ECONOMIC INDICATOR UPDATE

DATE: JULY 2025

The Economic Indicator Update complements the Detroit Regional Chamber’s annual State of the Region report by providing timely updates on key economic metrics throughout the year.

Together, these reports offer insights on business growth, employment, innovation, and consumer trends, helping leaders make strategic decisions in a changing economic environment. For more economic indicators and Chamber perspectives visit, detroitchamber.com/research.

(2019:Q3-2019:Q4)

(2024:Q4-2025:Q1)

Minimal Real GDP growth, yet in top quintile in growth among all states. GDP, U.S.

(2019:Q3-2019:Q4)

(2024:Q4-2025:Q1)

(Feb. 2020)

(May 2025)

(Feb. 2020)

(May 2025)

Real GDP growth contracted for first time in three years, driven by surge in imports.

Employment growth exceeds 6,000 jobs year-over-year. Varies by industry with manufacturing and professional services seeing larger decreases.

Region’s unemployment rate trending down, yet nearly 1 p.p. above the nation. Unemployment, U.S.

(Feb. 2020)

Job Postings, Detroit MSA

(Feb. 2020)

(May 2025)

(Jun. 2025)

U.S. unemployment rate at or under 4% since 2021. Up 0.3 p.p. over one year ago.

Postings down 5% in the Region, while the nation has double-digit growth compared to a year ago. Consumer Price Index, Detroit MSA

percent change (Feb. 2020)

percent change (Apr. 2025)

Regional inflation dropped below national levels, with energy and gasoline prices driving the decrease.

(Feb. 2020)

(Jun. 2025)

Consumer sentiment increased 16% in June, the first increase in six months.

(Feb. 2020)

(Jun. 2025)

After two months of expansion in early 2025, economic activity in the manufacturing industry has contracted for four consecutive months.

(Feb. 2020)

(Mar. 2025)

U.S. vehicle sales (SAAR) leveled off after spring surge as consumers pulled ahead purchases in advance of potential tariffs.

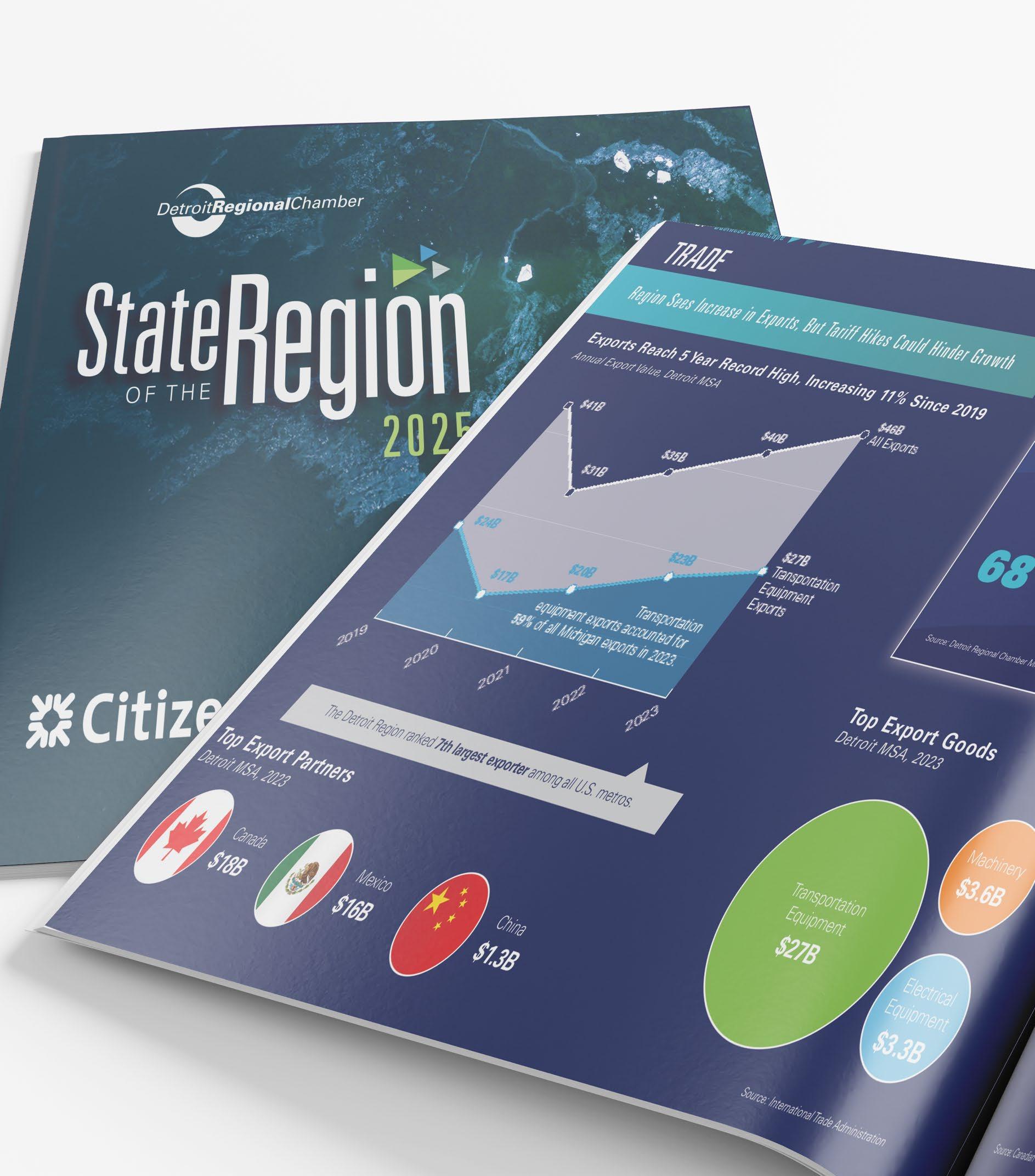

GDP Impacted by Surge in Imports in Q1

Real

The nation’s economic growth contracted for the first time in three years, impacted by the surge of imports in advance of potential tariffs. Economists do not expect imports to strongly affect second quarter GDP.

Real GDP dropped in 39 states in the first quarter of 2025. Michigan fared better than most with a 0.2% annualized change, landing the state in the top quintile for growth among all states.

States

Employment Exceeds Levels From a Year Ago,

Lag National Growth

Employment levels in the Detroit Region in May 2025 were nearly 6,000 jobs higher than a year prior. However, employment gains and losses vary by industry.

Industries that recorded among the largest growth over the year include:

- Mining and Construction 4.0%

Largest decreases in employment include:

Michigan’s Unemployment Rate

Trending Down Since March

The Detroit Region’s unemployment rate diverged from the nation’s rate beginning in 2025. After reaching 5.3% in March, the Region’s unemployment has dropped to 5.0% in May.

Despite unemployment rates higher than the nation’s rate, the Worker Adjustment and Retraining Notifications (WARN) for Michigan indicate layoffs year to date are 20% lower than 2024 levels, and 7% lower than 2023.

Unemployment Rate

Detroit MSA and United States

Source:

United States Detroit MSA

Job Postings Decline in the Region Year Over Year as the Nation Sees Growth

The Detroit Region has seen steeper declines in job postings than the nation, down 5% from the same month last year, while the nation has seen double-digit growth of 13%.

There are now fewer job postings than unemployed people in the Region. The ratio of job postings per unemployed person has declined, falling from 2-to-1 in 2022 to 1-to-1 in 2024 to 0.9to-1 in May 2025.

The Region’s top three industries with job postings in 2025 include: - Health Care - Administrative and Support and Waste Management - Retail Trade

Regional Inflation Rate Drops Below 2%

Regional inflation dropped significantly in April to 1.4% from a year ago. This is the lowest level seen since 2021, and nearly a percentage point lower than the U.S. rate. Energy prices in the Region were down 5.2% over the year, including gasoline prices down 12.5% compared to a year ago.

As of this report’s publication, U.S. levels for inflation for May, the latest month available, were reported up 2.4% from a year ago. Inflation is nearing the 2% target, yet the FOMC has opted to hold the federal funds rate at its current target range of 4.25-4.5% citing elevated inflation risks along with potential tariff impacts on the economy.

Consumer Sentiment Increases for the First Time in Six Months

Index of Consumer Sentiment

Consumer sentiment increased 16% in June, the first increase in six months. Sentiment remains well below the post-election level recorded in December 2024.

Consumers indicated improved optimism on personal finances and business conditions.

Concerns about the potential impact of tariffs remain, however, consumers have adjusted from the April tariff announcements and the following weeks of policy changes.

U.S. CEO Outlook

Optimism Increasing

Current and future business conditions improved for the third straight month, as trade negotiations settled.

The approaching July trade deadline finds U.S. CEO’s hopeful in clarity moving forward and further strengthening of the economy.

Only 28% expect a recession in the near term, down from 62% in April. However, two-thirds of CEOs expect costs to rise in the year ahead, despite the improving forecast.

Anticipate Revenue Growth

Source:

Economic Activity in Manufacturing Sector Contracting as Tarriff Concerns Persist

After two months of expansion in early 2025, economic activity in the manufacturing industry has contracted for four consecutive months.

The survey of the nation’s supply chain executives reported mixed indicators as production increased as manufacturers worked through backlog orders.

Employment on the other hand contracted as manufacturers managed existing staff rather than hiring. Higher prices for inputs and weaker demand were also reported as manufacturers navigate tariff policy outcomes.

A reading over 50% indicates the manufacturing sector is expanding.

After Strong Spring, Vehicle Sales Cool

New light-vehicle sales recorded the highest monthly SAAR in nearly four years in March and April as customers purchased vehicles in advance of potential tariff impacts.

Analysts expect sales pace to slow in the second half of 2025, after the spring surge. According to J.D. Power, 173,000 sales were pulled ahead into March and April in anticipation of automotive-related tariffs.

As of Q1 2025, EV sales have increased by 11.4% year-over-year, selling almost 300,000 units in 2025. Experts expect the sunset of EV tax credits in September to cause a brief uptick in EV sales, as buyers rush to make a purchase while incentives are available. However, sales are expected to slow down after that.

2.1% higher year-over-year in May, down from December peak