FISCAL YEAR 2026

OCTOBER 1, 2025 – SEPTEMBER 30, 2026

ON JULY 08, 2025

David K. Leigh Mayor

John R. Holmes Sr. Mayor Pro Tem

Dave Covington

Craig Pearson

Daniel Bucher

Luke Potts

Stephanie O’Banion

Sam A. Listi City Manager

Councilmember

Councilmember

Councilmember

Councilmember

Councilmember

This budget will raise more total property taxes than last year’s budget by $1,426,855 or 11.62%, and of that amount $450,402 is tax revenue to be raised from new property added to the tax roll this year.

PREPARED BY

William Michael Rodgers, CPA

Amanda Cox Director of Finance Assistant Director of Finance

Christina Sparks Senior Accountant

Sam A. Listi

Matthew Bates

City Manager

Assistant City Manager

John Messer City Attorney

Amy Casey City Clerk

Larry Berg Police Chief

Jonathon Fontenot Fire Chief

Michael Rodgers

Kim Kroll

Robert Van Til

Megan Odiorne

Chris Brown

Scott Hodde

James Grant

Cynthia Hernandez

Director of Finance

Director of Library

Director of Planning

Director of Human Resources

Director of Information Technology

Director of Public Works

Director of Parks & Recreation

Executive Director of Economic Development

The Government Finance Officers Association of the United States and Canada (GFOA) presented a Distinguished Budget Presentation Award to the City of Belton, Texas for its annual budget for the fiscal year beginning October 1, 2024. In order to receive this award, a governmental unit must publish a budget document that meets program criteria as a policy document, as a financial plan, as an operations guide and as a communications device.

This award is valid for a period of one year only. We believe our current budget continues to conform to program requirements, and we are submitting it to GFOA to determine its eligibility for another award.

The City of Belton Annual Budget provides citizens, staff, and other readers with detailed information about the City’s operations. The Annual Budget serves as a

Policy Document to describe financial and operating policies, goals, and priorities for the organization;

Financial Plan to provide revenue and expenditure information by fund, department, division, category, and account;

Operations Guide to describe the goals and objectives for the fiscal year; the workload measures to track the activities performed; the performance measures to track progress on the goals and objectives; and the general workforce trends; and as a

Communications Device to provide information on planning processes, budgetary trends, and integration of the operating and capital budgets

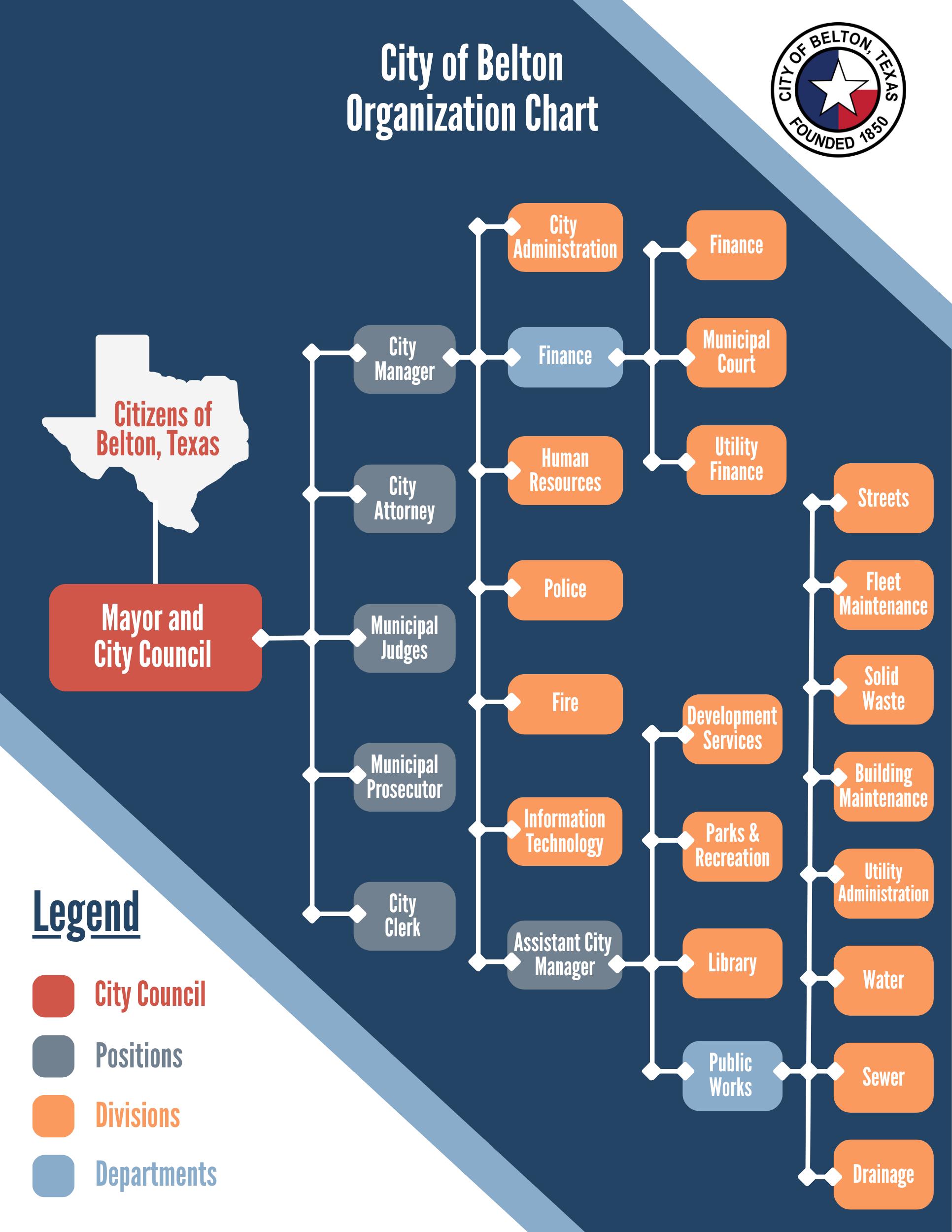

Introduction

This section includes the City Manager’s Budget Message which addresses major policies and key issues that impacted the development of the Annual Budget. This section also contains information about the City, the City of Belton Strategic Plan, a budget calendar, fund structure, organization chart, and employee count history.

Policies

This section includes the City’s financial management policies.

Budget Summaries

Several consolidated schedules of all City funds are presented to give an overall perspective of the upcoming budget as well as historical, estimated and projected fund balances.

General Fund Overview

This section describes and analyzes the General Fund using a combination of narrative, tables, and graphs to highlight key aspects of the budget including revenues, expenditures, and fund balance. A brief description is given of the sources, trends and assumptions made for major revenues. Expenditure information is detailed by division, category and account.

General Fund

This section provides strategic, operational, performance, and budgetary information for each of the City’s divisions within the General Fund. Each division’s operating budget includes a description of the division; goals and action items with their relationship to the overall City goals; workload and performance measures; significant changes for the upcoming budget year; and a personnel summary. Expenditure budgets for each division are detailed by account.

Debt Service Fund

This section outlines the City’s tax-supported debt. Amortization schedules for all outstanding debt are provided.

The operating budgets for the other funds of the City are presented in a manner similar to the General Fund. The overview page includes a description of the fund along with a fund balance history. Revenue and expenditure/expense budgets are detailed by account. Additional summaries are presented for the Water & Sewer Fund.

This section presents the City’s plan for development for Fiscal Years 2026 - 2030. Components of this section include:

An overview of the Capital Improvements Program;

A narrative summary of projects;

A five-year plan detailing expected project expenditures, potential sources of funding, and possible future impacts on operating budgets resulting from additional O & M expenditures;

A summary of unobligated fund balances in capital projects funds.

The operating budget for the Belton Economic Development Corporation is presented in a similar fashion to the General Fund. The overview page includes a description of the fund followed by a fund balance history. Goals, action items, and significant changes to the budget along with workload measures and performance measures are highlighted in the mission statement. Revenue and expenditure budgets are detailed by account.

This section contains supporting information, such as a chart of accounts, a glossary, a listing of acronyms, and Ordinances relating to the adoption of this budget and the property tax rate.

July 8, 2025

We are pleased to present the FY 2026 Proposed Annual Budget for the fiscal year that begins on October 1, 2025. This document represents the city’s financial plan and operations guide for the next fiscal year. It identifies issues confronting the community and provides a plan for serving our constituents. A discussion about the city’s vision and long-term strategic plan is also included. It takes a combined effort by City Council, management, and staff to allocate and deploy the city’s resources to meet the established goals while also maintaining sound financial policies. We will work diligently to administer this budget in a manner that provides exceptional service to the residents of Belton. This message discusses the major issues, initiatives, and assumptions addressed in the budget.

The FY 2026 Proposed Annual Budget includes total resources of $52,834,010 and expenditures of $47,624,660, including transfers and planned use of fund balance. For perspective, the originally adopted budget for FY 2025 contained resources of $50,903,660 and expenditures of $48,666,980.

The budget for FY 2026 is intended to be lean without significant changes from FY 2025. Consequently, no new positions will be added. No utility rate changes are included. While resources from property and sales taxes continue to rise at a modest rate, a fifteen percent jump in health insurance premiums and limited pay increases for employees elevate personnel costs. The appropriation for debt service increases after issuing bonds in 2025 for utility projects, a fire engine, and a facility acquisition. In FY 2026, the City of Belton will invest heavily in its information technology infrastructure with data center and software upgrades. Having funded several items during 2025, various transfers for capital projects and equipment will decrease in FY 2026.

The budget revolves around several core principles that have been established by the City Council. These philosophies provide guidance for the development of the annual budget.

The Strategic Plan is the City’s primary planning document. It outlines the City’s vision and goals for the long term. There are six goal categories: connectivity, economic/business development, quality of life, infrastructure and public facilities, engagement, and public safety. The Strategic Plan focuses on the City of Belton’s vision of being the “Community of Choice in Central Texas, Providing an Exceptional Quality of Life.”

Each year, the plan is reviewed, revised, and updated as needs and conditions dictate. The revised plan forms the framework upon which the budget is built. Performance of Strategic Plan initiatives is measured regularly during the year. Additionally, each department measures success and progress by tying both accomplishments for the prior year and goals for the upcoming year to the various Strategic Plan goals and tasks.

The FY 2026 budget enhances the city’s operating levels to meet the demands that are created by a growing population. Investment in infrastructure remains a priority. A balanced approach of focusing on improving levels of service, while remaining fiscally conservative, served as the basis for this budget. The issues impacting achievement of this goal include:

Serving citizens’ needs

Developing a sustainable annual budget

Adopting an adequate property tax rate

Responsibly managing utility rates and fees to fund important capital projects

Assessing staff workload, personnel, and compensation

Recognizing available funding limitations

Seeking supplemental funding through grants.

In addition to strategic long-range planning, the day-to-day government operations must continue. These tasks include maintaining city streets, repairing utility lines, delivering police and fire services, maintaining park spaces, and providing library and development services. These operational duties must be performed within the constraints of limited resources. The city has adopted financial and budget policies that reinforce the principle that we must live within our means.

Property value growth has slowed from the double-digit increases of the past few years. Sales tax revenue growth has also eased. Yields on investments, however, remain strong at approximately four percent. These growing revenues in FY 2026 provide the resources to fund Strategic Plan priorities.

The city also seeks grant opportunities whenever possible to fund major capital projects. Grant funding allows the scope of projects to extend beyond that which may be achievable by the city alone. Efficiencies are gained when the work and cost can be shared among agencies. Examples include Federal Highway Administration grants for sidewalks along East 6th Avenue, Federal Community Project Fund grant to replace and relocate the East Central Avenue/Spring Street bridge, and Texas Parks & Wildlife grant funding to construct Standpipe Park.

The city implemented a capital equipment replacement plan to provide for the replacement of vehicles and equipment based upon mileage, age, or maintenance costs. Money is set aside each year to ensure sufficient funding exists when the assets need to be replaced in the future.

A strong, thriving community requires continual investment in its people, facilities, and infrastructure to deliver an exceptional quality of life. As an important goal in the Strategic Plan, the City of Belton implemented a street maintenance plan with the desire to

sustainably fund it. The plan will elevate the quality of streets and create long-term savings through the systematic use of preventive maintenance. The cost of maintenance and other corrective actions each year are analyzed and included in the annual budget. Street maintenance funding tops $1,100,000 in FY 2026.

The City of Belton also implemented a five-year Capital Improvements Program (CIP). By identifying potential capital projects today, funds can be accumulated over time to meet future demand. The CIP includes an analysis of the timing of expenditures and the various sources of funding that may be available. The impact upon future operating budgets is also considered.

To become a “quality of life” city, a municipality must provide ample opportunities for residents and visitors to retreat from the rigors of daily life by enjoying the outdoors. The City of Belton addressed this by creating a Parks and Recreation Strategic Master Plan to guide the development of parks and recreation amenities within the city. The parks master plan will be updated in FY 2026. The result of this update will be a park system that is harmonious with its surroundings and available to all.

The General Fund is the chief operating fund of the government. It is used to account for all current financial resources not required by law or administrative action to be reported in other designated funds. The primary governmental functions occurring within this fund are public safety, parks, library, streets, and general administrative operations.

The city has adopted a policy of maintaining a reserve level of at least 30% of budgeted expenditures for the General Fund, Water & Sewer Fund, and the Drainage Fund. This policy ensures that funds will be available in the event of emergencies, financial recessions, and other unforeseen circumstances. Below is a chart of the General Fund’s unassigned spendable balances for the past two years, an estimated balance for the fiscal year ending September 30, 2025, and the projected balance for the fiscal year ending September 30, 2026. We expect the General Fund to remain in compliance for FY 2026 with an accumulated reserve level of 33% of budgeted expenditures.

$10,000,000

$9,500,000

$9,000,000

$8,500,000

$8,000,000

Total resources for the General Fund in FY 2026 are $25,434,780, an increase of $1,052,570 or 4.3% from the adopted budget for the prior year. Revenues are derived from several sources. Foremost among these sources are property and sales taxes.

Thirty-nine percent of General Fund revenues are derived from property taxes. The Bell County Tax Appraisal District reports that the taxable value of property located within the City of Belton has increased by nine percent to $2,569,394,000. Current property tax revenue of $9,843,280 is budgeted. The tax rate that will generate the amount reflected in the annual budget is $0.5300 per $100 of taxable valuation, an increase of 0.75 cents per $100 from the prior year.

The tax rate is comprised of two components - the debt service portion that is dedicated to the payment of principal, interest, and fees on general obligation debt, and the maintenance and operation (M&O) portion which is utilized in the General Fund for general governmental purposes. The rates for debt service and M&O are $0.0614 and $0.4686, respectively.

Another large revenue source in the General Fund is the sales tax. The FY 2026 Annual Budget anticipates sales tax revenue to grow by four percent to $6,810,390. The gain can be attributed to the ongoing expansion of the area economy as more consumers find Belton a great place to shop.

Refuse collection and contract fees increase by 9% over 2025 due to a rising customer count. Court fines and fees may rise by 11% as more citations are written. Interest income and public safety reimbursements are expected to fall by 10% and 13%, respectively.

General Fund expenditures in the FY 2026 Proposed Annual Budget total $25,413,950, increasing $500,060 over the FY 2025 adopted budget. Encompassing 59% of the budget, charges within the personnel category rise by $421,250 to cover the cost of rising health insurance premiums and annual merit increases for employees. At 25% of General Fund expenditures, the increase in appropriations for services is primarily due to higher costs for refuse collection and information technology services. The maintenance category includes $1,102,500 for contracted street maintenance.

Transfers from the General Fund occur when additional funding for capital projects is needed, or when the City Council wants to designate funds to be used for a special purpose over a series of years. For FY 2026, transfers for future vehicle and equipment replacement decrease with the cessation of an accelerated funding schedule.

This fund is used to accumulate a dedicated portion of property taxes for payment of the city’s general debt. Revenue from property tax collections is expected to be $1,551,450. Expenditure appropriations for FY 2026 total $1,508,740, increasing by three percent after the issuance of bonds during 2025. Payments on tax-supported debt comprise three percent of all appropriations included in the FY 2026 Annual Budget.

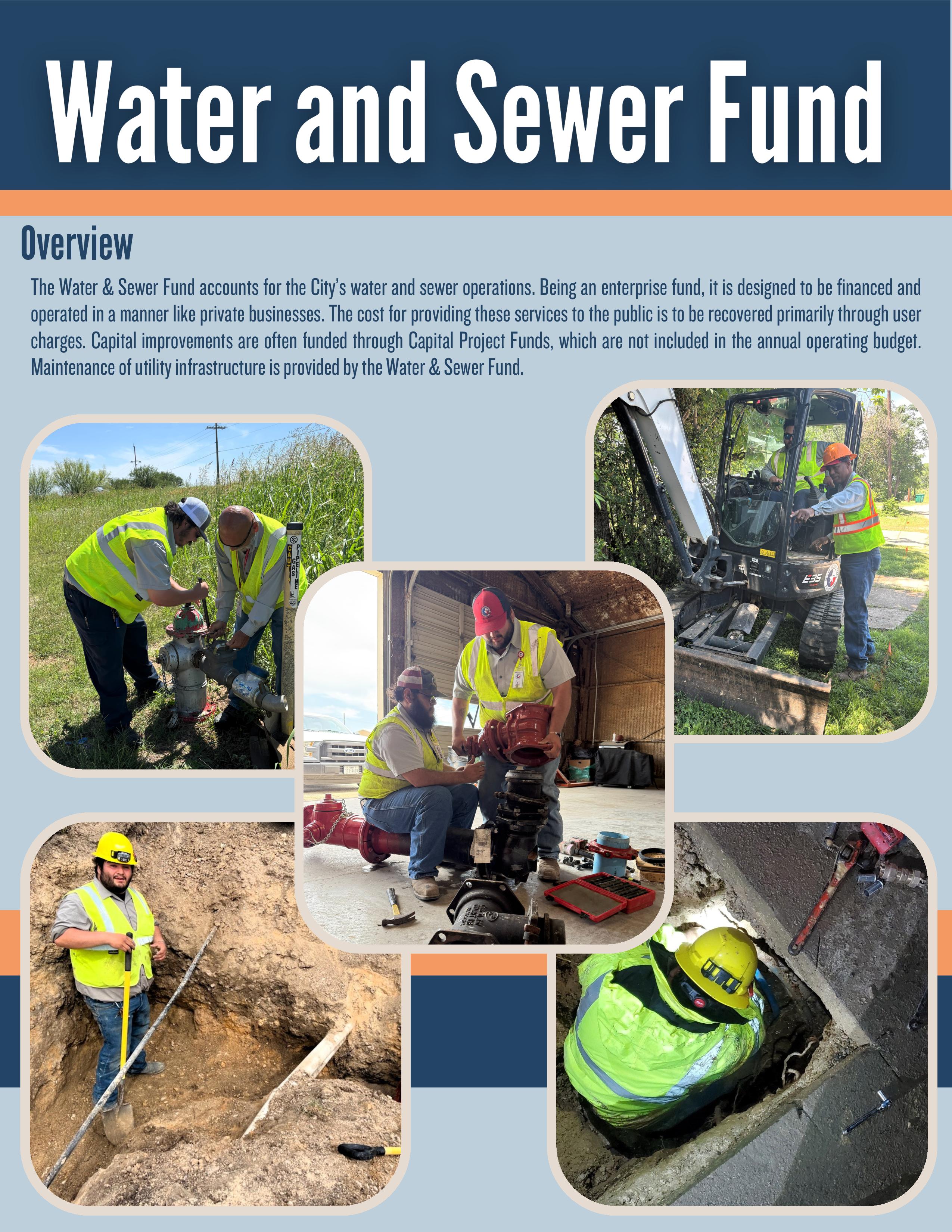

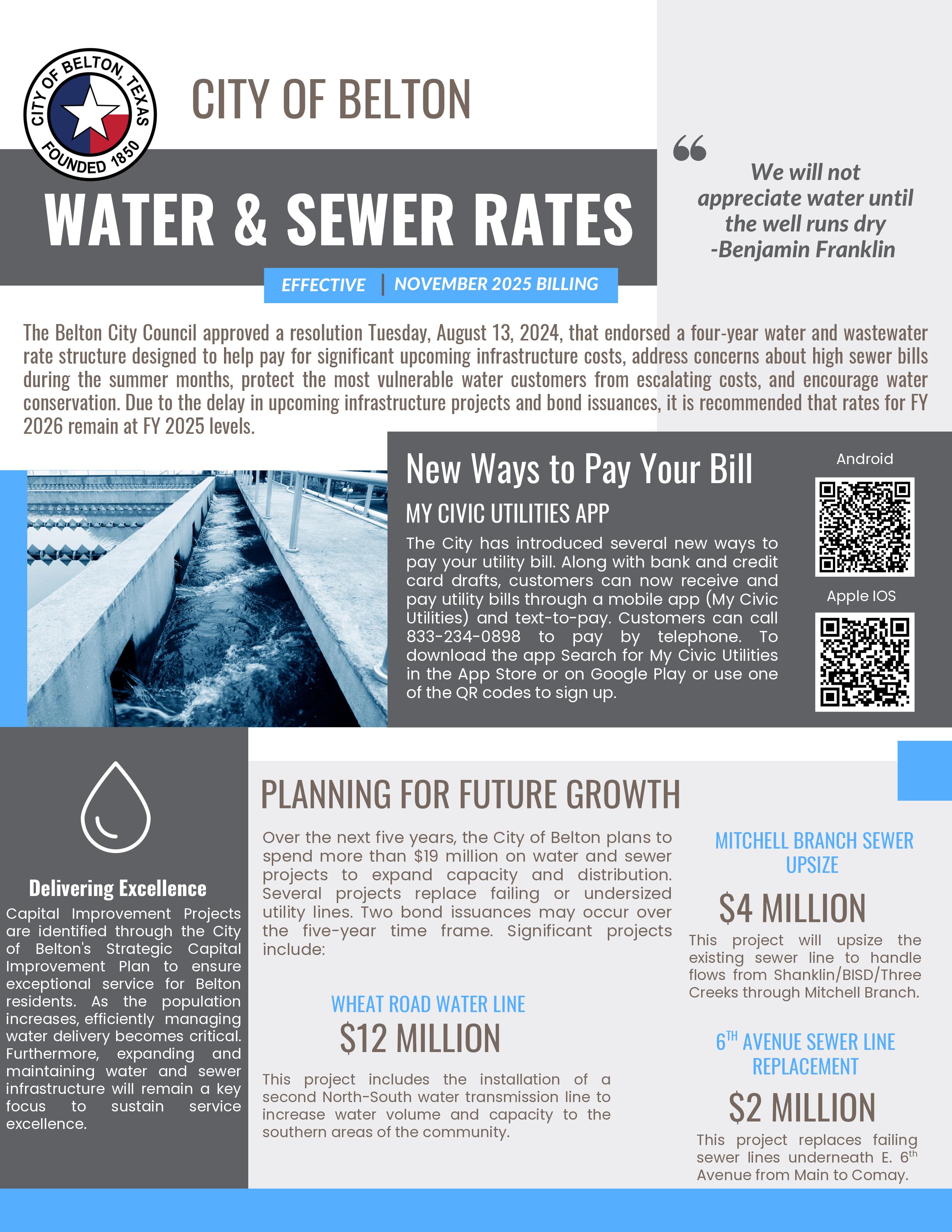

The Water and Sewer Fund accounts for all activities related to the provision of water and sewer services to the residents of Belton, including administration, operations, maintenance, debt service, billing, and collection. An enterprise fund of the city, it is designed to be financed and operated like a private business. Accordingly, utility fees should be sufficient to cover annual operating and capital costs while providing income

for future capital needs.

Total revenues of the Water and Sewer Fund are expected to increase by two percent on a budget-to-budget basis to $14,745,480. Compared to the FY 2025 estimate however, utility revenue increases by only $190,142, or 1.3%, with no rate increases planned for water and sewer services. Instead, the increase in revenue is derived from higher consumption due to a growing customer count.

The FY 2026 Proposed Annual Budget anticipates that Water and Sewer Fund expenses will fall by $283,570 to $14,271,850. Personnel costs decline by $90,700 with the reclassification of one Senior Accountant position. Transfers to the various capital project funds decrease by $226,000 after cash-funding several projects during FY 2025. Partially offsetting these savings, debt service expense grows by $145,900 due to the issuance of bonds for the wastewater treatment plant expansion and other utility projects.

Below is a chart of the Water & Sewer Fund’s unrestricted net asset balances for the past two years, an estimated balance for the fiscal year ending September 30, 2025, and the projected balance for the fiscal year ending September 30, 2026. Reserve levels may increase considerably at the end of FY 2025 due to unanticipated savings from a delay in the issuance of bonds. Though not included in the FY 2026 Proposed Annual Budget, these savings may be used for future capital projects. With reserves totaling 50.4% of expenditures, the Water & Sewer Fund will remain compliant with the fund balance policy at the end of FY 2026.

$8,000,000

$7,000,000

$6,000,000

$5,000,000

$4,000,000

$3,000,000

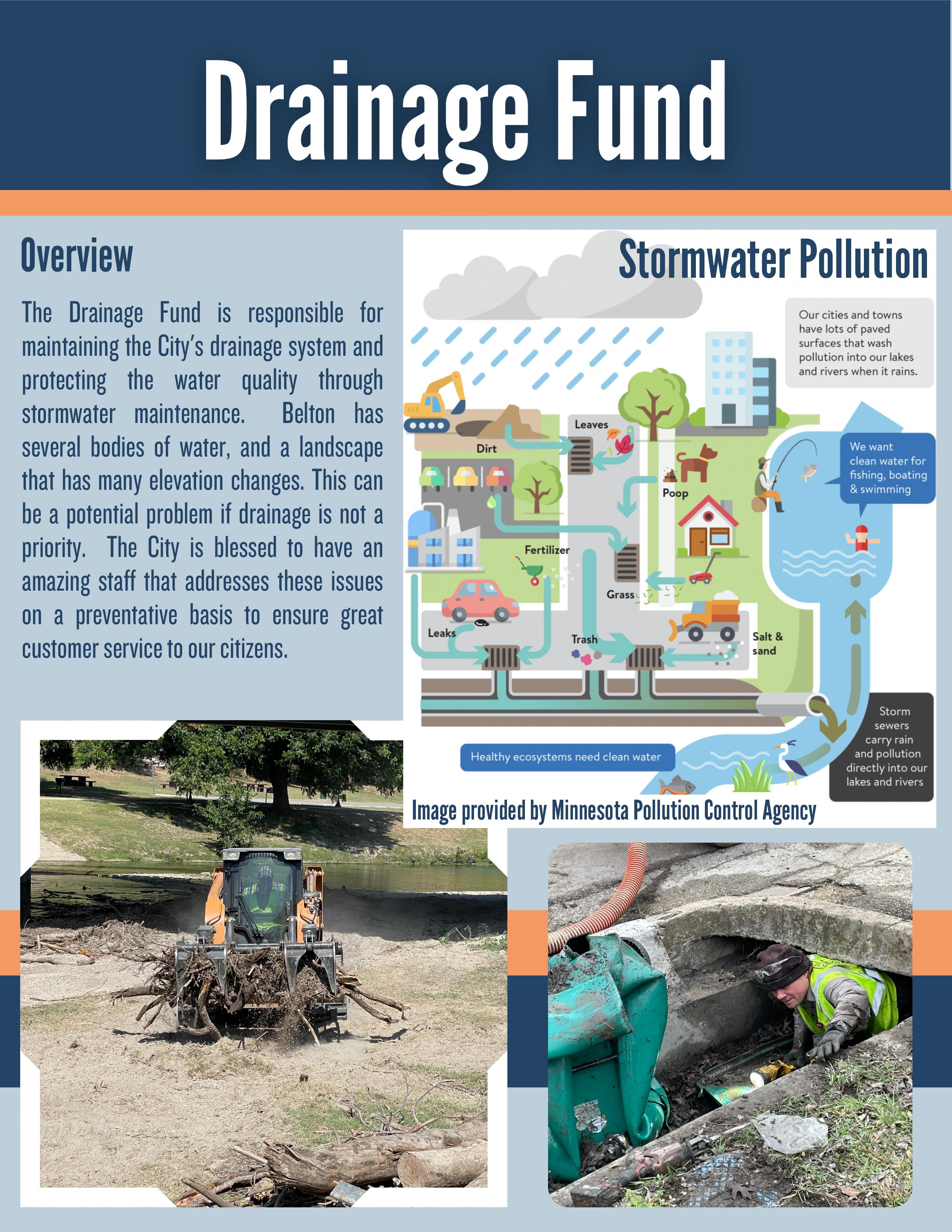

The mission of this fund is to maintain a stormwater management system that efficiently conveys storm water in a safe manner and prevents flooding. The Drainage Fund is considered a utility of the city. Accumulated revenues are used to fund drainage-related expenditures and associated public education.

The revenue for the Drainage Fund is generated by the city’s drainage fee. The adopted drainage fee remains unchanged at $5.00 per month for single family dwellings. Drainage fee revenues are expected to grow by five percent to $682,600 in FY 2026, while budgeted expenses total $617,220. The Drainage Fund remains compliant with the fund balance policy with a projected reserve balance of 57.8%.

$400,000

$300,000

$200,000

$100,000

$0

The Hotel Occupancy Tax Fund records the receipt and distribution of the hotel occupancy tax, which is levied at seven percent of the room rental rates. The City of Belton also receives a small portion of Bell County’s hotel occupancy tax. Authorized by state statute and approved by City Council, expenditures promote tourism and the hotel industry. For FY 2026, revenue in the Hotel Occupancy Tax Fund is projected to grow by 14% to $596,540 as numerous special events draw visitors into the city. Expenditures in FY 2026 total $503,630.

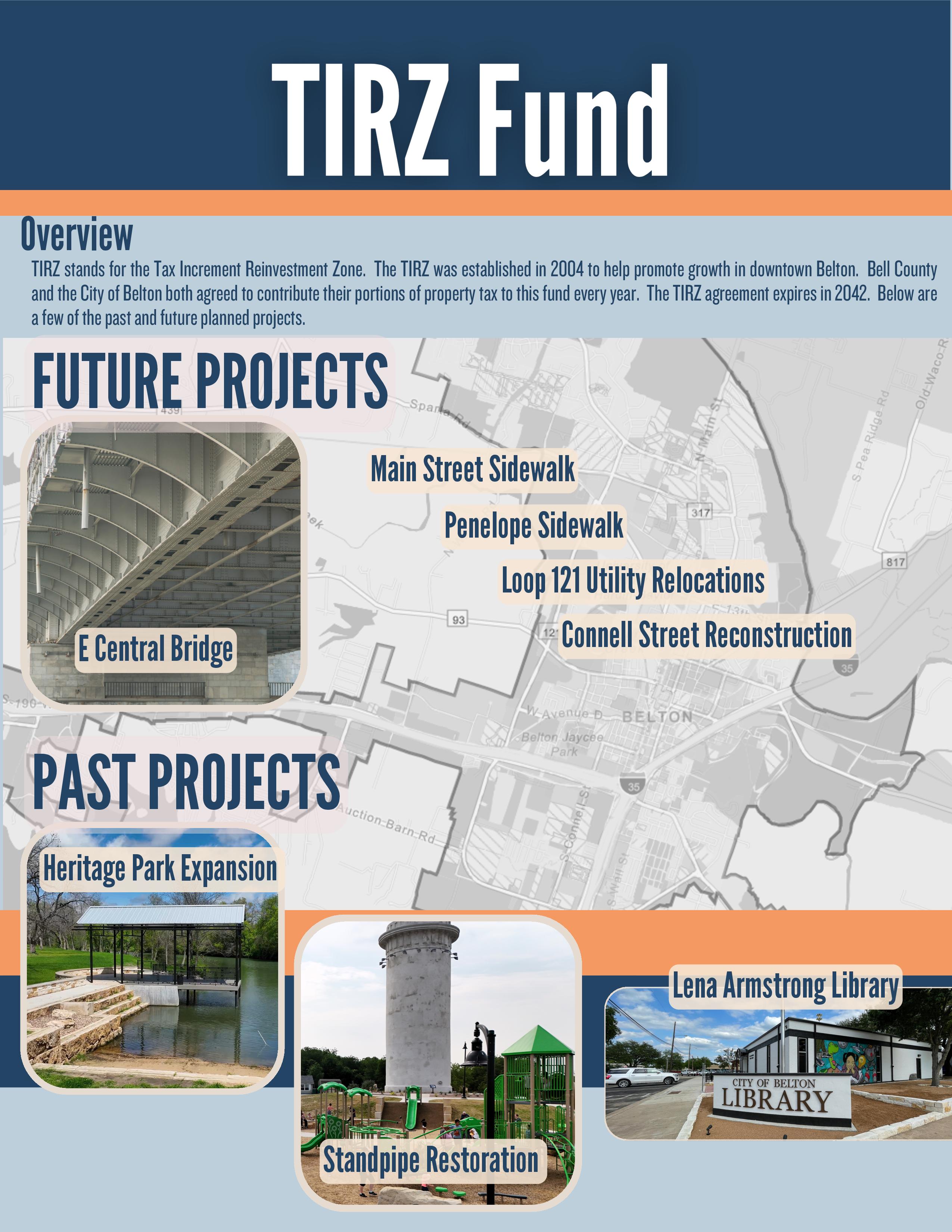

The TIRZ Fund is used to account for the accumulation of resources from ad valorem taxes collected on the incremental tax values in the Belton Tax Increment Reinvestment Zone No. 1. These revenues may only be expended on projects within the TIRZ zone that have been approved by both the TIRZ Board and the City Council. The City of Belton and Bell County participate in the TIRZ. In 2022, the boundary of the zone was expanded by 1,168 acres to a total of 4,384 acres. The TIRZ will expire in 2042.

TIRZ Fund revenue continues to grow rapidly as captured property values within the zone swell. Total revenues that are reflected in the FY 2026 Proposed Annual Budget increase by sixteen percent from $3,496,920 to $4,054,520. At $2,064,980, expenditures will decrease with less funding transferred for future capital projects.

The Information Technology Fund is an internal service fund used to account for all costs of providing general information technology services to city divisions. These activities are financed through charges to the divisions for services rendered. FY 2026 revenues total $1,538,110 while expenditures equal $1,530,240 to replace data center servers, phones, and several computers.

The Building Maintenance Fund is another internal service fund used to account for all costs of providing building maintenance throughout the organization. Charges to other divisions total $412,270, while expenditures total $480,030. The fund will draw down reserves in FY 2026 by $67,760.

The Economic Development Fund was created in 1991 pursuant to the ½ percent economic development sales tax approved by voters in 1990. This additional sales tax can only be used for economic development purposes. Acting through the Belton Economic Development Corporation, Inc., a governmental nonprofit corporation, the purpose of this fund is to promote, assist, and enhance economic development activities within the City of Belton.

Revenues in the FY 2026 Proposed Annual Budget are flat at $3,750,500. The corporation’s primary source of income, sales tax revenue, is expected to increase by four percent over FY 2025, but a decrease in miscellaneous income offsets the gain. Totaling $1,234,020, expenditures in FY 2026 include $150,000 for entry features within the Belton Business Park and $300,000 for infrastructure projects.

Conservative management has placed the City of Belton in a sound financial position. A growing property tax base provides resources to cover the increasing demand for city services, and sales tax revenue continues to rise. Nonetheless, the city will be challenged with increasing costs in most areas from personnel to capital projects.

The FY 2026 Annual Budget, while continuing prior year commitments to improve services and facilities, reflects a balanced approach to the multi-faceted needs of a growing community. This budget continues to build on the City’s successes, moving

steadily forward, seeking to meet the dual goal of preserving community character, while prudently planning for future growth.

The leadership of the City Council, as well as its time and attention during the development of the FY 2026 budget, is greatly appreciated. Gratitude is also extended to Department Heads and staff members for their work and dedication to serving the community.

Sam A. Listi

Michael Rodgers, CPA City Manager Director of Finance

Lena Armstrong, the City Librarian for 54 years and the unofficial historian of Belton, wrote the following synopsis of Belton’s history. She penned a longer version of Belton history, which is included in the two-volume edition of "The Story of Bell County" published in 1988 by the Bell County Historical Commission. Lena retired from the City in December of 1998, and subsequently passed away in January of 1999. She is fondly remembered and sorely missed.

In August 1850, the new pioneer town of Belton (first named Nolandville that was changed to Belton in 1851) was laid out in blocks, streets, and lots with the courthouse public square the center. It was designated County seat for the newly organized Bell County. Incorporated in 1852, it was the only town in the County and was the last place of civilization seen by the pioneers heading West by horseback or wagon train.

Within a month after lots were sold, a post office was established and mail was arriving by horseback. But in 1852, a stagecoach route beginning in Tennessee and ending in Brownsville was stopping weekly in Belton to deliver mail, new arrivals and freight. By now, the first courthouse was in use, a log cabin placed high on blocks as safeguard from devastating floods, provided all too frequently by Nolan Creek running very near the public square. In 1853, a two-story log jail was built followed by a school, hotel, church, saloons, stores and other businesses. Most were log buildings or pole shacks, but with a new surge of people, more permanent buildings were built. Stores were erected using native stone and were two-story with the business on the first floor, family quarters on the second. A number of these stores have survived and are still in use. The A.D. Potts building, built in the late 1860's, not only is still in use but is still owned by the Potts family.

Just prior to the Civil War, Sam Houston stumped the State, urging people to not vote for secession. He made two speeches in downtown Belton, but his talks were not well received. He was booed so loudly on one occasion, he took out his two pistols, laid them on the goods box he was using for a podium, and dared anyone to interrupt him. They did not.

In 1858, the County commissioners built a new courthouse, spending $14,000 for a twostory limestone building replacing the first courthouse which had become completely inadequate for the population the County now served. Bell Countians so opposed the new edifice, they voted out of office every commissioner, replacing them with more conservative men. It was 26 years before a third (and last) courthouse was approved and built.

Over a thousand Bell County and Belton men joined the Confederate Army and Belton women did their part by meeting daily at the courthouse to sew clothing for the soldiers. There was only one sewing machine in Belton, and it saw constant use. As the War progressed, the effects of the War were felt strongly. Supplies and inventories, as well as currency dwindled and many stores were forced to close. War's end, and defeat, saw all elected officials from the Governor to Mayors replaced with Union appointees. Federal troops patrolled the streets of Belton giving little protection to the citizens and their property. Outlaws roamed the area stealing, assaulting and killing to such an extent that Belton men decided to do something. In the dark of the night, bands of horsemen arrived at the County jail (still standing) where ten prisoners were jailed. The horsemen dismounted, moved into the jail and shot nine men to death. It is said that for decades after, outlaws rode wide around Belton. Sam Bass, on his way to rob a bank, refused to enter Belton, saying "Those Belton men are too tough for me".

The 1870's saw a boom with building, new businesses and new enterprises. A Belton group organized the Belton Telegraph Company that was chartered and extended to Round Rock where it joined Western Union. The telegraph provided daily quotes of the cotton market, necessary for an area where cotton was King. The 1870's also saw the formation of the now famous Belton Woman's Commonwealth, a loosely organized group that in retrospect seems more a battered wives' refuge than a utopian commune.

Belton met its first setback in 1881 when the City fathers, after meeting the demands of Santa Fe railroad representatives and putting up $75,000, found themselves duped out of a railroad in Belton. They sued, but the company built their own town that they named Temple. After many years, the Supreme Court finally ended the case in favor of Belton. Meanwhile, they contracted with the M.K. & T. and by 1882, the Katy's depot was built a block from the courthouse. In the interim, Belton went "modern" with a water system and mains throughout town, an electric and telephone companies, a fire department, lumber yard, flour mill, plus newspapers, and banks. There was also a new college: Baylor Female College, now the University of Mary Hardin-Baylor. Two beautiful parks, still maintained by the City of Belton, were acquired during these decades: the Confederate Park*, donated to the City by citizens honoring the ex-Confederate Veterans; and the Yettie Tobler Polk Park, commemorating Mrs. Polk and her four children who drowned in a devastating flood that inundated Belton in 1913.

Belton got into severe financial difficulties before the Great Depression, but managed to work its way out by the 1970's. World War II and the arrival of Fort Hood to the County brought economic relief and a surge of growth. Two large lakes built during this time provide tourist attractions and IH-35 makes Belton attractive to industries and businesses.

Lena Armstrong

*Editor’s note: In 2020, the name of Confederate Park was changed to Liberty Park.

City Council Three-Year Terms

Name Place

David K. Leigh, Mayor Place 4May 2027

John Holmes Sr., Mayor Pro Tem Place 1May 2026

Dave Covington Place 2May 2026

Craig Pearson Place 3May 2027

Daniel Bucher Place 5May 2028

Luke Potts Place 6May 2028

Stephanie O'Banion Place 7May 2028

Bell County Health District Board

Three-Year Terms

Name Term Expiration

Charla Peters October 11, 2025

Dan Kirkley (Alternate) March 14, 2026

Bell County Tax Appraisal District

Two-Year Terms

Name Term Expiration

Todd Scott December 31, 2025

Belton Economic Development Corporation

Three-Year Terms

Created by Resolution No. 030591-1

Name Term Expiration

Brandon Bozon, President

November 30, 2025

Marion Grayson November 30, 2025

John R. Holmes, Sr. November 27, 2027

Tyson McLaughlin November 30, 2026

Stevie Spradley November 30, 2026

Central Texas Housing Consortium Board

Two-Year Terms

Name Term Expiration

Marvin Bell January 24, 2026

Malinda Golden January 27, 2027

Name

Dr. Jude Austin II

Vacant

Amanda Lufburrow

Ethics Commission

One-Year Terms

Created by Ordinance No. 2005-47

May 27, 2026

May 27, 2026

May 27, 2026

Brooke Morrow May 27, 2026

Nicholas Rabroker

Mike Ratliff

May 27, 2026

May 27, 2026

Cathy Fox May 27, 2026

Amy Casey, Secy Virtue of position

Historic Preservation Commission

Two-Year Terms

Created by Ordinance No. 2012-18

Name

T. C. Lipe

Ann West

Eric Urben

Barrett Covington

Ann Carpenter

September 10, 2026

September 10, 2026

September 10, 2026

September 8, 2025

September 8, 2025

Tina Moore Virtue of position

Building and Standards Commission

(Replacing Housing Board of Adjustments & Appeals)

Two-Year Terms

Created by Ordinance No. 2020-42

Name

Brian Johnson

Eric Haugeberg

November 10, 2026

December 13, 2026

Ralph Masters January 12, 2027

Priscilla Linnemann November 10, 2026

Samantha Crumbaugh November 10, 2026

Elizabeth Scamardo (Alternate)

November 10, 2026

Clinton Bailey (Alternate) November 10, 2026

Three-Year Terms

Created by Ordinance February 28, 1933

Name Term Expiration

Melinda Lanham August 13, 2025

Roxanne Sanders November 30, 2026

Kerri H. Pridemore November 26, 2027

Meg Wagner November 26, 2027

Ann Locklin November 30, 2028

Chad Green August 13, 2025

Janice Pustka November 30, 2025

Municipal Judge & Associate Judge

Name Term Expiration

Steve Lee, Judge

May 13, 2027

Jasmine Rios-Harding, Associate Judge May 13, 2027

Parks Board

Two-Year Terms

Created by Ordinance No. 51083-3

Name Term Expiration

Ted Smith

Josh Pearson, Chair

Oscar Bersoza

Diane Ring

Jason Wolfe

June 20, 2027

June 20, 2026

June 20, 2026

June 20, 2027

June 20, 2027

Kayla Potts January 28, 2027

Jim Deeken January 28, 2027

Planning and Zoning Commission

Two-Year Terms

Created by Ordinance No. 52885-1

Name Term Expiration

Ty Taggart

Quinton Locklin

May 28, 2026

June 13, 2027

Brandon Skaggs May 28, 2026

Damon Gottschalk

Brett Baggerly

Alton McCallum

Dominica Garza

Justin Ruiz

Lisa Kamprath

May 28, 2026

June 24, 2027

May 28, 2026

June 13, 2027

June 13, 2027

May 28, 2026

Police and Fire Civil Service Commission

Three-Year Terms

Created by Ordinance No. 96-27

Name Term Expiration

Larry Thompson September 24, 2026

Jimmy Rowton September 24, 2025

Jerry Samu September 24, 2027

Public Property Finance Corporation Board of Directors

Six-Year Terms

Created by Ordinance No. 51987-1

Name Term Expiration

Vacant August 12, 2029

Stephanie O’Banion August 12, 2029

Daniel Bucher August 12, 2029

Tax Increment Reinvestment Zone Board

Two-Year Terms

Created by Ordinance No. 2004-64

Name Term Expiration

David Blackburn, Chair January 13, 2027

Barbara Bozon, Vice Chair January 13, 2027

Stephanie O'Banion January 13, 2027

Craig Pearson January 13, 2027

Russell Schneider January 13, 2027

Sam Listi, City Manager, Ex Officio Virtue of position

David K. Leigh, Councilmember, Ex Officio Virtue of position

Amy Casey, City Clerk, Ex Officio Virtue of position

Youth Advisory Commisssion

One-Year Terms

Created by Ordinance No. 2007-20

Name Term Expiration

Kira Woods, Chair August 27, 2025

Anaise Lopez-Rodriguez August 27, 2025

Jacqueline Gantivar August 27, 2025

Veda Bennett August 27, 2025

Cahaya Lane August 27, 2025

Stella Lufburrow August 27, 2025

Akina Gonzalez August 27, 2025

Finn Mauk August 27, 2025

Maddison Frazier August 27, 2025

Created by City Council April 1971

Name Term Expiration

Mat Naegele June 25, 2026

Amanda Hendrick August 22, 2025

Robin Alaniz August 22, 2025

Nelson Hutchinson June 25, 2026

Garrett Smith August 22, 2025

Judy Owens (Alternate) August 22, 2025

Ben Burnett (Alternate) August 22, 2025

The City of Belton is a home-rule city operating under a Council-Manager form of government. AllpowersofthecityarevestedinanelectedCouncil,consistingofamayor and six members. The Council enacts local legislation, determines City policies, and employs the City Manager. Citizens elect each Council member at large in nongeographic places for three-year terms.

TheCityManageristheChiefExecutiveOfficerandtheheadoftheadministrativebranch of the city government. He is responsible to the Council for the proper administration of all affairs of the city.

The city government provides a broad range of goods and services to its citizens. The activities and personnel required to provide these goods and services are organized into broadmanagerial areas called Funds. Fundsare separate fiscal and accounting entities with their own resources and budgets necessary to carry on specific activities and attain certain objectives.

Funds are further organized into functional groups called Departments. A Department is a group of related activities aimed at accomplishing a major city service or program (e.g. Police Department).

A Department may be further divided into smaller areas called Divisions. Divisions perform specific functions within the Department (e.g. Municipal Courtis a division of the Finance Department).

At theheadofeachDepartmentisa Directorwho isanofficeroftheCity. Directorshave supervision and control of a Department and the Divisions within it but are subject to the supervision and control of the City Manager. A Director may supervise more than one Department.

The City is organized into Funds. For fiscal (financial) purposes, a fund is a separate accounting entity with a self-balancing set of accounts in which cash and other financial resources,allrelatedliabilities,residualequities,andthechangesthereinaresegregated and recorded. The budgeted funds for the City include:

Governmental Funds:

General Fund: Accounts for all financial resources except those required to be accounted for in another Fund.

Debt Service Fund: Accounts for the accumulation of resources for, and the payment of general long-term debt principal and interest.

Hotel Occupancy Tax Fund: Accounts for activities related to the City's seven percent hotel occupancy tax. These funds can only be used for purposes designated by the State and further designated by the City Council.

TaxIncrementReinvestmentZoneFund: Thisfundisusedtoaccountforprojects financed with tax revenues collected in the city’s tax increment and reinvestment zone, created pursuant to the state tax code statutes.

Enterprise Funds:

Water & Sewer Fund: Accounts for operations related to providing water and sewer service to the citizens of Belton.

Drainage Fund: Accounts for operations related to providing storm drainage service to the citizens of Belton.

Internal Service Funds:

Information Technology Fund: Accounts for operations related to providing general information technology services for other city divisions.

Building Maintenance Fund: Accounts for operations related to providing building maintenance for City facilities.

Component Unit (A Governmental Fund):

Belton Economic Development Corporation Fund: Accounts for activities related to the one-half percent economic development sales tax approved by voters in 1990.

The Annual Comprehensive Financial Report includes non-budgeted funds that are not included in this budget document.

TheCity’sAnnualComprehensiveFinancialReport(ACFR)showsthestatusofthecity’s finances on the basisof generallyacceptedaccounting principles (GAAP). Under GAAP, the City reports governmental funds on a modified accrual basis of accounting and enterprise funds on an accrual basis of accounting. In most cases this conforms to the way the city prepares its budget. Exceptions are as follows:

Liabilitiesfor compensatedabsencesthatareexpected tobe liquidated withavailable financialresourcesareaccruedasearnedbyemployees(GAAP)asopposedtobeing expended when paid (budget basis).

Principal payments on long-term debt are applied to the outstanding liability on a GAAP basis, as opposed to being expended on a budget basis.

Capital outlays are recorded as assets on a GAAP basis and expended on a budget basis.

The General Fund balance shall be adequate to handle unexpected decreases in revenues plus extraordinary unbudgeted expenditures. The minimum fund balance shouldbeatleast30%ofoperatingexpenditures. Theprojectedfundbalanceattheend of FY 2025 is 34%.

Investmentsmade by the City shallbe in conformity with State law and the City of Belton investmentpolicy that is adoptedby theCity Council. All investments shallstress safety, liquidity, public trust, and yield - in that order.

An independent audit will be conducted annually.

The city will produce annual financial statements in accordance with generally accepted accounting procedures (GAAP) as outlined by the Governmental Accounting Standards Board (GASB).

The city will produce an Annual Comprehensive Financial Report (ACFR), which meets the requirements for the Government Finance Officers Association's (GFOA) Certificate of Achievement for Excellence in Financial Reporting. The City of Belton has received thirty-eight consecutive Certificates from FY 1986 through FY 2024. We believe the FY 2025 ACFR will also conform to the standards of the Certificate Program, and it will be submitted to GFOA for award consideration.

The budget should be balanced with current revenues plus available unreserved fund balances equal to or greater than current expenditures. All budgeted funds have balanced budgets for FY 2026.

The taxrateshouldbeadequatetoproducerevenues required topayfor city servicesas approved by the City Council.

Sales tax revenue projections should be conservative due to the elastic nature of this economicallysensitiverevenue source. FY2026salestaxrevenueswerebudgetedwith a conservative projected increase from the FY 2025 level.

The General Fund should be compensated by other funds for general and administrative services provided, including management, finance,personnel,and the use of city streets and the city fleet. The transfers for FY 2026 are $1,699,470.

The citywillnotissuedebt tofinance currentoperations. Nodebt wasissued inFY2025 to finance current operations.

Acontingencyamountshallbeincluded intheannualbudgetinan amountnottoexceed 3% of total General Fund expenditures, to be used in case of unforeseen items of expenditures. The FY 2026 contingency amount is set at $50,000 or 0.2% of operating expenditures before the contingency amount.

The city will maintain physical assets at a level adequate to protect the city's capital investment and minimize future maintenanceand replacement costs.

The city will produce an annual budget document that meets the criteria for GFOA's Distinguished Budget Presentation Award. The city has received the award for thirtythree consecutive years, for FY 1993 through FY 2025. We believe the FY 2026 budget willalso conform to the standardsof the Certificate Program, and it will be submitted it to GFOA for award consideration.

The city's water and sewer utilities shall operate on a self-supporting basis so that user charges for services shall fully cover the cost of providing those services. All water and sewer revenue in the FY 2026 budget is generated from user fees and interest thereon.

ThecitywillnotusepropertytaxesorotherGeneralFundrevenuestosubsidizetheutility operations. The FY 2026 budget does not subsidize the Water and Sewer Fund or Drainage Fund from the General Fund.

Utility rates shall be reviewed annually to ensure that they will generate revenues adequatetocoveroperatingexpenditures,meetbond covenants,and allowforadequate capital replacement.

Thecity'sratestructuresforwaterandsewerserviceswill(tothegreatestextentpossible) befairandequitabletoallcustomers. Thewaterbaserate,orminimumbill,isnowbased upon meter size and includes 2,000 gallons of water flow. Two water volumetric rates have been established, with customers paying a fee for each 1,000 gallons above 2,000 gallons. Thesewerbaserateisthesameregardlessofmetersize. Thesewervolumetric ratechargedforconsumptionover2,000gallonsisthesamerateforallcustomerclasses. For services providedoutside of the city limits, allrates are 1.25 times the prevailing rate within the City of Belton.

The city will maintain sufficient net revenues to meet the debt coverage required by existing revenue bond indentures. The projected coverage for FY 2026 exceeds current debt coverage requirements.

Theutilitysystemwillmaintainabondratingof‘AA’(Standard&Poor’s). Themostrecent rating is at this level.

The utility system will operate in the most efficient manner possible to keep rates as low as possible while maintaining sufficient revenues for the timely maintenance and replacement of utility system capital assets.

The city will make timely investment in the expansion of capital assets to provide adequate levels of service in conformance with State and Federal regulations, and meeting the appropriate health, safety, and environmental standards.

The city will provide timely and accurate billing to customers, providing safeguards to ensure prompt payment and minimal financial losses from delinquent customers which have to be passed onto the remaining customers.

February 1 to February 28

March 3

Budget preparation

Budget requests due

March 4 BEDC Board meeting

March 10 to March 31 Department meetings

April 1

April 22

May 6

BEDC Board meeting

Regular Council meeting

BEDC Board meeting

May 8 TIRZ Board meeting

May 27 Regular Council meeting

June 10 Regular Council meeting

June 24 Regular Council meeting

July 8

Regular Council meeting

July 21 Certified tax roll

August 8 Newspaper notice

August 12 Regular Council meeting

Departments prepare budget requests

Detailed line‐item requests are returned to Finance

BEDC budget kickoff

Departments meet with City Manager and Finance to discuss budget requests

BEDC budget workshop

Workshop to discuss Strategic Plan and long‐term goals for the City of Belton

BEDC approves its FY 2026 budget

TIRZ approves its FY 2026 budget

General Fund and Debt Service Fund

Water and Sewer Fund and Drainage Fund

General Fund and Debt Service Fund update if needed

Hotel Occupancy Fund, TIRZ, Information Technology Fund, Building Maintenance Fund, and BEDC

Discuss 2026 – 2030 Capital Improvements Program

Present the FY 2026 Proposed Annual Budget to City Council (Must be filed with Clerk at least 30 days before budget adoption)

Post proposed budget on City website

Call for public hearing on budget

BCAD delivers certified ad valorem tax values

Publish notice of public hearing on budget (10 – 30 days before hearing)

Budget updates if needed

Present the Strategic Plan

Present fee schedule

Propose an ad valorem tax rate for tax year 2025/fiscal year 2026

Call for public hearing on tax rate, if it exceeds no‐new‐revenue tax rate

Call for public hearing on Strategic Plan

Post proposed tax rates on website

August 26 Regular Council meeting

August 27 Newspaper notice

September 9 Regular Council meeting

Public hearing on budget (at least 15 days after filing with City Clerk)

Public hearing on Strategic Plan

Public hearing on fee schedule

Publish in newspaper and on City website the notice of public hearing on tax rate (if exceeds no‐new‐revenue tax rate, must be at least 5 days before hearing)

Continuous website notice of PH on tax rate (at least 7 days before hearing)

Public hearing on tax rate

Ratify tax revenue increase in budget, if necessary

Adopt fee schedule

Adopt Strategic Plan

Adopt FY 2026 Annual Budget

Adopt ad valorem tax rate (no more than 60 days after receipt of certified tax roll)

*The budget and tax rate must be adopted no later than 78 days before the uniform election date (August 18, 2025) if the City plans to adopt a tax rate that exceeds the greater of the voter‐approval rate or the de minimis rate. If a rate lower than the voter‐approval rate is proposed on August 12, 2025, adoption of the budget and tax rate can occur in September.

The following chart summarizes the budget process and the various steps leading to the adoption of the Fiscal Year 2026 Budget.

Strategic Planning:

Review and update Capital Improvement Projects as needed

Revenue projections developed

Budget orientation

Budget Development:

Budget staff prepares and send budget materials to divisions

Divisions prepare draft operating budgets

Budget review sessions with City Manager

City Council budget work sessions

Finance staff compiles Proposed Annual Budget

Proposed Annual Budget filed with City Clerk and published

Finalize and Adopt:

Finance staff finalizes Annual Budget

Public hearing on Annual Budget

City Council adopts annual budget

Public hearing on proposed tax rate if necessary

City Council adopts a tax rate

Annual budget published

Amend budget if necessary (after fiscal year has begun)

The City Charter establishes the fiscal year, which begins October 1 and ends September 30. Each February, Department Heads receive budget request packets from the Finance Department. These packets contain information about the department, including historical expenditure amounts, current expenditure and budget amounts, and estimated expenditure amounts for the upcoming budget year.

While the departments are preparing their budget requests, the Finance Department calculates personnel costs, debt service requirements, and revenue projections for the new year. This data combined with the department requests form a preliminary or "first draft" budget.

After receiving the first-draft budget from Finance, the City Manager conducts a series of meetings with the individual Department Heads to discuss their budget requests. Held in March, these meetings help the City Manager formulate his priorities and work agenda.

A series of City Council budget workshops are held, usually in May and June. These workshops are open to the public. Information as to date and time can usually be found in the local media coverage. The workshops allow the City Council to receive input on the budget from the City Manager, the various departments, and Finance. It is through these workshops, as well as discussions with city staff, that the Council forms its priorities and work program for the proposed budget.

With guidance from the Council, the City Manager then formulates a proposed budget that is submitted to Council in July. State law and the City Charter require that a public hearing on the proposed budget be held before the Council votes on its adoption. A notice of the public hearing is published in the local newspaper, and the hearing is held during a regular City Council meeting. This hearing provides an opportunity for citizens to express their ideas and opinions about the budget to their elected officials.

After the public hearing, the City Council votes on the adoption of the budget. If the budget is not accepted and formally approved by the City Council before September 28, the budget submitted by the City Manager is deemed to have been finally adopted by the Council until such time as the Council adopts a budget.

After adoption of the budget, the City Manager may approve transfers of any unencumbered budget amount or portion thereof between general classifications of expenditures within a division or department. At the request of the City Manager and within the last three months of the fiscal year, the Council may by resolution transfer any unencumbered appropriation or portion thereof from one division or department to another. The city budget may be amended and appropriations altered in accordance therewith in cases of public necessity after conducting a public hearing called for such purpose.

$2,568,610 $14,889,070

$1,234,020 $503,630 $2,064,980 $14,271,850 $617,220 $1,530,240 $480,030

Note: Positions are shown as full-time equivalent (FTE)

Notes:

of Belton, Texas

Notes:

Capital project funds are excluded from presentation because they are not part of the annual appropriations process. Appropriations for capital projects are made on a project basis and carry over until the project is completed. Special Revenue Funds

Funds

Service Funds

1,963,000

473,820

352,570

City of Belton, Texas

Consolidated Statement of Fund Balance

Budget Year 2026

1 Excludes use of prior years' fund balance

Reason for significant changes in fund balance, if any:

General Fund - The decrease in FY 2025 is a planned drawdown of reserves from 34% to 32% of budgeted expenditures.

Debt Service Fund - The significant changes eac h year reflect the low level of reserves.

Hotel Occupancy Tax Fund -Changes reflect revenue growth and relatively low level of spending.

TIRZ Fund - Changes reflect revenue growth and capital spending.

Water & Sewer Fund - The increase in FY 2025 will be used for future capital project funding.

Drainage Fund - The increase in FY 2026 will be used in future year capital project funding.

Information Technology Fund - The decrease in FY 2025 is due to capital purchases.

Building Maintenance Fund - The decrease in FY 2026 is due to a planned drawdown of reserves.

BEDC Fund - FY 2025 reflects land acquisitions. FY 2026 reflects the low level of spending compared to revenues.

Fiscal Years 2023 - 2026 All Budgeted Funds1

1 Capital projects funds are excluded from presentation because they are not part of the annual appropriation process. Appropriations for capital projects are made on a project basis and carry over until the project is completed.

General Fund

Fiscal Years 2023 - 2026

Cityof Belton, Texas

Consolidated Schedules of Resources and Expenditures

Debt Service Fund

Fiscal Years 2023 - 2026

Hotel OccupancyTax Fund

Fiscal Years 2023 - 2026

Cityof Belton, Texas

Consolidated Schedules of Resources and Expenditures

TIRZ Fund

Fiscal Years 2023 - 2026

Consolidated Schedules of Resources and Expenditures

Water & Sewer Fund

Fiscal Years 2023 - 2026

Consolidated Schedules of Resources and Expenditures

Drainage Fund

Fiscal Years 2023 - 2026

Cityof Belton, Texas

Consolidated Schedules of Resources and Expenditures Information TechnologyFund Fiscal Years 2023 - 2026

Cityof Belton, Texas

Consolidated Schedules of Resources and Expenditures

Building Maintenance Fund

Fiscal Years 2023 - 2026

BEDC Fund

Fiscal Years 2023 - 2026

The General Fund is the chief operating fund of the government. It is used to account for all current financial resources not required by law or administrative action to be accounted for in designated funds. The primary governmental functions occurring within this fund are police and fire protection, parks, library, streets, and general administrative operations. Operations within the General Fund are largely funded from taxes. Property taxes comprise thirty-nine percent of revenues, while sales taxes generate twenty-seven percent. Other revenues include franchise taxes, fines, fees, and charges for services such as garbage collection. The organizational structure of this fund can be broken into specific divisions of the government that are based upon the function that each serves. Related divisions may form a department withconsolidatedmanagement.

General Fund Long-Term Forecast Assumptions

Debt Service Fund is used for payment of the City's long-term debt. Bond obligations have been used to purchase parkland, park improvements, street and sidewalk improvements, bridges, Police Department expansion, and traffic improvement projects. Below are just a few of the projects that have been funded in the past.

The hotel occupancy tax was established in 1959 and given authority to municipalities in the 1970's. This tax was instituted and restricted to promote tourism and the convention/hotel industry. Belton is thankful to have the Bell County Expo center that brings many visitors to Belton. The City plans many events for FY 26 including Christmas on the Chisholm Trail, 4th of July events, B4 festival and an Octoberfest event .

Water base rates are charged by meter size, which is the industry standard. This recognizesthatlargermetersputagreater demand on the water system. The base rate includes 2,000 gallons for domestic consumption. Almost 90% of water customers have a 5/8-inch meter. For FY 2026,thebaseratefora5/8-inchmeterwill be $18 per month. The base rate for other meter sizes is shown in the following table. Allrateslistedinthefollowingtablesarefor CityofBeltonresidents.Thoseoutsideofthe citylimitswillpay1.25timesthecityrate.

Thevolumetricrateischargedforeach1,000gallonsofwater consumed. There are four customer classes: residential, multi-family, commercial, and non-residential sprinkler. Residential and non-residential sprinkler customer classes have a tiered rate structure while multi-family and commercial customer classes will continue being charged flat rates. With the new tiered rate structure, customers who consume less water will pay a lower rate than those who consume more water which promotes conservation. For FY 2026, water rates will remain at FY 2025 rates. A comparison ofthewatervolumetricratesforFY2025andFY2026isshown inthetablesbelow.

MULTI-FAMILY & COMMERCIAL CUSTOMER CLASS

NON-RESIDENTIAL SPRINKLER CUSTOMER CLASS

City services are extended outside of the city limits in certain instances. These water and sewer services are billed at a rate of 125% the inside city limit rates. Customers with these services will have an account number beginning with 38, 39, 46, 49, or 56. The base rate for water begins at $22.50 and the sewer base rate is $22.43, volumetric rates are listed below.

SomeresidentswithintheCitylimitsofBelton have water provided by another entity, Dog RidgeWaterSupplyor439WaterSupply,and sewer service provided by the City of Belton. These customers are billed for sewer based ontheirwaterconsumption.Thesecustomers will also be billed based on their winter averageconsumptionforwater.

Customersservicedby439WaterSupplyand connected to City of Belton sewer have an accountnumberbeginningwith41.Attheend of each month, water meter reads are provided to the City of Belton by 439 Water Supply. These reads are used to determine the amount of sewer billed. The winter average for water consumption will be used to determine the amount of sewer billed for thesecustomers.

Customers serviced by Dog Ridge Water SupplyandconnectedtoCityofBeltonsewer have an account number beginning with 56. On the 25th of each month, the City of Belton reads the waters meters for these accounts. These reads are used to determine the amount of sewer billed. The winter average for water consumption will be used to determine the amount of sewer billed for thesecustomers.

Forresidentialcustomers,winter-averagingwillbeinstitutedfor wastewater volumetric charges. Sewer charges will be based upon the average water consumption for the months of December, January, and February as consumption during thesemonthsbetterrepresentstheamountofwastewaterthat returns to the sewer treatment plant. The winter average then becomes the billed sewer volume for which sewer charges are applied throughout the year. New customers who have not establishedawinteraveragewillbechargedbasedupon6,000 gallons of usage until a winter average is determined. Multifamilyandcommercialclasswastewaterrateswillbebasedon water consumption. The non-residential sprinkler class will not paysewer,sincetheselinesareprimarilyforirrigation.

RatesforFY2026arerecommendedtoremainattheFY2025rate,resultinginnoincreasetocustomer’s waterandsewerbills.Samplecalculationstoexplainhowwaterandsewerchargesarecalculatedand theeffectsofwinteraveragingareshownbelow.

c},Wor */Ziefwyt *

J>0x�""

Annual Budget 2o26

FiscalYear

Bell County Expo Center- concert venue, livestock arena, conference center. City of Belton sponsored events include Christmas at the Chisolm Trail, B4 Festival, 4th of July Parade and PRCA Rodeo, Movies in the Park, Soggy Doggy Day, Family Fishing and Fun, Father Daughter Dance, and One Community One Day.

Nolan Creek Hike and Bike trail, baseball, softball, soccer, sand volleyball, basketball, pickleball courts, disc golf, dog park, playgrounds (handicap accessible).

Belton is the place to go for water activities we have Lake Belton, Stillhouse Lake, Nolan Creek, and coming soon fishing pier and kayak launch to Heritage Park with the expansion at Leon River. Belton offers amazing outdoor recreation: fishing, boating, skiing, camping, hiking, tubing, and kayaking for the whole family.

Belton is situated along the banks of the Leon River in the rapidly growing Central Corridor of Texas. It is on Interstate 35 near the geographic center of the state, approximately 137 miles south of Dallas/Fort Worth and 60 miles north of Austin. Local topography varies from rolling plains to wooded hills with two large lakes just ten minutes from downtown. Within a 175 mile radius of Belton is a market of over 9.4 million people, including the Dallas/Fort Worth Metroplex, San Antonio, and much of Houston. This region encompasses 55 percent of the population of Texas.

Average

Average Summer Temperature

Average Annual Temperature

93° F

77° F

36° F

71° F

(Bell, Coryell Counties)

Population Composition:

Under 5: 5.7%

6 - 18: 26.5%

19 - 64: 55.7%

Over 65: 12.1%

Population History

Veterans: 1,726

Households: 7,755

High school graduate or higher, age 25 or older: 85.8%

Bachelor’s degree or higher, age 25 or older: 30.8%

According to the U.S. Census Bureau, Belton’s population consists of 56.7% White, 29.0% Hispanic or Latino, 8.8% African American, and 5.5% all other ethnicities.

Population by City

Belton Independent School District:

• 3 - high schools, 4 - middle schools, 12 - elementary schools

• BISD received a A – Superior Achievement in the State of Texas FIRST ratings and a B rating based on the Accountability Ratings as of 2024.

Higher Education:

• Belton: University of Mary Hardin-Baylor

• Bell County:

• Area Colleges:

Texas A & M College of Medicine, Temple

Temple College, Temple

Central Texas College, Killeen

Texas A&M University Central Texas, Killeen

Baylor University, Waco

McLennan Community College, Waco

Texas State Technical College, Waco

Southwestern University, Georgetown

The University of Texas, Austin

St. Edwards University, Austin

Huston-Tillotson College, Austin

Concordia University, Austin

Austin Community College, Austin

Texas A & M University, College Station

Texas State College, San Marcos

Highways: Interstate 35, Interstate 14 (US Highway 190), State Highway 317, Loop 121, FM 436, FM 439, FM 93.

Bus Lines: HOP public micro transit and bus lines which run from Copperas Cove to Temple and Greyhound Lines.

Railroad: Santa Fe Railroad, Georgetown Railroad, AMTRAK passenger service in Temple.

Air: Killeen-Fort Hood Regional Airport, Temple Draughton Miller Central Regional Airport, Austin Bergstrom International Airport.

Belton's business community is diversified, with various sectors – manufacturing and distribution, retail, education, healthcare, government, and IT business process services.

The industrial sector is represented by companies manufacturing modular home structures, agriculture equipment, fiberglass tanks, roofing material, specialty advertising products, corrugated boxes, exercise equipment, school and office furniture, rapid prototypes, and centrifugal alloy castings. Various warehousing and distribution operations handle industrial gases, snack foods, and parcel delivery.

Fort Cavazos U.S. Army Installation is located 17 miles west of Belton. It is the largest United States Army Training Post, the largest single-site employer in the State of Texas with a force of more than 59,695 and a key economic driver for the area. The Texas Comptroller’s office reports that Fort Cavazos’ economic impact to the state was an estimated $39 billion in 2023.

Health care represents the largest private industry in Bell County. Over 38,962 individuals are employed in the medical field. Baylor Scott & White Health, the largest not-for-profit health system in the State of Texas, has a significant presence in Central Texas. This includes Scott & White Memorial Hospital, ranked by U.S. News and World Report as one of the top 10 hospitals in the state of Texas; McLane Children’s Hospital; and dozens of primary, urgent, and specialty care clinics staffed by over 800 physicians and 8,000 employees. Other medical facilities also service the area such as: Olin E. Teague Veteran's Center, Cedar Crest Hospital & Clinic, Metroplex Hospital, Seton Medical Harker Heights Center, and Darnall Army Medical Center.

There are five banks and two credit unions represented in Belton with branch offices located throughout Bell County and Central Texas.

The top 10 property taxpayers within the City limits have a combined taxable value for 2024 of $217,736,850, and are comprised of the following organizations:

Lakes: Belton Lake (7,400 acres) and Stillhouse Hollow Lake (6,340 acres) offer outdoor recreation, fishing, boating, skiing, boat rentals, launching ramps, picnic grounds, restrooms, restaurants, snack bars, drinking water, camping areas, RV areas, marinas, and nature trails.

Harris Community Center: This renovated structure is situated gracefully along Nolan Creek and is an ideal setting for meetings, receptions, and reunions. The original building was constructed in 1936 and housed the Harris School, a historic African American school recognized with a state historical marker for its contribution to African American education. The building and grounds were conveyed from the school district to the City of Belton in 2005 for renovation. The Center was dedicated in July 2006 in conjunction with the West Belton-Harris High Ex-Student’s Association annual reunion. The Center has already received numerous awards and accolades, and ensures that the legacy, heritage, and contributions of those who came before us will be remembered.

Bell County Museum: One of twelve remaining Carnegie Libraries in Texas, this historic building was restored in 1990 and now stands as the major collection of Bell County history. In 1991, the Bell County Museum was awarded the entire collection of artifacts of Miriam "Ma" Ferguson, the first woman governor of Texas and a native of Bell County.

Cadence Bank Center: Central Texas' best entertainment complex, the Cadence Bank Center includes a 9,400 seat main arena, a special events room, an assembly hall, an exposition building, and equine/livestock complex and champions club. Home of the Central Texas State Fair.

Heritage Park: This is a 150-acre park along the Leon River and is home to our baseball and soccer association with 5 baseball game fields and 4 soccer game fields. It has a 1.5acre dog park with a large dog side and a small dog side. This park also includes an inclusive handicap playground with artificial turf and a rentable pavilion next to it. It also has walking trails, fishing dock, picnic areas and a community garden that can be reserved for growing your own vegetables. There are lighted parking lots with plenty of open space for just about any outdoor activity. More recently a championship 18-hole disc golf course was added to Heritage Park. People from across the country have come to play on the disc golf course.

Chisholm Trail Park: This a 34-acre park and is home to our softball association with 3 softball game fields and 2 practice soccer fields. It has lighted walking trail, several picnic areas a horseshoe pit, basketball court, sand pit volleyball court, 2-pickle ball courts and a new playground for the kids. This park features a parking lot next to a large, covered pavilion breezeway for exercise classes with a large restroom nearby.

Harris Community Park: This park includes a playground, splash pad, picnic tables, horseshoe pits and three pavilions with restrooms. It is located near the renovated Harris Community Center and overlooks Nolan Creek and the Hike and Bike Trail.

Summer Fun USA: A water amusement park along the banks of the Leon River adjacent to Heritage Park. The park includes a swimming pool, giant water slides, children's area, concessions, and picnic area.

Independence Day Celebration and PRCA Rodeo: The Annual 4th of July Celebration has been celebrated since the late 1800's and attracts crowds from all over Central Texas. The Celebration includes a kick-off street party at the Bell County Courthouse on the square, a three-day Professional Rodeo Cowboy Association Rodeo, a family fun carnival, God and Country concert featuring religious and Texas music, July 4th parade and patriotic program, and a day full of activities in Yettie Polk Park. Festivities in Yettie Polk Park include Children's Day in the Park, Old Fiddler's Contest, gospel singing, arts and crafts festival, and food booths. The Celebration is sponsored by the Belton Area Chamber of Commerce.

Account Number: A code made up of numbers used to classify how specific dollar amounts come into the City or how they are being spent.

Accounting System: The methods and records established to identify, assemble, analyze, classify, record and report the City's transactions and to maintain accountability for the related assets and liabilities.

Accounts Payable (AP): A short-term (one year or less) liability reflecting amounts owed for goods and services received by the City.

Accounts Receivable (AR): An asset reflecting amounts due from other persons/organizations for goods and services furnished by the City.

Accrual Accounting: A basis of accounting in which revenues and expenses are recorded at the time they occur, rather than at the time cash is received or paid by the City.

Ad Valorem Taxes: Commonly referred to as property taxes. The charges levied on all real, and certain personal property according to the property's assessed value and the tax rate. Also known as property taxes.

Amortization: An accounting method that reduces the value of a loan or an intangible asset, over time.

Annual Comprehensive Financial Report: The City’s complete set of financial statements issued by a government entity in accordance with the requirements of the Government Accounting Standards Board. The report is comprised of the introductory, financial, and statistical sections in which all the annual reports for that specific fiscal year are summarized.

Appropriation: An authorization made by the City Council which permits the City to make expenditures and incur obligations.

Arbitrage: The reinvestment of the proceeds of tax-exempt securities in materially higher-yielding taxable securities.

Assessed Value: A valuation set upon real estate or other property as a basis for levying property taxes. All property values within the City of Belton are assessed by the Bell County Appraisal District.

Asset: The resources and property of the City that can be used or applied to cover liabilities.

Audit: An examination or verification of the financial accounts and records. The City is required to have an annual audit conducted by qualified certified public accountant, concluding in a written report called the Annual Report (AR).

Available Cash: Unobligated cash and cash equivalents.

Balanced Budget: A balanced budget occurs when the total sources of revenues a government collects in a year is equal to the amount it spends on goods, services, and debt service. In Texas, municipalities are allowed to use available fund balance as sources.

Basis of Accounting: Refers to when revenues, expenditures, expenses and transfers (and the related assets and liabilities) are recorded and reported in the financial statements.

Bond: A written promise to pay a specified sum of money (called the principal amount) at a specified date or dates in the future (called the maturity dates), and carrying interest at a specified rate, usually paid periodically. The difference between a bond and a note is that a bond is issued for a longer period and requires greater legal formality. The most common types of bonds are general obligation and revenue bonds. Bonds are usually used for construction of large capital projects, such as buildings, streets, and water/sewer system improvements.

Bonded Debt: The portion of indebtedness represented by outstanding (unpaid) bonds.

Bonds Issued: Bonds sold by the City.

Bonds Payable: The face value of bonds issued and unpaid.

Budget: A financial plan for a specified period of time (fiscal year for the City) that includes an estimate of proposed expenditures and the means for financing them.

Capital Assets: Assets of a long-term character which are intended to be held or used, such as land, buildings, machinery, furniture and equipment.

Capital Expenditures: Expenditures for the construction, purchase or renovation of City facilities or property with a value exceeding $20,000 and a useful life greater than two years.

CIP: Capital Improvements Program. A plan for capital expenditures to provide longlasting physical improvements to be incurred over a fixed period of several future years.

Capital Outlay: Expenditures resulting in the acquisition of or addition to the City's fixed assets.

Capital Projects Fund: A fund created to account for financial resources to be used for the acquisition or construction of major capital facilities or equipment.

Cash: Currency on hand and demand deposits with banks or other financial institutions.

Cash Basis: A basis of accounting in which transactions are recorded on when cash is received or disbursed.

Cash Equivalents: Short-term, highly liquid investments that are readily convertible to known amounts of cash.

Certificate of Obligation (CO): Legal debt instruments used to finance capital improvement projects. Certificates of obligation are backed by the full faith and credit of the government entity and are fully payable from a property tax levy. Certificates of obligation differ from general obligation debt in that they are approved by the City Council and are not voter approved.

Component Unit: Legally separate organization for which the elected officials of the City are financially accountable.

Contingency: The appropriation of funds for future allocation in the event specified budget allocations are insufficient and additional funding is required.

Current Taxes: Taxes that are levied and due within the ensuing fiscal year.

De Minimis Rate: The rate that would generate an additional $500,000 in revenue for the M&O rate plus the current debt rate.

Debt Service Fund: A fund established to account for funds needed to make principal and interest payments on outstanding bonds when due. Also referred to as an Interest and Sinking Fund.

Debt Service Requirements: The amount of money required to pay interest and principal for a specified period on outstanding debt.

Delinquent Taxes: Property taxes remaining unpaid after the due date. Delinquent taxes incur penalties and interest at rates specified by law.

Department: A functional group of the City with related activities aimed at accomplishing a major City service or program.

Depreciation: The proration of the cost of a fixed asset over the estimated service life of the asset. Each period is charged with a portion of such cost, and through this process, the entire cost of the asset is ultimately charged off as an expense.

Division: A grouping of related activities within a particular department. For example, Code Compliance is a division of the Police Department.

Encumbrance: The commitment of appropriated funds to purchase an item or service. An encumbrance differs from an account payable in that a commitment is referred to as an encumbrance before goods or services are received. After receipt, the commitment is referred to as an account payable.

Enterprise Fund: See Proprietary Fund.

Expenditure: If accounts are kept on the accrual basis, this term designates total charges incurred, whether paid or unpaid. If they are kept on the cash basis, the term covers only actual disbursements for these purposes. (Note: An encumbrance is not an expenditure. An encumbrance reserves funds to be expended.)

Expense: Charges incurred, whether paid or unpaid, for operation, maintenance, interest and other charges which are presumed to benefit the current fiscal period.

Equity: The difference between assets and liabilities of the fund.

Fiscal Year (FY)(Period): The time period designated by the City signifying the beginning and ending period for recording the financial transactions of the City. The City of Belton's fiscal year begins each October 1st and ends the following September 30th.

Full Faith and Credit: A pledge of the City's taxing power to repay debt obligations. Bonds carrying such pledges are referred to as general obligation bond or tax-supported debt.

Full-Time Equivalent (FTE): The number of full-time hours being worked by both parttime and full-time employees. The Full-Time Equivalent calculation is an employee’s scheduled hours divided by the Cities full time work week. The unit of measurement for one FTE is equivalent to an individual working 40 hours in a week, or 2080 hours in a year.

Fund: Separate fiscal and accounting entities with their own resources and budgets necessary to carry on specific activities and attain certain objectives.

Fund Balance: The difference between fund assets and fund liabilities of governmental & trust funds. Fund balance for general fund types using modified accrual accounting closely equates to available cash.

General Fund (GF): The largest fund within the City. Accounts for all financial resources except those required to be accounted for in another fund. The General Fund contains the activities commonly associated with municipal government, such as police and fire protection, libraries, streets, and parks and recreation.

General Obligation Bonds: Bonds that finance a variety of public projects such as streets, buildings, and capital improvements. The repayment of these bonds is usually made from the Debt Service Fund. They are backed by the full faith and credit of the City and voter approved.

Goals: Department/division objectives intended to be accomplished or begun within the coming fiscal year.

Governmental Funds: Funds generally used to account for tax-supported activities. These include the General Fund, Debt Service Fund, and Capital Projects Funds.

Grant: Contributions or gifts of cash or other assets from another government to be used for a specific purpose, activity or facility.

Infrastructure: Long-lived capital assets that normally are stationary in nature and can be preserved for a significantly greater number of years than most capital assets. Examples of infrastructure assets include roads, bridges, drainage systems, and water and sewer systems.

Interest and Sinking Fund: See Debt Service Fund.

Interfund Transfers: Amount transferred from one fund to another.

Intergovernmental Revenue: Revenues received from another governmental entity, such as county, state or federal governments.