SM

Proposed Budget Fiscal Year 2022-2023

TABLE OF CONTENTS – PROPOSED BUDGET

INTRODUCTION City Manager’s Transmittal Letter………………………………………………………………………………………………………………4 City Council………………………………………………………………………………………………….……………………………………………15 City Organization Chart 16 About the City……………………………………………………………………………………………………………………………………………17 Guide to the Budget Document ……………………………………………..19 Budget Process and Calendar……………………………………………………………………..……………………………………………..20 FUND SUMMARIES AND SCHEDULES Fund Descriptions………………………………………………………………………………………………………………………………………22 Fund and Department Relationships………………………………………………………………………………………………………….25 All Funds by Expense Category…………………………………………………………………………………………………………………..26 Expenditures by Department……………………………………………………………………………………………………………………..28 Expenditures by Fund and Fund Type…………………………………………………………………………………………………………30 Revenue by Fund and Fund Type………………………………………………………………………………………………………………..31 All Funds by Revenue Category Group………………………………………………………………………………………………………..32 General Fund Summary……………………………………………………………………………………………………………………………..34 Special Revenue Funds………………………………………………………………………………………………………………………………35 Enterprise Funds……………………………………………………………………………………………………………………………………….48 Internal Service Funds……………………………………………………………………………………………………………………………….51 Personnel – Total Full-Time Equivalent Employees……………………………………………………………………….……………56 Personnel – Citywide Salary and Benefits……………………………………………………………………………………………………57 DEPARTMENT SUMMARIES Community Services Community Development……………………………………………………………………………………………………………………….…58 Health and Animal Services. 71 Parks, Recreation, and Tourism………………………………………………………………………………………………………………….78 Finance and Administration Finance and Administration…………………………………………………………………………………………………………………….109 Human Resources……………………………………………………………………………………………………………………………………117 Law…………………………….……………………………………………………………………………………………………………………………118 Technology Services…………………………………………………………………………………………………………………………………119 Workers’ Comp………………………………………………………………………………………………………………………………………..122 Liability / Risk Management…………………………………………………………………………………………………………………….123

TABLE OF CONTENTS (CONTINUED)

Municipal Services Municipal Services ………………………………………………………………………………………………………………………………….124 Street Maintenance…………………………………………………………………………………………………………………………………130 Stormwater…………………………………………………………………………………………………………………………………………..…131 Central Garage 132 Sanitary Sewer……………………………………………………………………………………………………..………………………………….133 Policy and Leadership Office of the City Manager 143 Public Information Office..……………………………………………………………………………………………………………………….147 Offices of the Mayor and City Council 148 City Clerk…………………………………………………………………………………………………………………….…………………………..152 Public Safety Fire………………………………………………………………………………………………………………………………………………………….154 Municipal Court……………………………………………………………………………………………………………………………………….164 Police………………………………………………………………………………………………………………………………………………………166 Utilities Power and Light……………………………………………………………………………………………………………………………………….184 Water………………………………………………………………………………………………………………………………………………………206 Non-Departmental Non-Departmental ………………………………………………………………………………………………………………………………… 217 City Memberships………………………………………………………………………………………………………………………..………….219 Staywell 220 APPENDIX Capital Outlay Exhibit………………………………………………………………………………………………………………………………221 Budget Packages……………………………………………………………..………………………………………………………..…………….224 ARPA……………………………………………………………………………………………………………..…………………….………………….225 Glossary..……………..………………………………………………………………………………………………………………………………...227

April 29, 2022

Honorable Mayor and Members of the City Council:

I am pleased to submit to you this transmittal letter that details the Submitted Budget for the City’s fiscal year beginning July 1, 2022, in accordance with Section 8.2 of the City Charter. The proposed budget totals $338,538,661 or a decrease of 0.1% over FY 2020-21 actual expenditures.

The primary purpose of the City’s budgeting process is to develop, adopt, and execute a financial plan for accomplishing the City Council’s goals for the upcoming year. Development of the FY 2022-23 Submitted Budget was guided by the City’s strategic plan, Independence for All, feedback provided through a citizen survey of budgetary priorities, and the policy direction of the City Council within the context of a highly resource-restricted environment.

The Proposed Budget was developed as the pandemic transitioned to an endemic. While much of the uncertainty associated with the pandemic is behind us, we continue to navigate many of the lingering

FY 2020-21 (Actual) 2021-22 (Projected) FY 2022-23 (Proposed Budget) % Difference (Actual FY20-21 to FY22-23) Salaries $111,313,127 $116,079,028 $122,149,570 9.7% Retiree Health Insurance $5,326,829 $5,739,246 $5,911,000 11.0% Operating Expenses $141,056,436 $136,198,035 $143,599,665 1.8% Equipment $8,610,623 $5,571,575 $8,452,058 -1.8% Total - Operating $266,307,015 $263,587,884 $280,112,293 5.2% Capital Improvements $22,520,059 $19,813,557 $25,569,836 13.5% Debt Service $30,633,292 $19,808,754 $18,807,966 -38.6% Transfers Out $19,510,828 $13,417,000 $13,948,566 -28.5% Contingency $100,000 Total $338,971,194 $316,627,195 $338,538,661 -0.1%

City of Independence Proposed Budget FY 2022-23 Page 4

effects such as supply chain issues, labor shortages, and perhaps most significantly, inflation. Many of the City’s structural financial issues existed before the onset of the pandemic; the pandemic only exacerbated the challenges of these historical budgetary challenges. However, by exercising fiscal restraint, strong financial management, strategic use of intergovernmental revenue, and numerous strategies implemented at the pandemic’s outset, the City has been able to maintain core services over the preceding two years while avoiding staffing reductions, employee furloughs or the use of reserve funds.

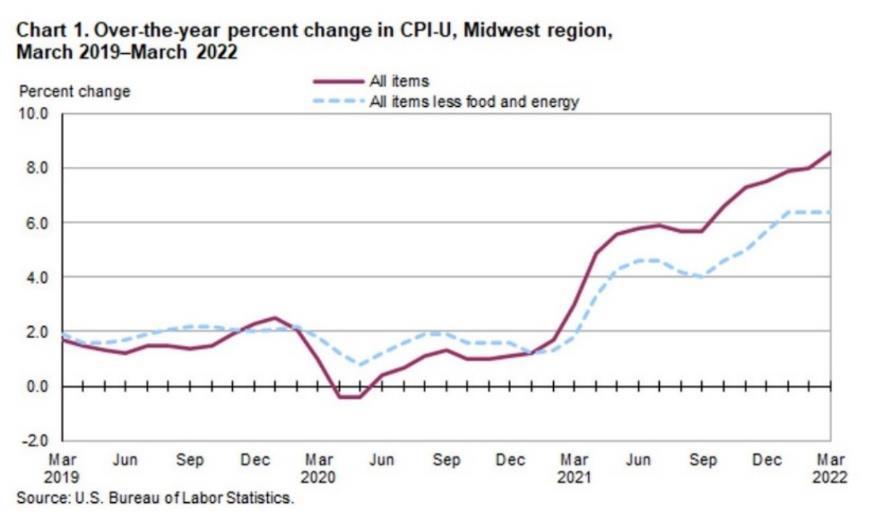

Economic Factors

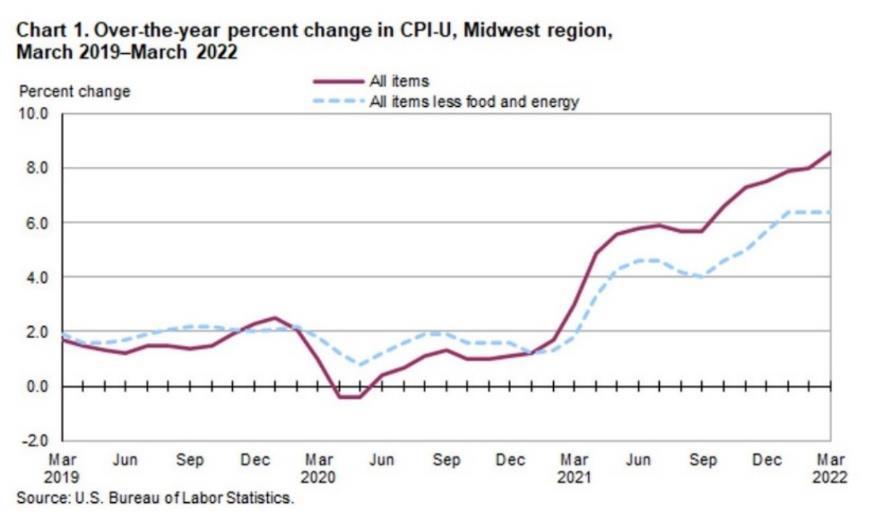

Similar to other businesses, inflation has impacted City operations. The Consumer Price Index for our region has increased nearly 9% from a year ago. For example, recent bids reflect a 33% increase in asphalt unit costs (from $12/sq. yard to $16) and 30% increase in steel costs over last year’s pricing. In contrast, as noted on page 10, sales tax funds are projected to increase 4.5%. If the City is fortunate enough to acquire needed supplies and materials, it costs significantly more. This has real implications on city operations and the ability to successfully execute projects.

City of Independence Proposed Budget FY 2022-23 Page 5

Unemployment peaked in the metro area in April 2020 and has rebounded quickly. The low unemployment rate strains the City’s ability to hire and retain a qualified and talented workforce. Providing competitive wages and benefits places additional pressure on the City’s limited financial resources.

Independence for All

After several months of stakeholder feedback, in March 2021, the City Council adopted updates to the City’s strategic plan, Independence for All. The strategic goals of the plan remain unchanged:

• Customer-Focused – Improve customer service and communication.

• Financial Sustainability – Ensure City finances are stable and sustainable.

• Growth – Increase the economic prosperity of the community.

• Quality – Achieve livability, choice, access, health and safety through a quality-built environment.

City of Independence Proposed Budget FY 2022-23 Page 6

The updated plan includes emphasis on five priorities:

• Reduce crime and disorder

• Communicate more effectively internally and externally

• Stabilize and revitalize neighborhoods

• Reduce blight

• Enhance public health

A survey was also administered leading into this year’s budget process. The service areas receiving the most support included (in priority order):

1. Maintain city streets, bridges, curbs, and sidewalks

2. Increase the number of police officers

3. Create a taskforce to increase services and outreach to homeless

Areas receiving the least support included (in priority order):

7. Increase funding for capital improvement repairs to city historic sites

8. Add additional fire stations throughout the city

9. Fund transit model to support commuter services to employment centers outside the city

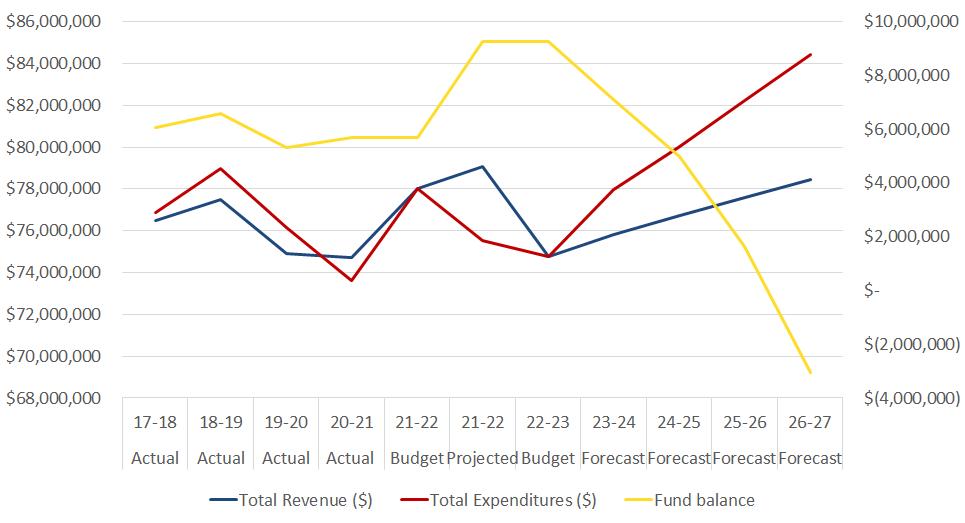

General Fund Five-Year Financial Forecast

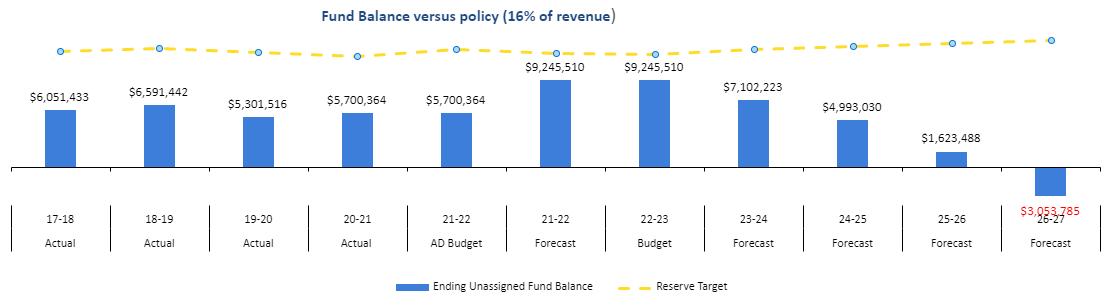

Leading into development of the Capital Improvements Program and Proposed FY 22-23 Budget, the General Fund Five-Year Financial Forecast was presented to the City Council in January. This reflects the latest financial data including recently authorized drawdowns and police personnel compensation program.

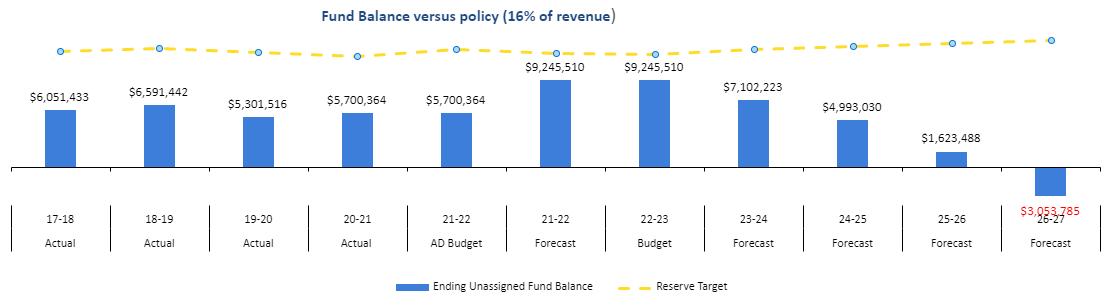

City Council Resolution 17-729 adopts a policy that the City will endeavor to maintain a minimum Unrestricted and Unassigned Fund Balance in the General Fund equal to 16% of annual operating revenues. Through the leadership of the City Council and strong financial management by City staff, the Unrestricted Fund Balance for the General Fund is projected to rise to 12% of budgeted expenditures in the 2022-23 Fiscal Year. While this is a significant improvement to the City’s overall financial position, the increase is not structural in nature as it reflects savings primarily from personnel vacancies and onetime intergovernmental revenue. This is also the final year of a pandemic grant subsidy for transit operations. Sustaining this service will require an additional $1.2M in general fund expenditures beginning in FY 23-24.

City of Independence Proposed Budget FY 2022-23 Page 7

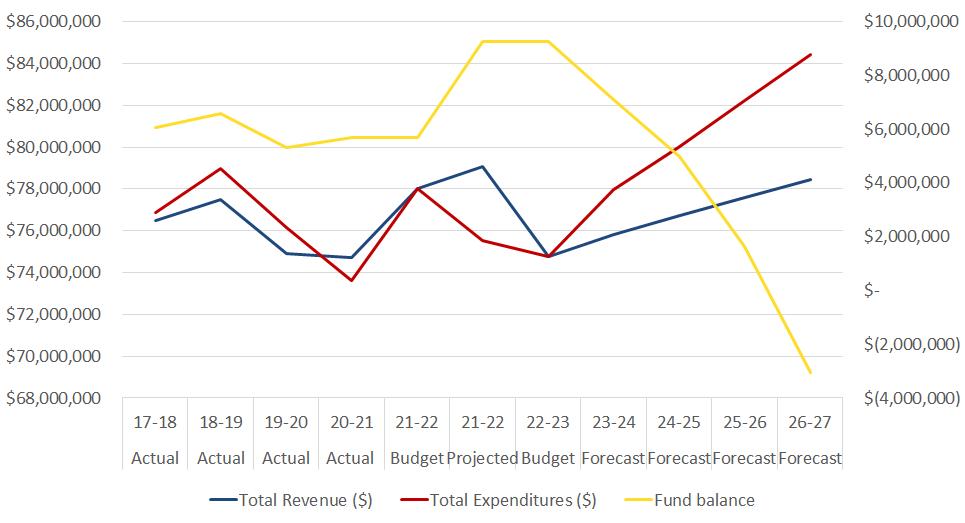

As the chart below indicates, expenditure growth is outpacing revenue growth. This structural imbalance leaves a projected ending fund balance of ($3M) by FY 26-27 (see chart above). This is not a sustainable trend as it does not provide the City with sufficient resources to navigate any further economic disruptions or the flexibility to make strategic investments or service enhancements within the financial plan period.

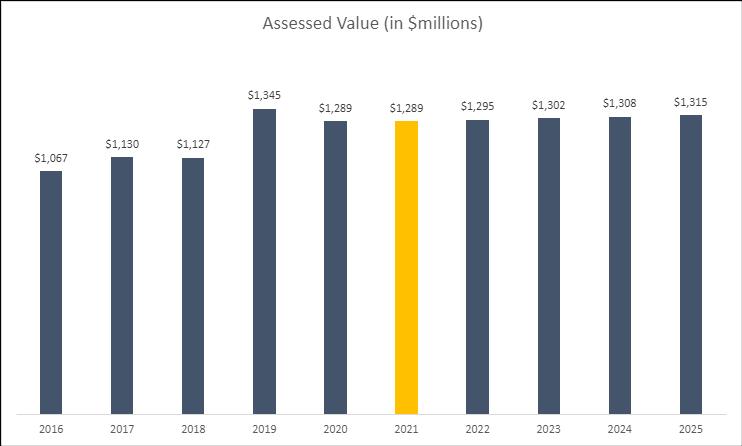

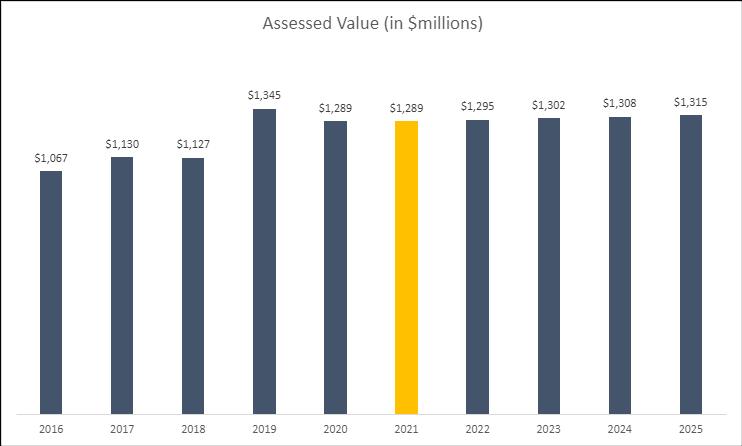

Over the past six years, focus has been placed on prioritizing services, managing expenditures, and developing and executing plans to address the ongoing structural imbalance that has negatively impacted the City’s financial position and service delivery for many years. This required the collaboration and support of the City Council, city leaders, bargaining units, and other stakeholders. The City has taken steps to address OPEB liabilities, compensated absences, restructuring debt, among many other initiatives to address legacy practices and modernize City operations. Continued stabilization of the City’s fiscal condition will require further efforts to critically examine and prioritize services, evaluate revenue options, as well as focus on attracting capital investment and other initiatives to grow the economy. However, the Assessed Value chart below demonstrates the challenges of relying on growth alone to address the City’s service needs.

City of Independence Proposed Budget FY 2022-23 Page 8

General Fund Overview

Total revenues for the General Fund in the Fiscal Year 2022-23 Budget are $74,755,611 which is a year over year reduction of $4.3M from 2021-22 Forecasted Revenues This reduction is primarily attributed to $3.1M in federal ARPA revenue that was used to support the FY 21-22 Budget. Revenue sources and performance over the previous three years is outlined in the table below:

As reflected in the table above, total General Fund Revenues in the Submitted Budget continue to remain flat. The significant growth in Franchise Fees is attributed to the increase in the State Gas Tax. This is offset by the multi-year reduction of the Cable Franchise Fee.

Total expenditures for the General Fund are $74,522,743 representing a year over year decrease of $767,132 (-1%) from 2021-22 forecasted expenditures.

Actual 20-21 Forecast 21-22 Budget 22-23 % Difference (Actual FY20-21 to FY22-23 Taxes 25,063,047 26,166,000 27,207,000 8.6% Franchise Fees 7,376,561 7,943,300 8,344,000 13.1% PILOTS 19,255,233 20,671,269 20,848,787 8.3% Licenses and Permits 4,772,400 4,430,983 4,410,950 -7.6% Intergovernmental Revenue 5,655,410 5,599,500 5,810,000 2.7% Charges for Services 2,013,571 2,089,792 1,955,400 -2.9% Fines and Court Fees 2,152,627 2,100,000 2,156,000 0.2% Interfund Charges 5,035,500 5,035,500 2,354,600 -53.2% Other Revenue 2,599,109 1,502,783 970,400 -62.7% Transfers In (includes ARPA) 808,336 3,528,762 698,474 -13.6% Revenue Total $74,731,793 $79,067,889 $74,755,611 0.0%

City of Independence Proposed Budget FY 2022-23 Page 9

As outlined in the FY 2021-22 Proposed Budget, the American Recovery Plan provided a temporary buffer enabling the City to assess its financial position and align resources in the General Fund to provide basic service delivery. Those resources are no longer an option, and this budget reflects that reality.

While the Proposed Budget is balanced as required by State Law, there is no built-in capacity for expansion. As such, any enhancements will require corresponding reductions in expenditures as an offset. Maintenance of currently funded items presented a deficit of $5.35 million in the General Fund at the onset of the budget development process due to the lack of growth in revenues. As I cautioned in the previous year’s budget message, without further structural reductions in operating expenses or an infusion of new revenues, the financial constraints experienced each year will continue to limit service delivery. Such options include:

• Make strategic changes to legacy expenditures that are growing at unsustainable rates, such as health benefits and overtime policies

• Attract and retain industry that meets market demand and provides employment opportunities for Independence residents

• Pursue other revenue growth opportunities through ballot initiatives.

• Strategically address service-level deployment models to match citizen/service level demand, emerging technologies, regional capacity, and industry best practices

• Make strategic use of one-time resources

• Make across-the-board reductions to an already-meager workforce and further reduce our ability to meet citizen demand for basic service delivery in high-priority areas.

General Fund proposed changes of note include:

• No service expansions except for full year funding for Retiree Benefits Specialist position.

• Reduced Fire Department overtime cost due to increased personnel supported by expanded Fire Sales Tax. This is a short-term savings and not structural in nature.

• Adoption of Fair Labor Standards Act in Personnel Policies and Procedures Manual to align overtime calculation with federal law and best practices among metro area cities.

• Stabilize the Stay Well Fund through structural plan design changes to manage health benefit costs

• Finance and Administration is moving to an internal service fund to improve transparency regarding cost allocation and allow for better resource planning and interdepartmental support. This model is similar to Central Garage, Worker's Comp, and Risk Management.

FY 2020-21 (Actual) 2021-22 (Forecast) 2022-23 (Budget) % Difference (Actual FY20-21 to FY22-23) Salary and Benefits $64,823,704 $64,579,844 $63,776,691 -2% Operating Expenses $8,201,714 $9,845,896 $8,529,629 4% Equipment $391,742 $417,050 $56,723 -86% F&A allocation & GF subsidies $2,217,168 Debt Service $165,879 $327,925 $165,400 0% Transfers Out $35,300 $35,000 $10,000 -72% Contingency $0 $317,028 $0 Expenditure Total $73,618,338 $75,522,743 $74,755,611 1.5%

City of Independence Proposed Budget FY 2022-23 Page 10

The proposed changes to FLSA overtime policies and anticipated plan design changes for the Stay Well Fund are necessary to balance this budget. If the City Council chooses not to adopt these provisions, corresponding budgetary reductions in excess of $2 million will be required. I fully recognize that these proposals will not be without controversy among many of our employees. However, recently released US Census data verifies the stark reality our community faces. In reviewing 2020 census data, 31% of homes in Independence have a total household income of less than $35,000. Even more alarming is that 11% of households are below $15,000 annually in income. While Missouri is seeing strong economic growth and low unemployment rates (3.7% statewide) in Independence we have an unemployment rate almost double at 6.5%.

As employees of the City of Independence, we must realize that we are fortunate to have a salary and benefit package that far exceeds the total household income of more than one-third of our citizens. We must then answer a fundamental question: as City employees, are we here to serve, or to be served? We must remain cognizant of our need to provide a competitive salary and benefit plan while maximizing the value of services our citizens underwrite. Reducing City services at the expense of propping up an extraordinary benefits plan is not a model I can recommend as your City Manager.

Health and Animal Services Fund

Following the reorganization and restructuring of the Independence Health Department in 2018, the City Council directed City staff in late 2020 to pursue recognition from the State of Missouri as a Local Public Health Agency (LPHA). Recognition was received from the State in early 2021, and this budget provides continued funding to provide baseline public health services.

FY 2020-21 (Actual) FY 2021-22 (Adopted) FY 2022-23 (Proposed) Revenues Real Estate Tax $874,492 $870,000 $881,500 Charges for Services $131,856 $516,432 $546,738 American Rescue Plan (ARP) $0 $150,000 $0 Investment Income $1,536 $0 $3,731 Other $113,262 $0 $14,000 Total-All Other $1,121,146 $1,536,432 $1,445,969 Transfers In from Other Funds $993 $0 $300,000 Total Revenues $1,122,139 $1,536,432 $1,745,969 City of Independence Proposed Budget FY 2022-23 Page 11

Use Tax Fund Overview

Estimated revenues in the Fiscal Year 2022-23 Proposed Budget from the Use Tax are outlined in the table below. Voters approved amended Use-Tax ballot language in November 2021 to support expanded applications of the Use Tax. While this provides much needed resources to police personnel, the additional $1M annually dedicated to Police increased the threshold amount that enacts the “waterfall” to other funds.

Sales Tax Funds Overview

In addition to the Use Tax, the City of Independence administers five additional voter-approved sales taxes. Like all City funds, these continue to experience pressure of increasing costs to support their intended uses against limited growth. The only exception to this is the Fire Public Safety Sales Tax which received voter approved expansion in November.

Expenditures Salary & Benefits $669,159 $1,255,102 $1,239,823 Retiree Health Insurance $56,552 $64,000 $61,000 Operating Expenses $342,501 $336,090 $469,145 Equipment $2,106 $8,000 $9,180 Operating Expenses $1,070,318 $1,663,192 $1,779,148 Capital Improvements $0 $0 $0 Debt Service $0 $0 $0 Transfers Out $0 $0 $0 Total Expenditures $1,070,318 $1,663,192 $1,779,148

2021-22 (Budget) 2022-23 (Proposed Budget) Animal Shelter Use Tax (010) $762,750 $781,819 Police (018) $3,032,000 4,100,000 Waterfall General Fund (002) $448,000 $289,349 Street Improv Sales Tax (011) 224,000 144,674 Park Improv Sales Tax (012) 112,000 72,337 Storm Water Sales Tax (013) 112,000 72,337 Police Public Safety Sales Tax (016) 56,000 36,169 Fire Public Safety Sales Tax (017) 56,000 36,169 Total Revenue (All funds + waterfall) $4,802,750 $5,532,854

• Parks, Recreation, and Tourism (4.0

• Fiscal Administrator (1.0) • PRT Maintenance Worker II (1.0) • Multimedia Communications Coordinator (1.0) • Right of Way Supervisor / Maintenance Supervisor (1.0) City of Independence Proposed Budget FY 2022-23 Page 12

FTE):

• Fire PST Changes (22 FTE):

• Battalion Chiefs, 3.0

• Fire Captains, 3.0

• Fire Equipment Operators, 3.0

• Fire Inspector – Communications, 1.0

• Firefighter Engineers, 6.0

Enterprise Funds Overview

The submitted budget does not forecast significant revenue growth in the enterprise funds which is a result of limited economic expansion, flat consumption, and fixed utility rates.

Highlights in the Proposed Budget include:

• Strategic drawdown from fund balance for capital investments in system infrastructure in the Sewer and Water Funds, including continued multi-year Water Main Replacement Program

• Careful financial management in IPL to determine if capital projects can be supported.

• Management of any utility budget through the capital program is not a sustainable strategy. Further evaluation is warranted to ensure system reliability.

• 4.0 FTE Equipment Operators, Sewer

• $254,000 for sanitary collection system repairs

• 2.0 FTE Equipment Operators, Stormwater

• $122,000 for storm water system repairs

• 1.0 FTE Meter Reading Supervisor, IPL

• $830k in Sewer Fund for Little Blue Valley Sewer District rate increase

FY 2020-21 (Actual) FY 2021-22 (Projected) FY 2022-23 Proposed Budget Street Improv Sales Tax (011) 8,781,615 9,296,000 9,715,000 Park Improv Sales Tax (012) 4,390,812 4,648,000 4,858,000 Storm Water Sales Tax (013) 4,390,812 4,648,000 4,858,000 Police Public Safety Sales Tax (016) 2,310,802 2,468,000 2,580,000 Fire Public Safety Sales Tax (017) 2,195,578 2,324,000 8,770,000 Total Revenue $22,069,619 $23,384,000 $30,781,000

FY 2020-21 (Actual) FY 2021-22 (Projected) FY 2022-23 Proposed Budget Power & Light (020) Revenue 132,287,568 141,478,425 142,060,700 Expenditure 168,875,370 143,584,047 140,450,668 Net -$36,587,802 -$2,105,622 $1,610,032 Water (040) Revenue 36,496,701 36,810,700 36,365,485 Expenditure 30,408,430 32,805,402 41,437,855 Net $6,088,271 $4,005,298 -$5,072,370 Sanitary Sewer (030) Revenue 35,596,117 34,380,884 36,369,338 Expenditure 30,143,678 31,372,796 36,203,389 Net $5,452,439 $3,008,088 $165,949

City of Independence Proposed Budget FY 2022-23 Page 13

Conclusion

As we reach the point of an endemic, is important to take a moment to thank all our City staff who provided and continue to provide critical services to the community. They do so with utmost professionalism and service commitment in a highly challenging environment.

I want to thank you, the City Council, and the City departments for the assistance provided in preparing this budget. The options presented as a part of this budget are not easy choices; my staff and I are ready to address any questions regarding the information presented.

Respectfully,

Zachary C. Walker City Manager

Zachary C. Walker City Manager

City of Independence Proposed Budget FY 2022-23 Page 14

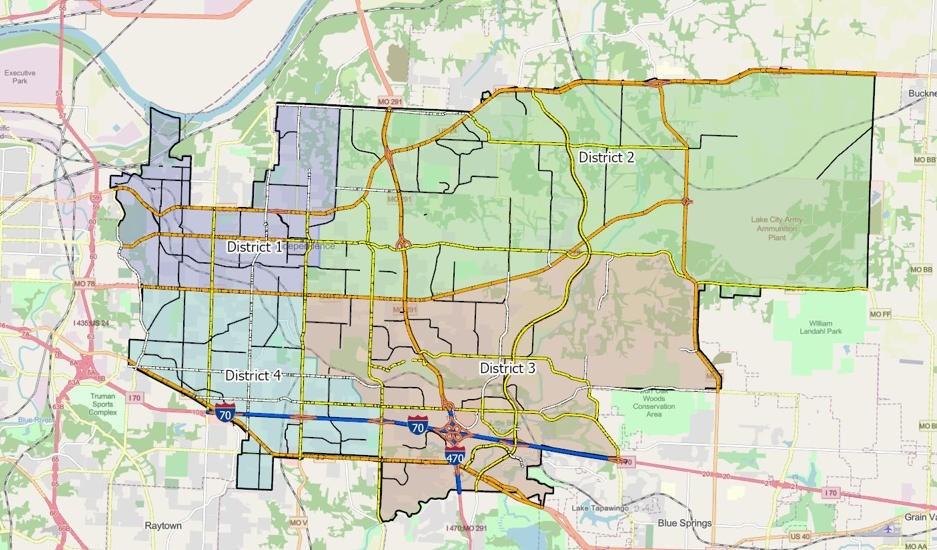

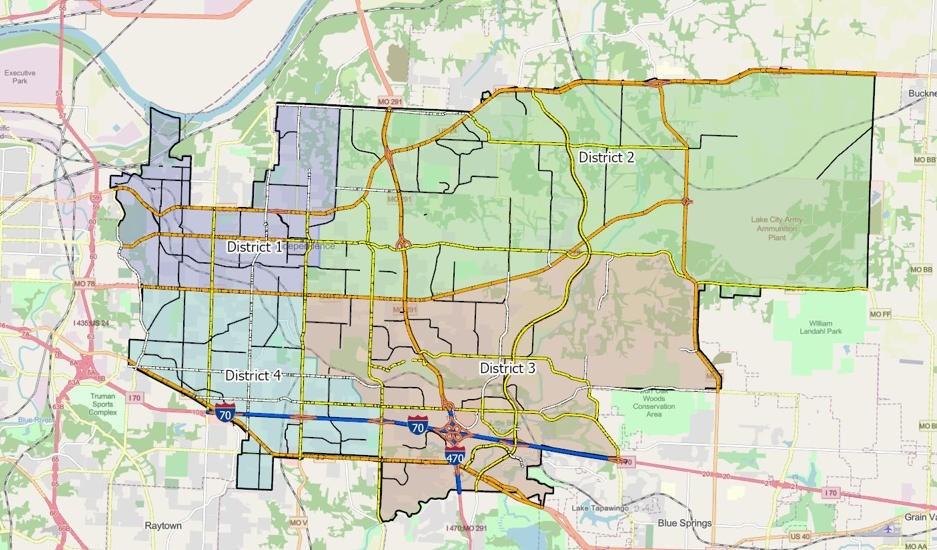

Form of Government

In 1961, Independence voters selected a council-manager form of government. Under Charter Article 2.1, this form of government calls for one mayor and two council members elected by the city, and four council members elected by districts. The mayor and all city council members are elected to staggered four-year terms. The governing body is generally referred to as the "City Council." As the policy makers, the City Council passes resolutions and ordinances, adopts the city budget, appoints citizens to advisory boards, and hires the city manager.

City Council

Rory Rowland – Mayor

John Perkins – District 1

Brice Stewart – District 2

Michael Steinmeyer – District 3

Dan Hobart – District 4

Jared Fears – At Large

Vacant – At Large

City of Independence Proposed Budget FY 2022-23 Page 15

CitizensofIndependence

Parks, Recreation& Tourism

Mayor&CityCouncil

DeputyCityManager

AdamNorris

Police

Management Analyst

Finance& Administration PublicUtilities

Community Development

Fire

Health& AnimalServices

MunicipalCourt

Boards& Commissions

CityClerk

CityManager

ZachWalker

City of Independence Proposed Budget FY 2022-23 Page 16

Municipal Services

About the City of Independence

Independence the fifth largest city in Missouri, located with Jackson County It is the largest suburb of the Kansas City metro on the Missouri side. Located ten miles east of Kansas City, Missouri in the geographical center of the United States. Independence has a Mayor / City Council / City Manager form of government. The Independence City Council is made up of six members, four are elected to represent one of the city districts, the other two are elected by the city as a whole. The City Mayor also sits on the City Council and serves as the "Head of Government" for the city. Members serve a four-year term, beginning on January 1 following the election.

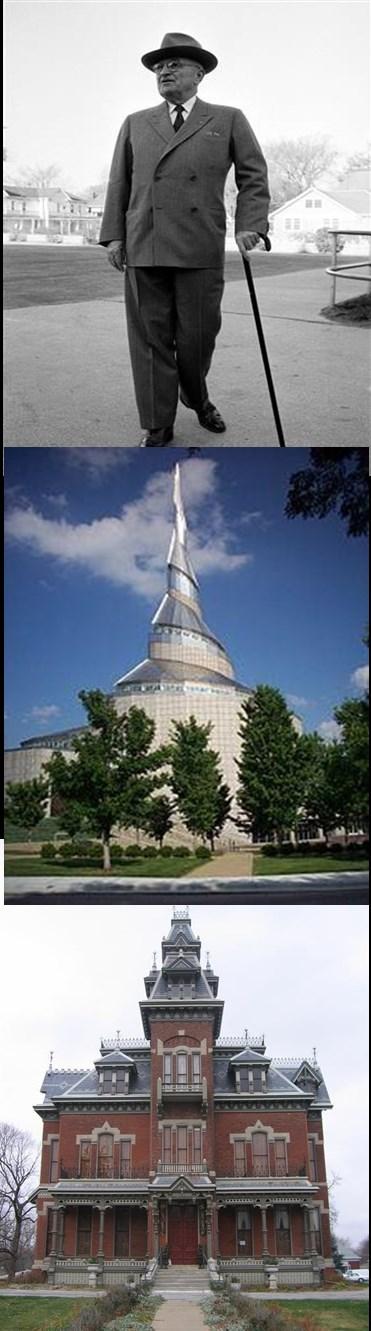

History

Independence was originally inhabited by the Missouri and Osage Indians and became part of the United States with the Louisiana Purchase in 1803. The city was founded on March 29, 1827. It was the farthest point westward on the Missouri river where steamboats or cargo vessels could travel. The city quickly became the hub of the California Trail, Santa Fe Trail, and the Oregon Trail. Independence was soon known as the Queen of the Trails, due to is unique location where all three trails converged. It wasn’t until the 19th century that Independence was defined by The United States Congress as the “Start of the Oregon Trail.” In 1826, Independence was named the county seat of Jackson County. During the years of 1862 and 1864 the First and Second battles of Independence were fought.

President Harry S. Truman grew up in Independence. In 1945, Harry S Truman took office as the 33rd and spent two terms as President of The United States, after which he returned to Independence, where the Presidential Library was built in 1957. For another two decades, he and his wife Bess remained Independence residents. The Harry S. Truman National Historic Site and the Harry S. Truman Presidential Library and Museum are both located in Independence.

Community Profile

Independence is positioned strategically at the crossroads of I70 and I-470, where approximately 150,000 cars pass each day. The Kansas City metropolitan area has more lane miles of freeway per capita than any other metro area in the United

City of Independence Proposed Budget FY 2022-23 Page 17

States. Two rail lines, three interstates and five state highways serve Independence. The city is located just 25 minutes from Kansas City International Airport.

Independence has seven police stations, ten fire stations, and the city provides Water, Sanitary Sewer, and Power and Light utilities, with three power stations.

The development of the Little Blue Parkway, a new thoroughfare connecting the eastern portion of the City from I-70 to 24 Highway will open 38 miles of land for development. It is estimated that by the year 2020, the Little Blue Valley will be home to an additional 20,000 people and 5,000 new office, industrial and retail jobs.

In the heart of the city, Historic Independence Square is undergoing a renaissance with substantial increase in private investment and a planned restoration of the Historic Jackson County Courthouse. The traditional town square offers unique shops, restaurants, loft-style apartments and a newly renovated cinema and bowling alley.

Creating the educated workforce of the future is a priority for the Independence Community. The city is supported by four award-winning public-school districts: Independence, Blue Springs, Fort Osage, and Raytown school districts. Independence is home to four colleges to support the higher education needs of our citizens, including Metropolitan Community College, Graceland University, Park University, and National American University.

Independence has a history of a pro-business attitude. Its low-cost environment is a natural incentive to companies looking to expand or relocate. Independence has the third lowest property tax rate in the Kansas City Metropolitan Area. Additionally, the City does not tax on personal property, including machinery and equipment. The city tax structure coupled with the many affordable housing options makes it the best value in the Metro for working and living.

Quick Facts about Independence

Population: 117,139

Square Miles: 78.25

Number of Households: 48,836

Average Household Size: 2.4

Median Household Income: $50,797

Median Age: 39.5

Median value of owner-occupied units: $121,200

School Enrollment: 29,949

Miles of highways: 46.38

Sister City: Higashimurayama, Tokyo, Japan

Source: City of Independence and Censusreporter.org

City of Independence Proposed Budget FY 2022-23 Page 18

Guide to the FY 2022-23 Budget Document

The purpose of this budget document is to provide a comprehensive view of the operating budget. The budget is a tool for management to plan services, but it is also a communication to the public on the overall financial and policy direction of the city. Use this guide to navigate the document.

Budget Transmittal letter

The City Manager’s Budget Message provides the framework for how the budget was developed, including contextual information on the city’s finances, economic trends, and changes to the budget.

Introduction

This section provides general information about the city:

• Names and photos of Mayor and City Council

• City of Independence overview and history

Fund Summaries

This section of the book gives the highest-level overview of the fund structure of the city.

• The breakdown of expenditure types across all funds

• The breakdown of revenue types across all funds

• Fund summaries for each fund, which show how the expenditures relate to the revenues.

Department Summaries

This section contains summary and detail information about each city department:

• Organizational chart shows the director and divisions of each department

• Department summary page highlights the mission of the department, the budgetary funds that make up the budget, a summary of expenditures, and total budgets and FTE counts

• The department is then broken down further into divisions (for instance, the Patrol Division of the Police department). The top half of the page will show summary information about the types of expenditures in that division, as well as the funding source and FTE counts.

Appendix

The appendix includes miscellaneous information that may help further understanding of the budget, including:

• Approved packages included in the budget

• Capital Outlay details by department

• ARPA summary

• Glossary of budget and finance terms

City of Independence Proposed Budget FY 2022-23 Page 19

Budget Development Process

Development of the annual City budget is a year-long process that culminates in June, with the formal adoption of the budget.

October - December: Planning

1. Finance develops the 2021 budget manual.

2. Finance meets to resolve issues and prepare budget outlook.

January - February: Operating Budget Kickoff & CIP Presentation

1. Finance meets with departments to kickoff budget process.

2. Updated Five Year Forecast presented to City Council.

3. Finance prepares the base budget, chargebacks, and preliminary personnel budgets.

4. Revenue projections and estimated actual expenses for prior year are prepared.

5. Capital Improvement Program budget presented by Economic Development to the Planning Commission.

March: Department Preparation

1. City Council adopts annual Strategic Plan update.

2. In conjunction with the Finance, departments and divisions prepare budget proposals.

3. Departments Directors present budgets and package requests to the City Manager.

4. Final adjustments in revenue and expenditure estimates are complete.

5. City Manager reviews recommended budget, and gives preliminary approval on budget changes to be included in Proposed Budget.

6. Finance prepares Proposed Budget document

April - May: Preliminary Review and Public Input

1. City Manager Proposed Budget submitted to the City Council.

2. Online budget survey for public input.

3. Capital Improvement Program memo with recommendations issued from Planning Commission.

4. City Council makes policy decisions and budgetary amendments to the Proposed Budget.

June - July: Final Review and Adoption

1. First reading of appropriation ordinances held adopting budget.

2. City Council proposes / amends budget per policy decisions.

3. Second reading of appropriation ordinances held adopting budget.

4. Finance begins production of final budget document

August - September: Property Tax Levy and Final Budget Book

1. Assessed valuation received from Jackson and Clay Counties to set Property Tax Levy Rates.

2. Public hearing to set Property Tax Levy held.

3. Second reading of appropriation ordinances held adopting the annual tax levy

4. Tax levy rates submitted to Jackson and Clay Counties.

5. Adopted budget book printed and published online.

6. First quarter budget amendment prepared for City Council approval.

City of Independence Proposed Budget FY 2022-23 Page 20

FY 2022-23 Budget Calendar

Item

Resident Budget Survey Posted (Closes at end of January)

Personnel Allocations and Overtime Budgets sent to departments

CIP updates and new projects entered in PlanIt

Budget Kickoff Meeting

Personnel Allocation Changes Due

Overtime Budget Changes Due

Mid-Year Financial Status / 5 Year Forecast Update at Study Session

CIP Preliminary Report Presentation at Study Session

Internal Service Charges due (Central Garage, Tech Services, WC, Risk)

Personnel Posted to Munis for department review

Finance set items and internal charges are loaded Munis is open for budget entry

Due from departments:

- Proposed department budgets and package requests

- CIP for the fiscal year

- Revenues

- Estimated Actual Expenditures

- Personnel corrections / adjustments

- Capital Outlay List

Finance review of department budget submissions

City Manager meets with departments to review proposed budgets

CIP Presented to Planning Commission

City Manager approves recommended changes for proposed budget, packages posted, and departments notified

Department summary pages and org charts due

Fee Changes are due from departments

City Manager Proposed Budget submitted to the City Council

Thursday, December 2, 2021

Wednesday, December 15, 2021

Friday, December 31, 2021

Wednesday, January 5, 2022

Friday, January 7, 2022

Monday, January 18, 2022

Monday, January 24, 2022

Monday, January 24, 2022

Tuesday, February 1, 2022

Tuesday, February 1, 2022

Thursday, February 3, 2022

Tuesday, March 1, 2022

March 1 - April 1, 2022

March 7 - April 1, 2022

Tuesday, March 8, 2022

Friday, April 8, 2022

Friday, April 15, 2022

Monday, May 2, 2022

Friday, May 6, 2022

Due Date

City of Independence Proposed Budget FY 2022-23 Page 21

FUND DESCRIPTIONS

General Fund (002) is used to account for all financial resources necessary to carry out basic governmental activities of the city that are not accounted for in another fund. The General Fund supports essential city services, including police, fire, municipal services, and administration.

Special Revenue Funds are used to account for specific revenues that are legally restricted to expenditures for specified purposes.

Street Improvements Sales Tax (011) Voters approved a one-half of one cent sales tax for streets, bridges and safety improvements. Additional revenues from the Proposition "P" waterfall provision are accounted for here.

Park Improvements Sales Tax (012) The Park Improvements Sales Tax Fund has been setup to account for the one-quarter cent sales tax identified for parks and recreation. Additional revenues from the Proposition "P" waterfall provision are accounted for here.

Storm Water Sales Tax (013) The Storm Water Sales Tax Fund has been set up to account for the onequarter cent sales tax identified for storm water system improvements. Additional revenues from the Proposition "P" waterfall provision are accounted for here.

Police Public Safety Sales Tax (016) The voters approved a Capital Improvements for Police Sales Tax in April 2016 at the rate of one-eighth cent of the receipts from the sale at retail of all tangible personal property or taxable services at retail for a period of January 2017 through December 31, 2028.

The Police (Capital) Sales Tax Fund has been set-up to account for the one-eighth cent capital improvements sales tax identified for police equipment. Additional revenues from the Proposition "P" waterfall provision are accounted for here.

Fire Public Safety Sales Tax (017) The voters approved a one-half cent Fire Sales Tax in November 2021 until repealed by voters to replace the current rate of one-eighth cent of the receipts from the sale at retail of all tangible personal property or taxable services at retail for a period of January 2017 through December 31, 2028. The Fire Public Safety Sales Tax Fund has been set-up to account for the one-half cent for improvements including replacing and maintaining fire stations, apparatus, and lifesaving equipment. Sales tax funds can also be used to hire additional firefighters, administration, and personnel to improve department training needs. Additional revenues from the Proposition "P" waterfall provision are accounted for here.

Animal Shelter Use Tax (010) Voters approved Proposition "P", a use tax on goods delivered to Independence addresses in 2019. The rate of the use is the same rate as the total City's retail sales. The first $1.5 million (adjusted for inflation annually) will be split equally between a fund for Animal Services and a fund for hiring up to 30 new police officers. The next $1.5 million of use taxes in the fiscal year are applied 100% towards hiring of police officers ($3 million total before inflation increase). Use taxes

City of Independence Proposed Budget FY 2022-23 Page 22

collected over the amounts identified in the special use taxes will then be receipted into any fund that has a sales tax prorated on its share of sales taxes.

Police Use Tax (018) The Voters approved in November 2021 to increase the Proposition "P" use tax to expand the use of funds for new and current Police Department personnel and equipment and to increase the total before inflation increase from $3 million to $4 million and does not change the first $1.5 million split between Animal Services and Police Department. Originally, Voters approved Proposition "P", a use tax on goods delivered to Independence addresses in 2019. The rate of the use is the same rate as the total City's retail sales. The first $1.5 million (adjusted for inflation annually) will be split equally between a fund for Animal Services and a fund for hiring up to 30 new police officers. The next $1.5 million of use taxes in the fiscal year are applied 100% towards hiring of police officers ($3 million total before inflation increase). Use taxes collected over the amounts identified in the special use taxes will then be receipted into any fund that has a sales tax prorated on its share of sales taxes.

Health & Animal Levy (005) Funded by the Health & Recreation tax levy collected against real estate within the city of Independence. The purpose of the levy is for Health and Parks and Recreation purposes. This levy is split between the Health & Animal Levy Special Fund and a Parks Health & Recreation Levy Fund.

Parks Health & Recreation Levy (007) Funded by the Health & Recreation tax levy collected against real estate within the city of Independence. The purpose of the levy is for Health and Parks and Recreation purposes. This levy is split between the Health & Animal Levy Special Fund and a Parks Health & Recreation Levy Fund.

Com. Dev. Block Grant (008) accounts for the federally funded Community Development Block Grant Act program.

HOME (009) accounts for the federally funded home program. Grants (015) accounts for other grants, including Police, Fire, and Health department grants.

Enterprise / Utility Funds are used to account for operations that are financed and operated similar to a private business where the intent is that the cost of providing services to the public is financed primarily through user charges.

Power & Light (020) operations of the city's power and light utilities. Water (040) operations of the city's potable water utility.

Sanitary Sewer (030) operations of the city's sanitary sewer utility.

City of Independence Proposed Budget FY 2022-23 Page 23

Internal Service Funds

are used to account for operations internal to the city where the intent is that the cost of providing services to the city department is financed primarily through department user charges.

Central Garage (090) Vehicle maintenance and operations of citywide fleet, including gas and oil charges.

Staywell Health Care (091) Activities related to the city's' self-insured health care plan.

Workers' Compensation (092) Management of workers’ compensation insurance and claims.

Risk Management (093) Management of city liability insurance and claims.

Enterprise Resource Planning (ERP) changed to Finance Internal Service (095) Management of Finance and Administration for the costs associated with providing services citywide including budget, accounting, human resources and technology services.

All funds in the operating budget book are appropriated by City Council via budget adoption.

City of Independence Proposed Budget FY 2022-23 Page 24

Fund and Department Relationships

*Internal service funds are shown with the department that oversees each fund.

Fund City Manager Community Development Finance & Admin. Fire Health & Animal Services Mayor & City Council Municipal Court Parks | Rec. | Tourism Police Power and Light Municipal Services Water General Fund (002) x x x x x x x x x Street Improvements Sales Tax (011) x Park Improvements Sales Tax (012) x Storm Water Sales Tax (013) x Police Public Safety Sales Tax (016) x Fire Public Safety Sales Tax (017) x Animal Shelter Use Tax (010) x Police Use Tax (018) x Health & Animal Levy (005) x Parks Health & Recreation Levy (007) x Tourism (004) x Com. Dev. Block Grant (008) x HOME (009) x Grants (015) x x x x x x Central Garage (090) * x Staywell Health Care (091) * x Workers' Compensation (092) * x Risk Management (093) * x Enterprise Resource Planning (095) * x Power & Light (020) x Water (040) x Sanitary Sewer (030) x

City of Independence Proposed Budget FY 2022-23 Page 25

Schedule 1

All Funds by Expense Category

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Salaries $ 111,313,127 118,981,964 116,079,028 122,149,570 Retiree Health Insurance 5,326,829 6,170,000 5,739,246 5,911,000 Operating Expenses 141,056,436 139,333,570 136,198,035 143,599,665 Equipment 8,610,623 6,907,718 5,571,575 8,361,058 Total - Operating $ 266,307,015 271,393,252 263,587,884 280,021,293 Capital Improvements 22,520,059 25,581,792 19,813,557 25,660,836 Debt Service 30,633,292 19,909,878 19,808,754 18,807,966 Transfers Out 19,510,828 20,052,404 13,417,000 13,948,566 Contingency - 417,028 - 100,000 Total $ 338,971,194 337,354,353 316,627,195 338,538,661 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Salaries $ 61,434,693 62,870,844 61,674,282 60,277,691 Retiree Health Insurance 3,270,335 3,789,000 3,495,700 3,499,000 Operating Expenses 8,017,871 10,795,896 9,043,349 10,746,797 Equipment 1,647,544 217,050 309,474 56,723 Total - Operating $ 74,370,443 77,672,790 74,522,805 74,580,211 Capital Improvements - - -Debt Service 165,879 327,925 325,100 165,400 Transfers Out 35,300 10,000 10,000 10,000 Contingency - 17,028 -Total $ 74,571,622 78,027,743 74,857,905 74,755,611 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Salaries $ 9,601,742 12,449,300 11,601,369 16,339,183 Retiree Health Insurance 165,037 175,000 234,600 240,000 Operating Expenses 9,613,635 9,916,756 10,227,195 10,310,343 Equipment 4,482,401 3,576,250 2,714,815 5,176,610 Total - Operating $ 23,862,815 26,117,306 24,777,979 32,066,136 Capital Improvements 10,202,905 9,232,836 8,198,330 10,805,836 Debt Service 686,083 777,546 623,736 1,880,600 Transfers Out 220,291 245,792 407,000 938,566 Total $ 34,972,094 36,373,480 34,007,045 45,691,138

Funds(1) General Fund Special Revenue Funds City of Independence Proposed Budget FY 2022-23 Page 26

All

Schedule 1

All Funds by Expense Category

Notes:

(1) In the All Funds Summary, the totals for Internal Service Funds expense have already been included in the operating expenses for GF, Special Revenues, and Enterprise Funds as they are charged out during course of the year for internal services provided to other departments/funds.

(2) The Internal Service Funds Summary is shown for informational purposes, the total amount is in the operating expenses for each fund. The All Funds Summary is the total of the General Fund, Special Revenue Funds, and Enterprise Funds.

(3) Finance and Administration was moved to an Internal Service Fund in FY 2022-23.

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Salaries $ 40,276,692 43,661,820 42,803,377 45,532,696 Retiree Health Insurance 1,891,457 2,206,000 2,008,946 2,172,000 Operating Expenses 123,424,930 118,620,918 116,927,491 122,542,525 Equipment 2,480,678 3,114,418 2,547,286 3,127,725 Total - Operating $ 168,073,757 167,603,156 164,287,099 173,374,946 Capital Improvements 12,317,154 16,348,956 11,615,227 14,855,000 Debt Service 29,781,330 18,804,407 18,859,918 16,761,966 Contingencies - 400,000 - 100,000 Transfers Out 19,255,237 19,796,612 13,000,000 13,000,000 Total $ 229,427,478 222,953,130 207,762,245 218,091,912 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Salaries $ 1,462,275 1,689,319 1,954,108 6,997,439 Retiree Health Insurance 30,591 33,000 48,000 320,000 Operating Expenses 30,006,885 29,221,003 27,933,500 36,236,960 Equipment 4,612,435 91,000 40,200 150,500 Total - Operating $ 36,112,186 31,034,322 29,975,808 43,704,899 Capital Improvements - - -Debt Service - - -Transfers Out - - -Total $ 36,112,186 31,034,322 29,975,808 43,704,899

Internal Service Funds(2) (3) Enterprise Funds City of Independence Proposed Budget FY 2022-23 Page 27

Schedule 2

Expenditures by Department

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Department Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget City Manager $ 1,162,545 1,185,232 1,150,064 1,101,987 Community Development 6,503,146 7,224,038 6,838,901 7,411,286 Debt Service 6,085 59,231 -Finance & Administration 5,583,710 6,836,869 6,815,440 613,311 Fire 26,755,291 26,688,951 25,700,436 30,706,583 Health & Animal Services 2,065,644 2,767,458 2,728,569 3,013,858 Mayor & City Council 884,063 1,037,094 1,291,039 908,806 Municipal Court 1,086,560 1,264,139 1,155,386 1,687,121 Non-Departmental 1,379,317 204,528 216,400 233,888 Parks|Recreation|Tourism 8,172,279 9,737,043 8,333,462 12,503,019 Police 37,083,532 38,541,257 37,683,309 42,012,538 Power and Light 168,875,370 148,308,154 143,584,047 140,450,668 Municipal Services 49,005,222 54,828,762 40,581,784 56,457,741 Water 30,408,430 38,671,597 32,805,402 41,437,855 Total $ 338,971,194 337,354,353 308,884,239 338,538,661 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget City Manager $ 1,162,545 1,185,232 1,150,064 1,101,987 Community Development 3,864,649 4,576,184 3,763,004 5,205,956 Debt Service 6,085 59,231 -Finance & Administration 5,559,895 6,698,806 6,787,096 585,419 Fire 23,482,679 23,852,022 24,574,980 23,811,497 Health & Animal Services 69,878 - -Mayor & City Council 884,063 1,037,094 1,291,039 908,806 Municipal Court 1,086,560 1,264,139 1,155,386 1,687,121 Non-Departmental 1,379,317 204,528 216,400 233,888 Parks|Recreation|Tourism - - 164,892 296,239 Police 31,882,206 33,155,226 30,600,216 34,972,002 Municipal Services 5,193,745 5,995,281 5,154,828 5,952,696 Total $ 74,571,622 78,027,743 74,857,905 74,755,611

General Fund All Funds (1) City of Independence Proposed Budget FY 2022-23 Page 28

Schedule 2

Expenditures by Department

Special Revenue Funds

Enterprise Funds

(3) Finance and Administration was moved to an Internal Service Fund in FY 2022-23, therefore most expenses are spread in the operating expenditures of all other departments.

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Community Development $ 2,638,497 2,647,854 3,075,897 2,205,330 Finance & Administration 23,815 138,063 28,344 27,892 Fire 3,272,612 2,836,929 1,125,456 6,895,086 Health & Animal Services 1,995,766 2,767,458 2,728,569 3,013,858 Parks|Recreation|Tourism 8,172,279 9,737,043 8,168,570 12,206,780 Police 5,201,326 5,386,031 7,083,093 7,040,536 Municipal Services 13,667,799 12,860,102 4,054,160 14,301,656 Total $ 34,972,094 36,373,480 26,264,089 45,691,138 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Power & Light $ 168,875,370 148,308,154 143,584,047 140,450,668 Water 30,408,430 38,671,597 32,805,402 41,437,855 Sanitary Sewer 30,143,678 35,973,379 31,372,796 36,203,389 Total $ 229,427,478 222,953,130 207,762,245 218,091,912

City of Independence Proposed Budget FY 2022-23 Page 29

Schedule 3

Expenditures by Fund and Fund Type Governmental Funds

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Fund Type Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Governmental Funds $ 109,543,716 114,401,223 108,864,950 120,446,749 Enterprise Funds 229,427,478 222,953,130 207,762,245 218,091,912 Total $ 338,971,194 337,354,353 316,627,195 338,538,661 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Fund Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget General Fund (002) $ 74,571,622 78,027,743 74,857,905 74,755,611 Street Improvements Sales Tax (011) 10,677,750 8,127,589 8,455,481 9,566,117 Park Improvements Sales Tax (012) 3,691,977 5,087,150 4,328,102 6,096,261 Storm Water Sales Tax (013) 2,990,049 4,732,513 3,341,635 4,735,539 Police Public Safety Sales Tax (016) 2,721,707 2,705,118 2,156,900 2,371,100 Fire Protection Sales Tax (017) 2,856,627 2,836,929 1,097,856 6,895,086 Animal Shelter Use Tax (010) 820,620 728,545 677,310 769,213 Police Use Tax (018) 444,123 2,258,155 2,625,800 4,029,166 Health & Animal Levy (005) 1,070,318 1,663,192 1,673,933 1,779,148 Parks Health & Recreation Levy (007) 1,744,163 2,099,104 2,168,042 2,554,180 Tourism (004) 1,542,824 2,550,789 1,672,426 3,556,339 Com. Dev. Block Grant(008) 1,104,275 1,621,700 1,689,389 800,000 HOME (009) 631,871 526,154 465,330 465,330 Grants (015) 4,675,789 1,436,542 3,654,841 2,073,659 Total $ 109,543,716 114,401,223 108,864,950 120,446,749 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Fund Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Power & Light (020) $ 168,875,370 148,308,154 143,584,047 140,450,668 Water (040) 30,408,430 38,671,597 32,805,402 41,437,855 Sanitary Sewer (030) 30,143,678 35,973,379 31,372,796 36,203,389 Total $ 229,427,478 222,953,130 207,762,245 218,091,912

Enterprise Funds All Funds City of Independence Proposed Budget FY 2022-23 Page 30

Schedule 4

Revenue by Fund and Fund Type

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Fund Type Actual Revenue Adopted Budget Estimated Revenue Proposed Budget Governmental Funds $ 113,494,519 114,564,222 120,854,305 121,486,553 Enterprise Funds 204,380,386 210,449,269 212,670,009 214,795,523 Total $ 317,874,905 325,013,491 333,524,314 336,282,076 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Fund Actual Revenue Adopted Budget Estimated Revenue Proposed Budget General (002) $ 74,868,433 78,027,743 79,067,889 74,755,611 Street Improvements Sales Tax (011) 9,890,321 9,035,391 9,510,800 9,937,000 Park Improvements Sales Tax (012) 4,944,673 5,277,749 6,878,696 5,756,150 Storm Water Sales Tax (013) 4,690,075 4,637,032 4,911,400 5,101,900 Police Public Safety Sales Tax (016) 2,486,696 2,459,201 2,597,203 2,658,600 Fire Protection Sales Tax (017) 2,282,003 2,271,486 2,416,270 8,841,000 Animal Shelter Use Tax (010) 750,769 762,750 766,977 785,000 Police Use Tax (018) 3,020,161 3,039,000 4,058,700 4,159,000 Health & Animal Levy (005) 1,122,139 1,536,432 1,679,014 1,745,969 Parks Health & Recreation Levy (007) 2,148,269 2,146,831 2,130,801 2,016,590 Tourism (004) 1,349,112 1,833,926 1,850,244 2,044,100 Community Development Block Grant (008) 1,105,772 1,605,692 1,689,389 800,000 HOME (009) 415,963 482,477 465,330 465,330 Grants (015) 4,420,133 1,448,512 2,831,592 2,420,303 Total $ 113,494,519 114,564,222 120,854,305 121,486,553 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Fund Actual Revenue Adopted Budget Estimated Revenue Proposed Budget Power & Light (020) $ 132,287,568 140,082,934 141,478,425 142,060,700 Sanitary Sewer (030) 36,496,701 35,473,105 36,810,700 36,365,485 Water (040) 35,596,117 34,893,230 34,380,884 36,369,338 Total $ 204,380,386 210,449,269 212,670,009 214,795,523

All Funds Governmental Funds Enterprise Funds

City of Independence Proposed Budget FY 2022-23 Page 31

Schedule 5

All Funds by Revenue Category Group

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Revenue Adopted Budget Estimated Revenue Proposed Budget Taxes $ 55,482,302 56,036,458 59,149,750 67,964,275 Franchise Fees 7,376,565 8,171,990 7,943,300 8,344,000 PILOTS 19,255,236 20,696,578 20,671,269 20,848,787 Licenses and Permits 4,772,400 4,050,350 4,430,983 4,410,950 Intergovernmental 11,591,515 8,827,563 10,454,776 9,475,110 Miscellaneous 1,105,885 716,639 664,000 25,700 American Rescue Plan (ARP) - 3,472,000 -Charges for Services 2,879,426 3,280,033 3,419,545 3,238,351 Fines and Forfeitures 2,152,627 3,710,000 2,100,000 2,156,000 Utility Service Charges 192,286,342 200,647,531 202,682,500 201,322,585 Investment Income 2,100,864 1,318,913 1,740,561 1,795,264 Other Revenue 6,879,313 5,579,604 6,537,699 7,830,050 Sub-Total $ 305,882,475 316,507,659 319,794,383 327,411,072 Interfund Charges 9,264,182 8,255,739 8,248,584 7,666,100 Debt Issuance 185,011 - -Special Items - - -Proceeds from Capital Leases 1,192,500 - -Transfers In 1,350,737 250,092 5,481,347 1,204,904 Total $ 317,874,905 325,013,491 333,524,314 336,282,076 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Revenue Adopted Budget Estimated Revenue Proposed Budget Taxes $ 25,063,048 25,217,431 26,166,000 27,207,000 Franchise Fees 7,376,565 8,171,990 7,943,300 8,344,000 PILOTS 19,255,236 20,696,578 20,671,269 20,848,787 Licenses and Permits 4,772,400 4,050,350 4,430,983 4,410,950 Intergovernmental 5,655,410 5,330,000 5,599,500 5,810,000 American Rescue Plan (ARP) - 3,172,000 -Charges for Services 2,013,571 1,908,000 2,089,792 1,955,400 Fines and Forfeitures 2,152,627 3,710,000 2,100,000 2,156,000 Investment Income 223,572 194,000 210,707 220,000 Other Revenue 1,319,968 541,894 1,292,076 750,400 Sub-Total $ 67,832,397 72,992,243 70,503,627 71,702,537 Interfund Charges 5,035,500 5,035,500 5,035,500 2,354,600 Proceeds from Capital Leases 1,192,500 - -Transfers In 808,036 - 3,528,762 698,474 Total $ 74,868,433 78,027,743 79,067,889 74,755,611

All Funds General Fund City of Independence Proposed Budget FY 2022-23 Page 32

Schedule 5

All Funds by Revenue Category Group

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Revenue Adopted Budget Estimated Revenue Proposed Budget Taxes $ 30,419,254 30,819,027 32,983,750 40,757,275 Charges for Services 865,855 1,372,033 1,329,753 1,282,951 Other Revenue 314,115 28,890 192,023 55,050 Investment Income 373,045 278,873 483,029 474,126 Intergovernmental 5,936,105 3,497,563 4,855,276 3,665,110 American Rescue Plan (ARP) - 300,000 -Sub-Total $ 37,908,374 36,296,386 39,843,831 46,234,512 Transfers In 532,701 240,092 1,942,585 496,430 Debt Issuance 185,011 - -Total $ 38,626,086 36,536,478 41,786,416 46,730,942 FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Category Actual Revenue Adopted Budget Estimated Revenue Proposed Budget Utility Service Charges $ 192,286,342 200,647,531 202,682,500 201,322,585 Investment Income 1,504,247 846,040 1,046,825 1,101,138 Intergovernmental - - -Miscellaneous 1,105,885 716,639 664,000 25,700 Interfund Charges 4,228,682 3,220,239 3,213,084 5,311,500 Other Revenue 5,245,230 5,008,820 5,053,600 7,024,600 Sub-Total $ 204,370,386 210,439,269 212,660,009 214,785,523 Special Items - - -Transfers In 10,000 10,000 10,000 10,000 Total $ 204,380,386 210,449,269 212,670,009 214,795,523 Enterprise Funds Special Revenue Funds City of Independence Proposed Budget FY 2022-23 Page 33

Notes: (1) Unassigned fund balance is per March 2022 financial statements.

Schedule 6

Governmental Funds

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Taxes Property $ 5,924,381 5,732,000 5,763,000 5,903,000 Sales 18,295,167 18,617,431 19,746,000 20,635,000 Use Tax 435,288 448,000 277,000 289,000 Cigarette 408,212 420,000 380,000 380,000 Total Taxes 25,063,048 25,217,431 26,166,000 27,207,000 Utility Franchise Fees Water 35,232 30,300 35,300 36,000 Gas 3,557,985 3,955,000 4,200,000 4,600,000 Telephone 1,796,726 2,068,240 1,698,000 1,696,000 Electricity 645,175 765,050 705,000 712,000 Cable 1,341,447 1,353,400 1,305,000 1,300,000 Total Franchise Fees 7,376,565 8,171,990 7,943,300 8,344,000 PILOTS Power & Light 12,602,965 13,832,000 13,932,000 14,071,000 Water Service 3,119,911 3,232,000 3,142,757 3,145,209 Sanitary Sewer 3,532,360 3,632,578 3,596,512 3,632,578 Total PILOTS 19,255,236 20,696,578 20,671,269 20,848,787 All Other Licenses & Permits 4,772,400 4,043,350 4,430,983 4,410,950 Intergovernmental 5,655,410 5,330,000 5,599,500 5,810,000 American Rescue Plan (ARP) - 3,172,000 -Charges for Services 2,013,571 1,915,000 2,089,792 1,955,400 Fines & Court Costs 2,152,627 3,710,000 2,100,000 2,156,000 Interfund Chrgs Supp Services 5,035,500 5,035,500 5,035,500 2,354,600 Investment Income 223,572 194,000 210,707 220,000 Other 1,319,968 541,894 1,292,076 750,400 Total All Other $ 21,173,048 23,941,744 20,758,558 17,657,350 Proceeds from Capital Leases 1,192,500 - -Transfers In from Other Funds 808,036 - 3,528,762 698,474 Total Revenues $ 74,868,433 78,027,743 79,067,889 74,755,611 Expenditures Salary and Benefits $ 61,434,693 62,870,844 61,674,282 60,277,691 Retiree Health Insurance 3,270,335 3,789,000 3,495,700 3,499,000 Operating Expenses 8,017,871 10,795,896 9,043,349 10,746,797 Equipment 1,647,544 217,050 309,474 56,723 Sub-Total Expenditures $ 74,370,443 77,672,790 74,522,805 74,580,211 Debt Service 165,879 327,925 325,100 165,400 Contingency - 17,028 -Transfers Out 35,300 10,000 10,000 10,000 Total Expenditures $ 74,571,622 78,027,743 74,857,905 74,755,611 Excess Revenues Over (Under) Expenditures $ 296,811 0 4,209,984Unassigned Fund Balance at Beginning of Year 5,708,549 9,976,519 Cancellation of prior year encumbrances 56,279Change in other fund balance components during the year 1,707Year-end investment market value adjustment -Ending Unassigned Fund Balance (1) 9,976,519 9,976,519

City of Independence Proposed Budget FY 2022-23 Page 34

General Fund Summary Comparison of Revenues, Expenditures and Change in Fund Balance

Schedule 7

Governmental Funds

Tourism Fund (004)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per March 2022 financial statements.

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Transient Guest Tax $ 1,321,757 1,652,283 1,800,000 1,975,000 American Rescue Plan (ARP) - 150,000 -Charges for Services 1,447 - 15,000 32,000 Investment Income 24,461 26,593 22,560 25,050 Other 1,447 5,050 12,684 12,050 Total All Other $ 1,349,112 1,833,926 1,850,244 2,044,100 Transfers In from Other Funds - - -Total Revenues $ 1,349,112 1,833,926 1,850,244 2,044,100 Expenditures Salary & Benefits $ 670,036 773,307 581,000 1,004,782 Retiree Health Insurance 16,498 19,000 31,000Operating Expenses 820,213 1,038,390 820,052 646,465 Equipment 8,882 - -Operating Expenditures $ 1,515,629 1,830,697 1,432,052 1,651,247 Capital Improvements 27,195 480,000 240,374 1,665,000 Debt Service - - -Transfers Out - 240,092 - 240,092 Total Expenditures $ 1,542,824 2,550,789 1,672,426 3,556,339 Excess Revenues Over (Under) Expenditures $ (193,712) (716,863) 177,818 (1,512,239) Beginning Unassigned Fund Balance 752,469 944,477 Cancellation of Prior Year Encumbrances 14,190Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance 944,477 (567,762)

City of Independence Proposed Budget FY 2022-23 Page 35

Schedule 7

Governmental Funds

Health & Animal Levy Fund (005)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per March 2022 financial statements.

(2) FY 2021-22 budget includes the consolidation of the Health Inspection division (previously in Community Development.)

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Real Estate Tax $ 874,492 870,000 860,000 881,500 Charges for Services 131,856 516,432 506,905 546,738 American Rescue Plan (ARP) - 150,000 -Investment Income 1,536 - 4,392 3,731 Other 113,262 - 7,717 14,000 Total All Other $ 1,121,146 1,536,432 1,379,014 1,445,969 Transfers In from Other Funds 993 - 300,000 300,000 Total Revenues $ 1,122,139 1,536,432 1,679,014 1,745,969 Expenditures Salary & Benefits $ 669,159 1,255,102 1,186,560 1,239,823 Retiree Health Insurance 56,552 64,000 56,000 61,000 Operating Expenses 342,501 336,090 429,535 469,145 Equipment 2,106 8,000 1,838 9,180 Operating Expenditures $ 1,070,318 1,663,192 1,673,933 1,779,148 Capital Improvements - - -Debt Service - - -Transfers Out - - -Total Expenditures $ 1,070,318 1,663,192 1,673,933 1,779,148 Excess Revenues Over (Under) Expenditures $ 51,821 (126,760) 5,081 (33,179) Beginning Unassigned Fund Balance 52,841 57,922 Cancellation of Prior Year Encumbrances -Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance 57,922 24,743

City of Independence Proposed Budget FY 2022-23 Page 36

Schedule 7

Governmental Funds

Parks Health & Recreation Levy Fund (007)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per March 2022 financial statements.

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Real Estate Tax $ 1,858,296 1,850,000 1,831,000 1,876,775 Charges for Services 174,429 230,746 179,504 120,650 Intergovernmental 85,023 65,985 55,152Investment Income 4,457 100 23,350 19,165 Other 26,064 - 41,795Total All Other $ 2,148,269 2,146,831 2,130,801 2,016,590 Transfers In from Other Funds - - -Total Revenues $ 2,148,269 2,146,831 2,130,801 2,016,590 Expenditures Salary & Benefits $ 1,318,166 1,579,350 1,407,400 1,414,695 Retiree Health Insurance 71,042 30,000 145,000 160,000 Operating Expenses 354,955 489,754 491,067 888,485 Equipment - - 124,575Operating Expenditures $ 1,744,163 2,099,104 2,168,042 2,463,180 Capital Improvements - - - 91,000 Debt Service - - -Transfers Out - - -Total Expenditures $ 1,744,163 2,099,104 2,168,042 2,554,180 Excess Revenues Over (Under) Expenditures $ 404,106 47,727 (37,241) (537,590) Beginning Unassigned Fund Balance 410,588 379,331 Cancellation of Prior Year Encumbrances 5,984Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance 379,331 (158,259)

City of Independence Proposed Budget FY 2022-23 Page 37

Schedule 7

Governmental Funds

Street Improvements Sales Tax Fund (011) Comparison of Revenues, Expenditures and Change in Fund Balance

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Sales Tax $ 8,781,615 8,770,391 9,296,000 9,715,000 Use Tax 217,644 224,000 138,000 145,000 Intergovernmental Revenue 107,124 - -Investment Income 58,438 41,000 76,800 77,000 Other 39,061 - -Total All Other $ 9,203,882 9,035,391 9,510,800 9,937,000 Issuance of Debt 185,011 - -Transfers In from Other Funds 501,428 - -Total Revenues $ 9,890,321 9,035,391 9,510,800 9,937,000 Expenditures Salary & Benefits $ 53,568 573,177 446,025 578,081 Retiree Health Insurance 2,689 3,000 2,600 4,000 Operating Expenses 300,882 385,000 429,000 492,500 Equipment 433,688 205,000 160,200 150,000 Total Expenditures $ 790,827 1,166,177 1,037,825 1,224,581 Capital Improvements 9,110,681 6,486,836 6,942,956 6,556,836 Debt Service 555,951 474,576 474,700 1,784,700 Transfers Out 220,291 - -Total Expenditures $ 10,677,750 8,127,589 8,455,481 9,566,117 Excess Revenues Over (Under) Expenditures $ (787,429) 907,802 1,055,319 370,883 Beginning Unassigned Fund Balance 1,885,478 4,953,253 Cancellation of Prior Year Encumbrances 44,933Change in Other Fund Balance Components 1,967,523Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance 4,953,253 5,324,136

Unassigned fund balance is per March 2022 financial statements.

(1)

City of Independence Proposed Budget FY 2022-23 Page 38

Park Improvements Sales Tax Fund (012) Comparison of Revenues, Expenditures and Change in Fund Balance

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Sales Tax $ 4,390,812 4,385,212 4,648,000 4,858,000 Use Tax 108,822 112,000 69,000 72,000 Charges for Services 361,812 519,752 442,335 474,540 Intergovernmental - - - 88,500 Investment Income 24,995 18,180 66,200 59,180 Other 28,007 2,513 10,576 7,500 Total All Other $ 4,914,448 5,037,657 5,236,111 5,559,720 Transfers In from Other Funds 30,225 240,092 1,642,585 196,430 Proceeds from capital lease - - -Total Revenues $ 4,944,673 5,277,749 6,878,696 5,756,150 Expenditures Salary & Benefits $ 2,038,702 2,256,369 2,019,700 2,891,026 Retiree Health Insurance 18,256 59,000 - 15,000 Operating Expenses 1,272,768 2,058,567 2,040,202 2,081,335 Equipment 1,834 - - 115,900 Total Expenditures $ 3,331,560 4,373,936 4,059,902 5,103,261 Capital Improvements 303,520 506,000 215,000 993,000 Debt Service 56,897 207,214 53,200Transfers Out - - -Total Expenditures $ 3,691,977 5,087,150 4,328,102 6,096,261 Excess Revenues Over (Under) Expenditures $ 1,252,696 190,599 2,550,594 (340,111) Beginning Unassigned Fund Balance 599,247 3,156,033 Cancellation of Prior Year Encumbrances 6,192Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance 3,156,033 2,815,922 (1) Unassigned fund balance is per March 2022 financial statements.

Schedule

Governmental Funds City of Independence Proposed Budget FY 2022-23 Page 39

7

Schedule 7

Governmental Funds

Stormwater Sales Tax Fund (013) Comparison of Revenues, Expenditures and Change in Fund Balance

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Sales Tax $ 4,390,812 4,385,212 4,648,000 4,858,000 Use Tax 108,822 112,000 69,000 72,000 Investment Income 170,047 132,000 163,500 164,000 Other 20,394 7,820 30,900 7,900 Total All Other $ 4,690,075 4,637,032 4,911,400 5,101,900 Transfers In from Other Funds - - -Total Revenues $ 4,690,075 4,637,032 4,911,400 5,101,900 Expenditures Salary & Benefits $ 1,267,245 1,441,072 1,096,480 1,701,139 Retiree Health Insurance - - -Operating Expenses 809,460 1,416,741 1,346,930 1,366,100 Equipment 151,835 109,000 98,225 168,300 Operating Expenditures $ 2,228,540 2,966,813 2,541,635 3,235,539 Capital Improvements 761,509 1,760,000 800,000 $1,500,000 Debt Service - - -Contingencies - 5,700 -Transfers Out - - -Total Expenditures $ 2,990,049 4,732,513 3,341,635 4,735,539 Excess Revenues Over (Under) Expenditures $ 1,700,026 (95,481) 1,569,765 366,361 Beginning Unassigned Fund Balance 9,476,507 11,292,253 Cancellation of Prior Year Encumbrances 245,981Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance 11,292,253 11,658,614 (1) Unassigned fund balance is per March 2022 financial statements.

City of Independence Proposed Budget FY 2022-23 Page 40

Schedule 7

Governmental Funds

Police Public Safety Sales Tax Fund (016) Comparison of Revenues, Expenditures and Change in Fund Balance

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Sales Tax $ 2,310,802 2,358,694 2,468,000 2,580,000 Use Tax 54,901 56,000 35,000 36,000 Investment Income 45,039 37,000 35,000 35,000 Other 75,954 7,507 59,203 7,600 Total All Other $ 2,486,696 2,459,201 2,597,203 2,658,600 Transfers In from Other Funds - - -Total Revenues $ 2,486,696 2,459,201 2,597,203 2,658,600 Expenditures Salary & Benefits $ - - -Retiree Health Insurance - - -Operating Expenses 1,087,276 1,113,098 1,074,500 1,141,400 Equipment 1,634,431 1,569,500 1,059,800 1,207,100 Operating Expenditures $ 2,721,707 2,682,598 2,134,300 2,348,500 Capital Improvements - - -Debt Service - 22,520 22,600 22,600 Transfers Out - - -Total Expenditures $ 2,721,707 2,705,118 2,156,900 2,371,100 Excess Revenues Over (Under) Expenditures $ (235,011) (245,917) 440,303 287,500 Beginning Unassigned Fund Balance 2,277,473 2,717,776 Cancellation of Prior Year Encumbrances - 24,047 Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance 2,717,776 3,029,323 (1) Unassigned fund balance is per March 2022 financial statements.

City of Independence Proposed Budget FY 2022-23 Page 41

Schedule 7

Governmental Funds

Fire Protection Sales Tax Fund (017) Comparison of Revenues, Expenditures and Change in Fund Balance

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Sales Tax $ 2,195,578 2,192,486 2,324,000 8,770,000 Use Tax 54,901 56,000 35,000 36,000 Investment Income 23,143 17,000 28,300 29,000 Other 8,381 6,000 28,970 6,000 Total Revenues $ 2,282,003 2,271,486 2,416,270 8,841,000 Expenditures Salary & Benefits $ 457,364 486,571 298,500 3,140,086 Retiree Health Insurance - - -Operating Expenses 800,620 1,042,122 696,120 1,108,300 Equipment 1,525,408 1,235,000 30,000 2,573,400 Operating Expenditures $ 2,783,392 2,763,693 1,024,620 6,821,786 Capital Improvements - - -Debt Service 73,235 73,236 73,236 73,300 Transfers Out - - -Total Expenditures $ 2,856,627 2,836,929 1,097,856 6,895,086 Excess Revenues Over (Under) Expenditures $ (574,624) (565,443) 1,318,414 1,945,914 Beginning Unassigned Fund Balance 678,965 1,999,612 Cancellation of Prior Year Encumbrances 2,233 21,960 Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance 1,999,612 3,967,486 (1) Unassigned fund balance is per March 2022 financial statements.

City of Independence Proposed Budget FY 2022-23 Page 42

Schedule 7

Governmental Funds

Animal Shelter Use Tax Fund (010)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per March 2022 financial statements.

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Use Tax $ 750,000 762,750 762,750 782,000 Investment Income 768 - 4,227 3,000 Other 1 - -Total All Other $ 750,769 762,750 766,977 785,000 Transfers In from Other Funds - - -Total Revenues $ 750,769 762,750 766,977 785,000 Expenditures Salary & Benefits $ 811,060 728,545 674,400 768,013 Retiree Health Insurance - - -Operating Expenses 9,560 - 2,910 1,200 Equipment - - -Operating Expenditures $ 820,620 728,545 677,310 769,213 Capital Improvements - - -Debt Service - - -Transfers Out - - -Total Expenditures $ 820,620 728,545 677,310 769,213 Excess Revenues Over (Under) Expenditures $ (69,851) 34,205 89,667 15,787 Beginning Unassigned Fund Balance 153,123 244,227 Cancellation of Prior Year Encumbrances 1,437Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance 244,227 260,014

City of Independence Proposed Budget FY 2022-23 Page 43

Schedule 7

Governmental Funds

Police Use Tax Fund (018)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per March 2022 financial statements.

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Use Tax $ 3,000,000 3,032,000 4,000,000 4,100,000 Investment Income 20,161 7,000 58,700 59,000 Other - - -Total All Other $ 3,020,161 3,039,000 4,058,700 4,159,000 Transfers In from Other Funds - - -Total Revenues $ 3,020,161 3,039,000 4,058,700 4,159,000 Expenditures Salary & Benefits $ 444,123 2,258,155 1,289,800 2,608,992 Retiree Health Insurance - - -Operating Expenses - - 80,000 231,700 Equipment - - 849,000 490,000 Operating Expenditures $ 444,123 2,258,155 2,218,800 3,330,692 Capital Improvements - - -Debt Service - - -Transfers Out - - 407,000 698,474 Total Expenditures $ 444,123 2,258,155 2,625,800 4,029,166 Excess Revenues Over (Under) Expenditures $ 2,576,038 780,845 1,432,900 129,834 Beginning Unassigned Fund Balance 3,546,492 4,979,392 Cancellation of Prior Year Encumbrances -Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance 4,979,392 5,109,226

City of Independence Proposed Budget FY 2022-23 Page 44

Schedule 7

Governmental Funds

Community Development Block Grant (008)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per March 2022 financial statements.

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Federal Grant $ 1,105,772 1,605,692 1,689,389 800,000 Total Revenues $ 1,105,772 1,605,692 1,689,389 800,000 Expenditures Salary & Benefits $ 138,071 126,903 113,068 136,227 Retiree Health Insurance - - -Operating Expenses 960,829 1,494,797 1,576,321 663,773 Equipment 5,375 - -Operating Expenditures $ 1,104,275 1,621,700 1,689,389 800,000 Capital Improvements - - -Debt Service - - -Transfers Out - - -Total Expenditures $ 1,104,275 1,621,700 1,689,389 800,000 Excess Revenues Over (Under) Expenditures $ 1,497 (16,008) -Beginning Unassigned Fund Balance (96,680) (68,213) Cancellation of Prior Year Encumbrances 28,467Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance (68,213) (68,213)

City of Independence Proposed Budget FY 2022-23 Page 45

Schedule 7

Governmental Funds

HOME Grant - Rental Rehabilitation (009)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per March 2022 financial statements.

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Federal Grant $ 415,963 482,477 465,330 465,330 Total Revenues $ 415,963 482,477 465,330 465,330 Expenditures Salary & Benefits $ 65,240 57,707 57,200 42,655 Retiree Health Insurance - - -Operating Expenses 50,188 30,697 43,900 27,145 Equipment 516,443 437,750 364,230 395,530 Operating Expenditures $ 631,871 526,154 465,330 465,330 Capital Improvements - - -Debt Service - - -Transfers Out - - -Total Expenditures $ 631,871 526,154 465,330 465,330 Excess Revenues Over (Under) Expenditures $ (215,908) (43,677) -Beginning Unassigned Fund Balance (401,485) (401,485) Cancellation of Prior Year Encumbrances -Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance (401,485) (401,485)

City of Independence Proposed Budget FY 2022-23 Page 46

FY 2020-21 FY 2021-22 FY 2021-22 FY 2022-23 Actual Expenditures Adopted Budget Estimated Expenditures Proposed Budget Revenues Federal & State Grants $ 4,222,223 1,343,409 2,645,405 2,311,280 Charges for Services 196,311 105,103 186,009 109,023 Other 1,544 - 178Total Revenues $ 4,420,078 1,448,512 2,831,592 2,420,303 Transfers In from Other Funds 55 - -Total Revenues $ 4,420,133 1,448,512 2,831,592 2,420,303 Expenditures Salary & Benefits $ 1,669,007 913,042 2,431,236 813,664 Retiree Health Insurance - - -Operating Expenses 2,804,383 511,500 1,196,658 1,192,795 Equipment 202,399 12,000 26,947 67,200 Operating Expenditures $ 4,675,789 1,436,542 3,654,841 2,073,659 Capital Improvements - - -Debt Service - - -Transfers Out - - -Total Expenditures $ 4,675,789 1,436,542 3,654,841 2,073,659 Excess Revenues Over (Under) Expenditures $ (255,656) 11,970 (823,249) 346,644 Beginning Unassigned Fund Balance (338,049) (1,161,298) Cancellation of Prior Year Encumbrances -Change in Other Fund Balance Components -Year-End Investment Market Value Adjustment -Ending Unassigned Fund Balance (1,161,298) (814,654) (1) Unassigned fund balance is per March 2022 financial statements.

Grant

Comparison of Revenues, Expenditures and Change in

City of Independence Proposed Budget FY 2022-23 Page 47

Schedule 7 Governmental Funds

Fund (015)

Fund Balance

Schedule 8

Enterprise Funds

Power and Light Fund (020)

Comparison of Revenues, Expenditures and Change in Available Resources

(1) Unassigned fund balance is per March 2022 financial statements.