+614 04 84 64 24

CHROME TEMPLE Investments Pty Ltd ACN 640 888 026 (Investment Manager), a corporate authorised representative (number 001284056) of SILC Fiduciary Solutions Pty Ltd ACN 638 984 602 (AFS licence number 522145) (AFSL Holder) The authority of the Investment Manager is limited to general advice and deal by arranging services to wholesale clients relating to the CHROME TEMPLE Investments Mach 1 Fund (Fund) only Specialised Investment and Lending Corporation Pty Ltd ACN 149 520 918 (AFS licence number 407100) is the trustee (Trustee) of the Fund and the issuer of the information memorandum and supplementary information memorandums This document contains general information only and is not intended to provide any person with financial advice or offer of any kind Prospective investors should carefully consider the contents in the information memorandum and supplementary information memorandums in full and seek professional advice prior to making any decision regarding an investment in the Fund No reliance may be placed on this document for any purpose nor used for the purpose of making a decision about a financial product or transaction Information relating to the Fund contained in this document has been prepared without taking into account the objectives, circumstances, financial situation or needs of any person, and may differ to information contained in the information memoranda This document may also contain forward looking statements regarding our intent, belief or current expectations with respect to market conditions

Past performance and/or forward looking statements are not a reliable indicator of future performance

Except as required by law and only to the extent so required, neither the Investment Manager, Trustee, AFSL Holder nor its affiliates warrant or guarantee, whether expressly or implicitly, the accuracy, validity, timeliness, merchantability or completeness of any information or data (whether prepared by us or by

AFSL number 407100

ACN 149 520 918

investors@silcgroup com au

any third party) within this document for any particular purpose or use or that the information or data will be from error Further, the Investment Manager, Trustee and its affiliates expressly disclaim any responsibility and shall not be liable for any loss, damage, claim, liability, proceeding, cost or expense arising directly or indirectly and whether in tort (including negligence), contract, equity or otherwise out of or in connection with or from the use of the information in this document

IMPORTANT: Past performance is not indicative of future performance and the expected returns of the Fund may not occur as expected or at all An investor's balance in the Fund may decrease as well as increase in value All statements that indicate expressly or by implication an expectation of investment returns are based on reasonable assumptions and commercial judgement and no representation is made or assurance given that such statements, views, projections or forecasts are correct or that the expected returns will arise or that investment balances in the Fund may not decrease You must read the Disclaimer and the contents of the Information Memorandum in full to understand the risks involved in an investment in the CTi Fund

1 Past performance is not indicative of future performance

2 Returns represent gross vehicle returns for vehicles currently held by the Fund, excluding fees and deposits and are calculated based on their valuation as of 31 December 2022 vs their valuation for the relevant comparison period (or their acquisition price if acquired after the comparison period)

3 Comparative indices results are before fees The S&P/ASX 200, FTSE100, NASDAQ, Gold (in AUD), Bitcoin (BTCAUD), S&P 500, HAGI and Hagerty indices are calculated as their 31 December 2022 prices vs 31 December 2021 prices (YoY) and 30 September 2022 (QoQ) Stock market indices obtained from Yahoo Finance and Wall Street

Journal HAGI and Hagerty obtained from their respective websites

4 Investopediacom “Advantages and Disadvantages of Real Assets” & "Money"

5 Credit Suisse “Collectibles: An integral part of wealth” October 2020

6 CBS News “Why you should buy gold during inflation” October 2022

7 AFR “Worst volatility since 2008” January 2023

8 Gross vehicle returns compare their 31 December 2022 valuation to their acquisition (Launch), 30 September 2022 (QOQ) and 31 December 2021 (YOY) values If a vehicle was purchased between the starting period and 31 December 2022, then the acquisition price was used as the starting value If the vehicle was sold before 31 December 2022 and acquired after the starting period, then its sale price was used as its ending value Gross vehicle returns exclude deposits

9 AFR “The Brief” 01 February 2023

10 Hagerty Market Rating Ferrari Index Market Rating Index

11 Historic Automobile Group International Top Index & Ferrari Index

12 The S&P/ASX 200, FTSE100, and Gold (in AUD) closing prices were rebased to 100 Mach 1 unit price was rebased to 100 based, pro forma for performance fees every quarter

13 Hagerty “Why enthusiasts shouldn’t stress fall’s cooling market” James Hewitt December 2022

14 Hagerty “Vehicle-value trends that point to a stabilizing market” Greg Ingold January 2023

15 Hagerty “What Economic Factors Are Weighing Most Heavily On Car Collectors” John Wiley June 2022

16 Hagerty “2022’s Stand-Out Collector Vehicle Segments” Grace Houghton December 2022

A review of current trends, and the potential outlook and impact of the industry.

We paired our Chairman with a Fund car. The result - the most performance driven, special-purpose dream team.

A purple patch is a period of excellent performance. And right now, everything is coming up purple Literally, including the Fund's very own purple (Viola 30) last of the line Lamborghini Aventador Ultimae which landed in the TEMPLE just before the New Year. Though we didn't realise it at the time, the colour selection was foreshadowing the Fund's purple patch

During a time period where the ASX/S&P 200 and S&P 500 experienced (-5%) and (-19%) declines, respectively, and the FTSE gained only marginally (+1%), the Fund generated +12% YoY gross returns through 31 December 2022.

1,2,4

Encouragingly, it's not just one factor that is positively contributing to the

Fund's current and foreseeable return growth profile Instead, it's a confluence of multiple factors prevailing in the current market

One factor relates to the stability of the vehicle asset class. When there is uncertainty and perceived risk in the market - Will interest rates continue to climb? Has inflation stablised? etcinvestments with (i) low volatility, (ii) anti-inflation properties and/or (iii) low market correlation have historically outperformed other traditional investments over those periods In the case of vehicle investments, it possesses all three of these characteristics which means vehicles can still appreciate even when the market is otherwise challenged.

While the current environment makes it difficult for the market to assess and price risk in stocks - this is why the Australian market has experienced the worst volatility since 2008, collectible cars have fared better because they preserve their purchasing power for long periods of time

4,5,6,7

On top of this, we are seeing three other key strategies play into the Fund's favour: instant appreciation, acquisition returns, and holding well.

This quarter highlights the importance of our hold strategy, and how it can be a critical element to navigating the current, more rationale car market and maximising the mid and longterm performance of the Fund. 1,4,5,6

At the moment the car market is in a cycle that we refer to as a wealth preservation cycle This is a period when opposing forces like inflation (which increases vehicle value) and a cooling industry (which decreases demand) result in a decline in commuter car values, while cars of distinction (Fund cars) act as a strong source of store of value (wealth preservation) with the potential to generate consistent moderate returns in an otherwise declining market.

In the current cycle, we can expect most collectible cars to appreciate modestly, while commuter cars are expected to decline in value and resume their normal depreciating trajectory And considering the conservative nature of our independent valuers approach, most of the fleet did just that - gains were modest for cars that have been in the Fund for

Some sceptics will think we should have swapped out Fund cars during the pandemic car bubble However, our analysis shows that most of the Fund's cars are still early in their appreciation trajectory.

Continuing to hold these vehicles is in the best interest of the Fund's value over time, even if in today's environment the gains are only modest Afterall, modest though their returns may be, in today's volatile market, slow and steady is certainly winning the race. And in the face of the current challenging market, the Mach 1 Fund has continued to create value for unit holders

With our hold strategy preserving the mid and long-term growth potential of the Fund, we'd like to strengthen

the value creation potential of the Fund by making even more acquisition returns in the coming quarter. It is the acquisition return strategy that will deliver those higher returns during this market. And there are plenty of indications that there are some great buying opportunities available to the Fund.

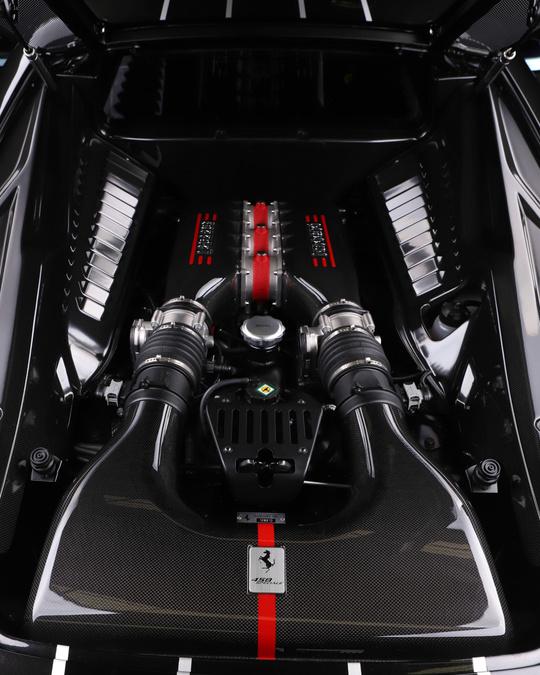

To do this, we are in the process of selling a couple of fleet vehicles that have a more gradual growth trajectory than some of the vehicle opportunities that have recently come to market as the true collectors reappear

Our Investment Committee's short list of expertly negotiated and sourced next purchases include some specialty cars (like a Ferrari 458 Speciale), one of the few Australian allotments for the last of the line Aston Martin V12 Vantage (333 to be made globally),

and some further opportunities that we think have the potential to be instant appreciation vehicles

I've remarked before that the automotive revolution is ushering in an age of instant appreciation (cars that never depreciate). And the Ultimae is a great example of those dynamics at work Between it's arrival and 31 December 2022, the Ultimae appreciated an impressive +40% and all indications from the market suggests that there is much more upside to come. We feel confident that the Ultimae's value may increase by at least another +10% in the next quarter alone - setting the Fund up for another potential period of excellent returns

1,8

Normally, I'm not one to torture investors by teasing content of the Fund's most recent edition without giving you a full look at all the goods, but for such a special car as the Ultimae, we want a commensurate unveiling. So until we have the unveiling event (invitation to hit your inbox soon), it's return profile - as vibrant as it's colour - will have to do

Sufficiently capitalised, these are the type of acquisition returns on the horizon for the Fund. And I can't wait to have you all over at the TEMPLE, because I'm confident that like me you'll be blown away by just how bright the Fund's purple patch looks!

It's a good time for the Mach 1 Fund, it generated +12% YoY gross returns through 31 December 2022 while traditional markets experienced YoY losses (-5% ASX/S&P 200, -19% S&P 500, -33% NASDAQ). Only the FTSE posted positive YOY gains, but at +1%, it was marginal.

The ability for the Fund to continue to generate positive returns during this time is a testament to the nature of this investment class as an anti-inflation hedge, with low volatility and low market correlation and our teams ability to buy the right car at the right time Even in a wealth preservation cycle, the Fund is capable of generating positive returns (and satisfy its minimum target return rate)

CTi valuations are based on the mid-point of the third-party assessment valuation range

The Fund's QoQ gross returns (+5%) were on the softer side compared to other markets, however when you have the Reserve Bank’s head of economic analysis, Marion Kohler, saying stock prices in Australia probably peaked at the end of 2022 (after posting a -5% YoY decline), Australia's sovereign wealth fund (Future Fund) losing -3.7% YoY, and the market experiencing the most volatility since 2008, the stability and wealth preservation that vehicles offer are a compelling reason to keep them as part of an investment portfolio.

This quarter experienced declines in two of the Mach 1 Fund's classes. Both the MkI and Mk-IV classes posted a QoQ decline, however the overall weighted returns were still positive (highlighting one of the

reasons we have multiple classes - it helps diversify the Mach 1 portfolio)

Approximately 80% of the Mk-I class is comprised of the Ferrari marque. While the Ferrari marque has largely been a stalwart of growth over the last year, it cooled somewhat over the last quarter. Hagerty's Ferrari index reported no movement over the quarter, and HAGI's Ferrari index reported a +1% marginal gain.

The current market is a rational market, sellers are willing to wait for the right price before they sell The Mk-IV class however is a short hold period, targeting less than 1-year and representing the closest thing to liquidity for the Fund. For this reason, we ask our valuers to price cars in this class at "priced to sell" values. The result is a value that is much more conservative than what the broader market might seek for the same car. We certainly look to get the best outcome regardless of valuation, but for providing Fund returns, we feel this approach represents the nature of the class best, even if it did result in a decline for the MkIV class in Q2 FY23.

Car indices HAGI & Hagerty generated above-average YoY returns in 2022 The results of Hagerty reflect a very broad market, which saw the most aggressive appreciation in ages, driven by the commuter car market. HAGI represents

the other side of the spectrum, a very curated, narrow selection of the most prestigious cars Over 2022, these most elite of the elite cars (we're talking $20mm+ dollar cars), set historical records that drove appreciation for the overall index. As the market cools, the returns of these indices will begin to stablise.

But the cooling market is nothing to fear Yes, it does mean quick flips are not envogue, but it also typically means that serious collectors and wealthy individuals who understand valuation fundamentals and are willing to pay top dollar for the right car are driving top results

FUM grew by +13% QoQ. The Fund's unit price at 31 Dec 2021 was $118698, or $1.16431 pro forma for performance fees. The 31 Dec '22 unit price of $1.25172 represents a +3% QoQ and 8% YoY increase, pro forma for fees.

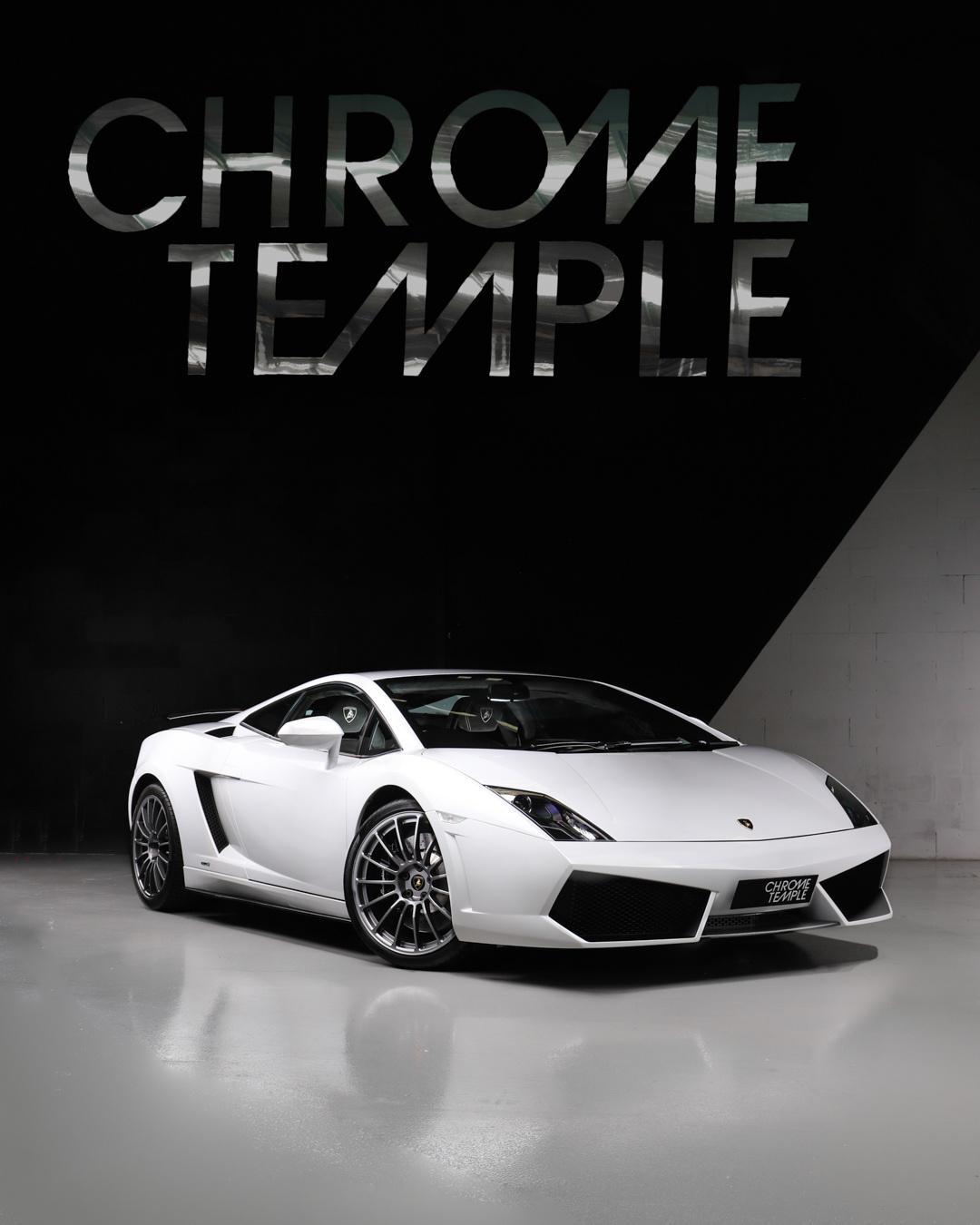

These days we can't read a car forum, facebook group or commentary section without the question "Is the car market cooling?" coming up The short answer to the question is, yes But there is no reason to fear a cooling car market, especially when you consider the context of what is cooling.

Is the car market cooling?

1,13 1,14

The 2022 car market was some of the most aggressive appreciation in ages. Of course, what goes up doesn’t go up forever. Toward the end of the year, we started to see a different side of the market. Previously hot segments either levelled off or receded

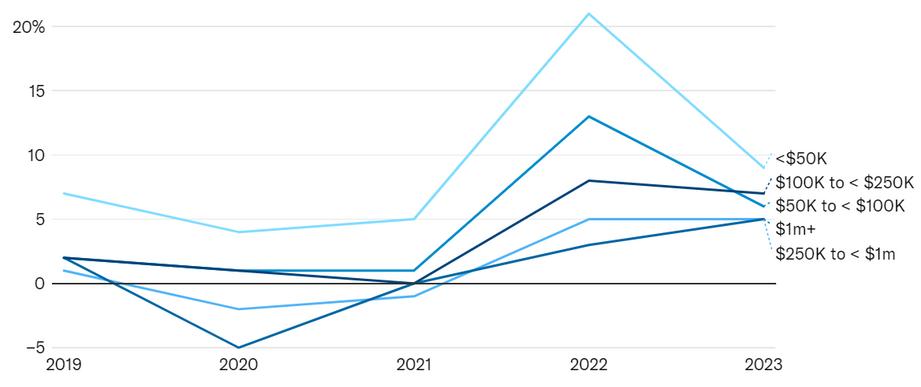

That said, the market is very segmented, and different strata behave in different ways

In 2022, the market was inundated with amateur investors. As a result, commuter vehicles and "affordable" classics (lower priced vehicles and lower quality vehicles) posted the best and most consistent returns over that period However, this latest quarter hints that the segment is correcting from the chaotic trading, signalling a return to sanity after a long streak of massive increases

The higher quality and higher priced cars are starting to dominate the results. For this reason we are seeing high-end vehicles hold their ground despite economic anxiety revolving around the pandemic, inflation, and volatility in other markets.

These dynamics reflect that buyers of "affordable classics" are impacted by the economic outlook and volatility much more so than the deeper pocketed buyers of cars of distinction.

Because the affordable car segment is large enough that it can obscure and dominate the overall car market results, we parse the data to get a better view of the trends for the Fund's vehicles When we do this, we see that there is stability at the top.

But even more promisingly, manual transmission, mid-mounted engine, little to no electronic “nanny” systems highperformance coupes with this trifecta had a big year. These turn-of-the-century models are seen as purer, harder-core and don't have the emissions-friendly hybrid systems now mandatory for traversing Europe’s low-emissions zones. These types of cars might have minimalist performance appeal compared to the newer models, but they're used to maximum effect.

Our outlook for 2023: we expect appreciation for lower-priced cars to slow, while higher priced cars (Fund cars) will appreciate with the highest priced cars appreciating even faster

In this quarter's podium, we paired our Chairman with a Fund car. The result - the most performance driven, special-purpose dream team.

And why wouldn’t theywho doesn't want to salivate lines, m and rare silhouet archives since we these be art, sauc one of t get to fu desires.

heroing have ne spotligh other he membe to right this (and podium showca of our B the Fun happen respecti

I had an idea of what car I thought each Director should be paired with.

The car I planned to pair Charlie with was the Fund’s manual Aston Martin DBS (the James Bond car).

Charlie is very well spoken, as you would expect from a gent born in the UK, but don’t be fooled by that, he’s more Aussie than most. Like Mr Bond, Charlie is fit, presents impeccably and prefers to let actions speak louder than mere words.

Whilst I chose the DBS for Charlie, he chose the other gentleman's marque in the Jag. Who am I to question his considered judgement?

With a personal soft spot, I can understand why Charlie chose the Project 7 To the eye, the shape and colour are just stunning. Then you start it and the supercharged V8 screams to life like a middle digit to the future. Based on an F-Type R convertible, but losing the folding roof entirely and adding a D-Type hump behind the driver, a wider, deeper front bumper and splitter, a longer rear diffuser, a whopping big rear wing and lots of carbon trim, the Project 7 is indisputably one of the sexiest modern cars Jaguar has made and one of the most captivating across any marque.

Nostalgic, raucous and with a stance that screams intent

But this is not just some show pony The Project 7 was built for performance and was Jaguar’s fastest and most powerful sports car at the time of production. The 575 horsepower from its 5 litre supercharged V8 engine, enables the all aluminium bodied car – which weighs 1,585kg – to reach 100kmph in 39seconds and onwards towards an electronically-limited (ie it could go faster) top speed of 300km/h. The fully road-legal two-seater roadster concept car was built to be the most performance-focused derivative of the acclaimed F-TYPE range.

Performance-focused That’s also the perfect way to describe Charlie and his role as Chairman of the Mach 1 Fund Afterall, he’s been performance-focused his entire career Whether serving as the Deputy Head of Equities and CoPortfolio Manager of the Industrial Share Fund for Perpetual, or the Head of Fundamental Equities for Blackrock, Charlie has always been laser focused on fund performance and results. And when you think about the Mach 1 Fund’s motto of “Results Before Romance” you start to see why Charlie is the perfect fit

Choosing someone who professes “not to be a car guy” to be the Chairman of a dedicated car fund might seem a bit wayward at first – until you get to know Charlie Lanchester. Then, you come to realise that Charlie has a very particular set of skills. Skills he acquired over a very long and successful career. Skills that make his knowledge of cars inconsequential to people like us.

Highly Specialised P 2 0 C T i M A C H 1 F U N D

Jaguar’s Special Operations team exists to develop a suite of products and services that enable the most discerning enthusiast to indulge their passion for the Jaguar marque In the Project 7, the team captures that spirit in its purest form, producing a car that is a product of pure passion and the pinnacle of Jaguar performance The name is inspired by the marque’s seven Le Mans wins between 1951-1990, and the car has just this purpose: to be driven fast and loud.

Here again, I can see the parallels. Having Charlie, a seasoned investor and fund manager on the CHROME TEMPLE team, has produced a purposeful, highly skilled, agile and powerful Board It’s like having our very own “special operations team" who enable investors to fuel their passion in a financially rewarding way.

Charlie pursued a career in fund management and investing as a graduate trainee at Schroders in London when a delightful interviewer in his 50s directed him to a career as a fund manager. What continues to drive him professionally is his passion – he loves investing. And when he delves into it, you can feel the enthusiasm emanating from his words as he describes how investing provides him the means to find and help great people that are investing back into their businesses for the long term.

Investing has always been an avenue for change and personal and professional growth for Charlie. Whether it’s building a business with the team at Perpetual (a professional highlight for him) or being in-

volved with the Mach 1 Fund, Charlie just wants to help others achieve great financial outcomes

But according to Charlie, there’s something that sets the Mach 1 Fund apart – “The Mach 1 Fund is a rare opportunity to acquire some scarce real world assets that will gradually turn from being used as cars to being appreciated as last in the line works of art. I believe the returns profile of the Fund is very promising and that’s why I personally invested in the Fund, but the chance for enthusiasts to enjoy them is a truly unique feature about this investment class - investors have the ability to look and touch these cars that are being so well looked after at CHROME TEMPLE’s storage facility And they’re given this wonderful opportunity to be part of the CHROME TEMPLE

community that is bringing together some great like-minded interesting people around a shared passion.”

But as much as Charlie appreciates that the Fund allows investors to indulge in their passion, when it comes to his role as the Chairman, his focus on performance and love for investing shine through most strongly.

“Whilst you [Lex] and the rest of the team have a genuine passion for collectible cars, we are focused on returns ahead of emotion and that is a major reason I joined the team – well that and the great people involved. We are taking this professional approach to an industry that is dominated by amateur passion investors and as a result, this should lead to superior returns”

And that it has The transition to scarcity for many of these cars is only just beginning As Charlie rightly points out, we have already demonstrated our team’s skill in acquiring the right vehicles at the right price. Like the rest of us, he is thrilled to see the early excellent track record of the Fund And what’s even more exciting for the guy who loves investing is that there is plenty of upside still to come.

When you think of a luxurious British car with an undeniably sporty character, Jaguar is the most likely brand that comes to mind. Sporty sophistication is another way to describe Charlie, who for all the formality of investment banking, likes nothing better than a swing of golf and surfing good waves So much so that when I asked what his parallel universe job would be, he said an adventure tour organiser (surf, golf or ski). Seriously.

He likes adventure travel so much that his favourite car at the moment is his camper van. Now, I realise that the image of a surf nomad is not something you’d normally expect from a traditional investment banker But that is Charlie - as skilled and passionate about his professional pursuits as his personal interests.

SO RARE THAT ONLY 10 OF THE TOTAL 150 GLOBALLY PRODUCED PROJECT 7'S, LANDED DOMESTICALLY AND I CAN ASSURE YOU THAT THERE IS ONLY 1 PERSON WITH THE CALIBRE OF CHARACTER, PROFESSIONALISM, AND GOOD NATUREDNESS OF CHARLIE LANCHESTER.

Frankly, I can’t sum up both this car and this Director more perfectly than that. And even though Charlie keeps reminding me that all of the Fund's key success factors are a result of planning and validation, I still can't help but feel pretty lucky to have secured this level of talent and support for the Fund.