Accessory Dwelling Unit (ADU)?

whatever) or with help from parents/ children/friends.

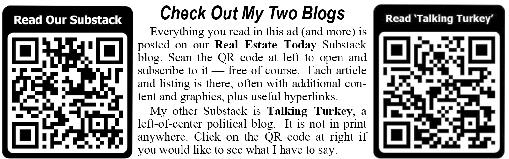

In my Real Estate Today column on February 20, 2025, which you can read on my blog referenced above, I discussed the basics of ADU finance. Today, I want to talk a bit more about the dynamics involved.

Financial issues are an impediment to getting an ADU built because of two general issues.

Have a friend or relative co-sign for the loan (a solution that could involve sharing ownership of the real estate).

Consider ways to show the lender the value of the ADU. A rental agreement with the tenant who will occupy the ADU, explain the ongoing rental value, or show how the ADU will increase the value of the real estate (thus increase the value of the mortgage security). Note, this sort of thing is just now being taken into account by the mortgage industry.

ADU and leave the primary mortgage in place; the result would be a “blended” interest rate that may be more palatable. In addition, there is an emotional issue, which may be present in buyers of moderate means. Taking on substantially more long-term debt can be intimidating. The “need” has to overcome the understandable reluctance.

So, you want to put an ADU on your property. How do you pay for it?

A couple of basics. First, an ADU is part of an existing piece of real estate (a primary residence). As a result, assuming money is borrowed to pay for it, the loan will be within the mortgage finance industry. Until recently, very few in that industry were knowledgeable about ADUs, much less about how they could be financed. Banks, other lending institutions, mortgage brokers, government finance authorities, didn’t understand how they fit in, but that is changing. Second, the amount of the loan will be relatively significant, far more than purchasing a nice automobile, or a

Credit Qualification. As anyone who has purchased a home knows, the mortgage industry has an extensive process to determine the credit worthiness of a borrower for a particular transaction (income, debt-toincome ratio, credit score, etc.). This is one of the reasons the majority of ADUs are built by relatively well off homeowners. For those of moderate means, financing the construction can be a challenge. This is unfortunate, because those are the homeowners who might benefit most having an ADU for intergenerational housing and, in the long term, creating rental income and building wealth by enhancing the value of their most valuable asset, their home. If a homeowner has a real need, and is determined to build the ADU, here are some practical suggestions that might improve credit worthiness:

Lower the amount of the loan and thus the monthly payment by increasing the down payment, using available cash (savings or

Successful Program Teaches Trades for the Autistic

I recently learned about a fascinating program called TACT — Teaching the Autistic Community Trades. I was so inspired visiting their Denver facility that I must share it with you!

TACT is a pioneering and innovative nonprofit organization that provides hands-on vocational and technical training to young adults with Autism Spectrum Disorder (ASD). TACT aims to combat the historically high 90% under- and unemployment rate within this community by equipping individuals with practical skills that lead to sustainable careers. Through its immersive training programs, TACT is preparing young people with ASD — who now represent 1 in 36 children — for high-demand careers in the skilled trades. TACT offers a wide range of programs, including auto mechanics, computer coding, cybersecurity, carpentry, electrical work, electric vehicle conversions, 3D modeling, welding, and culinary arts.

As a “specialized day school,” TACT also bridges the gap between secondary and postsecondary education, creating clear pathways to employment. Its programs empower students to become more independent and earn a living wage in high-skill, high-wage occupations. TACT remains the first and only trade program in the country designed specifically for individuals with ASD, and it has positively impacted thousands of individuals and families throughout Colorado.

TACT envisions a world where neurodiversity is not only accepted but celebrated, allowing individuals on the autism spectrum to fully contribute their talents and find personal fulfillment. With a mission to empower the entire spectrum of individuals with ASD through education and employment in the skilled trades, TACT continues to build on a strong foundation, fostering opportunities for success. I’ve posted an inspiring video at http://RealEstateToday.substack.com

In Colorado, legislation supporting ADU development (which takes affect this July) includes a provision (and some funding), tasking the Colorado Housing and Finance Authority (CFHA) with organizing a program that would help ADU purchasers of moderate means qualify for financing. That program should be announced soon.

Lower the cost of the ADU by choosing lower cost options, ranging from less expensive building materials to things like more affordable appliances.

Borrower reluctance. It should come as no surprise that interest rates play a major role. Homeowners can use the equity in their main residence (by refinancing their current mortgage) to build the ADU. However, if the primary mortgage carries a low interest rate, as most do these days, the borrower will not want to refinance at current rates.

A good alternative is to apply for a home equity line of credit (HELOC) to pay for the

Finally, there is the possibility of a third party (someone not living on the property) investing in the ADU, thus facilitating the financial piece. Under recent legislation the legal mechanisms to make it work would need to be developed. It is an interesting possibility and could overcome the financing obstacles, particularly for those of moderate means.

Although the dynamics are very different, a similar idea has been tried in South Africa to help ease the need for housing there. I have a link to a Bloomberg article about that project on my blog.

To help with these issues, Verdant Living has published a very useful buyers guide, BuyersGuideColoradoADUs.com, with advice on financing. Another good resource is the VerdantLiving.us, or contact John Phillips at 303-717-1962

I want to thank the following people in addition to John Phillips for their input: Jaxzann Riggs, The Mortgage Network; Kristen Stultz, Macro Financial; Charles Edington, LOANstar; Cindy Beier, Cindy’s Property Solutions.

Next month: Why smaller living spaces work well

These Past “Real Estate Today” Columns May Interest You

Clickable links for each column can be found at www.JimSmithColumns.com

May 29, 2025 — Divorcing Couples With a Home Need a Realtor With Specialized Training

May 22, 2025 — Home Sharing Helps Single Seniors Deal With Finance and Loneliness, Allowing Them to Age in Place

April 24, 2025 — Lennar to Build 1,500 Geothermal Homes; My Review of the Mustang Mach E

April 17, 2025 — Redfin Report Highlights the Increasing Cost of Buying versus Renting a Home

April 10, 2025 — The Typical Wood-Frame, SiteBuilt Home So Common Since the ’90s May Soon Be a Thing of the Past

Mar. 27, 2025 — Here’s How Money Is Handled at a Real Estate Closing

Mar. 20, 2025 — Thinking of Using a Reverse Mortgage to Purchase a Home? Here’s Some Information

Mar. 13, 2025 — Will Colorado Be Able to Sustain Its ‘Green Agenda’ Under Pressure From Washington?

Pollutants Emitted When Cooking With Gas

Oct. 31, 2024 — Cooperative Living Presents an Attractive Alternative for Downsizing Seniors

Sept. 26, 2024 — Some Thoughts on Keeping Your Death From Becoming an Undue Burden on Your Heirs

Sept. 5, 2024 — What Knowledge and Skills Should You Expect Your Real Estate Agent to Have?

Aug. 8, 2024 — Seniors Over 70 Might Consider Downsizing Into a Rental, Not a Smaller Home

July 25, 2024 — Many Homeowners Don’t Understand Title Issues, Which Could Lead to Big Problems Later On

June 6, 2024 — Here Are Some Simple Steps to Take to Avoid Unpleasant Surprises After Closing

Mar. 21, 2024 — What’s Behind the Buzz About ‘Indoor Air Quality’ and ‘Sick Building Syndrome’?

Feb. 22, 2024 — Most Sellers Don’t Know How to Interview a Listing Agent. Here’s Some Guidance.

We May Have Underpriced This Amazing Home!

$1,195,000

Here’s why. The fully equipped 511-sq.-ft. heated workshop shown here is included in the 3,500-sq.-ft. custom-built home at 2069 Garrison St. in Lakewood. Every possible power and hand tool a carpenter might want is in this workshop. The rest of this 3-bedroom/3-bath house is amazing, too, starting with the great kitchen, which has a built-in Miele espresso machine (my favorite!) plus a Sub-Zero refrigerator with cherrywood doors to match the kitchen cabinetry. The seller-owned 17-kW solar photovoltaic system meets all the electrical needs of the home, including charging the seller’s electric car. See all these features and more in the 11-minute video tour I posted at www.GRElistings.com. The website contains more photos and full descriptions of each room. Sorry, there will be no open houses. Call your agent or me at 303-525-1851 to see it in person.

Mar. 6, 2025 — 62% of Americans Think a 20% Down Payment Is Required, But It’s the #1 Myth

Feb. 27, 2025 — As Society Deals With Homelessness and Affordability, Expect a Greater Focus on Manufactured Homes

Feb. 20, 2025 — We Have a Tool to Help You Find the ‘Perfect’ Home That’s Not on the MLS

Dec. 26, 2024 — As Pro-Tenant Laws Expand, Some Small Landlords Are Considering Cashing Out

Dec. 19, 2024 — What Are the Costs of Buying or Selling a Home in Colorado?

Nov. 7, 2024 — We Need to Take Seriously the

Dec. 21, 2023 — D.R. Horton Inks Deal to Build Homes With OSB Made From Grass Instead of Wood

Nov. 23, 2023 — Scamming Has Become Its Own Industry, and We’re All Prospective Victims

Sept. 28, 2023 — Insurance Companies Are Pulling Out of California. Is That in Our Future?

Aug. 10, 2023 — What Are Some Common Mistakes That Homeowners Make When Selling?

June 15, 2023 — Don’t Let Capital Gains Tax Deter You From Cashing Out on an Investment Property

May 11, 2023 — Do Agents Inflate the Cost of Buying or Selling Your Home with ‘Junk Fees’?