In 2023, GDP is expected to grow, at a low rate. According to Colliers’ projections, growth rate may be around 0.5-1.5% this year and slightly higher at approximately 3-4% in the following year. Inflation and increased interest rates are also expected to show a slow, gradual decline. By the end of the year, domestic inflation, which was at 20.1% in June, could shrink to a single-digit figure. EUR/HUF exchange rate is expected to be stronger on average in 2023 compared to 2022, which can also support decrease in inflation. Despite economic challenges, tight labour market is contributing to stability in employment. Unemployment rate is anticipated to be around 4% nationwide in Hungary, while in Budapest, the rate is expected to remain below 3%.

Market summary

In first two quarters of the year, there has been a noticeable increase in tenant activity in the market. Net take-up, which measures the change in occupied space, grew by 7% on an annual basis, compared to the first half of 2022 and its share within total tenant demand increased to 50%. Increased activity is further supported by distribution of total tenant demand, where the proportion of new lease agreements approached 43% in first half of 2023 which is 13 percentage points higher compared to the same period of 2022.

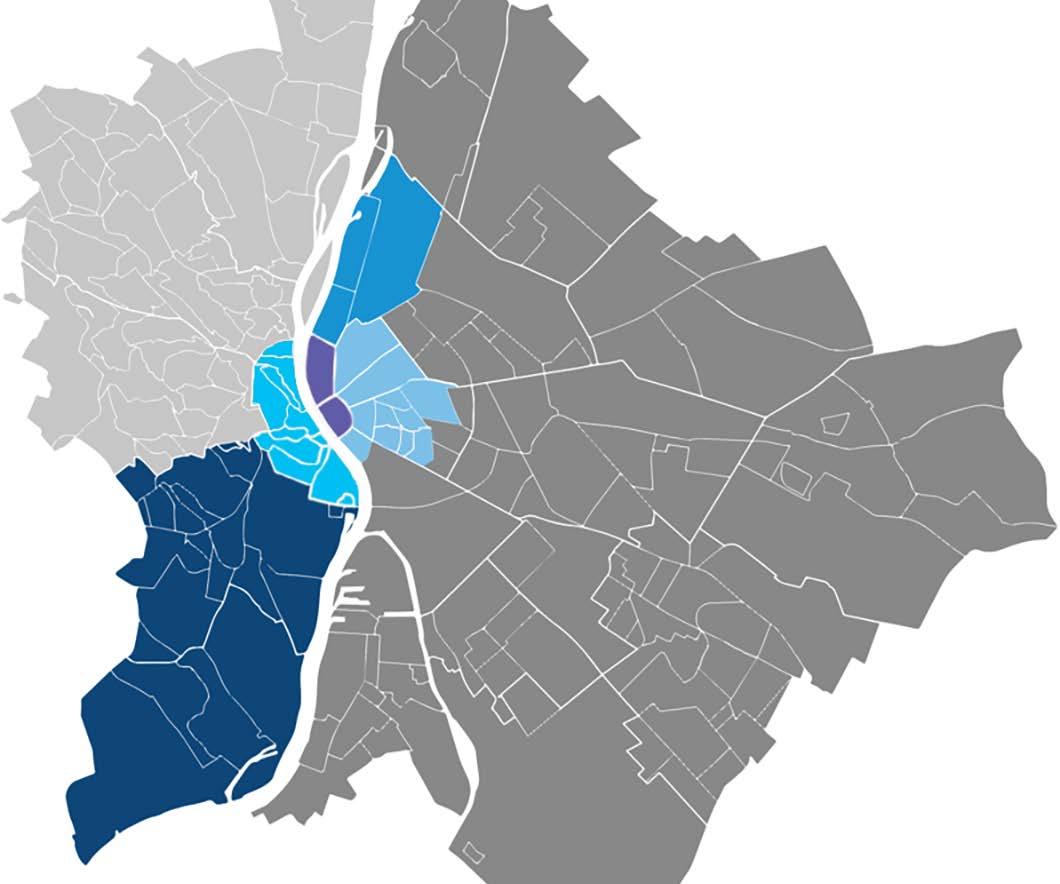

Additionally, after the first quarter of 2023, net absorption turned into a positive range in Q2, reaching 12,292 sqm. Tenants have shown a stronger preference for buildings that are sustainable, energy-efficient and meeting ESG criteria. This trend was particularly evident in Central Buda and in Váci Corridor, where demand remained stable, occupied area increased, and vacancy rates decreased on a quarterly basis.

Due to the high vacancy rate of new handovers total market vacancy continued to grow, reaching 12.6%, which represents an increase of 0.3 percentage points on a quarterly basis and

2.7 percentage points on an annual basis. Speculative vacancy rate also increased, reaching 15.5% at the end of the quarter, showing a quarterly increase of 0.5 percentage points and a year-on-year increase of 3.3 percentage points.

Looking ahead, total speculative office pipeline until the end of 2024 amounts to 186,114 sqm, out of which 62,028 sqm expected to be completed by the end of 2023.

During the quarter, three office buildings were added to the portfolio of cat A office buildings, totalling in 38,002 sqm. These include newly built F99 in South Buda, RoseVille in North Buda and BudaPart Downtown in South Buda.

Higher financing costs and increasing inflation are reflected in rents. Average rent for cat. A buildings was 16 EUR/sqm while for cat. B 12.4 EUR/sqm, which practically means stagnation compared to the previous quarter, but an annual increase of 7.5% and 3.3% respectively. Prime headline rent reached the level of 25 EUR/sqm, while new headline rent stood at 19 EUR/ sqm at the end of the quarter (+4.2% and +8.6% yoy).

DISTRIBUTION OF TRANSACTIONS (H1 2022, H1 2023)

Source: Colliers, BRF

SUPPLY, DEMAND AND VACANCY RATE (2018 – 2023)

Source: Colliers, BRF

Office Market Snapshot Q2 2023

Váci

According to our expectations, demand for prime locations and modern, green, energyefficient and ESG-compliant office buildings will be stable. In addition, the office market will remain tenant-driven during the year 2023, and flexibility in contracts will continue to be of fundamental importance. Overall, we do not anticipate a significant turnaround in vacancy rates, particularly in lower-grade properties, during 2023 and 2024.

About us

Head of Research, Hungary Kristof.Toth@colliers.com

Source: Colliers, BRF

This document has been prepared by Colliers for advertising and general information only. Colliers makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes all liability for loss and damages arising there from. This publication is the copyrighted property of Colliers and/or its licensor(s). ©2023 All rights reserved. Colliers International Group Inc.