PRISCILLA D'OLIVEIRA FRIEDMAN CrossTech, COO Industry Leader: FINTECH FORECAST, THE YEAR OF B2B PAYMENTS 2023 FINTECH TRENDS FROM EMBEDDED FINANCE, RECTECH (REGULATORY TECHNOLOGY). B2B PAYMENTS AND BEYOND. To Keep in Mind: Hugo Cuevas-Mohr CrossTech, CEO Fintech Insights: Nabil Kabbani Neofie, CEO Opinion: Vivian Portella B&T Group, Director

3

Priscilla D'Oliveira Friedman COO, CrossTech

TO KEEP IN MIND

HUGO CUEVAS-MOHR

Page 7

FINTECH INSIGHTS

NABIL KABBANI

Page 22

OPINION

VIVIAN PORTELLA

Page 26

Priscilla D'Oliveira Friedman COO, CrossTech

Page 14

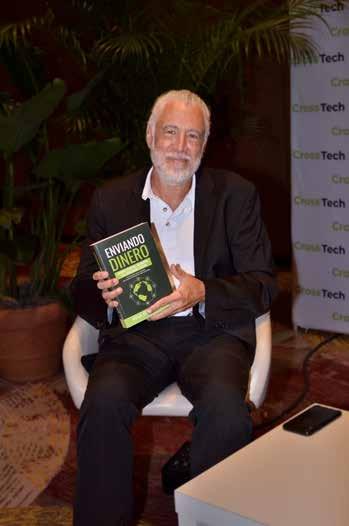

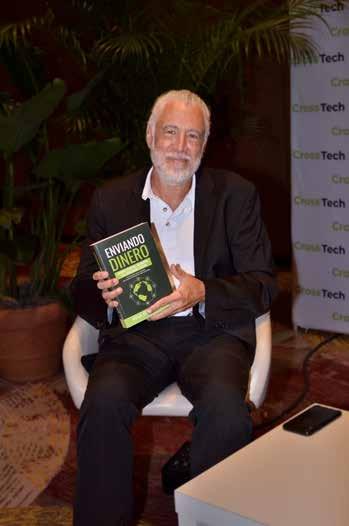

Check out the RECAP of our flagship event of the year with the graphic insight of the Conference, the Innovation Award 2022 Winner, and presentation of the Book “ENVIANDO DINERO”, by Hugo Cuevas-Mohr.

"PARTNERSHIP IS KEY FOR THE INDUSTRY TO SUSTAIN ITS GROWTH."

Industry Leader

4

PAYMENTS

WORLD 2023 OUR BUSINESS ECOSYSTEM

CONSULTANTS CONFERENCES

2023

HUGO CUEVAS-MOHR - TO KEEP IN MIND

Hugo Cuevas-Mohr is the founder of The Platinum Network, Inc (PNET). the company that developed and manages the IMTC Conferences, founded in 2010 and Mohr World Consulting (MWC), founded in 2001. Throughout his career, Hugo has developed other profit and non-profit initiatives in the areas of remittances & migration. Previous to PNET he spent more than 20 years in various roles in the money transfer & foreign exchange institutions, owned several MTOs and became a consultant, advising a number of companies & financial institutions in the Money Transfer & Cross-Border Payments Industry all over the world and is a mentor for several fintech start-ups. PNET has a presence in Miami, Mexico City, and Madrid. He has worked alongside many regulatory bodies looking to facilitate the dialogue between them and the industry, such as Banco de España, and he is part of the Industry Advisory Council (IAC) of the US MSB regulators.

NABIL KABBANI - FINTECH INSIGHTS

Nabil Kabbani is the CEO of Neofie, a Fintech company that offers a turnkey white-label Bank-as-a-Service, Neobank, and Core Banking platforms that enables companies to offer comprehensive banking services to their customers. He is also a board member of the IMTC and SRA (Arena Investors). Nabil is a growth driver and a multi-disciplinary global leader with a career built on leveraging strategy, technology, and people to transform and scale businesses. He spent twelve years at Western Union, helping it grow to a multi-billion dollar public company working from various locations in the U.S., Beirut, Dubai, Paris, and Brussels.

VIVIAN PORTELLA - OPINION

Vivian Portella é graduada em Comércio Exterior e Gestão Empresarial com especialização nas áreas de Governança e Compliance para instituições financeiras. Atual Diretora do B&T Group, fundadora e executivo da B&T Global, e fundadora e executiva do Zrobank, atuando a mais de 15 anos no segmento Financeiro de transferências internacionais.

6

CROSS-BORDER PAYMENTS: B2B AND BEYOND

Cross-Border Payments in 2022 saw the continuation of a trend that is gathering more news and analyses and would probably have a breakthrough moment in 2023.

What has been most surprising was the relatively quiet work of the digital B2B cross-border fintechs have been doing in transforming the payments ecosystem. FXC Intelligence was keen to note 2021’s shift to B2B for money transfers . These “crosstechs” (as I like to call them), with the intuition that the market is ripe for disruption, are building the blocks of the cross-border B2B payment ecosystem.

The performance of companies like Payoneer with its B2B volumes growing 39% YoY, in emerging markets such as Latin America at 50% YoY is making other fintechs realize their potential. If P2P payments are inching closer to US $750 billion, B2B payments have been estimated to be around US $150 trillion according to Ernst & Young; on the low-end Juniper Research’s estimate is US $35 trillion . And there are all the unrealized combinations that business payments bring: B2P (salaries, commissions, work compensation) and P2B (bills, investments). Government-related payments (pensions, social benefits, foreign aid) are

7

Hugo Cuevas-Mohr

CrossTech CEO

also growing, as some specialized foreign exchange entities have been realizing.

In order to seize the enormous potential that doing business globally provides, I have to quote what Mark Ruddock CEO of Nuula, a business app for SMBs, said: “My call to action for Fintechs that are working in the cross-border space is that there is a huge opportunity that’s here — right now — to innovate in the sector.” The virtual panel developed by PYMNTS and hosted by Ben Ellis, Global Head of Visa B2B Connect, called this moment we are facing “the imperfect storm, where challenges and opportunities collide”.

As it was noted by Ruddock, Ellis and Michael Orme COO of Immediate, there are many “pain points” to solve. I have categorized those pain points in the areas that we need to work on, as an industry, to bring the partnerships and developments that are necessary for B2B cross-border payments. I will try to summarize these pain points; this is more complex than it seems.

Regulation: Not all States in the US require the licensing of fintechs involved in B2B payments, so every company must inquire, specify its business model, and wait for the regulator to reply back if a license is needed or not, a long and expensive proposition. In Europe, any cross-border payment –domestic payments included– require Non-Bank Financial Institutions (NBFIs) to acquire a Payment Institution license (PI). The panorama across the world is challenging: all regulatory modalities can be found, from total restriction to total freedom. Twenty to thirty years ago we were faced with the same challenges with the payment of personal transfers (remittances); there was international pressure to license and regulate the P2P industry. Will it happen again? I don’t think so; the rights of migrants and the human aspect of remittances was a big driver. What is the big driver for uniform regulation here? I think the Europeans answered it clearly: bring transparency and competitiveness in the market between banks and fintechs. Do European fintech have an advantage over their US counterparts?

Compliance: Know-your-Client (KYC) rules regarding business payments is an area that is complex. How much KYC is required from a company, its owners, and top employees, in order to pass a due diligence check that in any event will show that a “complete” examination has taken place? What is the amount of documentation needed to be exchanged for different types of payments? Which are the Regtechs that can provide a reliable KYC for business clients? How reliable are they for sanctions? Are these third-party checks good enough? What are the red flags that need to be taken into consideration? What will the anti-money laundering (AML) expectations be for NBFIs, vis-à-vis banks? How important is Artificial Intelligence and Machine Learning (AI/ML) in terms of improving cross-border money transfer compliance and fraud mitigation?

Size of the Market and Consumer Demand: What is the market size of cross-border B2B Payments? Is there really a consumer demand for B2B payments? Where is it coming from? How to be as strategic as possible amid market uncertainties?

Corridors: Where are the coverage inconsistencies in the growing ecosystem? What are the corridors where crosstechs can be more successful? The ones where the volumes are high? The ones where there are more challenges to overcome and possibly have better returns? Which are the boundaries to “more risk, more reward”?

Partnerships: What partnerships are needed to be successful? Will NBFIs doing domestic business payments or foreign exchange firms be the best partners? What Banks are willing to cater to crosstechs and build a channel that is not wire-transfer based? Are card payment networks such as Mastercard or Visa the partners that you need for B2B payments? Would partnerships upsetting an inflow of P2P transfers with an outflow of B2B transfers, the best scenario?

9

Technology: Over the last several years, there has been a major movement towards mobile and web-based payments. Are mobile apps business-friendly? Are web-based applica tions the way to go? What are, beyond the pay ment or transfer of funds, the tech functional ities that will complement the business experi ence and drive customer adoption?

Products & Services (P&S): Do these P&S need to be targeted to specific types of clients, corri dors, trades? Should the growing SMB pay ments market be the primary focus? Or will all-around crosstech B2Bs succeed? How might these P&S be differentiated from bank wire transfers, besides speed, cost, and foreign exchange margins? How might sending disbursements cross-border be handled when you mix payments for businesses and individ uals?

Crypto & Blockchain Solutions: I believe, as do a number of colleagues in the industry, that the use of Crypto & Blockchain Solutions (CBSs) is a growing trend in back-office and treasury management. Is the advent of crosstechs building their rails using CBSs the way forward? Are stable coins the best solution available? How will these solutions interact with the rest of the ecosystem?

eCommerce: How are crosstechs positioning themselves in the eCommerce boom? Where do they fit and how can they compete, both facing the customers and as a back-office solution for marketplaces and importers and exporters? How do they fit into the logistics, custom and taxation part of the equation?

Credit and Conditional Payments: How can crosstechs manage supply chain financing? How does the industry solve hedging against risk for SMBs? How does managing conditional payments make it easier and more automated?

All of these questions are being faced by the growing digital B2B cross-border fintechs as investors and entrepreneurs learn and develop this next wave of solutions for the fintech community.

To learn from the leading companies and institutions disrupting cross-border payments for small and medium sized-companies, join us at CROSSTECH PAYMENTS 2023 at the INTERCONTINENTAL MIAMI HOTEL.

10

“The panorama across the world is challenging: all regulatory modalities can be found, from total restriction to total freedom.”

- 12

your tickets now!

11

Get

What are the biggest takeaways from 2022?

Priscilla D'Oliveira Friedman CrossTech, COO

2022 was a transformational year for cross-border payments and everyone in the payment industry. Being in a post-covid environment, many companies have had to learn how to adapt to a new culture and become digital. During the transition from 2021 to 2022, we noticed a need for seamless digital products to be available to consumers fast, and time to market has become a challenge for the industry.

There are three different examples we have seen. 1) The companies that were ready and adapted well during covid. They built different digital capable and were able to fulfill new creative ways of doing payments, like biometrics, using phone numbers and their apps, transforming the ways we make payments. 2) The companies that were unable to move fast enough to deliver a solution but are still in the game. 3) and companies that couldn't produce the digital solution that were left behind, and now that we enter 2023, we see these companies are losing relevance and market share.

INDUSTRY LEADER

12

My biggest takeaway from 2022 would have to be how you position your company to leverage digital so that you can beat time to market. That’s why the new trend coming into the industry is buying instead of building. We can attribute this to fintechs that have provided different services within the industry to solve other problems, from different payment methods to RegTech. We see the huge importance of connecting with the right partners. I also saw the market focusing on providing P2P growing into B2B payment solutions in 2022. By focusing on more B2B, companies can leverage the volume to grow. The final point from 2022 is to understand where your customer segments are going. With Covid, people rethought where they are going to live, and we saw a lot of migrations to countries in Europe, Africa, and Asia, so understanding your demographics and understanding where the next generation has moved, is very important for your next step. To summarize, can you beat your competition in time to market? Have you focused on B2B to grow your volume? Are you learning about your customer segmentation and entry into new markets?

What can we expect for the industry in 2023?

The main thing companies should expect for 2023 is to be able to deliver digital solutions in different segments and markets while being compliant. Now that the cross-border payment landscape is growing and people are getting more volume and VC injections, we have noticed a lot more focus on compliance and ensuring you have the proper process to deliver a seamless transaction to the customer. We see 2023 as a year of growth and volume, whereas 2022 was setting up the foundation. Now is the time for execution and ensuring you have the right partners. Keep your eyes open, Investors are not only looking for opportunities that are delivering volume, but they are also looking for solutions that have a gap in the market. So, make sure you build a product to solve existing gaps or deficiencies. Execute with excellence, do it with the right partner, and ensure you have a great compliance team. Compliance is the beginning of everything.

Also, 2023 is going to be a year of transformation. For example, Brazil launched a massive project with PIX in the last two years, and the U.S. is growing its product with FedNow. These initiatives aim at positioning payments to move into the instant deposit. We see new payment solutions coming from the government with instant payment at your fingertips. This is happening faster than expected, which tells us that all the companies within the cross-border space must catch up.

13

“Compliance is the beginning of everything.”

What can we expect from CrossTech 2023?

We have revamped our strategy for CrossTech 2023 to fulfill the transformation of the industry by including a new conference called CrossTech Payment 2023, where we will unite a new group of executive leaders, including investors, Fintechs, collaborators, cross-border payment providers, and technology solution providers because we see a trend on the payment space becoming more digital and more B2B. You will see much impact from CrossTech to deliver those networking opportunities for you to be in front of these new companies that are providing service to this new trend. On top of that, we will continue to do strategic partnerships to grow, one being the Global Forum on Remittances, Investment and Development Summit 2023 Africa promoted by United Nations in Nairobi, Africa, where we will be hosting the awards, utilizing our branded Remtech Awards, our award program in partnership with GFRID so that we can evaluate companies around the world and be able to deliver the next big players in the industry. Our focus is to be the disruptors, to be ahead, and to provide new opportunities to our customers and followers. On top of that, I have a personal passion for women's empowerment, so we will be working on more panels and discussions with women making a difference in the industry, not only in the money transfer field but also in the Technology, network, and banking partnerships. I am very excited to continue to provide opportunities for women leaders, founders, and C-level executives to continue to grow and mentor other women to pave the way for the next generation.

How do you see B2B payments in 2023?

The main goal of cross-border companies has been how do I get the most volume and beat time to market. With B2B, you can achieve volume faster. Especially after post-covid, with globalization, companies can now hire contractors and partners from different parts of the world.

They are not just thinking in the box. This has enabled banks and money transfer companies to diversify their teams and business partners. Having the payment solutions to do that in a one-stop shop is transformational. When I think about B2B, my question is, “Why haven’t we done this sooner?”

How do you see Crypto moving in 2023?

Crypto has been through a lot in the last year. We have seen volatility, especially in compliance, where they have yet to be able to navigate into some countries. But we have also seen some advancement. As you know, El Salvador was the first country to become digital with Crypto as a currency, and the Central African Republic followed suit last year. We will see more countries following this path. Crypto is here to stay. There will always be obstacles, but it's a business model that makes sense; with the right structure and solution behind it, it should become a more trusted currency. I see more crypto companies entering the space, especially in Cross-border, because of the advantages and efficiencies of trading crypto vs traditional currencies. On the counter, there are a lot of compliance issues that need to be top of mind. “It's not just a trend; it's here to stay!”

I look forward to seeing more cross-board payment companies adopt crypto solutions for their customers.

Where do you see mergers and acquisitions for 2023?

I see it everywhere. I see executives making decisions on M&A to exit their company or to make their company grow. So, when there is this much transformation in the industry, you must have a competitive advantage. It would be best if you had a strategy. Strategy one can be your exit strategy; you reach the market share you are looking for, you are stable, but you want to continue to grow in a bigger way that you don't have enough funds for; you would partner with a company that has the tech, and that are looking to invest, or you are a company that will not survive in the market, you are going to exit if you don’t make a Merger & Acquisition with investors to fulfill the needs you can’t fulfill on your own. It’s

15

16

becoming clear that without Mergers and Acquisitions, it will be very hard for companies to survive. M&A is also a great way to enter new markets instead of applying for your license. Why not purchase a business that already has the permit to save time? So, it has to be part of your business model to continue growing. Partnership is key for the industry to sustain its growth.

How is Women's empowerment impacting the industry today?

There is much work to be done. The cross-border payment industry is still very male-dominated. As I mentioned earlier, part of my mission as the COO of CrossTech is to provide the right tools and ways for other women to fulfill their career growth within the cross-border payment industry and to help the CEOs leverage how women in their executive teams are going to help them make better decisions. During our last conference, CrossTech World 2022, we had a panel to discuss women making a difference. We brought a founder, fintech leader, and a lawyer to discuss their careers and how they have grown and impacted the industry. My plan for 2023 is to be able to give women a place and a voice to be able to partner with other leaders to make a difference.

What keeps you motivated every day?

Working in an industry that provides value to society to move money and push an economy is amazing. To be able to understand immigration trends makes all this possible. The more we grow in cross-border payments, the more we help immigrants to continue to thrive, helping society to flourish. We have a passion for immigrants, as most of our team members are from different countries around the globe. We want to continue to push industry standards and solutions so this can continue to happen. You can count on CrossTech to continue to help revolutionize the industry landscape and have a social impact.

17

“My plan for 2023 is to be able to give women a place and a voice to be able to partner with other leaders and make a difference.”

DIGITAL INNOVATIION

This category was open to all MTOs, Banks, and FinTechs, who can demonstrate significant, tangible contributions in delivering value by creating new solutions and services in the international payments industry. The award celebrates and recognizes outstanding performance and innovation.

KYC SOLUTION OF THE YEAR

The Compliance Solution of the Year Award recognizes the most important innovation in preventing business laundering, financial crimes, and corrupt practices. It showcases the delivery of accurate and reliable information proven to help companies make informed decisions, build successful case studies, and reduce fraud-related lawsuits.

CONGRATULATIONS TO OUR WINNERS

FINTECHEE MAKING A DIFFERENCE

This category celebrates FinTech businesses that serve their customers and the international money transfer community the best in the financial services sector with new and innovative services, creating products and transforming the way they experience financial services.

INDUSTRY CHOICE

The Industry Choice Award goes to the company with the most votes, which allowed anyone online to select their company of choice.

CrossTech World 2022 Recap

Watch CrossTech World 2022 interviews, course, workshop, and Panels!

Take a look at what our attendess have to say.

Take a look back at CrossTech world 2022 and watch what our attendees have to say. From Fintechs to Bank. Networking is what we are all about.

CrossTech World 2022 Interviews now available on Youtube

Get the to know our industry leader, CEO’s, and Founders. Hear what they have to say about the industry, our conference and their business insights.

Women in the Cross-Border Industry Women making a difference in fintech

Moderator:

Priscilla D’Oliveria Friedman, COO CrossTech

Panelists:

Arina Anapolskaya,Founder CashQ

Marina Olman-Pa, Shareholder Greenberg Traurig

Ximena Azcuy, Fintech Expert

CrossTech @Imtconferences 20

How do you see the industry landscape shifting

Investment in fintech has decreased significantly. Total fintech funding reached $75.2bn, down 46% in 2022. More notably Q4 funding was less than 25% of the annual number at roughly $10bn, indicating a continuing decline. If you dig deeper in the number, a pattern appears around funding and company sizes: Unicorn “birth” is down over 85% (166 to 69) and mega-rounds are also down. Late-stage investing is also down considerably. This indicates that investors are more reluctant to fund companies that were massively burning cash by chasing growth OKRs yet had no plan to become profitable. Many companies will struggle with this change causing a paradigm shift in go-to-market mentality. The mid-to-late stage companies that are likely to succeed are those that can demonstrate a clear path to profitability, and can efficiently run their operations on reasonable expense budgets. Alternatively, exceptionally innovative ideas that create attractive client benefits will be rewarded by the market as has been indicated with increases in early-stage funding.

Overall, investments are gravitating toward companies with better business models and better financial prospects. Basic technology-driven innovation has become commoditized, so what is becoming more valuable is access to markets. Building a payment system, a connector, or a wallet is no longer a breakthrough innovation, it's all about the features it contains, how it is marketed, and what kind of access to customers the company has. Some companies are building specialized tools, while others are exploring new markets such as FinTech in agriculture, or even going to

Nabil Kabbani Neofie, CEO

demonstrate a clear path to profitability, and can efficiently run their operations on reasonable expense budgets. Alternatively, exceptionally innovative ideas that create attractive client benefits will be rewarded by the market as has been indicated with increases in early-stage funding.

Overall, investments are gravitating toward companies with better business models and better financial prospects. Basic technology-driven innovation has become commoditized, so what is becoming more valuable is access to markets. Building a payment system, a connector, or a wallet is no longer a breakthrough innovation, it's all about the features it contains, how it is marketed, and what kind of access to customers the company has. Some companies are building specialized tools, while others are exploring new markets such as FinTech in agriculture, or even going to demonstrate a clear path to profitability, and can efficiently run their operations on reasonable expense budgets. Alternatively, exceptionally innovative ideas that create attractive client benefits will be rewarded by the market as has been indicated with increases in early-stage funding.

Overall, investments are gravitating toward companies with better business models and better financial prospects. Basic technology-driven innovation has become commoditized, so what is becoming more valuable is access to markets. Building a payment system, a connector, or a wallet is no longer a breakthrough innovation, it's all about the features it contains, how it is marketed, and what kind of access to customers the company has. Some companies are building specialized tools, while others are exploring new markets such as FinTech in agriculture, or even going to new markets like Africa to find untapped opportunities. It will be expensive to acquire customers if you are generically targeting the US mass market for Gen Z and Millennials without a unique value proposition.

How do you see B2B payments changing vs B2C payments in 2023?

There is a growing interest in b2b payments because it offers higher Average Revenue per User (ARPU) and several ancillary product opportunities. The largest area that received funding in 2022 is Payments tech, almost double the money going into banking or digital lending. Currently, the process of making payments between businesses can be costly and time-consuming. Many companies still use manual methods like wires and checks, which are slow and inefficient. There is a lot of potential for companies to streamline payments and banking for businesses. Business banking can be expensive, with high account fees and transaction charges, which can be a challenge for small businesses.

22

However, there are new b2b banks and payments companies that are trying to make the process more efficient, by offering free or inexpensive payments. They are also developing new technologies like interfaces that automatically issue invoices and update accounting systems when payments are made.

B2b payments have a good outlook, but some companies may have made a mistake by offering free payments too early. As competition increases, they may struggle to generate enough revenue. However, there are other ways to earn revenue, like charging for banking fees, interchange fees, and additional services like integration with accounting software. It's important for these companies to find ways to generate revenue and become profitable soon, as investors are unlikely to continue funding companies without a clear path to profitability.

How do you see this impacting Embedded Finance?

Embedded finance is a promising field because it is flexible and allows for a variety of use cases. Companies that have reached a certain maturity stage will have to diversify their offering in order to keep their customers and increase profitability. Embedded finance can offer that, short of making acquisitions. It can be used in multiple ways with layered technology stacks, and can be integrated into different offerings in b2c or b2b payment companies. Even within one product offering there can be several layers of services that can be invoked. For example, in a lending use case, it could be used to interface with a lender, support account tracking and interest calculations, underwrite risk, and/or track financing and sources of funds, or a combination of these elements. This provides flexibility for different forms of lending, such as consumer lending, p2p lending, and agricultural lending. It can also be used for online payments, giving businesses the opportunity to expand their services and generate more revenue.

Businesses that specialize in specific areas such as business payments can benefit from embedded finance by “renting” a solution rather than building one for a faster go-to-market approach and to enable various tests. This allows them to focus on what they do best and acquire customers while adding a lending solution to their services. So they can launch a proof of concept then have the option to later shift to their own solution partially or fully once the volume justifies it.

What do you think should be the main focus for Fintechs in 2023?

It's important for FinTech companies to have a clear business model and a unique value proposition to attract customers. A plain vanilla FinTech product may not be enough to survive in a crowded market. Companies can either provide a specialized tool that appeals to a niche market, or they can have a unique competitive advantage in reaching a niche market through affinity, channel partnerships, or sponsoring programs. It's also important for companies to have a cost-effective customer acquisition strategy and a

realistic go-to-market plan. In order to be profitable, companies need to have a focus on running a tight ship and have a clear path to profitability. This will help them attract investors to fund their business. Companies should also be exploring innovative ways to improve their products and services. I think AI and ML are going to create breakthroughs in the industry whether it is on the risk and compliance side, or the customer behavior and ability to place product side. Additionally, companies should also have a clear plan for how they will generate revenue, whether it's through charging for services, providing additional value, or offering ancillary products. Companies can expand their offering and revenue-generating abilities, while keeping costs low, by outsourcing new products and systems to white-label third parties. The resulting speed to market, efficiency gains, and expertise-for-hire can quickly solve the revenue/cost equation for many companies. Conversely, those that choose to “own everything” and develop in-house face a long roadmap of leanings and experimentations that may prove too costly to keep investors engaged. Without a clear path to profitability and a focus on innovation, it may be difficult for companies to survive in the competitive FinTech market.

What is your biggest takeaway from 2022 in the industry?

It's clear that markets can shift quickly, as we've seen with the recent shift in investor sentiment towards FinTech companies. Many companies that were burning cash and had no clear path to profitability are no longer receiving funding. This is unfair, as some fintechs have been given a very short runway to prove their model, while social media companies have been given a decade to figure out their business model. Investors should be more patient and selective in their investments. Despite this, it's important for companies to have a solid business plan that includes a path to profitability, as the markets can change unexpectedly and funding may not always be available. The picture is not as dark as some of the numbers suggest. We are still at a higher level of funding than 2018 in Q4 and deal numbers are only down single digits and holding at 2020 levels; a healthy deal volume. The US is still the strongest market by far, exceeding Europe by almost 30% in deal numbers and amounts, and dwarfing Latam/Carib with roughly $4bn and 342 deals in Q$ in the US vs $0.6bn and 70 deals in Latam/Carib (Africa is less than half that size). We do expect a market comeback with investors being more selective about which deals they back and possibly looking at the global south as an area that has been so far underinvested. Over half the top 10 equity deals in Q4 2022 went outside the US, and 60% of Seed VC funding happened outside the US with 50% going to the Global South, indicating increased investor interest in these markets. Another positive trend for innovation is that 68% of deals were funded in early stage, the highest in the last 4-5 years. This is positive for innovators, but again I think investors will be selective about which ideas they back.

23

ABOUT NABIL KABBANI

Nabil Kabbani is the CEO of Neofie, a Fintech company that offers a turnkey white-label Bank-as-a-Service, Neobank, and Core Banking platforms that enable companies to offer comprehensive banking services to their customers. He is also a board member of the CrossTech powered by IMTC and SRA (Arena Investors).

Nabil is a growth driver and a multi-disciplinary global leader with a career built on leveraging strategy, technology, and people to transform and scale businesses. He spent twelve years at Western Union, helping it grow to a multi-billion dollar public company working from various locations in the U.S., Beirut, Dubai, Paris, and Brussels.

He led a venture capitalist funded startup that grew through nine acquisitions to become a major player in the Fintech industry.

He was the CEO of CommerceGate, a payment processing company in the e-commerce arena prior to joining ACT Holdings. He grew ACT from a $30MM student loan ARM company to an industry-leading $400MM+ diversified BPO. Lately, he was President of QLess, a disruptive SaaS technology startup, helping to scale the business, complete two fund raises, renegotiate venture debt, and double revenues.

Cross-Border Payments in Latin America & The Caribbean

The COVID-19 pandemic has pushed tens of thousands of businesses in Latin America and the Caribbean to go digital. Money transfer companies can now diversify their customer base and reach over 20 foreign markets when operating online, while those that operate offline have a limited reach. Digital payments enable this transformation at both domestic and cross-border levels.

But many challenges still exist that preclude the broadening of digital payment use throughout the region, from a lack of accessibility, regulatory harmonization, and affordable payment solutions, to a need for further public and private sector cooperation, consumer protections, and an open, inclusive and interoperable payment ecosystem.

Learn from the industry's experts in Latin America and the Caribbean as they share their experienced views, opinions, and predictions of regional trends in Latam and the Caribbean as they dive deep into high lighting the major opportunities and understand the most important challenges.

Moderator: Nabil Kabbani, CEO Neofie

Panelists: Jairo Riveros, Managing Director USA, and LatAm, Paysend Micael Martins, Frente Corretora; Gabriel Carvajalino, Vice President - Network Development, Thunes

24

CrossTech World 2022 Panel:

Mudanças do marco cambial para as casas de câmbio no Brasil

A Lei 14.286 de 2021 (marco cambial) trata da consolidação de mais de 400 normas de cambio que foram sendo criadas há mais de 100 anos. Ela revoga normas desde 1920. Observando isso, podemos entender o motivo dessa lei estar sendo chamada de Marco Cambial.

Dentre algumas mudanças para o mercado financeiro de câmbio propostas pela Lei do marco, podemos especialmente citar a flexibilização que a norma prevê. A expectativa é de que, com a entrada em vigor da nova Lei de Câmbio e com a aprovação das normas subsequentes de regulamentação, haja menos burocracia e maior agilidade nas transações de valores com outros países, inclusive por meio do uso de novas tecnologias para prestação de serviços de pagamentos e transferências internacionais.

Assim que regulamentada também, a nova norma sugere, por exemplo, a redução do número de naturezas de operação cambial, que hoje são mais de 300 tipos, e segundo a norma ainda, a responsabilidade pela classificação da finalidade das operações até U$50,000.00, que atualmente é das instutições financeiras, passa a ser do cliente, porém sem retirar das corretoras de câmbio a obrigação de orientar aos clientes quanto a esta classificação. Para os clientes consumidores do câmbio no Brasil, a norma prevê, por exemplo que para pessoas jurídicas que transacionam comercialmente no mercado internacional, serão eliminadas as restrições para uso dos recursos de exportação recebidos e mantidos no exterior. Além também de facilitar o pagamento de importações financiadas antes da entrada do produto no país.

Já para pessoas físicas vemos alterações como a autorização de pequenas transações privadas de ate U$500.00 ou equivalente em outras moedas, sem necessidade de registro no bacen e desde que sejam transações não profissionais; a alteração do limite de porte de valores em viagens para até U$10,000.00 sem declaração; e também a não obrigação de compartilhamento de dados pessoais que já possam ser consultados em bases de dados públicas ou privadas, o que pode obrigar à mais instituições à aderirem ao open banking para obtenção desses dados de clientes.

A obrigação de oferecer tratamento equivalente a contas correntes de residentes para as contas correntes de não residentes também é algo bastante relevante para os clientes e para as instituições bancárias que atualmente chegam a cobrar até R$2.000,00 mensais para manutenção de contas de não residentes e só podem ser abertas por bancos.

Há quanto tempo essas mudanças estavam em discussão? Por que houve tanta demora em se aprovar o texto?

A regulação de câmbio brasileira já vêm sofrendo alterações relevantes desde 2010 quando iniciou-se um grande movimento de flexibilização as normais cambiais. Em 2013 a Circular 3.691 substituiu todo o RMCCI (Regulamento do Mercado de Cambio e Capitais Interncionais), modernizando o arcabouço regulatório. E desde então diversas normas foram aditadas de maneira congruente, seguindo a essa mesma diretiva do Bacen, como por exemplo a Resolução 137 de 2021 que regulou e implantou o conceito de E-FX. Já a demora na aprovação da norma possivelmente decorre da necessidade do regulador em garantir que todo, ou a maior parte do mercado, esteja sendo abrangida dentro da nova regulação, o que demanda tempo de análises e revisões, bem como consultas públicas que vem sendo realizadas constantemente pelo Banco Central, o que é extremamente positivo para o mercado e para o público consumidor como um todo.

Qual o tipo de impacto financeiro para consumidores e empresas?

Observamos que o novo marco cambial também tenta estimular a concorrência das empresas e agentes do mercado de câmbio como bancos, corretoras de câmbio e, mais recentemente, as fintechs. Vemos isso pois a norma propõe redução de estruturas jurídicas e operacionais no segmento, além da redução burocrática e possivelmente redução dos custos de observância para a entrada de novas empresas da área.

Esse movimento de tornar o câmbio um serviço mais simples e menos burocrático, pode gerar no mercado uma redução os custos do serviço, refletindo ao consumidor um serviço mais democrático financeiramente.

A nova legislação está em linha com as normas internacionais? O que mais poderia ser aprimorado e que faltou ser debatido no marco cambial?

Um importante mérito da nova Lei consiste em incorporar as inovações trazidas por regulamentações anteriores, bem como permitir que novos modelos de empresas se tornem agentes do mercado de câmbio. O Brasil, em comparação com outras economias, é um país que internamente possui um sistema de pagamentos altamente desenvolvido e tecnológico e uma população bastante bancarizada, mas em relação ao câmbio ainda possui um viés mais conservador no que tange a liberdade econômica dos consumidores, demonstrando que ainda existe um nível de maturidade a ser alcançado para que essa liberdade possa se expandir.

A permissão para obtenção de contas em moeda estrangeira no país, por residentes, que se imaginou fosse ser concedida através desse marco, efetivamente ainda não foi tratada. Pelo entendimento da norma, apenas os modelos de conta para determinados negócios como empresas de agência de viagens e contas gráficas foram mantidas.

26

27

CEO B&T Global Exchange Consulting LLC.

28

MEET OUR TEAM OF CONSULTANTS

CONSULTANTS

Isabel H. Cortes

Jennifer Holguin

CLICK HERE TO BOOK A CONSULTATION

Priscilla D'Oliveira Friedman Hugo Cuevas-Mohr

A true engineering breakthrough

The Oura Ring may be small, but it is mighty. The most stylish wearable on the market is jam-packed with features, accuracy, and innovation. Sleep is foundational to improving your mental and physical health. That's why Oura started sleep tracking in 2013 and has been the category leader ever since.

$367.00

In this edition, we present a compilation of technological devices aimed at making your life easier with a touch of fun, emotion, and above all, a practical way of doing things and gettting the best experience you deserve Enjoy!

29

OURA RING GEN3

HELATH CARE

Introducing the Original Pilot Case, a new take on an iconic signature design for travel ing professionals.

Each of our suitcases features TSA-approved locks that can be opened by security during airline baggage checks without causing any damage.

Two zipped pockets on the top lid are ideal for small belongings such as electronics. A vertical pocket in the main compartment can hold additional travel essentials, like a 1/2L bottle or a compact umbrella.

$1,500.00

EZRI PREMIER

Notebook backpack

The minimalist craft of the EZRI Premier conceals all zippers and openings when seen at first glance. Nevertheless, the notebook backpack comes with five outer zipper pockets and 2 compressed bottle pockets that provide our customer with a full range of functionalities. On the inside, a wide range of pockets, including laptop and tablet compartments, make the EZRI Premier the best laptop backpack for our young business professionals.

$499.00

30

TRAVEL

RIMOWA ORIGINAL PILOT CASE SMALL CARRY-ON SUITCASE

Ekster Parliament Leather Wallet

SLIM YOUR POCKETS

THE NEXT GENERATION WALLET: This minimalist wallet gives you easier access to your cards and comes with built in RFID data protection to prevent wireless theft. Forget about rummaging through a bifold wallet, by using our patented card ejection mechanism, you can instantly pop out your cards at the click of a button.

SUSTAINABLE MATERIALS: The Ekster Parliament wallet is a men’s metal trigger wallet handcrafted from premium top-grain leather, tanned under silver-rated LWG-certified protocols, and 6063 T5 Aluminium. Durably designed for daily use, this wallet requires minimal upkeep to for a lifetime of use.

$89.00

Unistellar eQuinox 2 Smart Telescope

The eQuinox 2 is an innovative smart tele scope that brings the wonders of space within reach, even in brightly lit urban areas. Our technology eliminates the need for expertise in complex instruments, so you can effortlessly unlock the wonders of space with our user-friendly technology. Observe galaxies, nebulae, and planets in full color from even the most urban areas. Enjoy the click-and-wow telescope that is ready to explore space in just two minutes from any where.

$ 2,499.00

29

ENTERTAINMENT

FINANCIAL 31

COMPRE AHORA!

ENVIANDO DINERO

CAMBIO, REMESAS, MIGRACIÓN Y LA REVOLUCIÓN FINTECH

La Evolución de la Industria de Servicios Financieros Internacionales.

Esta obra compendia los conocimientos y experiencias de Hugo Cuevas-Mohr - Especialista en Transferencias de Dineroen torno a la provision de servicios financieros internacionales y las tendencias tecnologicas que permitieron su fortalecimiento y evolución.

En sus paginas se cuenta, con decenas de testimonios de los emprendedores que hicieron posible esta industria, la crónica de visionarios que han hecho posible le envio de dinero de migrantes a sus familias y su contribución a la actual revolución fintech.

BOOK PRESENTATION 3230

We are thankful to all our staff and the supporting team of collaborators who help us develop our conferences in each of the cities and regions we select to host them. Without their help, it would be impossible for us to give all the participants in our in-person and virtual events the unique experience we strive to give everyone attending.

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Director of Content

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Director of Content

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant

33

Lourdes Soto Spain Consultant

11 - 12

Annual conference sponsorship packages are now available!

Click here to contact us! help@crosstechpayments.com

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Director of Content

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant

David Lederman Marketing Director

Maria A. Garcia Sales & Community Manager

Virginia Martínez Technology & Online Events Admin

Marcela Molina Creative Manager

Ana González Director of Content

Diana Jofre Executive Assistant & HR Coordinator

Juan Posada Director of Business Intelligence

Jennifer Holguin Lead Consultant

Isabel Cortes UK Consultant