DRIVING WEALTH

THE ENDURING ALLURE OF CAR INVESTMENTS

lex@CHROMETEMPLE.com

+614 04 84 64 24

lex@CHROMETEMPLE.com

+614 04 84 64 24

Specialised Investment and Lending Corporation Ltd

AFSL number 407100

ACN 149 520 918

investors@silcgroup.com

CHROME TEMPLE Investments Pty Ltd ACN 640 888 026 (Investment Manager), a corporate authorised representative(number001284056)of SILCFiduciarySolutionsPtyLtdACN 638 984 602 (AFS licence number 522145) (AFSL Holder). The authority oftheInvestmentManagerislimited to general advice and deal by arranging services to wholesale clients relating to the CHROME TEMPLE Investments Mach 1 Fund (Fund) only. Specialised Investment andLendingCorporationLtdACN149 520918(AFSlicencenumber407100) is the trustee (Trustee) of the Fund and the issuer of the information memorandum and supplementary information memorandums. This document contains general informationonlyandisnotintended to provide any person with financial advice or offer of any kind. Prospectiveinvestorsshouldcarefully consider the contents in the information memorandum and supplementary information memorandums in full and seek professional advice prior to making anydecisionregardinganinvestment in the Fund. No reliance may be placed on this document for any purposenorusedforthepurposeof making a decision about a financial product or transaction. Information relatingtotheFundcontainedinthis document has been prepared without taking into account the objectives, circumstances, financial situationorneedsofanyperson,and maydiffertoinformationcontainedin the information memoranda. This document may also contain forward looking statements regarding our intent, belief or current expectations with respect to market conditions. Past performance and/or forward lookingstatementsarenotareliable indicator of future performance. Exceptasrequiredbylawandonlyto the extent so required, neither the Investment Manager, Trustee, AFSL Holder nor its affiliates warrant or guarantee, whether expressly or implicitly,theaccuracy,validity,timeliness, merchantability or completeness of any information or data (whetherpreparedbyusorbyany

thirdparty)withinthisdocumentforany particular purpose or use or that the information or data will be from error. Further, the Investment Manager, Trustee and its affiliates expressly disclaimanyresponsibilityandshallnot be liable for any loss, damage, claim, liability, proceeding, cost or expense arisingdirectlyorindirectlyandwhether in tort (including negligence), contract, equity or otherwise out of or in connectionwithorfromtheuseofthe informationinthisdocument.

IMPORTANT: Past performance is not indicativeoffutureperformanceandthe expected returns of the Fund may not occurasexpectedoratall.Aninvestor's balance in the Fund may decrease as wellasincreaseinvalue.Allstatements thatindicateexpresslyorbyimplication anexpectationofinvestmentreturnsare based on reasonable assumptions and commercial judgement and no representation is made or assurance given that such statements, views, projections or forecasts are correct or that the expected returns will arise or that investment balances in the Fund may not decrease. You must read the Disclaimer and the contents of the Information Memorandum in full to understand the risks involved in an investmentintheCTiFund.

1 Pastperformanceisnotindicativeof futureperformance.

2 Calculated as the percentage difference in unit price as at 30 June 2023 compared to 30 June 2022 (YOY), 30 March 2023 (QOQ), and at launch (May 2021) net of fees (pro forma for performancefeesasneeded).NetCAGR takes into account timing of returns sincelaunch.

3 Comparative indices returns are reported before fees. The S&P/ASX 200FTSE100, NASDAQ, Gold, (in AUD), Bitcoin (BTC-AUD), S&P 500, HAGI and Hagerty indices are calculated as their 31March 2023 reported prices vs 31 March2022prices(YoY)and31Dec2022

(QoQ). Stock market indices obtained from Yahoo Finance and Wall Street Journal.GoldobtainedfromWorldGold Council. HAGI and Hagerty obtained fromtheirrespectivewebsites.

4 Targetreturnsarenotguaranteedand total returns may be above or below targetrange

5 Hagerty Website. “Collector car market continues fall from 2021 heights.” July2023.“

6 Investopedia.com. “Advantages and DisadvantagesofRealAssets.”&"Money.

7 CreditSuisse.“Collectibles:Anintegral partofwealth.”October2020.

8 Investopedia.com“InvestinginCollectibleCars.”UpdatedJanuary2022.

9 Data consolidated from LamboCars.com and Classic.com for LamborghiniCountach.OutliersandCountach’s madein1970swereremovedfromthe dataset.

10 Grossvehiclereturnscomparetheir31 March2023valuationtotheiracquisition (Launch),31December2022(QOQ)and 31March2022(YOY)values.Ifavehicle was purchased between the starting period and 31 March 2023, then the acquisition price was used as the starting value. If the vehicle was sold before31March2023andacquiredafter the starting period, then its sale price was used as its ending value. Gross vehicle returns exclude deposits. Weightingisbasedongrossvalue.

11 Hagerty Website. “How the Hagerty MarketRatingworks“

12 Historic Automobile Group International.TopIndex.

13 Prices indices are before fees and wererebasedto100.Mach1priceswere rebased to 100, and are based on the relevantunitissuancepriceandarenet offees,includingperformancefees.

14 Knight Frank, “The Wealth Report," August2023.Corelogic"HedonicHome ValueIndex"July2023.

review of current trends, and the potential outlook and impact of the industry.

If you think you have Board Member Simon Franklin figured out, there's more to him than meets the eye.

THE FUND IN NUMBERS (30 JUNE 2023)

RETURNSSINCELAUNCH

AVERAGEANNUALCAGR

YEAROVERYEARRETURN

CURRENTASSETSUNDERMANAGEMENT

BY: LEX PEDERSEN

BY: LEX PEDERSEN

We're now two full financial years in, and the Fund has generated +29% returns, net of fees since launchresulting in an annual CAGR return of +13% per year, net of fees. CAGR (or compounded annual growth rate) representstheaverageannualgrowth rate of your investment, assuming growth builds upon itself (compounds)andit'sconsideredoneofthe most accurate ways to calculate and determinereturns.

We'reproudoftheseresultsforseveral reasons, not least of all because over thelasttwoyearswe'veoutperformed traditionalmarkets.

We're also encouraged to have delivered on our commitment to generateannualreturnsof+8%,netof fees, especially during a period in which segments of the car market were slowing down and even correctingfromapandemicbubble.

If there's one thing I want to stress about investing in the Fund, it is this: don'tlookattheshort-termreturns!

The Fund, in fact, performed solidly overtheshort-term.Overthislastyear, we generated 8% returns, net of fees. And over the last quarter, the Fund's fleet preserved value and generated a respectable,consistent2%QoQreturn, net of fees, without the volatility of traditionalmarkets.

That is what we believe is the beauty ofinvestingincars,theirabilitytobea store of value even in the short-term. And it's this potential that makes them a valuable diversification asset foraportfolio,amongstotherbenefits. But that short-term benefit, well, we thinkthatisjustthetipoftheiceberg.

Investingisalonggame,atleastthat's the view we take with the Mach 1 Fund and it's how we encourage investorstothinkabouttheFund.

As simple as this basic guiding principleis,itsinfluenceispervasivein all we do. When the Investment Committee meets to review acquisitions and sales, we approach each decisionwithalong-termmindset.

When the Board is evaluating the Fund's performance in relation to the greater market, we avoid knee-jerk reactionstoshort-termmovements.

And there's good reason for this patient and disciplined approach towards cars, their maintenance, and fund allocation. While short-term returnscanbeuncertain,thehistorical trendofthecollectiblecarmarkethas shown that investments tend to appreciate over time, making our long-term perspective key to successfulFundinvesting.

It's in cars' long-term potential where the real gains can be seen - with the helpofempiricaldatatoillustrate.

Take the Lamborghini Countach. If you only held one over this last quarter,youwouldhaveseenitsvalue onaveragegodown-4.6%QoQ.Butif you had held it over the last year, you would have seen its value on average go up +9% (not too shabby, even if beforecosts).

Andyet,hadyouhelditforthelast3-5 yearsyouwouldhaveseenanaverage annualreturnbeforecostsof15%-20%.

Now just imagine you had held it for the last 20-years, your average annual return before costs would have been 25%-30%peryear.

It'sthisparticulardispositionaboutcar investmentthatIthinkofwhenIask

that you evaluate the Fund over the long-term. It has nothing to with our short-termresults.Rather,thisrequest comes from my desire to maximise your returns, which I believe can be bestachievedovertime.

I've always said that there's no better time to be an investor in the Fund thannow.Andevenwitheachpassing year, I believe that to be true. That's because our analysis shows that like theCountach,thelonger(andsooner) youinvest,thebetterthereturn.

We vow to continue our disciplined

SectionReferences: 1,2,3,10,11,12,13,14

Stable and cautiously optimistic

Across the span of two years, the Fund has clocked countlessmilesofexperienceandtheresultsachievedarea testament to the journey undertaken. Since launching in May2021,theFundhasgenerateda29%return(netoffees), anda13%CAGR(netoffees).Thereturnsachievedoverthis span are not merely numbers; they encapsulate a story of diligence,expertise,andsteadfastdiscipline.

We are battle-hardened on what has worked well: spotting great opportunities. A lot of the Fund's buys were in the midst of a bit of a car bubble. Although the cars most significantly impacted by the bubble were commuter cars, a bubble has far reaching implications. A lot of the serious players sat on the side waiting for sanity to prevail. We did not. Instead,webecameobsessedwiththehuntof finding

CTi valuations are based on the mid-point of the third-party assessment valuation range.

Note: The Fund's results are reported net of fees while the comparative indices are listed on a gross basis. They do not adjust for fees, holding or custodian costs.

the automotive treasures. And it has worked.Ourbestreturnstodatearefrom theinitialup-liftvehiclesreceivedontheir firstvaluation.

They say patience is a virtue, for us it's a way of life. Take the AMG CLK63 Black Seriesbuild#1.Ofcourse,weboughtitat a great price (battle-hardened, remember) and since the initial uplift, it's ticked over a respectable 1%-2% QoQ growth on average. We've received fair purchase offers,whichwemighthavejumpedatto puttowardsotherstrongbuys,exceptwe are experienced in the long game. We understand that waiting it out has the potentialforamuchbiggerpay-off.

On the flip side of this, we readily admit that our least practiced skill has been in theartofselling.Butthat'snotforlackof knowledge or expertise, rather it's a biproduct of a steely resolve to play the long-game. While we haven't sold many cars, the real story is about the prevailing logicinthedecisionstosell.

We carefully plot the trajectory of each car, and update it with new transactions and market sentiment.When we make

the decision to sell, it's after carefully assessing its return profile vs other opportunities. And only when the financial analysis indicates funds would potentially earn better returns elsewhere, dowereleasecarsbacktothemarket.

We believe our steadfast approach has been rewarded. Since launch we've outperformed the ASX/S&P 200 by 10.8x, NASDAQby9.1x,S&P500by4.0x,FTSEby 3.9xandgoldby1.4x.

If we take a shorter-term view, it reminds us what a difference a year makes. Even though we’re still seeing records at auctions and premiums for the latest supercars, trends show a leveling off. We see that impact in Hagerty's 0% YoY returns and HAGI's 4% YoY return (before any fees remember). The Fund has fared better with 8% YoY returns, net of fees. Butthere's no denying that FY23 was a

different story to FY22. For the Fund, the difference reflects a shift in mix of the typeofreturnsfuellinggrowth.Inourfirst year, returns were heavily weighted towards acquisitions - we had no cars untilthen.Inoursecondyear,holdreturns weighted more heavily and fewer acquisitionsimpactedresults.

Atthispointyou'retiredofhearingitfrom me, but the best is yet to come - at least according to our analysis. We show hold strategies will gain more traction with timeandbuyingandsellingstrategieswill stillhavesignificantimpact.

FUM grew by +11% QoQ. The Fund's unit price at 30 Jun '22 was $1.22930, or $1.20358 pro forma for performance fees. The 30 Jun '23 unit price of $1.29465 represents a +2% QoQ and 8% YoY increase,proformaforfees.

ASAT30JUNE2023

Section

References:1,5,14

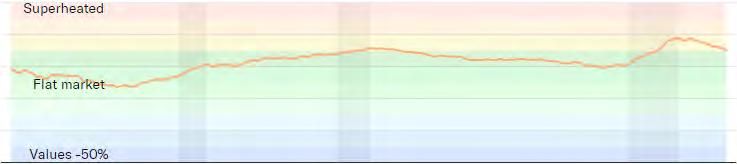

By many accounts, the collector car market is retreating. For US based Hagerty, the market rating has decreased 11 outofthelast13months.UKbasedHAGI's focus on top tier cars (which are more isolated from market fluctuations) hasn't had as obvious of a trendline, but it has still seen a decrease in 5 of the last 8 months. These trends mean claims about a slowing market are just accurate reflections of the data we're seeing. And yet, Hagerty's market rating is still in "rapid

expansion" territory, only just starting to threaten to depart into the higher end of an"expandingmarket".

Though it might feel like the trends are more substantial than that, the key point is that prices, adjusting for inflation, have dropped down to pre-pandemic levels, but the market remains strong. The typical increase has been in modern classics at the more conservative end of thepricerange.

FEATURE: THIS QUARTER'S PODIUM

PROFILE

probably comes to mind when you hear that one of our esteemed Board MemberswastheChiefRiskOfficerfor an Australian listed financial service provider, among his many illustrious career titles. And you’re not entirely wrong.BoardMemberSimonFranklin is every part the respected and qualified risk and compliance expert you would expect. He has a calm and amiable demeanour. He attends seminars and certification programs to keep on top of continuing educationhours.Hehasanetworkfull ofotherindustryprofessionals.Andhe

BOARD MEMBER SIMON FRANKLIN drivesarespectable,sounddailydrive. He is, in fact, everything you would hope and want from someone who looks after the Fund’s risk and compliance.But,ifyouthinkyouhave Simon figured out from his titles and roles, you’re missing out on pretty much the entire story that is Simon Franklin.

I challenge you to take the image you have in your head of a respected businessman driving along in his dependableLandRoverDiscoveryand add as a backdrop NWA’s “F**k Tha Police” bass blaring, straight from the undergroundplaying,lewd,crudeand mostly rude lyrics. Because whether it’s NWA, KRS-One, Geto Boys, or Pharcydethat’swhatSimonridesto.

Simonhassomehowcarved outaspaceforhimselfthatis bothexpectedandentirely unexpected,thatis traditionalwhilealsonot beingconventional,thatis

Is the picture in your mind starting to look a little different? It should.

TheFerrari550Maranellolooks allthepartofamodernclassic FerrariwithsleekPininfarina lines,coveredheadlights,fender vents,sweepingbacklight, abbreviatedtail,andround taillights.Anditisthe quintessentialFerrari–looking everypartofwhatyouexpecta massivelyunderestimatingthe impactandinfluenceofthe550

moretothiscarthanmeetsthe purposely,acompletedeparture prancinghorse’sstable.Ferrari didn’twanttomaketopspeed philosophythathadbeenonly Ferrari’sroadgoingflagshipshad puttingtheenginebehindthe

relocated the engine. According to Chief Engineer Amadeo Felisa, Ferrari didn't want another TR, but a car that was easier to drive. Although the 550 may not have quite the outright grip of a mid-engined car, or quite the samefluidfeeltothesteering,orquite the sharpness of turn-in, or quite the same uncompromising dedication to sheer speed, its front-to-rear weight distribution is better balanced than the TR's, and it's faster through twists and turns because it's so much easier to manage at the limit. In the years since it debuted, the 550 has become a true driver’s car – lauded amongst professionals as “one of the very best Ferraris.” Despite their efforts to designwithoutcompetitioninmind,a

number of privateer teams developed themodelintoareasonablysuccessful GTracer.

JUSTLIKESIMON,THEFUND’S550IS EXACTLYWHATYOU’DEXPECTWHILE STILLMANAGINGTOBEMORETHANYOU COULDHAVEHOPEDFOR.

Many things about Simon’s extensive experience are logical progressions in a career dedicated to risk managementandstrategicadvantage.Hehas a master’s degree in Operational and Strategic Risk Management. He started his career as a risk management consultant for six years before becoming a Practice Leader at Deloitte, andeventuallybecomingaChief Risk

Officer for an Australian listed company.Simonusedhisexperience tocarveoutacareerinprivateequity and direct investment. But what you wouldn’t suspect is that he was this close to becoming a record label executive.

Now,aloveformusicisn’tallthatout oftheordinary.But,aswithanything relating to Simon, the fascination is much more profound. As a youngster, Simon would often accompany hisfathertoarecordstorewithsome regularity. Pretty normal, right? Wrong! Unbeknownst to Simon at thetime,thetrip totherecord store

was a cover for his detective father, who would take Simon to informant meetings to reduce suspicion. The downtown record store was one of his father’s preferred meeting points, and Simon, none the wiser, spent a great dealoftimekillingtimeamongstvinyl records. Naturally, spending so much time in a record store would lead Simon to develop a passion for music that continues to this day. (Editor's note: this little anecdote made the DBS Bond car a high runner in the shortlistofpairings.Weevenshotit).

EVEN THE SIMPLEST THINGS ARE PROFOUND

Youcouldalsosaythatthe550wasa progression of past Ferraris. The styling was by Lorenzo Ramaciotti at Pininfarina. As well as borrowing cues from the Daytona, it also included a visual nod to that car’s predecessor,the275GTB,intheform ofthegillsinthefrontwings.The550 was unashamedly summoning the spirit of its legendary 1960s berlinettas.Itseemed,the550waspicking up where the 365GTB/4 Daytona left offin1971.

But then again, despite the F1 paddleshift gearbox having already appeared in the F355, the 550 was offered only with a traditional manual gearbox, a rear-mounted sixspeederthatwascombinedwiththe limited-slip differential. That manual gearboxwithits exposedmetal gate

was key to the car’s appeal. Although this was a thoroughly modern Ferrari, it was also a front-engined GT in the classicalidiom.

Ferrari president Luca di Montezemolo said that owners of its 12-cylinder models were fed up with a reclining seating position behind a steeply inclinedwindshield,poorvisibility,anda lack of luggage space. In their simple pursuit of producing a practical and comfy two-seater, with plenty of baggagecapacityandanenjoyableride,they ended up with something far more profound - one of the most classic Ferrarisevermade.

It’snothardtodescribethe550.There’s no temperamental character to it, it’s smooth and balanced, just like a Swiss watch.Andeveryonelovesthe way this

car drives. It’s effortless. The engine pullsfromjustaboutzerorevswithout a hiccup or tantrum. The 550’s 12 cylinders are among the most beautiful and potent Ferrari has ever produced for a road car. Michael Schumacher helped develop the motor (yes, the car not designed for competition got an F1 champion to help develop the engine) and at the time he said: “During the test period I took this 12-cylinder engine on tuning runs.It’snotonlysweetathighrevs,it getsamoveonrightfromthestart.”

And that’s probably also how I’d describe Simon’s contribution to the Fund. Simon has been involved with the Fund since its planning phase. He helped us structure the Fund and bring it to market. He moved right from the start, and he continues to help us rev the Fund, be it through process and protocols to mitigate risk oridentifyingstrategiesforgrowth.

Professionally, Simon strives to create and contribute to something unique. Between his life-long understanding of the value of passion (in the form of vinyl records), his vast experience in risk management within the financial sector, and his professional ambitions, CHROME TEMPLE represents an opportunity for Simon to bring all these things together: “I have been asked many, many times by my clientele for something with a high return profile, low risk, and liquidity. I usually have to settle for two of those, butwithCHROMETEMPLEwebuiltin allofthoseelementsandmore.”

For Simon, one of the most appealing aspects of the Fund is the club-like feel and high engagement with the assets. Never one to miss a CHROME TEMPLE event, Simon particularly loveswhentheBoardandInvestment Committee meetings collide because “I get this fantastic front row seat to car discussions. I'm in awe of the knowledge, particularly of the exotic car market, that my fellow board memberspossess.”

Although always interested in cars from living near and visiting the NationalMotorMuseumatBeaulieuin the UK, Simon’s preferences in collectible cars has a unique bias –“Amongmydreamcarsisa1958Land Rover Series II in Army Green. I'll also caveat the dream by practicality. Being 2.0m and 110kg, my options are always somewhat limited if I have to actuallydriveit.”

His response on his dream car is argumentenoughonwhySimonison our Board but not a member of our Investment Committee. But what did you expect? Afterall, he is a risk and complianceofficerfortheFundwhich means Simon ensures that the Fund complies with outside regulatory and legal requirements (as well as internal policies and bylaws). That might not sound as flashy as some of the other roles, but just like the 550 might not seem as flashy as some of the other cars in the Fund, it’s importance and significance for the enduring success of the brand, cannot be emphasised enough.