The meeting place where companies, technologies and data come together

Discover our global footprint with our 310+ data centers across 25+ countries and over 50+ metros digitalrealty.com

The meeting place where companies, technologies and data come together

Discover our global footprint with our 310+ data centers across 25+ countries and over 50+ metros digitalrealty.com

Publisher

Dutch Data Center Association (DDA)

Editor in Chief

Pim Kokke

Stijn Grove

Art Director

Sam Zondervan

Asha Garib

Marketing & PR

Zoë Derksen

Claire van der Bij

Carole Santens

Contributors

Laura Beukers, Michiel van Blommestein, Jasper Dietze, Julia Dilissen, Leyla Hesna, Natascha Geraedts, Iain Macdonald, Hugo Onink, Niek van der Pas, Penta Infra, Emily van Putten, Jan Willem van Roggen, Melissa Scholten, Patrycja Smoronska, Stroomkr8, Jeffrey Tijdhof, Peter Vermeulen (Pb7 Research), Yi-Chun Wieldraaijer

About

Datacentered is a publication of Foundation Dutch Data Center Association and occurs 3 times a year. No part of this publication may be reproduced and/or disclosed by print, photocopy, film or any other means without written permission from the publisher.

Location

Dutch Data Center Association

Herengracht 342 H 1016 CG Amsterdam

The Netherlands

Advertisements

For inquiries about advertisements, please contact info@datacentered.net

Supported by:

Legrand Data Center Solutions, STULZ, Stroomkr8, Eversheds Sutherland, Watts, DPR Construction, Deerns, AP, Maunt, Kelvion, Koninklijke van Twist, Volker Energy Solutions, EkkoSense, Panduit, Kenter, Eaton, Weiss Technik, Paroc Panel System, Rittal, Trescal, Arcadis, Beveco, Chatsworth Products, Exagate, Workrate, R&M Europe, ABB, Mitsubishi Electric, NL-ix, Dataport Eemshaven, Heijmans, Blygold, Huawei, TSL, Kohler, FNT, CBRE, Vertiv, Socomec, Royal HaskoningDHV, MarshMcLennan, Forehand, Coolgradient, Fluor, Alara-Lukagro, AKSA Power Generation, Rentaload, ACT Connectivity Solutions, CANS, Zwart Techniek, Dcongreen, Arup, Croonwolter&dros, Wesco Anixter, Aggrekko, Georg Fischer AG, DGMR, Turner & Townsend, Rolls Royce, Schneider Electric, RWL Advanced Solutions, SADC, FujiFilm, Schleifenbauer, SPIE, First-Case, Vattenfall, KWS Infra, Unica Datacenters, Securitas, Maxicom, ATS Global, Hug Engineering, Sims Lifecycle Services, Commscope, Mace, Red Bear Tech, Danfoss, Submer, Soben, DC People, Park Place Technologies, Johnson Controls, TÜVIT, Honeywell, Grundfos, Elinex, Equans, Pathema, APAC, Salute, All-Rack, ATC, CSB Energy Solutions, Delta Electronics, Kobespa, Waterfall Security, Lubron Waterbehandeling B.V., Simac, Circle-B, Polyned, Econocom, Riello UPS, EPI, AlternativeHEAT, Hochtief, CONTEG

THE SPECIALIST IN DATA CENTER AND TELECOM COOLING FOR 75 YEARS.

NATASCHA GERAEDTS What to expect from the NIS2 directive?

During the summer - just like in the Christmas season - there is more room for self-reflection. This may or may not happen over a glass of wine in the sun with good company. The subject of “work” is often a topic of conversation during those summer evenings. Am I still happy with the work I do? What satisfaction do I get from my job? In day-to-day tasks, we are less likely to ask ourselves these questions. We prioritize the daily banalities (what are we eating today?) and deadlines with targets.

I am no exception to this rule. During my vacation, I swam a few laps at Cape Sounion to unwind. As I floated in the water and enjoyed the view of the Temple of Poseidon, my thoughts wandered to Datacentered. A year ago, the first edition came out. It is during moments like these that you realize just how fast time goes by and that - ironically - you don’t think enough about what and also how you do something. For a moment, I was touched by the nostalgic feelings of 2023. In the Spring, publishing a magazine was only a figment of Stijn’s (ed. Grove) imagination. The task at hand was simple yet complex: make something beautiful. A goal was set: the magazine should be worthy of a spot on the coffee table. By showing the magazine to friends and family, people that work in the data center industry can show how cool our industry can be.

With these goals in mind, we took the time to create the first issue. Getting the basics right and keeping it simple was the credo that came up regularly in the brainstorming sessions. When issue No. 1 arrived through the mail, I was proud of of this magazine that had taken a lot of time to create. But foremost, I enjoyed creating something for which there were no expectations yet.

Under the Greek sun, began to realize that the second and third editions met a certain standard. However, there was something missing. During the creative process, I missed the uncompromising aspiration to create something special. Working in a formulaic way is efficient, but sometimes it can hinder creativity. With the fourth issue, we felkt like to to prove ourselves again. That is why we went back to the fundamentals of Datacentered. Emily van Putten’s inspiring story and the accompanying photoshoot are a great example of the next phase for Datacentered.

Moreover, you will find photos of the Nexus Data Center in Brussels. This data center, which was acquired by Penta Infra, symbolizes how you can built a future proof facility which contributes to the urban landscape. It’s just not your average grey box. I am also glad that Iain Macdonald is back with a great analysis about (future) data centers and the energy challenges (spoiler: nuclear energy could be the way to go). However, there is still some misconception about nuclear energy.

‘Without Prejudice’ as a subtitle for this edition is a summary of the past period. Going back to the feeling of where we once started - combined with the lessons learned from previous editions - makes this edition my all-time favorite.

FOR THIS ENERGY TRANSITION TO SUCCEED, THERE HAS TO BE AN ENERGY MIX AND THE MAJOR COMPONENT SHOULD BE NUCLEAR

TEXT: IAIN MACDONALD

Our near future is being defined by automation, climate change, urban densification, smart infrastructure and artificial intelligence. This digitalisation of the economy and society is paradoxically having a positive and negative effect. While enabling cities and corporations to function smarter and more efficiently, freeing individuals from static schedules and locations, the pervasive use of digital technology, the need to always be ‘on’ and the sheer physicality of digital real estate is impacting the environment. Not just through exponential growth in use of materials and emissions but most importantly energy consumption particularly electricity.

Across the globe advancing metropolises are those cities fostering ‘industrial ecosystems’ predominantly clean technologies embedding within urban areas, often downtown instead of a peripheral industrial zone. This reduces commuting brings ideation and production closer to higher education, consumers, suppliers and workers while at the same time reducing commuting and emissions. Within these ecosystems, buildings in Innovation Clusters are scaling up to provide sufficient flexible and sustainable space to attract

and retain hi-value companies and staff. Unsurprisingly ‘Urban Tech’s’ increasingly AI technology led operations, requiring low latency and significant resilient power must prove its carbon free energy credentials, construction and operational sustainability to gain regulatory approval and public acceptance.

Post Covid office space is now giving way to tall Lifesciences like One North Quay in London where vertical stacking of interdisciplinary research ‘neighbourhoods’ is pathfinding the real estate development of ‘Urban Science’. However laboratories are intensive energy users which with increasing adoption of technology including image analysis and robotics, contrasts city authorities’ push for net zero carbon in real estate. Again, designers and operators must demonstrate circularity including carbon free energy credentials to gain regulatory approval.

Innovation hubs

While data centers generally across the globe are scaling up to meet rapid growth in demand, proximity urban hyperscale and

“OUR NEAR FUTURE IS BEING DEFINED BY AUTOMATION, CLIMATE CHANGE, URBAN DENSIFICATION, SMART INFRASTRUCTURE AND ARTIFICIAL INTELLIGENCE.”

- Iain MacDonald

tall data centers are evolving whether combining innovation hubs and processing space or adding energy centers for district heating in an ESG focused strategy to appease planners and funds while avoiding energy moratoriums and stakeholder resistance. It is important to note Generative AI and Quantum Computing facilities may be an altogether different physical architecture. Technological innovation and changes in location, operational and environmental efficiency, effectiveness and aesthetic expression signal changing dynamics and value in digital real estate. This is why Instance is currently designing prototype ‘Super Tall’ and ‘Super Flat’ next generation AI centers.

If digitization is unstoppable, to build enough infrastructure and facilitate it, where do we need to go?

The US Department of Energy estimates, the water usage effectiveness (WUE) of an average data center using evaporative cooling systems is 1.8L per kWh, consuming 15.91 million litres per day – similar to a city of 30,000-50,000 people. If an urban hyperscale facility consumes 100 MWe its waste heat is theoretically sufficient to power and heat up to 15,000+ homes. The IAEA estimates emissions from data centers have grown modestly since 2010 despite rapidly growing demand for digital services. Energy efficiency improvements (PUE), renewable energy purchases and

broader decarbonisation of electricity grids in some regions has helped however to get on track with the UN’s net zero scenario, emissions must halve by 2030 and the energy nexus has to be addressed.

Twentieth century energy grids, often overloaded and subject to outtages, are the wrong type and in the wrong place to meet the geospatial load requirements of data centers and industry 4.0. Renewables alone will not solve this problem.

Circularity issues with the material and manufacturing processes for solar and the neutralisation of farmland particularly if they catch fire or the lack of efficiency, resilience and most importantly the significant spatial footprint of wind, make deployment of both forms, particularly in Europe increasingly controversial.

For this energy transition to succeed, there has to be an energy mix and the major component should be nuclear. In the USA, where data centers account for 9% of electricity consumption with an estimated 35 GW of load growth within 5 years, S&P Global Ratings consider higher power prices have created opportunities for nuclear operators to serve data centers that locate nearby. Amazon Web Services have signed with Talen Energy while Constellation Energy, Southern, PSEG Power and Vistra are also candidates for data center colocation beside their gigawatt nuclear plants.

However, these plants supply power to existing communities, services and industry and have a finite spare power capacity. In order to exploit the technological innovation and flexibility of new nuclear, the US Government’s Inflation Reduction Act is providing billions in funding for Small Modular Reactors (SMRs) and Nuclear Batteries (micro reactors).

Instead of the decade long environmental and labour cost of building gigawatt plants, SMRs offer an opportunity to go ‘off grid’ supplying 300-450 MWe power direct to consumers where it is required. GE VERNOVA’s Nth-of-a-kind BWRX-300 ‘using a combination of modular and open-top construction techniques, predominantly factory manufactured, can be constructed in 24-36 months while achieving an approximate 90 percent volume reduction in plant layout’. The X300 has been selected for sites in Canada, the US and Instance has been working for several years with GEV and associated EPCs on developing operationally efficient building and site configurations including a brand aware yet environmentally acceptable aesthetic.

Bill Gate’s Terrapower SMR is intended to supply some of Microsoft’s data centers while Westinghouse, Korea Power, Rosatom, Rolls Royce and NuScale have similar sized SMR programmes and are attracting attention from universities and government agencies as well as the data industry. With passive safety systems and an exclusion zone restricted to the building envelope, some companies such are CorePower and ULC Energy are building on naval experience to develop off shore and dock side solutions reducing transmission (and latency) distance.

SMR Campus development with colocated data, research, advanced manufacturing or synthetic fuels such as projects Karnfull Next are developing in Sweden and ULC in The Netherlands, is gaining traction with stakeholders, shifting public perception of energy and data infrastructure from something dark and polluting towards recognition of it as a bright, clean high skilled workplace.

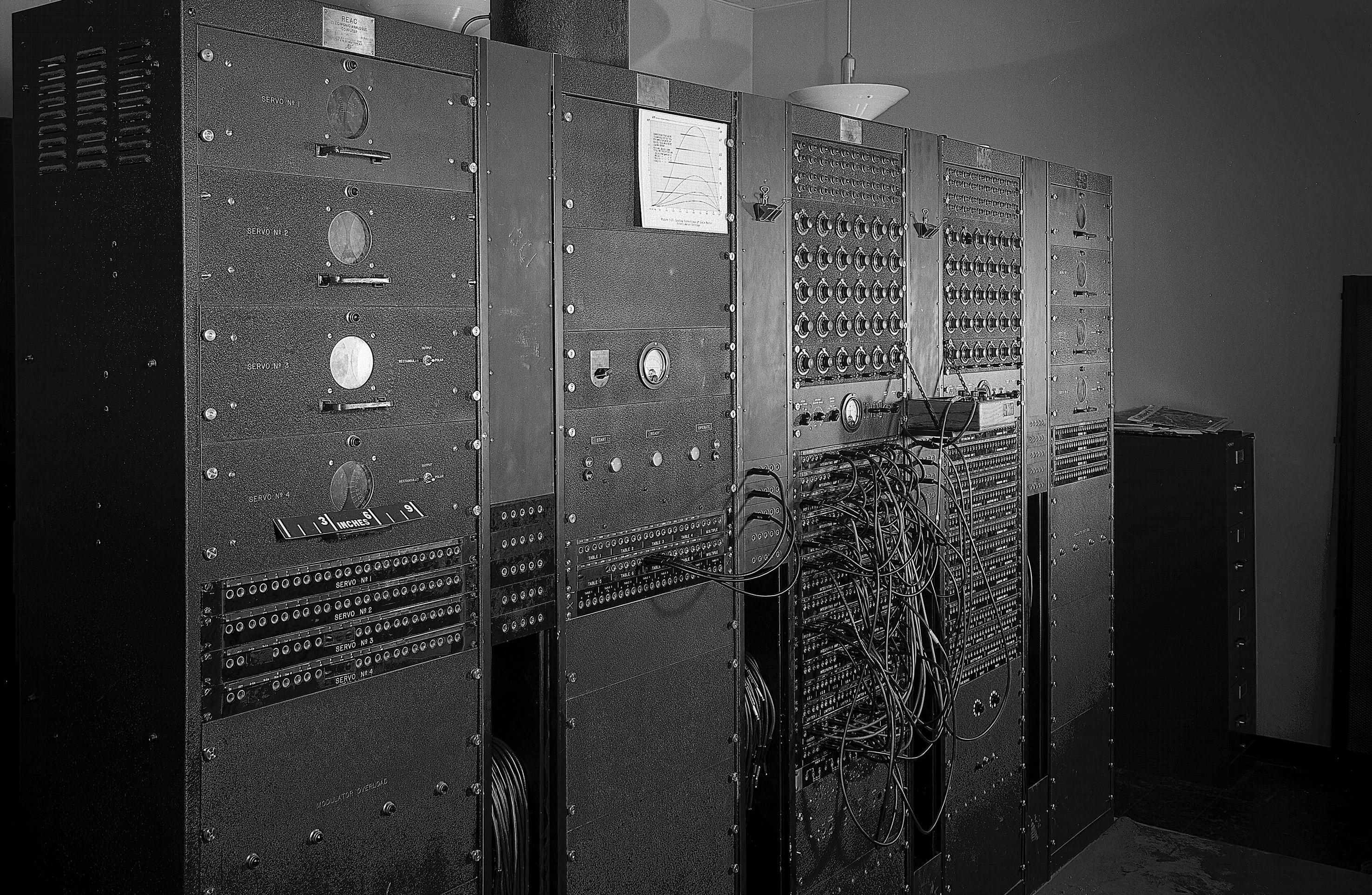

At a smaller but not less important scale, the National Academy of Engineering suggests we may be on the brink of a new paradigm for power generation similar to how centralized computers gave way to today’s widely distributed PCs. ‘A new generation of relatively tiny and inexpensive factory-built reactors, designed for autonomous plug-and-play operation similar to plugging in an oversized battery, is on the horizon’.

These micro reactors can provide heat for industrial processes or electricity for edge computing or a neighbourhood, running unattended for five to 10 years.

Situated inside two 6m or one 12m ISO container they can be swapped out in a day and trucked back to the factory for refuelling and refurbishment. Nuclear Batteries take the concept of factory fabrication and modularity to an extreme, capable of being deployed quickly, becoming a kind of ‘energy on demand service’. Several batteries could facilitate Day One development of a data center until power from an SMR comes online. Batteries could be located with AI, data, lifescience and other forms of real estate in urban areas as they provide a way for ultimately excluding UPS, UPS batteries, back up generators and fuel storage which is a desirable cost and environmental saving.

With BWXT’s Banner and Westinghouse’s e-Vinci reactors being commercially available by the end of the decade nuclear energy can be viewed as a product, not a mega-project, ideally suited to solving the data center-energy nexus.

Get your industry insights, research and more with a yearly subscription on Datacentered.

The magazine about data centers, cloud and connectivity appears 3 times a year.

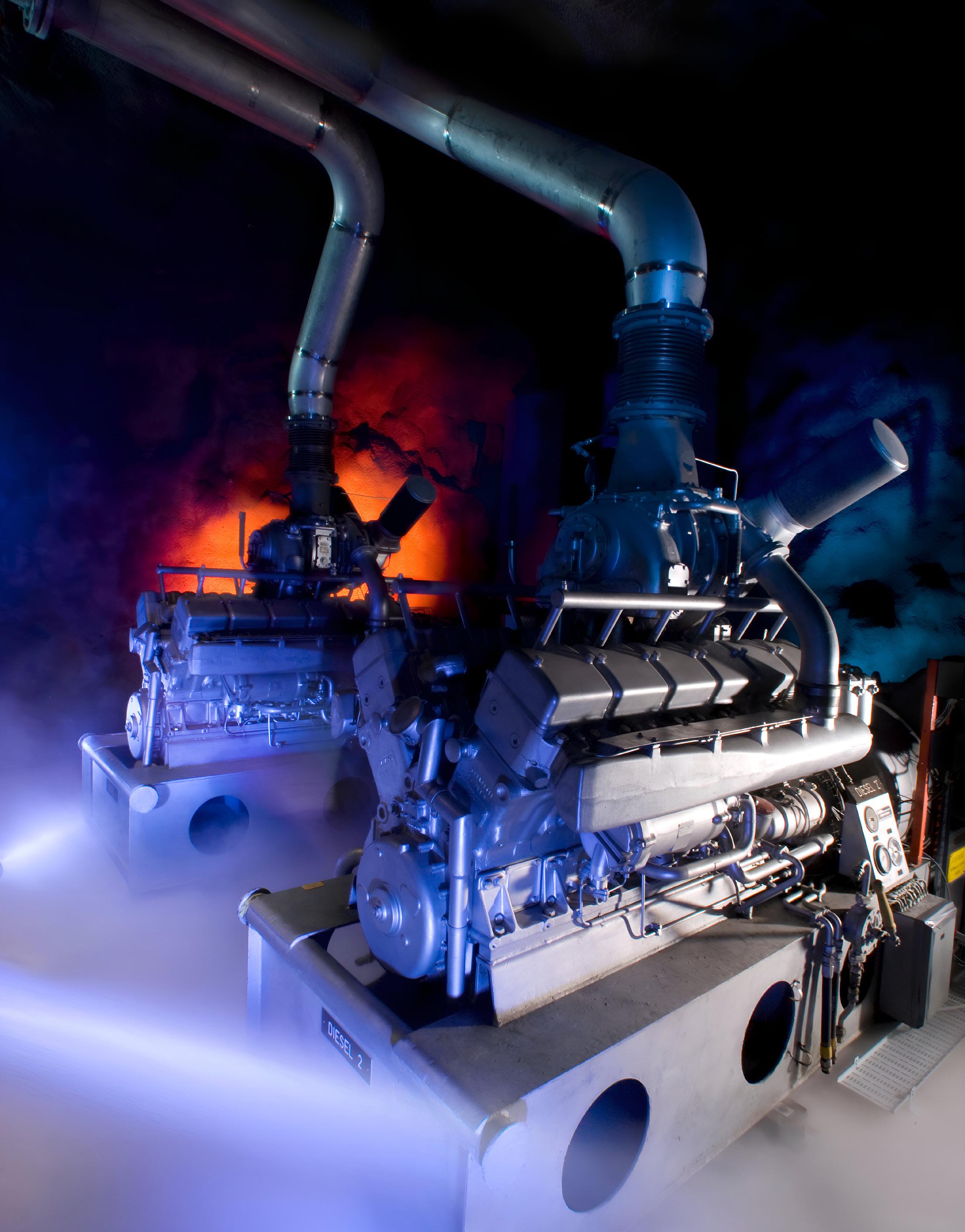

Pionen was originally built as a civil defense center back in 1943 and later converted into a data center by Bahnhof. The data center opened on September 11, 2008 and remains operational to this day. The underground facility is secured by a 15.75-inch (40 cm) thick door and can withstand a hydrogen bomb. It also serves as a co-location center, notably used by WikiLeaks in 2010. Designed to resemble a science fiction set, it retains its Cold War name, Pionen White Mountains, and its features.

• Own switchgear with 11 kV transformers connected directly to the public electricity network

• A total of 1 UPS with internal redundancy of the model Eaton 9395 with a total output power of 1.1 MW

• Redundancy ratio internal UPM: N+1

• Battery life at maximum load: 12 minutes

• All batteries are lead acid batteries

• Total output power of 1.8 MW

• 2 MTU V16 with individual extinguishing systems for each machine

• Redundancy ratio: N+1

• Main cooling

• 2 heat pumps with 500 kW cooling capacity each.

• Redundancy ratio: N+1

• Secondary cooling:

• 2 liquid chillers of 300 kW cooling capacity each.

• Redundancy ratio N+1

• The data center includes 140 cabinets each with an average power density of 5.7 kW

• Cooling systems, organized cabling, and electrical wiring are installed beneath a raised floor that is 3.3 feet (1 meter) deep

• It houses the Network Operations Center (NOC) for ISP’s entire operations, including five data centers nationwide

• The facility offers co-location hosting services, allowing customers to place their own servers there

The demand for European data centers continues to rise and is not expected to halt anytime soon. Strongly empowered by an almost exponential development of novel AI-technologies, double-digit growth forecasts are becoming the norm in the market. On top of that, recent favourable market developments have now caused the data center operators and its investors to shift their attention towards the European secondary Tier 2 markets as well.

The perfect combination between availability, affordability and proximity

As evidenced by continuously lowering vacancy rates, the traditional European FLAP-D markets remain highly in demand. Nevertheless, partially driven by the scarcity of power and suitable locations in this region, more large-scale greenfield campuses will be developed in other European geographies.

Secondary markets like Berlin, Milan, Madrid and Marseille can provide data center operators and its off-takers the perfect combination between land and power availability and affordability, whilst still providing proximity to the data generation. In addition, a huge accelerant for the secondary markets is the decreased dependency on latency, for instance in AI-training facilities. Financial institutions are therefore financing more green- and brownfield expansions in those regions as well. Another benefit of a secondary market like the Nordics is the abundant availability of renewable power, and the strong level of expected government support. The usage of renewable energy positively impacts the data center’s sustainability performances (PUE) and thereby increases the financial attractiveness.

Eastern- and Central Europe gain attraction from data center operators and investors

A more recent development is the increased development of data centers in Central- and Eastern Europe. Countries like

Czechia, Hungary and Poland, with the larger cities of Prague and Warsaw in particular, have recently experienced a strong increase in both greenfield deployments and investment appetite. Last year, Microsoft announced to have opened their first campus consisting of three data centers in Warsaw. On top of that, Data4 has chosen to build their campus with 60 MW in total capacity in this city as well. Another more western-located hub which benefits from this shift in deployment is Vienna. In the future it will be crucial for these younger markets to live up to their augmented forecasts to provide access to renewable energy sources as well.

Despite the traditional FLAP-D market being confronted more regularly with its power and land limitations, nearly all forecasters in the European data center market seem to be aligned on the enormous growth potential of European data center operators. Essential for these double-digit projections is the continued uptick in data center deployments in secondary Tier 2 markets in other European geographies like Madrid, Milan, Marseille and Warsaw. These relatively newer markets have the ability to provide great benefits both to operators and off-takers by supplying the necessary resources at competitive prices. This strong value proposition leads financiers to shift a great portion of their current and future attention to these European secondary markets.

Jan Willem van Roggen is a seasoned banker who has a successful career in the financial services industry. With over three decades of experience in banking, Jan Willem is currently heading the Commercial Real Estate and Digital Infrastructure teams at NIBC Bank, which operate extensively across Europe. His teams possess extensive knowledge of the latest market trends and financing opportunities, allowing them to offer valuable insights and solutions to clients.

The data center market in Eastern Europe is developing rapidly. Over the past couple of years, Warsaw has emerged as a key hub for Eastern Europe. Poland has experienced a long period of strong economic growth and is catching up quickly in digitalization. As a result, there has been a strong demand for local retail colocation. It also attracted the attention of global cloud players, who are investing in new cloud regions. On top of that, Warsaw is also attractive as an alternative to the congested FLAP-D markets. As a result, demand for wholesale and built-to-suit data centers has been robust.

In other Eastern European countries, there is a clear trend of improving the quality of new data centers to Tier-3 or even Tier-4 levels. Also, in terms of energy efficiency and renewables, many data centers will need to make additional steps. Additionally, the first large data centers are emerging in Bulgaria, Romania, and Croatia. Interestingly, there is also interest coming from the Far East to invest here, since these countries are the link between the West (FLAP-D) and the East. One of the benefits of investing this region are the relatively low costs.

Over 1 Gigawatt

The market is Eastern Europe has grown rapidly over the past years. By the start of this year, the combined countries were home to data centers with 457 MW of IT Power. For the future, when we combine all public announcements, there is 688 MW under construction or being developed. When we add announcements that have not (yet) been made public, the pipeline is well over 1 Gigawatt. The biggest portion of the announcements, more than 350 MW, is targeted at Romania, with Poland as a strong second with about 150 MW. There is plenty of momentum in Croatia and the Czech Republic. However, we also see a lack of large activity in Hungary and Bulgaria.

While Poland is by far the largest market in Eastern Europe, Bulgaria and the Czech Republic have a slighter higher “data center density”, in terms of the market size in Megawatts compared to population size. When we look at this metric, it becomes obvious that data center infrastructure is lagging in especially Slovenia, Hungary, Romania, and to some extent also Slovakia and Croatia.

Permitting process

In summary, the market in Eastern Europe is changing and maturing rapidly. There is a lot of local development going on, while also global vendors are starting to spread their wings across the region. There are also some obvious challenges, especially in terms of both physical and digital infrastructure (certainly not everywhere!) and red tape in the permitting process. With continued digitalization of the domestic markets, global investments in cloud and AI infrastructure, and market congestion in Europe’s TIER-1 markets, there are plenty of opportunities.

Bulgaria Telepoint Neterra Equinix

Croatia Cratis A1 Hrvatska Apis IT

Czech Republic Deutsche Telekom TTC Teleport seznam.cz

Hungary Deutsche Telekom Invitech Infotechna

Poland Atman Equinix Polcom

Romania Evobits Clusterpower NXDATA

Slovakia Deutsche Telekom CNC DCBA

Slovenia Telemach Posita Arctur

SIZE (2024) MARKET SIZE (2028)

CAGR (2024-2028)

€779.04 BILLION

€2.50 BILLION

€3.20 BILLION

SIZE (2024) MARKET SIZE (2029)

INTERNATIONAL TAX COMPETITIVENESS INDEX CAGR (2024-2029)

CAGR (2024-2029)

€120-140 MILLION

SIZE (2024) MARKET SIZE (2029) 8-10%

€277.00 MILLION

(2024)

BILLION

€196.18 MILLION

€243.68 MILLION

SIZE (2029) 4.43% CAGR (2024-2029)

(2029)

€312.86 MILLION

€412.48 MILLION

(2024-2028)

(2024)

€209.84 MILLION

SIZE (2029) 4.96% CAGR (2024-2029)

CAGR (2024-2029)

€259.6 MILLION

SIZE (2024) MARKET SIZE (2029) 4.76%

€269.8 MILLION

TEXT: PIM KOKKE

INTERVIEW: MELISSA SCHOLTEN

PHOTOGRAPHY: HUGO ONINK, LIFESHOTS PHOTOGRAPHY

MAKE-UP: PATRYCJA SMORONSKA , SPLASH PHOTOSHOOTS

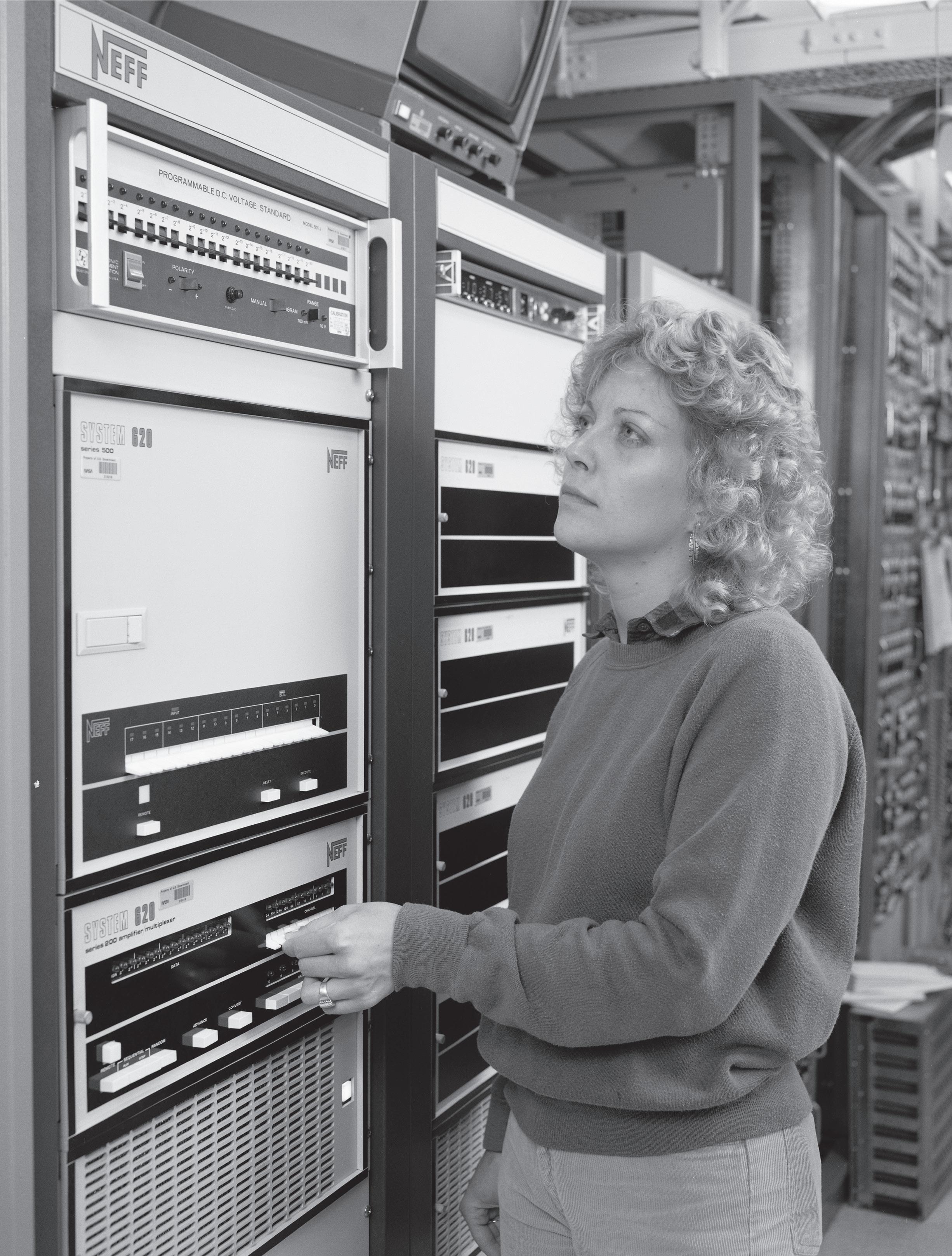

Every industry has developed a stereotype over the years. That this persona changes in doings due to the zeitgeist is undeniable. While men are fighting during World War II at the front, mostly women are at home programming computers. In the late 1960s, this picture changes. Computers are becoming more powerful, causing governments and companies to think about how important computers are going to be for the future. Women - who were already paid less - are replaced by men doing the same work.

In recent decades, the above mentioned image has not changed. The stereotype of engineers as a “male profession” is still there. However, the urge to change this stereotype has become louder in recent years. From the government but also from the business side, diversity in the work place is higher on the agenda. One of the drivers of diversity in the digital infrastructure industry is Emily van Putten. At the moment, she works in the field of cloud software but she was previously active in a data center. During the photoshoot, she walks through the server rooms, enthusiastically talking about the severs, fiber cables and UPSs. A nostalgic feeling prevails her. “This is the place where everything happens around the Internet. It also particularly reminds me of the time when was doing hardware maintenance at night.”

Melissa: “Do you sometimes miss working with hardware?” Emily: “No, I don’t. That has mostly to do with the developments going on in this market and especially how I have developed as a person myself. find it very good to have awareness of the fundamentals of data centers and experience how the technology works. That helps in understanding this at a higher level as I am now more concerned with strategy and leadership within IT.”

Melissa : “How would you describe your role?” Emily “I advise companies on cyber security measures to protect them from hackers. That mainly involves how you start implementing a cyber security strategy within an organization. In the past, people used to be go to a desk and present and verify their security solution. Nowadays,

security is more integrated in solutions. However, employees are not always sufficiently aware that they pose the greatest risk to the organization. Think, for example, of phishing, which happens a lot. That is why it is important to create awareness among employees about cyber security, what technical solutions there are to assist the user and having the infrastructure in order.”

During the conversation, Emily mentions her own eponymous website. On this website, she publishes articles about her personal life and IT. In one of her blogs, she writes about how she, as a child, secretly assembled computers and made them work. Even some high bills of a few hundred Dutch guilders that her father received didn’t stop her to follow her passion.

Yet there is something remarkable.

Emily: “I actually never used to have the goal of becoming an IT professional. Working with computers was mostly a fun hobby for me. In fact, I wanted to study electrical engineering where you build things with transistors and components. I found that a huge enrichment for my life. When ADSL came along, I wanted to create a website. At that time I had been to a camp and wanted to share photos of it with everyone. Through school got an old computer that took apart and hid under my bed so my parents wouldn’t see it. I built the website on that computer and every weekend pictures of parties were posted.”

It was eventually Emily’s mother who, during a gap year of Emily, shoved a newspaper under her nose containing a call from a Getronics subsidiary for a traineeship. In 2007, Emily enters the work field where she starts at the help desk. She then took on the role of system administrator before progressing to engineer. Yet the feeling creeps up on her to focus more on cyber security. According to Emily, the social relevance and her interest in the subject matter are what prompted her to take the plunge. In 2017, she asks her then-employer if she could take the Certified Information Systems Security Professional (CISSP) training which she later successfully completes.

For the industry, Emily also has some good advice: let data centers organize an open day once a year. This way, young people also get a sharper picture of what goes on inside a data center. In addition, it can also help them increase their interest in the profession.

Melissa “You were born into stereotypical gender male. Do you think if you had grown up as a woman you would have ended up in IT as well?

Emily: “I don’t think so, because even then there were very few women working in the industry. It is already enormously difficult to retain women in IT. The outflow of women in the first 5 years is three times higher compared to men. Slowly attention is being paid to this fact, but not enough in my opinion. Therefore, I also dare to say that if I had taken the same steps as a girl at the time, I would not have been at the same point in my career. Women face specific challenges in the workplace, which are widespread in this masculine industry. In addition, my qualities would not have been valued the same, which would have caused my career to run differently.”

Melissa: “Is that also something you’re working hard for as a board member of Dutch Women In Tech?”

Emily “Absolutely. My main focus right now is trying to focus on retaining women in IT, rather than attracting them. You see that there is a steady increase of women coming to work in this sector. Fortunately, there are a number of initiatives for that as well, but there is less emphasis on retention. That is why at Dutch Women In Tech we connect women in the sector, share experiences with each other and ensure that these ladies can flourish in IT. Yet, there are still challenges to overcome, because you cannot convince everyone.

Emily’s transition comes up. She talks about her masculine upbringing, where making a career was paramount and rationality took precedence over showing and expressing your emotions. Emily talks about how she became depressed and couldn’t explain where that feeling came from. The emptiness she felt was filled by buying new gadgets that then ended up back in the closet after two weeks. Eventually she met people experienced the same feelings. After that, the word came out: “I am transgender.”

Melissa: “How did your work place responded to this?

Emily: “I made the choice to let work lag behind reality so that I had flexibility to control the image. However, quickly noticed that when I was working at home and the camera came on, I put on my masculine clothes. Constantly changing clothes caused me a lot of distress and confusion. At some point I wanted to get rid of that. talked to my supervisor and explained the situation. But after that I noticed that something was still wrong. saw my birth name on the screen, because at that time my legal name was listed everywhere. The company then changed that and helped and supported me very much.”

Melissa: “What advise would you give to the industry?”

Emily “I personally notice how much everyone values social and societal expectations such as dress, appearance and behavior that have a lot of impact on one’s life. Therefore, I think the best thing is to go for your own happiness and make yourself vulnerable and be open to others. The latter is something that I have learned and that you also get back from other people. That creates deep connections with each other, where everyone listens to each other without judging.

Melissa: “There is still a long way to go. People have to confront prejudice and biases on a daily basis. But without dialogue, vulnerability and courage, no change at all would be possible within the industry.”

Eventually, in a few decades, we will look back on this time and hopefully see pictures of all kinds of people from different backgrounds. And how do we look at working in our industry at that time? The future and history will tell.

Biography

Melissa Scholten

Sr. Communications Manager, Digital Realty Netherlands

Emily van Putten

Expert in Cloud Security & Cyber Resilience

You always need people.

Data centers, along with the entire digital infrastructure, now involve investments upward of $100 billion dollar. Our economy and our national sovereignty increasingly hinge on our strength in digital fields. But how did the industry developed herself in the past decades and more importantly: what perception is needed to create sustainable growth?

It is an honor to address you tonight at the Dutch embassy here in Washington. I would like to thank the organizers of this dinner event, the embassy of the Netherlands, and Eurofiber as it is very valuable to have these events to connect and learn from each other.

Just over a century and a half ago, Alexander Graham Bell made the first telephone call. His message to his assistant, merely steps away in the next room, was simple: “Come here, want to see you.” Today, we might chuckle at the thought of using such groundbreaking technology for a mundane request. However, this moment marked the dawn of the telecommunications era — an era that none could have predicted would expand to encompass the global connectivity we rely on today.

We gather in this room, a melting pot of connected minds steering the colossal ship of the digital industry—integral to every aspect of modern life. Today, I want to take you on a journey through our past, our present, and the horizon that lies ahead. We’ll explore the landmarks of our industry’s history, the perceptions that shape us, and the dual challenges and opportunities that await.

The digital revolution

In 1988, a significant leap was made with the launch of TAT-8, the first transatlantic fiber optic cable linking the US and Europe. That year, a digital handshake across the Atlantic brought the NSFNET of the US into direct contact with networks in Amsterdam, marking the first US/EU internet connection. This connection transformed email from a twice-daily scheduled delivery into an instantaneous communication tool. Just two years later, Sir Tim Berners-Lee at CERN unveiled the World Wide Web. The first website, hosted on a server at CERN, bore a sign, probably for the cleaners: “Don’t switch it off, this is a server, not a desktop.” This first website, and webserver, facilitated access to CERN’s research data, and at around the same time, by its side, the third-ever website went live, belonging once again to the Math Faculty in Amsterdam.

So, this new subsea infrastructure, coupled with innovative ways to utilize the burgeoning network, sparked a technological revolution that continues to this day. As we stand on the shoulders of these technological giants, we are tasked with steering this revolution into a future that promises even greater connectivity and innovation.

Now, just 35 years since that first website, our global economy is deeply intertwined with digital services. Entire sectors have undergone transformations, with technology emerging as a crucial component for survival. Take, for example, my recent experience upon landing in Washington. While waiting in line for customs, I ordered an e-Sim online for local data services. We then shared an Uber from the airport, I checked into my hotel online, paid for my public transport card using Apple Pay, and even booked my Sunday visit to the beautiful Smithsonian museum - all digitally.

Today, seven out of the top ten largest companies in the world are in the tech sector. ASML, the largest Dutch company, is also a tech company and ranks as the third largest in Europe by market cap, making it the most valuable tech company on the EU continent. Rewind to 1990, and the top ten companies were predominantly in the automotive and oil industries.

How did such a seismic shift occur in such a brief span? It boils down to technology, demand, and, critically, digital infrastructure. These elements have fueled our connected world. Let me explain this through three fundamental laws:

Moore’s Law: Introduced by Gordon Moore of Intel, it observes that the number of transistors on a microchip doubles about every two years, thus correspondingly increasing computing power.

The Law of Data Gravity This concept describes how a hub’s attractiveness is inherently linked to its mass of data, which attracts more applications and services, enhancing its value and utility.

Metcalfe’s Law: This law addresses the concept of network effects, showing how the value of a communication network grows exponentially with the square of the number of its users. This principle extends beyond traditional networks to encompass all tech ecosystems, such as social media and cloud platforms. These platforms are revolutionizing the way we communicate, conduct business, and drive innovation, underscoring the importance of building and maintaining robust, inclusive technological networks.

Next to these three laws’, we also have Liebig’s Law, which posits that growth is constrained not by total resources but by the scarcest resource, the limiting factor. Especially in the layered model of technology.

A period of rapid transformation

We are transitioning to a new economic paradigm that prioritizes inclusivity, social responsibility, transparency, sustainability, and circularity—all underpinned by increasing digitization. The astonishing pace of change driven by artificial intelligence (AI) is set to accelerate even further, potentially outstripping our ability to measure it.

Ray Kurzweil, in his essay ‘The Law of Accelerating Returns’, compellingly argues that technological change is exponential, not linear. He predicts that the 21st century will not experience a mere hundred years of change, but an equivalent of 20,000 years of progress. He anticipates that within a few decades, machine intelligence will surpass human intelligence, leading us to the singularity — a moment so transformative that it could mark a breaking point in human history.

Sam Altman, CEO of OpenAI, remarked about future advancements in AI, saying it more bluntly, “When ChatGPT version 5 comes out, we will view the current version 4 as the dumbest model we have ever experienced and mildly embarrassing.” Of course, history has shown that grand predictions and promises of digital technology do not always become reality. But the decades behind us have proved that enormous changes and possibilities are lying ahead of us.

Our digital economy demands an unprecedented level of digital infrastructure development. Recent announcements in the last 3 months highlight the scale of these requirements. For example, AWS plans to invest $150 billion in digital infrastructure over the next 15 years and Microsoft has announced a new data center for AI with an investment of $100 billion. These investment figures are unprecedented and signify just the beginning of a long-term trend.

In line with Liebig’s Law, which states that growth is dictated by the scarcest resource, the expansion of data centers illustrates the need for comprehensive investment across the entire supply chain.

To effectively harness the power of AI, we require significantly more bandwidth, particularly as 95% of our global data transmission occurs over sea cables. As AI grows in strategic importance, it becomes imperative to invest in new and diverse routes to maintain stability in an increasingly unpredictable world. The interplay between AI advancements and the expansion of submarine cable infrastructure is of strategic international importance. These investments in digital infrastructure are designed not only to boost data capacity and reduce latency but also to enhance the overall resilience of the network against both physical and cyber threats.

Such enhancements are crucial for ensuring that Europe remains a central hub in the global data exchange network and that we the western world remains safe. Furthermore, the increased deployment of AI intensifies the phenomenon known as data gravity, where the performance of AI models is optimized through centralization. The FLAP hub continues to strengthen and serve as pivotal centers of development and economic value for any future digital infrastructure investments expand. With Amsterdam established as a crucial data distribution hub and landing point for subsea cables its role as a key digital gateway facilitating

optimal backhaul connectivity between Frankfurt and London is set to further expand. These enhancements will facilitate the emergence of new technologies and services that rely on ultra-fast and reliable connectivity. This infrastructure will not only support current digital demands but also catalyze the next generation of innovations which further solidifies Europe’s leadership in the global digital economy.

A new mindset is needed

Historically, our industry has operated ‘under the radar,’ often quite literally as with submarine cables on the ocean floor. However, as we continue to grow, increasing our visibility becomes crucial because our future depends on it. Data centers, along with the entire digital infrastructure, now involve investments upward of $100 billion and consume unprecedented amounts of energy. It’s imperative that we rethink our growth strategies to maintain a positive public perception and ensure sustainable development. Furthermore, as our sector expands, attracting and retaining talent, also more diverse than now, is essential to harness the enormous potential of this industry. Just a few years ago, the adage was that data is the new gold; more recently, the focus has shifted to computing power as the ultimate assest.

However, I believe a broader view is essential. In the Netherlands, our growth as a major digital hub illustrates the power of an expansive interpretation of Liebig’s Law, meshed with Metcalfe’s principles of network effects. This encompasses a wide array of initiatives: from investing in all digital infrastructure layers, ensuring a sufficient workforce, constantly adapting our educational systems to prepare for future jobs, focus on research on new technologies like photonics and quantum computing, launching new sustainability efforts, to integrating these advances with our power grids and strengthening our position as an international digital nexus.

Our economy and our national sovereignty increasingly hinge on our strength in digital fields. Undoubtedly, there’s a substantial amount of work ahead. The path of our progress

and the best strategies for moving forward, remain topics for lively debate. That’s precisely why we’ve gathered here today. We can only do this together and hope this evening will help us draw nearer to the next steps in our journey.

Background

In May, Stijn Grove (managing director of the Dutch Data Center Association) represented the trade association at the International Telecoms Week (ITW) in Washington. During this event, Stijn was invited by the Dutch Embassy for a dinner with the industry to give a speech about data centers and its crucial role in society. For this edition of Datacentered, we have re-written the speech of Stijn.

About the author

Stijn Grove is the Managing Director and founder of the Dutch Data Center Association (DDA), the national trade association for data centers in the Netherlands. He also leads Digital Gateway to Europe, which promotes the Dutch data center hub. Stijn is a Board Member of the European Data Centre Association and Belgium Digital Infrastructure Association. He chairs the Kickstart Europe Conference and the Green Data Center Conference and co-founded TouchDown Middle East and DigitalX. Stijn also established Datacenterplatform and Datacentered.

As the data center industry evolves, the importance of standardization cannot be overstated. These standards not only ensure efficiency and sustainability but also drive innovation and reliability in data center operations. In this article, I will delve into the current hot topics in data center standardization, concluding with areas I believe need further standardization.

PUE: A Key Metric Under Revision Power Usage Effectiveness (PUE) is a critical metric used to gauge the energy efficiency of data centers. PUE is defined as the total data center energy consumption divided by the total IT equipment energy consumption in a formula PUE =EDC/EIT Currently, there is an intense discussion on how to account for the energy consumed by heat pumps, especially when the heat energy rejected by IT equipment is reused, for example, by district heating systems. The temperature of an average data center’s waste heat is not high enough for a heating system network; thus, a heat pump is needed to amplify the temperature.

Three options are under discussion:

1. All energy consumed by the heat pump is included in EDC

2. An adjusted EDC is calculated based on the energy consumed by the heat pump divided by the CER (Cooling Efficiency Ratio ISO/IEC 30134-7) value of the data center cooling system.

3. None of the energy consumed by the heat pump is included in EDC

Option #1 reflects the current published ISO/IEC standard and is relatively simple. However, a data center using a heat pump to deliver higher temperature water to be used by that district heating system is penalized with a higher PUE.

This is because the heat pump has lower efficiency due to the transferring of the thermal energy to the higher demanded

temperatures, resulting in increased power consumption and hence a higher EDC. Additionally, the data center can’t rely on free cooling in winter and must use the heat pump to supply the district heating. To counter this, the German government’s Energy Efficiency Bill “Energieeffizienzgesetz” excludes the electricity consumption of systems solely recovering waste heat from the data center, aligning with Option #3.

However, Option #3 poses challenges. For instance, consider a scenario where the heat pump is used to heat a neighboring office building and is equipped with an extra dry cooler to ensure the system operates under all conditions.

When the office does not require heating in summer, the data center benefits from a lower PUE because the heat pump’s electricity consumption is excluded from EDC However, this situation results in the heat not being reused, which undermines the efficiency gains; this leaves Option #2, which considers the real efficiency of the system but is complex to implement.

Water Usage Effectiveness (WUE) is another area undergoing revision. Under the leadership of Arjan Westerhoff, the ISO/ IEC workgroup is improving the definition of different water types, such as reused and industrial water. The goal is to refine the KPI’s basics for ease of use, ensuring more effective water management in data centers.

Sustainable

In Europe, the Taxonomy framework, based on the EU Code of Conduct and the EN 50600 series, guides sustainable data center practices. The TS 50600-5-1 Maturity Model, released last year, is now being reviewed for inclusion in the ISO/IEC series, a set of international standards that provide a framework for the effective management and operation of data centers, reflecting its growing importance.

With the rise of AI and its associated higher power densities, there is an increasing demand for liquid cooling in data centers. Liquid cooling offers significant benefits, such as higher energy efficiency and reduced space requirements, but it also presents challenges, including potential leaks and the need for specialized maintenance. IEC 48D is conducting a study to determine standardization needs. I advocate for standardizing temperature, focusing on high-temperature heat reuse (>70 °C) or free cooling (>35 °C). If you want to make AI’s enormous energy requirements viable and sustainable, make all its energy easy reusable and operate with a near zero WUE.

Further standardization is needed in several key areas of data center operations. These include refining PUE metrics to account for heat pump energy use, improving WUE by better defining water types, and enhancing sustainable practices guided by the EU’s Taxonomy framework and EN 50600 series. Additionally, there is a pressing need for standards in liquid cooling, focusing on high-temperature heat reuse and free cooling to support the sustainability of AI’s energy demands.

In conclusion, while the path to standardization is complex and challenging, it is essential for the evolution of efficient, sustainable, and innovative data centers. As John F. Kennedy aptly said: “We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard.” The same spirit drives us to tackle these challenges in data center standardization

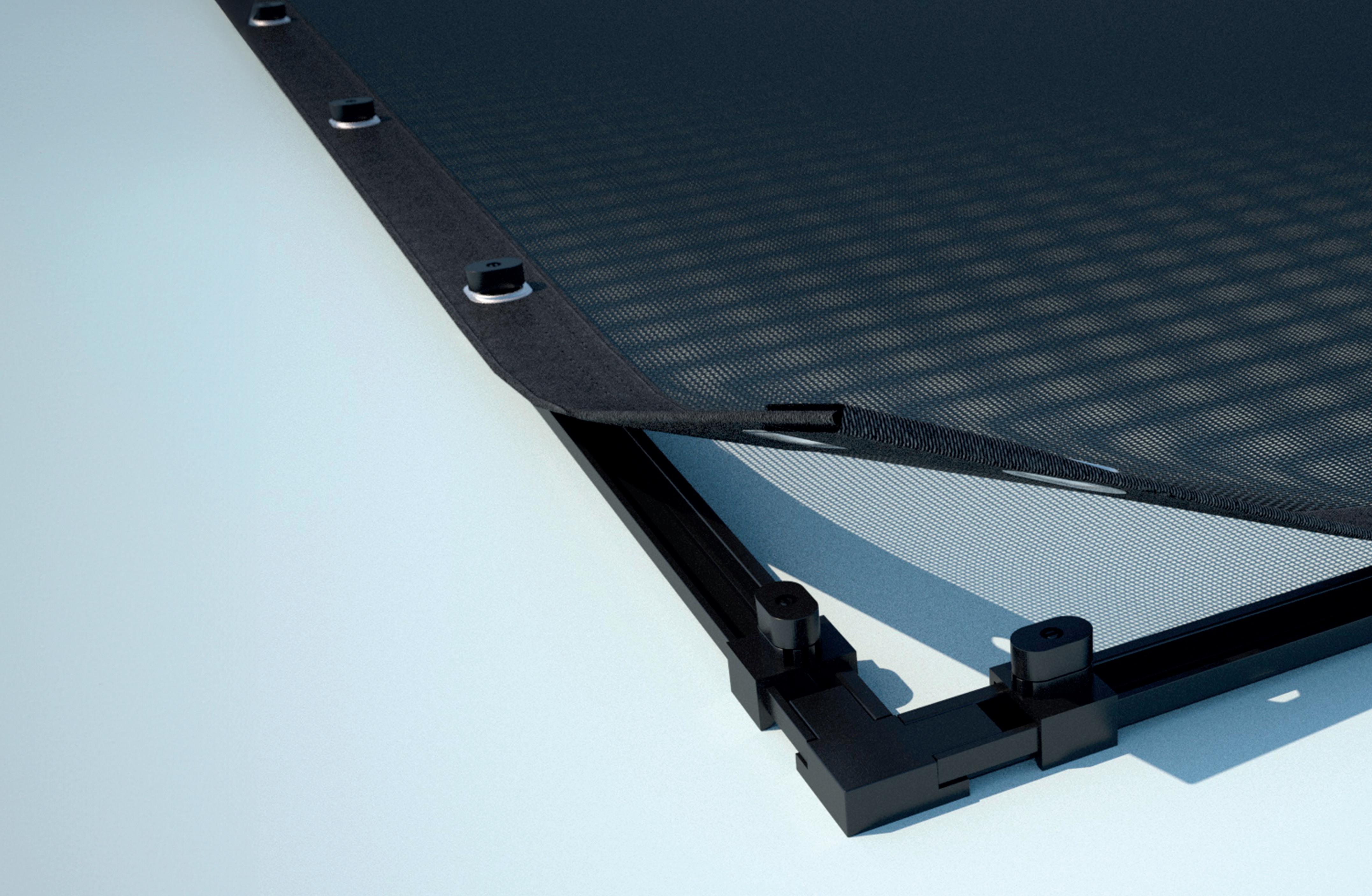

While data centers have been on the technical forefront in climate control systems and efficiency monitoring, innovations from other sectors occasionally make their splash in the IT facility sector. Interfilter Group is offering its ProScreens solution - an installation that protects outside cooling units from the elements and general debris - to data centers and it is generating impressive results.

“IT GOT ME THINKING WHETHER IT WOULD BE POSSIBLE TO PROTECT THOSE COOLING UNITS WITH SOME KIND OF SCREEN, WITHOUT CREATING AN EXTRA BURDEN.”

It all began when Randy Deden, New Business Sales Manager at Interfilter Group, noticed a non-data center customer’s cooling unit covered in a blanket of debris. “That simply had to hinder the efficiency,” Deden said. “It got me thinking whether it would be possible to protect those cooling units with some kind of screen, without creating an extra burden.”

The resulting mesh solution, ProScreens, captures particles that could hinder the performance of cooling units. These include dirt and soot, but also seasonal debris like pollen and leaves. “Removing these contaminations from the units is labor intensive and in most cases this needs to be done by a third party,” Deden explains. Debris removal from the ProScreens on the other hand is relatively easy. Rain and wind can even wash off of the contamination. All while maintaining airflow and efficiency. The design also accommodates tight installations, sometimes requiring internal mounting alongside soundproof enclosures.

Cooling units are crucial for data centers to operate, while efficiency is key for an industry that has been under scrutiny for years now. However, Deden needed to do some convincing before landing his first pilot project. “One common concern that they brought up is pressure drop, which can reduce efficiency,” he recalls. “ProScreens address this by allowing customers to monitor contamination levels and clean screens as needed, preventing neglect and maintaining performance.” However, he points out, deploying ProScreens also needs some adaptations of maintenance routines. While it saves on intensive servicing, the screens itself need to be washed down on a regular basis.

“In Dutch data centers, condensers are typically cleaned twice a year, which is an intensive and costly task that can also damage the condensers,” Deden continues. “In contrast, we recommend that based on the contamination cleaning our ProScreens approximately 3-4 times a year, easily done by users themselves with a brush or vacuum cleaner, empowering them to handle it independently rather than relying on a third party.” This approach not only enhances operational efficiency but also ensures long-term performance and reduces environmental impact, while saving costs on intensive maintenance services.

The results in the various data center environments where this solution is installed are impressive. ProScreens can reduce servicing costs by up to 50%, Deden claims. “This efficiency caught the eye of a data center sustainability manager, who noted the potential for significant reductions in Scope 3 emissions.” The solution also results in savings on service procedures, call-outs, and spare part transport, while increasing the lifespan of the cooling unit. Proper utilization of ProScreens enables energy savings of 8-12% to be achieved.

Being a low-tech system, the ProScreens are durable and straightforward to use. “ProScreens come with a five-year warranty, matching the lifespan of the cooling machines they protect,” Deden explains. “They are designed to withstand extreme weather conditions, including tornado-level winds up to 140 kph.” Being a turnkey solution, implementing ProScreens does require sufficient time to install or requires a project to be organised. “It’s usually a matter of weeks to set up,” Deden says. In addition, Interfilter Group manages the entire process from production to installation, ensuring seamless integration without interrupting the business operations. This approach allows us to fully support our customers throughout the process, providing peace of mind regarding the installation’s performance and lifespan.

The successes of ProScreens already has Interfilter looking at the future. One upcoming solution is aimed at preventing short-circuiting caused by warm air recirculation, including a quick scan. “The data center market is very quality driven, and that suits us,” Deden says. “We have more than enough capacity to scale up.”

Stroomkr8 is an independent energy consultancy company. They support their clients on all kinds of energy sourcing activities, from strategic/conceptual matters to daily and operational practice. They buy and sell energy for their clients in 17 different countries with a team of highly experienced colleagues within both supply companies and consultancy.

More information: www.stroomkr8.nl

In once again a year with many influences from escalations in the world, the energy market has been moving strongly up and down. Therefore we provide you with the latest details in the energy market and bring you up to speed on possibilities and risks. In this report we will share our view on the energy markets to help you understand the energy triggers and provide support to your procurement decisions.

The U.S. economy is showing a mixed picture, which is relevant for data centers focusing on cost management. The decline in housing construction permits to the lowest level in four years might prompt the Federal Reserve to cut interest rates by 0.25% in September. This could impact financing costs for infrastructure expansion or renewal. On the positive side, strong consumer spending and rising consumer confidence suggest a potential ‘soft landing’ for the economy without falling into a recession. This could ensure stable demand for data storage and processing.

The Chinese economy is showing signs of slowdown, with declines in both consumer and producer confidence. This cooling could impact the demand for cloud services and thus occupancy rates of data centers in the region. A decrease in the number of issued loans also indicates caution in investments, which could indirectly affect the sector.

For the Netherlands, the CPB predicts economic growth of 1.6% next year, with an increase in purchasing power. This year, growth remains modest at 0.6%. For data centers, this could mean that local businesses might invest more in IT infrastructure as a result of a stronger economy.

Oil prices remain volatile, with recent fluctuations that could affect operational costs for data centers, especially those reliant on generators for emergency power. Gas prices have also risen, directly impacting costs for energy-intensive data centers. The price increases are largely attributable to geopolitical tensions and the reduced availability of LNG.

Geopolitical risks, such as tensions in the Middle East and uncertainties around gas supply from Russia to Europe, remain a significant factor. These uncertainties could lead to higher energy prices and should be closely monitored by data centers aiming to manage their energy costs.

All these factors together underscore the importance of a flexible and well-informed energy procurement strategy for data centers, especially in a time when energy markets are highly dynamic.

The electrification of European economies, as highlighted by the Fit for 55 (F55) plan, represents a significant shift towards reducing emissions and increasing the share of electricity in the energy mix. This transition is driven by the urgent need to meet the 2030 target of a 55% reduction in emissions.

Key Points

Increased Electricity Demand: The push for electrification is projected to increase power demand by approximately 50% by 2030. This marks a reversal of the previous 15-year trend of declining power usage. Significant growth is expected from new sources such as electric vehicles, heat pumps, and industrial motors.

Investment Requirements: To support this shift, Europe needs to mobilize around €3.7 trillion in capital over the

next decade, with a substantial portion directed towards green energy infrastructure. This includes investments in renewable energy sources, power grid upgrades, and building renovations to accommodate new electric heating systems.

Impact on Power Prices: The reduction in legacy power plants, combined with the challenges in rapidly scaling up renewable energy sources like wind and solar, is likely to tighten the supply-demand balance, thus supporting higher power prices in the short term, especially in markets like Germany.

Benefits to Green Energy Majors: Companies involved in green energy are expected to see much higher returns, double-digit earnings growth, and significant value creation.

Electrification Strategy and Its Implications

Sector-specific Shifts: The automotive, real estate, and manufacturing sectors are key areas where electrification will have a substantial impact. The adoption of electric vehicles and the installation of heat pumps will significantly increase individual and aggregate power consumption.

Renewable Energy Expansion: The F55 plan anticipates a major ramp-up in renewable energy capacity, aiming for a 70% share by 2030. This will require an unprecedented acceleration in the installation of wind and solar capacity.

Financial and Policy Support: Achieving these goals will necessitate extensive financial investments and supportive policies, including subsidies for electric vehicles and heat pumps, to make the transition economically viable for consumers and industries.

and Considerations

Regulatory and Financial Risks: The scale of investment and the rapid changes in infrastructure may expose companies to regulatory uncertainties and financial risks, particularly if energy prices fluctuate or policy adjustments occur.

Technological and Operational Hurdles: The speed of technological adoption and the capability of industries and power grids to handle these changes without disruption pose significant operational challenges.

This electrification effort is not just about energy transition but is also a critical component of Europe’s broader environmental and economic policies aimed at sustainability and reducing dependency on fossil fuels.

Power market

In the energy market the power price driver is still gas, it controls the market when renewables aren’t sufficient. Providing opportunities for companies that have their demand during office hours and less benefit from renewables for baseload steady off takers like data centers. This because the low midday pricing is leveled out by high shoulder hours (19:00 to 24:00 and 06:00 to 08:00).

Naturally the low midday pricing has it’s impact for all off takers in the market. Not only beneficial, as risk from renewable’s in general, due to the unpredictable character of the imbalance market and therefore the risk for suppliers. How does imbalance work? In general most off takers allow their supplier to predict the next day usage or production, this is done the day before delivery at 11:00 for all of the suppliers portfolio, Tennet receives all predictions and will make sure that the volume that is produced in a country is sufficient to supply all, with a bandwidth for unexpected events. It is logical that a third party will always be wrong about what you will use or produce during the day, as no day is like the day before.

The mismatch between prediction and actual off take is imbalance. Why is the impact of renewables stronger that before? This is where the replacement of secure production location like coal and gas are being replaced with less predictable renewable sources. If the weather forecast shows a good amount of sunshine combined with a wind force of 4/5 Beaufort, it will provide enough power to supply the country. But as we all are aware of the weather predictions tend to be wrong. So in the case mentioned it suddenly is a cloudy day with hardly any wind the production will not meet the needed levels to have a safe supply of energy. Tennet will call upon quick responding production (gas power production installations) to ramp up and clear any inconvenience. Only they will produce at a beneficial high price for them, higher cost resulting in high imbalance prices. Suppliers that predicted high renewable output will have to pay this higher price as they did not match their prediction.

The logic being that this needed power production runs at prices of 2000 euro/15 min. With renewable production growing still, the risk for supplier seem to increase exponential. This results in higher cost to serve clients for suppliers and giving less room to decrease the service premiums.

The benefit for the market still lies with the long term positions from suppliers with LNG suppliers to continental Europe. At this moment the gas storage levels are well above the needed requirements for Europe giving a great ease in the market.

EUR/MWh

IN THE ENERGY MARKET THE POWER PRICE DRIVER IS STILL GAS, IT CONTROLS THE MARKET WHEN RENEWABLES AREN’T SUFFICIENT.

The long term contracts have been negotiated when Russian gas supply was cut off, allowing long term prices to be in backwardation as the expected supply to fill storages have been secured by now. Disruptions however have a strong

hold on gas as traders do not feel comfortable yet. This in the reason why the market reacts strong on any negative news on gas supply, form pipeline gas (Norway) or LNG.

1-1-2023 1-2-2023 1-3-2023 1-4-2023 1-5-2023 1-6-2023 1-7-2023 1-8-2023 1-9-2023 1-10-2023 1-11-2023 1-12-2023 1-1-2024 1-2-2024 1-3-2024 1-4-2024 1-5-2024 1-6-2024 1-7-2024 1-8-2024 1-9-2024 2025 2026 2027 EUR/MWh

Gas market

Why fundamentals have little impact at this time seems mainly driven by the fear in the market about what could happen in the Middle East and Ukraine. Everybody is aware that an escalation of the Middle East situation will have a strong impact on oil production and transport, this is widely known. The part that is less common to be aware of is the locations of the gas connectors towards Europe in the Kursk region that has been taken captive by Ukrainians in the last month. As Europe is still getting 10% of it’s gas from Russia trough countries like Turkey any disruption will be felt. This is

the reason why traders are uncomfortable with the current situation. Redraw from this region will allow the market to settle once again and the weather forecast will by then be the news to watch. Will we once again have short periods of temperature drops or will we experience a strong long winter. If we will go to lower temperature in 2024 against long term averages the prices will react bullish in a swift an explosive manner. As we still are not sure if we will be able to deal with a strong winter without Russian gas. On spot we see some variation but the Cal 2025 has reacted the strongest on the news mentioned before.

After the strong drop of EUA’s in March of 2024 the price have been bullish all summer long, strongly correlated with gas price and uncertainty about next tranches and new

legislation. Issues like ETS 2 and gas reduction programs in many European countries show that the industry has taken measures to reduce carbon emissions. At this time we still see a lot of movement caused by speculative trading from investors.

At the moment the fundamentals for the energy market are bearish, with a good flow of LNG to Europe there should be a stable market based on that. Key words will be disruptions, liquidity of volumes and escalations. The main issues have been resolved on supply to Europe. By having no new escalations, transport problems or sabotages the market will show a sideways movement until the end of the year. Weather predictions on a early winter could result in a market reaction that will drive gas prices up and in it’s airstream power. The current backwardation in pricing is something to keep in mind for long term hedging decisions and renewable investments.

It is a new playing field in the energy market and the historic prices provide no support for any movement in the current market. Basically Europe has experienced a reset on energy prices and the market is looking for the new price levels that is supported by long term fundamentals and innovation to set the cost of energy with renewables production and much needed alternatives. It highlights strategic thinking, resilience, and innovation, which are essential for thriving in a changing commodity market.

In my previous columns focused on the range of new legislation targeting the data center industry on energy and sustainability. This time focus is on the Network and Information Security Directive (NIS2). NIS2 is designed to help organizations protect themselves against cyber threats and to ensure that the cyber infrastructure within the EU is more secure and robust. NIS2 came into force at EU level on 16 January 2023, and Member States must implement NSI2 into national law by 17 October 2024.

Compared to NIS1, NIS2 broadens the scope of sectors required to comply. NIS2 addresses medium-sized or large organizations in specific sectors and introduces an extraterritorial reach. In principle NIS2 is not applicable to small and micro-enterprises that have fewer than 50 employees and an annual turnover of less than 7 million euros, or a balance sheet total of less than 5 million euros. Depending on size and sector, NIS2 differentiates between essential organizations and important organizations (where previously only a distinction was made between vital organizations that were covered by the NIS and non-vital organizations).

The main difference between essential and important organizations relates to the monitoring of compliance with the rules. Essential entities will be actively monitored and supervision is proactive. Important entities will only be checked for compliance after an incident. Data centers are in scope of NIS2, and it is crucial that data center owners and operators (if not done so already) prepare themselves to meet the new NIS2 requirements.

All organizations that fall under NIS2 have to comply with their duty of care. NIS2 includes a list of cybersecurity-risk management measures that need to be taken into account as a minimum, such as maintaining a basic level of digital hygiene and implementing cyber security education, attention to

crisis management and operational continuity in the event of a major cyber incident and use of cryptography and encryption.

Ensuring supply chain security is also on this list, meaning that businesses that do not directly fall under NIS2 could be indirectly impacted. There is also a reporting obligation for all organizations that fall under NIS2, consisting of a three stage process for reporting security incidents to the relevant authorities. An “early warning” must be submitted within 24 hours, an “incident notification” should be submitted within 72 hours and a “final report” should be submitted within one month. This final report should provide a more detailed description of the incident, lessons learned and mitigation measures.

NIS2 imposes new obligations on management bodies who must have regular training and must oversee implementation of the cybersecurity-risk management measures mentioned earlier. Top management can be held liable and accountable for noncompliance with these cybersecurity-risk obligations. Finally, sanctions and administrative fines can be imposed, which should ensure an effective compliance of the rules and obligations under NIS2.

Natascha Geraedts is a Partner at Eversheds Sutherland and part of Eversheds’ renowned Global Datacenter and Digital Infrastructure team. Natascha started her career at the Council of State and has over 20 years’ experience. Natascha is seen as the “go to expert” in the Dutch market for her knowledge in the data center sector and data center developments. Natascha frequently speaks and publishes on environmental and regulatory aspects of data centers and she has been a yearly speaker at the Kickstart Europe Conference since 2021.

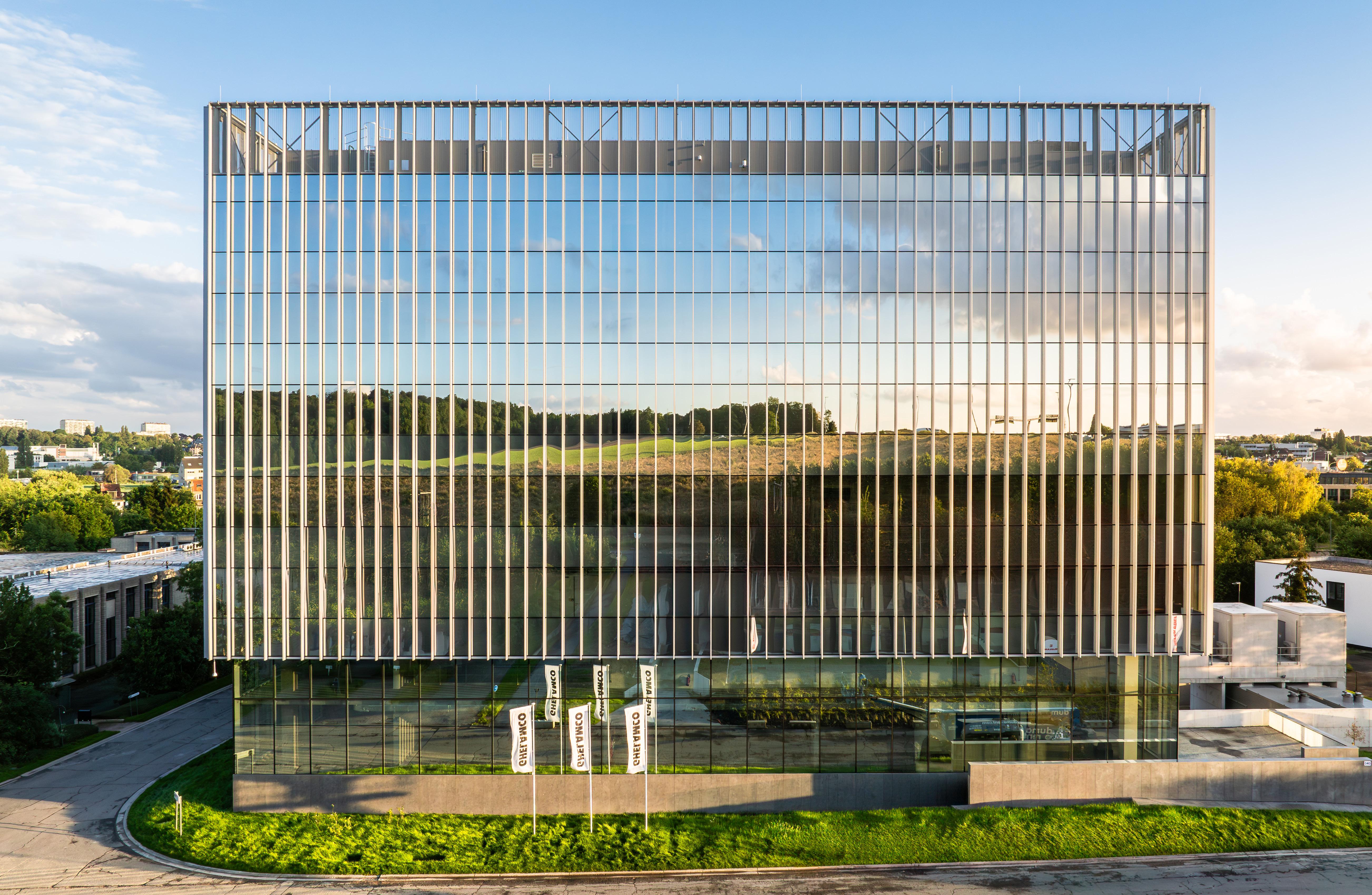

Take a look inside Penta Infra’s recently acquired Nexus Data Center in Brussels, which opened its doors in May this year.

• 7,2 MW IT capacity

• 3.500 m2 white space

• Triple certified for sustainability:

• BREEAM Excellent

• EDGE Advanced

• Uptime Institute Tier III

• Anchor tenants:

• VUB Brussels University

• UZ Brussel University Hospital

• VSC Flemish Supercomputer

• Industry-leading PUE

• Maximum on-site solar through photovoltaic facade

• Rainwater harvesting in sub-basement basin

• Cascaded HVAC: heat reuse, adiabatic, chillers

• On-campus heat recuperation grid

• Local smart grid island mode

• In the middle of FLAPD markets

• Within Brussels ringway

• Located on new technology and innovation campus “Green Energy Park”, which acts as an attractive hub for hi-tech companies

• Conveniently located with excellent transport links

• Rich in connectivity options, with major fiber operators redundantly connected

Last June, The Belgian Digital Infrastructure Association (BDIA) organized their first major conference to discuss the future of the digital infrastructure market in Belgium.

The most asked question: Can Brussels be the next major data center hub?

Text: Pim Kokke

Brussels must be one of the most interesting cities in Europe due to its geographical position and the presence of the European Parliament. Moreover, the country is still developing its digital infrastructure with one goal in mind: becoming a serious competitor in the FLAPD market. With this in mind, the Belgian Digital Infrastructure Association (BDIA) organized their first large event named DigitalX for 350+ visitors from all over the Benelux. According to the BDIA, the goal of DigitalX is to strengthen the relationships between the most important stakeholders (e.g., network suppliers, transmission operators, data centers, local and national governments) within the Belgian digital infrastructure.

Brussels is somewhat on the rise

One of the many presentations was given by industry veteran Kevin Restivo. As CBRE's European Head of Data Centre Research Advisory & Transaction Services, he provided an outlook for the data center market in Brussels. In sum, the market in Brussels exemplifies growth of broader European colocation data center market despite considerable difficulties meeting demand.

Furthermore, CBRE estimated that the total capacity in Brussels is 65 MW (Q4, 2023). In that year, Brussels posted exceptional supply growth, almost 140%. However, in 2024, this number is lower compa red to most secondary markets such as Madrid, Milan, Oslo, Stockholm and Zurich. Restivo: "Vacancy rates are usually lowest in the areas where capacity is in greatest demand. Typically, hyperscaler availability zones reside within those markets."

Energy: key challenges & opportunities for the grid

Another insightful presentation was presented by David Zenner, Chief Assests Officer at the ELIA Group. In his keynote, he showed that the demand for electricity is expected to increase significantly in the coming decade. This effect is mainly driven by new electrification in industry, transport and heating. For example, the yearly electricity consumption in 2024 is 82,6 TWh and will increase up to 132,9 TWh in 2035. However, this creates a challenge for the energy grid as the current market design is centered around Suppliers and Balance responsible parties (BRPs) with inflexible demand. In 2030, a future-proof energy epicenter which is based around the consumer is needed in order to keep up with the rising demand. Furthermore, Zenner presented three key products to bring financial incentives directly to customers which includes:

Multiple BRP (TSO) / Supply Split (DSO)

✓ Split between flexible and non-flexible assets

✓ Different contractual schemes

✓ More degrees of choice in energy services for the consumer

Real-Time Price (RTP)

✓ From a penalty to an incentive

✓ From a real-time/ex-post calculation to an ex-ante indicator

✓ From a multiple to a single key indicator

MPx – Direct Access to Market

✓ reducing complexity to access the DA/ID markets

✓ Propagate the real-time price for a full economical optimization of a flexible asset over all time horizons

✓ lower financial and infrastructure requirements to accommodate smaller portfolios, or even asset level

The next major hub?

In sum, Brussels can become a Tier 2 market in the future. However, this needs further collaboration between the digital infrastructure industry and federal/local governments. Due to the political complexity in Belgium with Flanders and Wallonia, this will be an big challenge for the future.

Data centers are more than just buildings with walls and office spaces. You do not witness their presence, but if you think for two seconds they are there for you when you wake up and go to bed. Every glance on your screen. Every message you receive. They connect us. They can make us create things we could not imagine before. So when you drive on the highway to get home, think about how data centers are part of your daily life that you plan, build and run.

www.datacentered.net