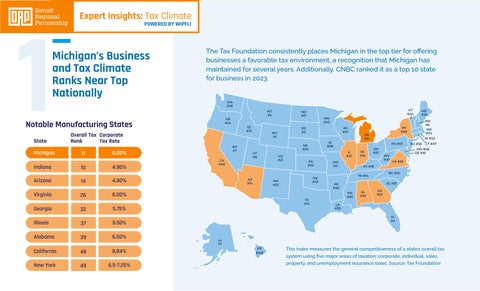

Michigan’s Business and Tax Climate Ranks Near Top

Notable Manufacturing States

The Tax Foundation consistently places Michigan in the top tier for offering businesses a favorable tax environment, a recognition that Michigan has maintained for several years. Additionally, CNBC ranked it as a top 10 state for business in 2023.

This index measures the general competitiveness of a state’s

system using five major areas of

and unemployment insurance

Source: Tax Foundation

Expert Insights: Tax Climate

Michigan’s Tax Advantages

Michigan’s tax advantages stand out when compared to other states, making it an appealing destination for manufacturing and technology businesses.

Michigan is recognized nationally for its straight-forward tax rates and available tax exemptions.

Michigan does not impose a franchise tax, easing administrative and financial burdens.

Michigan excludes manufacturing machinery, equipment, and utilities used in production.

Michigan stands out as a state where local sales taxes cannot be levied.

Corporate

Sales & use tax on tangible goods

Unemployment tax, up to $9,500 per employee

Real-property tax on building value (approx.)

Essential services tax on personal property

Personal property used in manufacturing is exempt from sales and use tax.

Michigan exempts business inventory from local property taxes.

Expert Insights: Tax Climate

EXAMPLE TAX FORECAST FOR AN EARLY STAGE MANUFACTURING PLANT IN MICHIGAN

Example Investment Scenario: A stamping plant in Michigan was constructed at a cost of $10 million, including $2.7 million for equipment and $2 million for inventory. The plant employs 16 individuals, and it’s important to note that no sales tax is paid or collected on purchases by or sales of parts to manufacturers due to Michigan’s robust Industrial Processing (IP) sales tax exemption.

This case study provides a comprehensive analysis underscores the importance of meticulous financial planning and tax management for businesses, particularly in a complex regulatory environment like the manufacturing industry.

Understanding and accurately forecasting tax liabilities is crucial for maintaining financial stability and compliance with tax laws. Contact WIPFLI to learn more.