CHICAGO — Mayor Lori E. Lightfoot and the Mayor’s Office for People with Disabilities (MOPD) announced the opening of the MOPD Career Center, dedicated to serving job seekers with disabilities and providing career readiness. The Career Center is located at the Central West Community Center, located at 2102 W. Ogden in the Tri-Taylor neighborhood. The Center is staffed by Career Placement Counselors who specialize in assisting job seekers with disabilities to access em ployment and accessibility, including an American Sign Language (ASL) interpreter on staff along with computer stations equipped with adaptive technolo gy to reduce barriers to digital access.

Under Mayor Lightfoot’s leadership, the City of Chicago is making a $1.2 million investment toward increasing disability employment, an import ant contribution to making the City of Chicago one of the most accessible cities in the nation.

The career center not only leverages the pan demic, which created a surplus of job opportunities available along with a labor shortage but also pro vides much-needed services to support people with disabilities seeking employment opportunities.

The event also celebrated the unveiling of a new mural at the Central West Community Center, created by local and internationally renowned artist Sam Kirk. The mural was a collaborative initiative by MOPD, the Department of Cultural Affairs and Special Events (DCASE), and the Department of Family and Support Services (DFSS).

MOPD, DFSS, DCASE, and Mayor Light foot also announced the selection of an inaugural Artist-in-Residence at the Central West Community Center, Ariella Granados.

Services at the Central West Community Center are available to people with disabilities who reside in the City of Chicago, are at least age 16, identify as a person with a disability, and want to get a job. City Colleges of Chicago students with disabilities are also eligible for services. This career center is one of the many investments Mayor Lightfoot has created to ensure job seekers have the resources and opportunities to access good-quality and sustainable jobs.

CHICAGO — Blick Art Materials is pleased to announce the opening of its newest retail store at 16 W. Randolph St. in downtown Chicago Situated in the heart of the city’s theater district, the new store is housed inside an historic Chicago building with a distinct architectural style.

Originally the site of the Old Heidelberg Restaurant, the building boasts an elegant façade de signed by the same architecture firm responsible for the Merchandise Mart and Civic Opera Building.

The new space features two stories and a media-spanning selection of over 18,000 products. Highlights include an enhanced selection of Utrecht Artists’ Paints, as well as trending craft items, stationery, and unique gifts. In addition to serving professional artists and hobbyists, the store will cater to students and educators from the nearby School of the Art Institute of Chicago, Columbia College Chicago, and The American Academy of Art College.

Blick has long supported arts education and community organizations throughout Chicago and nationwide and is intentional about inviting local artists to enhance its stores.

Blick Art Materials’ new Randolph St. store is accessible via the Lake station on the CTA Red Line and the Washington station on the CTA Blue Line.

BY TIA CAROL JONESAda S. McKinley Community Services, Inc., is more than an 100-yeasr-old organization, with a mission to educate, empower and employ people to change their lives and strengthen their communities.

According to its website, more than 7,000 people are served annually, and there are more than 70 pro gram sites throughout the Chicagoland area, Indiana and Wisconsin. Ada S. McKinley serves the South and West sides of the city. The programs range from education, behavioral health, foster care, childcare, environmental services, residential services, commu nity day services and employment services.

Ada S. Mckinley wanted to open the job fair to a multitude of job seekers and intentionally wanted to open the fair to those populations because they were the most in need of equal employment opportunities.

Alici McNeal is the Vice President of Communi ty Day Services and Supportive Employment. Neal said Ada S. McKinley reached out to several compa nies and it is expecting at least 150 attendees on the day to participate in the job fair. Rush Hospital and Medical Center, Hilton Chicago, Illinois Department of Human Services, Chicago Urban League, Greater Chicago Food Depository and Roosevelt Universi ty will be on hand at the job fair, as well as Ada S. McKinley’s own human resources team.

McNeal said this job fair is important because as we are coming out of the COVID-19 pandemic, staff numbers in social services, hospitals and healthcare,

hospitality have been low.

“When we’re talking about the Equity For All, we’re noticing too, here at Ada, based on the commu nities we serve, those resources, aren’t being allocat ed. We just want to create those equal outcomes for all the people that are in the community,” McNeal said.

In addition to the job fair, attendees can partici pate in job readiness and job development. Attendees will have the opportunity to receive resources appli cants might need, which includes resume assistance and transportation assistance. The goal is to ensure those applicants who receive a job offer can sustain the employment.

With Ada S. McKinley’s facilities management and environmental services program, the organization employs people with disabilities to work as janitors. It enables Ada S. McKinley to provide resources to people with disabilities and veterans, who might not know where to begin with seeking employment.

“To have that be a pillar, where they know where to come for those additional resources that they would need, and we here at Ada have experience, because we’re currently doing those placements now, we are able to be a face within that community for them to come and seek those resources if they need them,” McNeal said.

Those interested are encouraged to dress to im press and bring their resumes.

For more information about Ada S. McKinley, visit www.adasmckinley.org.

To help Chicagoans take the first step toward a career in transportation, the Chicago Transit Authority (CTA) has recently partnered with Olive-Harvey College to offer a free preparatory course to assist candidates in meeting the hiring requirement of obtaining a Commercial Learner’s Permit (CLP). This new program is the latest in a series of measures introduced in support of the agency’s “Meeting the Moment: Transforming CTA’s Post-Pandemic Future” – a multi-pronged effort to provide more reliable service, improve the customer experience and invest in employees.

The two-week course, available to qualified CTA applicants, helps candidates acquire a CLP, which is needed to obtain a Commercial Driver’s License (CDL) Class “B”. To remove financial barriers for students to pursue and complete the program, CTA covers the costs of tuition, training, books, fees and other expenses associated with the program along with the cost of taking the permit exam.

“One of the supporting pillars of the ’Meeting the Moment’ Action Plan focuses on delivering reliable and consistent service, which is not possible unless CTA can hire the workforce needed to operate scheduled service,” said CTA President Dorval Carter, Jr. “This program, which began in August, has already produced a dozen new hires currently in training, showing that thinking outside the box and finding ways to reduce barriers will be vital in speeding up the bus operator hiring process.”

The CDL program partnership with Olive-Harvey is

one of many initiatives the CTA has undertaken to address workforce challenges brought on by the pandemic. Like other transportation entities, from airlines to trucking companies, the CTA faces the effects of the Great Res ignation and challenges of recruiting in a competitive industry.

Other measures taken by the CTA to address these issues include recent changes to workforce rules allow ing for the direct hire of full-time operators, increased wages and improved healthcare benefits, strong recruiting and marketing efforts, as well as hosting both virtual and in-person job fairs.

“Olive-Harvey College is committed to be of service to our students and city while also meeting the talent needs of employers. We are excited this partnership with CTA will help build a pipeline of amazing bus operators while positively impacting transportation services in our communities,” said Dr. Kimberly Hollingsworth, Presi dent, Olive-Harvey College.

“The CTA provides the opportunity to not just serve the City of Chicago as bus operator, but also start a career in transportation that provides good pay and benefits,” said Tom McKone, Chief Administrative Officer. “This partnership with Olive-Harvey helps eliminate what is often the biggest hurdle for many qualified candidates and allows them to take their first step towards establishing their future career.”

For more information about CTA employment opportu nities, visit transitchicago.com/careers.

SPRINGFIELD – Workers in Illinois who participate in the Secure Choice retirement savings program have set aside more than $90 million of their own money for their retire ment, Illinois State Treasurer Michael Frerichs said.

The accomplishment signals a growing recognition that workers understand Social Security will not provide enough income after their working days are over and reflects data that shows workers are more likely to save for retirement if they can do so through workplace payroll deductions.

“While each person has their own American dream, each dream includes a retirement with dignity and confi dence,” Frerichs said. “Secure Choice can help accomplish both.”

The Illinois General Assembly created Secure Choice in 2015 and declared employers must either offer a retirement savings program or participate in Secure Choice. In doing so, lawmakers assured employers they would not be responsible for invest ment decisions and barred them from contributing to a worker’s account. Lawmakers also assured workers that their accounts would travel with them if they changed employers.

Lawmakers also created a seven-member board to oversee the program; determined that investments would be managed by the private sector; and assigned implementation of the savings program to the Illinois State Treasurer’s Office. Based on recommendations from the board, and with consultations with lawmakers, the program launched in 2018.

with 7,400 employers to set aside $91 million.

Enrollment was apportioned by employer size so as not to overwhelm employers. Wave one in 2018 included employers with 500 or more employ ees. Wave two in 2019 included em ployers with 100 499 employees and another wave that same year included employers with 25-99 employees. The deadline for wave four, employers with 16 or more employees, is Nov. 1, 2022. The deadline for wave five, employers with five or more employees, is Nov. 1, 2023. Eligible employers can register or report an exemption at www.ilse curechoice.com any time before their applicable deadline.

Secure Choice is critical because 40 percent of Illinois’ private-sector workers do not have access to an employer sponsored retirement plan and 23 percent of retirees rely upon Social Security for 90 percent of their retirement income. The employer com ponent is key because workers are 15 times more likely to save for retirement if they can do so through payroll de ductions, according to an AARP study.

The default option for program participants is to enroll in a target-date Roth IRA with a five percent contri bution rate. Participants can choose to change their contribution level or fund option at any time. Accounts are owned by individual participants and are portable from job-to-job. Investments are held in a separate trust outside the Illinois Treasury.

The COVID-19 pandemic further exacerbated the health inequities facing communities throughout Illinois. Five organizations in portions of Kankakee and Will Counties represented by State Senator Patrick Joyce have been award ed funding to implement health equity strategies, he announced Thursday.

“The pandemic showed us firsthand the inequity and inequality in our health care system,” said Joyce (D-Essex). “This program will help combat the health equity gaps taking place in all corners of our state.”

Activating Relationships in Illinois for Systemic Equity (ARISE) is a joint initiative of the Illinois Department of Public Health’s Center for Minority Health Services and The Center for Rural Health, in collaboration with Well-Being and Equity (WE) in the World.

Between Joyce’s district in Kanka kee and Will counties, five organiza tions will receive funding to address systemic health disparities highlighted by the COVID-19 pandemic: Kankakee County Health Department, Coordinat ed Care Alliance in Kankakee and Will counties, Will County Health Depart ment and Junior Medic LLC.

SOUTH

Today, 109,000 workers, many of whom never thought they could save for retirement, have worked

“This is a program that’s easy to implement and anything I can do to help my employees both professional ly and personally is a win-win.” said Keely Selko, Office Manager at the Dearborn in Chicago, an early Secure Choice participating employer.

Funded by the Centers for Disease Control and Prevention, ARISE intends to support socio-economically disad vantaged and historically marginalized communities outside of Cook County that have been disproportionately im pacted by COVID-19. Further, organi zations will be able to address enduring health inequities in their communities that have been exacerbated by the COVID-19 pandemic.

Chicago, Ill. – Whether looking to prepare for winter with a free flu shot, looking for employment, information on city services, or learning about nearby amenities, far south side residents will want to be at the 9th Ward’s Resource Fair on Thursday, Oct. 27.

Hosted by 9th Ward Alderman An thony A. Beale and State Representatives Nicholas “Nick” Smith and Robert “Bob” Rita, the Resource Fair will take place from 10 a.m. to 2 p.m. at the Pullman Community Center, 10355 S. Woodlawn.

With broad participation from the City of Chicago, Cook County, State of Illinois, and Cook County Sheriff’s Department, attendees will have an op portunity to meet organizations, vendors, and social service agencies who offer support services in the areas of health

and wellness, transportation, community safety, and more. Among the many free services offered at the 9th Ward Resource Fair are shredding, electronic recycling, reasonable junk removal, and the disposal of prescription medications. Additional services being offered are COVID vacci nations and boosters, flu shots, and blood donations.

“We’ve assembled a broad range of services that we know match peoples’ real needs – whether that be for a flu shot or document shredding – both essential to keeping their families safe,” says Alder man Beale.

This event is free and open to the public. No need to register, but if you would like more details, please email Ward09@CityofChicago.org or call the 9th Ward office at 773.785.1100.

The selected ARISE Community Equity Zone communities will engage in a rigorous “learning-and-doing” capac ity building program to advance health equity in the short, medium and long term. The community coalitions will address inequities in mental, physical and social well-being in communities that are experiencing the brunt of these disparities by connecting people to vaccinations, food, and other well-being needs. They will also address underly ing community needs such as humane housing, reliable transportation, and the root causes of these inequities, includ ing racism and poverty.

“This initiative is targeting disadvantaged communities that are struggling to bounce back,” said Joyce. “Through these grant opportunities and community efforts, the state is seeing strides in healing post-pandemic.”

To learn more about the ARISE initiative, people can visit www.wein theworld.org/arise-project

“LIZZIE G” ELIEFinances are different for everyone, and so are the life events we all go through. An emergen cy fund is your financial line of defense against life’s lemons. Although there are many financial rules of thumb, there is no “normal” way to han dle your emergency fund.

The bottom line: saving money is the first line of defense to financial wellness, especially when the unexpected happens. While nobody can predict the future, everyone can prepare for it.

What is the reason for my emergency fund?

Your emergency fund is a safety net that can help you avoid getting into a difficult financial situation due to a loss of income or unexpected, one-time expenses. Having one in place can reduce stress, anxiety, and other emotions that could make han dling the non-financial aspects of an emergency much more difficult.

It may seem a little obvious that an emergency fund is for emergencies. However, one of the challenging aspects of an emergency fund is knowing what expenses qualify as an emergency. This fund’s sole purpose is to prepare you for costs that you cannot or would not typically plan out. For example, oil changes and new tires are predictable vehicle expenses you should plan for in your regular savings. However, you wouldn’t typically plan for costs that you could incur on the off chance that you need to make emergency home repairs or pay for emergency medical expenses. You would cover these from your emergency fund.

How much do I need?

How much would a new furnace cost? If you could not work, how much would you need to cover essential expenses until you could? Asking yourself these kinds of questions will help you set a goal amount for your emergency fund.

The general rule of thumb is three to six months of essential expenses. However, you can always start with a goal you find achievable. Say, $1,000. Once you reach that goal, aim for three months of rent, then three months of essential expenses, and so on.

Tracking your spending can help you estimate monthly expenses. Completing this exercise can also help you figure out how much you can afford to save toward your emergency fund each month.

How do I save that much?

Start small: If you haven’t started, consider putting $25 from every paycheck into a savings account. Even a few dollars can make a big impact in the long run. Check your budget or spending plan to see how much you can save after you’ve paid essential expenses and before budgeting for discretionary spending.

Keep it separate: Open a separate savings account to

help you resist the temptation to dip into it. Remember, this account is for emergencies, so keep it away from your daily spending accounts and separate it from vaca tion and holiday savings. This method will help you stay organized, visualize your progress, and provide peace of mind.

Automate your savings: One way to automate is via direct deposit. You may be able to instruct your employer to deposit a portion of your paycheck directly into your emergency savings account every pay period. Alterna tively, you can set up an automatic transfer from your primary checking account to your emergency savings ac count on payday. Both methods save you from adding a manual transfer to your to-do list that may be overlooked if things get busy!

Will I ever need to change the amount?

As your life changes, the amount you need in your emergency fund will change as well. It’s a good idea to revisit your emergency fund plan every six months or any time you experience a life event that impacts your income. Marriage, starting or adding to your family, buying a home, and divorce are just a few examples of when you may need to increase your emergency fund. A good savings plan can roll with the punches right alongside you!

How do I prioritize emergency savings against debt and other goals?

Deciding whether you should pay down debt, save for other goals, or grow your emergency fund is all about the big picture. Everyone has different financials, so that picture will vary person-to-person. What will impact you the most financially? Paying down debt and saving mon ey long term or having a plan B that allows you to keep making minimum payments if you lose income? There is no right or wrong answer.

Your emergency fund is there to help you expense the unexpected. So, make a plan and be ready for what ever comes your way!

Sponsored content from JPMorgan Chase & Co.

-Funding accelerates commercialization of researchenabling solutions to speed up therapies for obesity, diabetes, and cancer across diverse populations

NEW ORLEANS -- (BUSINESS WIRE) -- Obatala Sciences, a New Orleans biotechnology company recognized for speeding up therapies for obesity, diabetes, and cancer across diverse populations, today announced the closing of a $3 million Series A finance round coled by être Venture Capital and Ochsner Lafayette General Healthcare Innovation Fund II and joined by Benson Capital Partners, Elevate Capital Fund, and The Hackett-Robertson-Tobe Group.

The funding will be used to further the commercialization of its first-of-kind research-enabling products and platform for drug discovery and development. These solutions, provided to pharmaceu tical companies, government labs, and researchers, are designed to accelerate the study and prevention of diseases in the fields of obesity, diabetes, cancer, and regenerative medicines.

“Recently the FDA has signaled the need to improve predictivity by reducing the use of animal-derived tissues, while the NIH has been calling for greater diversity in testing. Obatala Sciences’ diverse human-derived products are the exact solution designed for these market directions,” said Jennifer Kuan, partner at être Venture Capital. “Obatala’s solutions enable their custom ers to significantly reduce failure rates, reduce the time to market, and thereby reduce costs. Combine that with Obatala’s extensive intellec tual property portfolio, manufacturing strength, and rapidly growing customer base, and you can see why Obatala is positioned to be a leader in the 3D culture market.”

“We are thrilled to have the support of our investment partners. Their belief in us, and their commitment to support minority-led compa nies and communities, like New Orleans, is changing the landscape for biotech companies like Obatala Sciences,” said Obatala Sciences CEO Trivia Frazier, Ph.D., MBA. “This funding will accelerate the commer cialization of our pipeline products as we work towards our milestones, which include the build-out of our lab at The Beach at UNO, a Research Park District located near the University of New Orleans campus, obtaining our ISO certifications, expanding our North American and international distribution network, and deepening our sales, marketing, and customer support teams to support our growing global customer base.”

SAN DIEGO -- (BUSINESS WIRE) -- Acadia Pharmaceuticals Inc. (Nasdaq: ACAD) has announced the appointment of Adora Ndu, Pharm.D., J.D. to its Board of Directors. Dr. Ndu is a biopharma executive with more than 15 years of experience in regulatory affairs and clinical development.

“We are pleased to welcome Dr. Ndu to Acadia’s Board,” said Stephen R. Biggar, M.D., Ph.D., Chairman of Acadia’s Board of Directors. “Dr. Ndu’s significant regulatory and clinical development experience, combined with her extensive background in rare disease nicely complements the skill sets of our current membership. Her expertise will be invaluable as we continue to pursue our strategic initiatives in disorders affecting the central nervous system, particularly as the company prepares to launch its second commercial product, trofinetide, for the treatment of Rett syndrome.”

“I am honored to join Acadia’s Board of Directors. I look forward to collaborating with its members alongside

Acadia’s talented management team as they develop and commercialize innovative new therapies addressing high unmet needs in the field of CNS,” said Dr. Ndu.

Since 2022, Dr. Ndu has served as the Chief Regulatory Affairs Officer of BridgeBio. Previously, she was the Group Vice President, Head of Worldwide Research and Develop ment Strategy, Scientific Collaborations and Policy at BioM arin Pharmaceutical. She brings over 15 years of complemen tary experience in drug development and regulatory affairs. Dr. Ndu has spent eight years in various leadership roles in the biopharmaceutical sector. Her expertise includes regulatory strategy, patient engagement, prescription drug promotion, and policy for U.S. and international markets. Additionally, Dr. Ndu spent eight years at the U.S. Food and Drug Admin istration, Center for Drug Evaluation and Research, where she progressed in leadership serving most recently as Director for the Division of Medical Policy Development and Command er in the U.S. Public Health Service. She has been involved

in the registrations of multiple products globally and is a re spected thought leader in regulatory science, having played a significant role in developing and evaluating guidance, as well as shaping regulatory policy. Dr. Ndu currently serves on the board of DBV Technologies. Dr. Ndu received her doctorate in pharmacy from Howard University’s College of Pharmacy and a law degree from the University of Maryland.

Acadia is advancing breakthroughs in neuroscience to elevate life. For more than 25 years we have been working at the forefront of healthcare to bring vital solutions to people who need them most. We developed and commercialized the first and only approved therapy for hallucinations and delusions associated with Parkinson’s disease psychosis. Our clinical-stage development efforts are focused on treating the negative symptoms of schizophrenia, Rett syndrome and neu ropsychiatric symptoms in central nervous system disorders. For more information, visit us at www.acadia.com and follow us on LinkedIn and Twitter.

FRAMINGHAM, Mass., PRNewswire -- As part of its mission to provide women with essential tools that empower them to ditch the fear of failure and put themselves first, T.J. Maxx is launching its Find Your Maxx workshop series this weekend. Find Your Maxx is part of The Maxx You Project, T.J. Maxx’s ongoing initiative to support women with tools and resources as they navigate the process of becoming their most authentic, unapologetic selves.

Earlier this year, T.J. Maxx and Emmy-nominated actress, comedian, and writer, Yvonne Orji partnered to launch Find Your Maxx, offering one lucky grand prize winner the mentorship of a lifetime and $50,000 in starter funds to help propel them toward their Maxx self. Now, Yvonne will kick off an interactive virtual workshop series with the ‘Maxx Your Mindset’ session, co-hosted by seasoned life coach Sophia Casey. The first workshop took place on Instagram Live via @ tjmaxx on Oct. 15. Following Orji’s workshop, five additional workshop installments will follow, each hosted by two influen tial women, throughout October and November via Instagram Live and TikTok Live and will provide viewers with support and resources they need to break down the barriers of self-pri oritization and maintain a confident mindset.

“Over the years, I’ve learned that it’s not always easy to Maxx Your Mindset – sometimes we just need a little help get ting started! During my virtual workshop, I’ll be hosting a dis

cussion on how I tap into my Maxx self, and I’ll share tools to help you become your best, most confident self,” said Yvonne Orji. “I’m also excited to introduce the Find Your Maxx grand prize winner as we kick start her journey. Be sure to tune in on @tjmaxx’s Instagram Live and ask questions – I can’t wait to pass along what I’ve learned from my mentors and inspire women everywhere to be their most unapologetic selves.”

The workshop series is designed to provide women with actionable tools to become their most authentic self and includes themes like ‘Maxx Your Mentors’ and ‘Maxx Your Confidence.’ T.J. Maxx will also collaborate with global non-profit organization Dress for Success – an ongoing partner – on the ‘Maxx Your Career’ virtual workshop to support its mission of empowering women to transform their lives and re-envision their futures.

“The Maxx You Project community has grown tremen dously since it began in 2017, and we’re proud to provide women with tools and resources that empower them,” said Robyn Arvedon, Assistant Vice President of Marketing, T.J. Maxx. “We look forward to kicking off the Find Your Maxx workshop series and continuing this impactful movement we’ve started.”

For more information on The Maxx You Project, as well as tools and resources to use during the Find Your Maxx work shops, visit maxxyouproject.com.

-- On Tuesday, Oct. 11, the Saks Fifth Avenue Foundation celebrated its ongoing commitment to support mental health with a cocktail fundraiser hosted by Executive Chairman of Saks and President of the Saks Fifth Avenue Foundation Richard Baker and Saks CEO Marc Metrick at L’Avenue at Saks in New York City. The event raised $1.8 million to help strengthen the Foun dation’s mission to make mental health a priority in every commu nity by increasing awareness and education, improving access to care, and promoting the tools and skills that build positive mental health for those who need it most.

“There is no doubt that the last two and a half years have chal lenged people around the world in unforeseen ways,” said Richard Baker, Executive Chairman of Saks and President of the Saks Fifth Avenue Foundation. “The need for mental health support has never been more urgent, and we are grate ful to our many partners who make our efforts possible through their generous donations. With this latest funding, we are able to continue supporting our nonprofit partners in delivering crucial mental health support to those in need.”

Since the Foundation’s found ing in 2017, Saks Fifth Avenue and the Saks Fifth Avenue Foundation have donated more than $5.8 mil lion for U.S. mental health initia tives and reached over 6.6 million individuals through programs that promote positive mental health, with a focus on allocating resources to underserved communities. This

year, the Foundation launched a $250,000 fund that will support grassroots, community-based organizations whose local efforts are critical in offering support to the health and wellbeing of those they serve.

“Five years ago, the Saks Fifth Avenue Foundation embarked on a journey to make an impact on mental health, and today, we feel just as passionate about supporting this increasingly important cause,” noted Marc Metrick, CEO of Saks and Saks Fifth Avenue Foundation Board Member. “We are proud of the incredible work our nonprofit partners are doing to ensure that underserved communities and pop ulations disproportionately affected by mental health issues receive criti cal access to care. We appreciate our many partners who make this work possible through their continued dedication to the Saks Fifth Avenue Foundation’s efforts.”

Guests at the fundraiser enjoyed a special performance by six-time GRAMMY Award-win ning artist and pop culture icon, Dionne Warwick, who sang three of her top hits including “What The World Needs Now Is Love,” “That’s What Friends Are For,” and “If I Want To.” Dionne joins an impres sive roster of legendary artists who have performed at the Foundation’s annual Fall Fundraiser, including Patti LaBelle, Cyndi Lauper and Rufus Wainwright.

“There’s something that can be done about mental illness and it takes all of us to do that,” noted Ms. Warwick. “All we have to do is care, truly care, and always try

including

One, Kering, Simon

and Wendy & Ste

Betteraccess to healthcare equals better health outcomes. Biogen strives to increase access and address the barriers that patient populations face. Oftentimes, health outcomes depend on factors beyond the control of patients and their doctors. Dis parities across age, gender, race, ethnicity and socio economic level are some examples. One of the key parts to Biogen’s approach involves researching and understanding these issues as well as their compound ing factors, such as, inadequate representation in clin ical trials and limitations to accessing care. Overall, the goal is clear: improve health outcomes for Black, African American, Hispanic, Latino and other under served communities in Biogen’s main disease areas.

Issues of culture awareness and mistrust remain prev alent alongside a host of other considerations prior to enrollment in a clinical trial. To address these issues, Biogen uses a multi-channeled health equity strate gy which includes incorporating diverse community perspectives and insights into our drug development and engaging with the community by partnering with organizations to educate, build awareness, establish trust, and drive health equity.

In partnership with the Center for Information and Study on Clinical Research Participation (CISCRP), Biogen formed a Community Advisory Board (CAB) of patient advocates from underserved and underrepre sented communities who co-develop honest and trans parent educational assets for patients, HCPs and clin ical trial sites to discuss the importance of diversity in clinical trials. The CAB has also advised on various program and study designs as well as the develop ment of Biogen Trial Link, a publicly facing website to learn more about and find clinical trials.

In collaboration with the National Minority Quality Forum (NMQF), Biogen launched the Clinical Trial Index and Clinical Trial Learning Community (CTLC) which uses U.S. heat maps of Medicare/Medicaid ben eficiary data by patient demographics and maps them against clinical trial site locations. This information seeks to identify the right sites in the right locations to meet patient needs. The CTLC launched as a vir tual space for local stakeholders and subject matter experts to integrate routines in local care networks to increase underrepresented and underserved popula tion participation in clinical trials.

As the clinical study recruitment begins, Biogen teams track and report their progress toward the study tar gets that represent the epidemiology of their respec tive disease. Given this commitment, 2021 had 100% of Phase 1–4 studies in the U.S. including a plan to recruit participants from underrepresented commu nities to ensure the study population is representa tive of the intended treatment population. They also launched an Internal Participant Demographic Dis tribution Dashboard to track and measure the demo graphic distribution of participants across programs and studies, and to compare directly to epidemiology targets. Within certain disease areas, Biogen has built community and faith-based outreach and education programs for disease awareness and general clinical trial education with trusted organizations such as HEAL Collaborative and Proximity Health Solutions.

In Alzheimer’s specifically, they have sponsored the Bright Focus Foundation’s Virtual Community Out reach Series, bringing sustained Alzheimer’s disease and clinical trial education and access to communities with an underrepresented focus. Additionally, Biogen co-developed a paper with the NMQF titled “A Road map for Real-World Evidence Generation in Alzhei mer’s Disease.” It highlights how real-world evidence can include larger patient populations that are his torically underrepresented in randomized controlled trials.

In Lupus, Biogen collaborated with Saira Z. Sheikh, M.D., Director of University of North Carolina (UNC) Rheumatology Lupus Clinic and Director of the Clin ical Trials Program at UNC’s Thurston Arthritis Re search Center, to gather insights on barriers to clini cal trial enrollment among underrepresented groups. These insights are being used to inform Biogen’s clin ical development programs in lupus and address eq uity in study participation. For the Phase 3 studies in systemic lupus erythematosus (SLE), Biogen set enrollment targets that reflect the prevalence of SLE in Black or African American and Hispanic and/or Latino communities to achieve appropriate represen tation. Through partnerships with community-based Proximity Health Solutions and faith-based HEAL Collaborative, along with expert panels of commu nity leaders, HCPs and patient advocates, they par

ticipated in seven events across the U.S. in 2021 to educate communities about lupus and clinical trial research.

Beyond this commitment to the patients and their specific needs, Biogen also focuses on the workers in volved in clinical trials. In 2021, they joined the Asso ciation of Clinical Research Professionals (ACRP) as part of ACRP Partners in Workforce Advancement™, which works to expand the diversity of the clinical re search workforce and to set and support standards for workforce competence.

Additionally, Biogen has fostered employee collabo ration to increase awareness of health equity needs cross-functionally. In 2021, they introduced a Health Equity Ideas Cafe Series to deepen organization-wide understanding of Biogen’s commitment, including representation in our clinical trials and equitable ac cess. The three-part series engaged internal and ex ternal guest speakers on themes of lupus awareness, patient voices and community partnerships, and equi table access to healthcare. In addition, Biogen hosted an event with John Sawyer, Ph.D., ABPP-CN and a board-certified clinical neuropsychologist of the Ochs ner Neuroscience Institute; and Donnie Batie, M.D., on successful approaches to caring for underrepre sented patients.

From their research into healthcare disparities and patients’ needs, Biogen’s approach to health equity is guided by the motivation to help those who have his torically been underserved. Concretely, this commit ment to health equity looks like: clinical trial diver sity, empowering underrepresented groups, engaging employees, and launching new tools to improve acces sibility.

Visit Biogen Trial Link to learn more about clinical trials and how you can support equity and access ef forts such as these.

The Theta Omega chapter of Alpha Kappa Alpha Sorority Incorporated will host a double celebration to commemorate its Centennial and to celebrate the payoff of its 30-year mortgage on its multimillion-dollar AKARAMA Foundation Community Service Center in 15 years. The Center is under the umbrella of the AKARAMA Foundation, the charitable arm of Theta Omega chapter.

The Chapter will honor these milestones with a Reception on Saturday, November 5 from 2-5 PM at the Center, 6220 S. Ingleside. The theme of the celebration is “100 Years of Sister hood and Service: Strengthening Our Community.” Founded on November 5, 1922, the chapter is hailed as one of Alpha Kappa Alpha Sorority’s premiere chapters. Theta Omega Chapter was the first Graduate Chapter in Chicago and boasts an illustrious history.

During the reception, members will reflect on the past 100 years and will make projections for the future. Several organizations such as Legal Aid Chicago, DLA Piper Law Firm, University of Chicago Office of Civic Engagement will be recognized and will receive expressions of appreciation for being sustained supporters through the years.

In making the announcement, Kimberley Egonmwan, Esq. President of the AKArama Foundation and Theta Omega chapter declared that the reception will hail the chapter’s Centennial milestone. Egonmwan also asserted: “Retiring the mortgage is a triumph and a reflection of the Foundation’s love and devotion to serving the community.”

Located in the heart of the Woodlawn community, the Center is heralded as a beacon of light. Under its roof is a service haven where programs are planned and hosted by mem bers who reach out to the community and provide information, tools and resources.

Egonmwan declared that the payoff of the Center rep resents the culmination of a dream by the Foundation members. “In illustrating their financial might, members pooled their

resources, combined their talents, crafted a plan, harnessed their strengths and executed their mission: to own, manage and control the Foundation’s direction and destiny. It is a powerful show of Black economic empowerment by African-American women.”

The President revealed that the early payoff was because aggressive fundraising efforts were mounted. Additionally, with extra-generous donations from members and substantial amounts bequeathed to the chapter, the mortgage was paid off in half the time.

During the event on Saturday November 5, members will host a symbolic “Burning of the Mortgage.”

The AKArama Community Service Center stands as a brick-and-mortar extension of the Foundation members’ passion, resolve and commitment to service. Under its roof, the Foundation has served millions, awarded over $1 million in scholarships and, overall, earned its designation as a citadel of service.

The acquisition and ownership of the Community Service Center is a major part of the arc of history of Theta Omega and the AKARAMA Foundation. In the 1990s, members began craving for a bigger space. These constant laments represented the tipping point that led to the eventual building of the Center. Audrey Cooper-Stanton, chapter president in 1999, led the charge. She put in motion a plan, assembled a team, and did the preliminary work that achieved results.

To seek support, Cooper-Stanton met with State Senator Emil Jones, Jr., who was also president of the State Senate.

Impressed with the community service focus, Jones directed Cooper-Stanton to prepare a plan capturing the vision. She crafted and submitted a proposal. Within a month, Coo per-Stanton received a commitment that the Foundation was awarded $500,000 from the Illinois First Fund. Additionally, the City sold the chapter eight parcels of land valued at $450,000 for a total of $1 per parcel. Reflecting on the significance of

these two developments Stanton-Cooper remarked: “With these two events, the Center went from a dream to a reality.”

The contractors charged with the overall project were Black-owned firms: The architect was Raymond Broady of RBA Architects; construction management was entrusted to UBM, Inc., whose president is Paul J. King, Jr.

In 2007, five years after the groundbreaking, the AKAra ma Foundation Community Service Center opened its doors to much fanfare and excitement.

Spotlighted among the attendees was State Senator Emil Jones, Jr. who was hailed for his role in giving life to the Center. Jones is invited to attend and will be applauded at the reception on November 5.

With pride, Egonmwan declared, “The AKArama Com munity Center is emblematic of the 100 years of service that defines the Foundation and the chapter. The Center has emerged as a service haven where programs are planned and hosted by members who reach out to the community and provide infor mation, tools and resources. We invite the public to participate in the many activities that take place at the Center.

The reception will be the first of three events to com memorate Theta Omega’s Centennial. Following are the other high-profile events and the dates:

• On Saturday November 12 the chapter will host a gala formal at the Marriott Hotel, 540 N. Michigan Avenue begin ning at 6:00 P.M. Members will reflect on 100 years of service through testimonials and anecdotes.

•On Sunday, November 13.the Centennial Celebration will culminate with a brunch, also at the Marriott, beginning at 11: A.M. Members will offer final words of praise and gratitude while looking forward to the second century.

To purchase tickets to the Centennial events and for more information, log on to https://www.eventbrite.com/e/celebrat ing-100-years-of-sisterhood-service-a-centennial-ball-tick ets-412891378227.

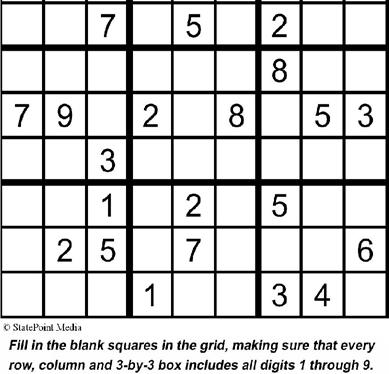

(StatePoint) As inflation continues to put a strain on budgets, talk of an upcoming recession has Americans worried about their finances. Prices on everyday items continue to rise and consumers are trying to find ways to make their dollar stretch further while safeguarding their money against the potential challenges a recession may bring. The future may be difficult to predict, but preparing now can help consumers protect their financial health during a recession.

A recent Experian survey found that two in three U.S. adults are con cerned about a recession occurring in the United States. Consumers are most worried about the affordability of routine expenses, with 73% concerned that the price of everyday items like gas, groceries and rent will continue to rise to a level they can’t afford. Meanwhile, 55% harbor supply chain concerns and 38% are stressed about the affordability of big, planned purchases such as a home or a car.

As recession worries grow, more Americans are sizing up their finances to see where they stand. Only 48% are confident that they can financially handle a recession, and two in five believe that they’ll need to rely on credit to cover essential and unexpected expenses over the next three months. In fact, 27% have already increased their credit card debt within the past three months. This trend is accompanied by addi tional anxieties: two in three survey respondents are concerned to some degree that their credit score will negatively affect their ability to access credit in the next three months.

Being proactive is key to weathering financial storms, yet less than half of consumers have prepared for a recession when it comes to their finances and credit. Those who have are finding different ways to do so: 49% have cut non-essential expenses like entertainment and vacations, 45% have created a budget and 40% have paid down debt. While these are effective actions, there are other steps consumers can take to understand their credit history and safeguard their credit. Consumers should check their credit report and credit score regularly to know exactly where they stand in the event that they need to apply for credit, or simply to be better informed as they prepare to pay down their debt ahead of an economic decline. They can get a free credit report and credit score from Experian (Spanish-language credit reports

are also available) as well as access to free financial tools, an auto insurance shopping service and credit card marketplace.

Those who need help increasing their credit score can sign up for Experian Boost. This free feature enables consumers to add their monthly payments for cell phone bills, utility bills, rent and video streaming swervices to their credit history to potentially increase their FICO Score instantly. To learn more, visit experian.com/boost.

“Inflation and recession fears are putting pressure on consumer’s finances, but proactively planning for the worst can help con sumers make it through potential challenges. Many consumers are already taking great steps to prepare, like creating a budget and paying down their debt, and we encourage them to utilize other available resources and tools to help,” says Rod Griffin, senior director of Public Education and Advocacy at Experian.