Modular attack craft set for sea

It can integrate a wide array of mission payloads. Singapore

Singapore-based shipbuilder Strategic Marine has signed a deal with US-based Eureka Naval Craft to build the first-ever Aircat Bengal MC Modular Attack Surface Craft.

In a statement, Strategic Marine said the memorandum of understanding “will give a significant boost to the global maritime sector and brings together Eureka’s pioneering modular naval Surface Effect Ship (SES) design and Strategic Marine’s world-class shipbuilding expertise.”

The 36m modular platform Aircat Bengal MC is based on the proven Aircat Crewliner 35 SES, originally designed by ESNA AS in collaboration with Aircat Vessels and further developed by Eureka.

Amongst its features, the vessel is designed to integrate and swap a wide array of mission modules and

payloads, including advanced sensors, unmanned systems, weapons, communications suites, and specialised equipment for both defence and civilian operations.

Meanwhile, the Aircat Bengal MC’s large aft deck, substantial ~40-ton payload capacity, and high speed make it a valuable asset for offshore oil and gas exploration and production logistics.

“The expansive aft deck is ideal for transporting equipment, supplies, and personnel to and from offshore platforms, whilst the vessel’s stability and speed ensure safe and efficient operations even in challenging sea conditions,” Strategic Marine said.

The Aircat Bengal MC also enables the fast movement of time-critical items offshore for urgent maintenance, repairs, or supply needs, as well as fast and safe mode of personnel transfer offshore.

Hanwha Ocean to build icebreaker vessel

Shipbuilding and marine engineering company

Hanwha Ocean Co., Ltd. is set to build the nextgeneration icebreaking research vessel for the polar regions in South Korea.

The vessel, to be completed in December 2029, will have a gross tonnage of 16,560 tonnes. It will be equipped with a liquid natural gas (LNG) dual-fuel electric propulsion system.

According to the Korea Polar Research Institute (KOPRI), an icebreaker is a ship that is specially designed to navigate through ice-covered waters, and also to provide a safe waterway for other vessels, which means it can sail to places where normal ships cannot, including the poles.

“Some icebreakers may not have icebreaking capabilities, but they are ice-strengthened vessels with a reinforced outer hull, making it possible to navigate through Polar Regions that are full of scattered icebergs and drift ice,” KOPRI added.

Hanwha Ocean said its Polar Class (PC) 3 vessel will be capable of breaking through 1.5-metre-thick ice and withstand temperatures as low as -45 degrees Celsius.

The company was selected as the project’s preferred bidder, led by South Korea’s Ministry of Oceans and Fisheries.

Hanwha Ocean started building icebreakers in 2008, when it began developing polar vessels in anticipation of the potential for Arctic

shipping routes.

Since then, the company has built the most icebreaking LNG carriers in the world, including a total of 21 icebreaking LNG carriers, with 15 being built in 2014 and six in 2020.

“Our next-generation icebreaking research vessel aims to be a ‘completely new icebreaking research platform,’” said an official from Hanwha Ocean. “This ship will bring to focus the core competencies of Hanwha Ocean as a top-tier global shipyard.”

For optimal research results under extreme conditions, the ship’s facilities, such as cabins, reception rooms, and dining rooms, have been designed to provide the same level of

The vessel can withstand temperatures as low as -45 degrees Celsius (Photo from Hanhwa Ocean)

The Polar Class 3 vessel can break through 1.5-metre-thick ice.

South Korea

The Aircat Bengal MC Modular Attack Surface Craft (Photo from Strategic Marine)

EDITORIAL MANAGER Tessa Distor

EDITOR Eleennae Ayson

JOURNALISTS Vincent Mariel Galang Ibnu Prabowo

EDITORIAL RESEARCHER Angelica Rodulfo

GRAPHIC ARTIST Simon Engracial

Banner Story...frompage1

comfort and convenience as a luxury cruise ship.

Hanwha Ocean said the vessel will be deployed for polar missions and research at the Polar Research Institute, which is an affiliate of the Korea Institute of Ocean Science and Technology.

The ship’s completion in 2029 is expected to help expand South Korea’s polar research mission.

According to South Korea’s Ministry of Oceans and Fisheries, the icebreaker vessel is expected to commence navigation throughout the entire Arctic Ocean by the summer of 2030 when it is deployed to the North Pole, noting that it is “playing a major role in the era of the Northern Sea Route such as securing the data necessary for developing the Northern Sea Route.”

Our vessel aims to be a completely new icebreaking research platform

Ocean will also help distribute the missions currently concentrated on the Araon, South Korea’s first icebreaker research ship.

“Furthermore, the issue of overburdened missions—such as polar research and base resupply—being concentrated on the existing Araon icebreaker is expected to be resolved, thereby extending the actual research period from the current 40 days to approximately three to four times longer,” the ministry said.

Construction Co. Ltd., which is now known as HJ Shipbuilding & Construction Co. Ltd., in 2009.

The 6,950-ton Araon, handed over to the Korea Polar Research Institute, is used for both polar research and for supplying South Korea’s two Antarctic research stations King Sejong Station and Jang Bogo Station.

Hanwha Ocean said it aims to develop more icebreakers, making it one of its future growth engines.

Hanwha Ocean’s Product Strategy & Technology Centre was also awarded the Ministry of Trade, Industry and Energy’s national project to develop a world-class PC 2 icebreaker capable of year-round operation at high northern latitudes, contributing to South Korea’s journey to explore the North and South Poles. PUBLISHER

EDITORIAL ASSISTANT Vienna Verzo

COMMERCIAL MEDIA TEAM Jenelle Samantila Dana Cruz

ADVERTISING CONTACTS Shairah Lambat shairah@charltonmediamail.com

AWARDS Julie Anne Nuñez-Difuntorum awards@charltonmediamail.com

ADMINISTRATION Eucel Balala accounts@charltonmediamail.com

EDITORIAL marinereport@charltonmediamail.com

The new vessel from Hanwha

Araon was constructed by Hanjin Heavy Industries &

The new vessel will help distribute missions on ARV Araon, South Korea’s first icebreaker research ship (Photo from KOPRI)

Singapore-India corridor may spur green fuel bunkers

The digital side of the deal could improve port operations. Asia

Singapore and India’s green and digital shipping corridor is expected to create opportunities for clean-fuel bunkering and infrastructure as the maritime sector prepares to align with the International Maritime Organization’s (IMO) target of netzero emissions by 2050.

Shahrin Osman, business development director for maritime advisory at Norway-based classification society DNV, said India’s renewable energy capacity of 234 gigawatts, based on Rystad Energy’s July report, positions it to produce zero- or near-zero-emission fuels.

“They have that ability to produce zero or near-zero fuels… that gives an opportunity to this ecosystem to look at how they could use this green and digital shipping corridor to enter into this alternative fuel bunkering,” he told Marine & Industrial Report

Establishing the corridor

Singapore and India signed a deal in early September to establish the Singapore-India Green and Digital Shipping Corridor. The partnership seeks to develop infrastructure and technologies that support lowemission fuels and enable digital information exchange between ports.

Osman said alternative fuel bunkering could spur industries around fuel storage and supplier services.

“When you have the ability to provide that, then the port will

Aster

When you have the ability to provide zeroemission fuels, then the port will become more attractive

become more attractive,” he said via Zoom. “Even though they may not have cargo, load or discharge, if there is a competitive supply of cleaner fuels, then the vessel will call the port to get that supply.”

The partnership comes ahead of the IMO’s adoption of its Net-Zero Framework, which introduces penalties for ships that fail to meet emission targets. From 2028 to 2030, fees will be set at $100 per tonne of carbon dioxide equivalent for ships near compliance and $380 per tonne for those further off-target.

Osman said such rules would push ship owners to adopt alternative fuels rather than pay penalties.

Beyond fuels, the corridor also opens the door for shore power supply at ports, where ships plug directly into clean electricity. The DNV expert said this could be four times more efficient and cheaper than producing synthetic e-fuels.

Goh Puay Guan, associate professor at the Department of Analytics and Operations at the National University of Singapore, explained that digital side of the agreement could improve port operations.

“Digitalisation is an opportunity

invests $125m

for single buoy mooring

Singapore

Aster is investing $125m (S$161.25m)to enhance its single buoy mooring (SBM) and SBM pipeline infrastructure.

The company said the overall multiphase investment programme will support high-volume energy imports, helping ensure the reliability and competitiveness of Singapore’s refining and petrochemical sectors.

The infrastructure is an offshore facility around 5.1 kilometres in sea away from Aster’s assets on Bukom.

The SBM enables large tankers to safely and efficiently transfer crude oil directly to Aster’s onshore refinery and storage facilities via a subsea pipeline. Aster said this move aims to improve operational efficiency by streamlining logistics through relieving existing jetty capacity demand, which will enable the future growth plans of Aster to rejuvenate its refinery and condensate

splitter unit.

Aster director for Projects & Technology Mashhad Dohadwala said the upgraded SBM pipeline is projected to provide more than 20 years of service, supporting Singapore’s growth, competitiveness, and laying the groundwork for continued economic development of Singapore as a vital energy and logistics hub.

The contracts will be awarded to global partners, including Allseas and DOF, who will be responsible for building, installing, and commissioning the SBM and pipeline infrastructure.

“With more than 40 years of pipeline installation experience, Allseas is expanding its footprint in Asia to support the region’s critical energy infrastructure build,” Allseas vice president for projects Matthijs Groenewegen said.

for improving efficiencies and cost effectiveness, which could be served by companies in supply chain visibility, artificial intelligence, data analytics, robotics and automation, that are able to customise these tools for the maritime industry,” he said in an emailed reply to questions.

Osman said ship owners could also integrate energy-saving technologies such as wind-assisted propulsion systems (WAPS). These can reduce fuel use and emissions by as much as 40%, though they require at least $500,000 in upfront costs per vessel,

DNV said in a report in March.

About 50 commercial ships were equipped with WAPS as of January, with more orders expected.

Solar panels are another option, though their contribution is typically limited to a 2% reduction in fuel consumption due to space constraints on vessels, according to the report.

Osman cited Norway’s Green Shipping Programme as a model, with 19 of 53 pilot projects producing lowor zero-emission solutions since 2015. Goh added that the corridor could expand to include other countries.

Koh Chee Wee, Mashhad Dohadwala, and Jignesh Halani at the signing ceremony (Photo from Aster)

Shahrin Osman, DNV business development director, and Goh Puay Guan, NUS associate professor

Indonesia’s ports push smart and blue agenda

Pelindo and KBS want to become models of efficiency and ‘green’ stewardship.

Indonesia’s port operators are stepping up efforts to integrate digitalisation and sustainability in their operations as its logistics sector grapples with rising emissions, even while remaining a key driver of the country’s economy.

State-owned PT Pelabuhan Indonesia (Pelindo) and PT Krakatau Bandar Samudera (KBS) are positioning their Smart and Blue Port initiatives as models of efficiency, resilience, and environmental stewardship.

“The Blue Port initiative marks not just the beginning of smarter ports, but the gateway to a sustainable maritime future,” Febriandika Putra Anggia, head of research and innovation at Pelindo, told a forum in Jakarta in July.

Planned upgrades

Pelindo is rolling out Internet of Things, artificial intelligence, blockchain, digital twin systems, and 5G-powered automation to strengthen cargo flow efficiency and safety.

The company is also electrifying loading equipment, installing shoreto-ship power, and deploying hybrid auxiliary systems for

Digitalisation and sustainability are key to maritime supply chain efficiency

engines. Solar plants, energyefficient lighting, and seawater reverse osmosis facilities are also currently in development.

Environmental rehabilitation features prominently. Projects include coral reef restoration on Pendawa Coast, mangrove replanting, and seagrass transplantation on Bintan Island, as well as protection programs for turtles, sharks, whales, and green mussels.

“Digitalisation and sustainability are key to maritime supply chain efficiency,” Febriandika said.

“We are investing not only in technology, but also in human resources to ensure long-term resilience,” he added.

KBS, which operates Krakatau International Port in Cilegon City, Banten province, is taking a similar path. The port handles 25 million tons of dry bulk annually and throughput of 20,000 tons a day across 17 berths and 11 harbor cranes.

“At KBS, we believe efficiency and sustainability must go hand in hand,” Mulyadi, vice president for maintenance at KBS, told the same forum.

Its proprietary KIP operating system, integrated with enterprise resource planning software developed by the German company SAP SE, has streamlined operations and set a benchmark for the dry bulk sector.

KBS’s broader Smart Port ecosystem includes vessel tracking, intelligent navigation, estimated time of arrival prediction, digital

cargo handling, automated gates, and online booking and payments. To speed up trade, its platforms are linked with Customs and Agricultural Quarantine systems.

The company has introduced water mist conveyor systems to curb coal dust, oil spill response units, and a 30 cubic-meter sewage treatment plant for water recycling. Renewable efforts include 22 kil1owatt-peak of solar panels powering capacitor banks, electric vehicle shuttles, and solar streetlights.

Biodiversity surveys have

guided recent conservation efforts for Javan sparrows, Maroon clownfish, and Acropora corals.

“Our environmental responsibility is as important as our operational role,” Mulyadi told the publication. “From water mist systems that reduce coal dust, to oil spill readiness and biodiversity conservation, we are proving that growth and sustainability can coexist.”

Both Pelindo and KBS have laid out a 2025–2035 roadmap focused on stronger public-private partnerships and incentives.

Pelindo and KBS plan to add 5G-powered automation to strengthen cargo flow efficiency (Photo from Pelindo)

What pushed spot container freight rates up in 2024

Rerouting due to the Red Sea crisis was a major factor.

Ongoing geopolitical tensions are the primary reason why volatile freight rates have become the new normal across all shipping segments, particularly fuelling the spike in spot container rates throughout 2024.

In its latest review of maritime transport, the United Nations Trade and Development (UNCTAD) noted that a major factor that affected freight rates at least in 2024 was disruptions caused by the Red Sea crisis.

“Rerouting via the Cape of Good Hope extended voyage times, reduced effective capacity and increased operating costs, driving spot and charter rates to near COVID-19 peaks by mid-2024 before moderating by the end of the year,” the report read.

For instance, the Shanghai Containerized Freight Index, a key benchmark for spot rates on containerised shipments from Shanghai to major global destinations, averaged 2,496 points in 2024. The report projects a 149% increase from the 2023 average.

The index peaked at 3,600 points in mid-2024, its highest level since the global logistics crunch of 2021–2022 triggered by the COVID-19 pandemic. This increase was reflected across major trade routes.

Volatility continued into 2025 amidst announcements of tariff rate changes by the US and mounting geopolitical risks, including around the Strait of Hormuz.

High trade volume

Aside from the impact of the Red Sea disruption, global cargo volumes also grew more than anticipated in 2024, further constricting vessel availability and maintaining high freight rates. This growth was driven by trade between North America and other regions, particularly Asia, as well as by the continued expansion of South-South trade between Asia and developing economies in Africa, Latin America and the Middle East.

UNCTAD noted that demand in the container shipping market grew 7.1% 2024 from a 1.5% contraction in 2022 and stagnation in 2023. On the supply side, global container shipping capacity grew by 10.1% in 2024, equivalent to nearly 3 million twenty-foot equivalent unit (TEU), the highest annual growth since 2008.

“Much of the new tonnage was absorbed by increased demand from longer voyages due to Red Sea rerouting and broader economic activity. Consequently, the additional capacity did not immediately drive rates lower; instead, it continued to support elevated

Demand rebounded in the container market in 2024, but remained below supply growth

Source: UNCTAD

Much of the new tonnage was absorbed by increased demand from longer voyages due to Red Sea rerouting and broader economic activity

spot freight rates,” the report said. By the end of 2024, spot container freight rates eased from midyear peaks but stayed well above levels observed before the onset of the Red Sea crisis in December 2023.

UNCTAD said container demand projections for 2025 remain uncertain amidst growing geopolitical tensions and trade policy shifts. On the supply side, container fleet capacity is still growing as new ships ordered during the post-COVID-19 period of booming earnings continue to be delivered.

Port congestion also contributed to high freight rates last year, driven by factors including the disruption to shipping operations in the Red Sea, weather-related challenges in Asia and the Caribbean, and ongoing labour issues in the United States and Europe.

“These elements were in addition to infrastructure bottlenecks and operational inefficiencies, and a general surge in container cargo volumes. Such conditions placed significant strain on port operations, leading to increased turnaround times and delays,” UNCTAD said.

“The resulting congestion reduced the effective supply and timely deployment of vessels, diminishing available shipping capacity and reliability. This, in turn, exerted upward pressure on freight rates,” it added.

Source: UNCTAD

Shanghai Containerized Freight Index spot rates

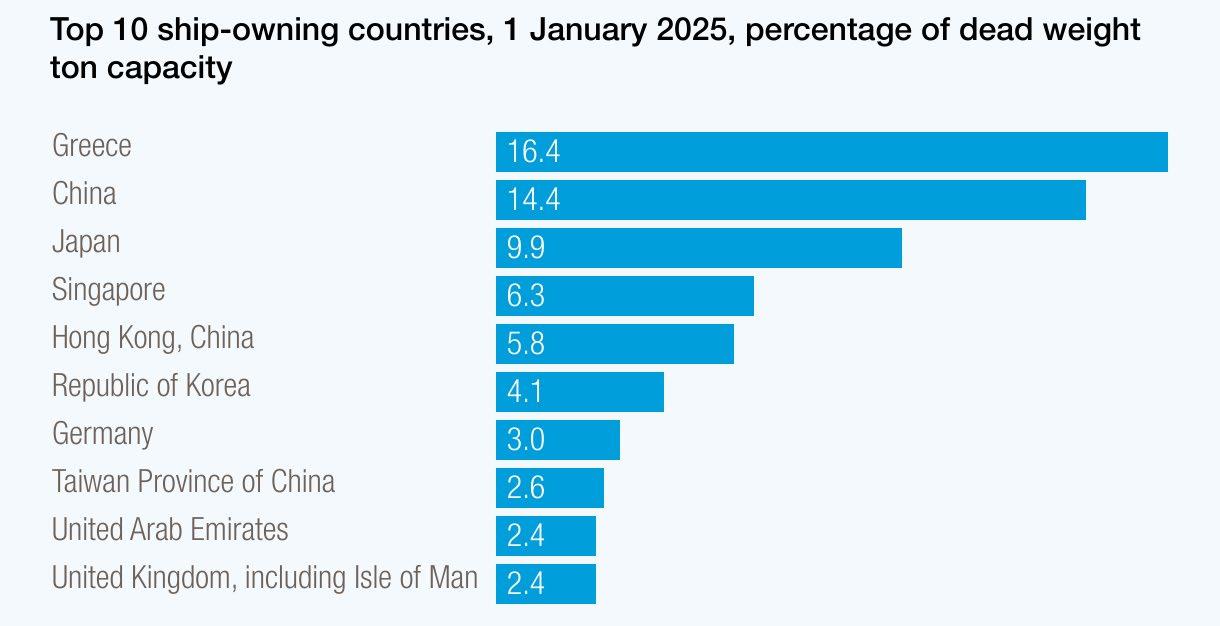

Some nations bet on shipbuilding for economic growth

Western shipbuilding companies face intense competition from Asian rivals.

Interest in shipbuilding is increasing, with some countries considering it a critical factor in their growth strategies.

According to the United Nations Trade and Development’s (UNCTAD) latest maritime industry analysis, Asian shipbuilders are showing potential to become a major rival for Western firms, as the US averaged only 0.04% of global shipbuilding output in 2024 and only 0.1% of the global orderbook by gross tonnage at the start of 2025.

“The share by gross tonnage of ships registered under the United States’ flag and operating internationally has declined since the 1980s, alongside growth in open registries such as Liberia, Panama and the Republic of the Marshall Islands,” the report read.

Regional updates

UNCTAD said about 348 operational shipyards worldwide reportedly secured new contracts or completed deliveries in 2024. This is half the peak of 2007 before shipyard consolidation.

Over the years, China has emerged as a leading global

Source: UNCTAD

shipbuilder, with the East Asian superpower accounting for half of the world’s shipbuilding output by gross tonnage in 2023. In 2024, this share increased to around 55%, as it also accounted for 74.4% of contracted gross tonnage. At the start of 2025, it had 63.7% of the global orderbook by gross tonnage. As of May 2025, 6 of the 10 leading shipyard groups were in China.

“Support through targeted industrial policy, available capacity, cost competitiveness and reliance on a comprehensive shipbuilding supply chain have helped China’s shipbuilding expansion,” the report read.

In 2024, China entered a new phase of shipbuilding expansion. Once this is complete, the current global shipbuilding capacity is

projected to grow by about 200 more ships per year, with total capacity rising to 1,700 ships per year.

South Korea and Japan are also major players in shipbuilding, leading in the high-value and high-tech segment. Specifically, Seoul accounted for 28.02% of the global shipbuilding output in 2024, ranking next to China, whilst Tokyo accounted for

Support through targeted industrial policy and reliance on a comprehensive shipbuilding supply chain have helped China’s expansion

However, the South Korean market specifically is facing labour issues, leading the Government to relax national immigration laws in 2023. The government also set up a shipbuilding training centre in Indonesia in 2024, whilst shipbuilders are investing abroad and outsourcing production to China, the Philippines and Vietnam to expand their production base.

“In the longer term, leading shipbuilders such as Japan and the Republic of Korea could regain some market share by leveraging technology and taking advantage of anticipated growth in demand for higher-value ships fitted with energy-saving technologies or running on low- or zerocarbon fuels,” UNCTAD said.

DP World, ATI deploy first electric transfer vehicles

DP World and its partner, Asian Terminals Inc. (ATI), have deployed their first batch of electric internal transfer vehicles at the Manila South Harbour in the Philippines.

In a statement, DP World said a total of 15 vehicles were deployed along with the corresponding rapid-charging infrastructure.

The $2.1m project, which is part of the $100m investment announced in May, will facilitate the transportation of containers between vessels and the shipyard for a quicker vessel turnaround time and improved overall terminal efficiency.

“This milestone also accelerates the terminal’s transition to clean energy-powered landside operations, marking a huge step towards the goal of operating a fully-decarbonised fleet by 2030,” DP World added.

The vehicles were manufactured by Sany Heavy Industry Co., Ltd and are equipped with high-capacity batteries, electric drivetrains, and advanced control systems. Before deployment, the electric fleet underwent a year of technical and safety evaluation by DP World and ATI engineers to ensure optimum performance under local conditions.

Plans are underway for the deployment of more electric equipment, including rubber-tired

gantry cranes, side loaders, reach stackers, and forklifts, in the next few years.

Before this project, DP World rolled out other improvements at the harbour. This includes adding two new ship-to-shore cranes (STS), which are amongst the largest and most technologically advanced in the Philippines.

The improvements raised the terminal’s annual throughput capacity to almost 2 million twenty-foot equivalent units from 1.45 million. Its ship-to-shore cranes can now handle vessels up to 20 containers wide.

This initiative aligns with DP World’s global decarbonisation roadmap, which targets a 42% reduction in carbon emissions by 2030, and net-zero operations by 2050. It also supports the Philippine government’s thrust to modernise the country’s key gateways.

Electric transfer vehicles (Photo from DP World)

Tsuneishi develops vessel for offshore rocket launch

Tsuneishi Solutions Tokyobay Co., Ltd. has entered into a collaboration agreement with Innovative Space Carrier Inc. for the commercialisation of offshore rocket launch and recovery operations.

“To achieve the goal of providing space transportation services using ISC’s reusable launch vehicle ‘ASCA 1,’ we are developing a recovery vessel by utilising our experience in shipbuilding and engineering to realise offshore launch and recovery technology,” said Tsuneishi.

Tsuneishi will collaborate with ISC and MOL in exploring various initiatives, such as examining the

design requirements for rocket recovery ships, conducting a feasibility study to evaluate their applicability to the ASCA 1 reusable rocket developed by ISC, and proceeding with various verification tests to validate the findings.

A feasibility study on the commercialisation of offshore launch vessels for rockets will also be conducted. They will examine design requirements for offshore launch vessels for rockets, conduct technical and economic feasibility studies, assess their applicability to the ASCA 1, and proceed with verification tests to validate the findings.

Yangzijiang Shipbuilding bags $440m in contracts

Yangzijiang Shipbuilding (Holdings) Ltd. has secured additional shipbuilding contracts for eight vessels with an aggregate contract value of $440m. In a bourse filing, the company said the contracts include four units of containerships and four units of bulk carriers.

Two units of 11,800 TEU containerships were placed by Seaspan Corporation, one of the group’s long-standing partners.

The contracts are scheduled for deliveries between 2027 and 2029 and are not expected to have any significant impact on the earnings of the group for the financial year ending 31 December 2025.

Yangzijiang Shipbuilding also announced in a separate filing that its three subsidiaries, Jiangsu

Yangzijiang Shipbuilding Group Co., Ltd, Jiangsu New Yangzi Shipbuilding Co., Ltd, and Jiangsu Yangzi Xinfu Shipbuilding Co., Ltd., had terminated shipbuilding contracts for four 50,000DWT MR oil tankers valued at around $232.2m (US$180m).

The deal was terminated “following certain critical information just disclosed by the buyer (which had not been previously known to the Subsidiaries), despite earlier extensive due diligence on the Buyer and its shareholder.”

“This critical information contains allegations that the buyer’s sole shareholder was involved in a scheme to circumvent U.S. sanctions laws and regulations,” Yangzijiang Shipbuilding said.

Nam Cheong debuts multipurpose support vessel

Nam Cheong Group has unveiled SKG 520, Malaysia and Sarawak’s first purposebuilt multi-purpose support vessel.

According to Nam Cheong, the vessel was “designed to meet the complex and evolving demands of both traditional oil & gas and the burgeoning renewable energy sectors.”

It can be used for geotech drilling rig for seabed characterisation and geotechnical surveys, deployment of subsea remotely operated vehicles, air diving deployment, survey equipment for marine surveys and data acquisition, and walk-to-work gangway for safe and efficient personnel transfer to offshore installations.

Nam Cheong said SKG 520’s concept is based on the retrofitting of

the SK Eonik, a vessel that has been converted and is currently deployed to Japan for a project under a 2+2-year charter.

Tan Sri Datuk Tiong Su Kouk, founder of Nam Cheong Group, said that SKG 520 also showcases the company’s Miri Dockyard.

“As Sarawak positions itself as a leader in the green hydrogen economy and offshore renewables, the SKG 520 stands ready as a versatile, purpose-built asset, proudly owned by a Malaysian and Sarawakian company, to support these critical developments both locally and internationally,” said Leong Seng Keat, Group CEO of Nam Cheong.

The SKG 520 is scheduled for a formal naming ceremony in August.

Singapore

It is a collaborative project with ISC and MOL (Photo from Tsuneishi) Japan

Malaysia Leong Seng Keat, Nam Cheong Group CEO during the SKG 520 launch and signing (Photo from Nam Cheong)

Smart underwater vehicles market to hit $2.9b in 2025

This will be driven by more underwater exploration operations for energy and scientific research.

Global

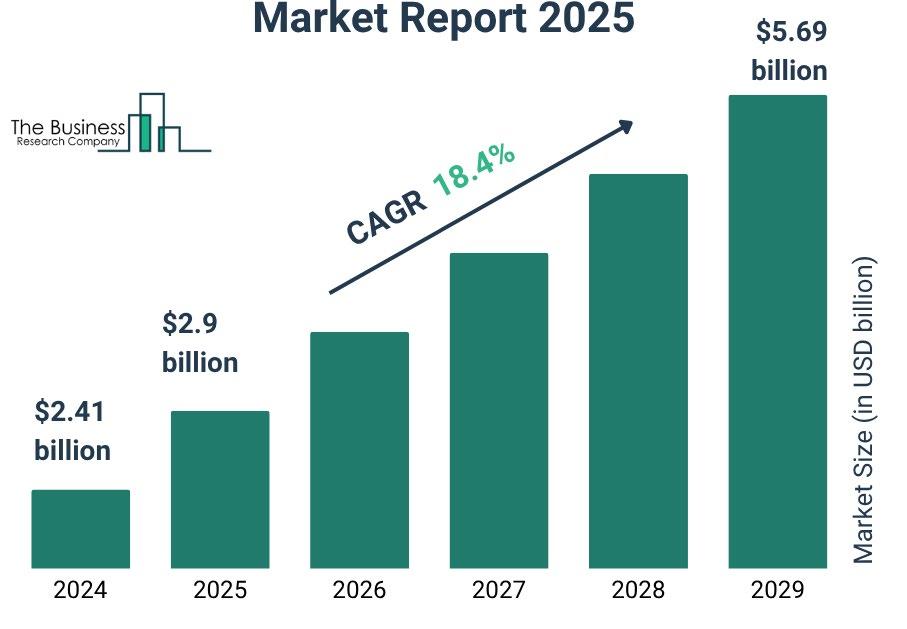

The market size of autonomous underwater vehicles is projected to reach $2.9b in 2025 from $2.41b in 2024, reflecting a compound annual growth rate (CAGR) of 19.9%.

According to the Business Research Company, Asia Pacific led the market for autonomous underwater vehicles in 2024. The growth was being driven by various factors such as energy exploration, data gathering and economic underwater exploration, and ocean exploration, amongst others.

By 2029, the market may reach $5.69b by 2029, with a compound annual growth rate of 18.4%.

The projected growth will be driven by the intensifying need for underwater surveillance, monitoring of climate change effects, exploration of deep-sea mining, commercial uses in the fishing industry, autonomous navigation capabilities, and improved autonomous decision-making.

Meanwhile, the global autonomous ships market size is also projected to expand 9.5% from 2024 to 2033,and is set to reach $217.6b by 2033.

According to the Allied Market Research, the market was valued at $89.3b in 2023, experiencing a “significant growth and transformation, driven by an increase in demand for cargo

There is an increase in demand for operational safety of ships

transportation, a surge in focus on reducing emissions, and an increase in operational safety of ships.”

Autonomous ships, also known as unmanned or smart ships, are vessels which operate with minimal or no human intervention. They rely on advanced technologies such as artificial intelligence, machine learning algorithms, sensors, navigation systems, and real-time data connectivity.

Allied Market Research noted in its report that advancements in real-time data sharing and connectivity solutions, and supportive regulatory frameworks are anticipated to provide market growth opportunities during the forecast period.

The International Union of Marine Insurance (IUMI) has updated the set of best practices and recommendations for the safe carriage of electric vehicles, which it issued in 2023. Entitled “Risk mitigation for the safe ocean and short-sea carriage of electric vehicles,” the updated version covers five key areas. These are potential gas accumulation, total energy release and peak temperatures, challenges

Chemical spill drill tests maritime readiness

Stakeholders have emphasised the importance of ensuring safety at sea through workforce preparedness and collaboration amidst the evolving maritime sector.

During the opening ceremony for this year’s Safety@Sea Week, Murali Pillai, senior minister of state, Ministry of Law and Ministry of Transport, said that the maritime sector is facing increasingly complex global challenges.

This can be tackled by “equipping our workforce for future challenges, harnessing collective expertise through close collaborations and partnerships, and drawing upon technology and innovation to augment our capabilities.”

Part of the event was the conduct of a multiagency chemical spill exercise to strengthen Singapore’s

operational readiness. This was held off the southern coast, involving 11 vessels and over 150 personnel from more than 10 government agencies and industry partners. The exercise simulated a methanol spill from a collision involving a methanolcarrying tanker, triggering a multiagency response.

with PCTC ship design, “Fixed First” approach for PCTCs, and limitations of foambased extinguishing systems.

IUMI Secretary General Lars Lange said the volume of cars being shipped by maritime transport globally is around 20 million units per annum.

“There appears to be an increasing frequency of fires onboard car carriers, although none to date have been found to be solely attributable to an electric

vehicle – although it is possible that an EV was the culprit,” he noted.

“However, we are well aware that the characteristics of an EV fire are different to those emanating from a standard internal combustion engine vehicle (ICEV), and it is important that carriers, operators and insurers understand the risks involved and the measures that might reduce that risk,” Lange said.

Singapore

Chemical spill exercise

Autonomous underwater vehicles global market report 2025

Source: The Business Research Company

ASDP goes ‘green’ with low-carbon shipping

Efficient, ecological, and resilient sea connectivity is the only way forward.

PT ASDP Indonesia Ferry (Persero) is accelerating its transition to cleaner and more sustainable operations in line with the enforcement of stricter global standards on ship emissions this year.

The state-owned company, which operates the biggest ferry transport network in Indonesia, has been using B35 biofuel across its fleet, solar panel installations at key ports, digital engine monitoring on 99 vessels, and shore-side electricity systems to cut emissions whilst docked.

“As an archipelagic nation, we can no longer rely on a continental approach to national distribution,” Rio Lasse, director of operations and transformation at ASDP, told a maritime forum in Jakarta in July.

“Efficient, green, and resilient sea connectivity is the only way forwards,” he added.

ASDP operates 217 ships across 309 routes, covering 27 branches and 37 ports nationwide. About 67% of its routes serve frontier, outermost, and disadvantaged areas— locations often inaccessible to commercial operators— delivering essential goods such as fuel, food, and medicine.

Clean energy measures include solar panels at Merak’s

executive terminal and on KMP

Asa-Asa in Lake Toba, whilst the Siemon system now tracks and optimises operations on almost 100 ships.

Ports are adding electric vehicle charging stations, and operational vehicles are being switched to electric power.

Fourteen ports have been equipped with autonomous electricity platforms, letting ships shut down main engines when they are berthed.

“This transformation is not just about complying with International Maritime Organization (IMO) regulations or external pressure,” Rio said. “It’s about long-term efficiency

and the sustainability of our own logistics system.”

Dimas Ruliandi, vice president of project management and acceleration at Pertamina NRE, said maritime decarbonisation is a key part of Indonesia’s “blue energy transition.”

He said the state-owned company, which develops and operates clean and low-carbon energy projects. is pursuing a dual growth strategy—balancing traditional energy operations with low-carbon initiatives.

Pertamina NRE plans to scale biofuel production to 630,000 kilolitres yearly, expand solar, wind, and geothermal capacity

Seatrium to pay $110m in DPA over Brazil offences

Seatrium Limited, formerly known as Sembcorp Marine Limited, has agreed to pay a financial penalty of $110m under a Deferred Prosecution Agreement (DPA) with the Singapore Public Prosecutor over corruption offences that occurred in Brazil.

According to a statement released by the Attorney-General’s Chambers (AGC), the DPA stems from alleged corrupt practices involving the company’s business operations in Brazil. In February 2024, Seatrium said that it had reached in-principle settlement agreements with the Brazilian authorities in connection with Operation Car Wash, which is

Brazil’s massive anti-corruption and anti-money laundering investigation that began in March 2014.

In a separate statement, Seatrium said AGC has agreed for up to a maximum of $53.0m of the payments to be made by the company to the Brazilian authorities to be credited against the financial penalty.

Accordingly, the amount payable by the company to the Singapore authorities under the DPA will be $57.0m.

Should Seatrium fail to meet the conditions set out in the agreement, the Public Prosecutor retains the right to terminate the DPA and initiate criminal proceedings against the company for the alleged offences.

The AGC’s Strategic Communications Department emphasised that the DPA represents a legal mechanism to ensure accountability while allowing the company to reform and avoid prosecution, provided it fulfills all obligations under the agreement.

“The company wishes to emphasise that it remains committed to the highest standards of corporate governance and business integrity, including zero-tolerance for fraud, bribery and corruption,” Seatrium said in a statement.

“Robust policies and procedures have been put in place to instill the highest standards of discipline, ethics, and compliance across our global operations,” it added.

to more than 2.7 gigawatts, develop green hydrogen, and deploy carbon capture, use, and storage solutions that can cut 19 million tonnes of CO₂ annually.

The IMO has warned that without intervention, global shipping emissions could rise by as much as 130% from 2008 levels. The maritime sector accounts for about 3% of global carbon output.

The third phase of the IMO’s Energy Efficiency Design Index (EEDI) mandates at least a 30% emission cut for new vessels from 2025. ASDP’s response includes optimised ship design, route efficiency, artificial intelligence (AI)-based tracking,

Efficient, green, and resilient sea connectivity is the only way forward

and predictive maintenance.

Modernisation is also being rolled out at ports in priority tourism zones such as Lake Toba and Nias. ASDP operates the Ajibata and Ambarita ports in Lake Toba and runs routes connecting Samosir Island to the mainland. In Nias, its ferries link four regencies and one municipality with almost a million residents.

A planned water taxi service from I Gusti Ngurah Rai Airport to Kuta and Canggu will shorten the journey from 90 minutes by road to about 20 minutes by sea.

Challenges to achieving a low-carbon goal remain, including an ageing fleet—most vessels are over 20 years old— limited port electrification, slow adoption of shore power, and the economic appeal of heavily subsidised fossil fuels.

“If we don’t transform today, we’ll lose relevance tomorrow,” Rio said. “And this transformation cannot rely solely on the government or operators—everyone in the ecosystem must act.”

India okays bill to boost coastal cargo by 2030

Indiahas approved the bill that aims to fuel the country’s coastal cargo share to 230 million metric tonnes by 2030.

According to the Ministry of Ports, Shipping and Waterways, the Coastal Shipping Bill 2025 “is set to unlock the tremendous and vast potential of India’s 11,098 kilometres long strategic coastline, spanning nine coastal states and four union territories.”

The bill, which has been passed by the Lok Sabha on 3 April, seeks to simplify and modernise the legal framework governing coastal shipping, replacing Part XIV of the Merchant Shipping Act, 1958.

The Coastal Shipping Bill, 2025 comprises six chapters and 42

clauses. It introduces a simplified licensing system for coastal shipping and lays down the framework for regulating foreign vessels engaged in coasting trade. It also mandates the formulation of a National Coastal and Inland Shipping Strategic Plan to guide future infrastructure development and policy direction.

The newly approved legislation also provides for the creation of a National Database for Coastal Shipping, enabling real-time access to authentic and regularly updated data.

Once implemented, the bill is expected to significantly enhance supply-chain security by increasing Indian ships’ participation in domestic cargo movement.

The company uses B35 biofuel across its fleet (Photo from ASDP)

The bill simplifies licensing for coastal shipping and regulates foreign coasting vessels

India

Steelpaint returns to India with Chennai coatings

The German company partners with Kaptel Overseas to deliver its Stelcatec coatings system.

Germany’s Steelpaint has delivered its Stelcatec corrosion resistant coating system for trial application to a range of cranes at the Port of Chennai, marking the German manufacturer’s first return to the Indian market in more than 16 years.

The company, known for supplying high-performance protective coatings to ports and shipyards across Europe, confirmed that its Stelcatec LPR primer and Stelcatec LTC topcoat have been shipped to India for application to RTGs and ship-to-shore cranes.

The field trial is due to start this month in cooperation with New Delhi-based Kaptel Overseas, Steelpaint’s newly established regional partner which has been serving the Indian market since 1993.

Steelpaint Director Frank Müller said the development represents a strategic milestone in the company’s global expansion. “After many years away from India, we are very pleased to be back with a trusted local partner. Our Stelcatec system has delivered outstanding results in Germany’s major seaports, and we are confident it can

help operators in Chennai and across the sub-Continent extend asset life and reduce maintenance costs.”

Steelpaint’s coatings have already been proven on ship-to-shore cranes and container handling equipment in Hamburg, Wilhelmshaven and Cuxhaven, where durability under harsh marine conditions is essential. The Stelcatec system, engineered to combine ease of application with resistance to corrosion, has gained traction among terminal operators seeking longer maintenance cycles.

India’s expanding port

PIL launches first LNG dualfuel vessel in Ghana

Pacific International Lines (PIL) has conducted the naming ceremony for its latest 8,200 twenty-foot equivalent unit liquefied natural gas dual-fuel container vessel at the Port of Tema.

In a statement, PIL said thai marks a historic first for the company in Ghana. The vessel, part of PIL’s new “O” Class series, was officially named Kota Odyssey.

The vessel will operate on PIL’s South West Africa Service (SWS), connecting China, Singapore, Ghana, Togo, Nigeria, and Côte d’Ivoire through a direct weekly service. This strengthens trade flows between Asia and West Africa and reinforces Ghana’s role as a

strategic logistics hub.

“This ceremony underscores our commitment to supporting Ghana’s maritime ambitions and contributing to its economic development,” said Lars Kastrup, CEO of PIL.

“As we continue to develop our operations here, we remain focused on delivering sustainable, integrated shipping and logistics solutions that meet the evolving needs of Ghana and the wider African trade landscape,” he added.

PIL has operated in Africa since the 1970s and now serves over 30 African countries, with seven weekly services and a feeder network connecting more than 40 ports.

It can help operators in Chennai and across the sub-Continent extend asset life and reduce maintenance costs

sector is now seeking similar outcomes. Operators face challenging environments, with high salinity, heat and humidity creating rapid degradation of steel assets.

For shipowners and terminal operators alike, reliable equipment availability is a crucial factor in maintaining schedule integrity.

“The Indian market is price sensitive, but we believe our field trial will show that using high-performance protective coatings is an investment rather than an expense,” Müller said. “Extending intervals between maintenance cycles means less downtime, greater safety and better operational efficiency.”

Kaptel Overseas represents multiple international equipment suppliers and is focused on delivering new technologies like the paint coatings to Indian terminals.

Nishanth Maliyekkal, CEO of Kaptel, said: “India

is investing heavily in its maritime sector, with new projects such as the Vizhinjam International Seaport and a $1 trillion infrastructure roadmap that will transform port operations nationwide. The government’s Indian Ports Bill, 2025 has also reinforced the sector’s focus on modernisation and sustainability. As such, we see strong potential for Steelpaint in India as its coatings technology not only improves asset durability and availability but can withstand the toughest maritime conditions.”

Further opportunities

The company’s re-entry into India coincides with its participation at INMEX India in Mumbai, which marks its first appearance at the international maritime exhibition in nearly two decades.

Steelpaint will use the show to demonstrate how coatings can reduce cost, improve efficiency, and support sustainability across the shipping and port value chain.

The company expects that a successful Chennai trial will open further opportunities across India’s container and bulk ports, as well as in the ship repair and newbuild sectors.

What drove hull premium performance last year?

The global hull premium increased by 3.5% to $9.67b in 2024, according to the International Union of Marine Insurance (IUMI).

In a statement, IUMI said Asia/ Pacific accounted for 35% of the hull premiums, whilst Europe dominated with 53%.

“This concentrated picture meant that there was ‘intense competition’ in the key regions and ‘significant vulnerability’ in the event of a major loss in a key premium centre,” IUMI said.

The global fleet also increased by 4% in value, reaching $1.54t. This, and a robust sale and purchase market, indicated positive economic sentiment but significantly increased exposure as well.

According to Ilias Tsakiris, chair of the IUMI Ocean Hull Committee, the ocean hull market is returning to a “soft environment”.

“Whilst the overall premium base continues to rise, the underlying risk environment is intensifying, driven by an ageing fleet, more severe losses, geopolitical shocks and the operational complexity of the energy transition,” he noted.

The ageing fleet is “a quiet but powerful driver of claims,” said Tsakiris. The average world fleet age is 22.6 years, with 35% of ships more than 25 years and 61% more than 15 years.

Meanwhile, the order book for replacement vessels is a modest 16% of the existing fleet, and scrapping sits at multi-year lows.

India

Stelcatec primer and topcoat will be applied to RTGs and ship-to-shore cranes (Photo from Steelpaint)

Ghana

The vessel will operate on PIL’s South West Africa Service (Photo from PIL)

Hull premium trends by major market

Ammonia gains traction as ship fuel, but safety gaps remain

Experts are still concerned with its toxicity and high cost.

DR LI HONGYAN

Research Fellow Energy Studies Institute, National University of Singapore

Transforming shipping through strategic publicprivate finance

Singapore’s position as a global maritime hub places it at the forefront of shipping’s decarbonisation journey.

Whilst the International Maritime Organisation’s (IMO) 2050 net-zero strategy provides a clear direction, the financial pathway is formidable. Public funds and government grants are vital to kick-start the transition, but they cannot cover the immense capital expenditure required. Unlocking private capital and innovation will be indispensable.

The future of green shipping depends on a strategic partnership between public and private finance.

Moving from concept to early-stage implementation in just five years, ammonia has a path to becoming a low-GHG fuel alternative for deep-sea shipping, according to a new paper from DNV.

“Ammonia is a substance well known to the shipping industry, which already has extensive experience in handling and transporting ammonia as cargo at sea, with approximately 18 to 20 million tonnes of ammonia traded annually (some 10% of the production). Ammonia is also used as a refrigerant in certain ship systems,” DNV said in its new report Ammonia in Shipping: Tracing the Emergence of a New Fuel.

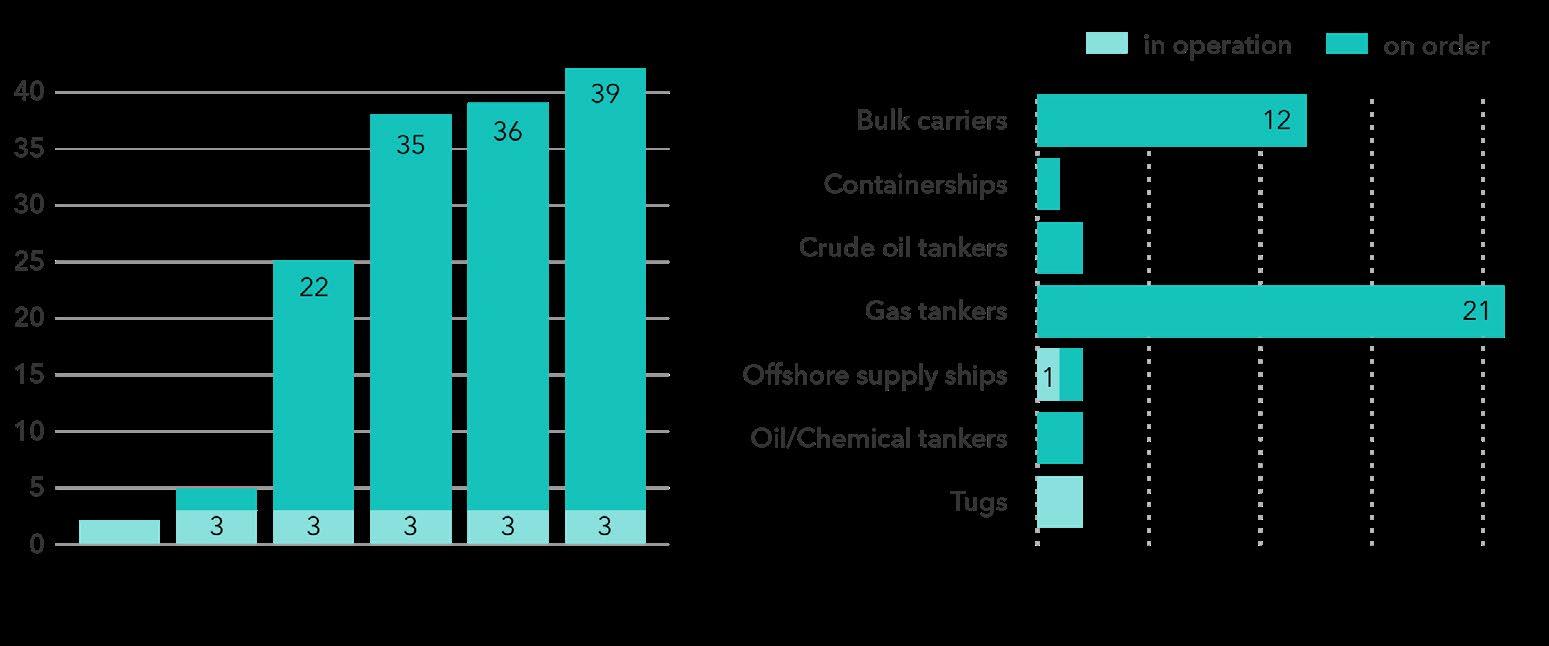

Growing demand DNV data also showed that there is growing interest in ammonia-fuelled ships, most of which are on order.

This includes WinGD which secured nearly 30 orders for X-DF-A engines in the bulk carrier, containership, tanker, and LPG/ammonia carrier segments,7 and is currently offering 2-stroke ammonia engines from 5 MW to 31 MW.

Meanwhile, an NYK ship, scheduled for delivery in 2026, will utilise a J-Eng ammonia

Renewable energy is being utilised in port operations

engine. J-Eng plans to complete its first 50-bore ammonia engine in 2025 and to follow up with a 60-bore engine after 2026.

Given this growth, the DNV report outlined a twophase pathway for ammonia’s widespread adoption in shipping. The first phase would see the building, fuelling, and operation of a pioneering ammonia-powered fleet consisting of a few dozen vessels, crewed by a few hundred competent personnel, and bunkering a few million tonnes of ammonia from a dozen ports. The second phase would include scale up with global infrastructure, production and IMO regulations.

Knut Ørbeck-Nilssen, CEO of DNV Maritime said: “The groundwork for ammonia as a fuel is being laid, and the orderbook proves it’s no longer just a theoretical fuel. Ammonia’s toxicity and high cost remain a challenge. With targeted financial support mechanisms for a pioneering fleet, supply and infrastructure developments and robust safety regulations, we can progress. While we have seen great

progress recently, the next years will determine the role of blue and green ammonia in the future fuel mix.”

According to the report, ammonia as ship fuel has made measurable progress since 2020 across regulation, technology, and infrastructure. Safety frameworks have evolved from risk-based approvals to interim guidelines by the International Maritime Organization (IMO) and annually updated class rules. Technical readiness is advancing with 39 ammoniafuelled vessels on order, commercial engines available, and the first use of the fuel demonstrated. Production of blue and green ammonia is currently low, but confirmed plans in place will see it rise to 14 million tonnes per annum (MTPA) by 2030. Bunkering infrastructure is also emerging, with trials completed in key ports including Singapore and Rotterdam.

Risk-based frameworks

For shipowners considering ammonia as fuel, the current barrier levels necessitate focused attention and effort on key aspects of the design, approval, and safe operation.

“Scaling up use of ammonia as ship fuel requires a framework of standardised solutions that can be easily adopted across the industry,” said Linda Hammer, principal consultant at DNV and lead author.

“The current risk-based approval framework must be replaced by prescriptive regulations mandated by the IGF Code, production needs to be increased, and more ports must be able to supply green and blue ammoniarequiring harmonisation of port safety standards and dissemination of lessons learned. Standardised training is also essential to ensure sufficient competent crew.”

International shipping remains overwhelmingly fossil-fuelled and carbon-intensive. In 2022, it produced around 2% of global energy-related CO₂, and in 2021, it consumed roughly 8.7 exajoules of energy—almost all from oil-based fuels. These realities make decarbonising the sector urgent, not optional.

The IMO now charts an ambitious path to net-zero GHG emissions by around 2050, with indicative checkpoints of at least 20% by 2030 and at least 70% by 2040 versus 2008. However, it is as much economic as it is technological. Low-emission fuels like sustainable biofuels, green ammonia, and green hydrogen remain costly and scarce, with underdeveloped supply chains and limited quality assurance.

The Global Maritime Forum estimates that $1t to $1.4t (approximately $50b to $70b yearly) is required to halve shipping emissions by 2050; aligning with the IMO’s net-zero ambition increases the total to $1.4t to $1.9t. This financing must fund the entire value chain, from onshore fuel production to port infrastructure, not only vessels.

Unlocking private capital and innovation will be indispensable

The cost premium is striking even at the micro level. A new dual-fuel vessel typically costs 20% to 40% more than a conventional ship, adding $15m to $30m to the price of a large container ship.

Retrofitting engines or installing dual-fuel conversion kits can lower the outlay, but the expense remains substantial. This “green premium” is far too high for any single company to absorb.

Without support, firms face risks from new policies and stranded assets, as vessels become uneconomic before the end of their service life.

Public support is essential to make first-mover projects bankable. Revenues from carbon pricing, grants, and fee relief can be combined with concessional and commercial finance to create viable projects. EU ETS revenues illustrate the power of public finance in action. The EU ETS began covering maritime on 1 January 2024, with the first allowance surrender due in September 2025 for 2024 emissions.

The system raises substantial capital— $47.2b in 2023 and $42b in 2024—with proceeds flowing to Member States and EU decarbonisation funds. Through the Innovation Fund, around 20 million allowances (≈US$1.73b at ~US$86.6 per allowance) are earmarked through 2030 specifically to support maritime decarbonisation.

These funds will support projects across the value chain—fuel production and uptake of renewable or low-carbon fuels, vessel and port upgrades, and enabling infrastructure—at a meaningful scale. Since 2023, Member-State auction revenues have been ringfenced for climate and energy purposes, a mandate that now explicitly includes shipping and ports.

Knut Ørbeck-Nilssen, DNV CEO, and Linda Hammer, principal consultant

Growth of ammonia fuel uptake by number of ships and ship type

Source: DNV

Fixed & portable gas and flame detection solutions with industry leading strategic insight give you the power to protect. With hundreds of years of combined experience and the most comprehensive gas and flame detection portfolio in the industry, Teledyne Gas & Flame Detection is dedicated to protecting people, assets and the environment.

Teledyne Gas and Flame offers a wide range marine approved and certified portable and fixed gas detectors for the Marine Industry. Our products have been developed in combination with extensive consultation, technical expertise and regulatory expertise in mind. Our comprehensive range offers highly reliable, compact and rugged designs and the flexibility to adapt to specific use requirements to offer the complete solution for the marine industry.

Shipsurveyor