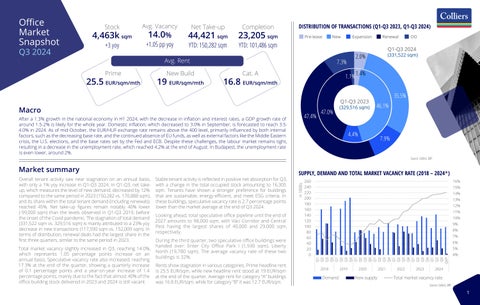

23,205 sqm YTD: 101,486 sqm

Avg. Rent

After a 1.3% growth in the national economy in H1 2024, with the decrease in inflation and interest rates, a GDP growth rate of around 1.5-2% is likely for the whole year. Domestic inflation, which decreased to 3.0% in September, is forecasted to reach 3.54.0% in 2024. As of mid-October, the EUR/HUF exchange rate remains above the 400 level, primarily influenced by both internal factors, such as the decreasing base rate, and the continued absence of EU funds, as well as external factors like the Middle Eastern crisis, the U.S. elections, and the base rates set by the Fed and ECB. Despite these challenges, the labour market remains tight, resulting in a decrease in the unemployment rate, which reached 4.2% at the end of August. In Budapest, the unemployment rate is even lower, around 2%.

Market summary

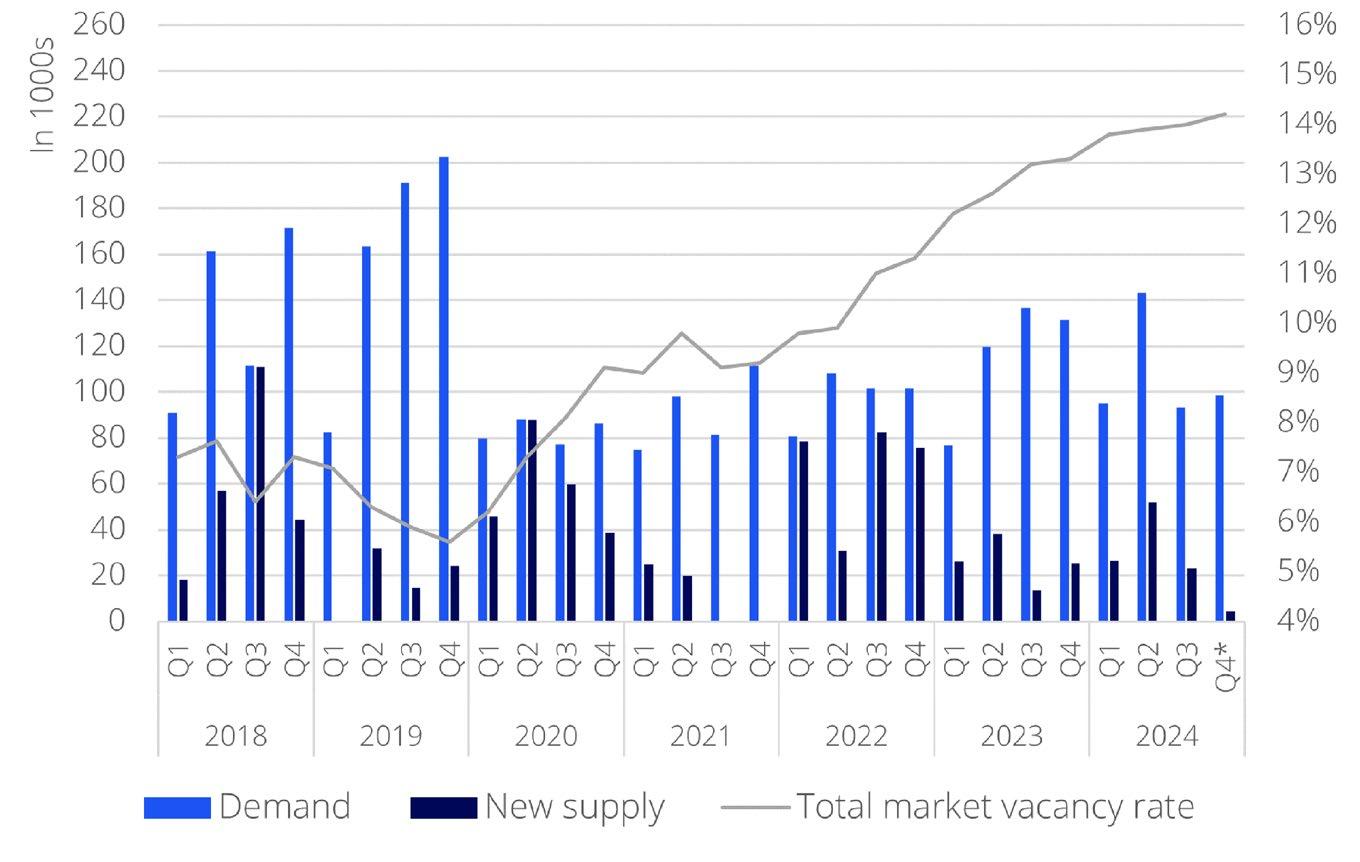

Overall tenant activity saw near stagnation on an annual basis, with only a 1% yoy increase in Q1-Q3 2024. In Q1-Q3, net takeup, which measures the level of new demand, decreased by 12% compared to the same period in 2023 (150,282 vs. 170,888 sqm), and its share within the total tenant demand (including renewals) reached 45%. Net take-up figures remain notably 40% lower (-99,000 sqm) than the levels observed in Q1-Q3 2019, before the onset of the Covid pandemic. The stagnation of total demand (331,522 sqm vs. 329,516 sqm) is mainly attributed to a 23% yoy decrease in new transactions (117,590 sqm vs. 152,009 sqm). In terms of distribution, renewal deals had the largest share in the first three quarters, similar to the same period in 2023.

Total market vacancy slightly increased in Q3, reaching 14.0%, which represents 1.05 percentage points increase on an annual basis. Speculative vacancy rate also increased, reaching 17.3% at the end of the quarter, showing a quarterly increase of 0.1 percentage points and a year-on-year increase of 1.4 percentage points, mainly due to the fact that almost 40% of the office building stock delivered in 2023 and 2024 is still vacant.

Stable tenant activity is reflected in positive net absorption for Q3, with a change in the total occupied stock amounting to 16,305 sqm. Tenants have shown a stronger preference for buildings that are sustainable, energy-efficient, and meet ESG criteria. In these buildings, speculative vacancy rate is 2.7 percentage points lower than the market average at the end of Q3 2024.

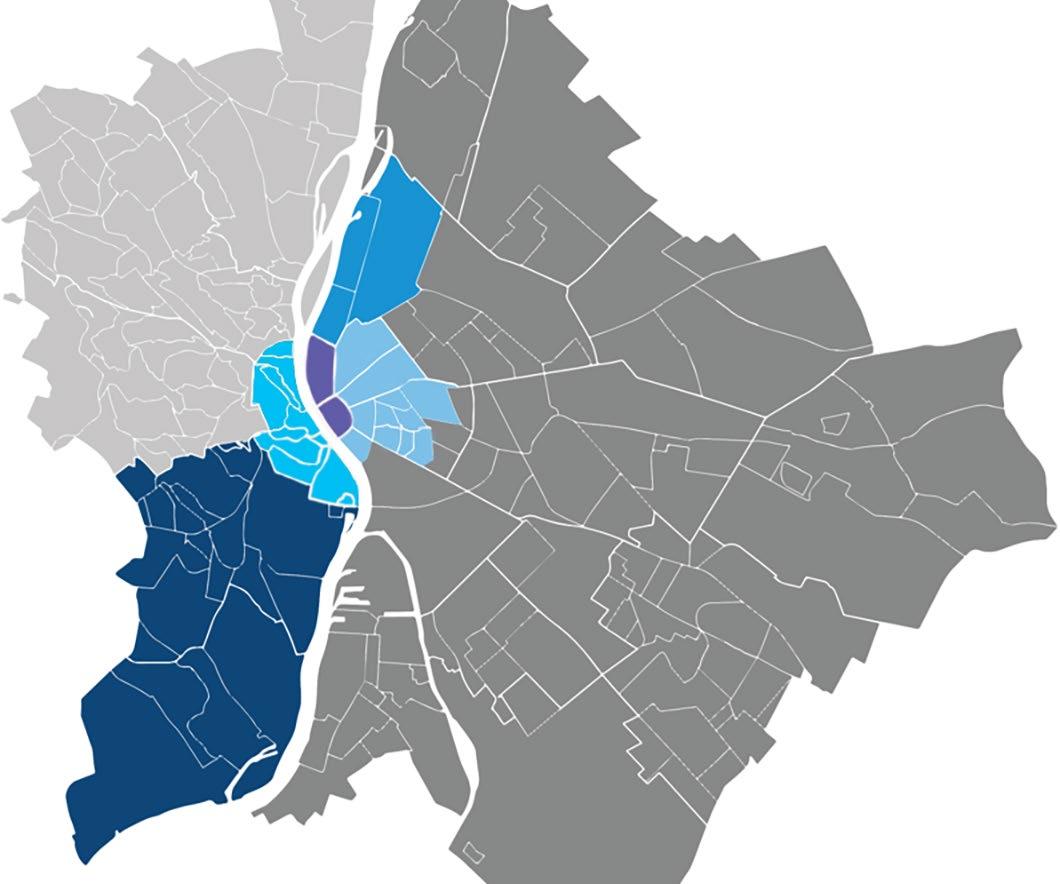

Looking ahead, total speculative office pipeline until the end of 2027 amounts to 98,000 sqm, with Váci Corridor and Central Pest having the largest shares of 40,000 and 29,000 sqm, respectively.

During the third quarter, two speculative office buildings were handed over: Enter City Office Park I (1,930 sqm), Liberty North (19,780 sqm). The average vacancy rate of these two buildings is 32%.

Rents show stagnation in various categories. Prime headline rent is 25.5 EUR/sqm, while new headline rent stood at 19 EUR/sqm at the end of the quarter. Average rent for category “A” buildings was 16.8 EUR/sqm, while for category “B” it was 12.7 EUR/sqm.

DISTRIBUTION OF TRANSACTIONS

Pre-lease Expansion New

(Q1-Q3 2023, Q1-Q3 2024)