TABLE OF CONTENTS

TABLE OF CONTENTS (CONTINUED)

May 10, 2021

Honorable Mayor and Members of the City Council:

Through thoughtful and deliberate decision-making, I am pleased to submit to you this transmittal letter that details the Submitted Budget for the City’s fiscal year beginning July 1, 2021 and ending June 30, 2022 in accordance with Section 8.2 of the City Charter. The proposed budget totals $337,354,793 or an increase of $23,394,720 (approximately 7.4%), due to increases in salaries and benefits, retiree health insurance, capital improvement projects, and operating expenditures.

The COVID-19 pandemic created an economic crisis unlike any other in recent memory. While this pandemic challenged our finances, we rose to meet the financial challenges presented by this global health pandemic and avoided drawing on the $25 million interfund loan from the City’s pooled cash and investments approved by City Council, or the $1.5 million COVID contingency fund included in last year’s adopted budget. We displayed this strong fiscal prudence without needing the employee layoffs and furloughs that were all too common for both public and private sector employers. In so doing, we ensured City staff were able to continue delivering the services that our residents and business owners depend on. Our employees were on the front line of battling this deadly virus, and their service to our community cannot be overstated.

Tracking the Economic Recovery

From our jobs to our homes to how we shop, COVID-19 has disrupted nearly every aspect of life. As a result, the economy continues to evolve as we grapple with life during the pandemic. While there are reasons to be optimistic, enough uncertainty remains to urge a cautious approach to the development of the Submitted Budget.

As I have stated throughout the past year, economic recovery is dependent on two factors: the timing of vaccine distribution versus future outbreaks and consumer confidence. In one sense, there are reasons to be positive. The Conference Board’s consumer confidence index jumped 19.3 points to a reading of 109.7 for March 2021, the highest level since the onset of the pandemic in March 2020. The increase was the largest since April 2003. Fueled by this increased consumer confidence and supplemented by the federal government’s $1.9 trillion pandemic relief package, Federal Reserve Chairman Jerome Powell has indicated that he feels the economy and job creation are about to start growing “much more quickly.”

Economists predict the economy will this year experience its best performance in nearly four decades. Surveys show more consumers intended to buy homes, cars, and household appliances over the next six months.

There is also reason for optimism regarding the timing of vaccine distribution. While case rates have risen slightly as of late in Eastern Jackson County, they have stayed far below the spikes seen in other places of the country. Restrictions on non-essential businesses are being rolled back as more Americans get vaccinated against COVID-19. Missouri ranks 50th among states where coronavirus is spreading the fastest on a perperson basis. To date, 34.3% of Missouri residents have received at least one dose of the vaccine.

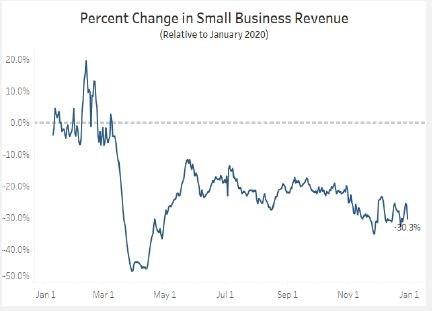

Conversely, there are plenty of reasons for continued pessimism. While consumer confidence has soared, it remains well below its lofty reading of 132.6 in February 2020. Moreover, while employment rates have rebounded to nearly pre-COVID-19 levels for high-wage workers, they remain significantly lower for low-wage workers. In the United States, employment rates for workers making more than $60,000 per year is only down 1.6% from a year ago, while employment rates for those making less than $27,000 is still 28% less than a year ago. Several key economic indicators within Jackson County also remain stubbornly low. Between January 2020 and January 2021 employment rates decreased by 15.3%, total spending by all consumers decreased by 18.7%, total small business revenue decreased by 39.4%, and the number of small businesses open decreased by 26.8%.

Given this economic fluctuation, this budget has been prepared with the following priorities:

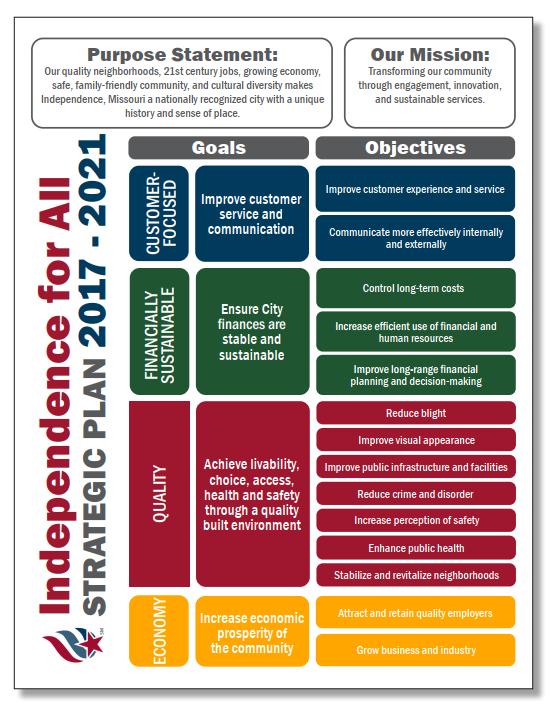

Address City Council strategic priorities as outlined in Independence for All

Make strategic use of one-time revenues to further navigate economic uncertainties

Independence for All

The same proven strategic plan has served our organization since 2017: Independence for All. With its guidance, I have recommended a plan in each of the last four submitted budgets that sought to implement many of the strategies behind the four goals identified by the City Council:

• Customer-Focused – Improve customer service and communication.

• Financial Sustainability – Ensure City finances are stable and sustainable.

• Growth – Increase the economic prosperity of the community.

• Quality – Achieve livability, choice, access, health and safety through a quality-built environment.

The results of our thoughtful planning and superior delivery of City services are impressive. I can enthusiastically report that the strategies behind Independence for All are working, as we have now completed nearly all of the 74 identified strategies outlined in Independence for All

In August 2020, the City Council met to launch the new, fiveyear strategic planning process and outline their priorities for the next year. This was followed by a citywide survey for residents to provide feedback on the City Council goals, objectives, and priorities. Having received this feedback, the City Council adopted the 2021 Strategic Plan for the City of Independence in March. The heart of the plan continues to be captured

in four goals: Customer-Focused, Financially Sustainable, Economy, and Quality, with a focus on five priorities:

Reduce Crime and Disorder

Communicate More Effectively Internally and Externally

Enhance Public Health

Stabalize and Revitalize Neighborhoods

Reduce Blight

Independence for All focuses on interdepartmental collaboration, access, and equity in all its components and will continue to be evaluated quarterly to measure its success and ensure it represents the priorities of both the City Council and residents.

General Fund Overview

Total revenues for the General Fund in the Fiscal Year 2021-22 Budget are $78,362,743 (including one-time American Recovery Plan funding). Revenue growth is primarily attributable to an estimated 1.5% increase over current fiscal year projected sales taxes revenues. Despite the loss of several major retailers in the last year, this increase is driven by to the Use Tax waterfall provision. A total of $448,000 in Use Tax revenues is expected to waterfall to the General Fund in the Fiscal Year 2021-22 Budget.

1.5% increase in sales tax revenue

General Fund Revenues in the Submitted Budget also continue to be plagued by the same revenue erosion issues that I have highlighted in recent years, including continued forecasted losses in the Cable Franchise Fee (-3%), Telephone Franchise Fee (-22%), and Fines and Court Costs (-2%).

Total expenditures for the General Fund are $78,362,743, or an increase of $3,925,730 or 5.3% over the 2020-21 Adopted Budget Expenditure growth is the result of continued increases in salary and benefit costs, which are budgeted to grow 10.5% this year. Major contributing factors include budgeted increases for employee health insurance (4%), LAGERS (15%), Workers Compensation (30%), retiree health insurance (104%), and Fire Department minimum staffing (34%). LAGERS rates increased 1%, the overall LAGERS increase is due to being budgeted separately for all qualifying pays instead of being combined with salaries. This budget also includes 2% across-the-board wage increase for all nonrepresented employees as well as appropriate funding to meet contractually obligated wage and benefit increases for represented employees. In addition, all previously frozen vacant positions are fully funded in this budget.

To balance this budget as required by the Missouri State Constitution, a total of $4,172,000 in one-time revenues from the federal American Recovery Plan are contemplated for use in the General Fund. Additional ARP funds have been included in the budget as highlighted in the appendix.

Should the City Council ultimately decide to redirect these revenues for another use, corresponding reductions in expenditures will be necessary. To be direct, this budget is making use of one-time revenues to bridge a continued structural imbalance in the General Fund and to accurately budget for the Stay Well fund, the newly re-established Health Department, and continued operation of the intra- and inter-city transit system. Without further strategic reductions in operating expenses or an infusion of new revenues in the next 12 18 months, we will be confronted with a financial problem of similar-or greater-magnitude next fiscal year. To be clear, our options can be summarized as such:

• Make strategic changes to legacy expenditures that are growing at unsustainable rates, such as health benefits, vested leave payouts, and other benefit programs.

• Attract and retain industry that meets market demand and provides employment opportunities for Independence residents.

• Pursue other revenue growth opportunities through ballot initiatives.

• Evaluate citizen demand for services and strategically address service-level deployment models to match citizen/service level demand, emerging technologies, regional capacity, and industry best practices.

• Make across-the-board reductions to an already-meager workforce and further reduce our ability to meet citizen demand for basic service delivery in high-priority areas.

The American Recovery Plan provides us with an additional year to assess our financial position and align our resources to meet our citizen’s expectations for basic service delivery, but we simply do not have the one-time resources beyond this year to sustain such a practice. We must work in earnest over the next year to address these ongoing structural deficiencies.

City Council Resolution 17-729 adopts a number of financial policies for the City, including setting minimum Unrestricted Fund Balances. This policy states that the City will endeavor to maintain a minimum Unrestricted and Unassigned Fund Balance in the General Fund equal to 16% of annual operating revenues.

The Unrestricted Fund Balance for the General Fund is increasing in the Proposed Budget. The Fiscal Year 2020-21 Adopted Budget showed fund balance at $5,293,903 (7.11%), while the estimated fund balance for Fiscal Year 2020-21 is $5,812,237 (8.68%). For Fiscal Year 2021-22, I am projecting the Unrestricted Fund Balance will remain at $5,812,237 (8.68%). As reflected in the chart below, I must caution the City Council that our five-year financial forecast indicates the unrestricted fund balance will decrease to 2.44% in Fiscal Year 2022-23 and will fall below zero in Fiscal Year 2023-24.

Over the past five years, we have worked diligently to reduce expenditures and tackle structural budget issues that have plagued our City finances for years. More than ever, it is imperative that all parties collaborate to address our expenditures and grow revenues if we are to adapt to this new normal and sustain the progress we have collectively made to date.

Due to this budget constriction and the lingering economic uncertainty presented by the COVID-19 pandemic, this budget does not recommend funding for many new programs or initiatives; instead, many

of the items that align with the strategic priorities of Independence for All are funded through the American Recovery Plan.

General Fund changes of note include:

• $295,000 for streetlight consumption costs.

• $45,000 for 457 plan advisory costs.

• $20,063 for the addition of one part-time Detention Officer.

• Convert 6.0 Police Officer positions to Cadets to begin new recruitment program

• Full-year funding for Vacant Building Registry Program.

• Full-year funding for Neighborhood Services Manager to build proactive code enforcement capacity.

• $100,000 for Mayor and City Council At-Large elections.

• Increase of $610,000 for Retiree Health Insurance.

• Continued consolidation of services to drive efficiency all mowing and grounds maintenance will transition to Parks and Recreation in the upcoming fiscal year.

Health and Animal Services Fund

Following the reorganization and restructuring of the Independence Health Department in 2018, the City Council directed City staff in late 2020 to pursue recognition from the State of Missouri as a Local Public Health Agency (LPHA) to better serve the needs of the community in response to the COVID-19 pandemic. Recognition was received from the State in early 2021, and this budget provides the funding necessary to resume public health responsibilities at a baseline level.

Total expenditures for the Health and Animal Services Department are $2,767,298 and includes $346,104 in the General Fund, $1,316,928 in the Property Tax Levy Fund, $728,545 in the Animal Shelter Use Tax Fund, and $375,721 in Health Services Grants, with a revenue supplement of $150,000 from the American Rescue Plan (ARP). This budget supports 32.75 total full-time employees, 5.0 are grant funded.

Use Tax Fund Overview

Estimated revenues in the Fiscal Year 2021-22 Submitted Budget from the Use Tax are $4,802,750. In accordance with the voter-approved ballot language, $762,750 is budgeted for animal shelter operations, while $3,032,000 is budgeted to fund up to 30 sworn police personnel. Having satisfied these requirements, this leaves a total of $1,008,000 to waterfall to the appropriate originating sales tax fund. The breakdown of this allocation is as follows:

• General Fund: $448,000

• Street Improvement Sales Tax: $224,000

• Park Improvement Sales Tax: $112,000

• Storm Water Sales Tax: $112,000

• Police Public Safety Sales Tax: $56,000

• Fire Public Safety Sales Tax: $56,000

Sales Tax Funds Overview

In addition to the Use Tax, the City of Independence administers six additional voter-approved sales taxes. While these funds were already experiencing increasing costs against diminishing revenues, the COVID19 pandemic has further weakened their financial position. After an anticipated decline in revenue of 21% last fiscal year, five of these six funds are now estimated for a see positive revenue growth in Fiscal Year 2021-22, with a 2.0% increase over the estimated FY 2020-21 revenue. Only the Transient Guest Tax is budgeted to experience a revenue decrease, which is budgeted at 3.8% less than Fiscal Year 2020-21.

Enterprise Funds Overview

The submitted budget does not forecast significant revenue growth in the enterprise funds because of the COVID-19 pandemic. As economic markers remain stubbornly inconsistent, this may portend a continued issue for residential customers who may struggle to make their monthly payments. Similarly, any combination of lingering economic shutdowns or business closures along with any increases in infection rates may signal public health restrictions that could adversely impact revenues from commercial and industrial accounts. Against that backdrop, the budgets for the enterprise funds have been developed with minimal revenue growth while accurately budgeting for planned expenditures, including capital programming and system maintenance. As a result, the proposed budget reflects unrestricted fund balance will be drawn down in the Power & Light Fund by $8,225,219, by $3,778,368 in the Water Fund, and the Sanitary Sewer Fund by $400,275. Staff will need to manage financial performance throughout the year to determine if planned capital investments are supported by a reversal in the current negative demand and revenue trends or require reductions or elimination altogether of

investments to match revenues and avoid further erosion of each utilities’ fund balance. These funds will also require monitoring for compliance with their respective Resiliency and Cash Balance Policies.

• Full-year funding for Public Education and Outreach Coordinator

• $1,467,000 additional funding for Retiree Health Insurance.

• Increase of 3.0 FTE for temporary Meter Readers

• $136,000 for meter reading handheld computers

• Initiating multi-year planned drawdown of fund balance in the Water Fund for Water Main Replacement Program ($1,745,000).

• $450,000 in Sewer Fund for Little Blue Valley Sewer District rate increase.

• $184,000 for 3.0 FTE for a Sanitary Sewer Evaluation program.

Conclusion

The turmoil brought about by the COVID-19 worldwide pandemic is devastating for many reasons, from the loss of life to the uncertain economic impact. Despite this catastrophic moment in time, I am confident that the submitted budget will not only provide the financial resiliency needed to weather the current storm but will also allow the City of Independence to provide the services that are most essential to our citizenry.

It is also important to take a moment during these challenging times to thank all our City staff who continue to respond to this event with the utmost professionalism and commitment to the services we provide to our citizens. It is because of them and the resiliency of this community, that there is a light at the end of this journey.

I want to thank you, the City Council, and the City departments for the assistance provided in preparing this budget. The options presented as a part of this budget are not easy choices; my staff and I are ready to address any questions regarding the information presented. Together we will ensure the long-term financial sustainability of the City while providing the services that truly make us an Independence for All

Respectfully,

Zachary C. Walker City Manager

Form of Government

City Council

Eileen N. Weir

Karen M. DeLuccie At-Large

Mike Huff At-Large

John Perkins District 1

Brice Stewart District 2

Michael Steinmeyer District 3

Daniel Hobart District 4

Mayor

Eileen N. Weir

Karen M. DeLuccie At-Large

Mike Huff At-Large

John Perkins District 1

Brice Stewart District 2

Michael Steinmeyer District 3

Daniel Hobart District 4

Mayor

Guide to the FY 2021-22 Budget Document

The purpose of this budget document is to provide a comprehensive view of the operating budget. The budget is a tool for management to plan services, but it is also a communication to the public on the overall financial and policy direction of the city. Use this guide to navigate the document.

Budget Transmittal letter

The City Manager’s Budget Message provides the framework for how the budget was developed, including contextual information on the city’s finances, economic trends, and changes to the budget.

Introduction

This section provides general information about the City:

• Names and photos of Mayor and City Council

• City of Independence overview and history

• Independence for All 5-Year Strategic Plan

Fund Summaries

This section of the book gives the highest-level overview of the fund structure of the city.

• The breakdown of expenditure types across all funds

• The breakdown of revenue types across all funds

• Fund summaries for each fund, which show how the expenditures relate to the revenues

Department Summaries

This section contains summary and detail information about each city department:

• Organizational chart shows the director and divisions of each department

• Department summary page highlights the mission of the department, the budgetary funds that make up the budget, a summary of expenditures, and total budgets and FTE counts

• The department is then broken down further into divisions (for instance, the Patrol Division of the Police department). The top half of the page will show summary information about the types of expenditures in that division, as well as the funding source and FTE counts.

Capital Improvements Program

This section contains the six-year CIP plan that was approved by the Planning Commission in March 21, 2021, including:

• Summary of Projects

• Funding Sources

• Project details

Appendix

The appendix includes miscellaneous information that may help further understanding of the budget, including:

• Budget Survey Summary

• Changes made from the proposed budget to the adopted budget

• Financial and budgetary policies/procedures of the city

• Glossary of budget and finance terms

Budget Development Process

Development of the annual City budget is a year-long process that culminates in June, with the formal adoption of the budget.

October - December: Planning

1. Financedevelopsthe2021budgetmanual.

2. Financemeetstoresolveissuesandpreparebudgetoutlook.

January - February: Operating Budget Kickoff & CIP Presentation

1. Financemeetswithdepartmentstokickoffbudgetprocess.

2.UpdatedFiveYearForecastpresentedtoCityCouncil.

3. Financepreparesthebasebudget,chargebacks,andpreliminarypersonnelbudgets.

4.Revenueprojectionsandestimatedactualexpensesforprioryearareprepared.

5.CapitalImprovementProgrambudgetpresentedbyEconomicDevelopmenttothePlanning Commission.

March: Department Preparation

1.CityCounciladoptsannualStrategicPlanupdate.

2.InconjunctionwiththeFinance,departmentsanddivisionspreparebudgetproposals.

3.DepartmentsDirectorspresentbudgetsandpackagerequeststotheCityManager.

4.Finaladjustmentsinrevenueandexpenditureestimatesarecomplete.

5.CityManagerreviewsrecommendedbudget,andgivespreliminaryapprovalonbudgetchangesto beincludedinproposedbudget.

6.FinancepreparesProposedbudgetdocument

April - May: Preliminary Review and Public Input

1.CityManagerproposedbudgetsubmittedtotheCityCouncil.

2.Onlinebudgetsurveyforpublicinput.

3.CapitalImprovementProgrammemowithrecommendationsissuedfromPlanningCommission.

4. CityCouncilmakespolicydecisionsandbudgetaryamendmentstotheProposedbudget.

June - July: Final Review and Adoption

1. Firstreadingofappropriationordinancesheldadoptingbudget.

2. CityCouncilproposes/amendsbudgetperpolicydecisions.

3. Secondreadingofappropriationordinancesheldadoptingbudget.

4. Financebeginsproductionoffinalbudgetdocument

August - September: Property Tax Levy and Final Budget Book

1. AssessedvaluationreceivedfromJacksonandClayCountiestosetPropertyTaxLevyRates.

2. PublichearingtosetPropertyTaxLevyheld.

3. Secondreadingofappropriationordinancesheldadoptingtheannualtaxlevy

4. TaxlevyratessubmittedtoJacksonandClayCounties.

5.Adoptedbudgetbookprintedandpublishedonline.

6.FirstquarterbudgetamendmentpreparedforCityCouncilapproval.

FY 2021-22 Detailed Budget Calendar

adoption of the FY 2021-22 Operating Budget Appropriation Ordinance (Must be before June 27 or the proposed budget as amended will become effective)

About the City of Independence

Independence the fifth largest city in Missouri, located with Jackson County It is the largest suburb of the Kansas City metro on the Missouri side. Located ten miles east of Kansas City, Missouri in the geographical center of the United States. Independence has a Mayor / City Council / City Manager form of government. The Independence City Council is made up of six members, four are elected to represent one of the city districts, the other two are elected by the city as a whole. The City Mayor also sits on the City Council and serves as the "Head of Government" for the city. Members serve a four-year term, beginning on January 1 following the election.

History

Independence was originally inhabited by the Missouri and Osage Indians and became part of the United States with the Louisiana Purchase in 1803. The city was founded on March 29, 1827. It was the farthest point westward on the Missouri river where steamboats or cargo vessels could travel. The city quickly became the hub of the California Trail, Santa Fe Trail, and the Oregon Trail. Independence was soon known as the Queen of the Trails, due to is unique location where all three trails converged. It wasn’t until the 19th century that Independence was defined by The United States Congress as the “Start of the Oregon Trail.” In 1826, Independence was named the county seat of Jackson County. During the years of 1862 and 1864 the First and Second battles of Independence were fought.

President Harry S. Truman grew up in Independence. In 1945, Harry S Truman took office as the 33rd and spent two terms as President of The United States, after which he returned to Independence, where the Presidential Library was built in 1957. For another two decades, he and his wife Bess remained Independence residents. The Harry S. Truman National Historic Site and the Harry S. Truman Presidential Library and Museum are both located in Independence.

Community Profile

Independence is positioned strategically at the crossroads of I70 and I-470, where approximately 150,000 cars pass each day. The Kansas City metropolitan area has more lane miles of freeway per capita than any other metro area in the United

States. Two rail lines, three interstates and five state highways serve Independence. The city is located just 25 minutes from Kansas City International Airport.

Independence has seven police stations, ten fire stations, and the city provides Water, Sanitary Sewer, and Power and Light utilities, with three power stations.

The development of the Little Blue Parkway, a new thoroughfare connecting the eastern portion of the City from I-70 to 24 Highway will open 38 miles of land for development. It is estimated that by the year 2020, the Little Blue Valley will be home to an additional 20,000 people and 5,000 new office, industrial and retail jobs.

In the heart of the city, Historic Independence Square is undergoing a renaissance with substantial increase in private investment and a planned restoration of the Historic Jackson County Courthouse. The traditional town square offers unique shops, restaurants, loft-style apartments and a newly renovated cinema and bowling alley.

Creating the educated workforce of the future is a priority for the Independence Community. The city is supported by four award-winning public-school districts: Independence, Blue Springs, Fort Osage, and Raytown school districts. Independence is home to four colleges to support the higher education needs of our citizens, including Metropolitan Community College, Graceland University, Park University, and National American University.

Independence has a history of a pro-business attitude. Its low-cost environment is a natural incentive to companies looking to expand or relocate. Independence has the third lowest property tax rate in the Kansas City Metropolitan Area. Additionally, the City does not tax on personal property, including machinery and equipment. The city tax structure coupled with the many affordable housing options makes it the best value in the Metro for working and living.

Quick Facts about Independence

Population: 116,673

Square Miles: 78.25

Number of Households: 47,329

Average Household Size: 2.4

Median Household Income: $52,325

Median Age: 36.8

Median value of owner-occupied units: $122,104

School Enrollment: 24,408

Miles of highways: 46.38

Number of new business licenses in 2020: 822

Sister City: Higashimurayama, Tokyo, Japan

Source: City of Independence and Censusreporter.org

Statistical Information

INCOME

Per capita personal income, Missouri Adjusted Gross Income per return data for the city, County and State are presented in the following table:

POPULATION

The population trends for the city, county, and state are shown in the table below.

Source for Income and population data: City of Independence, Jackson County, State of Missouri

MAJOR EMPLOYERS

The major employers in the city by number of employees (full and part-time).

Source: Independence Council for Economic Development and Mid-America Regional Council.

LARGEST TAXPAYERS

The table below shows the city’s ten largest taxpayers for 2019, the total assessed valuation for the city was $1,613,879,510.

Independence for All Strategic Plan

2017 - 2021 Strategic Plan Adoption

The 2017 – 2021 Strategic Plan for the City of Independence was adopted by the City Council on February 6, 2017. The process began in November 2016 with a City Council planning session. The Council set a community vision and identified goals and objectives to support that vision. The heart of the plan is captured in four goals: customer-focused, financially sustainable, growth and quality. In December, staff completed a planning exercise to build upon the Council's work. Staff identified specific strategies to achieve the Council's goals and measure to track success over time. The plan includes a mission statement that explains the role of the city organization in achieving the vision. It also includes a statement of values to communicate to citizens how staff will live out the mission in the conduct of business.

The intent is for the Council to renew its planning session on an annual basis to monitor progress and direct adjustments as needed. Staff will also work with the Council on a communications strategy to share the plan and engage support from internal and external audiences. The plan helps direct limited resources to make the maximum impact on community needs. The city is committed to a unified vision that stretches from the Mayor and City Council to front-line employees and includes citizens and community partners.

The Council established goals and objectives that were informed by results from prior citizen surveys and input from civic leaders. The plan includes specific strategies that outline how staff will achieve each of the Council’s objectives. Performance measures set the foundation for a continuous cycle of monitoring progress and adjusting as needed to ensure success.

2021 Strategic Plan Update

In 2020, the Independence City Council met to review the Independence for All Strategic Plan and made updates to reflect community priorities. Between November 2, 2020, to January 15, 2021, community members had the opportunity to watch a video about the strategic plan updates and to complete a survey asking two key questions:

•Is this the right plan to improve Independence for All?

•What are your top three community priorities for 2020-2021?

82% of survey participants agreed or strongly agreed the City Council’s strategic plan is the right plan to improve Independence for All.

On January 21, 2021, the Independence City Council met again to review community input and to prioritize goals for 2021. The 2021 Strategic Plan for the City of Independence is the result of several months of focus and discussion updating Independence for All, to plan and guide the City's course for the future.

The heart of the plan is captured in four goals: Customer-Focused, Financially Sustainable, Economy, and Quality with five priorities:

Adoption of the Strategic Plan is a continuous planning process. Staff can begin implementing some of the proposed strategies immediately, but others are dependent on decisions that must be evaluated in the upcoming budget process and development of business plans. The intent is for the Council to review and update the Strategic Plan on an annual basis to monitor progress and direct adjustments as needed.

Vision

Our quality neighborhoods, 21st century jobs, growing economy, safe, family-friendly community, and cultural diversity makes Independence, Missouri a nationally recognized city with a unique history and sense of place.

Mission

Transforming our community through engagement, innovation, and sustainable services.

Goals

Goal: Customer-Focused Improve customer service and communication

Goal: Financially Sustainable Ensure City finances are stable and sustainable

Goal: Growth Increase economic prosperity of community

Goal: Quality Achieve livability, choice, access, health, and safety through a quality-built environment

2021 Strategic Plan Action Plan

The 2021 action plan was approved by the City Council on September 7, 2021. The action plan is updated annually after the Strategic Plan and serves as the guidance for city departments to implement the Strategic Goals. The action plan includes a designation of the primary department(s) responsible for each item and performance measures.

Independence for All 2021 Action Plan

GOAL: CUSTOMER FOCUSED Improve customer service and communication

OBJECTIVES STRATEGIES

Improve customer service

Increase use of IndepNow to better track and respond to citizen calls for service.

Implement customer service training of all front-line employees to ensure the equitable treatment of all customers.

Continue to use social media to engage with customers/citizens.

Streamline reporting to make efficient use of staff time to deliver clear, concise information to the City Council and public.

Develop and implement a communication strategy to share the strategic plan with city employees and public.

PRIMARY DEPARTMENT(S)

Communications

Communications, Human Resources

Communications

Communications

Communications

Communicate more effectively internally and externally

Enhance the City's primary public information tools: Channel 7, website, CityScene newsletter, social media.

Expand collaborative use of Cityworks and enhance existing workflow processes to better support city departments.

GOAL: FINANCIALLY SUSTAINABLE

Ensure City finances are stable and sustainable

OBJECTIVES STRATEGIES

Control long-term costs

Optimize resources

Sustainable Funding

Long-range financial planning

Communications

Tech Services

PRIMARY DEPARTMENT(S)

Continue to advance the employee wellness program to contain health insurance and workers compensation costs. Human Resources

Pursue plan design changes to Stay Well Employee Insurance Program to control long-term expenditures.

Conduct a market salary study and implement recommendations in the employee pay plan focused on recruitment and retention.

Negotiate fair, sustainable compensation and benefit agreements with labor unions.

Utilize technology to make city operations more efficient.

Improve the management of cyber security risks while protecting sensitive information.

Seek voter approval of general obligation bonds for infrastructure and facilities projects.

Seek voter approval of City Charter changes to reflect updated best practices.

Expand the scope of the Shared Services Initiative to leverage relationships with participating jurisdictions and capture economies of scale.

Obtain permanent, viable funding for the Health Department.

Identify and capture funding for Cemetery maintenance and support.

Pursue the Museum and Tourism Related Activities Tax to support tourism needs.

Human Resources

Human Resources

City Manager, Human Resources

Tech Services

Tech Services

Finance & Administration

City Manager

City Manager

City Manager, Health & Animal Services

City Manager, Parks, Recreation & Tourism

City Manager, Parks, Recreation, & Tourism

Research additional long-term revenue streams and funding sources to support delivery of basic services. Finance & Administration

Develop cost of service studies for utilities and ensure appropriate customer rates.

City Manager, all Utilities

Begin to establish life-cycle costing analyzing the total cost of ownership for fleet, facility, and infrastructure investments. Finance & Administration, Municipal Services

Complete implementation of financial and human resources management software.

Finance & Administration, Human Resources

Independence for All 2021 Action Plan

GOAL: QUALITY

OBJECTIVES STRATEGIES

Conduct proactive code enforcement sweeps in neighborhoods along key commercial corridors and entryways.

Research code enforcement best practices and develop a rapid response plan to quickly address code violations.

Work with community partners to acquire blighted properties that could be redeveloped for improved economic activity.

Update the Trails Museum Master Plan to focus emphasis on museum exhibits and visitor experience.

PRIMARY DEPARTMENT(S)

Community Development

Community Development

Community Development

Parks, Recreation & Tourism

Improve appearance of major commercial corridors and historic sites

Implement recommendations of the Downtown Redevelopment Plan as guided by the Independence on a Roll working group.

Develop and implement strategies to reduce chronic issues of litter and debris and illegal dumping within the community.

Explore land acquisition along Truman Road to enable beautification of major entryways into the city.

Target street and sidewalk maintenance along major corridors and around historic sites.

Evaluate space and maintenance needs for city buildings and determine a long-term strategy for needed improvements.

Municipal Services, Community Development

Municipal Services, Communications

Municipal Services, Community Development

Municipal Services, Community Development

Municipal Services

Improve public infrastructure and facilities condition

Enhance Public Health

Ensure the Complete Streets Policy is implemented during all new construction and renovation.

Develop new Parks and Recreation Master Plan.

Expand water main replacement program.

Identify strategies to improve and expand resources for mental health needs, including expansion of behavioral crisis and intervention centers.

Create a Community Paramedicine Program to support medical outreach, including mental, homeless and substance abuse.

Continue Trap, Neuter, Release (TNR) program to reduce feral cat population.

Maintain status as no-kill Animal Shelter.

Increase public education regarding crimes of opportunity.

Reduce crime and disorder

Increase perception of safety

Implement a business crime prevention outreach program.

Proactively address crime trends and patterns with targeted policing efforts.

Improve Fire Department deployment to address increase in responses and response time.

Amend the Unified Development Ordinance (UDO) to include Crime Prevention Through Environmental Design (CPTED ) regulations for certain uses.

Increase enforcement of solicitation and loitering ordinances.

Improve street lighting and sidewalks in priority locations.

Expand the Neighborhood Watch Program.

Balance proactive policing efforts with community engagement within allocated resources.

Continue to support and enhance Volunteers in Police Services (VIPS) program.

Implement and support development of Cadets program.

Increase park patrol to enhance perception of park safety.

Improve community outreach and good news stories.

Develop a homeless strategy to reduce unhoused population to effective zero and connect individuals with necessary resources.

Develop cooperative agreements with neighboring municipalities to address issues related to homelessness along shared jurisdictional boundaries.

Municipal Services

Parks, Recreation & Tourism

Water

Police, Fire, Health & Animal Services

Fire, Health & Animal Services

Health & Animal Services

Health & Animal Services

Police

Police

Police

Fire

Community Development

Police

Municipal Services, Power & Light

Police

Police

Police

Police

Police, Parks, Recreation & Tourism

Police, Fire, Communications

Community Development, Police, Health & Animal Services

Police, Health & Animal Services

Stabilize and revitalize neighborhoods

Target incentive programs (including tax abatement), CDBG and HOME resources in neighborhoods, activity centers and along corridors to support revitalization and stabilization.

Implement the vacant building registry program.

Incorporate best practices code changes into the UDO to encourage infill housing units in neighborhoods, around transit and activity centers.

Rehab blighted housing for low-income home ownership.

Collaborate with community partners on various methods to stabilize neighborhoods.

Community Development

Community Development

Community Development

Community Development

Community Development

Independence for All 2021 Action Plan

GOAL: Growth Increase economic prosperity of community

OBJECTIVES STRATEGIES

Support and empower the Independence Economic Development Council to recruit/retain businesses, develop entrepreneurs, and facilitate workforce training with community partners.

Invest in and publicize workforce development programs.

Continue partnerships and coordination with all school districts and social service agencies to address community needs.

Coordinate with RideKC partners to ensure that public transportation connects the Independence workforce to quality jobs.

Support development of an industrial/office business park. Evaluate the development of a certified site, with all infrastructure in place.

Develop utilities master plans for areas targeted for development in the Comprehensive Plan.

Support redevelopment of key corridors through land use planning/zoning and incentives.

Adopt International Code Council (ICC) building and energy codes.

Update Business License Code.

Attract and retain visitors to the City's historic sites, amenities, and events.

Begin implementation of enhancements to City-owned historic sites.

Complete Master Housing Study and implement strategies to address various community housing needs.

Leverage and maximize the Historic District designation for the Square, and explore establishing additional historic districts to preserve historic appearance.

Research and implement strategies and goals in the Historic Preservation Master Plan to protect community historical resources.

PRIMARY DEPARTMENT(S)

City Manager, Community Development

Community Development

Community Development

Community Development

Community Development

Community Development, Utilities

Community Development

Community Development

Community Development

Parks, Recreation & Tourism

Parks, Recreation & Tourism

Community Development

City Manager

Community Development

Budget Overview

Economic Outlook and Condition

The following considerations were made in building the budget for FY 2021-22.

Nationwide Unemployment

• Non-farm payroll employment has recovered more than half (55%) of the jobs lost at the peak of the economic shutdown

• Recent months show the recovery stalling

Source – Economic Outlook for Local Officials, presented January 12, by MARC, KU, United Way of KC, MO Dept of Econ Dev and BLS data

Kanas City Metro Unemployment

• As of November 2020, KC’s unemployment rate is about 2 percentage points below the nation’s

• Progress has slowed considerably in recent months

• State of MO lost 346,000 jobs in March / April, has recovered 2/3 of those jobs

Source – Economic Outlook for Local Officials, presented January 12, by MARC, KU, United Way of KC, MO Dept of Econ Dev and BLS data

Federal Stimulus Bill

• Individuals: $600, with $600 for qualified dependents

• Moratorium on evictions until January 31st

• Federal unemployment $300 per month until March 14th

• Support for businesses – entertainment, agriculture, economic injury disaster loans

• Billions in rental, food, and childcare assistance

• Other aid: billions in transit, education, and vaccine distribution

Local Impact

• City of Independence estimated median income 2019 was $59,000 according to Independence Chamber of Commerce

• Data through end of October shows that jobs for those earning > $60,000 per year have mostly recovered (down -1.6%)

• Jobs for people earning $27,000-$60,000 down -3.9%

• Jobs for people earning < $27,000 down -17.2%

Missouri’s Economic Outlook

• COVID was and remains devastating to Missouri’s economy

• The recovery was fairly robust compared to other states, but we have a long way to go

• Missouri had some highlights with manufacturing and construction

• There are still concerns, especially in consumer spending and small business revenue

• Consumer spending is still down 10% in Missouri relative to the pre-covid level

• Small business revenue is down 30% in Missouri relative to the pre-covid level

Source – Economic Outlook for Local Officials, presented January 12, by MARC, KU, United Way of KC, MO Dept of Econ Dev and BLS data

General Fund – Five Year Forecast Update

• Top 3 revenue categories represent 62% of general fund revenue

• Sales tax susceptible to economic cycles

• Franchise fees

• Uncertain long-term outlook

• Energy efficiency (gas, electric)

• Technological change and customer trends (telephone and cable)

• Total General Fund budgeted revenues are $74.4M before any ARP supplements

Major Sources of General Fund Revenues

General Fund Revenue Summary

Property tax

• City has experienced solid assessed value (AV) growth in reappraisal years (odd-numbered years)

• Slight pullback in even-numbered years

• 2020 AV decrease primarily a result of BOE property tax appeals from 2019 reappraisal

• Model assumes slower pace of AV growth compared to 2019 reappraisal

• Revenue upside is limited by Hancock amendment, if more aggressive AV projection were to be assumed

Breakdown of Resident Property Bill

Where Your Property Taxes Go

City Health, $46

Jackson County, $136

City General, $103

Jackson County, $136

Board of Disabled Services, $14

City General, $103

School (average), $1,327

City Health, $46

Mental Health, $24

Metro Junior College, $48

Mid-Continent Library, $83

State Blind Pension, $7

School (average), $1,327

Sales tax

• FY21 budgeted sales tax number projected during COVID lockdown

• State DOR remits data to Finance with a two-month lag

• Monthly sales tax receipts have been resilient to date

• Updated projection to incorporate actual experience YTD

Sales tax (in $millions)

Based on 2018 Median Home Value of $117,576 and property tax bill of $1,788

Sales tax annual change (%)

Use tax – Waterfall Provision Impact on the General Fund

• On track to trigger the waterfall provision this fiscal year

• Forecast a total of $665,000 will waterfall in FY 2020-21, if the CPI remains relatively flat and the use tax receipts remain stable

• The General Fund share of this revenue is $295,963

• Other funds receiving revenue – Street Sales Tax, Park Sales Tax, Stormwater Sales Tax, Fire Sales Tax, Police Sales tax

• Offsets lost revenue from closure of Penny’s and Macy’s - tax has collected $3.51 million calendar year-to-date and is now yielding an average monthly collection of $319,073, estimate $3.83 million annually

• Assuming the CPI remains relatively flat, that the average salary and benefit costs of a police officer is $100,000 per year, and that no equipment purchases are authorized from this fund, then a total of $3,750,000 (not including CPI) would be needed to satisfy the ballot language requirements and trigger the waterfall provisions

• Currently on target to eclipse this provision this fiscal year, with total collections expected to reach $4.42 million. This would mean a total of $665,000 would “waterfall” to the other funds if these trends hold

• FY 2021-22 budget estimates $448,000 will be allocated to the General Fund based on the waterfall provision

PILOT Revenue in the General Fund

• Based on gross revenue

• Expected trend is slightly upward

Utility franchise fees

• Water: Historically, volatile revenue source, but very small component of total

• Gas: Performance dependent on weather

• Telephone: Projected structural decline as citizens cut cord

• Electricity: Performance dependent on weather; energy efficiency efforts

• Cable: Projected structural decline as citizens cut cord

Franchise Fees (in $millions)

Franchise fees annual change (%)

Fines and Forfeitures and Charges for Services

• Both trending down

• Fines and forfeitures are trending $1.8M less than budget due to court closures and residual impacts of SB5

• Charges for services are trending $1M less than budget

• TIFF charges, transit revenues, code enforcement, school resource officers

Fines and Forfeitures (in $millions)

Charges for Services (in $millions)

General Fund Expenditures Summary

General Fund Assumptions

• Five-year model forecasts salary and benefit expenditures under current CBA for each represented group

• Includes:

• 2% cost increase for non-represented employees

• 1% increase for operating expenses, continued budget diligence

• Employee pays / benefits total including retiree health (1.9M budget) = 81% or $58M

• Other pays: automobile, clothing/uniform, employee / other allowance, other pay types, OT, personnel services charged to projects

General Fund Expenditures General Fund

• The General Fund has constraints on spending tied to the city charter, state law, and other criteria

• Fixed costs:

• Police & Fire include dept operations as indicated in charter, and salary/benefits/retiree health for all divisions.

• Other costs are trash & landfill fees = $162,000

• Flexible:

• Flexible is a misnomer – this includes city administrative operations, flexible only indicates it is not legally mandated by one of the other categories

• Administrative and operating costs for: Community Development, City Administration, Municipal Services

General Fund Budgetary Constraints

Budget Impacts and Considerations

• Forecasted revenue and expenses for FY 21 are trending below budget, being conservative with spending and long-term obligations

• Future Budget Impacts that will need to be monitored:

• Increasing Healthcare costs

• Transit program subsidies

• Union negotiations

• Projected year end unassigned fund balance is $5.8M

• The City’s reserve balance policy is 16% of annual revenues

• The City must continue to make additional adjustments over 5-year horizon to meet this goal

Enterprise Funds

Enterprise Funds Overview

• The three enterprise funds are Sanitary Sewer (formerly Water Pollution control), Water, and Power and Light (also referred to as IPL / Independence Power and Light)

• Enterprise funds support the operation these departments, separate from the General Fund

• Revenues are based primarily on utility rates.

• These funds are established to account for services financed and operated in a manner like private businesses.

• Total Budget (including capital):

o Sanitary Sewer, $38,671,597

o Water, $35,973,379

o Power and Light, $178,308,154

Debt & Leases, $19,297,056, 8%

Capital Budget, $16,413,956, 6%

Operating Budget, $217,242,118, 86%

Grant Funds

• These are only “known” or expected grants that were included in the budget.

• There may be other grants, particularly in Health and Safety, that the city is able to obtain, at which time a budget amendment will be done.

Use Tax Overview

• The use tax is explained previously in the General Fund revenues

• This shows the waterfall impact on special revenue funds setup for the use tax

• Budget estimated that the sales subject to use tax are $44,592,694

• Ballot language requires these two funds to be allocated first:

o Animal Shelter Use Tax Fund, $762,750

o Police Use Tax Fund, $3,032,000

• Remainder estimated to waterfall is $1,008,000

General Fund (002)

Fund Descriptions

is used to account for all financial resources necessary to carry out basic governmental activities of the city that are not accounted for in another fund. The General Fund supports essential city services, including police, fire, municipal services, and administration.

Special Revenue Funds

are used to account for specific revenues that are legally restricted to expenditures for specified purposes.

Street Improvements Sales Tax (011)

Park Improvements Sales Tax (012)

Voters approved a one-half of one cent sales tax for streets, bridges and safety improvements. Additional revenues from the Proposition "P" waterfall provision are accounted for here.

The Park Improvements Sales Tax Fund has been setup to account for the one-quarter cent sales tax identified for parks and recreation. Additional revenues from the Proposition "P" waterfall provision are accounted for here.

Storm Water Sales Tax (013) The Storm Water Sales Tax Fund has been set up to account for the one-quarter cent sales tax identified for storm water system improvements. Additional revenues from the Proposition "P" waterfall provision are accounted for here.

Police Public Safety Sales Tax (016)

Fire Public Safety Sales Tax (017)

The voters approved a Capital Improvements for Police Sales Tax in April 2016 at the rate of one-eighth cent of the receipts from the sale at retail of all tangible personal property or taxable services at retail for a period of January 2017 through December 31, 2028. The Police (Capital) Sales Tax Fund has been set-up to account for the one-eighth cent capital improvements sales tax identified for police equipment. Additional revenues from the Proposition "P" waterfall provision are accounted for here.

The voters approved a Capital Improvements for Police Sales Tax in April 2016 at the rate of one-eighth cent of the receipts from the sale at retail of all tangible personal property or taxable services at retail for a period of January 2017 through December 31, 2028. The Fire Public Safety Sales Tax Fund has been set-up to account for the one-eighth cent capital improvements sales tax identified for fire equipment. Additional revenues from the Proposition "P" waterfall provision are accounted for here.

Animal Shelter Use Tax (010)

Voters approved Proposition "P", a use tax on goods delivered to Independence addresses in 2019. The rate of the use is the same rate as the total City's retail sales. The first $1.5 million (adjusted for inflation annually) will be split equally between a fund for Animal Services and a fund for hiring up to 30 new police officers. The next $1.5 million of use taxes in the fiscal year are applied 100% towards hiring of police officers ($3 million total before inflation increase). Use taxes collected over the amounts identified in the special use taxes will then be receipted into any fund that has a sales tax prorated on its share of sales taxes.

Police Use Tax (018)

Voters approved Proposition "P", a use tax on goods delivered to Independence addresses in 2019. The rate of the use is the same rate as the total City's retail sales. The first $1.5 million (adjusted for inflation annually) will be split equally between a fund for Animal Services and a fund for hiring up to 30 new police officers. The next $1.5 million of use taxes in the fiscal year are applied 100% towards hiring of police officers ($3 million total before inflation increase). Use taxes collected over the amounts identified in the special use taxes will then be receipted into any fund that has a sales tax prorated on its share of sales taxes.

Health & Animal Levy (005)

Parks Health & Recreation Levy (007)

Funded by the Health & Recreation tax levy collected against real estate within the city of Independence. The purpose of the levy is for Health and Parks and Recreation purposes. This levy is split between the Health & Animal Levy Special Fund and a Parks Health & Recreation Levy Fund.

Funded by the Health & Recreation tax levy collected against real estate within the city of Independence. The purpose of the levy is for Health and Parks and Recreation purposes. This levy is split between the Health & Animal Levy Special Fund and a Parks Health & Recreation Levy Fund.

The Tourism Sales Tax Fund is supported by both admission fees to the National Frontier Trails Museum and a 6.5% Transient Guest Tax. The 6.5% Transient Guest Tax is to be paid on the gross daily rent due from or paid by transient guests of all hotels and motels, bed and breakfast inns and campgrounds. Com. Dev. Block Grant(008) accounts for the federally funded Community Development Block Grant Act program.

Tourism (004)

HOME (009) accounts for the federally funded home program.

Grants (015) accounts for other grants, including Police, Fire, and Health department grants.

Enterprise / Utility Funds

are used to account for operations that are financed and operated similar to a private business where the intent is that the cost of providing services to the public is financed primarily through user charges.

Power & Light (020) operations of the city's power and light utilities. Water (040) operations of the city's potable water utility. Sanitary Sewer (030) operations of the city's sanitary sewer utility.

Internal Service Funds

are used to account for operations internal to the city where the intent is that the cost of providing services to the city department is financed primarily through department user charges.

Central Garage (090) Vehicle maintenance and operations of citywide fleet, including gas and oil charges. Staywell Health Care (091) Activities related to the city's' self insured health care plan.

Workers' Compensation (092) Management of workers’ compensation insurance and claims. Risk Management (093) Management of city liability insurance and claims. Enterprise Resource Planning (ERP) (094) Management of technology asset, MUNIS, and costs associated with providing an ERP citywide.

All funds in the operating budget book are appropriated by City Council via budget adoption.

Department Fund Relationship

*Internal service funds are shown with the department that oversees each fund.

Schedule 1

All Funds by Expense Category

Schedule 1

All Funds by Expense Category

Enterprise Funds

Notes:

(1) In the All Funds Summary, the totals for Internal Service Funds expense have already been included in the operating expenses for GF, Special Revenues, and Enterprise Funds as they are charged out during course of the year for internal services provided to other departments/funds.

(2) The Internal Service Funds Summary is shown for informational purposes, the total amount is in the operating expenses for each fund. The All Funds Summary is the total of the General Fund, Special Revenue Funds, and Enterprise Funds.

Schedule 2

Expenditures by Department

All Funds

Fund

Schedule 2

Expenditures by Department

Special Revenue Funds

Enterprise Funds

Schedule 3

Expenditures by Fund and Fund Type

All Funds

Governmental Funds

Enterprise Funds

Schedule 4

Revenue by Fund and Fund Type

All Funds

Governmental Funds Enterprise Funds

Schedule 5

All Funds by Revenue Category Group

Schedule 5

All Funds by Revenue Category Group

Special Revenue Funds

Enterprise Funds

Notes:

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 7

Governmental Funds

Street Improvements Sales Tax Fund (011) Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 7

Governmental Funds

Park Improvements Sales Tax Fund (012) Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 7

Governmental Funds

Stormwater Sales Tax Fund (013) Comparison of Revenues, Expenditures and Change in Fund Balance

Schedule 7

Governmental Funds

Police Public Safety Sales Tax Fund (016)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 7

Governmental Funds

Fire Protection Sales Tax Fund (017) Comparison of Revenues, Expenditures and Change in Fund Balance

Schedule 7 Governmental Funds

Animal Shelter Use Tax Fund (010)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 7

Governmental Funds

Police Use Tax Fund (018)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 7 Governmental Funds

Health & Animal Levy Fund (005)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per February 2021 financial statements.

(2) FY 2021-22 budget includes the consolidation of the Health Inspection division (previously in Community Development.)

Schedule 7

Governmental Funds

Parks Health & Recreation Levy Fund (007)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 7

Governmental Funds

Tourism Fund (004)

Comparison of Revenues, Expenditures and Change in Fund Balance

Schedule 7

Governmental Funds

Community Development Block Grant (008)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 7

Governmental Funds

HOME Grant - Rental Rehabilitation (009)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 7

Governmental Funds

Grant Fund (015)

Comparison of Revenues, Expenditures and Change in Fund Balance

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 8

Enterprise Funds

Power and Light Fund (020) Comparison of Revenues, Expenditures and Change in Available Resources

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 8

Enterprise Funds

Sanitary Sewer Fund (030)

Comparison of Revenues, Expenditures and Change in Available Resources

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 8

Enterprise Funds

Water Fund (040) Comparison of Revenues, Expenditures and Change in Available Resources

(1) Unassigned fund balance is per February 2021 financial statements.

Schedule 9

Internal Service Funds

Central Garage Fund (090)

Comparison of Revenues, Expenditures and Change in Fund Balance

Schedule 9

Internal Service Funds

Staywell Health Care Fund (091)

Comparison of Revenues, Expenditures and Change in Fund Balance

Schedule 9

Internal Service Funds

Schedule 9

Internal Service Funds

Risk Management Fund (093)

Comparison of Revenues, Expenditures and Change in Fund Balance

Schedule 9

Internal Service Funds

Enterprise Resource Planning (ERP) Fund (095)

Comparison of Revenues, Expenditures and Change in Fund Balance

Schedule 10

Full-Time Equivalent Employees

Notes:

FY 2019-20 & FY 2020-21 FTE do not include Internal Service Funds headcount.

FY 2020-21 reduction in FTE is due to positions frozen during COVID-19.

FY 2021-22 includes part-time corrections to more accurately show hours worked, and the activation of previously frozen positions.

FY 2021-22 Police adopted includes headcount added outside of the budget process. Park, Recreation, and Tourism increase from Adopted to Adopted are due to a budget amendment that was included with the adoption of the

Department page FTE totals reflect where salaries are budgeted, the chart above reflects the reporting structure.

Schedule 10

Citywide Salary and Benefits Summary

FY 2021-22 represents the cost of full employement, assumes all vacancies are filled, and positions frozen during prior years are funded and filled.

Schedule 10

Total Personnel Budgets

Notes:

Excludes Retiree Health Insurance.

FY 2021-22 represents the cost of full employements, assumes all vacancies are filled, and positions frozen during prior years are funded and filled.

Community Development

Total Full Time Equivalent Positions

MISSION

The purpose of the Community Development Department is to enhance the quality of life in Independence by encouraging public involvement in the planning and creation of quality places in which to live, work, and play.

Community Development Administration

Total Full Time Equivalent Positions

The mission of Community Development Administration is to lead and direct development policy for the City so that safe, livable and sustainable environments are created and maintained.

SIGNIFICANT BUDGET CHANGES

Operating expenses increased primarily due to Tech Services ($15,000) and Risk Management ($5,000).

Community Development Neighborhood Services

Total Full Time Equivalent Positions

The Neighborhood Services Division strives for partnerships with citizens and businesses to promote and maintain a safe, healthy, and desirable living and working environment through the administration of the Property Maintenance, zoning, and right-of-way codes.

SIGNIFICANT BUDGET CHANGES

Operating expenses increased primarily due computer replacements ($4,600).

Community Development Development Services

Total Full Time Equivalent Positions

The mission of the Development Services Division is to apply City standards, Ordinances, and the Comprehensive Plan to ensure an attractive, safe, and functionally built environment that maintains the vision, values, and priorities of the community.

ACCOMPLISHMENTS

- Completed revisions to Unified Development Ordinance.

Community Development Transportation

Total Full Time Equivalent Positions

The purpose of the Transportation function is to provide a rider-focused transit system that provides access to employment, health, educational and social destinations through a fixed route system and paratransit program.

SIGNFICANT BUDGET CHANGES

One-time grants for KCAT ($500,000) and CDBG ($607,000) along with corresponding expenses moved to the grant funds: KCAT to Grant Fund 015 and CBDG to the CDBG Fund, 008.

Community Development Historic Preservation

Total Full Time Equivalent Positions

The Historic Preservation Division assists in cultivating diverse and sustainable places by encouraging community-wide preservation of our irreplaceable, historic built and natural environments through proactive preservation planning, public engagement, and reinvestment in traditional building stock.

Community Development Building Inspections

Total Full Time Equivalent Positions

The Building Inspections Division enhances the quality of life in Independence by ensuring that buildings are constructed, utilized, and maintained in a manner that reduces the risk to public health, while ensuring the safety, welfare, and trust of citizens, business owners, and visitors in all elements of construction throughout the City.

ACCOMPLISHMENTS

- Dangerous and unsafe building implementation in CityWorks.

- Implemented Vacant Structure Registration.

Community Development Regulated Industries

Total Full Time Equivalent Positions

The purpose of Regulated Industries is to issue licenses and permits to businesses and to inspect said businesses for compliance with City ordinances so that safe, healthy and livable environments are maintained.

ACCOMPLISHMENTS

- Revised business license process.

- Updated website and forms.

- Moved Food Handler classes online.

- Revision to Alcoholic Beverage Code.

- Implemented new small business fee and adjusted food truck fees.

SIGNIFICANT BUDGET CHANGES

The Health Inspector positions and food handler positions were moved from this division to the Health and Animal Services Department.

Community Development Grants

SIGNFICANT BUDGET CHANGES

One-time grants for KCAT ($500,000) along with corresponding expenses moved from the General Fund (002-4414).

Community Development Community Development Block Grant

Development Block Grant (008)

Total Full Time Equivalent Positions

The mission of the Community Development Block Grant (CDBG) Program is to improve the quality of life of low- and moderate-income residents living in Independence by providing for the availability, affordability, and sustainability of suitable living environments, decent housing, and economic opportunities.

SIGNFICANT BUDGET CHANGES

One-time grant for CDBG ($607,000) along with corresponding expenses moved from the General Fund (002-4414).

HOME Grant Community Development

The purpose of the HOME Investment Partnerships Program is to improve the quality of life in Independence by addressing the unmet housing needs of very low, low, and moderate income persons.

Health and Animal Services

Total Full Time Equivalent Positions

MISSION

Our mission is to protect and promote health and safety and prevent disease and injury for the residents and visitors in our community through a variety of programs and services.

Health and Animal Services Animal Services

Total Full Time Equivalent Positions

MISSION

Our mission is to protect the safety and welfare of people and animals in our community by promoting an environment of responsible pet ownership. Basic animal services, such as animal control, are provided through funding from the Health and Recreation levy (funds previously collected in the General Fund), and fees for services.

Health and Animal Services Animal Shelter Use Tax

Total Full Time Equivalent Positions

MISSION

Our mission is to protect the safety and welfare of people and animals in our community by promoting an environment of responsible pet ownership. This cost center provides for the operations of the regional animal shelter through funding from the Proposition P use tax.

ACCOMPLISHMENTS

- Maintained no-kill shelter status.

Health and Animal Services Environmental Services

SIGNIFICANT BUDGET CHANGES

Environmental Services was previously under Community Development, and was moved to be part of Health and Animal Services this year.

Health and Animal Services Health Services

Our mission is to protect the health, safety, and welfare of our community.

MISSION ACCOMPLISHMENTS

- Received State recognition as a stand-alone Health Department.

- Created structure of a new department.

- With the help of volunteers and staff from Fire and PRT, conducted COVID testing and vaccination clinics.

- Vaccinated more than 1,270 residents in the first week.

SIGNIFICANT BUDGET CHANGES

The Health Department was recognized by the State as a local public health authority, and staffing and resources were re-organized to meet the needs of the City. Environmental Services was previously under Community Development, and was moved to be part of Health and Animal

CemeteryMaintenance

AdventureOasisWaterPark

HistoricSites

GeorgeOwensNaturePark

FamilyRecreationPrograms

Nat’lFrontierTrailsMuseum

TurfFacilitiesMaintenance

PalmerSr.AdultCenter

TourismAdministration

ParksMaintenance

RogerT.SermonCommunityCtr.

TourismSales&Service

SeniorAdultServices

SportsAdministration

TrumanMemorialBuilding

Parks, Recreation, and Tourism

Parks, Recreation, and Tourism

The mission of Parks, Recreation and Tourism is to provide quality leisure, recreational, and educational opportunities for visitors to and residents of Independence.

Total Full Time Equivalent Positions MISSION DEPARTMENT WIDE ACCOMPLISHMENTS

The COVID-19 pandemic posed a significant impact on Parks/Recreation/Tourism operations. When the pandemic initially hit, staff successfully transformed our recreation facilities from their traditional role to pandemic response centers by hosting various collection sites for pandemic response items, COVID testing sites, food box distribution sites, and housing for AmeriCorps volunteers. Additionally, the Palmer Center transitioned from providing congregate to home-delivered meals, resulting in increased food delivery patron numbers. Staff at Palmer Center also increased wellness calls and continue to assist with the regional 211 vaccination help line for senior citizens. Once the pandemic allowed for eased restrictions, our facilities were reopened under modified conditions and staff successfully modified operations at every stage to accommodate current safety protocols, while serving our core purpose of recreation and wellness to the citizens of our community. Parks/Recreation/Tourism has and will continue to play an integral part in ESF-6 operations and continue to assist with the Region’s expanding mass care response. Park Maintenance staff took on the added role of elevated disinfection efforts on a regular basis within our recreation facilities and public outdoor use spaces, including playgrounds and pavilions. While the Tourism Division’s revenues were severely impacted by the COVID-19 pandemic, staff secured major grant funding that enabled us to market our community on a national scale in preparation for post-COVID tourism within our community.

Parks, Recreation, and Tourism

This division oversees the various divisions within the department to promote the City as a quality place to visit and reside by providing quality historic sites, parks, recreation facilities, tour packages, and various types of programs.

Parks, Recreation, and Tourism Park Maintenance Administration

Total Full Time Equivalent Positions

MISSION

This division runs daily park maintenance operations by scheduling work projects, purchasing materials, implementing repairs, and responding to inquiries from the public and other Cityaffiliated departments.

Parks, Recreation, and Tourism

Turf Facilities Maintenance

Total Full Time Equivalent Positions

MISSION

The Turf and Facilities Division is responsible for daily park maintenance operations, including: the care and cleaning of picnic shelters and park restroom facilities, athletic fields and landscape beds, snow removal, and mowing and trimming all City parks and related facilities.

SIGNIFICANT BUDGET CHANGES

- Increases due to Workers’ Compensation ($7,000) and increased Central Garage and fuel charges ($7,000).

Parks, Recreation, and Tourism Cemetery Maintenance

Total Full Time Equivalent Positions

MISSION

The Cemetery Maintenance Division is responsible for daily maintenance operations at Woodlawn Cemetery, including: routine turf and landscape maintenance, coordinating final arrangement needs and internments, and providing accurate facility records for public viewing.

Parks, Recreation, and Tourism Recreation Programs/Facilities Administration

Total Full Time Equivalent Positions

Recreation Programs/Facilities Administration is responsible for the daily management of a variety of recreation programs, facility operations, and staff associated with recreation programs/events, nature/community centers, sports complexes and other designated venues.

Parks, Recreation, and Tourism

Senior Adult Services

Total Full Time Equivalent Positions

MISSION

This cost center provides ongoing programs for resident senior adults and individuals with disabilities. These programs focus on, but are not limited to, nutritious lunches, nutrition and consumer education, health programs, social integration, and assistance with support services.

SIGNIFICANT BUDGET CHANGES

- Increase in Center Attendant hours (part-time, 0.25, $10,000) to support additional Senior Services.

- Addition of 1.0 FTE, Senior Program Specialist ($59,000).

- All costs associated with senior adult programs provided for through MARC and CDBG grant funds have been consolidated within this org key.

Parks, Recreation, and Tourism

Roger T. Sermon Community Center

Total Full Time Equivalent Positions

MISSION

The mission of the Roger T. Sermon Community Center is to provide an affordable and modern option for a variety of services, including: health and physical fitness opportunities; rental options for weddings, birthday parties, and business meetings; as well as cultural arts through theatre performances.

Parks, Recreation, and Tourism

George Owens Nature Park

Total Full Time Equivalent Positions

MISSION

George Owens Nature Park is an 85-acre park site that features natural areas, restored grasslands, two lakes, an extensive hiking trail system, a nature center with hands-on children activities and exhibits, picnic opportunities and an organized camp area.

Parks, Recreation, and Tourism Wellness Administration

Total Full Time Equivalent Positions

MISSION