ONG&ONG

50 YEARS OF EXCELLENCE IN TRANSFORMATION

Digital transformation marks the most recent stage of change for our 360 solution consultancy, empowering the seamless integration of virtual workspaces for collaboration, and realising higher levels of agility and efficiency.

We continually invest in talent and technologies, fostering an

Architecture

Engineering

Interior Design

Landscape

Lighting

Masterplanning

Project Management

Project Solution

Workplace Interior

Brand Engagement

Experience Design

Wayfinding Strategy

REAL EST ATE ASIA

About Us

Real Estate Asia is the industry portal serving Asia’s dynamic real estate industry. Each section carries a balance mix of articles which appeal to the C-level executives of large real estate developers, investors, brokers, and property services institutions in Asia.

Do reach out to us if you would like us to tell your story to our readers via print and online advertising or events.

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

EDITORIAL MANAGER Tessa Distor

PRINT PRODUCTION

EDITOR Eleennae Ayson

PRODUCTION TEAM Alec Maquiling

Diana Dominguez

Vincent Mariel Galang

Noreen Jazul

Lady Jo-An Llorin

Jaleen Ramos

Joanne Christine Ramos

Anlene Rosales

EDITORIAL RESEARCHER Angelica Rodulfo

GRAPHIC ARTIST Simon Engracial

EDITORIAL ASSISTANT Vienna Verzo

COMMERCIAL MEDIA TEAM Jenelle Samantila Dana Cruz

Danielle Goh

ADVERTISING CONTACTS Shairah Lambat shairah@charltonmediamail.com

AWARDS Julie Anne Nuñez-Difuntorum awards@charltonmediamail.com

ADMINISTRATION Eucel Balala accounts@charltonmediamail.com

EDITORIAL editorial@realestateasia.com

SINGAPORE

Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 +65 3158 1386

HONG KONG Room 1006, 10th Floor 299 QRC, 287-299 Queen's Road Central, Sheung Wan, Hong Kong +852 3972 7166 www.charltonmedia.com

MIDDLE EAST FDRK4467, Compass Building, Al Shohada Road, AL Hamra Industrial Zone-FZ, Ras Al Khaimah, United Arab Emirates

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at editorial@realestateasia.com. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email editorial@realestateasia.com with “Partnership” in the subject line.

Subscriptions email: subscriptions@charltonmedia.com

Real Estate Asia is published by Charlton Media Group. All editorial is copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Real Estate Asia can accept no responsibility for loss. We will however take the gains.

Sold on newstands in Singapore, Malaysia, Hong Kong, London, and New York. Also out in realestateasia.com with online readership of 215,000 monthly unique visitors*.

FROM THE EDITOR

Across Asia, sustainable design is being applied in practical and creative ways. In Singapore, decommissioned MRT trains are converted into compact rooms for a boutique co-living hotel, offering guests a rare stay in a carriage that once ran on the Green Line. The full story and a closer look at the facilities can be found on page 11.

Technology is moving just as quickly. With urban density rising, demand for smart housing solutions and digital management tools is accelerating. On page 8, analysts outline the momentum behind proptech, whilst on page 18, Realion CEO Desmond Sim unveils plans for a super-app combining banking, renovation, and property services into one streamlined platform.

Capital flows mirror these shifts. Institutional investors are tilting towards logistics facilities and data centres for their resilience, leaving retail, residential, and office on weaker footing. This shift is examined on page 24. Meanwhile, 5-year expansion plans from logistics operators are covered on page 10, and DHL’s new $11.36m pharmaceutical hub in Singapore is featured on page 13.

We also shine a spotlight on companies and projects setting benchmarks for excellence in real estate, construction, and interior design across Asia. The Real Estate Asia Awards and Built Environment Awards celebrate their achievements and showcase the ideas shaping the industry’s future. Discover the full list of winners on pages 38 to 41.

Read on and enjoy.

Tim Charlton

Real Estate Asia is a proud media partner and host of the following events and expos:

*Source: Google Analytics **If

News from realestateasia.com

Daily news from Real Estate

Which area in Thailand recorded the highest land price growth?

Jakarta CBD to see 100,000sqm of new office space by 2028

A total of 2,520 rooms from seven new hotel projects are set to enter the Kuala Lumpur market in 2025, with luxury and upscale hotels leading supply growth. The hotel capital market has been muted since 2024, with no new transactions in the market as owners hold on to their assets in light of inbound tourism.

There were no completions and multiple withdrawals over the quarter in the Sydney CBD which were associated with the Halo development site on Hunter Street. Data from a JLL report said there is 244,100 sqm of stock under construction across eight projects with delivery between Q2 2025 and Q4 2027.

According to the Real Estate Information Center (REIC), land prices in the Eastern Economic Corridor (EEC) continued to rise, reflecting strong demand in Thailand’s key economic zone, which covers Chonburi, Rayong, and Chachoengsao. The price increases can be attributed to ongoing industrial expansion.

Singapore shophouse leasing demand declines by 4% in Q1

In a recent report, PropNex said leasing demand for shophouse spaces in Singapore slowed during the first quarter. With 836 rental contracts signed in Q1 2025, this represented a contraction of 4.0% quarter-onquarter. from 871 contracts in Q4 2024. There were only 836 rental contracts during the quarter.

Newly launched office construction has yet to surface in Jakarta, a Colliers report said. As a result, the overall supply remains largely steady. Within the CBD, the cumulative supply of office spaces remains unchanged at around 7.38 million sqm, whilst outside the CBD, it stands at around 3.83 million sqm as of Q1 2025.

College homes, industrial sites a bright spot in Hong Kong property

Investors are bottom-fishing for properties with stable returns such as hotels that can be converted into student houses, and industrial sites that can be repurposed into cold storage or data centres amidst Hong Kong’s ongoing property slump. They are also targeting distressed homes and retail spaces, analysts said.

Kuala Lumpur to see seven new hotels this year

Eight office projects currently under construction in Sydney CBD

LIFE SCIENCES BOOST DEMAND FOR LAB REAL ESTATE

SPECIAL PURPOSE

The growing prominence of the life sciences industry sparked a wave of real estate development globally, with Beijing and Shanghai leading global life sciences construction activity with more than 13.7 million sq. ft. combined, according to a new report from CBRE.

CBRE analysed many of the key life sciences markets across the globe and found that, overall, most demand drivers are improving. Global venture capital investment in life sciences companies last year exceeded the 2019 total by 43%. In-progress construction of lab space globally totalled more than 35 million sq. ft. last year.

“Beijing, Shanghai, Singapore, and Greater Tokyo are the largest life sciences markets in the Asia Pacific region,” said Paul Peeters, APAC head of life sciences for the Leasing division at CBRE. “Whilst China leads the world in in-progress lab construction, India is emerging as an attractive life-sciences manufacturing hub. We witness strong growth momentum of the life sciences industry in the region.”

Patent applications

The largest global markets by square footage of lab and research & development space are Boston (56 million sq. ft.), San Francisco (43.6 million) and San Diego (27.3 million). The largest markets outside of the US are Beijing at No. 4 with nearly 22 million sq. ft. and Shanghai, placing seventh at nearly 13 million sq. ft. Chinese markets have by far the most lab and R&D space under construction as of last year’s fourth quarter: 7.4 million sq. ft. in Beijing and 6.4 million sq. ft. in Shanghai.

Whilst the US has the most patent applications for biotech, pharma, and medical technology, China and South Korea have more momentum with patent growth of 379% and 134%, respectively, since 2014. However, those growth rates are much smaller base amounts than the US.

across 26 developments, Phuket has the highest concentration amongst key destinations, followed by cities such as Manila and Bangkok.

“Whilst luxury hotel brands still dominate, we are now seeing non-hotel brands such as fashion houses, car companies, and lifestyle brands enter the space,” he said.

Bill Barnett, managing director at C9 Hotelworks, told the magazine that Thai property developer Ananda is working with Porsche to build the Porsche Design Tower, with units priced at $15m to $40m.

“Beyond automotive, we are also seeing the growing presence of fashion and culinary brands such as Fendi, Armani, and Nobu entering the residential market,” he said.

Whilst accounting for only 5% of the market, branded residences are very lucrative, Barnett said.

“Licensing their brand for residential projects allows them to tap into new sectors and leverage their existing brand equity," he added.

Investors turn to safehaven branded

RESIDENTIAL PROPERTY

Investors are eyeing branded residences, now a distinct safehaven asset, as global stock market swings push investment towards tangible assets, analysts said.

“One of the market’s biggest drivers is the increasing number of high-networth individuals across the region who see these properties as both a lifestyle choice and a solid investment,”

Otto Twist, Southeast Asia director for international residential sales at Savills Singapore, told Real Estate Asia.

Branded residences in Asia hit a record value of $30.7b in the first half, covering 38,893 units across 178 projects, according to a report by C9 Hotelworks Ltd. Asia had 67,353 units across 283 projects in the pipeline.

Thailand led the market with a 23.3% share, followed by the Philippines with 17.3% and South Korea with 11.6%. Malaysia, Vietnam, and India collectively accounted for 24.5% of the total, it said.

homes

Beyond automotive, we are also seeing the growing presence of fashion and culinary brands

He noted that with multimilliondollar properties, the associated lincence fees typically range from 5% to 10% of the sales, offering a significant revenue stream for the brand.

Benjamin Grint, global director of sales and partnerships at Bangkokbased consultancy Brand Atlas, cited rising interest in branded residences amongst younger high-net-worth Singaporeans. “They’re really intrigued by branded residences and are looking all over the globe,” he told Real Estate Asia at the Global Property Expo.

Right local expertise

Twist said some of the most active markets for branded residences in the region are Thailand, which continues to attract local and international buyers, and Japan and Vietnam.

With 4,771 branded residence units

To maximise market growth, nonhospitality brands should partner with experienced real estate developers and property management firms that understand the industry, Barnett said.

“Having the right local expertise is crucial, ensuring that the brand’s values and aesthetics are consistently reflected throughout the project,” the analyst said.

The supply of branded residences in Asia is expected to almost double starting this year, as 43,100 units across 180 projects are completed.

Twist expects the branded residence sector to see strong growth in the secondary and resort markets, characterised by personalised products, high-end concierge services, digital integration, and a focus on sustainability and smart living.

Porsche Design Tower units are priced at $15m to $40m (Photo from Porsche)

Otto Twist

Bill Barnett

CapitaLand invests $700m in first data centre in Japan

CapitaLand Investment Ltd. (CLI) is investing more than $700m in Osaka—its first data centre in Japan—in line with its digitalisation investment theme and push to expand its geographical reach.

“We chose to expand our data centre portfolio in Japan because we believe the country is a tier-one data centre market and is one of the largest markets in Asia Pacific,” Kenny Khow, managing director for Global Data Centre at CLI, told Real Estate Asia in an interview.

“In the last couple of years, we have observed that the adoption of cloud, social media, and increased

The cost to fit out an office in key locations across the Asia-Pacific region has continued to rise, although at a slowing rate, according to a Cushman & Wakefield report published in June.

video streaming are some of the main drivers of data centre demand,” he said.

This has spurred significant investments in data centre infrastructure, according to the Singapore-based real asset manager.

“These facilities are increasingly regarded as a vital and permanent asset class—in my view, they are here for the long term,” Khow said.

Market condition

The Japanese data centre market was valued at $9.93b in 2024, and is projected to grow 5% annually to $13.35b by 2030, according to Dublinbased Research and Markets.

The global real estate service provider’s annual report showed fit out costs range from $195 per square foot (psf) in Tokyo to $58 psf in Jakarta.

Similarly to previous years and in line with expectations, Japanese cities were the most expensive markets whilst cities in the Southeast Asia region were the most affordable locations for office fit outs.

Whilst there was some fluctuation at a market level and within local currencies, the ranking of most to least expensive fit out costs in US dollars per square foot remained largely unchanged, though gaps have narrowed between some markets.

Surging demand for data infrastructure is fuelling real estate transformation across global data centre markets, Cushman & Wakefield said in a May report.

The sector continues to attract significant institutional investment, with a sharp rise in joint ventures, mergers, and acquisition activity across co-location, hyperscale, and infrastructure outfits, it said.

Steady growth

Khow’s outlook for the market remains positive, but the global trade tensions and US restrictions on graphics processing unit (GPU) chip exports present uncertainties.

“This industry will continue to grow steadily in the next couple of years,” he said. “But it will always be subjected to certain economic currents like the US policy on tariffs and the restrictions on GPU chip distribution to certain countries.”

Khow said CLI chooses the right location for its data centres based on land and its accessibility to sources of renewable energy.

These facilities are increasingly regarded as a vital and permanent asset class—in my view, they are here for the long term

Hong Kong jumped from 9th to 5th most expensive, overtaking Auckland, Seoul, Sydney and Melbourne, propelled by the strong US dollar to which its currency is pegged.

Manila climbed from 20th to equal 17th with Shanghai, overtaking other Chinese mainland cities Shenzhen and Guangzhou which experienced declining rates.

Jakarta fell from 24th to 33rd position as occupiers opted for lower-spec fit outs, making it the most affordable fit out destination in the region, ahead of Ho Chi Minh City, which was the most affordable destination last year.

According to Dominic Brown, head of International Research in EMEA & APAC and the report's author, changes to local fit out costs were largely aligned with the economic outlook of each market and the related office leasing activity.

"The company’s goal is to achieve energy efficiency by having the lowest possible power usage effectiveness—a standard efficiency metric in the industry—to ensure that nearly all power is used directly by information technology equipment,” he said. He added that this is increasingly becoming critical with the rise of artificial intelligence, which has led to higher rack densities and increased power consumption.

The Japanese data centre market is set to grow to $13.35b by 2030 (Photo from CLI)

Fit out costs in APAC region

Source: Cushman & Wakefield

Kenny Khow

INDUSTRIAL PROPERTY

AI and smart city initiatives spur proptech adoption in Asia

Rapid urbanisation in Asia is driving investment in property technology (proptech) companies that develop smart housing solutions, according to analysts.

“Asia is experiencing unprecedented urban density as it is now home to over 50% of the world's megacities and will account for roughly 60% of all global construction by 2030,” Ariel Shtarkman, co-chair at the Urban Land Institute Asia-Pacific Technology and Innovation Council, told Real Estate Asia. But real-estate owners are often reluctant to spend on anything perceived as a “must-have,” she pointed out. “For proptech companies, the biggest hurdle is convincing these owners that their solutions offer an immediate positive return on investment,” she said.

Another challenge is proving local relevance. “Singapore's real estate market operates very differently from Japan's, China's, or India's—meaning a solution that scales across the entire region is hard to come by,” said Shtarkman, who is also co-founder and managing partner at Hong Kong-based Undivided Ventures.

Eli McGeever, director of data and innovation at Jones Lang LaSalle Inc., told the magazine that the rise of a massive, tech-savvy

middle class is reshaping housing demand, as these consumers now expect the same digital convenience in finding an apartment as they do when ordering dinner.

“Many governments are also pushing ‘smart city’ initiatives, essentially rolling out the red carpet for prop technology innovation with funding and supportive policies,” he said.

New revenue streams

He added that businesses that use digital tools do not just automate tedious tasks to cut costs and free up staff to do more valuable work.

“The data gathered also unlocks entirely new revenue streams, including co-living spaces, flexible offices, and monetising all that valuable data they're collecting,” he pointed out.

The global property technology market is expected to grow 11.8% annually to $103.57b by 2033 from 2023, according to India-based Spherical Insights & Consulting.

McGeever said companies fear data privacy and security because one major breach could set back trust for years.

“Lastly, there simply are not enough people who understand real estate and technology, and that gap needs to be filled to keep innovation running,” he said.

Smaller households drive Asia-Pacific housing crunch

Private developers and governments across the Asia-Pacific region are struggling to meet housing demand as more people form smaller households, increasing the need for individual units even in cities where population growth is slow.

This has prompted calls for faster construction, streamlined approvals, and expanded rental markets.

“Even if the population is not growing rapidly, we need more individual housing units to accommodate everyone,” Mark Cooper, senior director of thought leadership at ULI Asia-Pacific, told Real EstateAsiain an interview.

A recent ULI study found that only seven of 51 market segments in the region offered attainable housing— homes priced at five times the median income or less—in 2024.

Cities where housing remains relatively attainable include Singapore, Melbourne, and Kuala Lumpur.

Singapore’s abundant supply of public housing is a key factor in its affordability,

according to Alan Cheong, executive director for research and consultancy at Savills Singapore.

“For countries that did not provide sufficient public housing in their earlier years of development, even if the country develops rapidly and income rises accordingly, private house prices will outstrip median household income,” he said in a separate interview.

New construction technique

Cheong said house prices often track the earnings of top-income groups, leaving lower-income households priced out.

In South Korea, for instance, housing is affordable in provincial cities but remains costly in Seoul, where population density reaches 16,000 people per square kilometre and public housing supply lags.

Cooper said new construction techniques are one way to accelerate homebuilding and reduce costs. “If you can construct a building in half the time, it would not necessarily be half the price, but it will certainly be cheaper.”

Shtarkman said property companies should view these technologies, especially artificial intelligence (AI), not as a standalone gimmick but as a transformative tool.

She said the true power of AI in real estate lies in its convergence with other technologies, such as the Internet of Things (IoT) and augmented or virtual reality (AR/VR).

“When AI is integrated with IoT, it enables the creation of autonomous buildings that can self-regulate energy consumption, optimise interior layouts based on real-time usage, and even predict and preempt maintenance failures,” Shtarkman said.

McGeever said augmented reality allows a facility manager hold up a tablet and “see” through walls to view wiring, or get step-bystep repair instructions overlaid on a broken piece of equipment.

Asia will account for about 60% of global construction by 2030

Smaller households mean more homes are needed

Qatar’s Leading Business District

Msheireb Downtown Doha

Strategically positioned in the heart of Qatar’s capital, Msheireb Downtown Doha is the world’s first fully built smart and sustainable district, designed to empower businesses of every scale.

Home to global names such as Google Cloud, Microsoft, Qatar Airways, TotalEnergies, Schneider Electric, Vodafone Qatar, HSBC, American Express, Ernst & Young and HEC Paris, among many others, the city brings together multinationals, local entities, ministries and SMEs all in one dynamic, collaborative environment.

Be where business thrives.

Explore more www.msheireb.com

WHERE DO LOGISTICS OPERATORS PLAN TO GO NEXT?

Expected business performance and major challenges

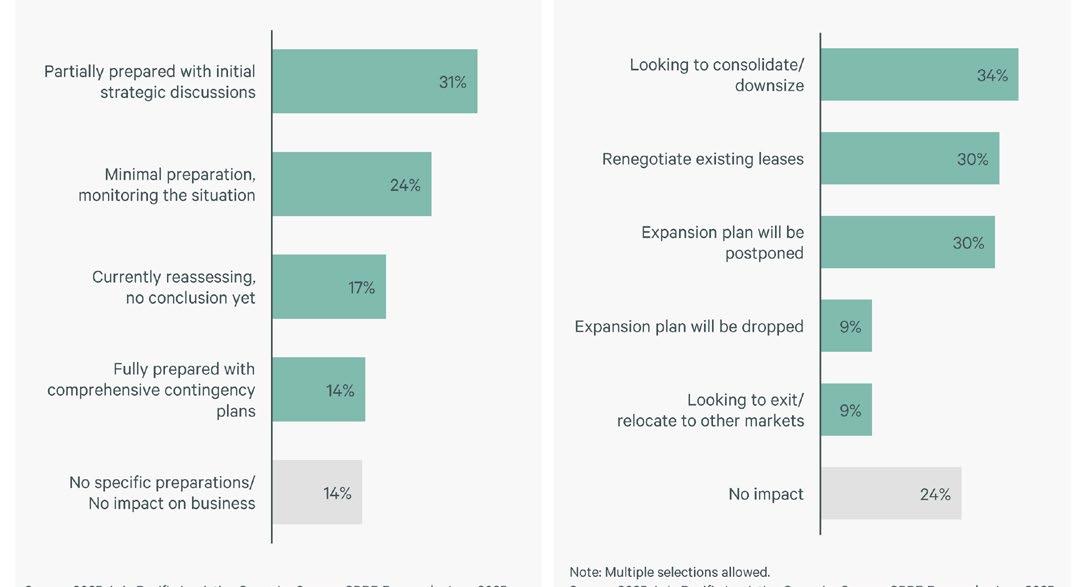

Level of preparedness and plans for increased tariffs

Source: 2025 Asia Pacific Logistics Occupier Survey, CBRE Research

Net expansion interest by market

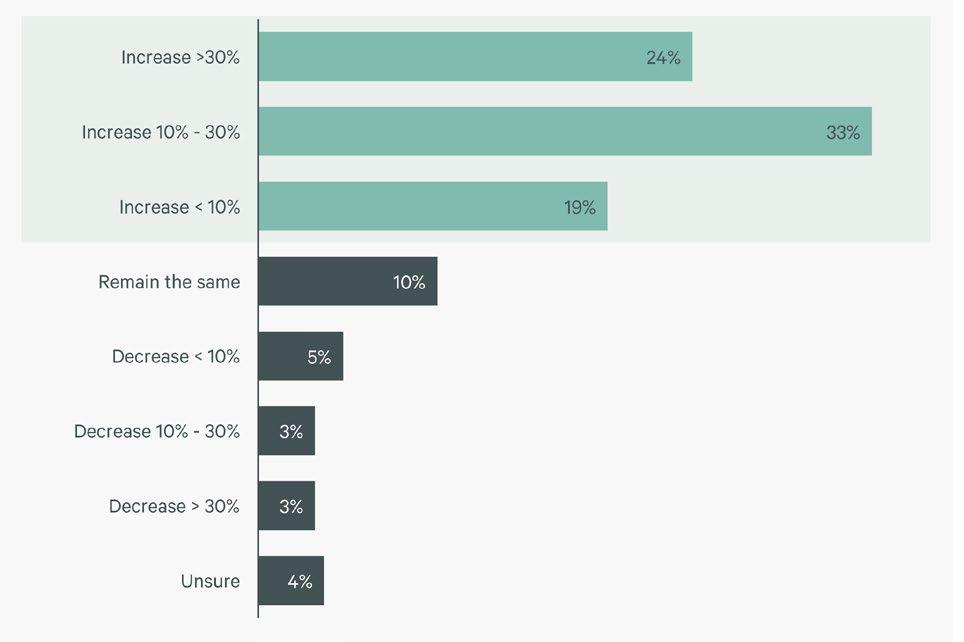

Expected change in real estate portfolio

APAC logistics occupiers eye expansion in next 5 years

Over 76% of logistics occupiers in APAC are looking to expand their real estate footprint over the next three to five years despite ongoing global trade policy uncertainty, a CBRE survey revealed.

The survey, which gathered insights from more than 380 companies across the region, revealed a long-term optimistic outlook tempered by short-term caution. Whilst 69% expect improved business performance in the next two years, this reflected a decline from 81% in 2023. The findings also highlight a shift in occupier priorities, with greater emphasis on cost efficiency and strategic location selection amid evolving market dynamics.

Whilst economic uncertainty and cost escalation remain the top two challenges for logistics occupiers, the survey showed a notable increase in concern regarding trade policies.

Occupiers are becoming increasingly cost-

conscious this year, with 78% identifying rent reduction as the primary driver for relocation decisions. There is also a growing interest in strategic assets located near transportation hubs, customer bases, and the supply chain, as these locations offer operational advantages such as reduced transportation costs, enhanced supply chain resilience, faster time-to-market, and improved customer satisfaction.

“CBRE’s analysis shows that real estate accounts for just 3 to 6% of the total logistics cost structure,” said Michael Bowens, head of Industrial & Logistics Leasing, Asia Pacific, CBRE.

“We advise occupiers to focus on total occupancy costs, not just face rent, when planning their real estate strategies. This comprehensive approach includes factors like transportation, labour availability, last-mile efficiency, and inventory management.”

Train Pod turns old MRT into co-living hotel

It’s also a living museum for a train car that once served Singapore’s Green Line.

Aco-living hotel repurposed from a decommissioned metro train has arrived in Singapore and is set to open its doors in the second half of the year, its founder said.

Train Pod @ one-north offers eight compact rooms, each about 7.5 square metres, featuring private bathrooms and Murphy bunk beds that fold neatly into the wall, letting guests convert the sleeping area into a functional workspace.

There is a premier room at the front of the train car that features the original driver’s seat, giving guests a rare chance to play conductor.

Seah Liang Chiang, founder of Tiny Pod, the company behind Train Pod, noted that whilst much of the train’s

interior had to be removed to meet structural and fire safety rules, original elements such as the train walls and decals had been preserved. The hotel also serves as a “living museum” for a train car that no longer runs on the tracks and once served Singapore’s Green Line for 30 years. The rooms are named after Green Line stations, including Jurong East and Raffles Place.

When checking in, guests are guided to use a mobile phone at the front desk, where they key in their booking details. The system then uses facial recognition to confirm their identity. Inside each room, guests scan a QR code to access the digital concierge for requests like dining recommendations, extra towels, or the Wi-Fi password.

Seah Liang Chiang

1 The MRT car used for the hotel served the Green Line for 30 years.

4 All rooms also have private bathrooms.

2 The premier room located at the front of the train features the original driver’s seat.

5 The deck is stocked with vending machines offering food and drinks and is also open to the public.

3 Each room has Murphy bunk beds that fold neatly into the wall.

6 Outside the rooms is a spacious deck where guests can relax or dine. (Photos from JTC)

PROPERTY WATCH: SKYPARK ELARA LAKELANDS

Banyan Group turns roofs into retreats

It is part of the Singaporean property developer’s ‘reach for the sky’ strategy.

Banyan Group is rethinking how luxury condominiums use space in Phuket, where rising land values and limited beachfront plots are reshaping development. Its latest project, Skypark Elara Lakelands, puts its luxury amenities in the sky rather than on the ground.

The 220-unit condominium, part of the Laguna Lakelands brand, carries a “reach for the sky” theme. Rooftops are designed as shared spaces, offering an infinity pool, jogging and walking tracks stretching nearly a kilometre, barbecue areas, and landscaped leisure zones with views of forests and lagoons.

“Swimming pools used to be always down on the ground floor. We put it all up on the roof, and we're doing it again. In fact, we're doing that in all our properties now because the rooftop actually is a very lovely place to be at.,” said Kwon Ping Ho, founder and executive chairman of Banyan Group. Managing director Stuart

Reading said the shortage of prime land on Phuket’s west coast has prompted the company to design high-spec apartments with private terraces or rooftop pools instead of sprawling villas.

Skypark Elara follows the reception of Skypark Celeste, Banyan’s first Skypark project, and is intended as an evolution of that model. “It's like rolling out a prototype car, then releasing version 2, and version 3 is always an improvement in every little aspect,” Ho said.

The first phase includes three seven-storey blocks, with one- to three-bedroom units spanning 54 to 183 sq m. Prices start at $233,500 (THB8m), aimed at buyers looking for affordable luxury in Phuket’s competitive market.

Beyond design, Banyan Group is exploring innovation as part of its long-term strategy. Artificial intelligence is being studied not as a distant concept but as a practical tool. He dismissed science fiction fears,

instead stressing its role in efficiency and data-driven decision-making.

Cultural awareness is another focus. Operating across Japan, Australia, China, Vietnam, and Indonesia requires sensitivity to local norms, Ho said.

“In the West, when you talk to someone and they say yes, it means, ‘Yes, I agree with you. I’m going to do it.’ But in many Asian societies, when you say yes, it actually means, ‘I hear you,’ but it doesn’t necessarily mean ‘I agree with you,’ and it certainly doesn’t mean ‘I’m going to do it,’” he said.

Ho’s leadership style draws from his early years as a journalist. “As a reporter, you had to learn quickly, ask questions, and arrive at a conclusion. In business, asking the right questions is often more important than having the right answer.”

With Skypark Elara, Banyan Group is betting that smarter space management and thoughtful design will appeal to buyers who value both affordability and distinctive features.

The condominium has a "reach for the sky" theme

It has 220 one- to three-bedroom units

Unit prices start at $233,500

It offers rooftop experiences like an infinity pool

(Photos from Banyan Group)

Stuart Reading

Kwon Ho Ping

DHL opens $11.36m pharmaceutical hub

The logistics centre offers seamless connectivity to Changi Airport and Tuas Port.

DHL Supply Chain has opened a $11.36m (S$14.6m) pharmaceutical hub in Singapore, part of DHL Group’s $569.62m (S$732m) investment to boost its healthcare infrastructure in the Asia-Pacific region, where there is a critical need for resilient supply chains amidst a booming medical market.

“It is specifically developed to meet the stringent requirements of pharmaceutical and medical device companies, offering specialised capabilities across storage, handling, and global distribution,” Eunis Hew, managing director at DHL Supply Chain Singapore, said in an exclusive interview with Real Estate Asia.

The 8,200 square-metre Pharma Hub at 8 Jurong Pier Road

features temperature-controlled zones including ambient (15°C to 25°C) and cold room (2°C to 8°C), ensuring precise storage conditions for sensitive healthcare products.

“This building also comes equipped with purposebuilt chambers to store up to six classes of dangerous goods,” she told the magazine.

The DHL Pharma Hub, which is near Tuas Biomedical Park, offers seamless connectivity to Changi Airport and Tuas Port, allowing efficient regional and global distribution for pharmaceutical partners, DHL said in a separate statement.

DHL Supply Chain, which is based in Bonn, Germany, plans to introduce automation and robotics to improve operations and expand the facility with modular rooms.

1 Exterior of DHL’s 14,600 sqm pharma hub, built for compliant global health logistics.

2 The cold room maintains 2°C to 8°C for temperaturesensitive pharmaceutical products.

3 DHL’s outbound cold room ensures safe handling before pharma goods leave the facility.

4 The Workplace and Excellence School trains pharma hub teams in standards and best practices.

5 Interior view of the loading bay designed for smooth pharma logistics operations.

6 Built to serve pharmaceutical and medical device firms, the warehouse offers specialised storage and handling. 1

Eunis Hew

Relaxed height rules to spur property boom near Changi

Private apartments from the 1990s could end up being ripe for collective sale.

Aplan to ease height restrictions could spur land and commercial property values near Singapore’s airports, potentially narrowing the price gap with more developed parts of the island, analysts said.

“The [building] intensification will increase land values in the short term, but it may help reduce unit land costs,” Sing Tien Foo, provost’s chair professor at the National University of Singapore (NUS) Business School’s Department of Real Estate, told Real Estate Asia

“For example, the cost per square foot of real estate space could be lower, since more space can be built on the same land parcel,” he said.

Under the rules, commercial and industrial property may be built nine storeys higher, whilst residential houses may be 15 storeys higher on sites near airports.

The average monthly rental rate in Changi Business Park is about $3.50 (S$4.50) per square foot, and

$7.7 (S$10) in Raffles Place, which is part of Singapore’s central business district, according to 2024 data from Office Spaces.

Singapore has nine airports, though only two are active civilian airports—Changi Airport, the main international hub, and Seletar Airport, which is mainly used for regional and business flights. The remaining seven are military air bases.

The increase in commercial property values near the airports would hinge on the master plan, particularly whether it revokes existing gross plot ratio controls, according to Alan Cheong, executive director of research and consultancy at Savills Singapore.

“If they intend to revise the height limit, if we raise them, then the plot ratios should also increase accordingly,” he said.

“Otherwise, if the height increase alone is not accompanied by a plot ratio increase, the case will possibly be that nothing changes.”

Urban Redevelopment Authority (URA) figures show that plot ratios in Changi Business Park Central 2 range from 1.4 to 2.0, meaning that for every square metre of land, a developer can build 1.4 to 2 times that amount in total floor area, also known as the gross floor area.

For example, a 1,000 square-metre plot allows 1,400 to 2,000 square metres of floor space across multiple levels, such as two floors of 1,000 sqm or four floors of 500 sqm.

In comparison, the Downtown Core, which is part of the central business district, allows much denser construction, with some commercial zones having plot ratios of as much as 5.6.

Wong Xian Yang, head of research for Singapore and Southeast Asia at Cushman & Wakefield, noted that if the gross plot ratio remains unchanged, “the revision of building height limits may not trigger a widespread wave of redevelopments.”

“Selective redevelopment opportunities may still arise in specific pockets where sites have not fully utilised their gross floor area,” he added. Still, the relaxed height limits are significant for Singapore given that it is a small island, Sing said.

“The buffer imposes physical constraints on land use allocation, which impacts a large tract of the island set aside as buffer zones near civil airports,” he said.

“The relaxation of the height limits could free up airspace near airports and also enable the intensification of land [development] near the buffer zones and along the flight paths of the airports,” he added.

Residential property

Sing also expects more stable property prices in the long term.

Cheong explained that residential properties near airports, particularly older apartment blocks, could become more attractive. “It could encourage owners to consider a collective sale to a developer, who could then redevelop the site for higher or more intensive use.”

He expects a bigger impact around Changi and the Paya Lebar/ Macpherson area, where there are more private apartments, unlike in Seletar, which is largely made up of low-rise landed government properties and public housing.

Commercial properties may be built nine storeys higher

Wong Xian Yang

Alan Cheong

Sing Tien Foo

Shaping the Future of Community Living

As one of the Middle East’s largest community management organisations, Dubai Holding Community Management oversees Dubai’s much-loved districts and lifestyle destinations; from luxury waterfronts to contemporary neighbourhoods.

Serving over a million residents, we combine global best practices, smart technology and a people-first approach to create vibrant communities where life thrives.

BUILDING TOMORROW TOGETHER

We craft moments into exceptional living.

SCAN TO KNOW MORE

Hong Kong tax cuts lift sales but oversupply holds prices

They could boost sentiment and reinforce signs of a stabilising property market.

HONG KONG

Lower stamp taxes on Hong Kong’s residential properties are unlikely to drive prices up despite a surge in transactions under $514,266 (HK$4m) because of a persistent oversupply, analysts said.

With about 108,000 private homes forecast to come to the market in the next three to four years, developers are under pressure to keep rather than raise prices, Elliott Hau, head of financing valuation at Colliers Hong Kong, told Real Estate Asia

“The overall impact on property prices may be limited due to the ongoing oversupply issue,” he said in an exclusive interview.

The government cut the ad valorem duty for flats worth $514,266 to $1.28m (HK$100m) from $7,713 (HK$60,00) on 26 February, spurring a 33% increase in transactions in March from a month earlier, Hau said.

“But the increase is not solely due to the ad valorem duty adjustment,” he said. A significant factor is the large property stock developers are holding, which is driving them to cut prices and use various marketing tools to boost sales, he added.

Gradual impact

In March, the government dismissed claims of a residential oversupply, citing a private housing vacancy rate of 4.5% at end-2024 — which is in line with the 20-year average — along with rising rental prices.

Lucia Leung, director of research and consultancy for Greater China at Knight Frank, noted that the impact of of lower taxes on house prices would be gradual, adding that increased real-estate activity could help stabilise the market.

“I don’t think the adjusted ad valorem duty thresholds will have any direct and immediate impact on property prices in Hong Kong,” she told Real Estate Asia. Both analysts said lower taxes could make housing more affordable for entry-level buyers but might not trigger a dominant market shift.

"This adjustment may increase demand in this segment, making it easier for potential homeowners to enter the market," Hau said.

According to Hau, overall demand continues to favour more expensive units. In March, properties priced above $514,266 accounted for 71.4% of transactions, up from 63.9% a month earlier.

“This suggests that the market may not react significantly to the policy, indicating that flats below $514,266 are not dominating the market as anticipated,” he told the magazine.

Outlook

Developers have started lowering prices to take advantage of the tax cuts, particularly for properties under $514,266, Hau said. There were 440 first-hand property transactions below $514,266 in March, he pointed out.

The top-selling project was Vanke Le Mont in Tai Po with 182 units sold, followed by Sun Hung Kai’s YOHO West Parkside in Tin Shui Wai with 75 transactions, and The HAVA in Yuen Long by Kerry

Properties with 68 units.

Leung also expects more developers to lower the prices of units that they originally targeted to price higher than $514,266 or below to stimulate sales.

Meanwhile, the Colliers head forecasts continued growth in transaction volumes over the next six to 12 months.

He noted that 12,193 housing units were sold in the first quarter, 24.1% more than a year earlier.

In March alone, deals rose 68% to 5,367 from a month earlier, he pointed out to the magazine.

Leung predicts transactions for flats below $514,266 to rise 5% to 10% in the next six to 12 months.

“The revised ad valorem duty is likely to boost overall transaction volumes, not just for properties under $514,266, but across the entire market,” Hau told Real Estate Asia.

But prices would remain low in the short term due to the anticipated large supply of homes coming to the market, he added.

According to Leung, the tax cuts would support the broader property market by boosting sentiment and reinforcing signs that the market is showing stability.

“If interest rates continue to decline, coupled with developers actively launching new projects, it will further unleash market momentum, especially for lowpriced properties,” she added.

12,193 housing units were sold in the first quarter

Elliott Hau

Lucia Leung

Realion builds a one-stop proptech app

The app aims to unify banking, renovation, and property management services.

Realion Group is investing heavily in software and digital platforms to unify property technology services in the Asia-Pacific region.

“This is in response to the challenge of the abundance of applications and technologies in real estate that lack a singular, comprehensive, and client-focused approach in Asia-Pacific,” CEO Desmond Sim told Real Estate Asia

The company, created from the merger of Singaporebased Edmund Tie & Co. and OrangeTee & Tie, seeks to create a platform that could anticipate buyer needs and integrate services such as banking, renovation, and property management, he said.

The Asia-Pacific property tech market is expected to grow more than 17% annually to $51.8b by 2035, spurred by rapid urbanisation and increasing demand for innovative real estate solutions, according to India-based research firm Market Research Future.

Satoshi Murakami, director and head of Asia Pacific at MetaProp, said that currently, the biggest untapped opportunity in proptech is not planning but residential property management, during an interview at the Global Property Expo in Singapore.

“Rent collection, inspection and repair tracking and tenant communications—nowadays, still in this era, people like using a phone or a spreadsheet or emails,” Murakami added. “But if someone built a one-stop platform that anyone in Asia can use, they'll be huge.”

Sim said the platform would be powered by strong data capabilities, letting clients access a broad range of services in one channel. “Our future app would not merely be for property transactions," he told the magazine.

Corporate strategy

The company’s strategy builds on the strengths of its two founding firms. Edmund Tie operated mainly in the business-to-business space, providing advisory services to institutions, corporations, and people, whilst Orange Tee focused on business-to-customer transactions through its extensive agency network.

Realion is expanding regionally to Malaysia, Thailand, and Japan, and through partnerships, its reach extends to Europe, he said. Globally, the market is expected to grow 11.8% annually to $103.57b by 2033 from 2023, according to India-based Spherical Insights & Consulting.

The company is in an alignment and identification phase, assessing the combined talent pool and harmonising best practices from both entities. Sim said this process includes adopting effective management frameworks and engaging staff and stakeholders in shaping the group’s vision.

By integrating technology with a consolidated service

model, Realion aims to position itself as a one-stop solution for property-related needs, tapping into the region’s fast-growing proptech potential, he added.

Analysts noted that the rapid growth of Asian cities is driving increased investment in firms developing technology and solutions for smart homes.

The Asia-Pacific region now has more than half of the world's megacities and will be responsible for about 60% of all global construction by 2030, according to Ariel Shtarkman of the Urban Land Institute.

However, she noted that a major challenge for these companies is persuading property owners to invest, as they are often hesitant to spend money on anything that doesn't offer an immediate and clear return.

Proving local relevance is another challenge. “A solution that works in one Asian market, like Singapore, is unlikely to be successful in others, such as Japan, China, or India, due to significant differences between their real estate sectors,” Shtarkman told the magazine.

Murakami pointed out how automation is streamlining workflows and freeing up developers’ time. “That creates extra time to plan and find another good land, something like that,” he added. “I see a lot of artificial intelligence (AI)-powered solutions which save a lot of processes. So I think we will see more and more solutions like that.”

Whilst the management side remains underdeveloped, Murakami said there has been rapid progress in real estate planning, particularly through AI-powered tools aimed at offsetting labour shortages.

Desmond Sim, Realion Group CEO APAC

Satoshi Murakami

Ariel Shtarkman

Are global hotel brands shut out of Japan?

Traditional inns continue to dominate the accommodation sector.

Global hotel brands continue to play a limited role in Japan’s hospitality landscape, even if the government expects another record year in foreign tourist arrivals.

Noboru Takimoto, director at CBRE Hotels Japan, explained that the gap stems from the historical dominance of small, traditional inns such as ryokan and hatago, as well as Japan’s long-standing preference for the “owner-operator” model— where the hotel owner also manages the property's operations.

“Crucially, many hotels in Japan have been owned and managed by the same entity,” he told Real Estate Asia in an interview.

This model contrasts with the approach of many foreign operators. Global brands often prefer a management contract model, a structure that lets them operate and manage properties they do not own.

Last year, Japan had 37 million tourist arrivals, surpassing its previous peak of 32 million in 2019 before the COVID-19 pandemic. Its hotel market is projected to grow 1.29%

There will be increased opportunities for operators who have not yet entered the Japanese market to acquire existing hotels through mergers

annually to $26.85b by 2033 from 2024, according to Dublin-based Dublin-based Research and Markets.

“Key locations for the hotel market include major cities with high international tourist demand, such as Tokyo, Osaka, Kyoto, Fukuoka, and Sapporo,” Takimoto told the magazine.

Slowdown

Despite this demand, Tokyo’s hotel development pipeline is slowing. The capital’s annual new hotel supply, which grew almost 6% yearly over the past decade, is expected to drop to just 0.4% annually over the next five years.

“Although there are slight differences depending on the city, the lack of new supply is a nationwide trend,” Takimoto said, citing rising land prices, higher construction costs, and labour shortages as key constraints.

He sees this slowdown as an opening for international hotel groups and expects increased rebranding in the coming years.

Despite the absence of new

international brand hotel openings in the first quarter of 2025, according to JLL, international brands remain keen on Tokyo, with a wave of luxury hotels, including Fairmont, JW Marriott, and 1 Hotel, slated to debut in the latter half of the year.

“We also expect that there will be increased opportunities for owneroperators who have not yet entered the Japanese market to acquire existing hotels or platforms through mergers and acquisitions,” he added.

Takimoto also cited a shift in corporate behaviour that could benefit foreign investors of hotel brands.

Sustained international interest Japanese companies are increasingly selling off assets, driven by factors such as pressure from activist investors and a desire to maximise corporate value, he pointed out.

“This trend presents a significant opportunity for well-capitalised foreign investors and major domestic developers looking to acquire these available assets,” the CBRE Hotels director added.

A Knight Frank report revealed that Japan's real estate market maintains its appeal to international capital, with foreign investors acquiring approximately $2.4b in assets.

Despite transaction volumes declining by 14.8% year-on-year, sustained international interest reflected the market's strong fundamentals, as investment activity was largely concentrated in the living and industrial sectors.

Moreover, Japan ranked amongst the top five global cross-border capital destinations for standing assets, and its share of activity remains above the five-year average, according to a report published by Colliers.

“In addition to luxury brands that attract the wealthy class, social and lifestyle hotels that are rebranded from existing hotels will be a notable asset type,” Takimoto said.

He also believes that assets that combine rental apartments and hotels, primarily targeting digital nomads, will also become more widespread.

Japan's hotel market is set to grow to $26.5b by 2033

Noboru Takimoto

Grand Villas Available View Space for Life

Ayala Land to double hotel rooms with $500m expansion

The capital expenditure will cover Makati, Cebu, and Clark.

Ayala Land, Inc. (ALI) has allotted more than $500m to fund its hotel expansion as it seeks to double its 4,000-room inventory by 2030.

The publicly listed Philippine property giant announced the plan as it relaunched its hotel and resort arm Ayala Land Hospitality (ALH), which manages brands such as Seda Hotels, El Nido Resorts, as well as Huni Lio.

“We feel that just Seda and El Nido Resorts alone won't cover all of the opportunities in the tourism market today, so part of what we're launching are new brands and products that will serve the markets that we feel are underserved today,” Mariana Zobel de Ayala, senior vice president for leasing and hospitality at Ayala Land, told Real Estate Asia in an exclusive interview on the sidelines of the launch in March.

The $500m investment will be used for both existing and new brands and will be financed by debt and equity in the next five years.

Ayala Land would focus on cities where it already has a presence, including Makati, and areas with direct international flights such as Clark and Cebu, Mariana told a news briefing in Manila.

She noted that many of their

new projects appeal to the leisure traveller or the longer-staying, higherspending foreign tourists.

Expansion plans

To support the expansion, George Aquino, president and chief executive officer of ALH, said the company would align its projects with major government infrastructure developments to ensure accessibility and long-term viability.

Another major factor in ALH’s expansion strategy is its people.

“Any developer can build a beautiful hotel, but it comes down to the people who are serving our guests, the people who are leading our teams, and that is where our main focus is going to be, making sure we have the talent,” he told Real Estate Asia during the launch.

Paloma Urquijo Zobel de Ayala, creative officer at Ayala Land Hospitality, told the magazine that what differentiates the company’s developments is “how they synthesise what it truly means to be Filipino.”

The company tapped local artisans and craftsmen to upgrade Lagen Island Resort in El Nido, Palawan province. The resort is set to reopen in the third quarter after renovation started in June 2024.

The property will feature an arrival hall inspired by a traditional fishing boat, along with a spa and fitness centre adorned with Filipino wood carvings and patterns.

Mariana said they expect a significant jump in ALH revenue through increased room rates after the renovation. For Lagen and Seda alone, fees are expected to increase by about 20% and 80%, respectively.

ALH would look at opportunities in its parent company’s portfolio, including club management and residential property development, according to Aquino.

Hospitality boom

Manila’s hotel inventory held steady in the second quarter, but approximately 3,000 new rooms are anticipated to be completed in the second half of 2025, significantly expanding the Metro’s accommodation capacity, according to a report by JLL.

“International hospitality brands continued to show strong interest in the Metro Manila market, with multiple completions scheduled for the second half of 2025, reflecting sustained confidence in the Philippine tourism sector’s growth potential,” the report continued.

The Metro Manila hotel market continues to demonstrate strong momentum with its revenue per available room (RevPAR) showing solid year-on-year (YoY) growth.

This performance indicates robust demand and growing traveller confidence in the Philippine capital’s hospitality offerings.

Hotel occupancy reached 78.3% in the second quarter, a 143.4 bps YoY growth. Luxury and upscale segments maintained their strong performance. Average room rates increased by 0.1% YoY, from PHP 7,916 in the second quarter of 2024 to PHP 7,917 in the second quarter of 2025, the JLL report stated.

In addition, foreign hotel brands are expanding aggressively, partnering with local developers in key and emerging markets. Notable ventures include Dusit, Wyndham, Accor, Marriott and The Ascott Group. The land lease extension and REIT integration are expected to further stimulate investment, especially in tourism-driven townships and convention facilities, according to a report released by Colliers.

ALI seeks to double its 4,000-room inventory by 2030 (Photo from ALI)

PHILIPPINES

George Aquino

Mariana Zobel de Ayala

Investors pivot towards logistics, data hubs

Amidst weak market recovery, institutional investors are shifting to long-term focus.

Institutional investors in Asia

Pacific are making a long-term pivot towards logistics assets and data centres, as traditional real estate segments like retail and office continue to face increasing pressure from high interest rates and uncertain market conditions.

This structural shift has been underway for more than a decade but is now becoming more pronounced, according to the Emerging Trends in Real Estate Global Outlook 2025, jointly published by PwC and the Urban Land Institute (ULI).

“Logistics is now a very important part of institutional real estate investors' real estate portfolios,” according to Mark Cooper, senior director of Thought Leadership at ULI Asia Pacific.

Muted capital market

The reallocation comes at a time when overall capital market activity remains muted, despite a 13% quarter-on-quarter increase in real estate investment volumes in the fourth quarter of the year.

Much of that uptick was due to a single large deal, whilst the broader market continues to suffer from low yields and elevated borrowing costs.

The demand for logistics stems from persistent structural changes in consumer behaviour, particularly the rise of e-commerce, which has boosted warehouse demand across the Asia-Pacific region.

In Indonesia, new logistics supply in Jakarta was set to come online with a total annual addition of almost 250,000 sqm in 2025, with projections reaching 3.2 million sqm of total cumulative supply whilst maintaining single-digit vacancy rates of approximately 9%, according to a report by JLL.

Several barriers needed addressing to enhance global competitiveness and sustain foreign direct investment, including permitting processes and supporting facilities within industrial estates, the report added.

“Data centres are slightly different. There is some disagreement

about whether it’s real estate or infrastructure, but regardless of which bucket it’s held in, this sector is seen as a fundamental infrastructure support for modern digital business,” Cooper noted. “Therefore, I think the interest is going to be long term.”

Long-term themes

Stuart Porter, APAC Real Estate Leader at PwC, echoed Cooper's sentiments. “Let’s say there’s 200 or so data centres in Japan, and there’s 5,000 in the US, so there’s much longterm opportunity, and you see that in the rest of Asia as well," he added.

However, he cautioned that challenges remain. “If you talk to the engineers and the real specialists, you’ve got group capacity issues in places like Japan as well. So the growth may not be exponential to the extent of catching up to places like the US, but it’s certainly there and embedded," he said.

Despite near-term volatility and ongoing macroeconomic headwinds,

investors now seem more focused on long-term structural themes instead of reacting to short-term cycles.

“Yes, Deep Seek and others have a little bit of a shock to the thinking, but I don’t think that changes the trajectory,” Porter added. “It probably just makes the analysis a little bit more refined and thoughtful, as opposed to just piling in.”

Despite an expected doubling of Asia Pacific data centre supply in the next three years, there will still be a shortage of 15 to 25 gigawatts by 2028, due to insufficient power supply and a lack of artificial intelligence (AI)-ready data centres, according to a CBRE report.

Whilst the surge in artificial intelligence adoption and the increasing demand for cloud services are notably boosting data centre requirements across the AsiaPacific region, not all existing and upcoming data centres in the region are equipped to handle artificial intelligence workloads.

Data centres are seen as a fundamental infrastructure for modern business

APAC

Mark Cooper

Stuart Porter

ARCHITECTURE LUMINARIES

Singapore's 20 most notable architecture professionals under 40

In search of the best architecture professionals under 40, Real Estate Asia reached out to more than 25 architecture firms in the city-state.

After rigorously reviewing submissions from the firms, eight women and 12 men made it to the final cut.

Agents on this year’s list come from Aedas Architects, CPG Consultants, DP Architects, HYLA Architects, JGP Architecture (S), ONG&ONG, RSP Architects Planners & Engineers, SAA Architects, and Swan & Maclaren Architects. Leading the pack is DP Architects, with six representatives. The youngest on the list is from ONG&ONG.

This year’s honourees designed and managed major projects such as Woodlands North Station and JTC Bulim Square, as well as properties including Paya Lebar Green, The Golden Mile, Marina One, Hotel Faber Park, Minion Land in Universal Studios Singapore, and Hyll on Holland. One of the honourees is involved in the upcoming Changi Airport Terminal 5 project.

Here are this year’s honourees, arranged from youngest to oldest.

Wenwei advocates for a design approach that balances innovation, sustainability and cultural sensitivity. His expertise includes a mix of new-build and Additions & Alterations (A&A) work for hospitality, retail and institutional projects in Singapore and abroad. In Singapore, he played a key role in the completion of two major hospitality landmarks: the Pullman Singapore Hill Street and Pullman Singapore Orchard. His international portfolio includes retail planning for Empire City in Vietnam and the A&A for Grand Indonesia Mall in Indonesia.

Ryan has a diverse portfolio across public and private sectors. His work focuses on creating practical, sustainable, and community-friendly designs for institutional, commercial, and educational facilities. His most meaningful completed project is the Pathlight School (Tampines), a campus for special needs children that combines accessibility with inclusivity and features a publicly accessible landscaped forecourt. Ryan's first completed project was the Jurong Town Hall Bus Interchange, which he designed with a focus on accessibility, efficiency, and user comfort.

Timothy uses technology to enhance his projects' creativity and productivity. With his expertise in BIM and understanding of Singapore's complex regulatory frameworks, he offers design solutions at every stage and scale of any project. Having worked with distinguished clients, including Lendlease, Certis, Great Eastern and the Singapore Grand Prix, his key projects include Paya Lebar Green, and his work on the F1 Singapore Grand Prix 2023 for Paddock Club Atrium (PCA) and the F1 Singapore Grand Prix 2024/2025 for A&A works to the PCA.

Yih Xi has a Master in Architecture (specialisation in Urban Design) from the National University of Singapore. With six years of experience, her portfolio spans both public and private sectors. As Project Architect for St Andrew’s Community Hospital (Bedok), she led design coordination and on-site implementation. She also joined The Landmark, a highrise condominium, during its completion stage and is currently developing an immersive cinema experience for Shaw Theatres at JEM.

Fadzli is a people focused professional who turns bold ideas into meaningful realities through collaboration and clear communication. With a hands-on approach from design to execution, he blends ambition with technical precision to deliver standout projects. His portfolio features Mandai's Indoor Attraction Buildings, Exploria and Curiosity Cove, and the upcoming Changi Airport Terminal 5. A Green Mark Accredited Professional, Fadzli drives sustainability and industry innovation while holding leadership positions in community organisations.

1 Ryan Teo Jun Yan 30, ONG&ONG Pte Ltd

2 Lim Yih Xi 30, Swan & Maclaren Architects Pte Ltd

3 Wu Wenwei 30, DP Architects

4 Timothy Ou 31, DP Architects

5 Muhammad Fadzli Bin Jani, 32, RSP Architects Planners & Engineers

Pathlight School (Tampines)

Changi Airport Terminal 5 Artist’s Impression (Photo credit: Changi Airport Group)

St Andrew’s Community Hospital (Bedok)

Pullman Singapore Hill Street (Photography Credits: Bai Jiwen, Courtesy of DP Architects)

Project: Paya Lebar Green (Photography Credits: David Yeow, Courtesy of DP Architects)

ARCHITECTURE LUMINARIES

A registered architect with eight years of experience, Stephanie has demonstrated exceptional leadership and dedication across various project types. She has worked as a Design Architect and Project Architect, excelling in both roles. She is currently involved in the infrastructure projects within the Bulim precinct. Her portfolio includes the Woodlands North Station – part of the Rapid Transit Link – and JTC Bulim Square, a 1.7 million sq ft industrial mixeduse development. She also contributed to Northpoint City and managed the A&A works for Choa Chu Kang Sports Centre.

Anissa is a Registered Architect and Green Mark Accredited Professional with over eight years of experience. Her portfolio spans typologies including the Jurong Lake District Masterplan, JTC Bulim Square, and Tanjong Katong Nursing Home. She has led projects from concept to completion, such as the Asset Enhancement Initiative for 108 Robinson Road, Urban Treasures, and is currently Project Architect for The LakeGarden Residences – one of the first private condominiums to achieve Green Mark Platinum SLE. She also contributes to SAA’s design stewardship.

David believes that learning different design languages and cultures unlocks diverse perspectives, which the registered architect integrates into his work. Embracing complexity, he views architectural solutions as shaped by contextual factors rather than a linear process. His completed projects include The Verandah Residences, Affinity at Serangoon, Midwood, Mayfair Modern, Mayfair Gardens and Boulevard 88. He also worked on the A&A works for Duo Andaz and The Singapore Edition Hotel, and was involved in Aurea, the residential component of the ongoing rejuvenation of The Golden Mile.

A graduate of the National University of Singapore with a Master of Architecture degree, Qiao Yan is a registered Architect with eight years of experience. As a Senior Principal Architect at CPG Consultants, her diverse portfolio spans educational, residential, and commercial projects, with a growing focus on educational institutions. She is currently shaping the future of learning spaces through her involvement in the Singapore American School Campus Upgrading Project and the Anderson Serangoon Junior College redevelopment, creating environments that will nurture future generations.

Wanxuan’s work is defined by her strong commitment to adaptive reuse and community-focused design. She was instrumental in the design and project management of the ongoing rejuvenation of The Golden Mile, where she helped shape a network of internal urban streets that connect to a vibrant streetscape, thus breathing new life into the conserved building. Beyond design, she oversees site management to ensure proper protection of conserved elements during construction. At Plantation Village, a public housing project, she helped create interesting communal spaces.

With a strong background in large-scale master planning, Yili is adept at managing complex projects from conceptualisation to completion, focusing on hotel, mixed-use and commercial typologies. Her extensive skills, honed through feasibility studies and rigorous design competitions, enable her to lead and coordinate multi-disciplinary teams effectively. Her key projects include Hotel Faber Park and Lusail Commercial Boulevard, with the latter showcasing her expertise in master planning and project coordination. Yili is also actively involved in the firm's code arm to ensure a high-quality standard of work delivered.

6 Stephanie Loh Qi Jia 32, SAA Architects Pte Ltd

7 David Ardiansyah 32, DP Architects

8 Khor Wanxuan 32, DP Architects

9 Anissa Tan Hui Ping 33, SAA Architects Pte Ltd

10 Lee Qiao Yan 33, CPG Consultants Pte Ltd

11 Chen Yili 34, DP Architects

Bulim Infrastructure Phase 2 - Artist Impression (Subject to change)

The LakeGarden Residences - Artist Impression Singapore American School Campus

Hotel Faber Park (Photography Credits: Finbarr Fallon, Courtesy of DP Architects)

Mayfair Gardens (Photography Credits: Roy Chuang, Courtesy of Oxley Holdings Limited)

Project: The Golden Mile (Image Credits: Perennial Holdings and Far East Organisation)

ARCHITECTURE LUMINARIES

Ethan combines analytical precision with a human-centric approach. He has six years of experience across various sectors. His completed projects include Hotel Mi Rochor, St. Regis Residences, and the Remodelling of Wards 10 and 11 at Alexandra Hospital. He also contributed to the transport infrastructure design for Loyang MRT Station and workplace interiors for Capital Tower's Caphub 2.0. Beyond his professional work, he led the rebuilding of Ah Ma Drink Stall on Pulau Ubin and was a volunteer lead for a planned heritage museum in Queenstown.

Yoga is a Senior Principal Architect at CPG Consultants, with experience in large-scale public sector projects, including healthcare and mixed-use developments. Guided by a human-centric approach, he creates architectural solutions that balance functionality, inclusivity, and community well-being. A certified Universal Design Assessor, Yoga is also a part of the Built Environment Young Leaders programme. He is currently working on the Eastern General Hospital (EGH) Campus project. Looking ahead, he aims to continue championing inclusive and sustainable architecture.

Fei is an architect with over a decade of experience and holds degrees in architecture and urban design. Her most notable completed project is Universal Studios Singapore expansion - Minion Land, where she played a key role from design development to execution. Fei has also contributed to a range of other projects, including Shaw Plaza and Tampines East Community Club, across various retail, recreational, and residential typologies. Her versatile skills and broad experience enable her to deliver functional, culturally sensitive designs that are meaningful to the communities they serve.

Director of HYLA

Gomes continues the firm’s 30-year body of work in landed housing, defined by inventive form and material. Over the past decade, he has built a portfolio of more than 20 high-end houses, including Cloister House and Heaven & Earth House—each offering a distinct response to tropical living. A top graduate of the University of Tasmania and Gold Medal recipient from the National University of Singapore, his work is regularly featured in print and digital media, contributing to Singapore’s architectural landscape.

Frederick’s work spans multiple scales and typologies, from master planning to integrated hubs and small-scale developments. Key projects include Bukit Canberra, the NUS Land Optimisation Master Plan, and a Good Class Bungalow in Central Singapore. Frederick also holds a master’s degree in Sustainability Management from Columbia University, which complements his practice by deepening his understanding of how climate policy and environmental science shape strategies for the built environment. He is currently working on the restoration of a national monument whilst actively advancing DP’s sustainability efforts.

Rovi has nearly a decade of experience across various building types, including healthcare, institutional, and mixed-use projects in Singapore and Vietnam. His expertise spans design, documentation, and contract administration. His completed projects include the design and delivery of the International French School Singapore expansion, as well as leading various highend asset enhancement developments to the Marina Bay Sands Integrated Resort. He is also a design team member for regional projects such as Celesta Heights (Residential) in Vietnam.

As

Architects, Nicholas

12 Ethan Chung Er Pei 34, RSP Architects Planners & Engineers

13 Fei Bo 35, RSP Architects Planners & Engineers

14 Frederick Low 35, DP Architects

15 Yoga Utomo 36, CPG Consultants Pte Ltd

16 Nicholas Shane Oen Gomes, 36, HYLA Architects Pte Ltd

17 Rovi Lau 37, Aedas

Hotel Mi Rocher (Photo credit: Madeni Bin Jais)

Eastern General Hospital (EGH)

Cloister House

International French School Expansion

Minion Land (Photo credit: Madeni Bin Jais)

Bukit Canberra (Photography Credits: Jerome Teo, Courtesy of DP Architects)

ARCHITECTURE LUMINARIES

Hyo Sun is a Singapore-registered architect with over 13 years of experience. In her role at SAA Architects, she is the regulatory lead for the Changi Airport Terminal 5AB project, a key strategic infrastructure development. Throughout her career, she has contributed to high-impact projects

Wencan has a 12-year experience in architecture and holds a Master of Architecture degree from the University of Michigan. His strengths lie in bridging client vision with pragmatic execution and a human-centric approach that prioritizes the user's experience. He has worked on

Tony is a Senior Associate & Deputy Studio Master at JGP, with over 13 years of experience in Singapore & Hong Kong. He is an integral member of the JGP Healthcare Team. He has been actively involved in healthcare projects, including MOH Nursing Homes in Aljunied Road, Punggol Field, Tampines Street 96, Jelapang Road & Dover Road, as well as residential projects & design competitions. His diverse background includes past works on large-scale projects, including Temasek Polytechnic Campus Development & SIT, MRT Circle Line Stage 6 & Kansai International Airport A&A.

18 Lee Hyo Sun 37, SAA Architects Pte Ltd

19 Xue Wencan 38, Aedas

20 Tony Hartono Wijaya Zhang, 38, JGP Architecture (S) Pte Ltd

Changi Airport Terminal 5 - Photo

Credit: Changi Airport Group

Hyll on Holland

MOH Nursing Home at Aljunied Road

REAL ESTATE LUMINARIES: SINGAPORE

Most notable real estate agents under 40

In search of the most notable real estate agents under 40, Real Estate Asia reached out to more than 35 property firms in the city-state.

After rigorously reviewing submissions from the firms, 10 women and 10 men made it to the final cut.

Agents on this year’s list come from Cushman & Wakefield, Huttons Group, JLL, MindLink Groups Pte Ltd, OrangeTee, and Savills. Leading the pack are Huttons Group and OrangeTee, with six representatives each. The youngest on the list is from JLL.

Realtors in the residential market took the lead, taking nine spots.

This year’s honourees are million and billion sellers and have handled big clients such as Maritime Port Authority, National Environment Agency, Ho Bee Land, CapitaLand, JTC, P&G, and LVMH.

Notable deals by this year’s honourees include the sale of an office floor at Solitaire on Cecil, which achieved the highest per square foot price ever recorded for a full floor in the Central Business District.

Here are this year’s honourees, arranged from youngest to oldest.

Chloe has been on JLL's Office Leasing Team for a year, after spending two years in Project and Development Services. She has quickly established herself as a valuable professional, building strong client relationships and contributing to the team's success. As both a tenant and landlord representative, she has gained a comprehensive understanding of the market. Chloe's notable transactions include closing 25 deals totaling around $605,693 with deals in key buildings like IOI Central Boulevard Towers and Millenia Tower.

Esther specialises in Singapore's commercial office leasing market, bringing a 360-degree perspective from her work in both landlord and occupier representation. She has been the top-earning non-director-level broker for two years in a row. Her notable landlord representations include prominent buildings such as One George Street, Keppel South Central, and Hong Leong Building. On the occupier side, she has represented major corporations across diverse sectors, including AIG, ANT Financial, AET Tankers, and IPG. Esther delivers tailored real estate solutions by strategically understanding clients' business objectives.

Jian Hao is a direct and results-driven agent known for his straightforward approach to difficult listings. With a year of experience at his current firm, he believes every property is sellable. His recent transactions highlight this tenacity, including the sale of a mid-floor unit at Penrose that faced the PIE expressway, amounting to $1.5m, which he sold above the highest previously transacted price for that stack. He has also successfully moved other "difficult" units, including a property in Jurong West amounting to $601,000, earning a reputation for delivering results in the toughest deals.

Felicia has over seven years of real estate experience, specialising in tenant and landlord representation. She has successfully managed the full transaction cycle for numerous high-profile projects. Clocking 150,000 square feet in annual transactions, her track record includes major clients like Hewlett Packard Enterprise and Horiba. She has also secured exclusive mandates with CapitaLand and JTC, consistently driving higher occupancy rates. As a trusted adviser, Felicia provides market research and consultancy reports.

5

Sophia has been in real estate since 2017 and, in just eight years, has risen to lead a dynamic team while consistently ranking as a top achiever. Known for her sharp market acumen and strategic thinking, she has achieved record prices in competitive segments, swiftly secured tenants for challenging commercial spaces, and guided clients toward cost-saving financing solutions. Notable deals include selling her first strata shop at 2 Fowlie Road within a month above expectation and assisting an overseas client to purchase Park Place Residence fully online. With nearly 200 transactions, Sophia continues to earn lasting client trust.

1 Gwee Zi Qian Chloe 28, JLL

2 Felicia Tan 30, Cushman & Wakefield

3 Esther Ho 30, JLL

4 Fong Jian Hao 31, MindLink Groups Pte Ltd

Sophia Ong 31, OrangeTee

REAL ESTATE LUMINARIES: SINGAPORE

Zen is a results-driven real estate leader known for strategic thinking and a deep commitment to client success. With a strong track record in both residential and investment sales, he has achieved above-market prices for sellers and secured premium properties for buyers. Notable achievements include helping clients acquire two units at Jalan Terang Bulan Terrace for $4.4m, negotiated $232,959 below asking against competition, and securing a record-price rental at 28 Imperial Residences within a month through effective staging. With ethical practices, transparent communication, and sharp market analytics, Zen has earned a reputation as a trusted adviser in Singapore’s real estate market.

Qing Jie joined the industry in 2017, bringing his economics and finance background with a genuine passion for helping his clients. A consistent top achiever since 2020, he led as Project IC for the remarkable launch of Lentor Central Residence. His highlights in 2025 include achieving record price at Sims Urban Oasis within a month and realising close to $776,530 profit for a family that moved to Cabana from their Punggol HDB several years ago. Valued for his honesty and client-first approach, Qing Jie makes complex transactions seamless and rewarding. He has also consistently achieved premium sales prices for his clients, often well above market expectations.

Since entering real estate in 2020, Sam has quickly emerged as a high-performing leader with a proven track record in both residential and investment deals. Known for reliability and client trust, he now leads a dynamic team with fresh perspectives and a collaborative spirit. His portfolio showcases standout achievements, including securing a record-high $1.44m sale for a 3-bedroom unit at Sunny Spring Condo for Mdm Rosni and negotiating a rare 2-bedroom patio unit at Miltonia Residence below market value for Mr Lim. With sharp marketing strategies and market analysis, Sam consistently delivers optimal outcomes for first-time buyers, investors, and upgraders.