AXIS Connect™ enables you to:

Reduce operating costs

Integrate workflows to enhance productivity

AXIS Connect™ is an open, secure and integrated survey management tool, where survey tools connect to the cloud, drillers connect with geologists, and measurements connect with reporting and geological modelling.

The platform simplifies drilling operations, minimising disruptions while ensuring accurate and efficient data collection in the field.

To learn more about AXIS Connect and how it can support your operations, contact your local Orica Digital Solutions representative or visit orica.com/axisconnect

Enhance orebody knowledge

Connect survey to geological models

Exclusive interview with Boyuan Tian, Managing Director of Jinshi

Topdrill Digging deep: A story of grit and growth

STATISTICS

20 Top mineral exploration drilling contractors 2024 Statistics of diamond drilling meters by Maksim M. Mayer, Editor at Coring Magazine

STUDY

24 The role of directional core drilling in tunneling. Methodologies for comprehensive rock investigation by Ivan Dimitrov, WSenior Field Engineer at IMDEX, Outi Ahvenjärvi and Tiia Kivisaari, Project Geologists at Anglo American, Sakatti Project

30 Alton Drilling Driving innovation in remote exploration at WKP by Fabian Harley, North Island Operations Manager, and Sarah Keenan, Executive Assistant at Alton Drilling

/DRILLING SOFTWARE

32 Krux Analytics Redefining drilling data for a smarter future

/EXPLORATION & MINING GEOLOGY

37 Q&A from the experts: In conversation with Steve Beresford, Director of Power Metallic

44 Beer and geology You can’t have one without the other by Richard Fink, former Vice President - Technical (retired), Global Ferroalloys at Cliffs Natural Resources

46 Core photography guidelines by Brenton Crawford, Chief Geoscientist at Datarock

52 Folding through time Unravelling orogenic imprints in the Aravalli Supergroup, NW India by Dr Jaideep Kaur Tiwana, Geologist at Geological Survey of India

/EXPLORATION DRILLING CATALOG

56 Drilling services 57 Drilling equipment & accessories 61 Survey equipment 61 Miscellaneous

Boyuan Tian Managing Director of Jinshi Drilltech Co Ltd.

Fabian Harley, North Island Operations Manager

Sarah Keenan, Executive Assistant at Alton Drilling

Brenton Crawford Chief Geoscientist at Datarock

CORING MAGAZINE

September 2025

Cover photo Topdrill

Issue 32

ISSN 2367-847X

Not for resale. Subscribe: coringmagazine.com/subscribe

Contact Us

Coring Media Ltd.

57A Okolovrasten pat street, r.d. Manastirski Livadi, Triaditsa region, 1404 Sofia, Bulgaria

Phone +359 87 811 5710

Email editorial@coringmagazine.com Website coringmagazine.com

Maksim M. Mayer

Editor at Coring Magazine

Steve Beresford Director of Power Metallic

Dr Jaideep Kaur Tiwana Geologist at Geological Survey of India

Publisher

Coring Media

Executive Officer & Editor in Chief

Martina Samarova

Editor Maksim M. Mayer

Section Editor – Exploration & Mining Geology

Dr Brett Davis

Digital Marketing Manager

Elena Dorfman

Assistant Editor

Adelina Fendrina

Graphic Design

Cog Graphics

Want to contribute to Coring Magazine? Get in touch with us at: editorial@coringmagazine.com

Coring Magazine is an international quarterly title covering the exploration core drilling industry. Published in print and digital formats, Coring has a rapidly growing readership that includes diamond drilling contractors, drilling manufacturers and suppliers, service companies, mineral exploration companies and departments, geologists, and many others involved in exploration core drilling.

Launched in late 2015, Coring aims to provide a fresh perspective on the sector by sourcing authentic, informed and quality commentary direct from those working in the field.

With regular interviews, insightful company profiles, detailed product reviews, field-practice tips and illustrated case studies of the world’s most unique diamond drilling and mineral exploration projects, Coring provides a platform for learning about the industry’s exciting developments.

After studying finance and economics and attempting a few side projects, Boyuan found a real career path in the family business of Jinshi Drilltech. Founded by his father in 1996, today Jinshi is the largest manufacturer of core drilling tools in China. With the experience he accumulated while living and studying in Canada, Boyuan has since helped spearhead Jinshi’s expansion abroad. Over the last years, several international branches of the company were established in South America and Asia, further strengthening their position among suppliers from China.

In China, Jinshi Drilltech is a full drilling solutions provider and a domestic industry leader. And in his current role as Managing Director, Boyuan is aiming to build the Jinshi brand abroad - by leaning on the quality of their products, refined in real operations, and combining their local presence and logistics experience.

Grigor Topev: It is a pleasure to have you as our guest interviewee at Coring Magazine! I like to start every interview with the same question: What first drew you to the drilling industry, and how did you get your start?

Boyuan Tian: Thanks for giving me the opportunity. I’m honored to be here, as I feel I’m still early in my career compared to some of the interviewees before me.

Well, I had my options open and studied finance and economics, but I didn’t manage to find a real career path in the few side projects I attempted. Jinshi Drilltech is a family business that I am part of, so it was natural for me to get into it. Looking back, the choice worked out well for me. Today, I feel much more comfortable and confident in this field.

GT: You spent some years in Canada. What are your general impressions of the drilling business there?

BT: I lived in Canada for 12 years for education and family reasons, and I moved back to China recently to achieve a better balance between work and family. Canadian drilling companies are well-equipped, technically sophisticated, and highly regulated. When it comes to manufacturers, I find the business environment to be stable and mature, but it tends to operate at a lower pace in some regards compared to my home country. Chinese companies were lucky to catch the golden period of China’s rapid economic growth and reap the benefits of the times. Now, as the drilling industry becomes more mature, we can learn a great deal from mature markets like Canada.

GT: Could you tell us more about the story of Jinshi Drilltech Co Ltd. and its line of products?

BT: My father, Tian Bo, had a humble start in a national geological institute. He worked his way up to shop manager before quitting his job and starting his own business in 1996, producing diamond core bits. In the years since, the company expanded the product line to include rods and casings, in-hole tools, and eventually hydraulic rigs—a major step that positioned

Jinshi as a full drilling solutions provider rather than just a tool manufacturer. This growth happened at a time when China was investing billions in exploration both at home and overseas. Jinshi’s ability to meet the growing demand with high-quality products propelled the company to become a domestic industry leader. Last year, our company produced 1.4 million meters (4.59 million feet) of rods and 210 000 diamond tools, making Jinshi the largest manufacturer of core drilling tools in China and positioning the company among the leading producers worldwide.

GT: What is the structure of the company, and how is it connected with its international subsidiaries?

BT: Jinshi Drilltech has a team of more than 500 employees, with about 80% working in manufacturing and the rest in sales and management. Our headquarters are in Tangshan, just a two-hour drive northeast of Beijing, which gives us direct access to China’s capital for logistics, talent, and business connections. We operate three production facilities in Tangshan, covering a combined area of 93 000 m2 (1 001 044 ft2). We keep our subsidiaries intentionally small, with a mix of employees dispatched from headquarters and local hires. Strategic decisions are made at the headquarters level, ensuring consistency across operations. To stay aligned, there is daily communication between subsidiaries and the operations management team, while senior management holds weekly meetings to review sales, inventory, customer feedback, and other key topics.

GT: What are your responsibilities within the global structure?

BT: My major role is in management now. Basically, my department empowers the sales department and coordinates with the manufacturing side. We have a big team, as I mentioned, and the responsibilities are subdivided across the department. Even though I had exposure to sales, marketing, and finance, I see myself more as a coordinator, making sure our teams stay aligned and work effectively together.

of that, mining and exploration cycles influence tool manufacturers directly. Ramping up capacity in an upturn is challenging and keeping the capacity utilized during an industry downturn is even harder. To avoid such issues, Jinshi started to invest and nurture the market in good times to live through the bad.

We started the Peruvian subsidiary in 2013, which was the end of our last boom. We brought some drill rods with couplings, quite common in China, to the Peruvian market in the hopes that we could talk drilling companies into switching from wireline to our standard. That didn’t go well, and we learned a lesson. Besides mistakes like this, we had setbacks like fraud and an armed robbery in our Peruvian branch. Those challenges are now behind us, and today our Peruvian branch enjoys a solid reputation and strong performance. With the experience from Peru, Jinshi ventured into more countries to establish footholds in major markets and build strong ties with the local drilling communities.

‘What really makes Jinshi stand out is that we are also a drilling company ourselves. This gives us a different perspective, personnel with hands-on drilling experience, and the ability to test and refine our products in real operations, which makes a huge difference in quality.’

GT: The company has several international branches—in Peru, Mexico, Kazakhstan, Türkiye, and recently, Indonesia. What were some of the challenges the company faced when expanding to and working in these markets?

BT: It’s challenging to set foot in a mature market for the first time. Making the right choices, maintaining a positive mindset, and above all, having patience, as it can take years, are the keys to making a subsidiary successful. On an execution level, building a small yet resilient team is the dominant challenge. Compared with many big Chinese firms venturing overseas with big investments, Jinshi faces a unique challenge coming from the small and volatile nature of the drilling tool industry. The local team has to excel at being small, efficient, and team-oriented—a balance that is never easy to achieve. On top

GT: Do your international branches help you differentiate as a manufacturer? Do they also provide local storage, or are products delivered directly from China?

BT: To be honest, I can hardly tell competing products apart on platforms like Temu or Alibaba, and I’m not willing to take risks experimenting when I’m the buyer. I can imagine how hard it must be for foreign companies to recognize which drilling brands are truly reliable and high quality when the market is flooded with a long list of Chinese manufacturers.

What really makes Jinshi stand out is that we are also a drilling company ourselves. This gives us a different perspective, personnel with handson drilling experience, and the ability to test and refine our products in real operations, which makes a huge difference in quality. In addition, becoming a locally operated entity at select locations further strengthens our position among suppliers from China.

All of our products are manufactured at our headquarters facility in China, ensuring strict control over quality. We do maintain local stocks, but the reality is that no company can keep every item on hand. What matters is that our local inventories are growing steadily, and products for regular customers are becoming more and more readily available, with stock managed directly at the subsidiary level. For new customers ordering directly from headquarters, it may sound complicated or time-consuming, but in practice it’s straightforward and efficient. Some of our largest customers have been purchasing this way for many years. We work with the world’s leading couriers and freight forwarders, and while bulky shipments naturally take longer, our logistics experience ensures they are handled smoothly and reliably. Consistently meeting lead times is one of the cornerstones of our logistics, so customers can rely on receiving their products exactly as promised.

GT: You were an International Business Development Manager for Jinshi Drilltech. Which one of these markets has been the hardest to establish a foothold in?

BT: So far, Mexico has been the hardest market for us to establish ourselves in. When I first visited Hermosillo, Sonora, in 2017 to investigate the market, we realized that simply finding a distributor would not be enough. Before taking that step, we had to penetrate the market directly and build recognition for the Jinshi brand. Mexico was attractive because it needed budget-friendly drilling tools, but long supply chains and trade barriers made it difficult for contractors to source directly from China. That was a gap Jinshi managed to fill with the help of our previous experience in Latin America, and today the branch is proud to have had a strong start in the market.

Globally, developed markets like Australia and Canada remain the most difficult markets for us to enter. From a strategic perspective, we focus on identifying gaps that we can fill with certainty, rather than chasing entry into developed markets without careful consideration. Nonetheless, I am confident Jinshi will be able to set a foothold in Canada and Australia under the Jinshi brand in the future.

GT: Will Jinshi consider building a factory outside China?

BT: As I see it, building a factory in a target market is something we are open to in the future, but we don’t have a clear plan in place yet. With global trade conditions fluctuating and many governments pushing for local manufacturing, we recognize that local production may become necessary in some regions. Of course, building a factory outside China would be far more challenging than setting up a sales office. That is why we are more open to potential joint ventures with investors from the global drilling community. Any country with mineral resources to explore can potentially support local manufacturing of drilling tools. This is the direction many governments are encouraging.

GT: What are the short- and long-term goals of Jinshi Drilltech?

BT: I am sure many Coring readers are hearing about our brand for the first time, even though we have been in the business for many years. This shows that we have not marketed the Jinshi brand properly and consistently. A few years ago we went through a renaming and rebranding, which also had its impact. Now one of our short-term

goals is to build stronger brand awareness, create trust, and improve our reputation.

Jinshi is deeply embedded in the Chinese market, a market I consider more volatile and more competitive than its developed counterparts. However, we want to diversify and reduce our reliance on a single market. Ideally, foreign sales should account for 50% or more of our total revenue. To achieve this, we are working to improve our overseas sales structure by engaging more distributors and key customers abroad, and by shifting away from a purely trade-oriented business. As for the long term, our goal is straightforward: to stay in business and continually refine our products. There are countless improvements we can make at the operational level, but I believe chasing a ‘grand vision’ is not practical in today’s rapidly changing environment. At this stage, it is less about being ambitious and more about pursuing steady, sustainable progress.

GT: You are mentioning a strong presence in the Chinese market. Tell us more about that.

BT: In the domestic market, Jinshi does more than supply tools—we provide complete solutions built on years of drilling experience, technical know-how, on-site support, and subcontracting capabilities. Our service package is a unique advantage that strengthens customer loyalty and has been a key reason why Jinshi has become the largest supplier of core drilling tools in China.

GT: Personally, which Jinshi Drilltech product(s) are you the proudest of? What makes it or them unique?

BT: I am the proudest of our number one factory that houses a highly-automated production line for wireline drill rods. With an output of 2500 rods per day—an impressive figure for a single manufacturing plant, our number one factory stands for advanced manufacturing. The automation has also dramatically reduced the amount of manual labor and improved working conditions.

On the product side, we developed the HY-thread heavy-duty wireline drill rods, which have a depth capacity of 2500 m (8202 ft). Compared to standard wireline rods, they provide better reliability and safety when drilling at greater depths.

GT: Can you share the most impressive projects Jinshi Drilltech has been involved with?

BT: Something unique I can think of is the geotechnical drilling projects done for those mega infrastructure projects. One of the most recent is the soon-to-be-built Motuo hydropower dam in China, which began construction in July. Jinshi Drilltech is proud to supply tools and drilling consultation for the geotechnical drilling programs. One of the ongoing geological survey holes is horizontal with a designed depth of 2400 m (7875 ft) in H-size and 3000 m (9843 ft) in N-size.

Another project where Jinshi contributed is wireline drilling in sandstone-type uranium deposit ground conditions. For better context, some of China’s uranium reserves are hosted in sandstone strata. Limited by the poor cementation of the strata and poor fluid circulation, drillers traditionally used the conventional coring method. Productivity and core recovery were far from ideal, while standard wireline operations were difficult because the inner tubes and rods frequently got stuck. Jinshi designed and manufactured a new set of wireline tools for these strata to increase annular space and unstick the inner tube. Those very tools made wireline coring possible in similar strata.

GT: I’m sure many of our readers want to know, how is diamond drilling in China? What’s the reach and scale?

BT: I know there is curiosity about the drilling industry in China in general. I am honored to share my experience and opinion here, but I have to put out a disclaimer in advance: I represent Jinshi Drilltech only, not the Chinese drilling community or any official drilling organizations. China’s drilling industry is very diverse, and my perspective reflects only our company’s experience.

So, back to the question: we have lots of drilling companies out there. Many state-owned geological companies provide a broad mix of geological services, and diamond drilling is only a part of what they offer. We also have a few companies that focus solely on contract drilling. Unfortunately, I don’t have a reliable estimate of the total number of active drills or total volumes.

China, now a big player in mining, is investing billions in mineral exploration. However, in terms of contract drilling, I think our market is more fractured, with many small- and medium-sized companies compared to developed markets, where a few very large companies dominate. I don’t know of any domestic company that operates more than 50 drills like the major players. Over the past decade, we have also seen many Chinese drillers working overseas, primarily in Africa.

GT: What is the state of competition between Chinese manufacturing companies? Are they more oriented abroad, or do they focus on the local market?

BT: Like all manufacturing industries in China, the competition is

fierce. The Chinese market is saturated with cheap products. For example, a very popular product is the 5 ft (1.52 m) NTW rod, which you can buy on the market for USD 20 apiece. Well, I think only the good manufacturers are able to do well in foreign markets. Focusing on the domestic market is usually more of an involuntary choice than an orientation. In the context of foreign trade, some peers had a good strategy in penetrating certain markets.

GT: When you mention good strategies, I have to bring this up. I constantly receive messages on LinkedIn, through email, and even WhatsApp from salespeople of Chinese companies. To me, that feels like spam, and honestly, it doesn’t work with me. What’s your take on that?

BT: That is a good question. I understand that you feel harassed; many people have complained to me about the same thing. Even I sometimes feel the same way. In China, some foreign trade salespeople are involved in selling a wide range of products. Mass marketing emails and unsolicited private messages, based on informa-

tion gathering and reselling, are a low-cost, hit-or-miss sales tactic. For specialized products like core drilling tools, this kind of marketing approach is certainly not suitable. Many customers prefer salespeople to reach out in a more professional manner, and that is also what we aim to achieve. However, it’s not easy to shift away from this marketing strategy overnight, and sadly, some Chinese suppliers are sometimes dragged down by the poor impression left by their less professional peers.

GT: Is it difficult to find qualified experts in China, knowing that there are significant shortages globally?

BT: On the drilling side, recruiting drilling experts is challenging for Jinshi. Most foremen and project managers would prefer starting their own drilling business to doing the same job for just a paycheck. We operate ten drills and would like to run more. A shortage of skilled labor limits the size of our contract drilling department. Overall, I see an aging skilled workforce with no sign of reversing in the near future.

On the manufacturing and R&D side, it is less difficult to recruit candidates. Our managers and engineers have worked at Jinshi for years and have become experts themselves. When we look for experts to fill positions, promoting good candidates within the team has proved to be more successful than hiring experts from within the industry.

GT: What are some of the differences you have found between Canadian and Chinese contractors?

BT: As I mentioned, Jinshi Drilltech has ten drills operating across China. As a for-profit entity, I think we behave much like Canadian contractors, although we do some things differently. Like any other contractor, we have to consider costs such as diesel, labor, and tools. The risk of downtime and HSE costs are also taken into account when preparing a tender price. What we can definitely learn from our Canadian peers is their approach to HSE, maintenance, and training.

GT: Can you tell us about the national R&D programs for exploration drilling? Do they attract the whole industry in China, and what are the benefits of such programs for diamond drilling and manufacturing?

BT: On the materials science side, the drilling R&D programs are concentrated in a few research institutions that we work closely with. I came from an economics and finance background, so I can’t really tell whether those R&D programs contributed to the industry directly or indirectly. On the application level, many researchers contributed to the industry by demonstrating borehole structure design, drilling fluid composition, and solutions to problems caused by certain geological conditions. Over time, we witnessed a great improvement in drilling speed, portability of equipment, and reliability of tools. The R&D on the application level contributes to the industry’s progress by sharing knowledge and giving guidance.

On the manufacturing side, Jinshi Drilltech surely benefited from better equipment and materials from our suppliers. Much of the progress is R&D- and competition-driven.

GT: Are there any significant Chinese drilling innovations the world has yet to catch up on? On the flipside, are there products/drilling technologies that are popular elsewhere but not so much in China?

BT: In terms of deep hole drilling, China is not limited by a set of exploration drilling tools and methods. Many boreholes—exploration, geological, hydrological, and geothermal—are designed to be deep

and large in diameter. For example, core drilling a 2000 m (6562 ft) borehole with an end diameter of 216 mm (8.5 in) is impossible with a standard exploration drill and tools. Some tools are improvised from the oil and gas sector, and drillers have the flexibility to adjust any parameter on the tools. Overall, this approach provides flexiblity. As the industry inevitably drills deeper, many of the Chinese drilling projects and tools can serve as a reference for drilling in other countries.

In terms of contract exploration drilling, we have a lot to learn from the West in areas like management, HSE, training, and maintenance. Some big Western contractors manage over 50 drills, and this requires a different level of management. The speed is also something we can improve on. In China, most drillers aren’t allowed to and have no incentive to push the drill and tools to their limit to put more core in the box. I don’t know if anyone in China has pulled out even 100 m (328 ft) of core in a shift.

GT: More broadly, what do you think is the future of drilling? What developments are you keeping your eye on?

BT: I don’t see the core drilling business changing significantly in the future. In different markets, the drilling contractors face unique challenges. At the frontier of the drilling industry, some innovations focusing on automation and ESG take place to address the skill shortage and compliance pressure. Contractors in China face different challenges, and as a result, innovations in recent years have focused on cost-cutting. What we all have in common is that we’ll go deeper and deeper. I keep an eye on new developments that increase depth capacity in a cost-efficient manner. Also, I wonder if something will appear to make drillers’ jobs fun with instant feedback to attract the young generation.

GT: Without going into the politics, let’s discuss the Trade War. Have you felt its impact, and what do you expect to happen, particularly in terms of drill supplies manufacturing?

BT: In terms of direct impact on exports, I think the effect is little so far. The tariffs against Chinese steel were implemented over the years by almost all steel-producing countries. Unfortunately, some drilling tools fall into the tubing category, and we have to live with it. I find a reasonable percentage tariff with clear rules acceptable, and in most cases, what affected our business is permits, quotas, and uncertainty.

The global trade system underpinned by the WTO is undergoing significant changes. The growing prevalence of regional trade agreements suggests that, in the future, decentralized production will be of critical importance to manufacturers. On the drilling tool manufacturing side, the trade barriers are not what stopped a newcomer from operating globally. This market was quite segmented and will probably remain so. Jinshi Drilltech still has a shot to become a major international player despite these trade barriers.

GT: Thank you for taking the time to answer our questions! Lastly, what do you do to relax? Do you have any hobbies and interests?

BT: Thanks for your invitation. I like to do some woodworking for entertainment. I practice sports like swimming and tennis to stay fit and happy. For more information

Visit: en.jsexplo.com

Deep Capacity RC Drilling

Diamond Core Drilling

Deep Directional Navi Drilling

Grade Control Drilling

Air-Core Drilling

Underground Drilling

Geotech Drilling

®

Ahougnansou Bouake Quartier 04 BP 359, Bouake 04

+225 8875 1895

+225 0929 4604

Lima

Recon Drilling SAC

Calle. Los Eucaliptos Mz. D

Lote 15, Urb. Los Huertos de Santa Genoveva, Lurín

+51 (0) 1 748 5738

info@recondrilling.com

New Cairo

Katameya Office Park F19

Katameya Heights

+20 22 020 0084

+20 120 1598 527

+20 128 645 4285

La Serena

Recon Drilling SPA

Kilómetro 12

Quinta Los Rosales

Comuna de La Serena 1711112 info@recondrilling.com

Dakar

+225 07 8875 1895

+225 07 8875 1895

Founded by Tim Topham, Topdrill began in 2006 in a small yard in Kalgoorlie-Boulder, Western Australia. Tim, who had relocated from New Zealand after completing a degree in agricultural science, initially aimed for farm ownership and began working as a Driller’s Offsider. But after witnessing the booming mining sector of the Goldfields, Tim quickly shifted his sights to the drilling industry.

The early years were not without their challenges. Tim purchased a second-hand drill rig in 2006, and when things were starting to look up, the Financial Crisis hit. Overnight, drilling contracts became incredibly scarce. Despite the challenges, in 2008, Tim purchased Topdrill’s first brand-new drill rig. From there, Topdrill steadily grew, weathering downturns and market softening by leveraging strategic capital purchases and expanding its capability with industry-first mechanical innovations, such as bringing hands-free rod handling to diamond drill rigs.

Today, Topdrill stands as one of Australia’s largest privately owned, founder-led exploration drilling companies, a testament to relentless determination, innovation, and the ability to pivot in a fast-moving industry. Topdrill’s commitment to delivering exceptional drilling solutions, backed by digital innovation and continuous fleet improvement, is why they are a trusted exploration partner for Australia’s top-tier miners.

Topdrill is more than an exploration drilling company—it’s a complete project partner. Operating across Australia, the company is supported by its wider network, Topgroup, which brings together JB Contracting, Topcamps, and Tophire. This integrated offering means clients benefit from early-stage earthworks, pad preparation, logistics, fully serviced exploration and mine site camps, as well as vehicle hire and mechanical support. All under one trusted group.

What gives Topdrill its competitive edge is the combination of operational excellence, industry-first digital systems, and an uncompromising focus on safety. Unlike larger corporations, Topdrill’s privately owned structure provides the agility to make fast, informed decisions that deliver results for clients. From mobilization through to transparent digital reporting, every stage of the process is built for performance and accountability.

At the heart of Topdrill’s success are its people—highly trained, experienced, and committed to project outcomes. With a strong culture that puts people first, Topdrill continues to set the standard in safety, reliability, and drilling performance across the exploration industry.

Topdrill’s strategic advantage stems from full operational control, extensive remote area exploration experience, and a systems-driven approach that prioritizes safety, drilling uptime, and real-time data transparency. From the carefully selected standardized rigs they run, to the teams that operate them, every operational element is designed and managed to deliver in environments others find technically difficult.

Their integrated structure, reporting capabilities, and proactive maintenance and safety systems ensure Topdrill stay ahead of risk while driving drilling efficiency and delivering value for their clients.

‘Topdrill’s safety protocols and proactive steps to ensure safety and well-being stood out to us. These efforts really highlight how committed Topdrill is to the safety of their people,’ says Kale Ross, GM Safety at Ora Banda Mining.

Renowned for their precision-focused approach and backed by industry-leading equipment, Topdrill specializes in reverse circulation (RC) drilling, diamond (DD) drilling, grade control drilling, and water well drilling. They also offer geotechnical services, including tailings dam work and site investigation.

Topdrill is proud of its reputation and partners with major mining clients, including Northern Star Resources, Greatland Gold, Capricorn Metals, Westgold, Ora Banda Mining, and Brightstar Resources, to name a few. Topdrill was also part of the discovery hole team for De Grey Mining’s Hemi Project and Spartan Resources.

‘Brightstar has chosen Topdrill for safety, professionalism, and efficiency. Beyond the rig, the support provided by Topdrill is second-tonone,’ says Dean Vallve, COO of Brightstar.

With a fleet of over 38 standardized Schramm and Sandvik rigs, and over 400 support trucks and light vehicles, Topdrill has designed a world-class fleet built for precision, power, and reliability.

Backed by an in-house maintenance team, live rig monitoring, AI-powered preventative maintenance servicing, and an aviation team to ensure rapid response across all locations, Topdrill is well known for its fleet of equipment that delivers consistent output with minimal downtime and maximum performance.

Topdrill’s fleet is built tough, choosing only to invest in durable, high-performance equipment engineered to tackle any terrain. The inclusion of innovations such as hands-free rod handling, rod breakout tools, GPS location tracking, and live rig monitoring helps operators work safely and more efficiently.

With a dedicated aviation division, regional operations managers, supervisors, and on-the-ground fitters, Topdrill delivers unmatched responsiveness. Whether it’s a part, a person, or a whole support crew—if it’s needed on site, Topdrill can get it there fast.

Topdrill RIG05 experienced a mechanical failure while on site. Under inspection, it was determined that its engine had blown and required immediate replacement for work to recommence. The Topdrill field maintenance crew removed and stripped the engine. A replacement engine was sent to the site with critical spares, and a mechanic was flown in using the Topdrill aviation team. The new engine was installed, commissioned, and the rig was back up and drilling within 26 hours.

The Topdrill name has become synonymous with safety and performance. Their experience brings an understanding of client responsibilities and a commitment to making compliance effortless through the continuous investment in proactive safety protocols and technology. By leveraging innovations such as real-time data and monitoring, Topdrill is able to mitigate risk, ensuring their people and clients are protected at every stage of the drilling project.

By harnessing data through their proprietary analytics software— Toplytics—Topdrill turns reporting into real-time actionable insights. Toplytics brings 13 different platforms into a single digital solution helping clients make smarter, more informed decisions that optimize performance, mitigate risk, and achieve successful project outcomes.

Through the innovation of Toplytics and AI-powered predictive analytics, Topdrill can identify and resolve any potential issues before they impact productivity. This key feature alone has helped to reduce downtime by 77% over the past five years and increase drilling efficiency by 49%.

Topdrill employs over 400 staff, a considerable expansion from its early days. The team includes skilled operators, experienced tradespeople, qualified managers, a dedicated digital and analytics team, and an extensive support crew.

↑ Topdrill introduces a first-to-market technology, hands-free rod handling integrated across its fleet.

↓ Out in the field, Topdrill’s reach extends across some of Australia’s most remote and challenging landscapes.

↑ Topdrill’s greatest strength lies in its people—skilled, committed, and backed by a strong foundation of training and teamwork.

With the development of Topdrill Drill School, Topdrill ensures all team members are highly trained and safety-focused. Their success isn’t just driven by their industry-leading fleet, but also by having the right people to deliver results, safely and efficiently.

Topdrill’s drill crews are some of the most highly skilled in the industry. Hand-picked for their technical skills and experience, every crew member works within a structured support system and is trained to deliver consistent performance.

Topdrill’s in-field fitters and maintenance team operate around the clock to ensure rigs stay operational and productive. With extensive knowledge and fast response times, they keep drilling programs moving to limit costly downtime in the field.

Exploration doesn’t stop at the rig. Topdrill’s in-house support team works alongside operations to ensure clients receive accurate, timely, and actionable information from the field. Through efficient systems

and digital integration, Topdrill can streamline sample tracking, daily reporting, and data handover to support better decision-making in the field.

One of Topdrill’s standout differentiators is its dedicated safety and training team, which ensures every team member is fully prepared, compliant, and site-ready. From induction through to continuous upskilling, Topdrill embeds a safety-first mindset across all operations and helps crews maintain compliance in dynamic drilling environments.

Culture and inclusion aren’t just a checkbox at Topdrill. They have taken a proactive approach, setting targets and standards for accountability and growth. From attaining a triple ISO rating to the initiation of a strong ESG strategy, Topdrill is focused on doing things the right way, safely, responsibly, and with the future in mind. With benchmarks set across safety, community, and workforce development, Topdrill has committed itself to leaving a lasting positive impact on the environments in which the company works.

Topdrill is recognized for its inclusive culture, having over 20% female executives and senior leadership team members. Its community

endeavors are also well-regarded, having raised over AUD 1.5 million in funds for the Royal Flying Doctor Service and Kalgoorlie-based not-for-profit Full Circle Therapies over the past five years through its Resources Industry Charity Sundowner. Topdrill invests over AUD 200 000 each year in community initiatives, understanding that a strong community supports their families and business.

Their strategic local supply partnerships, such as first-choice procurement with First Nations-owned businesses, a commitment to a 40% decrease in emissions, and early investment into electrification all reflect a broader commitment to community and sustainability.

Topdrill’s journey, from inception through to building one of Australia’s most resilient, digitized, and socially responsible exploration drilling companies, is a remarkable story of grit, vision, and innovation.

As the company nears 20 years in business, one thing is clear—Topdrill continues to lead the exploration industry in safety, performance, and technology. Its people, culture, and community focus will remain the strongest pillars in a competitive landscape.

Visit: topdrill.com.au

Traditionally, Topdrill’s mechanical fitters rely on diesel-powered generators, which present several challenges. These factors highlighted the need for a more responsible and efficient solution. So, in late 2024, the Topdrill team explored the potential of the Instagrid One portable power station supplied to one of Topdrill’s in-field mechanical fitters by APS.

The introduction of the Instagrid One improved vehicle space capacity due to its compact design, required no refueling or dedicated transport, and required no routine maintenance. Able to power high-amperage stick welding, charge a 12V and 8V battery, and support a Starlink unit for a full day, it is estimated that the introduction of the Instagrid One power station will reduce costs by more than AUD 12 000 over the lifespan of the product, whilst reducing emissions by over 20 000 kg (44 092 lb).

by Maksim M. Mayer, Editor at Coring Magazine

Disclaimer: Coring Magazine proudly presents the new statistics of ‘Top mineral exploration drilling contractors for 2024’ ranked by the number of meters achieved exclusively through diamond drilling. All figures were provided and verified by the companies, and were rounded to whole numbers where needed. Results include a mix of calendar and fiscal year data, as noted throughout the text. Some qualifiying companies are not listed, having either declined to participate or not responded.

Coring Magazine cannot be held liable for any errors or inconsistencies presented in this report.

Editorial note: After publication, Major Drilling requested that their data be changed from calendar to fiscal years, as this provides a more accurate comparison.

For FY25 (ended April 30), Major Drilling reported 2 591 763 m (8 503 160 ft). This is an increase of over 55 000 m (180 446 ft) from FY24. Notably, Latin American Explomin Perforaciones which was acquired by Major Drilling Group in November 2024, is included in FY25 and is no longer listed as a separate entity. For FY24, when Explomin was a separate entity, its diamond drilling results were 586 811 m (1 925 233 ft). RC drilling results for the entire Group indicate more significant growth—1 287 131 m (4 222 871 ft) in FY25 versus 917 069 m (3 008 753 ft) in FY24. The company’s fleet totals 708 rigs. Major Drilling is celebrating its 45th anniversary in 2025.

Perenti Drilling Services reported 2 520 949 m (8 270 830 ft) achieved through diamond drilling in FY2025 (ended June 30, 2025). The results mark an 8% increase over 2023. Furthermore, the company has reported increases in RC drilling and aircore results, as well as in revenue and profits. Formed by the mergers of drilling brands DDH1, Swick, Ausdrill, Ranger, and Strike, Perenti has added 9 drill rigs to its fleet, bringing their total to 312.

On the back of a transitional 2024, Boart Longyear has reported 2 238 556 m (7 344 344 ft) achieved through diamond drilling. The decrease can be attributed to the strategic exits from volatile parts of West Africa. Despite the decline, profitability has improved. Management noted they are on track to replace this volume in 2025 and continues their commitment to safety and strategic market entries.

Orbit Garant, celebrating its 40th anniversary this year, reported slightly lower results in FY2024 (ended June 30, 2024; FY2025 not yet available) with 1 310 460 m (4 299 409 ft) achieved, a 10% decrease from the record-breaking FY2023. This was caused by project tailwinds, which are expected to subside in 2025. The company is operating a total of 188 drill rigs and has put an emphasis on innovations in both safety and productivity for its fleet.

Canadian Forages Rouillier achieved 679 729 m (2 230 082 ft) in 2024 through diamond drilling. The company’s results are around 20% higher than in 2023.

Just a few thousand meters behind is Foraco International with 676 529 m (2 219 583 ft) achieved in 2024 (calendar year matches fiscal). Furthermore, the company reported 137 172 m (450 039 ft) of RC drilling and another 180 084 m (590 827 ft) of grade control. These results represent a sizeable decrease from 2023, which Foraco’s reports have attributed to its exit from several volatile markets. The company’s fleet stands at 255 drill rigs.

Hy-Tech Drilling reported a modest decrease in their results for 2024—540 535 m (1 773 409 ft) in 2024 versus 574 464 m (1 884 724 ft) in 2023. Management notes that this shift reflects a growing focus on high-altitude projects, where productivity is influenced by elevation and access. The company’s fleet has, however, increased by 12 machines, reaching 94 drill rigs.

RJLL Drilling, a Canadian company and new entrant to the statistics, reported 486 906 m (1 597 461 ft) achieved through diamond drilling. This result is nearly double their 2023 meterage, which was 252 704 m (829 081 ft). This growth was fueled by more demand, as the company was working on 16 projects in 2024, 7 more than the year prior. Similarly, RJLL’s fleet increased to 32 rigs.

The results of Geodrill and its South American subsidiary Recon Drilling for 2024 also mark an increase of over 20%. The company has drilled 439 645 m (1 442 405 ft) via DD, yet the majority of their results come from RC drilling—825 958 m (2 709 836 ft). The total fleet increased to 102 mostly multipurpose rigs. The company had 38 projects in 2024. As noted previously in Coring, Geodrill reported that 2024 was its best year ever in terms of earnings.

Another company that primarily performs other types of drilling, Capital Drilling, reported achieving 370 948 m (1 217 021 ft) via DD. This is a nearly 50% increase on the results for 2023. The company’s annual report also noted increases in almost every metric related to exploration drilling. Their diamond drilling fleet was 58 and the company had 17 DD projects.

Australian Topdrill, featured in this issue’s In Focus (p. 12), has achieved 233 209 m (765 121 ft) through diamond drilling and another 672 738 m (2 207 146 ft) through RC. Both results are a tremendous growth from 2023, empowered by new projects. The company now has 45 diamond drilling projects utilizing 13 DD rigs, and another 79 RC projects being served by 18 RC rigs.

Arctic Drilling Company, based in Finland, reported 209 738 m (688 117 ft) achieved through diamond drilling and 27 748 m (91 037 ft) of RC drilling in 2024. The results mark a less than 5% increase in DD meterage and an 8% decrease in RC.

GEOPS, a company with similar results, has drilled 208 545 m (684 203 ft) in 2024. This diamond drilling result marks a less than 10% increase over the previous year and a continued trend of growth. Turkish contractor and manufacturer Ortadoğu Drilling achieved 208 428 m (683 819 ft) through diamond drilling in 2024. This is a slight decrease from the year prior, as the company has 31 projects, 4 fewer than in 2023. Ortadoğu Drilling has 40 drill rigs.

Canadian contractor Team Drilling reported 162 000 m (531 496 ft) of DD for 2024. This is a decrease from 2023’s 189 500 m (621 719 ft).

Hall Core Drilling from South Africa reported a decrease in its DD results for 2024—141 902 m (465 558 ft) versus 170 392 m (559 029 ft) in 2023. The company has 28 drill rigs operating on 2 projects.

Finnish KATI Oy (read more about their Sakatti project on p. 24) reported a small contraction in its diamond drilling results, from 143 000 m (469 160 ft) in 2023 to 137 400 m (450 787 ft) in 2024. According to the company, results for 2025 will be better.

In FY2024 (ended March 31, 2025), New Zealand company Alton Drilling reported 98 641 m (323 625 ft) achieved through diamond drilling. The result is a 6000 m (19 685 ft) improvement over their number for FY2023. Read more about their WKP project on p. 30.

Canadian contractor Bryson Drilling, another new entry in the statistics, achieved 72 605 m (238 205 ft) through diamond drilling, which is an improvement of nearly 41% on 2023 results.

Coring Magazine extends its congratulations to all companies for their outstanding results and expresses gratitude for their support!

For over 50 years, Hydracore has been the leader in lightweight big-power drills and rotation heads. The new REVOLUTION P Nitro Head is proving itself across the globe with unmatched uptime, reduced maintenance, and performance that drillers can trust.

Gear-Belt Drive – half the parts, double the reliability

Belt rated for 500HP – built to handle extreme power

Low Maintenance – no leaks, no failures, no wasted time

Proven in the Field – tens of thousands of meters drilled with minimal to zero downtime

Lightest P Head on the market @ 431kg EXPERIENCE THE REVOLUTION. UPGRADE YOUR FLEET TODAY.

Glen Sigstad, Assistant Operations Manager

@ Team Drilling

“Since we started using the Revolution in 2022, we have noticed a significant decrease in repairs which has led to more production hours and a reduced cost.” ~100,000 meters drilled with the Revolution P Nitro Head

Denis Desrosiers, General Manager

@ Rodren Drilling

“We have seen an increase in production time of 32% over a 12-month period on one program alone. Reliable and easy to maintain. Belt drive saves on leaks and possible environmental disasters.”

Jamie Lyons, Co-Owner

@ Atlas Drilling

“We’ve had the new Revolution on our two Hydracore 5000’s for the last two seasons, performing awesome with zero downtime. Both drills were doing 1,500–1,800 meters of NQ at the end and approximately 1,200 meters of HQ. Very happy with both versions of these heads and their dependability!”

Tyler Etches, Shop Foreman

@ Hy-Tech Drilling

50 YEARS OF EXPERTISE SUPERIOR LIGHTWEIGHT POWER UNMATCHED RELIABILITY

“From the shop side, the Revolution - Tech 5000 drill integration was smooth. Out in the field, the feedback so far has been extremely positive. Drillers say it’s awesome to operate and easy to maintain.”

by Ivan Dimitrov, Senior Field Engineer at IMDEX, Outi Ahvenjärvi and Tiia Kivisaari, Project Geologists at Anglo American, Sakatti Project

Assessing rock mass conditions for underground construction, such as tunnels, requires significant investment and extensive investigation. These studies integrate geology, geotechnical engineering, and hydrogeology to understand rock behavior, which is crucial for safe and reliable underground development.

When using diamond drilling from the surface to collect geotechnical data, the number of drill core samples available at the tunnel level is related to the drill hole spacing. Therefore, as geological and geotechnical data is only retrieved from a limited part of the tunnel, inaccurate interpretations can occur and lead to problems if unexpected rock conditions are encountered during excavation.

To enhance data coverage, Directional Core Drilling (DCD) can be employed to guide the drill holes to the planned tunnel level and align with the tunnel path, enabling continuous core sampling along the planned tunnel trajectory. This significantly improves the density

of data and the chances of gaining a complete understanding of rock mass conditions prior to construction.

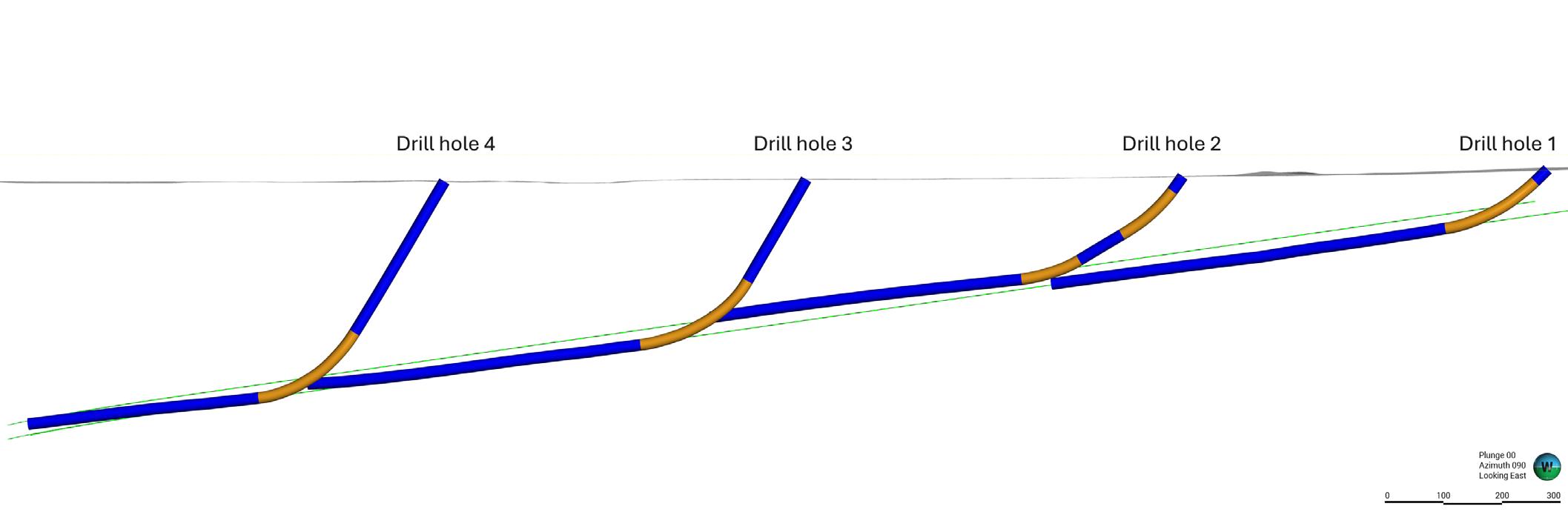

This article presents a case study from Anglo American’s Sakatti project in Sodankylä, Finland, where DCD was used to obtain high-resolution core data along planned tunnel alignments. The drilling was a collaboration between IMDEX, responsible for DCD services, and Oy KATI Ab, which conducted the standard diamond drilling.

The Sakatti polymetallic deposit, with a primary product of copper, is mainly located at 350–1200 m (1148–3937 ft) depth, at the edge of the Viiankiaapa Natura 2000 site. To minimize environmental impact, the concentration plant is planned to be located outside the protected area in a commercial forest. Tunnel access to the underground mine spans more than 5 km (3.1 mi). The project is studying the potential use of tunnel boring machine (TBM) technology for better groundwater management and faster progress compared to traditional drilling and blasting methods.

Anglo American began studying the planned TBM tunnel alignment in 2018, and by 2023, twenty diamond drill holes had been drilled. These were drilled at steep angles, with an average spacing of 200 m (656 ft), and the longest went beyond 400 m (1312 ft). However, the sparse distribution of these holes resulted in insufficient geotechnical data for detailed tunnel planning at the time.

Building on successful experience with directional core drilling during infill drilling at the Sakatti deposit, the team decided to apply the same method to study the TBM alignment. Instead of relying on subvertical surface drilling, the drill holes were turned using DCD technology to follow the tunnel path almost horizontally. This approach enabled continuous core sampling along the proposed tunnel route, providing critical data for strength and stability assessments and informing the proposed mine design.

The horizontal drilling was executed in two winter campaigns—2023–2024 and 2024–2025—comprising six horizontal drill holes in total.

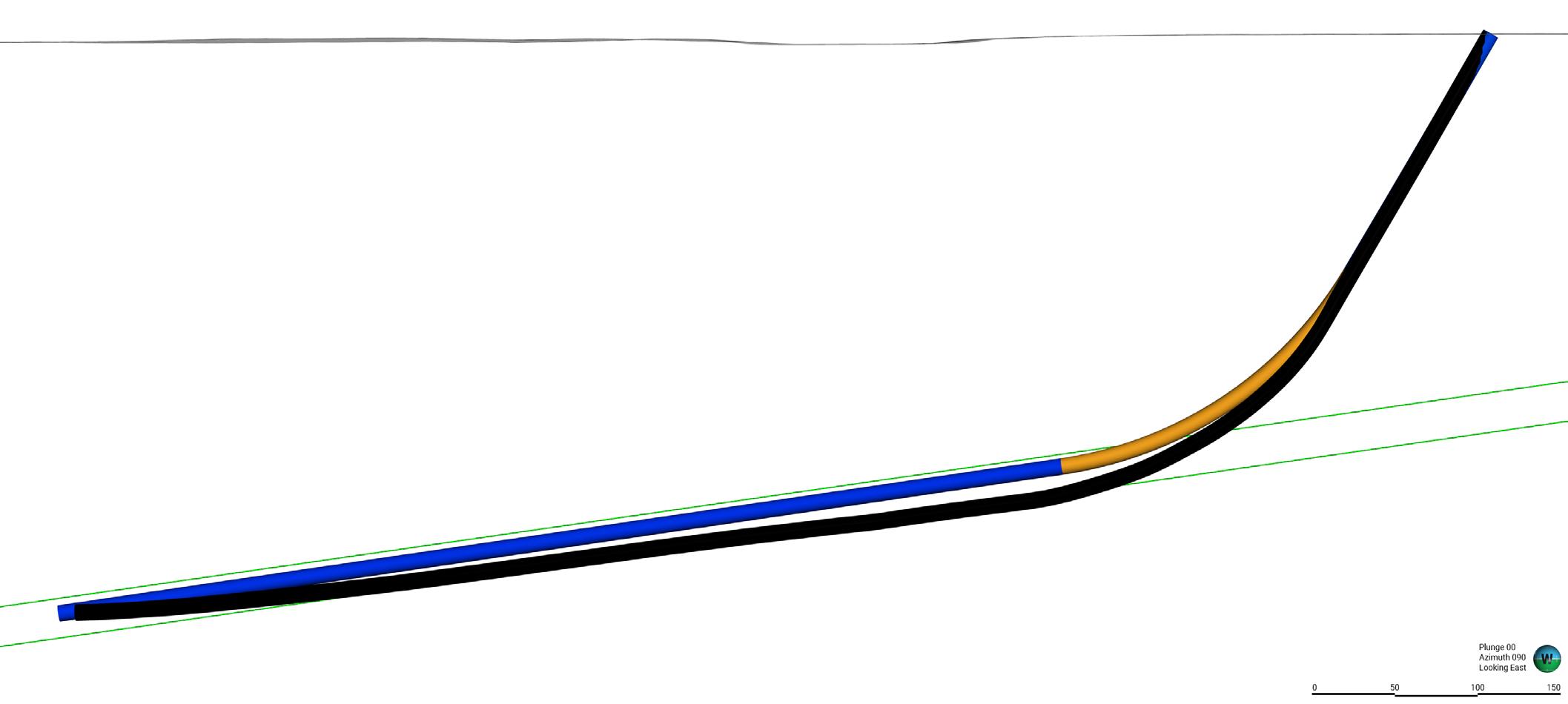

The horizontal drill hole profiles can be structured into three sections:

1. Standard Core Drilling: from the surface down to the point where directional core drilling begins.

2. Directional Core Drilling (DCD): to gradually adjust the drill hole dip to a near-horizontal orientation.

3. Horizontal Drilling: horizontal section along the descending tunnels at an angle of 6°.

Short DCD intervals can also be incorporated within the horizontal section when drill hole path corrections are necessary.

Drill holes were intentionally positioned outside the planned tunnel alignment, maintaining a maximum offset of 20 m (66 ft). This precaution ensured that the drill holes would not interfere with future TBM excavation. To minimize the length of the DCD section, drill holes were initiated at the lowest technically feasible dip angle, typically between 45° and 60°.

Drilling commenced with larger-diameter HQ equipment to stabilize the hole and reduce deviation risks before entering the more complex DCD and horizontal sections. Approximately 5–10 m (16–33 ft) before the DCD phase, the drill string transitioned to NQ size, while the HQ rods were left in place to act as a stabilizing casing. The horizontal section was drilled using NQ rods.

Preliminary drill hole planning began with a thorough assessment of terrain and geological constraints such as known fault zones. Factors such as swamps and wetland areas were considered, as these locations are only accessible to drill rigs during winter when ground conditions are stable and safe.

An estimated drill hole length of 1000 m (3281 ft) was used as a benchmark, based on the assumption that the drill rigs could achieve this distance horizontally. Drilling would start near the tunnel portal area, where the tunnels are planned to be at shallow depths. This location was chosen due to its favorable geology—primarily composed of competent mafic volcanic rock—which was expected to reduce drilling complications. Additionally, the hard ground in this area allowed for easier access during autumn, when the drilling was planned to start.

The first drill hole, located closest to the tunnel portal, was started where the tunnels are at a depth of approximately 100 m (328 ft), allowing the drill to be steered along the tunnel path. Subsequent drill holes were strategically placed to provide continuous coverage along the tunnel alignment toward the deposit. It was crucial to consider that as the tunnel profile deepens, the effective drilling coverage along the tunnel’s path decreases. The final drill hole was planned where tunnels reach a depth of 550 m (1804 ft), leaving the last kilometer (0.62 mi) to be investigated using conventional drilling, rather than horizontal.

A key parameter in directional drilling is dogleg severity, which measures the rate of directional change in degrees per 30 m (98 ft). A dogleg severity of 7° was used, as based on IMDEX’s experience, it would be a realistic value for the whole duration of the DCD sections.

Orebody

Protected area boundary

Mine permit boundary

Access tunnel

Concentrator area

Fresh water intake ⑦ Release of cleaned process waters

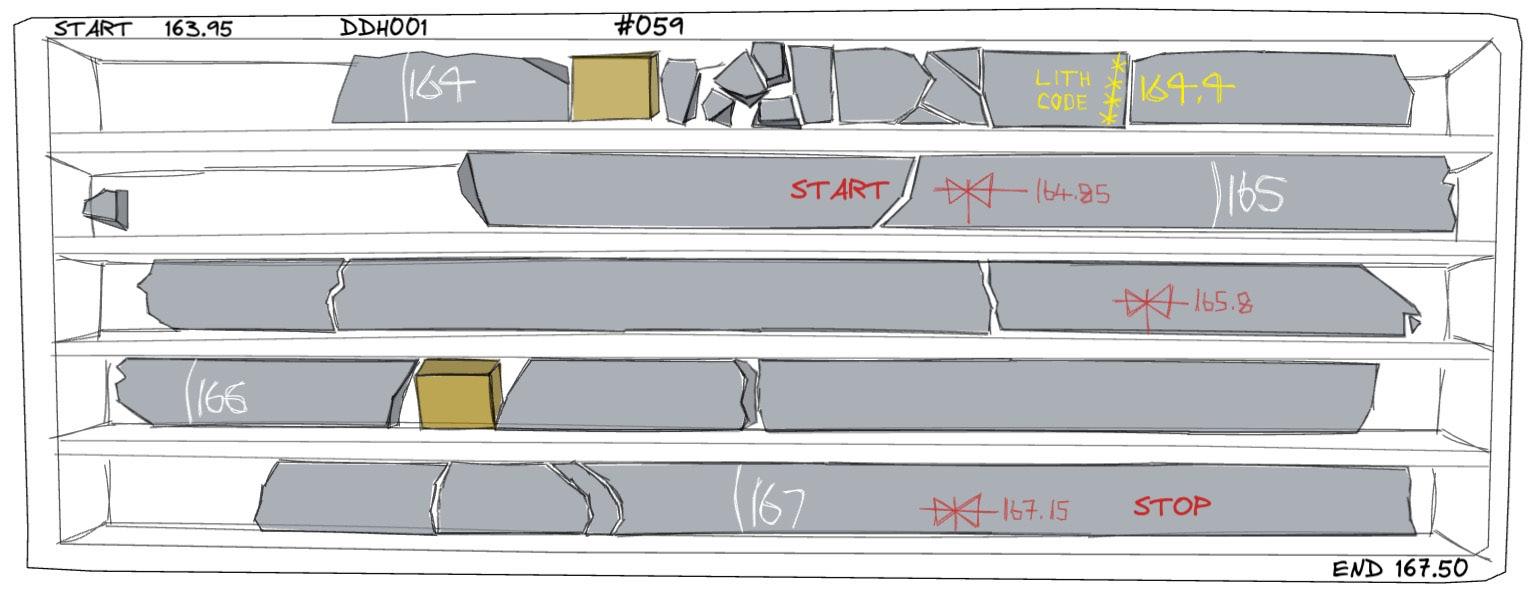

↑ South-north section along planned tunnels, facing towards the east. Picture showing a planned drill hole (blue/orange) and a realized drill hole (black). The orange section represents the DCD section, and the blue—standard core drilling section. Planned tunnel alignment is shown in green color.

During the drilling campaigns, Oy KATI Ab was responsible for conducting the standard core drilling, and their survey team was responsible for the downhole deviation surveys. KATI, which designs and manufactures its own drill rigs, deployed four different units throughout the program. Each rig operates with a closed-circulation system, significantly reducing water consumption and efficiently separating cuttings from the drilling fluid.

The use of drilling additives played a crucial role in overcoming challenges such as collapsing borehole walls, leakage zones, dry holes, and abrasive or clay-rich formations. These additives also helped maintain optimal fluid viscosity, ensuring effective flushing of cuttings from the hole bottom.

IMDEX led the directional core drilling operations. Their engineers worked seamlessly with the drilling contractor to ensure adherence to the drilling plan. This included monitoring borehole deviation, executing long DCD corrections to steer the hole along the pre-planned path, and managing natural deviations during horizontal drilling.

The DeviDrill™ system, used by IMDEX, integrates directly with an NQ wireline drill string and operates with the same equipment and parameters as a standard core barrel. It allows for drill hole steering while simultaneously retrieving a 31.5 mm (1.24 in) diameter core sample.

Drill hole deviation is a common issue in diamond core drilling, influenced by factors such as rock anisotropy, alternating soft and hard rock layers, rock fracture patterns, and broken rock intervals. These geological conditions directly impact the deviation rate in directional drilling sections. One of the key advantages of DCD is its ability to implement corrective adjustments, guiding the drill hole back to its intended trajectory. As such, continuous monitoring and adaptive planning were essential throughout the horizontal drilling campaigns to mitigate geological factors.

The drilling program comprised of a total of six drill holes, each steered to follow the planned tunnel path in a near-horizontal orientation. Drill Holes One, Two, and Three closely adhered to their intended trajectories from the surface through the initial straight section to the kick-off point. These were followed by directional core drilling sections ranging from 170 to 220 m (558 to 722 ft), successfully guiding the holes into the designated TBM tunnel alignment with high precision.

At Drill Hole Two, an alternative approach was applied: two separate 100 m (328 ft) DCD sections were interspersed with 100 m (328 ft) of standard core drilling. This method was used exclusively for that drill hole, as planning showed that a single long DCD section from that collar position wouldn’t overlap precisely with the end of the first drill hole.

Once the drill holes were aligned with the tunnel path, the methodology reverted to standard core drilling. During this phase, a couple of minor directional corrections were made due to drill hole drift. Collectively, the first three drill holes contributed 2100 m (6890 ft) of exploration core drilling parallel to the planned TBM trajectory.

Valuable insights were gained during the drilling of the first hole. For instance, the importance of maintaining the pre-planned trajectory was evaluated, resulting in more frequent corrections in the horizontal section compared to later holes. Additionally, the impact of natural deviation in horizontal drilling was not fully understood before this project, as previous drill holes had been much steeper.

Drilling intersected both known and unknown fault zones. In some cases, the dip and direction of drilling allowed penetration through structures that had previously caused significant issues with almost vertical drilling. Challenging rock conditions suggested the potential need for grouting, a technique used in other projects. While core samples from standard drilling were generally solid, those obtained during DCD—due to their smaller diameter—were often more fractured. However, the use of appropriate drilling additives ultimately

↑ South-north section along planned tunnels, facing towards the east. Drill Holes 1, 2, 3, and 4. The orange part of the drill hole shows the DCD section, and the blue parts—standard core drilling sections. Planned tunnel alignment is shown in green color. The true vertical depth of the end of Drill Hole 4 is 410 m (1345 ft).

stabilized the structures, eliminating the need for grouting.

As the tunnel profile deepened, Drill Holes Four and Five required longer straight sections before entering the main DCD phase. The lithology in these areas consisted largely of disrupted zones with varying hardness, and broken rock intervals persisted throughout the directional drilling. These conditions made it difficult to follow the original trajectory precisely, resulting in extended DCD sections of 200 to 220 m (656 to 722 ft). Despite these challenges and through collective efforts, the drill holes were completed within the planned tunnel path limits, investigating 700 m (2297 ft) alongside the TBM alignment.

Drill Hole Six, located closest to the deposit, was drilled in the opposite direction to the previous holes, as the tunnels were already at a deeper level. Like the others, this drill hole consisted of the same three segments—standard core drilling, DCD, and horizontal drilling—but the horizontal section was executed at a slightly steeper angle.

Although this hole did not follow the tunnel path but rather intersected it, geologically, this was enough to obtain representative samples from the area.

Despite encountering highly fractured rock intervals and other geological challenges, the project successfully achieved the majority of its predefined objectives. The completion of all six drill holes yielded a total investigated length of 3000 m (9843 ft) within the planned TBM trajectory, consistently maintaining exceptional overlapping precision between each drill hole.

Directional Core Drilling (DCD) provides an optimal solution for tunnel investigation projects, offering precise control over drill hole trajectories. By overlapping drill holes within tunnel sections, DCD allows the continuous study of the planned tunnel path, regardless of lithological complexity.

One of the key advantages of this method is the ability to obtain core samples from each directional drilling section. Gathering comprehensive data along the pre-planned tunnel alignment is essential for ensuring the safe and successful construction of tunnels.

IMDEX, with its long-standing experience in geotechnical projects, demonstrated the effectiveness of its technology and field engineer expertise throughout this campaign. Their proven, reliable systems and collaborative approach consistently ensure the successful completion of projects. For

Visit: imdex.com , angloamerican.com , oykatiab.com

xFORM multifunctional fluids eliminate the guesswork from onsite preparation and execution. With a single fluid solution, you can trust that your mud program will be optimised from the start.

Simplify inventory management with a streamlined supply chain designed to support your next drill site. Reduce administrative overhead with just one fluid to register for QHSE compliance and risk assessment.

Rely on lab-developed, field-tested multifunctional formulas, backed by over 40 years of experience helping drilling contractors achieve optimal results.

Alton Drilling Limited is a New Zealand-owned company with deep roots in Waihi, the country’s gold mining hub, and the base for Alton Drilling’s main office and workshop. Known for being resourceful, genuine and respectful, the company has built a strong reputation for delivering safe, efficient, and tailored drilling solutions across some of New Zealand’s toughest terrains.

Beyond technical expertise, it invests heavily in its people, fostering a culture of continuous improvement and innovation. This commitment positions Alton Drilling as a trusted partner in advancing exploration and resource development across New Zealand and beyond.

Located 10 km (6.2 miles) north of Waihi in steep, dense bushland, the Wharekirauponga Exploration Area (WKP) is one of New Zealand’s most challenging exploration environments.

At WKP, Alton Drilling operates from three active drill sites, with the EG vein zone being the current near-term focus. Strict environmental consents restrict drill platforms and work areas to just 144 m2 (1550 ft2). Rigs are kept busy year-round, 24 hours 7 days a week. Hole depths range from 500 to 700 m (1640–2296 ft). Many are steered using a combination of Alton-built PQ casing wedges and contracted Navi tool equipment. So far, we have successfully drilled 10 daughter holes from one mother hole, with an inclination set at -40° and a lifting up to -13°.

The WKP Exploration Area (as part of the Waihi North Project) has now been submitted for fast-track approval, a significant step in advancing this resource into its next stage of development.

With its own in-house manufacturing division, Alton Drilling designs and adapts equipment to meet the unique demands of each project. This capability is central to the company’s success at WKP.

The heli-portable SC11 drill rig, enhanced with a rod handler and synchronized chuck, enabled angled drilling and safer intercepts.

Shallow, angled holes generally require a larger diameter casing than what is compatible with the SC11 drill. Running and retrieving PW casing had always been done manually in the past, using clamps and pipe wrenches without the aid of a winch, which led to injuries.

The PW rod handler conversion kit, developed by Alton Drilling’s manufacturing division, eliminated manual handling injuries by adapting existing components for safer casing operations.

These innovations ensured efficiency and precision drilling, while upholding the highest safety standards.

Recent changes to regional water take requirements have driven Alton Drilling to rethink water and power systems. Historically, mechanical pump stations operated continuously, supplying the rigs and redirecting any unused water back to the water source. Continuing with this method would have exceeded the new take limits and increased downtime due to weather impeding helicopter access.

To solve this challenge, mechanical pumps were replaced with electric pump systems with optional telemetry monitoring, cutting downtime and reducing environmental impact. Additionally, the setup cost is significantly lower, with savings multiplying as more rigs are added to the project.

To address the issue of housing up to 18 employees in New Zealand’s

challenging conditions, the company designed and built modular, insulated camps that have been tested and proven in some of the country’s harshest climates.

Another logistical challenge arose when attempting to gain a better understanding of the aquifer in WKP led to an increase in geotechnical drilling and a need for pump vein testing. The drill sites were limited to any clearings in the bush canopy where a small Alton-built LT140 drill could be lowered through and reassembled. The pump vein testing required our workshop team to disassemble and then reassemble a 2-ton air compressor and transport it via helicopter to an existing drill site, showcasing the ingenuity and resourcefulness of Alton Drilling’s team in the process.

Over the past eight years, Alton Drilling has completed more than 100 exploration holes at WKP, generating the data and confidence needed for ongoing resource growth.

By combining creative problem-solving, engineering innovation, and a strong people-first culture, the company continues to cement its reputation as a leader in remote and complex drilling projects, both in New Zealand and internationally.

‘Innovation, safety, and people are the foundations of Alton Drilling’s success at WKP.’

In the high-stakes world of drilling, where every meter counts and every delay costs, one company is quietly transforming how the industry approaches data. Krux Analytics, founded in 2016 in Calgary, Alberta, is not just a software provider - it’s a catalyst for operational transformation.

With a mission to empower drilling teams through better data, Krux is helping resource owners and service providers unlock performance, reduce costs, and make smarter decisions in real time.

Krux was born from a simple but powerful idea: drilling teams deserve better data. Founder and CEO Jody Conrad, a field-data management expert with over two decades of experience in oil and gas operations, saw firsthand how manual data entry and fragmented systems were holding teams back. Her vision was to build a platform that turns raw drilling data into actionable insights.

Starting as a lean startup, Krux worked hand-in-hand with drillers and field teams to develop tools grounded in real-world workflows. Early versions focused on eliminating inefficiencies caused by paper plods and inconsistent spreadsheets. Over time, Krux has evolved into an enterprise solution offering real-time analytics, mobile reporting, and seamless integrations with other drilling industry solutions.

In 2023, Krux entered a strategic partnership with global mining-tech leader IMDEX, which acquired a 40% stake in the company. This move accelerated product development, expanded Krux’s global footprint, and deepened its capabilities in predictive analytics and workflow automation.

Today, Krux operates across six continents and is a trusted partner to many of the world’s largest resource owners and drilling service providers.

At its core, Krux is a data platform that enables teams to collect, validate, and analyze drilling data in near real-time. The platform provides a single source of truth for operational data—ensuring consistency, transparency, and trust.

‘We’re unapologetically obsessed with data quality,’ says Jody. ‘Because when your data is clean, consistent, and validated, everything else—performance, cost control, decision-making—gets better.’

Key capabilities include:

• Operational cost tracking: analyze costs in real time, compare performance vs. plan, and identify inefficiencies.

• Enhanced drilling performance: monitor and compare drilling programs across sites and rigs.

• Integrated workflows: built-in APIs allow seamless connection to existing systems for payroll, reporting, and analytics.

Krux’s solutions are purpose-built for the future, challenging the status quo with tools that empower mining teams to make smarter, more holistic decisions. The platform is modular, scalable, and user-friendly. It is suitable for both small operations and enterprise-scale deployments.

Krux’s product suite is designed to optimize drilling workflows from the rig to the boardroom.

KruxLog

A mobile app for entering daily shift reports (DSRs), timesheets, and operating data. It eliminates manual paper logs and spreadsheets, ensuring consistent data capture at the source.

A web-based platform for performance tracking, cost analysis, and KPI monitoring. It features customizable dashboards, drill plan imports, and data exports that give teams the insights they need to optimize their drill programs, fast.

The platform is built on a robust technical architecture that supports real-time data flow, secure cloud storage, and seamless integration with third-party systems. Krux’s APIs allow clients to plug drilling data directly into their existing workflows—whether for payroll, reporting, or advanced analytics.

Unlike legacy systems, Krux offers a unified, validated, and transparent data environment. This not only improves operational efficiency but also enables strategic decision-making based on accurate and timely insights.

Krux’s global team includes geoscientists, drillers, data scientists, and software engineers—many of whom have firsthand experience in the field. The team understands the challenges faced by those in the field and those back in the office. That’s why they are focused on building solutions that work in both worlds. With around 50 employees worldwide, the company maintains a startup spirit while delivering enterprise-grade solutions.

The culture at Krux is built on collaboration, innovation, and impact. Employees are empowered to challenge assumptions, contribute with ideas, and shape the future of drilling optimization. Flexible work arrangements, as well as inclusive leadership, are central to the company’s ethos.

↑ KruxMetrix, a web-based platform for performance tracking, cost analysis, and KPI monitoring

← Hole path detail in Krux Analytics

Krux’s technology has helped clients across the globe achieve measurable improvements in drilling performance.

Barrick faced significant challenges at a remote site in Argentina. Data was inconsistent and hard to manage, with gaps in drill density affecting orebody confidence. Over 25 rigs operated by multiple drilling companies were reporting inconsistently, and harsh weather conditions caused logistical delays.

By implementing Krux across all contractors, Barrick digitized and standardized drilling activity logs, tied contractor payments to drilling metrics, and analyzed standby time, downtime, and rig productivity.

The results:

• Standby reduced from 66% to 46%;

• Downtime dropped from 9.5% to 6.1%;

• More meters drilled—without adding rigs.

‘It’s results like those seen by Barrick that show just how important good drilling data is,’ says Jody. ‘Imagine what a difference we could see across the industry if everyone prioritized their data.’

Capital Drilling faced inconsistent reporting and delayed data across their operations. Manual data-entry processes led to billing inaccuracies, operational inefficiencies, and a lack of real-time visibility.

By implementing Krux’s intuitive platform, Capital standardized reporting across contractors and projects, enabling faster, more accurate decision-making. Field teams focused on drilling while office teams accessed validated data instantly—eliminating end-of-month surprises and accelerating payment cycles.

The result: improved transparency, reduced costs, and a competitive edge.

‘Moving from our old system to Krux has seen a far more streamlined approach. The data is cleaner, it’s approved, the client signs it off, and you can move on to the next day,’ says William Ward, Operations Manager – East Africa at Capital Drilling.

These examples highlight Krux’s ability to deliver not just software, but operational transformation.

Krux is more than a technology provider; it’s a trusted industry partner. The company actively collaborates with clients, contractors, and industry bodies to drive innovation and set new standards for drilling data management.

Jody Conrad and her team strongly believe in the power of the collective industry. That’s why Krux works closely with customers and partners to drive the drilling industry forward. No one company can do it alone, but true drilling optimization can be achieved together.

Krux’s product roadmap is shaped by customer feedback and evolving industry needs. Whether it’s integrating with new systems or developing features for emerging markets, Krux always builds with the future in mind.

• B20 Drill Heads “H” & “P”

• 12HH Chuck Assy’s

• “H” & “P” Hydraulic Clamps

• Quality Repair Parts

• Jaw Sets

- Boyles 12HH, 35PH

- LY Nitro Chuck

- Christensen

- MiRoW “P” Clamp

Looking ahead, Krux is focused on continuous improvement, guided by customer feedback and industry trends.

‘We see tremendous opportunity to create a more interactive experience between drillers and their data,’ says Jody. ‘Machine-generated data can automatically populate up to 80% of the Daily Shift Report, enabling drillers to validate and complete the rest. This drives standardization and efficiency right at the source, making data cleaner and processes faster.’

But the real power lies in using that data to actively guide the drilling process itself. Krux wants to help drillers answer key operational questions in real time: Has the rock hardness changed? Have I already drilled through the target zone? Do I have enough weight on the bit? Krux’s goal is to deliver real-time feedback and insight that improves decisions at the rig, not just in the office.

Krux believes the future of mining lies in the optimization of its biggest asset—data. With Krux, innovation isn’t an add-on. It is the foundation.

In this Issue:

Q&A from the experts

In conversation with Steve Beresford, Director of Power Metallic

Beer and geology

You can’t have one without the other by Richard Fink, former Vice President - Technical (retired), Global Ferroalloys at Cliffs Natural Resources

Core photography guidelines by Brenton Crawford, Chief Geoscientist at Datarock

Folding through time

Unravelling orogenic imprints in the Aravalli Supergroup, NW India by Dr Jaideep Kaur Tiwana, Geologist at Geological Survey of India

Steve Beresford Director of Power Metallic

Steve Beresford is an exploration geologist based in Perth, Western Australia. He is an ex-university Professor at UWA (and lecturer at Monash University), ex-Chief Geologist of three major mining companies, part of the WMC mafia, and founder and advisor to numerous junior metal explorers.

Steve’s focus is polymetallic Ni-Cu-PGE deposits with companies in Canada, Central Asia, and Europe. His field experience spans across 70 countries, and he has worked on the majority of the world’s nickel sulfide camps and explored on six continents. Steve has been involved in a few major initiatives, such as coauthoring UNCOVER and Australia’s decadal plan for Earth Sciences, and two major discoveries, but these days he tries to just walk the talk. He’s also on the board of Power Metallic, which is in the middle of a polymetallic Cu-PGE discovery in Quebec.

Brett Davis: Firstly, thanks for giving Coring the opportunity to talk, Steve. I’ve been a fan of your work and musings for a long time, and it’s a real pleasure to sit down and chat with you. Can we start by having you tell the readers what interested you in a career in geology?