LUXURY REPORT EXPLAINED

The Institute for Luxury Home Marketing has analyzed a number of metrics — including sales prices, sales volumes, number of sales, sales-price-to-list-price ratios, days on market and price-persquare-foot – to provide you a comprehensive North American Luxury Market report.

Additionally, we have further examined all of the individual luxury markets to provide both an overview and an in-depth analysis - including, where data is sufficient, a breakdown by luxury single-family homes and luxury attached homes.

It is our intention to include additional luxury markets on a continual basis. If your market is not featured, please contact us so we can implement the necessary qualification process. More in-depth reports on the luxury communities in your market are available as well.

Looking through this report, you will notice three distinct market statuses, Buyer’s Market, Seller’s Market, and Balanced Market. A Buyer’s Market indicates that buyers have greater control over the price point. This market type is demonstrated by a substantial number of homes on the market and few sales, suggesting demand for residential properties is slow for that market and/or price point. By contrast, a Seller’s Market gives sellers greater control over the price point. Typically, this means there are few homes on the market and a generous demand, causing competition between buyers who ultimately drive sales prices higher.

A Balanced Market indicates that neither the buyers nor the sellers control the price point at which that property will sell and that there is neither a glut nor a lack of inventory. Typically, this type of market sees a stabilization of both the list and sold price, the length of time the property is on the market as well as the expectancy amongst homeowners in their respective communities – so long as their home is priced in accordance with the current market value.

Q2 2025 LUXURY REVIEW

LUXURY REAL ESTATE MID-YEAR 2025: A MARKET DEFINED BY STRATEGY AND RESILIENCE

As we close the books on the second quarter of 2025, the luxury residential real estate market across North America reveals a landscape in transition.

While broader economic uncertainties, ranging from interest rate volatility to geopolitical pressures, have led to more measured behavior from buyers and sellers alike, the market itself remains notably resilient. The median sold price is holding firm, inventory has grown without overwhelming the market, and affluent buyers continue to engage - although with a sharper eye on long-term value, lifestyle alignment, and timing.

Q2 2025: A COMPLEX BUT STABILIZING LANDSCAPE

The second quarter of 2025 has been marked by a mix of strategic pause and steady resilience. After a relatively slow April, which stirred concern over a 12% drop in pending luxury sales, May and June proved more balanced, especially in the single-family segment.

By the end of Q2, total sales of single-family luxury homes rose by 2.6% compared to the same period in 2024, while attached home sales - including condos and townhomes - declined by 8.1%. This divergence highlights a clear shift in buyer preference toward privacy, space, and exclusivity - attributes more commonly associated with single-family homes.

It also reflects the greater sensitivity of the attached segment to economic factors such as interest rates, financing costs, and overall market volatility, as this category tends to attract a higher proportion of priceconscious buyers, including first-time luxury purchasers, millennials, and second-home seekers.

One of the most telling dynamics of the quarter has been the growth in available inventory. Single-family homes saw inventory levels rise by nearly 30% compared to this time last year, and attached properties followed with a 24.6% increase.

However, the pace of new listings entering the market has slowed notably since April, indicating a

more cautious approach from sellers. Perhaps waiting for stronger signals from the financial marketsparticularly potential interest rate cuts - before fully reengaging.

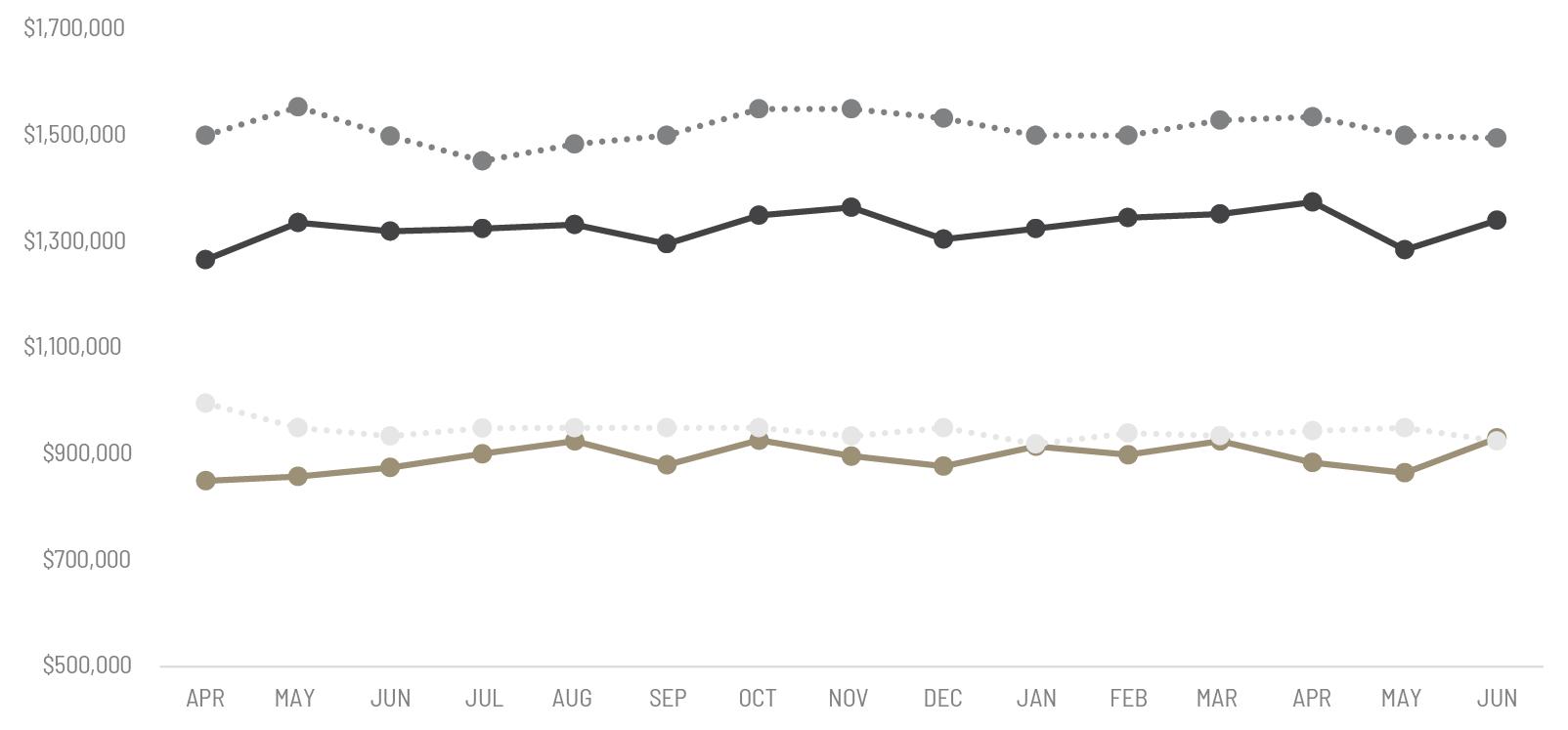

Despite this influx of inventory, sold prices have remained stable. The median sold price for single-family luxury homes appreciated by 2% year-over-year in Q2, while attached homes saw a robust 3.8% gain. These figures reflect the continued appeal of well-located, move-in-ready homes that meet modern luxury expectations. In contrast, properties lacking quality finishes or lifestyle-driven features are spending more time on the market, often resulting in reductions from the original list price.

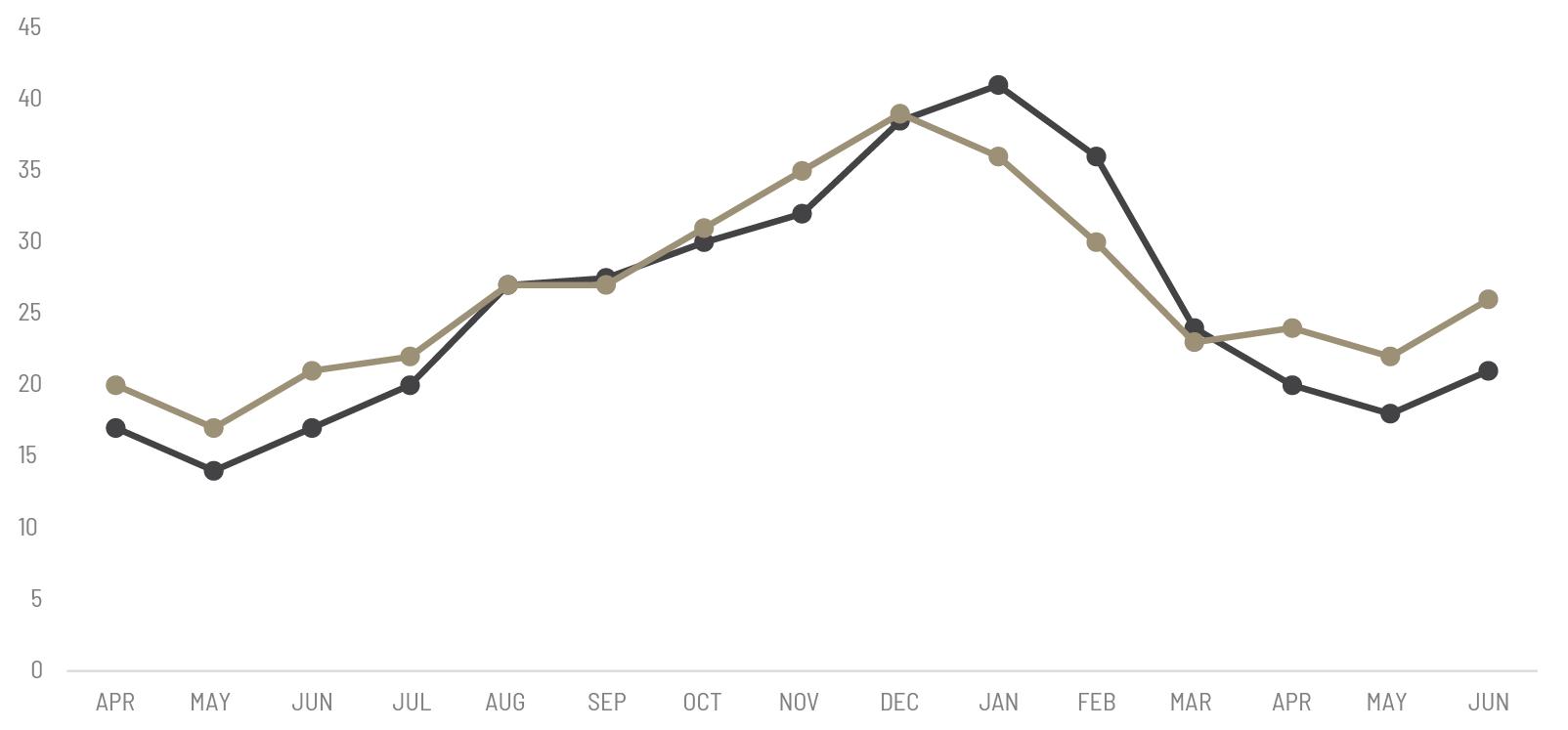

Another notable shift this quarter has been the increasing time properties are spending on the market. Compared to 2024, homes in Q2 2025 took approximately 23% longer to sell, a direct result of the more deliberate mindset now driving the market. This isn’t a sign of distress, but rather a recalibration - a new norm in which buyers and sellers alike are prioritizing precision over urgency.

STRATEGIC PATIENCE IS THE NEW NORM

Affluent buyers are not exiting the market; they’re engaging more strategically. While they are still willing to pay a premium for homes that align with their lifestyle aspirations, they are doing so with far more caution than in previous years. The market’s recent financial volatility, along with attractive returns in private equity, venture capital, and digital assets, has made buyers more discerning. Luxury real estate’s value proposition has now shifted from aggressive growth to security, diversification, and lifestyle utility.

As a result, decision-making timelines have lengthened. Buyers are carefully comparing options, seeking properties that offer turnkey ease, sustainability, and features aligned with wellness and technology. At the same time, many are waiting to see if interest rate adjustments or further macroeconomic clarity will offer a better window for purchase. Sellers, in turn, are equally calculated - some testing pricing thresholds, others delaying listings in anticipation of a more favorable late-summer or fall environment.

INVENTORY GROWS, BUT NEW LISTINGS SLOW

The expansion in total inventory levels is not indicative of oversupply, but rather a reflection of the previous shortage finally beginning to clear. Single-family homes, in particular, have become more available, with lifestyle-oriented markets seeing increased options for buyers. Yet this growth has not been accompanied by a flood of new listings. On the contrary, new listings in both

the single-family and attached segments slowed significantly after April, with June’s gains tapering off compared to earlier in the quarter.

This suggests that many potential sellers, especially those outside the ultra-high-net-worth bracket, remain in a holding pattern. Aspirational luxury sellers are watching economic indicators closely, and many are reluctant to list while mortgage rates remain elevated, or while the broader economy feels unsettled. This seller hesitance is helping to keep pricing stable even as more homes become available.

RENOVATION OVER NEW CONSTRUCTION

On the development side, the luxury new-build market is feeling the weight of inflation, tariffs, and labor constraints. Tariffs on imported materials like Canadian lumber and steel have significantly raised construction costs. Compounding this are ongoing labor shortages and persistent supply chain delays that are increasing timelines and limiting new construction capacity.

As a result, there is a marked shift toward renovation and remodeling. Developers and homeowners alike are finding more flexibility, efficiency, and cost control by upgrading existing properties rather than building from the ground up. This trend is also being supported by consumer preferences: many buyers now prefer to customize an existing home to match their tastes, especially with wellness and sustainability features, rather than take on the complexity of new construction.

The North American Home Builders Association expects this renovation trend to grow through the remainder of 2025, particularly in markets where land is scarce and older homes are abundant. From upgraded kitchens and spa bathrooms to AI-powered smart systems and eco-conscious upgrades, remodeling could become the bridge between market constraints and modern luxury demand.

WHAT TO EXPECT FOR THE SECOND HALF OF 2025

As we look ahead, several forces are expected to shape the trajectory of the luxury market. The most immediate is monetary policy. If a meaningful interest rate cut is announced, it could unlock a surge

of new listings from sellers who have been waiting on the sidelines, while also improving affordability perceptions for some buyers - even if they are transacting in cash or using non-traditional financing.

However, buyer selectiveness is here to stay. Affluent individuals are aligning real estate decisions not only with financial indicators but with personal values - privacy, sustainability, design, and wellness remain top priorities. Second-home and lifestyle markets continue to outperform urban cores, though signs of renewed interest in city living are emerging, particularly among Gen X and millennial buyers.

At the same time, value-seeking buyers are targeting underpriced or dated homes in A+ locations, planning custom renovations that reflect their evolving needs. This trend supports the renovation boom and could shape buying behavior for the rest of the year.

Time on market may remain elevated in the short term, particularly if inventory continues to build without a corresponding rise in urgency. But with pricing remaining firm and demand steady for well-positioned homes, sellers who are well-prepared and well-advised still stand to succeed.

CONCLUSION: A MARKET RECALIBRATING WITH PURPOSE

The first half of 2025 has made it clear: the luxury real estate market is not cooling - it’s recalibrating. It is a market defined by intention, not inertia. Prices are stable. Inventory is expanding, but rationally. Buyers are active, though cautiously so. And sellers are more strategic than speculative.

In this climate, success belongs to those who are informed, agile, and ready. With financial markets stabilizing and economic signals beginning to clarify, the second half of the year promises meaningful movement - especially for those with the insight and strategy to recognize when the timing is right.

LUXURY MARKET REVIEW

A REVIEW OF KEY MARKET DIFFERENCES YEAR OVER

YEAR

ATTACHED HOMES

List Price, Sale Price, SP/LP Ratio, Sales Ratio, Price Per Square Foot, Days on Market, and Home Size are

ATTACHED HOMES MARKET SUMMARY | Q2 2025

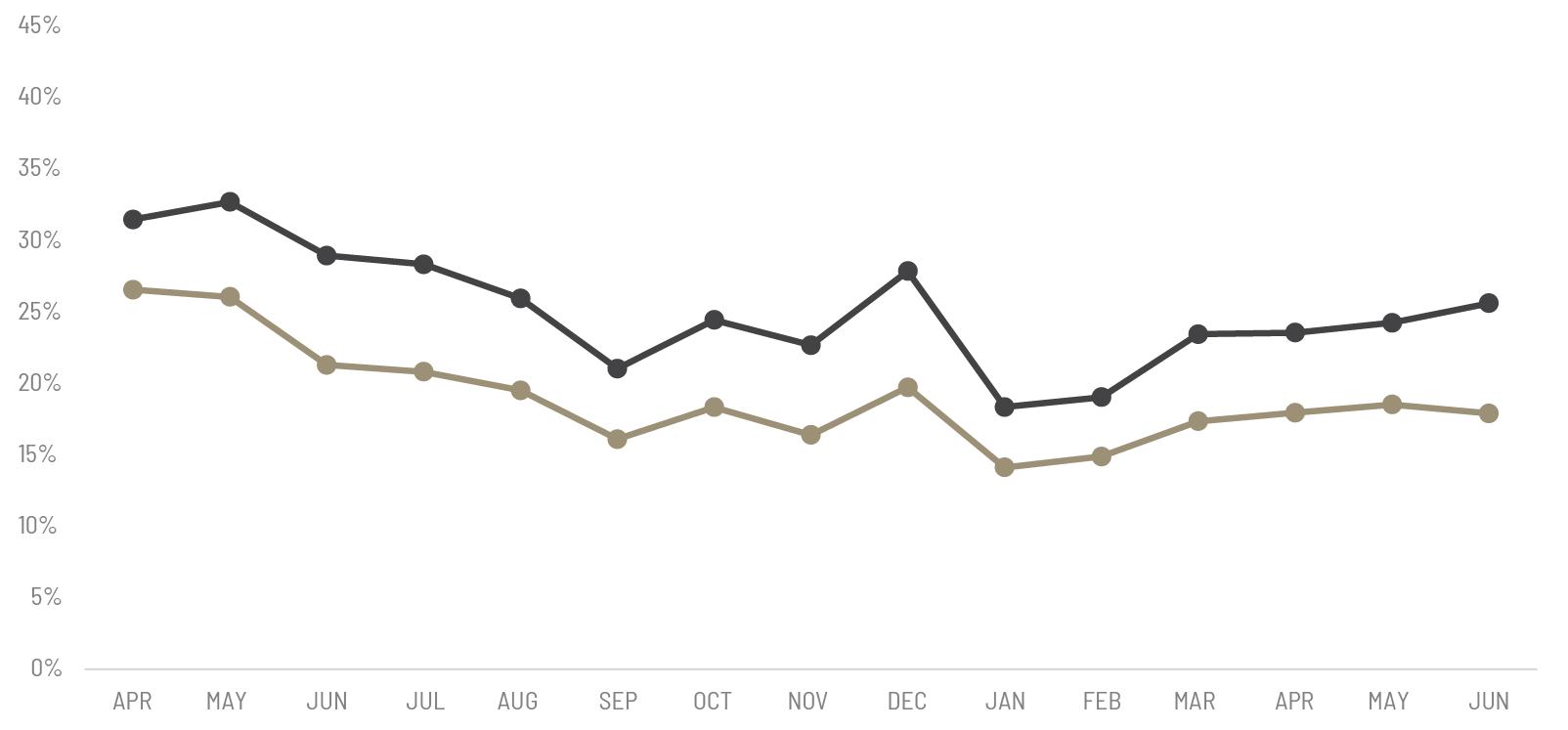

• Official Market Type: Balanced Market with a 18.14% Sales Ratio 1

• Attached homes are selling for 98.76% of list price

• The median luxury threshold2 price is $700,000, and the composite attached luxury sale price is $893,423.

• Markets with the Highest Median Sales Price: Pitkin County ($2,725,000), San Francisco ($2,428,333), Park City ($2,259,167), and Whistler ($2,109,667).

• Markets with the Highest Sales Ratio: Howard County (148.8%), Fairfax County (102.6%), Arlington & Alexandria (83.0%), and Anne Arundel County (75.2%).