A

Th e

Component Manufacturing dverti$er

Adverti$er

Don’t Forget! You Saw it in the

January 2018 #10222 Page #79

Lumber Briefs

LAYMAN'S LUMBER MARKET BRIEF By Matt Layman COMPONENT MANUFACTURER'S EDITION Publisher, Layman’s Lumber Guide

Hello 2018... The Year of the Bearish Lumber Market Hello 2018...The Year Of the Bearish Lumber Market Matt Layman, Publisher January 2018

T

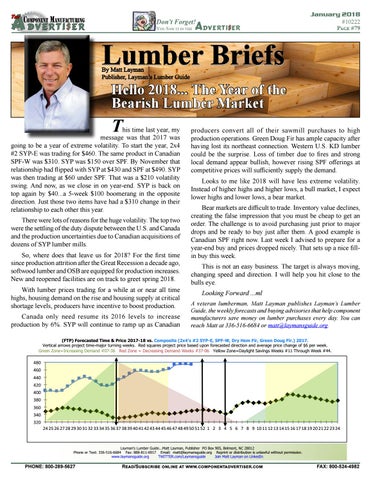

This time last year, my message was that 2017 Canada only need resume its 2016 levels to increase his time year, myproduction producers convert their sawmill to high was going to be a year of extreme volatility. Tolast start by 6%. SYP all will of continue to ramp purchases up as message was that 2017 was production operations. Green Doug Fir has ample capacity the year, 2x4 #2 SYP-E was trading for $460. The Canadian producers convert all their sawmill purchases to after going to be a year of extreme volatility. To start the year, 2x4 lost its northeast connection. KD lumber same product in Canadian SPF-W was $310. SYP was high having production operations. Green DougWestern Fir has U.S. ample #2 SYP-E was trading for $460. The same product in Canadian could be the surprise. Loss of timber due to fires and strong $150 over SPF. By November that relationship had capacity after having lost its northeast connection. SPF-W was $310. SYP was $150 over SPF. By November that local demand appear bullish, however rising SPF offerings at flipped with SYP at $430 and SPF at $490. SYP was Western U.S. KD lumber could be the surprise. Loss of relationship had flipped with SYP at $430 and SPF at $490. SYP competitive prices sufficiently supply appear the demand. then trading at $60 under SPF. That was a $210 timber due to fires andwill strong local demand was then trading $60now, under That in was $210 volatilitybullish, however rising SPF offerings at competitive prices volatility swing. at And as SPF. we close onayear-end. Looks to me like 2018 will have less extreme volatility. swing. as again we close in on year-end. SYP is back onwill sufficiently supply the demand. SYP is And back now, on top by $40...a 5-week $100 Instead of higher highs and higher lows, a bull market, I expect top again byin$40...a 5-week direction. $100 boomerang in the boomerang the opposite Just those twoopposite Lookshighs to meand likelower 2018lows, will have extreme lower a bearless market. direction. Just those two change items have had arelationship $310 changetoin theirvolatility. Instead of higher highs and higher lows, a bull items have had a $310 in their markets arehighs difficult trade.lows, Inventory value declines, each other this year. relationship to each other this year. market, IBear expect lower andtolower a bear creating the false impression that you must be cheap to get an There lotsofofreasons reasons huge volatility. There were were lots forfor thethe huge volatility. The top twomarket. order.markets The challenge is to avoid purchasing justvalue prior to major The top two were the settling of the duty dispute Bear are difficult to trade. Inventory were the settling of the duty dispute between the U.S. and Canada dropscreating and be ready to buy just afterthat them. goodbe example is between the U.S. and Canada and the production declines, the false impression youAmust and the production uncertainties due to Canadian acquisitions of Canadian SPF right now. Last week I advised to prepare for a uncertainties due to Canadian acquisitions of dozens cheap to get an order. The challenge is to avoid dozens of SYP lumber mills. of SYP lumber mills. year-end buyprior and to prices dropped setstoupbuy a nice fillpurchasing just major drops nicely. and beThat ready where does So, where does that that leave leave us us for for 2018? 2018? For Forthe thefirst timejust after A good example is Canadian SPF right in buythem. this week. since production attrition after the Great Recession a decade ago,now. Last week I advised to prepare for a year-end buy first time since production attrition after the Great This is not an easy business. The target is always moving, Recessionlumber a decade ago,are softwood lumber and OSBincreases.and prices dropped nicely. That sets up a nice fill-in buy softwood and OSB equipped for production changing speed and direction. I will help you hit close to the are equipped for production New and reopened facilities areincreases. on track toNew greetand spring 2018. this week. bulls eye. reopened facilities are on trackfor to agreet spring With lumber prices trading while at or 2018. near all time This is not an easy business. The target is always ...mldirection. I will help you hit With lumber prices trading for a while at or near all moving, Looking changingForward speed and highs, housing demand on the rise and housing supply at critical time highs, housing demand on the rise and housing closeAtoveteran the bulls eye. lumberman, Matt Layman publishes Layman’s Lumber shortage levels, producers have incentive to boost production. supply at critical shortage levels, producers have Guide, the weekly forecasts and buying advisories that help component Canadatoonly resume its 2016 levels to increase incentives boostneed production. Looking Forward...ML manufacturers save money on lumber purchases every day. You can production by 6%. SYP will continue to ramp up as Canadian reach Matt at 336-516-6684 or matt@laymansguide.org. (FTP) Forecasted Time & Price 2017-18 vs. Composite (2x4's #2 SYP-E, SPF-W, Dry Hem Fir, Green Doug Fir.) 2017. Vertical arrows project time-major turning weeks. Red squares project price based upon forecasted direction and average price change of $6 per week. Green Zone=Increasing Demand #07-36 Red Zone = Decreasing Demand Weeks #37-06 Yellow Zone=Daylight Savings Weeks #11 Through Week #44.

480 460 440 420 400 380 360 340 320

24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Layman's Lumber Guide...Matt Layman, Publisher PO Box 905, Belmont, NC 28012 Phone or Text: 336-516-6684 Fax: 888-811-6917 Email: matt@laymansguide.org Reprint or distribution is unlawful without permission. www.laymansguide.org TWITTER.com/Laymansguide Join Matt Layman on LinkedIn

PHONE: 800-289-5627

Read/Subscribe online at www.componentadvertiser.com

FAX: 800-524-4982