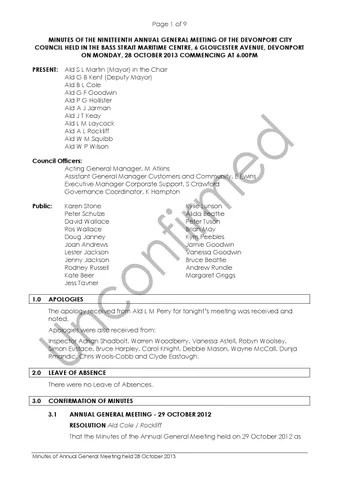

Page 1 of 9 MINUTES OF THE NINETEENTH ANNUAL GENERAL MEETING OF THE DEVONPORT CITY COUNCIL HELD IN THE BASS STRAIT MARITIME CENTRE, 6 GLOUCESTER AVENUE, DEVONPORT ON MONDAY, 28 OCTOBER 2013 COMMENCING AT 6.00PM PRESENT:

Ald S L Martin (Mayor) in the Chair Ald G B Kent (Deputy Mayor) Ald B L Cole Ald G F Goodwin Ald P G Hollister Ald A J Jarman Ald J T Keay Ald L M Laycock Ald A L Rockliff Ald W M Squibb Ald W P Wilson

Council Officers: Acting General Manager, M Atkins Assistant General Manager Customers and Community, E Ewins Executive Manager Corporate Support, S Crawford Governance Coordinator, K Hampton Public:

1.0

Karen Stone Peter Schulze David Wallace Ros Wallace Doug Janney Joan Andrews Lester Jackson Jenny Jackson Rodney Russell Kate Beer Jess Tavner

Kylie Lunson Alida Beattie Peter Tuson Brian May Kym Peebles Jamie Goodwin Vanessa Goodwin Bruce Beattie Andrew Rundle Margaret Griggs

APOLOGIES The apology received from Ald L M Perry for tonight’s meeting was received and noted. Apologies were also received from: Inspector Adrian Shadbolt, Warren Woodberry, Vanessa Astell, Robyn Woolsey, Simon Eustace, Bruce Harpley, Carol Knight, Debbie Mason, Wayne McCall, Dunja Rmandic, Chris Wools-Cobb and Clyde Eastaugh.

2.0

LEAVE OF ABSENCE There were no Leave of Absences.

3.0

CONFIRMATION OF MINUTES 3.1

ANNUAL GENERAL MEETING - 29 OCTOBER 2012 RESOLUTION Ald Cole / Rockliff That the Minutes of the Annual General Meeting held on 29 October 2012 as

Minutes of Annual General Meeting held 28 October 2013