Delta Capita is a leading Managed Services, Consulting and Technology provider with a unique combination of FS experience and tech innovation capability.

Services: We provide solutions ranging from Resource Augmentation through to fully tech-enabled, Mutualised Managed Services. We currently provide services in Client Lifecycle Management, Post Trade, Structured Products, Pricing & Risk and Market Infrastructure.

Mutualised Managed Services: Our vision is to reinvent the Financial Services Value Chain. We leverage our industry expertise, proprietary technology & investment capital, and work with our clients to:

► Replace high-cost, non-differentiating in-house platforms with our Mutualised Managed Services to reduce costs and improve efficiency.

► Identify valuable technology assets, supporting non-differentiating functions, which can be commercialised in a joint venture.

► Consulting: We provide a proven advisory and transformation execution capability, which can accelerate the delivery of change programmes from inception through to benefits realisation.

1,250

At Delta Capita, we commit to responsible business practices that benefit our people, clients, communities and planet. This comm itment sits at the core of our DC Values and informs how we work with people across our ecosystem.

We partner with EcoVadis one of the world’s most trusted sustainability ratings providers and with our clients, to continually assess and improve our position in all aspects of ethics and sustainability.

We maintain this focus through strong executive sponsorship and active global colleague networks, who create and embed actions that drive our sustainability agenda.

► Delta Capita has made a commitment to consciously limit its impact on the environment and, as such, aspires to operate in a manner that minimises its carbon footprint. Delta Capita Group aims and has publicly committed to become carbon neutral by 2040, Delta Capita will operate in compliance with all relevant environmental legislation in each jurisdiction we operate within

► At Delta Capita, we strongly advocate human rights. We have zero tolerance toward any rights abuses from discrimination, to slavery and unsafe working practices – in any part of our business or supply chains.

► We believe strongly that the success and long-term sustainability of our business depends on our people. . We actively seek to create diversity of gender, ethnicity, age, skills and experience across our global workforce.

► We maintain a robust control environment across the full spectrum of our business. Our colleagues adhere to a comprehensive Code of Ethics, supported by a extensive training curriculum.

► Our clients can rely on us to uphold the highest standards of performance across our global enterprise. Our performance is underpinned by ambitious goals and associated KPIs

Our clients can rely on us to uphold the highest standards of performance across our global enterprise. Our performance is underpinned by ambitious goals and associated KPIs

► CLM - Client Life Cycle Management ► CMMS – Capital Markets Managed Services ► Consulting

Led by experienced industry practioners

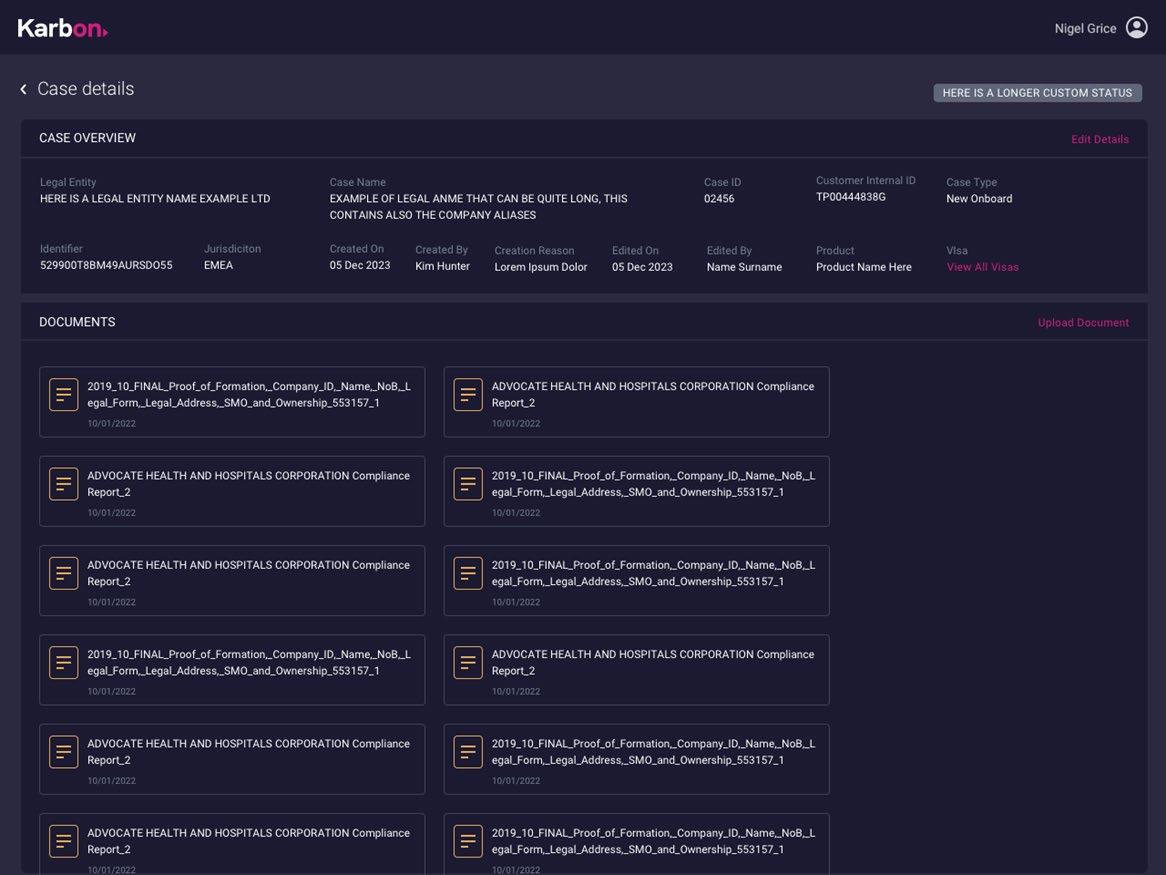

Our Client Lifecycle Management (CLM) Services provides end to end to KYC/AML and client due diligence (CDD) capabilities to help organizations optimize the management of their client lifecycle.

Global Operations across APAC, EMEA, US & UK

45+

Global client base ranging from Tier 1 banks to Hedge funds to Brokers

~500 Dedicated KYC permanent employees

Our CLM team combines extensive experience with domain expertise in delivering KYC services across multiple organizations underpinned with an in-depth knowledge of AML regulations and supported by an eco-system of proprietary technology accelerator solutions.

► Managed Services. Full KYC managed service covering the full end-to-end CLM lifecycle and ongoing monitoring, powered by Karbon.

► Managed teams and staff augmentation. KYC remediation and uplift projects are conducted with domain expertise spanning across multiple jurisdictions and entity types.

► Policy Services: Policy and Controls SMEs can provide updates on clients’ AML polices and procedures to ensure compliance with the latest regulatory updates, and conduct documentation, processes and procedures reviews to drive efficiencies as well as improve controls.

► CLM advisory. (powered by Advisory Consulting) Target operating model, processes and procedures reviews to optimise the clients CLM capability.

► Technology: Delta Capita have a suite of innovative technology solutions that we bring together as Karbon. Our Karbon Core technology provides: Client Portal & dashboard, Workflow, rules engine & risk matrix. We can offer API integrations to external and internal sources. Our Karbon Outreach provides a digital customer outreach capability, alongside IDV biometrics, liveness testing, dynamic OCR and individual authentication.

► We have developed a ‘Market Manual’ to provide live feedback on data source integrity & accuracy gained across multiple clients.

► Our CLM team combines extensive experience with domain expertise in delivering KYC services across multiple organisations.

► 500+ dedicated KYC permanent employees with global footprint.

► Comprehensive KYC/AML training programme. Team

► 45+ global client base ranging from Tier 1 banks to Hedge Funds and Brokers

► Active pipeline of clients and dedicated CLM sales team.

► Experts in industry move to a managed service offering for non-differentiating services. Clients

DC-CMS combines our Structured Products, Post Trade and OTC Derivatives businesses under one collaborative umbrella, as one team.

CMS brings together our capital markets operational services and technology capabilities in order to become a long-term service provider for our clients.

It enables us to create a new level of scale and capability that combines:

► 450+ operations specialists

► Technology capability of 50+ engineers and developers

► Across 20+ live clients

► Dedicated, specialist Sales Team working with our global capital markets Clients

► Lead by a single, focussed management team

We work with our clients to assess their specific requirements, operating at speed to offer a solution to Run the Bank functions and large scale global remediation projects.

We help clients to:

• Simplify Operations

• Comply with regulatory obligations

• Innovate business models and technologies

• Improve process efficiency

Trade

offering has longstanding credibility supporting financial institutions by providing subject matter expertise across multiple asset classes.

A team of 100+ Structured Products specialists supporting global issuers throughout the product lifecycle

Structured Products issuers and supported by Structured Products SMEs Services

Specialist technology, inSPire, designed for

Senior industry professionals bringing industry insights and best practices to inform your transformation agenda

Delta Capita’s Structured Products & Derivatives business provides a unique range of tools through its inSPire platform to support structured products manufacturers through the issuance process, platform management, product governance and full lifecycle support.

Workflow orchestration from deal capture to post-trade lifecycle management and market connectivity with control and transparency

A product documentation service combining a state-of-the-art automation solution with manual drafting services

Product Approval, Testing and Target Market administration, oversight support and monitoring, using our powerful rules engine for Pre and Post Trade controls

Complete solution for Structured Product distributor due diligence covering KYD, DA drafting, KYC and market research services

Fee Management

Technology solution to manage

Up-Front and Running Fee payments to Distributors and other market intermediaries

SME support to establish frameworks, configure and run applications, deliver continuous automation and resolve exceptions

Our team of experts and specialist technology is used by many of the leading structured product issuers to reduce the strain on their resources and benefit from industry standards and mutualisation.

► Use the inSPire platform to manage the full end-to-end processing of structured products from pre-issuance and issuance activities, sales and offer periods through to lifecycle management using the inSPire platform benefiting from intelligently designed workflow, service orchestration, product store and business intelligence reporting tools

► Select from a range of inSPire service modules covering all of the core issuance lifecycle management activities, access directly via API or through the inSPire portal, all supported by purpose designed rules engine, controls and testing capabilities

Our OTC Derivatives Managed Service will support the core operational aspects of the OTC Derivatives Confirmation & Settlements trade lifecycle. Including indexing and affirmation, confirm drafting (manual & automated), template development and maintenance, matching & execution, exception management and break remediation.

Aiming to permanently address perpetual challenges faced by Operations management:

► Operations headcount and budget restrictions out of synch with business volumes and processing complexity

► Insufficient Operations IT budget to invest in process improvement

► Front office demands for scalability, expansion to new asset classes and products

► Insufficient Operations IT strategic technology investment

► Non-strategic response to regulatory change

Offering our clients a range of significant benefits including:

► Transparency on the cost of transactions by asset class and method of processing, enabling the business lines to focus on profitable clients.

► Migration to an industry leading technology platform, where change and regulatory compliance costs are mutualised across many participants whilst segregating individual clients data and accommodating individual clients controls and sign off procedures.

► Variable cost reporting opportunity from a transaction-based service charge, including contra revenue.

We are the trusted challenger to Financial Services using our unique blend of high-quality expert resource anda scalable delivery capability

Delta Capita, the Financial Services business of Prytek, is a leading Consulting, Managed Services and Technology provider with a unique combination of FS experience and tech innovation capability.

Our Consulting Capabilities

We have a strong delivery capability within:

► Strategy and Operating Model

► Business Analysis and Performance Improvement

► Project and Programme Delivery

► Data, Technology, Automation and Testing

► Risk and Regulation

Why we’re different

High quality people

Delivery focus

How we engage

And additional experts focused on:

► Payments

► ESG

► CLM

► Post Trade Services

► Pricing and Risk

► Structured Retail Products

Deep Industry knowledge

Proprietary tech / accelerators Competitive commercials Global scale

Clients Globally across Banking, Capital Markets, Insurance and Fintech

Resource Augmentation

Capacity and/or specific expert resources to deliver within a client's team on a time and materials (T&M) basis. Provides quick flex and cost transparency

Consulting Advisory & Delivery

Fixed Price / Outcome based work for a scoped book of work. Providing risk sharing and cost predictability.

Managed Services

Delivery of entire functions inclusive of technology, people and support. Providing cost reduction and certainty plus service enhancement

1,250

Expert practitioners and consultants globally

We have retained the existing practice areas but placed a refreshed emphasis on global connection

Strategy & operating model

► Cost Analysis & Root Cause Assessment

► Operating Model Design

► Operating Model Implementation

► Business Case Development

► Data Analytics & Business Intelligence (BI)

► Data Management & Governance

► Architecture

► Data Science

► AI & Machine Learning

Project & Programme Delivery

► Project Management and Recovery

► Programme Communications

► Accredited Agile

► Change Management

► PMO

Business Analysis & Performance Improvement

► Cost Take Out

► Digitisation of Value Streams

► Requirements Documentation

► Process Modelling and Improvement

► Continuous Improvement

► Functional Testing and Assurance

Risk and Regulation

► Regulatory assessment-> Change management -> Post implementation / Ongoing Compliance

► Transaction reporting

► Operational resilience

► CSDR / T+1

► Consumer reg’s: e.g. consumer duty ++

► Rapid Application Development

► Solution Architecture

► Cloud Strategy & Migration

► Application Lifecycle Management (Front, Middle and Back End)

► Enterprise Integration & APIs

Automation & Process Improvement

► Robotic Process Automation (RPA)

► Intelligent Process Automation (IPA)

► Business Process Management (BPM) incl. Agile, Scrum, Lean

► Low-code/No-code Development

CLM Advisory Data

► Data Standards & Client Outreach

► Banks ISO 20022 Migration

► Modernisation of Workflow, Controls and Thresholds

► New Payments Platforms

► Market Infrastructure Transformation

Testing and Quality Assurance

► Test Automation Solutions

► Test Consulting and Advisory

► Core Testing incl. functional, performance, security testing)

► Specialised Testing incl. DevOps & Continuous Testing, APIs Payments

► CLM health check / Strategic alignment

► Technology & data readiness

► Technology selection

► Technology delivery

► People, policy & process design

► Regtech advisory: Insight, Strategy, sales enablement and training

► Sustainability health check

► Corporate Sustainability Reporting Directive (CSDR) and Reg compliance

► Sustainability Strategy

► Data Insights and reporting Sustainability / ESG Advisory

Capital Markets Services

Operations RTB resource augmentation support through to fully tech enabled managed services across

► Post trade services

► Pricing and Risk

► Structured Retail Products

► Client Lifecycle management

We have a toolkit of methods, technology and experience to support us in benchmarking, voice of the customer, customer insights through to implementation.

Our approach:

Our approach to a voice of the customer piece of work is driven by the objectives and current state of the customer research and strategy. We therefore design a tailored approach bringing in relevant parts of the toolkit subject to the specific goals and work done to date.

Understand the vision: First is to understand the vision, problem statement, goals of any voice of the customer research, and the brand values etc.

Validate the current information:

► Customer insights: any insights previously gathered are essential to consider unless the data is redundant due to time period or retired products / services. This is essential to prevent duplication and ensure that you do not frustrate customers by asking the same questions twice.

► Benchmarking: we track the market and can provide market insights around positioning as well as bespoke research into points of differentiation linked to your market positioning strategy. This is essential to bring in as it’s important to understand the alternative options available to customers.

► Data Insights: gathering meaningful data insights whether from operations or customer data and any previous work conducted.

Example group: Determine the segments, personas or characteristics of your desired example group. Unless there is a capability to reach out to every single customer to ask for feedback it is essential that a representative group of either existing or target customers is profiled in order to gather diverse and impactful feedback. Even if a customer wide survey is launched then an engaged sample set is still required for depth interviews and as a user testing group.

Playback and Prototype: Depending on the scale of the project we would then playback the findings into core themes across different target groups. Once validated we can either present recommendations or we can support in realising the change working to create design mock -ups, screen prototypes etc, the concept is to get simple wireframes and hi-fi prototypes into the hands of customers to gather feedback prior to investing in making any of the changes. The next step would be again to listen, ensure there is sufficient critical mass in feedback and then begin to implement.

One-on-one session to understand the individual

Expose an issue by pitting opposing choices against the other

Auto-Ethnography

Enable the customer to log their own behaviour

Brief but rapid feedback from a broad panel of people

Observe the behaviour to establish patterns

Desk Research

Use existing research to build up a bank of insights

Mining existing online conversations for insights

Harness latest tools to passively collect behavioural data

Enables people to interact with each other and debate issues together

► Natural use of product – goal is to minimise interference from the study in order to understand behaviour of attitudes as close to reality as possible – greater validity but less control over what topics you learn about

► Scripted use of product – focus the insights on specific usage aspects

► Not using product during the study – examine issues that are broader than usage and usability, such as a study of the brand of larger cultural behaviours

► Development of project and programme communication strategy

► Multiple communication streams utilised, leveraging tools, templates and client infrastructure

► Work with clients on strategic planning, identifying trends & opportunities and securing stakeholder buy-in through effective communication

► Programme Communication management across multi-year non-financial risk transformation programme, Ensuring consistency of programme communication and stakeholder engagement, direction and delivery across all projects

► Qualified and experienced PMs managing complex, multi-disciplined projects and programmes across Financial Services

► Project and Programme delivery from workstream to macro-level

Case Studies

► Proven F2B delivery from discovery to benefits analysis and realisation

► Extensive stakeholder management expertise, across all business areas and value streams

► Failing project recovery and assurance

► PRINCE2

► AgilePM / SAFe

► Scrum / Kanban / Scrumban

► Lean / Six Sigma transformation

► approach

► Education of Agile methodology with project team, stakeholders and BAU resources

► Enterprise-wide change assessments

► Communication strategy

► Embedding change culturally

► Vendor Selection processes

► Business case development

► Checkpoint reports

► Facilitating RFP processes and

► third-party vendor management

► Developing Target Operating Model design across businesses and value streams

► Agile accredited PMs

► Culture of learning & collaboration

► Multiple Agile disciplines

e.g., SAFe, Scrum

Case Studies

► We have experience in supporting our clients to deliver their Agile vision and business strategy

► Internal accredited trainers

► Flexibility to adapt to various

► levels of Agile adoption

► Experience across a mix of leading Agile Frameworks including, (but not limited) to SAFe, Scrum, Kanban, etc.

► Guidance on implementation of Agile across programmes / institutions

► Project status report

► RAID

► PID

► RACI

► Best practice / PMO set-up

► Provision of PMO resources to set up PMO best practice and governance structures

► Individual PMO support for PMs

► Lessons learned reviews

► Understand, plan, implement, communicate change strategies

► Agile delivery methodologies (e.g., retrospectives)

► Transforming operating model, processes and tools in response to regulatory requirements e.g., MiFID II

► Governance structure optimization

► Project planning to appropriate horizons (strategic, initiative, delivery)

► Timebox/sprint run rates

► Delivery of Programme level PMO support to establish, track and monitor cross-functional workstreams aimed at delivering organisational strategy

► Map and digitise end-to-end processes for automation, streamlining and omnichannel access.

► Utilise low-code development to rapidly update digitised processes.

► Develop digitisation roadmap, manage change via training, stakeholder buy-in and benefit tracking.

► Analyse data, identify high-cost trends, optimise workforce and renegotiate vendor contracts.

Case Studies (Asset Manager)

► Redesigned value streams

► Implemented new technologies

Case Studies (International Insurer)

► Implemented Agile & Change Management

► Reduce costs across headcount, vendors, processes, technology and assets through a data driven approach

► Increased business agility

► 15% cost saving achieved

► $5M in annual cost savings achieved

Continuous Improvement

► Continuously improve CEX by enhancing products, services and delivery through engagement, empowerment and tools & training (e.g. Lean Six Sigma).

Case Studies (Tier 1 Bank)

► Standardised Operating Model

► Enhanced visibility with KPIs

► Use data to measure progress on KPIs and identify improvement areas and ensure sustainability over time.

► Reduction of cycle times across core processes

Change Optimisation

► Clarify process ownership and governance to sustain change and ROI

► Align changes to strategic goals

► Continuously monitor rollout progress

Case Studies (Tier 1 Bank)

► Redesigned the banks change processes to Scaled Agile methods

► Reduced time to market for new products and services

► Improved processes helped improve staff retention

Key Benefits:

► Effective strategy delivery focusing on the root causes & requirements

► Metrics and data driven outcomes

► Achieved 300 % faster time to market for new products and services

► Engage stakeholders with optimal communication.

► Identify impediments and capture root requirements.

Case Studies (Tier 1 Bank)

► Regulatory analysis of EMIR 3.0

► Identifying and collaborating with Stakeholders through interactive workshops

► Analyse and prioritise needs.

► Determine optimal solutions to meet requirements.

► Gathered requirements from documents and SME’s

► Map processes, analyse metrics, find improvement areas and root causes

► Redesign processes for future state, validate changes, achieve buy-in, train and rollout

Case Studies (Tier 1 Bank)

► Process analysis, modeling & mapping to BPMN standards

► Tracked progress continuously

► Verify functionality, align with business requirements and identify defects early

Case Studies (Tier 1 Bank)

► Defined overall test strategy and process

► Collect data continuously, review performance and implement incremental improvements

► Iterative delivery

► Comprehensive Process Documentation produced

► Ensure end-to-end integration testing and test case coverage

► Execute functional and non-functional test cases

► Executed SIT & UAT testing.Identified defects for resolution.Implemented new test tool (Xray)

► Reduced costs, improved service levels & optimised processes

► Move to a process-led culture

Delta Capita partners with clients across Retail, Wealth, Asset Management, Capital Markets & Market Infrastructure Providers to help navigate competing global regulatory priorities by assessing impact, designing and delivering regulatory change programmes, providing assurance services and ongoing support.

Delta Capita have a team of senior regulatory SMEs and industry veterans who bring deep content insights to our clients through their extensive industry experience as well as involvement with key industry and regulatory forums. Delta Capita, being a technology focused consultancy, also provide our clients deep insights into the RegTech sector through our proprietary solutions as well as leading ‘partner’ firms.

We have a large team of regulatory experts, industry SMEs as well as access to legal opinion who help our clients understand and respond to the changing regulatory landscape.

Delta Capita SMEs actively participate in regulatory conferences, working groups, round tables, and industry leading regulatory publications, as well as having strong connections to regulatory bodies, to provide clients updated regulatory insights.

Delta Capita source global regulatory updates to create horizon scanning materials keeping up with the latest regulatory announcements and trends that are provided to our clients enabling effective ongoing compliance planning.

As a consulting firm with a FinTech DNA, Delta Capita couple regulatory knowledge and delivery experience with a large portfolio of proprietary and ‘partner’ RegTech and FinTech solutions to support our clients across all stages of the regulatory lifeycle and in all areas.

Our regulatory expertise, combined with extensive knowledge of vendors means we are best placed to support clients embed and adopt technical solutions.

Delta Capita SMEs actively participate in financial technology conferences, working groups and round tables. We source global regulatory updates to track regulatory technology trends.

Our Data, Technology, Automation and Testing (DTAT) solutions practice combines Delta Capita’s deep industry and domain expertise across

services with our technical service layer capability to deliver bespoke, results-focused, solutions for our clients

Shaping a new digital future requires interdependent transformation of connected organisational capabilities and departments. Delta Capita brings our relevant specialist practice areas together to deliver a bespoke solution to each client problem/ambition

Digital Strategy

► Vision Setting

► Unmet needs / market analysis

► Business case creation

► Review of current strategy and roadmap

► Products & Services review

► Product roadmap: harmonisation & focus

► New differentiated and tailored propositions

Journey Review / Design

► Optimised and differentiated customer journey

► Omni-channel servicing

► Journey prioritisation / scorecards

► Op model modelling and visualisation (DC Modus)

► Impact analysis across dimensions of change

► Workforce skill gaps

► E2E process design

► Assignment of tasks & responsibilities

► Operational Excellence

► Automation opportunities / implementation

Data

► Data definitions, lineage & quality assurance

► Data Science, Insights & analytics

► Data Protection, consumer duty and Risk and Regulation

► Solution architecture

► Legacy & Cloud migration

► Build v Buy & Integrate

& Culture

► Design/embed new way of working

► Cultural transformation

► Organisational / leadership buy in

Vision: To be the trusted go-to partner who empowers clients with strategic technology solutions, driving their growth, innovation, and competitive advantage. Financial services firms are strategically realigning their operations to streamline systems, adopt cutting-edge technology, and transition to cloud-based solutions in a methodical approach. As organisations become digitally native, security and security risk awareness is critical

► Cloud strategy and advisory, assessments, recommendations, TOM build and roadmaps

► Cloud infrastructure application and data migration (deployment Models: IaaS, PaaS, SaaS)

► Cloud and Cyber Security and Resilience

EMERGING TECHNOLOGY STRATEGY & BUILD

► DLT (Blockchain)and Smart

► Contracts

► Digital Assets

► Data Warehouses & Stores

► AI, Machine Learning and Language Model Solutions

► Tool Implementation (with other Consulting competencies – core BA/PM activity and including Testing)

► Integration Management

► Establishment of Technology Centres of Excellence

► Application Lifecycle

► Management / Development

► System and Tool Implementation

► Integration and Connections API Design, Development

► Quality Assurance and

► End-to-End Testing

► Solution Architecture, Strategy

► and Technology Advisory, TCO analysis

► Modelling, documentation and

► explanation or training

► Solution Design, System and Tool Selection

► Design (UI/CX)

► Security Assessments

► Vendor Value Stories and Market Positioning

► Vendor Prof Services Implementation

► Vendor Product Roadmaps

THE CLM EXPERTS TM

Specialist knowledge in banking operations, middle office enablement, and Client Lifecycle Management technology (CLM).

We help financial institutions, consultancies and software companies deliver real change.

► Rapid review of your strategy, including approach to organization, tech & data to make your CLM delivery a success

► Drive the shape of your future state organisation, from people strategy to product enhancements and team training

► Prepare your organisation for the implementation of your chosen platform or managed service

► Leverage our network of trusted technology solutions to select the right choice for your organisation

► Delivery of your technology solution end-to-end, from platform configuration to integrations with data at the core of your solution

Our decades working within the Financial Services sector gives us the insight and knowledge to understand what resonates. We can help RegTech providers understand the market, optimise their sales process and reimagine their messaging.

► Understand the scale of your opportunity. Enter new markets and launch new products with confidence and gain clarity on opportunities and challenges ahead.

► Create impact with your target buyer. Get the insight needed to change the way you look and sound to your customers, and ultimately win more business.

► Enhance your sales journey, messaging, and assets. Show your product in the best light, from the initial meeting, through the demo journey.

► Enhance your sales journey, messaging, and assets. Show your product in the

► best light, from the initial meeting, through the demo journey with your prospects.

► Delivery of your technology solution end-to-end, from platform configuration to integrations with data at the core of your solution

There are four core services that we provide to help our clients set clear business objectives and effect change in complex operating environments. These services can be deployed at various stages of a client’s transformation agenda to align the organisation towards shared goals and measurable business results.

Assessment

► Functional impact assessment on existing operating model

► Identification of underlying mis-performance

► Response planning and prioritisation

Operating Model Design

► Vision and Strategy development and articulation

► Current state assessment

► Model design, roadmap, and business case creation

Operating Model Implementation

► Implement strategic change to support operating model transformation

Business Case Development

► Business case articulation and organisational alignment

► Opportunity sizing and measurement

Seasoned professionals with Institutional knowledge of banks post trade operations & technology infrastructure and market infrastructure. Experience in both Run the Bank (RTB) & Change the Bank (CTB) around cost / benefit & business case analysis, building and managing a change book of work, and design of operating models.

Our team's partner with our clients to determine the levels of support required, across multi-phased change agendas. We understand and can position the required change in the context of the broader organisational design and change book of work.

We have extensive experience of strategic reviews and target operating model design with over 100 engagements across many different business domains. We have developed a repeatable agile methodology that accelerates the review process and the level of detail available to support investment decisions.

Business aspirations and guidelines to guide current and future state thinking. Specific outcomes that demonstrate the realization of the Vision

4. Business Standards

Parameters and values that will influence the design and execution (legal entity structure, core values, culture etc.)

Business Structure

The framework through which the business will operate

Business Infrastructure and Operations

The fundamental activities and operating environment

DC were engaged by a leading clearing house to assist with aligning, communicating and developing their strategy. Findings and recommendations were provided to help enhance their strategy formulation process and inform business model changes

DC were engaged to help the client develop a target operating model that would enable them to meet ambitious growth targets against a backdrop of historic underinvestment and ongoing regulatory scrutiny

DC were engaged by a prominent market infrastructure provider to perform an external ‘voice of customer’ exercise to help focus, refine and validate their business strategy, business case and roadmap

At Delta Capita, we support our clients across the breadth of the insurance industry. From strategy and target operating model definition through to delivery expertise and capacity. We combine this with experts in data, regulation and process design plus expertise in areas such as Delegated Authority, Underwriting, Claims Handling, Due Diligence and Bordereaux Analysis.

We swiftly adapt to change, driving progress through our collaborative and innovative approach

We specialise in financial services, leveraging our cross-industry expertise to deliver high-quality results

We partner with our clients to drive change, employing a best-in-class approach that leaves a lasting legacy in how we work together.

Clients We Have Worked Within The Sector

We offer the expertise of Big 4, but at rates 20-30% lower, all while providing stronger delivery oversight

We hire very selectively to bring in those of a can-do attitude, value add mindset, and work with our clients collaboratively

COMMERCIALLY ENTREPRENEURIAL

Commercially Entrepreneurial

We are open to new and innovative commercial models

Effective strategy delivery focusing on the root causes & requirements

Metrics and data driven outcomes

Reduced costs, improved service levels & optimised processes

Move to a process-led culture

We leverage our unique position to deliver a holistic approach across our Insurance capability by combining cross-domain expertise, extensive client experience, in-house technology solutions and select partnerships to drive transformation within your organisation

► Strategy and Target Operating Models

► Transformation

Insurance

Offerings

Change, Transformation and Testing

► Underwriting

► Claims

► Actuarial

► Delegated Authority

► Due Diligence

► Bordereaux Analysis

► Digital Strategy

► Proposition Design

► Customer Journey Review / Design

► Complex Delivery

► Project & Programme Management

► Test Consulting and Advisory Services

► Testing Services

► Specialised Testing Areas

Insurance

Capabilities

Data, Analytics and Technology

Risk & Regulation and Sustainability

& ESG

► Data Analytics

► Data Management and Governance

► Data Architecture

► Performance Optimisation and Automation

► Data Science (incl. AI & ML)

► Regulatory Assessment

► Regulatory change management

► Post implementation

► Ongoing compliance

► Cloud Transformation

► System Integration / Delivery

► Emerging Technology Strategy & Build

► Technology Engineering

► Client and Vendor Support

► ESG Advisory & Strategy Services

► ESG & Sustainability Benchmarking

► Impact & Gap Assessment

► ESG Delivery

Compliance analysis against EMIR regulation variation margin requirements and solution modelling Risk Steering Insurance

of delivery for an E2E insurance offering

Design and implementation of an organization-wide risk steering framework and automated dashboard

VIPR Implementation

Accelerating data capture into VIPR, enabling Solvency II compliance and readiness for DA SATs

Implementation of internal control framework for a large Dutch insurer, managing the entire project’s delivery

Agile Adoption Programme

Delivery of an agile programme to improve transparency and speed of delivery for an E2E insurance offering

Fusion Market Connectivity

Support for market connectivity project. Including design, digitisation, automation, and scrum master delivery

Reinsurance Hedge Fund: TOM Design

Developed a TOM and ABC model to link

Solvency II Reporting

Implementation of process automation software for SCR calculations, with refined quarterly movement analysis

Data & User Migration

Managed IT tools that needed to be adapted, or developed new tools; during a merger of insurance companies

Fusion Tech & Data Foundations

Coordination and management functions across 17 projects of an architecture driven portfolio of work

Fusion Tech & Data Foundations

Coordination and management functions across 17 projects of an architecture driven portfolio of work

Implementing Solvency II

Company-wide implementation of Solvency II legislation, including datalineage processes and actuarial models

Global Technology

Supporting across the IBOR programme from transition portfolio pre-execution, to the TPM governance framework

and

Development and execution of a front to back RFI and RFP

to improve operational data services

Global Markets Technology

Coordination of the implementation of automation technology controls around KYC and Client Data

Created in 2020, the Payments practice is one of the newest and fastest growing domains at Delta Capita having been driven by unique propositions to meet client demand and deep industry expertise working with top-tier banks, SWIFT and other payment infrastructures.

Assisting Payment Infrastructure providers with Standards, internal product development, market infrastructure adoption, communications and client outreach to the community.

How we work?

► We collaborate with our clients by co-creating propositions that meet our clients’ requirements. This includes working on everything from business and technology advisory, impact assessments, voice of the customer, centre of excellence creation, SME support, payment controls, gap analysis, through to project and programme delivery.

► We work with banks, Fintechs and central banks on a number of emerging payments and market infrastructure developments covering digital assets, Distributed Ledger Technology (DLT) and tokenisation. Our expertise

► We bring together specialist consultants with years of payments and banking industry experience, as well as in-depth knowledge of the latest technologies. Our Payments team is led by subject matter experts with over four decades of industry experience across market infrastructures, financial institutions and technology.

► We are seen as thought leaders with practical experience in the ever-changing Payments transformation space. From advising top-tier banks on their current technology and commercial strategy to working with existing and new market Infrastructures initiatives and their early adopter communities.

► We have the capability and resource availability to provide fit for purpose teams and individuals at various levels of seniority and expertise, ranging from entry level doers to business analysts, project managers and senior subject matter directors.

Assisting clients with their ISO 20022 migration starting in Nov 22 and ending after the coexistence period Nov 2025.

Assisting clients on modernising legacy technology and establishing the requisite workflow, controls and optimal operations to minimise the risk of erroneous payments leaving the organisation.

Assist clients with advisory and discovery work, impact assessments and new target operating models.

Work with clients on new market infrastructure initiatives including (but limited to) digital assets, distributed ledger technology (DLT) and tokenisation in the payments and settlements space.

Highly skilled resources with deep domain expertise and access to cutting-edge technologies

Implementation and integration of new trading and risk management systems, system migrations, and transition to new technology architecture.

Risk Operations

Financial & Non-Financial Risk, Valuations, Risk and Market Data operations.

Model Risk

Model Development, Validation, Model Risk identification and performance measurement.

Delta Capita’s Trading, Pricing and Risk business provides comprehensive advice and infrastructure tools to facilitate financial services firms to trade, book and risk manage securities and derivatives.

Our team of experts and partner solutions is used by many leading financial institutions to remain focused in achieving their business objectives and adopt advance processes and technologies.

We provide comprehensive advice and infrastructure tools to facilitate the operation of a trading business within a financial institution. We support the implementation of new systems, migrations and the decommissioning of legacy technologies.

Our objective is to bring solutions to our clients that support an efficient operating model, timely turn-around and delivery of regulatory, strategic cost reduction and revenue generating requirements.

Delta Capita’s MoRiForm service combines deep industry and domain expertise with the use of highly skilled resources and specialist vendor technologies to deliver bespoke results -focused solutions for our clients. Our team has proven modelling and model validation experience across the spectrum of models found in financial services firms.

Framework & Design

Highly skilled resources with deep expertise in financial modelling & validation and working knowledge across all

Model families

Delta Capita’s MARVIN service deploys highly skilled resources with deep expertise in risk & valuations and uses the latest technologies to deliver bespoke results-focused solutions for our clients. Our team has proven experience delivering services in risk and valuations across all asset classes.

Market Data

Operations

Risk Operations

Product Control

Operations

Valuation

Control

Raising requests or integrating into front end systems for new onboarding and periodic refresh cycles

Workflow - easily configured to meet your processes

Risk assessment Rules engine and policy enforcement – configure to your policy / polices

Data gathering and enrichment –using data robotics, from external and internal data sources

Screening –integrate to your screening provider

► Browser-based end-client portal with your corporate branding.

► Consolidated end client outreach task List with individual task submission.

► Secure multi-factor authenticated end-user access

► Fully configurable online forms and questionnaires

► Simple document upload submissions and recertification

► View and downloadable informative documents and one-way letter provision.

► Customisable dashboards & metrics

► Configurable MI widgets

► Standalone browser-based analyst portal for client entity, case and workflow creation and management

► Full API for automated integration with internal or Delta Capita onboarding case management systems

► Multiple outreach workflows and task sets to support your various legal, regulatory and onboarding requirements.

► Conditional logic to select the relevant tasks for the client based on relationship, product, and service types.

► On portal secure messaging between your end clients and your analysts

► Private comment capability between multiple end users

► Mobile identifies document scanning and OCR

► Mobile liveness checks & biometric identity verification

► Task submission notifications

► Upload and online form review, feedback and approval

► Task cancellation, case suspension or approval

► Get it right first time. Remove back and forth with your end client

► Task by task-based submission. Not all or nothing

► Recertification of pre-approved data

► Improve review approval. Highlight data points to expedite review

► Understand the status of all outreach tasks real time

► Reduce dual keying Data points stored and integrated via API’s

The most important asset of the financial institution or any other entity is the customer, making a customer-centric approach vital, even after the onboarding process is complete.

Your organization needs to manage the identity of the customer throughout their lifecycle in the organization, managing customers’ lists and data seamlessly and without error.

Delta Capita’s Karbon IDnV platform is a state-of-the-art tool providing identity management across business units and service channels, both at scale and in real time.

Seamless Integration: Effortlessly integrate workflows and case management.

Digital File Mastery: Generate comprehensive digital files and ingest all data effortlessly.

All-Round Biometrics: Capture facial, fingerprint, and iris data for complete identity assurance.

Continuous Identity Care: Consistently verify and refresh biometric samples, ensuring updated identity verification.

Stay Updated: Promptly check and update essentials like phone ID and address.

Always-On Verification: Execute identity verification across all scenarios, keeping you ahead.

Background Vigilance: Run ongoing background checks on every identity in the system.

Custom List Management: Handle biometric lists, from VIPs to fraud watch, tailored to your needs.

Mach technology comprises six core components that target the cost savings, capital reductions and new revenue opportunities of digital assets

1. Tokenised assets are $87bn today. BCG estimates they will rise to $11 trillion by 2030

2. There are $584bn of digital assets under custody (Statista, Oct 2024)

3. Existing EU law and regulation supports digital assets and digital market infrastructures

4. Settlement efficiency is falling whilst costs are rising

5. End investors remain sensitive to costs for issuance, settlement, collateral and safekeeping

6. DLT has matured and platforms are now being delivered into production

7. DLT offers solutions for collateral mobilisation, real-time settlement and fractionalisation that positively impact cost, revenue and capital

De-centralised digital passports

Links legacy and DLT ledgers via API, ISO and DLT nodes

Issue, transfer & custody of all assets

Mint, transfer lock & burn

Conventional, digital and tokenised assets on one ledger

Multi-lateral netting of settlements

1. DLT enables a more resilient infrastructure

2. Increased cyber protection, data protection and permissioning

3. New ledger structure increases transparency of chain of custody (UBO, Beneficial Owner etc)

4. Improved latency of information, regulatory oversight and corporate governance for issues (SRDll)

5. Structure compliant with PFMI Principles

6. Interoperable ecosystem – MACH supports ISO messaging, API, public and private DLT networks

MACH CSD is built on a robust three-tier architecture designed to enhance efficiency, security, and scalability.

• Workflow Engine: Manages business logic and workflows with intelligence developed to support financial services.

• Liquidity Management System (LMS): Enables efficient reserve asset and risk management. Facilitates the processing of SWIFT messages, confirmations of matched buy and sell orders, validation checks, near real-time transfer of assets, and alignment with T2 using SWIFT messaging.

• Business Logic: Supports complex financial operations and integrations, including issuer registration and wallet opening for the accounting and storage of tokenised bonds, broker registration and wallet management, and the issuance and validation of bonds.

Management

3 Tier Architecture

1. The Business Logic layer enables business logic and workflows to be implemented, with intelligence developed to support financial services workflows

2. Layer 2, Identity and Authentication, authenticates and manages interaction with the core blockchain, users and reference/static data (e.g. instrument lists)

3. Layer 3, Core Cryptographic Ledger Primitives, consists of the core blockchain solution

• Transactions: Manages and processes transactions efficiently, ensuring all transactions are executed and recorded accurately. Key management enforces secure and permissioned transactions processing.

• Multi-Ledger Wallet: Supports synchronisation and interoperability across multiple ledgers, including omnibus wallets for broker’s clients.

• Synchronisation: Ensures data consistency across systems.

• Interoperability: Seamlessly integrates with existing financial systems and infrastructures, supporting both traditional and digital assets.

• Cost Reductions: Lays the foundations for internal operational and technical re-engineering.

• Promote Innovation and Competition: Helps solve current challenges presented by existing market incumbents.

• New Products: Creates an independent and user-focused market community that is guided by market participants to shape, create and implement new products.

• Future Proof: Allows for traditional assets to be supported more efficiently and create the foundation for new digital / tokenised solutions.

Qwyn streamlines communications with intelligent features that help users prioritize client inquiries and collaborate more efficiently as a team.

Not only does Qwyn enhance client experience and reduce operational risk, but it also improves the lives of our users by providing peace of mind.

Users struggle to manage and automate communication workflows due to the number of platforms involved in the process.

Competing priorities lead to missed communication deadlines which carry risk to the firm and impact client service.

Over 50% of users’ time is spent manually handling communications like emails and chats.

Limited data analytics on communications activity and client response times.

Robust integrations that centralize, structure, and action all communication workflows and automations.

Users can prioritize their most important inquiries utilizing Qwyn’s structure and routing features.

100+ features, including AI automations, to reduce duplicative work across teams and resolve inquiries faster.

Data-driven insights to help teams enhance processes and manage capacity to improve client service and team productivity.