce the structural tailwinds supporting a stronger close to the year, as cyclicalliquidity,institutionalinflows,andhistoricalseasonalityconverge.

AlargepartofBitcoinʼsexplosivereboundhasbeendrivenbytheabatement ofsellpressureandthereturnofinstitutionaldemand.Asdiscussedinearlier editions of Bitfinex Alpha, as short-term holders STHs found themselves underwater,combinedwithaclassic“sell-the-newsˮreactiontolastmonthʼs rate cut, we saw a substantial market correction. This phase washed out leveragedpositionsandcoincidedwithheavydistributionfromlargerwhales, keeping BTC pinned under the $110,000$112,000 zone as fresh demand struggledtoabsorbtheselling.Oncepriceclearedthesetechnicallevels,the marketralliedswiftlytonewhighs.

Whileminorcorrectionsremainpossible,thebroadercontextcontinuestofavour a bullish fourth quarter. The return of institutional inflows, supportive macro tailwinds, and positive October seasonality all align with our thesis of renewed upsidemomentum.

However,sustainingourmovebeyondthecurrentATHwillrequireovercominga significant technical and behavioural barrier. As seen in the figure 4 above, we movedpastadensesupplyclusterbuiltinlateAugustatthe$114,000$118,000 range. Many holders who accumulated near these levels are likely to view the rallyasanopportunitytoexit,creatingnotableoverheadresistance.Thisusually happens if price revisits these levels. A fall to the aforementioned area would determine whether we sustain and flip the zone below $118,000 as support to movehigherimmediately,ornot.

Stability above $118,000 would confirm that buy-side demand is successfully absorbingdistributionfrompriortopsellers,astructuralshiftthatwouldreinforce themarketʼsfoundationandstrengthenthecaseforcontinuedupsidethroughQ4.

Currently, we see a unique confluence of tailwinds in October: The Federal Reserve has formally pivoted toward an easing stance, US spot ETFs are consistently absorbing supply with daily inflows averaging more than $647.2 millionoverthepastweek(seeFigure5below)afterexperiencinglargeoutflows at the range lows, and BTC has held firm above key support at $110,000 despite record-sizedoptionsexpiries.

Adding to this backdrop, recent comments from former US President Donald Trump suggesting the possibility of stimulus cheques to citizens funded through tariff revenues could act as an additional liquidity catalyst. A similar dynamic played out following the COVID-era stimulus, which injected substantial liquidity intobothtraditionalanddigitalmarkets,contributingtoBitcoinʼsexplosiverallyat thetime.

There is an additional factor: which is the abatement of selling pressure from whales on-chain. Figure 6 below tracks the 30-day percentage change in the amount of BTC held by whales, providing a clear view of how large holders influence market direction. Negative readings indicate that whales are distributing coinsandthuscreatingsell-sidepressure.

As of September 2025, whale balances have declined noticeably. The red line on the chart highlights this downtrend, showing that whales have offloaded a significant volume of BTC over the past month. This sustained selling has exerted pressure on price; however, a key shift has begun to emerge, with the whales gradually slowing the pace of distribution, which has contributed to the price movinghigher.

In recent days, the narrowing purple band signals a recovery from negative territory, indicating that net selling is easing. After nearly a month of persistent distribution, this moderation in whale activity during early October suggests the potentialonsetofare-accumulationphase.Inshort,whalesappeartobereaching apointofsellingexhaustion,adevelopmentthatcouldlendsupporttoashort-term uptrend,providedthestabilisationinholdingscontinues.

Alongside these on-chain drivers, steady ETF inflows continue to provide a structural tailwind. Inflation data remains benign, while the Fedʼs dovish tilt has revived risk appetite across global markets. Market sentiment remains constructive without veering into excessive optimism. If ETF inflows persist and macro data remains stable, the path toward new all-time highs in Q4 appears increasingly well supported, with liquidity, policy, and structural demand all alignedinBitcoinʼsfavour.

The US labour market showed further signs of weakness in August, with modest gains in job openings offset by slower hiring and falling worker confidence. Data from the BureauofLaborStatisticsʼJobOpeningsandLaborTurnoverSurveyJOLTS,released lastTuesday,September30th,indicatedthatconditionsremainsubduedandvulnerable toshocks,evenastheFederalReserve movesforwardwithinterestratecutstosupport employment.

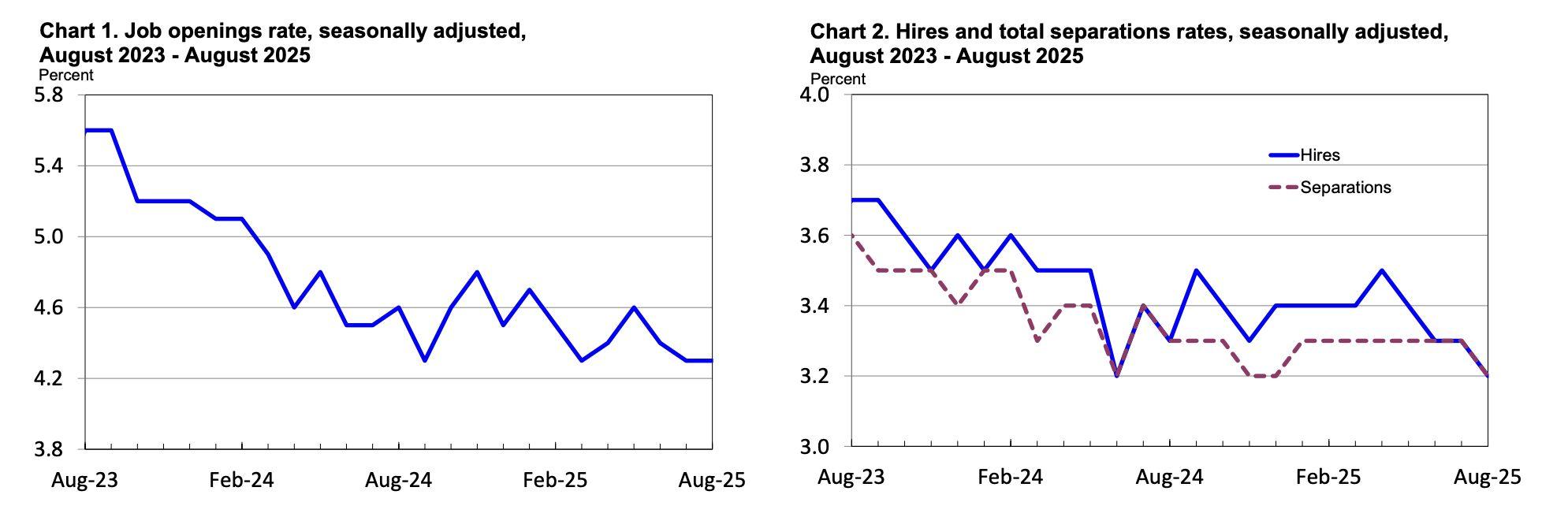

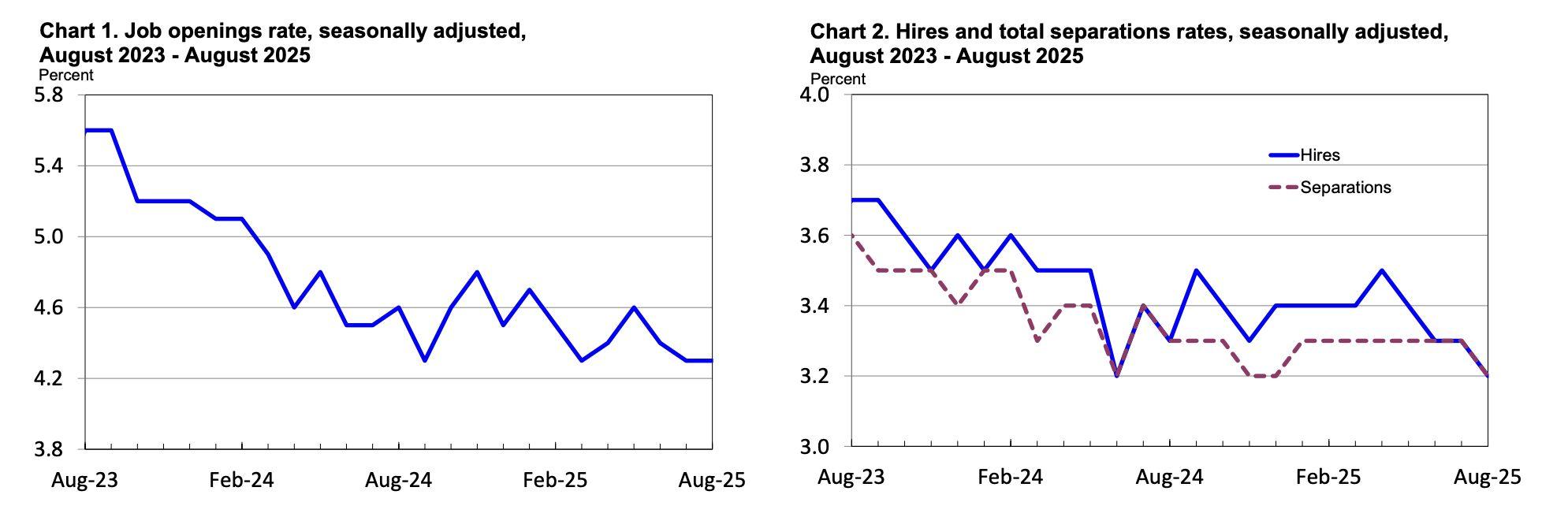

Figure7.JobOpeningsRateLeftandHires&SeparationsRight Source:BureauofLaborStatistics)

JobopeningsroseslightlyinAugustto7.23million,upfrom7.21millioninJuly,leaving nearlyonevacancyforeveryunemployedperson.Theincreasewasconcentratedinthe accommodation, food services, and retail sector, while construction and federal governmentvacanciesdeclined.Thejobopeningsrateheldsteadyat4.3percent.

Atthesametime,hiringfellsharply.Totalhiresdecreasedby114,000to5.12million,with losses concentrated in trade, transportation, and utilities, as well as in leisure and hospitality. Immigration enforcement actions have also reduced the available labour supplyinsomeserviceindustries.

Layoffsprovidedasmallbrightspot,slippingto1.72million,thelowestlevelsinceearly summer. Employers appear reluctant to lay off workers, but weak hiring means displacedworkersfacegreaterdifficultyfindingnewopportunities.

Meanwhile,resignationsfellforthethirdconsecutivemonth,withthequitsrateslipping to 1.9 percent. That suggests workers are less confident about finding new jobs and couldmeanslowerwagegrowthahead,adevelopmentthatwouldweighonconsumer spending.

The release of official September payroll figures was delayed due to the partial government shutdown, leaving private-sector data as a substitute measure of labour market health. ADPʼs National Employment Report, published last Wednesday, October 1st, showed US private-sector employment declined by 32,000 in September, with the losses concentrated among small and medium firms. Meanwhile, service sectors collectively lost 28,000 jobs and goods-producing industries fell by about 3,000. Education and health services bucked the trend, adding 33,000 positions, and large firmsadded33,000jobsoverall.

ADPalsoreviseddownitsAugustestimate,reflectinganetlossof3,000positions.The weaker figures, combined with ongoing policy uncertainty over trade, immigration, and fiscalnegotiations,highlightfragileconditionsforemployers.

The Fed, which cut its benchmark overnight rate by 25 basis points last month to a target range of 44.25 percent, is expected to weigh labour market weakness more heavilyinitsnextmeetingonOctober2829.Policymakersfaceaddedchallengesfrom theshutdown,whichmaydelaycriticaldatareleasesandcomplicatedecision-making.

The recent consumer spending and GDP reports remain relatively strong, but hiring stagnation raises questions about the durability of growth. Nonfarm payroll gains averagedjust29,000permonthinthethreemonthstoAugust,asharpslowdownfrom 82,000overthesameperiodlastyear.

While the worst of the labour market downturn earlier this year may have passed, conditions remain fragile. Excessive inventories of labour in some industries, coupled with demographic headwinds and immigration constraints, continue to cap hiring. Worker pessimism, as reflected in falling quits and consumer confidence, signals that householdsarebracingforleanertimes.

Unless new shocks emerge, easing monetary and fiscal policies could provide gradual support into 2026. But with businesses cautious and job seekers facing fewer opportunities, the labour market is likely to remain a drag on the economy in the near term.

The US economy faces renewed headwinds following the start of the government shutdownlastWednesday,October1st,2025,markingthe21stsuchepisodesince 1976 and the first in seven years. While short shutdowns often leave only muted effects,thelongertheimpasselasts,thegreaterthedragongrowth,confidence,and labourmarketstability.

AccordingtotheBureauofLaborStatisticsBLS,thereferenceperiodforitshousehold employment survey is generally the calendar week that includes the 12th day of the month. If the government shutdown continues through that mid-October reference week,hundredsofthousandsoffurloughedfederalemployeeswouldlikelybecounted asunemployed,potentiallypushingthenationaljoblessratetoaround4.8percent

The US Congressional Budget Office suggests that about 700,000 federal employees are directly affected by the current closure. Lost wages and productivity will ripple through local economies, resulting in reduced household spending. Meanwhile, unrecoverable consumption, such as cancelled healthcare appointments and missed servicescoveredunderMedicare,willincurintangiblecostsovertime.

Iftheadministrationfollowsthroughonthreatsofmassdismissalsbeyondfurloughs,it could significantly drag the GDP in the fourth quarter, especially as corporate investmentconfidenceerodes.

Beyond immediate growth effects, the repeated brinkmanship risks undermining confidence in the federal governmentʼs financial obligations, raising the spectre of futurecreditratingdowngradesandhigherriskpremiumsforUSdebt.

Evenbeforetheshutdown,householdsentimentwasonthedecline.TheUniversityof Michiganʼs consumer sentiment survey released on September 26th, and the Conference Boardʼs consumer confidence index published on September 30th both showed notable drops. Together, these point to a longer-term downtrend in how Americansviewtheeconomy.

Households are facing a challenging backdrop of reduced job opportunities and rising prices, leaving their disposable incomes under pressure. With the shutdown now in effect,theriskisthatconfidenceerodesfurther,potentiallycurbingconsumerspending, whichmakesuproughlytwo-thirdsofUSeconomicactivity.

Marketsofferedanearlyreadonhowinvestorsperceivetheshutdown.Equitiesshowed surprising resilience: the S&P 500 and Dow Jones Industrial Average closed at record highs on both October 1st and October 2nd, while the Nasdaq Composite also gained beforeeasingslightlyonOctober3rd.Overall,allthreeindicesstillpostedweeklygains, suggestingthatinvestorsexpectthedisruptiontobetemporary.

10.S&P500,DowJonesIndustrialAverage,NasdaqComposite ChartSource:TradingView)

In contrast, the Treasury market signalled caution. Yields on the 2-year note fell to the mid-3.5percentrangeandthe10-yearyieldhoveredaround4.1percentintheimmediate aftermath, reflecting safe-haven demand and expectations of further Federal Reserve rate cuts. By the end of the week, yields had inched slightly higher but remained below pre-shutdownlevels.

Bitcoin, meanwhile, surged, hitting new all time highs on October 5th, gaining nearly 5 percentinjustthreedays.InvestorsseekingalternativeassetsamidUSfiscaluncertainty andspeculationthataprolongedshutdowncouldencourageloosermonetarypolicy.

Theshort-termeconomicimpactofashutdownmayappearmodestifresolvedquickly, but the broader risks are mounting. With consumer sentiment already weakening and financialmarketsflashingmixedsignals,stocksrallying,bondyieldssliding,andcrypto climbing, the fiscal standoff adds uncertainty at a critical juncture, potentially complicating the Fedʼs late-October policy meeting as it weighs how much further to ease amid slowing hiring and fragile confidence. A protracted shutdown could erode confidence,raiseunemployment,andcomplicatepolicymakingfortheFed.Morethana temporary disruption, the episode underscores how political gridlock can translate into lastingrisksforgrowth,stability,andAmericaʼsfinancialcredibility.

LastWednesday,October2nd,theEuropeanCentralBankECB)announcedthat it has finalised agreements with several technology providers to develop key components for a potential digital euro, marking a significant step in the EuropeanUnionʼsongoingexplorationofacentralbankdigitalcurrencyCBDC.

According to the ECBʼs notice, the selected firms will deliver essential services such as fraud and risk management, app and software development, alias lookup, secure data exchange, and offline payments. Each category will have a primary provider and a secondary backup vendor to ensure continuity and redundancy.

AmongthechosencompaniesareFeedzaiandCapgeminiDeutschlandforfraud management, Almaviva and Fabrick for application development, Giesecke+Devrient for offline solutions, and EquensWorldline and Senacor FCS for secure information exchange. Additional providers, including Sapient GmbH andTremendSoftwareConsulting,wereassignedtomultipleserviceareas.The ECBnotedthatonemoreofflineserviceproviderwillbeannouncedlater.

The institution emphasised that no payments have been made yet, as these frameworkagreementsarepreparatoryandsubjecttofutureEUlegislation.Thefinal decision to issue a digital euro will only be made after the Digital Euro Regulation, which is still being debated, is officially adopted. The development of specific technicalcomponentswilldependonsubsequentapprovalfromtheECB'sGoverning Council.

ThemovesignalstheEUʼscommitmenttomodernisingitsfinancialinfrastructure,but reducing reliance on private stablecoins, and ensuring the euroʼs relevance in the digitaleconomy.However,evenwithprogressonthetechnicalfront,thelaunchofa digitaleuromaynothappenuntiltheendofthedecade.

The ECBʼs latest step echoes other regions where there is regulatory momentum toward state-backed digital currencies, and it could reshape the role of stablecoins and payment tokens in Europe. As the EU advances its digital euro framework, the competitionbetweendecentralisedcryptoassetsandregulatedCBDCsisexpectedto intensify.

Last Thursday, October 2nd, CME Group announced that beginning in early 2026, pendingregulatoryapproval,cryptocurrencyfuturesandoptionstradedontheplatform, will be available for round-the-clock trading, with only a brief maintenance pause each weekend.

ThemovemarksasignificantshiftfromCMEʼscurrentweekday-onlystructure,aligning itsregulatedderivativesmarketmorecloselywiththecontinuousnatureofglobalcrypto spot trading. According to CME, the change is driven by strong client demand for the ability to hedge and manage risk at any time, underscoring the growing integration of digitalassetsintoinstitutionalportfolios.

The announcement follows a record year for CMEʼs crypto suite, with open interest reaching a notional $39 billion in September 2025, and daily volumes surging over 200 percent year-on-year. This growth reflects the increasing participation of large institutional investors and reinforces CMEʼs position as a leading regulated venue for cryptoderivatives.

Byextendingtradingtoweekendsandholidays,CMEwillalsoaddressthelong-standing issue of “CME gapsˮ, price voids on Bitcoin and Ethereum charts caused by the platformʼs previous trading schedule. As continuous trading takes effect, these gaps, whichhaveinfluencedmarketstrategiesforyears,areexpectedtodisappear.Although transactions executed outside business days will still be recorded under the next business dayʼs date for clearing and reporting, the introduction of nonstop access representsamilestoneintheinstitutionalisationofdigitalassets.

This expansion presents both operational challenges and strategic advantages: it will requireenhancementstosettlementandcollateralsystems,yetitalsoprovidesinvestors with a regulated 24/7 alternative to unregulated crypto exchanges. In essence, CMEʼs transition bridges the structural divide between traditional finance and crypto-native markets, positioning the exchange as a key gateway for the next phase of institutional cryptoadoption.

At least two dozen new cryptocurrency-focused exchange-traded funds ETFs were submitted to the US Securities and Exchange Commission SEC) on Friday, signalling a surgeofactivityamongissuerseagerforregulatoryclearance.

REXSharesandOspreyFundsjointlyfiledprospectuseslastFriday,October3rd, for21 different ETFs, covering assets from SUI and Bitcoin Cash BCH) to HYPE and several productsthatincorporatestakingfeatures.DefianceETFsLLCalsolodgedfilingsonthe samedayforleveragedfundslinkednotonlytocryptocurrenciesbutalsotomajortech stockssuchasTeslaandAmazon.

TheSECcontinuestoreviewagrowinglistofapplicationsfordigitalassetETFs,including thosetiedtoDOGE,XRP,andLTC.Thewaveoffilingscomesamidaperceptionofamore open regulatory stance toward crypto markets since President Donald Trumpʼs administrationtookofficeinJanuary.

FridayʼsfilingsfollowedtheSECʼsrecentapprovaloflistingstandardsproposedbythree exchanges. These rule changes update the framework governing the trading and listing of commodity-based trust shares, an adjustment that effectively allows multiple crypto ETF applications to bypass the lengthy 19b-4 rule change process. This development significantlyshortensthetimelinefornewcryptoETFstopotentiallylaunch.However,the current momentum faces a new obstacle: the US government shutdown. With federal operationshaltedafterCongressfailedtoreachafundingagreementonWednesday,the SECisfunctioningwithlimitedcapacity.Theagencyisunlikelytotakesubstantiveaction onETFapprovalsorregistrationstatementsuntilnormaloperationsresume.

Several ETF proposals that were further along in the review process are now at risk of delay as their decision deadlines approach. Unless SEC Chairman Paul Atkins and division leaders instruct staff to prioritise certain short-term items, progress on crypto ETFapprovalsisexpectedtoremainonholduntilthegovernmentreopens.