|

WHERE THE BEST ARE BUILT

MARKET UPDATE June 23, 2023

EXECUTIVE SUMMARY

• While some commodities prices have come down, equipment has not followed the trend. Equipment prices continue to rise, however, at decreased intervals.

• Lead times are getting better. Only a few products have not improved.

• The micro-chip shortage is still negatively impacting the lead times. Equipment with ECM motors and VFDs tend to have the longest lead times.

• Major equipment manufacturers may require an approved submittal to secure pricing, not just a purchase order.

• Some major equipment players are requiring up-front payment and/or interval payments.

Rich Mouradian VP / Business Development

t. 781.953.0318

e. rmouradian@coxeng.com

Stephanie Wickman Estimating Coordinator

t. 781.807.0427

e. swickman@coxeng.com

|

SELECT EQUIPMENT & MATERIAL LEAD TIMES

(Lead times are based on approved submittal release.)

WWW.COXENGINEERING.COM |

Trending Up

Trending Down Remaining Stable LEAD TIMES TRENDS AHUs Custom AHUs 15-45 weeks Packaged AHUs 9-38 weeks Modular Catalogue AHU 11-50 weeks Make-Up Air Units 4-30 weeks ERUs 4-50 weeks FANS General Fans 5-25 weeks Lab Fans 16-45 weeks TERMINAL UNITS VAV Boxes 3-20 weeks Fan Powered Boxes 3-20 weeks Heat Pumps 6-16 weeks Fan Coil Units 3-12 weeks Computer Room A/C Units (CRAC) 15-60 weeks Unit & Cabinet Heaters 14 weeks

Delays

Delays

SELECT EQUIPMENT & MATERIAL LEAD TIMES

(Lead times are based on approved submittal release.)

WWW.COXENGINEERING.COM |

TIMES TRENDS HYDRONIC EQUIPMENT Air Cooled Chillers 14-50 weeks Water Cooled Chillers 13-58 weeks Modular Chillers 18-60 weeks Cooling Towers 12-32 weeks Stainless Steel Cooling Towers 18-32 weeks Pumps 10-17 weeks Large Split Case Pumps 22-28 weeks Pump Specialties 6-18 weeks Heat Exchangers 10-22 weeks Boilers 4-18 weeks Baseboard Fin Tube 10 weeks

EQUIPMENT Split A/C Systems 4-34 weeks VRF Equipment 4-24 weeks FUEL OIL Fuel Oil Tank 10-16 weeks Fuel Oil Pumps 8-16 weeks Delays Trending Up Delays Trending Down Remaining Stable

LEAD

REFRIGERANT

SELECT EQUIPMENT & MATERIAL LEAD TIMES

(Lead times are based on approved submittal release.)

ADDITIONAL EQUIPMENT

Delays Trending Up Delays Trending Down Remaining Stable

WWW.COXENGINEERING.COM |

LEAD TIMES TRENDS

Control Dampers 4-22 weeks Fire / Smoke Dampers 4-22 weeks RGDs 3-7 weeks HEPA Type RGDs 3-5 weeks Sound Traps 3-16 weeks Supply / Exhaust Lab Valves 6-12 weeks VFDs 6-60 weeks Chilled Beams 4-20 weeks MATERIALS Galvanized Sheet Metal 3-4 weeks 304 Stainless Steel Sheet Metal 3-4 weeks 316 Stainless Steel Sheet Metal 3-4 weeks Aluminum Sheet Metal 1-3 weeks

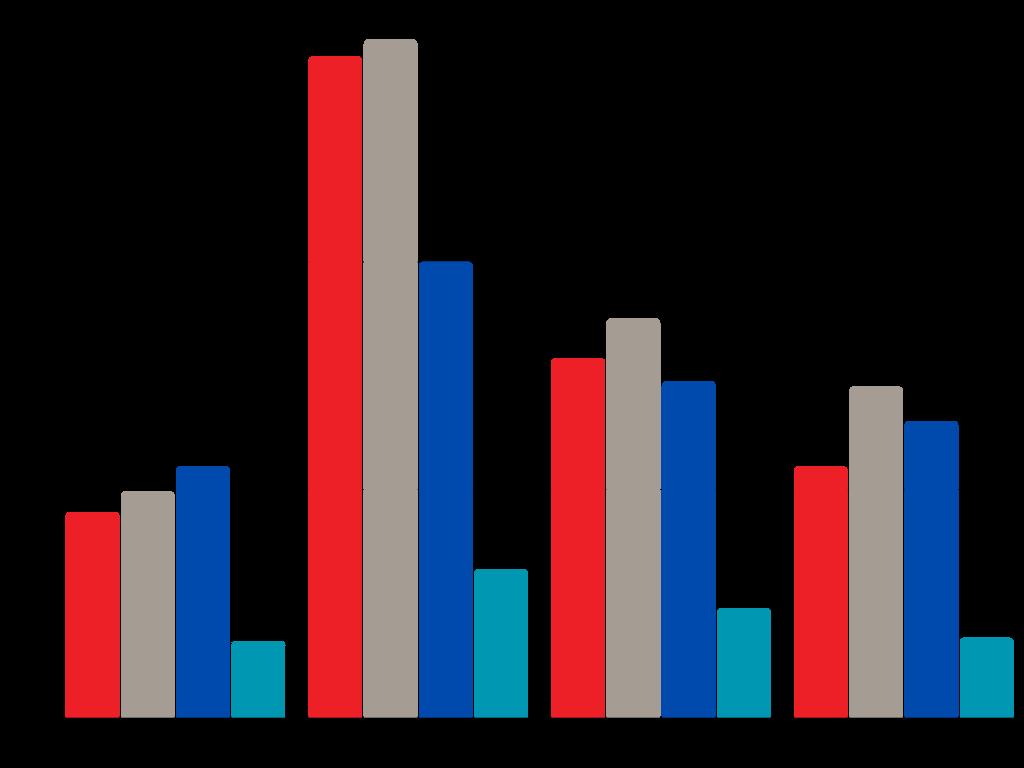

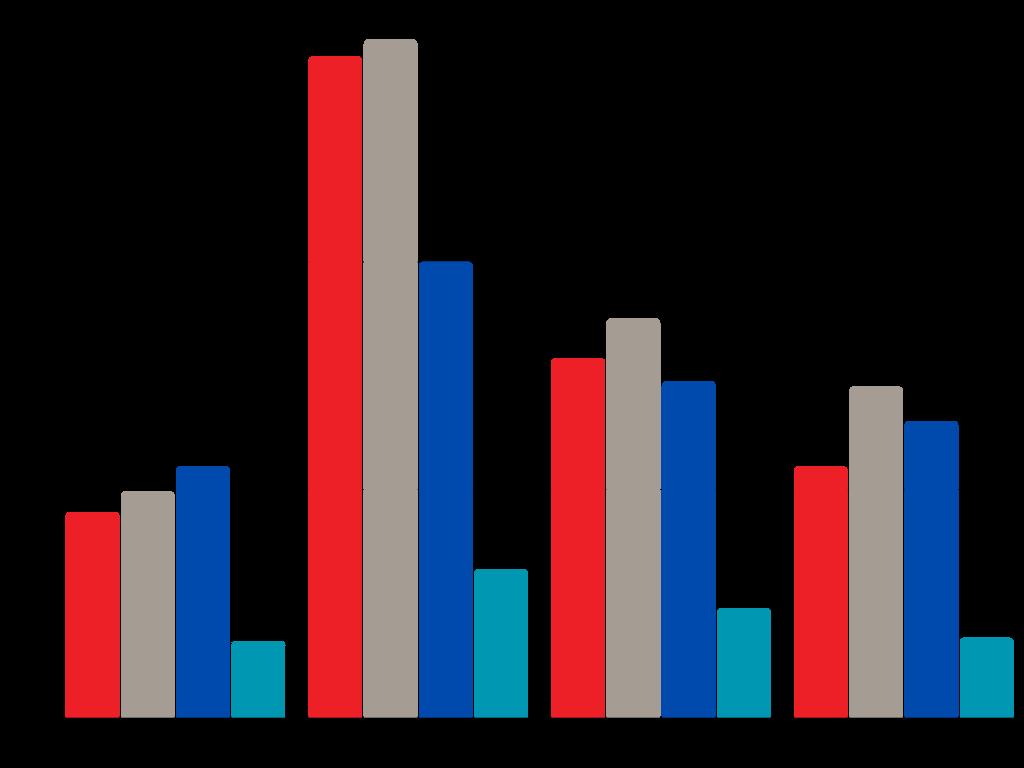

SHEET METAL PRICING

Galvanized Coil Stock has dropped to near pre-covid values. Stainless and aluminum dropped a bit over the past few months to below $3.00/lb. (All prices below are dollar per pound.)

WWW.COXENGINEERING.COM

304 Stainless Steel Sheet Metal

316 Stainless Steel Sheet Metal

|

Aluminum Galvanized Sheet Metal

$0.70 $0.96 $1.30 $2.60 $2.95 $2.20 $2.90 $3.50 $5.95 $2.20 $3.15 $5.80 $4.00 $0.67 $1.98 $1.80

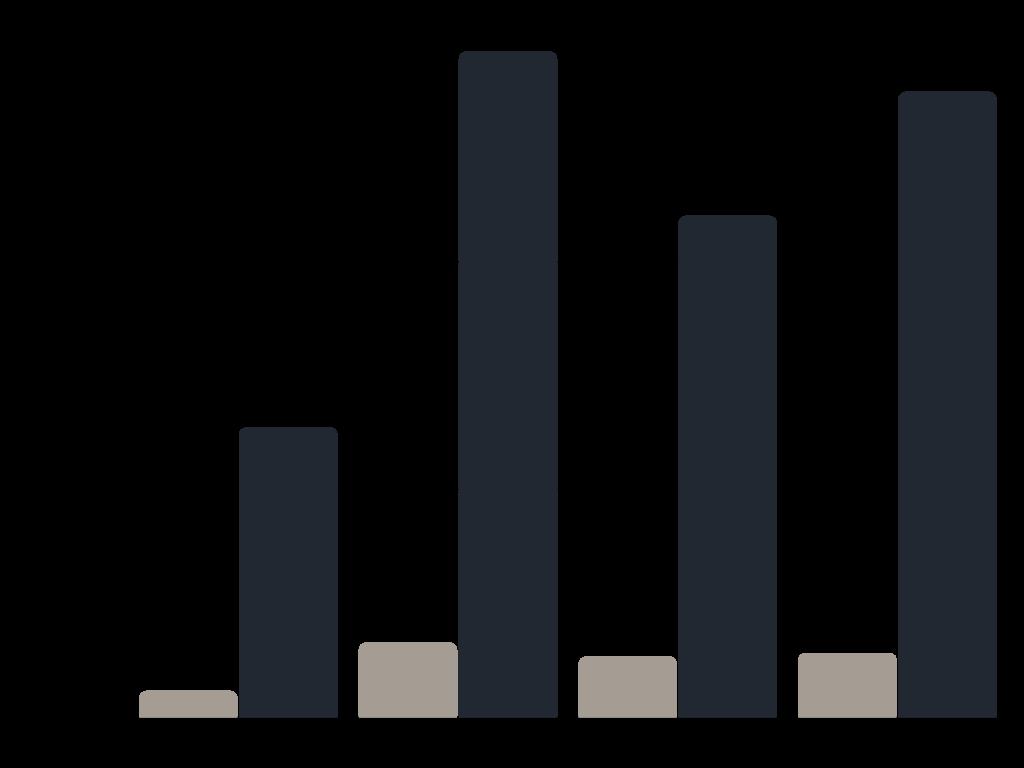

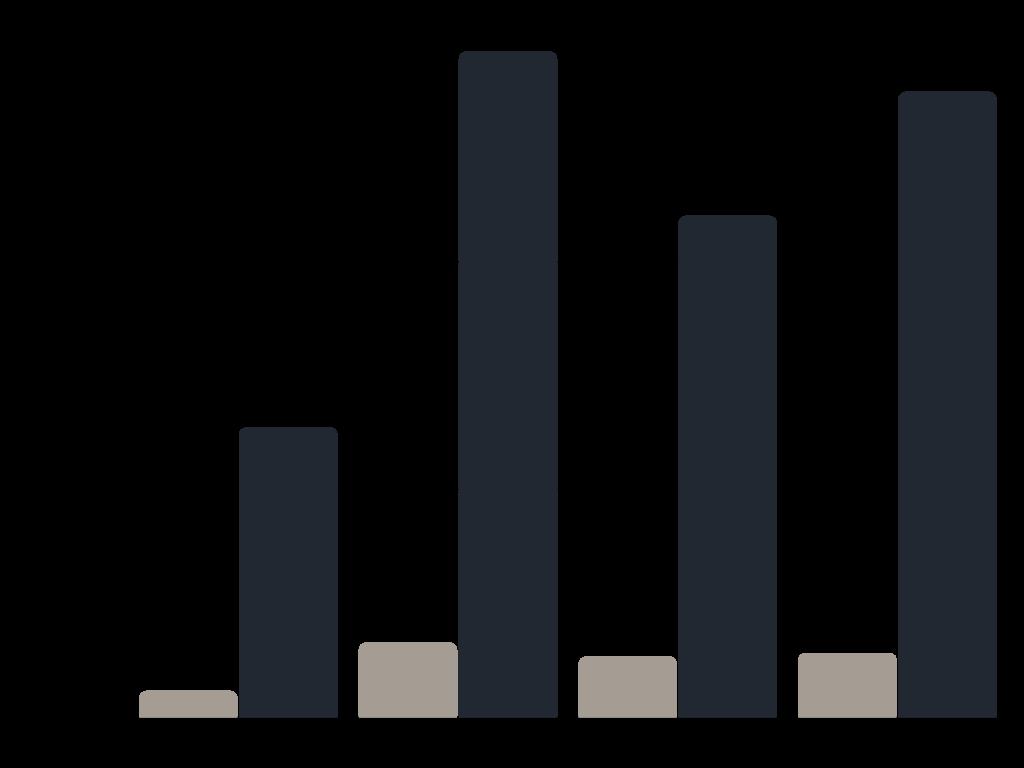

PIPE & TUBE PRICING

Unlike sheet metal, piping materials remain significantly higher than Pre-Covid levels. (All prices below are price per foot.)

1/2”

6” Black Steel Price Per Foot

WWW.COXENGINEERING.COM |

Copper Tube Price Per Foot

$29.22 $3.30 $12.73 $1.19 $2.69 $22.01 $2.84 $27.45

UNION LABOR FORCE

|

12

Current Supplemental Union Labor Force (Travelers) Sheet Metal Labor (Local 17)

Pipe Labor (Local 537) 200

About Cox Engineering

For more than 100 years, Cox Engineering has provided sheet metal and mechanical services including custom air-handling manufacturing (Cambridgeport Custom) and sheet metal accessory manufacturing (Cambridgeport Air Systems). At Cox Engineering, we do what we say; we’re on your side; we’re always getting even better. It’s why we are where the best are built.

WHERE THE BEST ARE BUILT