Our

Unifying & Advancing All

of the Industry Industry Leader Kathryn Tomasofsky Executive Director, MSBA The Global Remittance Market Is Poised For Rapid Growth. Aquanow's Role in the Global Adoption of Digital Assets Navigating New Risks: Building Resilience in Cross-Border Payments Shattering Boundaries How Fintech is Making a Change 15th Edition

Mission:

Areas

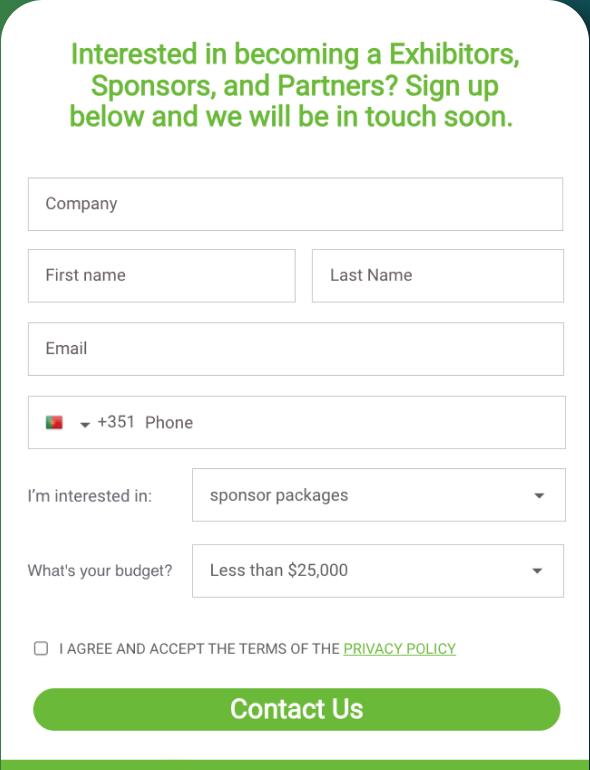

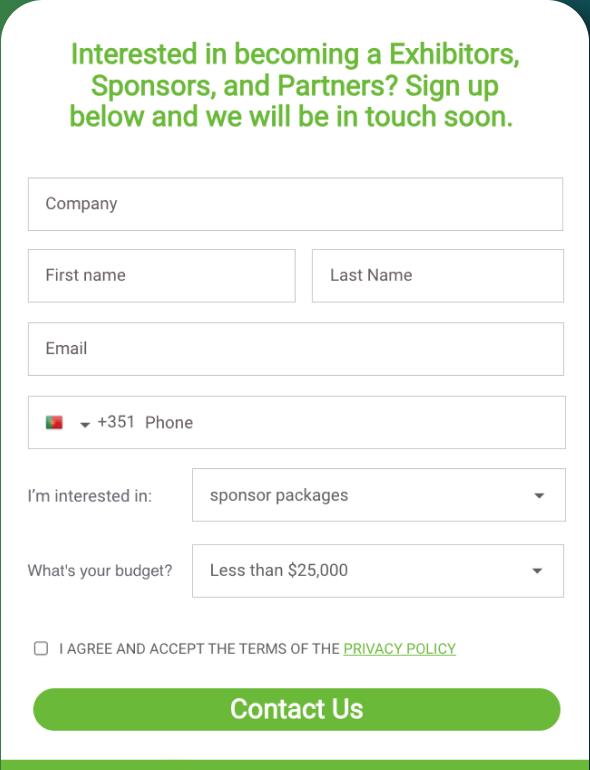

Become a Sponsor or Exhibi tor Seminole Hard Rock Hotel & Casino Mami, USA

500

2 14th Edition

NOV 14 - 1 6 FROM

40 COUNTRIES

MORE THA N AT TENDEES

OVER

By partnering with us, your business will be showcased throughout our platforms that reach a broad audience within the industry.

Past Sponsors and Exhibi tors Leave your footprint in the industry ! Be a sponsor and exhibitor.

Priscilla

D'Oliveira

began her career in American Express USA and LATAM where she managed the Global Networking Services division with banks in Latin America, built online products to deliver collaboration at Laureate Education .She now joins cross-border payment space to contribute to the payment industry, delivering consulting and conferences for payments companies worldwide.

In today's globalized world, collaboration is more than just a buzzword; it's a game-changer. By forging partnerships with other stakeholders, including banks, fintech companies, and regulatory entities, we can create synergies that propel the entire industry forward. Together, we can devise innovative solutions to address the pain points of cross-border payments, enhancing speed, transparency, and security.

In this edition, we will explore how partnerships foster trust among participants, a vital element in an industry where financial security is paramount. By working together, we demonstrate our commitment to creating a seamless, reliable, and inclusive cross-border payment ecosystem.

The cross-border payments industry's future hinges on collaboration, we recognize the significance of coming together, pooling our expertise, and driving innovation to reshape the landscape of cross-border payments and ensure that it serves as a catalyst for global economic growth and prosperity.

Our mission in CrossTech is to facilitate these partnerships to position you to success and gain time to market in the industry. Let's embrace the power of partnership and embark on this transformative journey together!

The views and opinions expressed in this magazine are those of the authors and contributors and do not necessarily reflect the position of CrossTech, The Platinum Network, or IMTC. The content here is for informational purposes only and should not be taken as investment business, compliance, or legal advice. Content contained within this publication is not to be reproduced in whole or part without the prior written consent of the company. We welcome quotes of our articles by mentioning “CrossTech Magazine” or #crosstech and share the quote with us using our social media channels.

3 crosstechpayments.com

editor’s letter

Us At help@crosstechpayments.com

PRISCILLA D’OLIVEIRA COO, CrossTech

Contact

4 14th Edition table of contents 8 Shattering Boundaries: How Fintech is Making a Change 10 The Global Remittance Market Is Poised for Rapid Growth 12 Navigating New Risks: Building Resilience in Cross Border Payments 14 Meet this Month's Industry Leader: Kathryn Tomasofsky Featured 20 Aquanow's Role in the Global Adoption of Digital Assets 22 Unlocking Opportunities 24 Five Things You Need to Know About DolfinTech 28 Gadget Corner 30 CrossTech World 2023 p. 10 Industry Leader p. 14 p. 12 p. 30

The 2023 CrossTech Innovation Awards are an esteemed recognition program that celebrates and honors exceptional achievements in the realm of cross-border payments and financial technology. These awards aim to highlight the significant contributions of various companies and solutions in advancing the global financial landscape. The awards ceremony will acknowledge outstanding performers in five distinct categories, each representing a crucial aspect of the cross-border payments industry.

Submission Deadline: OCTOBER 13 | 11:59 PM EST

year

5 crosstechpayments.com

business payment solution of the

Calling all CrossTech Innovators: Make Your Mark in Cross-Border Payments! white label provider fintech startup solution in cross-border industry leader banking solutions for msb submit here

Kathryn Tomasofsky

MSBA

Kathy Tomasofsky is the Executive Director of the Money Services Business Association (MSBA), the only trade association focused on money transmission payments and products. Ms. Tomasofsky earned an MS in Management Information Systems from the University of Baltimore and a BA in Business Administration from Loyola College in Maryland. She holds a MAT degree from Fairleigh Dickinson College, in New Jersey and has certifications in Project Management and Insurance.

Inés Fernández

Inés Fernández is Vice President of Solutions Engineering at Aquanow. She is a capital markets and technology leader, with experience across the capital markets ecosystem, including various roles in front office, technology, and analytics. Previously, Inés worked at the Toronto Stock Exchange (TMX Group) and RBC Capital Markets in Toronto, and London, UK.

Jennifer Holguín

Aquanow CrossTech

Jennifer Holguín is a lead consultant with a finance, sales, and marketing background. Jennifer started her career in the banking industry in 2010 with a strong experience in business development in LATAM and US market. Since June 2020, Jennifer is the consulting lead for CrossTech Consultants where she manages partner consultancy firms as well as partner companies.

6 14th Edition contributors

Arina Anapolskaya CashQ

Arina Anapolskaya is the Founder and Chief Operation Officer of CashQ embedded cross-border payment platform for banks and neobanks. Before joining CashQ, Arina founded and managed multiple businesses in Florida and Massachusetts. Arina most recently served as the Chef Operation Officer at B Platform, where she developed and managed operations of a real-time payment platform.Arina holds B.S. in Computer Science from Boston University and Harvard Extension School.

Leon Isaacs Saver Global

Leon Isaacs is a partner and founder of DMA in London where he provides assistance to and delivers projects for a wide range of stakeholders interested in harnessing remittances for development. Prior to establishing Developing Markets Associates (DMA), he worked for 15 years at a senior level for a number of international money transfer companies including MoneyGram, Travelex, Thomas Cook and Coinstar.

Alex Pereira PMI Americas

Alex Pereira is the Founder and CEO of PMI Americas, a leading financial technology company focused on payment solutions and business innovation. Alex has vast experience in global financial services, having collaborated with several large corporations to implement cross-border payments solutions for remote workers, freelancers, and outsourced staff.

7 crosstechpayments.com

Fintechs have brought about a positive disruption in the cross-border industry, providing consumers with more efficient and affordable payment solutions. The advent of digital payment technologies has paved the way for Fintechs to enter the cross-border space, which traditional financial institutions once dominated. With the emergence of Fintechs, we can expect to see further innovation and disruption in the cross-border industry in the upcoming years.

One of the primary advantages of Fintechs in the cross-border space is the speed and ease of transactions. Fintechs leverage modern payment technologies such as blockchain and artificial intelligence to provide faster and more secure payment services. This has significantly reduced the transaction time and increased the convenience of cross-border payments. Additionally, Fintechs have introduced cost -effective payment solutions, making cross-border payments accessible to a wider audience.

a surge in innovation in recent years, with Fintechs at the forefront of this disruption. We can expect further advancements in payment technologies, leading to greater convenience and security in cross-border transactions. For instance, adopting decentralized finance (DeFi) solutions will enable consumers to make cross-border payments without intermediaries, leading to faster and cheaper transactions.

SHATTERING BOUNDARIES: HOW FINTECH IS MAKING A CHANGE

By Leon Isaacs

The increasing adoption of mobile payments will also drive innovation in the cross-border industry. Fintechs are leveraging mobile payment technologies to provide consumers with more convenient payment options. This trend is particularly relevant in emerging markets, where mobile phones are the primary mode of accessing financial services. Fintechs are therefore well-positioned to tap into this market and provide innovative payment solutions that cater to the needs of consumers in these markets.

Fintechs have also brought about greater transparency in the cross-border industry. Traditional financial institutions have been criticized for their opaque pricing and fee structures. However, Fintechs have adopted a more transparent approach, enabling consumers to have a clear understanding of the costs involved in cross-border transactions. This has increased trust and confidence in the industry, which was once rife with scams and fraudulent activities.

The cross-border industry has witnessed

Another trend we can expect to see in the cross-border industry is the convergence of payment technologies. Fintechs are increasingly integrating different payment solutions to provide a seamless payment experience to consumers. For instance, some Fintechs are integrating blockchain and AI technologies to provide faster and more secure payment solutions.

Fintechs have brought about a positive disruption in the cross-border industry, providing consumers with faster, more secure, and

8 14th Edition

cost-effective payment solutions. With further advancements in payment technologies and the increasing adoption of mobile payments, we can expect to see further innovation and disruption in the cross-border industry. As Fintechs continue to revolutionize the industry, consumers can look forward to a more convenient, transparent, and accessible cross-border payment experience.

9 crosstechpayments.com

“Fintechs are increasingly integrating different payment solutions to provide a seamless payment experience to consumers.”

fintech insights

Image: Freepik.com

Leon Isaac s Founder, Chief of Digital Payments & International Parnerships saverremit.com

The Global Remittance Market is Poised for Rapid Growth

by Arina Anapolskaya

Cross-border payments are a critical need for millions of people worldwide, especially those who rely on remittances to support their families and communities. The remittance market has been growing steadily over the years, and according to World Bank data, it is projected to reach $715 billion by the end of 2022.

This growth is driven by increasing globalization, the rise of the gig economy, and the growing need for fast and reliable cross-border payments. However, despite the rapid growth of the remittance market, many still face high fees and slow transaction times when sending money abroad. Traditional banks and neobanks often rely on outdated technology like SWIFT, resulting in high costs and slow transactions.

That’s where CashQ comes in. CashQ is a global push payments platform changing the game for banks and neobanks. With CashQ, funds can be sent instantly, seamlessly, and securely to any account using card or phone numbers. This innovative platform is designed to make cross-border payments more efficient,

cost-effective, and accessible to more people. CashQ was created to solve the challenges faced by traditional banks and neobanks in the cross-border payments market. Using cuttingedge technology, CashQ can offer competitive and convenient cross-border payment options that traditional banks can’t match. With CashQ, banks can provide their customers with a superior cross-border payment experience, increasing their revenue and retaining their customers.

10 14th Edition

In addition to its benefits for banks, CashQ is also suitable for consumers. With CashQ, customers no longer have to pay high fees and wait several days for their transactions to be processed. They can now send money instantly and securely to anyone, anywhere in the world. And best of all, they can do it quickly and at a fraction of the cost.

The remittance market is overgrowing, and the demand for fast, reliable, and cost-effective

cross-border payments will only increase. With CashQ, banks and neobanks can tap into this massive market and provide their customers with a better cross-border payment experience. So what are you waiting for? Join the revolution and transform the way you make cross-border payments with CashQ.

11 crosstechpayments.com

“With CashQ, funds can be sent instantly, seamlessly, and securely to any account using card or phone numbers.”

around the globe

Image:

Freepik.com

Arina Anapolskaya Founder & COO mycashq.com

Navigating New Risks: Building Resilience

in Cross-Border Payments

By Alex Pereira

The cross-border payments industry is rapidly evolving, and with this evolution comes new risks and challenges that businesses must overcome to succeed in this space. One of the most significant risks facing businesses in the cross-border payments industry is the threat of fraud and cybercrime. In this article, we will explore the new risks and resilience solutions in the cross-border payments industry.

New Risks in the Cross-Border Payments Industry

The cross-border payments industry is facing new risks as technology advances and criminals become more sophisticated in their tactics. One of the most significant risks facing businesses in this space is the threat of fraud and cybercrime. Criminals can use a range of tactics to commit fraud, including phishing attacks, malware, and social engineering.

Another risk facing businesses in the cross-border payments industry is regulatory compliance. Businesses must comply with a range of regulations in each country they operate in, which can be challenging to navigate without the support of local partners. Failure to comply with these regulations can result in hefty fines and reputational damage.

12 14th Edition

Image: Freepik.com

Resilience Solutions in the Cross-Border Payments Industry

To address these new risks, businesses in the cross-border payments industry are adopting new resilience solutions. One such solution is using artificial intelligence (AI) and machine learning (ML) to detect and prevent fraud. These technologies can analyze large amounts of data in real-time to identify suspicious transactions and flag them for review.

Another resilience solution is the use of blockchain technology to secure transactions and prevent fraud. Blockchain technology provides a tamper-proof record of transactions, making it nearly impossible for criminals to commit fraud or alter transaction records. Some companies in the cross-border payments industry are already using blockchain technology to improve security and reduce costs.

In addition to these technological solutions, businesses in the cross-border payments industry are also adopting more collaborative approaches to risk management. This involves partnering with local companies and regulatory authorities to understand better and manage risks in foreign markets.

In conclusion, the cross-border payments industry is facing new risks and challenges as technology advances and criminals become more sophisticated in their tactics. To overcome these risks, businesses in this space must adopt new resilience solutions, such as AI and blockchain technology, and take a more collaborative approach to risk management. By embracing these new solutions and working together, businesses in the cross-border payments industry can reduce risks, improve security, and create new growth opportunities.

13 crosstechpayments.com

Freepik.com

Image:

keep in mind

“To overcome these risks, businesses in this space must adopt new resilience solutions, such as AI and blockchain technology, and take a more collaborative approach to risk management.”

Alex Pereira

Founder & CEO pmi-americas.com/en/

KATHRYN TOMASOFSKY

ance, fair business practices and business leadership and education.

The Money Services Business Association (MSBA) was established in 2015 by a small group of visionary companies that recognized the need to collaborate to improve the understanding of the industry and to keep the companies informed of the ever-changing licensing requirements throughout all 49 states.

The Association has grown significantly in the last eight years both in membership numbers and in our role in educating and advocating on behalf of the industry. Our membership includes companies within the following areas: Traditional Money Transmitters with Agent Networks, Financial Institutions and Payroll Companies, Digital Money Transmitters, Prepaid Cards, e-Wallets, Payroll, Bill Payment, Currency Exchangers and Money Order companies. Our Mission is "Sharing One Vision." Although there are many diverse products, at the heart of what we do, our mission is to increase the awareness of the beneficial services the industry provides and to support and promote payments innovation. MSBA members are guided by principles that promote regulatory and anti-money laundering compli-

This mission requires that we track legislation and regulation for our members and outreach when there are unintended consequences of a new law or regulation.

In the area of regulation, any change movement is a slow process, and requires continual diligence in tracking. Companies that conduct business in the US or are considering doing business in the US recognize the maze that they must go through to obtain a license to operate can be confusing and time-consuming. Once the license is obtained, there are continual requirements that must be met to comply with supervision and renewal. For example, one of our recent, successful collaborations was that MSBA was selected to be part of a specialized group along with designated industry companies and state regulators to work on harmonizing the requirements for obtaining a money transmission license. The process required weekly meetings over a 12-month-period to develop a compromise that resulted in the Money Transmission Modernization Act (MTMA). This act will synthesize the rules and regulations for companies and make it more efficient to do business in the United States. The creation of the MTMA was the first step in the process. This Act will provide a set of clear stan-

14 14th Edition

Q. Highlight some recent successful collaborations or initiatives undertaken by the association to foster innovation in the Money Transfer sector.

MSBA

Image: MSBA

Image: MSBA

members are guided by principles that promote regulatory and anti-money laundering compliance, fair business practices and business leadership and education.

industry

leader " "

dards that can be implemented by state regulators in a consistent and coordinated manner, which will benefit all.

We began to contact state legislators in 2023 to incorporate the MTMA into their statutes. We were successful with 23 states passing part or all the MTMA and have already begun to work with states for 2024 Legislative sessions.

MSBA recognized the need to assist companies’ transition to the MTMA in the short-term as they must still operate with multiple state requirements. To assist our members and others in the industry, we conducted two webinars this summer on the MTMA. We also provide monthly updates to our membership. Each month we have a General Membership meeting that is conducted to highlight proposed legislation, regulation, and any updates in these areas. We also have a guest speaker that assists the membership in tracking innovation and/or new topics, or we have guest regulators attend the

meeting to speak to our members. The Association also has more in-depth meetings with groups dedicated to Licensed Money Transmission, Banking, and Government Relations. All these member-driven groups help to inform the member companies and highlight important topics that we need to address as an industry.

The second key regulator that the MSBA works with and is involved in Money Transmission licensing is “FinCEN.” Its goal is to ensure that the financial system is safeguarded, so developing and instilling an effective AntiMoney Laundering and Counter-Financing of Terrorism Compliance (AML/CFT) Program is essential. Money Services Business Association (MSBA) released a comprehensive template for companies that represent the full range of MSBs. This extensive cross-sector effort produced a template for existing companies to evaluate its programs, and to guide new company entrants. It took several years to develop this template

16 14th Edition

Kathryn Tomasofsky Money Service Business Association https://www.msbassociation.org/

of best practices and the creators will continue to update it bi-annually to keep abreast of the evolving payments industry.

The MSB Best Practices reflect the MSB industry’s commitment to ensuring a safe and compliant environment. The document reflects two important goals:

1. Considering the fast advancement of financial innovation, the MSB Best Practices address how the payments industry protects the US financial system and consumers from money launderers, sanction evaders, human traffickers, and fraudsters.

2. These best practices serve as a blueprint for established firms and new market entrants in managing risks so that payments can be securely and safely sent and received. The best practices recommend using a riskbased approach to guide any MSB involved in any activity.

The value of the MSB Best Practices and the Money Transmission Modernization Act to the industry is significant. If you are a recent entrant into the Payments Industry, ensure that you have checked the box and know your responsibilities regarding these Federal and State Regulations. Fines for non-compliance can be significant and are not worth the short cuts of not staying up-to-date.

Q. What advice do you have for emerging professionals and businesses aiming to enter the cross-border payments arena?

As of December 31, 2021, 47 states, the District of Columbia, and Puerto Rico managed their MSB licenses on the NMLS System. The NMLS system via the MSB call report notes that there were over 2,800 companies that held licenses and conducted business for a total of

17 crosstechpayments.com

Image: MSBA

6 trillion dollars. The magnitude of the money that is being transferred is significant and does not show signs of slowing down.

Given the significant size of the market, we can expect that companies will continue to emerge with new products to support the movement of this money both person-to-person as well as business-to-business.

The Association’s role is to assist in helping to educate regulators about these new products and help businesses to navigate the requirements. An example of an emerging technology is embedded finance platforms, which may or may not require a license. Embedded finance is the placing of a financial product in a nonfinancial customer experience, or platform. The embedding itself is nothing new. For decades, nonbanks have offered financial services via private-label credit cards at retail chains, supermarkets, and airlines. This new process creates the opportunity to help the regulator understand that the consumer is protected.

As a company enters the cross-border space, a key element that is required to communicate with your bank, regulator and investor is a concise business plan. The degree to which you technically communicate plans to the interested parties may vary but all require a solid understanding of how the funds will flow, and who is responsible for the funds at each step of the process until they are delivered successfully to the consumer.

I recommend that even companies with dedicated legal and compliance resources spend time with an expert in the industry to help evaluate and prepare them for the licensing process and serve as a safeguard as you move through the cumbersome process.

Of course, I recommend that companies become part of the Association as well. A new company can join for a very nominal amount,

and it has a two-fold purpose. It assists in staying abreast of changes that may affect your business and demonstrates to your financial institution partner and regulator that you are updated and interested in staying updated. We are a tactical association that provides value to all departments within your organization –from Marketing to Compliance to Government Relations. You do not want to miss out on this opportunity to learn from us and connect with your colleagues.

Money Service Business Association

29 Valley View Terrace Montvale, NJ 07645-1022

Phone: 201-781-2590

Email: info@msbassociation.org

18 14th Edition

Image: MSBA

19 crosstechpayments.com Contact Us info@msbassociation.org Be briefed on latest industry trends. Track legislation at federal and state levels. Build relationships with other industry stakeholders worldwide. Sharing Sharing One One Industry Voice Industry Voice J o i n u s f o r a m e m b e r m e e t i n g t o e v a l u a t e b e n e f i t s . I n c l u d e M S B A i n y o u r 2 0 2 4 b u d g e t !

Aquanow's Role in the Global Adoption of Digital Assets

By Ines Fernandez

Similar to many of her colleagues at Aquanow, Inés Fernández has an extensive background in traditional capital markets. She started to explore the digital assets ecosystem a few years back and was fascinated by its transformational potential. In 2022, she joined Aquanow, a leading digital assets infrastructure and liquidity provider, where she runs the Solutions Engineering team. The company is headquartered in Canada, a leader in digital assets regulation, and it supports its financial services clients in over 50 countries worldwide. Inés works closely with clients to understand how to leverage Aquanow’s best solutions to create positive outcomes for their businesses.

A couple of use cases that attracted Inés to this industry are remittances and digital payments. Being from Lima, Peru, she knows how important access to an inexpensive cross-border currency exchange can be for families and small businesses. The millions of people who work abroad and send money back home to

Latin America face exorbitant fees, a reality that impacts the balance that ultimately reaches families on the receiving end.

The World Bank recently observed that remittances will continue to grow despite global instability. This growth in global remittances may be especially rapid in geographies like Latin America, where access to banking services may be limited. In some countries, remittances can make up more than 20% of GDP. Using digital assets for cross-border payments unlocks significant efficiencies, as it cuts down settlement times and reduces costs.

Aquanow’s platform provides the back-end infrastructure for financial service companies to build crypto-powered products. This fullsuite solution allows Aquanow’s clients to focus on what matters most to them––their users. Aquanow has developed a comprehensive and secure infrastructure layer that enables fast, inexpensive, and reliable processing functions for payment service providers via digital assets.

20 14th Edition

“I’m proud of Aquanow’s role in transforming international payments and remittances,” says Inés. “It’s exciting to be at the cutting edge of this change.”

It is anticipated that there will be continued growth of cross-border remittances and payments in the coming years, fueled by the increased movement of people and the adoption of blockchain technology to drive the efficient movement of assets. Aquanow is keen to be a key contributor to this evolution.

Inés Fernandez is Vice President of Solutions Engineering at Aquanow. She is a capital markets and technology leader, with experience across the capital markets ecosystem, including various roles in front office, technology, and analytics. Previously, Inés worked at the Toronto Stock Exchange (TMX Group) and RBC Capital Markets in Toronto, and London, UK.

Inés Lucia Fernandez VP, Solutions Engineering aquanow.io

21 crosstechpayments.com

executive spotlight

Image: Aquanow

Unlocking Opportunities

Why Cross-Border Payment Companies Should Open Accounts in Multiple Countries?

By Jennifer Holguín

Cross-border payment companies are the backbone of the modern global economy, facilitating seamless transactions across borders. To thrive in this dynamic industry, it's increasingly imperative for these companies to consider the strategic move of opening accounts in multiple countries. Here's why:

1

Operating with accounts in multiple countries allows cross-border payment companies to provide a localized experience to customers. It eliminates the hassle of currency conversion and offers faster, more cost-effective transfers. This fosters customer trust and loyalty.

2 3 4

Different countries have distinct regulatory frameworks. With accounts in various nations, payment companies can stay compliant with local regulations, reducing the risk of legal issues and fines.

Geopolitical, economic, or financial crises in one country can disrupt operations. Diversifying accounts across several countries hedges against these risks, ensuring business continuity.

Opening accounts in multiple countries opens doors to new markets and partnerships. It allows for expansion into regions with high demand for cross-border payment services.

22 14th Edition

Enhanced Customer Experience Regulatory Compliance Risk Mitigation Access to New Markets

5 6 7

Managing multiple accounts facilitates currency management. It enables companies to optimize their currency holdings, reducing exposure to currency fluctuations.

Opening accounts in multiple countries is a strategic move that equips cross-border payment companies with the tools they need to thrive in a globalized world. It enhances customer satisfaction and regulatory compliance and positions these companies for sustainable growth and resilience in facing challenges.

CrossTech Consultants offers a variety of options for you to be prepared to operate in a new market. Contact our team today for a consultation to explore opportunities.

Offering services with accounts in various countries can set a cross-border payment company apart from competitors. It demonstrates a commitment to global reach and reliability.

Currency Management Competitive Advantage Network Building

Having accounts in multiple countries fosters relationships with local banks, regulators, and businesses, strengthening the company's network and reputation.

Jennifer Holguín

Lead Consultant

Lead Consultant

23 crosstechpayments.com

crosstechpayments.com

keep in mind

FIVE THINGS YOU NEED TO KNOW ABOUT DolFin TECH a article

Q. HOW WAS DOLFINTECH FORMED?

DolFinTech was formed in December 2022 after the strategic merger between DolEx Dollar Express, Inc. and Barri Money Services, LLC. We now have over 2,300 employees with offices in Texas, Mexico, and Spain, and are now headquartered in Houston, TX.

Q. WHERE DID THE IDEA FOR THE NAME DOLFINTECH CAME FROM?

We were playing with a combination of words between both company names and industry terms, and came up with DolFinTech:

Dol: this is the first part of the DolEx name, and when combined with FinTech it sounds like dolphin. Dolphins are fast and agile, smart,

quick learner, and loyal, which are all great characteristics we have as a company.

FinTech: the industry that we have been a part of for many years and will continue to grow and innovate in it. DolFinTech will maintain and grow its various customer brands in the market, namely Barri, DolEx and Quisqueyana in the US.

Q. HOW MANY RETAIL LOCATIONS DO YOU CURRENTLY HAVE?

We have coverage nationwide now, with over 600 company owned branches (we are the industry leader in this category) and over 5,000 third party agents. We also have our Barri mobile app and will soon launch the DolEx mobile app as well. We want to be able to help and meet

24 14th Edition

customers where they are, whether in person or online or on their phone, and offer them the best array of financial services possible.

Q. WHAT ARE SOME OF THE MAIN BENEFITS YOU OFFER BUSINESSES THAT WANT TO PARTNER WITH YOU?

We are currently looking for business and supermarket owners to partner with, to either open a branch or kiosk within their business or as a third-party agent. One of the main benefits will be the increased foot traffic at their store; more customers that can do more transactions or purchase more goods or services from these businesses. Another huge benefit is the incremental revenue opportunities in the form of rent (for branches or kiosks) or commissions (for third party agents). We will continue to offer great service to customers and our agent business owners, which is something we are well known for.

Q. WHAT DIFFERENTIATES YOU FROM OTHER COMPANIES IN THE SAME CATEGORY?

Our mission is to be a customer-centric organization that provides outstanding financial services or superior value, trust, speed, reliability, and convenience through excellence in service delivery with state-of-the-art technology solutions. To our customers, we offer multiple pricing options to fit their needs and they can also perform multiple services all under one roof and mobile phone. To our business partners, we offer multiple services all fully integrated in one system, one settlement, one reporting, with best in class compliance team, dedicated field operations team (for company owned stores and third-party agents), and extended customer service and tech support hours with fully bilingual representatives (English and Spanish).

Image: Freepik.com

Bringing great companies TOGETHER Leader in the financial services industry, focusing on enabling a better everyday life for our customers, employees, and communities around the world. Excellence Integrity Growth For more information visit www.dolfintech.com or email us at info@dolfintech.com

Latam Fintech Market 2023

Este año esperan a más de 1.200 asistentes, tendrá más de 50 speakers de todo el mundo, tendrá un gran espacio de networking que es clave para el desarrollo de los negocios fintech y otras sorpresas.

El Latam Fintech Market es un referente en materia de tecnología financiera porque será el espacio que reunirá a los líderes de la industria Fintech.

De igual manera, será un espacio académico en donde se conocerán y se discutirán las principales tendencias del ecosistema y el futuro financiero del país.

El evento contará con expertos de otras latitudes del mundo, firmas de consultoría e inversionistas. Por otro lado, también contará con la participación de los líderes financieros del país.

Bajo ese contexto, las personas que estén interesadas en aprender de finanzas abiertas, Inteligencia Artificial, negocios financieros, sistemas de pagos interoperables, entre otros temas, podrá asistir al evento el próximo Latam Fintech Market 2023 el 28 y 29 de septiembre.

27 crosstechpayments.com Que Se Espera Para El

Anker 317 Laptop Charger

From phones to laptops and more, our proprietary PowerIQ 3.0 technology provides flawless compatibility with virtually any mobile device. The charger’s compact size and foldable plug make it easy to take wherever you go, while saving valuable space in your bag or pocket.

Raptic Link + Lock takes AirTag tracking to a higher level of security with a built-in combination lock. Simply snap your AirTag into Link + Lock and secure it to your items with the integrated carabiner, then lock it in place. Integrated carabiner with combination lock quickly hooks onto a variety of items.

The compact design is perfect for keeping at your desk or in your laptop bag. Use with: laptops, phones, tablets. To clean the microfiber, spot clean with warm water and mild soap. Blot out excess moisture with a clean dry towel and air dry. Retractable brush and storage cover keep both ends protected when not in use.

28 14th Edition gadget corner

OXO Good Grips Sweep a Swipe Laptop Cleaner

Raptic Link & Lock for Apple AirTags

Enviando Dinero

Cambio, Remesas, Migración y la Revolucón Fintech

La Evolución de la Industria de Servicios Financieros Internationales. Esta obra compendia los conocimientos y experiencias de Hugo Cuevas-Mohr -Especialista en Transferencias de Dinero- en torno a la provision de servicios financieros internationales y las tendencias technologicas que permitieron su fortalecimiento y evolución.

En sus paginas se cuenta, con decenas de testimonios de los emprendedores que hicieron posible esta industria, la cronica de visionarios que han hecho posible le envio de dinero de migrantes a sus familias y su contribución a la revolución fintech.

29 crosstechpayments.com buy your book

31 crosstechpayments.com Early Bird $1,495 Aug 28 to September 27 STAY ON-SITE AT CROSSTECH WORLD 2023! Don’t miss the opportunity to secure your hotel accommodations with our special rate by visiting our registration page. BOOK YOUR ROOM AT A SPECIAL RATE!

32 14th Edition Diamond Platinum Gold Silver Bronze B1 B2 B3 B4 B5 B8 B9 B10 B6 B7 S1 S2 S3 S4 S5 S6 S8 S9 S7 G1 G4 G5 G6 P1 P2 P3 P4 D1 D2 G2 G3 maria@crosstechpayments.com www.crosstechpayments.com help@crosstechpayments.com World 2023

33 crosstechpayments.com maria@crosstechpayments.com Trade Fair

www.crosstechpayments.com help@crosstechpayments.com

Layout

World 2023

AGENDA DAY 1 // Nov 14, 2023

08:00 - 09:00

Welcome Break sponsored by

Opening Remarks

09:15 - 10:00

CTC Compliance Workshop: AML Risk Management

Course Instructors: Robin Garrison (First Bank)

10:00 - 11:15

11:15 - 12:00

CTC Compliance Workshop: AML Risk Management

Cryptocurrency Workshop

Course Instructors: Erick Schneider (CrossTech)

Coffee Break - Networking Meetings

Course Instructor: Joe Ciccolo (BitAML)

12:00 - 12:45

CTC Compliance Workshop: AML Risk Management

Course Instructor: Brandi Reynolds (Bates Group)

Cryptocurrency Workshop Cryptocurrency Workshop

Course Instructor: Drew Hinkes (K&L Gates)

Lunch Break 12:45 -

14:00 -

Compliance Officers Discussion Forum: Compliance Evolution: Exploring the Role of KYC and KYB in Shaping Cross-Border Payment Regulations

Course Instructors: Daniel Wood (Pillsbury)

Panelists: Marcelle Dadoun (The AML Shop)

Compliance Officers Discussion Forum: Regulation US & Europe Updates

Moderator: Amy Greenwood Field (McGlinchey Stafford PLLC)

Panelists: Carsten Kociok (Greenberg Traurig Germany), and Marcelle Dadoun (The AML Shop)

Coffee Break - Networking Meetings 14:45 -

MTCC Advanced Compliance Workshop: State & Federal Level Updates

Course Instructors: Kathy Tomasofsky (MSBA), Daniel Wood (Pillsbury Law), Amy Greenwood Field (McGlinchey Stafford PLLC), Rick St. Onge (OFR), and Mary Pfaff (Conference of State Bank Supervisors)

-

16:45

MTCC Advanced Compliance Workshop: Sanctions - US & Other International Markets

Course Instructors: Kathy Tomasofsky (MSBA), Anthony Rodrigues (ACAMS), and Carsten Kociok (Greenberg Traurig Germany, LLP)

Moderator: Joe Ciccolo (BitAML)

Panelists: Brandi Reynolds (Bates Group)

Spanish Compliance Track 1: Regulaciones de Cumplimiento en España & EU

Course Instructor: Lourdes Soto (Spaintech)

help@crosstechpayments.com

34 14th Edition World 2023

16:00

14:00

09:00 - 09:15

Compliance Officers Discussion Forum: Exploring Crypto Compliance: Insights and Strategies for Cross-Border Payments 14:45

17:30

16:45

21:00 World 2023 www.crosstechpayments.com help@crosstechpayments.com

Welcome Reception sponsored by

16:00 -

18:00 -

Panel Workshop Event/Meal Compliance Forum maria@crosstechpayments.com

AGENDA DAY 2 // Nov 15, 2023

AGENDA DAY 2 // Nov 15, 2023

09:00 -

Hugo Cuevas-Mohr (CrossTech), Daniel Webber (FXC Intelligence), Mark Corritori (MasterCard), and Alberto Guerra (UniTeller)

Fireside Chat - Global State of the Industry

Special Announcement

Hugo Cuevas-Mohr (CrossTech), Daniel Webber (FXC Intelligence), Mark Corritori (MasterCard), and Alberto Guerra (UniTeller)

Investment Insights: Navigating the Cross-Border Landscape

Compliance Officers Discussion Forum: Regulatory Compliance in Cross-Border Payments: Facilitating the Secure Flow of Funds

Opening Remarks

10:00

Moderator: Priscilla D' Oliveira (CrossTech)

Panelists: Hugo Cuevas-Mohr (CrossTech), Nabil Kabbani (Neofie), Odilon Almeida (International Consultant), and Ernie García (YHVH Equity Partners)

Moderator: Joseph Ciccolo (BitAML), Robin Garrison (FirstBank)

Panelist: Brandi Reynolds (Bates Group)

Special Announcement 10:30 -

Investment Insights: Navigating the Cross-Border Landscape

Coffee Break - Networking Meetings

Moderator: Priscilla D' Oliveira (CrossTech)

Panelists: Hugo Cuevas-Mohr (CrossTech), Nabil Kabbani (Neofie), Odilon Almeida (International Consultant), and Ernie García (YHVH Equity Partners)

Moderator: Mariano Dall’Orso (CrossTech)

11:15 - 11:45

Moderator: Hugo Cuevas-Mohr (CrossTech)

Panelist: Etimbuk Bassey (Budpay) and Luis Cambronero (AZA Finance)

11:45 -

Compliance Officers Discussion Forum: Regulatory Compliance in Cross-Border Payments: Facilitating the Secure Flow of Funds

Compliance Officers Discussion Forum: Insights for Compliance Officers Exploring the Impact of FedNow on Cross - Border Payments

Moderator: Joseph Ciccolo (BitAML), Robin Garrison (FirstBank)

Panelist: Brandi Reynolds (Bates Group)

Moderator: Kathy Tomasofsky (MSBA)

Panelists: Daniel Wood (Pillsbury Law), Marina Olman-Pal (Greenberg Traurig), and Anthony Rodrigues (ACAMS)

Compliance Officers Discussion Forum: Optimizing Compliance: Best Practices and Strategies for Partner Due Diligence in Cross-Border Payments.

Moderator: Marina Olman-Pal (Greenberg Traurig)

Regional Trends

Panelists: Amy Greenwood Field (McGlinchey Stafford PLLC) and Rick St. Onge (OFR)

Coffee Break - Networking Meetings

14:30 -

Moderator: Mariano Dall’Orso (CrossTech)

Partnerships Track 1: Roundtable Pioneering Cross-Border Payments: Fintechs Leading the Way through Strategic Alliances

Moderator: Marcela Gonzalez (CrossTech)

13:15

Regional Trends

Cross-border Payments in Africa & The Middle East 12:30

Panelists: Judie Rinearson (K&L Gates), James Cresswell (Paysend), and David García (Helix by Q2)

Compliance Officers Discussion Forum: Insights for Compliance Officers Exploring the Impact of FedNow on Cross - Border Payments

Moderator: Kathy Tomasofsky (MSBA)

Panelists: Daniel Wood (Pillsbury Law), Marina Olman-Pal (Greenberg Traurig), and Anthony Rodrigues (ACAMS)

Banking Track 1: Roundtable Global Banking Solutions: Exploring the Ideal Bank for International Expansion

Moderator: Jennifer Holguin (CrossTech) and Priscilla D’Oliveira (CrossTech)

Panelist: Gustavo Nuñez (Areti Bank) and Rob Ayers (Fintech Advisors)

Moderator: Hugo Cuevas-Mohr (CrossTech)

Panelist: Etimbuk Bassey (Budpay) and Luis Cambronero (AZA Finance)

Partnerships Track 2: Roundtable Partnerships between Banks and the Cross-Border Payment Companies

Moderator: Hugo Cuevas-Mohr (CrossTech)

Panelists: Bruno Foresti (Banco Ourinvest), and Luis Cambronero (AZA Finance)

www.crosstechpayments.com

Coffee Break - Networking

Sponsored by:

The Rise of Digital Assets: Cryptocurrencies and Blockchains in Cross-Border Payments

Moderator: Erick Schneider (CrossTech)

Partnerships Track 1: Roundtable

Spanish Track 1: Roundtable Conquistando el Mercado B2B: Adaptación y Evolución de la Industria de Pagos.

Compliance Officers Discussion Forum: Optimizing Compliance: Best Practices and Strategies for Partner Due Diligence in Cross-Border Payments.

Moderator: Lourdes Soto (Spaintech)

Moderator: Marina Olman-Pal (Greenberg Traurig)

Panelists: Amy Greenwood Field (McGlinchey Stafford PLLC) and Rick St. Onge (OFR)

Sponsored by:

Portuguese Track 1: Roundtable Diving Growth: Brazil’s Gateway to B2B Success

Moderator: Priscilla D’Oliveira Friedman (CrossTech)

Panelists: Judie Rinearson (K&L Gates), Matthew Castricone (ARF), and Kennetu Chua (PDAX)

Pioneering Cross-Border Payments: Fintechs Leading the Way through Strategic Alliances

Moderator: Marcela Gonzalez (CrossTech)

Panelists: Judie Rinearson (K&L Gates), James Cresswell (Paysend), and David García (Helix by Q2)

Panelists: Thiago Gubert (Wepayments)

Moderator: Jennifer Holguin (CrossTech) and Priscilla D’Oliveira (CrossTech)

Panel Workshop Event/Meal Compliance Forum

Panelist: Gustavo Nuñez (Areti Bank) and Rob Ayers (Fintech Advisors)

help@crosstechpayments.com

16:15

17:30 15:15

Partnerships Track 2: Roundtable Partnerships between Banks and the Cross-Border Payment Companies

Moderator: Hugo Cuevas-Mohr (CrossTech)

Panelists: Bruno Foresti (Banco Ourinvest), and Luis Cambronero (AZA Finance)

Sponsored by:

The Rise of Digital Assets: Cryptocurrencies and Blockchains in Cross-Border Payments

Moderator: Erick Schneider (CrossTech)

Panelists: Judie Rinearson (K&L Gates), Matthew Castricone (ARF), and Kennetu Chua (PDAX)

35 crosstechpayments.com maria@crosstechpayments.com www.crosstechpayments.com help@crosstechpayments.com

10:30

11:15

-

14:30 - 15:15 Lunch Break 12:30 - 13:15 09:00 - 09:15 Opening Remarks 09:15 - 10:00 Fireside

State of the Industry

Meetings

Chat - Global

11:15 - 11:45 Regional Trends Cross-border Payments in Latin America & The Caribbean Regional Trends Cross-border Payments in Africa & The Middle East 11:45 - 12:30

13:15- 14:30 16:15

17:30 15:15

16:15 10:00 - 10:30

-

-

World 2023

11:15

Coffee Break - Networking Meetings 15:15

Lunch Break 09:15

12:30 -

09:15 - 10:00

Cross-border Payments in Latin America & The Caribbean

13:15- 14:30 16:15

- 10:30 World 2023

Banking Track 1: Roundtable Global Banking Solutions: Exploring the Ideal Bank for International Expansion

-

-

AGENDA DAY 3 // Nov 16, 2023

09:00 - 09:15

09:15 - 10:00

The Evolution of Business Payments: The Future of Cross-border Payments

Moderator: Hugo Cuevas-Mohr (CrossTech)

Panelists: Matthew Castricone (ARF)

10:00 - 11:00

Sponsored by:

11:00 - 11:45

From Local to Global: Harnessing the Power of White Label & Payment Facilitators

Moderator: Erick Schneider (CrossTech)

11:45 - 12:30

Fintechs: Shaping the Crosstech Industry

Moderator: Nabil Kabbani (Neofie)

12:30 - 13:15

Opening Remarks

Coffee Break - Networking Meetings

13:15 - 13:30

13:30- 14:45

Women in the Cross-Border Payments Industry: Driving Change in Fintechs and B2Bs

Moderator: Priscilla D’Oliveira Friedman (CrossTech)

Panelists: Lauren Windebank (Tribe), Nathalia Rodrigues (Nomad), Lucy Casas (JP Morgan), and Aurora Garza (PNC Global Transfers)

Announcements: New Services & Partnerships

Lunch Break

Sponsored by:

Emerging Trends in Global Payments: A Cross-Border Dialogue

Moderator: Nabil Kabbani (Neofie)

Banking Track I Banking Revolution: Shaping the Future of Cross-border Payments

Moderator: Priscilla D’Oliveira Friedman (CrossTech)

Panelists: Bruno Foresti (Banco Ourinvest), Allison Barbosa (RTGS.global)

Coffee Break - Networking Meetings sponsored by

Navigating the Global Landscape: Transformations of the Financial Services Industry

Moderator: Rob Ayers (Fintech Advisors)

The Rise of Mobile Solutions: Disrupting the Money Transfer Landscape

Moderator: Marcela Gonzalez (CrossTech)

Panelists: Nabil Kabbani (Neofie)

CrossTech Innovation Awards Ceremony

Closing Networking Party sponsored by

Panel Workshop Event/Meal

36 14th Edition www.crosstechpayments.com maria@crosstechpayments.com help@crosstechpayments.com World 2023

16:30

15:30 16:30

17:15 17:15

18:15

20:00 www.crosstechpayments.com help@crosstechpayments.com World 2023

15:30 -

14:45 -

-

-

18:00 -

World 2023

Marcela Perez Sales Director

37 crosstechpayments.com

Partners Sponsors Exhibitors

more information, please contact our sales team! maria@crosstechpayments.com www.crosstechpayments.com Meet our Preliminary Exhibitors, Sponsors, and Partners! help@crosstechpayments.com World 2023

For

our core consulting services

Valuations, Mergers & Acquisitions

Open Bank Accounts in Multiple Countries

Licensing, Regulatory & Compliance Assistance

We can also help you with

Business & Marketing Analysis Management

Client & Partner Referrals

White Label Solutions

Digital Payments

38 14th Edition

We want to partner with

Jennifer Holguín

Priscilla D'Oliveira

book a consultation here

Hugo Cuevas-Mohr CONSULTANTS

OUR BUSINESS ECOSYSTEM

40 14th Edition

WORLD 2023

ANTS CONFERENCES

We are thankful to all our staff and the supporting team of collaborators who help us develop our conferences in each of the cities and regions we select to host them. Without their help, it would be impossible for us to give all the participants in our in-person and virtual events the unique experience we strive to give everyone attending.

41 crosstechpayments.com

our team

Diana Jofre Executive Assistant & HR Coordinator

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Marcela Perez Sales Director

David Lederman Marketing Director

Ana González Content Director Lourdes Soto Spain SpainTech CCO

Isabel Cortes UK Consultant

Jennifer Holguin Lead Consultant

Priscilla D’Oliveira COO

Hugo Cuevas Mohr President & CEO

Juan Posada Director of Business Intelligence

BE A PART OF CROSSTECH MAGAZINE!

42 14th Edition MAGAZINE

Monthly hybrid digital & print magazine contact us! 42 Countries 23% Female Readers 77% Male Readers 21,000 Impressions +8,500 Total Distributions 6 Contributors per Issue Content Reviewed & Approved by our Committee our readers our magazine help@crosstechpayments.com WORLD 2023 Find our magazine at industry events such as

Image: MSBA

Image: MSBA

Lead Consultant

Lead Consultant