Digital warrant issuance and full lifecycle processing

Go-live Q4 ‘26

Collateral tokenisation & mobilisation

POC Q2 ‘26

Settlement Optimisation

POC Q3 ‘26

European “challenger” CSD

• Authorisation Q4 ‘25

• Go-live Q2 ‘26

APAC “challenger” CSD

• Authorisation Q4 ‘26

• Go-live Q1 ‘27

Environmental Credits Ledger

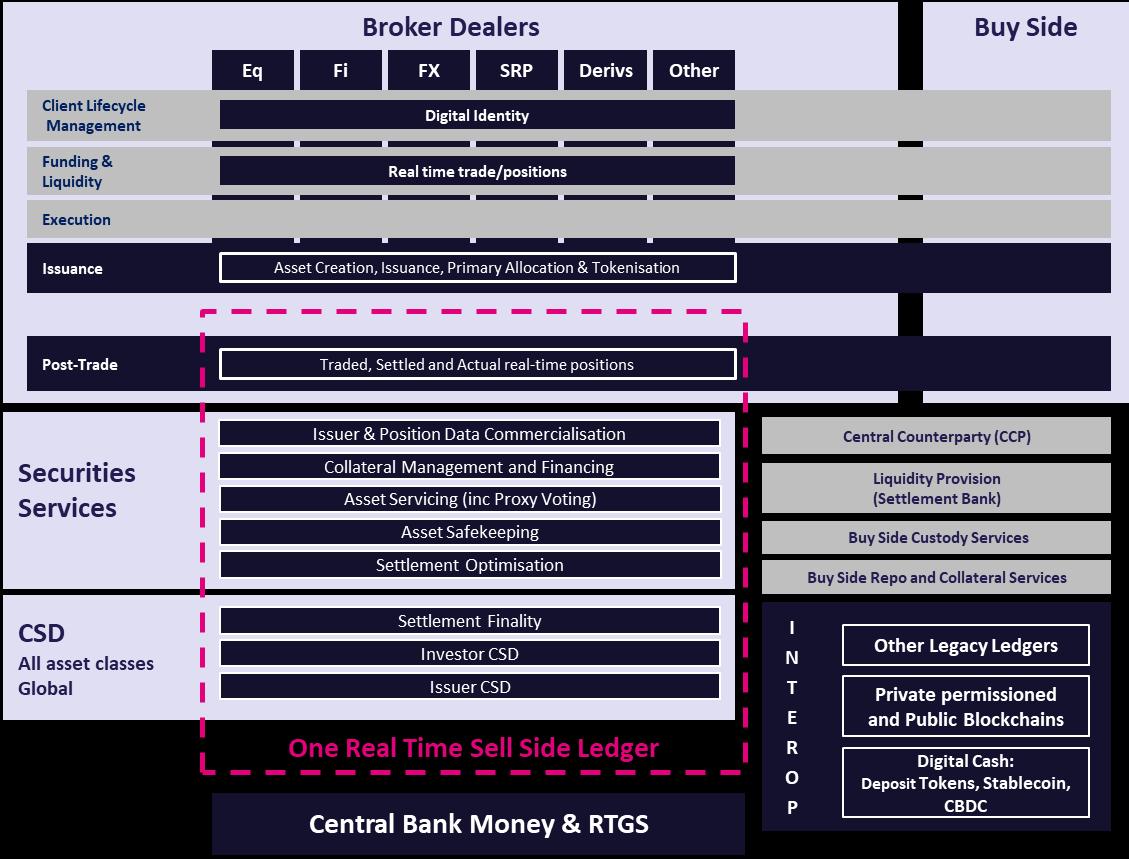

Mach technology comprises six core components that target the cost savings, capital reductions and new revenue opportunities of digital assets

1. Tokenised assets are $87bn today. BCG estimates they will rise to $11 trillion by 2030

2. There are $584bn of digital assets under custody (Statista, Oct 2024)

3. Existing EU law and regulation supports digital assets and digital market infrastructures

4. Settlement efficiency is falling whilst costs are rising

5. End investors remain sensitive to costs for issuance, settlement, collateral and safekeeping

6. DLT has matured and platforms are now being delivered into production

7. DLT offers solutions for collateral mobilisation, real-time settlement and fractionalisation that positively impact cost, revenue and capital

De-centralised digital passports

Links legacy and DLT ledgers via API, ISO and DLT nodes

Issue, transfer & custody of all assets

Mint, transfer lock & burn

Conventional, digital and tokenised assets on one ledger

Multi-lateral netting of settlements

1. DLT enables a more resilient infrastructure

2. Increased cyber protection, data protection and permissioning

3. New ledger structure increases transparency of chain of custody (UBO, Beneficial Owner etc)

4. Improved latency of information, regulatory oversight and corporate governance for issues (SRDll)

5. Structure compliant with PFMI Principles

6. Interoperable ecosystem – MACH supports ISO messaging, API, public and private DLT networks

Reach out to book a demo of the platform GUI and functionality.

API’s provide read/write functionality and connect; the trading venue, SWIFT, and participants to the platform.

MACH features its own proprietary private permissioned blockchain that is built for scalability and performance and conducts frequent reconciliation checks against any external DLTs. The MACH chain can also store metadata required for regulatory and legal adherence

See Workflow Engine slide for more information.

The GUI provides the ability to monitor LMS, see errors and platform procedures, enforce 4-eyes checks and other admin activities such as user and participant management.

See MACH Blockchain slide for more information.

SWIFT messages are sent to participants, including MT54’s, MT56’s, MT53’s, MT900, camt.054, pain.998.

The workflow engine drives the settlement process and ensures adherence with regulatory and legal requirements.

See LMS slide for more information.

The Liquidity Management System (LMS) ensures alignment with Target2 and tracks participant thresholds.

See MACH Bridge section for more information.

Assign ensures tokens are assigned the correct information to ensure regulatory adherence and enable token management

Tokenise facilitates the tokenisation of traditional assets and can create native digital assets on private and public networks.

Notifications inform users of errors. The MACH platform includes exceptions management screens and a ‘Camunda cockpit’ to view and manage errors on the platform.

Bridge provides interoperability between DLTs to perform DLT operations

See Apache Kafka slide for more information on connectivity between system components.

Optimise facilitates settlement finality, including netting of transactions.

Ledger provides a single source of truth for traditional, tokenised and native digital assets. It provides the foundation for future-proof process handling.

Tier Architecture

The Business Logic layer enables business logic and workflows to be implemented, with intelligence developed to support financial services workflows

and

and

MACH CSD is built on a robust three-tier architecture designed to enhance efficiency, security, and scalability.

• Workflow Engine: Manages business logic and workflows with intelligence developed to support financial services, including the securities settlement system, asset lifecycles, user permissions, unhappy paths, and approval processes.

• Liquidity Management System (LMS): Enables efficient reserve asset and risk management. Facilitates the processing of SWIFT messages, confirmations of matched buy and sell orders, validation checks, near real-time transfer of assets, and alignment with T2 using SWIFT messaging.

• Securities Settlement System: Ensures the transfer of securities and funds between parties after a trade is executed. MACH's SSS mitigates settlement, and counterparty risks and ensures timely and accurate settlement of transactions.

• Business Logic: Supports complex financial operations and integrations, including issuer registration and wallet opening for the accounting and storage of tokenised bonds, broker registration and wallet management, and the issuance and validation of bonds.

• Transactions: Manages and processes transactions efficiently, ensuring all transactions are executed and recorded accurately.

• Multi-Ledger Wallet: Supports synchronisation and interoperability across multiple ledgers, including omnibus wallets for broker’s clients.

• Synchronisation: Ensures data consistency across systems.

• Interoperability: Seamlessly integrates with existing financial systems and infrastructures, supporting both traditional and digital assets.

• Cost Reductions: Lays the foundations for internal operational and technical re-engineering.

• Promote innovation and competition: Help solve current challenges presented by existing market incumbents.

• Independent and user-focused market community: Guided by market participants to shape, create and implement new products.

• Supporting Asset Classes: Deploy a technology solution that allows for traditional assets to be supported more efficiently and create the foundation for new digital / tokenised

& Administrators

Workflow Engine

• Manages business workflows, Liquidity Management System, and coordinates business processes

• View and fix

• Member credentials, permissions, accounts, and other info

• Workflow reference, state, and error data Member Data Store

Workflow Data Store

• Single bridge between application and all DLTs Workflow Administration

• Securities definitions and other ref data.

Securities & Cash Data Store

• Securities holdings cache for faster queries

Participant Wallet

• A participant wallet is a logical construct that enables each participant to view their security holdings and transaction history across DLTs.

• Each participant can use this concept to view security holdings, transaction history and eventually other information – for example, funding details.

• Locking information and address translation tables

Bridge Data Store

• KMS used for encrypting and decrypting private keys