Publisher

Dutch Data Center Association (DDA)

Editor in Chief

Pim Kokke

Stijn Grove

Art Director

Sam Zondervan

Marketing & PR

Zoë Derksen

Research Partner

Peter Vermeulen, Pb7 Research

Contributors

Daniëlle Arets, Laura Beukers, Michiel van Blommestein, Natascha Geraedts, Manuel Giménez, Joni Israeli, Merian Kruiger, João de Lima, Niek van der Pas, Cees-Jan Pen, Max Roest, Jan Willem van Roggen, Stroomkr8, Kees Verhoeven, Bart Wernaart, Michael Winterson

About

Datacentered is a publication of Foundation Dutch Data Center Association and occurs four times a year. No part of this publication may be reproduced and/or disclosed by print, photocopy, film or any other means without written permission from the publisher.

Supported by:

Location

Dutch Data Center Association

Laarderhoogtweg 18

1101 EA Amsterdam Zuid-Oost

The Netherlands

Advertisements

For inquiries about advertisements, please contact info@datacentered.net

Legrand Data Center Solutions, STULZ, Stroomkr8, Eversheds Sutherland, Watts, DPR Construction, Deerns, Kirby, AP, Maunt, Kelvion, Koninklijke van Twist, Volker Energy Solutions, EkkoSense, Panduit, Kenter, Eaton, Weiss Technik, Paroc Panel System, Rittal, Moy, Supermicro, Trescal, Arcadis, Beveco, Chatsworth Products, Exagate, Workrate, R&M Europe, ABB, Mitsubishi Electric, NL-ix, Data Ports Groningen, Heijmans, Blygold., Huawei, TSL, Kohler, Elmon-Intertech, DC Pro, FNT, CBRE, Vertiv, Socomec, Royal HaskoningDHV, MarshMcLennan, 7Digits, Forehand, Coolgradient, Fluor, Alara-Lukagro, Aksa Power Generation, Rentaload, ACT Connectivity Solutions, CANS, Zwart Techniek, Dcongreen, TA Control Systems, Arup, Croonwolter&dros, Rahi Systems, Aggrekko, Georg Fischer AG, Black Box, DGMR, Turner & Townsend, Viking, Rolls Royce, Schneider Electric, RWL Advanced Solutions, SADC, FujiFilm, Schleifenbauer, Spie, First-Case, Vattenfall, KWS Infra, Unica Datacenters, Securitas, Maxicom, ATS Global, Hug Engineering, Sims Lifecycle Services, Commscope, Mace, Red Bear Tech, Danfoss, Submer, Soben, Juniper Networks, DC People, Novenco, Worldwide Services, Park Place Technologies, Johnson Controls, TÜVIT, Honeywell, Zentrys, Secior, Grundfos, Elinex, Equans, Pathema, APAC, Salute Mission Critical, All Rack, ATC, CSB Energy Solutions, Delta Electronics

In this world of information overload it is a real challenge to filter out the relevant information. Day to day news does not provide the insights needed by industry leaders to strategize future plans. It’s with that in mind we initiated our Kickstart Conference now 6 years ago. To create a network event where trends and insights are given by and for industry leaders. It has grown to become - the key event - in Europe. And now, we are taking the next step in our journey. Today, we are introducing Datacentered: a quarterly magazine that features analyses, research, interviews, news and insights about our data center industry in Europe.

Just with all the initiatives of the Dutch Data Center Association (e.g. Kickstart Europe Conference, Datacenterplatform and reports), we are always striving for quality in a fashionable way. During the first brainstorms, we discussed which magazines Stijn Grove and did were discussing esthetics. In these sessions, we looked at magazines that were not focused on data centers and IT. Instead, our inspiration came from highly esthetic fashion, design and architecture magazine. The question remained: how can we create an appealing magazine that has the look and feel of a fashion magazine, but features all the information that we want to present to data center industry leaders?

Pim Kokke Editor-In-Chief

In order to do this, we contacted our community and decided that we want to feature industry experts across Europe to share their expertise and vision about investments, legislation, sustainability and tech. We are very proud that you are now able to expand your knowledge by reading the articles from our contributors. For example, Michael Winterson (Chairman of the European Data Center Association) explains why the broad level of national and regional regulations will truly be a game changer for the upcoming years and how the digital transformation has the power to be disruptive.

Furthermore, the first issue features interviews with Emmanuel Becker (President of the Italian Data Center Association) about the Italian market and Vincent in ‘t Veld

(Managing Director of Digital Realty Netherlands) who talks about his first 100 days as managing director. Moreover, we present the latest insights and trends from the Southern European Market and the longread ‘The Future of Data Centers in Europe’ discusses the sustainability public relation (PR) challenges of the data center industry.

With Datacentered, you have a magazine that is a need and nice-to-have, which you can read inside and outside the office. Additionally, we challenge the boundaries of creating a magazine that will become the main reference for the data center industry.

Thank you for your support.

The Kickstart Europe Conference in Amsterdam has become one of the largest strategy and networking events in the digital industry. Industry leaders and professionals from over 30 countries come together to share the latest trends and developments about data centers, cloud and connectivity. This year, a lot of attention was place on investment strategies and challenges in the EU-regions.

WRITTEN BY PIM KOKKEThe increasing inflation rates in Europe has created tensions in society and all industries. To challenge the rising prices, the European Central Bank (ECB) has increased the interest rates multiple times since the Russian invasion of Ukraine. The developments and the subsequent increase in energy prices have led to more concerns on how to become more sustainable. At the most recent edition of the Kickstart Europe Conference in February, visitors discussed what steps the digital industry needs to take in order to become more sustainable while still achieving business goals.

Various panel sessions at the Kickstart Europe Conference discussed the opportunities of re-using the energy of data centers and the re-use of water. In the session ‘Guide to Sustainable Data Centers’, the main topic was how data centers and suppliers can achieve certain sustainability goals from a product and solution point-of-view. For example ten years ago, we saw around 10 to 15 zettabytes of data in the world Today, we are seeing around 100 to 110 zettabytes of data in the world. So we see a sharp increase in data that’s only going to continue.

However, the energy and water use of data centers remained stable in the last ten years in which you could say that data centers and suppliers took their responsibility in becoming sustainable. We realize that we’re at the center of a community and quite some priorities around being sustainable and take that responsibility got very serious.

As mentioned, the industry has taken large steps to be energy efficient. Daniel Turk, Solution Portfolio Manager for Data Centers at ABB, was also one of the panel members and elaborates on how everyone in the industry is taking their responsibility. “Everybody has a mobile phone and uses streaming services. The amount of data has increased so much, but the usage of electricity has not increased that much. However, there are always things to do as well. If we look from the side of ABB, we have good and efficient motors for cooling. A more efficient uninterruptible power supply (UPS) or better cooling switchgear can improve your energy efficiency.

The first step, however, is to set a target for your organization. For example, the science-based goals from

the Paris Agreement about the climate could function as a reference for your own business. “At Legrand, we are very committed to our developed Corporate Social Responsibility (CSR) roadmap that we launched in March 2022 and will last up to 2024 in which we want to complete our goals. We have 15 targets, divided in four areas that we want to have completed next year. For example, we want to reduce our CO2 emissions within scope 1 and 2 by 10% each year through energy efficiency improvements at our manufacturing sites and renewable energy deployment. Furthermore, we want to eliminate 100% of single-use plastic in flow packs and expanded polystyrene packaging”, says Ralf Ploenes (Vice President of Legrand Data Center Solutions Europe).

Moreover, we see an increase in demand for hardware and renewal of IT hardware but in the end we want to keep the life cycle of these products as long as possible. This contradiction sparks the discussion on how to cope with this fact. Jelle Slenters, commercial director at Sims Lifecycle Services, explains:

DESPITE THE HIGHER CONSTRUCTION COST AND INTEREST RATES, WE STILL SEE A HEALTHY ENVIRONMENT WHERE THERE IS ENOUGH CAPITAL AND FINANCING AVAILABLE.

It is easy to recover material by just moving it on to the secondary market and taking back the residual value. I think that we as an industry should do a little bit more. For example, when we get a server in, maybe we should prepare it for liquid cooling. There are some parts and components that we can buy and, in this way, upgrade those machines up to a certain standard. However, we need demand for these solutions. If you look at the automotive industry, somebody needs to buy that three or four year old Audi. Therefore, think we need to enhance the product before it goes onto the market by, for example, extend the life cycle or expand the warranty upgrades.”

In the Investment Outlook panel, the topic focused on the capital availability within the industry. Timo Buijs, Director Project & Infrastructure Finance at the Dutch bank ABN AMRO, explains that this year growth will still be substantial. “From the banking side, there is still a demand for financing data centers. We do believe that in a couple of years, just like in the United States, other sources or at least debt funding will come to the market and will serve as an important alternative form of investing in data center projects in Europe. Furthermore, there is still a healthy growth and demand from enterprise hyperscalers which drives the prices up. Despite the higher construction cost and interest rates, we still see a healthy environment where there is enough capital and financing available.” The latter is also what Konstantin Hartmann, Vice President Sales & Commercial at NTT Global Data Centers EMEA, sees. “There will be a large portion of organic growth in existing markets. At NTT, we have a strong basis in Frankfurt and London but also in other markets. We will come into, I would say, a decade in the next few years where we will see a lot of deliveries going on. And think this is going to shake off a little bit the Merger & Acquisition (M&A) activities in the market as well, because it’s going to be exciting to see how all these commitments, specifically the pre-leased commitments that many providers have done, are going to be delivered. These M&A activities will also be focused on certain markets in order to get knowledge about these markets.”

Many National Trade Associations (NTA’s) came together at Kickstart Europe to discuss their mutual challenges. One of the most heard key-messages at the Kickstart Europe Conference was perception of data centers towards media, politics and society. The framing that data centers have a large impact on climate change has to be debunked in a way that the industry should clearly inform the public opinion about the energy usage and which initiatives are already implemented in order to achieve the global sustainability goals.

For Southern Europe, executives of the NTA’s from Spain, IItaly and France joined the panel session in which they discussed recent developments and challenges in their country. Robert Assink, co-founder of the Spanish Data Center Association, shared how the DC-market in Spain is growing. “There are a lot of new investments in the Spanish market. In 2019, there were only three international multi-tenant data center operators in Spain. Nowadays, there are already six operators and if all the announced plans come through, we expect 12 operators in the upcoming 2-3 years.”

According to Assink, a lot of investments occur in the Mediterranean area because of the Strait of Gibraltar that is connected to the subsea cables in the Atlantic Ocean, and the Suez Canal that is connected with the Pacific Ocean. “For geographical metrics, the distance between the continents in order to connect each other is shorter thus leading to lower latency and lower costs. In this way, we can create a fast Internet highway which connects three continents from Virginia (United States) to Bilbao (Spain) with connections through Barcelona, Marseille and the Pacific Ocean.”

In France, legislation and sustainability are the main topics for the industry but also the national authorities. “As an association, we have a working group on data center and cloud that addresses the circular economy, renewable energy, energy efficiency and cooling systems. We want to decarbonize our industry in which we collaborate with the public authorities. With the latter, it took time to establish a realistic dialogue with the public authorities to explain what a data center is. But now we are more well-known, which is good because regulation is growing in France. For example with sustainability, we have 2-3 new laws every year that affect data centers”, says Geraldine Camara, managing director of the France Datacenter.

The same challenges occur in Italy. Emmanuel Becker, managing director of the Italian Data Center Association (IDA). “The key challenge is to deliver enough capacity for the requests in the market as the countries in Southern Europe have become more popular in constructing new DC-locations, which also attract suppliers and cloud service providers. Furthermore, the connectivity between these countries is still a challenge as we are mainly discussing the use of subsea cables and not specifically what connectivity we can have between each other in order to connect ourselves on an interconnected global level.”

In the panel discussion about the Nordics, the members discussed the strategies and developments in their country, and the perception of data centers in the media. For example, Veijo Terho, chairman of the Finnish Data Centre Association, shared that the demand for new DC-locations in Finland are quite high. “Microsoft is building multiple data centers and Google is also further expanding their existing data centers. However, we are also dealing with bureaucracy in the way of getting permission for building new data centers despite all the green energy (e.g. wind) sources that we have.”

In Sweden, the perception of data centers and public opinion differs compared to Ireland and The Netherlands. However, there is still plenty room for improvement regarding this topic. “We really need to talk with others about the importance of our

digital infrastructure, because this is an enabler for all the digital solutions that positively impacts our everyday life. Then, we can encourage younger generations to work in our industry”, explains Isabelle Kemlin, vice chairman of the Swedish Data Centre Industry Association. The perception of data centers is also a hot topic in Norway. “We see a change of perception in Norway. Previously, our country was mostly regarded as ‘too exotic’ for large investments due to the historical factors such as the lack of connectivity and the fact that Norway, because of our landscape, was not fitted for the construction industry. However, this frame has changed quite rapidly in the short term and we see that more tech companies are evaluating new projects in the country”, says Bjørn Rønning, general manager of the Norwegian Data Center Industry.

Thomas Volder, chairman of the Danish Data Center Industry, explains the current situation in Denmark. “We saw quite a positive momentum for hyperscalers by having Google, Apple, Facebook and three data centers from Microsoft. Those were big investments in our digital infrastructure. However, on the colocation side there was some growth but not at the pace of Norway. Therefore, I believe that we will see a bigger momentum on this site for the future which will go hand in hand with the further developments at the hyperscalers sites. “

But what trends are evolving in Western Europe? In the FLAPD and Belgium, there are a lot of developments that need to be addressed by the representatives.

Friso Haringsma, co-founder of the Belgian Digital Infrastructure Association (BDIA), explains what is happening in the Belgian market. “In Belgium, there is a decentralization of the data as it’s stored mainly in on-premise data centers. If you look at the size of that, it’s almost double the size of co-location. Therefore, there is a lot of potential in working with IT concentration and to have a more efficient way of handling the data.” When

addressing the regulation, Haringsma explained that Belgium is working towards the European perspective as local politicians are not prioritizing data centers. Furthermore, he explains that there are some regions in Belgium that have not invested in the future thus leading to some challenges for the grid. “Because of this, there is a lot of potential for investments to be made in order to make sure that there will be no issues on grid usage”, says Haringsma.

In Germany, there is a lot of discussion about the amount of regulations for data centers. Anna Klaft, chairwoman of the German Data Center Association, explains: “We recently got a new energy efficiency law that wants to regulate mandatory heat recovery aspects for new facilities and limitate the server temperatures. However, we think that this law does not suit our industry thus leading us to further discuss the implementation of it with politicians, decision makers and the municipal authorities.” Klaft further addresses that Berlin is expanding itself as the second DC-market in Germany because Google chose the city for building a full cloud service region. “But we also have Munich, Düsseldorf and Nuremberg where a lot of local data centers are situated”, tells Klaft.

Gary Connolly, president of Host in Ireland, shares that the industry should focus on the two biggest trends: decarbonization and digitalization. Furthermore, Connolly addresses that the power grid limits are something that needs to be taken seriously. “In Ireland, we have a 1 Gigawatt (GW) now at the moment with 600 Megawatt (MW) under development. The challenge is that you are looking to integrate 1.6 GW with a two Gigawatt funnel into a 5 Gigawatt (GW) grid. That is insane. And as data centers are just a large floppy disk, we are more interested in the data itself.”

The limits of the power grid is not the only thing that comes to mind. Stijn Grove, managing director of the Dutch Data Center Association (DDA), explains that the industry also has to address how it can grow as there is a lot of

“WE REALLY NEED TO TALK WITH OTHERS ABOUT THE IMPORTANCE OF OUR DIGITAL INFRASTRUCTURE, BECAUSE THIS IS AN ENABLER FOR ALL THE DIGITAL SOLUTIONS THAT POSITIVELY IMPACTS OUR EVERYDAY LIFE.”

ISABELLE KEMLIN, VICE CHAIRMAN OF THE SWEDISH DATA CENTRE INDUSTRY ASSOCIATION.

WE SAW QUITE A POSITIVE MOMENTUM FOR HYPERSCALERS.

shortage in various domains. “There is a shortage of people, power grids and land. Therefore, think the data center industry needs to integrate more with the grid. So we are looking into new areas where we can build substations ourselves and connect them directly to the high voltage grid. Let us use the grid connection that we also have for batteries in between, because they also have a shortage of grid connections. In this way, we can grow in an integrated way”, tells Grove.

Grove further explains that in the Netherlands data centers take a leading position in the new economy. “The new economy is open, transparent, inclusive and sustainable. And in order to build this, you need digital services and a solid infrastructure as we live in a time where we rely more on the infrastructure in our own country. Therefore, we will also change the way we build data centers in the future and the place where we build.”

The Eastern Europe market is also growing. According to the panel members, the market size will grow exponentially in the upcoming years. “Currently, there are 70 data centers and this number is still growing. For example, Vienna has more carriers, Internet exchanges

and content providers than any of the other regions in the local market. And based on that, data center market used to grow exponentially when hyperscale providers got interested in that market, not only to access the Austrian customers, but to have a point of presence in the Central East European region to reach out to the neighboring countries as well. From Vienna, you can reach five capital cities within less than five milliseconds, which is a strategic advantage, definitely if we want to reach out into the region. Furthermore, there are also a lot of regional players in the regions like Styria (upper Austria) where the

demand for data centers expands”, says Martin Madlo, president of the Austrian Data Center Association. In Poland, there are three challenges in the local market. Sławomir Koszołko, CEO at Atman, explains how energy prices, availability and Megawatt connections are the biggest challenges for the country.

“If you build more and more, you will have the problem of availability of energy and connections. For example, every operator wants to be in the same place like Warsaw. One of the solutions is to move to other cities and create some form of diversification.”

In sum, you could say that in all EU-regions the same challenges are occurring. The power grid, energy availability, the public opinion about data centers and future constructions are just a few that were mentioned during the panel discussion at the Kickstart Europe Conference. But despite these challenges, the investment climate for (new) data centers is and will be booming.

Marenostrum 4 is a supercomputer located in Barcelona’s Chapel Torre Girona and part of the Barcelona Supercomputing Center (BSC), The supercomputer has gained significant recognition as one of the most powerful and advanced supercomputers in Europe.

Installed in 2004, it has undergone several upgrades since then to maintain its cutting-edge capabilities. Furthermore, the MareNostrum consists of multiple interconnected clusters of processors and accelerators, enabling parallel processing and efficient computation.

The general-purpose block has 48 racks with 3,456 nodes. Each node has two Intel Xeon Platinum chips, each with 24 processors, amounting to a total of 165,888 processors and a main memory of 390 Terabytes.

Spain and the data center sector are living in an idyllic moment, like the beginning of a love affair where everything is perfect, everything adds up and everything fits together. Those are known as “days of wine and roses”

For the first time in its recent history, Spain caught the train of an industrial revolution and are seated in the first class wagon. It is located at one end of Europe with direct communication to Africa, America and the center of the continent. Due to a solid network of connections and an enormous development of renewable energies, Spain firmly position itself as the hub of digital communications in Southern Europe.

Large companies and major international investors have set their sights on Spain, which in the coming years will receive close to 7,000 million euros in direct investment and another 10,000 million euros in indirect investment. This growth will lead the country to comfortably exceed 600 MW of power by 2026, bringing it closer to the most mature markets in Europe. In short, Spain has gone from being very distant from the large data centers, the so-called FLAPs (Frankfurt, London, Amsterdam and Paris), to becoming one of them. We could already speak of FLAPS including the S for Spain.

The rapid growth of data usage, post-pandemic world, and the new trends in all fields (health, mobility, education, etc.) explain this unstoppable process towards digitalization, decarbonization and, therefore, sustainable development. data centers is a centerpiece of this process that is fundamental to humankind.

The expectations must give way to a mature and serene

analysis. This rapid growth is not without risks and challenges. The first of these challanges is undoubtedly sustainability. The data center sector must take a firm step towards climate neutrality and Spain is at the forefront with respect to its neighboring countries. Thanks to its strength in renewable energies and a more recent start of activity, it could be said that the data centers in our country are natively sustainable. We need to achieve full integration of the data center into the environment and society, so that we are seen as part of the solution to environmental problems, the climate crisis and the rational use of natural resources.

Talent is another great challenge facing the industry. The rise of digital transformation is causing an increase in the demand of data centers, which must be nourished by professionals with a high technological profile. Thousands of them will be needed in the coming years and despite the public-private efforts there is a shortage in the market.

Finally, the challenge of regulation. The development of the data center sector needs strong institutional support at all levels, local, regional and national. It is our responsibility to make authorities and society aware of how necessary the data center is to successfully grasp a digital, decarbonized society. Development indexes are much higher in regions where data centers are installed: job and wealth creation is much stronger where digital and green transitions are more advanced.

These challenges are the thorns on the roses I mentioned at the beginning. Thorns that need to be trimmed so that they do no harm. Spain has a great opportunity to grow and to do so without harming anyone or anything.

The concurrent need for sustainability, energy transition and cost reduction has become pervasive throughout the entire data center industry. “All the while, well-known requirements such as security and compute power have not allayed, resulting in a ‘New Normal’ for the entire market”, says Carlo Brouwer, managing director of STULZ Benelux.

WRITTEN BY MICHIEL VAN BLOMMESTEIN

WRITTEN BY MICHIEL VAN BLOMMESTEIN

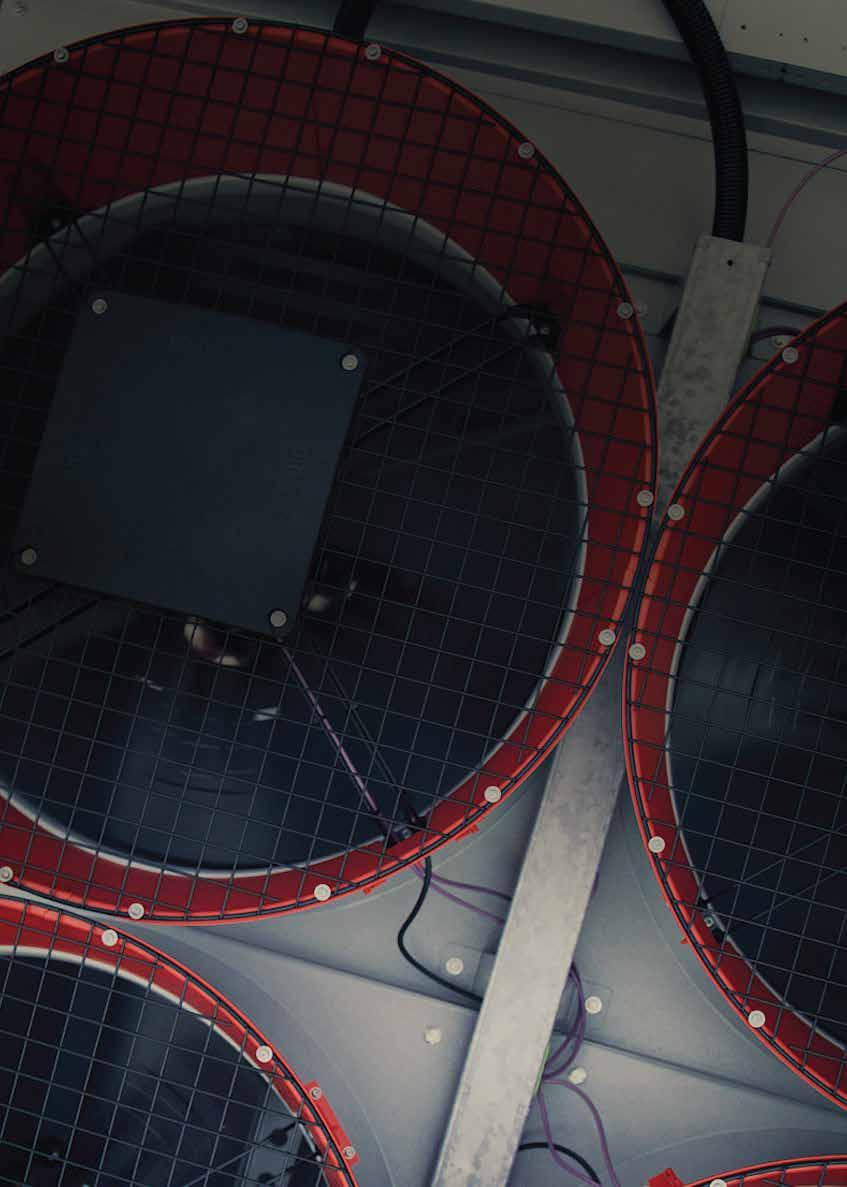

The entire world is in the midst of a transformative phase, focusing on sustainability, energy transition, and cost savings. That has numerous implications that complicate operations and design of data centers. “One of the crucial factors impacting data centers is the increasing temperatures within facilities,” Brouwer says. “Increasing the temperature by just a bit can have a significant effect on power usage. However, higher temperatures also have a significant impact on equipment such as chillers and coolers. Refrigerants are becoming increasingly critical.” Scalability is becoming a pressing concern as well. “In the past, we saw modules with a capacity of 500 kW per room. But now, 2 MW is becoming increasingly common. Another example is the power per rack, where we are often well over 10 kW, with extremes even reaching 100 kW.” It’s not easy to manage such changes, and Brouwer

concurs. “Simply increasing the airflow until you get small-scale tornadoes in your IT room is not viable. And newer techniques such as liquid cooling do work, but then the return temperature puts additional strain on the chillers. So you need to prepare for all of that.”

It’s these kinds of challenges that are in the ballpark of STULZ to solve. “For example, we’ve been working with Cool-IT in offering on-chip cooling,” Brouwer says. “Such techniques, as well as submersive cooling, can really help data centers tackle the high power densities we’re seeing these days.” The solutions offered by STULZ naturally also help data centers in their goals of offering heat to other objects and buildings. “Heat reuse is a challenge, as the heat is being generated 24 hours per day and 7 days per week throughout the entire year. There are not many prospective customers who need all that heat all the time. It also demands that the data center facilities are near such heated objects, which often is a break from the traditional out of the way locations where data centers have always been constructed.”

On paper at least, these challenges of the New Normal are as good as solved. But there are still areas where more discussion and research are needed, Brouwer warns. “We don’t know what to do with F-gases,” he says, mentioning refrigerant gases that while ozone friendly has an enormous global warming potential. “Sure, there is much mentioning of propane as an alternative. However, the quantities needed would be extremely high. Finding a balance between advantageous properties and regulatory compliance is essential.” Brouwer highlights the importance of open discussions among industry stakeholders, suppliers, and government bodies to collectively explore further possibilities. “We are working to create think tanks to tackle such subjects. These groups will include some of the key players in the market.”

WE ARE WORKING TO CREATE THINK TANKS TO TACKLE SUCH SUBJECTS. THESE GROUPS WILL INCLUDE SOME OF THE KEY PLAYERS IN THE MARKET

Meanwhile, the dynamic nature of the industry means that data centers have to keep delivering ever increased performance and security. Driven by innovations such as artificial intelligence (AI), the exponential growth in computing capabilities has made data centers the PCs of the modern era. “Whether you want it or not, modern society simply needs the services offered by data centers,” Brouwer says. “Many applications that are vital for healthcare for example wouldn’t exist without them. And AI will become equally important.” While some concerns around the proliferation of AI have become part of the public debate, Brouwer states it’s very important to foster acceptance through regulations.

The data center industry is undergoing a paradigm shift towards sustainability, compliance with regulations, and innovative technologies. It continues to play a vital role in supporting various sectors, collaboration, and open discussions among industry stakeholders will be crucial to navigate these changes successfully within this New Normal. “And we need to keep up”, Brouwer concludes.

Undoubtedly, data centers have been the subject of debate in the Netherlands in recent years. While the demand for data storage increased immensely, scarcity of land, power constraints and a national nitrogen crisis have caused national and local governments to formulate stricter requirements for operating data centers.

In July 2019 the municipalities of Amsterdam and Haarlemmermeer both announced a moratorium, and the construction of new data centers within their borders was temporarily halted until local policies were set in place. On 16 February 2022, the National Minister for Housing and Spatial Planning issued a preliminary planning decision on hyperscale data centers. With the exception of two areas, hyperscale data centers were banned nationwide and stricter rules were announced for data centers larger than 10 hectares and consuming 70 MW or more of power.

Since 2020 we have seen local and regional governments starting to formulate data center policies and strategies. These documents all have a strong focus on sustainability and on spatial aspects such as integration of data centers. Designated and specific locations for data centers are embedded in zoning plans, which also contain rules on landscaping. Sustainability aspects mainly focus on energy consumption, use of sustainable energy, residual heat and water safety and water usage.

Province of North Holland in their Data Center Strategy 2022-2024, will take shape over the coming period. Developers and operators should expect additional and detailed conditions e.g. on energy savings and water usage. These conditions will become part of the permitting process for new data centers and existing data centers that want to expand.

It will be interesting to see how governmental authorities will be able to support data center operators and developers who are facing all these environmental challenges at the same time. The nitrogen crisis currently prevents any construction that adds more nitrogen into the environment – even if it concerns construction of a sustainable project such as CCS or the simple installation of solar panels. Finally, let’s not forget the new Environment and Planning Act. This Act is still expected to take effect as of 1st of January 2024. This major piece of new legislation combines laws for spatial planning, infrastructure, environment, nature and water and will have a major impact on how we deal with regulatory aspects.

These policies and strategies have in itself created a framework for data centers in addition to the applicable EU and national legal framework as set out in specific environmental legislation. We foresee that establishment conditions for data centers that were announced by the

Natascha Geraedts is a Partner at Eversheds Sutherland and part of Eversheds’ renowned Global Datacenter and Digital Infrastructure team. Natascha started her career at the Council of State and has over 20 years’ experience. Natascha is seen as the “go to expert” in the Dutch market for her knowledge in the data center sector and data center developments. Natascha frequently speaks and publishes on environmental and regulatory aspects of data centers and she has been a yearly speaker at the KickStart Europe Conference since 2021.

Governments and policymakers around the world have begun introducing codes and regulations for organizations to help meet ESG and sustainability goals. The European Union has introduced the Corporate Sustainability Reporting Directive (CSRD), which will require about 50,000 organizations to formally report on an annual basis starting in 2025, based on 2024 data.

FIRST OF ALL, WHAT FALLS UNDER ESG?

ESG has become a top of mind topic for management and boards especially in the last couple of years. With the introduction of CSRD, companies’ claims and commitments on ESG matters shall be put to the test once they start reporting on them.

Over 90% of studies show a positive correlation between ESG factors and financial performance.

Organizations need to quantify and address these topics with both short-term and long-term strategies to manage their risk exposures. Also, it is important to understand who the stakeholders are and what their drivers are.

ENVIRONMENTAL SOCIAL ENVIRONMENTAL

Carbon

Carbon Emissions

Product Carbon Footprint

Financing Environmental impact

Climate change vulnerability

Natural Resources

Water Stress

Biodiversity & Land use

Raw Material Sourcing

Pollution & Waste

Toxic Emissions & Waste

Packaging Material & Waste

Electronic Waste

Environmental Opportunities

Clean Tech

Green Building

Renewable Energy

Human Capital

Labor Management

Health & Safety

Human Capital Development

Supply Chain labor Standards

Product Liability

Product Safety & Quality

Chemical Safety

Financial Product Safety

Privacy & Data Security

Responsible Investment

Health & Demographic Risk

Stakeholder Opposition

Controversial Sourcing

Social Opportunities

Access to Communities

Access to Communications

Access to Finance

Access to Health Care

Opp’s in Nutrition & Health

Carbon

Carbon Emissions

Product Carbon Footprint

Financing Environmental impact

Climate change vulnerability

Natural Resources

Water Stress

Biodiversity & Land use

Raw Material Sourcing

Pollution & Waste

Toxic Emissions & Waste

Packaging Material & Waste

Electronic Waste

Environmental Opportunities

Clean Tech Green Building

Renewable Energy

Over 1,800 climate-related laws and policies are already in place globally. Over 500 sustainable finance policy instruments are in place in the largest 50 global economies.

Increased reputation translating into up to 11% higher market cap. 76% of consumers would refuse to buy a product if a company operated contrary to their beliefs. 66% of consumers are willing to pay more for sustainable brands.

1 3

Good ESG helps win the competition for talent. 55% higher employee morale. 16% higher productivity, with measurable impact on shareholder value.

2 4

Investing in .

Climate change policies

Energy efficient technologies

Carbon reduction measures

Environment preservation initiatives

Environmental loss prevention

Improved labour standards

Anti corruption and frauds controls

Privacy and data protection

Health and safety

Roles and responsibilities

ESG budgeting process

Monitoring metrics and KPIs

Reporting

E S G

Operational efficiency

Stronger market positioning

Positive reputational effect

Reduced costs of accidents and ill health

Higher employee retention

Reduced risk of internal & external frauds

Mitigated risk of fines and compensations

Align investments vs. business priorities

Improved reputation

Disclosure to relevant stakeholders

Access to cheaper financing

ESG transformations. We work with you to develop a plan and integrate it into your future ERM processes to better align risk and insurance management in terms of coverage responses and renewal information. Datacentered ESG Strategy 48

In Southern Europe, the data center market is developing rapidly. At the moment, Pb7 Research has identified a colocation data center capacity of 360 Megawatts. The majority of that capacity is spread across Spain and Italy, especially in and around Madrid and Milan. However, the Portuguese and Greek markets are actually quite sizable. And when we made a thorough inventory of all the planned data center developments for the coming five years, we were able to identify an enormous volume of 760 Megawatts in total. Obviously, there will be plans that have not been made public and escaped our eyes, especially in Greece and other countries such as Croatia and Malta. And on the other hand, there are some plans that are quite speculative. However, it is clear that the data center industry is booming in Southern Europe.

The growth is the result of a number of complementary trends. The key driver is the demand from hyperscale cloud providers, such as AWS, Google, Microsoft, and Oracle. In Europe, also in the south, they use a fairly even mix of colocation (wholesale and built-to-suit) and self-built data centers. Further, Southern Europe has developed into a major intercontinental connectivity hub. It has become a crossroads of major sea cables from the Americas, Africa, the Middle East and Asia. In the meantime, Southern European governments are very eager to attract data centers and other international digital investments. Finally we also see that digital transformation is being embraced at a high speed, resulting in growing local demand for professional data center housing.

Southern Europe: Pb7 Research is using the United Nations definition of Southern Europe. That means we include Albania, Andorra, Bosnia and Herzegovina, Croatia, Gibraltar, Greece, Italy, Kosovo, Malta, Montenegro, North Macedonia, Portugal, San Marino, Serbia, Slovenia, Spain, and Vatican City. The region is responsible for 18% of the European GDP, and within the region, 81% of the GDP is produced in Spain and Italy. In 2022, most countries in the region outperformed the EU growth rate. Italy performed only just above average, but countries such as Spain, Portugal, Greece and a number of smaller countries showed GDP growth of more than 5%.

During the past five years, countries such as Spain, Portugal, Italy, and Greece have shown signs of economic improvement. These nations have implemented structural reforms, pursued fiscal consolidation measures, and attracted foreign investments, contributing to increased economic activity. At the moment, the region is host to just 8% of all European colocation data centers in terms of IT power (MW). While governments in the North West of Europe are putting brakes in place for major data center investments, the South of Europe is still very much actively attracting new investments.

Across the South of Europe, we see a lot of announcements that are directly related to investments by hyperscale cloud providers. When these providers first settled in Europe, in the first half of the 2010’s, they focused their investments in the Nordics and the North West of Europe. The Nordics were attractive due to a combination of widely available low cost renewable power, plenty of space and a cool climate. The North West was important as it provided all connectivity requirements and closeness to a large number of consumers and business centers.

In more recent years, hyperscalers have moved from a centralized approach to a mixed approach, where they move closer to the edge. Some activities will remain concentrated, but they started to roll out data centers – self-built and rented - to new locations, distributed across Europe. With these new data centers come new ‘local zones’ where data can be stored and processed. There is a clear customer demand for more local zones by customers, in order to boost performance (reduce latency) and to achieve data sovereignty and compliance. Hyperscalers have achieved the scale that they can afford to do this cost-effectively.

At the same time, building and operating data centers in the FLAP-D markets (Frankfurt, London, Amsterdam, Paris, Dublin) are becoming complex due to shortages in grid power and space. As a result, hyperscalers are more open to exploring alternative locations. Many Southern European governments are rolling out the red carpet for these investments and they have a lot to offer. For example, Southern Europe holds great opportunities for carbon free energy production based on solar energy.

The countries in the North West of Europe on average have about 1500 hours of sunshine, the UK and Ireland even less. But in the South of Europe, countries on average have about 2800 hours of sunshine that are also more evenly spread across the calendar.

Furthermore, we see that the difference in required cooling power between the North and South has declined rapidly and will likely decline even further. Free air cooling is realistic for most of the year. As a result, PUE’s even below 1.2 are feasible and are increasingly being achieved. This has leveled the playing field in Europe significantly. With the anticipated string growth in the adoption of liquid cooling, the differences will decline even further before we hit 2030. With the growth of very large data centers, the demand for water will also grow, a resource that is increasingly scarce in the North and South. We already see data centers being creative, for example by storing rainwater in big tanks. However, governments will also have a role in establishing rules and guidelines for water usage.

In sum, hyperscale cloud providers are investing heavily and are responsible for probably 80% of all new data center demand in Southern Europe in the coming five to ten years. They are renting large buildings and entire data centers in and around the key metropolitan areas. As a result, not only the traditional data center cities (Madrid and Milan) benefit, but also cities such as Barcelona, Athens and Rome. In addition, they build hyperscale data centers at strategic locations, for example where intercontinental sea cables come ashore. As a result, opportunities emerge in locations such as Portugal (Sines) and the North-West of Spain (Galicia).

The FLAP-D markets biggest raison-d’être is acting as the digital gateway between the United States and Western Europe. Historically, that’s where the first transatlantic cables landed and the transatlantic internet interactions emerged. While the Northwest of Europe continues to be a major economic and digital key market, we are seeing strong economic developments in other European regions as well, including Southern Europe. More importantly, the global connectivity map has changed significantly over the last ten years. Portugal is a major landing point for submarine cables to and from Asia, Africa and South America. And in the North West of Spain there are multiple landing points connecting Spain to North America.

A lot has also been written about Marseille in the south of France as a connectivity hub with great connectivity to the East. But also the South of Spain, Crete, Italy (Sicily in particular) and Cyprus are well connected to submarine cables to and from the Far and Middle East. This provides a lot of opportunities for international colocation and makes the South of Europe attractive for new hyperscale campuses.

Governments focus on attracting international investments

Governments in most parts of Southern Europe are very welcoming to data center investments. They perceive data centers as a crucial part of the digital infrastructure that is required to build a modern economy. Furthermore, data centers offer a lot of job opportunities during the construction of new locations and when these locations are operational. To support this ambition, they are welcoming big connectivity initiatives, resulting in a strong

increase in subsea cable landing points. Moreover, they invest strongly in the digital infrastructure on land to consumers and businesses, and the end users in order to drive the local digital agenda. For example, broadband penetration is still relatively low in Spain and Italy, but Greece and Portugal are keeping up very well compared to FLAP-D countries. And when we look at the role of fiber, Spain and Portugal are very much at the forefront. Italy however, still has its work cut out.

Source: OECD, Broadband Portal, http://www.oecd.org/digital/broadband/broadband-statistics/

In general, Southern European governments are quite active in investigating digital usage to create new economic opportunities. They may have a reputation of being somewhat difficult to work with, with a lot of red tape and many delays as a result. But at the same time they have a very positive mindset towards (foreign) digital investments and the digital agenda in general. We also see private/public partnerships being put in place to get new projects off the ground. And in some of the smaller Southern European countries with small data center sectors, we also see central governments discussing directly and very actively with big technology vendors for new projects.

The improving digital infrastructure delivers a lot of opportunities for building out the digital economy in these countries. Better connectivity results in a better end-user experience and therefore more digital consumption by consumers. It also means that cloud services are easier to use, bringing a vast range of on demand digital services and solutions to enterprises and SMEs alike. With access to the cloud and great connectivity, businesses can invest in new business models, from online sales to all kinds of new digital

• RAI announced an edge data center network, comprising of 18 edge data centers (3.4MW), supplemented by Milan (4MW) and Rome (40MW) data center

• The Municipality of Arcene is talking with Vitali to develop an 18 ha data center campus

• Aruba launches two new data centers in Lombardy, offering 17 MW or power

services and customer experiences. They can attract new customer bases that used to be out of reach and provide new services to existing customers.

Digital technology is moving very fast. At the moment we are all looking at generative Artificial Intelligence (AI) as a not yet completely mature solution that is already disrupting areas such as online search. This may seem small, but it can potentially shake up the entire Big Tech landscape. Generative AI is expected to grow very rapidly and will require an enormous amount of data center capacity. Moreover, Generative AI is only a subset of the overall AI opportunity and AI itself is only a part of the big technology changes that provide big business opportunities. For example, we also need to consider the rise of smart appliances ranging from light bulbs to cars, and from drones to smart farming.

The south of Europe is better positioned than ever before to benefit from these technological advances. Governments and businesses will embrace it as consumers will demand it. These new digital products and services desperately need a robust and reliable infrastructure. The networks are in place or put in place and many companies will face make-or-buy decisions in terms of their data center. Many will decide to move it entirely to the cloud and even more organizations will move to a combination of cloud infrastructure and on-premises infrastructure. Cloud infrastructure requires a lot of data center space and organizations need to figure out if they can build and run robust, efficient data centers themselves, or if they should leave that to the professional. So far, this retail colocation opportunity has hardly been touched so get ready for it.

• Stack opens the MIL02 data center (10MW) near Milan, bringing the total capacity to 50MW

• Aruba opens Hyper Cloud Data Center (IT4) in Rome, start of five 6MW data centers

• Plans to turn former waste management plant in Tuscany into a 20MW data center

• Panatoni launches plan for 42MW data center in Catalonia, 20 kilometers from Barcelona

• Ingonestica is partnering with Impulsa Galicia for a 15MW carbon neutral data center

• Ingonestica is building a 150 MW data center in Cáceras (Extremadura region)

• Merlin properties started construction on the Arasur data center in Vitoria (south of Bilbao), with 70 MW in two phases.

• Nethits Telecom plans 20 MW data center in Valencia

• Start Campus started building first 15MW facility on the new Sines data center campus, plans to scale up to 135 MW and eventually grow into a 495MW campus by 2030.

GENERATIVE AI IS EXPECTED TO GROW VERY RAPIDLY AND WILL REQUIRE AN ENORMOUS AMOUNT OF DATA CENTER CAPACITY.

Most Connected

$1.281 TRILLION

DATACENTERS

GDP DESI INDEX

81

Digital Realty Spain

• Interxion Madrid (MAD1) (182)

• Interxion Madrid (MAD2) (182)

Equinix Spain (53)

• Equinix MD2 (53)

• Equinix BA1 (52)

ESpanix Datacenter (27)

Largest Sites

APTE Spain

• Telefonica Barcelona 1-3

TATA Group Spain

• Tata Madrid

Malaga Data Center Spain

• Malaga Data Center

#7

INTERNATIONAL TAX

COMPETITIVENESS INDEX

#34

Data4 Group Spain

• Data4 Espagne

Orange Spain

• Orange Santander

Most Locations

• Equinix Spain (4)

• Digital Realty Spain (3)

• ADAM (3)

• ADAM Spain (3)

• EXA INFRASTRUCTURE SPAIN (3)

AMOUNT OF IX-MEMBERS

194

Most Connected

MIX S.R.L. Italy (175)

• MIX Caldera

CDLAN S.R.L. Italy (35)

• CDLAN Caldera21

Data4 Luxembourg S.A.R.L. Italy (28)

• Data4 Italy Datacenter Campus

Equinix, Inc. Italy (28)

• Equinix ML2 - Milan, Cascia

Seeweb S.R.L. Italy (26)

DATACENTERS

GDP DESI INDEX

138

• Seeweb Milano Caldera

Largest Sites

DEV Italia Datacenter Pisa Italy

• DEV Italia DataCenter Pisa

Planetel SPA Italy

#18

INTERNATIONAL TAX COMPETITIVENESS INDEX

#37

• Planetel Treviolo

Universitá Degli Studi Di Padova Italy

• VSIX DC

Retelit Group Italy

• Retelit Modera

AtlasEdge Data Centres Italy

• AtlasEdge DC Milan

Most Locations

• Retelit Group (30)

• Centerserv Italy (12)

• Interoute/GTT Italy (7)

• Stack EMEA (7)

AMOUNT OF IX-MEMBERS

383

GDP DESI INDEX

DATACENTERS

INTERNATIONAL TAX

COMPETITIVENESS INDEX

Most Connected

Equinix Portugal (48)

• Equinix LS1

Fundação para a Ciência e a Tecnologia, I.P. Portugal (7)

• FCCN Lisbon - SE06

Fundação para a Ciência e a Tecnologia, I.P. Portugal (7)

• FCCN Lisbon - SE03

ONI Telecom Portugal (6)

• ONI Telecom Lisbon Matinha

Dotsi Portugal (3)

• Dotsi Lisbon DC1

Largest Sites

Tata Communications Portugal

• Tata Communications Seixal

AR Telecom Portugal

• AR Telecom Porto

Fundação para a Ciência e a Tecnologia, I.P.

• FCCN Lisbon - SE03

Equinix Portugal

• Equinix LS1

Claranet Portugal

• Claranet Porto

Most Locations

• Fundação para a Ciência e a Tecnologia, I.P. (4)

• AR Telecom Portugal (3)

• Webtuga (3)

AMOUNT OF IX-MEMBERS

54

Most Connected

Ziemer Group AG

• SIS Ltd Malta Data Centre

University of Malta

• Malta University Data Centre

BMIT Technologies PLC

• BMIT Qormi

CSL Data Centre Services Ltd

• CSL Data Centre

• Melita

• Melita Data Centre

Most Locations

• BMIT Technologies PLC (2)

• CSL Data Centre Services Ltd (1)

• Melita (1)

• GO PIC (1)

• University of Malta (1)

GDP DATACENTERS

$22.8 BILLION 12

Most Connected DEFI Andorra

• DEFI Data Center

MYP Proveidor Serveis Internet

• Myp Andorra Data Center Andorra Telecom

• Comella Data Center Andorra Telecom

Most Locations

• DEFI Andorra

• MYP Proveidor Serveis Internet

• Andorra Telecom

GDP DATACENTERS

Most Connected

Gibraltar Savings Bank

• Rockolo Limited World Trade Center

• Gibtelecom Data Center

Continent 8 Technologies

• Continent 8 DC

Sapphire Networks

• Sapphire Networks Data Center

Most Locations

• Gibraltar Savings Bank (2)

• Sapphire Networks (1)

• Continent 8 Technologies (1)

GDP DATACENTERS

$3.2 BILLION 4

Most Connected Semplify

• Semplify DC

Most Locations

• Semplify

SAN MARINO $2.09 BILLION

GDP DATACENTERS

Amsterdam has plenty of cloud cover, and for once, it is not related to the weather. In fact, the FLAP (Frankfurt, London, Amsterdam, and Paris) data center market is expected to grow at a CAGR of 3% until 2027; and Dublin is likely to experience similar figures. With that in mind, as a banker, cannot help but consider the impact of the increasing interest rates on data centers’ financing. Will the financing of new data center projects come to a temporary halt?

On one hand, the European Central Bank has increased the interest rate by a total of 175 bps, since December 2022. On the other hand, the demand for data centers remains high, powered by the increasingly data-hungry economy. Some of its drivers are among the most trending topics of the year, such as the rise of artificial intelligence, the use of video content, automation, edge computing, and augmented reality.

The amount of new data created and consumed has grown exponentially in the last two decades. To put things into perspective, Statista expects the amount of new data to grow to 181 zettabytes in 2025. That is more than all the produced data over the 2010-2019 period!

However, something to stay vigilant about is the sustainability and regulatory aspects around data centers, and their role in society. An example is the EU Code of Conduct for Data Centers that provides recommendations supporting the European Energy Efficiency Directive (EED).

The impact of interest rates on the development of data centers should not be keeping anyone awake at night. Of course, being a debt-loaded sector, it is natural for rising interest rates to have an impact; especially on the timing and structure of financing. However, it is unlikely to materialize in reduced growth for the sector. The strong fundamentals driven by contracted revenues from hyperscalers and the wholesale collocation of data centers as a service, make data centers a resilient business. Right now, there is a good opportunity for data center groups to reevaluate the strategy going forward, and improve their credit profile. Furthermore, the development of new data centers will have an increased dependency on how these fit and relate to their community. Once the inflation and monetary policy allow for more visibility, it will be worth taking a deep dive into the environmental, social, and regulatory factors that present a challenge to the data center sector.

Jan Willem van Roggen is a seasoned banker who has a successful career in the financial services industry. With over three decades of experience in banking, Jan Willem is currently heading the Commercial Real Estate and Infrastructure teams at NIBC, which operate extensively across Europe. His teams possess extensive knowledge of the latest market trends and financing opportunities, allowing them to offer valuable insights and solutions to clients.

Last march, various professionals from the European data center industry came to Milan for the launch of the Italian Data Center Association (IDA). With the installation of a new National Trade Association (NTA), the European data center industry takes a big step in further professionalizing the relationships with local and national governments. Emmanuel Becker, President of IDA, talks about the first months of IDA, recent developments and challenges in the Italian market.

WRITTEN BY PIM KOKKEThe past months have been quite busy for Emmanuel Becker, President of the Italian Data Center Association (IDA) and managing director of Equinix in Italy. It was in the Fall of 2022 when Becker met his colleagues from the industry. During this meeting, the question came up as to why there was no National Trade Association (NTA) representing the Italian data center industry. “This became the starting point and we came together with the founding parties (Microsoft, Equinix, Rai Way, Data4, STACK Infrastructure, Digital

Realty, Vantage Data Centers and CBRE Data Centers) and founded the association last December. At this moment, we have already over 65 members. Therefore, am very proud that we have already reached this number in a short term as it means that there was a strong interest for an association”, tells Becker.

Becker addresses that more business needs to be deployed to the digital industry of Italy and to further collaborate with local authorities. “IDA is committed to be the representative source for objective information about our industry. For example, we have to inform the audience and governments about sustainability as data centers can play an important role for this matter. We explain and demonstrate to our government how, for example, centralization can lead to more efficient energy usage, promote social environmental sustainability and we have signed the Climate Neutral Data Center Pact (CNDCP) with other NTA’s in Europe.”

Another major scope of IDA is to strengthen the position of Italy as a location for data center development. “Compared to the Netherlands, people are not always aware of the importance of our digital infrastructure for our economy. They need to understand how data centers and solid infrastructure can have a positive impact on the development of a country and its gross domestic product (GDP). Therefore, having conversations with political stakeholders is very important in order to create awareness among them and thus improving our data center ecosystem.”

According to Becker, attracting data center operators and other digital parties to the Italian market is a first step in this process. “The goal is that data traffic will come directly from our data centers instead of only being a passthrough traffic point. That way, you will have a magnetism effect, thus a growing digital economy.”

Developing a digital hub also requires building permits. In Italy, application times vary by region. “In Lombardy, the region around Milan, it is much easier to get your permission compared to, for example, Roma. Luckily, you will obtain your building permit from 6 to 12 months. However, sometimes it can take you up to 18 months and if you talk about constructions with high voltage (more than 9 megawatts) it could be up to four years”, tells Becker.

In sum, IDA keeps growing after its launch and has also already formed various working groups on topics such as sustainability, energy access, energy cost, industry recognition, permits and classification and education. Becker: “For the permits and classification, our country requires a more streamlined process for the construction and operation of data centers, in addition to a clearer regulatory framework regarding land use and ATECO classification.”

Emmanuel Becker joined Equinix in August 2017 as Managing Director for Italy. Before joining Equinix, he served as Managing Director for Italy at eServGlobal, Vocalcom, Easynet Group (now Interoute) and DATA4 Group.

Outside Italy, Emmanuel has developed and supported businesses, including his consulting company BDM International, in Germany, Spain, France, Belgium and Argentina.

Emmanuel brings valuable experience to Equinix having worked in several vertical markets, particularly in the ICT and telecommunications sector. He boasts a rich network of professional relationships and he is a member of important industry associations and is an ambassador of French Tech Milan. From December 2022, he is the President of IDA (Italian Data Center Association). Emmanuel holds a degree in Computer Science from Itin-Escia in Paris

THEREFORE, I AM VERY PROUD THAT WE HAVE ALREADY REACHED THIS NUMBER IN A SHORT TERM AS IT MEANS THAT THERE WAS A STRONG INTEREST FOR AN ASSOCIATION

The European Commission launched an exploratory consultation to gather views on the potential developments of the connectivity sector and its infrastructure. For the consultation, the EU asked various stakeholders to share their views about the current situation and future of the electronic communications sector (e.g. cloud data storage, edge computing, artificial intelligence, virtual reality). However, the consultation was particularly controversial because it contained questions regarding the idea of large ISPs that big data and application providers should pay them internet traffic fees for the use of their infrastructure. Therefore, Cloud Infrastructure Service Providers of Europe (CISPE), the trade association for IaaS providers in Europe, are concerned that this tax could have a negative impact on European companies and customers. In response, they published a position paper (free download) that contains the following five outcomes about the potential consequences of the Internet tax:

1. It would lead to higher prices and therefore would constitute a hidden ‘consumer tax’

2. It would jeopardize the EU’s sustainability objectives by slowing down the transition to more energy-efficient cloud solutions

3. It would threaten the EU’s digitalization targets by hindering CAPEX investments by CISPs

4. It would distort competition in favor of large ISPs against smaller ones, as well as large content providers against their smaller competitors

5. It would allow telcos to further leverage their termination monopoly

THE EU ASKED VARIOUS STAKEHOLDERS TO SHARE THEIR VIEWS ABOUT THE CURRENT SITUATION AND FUTURE OF THE ELECTRONIC COMMUNICATIONS SECTOR.

MICROSOFT LAUNCHES ITS FIRST DATACENTER REGION IN POLAND AS DEMAND CLOUD SERVICES IS GROWING

Aruba S.p.A, Italy’s largest cloud provider and leader in data center, web hosting, e-mail, PEC and domain registration services, strengthens its renewable energy capacity with the acquisition of two new hydroelectric power plants in the province of Bergamo, near the Global Cloud Data Centre in Ponte San Pietro, with a total capacity of 2MW.

The new hydropower plants‘Paladina’ and ‘Ponte Briolo’ - share the same water intake on the Brembo river and are joined by a private adduction canal. They join the plants that were already present within Aruba’s Global Cloud Data Centeralso on the Brembo river - and the further four ones acquired by the

company in 2020 in Melegnano (MI), in Chiuppano, Calvene (VI) and in Pontebba (UD).

The entire network of Aruba’s hydroelectric power plants has a capacity of 9.2 MW for the production of clean energy and the expected annual output is approximately 50 GWh.

energy production capacity in order to reduce the impact on the environment as much as possible and to make the activities of the entire group sustainable. In addition to investment in hydroelectric plants, Aruba are also continuing investment in photovoltaic plants.

The launch of the Microsoft region is a continuation of the company’s more than 30-year engagement with Poland and a commitment to continue to support the country’s technological development of society, business and the economy.

“Microsoft’s investment in Poland will accelerate our country’s transformation into a technology hub for the Central and Eastern European region,” said Prime Minister Mateusz Morawiecki. “Thanks to the development of the Polish Digital Valley, hundreds of engineers and developers will be able to play a key role in the global economy without leaving the country. This is responsible development,” Morawiecki explained. He added that in times of economic and geopolitical uncertainty, it is also very important to maintain the highest standards of data storage security. “Building resilience in this regard is crucial for the Polish economy and society,” said Morawiecki.

Datacentered Cloud Insights 83 Datacentered Cloud Insights 82

CaixaBank, a Spain-based financial institution, announced a new strategic, multi-year partnership with Google Cloud to accelerate the bank’s transition to the cloud and drive innovation using data and analytics technologies. As a part of the agreement, the bank will leverage Google Cloud’s cloud computing, data analytics, and artificial intelligence (AI) capabilities to develop new services for its customers and drive the organization’s digital transformation.

The collaboration between CaixaBank and Google Cloud is a key element of the bank’s cloud-based strategy. This strategy is aimed at improving data analysis and leveraging AI and machine learning (ML) technology, since it is a key tool for driving the customization of the commercial offering and improving the relationship with customers. In addition, data analytics open up great potential in the decision-making process and the creation of new products and services.

Google has announced the opening of a new cloud region in Turin, Italy. The new region will serve as a strategic hub, catering to the needs of businesses and organizations across Italy and the wider European region. With this launch, customers can expect improved performance, reduced latency, and enhanced reliability when utilizing Google Cloud’s services in the area.

“With the availability of the Turin Google Cloud region, that follows the one of Milan, the path that will allow Intesa Sanpaolo to fully exploit the potential of cloud technology and further accelerate the process of digitization of its services, is completed,” said Enrico Bagnasco, Executive Director Information Systems of Intesa Sanpaolo. “A cloud hyperscaler like Google with two regions on the national territory will facilitate all Italian companies and the Public

Administration in accessing the cloud by providing greater security and simplifying business continuity and data protection. In parallel, the Opening Future initiatives will promote both the dissemination of digital skills in schools, SMBs and start-ups in the territories and a sustainable growth, with employment benefits and social and economic repercussions.”

A growing ecosystem of technology partners will also benefit from new Google Cloud regions in Italy. An independent study by the Digital Innovation Observatories and the Energy & Strategy group of the Milan Politecnico calculates that, thanks to the Google Cloud regions of Milan and Turin, projects across the supply chain will generate a new market for partners estimated at around €1.904 billion in the three-year period 2023-20252.

As I sat down to write this article I thought about where our industry was two years ago and where we will be in the next two. It is phenomenal how data centers went from an unknown, misunderstood element of the IT market to headlining the news and in key legislation.

So let’s look at where we are going. First off, but by no means the most important issue, is that of a negative public perception. The world is changing and this concerns citizens. Data centers are a visible representation of the changing economy - Industry 4.0 is upon us. For most in the industry this is exciting. It represents opportunity, growth and the ability to use digital technology to solve so many problems in today’s physical world: sustainability, productivity, education, social mobility and more!

But, digital transformation will be disruptive. Automation, AI and rapid data center and cloud build out makes people fear for their jobs, their cost of living, their ability to enjoy their country. It is this that will drive our agenda going forward in two very important ways.

First off, the data center industry will be disrupted as well - the digital technology of the future is not compatible with the data center of today. Technologically, we have to do a full root and branch relook at what is a data center and how it operates. As operators, we will need to rethink both our designs and how we interact with a smart, renewable energy grid.

However, it is the broad level of local, national and regional regulations that will be a game changer. We are being regulated and treated like a utility. This will mean meeting stricter standards; measuring and managing ever harder targets; and transparently reporting to myriad of agencies.

Some of these regulations will be malformed and add cost to our business. Others will be used by regulators and planning officials to implement a NIMBY* agenda that may please voters but will ultimately cost those voters in lost digital opportunities.

As I look at this have a positive outlook. The European Data Centre Association (EUDCA) can directly speak with EU officials and we have partnered with many National Trade Associations (NTAs) to share ideas and work together to better represent our members to governments. In reality, all governments want digitisation and sustainability. It is our job to work together to show regulators that digitisation needs clouds, 5G, AI, IOT and fiber optic networks. And clouds, 5G, AI, IOT and fiber optic networks all need data centers to aggregate, store, process and trade data. Europe is committed to being climate neutral in a way that will be a beacon to other countries. Europe’s unique views on data and rights of citizens will also influence how digital technologies develop globally.

In the short-term, this may be frustrating and maybe even costly. In the long run, we believe a regulatory environment can level the playing field for our industry and develop trust in the economic value of the buildings and IT we are investing in.

Michael Winterson joined Equinix in September 2007 through the acquisition of IXEurope where he was part of the founding leadership team. Now Managing Director for Equinix Services, in addition to being Vice President for Business Development, Michael has held many roles at the company. Since 2016, he is Chairman of the European Data Center Association (EUDCA).

Following the rise in prominence of the French data center market, France Datacenter has become a force in the European data center industry. “Established in 2008 and reorganized in 2017 with an expanded team, we recognize the importance of addressing the perception challenges faced by the industry”, says Géraldine Camara, managing director.

WRITTEN BY MICHIEL VAN BLOMMESTEIN

WRITTEN BY MICHIEL VAN BLOMMESTEIN

The data center market in France has experienced significant growth over the past three years. The industry is set to witness a consistent 10 percent growth in the coming years as well, and especially the Paris data center hub is often named in one breath with other leading European locations, including even Amsterdam and Frankfurt. The location and size of the country have been important factors in that success, Camara said. “It’s a little funny

we are sometimes considered a Southern European market.” The northern part of France is only a little bit more southern than Frankfurt, and there are also hubs in other parts of the country -like Bordeaux and especially Marseille- that offer connectivity access to other parts of Europe and Northern Africa. “So our location is better described as being central.”

Under its 13 member board and Camara’s operational leadership, France Datacenter has grown to around 100 members, comprising of architects, vendors, operators and other key industry players. The board consists of the presidents of Data4 group, Equinix, Digital Realty, Global Switch and CBRE, to name a few. “One of our primary objectives is to provide members with technical expertise and insights into industry trends,” Camara explains. “We organize several annual events, including two events in Paris and two in specific regions.” Through various publications, France Datacenter disseminates valuable information on topics such as cooling techniques, commissioning procedures, and heat recycling. “Furthermore, we take on the responsibility of bridging the gap between the data center industry and the media by explaining the significance of data centers in powering smartphones and IT applications.”

Camara outlines four key priorities for the data center industry in France from 2020 to 2025. The first priority is focused on employment and training, as the industry faces a shortage of qualified personnel, as is the case in the rest of Europe. “France Datacenter aims to address this challenge by establishing a commission that is thinking about specific training to attract and nurture talent,” she explains. “Yes, it may be a digital industry, but it still needs human resources and the interest of young talent.”

The second priority she names is resilience, with a particular emphasis on cybersecurity and safety measures such as fire prevention, in order to ensure vital industries access to data and IT. Innovation for environmental sustainability, including energy consumption control and circular economy practices, is the third priority.

This is especially vital considering the active stance taken by the French government on themes concerning sustainability, Camara says. “We are being challenged by the French government to continue to improve our PUE, lower consumption, find the best solutions and come up with innovations like recycling heat.” Lastly, France Datacenter aims to enhance the competitiveness of France’s data center industry in general.

Regarding regulations, France Datacenter is actively involved in mapping the current regulatory landscape, both within France and across Europe. “Directives related to energy consumption reporting, heat recycling, and energy efficiency, such as ISO 50001 and membership in codes of conduct, are being discussed and implemented”, Camara says. The association acknowledges that these regulations present positive challenges and lead to increased efficiency and performance within the industry.

On the whole, Camara thinks the industry’s future in France looks bright. “Both Marseille and Bordeaux are getting new submarine cable connections, and especially Marseille is a true gateway to Africa and further east,” she says.

“We offer favorable climate conditions that enable free cooling for approximately 80 percent of the year. France’s market is driven by factors such as population density, connectivity, and the perception of being a vital growth market for hyperscalers in the near future. By prioritizing employment, resilience, innovation, sustainability and competitiveness, the association is proactively shaping the future of the sector “with a diverse team and a keen focus on inclusion,” Camara says.

Leading organizations from our industry publish various reports about trends, investments and more. In this section, we chose the must read reports and whitepapers and selected the main highlights for you.

The Age of Enlightenment popularized the use of reason to pursue knowledge, resulting in a society based on logic and science instead of relying on emotions and doctrine to make decisions. However, the fundamentals of enlightenment are at stake as decision makers become increasingly influenced by emotions rather than reason, which affects the data center industry. As a result, the basis of the legislation is the most controversial headline and the accompanying emotions, with rules and regulations that do not align with the sector’s realities. This makes it increasingly difficult for the data center sector to implement positive and sustainable changes.

The 9th edition of State of the Dutch Data Centers Report focuses on presenting the facts of the data center industry in the Netherlands. The facts and figures are essential for government agencies to make informed decisions about data centers. For example, the research shows that in 2023, 99% of all energy consumed by colocation data centers comes from green sources, compared to 90% in 2022. A small portion of that comes from Dutch wind and solar power.

You can download the full report via the website of the Dutch Data Center Association.

CBRE has published its quarterly report about the European Data Center Market for the first quarter of 2023.

In the most recent publication, they found that Europe’s top colocation data center markets are poised for another year of considerable growth despite economic uncertainty in Europe and declining growth of the hyperscalers cloud operations. Furthermore, CBRE expects a substantial increase in supply in the second half of the year with mega facilities that will be delivered in Paris and Frankfurt.