Office Market Snapshot Q1 2023

In 2023, despite economic uncertainty, partly as a result of the Russian-Ukrainian conflict, high inflation, financial costs, and decreasing demand, the GDP is expected to expand, albeit at a low rate. According to Colliers, the expectation is for the GDP to grow by 0.5-1.5% this year, but in 2024 and 2025, predicted GDP growth will be around 3-4% on an annual average. The unemployment rate was 4% at the end of February and is expected to slightly increase this year, reaching 4.1% on an annual average. For Hungary, parallel to the economic recovery next year, a 3.8% annual rate is forecasted, but in Budapest, the rate can be more than one percentage point lower than the national average.

(Q1 2022, Q1 2023)

The restrained performance of economic dynamics was also reflected in demand activity. TLA (total leasing activity) decreased both annually (-5%) and quarterly (-21%). The distribution of demand is basically the same compared to the same period of the previous year; renewal deals had the largest share with 56%, then new contracts with 39%.

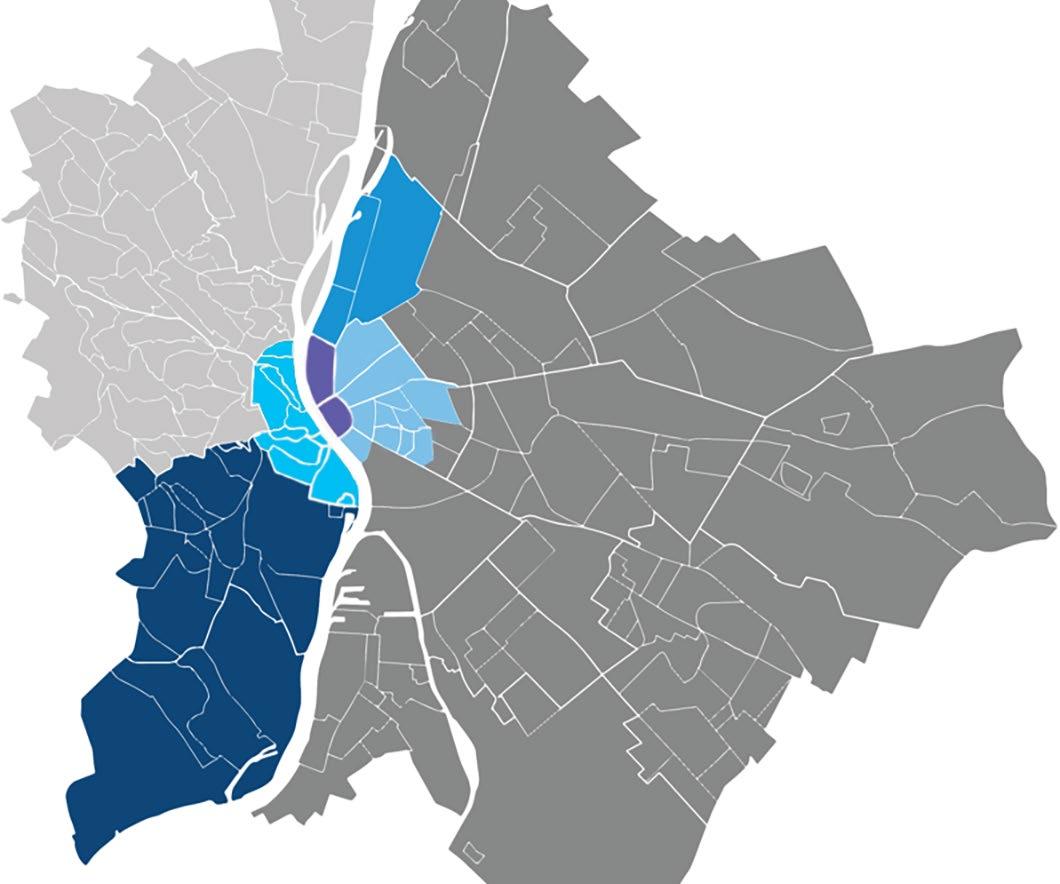

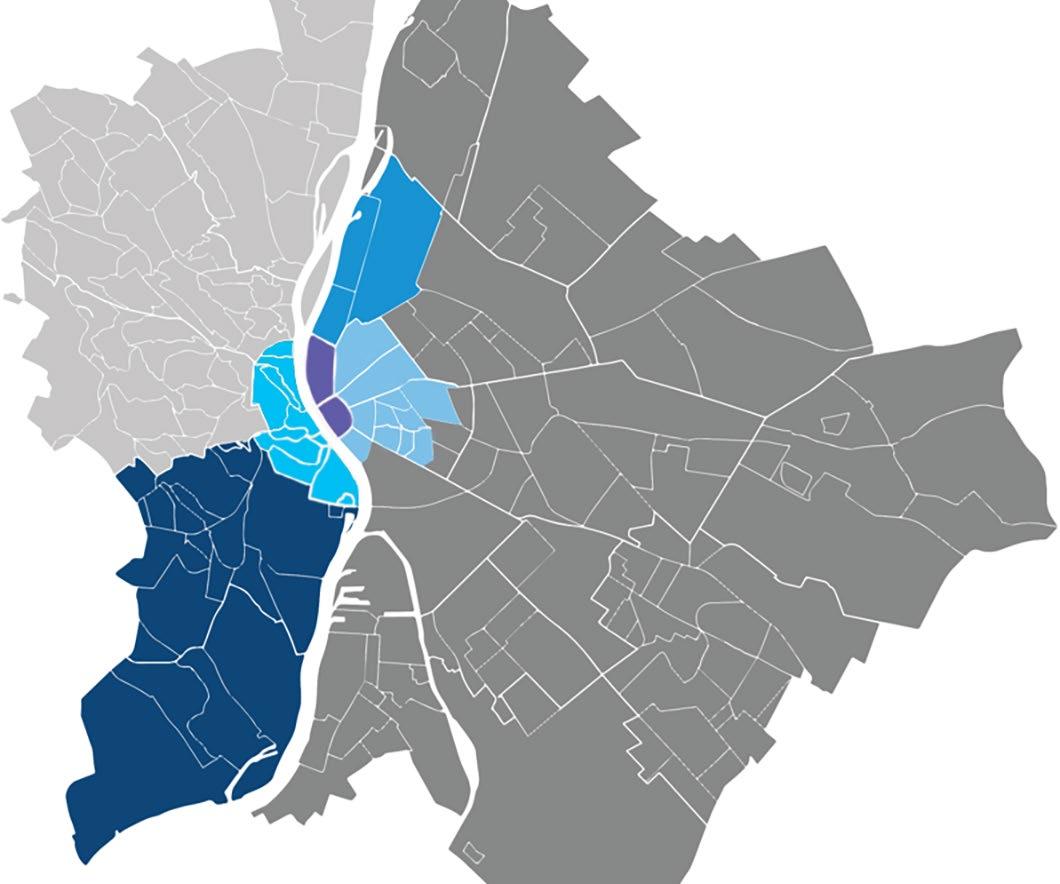

After the last quarter of 2021, partly because of stock correction and new completions, net absorption turned to a negative range in Q1 2023 (-19,160 sqm). Tenants put a greater focus on buildings that are sustainable and energy-efficient. This trend appeared at CBD, Central and North Buda, where demand remained stable, the occupied area increased, and vacancy decreased on a quarterly basis.

The total market vacancy rate continued to grow, reaching 12.2%, which is an increase of 0.9 pp on a quarterly and 2.4 pp on an annual basis, respectively. The speculative vacancy rate was 15% at the end of the quarter (+1.2 pp qoq and +3.3 pp on yoy).

The total speculative office pipeline until Q2 2024 accounts for 220,000 sqm, out of which 109,000 sqm of office space is expected to be handed over by the end of 2023.

Two office buildings were added to the portfolio of category A office buildings, totaling 26,054 square meters; the newly built Corvin Innovation Campus Phase 1 (Central Pest) and the renovated BIF Tower (Non Central Pest).

Higher construction and financing costs, parallel with increasing inflation, are reflected in rents. The average rent on the market for cat. A was 16 EUR/sqm, for cat. B 12 EUR/sqm, which practically means stagnation compared to the previous quarter, but an annual increase of 7.5% and 3.3% respectively. The prime headline rent reached the level of 25 EUR/sqm, while the new build average rent stood at the level of 19 EUR/ sqm at the end of the quarter (+4.2% and +8.6% yoy).

SUPPLY, DEMAND AND VACANCY RATE (2016 – 2023)

1 Stock 4,301k sqm +6% yoy Avg. Vacancy 12.2% +2.4 pp yoy 55.8 % 47.5 % 100 80 60 40 20 0

Q1 2022 Q1 2023 Macro * Completion 26,054 sqm -67% yoy

Source: Colliers, BRF

TLA 76.664 sqm -5% yoy

Source: Colliers, BRF

Market summary

TRANSACTIONS

Demand New supply Vacancy rate Pre-lease Renewal Expansion New 38.7 % 27.3 % 10.2 % 15.0 % 0 50 100 150 200 225 Q4* Q3* Q2* Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 2016 2017 2018 2019 2020 2021 2022 2023 In 1000s 15 12 9 6 3 Forecast % Avg. Rent Cat A 16 EUR/sqm/mth +7.5% yoy Prime 25 EUR/sqm/mth +4.2% yoy New Build 19 EUR/sqm/mth +8.6% yoy

DISTRIBUTION OF

Office Market Snapshot Q1 2023

North Buda yoy change Vacancy (%) 3.7% -2 pp Total Leasing Activity (sqm) 2,829 -67%

Váci Corridor yoy change

Vacancy (%) 12.4% +5.1 pp

Total Leasing Activity (sqm) 23,471 +71%

Completion (sqm) 0 -

Net absorption (sqm) -2,483 -

Average rent (EUR/sqm) 15.0 +1%

Due to the macroeconomic outlook and the growing interest rate environment, we could expect a slowdown in market activity in the upcoming period. In addition to new handovers in 2023, we anticipate modest demand and higher vacancy rates compared to previous years. This shift towards a tenantoriented market is expected to lead landlords to offer discounts to some extent.

About us

South Buda yoy change

Vacancy (%) 13.3% +2.1 pp

Total Leasing Activity (sqm) 8,929 -46%

Completion (sqm) 0 -

Net absorption (sqm) -13,602 -

Average rent (EUR/sqm) 13.6 +3%

Periphery yoy change

Vacancy (%) 36% +4.9 pp

Total Leasing Activity (sqm) 3,382 +24%

Completion (sqm) 0 -

Net absorption (sqm) -2,418 -

Average rent (EUR/sqm) 8.9 -3%

Non-Central

change

KATA MAZSAROFF

Managing Director, Hungary

Kata.Mazsaroff@colliers.com

MIKLÓS ECSŐDI

Head of Occupier Services, Hungary Miklos.Ecsodi@colliers.com

KRISTÓF TÓTH

Head of Research, Hungary

Kristof.Toth@colliers.com

This document has been prepared by Colliers for advertising and general information only. Colliers makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes all liability for loss and damages arising there from. This publication is the copyrighted property of Colliers and/or its licensor(s). ©2023 All rights reserved. Colliers International Group Inc.

2

Vacancy (%)

Total Leasing Activity (sqm) 7,313 +20% Completion (sqm) 0Net absorption (sqm) 2,300 Average rent (EUR/sqm) 19.4 +8% Central

Vacancy (%) 15.3% +4.1

Total Leasing Activity (sqm)

Completion (sqm) 17,524Net absorption (sqm) -6,611Average rent (EUR/sqm) 14.7 +4%

Vacancy

Total

Completion

Net absorption

Average rent

Central Business District (CBD) yoy change

9.2% -1.4 pp

Pest yoy change

pp

17,757 +41%

Central Buda yoy change

(%) 5.7% -2 pp

Leasing Activity (sqm) 11,525 +54%

(sqm) 0 -

(sqm) 3,773 -

(EUR/sqm) 15.4 +7%

Completion (sqm)

Net absorption (sqm) -1,234

Average rent

+5%

Pest yoy

Vacancy (%) 13.8% +3.4 pp Total Leasing Activity (sqm) 1,457 -89%

8,530 -

-

(EUR/sqm) 11.7

Net

Average

Outlook

Completion (sqm) 0 -

absorption (sqm) 1,113 -

rent (EUR/sqm) 13.8 +13%