I N V E S T M E N T S L O W M A R K E T C O R R E L A T I O N N A T U R A L I N F L A T I O N H E D G E L O W V O L A T I L I T Y & M A R K E T C O R R E L A T I O N + 1 8 5 % 1 0 Y R R E T U R N S M A R C H 2 0 2 3 E C A R N O M

1,2 YOURGUIDETOINVESTINGINVEHICLES 3,4,5 3,4,5 3,4,5

I C S

LEX

PEDERSEN

lex@CHROMETEMPLE.com

+614 04 84 64 24

TRUSTEE

Specialised Investment and Lending Corporation Ltd

AFSL number 407100

ACN 149 520 918

investors@silcgroup.com.au

DISCLAIMER

CHROME TEMPLE Investments Pty Ltd ACN 640 888 026 (Investment Manager), a corporate authorised representative (number 001284056) of SILC Fiduciary Solutions Pty Ltd ACN 638 984 602 (AFS licence number522145)(AFSL Holder).

The authority of the Investment Managerislimitedtogeneraladvice and deal by arranging services to wholesale clients relating to the CHROME TEMPLE Investments Mach1Fund(Fund)only.Specialised Investment and Lending Corporation Ltd ACN 149 520 918 (AFSlicencenumber407100)isthe trustee (Trustee) of the Fund and the issuer of the information memorandum and supplementary informationmemorandums.

This document contains general informationonlyandisnotintended toprovideanypersonwithfinancial adviceorofferofanykind.

Prospective investors should carefully consider the contents in theinformationmemorandumand supplementary information memorandums in full and seek professionaladvicepriortomaking any decision regarding an investmentintheFund.

No reliance may be placed on this documentforanypurposenorused forthepurposeofmakingadecision about a financial product or transaction.

Information relating to the Fund ontainedinthisdocumenthasbeen prepared without taking into account the objectives, circumstances,financialsituationor needsofanyperson,andmaydiffer to information contained in the informationmemorandum.

This document may also contain forwardlookingstatementsregarding our intent, belief or current expectations with respect to market conditions.

Past performance and/or forward looking statements are not a reliable indicatoroffutureperformance.

Exceptasrequiredbylawandonlyto the extent so required, neither the Investment Manager, Trustee, AFSL Holder nor its affiliates warrant or guarantee, whether expressly or implicitly, the accuracy, validity, timeliness, merchantability or completeness of any information or data(whetherpreparedbyusorbyany third party) within this document for any particular purpose or use or that the information or data will be from error.

Further, the Investment Manager, Trustee and its affiliates expressly disclaim any responsibility and shall not be liable for any loss, damage, claim, liability, proceeding, cost or expense arising directly or indirectly and whether in tort (including negligence), contract, equity or otherwiseoutoforinconnectionwith orfromtheuseoftheinformationin thisdocument.

REFERENCES

IMPORTANT: Past performance is not indicative of future performance and theexpectedreturnsoftheFundmay not occur as expected or at all. An investor's balance in the Fund may decreaseaswellasincreaseinvalue. All statements that indicate expressly or by implication an expectation of investment returns are based on reasonable assumptions and commercial judgement and no represent-

ationismadeorassurancegiventhat suchstatements,views,projectionsor forecasts are correct or that the expected returns will arise or that investmentbalancesintheFundmay not decrease. You must read the Disclaimer and the contents of the Information Memorandum in full to understand the risks involved in an investmentintheCTiFund.

1 Pastperformanceisnotindicativeof futureperformance.

2 Historic Automobile Group International (“HAGI”) data through 31 December 2022. Returns based on vehicle valuations excluding any related costs (e.g. fees to acquire/sell, maintenance,storagecosts).

3 Investopedia.com “Advantages and DisadvantagesofRealAssets.”

4 Credit Suisse. “Collectibles Amid Heightened Uncertainty Around Inflation.”June2022.

5 Credit Suisse. “Collectibles: An integralpartofwealth.”October2020

6 Data from Yahoo finance (S&P/ASX 200), Wall Street Journal (FTSE 100), HAGIandWorldGoldCouncil.Market. Data. For the S&P/ASX 200, FTSE100, NASDAQ and Gold (in AUD) indices closing prices were rebased to 100. Collectible car returns over the last decaderepresentedbyHAGITopindex price.

7 Knight Frank. “The Wealth Report 2023.”

8 Hagerty.“Whyenthusiastsshouldn’t stress fall’s cooling market” James Hewitt.December2022.

9 Hagerty. “Vehicle-value trends that point to a stabilizing market” Greg Ingold.January2023.

10 Hagerty “What Economic Factors Are Weighing Most Heavily On Car Collectors.”JohnWiley.June2022.

11 Hagerty.“2022’sStand-OutCollector Vehicle Segments.” Grace Houghton. December2022.

ECARNOMICS:YOURGUIDETOINVESTINGINVEHICLES

CHROMETEMPLE.COM P. 02

CHROMETEMPLE.COM INVESTMENT OUTLOOK 04 05 06 07 09 ASSET HIGHLIGHTS INTRODUCTION TO VEHICLE INVESTMENT SPOTLIGHT ON RETURNS INDUSTRY OVERVIEW Contents ECARNOMICS:YOURGUIDETOINVESTINGINVEHICLES P. 03

CHROMETEMPLE.COM INVESTING IN VEHICLES CAN BE AN EFFECTIVE WAY TO DIVERSIFY AN INVESTMENT PORTFOLIO. 96% One of the best return to volatility ratios OutperformedTraditional MarketsOverTheLastDecade +4x Lowannualvolatility ✔ +185% Strong consistent returns over the past decade Natural inflation hedge ✔ Lowmarketcorrelation ✔ 1,2 1,3,4,5 1,3,4,5 1,3,4,5 1,6 1,3,4,5 Asset Highlights Price Performance Indexed to 100 1,14 P R I C E $285 $126 $168 $151 Pastperformanceisnotindicativeoffutureperformance. Collectible cars price represents HAGI Top Index ECARNOMICS:YOURGUIDETOINVESTINGINVEHICLES P. 04 1,6 COLLECTIBLE CARS FTSE100 GOLD S&P/ASX 200 $100

One of the best risk/returns profile amongst passion assets

This asset class has largely been attractive to ultra high net worth individuals – amassing a private collection of vehicles and the associated carrying costs of care, storage, insurance and upkeep requires a significant investment andcommitment.

Yet,consideringthatcollectiblecars have generated 185% returns in the last decade, outperforming stock markets over that same period, the financial merits of investing in collectible vehicles is attractive to

1,3,4,5

more than just car enthusiasts and ultra-high-networthindividuals.

Likeothertangibleorrealassets(e.g. realestate,land),vehiclescanoffera naturalhedgeagainstinflation,with prices and value typically increasing duringtimesofinflation.Asawealth preservation tool, vehicles preserve value over long periods of time. In addition, they are unlikely to go bankrupt, and their prices won’t go to zero. And they are considered to have one of the best risk/returns profilesamongstpassionassets.

CHROMETEMPLE.COM 125% 100% 75% 50% 25% 0%

INTRODUCTION TO VEHICLE INVESTMENT

Real

Historical Return to Volatility Ratio 1,3,4,5 Pastperformanceisnotindicativeoffutureperformance. 1,4 ECARNOMICS:YOURGUIDETOINVESTINGINVEHICLES P. 05 1,2

Global Commodities Gold Art Wine Cars Watches

Estatee Global Equities

Trends point to a stabilizing market

These days we can't read a car forum, facebook group or commentary section without the question"Isthecarmarketcooling?" comingup.Theshortanswertothe question is, yes. But there is no reason to fear a cooling car market, especially when you consider the contextofwhatiscooling.

The 2022 car market was some of the most aggressive appreciation in ages. Of course, what goes up doesn’t go up forever. Toward the end of the year, we started to see a different side of the market. Previously hot segments either levelled offorreceded.Thatsaid,themarket is very segmented, and different stratabehaveindifferentways.

In 2022, the market was inundated with amateur investors and enthusiasts. As a result, commuter vehicles and "affordable" classics (lower priced vehicles and lower qualityvehicles)postedthebestand most consistent returns over that period. However, this latest quarter hintsthatthesegmentiscorrecting fromthechaotictrading,signallinga returntosanityafteralongstreakof massiveincreases.

Thehigherqualityandhigherpriced cars are starting to dominate the results.Forthisreasonweareseeing high-end vehicles hold their ground despite economic anxiety revolving around the pandemic, inflation, and volatilityinothermarkets.

P. 07 1,9 1,8 1 CHROMETEMPLE.COM 1,8

FEATURE| INDUSTRY OVERVIEW

Pastperformanceisnotindicativeoffutureperformance. 1,9 ECARNOMICS:YOURGUIDETOINVESTINGINVEHICLES

Investment Outlook 1,2

Certain iconic classic cars have experienceda+185%increaseinthelast 10-years.Andbecausepastperformance is not necessarily indicative of future performance, the challenge remains in finding tomorrow's future classics, today, before availability and pricing reflect how rare and scarce these cars aredestinedtobecome.

Havingaccesstothenetworkofprivate collectors and having the time to monitor and search through the multiple online platforms that have emergedisanimportantcomponentfor investors to consider when it comes to investinginvehiclesforfinancialreturns. Many people find that they are unable to dedicate the time and resources to find and react to market trends and pricing.

WebelievethattheFundhasthereach, resources and knowledge to find these opportunities. And because of our unemotional, professional approach to buying,holdingandsellingvehicles,we believetheFundcangeneratestronger returnsthanprivatecollections.

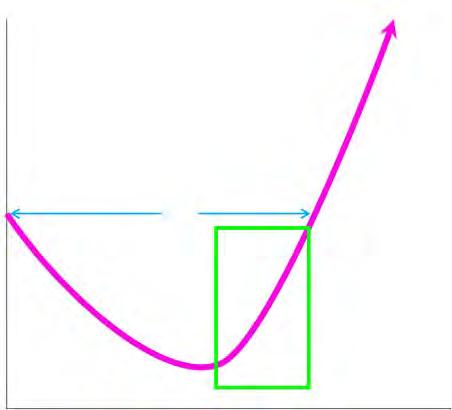

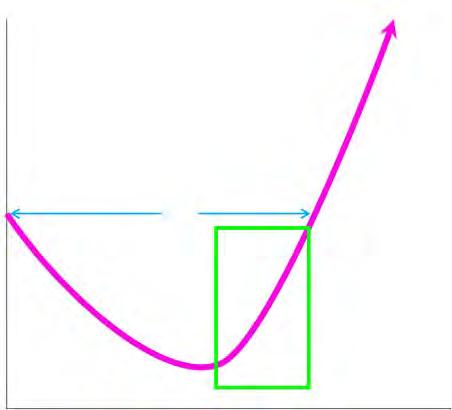

The J-Curve helps visualise how we think about targets.

Most of us are aware of the immediate depreciation most cars experience from their original purchase price. The more commoditised the vehicle, the more likely it is that it will continue on that downwardtrajectory.

Desirable vehicles, however, follow a differenttrajectory.After“bottomingout” they begin to appreciate in value. And vehicles of distinction continue to appreciate on a journey to their original purchasepriceandbeyond.

P. 09 CHROMETEMPLE.COM V A L U E

Vehicle J-Curve CTi Targets Original Purchase Price Depreciation Appreciation

YEARS Classic

MEET THE J CURVE Pastperformanceisnotindicativeoffutureperformance.