Shonik Goyal, President & Head – Supply Chain Management, Sheela Foam Ltd.

Breaking Maritime Logistics’ Digital Deadlock Pradeep Chaudhary, Senior Domain Consultant, Tata Consultancy Services

Shonik Goyal, President & Head – Supply Chain Management, Sheela Foam Ltd.

Breaking Maritime Logistics’ Digital Deadlock Pradeep Chaudhary, Senior Domain Consultant, Tata Consultancy Services

Dear Readers,

As we step into the mid-year mark, the momentum in India’s economic trajectory is unmistakable. The April edition of the IMF’s World Economic Outlook has painted an inspiring picture—India is on track to become the world’s fourth largest economy by the end of 2025 , overtaking Japan. With an estimated nominal GDP of $4.18 trillion and a projected growth of 6.2% in 2025 and 6.3% in 2026 , India is poised to lead not just regionally, but globally, reinforcing its role as a vital player in the evolving economic landscape.

This rapid ascent isn’t just about numbers—it signals a transformative shift . In a world marked by volatile geopolitical equations, from Trump’s unpredictable tariff stances to India’s strategic assertion on the global stage , supply chains and logistics are no longer behind-the-scenes operations. They are frontline enablers of national resilience and growth. The global supply chain playbook is being rewritten—more interconnected, but also more vulnerable. This makes agility, collaboration, and foresight not just strategic advantages, but necessities.

It is in this context that we look forward to the 7th edition of the Celerity Supply Chain Tribe Conference & Awards . Scheduled for August 6, 2025, in Mumbai , this flagship event will bring together the sharpest minds to deliberate on building future-ready, geopolitically aware, intelligent, interconnected, and inclusive supply chains.

The stage is set for India to lead—not just in GDP— but in supply chain excellence . Let’s get ready to shape that future together.

Happy Reading!

Charulata Bansal Publisher Charulata.bansal@celerityin.com

www.supplychaintribe.com

Edited by: Prerna Lodaya e-mail: prerna.lodaya@celerityin.com

Designed by: Lakshminarayanan G e-mail: lakshdesign@gmail.com

Logistics Partner: Blue Dart Express Limited

The New Infrastructure Mandate: RETHINK. REBUILD. REINVENT.

Today’s supply chain leaders are under pressure to deliver infrastructure that is not only agile and cost-effective but also radically more sustainable. It means integrating ESG accountability into capital expenditure—and doing so under intense time and cost pressures. In this high-stakes environment, we asked industry experts one question: What will it take to rethink, rebuild, and reinvent infrastructure for a supply chain that’s ready for what’s next? Their answers reveal a sector in transition—where ambition, innovation, and collaboration will decide who leads and who lags…

6 | Next-Gen Supply Chain Loading… Gender-Inclusive And People-First

I see a future where women are driving transformation across every part of the supply chain— from digital planning to shop floor innovation. Where leadership is based on talent, not gender, envisages Rajni Gupta, AVP – Manufacturing and Supply Chain /SCC Head, Jubilant FoodWorks Ltd.

| The Sleep Revolution Meets Smart Logistics

Shonik Goyal, President & Head – Supply Chain Management, Sheela Foam Ltd., emphasizes that effective inventory volatility management in hyperlocal fulfillment is no longer about reacting to demand—it’s about engineering a predictive, adaptive, and fully integrated ecosystem.

24 | Breaking Maritime Logistics’ Digital Deadlock

Maritime logistics, long defined by tradition and steady rhythms, now finds itself on the cusp of meaningful change, writes Pradeep Chaudhary, Senior Domain Consultant, Tata Consultancy Services.

27 | Capitalism, Consumerism, and the Supply Chain Dilemma – What India Must Fix Before It’s Too Late

Sanjay Desai opens a compelling discussion in this expert piece, urging a relook at the values driving consumption, growth, and supply chain design.

A curated round-up of the latest news, insights, and perspectives shaping supply chains across the globe—stay informed, stay ahead.

“I see a future where women are driving transformation across every part of the supply chain— from digital planning to shop floor innovation. Where leadership is based on talent, not gender. I want the next generation to enter this space without needing to prove they belong. I want them to see more women in key roles, building each other up, and creating a culture where ambition is celebrated, not questioned,” envisages Rajni Gupta, AVP – Manufacturing and Supply Chain /SCC Head, Jubilant FoodWorks Ltd. (JFL), during this exclusive interview…

In your journey so far in the supply chain, what have been some genderspecific challenges you’ve faced, and how did you navigate them?

One of the biggest gender-specific challenges I’ve encountered is dealing with unconscious bias—especially in operational settings where women have traditionally been underrepresented. Early on, I often found myself being the only woman in the room—whether it was on the shop floor or during critical vendor negotiations. I clearly remember one negotiation where, despite me leading the project, all questions were directed to my male colleague.

It was frustrating, but I knew I had to take the lead. I stepped in with confidence, backed by data and preparation, and gradually shifted the dynamic. It wasn’t about proving a point—it was about being seen as the decision-maker, which I was. Over time, I learned that consistent performance, cross-functional collaboration, and speaking up—even when it feels

uncomfortable—are key to challenging bias. I also leaned on mentors and allies, both men and women, who helped me stay grounded and navigate those tough moments. Slowly, those experiences reshaped how others perceived me—and more importantly, how I saw myself as a leader.

How do you balance highperformance manufacturing goals with people-centric leadership, especially in a sector that demands both speed and precision?

In manufacturing, the pressure to meet numbers and timelines is constant— but I’ve come to believe that strong performance actually starts with people. During a demanding ramp-up period, it would’ve been easy to just double down on output targets. Instead, I chose to spend more time on the floor, having honest check-ins and setting up simple yet effective practices like daily huddles and feedback boards. That connection created trust and ownership within the team. When people feel respected

With over two decades of experience spanning operations, supply chain, manufacturing, transformation, operations excellence, Rajni Gupta has previously worked with industry leaders such as Pernod Ricard India and IMI Norgren. An alumni of IIM Ahmedabad and Symbiosis Institute of Management Studies, Rajni is known for her strategic thinking, people first leadership, and ability to drive transformation.

and supported, they naturally push themselves to deliver. For me, it’s always about combining clear, high expectations with a work environment where people feel seen and valued.

How does gender diversity within supply chain teams influence decision-making and operational efficiency?

Gender-diverse teams approach challenges from multiple angles—and that improves the quality of decisions. I’ve seen this firsthand. Women often

bring a collaborative mindset and a knack for asking the ‘what if’ questions others might miss. In one case, during a network redesign, a woman on our team flagged a potential customer disruption we hadn’t considered. That input led us to tweak the rollout and avoid issues down the line. It’s not just about inclusion, it’s about sharper thinking, better planning, and more resilient execution. The diversity of perspective makes us better as a team.

In a fast-paced QSR environment, what unique perspectives do women bring to manufacturing and logistics?

Women often bring a great mix of agility, attention to detail, and emotional intelligence—qualities that are incredibly valuable in fast-moving environments like QSR or FMCG. I’ve seen women who could spot process gaps mid-shift and make adjustments without disrupting flow—all while keeping the team upbeat and aligned. Beyond task management, many also foster stronger team dynamics. Their ability to lead with empathy makes people feel supported, which matters even more during highpressure situations. It’s that balance of precision and people-focus that really sets them apart.

Could you share an example of a difficult supply chain disruption you handled, and how your leadership played a role?

The second COVID wave was a defining moment. With supplier shutdowns and logistics collapsing, it was chaos. But customer demand didn’t slow down— in fact, it spiked. I formed a task force across procurement, planning, logistics, and finance to take fast, informed

For me, resilience, empathy, and adaptability have been non-negotiables. This field is unpredictable—you need to be able to think fast, stay calm, and keep your team centered. I do believe many women lead with a strong sense of emotional intelligence. They listen deeply, communicate clearly, and build trust—which is crucial when you’re managing large, diverse teams under pressure. These aren’t ‘soft’ skills— they’re strategic ones.

decisions. We reworked sourcing, shortened lead times where possible, and focused on our most critical SKUs. What helped the most was transparent, steady communication—keeping the team aligned, even when the path wasn’t clear. Looking back, it wasn’t just a recovery, it was a transformation. We came out of that crisis faster, smarter, and more connected.

What initiatives have you led (or want to implement) to make supply chain and manufacturing more inclusive for women?

One initiative I’ve supported is a buddy system for women in frontline roles— especially in manufacturing setups where the environment can be intimidating at first. It helped new joiners settle in faster, gain confidence, and build a support network from day one. I’ve also pushed for better shift flexibility and safe transport options, because these are basic enablers that many women silently struggle with. Looking ahead, I’d love to build structured leadership programs that support mid-career women— because that’s where we tend to lose strong talent due to lack of visibility or support.

How has women’s representation in supply chain leadership evolved over the past decade?

It’s definitely come a long way. When I began, it was rare to see women leading plant ops or logistics. Today, we’re seeing women in strategic roles, driving automation, sustainability, and even digital supply chains. What’s driven this? Intentional hiring, targeted leadership development programs, and most importantly—visible role models. When you see women breaking barriers in traditionally male-dominated areas, it shifts the mindset of everyone watching, including young women considering this path.

What leadership traits have helped you succeed—and do women bring a different lens to supply chain leadership?

For me, resilience, empathy, and adaptability have been non-negotiables. This field is unpredictable—you need to be able to think fast, stay calm, and

keep your team centered. I do believe many women lead with a strong sense of emotional intelligence. They listen deeply, communicate clearly, and build trust—which is crucial when you’re managing large, diverse teams under pressure. These aren’t ‘soft’ skills— they’re strategic ones.

If you were to build a women-centric leadership program in supply chain, what core pillars would you include?

I’d structure it around four pillars:

Confidence and communication: Many women have the skills but hesitate to speak up. Training in presence and assertive communication can change that.

Mentorship and sponsorship: Access to mentors who advocate for women behind closed doors is a game changer.

Cross-functional exposure: Rotations across functions like planning, procurement, and plant ops to build holistic understanding.

Hands-on leadership labs: Real project simulations that develop strategic thinking and decisionmaking. Most importantly, I’d create safe peer spaces where women can share openly—because community and shared experiences accelerate growth.

What message would you give to young women considering a career in supply chain or manufacturing?

Don’t second-guess your place here— you belong. This field isn’t just about systems and processes; it’s about people, decision-making, and real-world impact.

Your voice, your perspective, your leadership—it’s needed. Walk in with confidence, stay open to learning, and don’t wait for permission to lead. The industry is changing, and you can be part of that change.

What’s your vision for the next generation of women in supply chain and manufacturing in India?

I see a future where women are driving transformation across every part of the supply chain—from digital planning to

shop floor innovation. Where leadership is based on talent, not gender. I want the next generation to enter this space without needing to prove they belong. I want them to see more women in key roles, building each other up, and creating a culture where ambition is celebrated, not questioned.

◊ Rajni Gupta has successfully led large scale automation and digital transformation initiatives, built agile, future ready supply chains, and turned around complex manufacturing setups under tight timelines.

◊ Her leadership during crises—such as maintaining operational continuity during lockdowns—reflects her resilience and decisiveness. She takes great pride in mentoring cross functional teams, many of whom have progressed into leadership roles themselves.

◊ A strong advocate for diversity, sustainability, and ethical business practices, Rajni believes that inclusive teams drive lasting innovation.

◊ Beyond work, she enjoys reading, traveling, spending time in nature, and practicing mindfulness and journaling to stay grounded.

◊ She once managed a full production turnaround during the Diwali festival—an experience that taught her the real power of calm leadership under pressure. Her guiding belief: “In the middle of difficulty lies opportunity.”

“Effective inventory volatility management in hyperlocal fulfillment is no longer about reacting to demand—it’s about engineering a predictive, adaptive, and fully integrated ecosystem. Organizations that invest in the right technology stack, cultivate strategic supply chain partnerships, and embed data intelligence at the core of their operations are best positioned to outperform in this high-velocity fulfillment environment,” emphasizes Shonik Goyal, President & Head – Supply Chain Management, Sheela Foam Ltd., during this exclusive interview…

The mattress industry was once seen as low-involvement and largely offline — but in the last few years, it has transformed with technology, personalization, and online models. What drove this shift, and how is Sheela Foam using innovation and customer insights to stay ahead in such a personal and evolving category?

Mattresses, until recently, were considered a once-in-a-decade purchase, often decided by the retailer, not the end customer. But that changed dramatically due to three converging factors: evolving customer awareness about sleep health, a spike in digital-first brands reshaping expectations, and the pandemic accelerating online experimentation even in touch-and-feel categories like ours.

At Sheela Foam, with brands like Sleepwell and now Kurlon under our umbrella, we’ve embraced this disruption with purpose. Let me break this into three areas:

Product Science and Innovation: We’ve invested deeply in foam science, not just to sound “techy,” but to solve real customer problems — posture support, temperature regulation, motion isolation. Products like Sleepwell Nexa or the Fit Series are engineered for specific needs — from orthopedic alignment

to athletic recovery. Our R&D teams in Australia and Spain contribute to global-grade tech that’s localized for Indian consumers. Memory foam is no longer the benchmark — we’re working on multi-zone support structures, AIinfluenced material mixes, and antimicrobial treatments as sleep needs evolve.

Channel Evolution: Offline + Online + Experience: Sleep is deeply personal, and consumers still want to “feel” before they buy. So, while the online share has grown from under 5% to over 10%, we haven’t abandoned retail — we’ve transformed it. Our Sleepwell Experience Centers blend physical and digital — they use pressure-mapping tech to help buyers find the right firmness or support. And yes, we’ve also cracked the logistics of bed-in-a-box, where compression and smart packaging allow high-rise delivery — though returns and sizing errors still remain a challenge we’re streamlining.

Customer Trust and Value Creation: What used to be ‘a piece of foam wrapped in nice fabric’ is now a health product. So, we’ve had to rethink the entire value equation — from trial periods and warranties to educating users about replacement cycles and posture science. Our newer platforms allow custom

experience in end-to-end supply chain management including Strategic Sourcing, Capital Sourcing, Contract Governance, Material Planning, Distribution Management, Order Fulfillment, Customer Service, Production Planning, Cost Management & Budgeting. He is the Master of Supply Chain & Manufacturing Network design to drive cost efficiency and best in class Customer Service.

Sleep is deeply personal, and consumers still want to ‘feel’ before they buy. So, while the online share has grown from under 5% to over 10%, we haven’t abandoned retail — we’ve transformed it. Our Sleepwell Experience Centers blend physical and digital — they use pressure-mapping tech to help buyers find the right firmness or support. And yes, we’ve also cracked the logistics of bed-in-abox, where compression and smart packaging allow high-rise delivery — though returns and sizing errors still remain a challenge we’re streamlining.

mattress sizing, subscription models for mattress protectors, and even sleep consultations in some pilot cities.

So, to your point: yes, this category has evolved — and brands that don’t evolve with it will lose relevance. For us, the goal isn’t just disruption — it’s sustainable innovation that helps consumers sleep better, live better, and stay connected with the brand beyond just one transaction every 10 years.

How do you see AI driving efficiency in quick commerce, especially across order management, delivery, and tech? What key opportunities or challenges stand out to you?

AI is also transforming how we predict demand. With dynamic replenishment systems in place, we can now forecast demand at a SKU-level, which helps us segregate stock into ‘made-To-Order’ and ‘made-To-Stock’ categories. This has been a gamechanger for our inventory management and fulfillment speed, especially when it comes to meeting quick commerce expectations. For example, made-to-stock items are guaranteed to be delivered within 24 hours, while madeto-order products are allocated different delivery windows depending on the location. AI’s role in demand prediction allows us to manage inventory more efficiently, resulting in better service levels and reduced stockouts.

Quick commerce is scaling fast, but profitability remains a challenge. Can it deliver long-term value, or is the model fundamentally unsustainable? What will it take to build a more viable ecosystem?

For us, it was indeed a tricky decision. As the leading offline mattress brand, we had to choose whether to stay focused on our dominant offline presence or

step into the online space, where the dynamics were very different. Ultimately, we decided to enter online because we noticed the competition scaling aggressively in that channel—and we didn’t want to be left behind or allow others to gain an unchallenged foothold online and eventually encroach on our offline turf.

Yes, in the initial phase, our online journey involved burning cash. There were growing pains—logistics inefficiencies, high return rates, and challenges around size customization. But over time, we’ve taken several structural steps to bring this under control.

First, we optimized our manufacturing footprint. We now operate multiple decentralized facilities across the country. This not only reduces shipping costs but also shortens delivery times significantly, which is key for both cost efficiency and customer satisfaction.

Second, we’ve invested in roll-pack technology at a national scale, allowing us to ship bulkier products like mattresses more cost-effectively, with lower chances of damage or returns. That has been a game-changer for improving margins.

Third, we are actively refining our return management process. We’re leveraging better sizing guides, AI-driven personalization tools, and in some cases, even deploying service staff to customer homes to verify dimensions and suitability before dispatch. This human touch has helped reduce costly errors and improve customer trust.

We’ve also begun using predictive analytics to flag high-return-prone orders and proactively offer assistance or restrict COD options. This is helping lower our reverse logistics cost. While the journey hasn’t been easy, our aim is clear: to move toward sustainable profitability while staying relevant in

a fast-evolving channel. E-commerce will never be a perfect mirror of offline retail—but it doesn’t have to be. It has its own strengths, and we’re now in a better position to harness them.

How can companies balance speed versus cost-efficiency in Q-commerce logistics?

Q-commerce companies can balance speed and cost-efficiency by strategically placing warehouses close to customers, leveraging technology for route optimization, and partnering with local retailers. This approach minimizes delivery times and associated costs while ensuring efficient inventory management and faster, more reliable service.

Strategic Warehouse Placement: Establishing micro-warehouses, also known as dark stores, in urban areas significantly reduces delivery times. These stores are designed for rapid order fulfillment, enabling quicker delivery to customers within a short radius.

Technology Integration: Advanced technologies like AI and machine learning are used to optimize inventory management, route planning, and predictive analytics for demand forecasting. This ensures smooth operations, consistent inventory levels, and high fill rates.

Route Optimization: Route optimization algorithms, powered by AI and machine learning, strategically plan delivery routes to minimize delays, reduce costs, and optimize fuel consumption. These algorithms consider various factors like traffic patterns, vehicle capacity, and delivery time windows.

Local Partnerships: Collaborating with

local retailers and suppliers enhances inventory availability and distribution efficiency. This can involve partnering with local grocery stores or Kirana shops to ensure popular items are readily available.

Sustainability: Adopting eco-friendly practices, such as using electric vehicles for deliveries and sustainable packaging, can mitigate environmental concerns and appeal to eco-conscious consumers, potentially leading to lower long-term costs.

What strategies are proving most effective in managing inventory volatility in hyperlocal fulfillment models?

Managing inventory volatility in hyperlocal fulfillment models demands a sophisticated, multi-pronged approach rooted in real-time intelligence, predictive analytics, and operational agility. These models, characterized by their emphasis on rapid delivery within tightly defined geographies, necessitate inventory systems that are not just responsive, but anticipatory in nature.

At the core is real-time inventory visibility. Hyperlocal fulfillment leaves no room for latency in inventory updates— every transaction must be instantly reflected across all nodes in the network. Advanced Inventory Management Systems (IMS) are indispensable in this context. These systems must support dynamic synchronization across multiple fulfillment centers, enabling precise stock tracking, immediate replenishment alerts, and seamless integration with e-commerce platforms and point-ofsale systems. Without this level of granularity and automation, the risk of stock discrepancies and fulfillment errors escalates sharply.

Equally critical is predictive demand forecasting. Leading organizations are leveraging AI and machine learning algorithms to process vast datasets encompassing historical sales, promotional calendars, local market behavior, and external factors such as weather or regional events. This allows for the generation of highly granular forecasts, tailored down to the SKU level and hyperlocal geography. Such forecasts underpin robust demand planning,

enabling businesses to optimize reorder points, set dynamic safety stock thresholds, and adjust procurement strategies in near real time.

Warehouse and fulfillment network optimization is another strategic imperative. Hyperlocal efficiency hinges on micro-fulfillment strategies that bring inventory closer to the end consumer. This includes deploying multi-node warehousing models and leveraging dark stores or urban fulfillment hubs. Just-in-Time (JIT) inventory strategies can further reduce holding costs while maintaining responsiveness, but must be underpinned by highly reliable supply chain coordination. Fulfillment processes themselves must be engineered for speed and accuracy, incorporating technologies such as automated picking systems, robotics, and real-time order routing to accelerate throughput and reduce error rates.

Collaboration across the supply chain is also evolving into a key differentiator. Strategic partnerships with thirdparty logistics (3PL) providers offer scalability, geographic reach, and fulfillment expertise, especially in lastmile delivery. Deep supplier integration is equally vital. Advanced supplier relationship management ensures agile replenishment, while Vendor-Managed Inventory (VMI) frameworks enable suppliers to take proactive control of inventory levels based on real-time consumption data—reducing latency and minimizing inventory risk.

Data analytics serves as the intelligence layer across all these strategies. Mature hyperlocal operators are investing in advanced analytics platforms that provide end-to-end visibility and decision support. These systems can surface actionable insights, identify anomalies, forecast disruption risks, and simulate inventory scenarios. The most advanced use cases incorporate prescriptive analytics and digital twins, allowing for continuous optimization of fulfillment and inventory strategies.

In sum, effective inventory volatility management in hyperlocal fulfillment is no longer about reacting to demand—it’s about engineering a predictive, adaptive, and fully integrated ecosystem. Organizations that invest in the right technology stack, cultivate

strategic supply chain partnerships, and embed data intelligence at the core of their operations are best positioned to outperform in this highvelocity fulfillment environment.

How do you see the convergence of Q-commerce and traditional e-commerce models playing out in the next 3–5 years?

In my view, in the next 3-5 years, Q-commerce and traditional e-commerce will likely converge, with Q-commerce focusing on convenience and speed for essential goods, and traditional e-commerce handling broader product categories and bulk purchases. Both will leverage technology for optimization and customer experience and may even integrate operations for greater efficiency.

Hybrid Models: We might see the emergence of hybrid models where Q-commerce platforms expand their product range and offer longer-lead-time deliveries, while traditional e-commerce platforms introduce faster delivery options for certain items.

Integration of Technology: Both Q-commerce and traditional e-commerce will rely heavily on technology to improve customer experience, optimize operations, and personalize the shopping journey.

Customer-Centric Approach: The focus will be on delivering a seamless and convenient experience, with companies adapting their business models to meet the evolving needs of consumers.

Competition and Innovation: The competition between Q-commerce and traditional e-commerce will drive innovation and lead to better services and lower prices for consumers.

Logistics infrastructure is no longer just about moving goods—it’s about MOVING FAST, MOVING CLEAN, and MOVING SMART. As global supply chains confront a convergence of forces—digital disruption, climate imperatives, rising consumer expectations, and volatile market dynamics—business-as-usual is no longer viable. What once passed as forward-looking infrastructure is now the baseline. The old playbook of incremental upgrades won’t cut it. Today’s supply chain leaders are under pressure to deliver infrastructure that is not only agile and cost-effective but also radically more sustainable. That means electrifying fleets, reengineering warehouses for energy efficiency, embedding AI into network design, and forming bold new partnerships across value chains. It means integrating ESG accountability into capital expenditure—and doing so under intense time and cost pressures. In this high-stakes environment, we asked industry experts one question: What will it take to rethink, rebuild, and reinvent infrastructure for a supply chain that’s ready for what’s next? Their answers reveal a sector in transition—where ambition, innovation, and collaboration will decide who leads and who lags…

Supply chain infrastructure is being tested like never before pushed to deliver faster, smarter, and greener. With customer expectations evolving rapidly and sales channels multiplying, businesses face a high stake balancing act: scaling operations while embedding sustainability at the core.

Given the convergence of empowered consumer behaviour, omnichannel complexity, and rising sustainability expectations, how should organizations prioritize their infrastructure investments to ensure both agility and environmental accountability—especially in markets as diverse and dynamic as India?

Shammi Dua, VP, Kearney: The modern customers are no longer passive recipients of goods & services; they are discerning, empowered, and increasingly dictate the terms of engagement. They demand not only an expansive range of choices but also the freedom to receive selected product precisely when and where they desire. Furthermore, their expectations do not end at the point of purchase—they seek the flexibility to modify delivery preferences postorder, whether it's the timing or the destination. This dynamic and fluid consumer behaviour renders traditional demand forecasting increasingly obsolete, compelling organizations to fundamentally reimagine how their infrastructure supports responsiveness at scale.

Compounding this complexity is the proliferation of sales channels. The same customer now shops seamlessly across general trade, e-commerce, direct-toconsumer (D2C), and quick commerce platforms. While they remain a single consumer, their needs shift based on the context of each channel—requiring businesses to tailor offerings accordingly. This omnichannel reality drives SKU proliferation, accelerates product turnover, and significantly shortens shelf lives. Supply chains, as a result, must

evolve to become highly modular, nimble, and capable of navigating fragmentation without compromising efficiency.

Simultaneously, the path to purchase has become increasingly unpredictable. Today’s shopper might discover a product on Instagram, evaluate it on an e-commerce site, and ultimately complete the transaction through a direct brand platform. In this fluid digital ecosystem, infrastructure must support real-time adaptability, cross-platform consistency, and hyper-localized fulfillment. While technology—through AI, data analytics, and cloud computing—enables deeper insights and faster decisions, the true test lies in whether our physical infrastructure can keep pace. Are our warehouses intelligent and scalable? Are our distribution networks designed for speed and precision? Can our systems handle constant recalibration while remaining sustainable?

This brings us to a pivotal inflection point: the imperative of sustainability. What was once a peripheral concern has now become central to brand credibility and long-term viability. Today’s stakeholders—consumers, regulators, and investors alike—are no longer satisfied with broad sustainability claims; they expect transparent, measurable action. Critical questions are being asked: Are logistics operations reducing carbon emissions? Are our facilities energyefficient and built to green standards? Are we minimizing packaging waste and embracing circular models? Governments are clamping down on greenwashing, demanding evidence of real progress, not just polished narratives.

With your experience across sectors, how have changing

customer behaviors and the rise of sales channels like e-commerce and quick commerce impacted warehouse operations? And how do you balance investing in infrastructure now versus waiting for scale?

Kapil Premchandani, Founder & MD, KD Supply Chain Solutions:

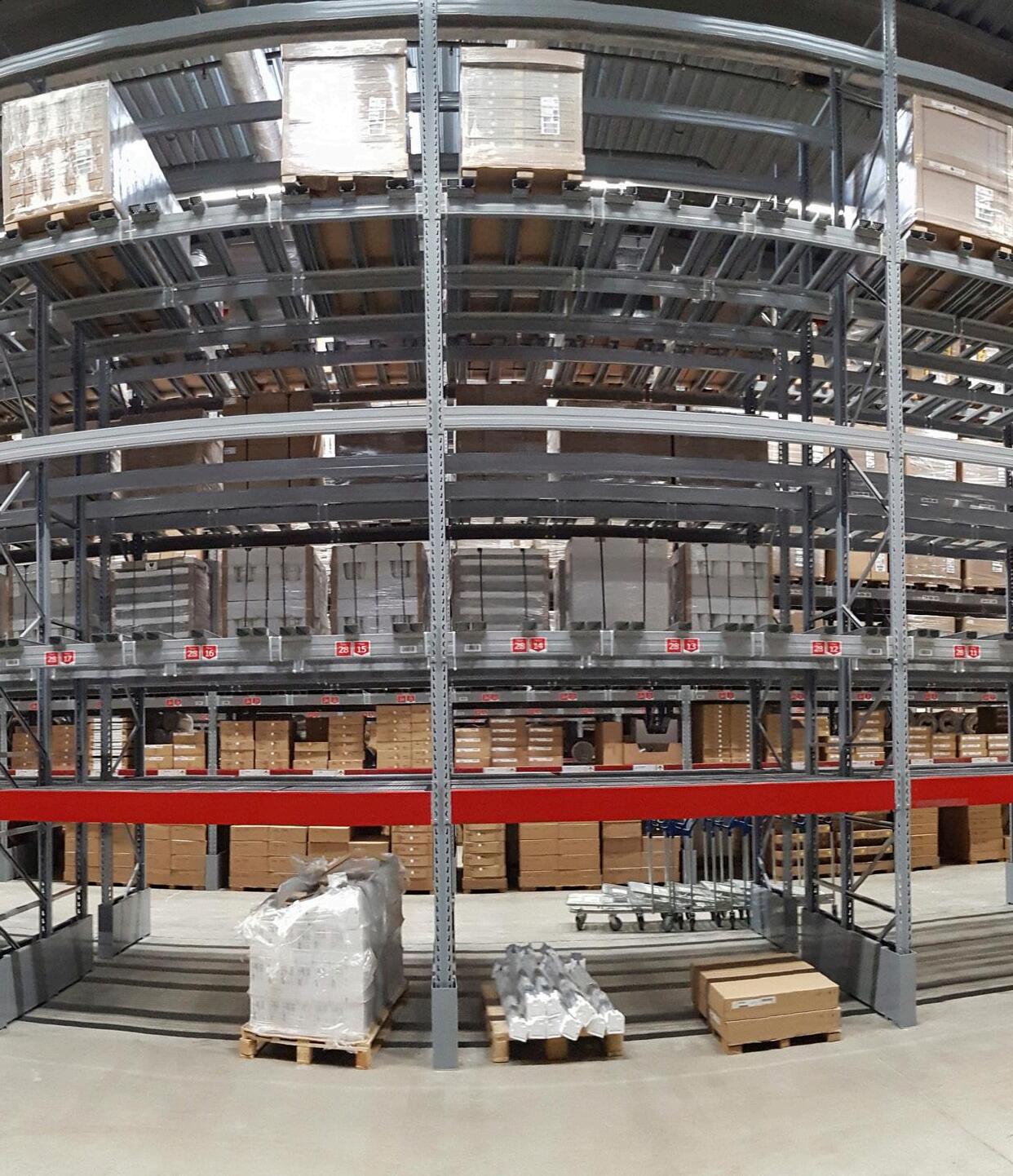

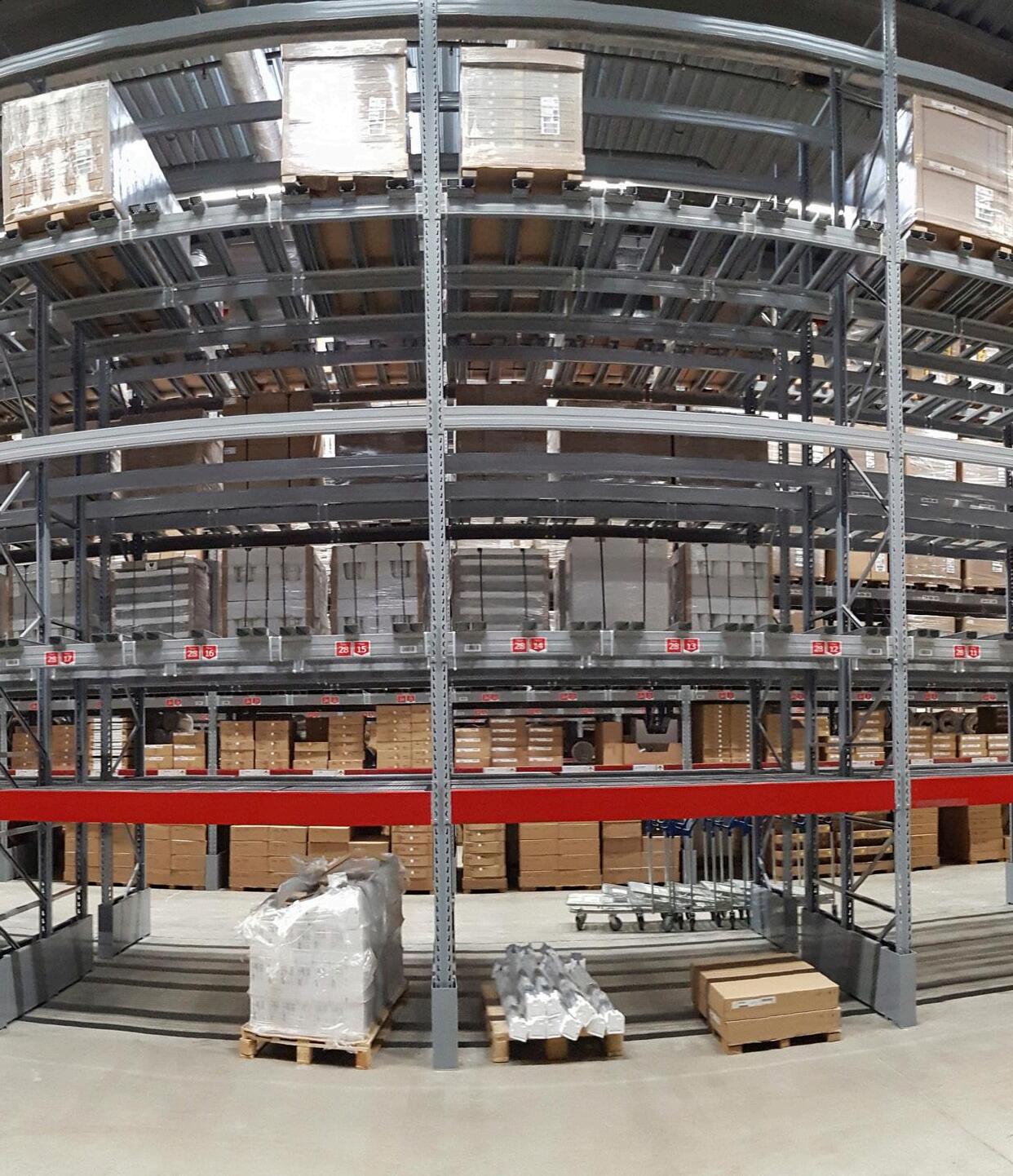

Over the past two decades, we’ve witnessed a tremendous shift in supply chain dynamics—especially when it comes to warehousing. When I started, the typical warehouse setup was very basic, essentially a godown with simple storage functionality. The structures were lowtech and focused on storing goods in bulk. At that time, 8-meter-high warehouses were the standard, and they were largely designed to meet the basic needs of traditional warehousing operations.

However, as the years passed, this model began to evolve. We started moving towards more high-tech, highcapacity warehouses. The height of the warehouse increased from 8 meters to 12 meters, a significant change in terms of maximizing vertical space. These upgrades were not just about aesthetics or capacity; they were about improving efficiency and scalability. The need for more advanced storage solutions became evident as demand grew.

In my experience, especially after founding my own organization in 2005, we’ve seen the warehouse transform from a place of basic storage to a fully automated, tech-enabled facility. Initially, warehouses had simple features—basic inventory management systems and a few manual processes. Today, those same warehouses are filled with racks, automation systems, and sophisticated inventory management software that

The current state of infrastructure logistics is marked by growing digital integration, strained global supply chains, and a push for sustainability. Urban congestion and aging infrastructure challenge efficiency, while AI, IoT, and automation drive innovation. Looking ahead, the sector will likely see smarter, greener logistics systems, with increased resilience and responsiveness powered by data analytics, autonomous transport, and collaborative global networks. Sustainability and adaptability will define future success.

drive operational efficiency. It's quite incredible to look back at how quickly the industry has moved in terms of technology adoption.

Moreover, the nature of the demand itself has changed. Previously, we were just serving a single channel or a couple of customer segments. But today, warehousing has to cater to multiple types of sales channels: general trade, modern trade, quick commerce, and e-commerce. These channels require completely different logistical approaches and speed requirements. For example, quick commerce demands rapid fulfillment, often within hours, while modern trade may require larger batches of products for brick-and-mortar stores. In essence, the same warehouse now serves a wide range of operational needs, creating

complexity in the supply chain.

One thing that stands out in this evolution is how different channels demand tailored warehousing strategies. It's no longer about just storing products; it's about making the right decisions in real-time—optimizing space, automating processes, and even integrating software solutions that sync with the different marketplaces. This integration of software platforms and physical infrastructure is key. We are now managing multiple workflows within the same space, which requires adaptability and smart design to maintain efficiency.

In terms of handling this increasing complexity, we must ask ourselves: should we invest now to handle the scale we anticipate, or should we wait for the scale to materialize before making

these significant investments? This is the dilemma that I’m currently facing in my own business. There’s no clearcut answer. On one hand, waiting for the scale might seem less risky, but on the other hand, there’s a growing need to prepare for future demands. The investments we make in automation, AI, and data integration today could place us ahead of the competition tomorrow.

It’s truly a paradox of change. As the customer's expectations and the complexity of supply chains increase, we are left balancing the need to invest proactively with the uncertainty of exactly when that investment will start paying off. The decision to invest requires a level of foresight, an understanding of future trends, and a willingness to take calculated risks in the face of growing demand.

In today’s dynamic markets like India, infrastructure investments must evolve to meet empowered consumers’ demand for seamless, flexible, and omnichannel experiences. With rapid SKU proliferation and unpredictable purchase journeys, supply chains need to be agile, modular, and tech-enabled to respond in real time. Equally critical is embedding sustainability at the core— stakeholders now expect transparent, measurable environmental action, from carbon reduction to circular operations. Success lies in balancing speed, precision, and green accountability to futureproof business resilience.

Adopting sustainable infrastructure in supply chains involves navigating complex challenges—from financial constraints and risk mismatches to evolving technology and policy gaps.

From the perspective of a supply chain user, what are the practical barriers to adopting sustainable infrastructure—such as EV fleets and solar-powered warehouses— and how do financial planning cycles, risk appetite, and policy support influence these decisions?

Anirban Sanyal, Sr. GM – Supply Chain & National Logistics, Century Ply: Let me be candid—there is considerable frustration on the user side, just as there is on the service provider side, when it comes to implementing sustainable practices. While the intent is unanimous, the execution is riddled with very real constraints.

Take budgeting, for example. As we approach the close of the financial year, most of us are focused on finalizing our Annual Operating Plans (AOPs). Realistically, no supply chain leader can walk into a board meeting and propose an AOP that increases cost-to-serve per unit by double digits—even if it’s for a sustainability initiative. That would be professionally untenable.

We operate in a highly cost-sensitive market. While solar installations on warehouse rooftops sound appealing, the return on investment typically spans seven years. The reality? Very few of us commit to warehouse leases beyond a 3-year business horizon. In Year 1, we might only utilize 50–60% of that space. Investing in solar under such conditions becomes financially unjustifiable— especially when space utilization and

energy ROI don’t align.

This brings me to risk appetite. As a manufacturer, we are prepared to take calculated risks—like when we set up a new facility in Andhra Pradesh. That’s our core competency. But in areas like logistics infrastructure, the risk lies largely with our service providers. We expect them to absorb long-term risks while we operate within short-term commercial guardrails. It’s an inherent mismatch.

Consider electric vehicles (EVs). We started with 3-wheelers and have gradually moved to larger formats like the Tata Ace and 4.7-ton vehicles. But the ecosystem is still evolving— battery performance, vehicle capacity, and charging infrastructure are all in flux. This uncertainty creates decision paralysis. Should we invest now or wait for more mature technology? Further complicating this is the structure of corporate performance metrics. Our KPIs, PMS scores, and business targets are all tied to next-year outcomes. There’s limited room to back long-gestation projects when success is measured annually.

As for policy support, the landscape is patchy. An individual buying an EV gets tangible tax benefits. But when it comes to commercial or industrial users, incentives are unclear or insufficient. There’s a gap between sustainability narratives and actionable government support at the execution level.

In theory, we talk about strategic

partnerships with our 3PLs. But in practice, we often highlight the opportunity while remaining silent on the risk. And that’s because most of us simply cannot make 6–7-year commitments in a planning environment that doesn’t support it.

The true bottlenecks to sustainability adoption aren’t just ROI-related. They stem from misaligned planning horizons, low collective risk tolerance, and insufficient regulatory incentives. Until these factors are addressed, sustainability will remain a wellintentioned conversation, rather than a concrete roadmap.

How are service providers navigating the ROI dilemma when clients demand sustainable solutions like EVs and warehouse automation, but resist long-term commitments or cost-sharing?

Kapil Premchandani: This challenge strikes at the heart of a growing paradox in supply chain and logistics: the rising demand for sustainability without the willingness to invest in or share the risk of transformation. Large customers often mandate sustainability initiatives like shifting to electric vehicles (EVs) or automating warehouses, citing internal ESG targets or board-level optics— “because our CEO has to show it in the quarterly report.” Yet, these same customers expect service providers to shoulder all the capital expenditure (CAPEX), whether it's for purchasing EVs

The true bottlenecks to sustainability adoption aren’t just ROI-related. They stem from misaligned planning horizons, low collective risk tolerance, and insufficient regulatory incentives.

I see six high-impact focus areas for sustainable transformation in supply chains. First is reducing carbon emissions, particularly across Scope 1, 2, and 3 activities. Second, enhancing operational efficiency through digital technologies like AI/ML and IoT, which help uncover and eliminate waste. Third, implementing the 3Rs—Reduce, Reuse, Recycle—to minimize resource consumption and extend product lifecycles. Fourth, preparing for closed loop and circular supply chains, where reverse logistics and returns become integral to warehousing and inventory planning. Fifth, increasing the use of biodegradable, non-toxic materials—especially in packaging. And sixth, transitioning to bio-based products and raw materials, which align both with ecological goals and emerging consumer preferences.

or reconfiguring warehouses to handle fragmented orders, all while refusing to extend contract lengths or commit to long-term volumes.

I’ve had clients tell me: “We want you to move to EVs immediately.” When I ask, “Will you sign a 5-year contract? Because the EV costs ₹40 lakhs today compared to ₹18 lakhs earlier,” the answer is often: “No, we don’t know how this will work out.” Yet in the same breath, they say, “If you want the business, you’ll have to do it.”

This mindset throws ROI out of the window. Traditionally, ROI was a central part of investment decision-making. But in the current scenario—where client expectations shift faster than asset cycles—the concept has become arcane. The real cost of doing business is now absorbing this risk to stay relevant.

Another critical issue is short contract tenures. Clients demand multi-milliondollar investments in automation, like ASRS systems or solar-powered infrastructure, but only offer 3–5-year contracts. These assets, however, have a life cycle of 10–12 years. What happens if the contract isn’t renewed? Even with buyback clauses, recovering sunk costs is difficult because disassembling and reinstalling equipment like racking systems can cost ₹300–500 per pallet.

The solution isn’t just about technology. It starts with intelligent warehouse planning—right from layout and racking to energy usage and natural lighting. For example, while most

companies focus on leak-proof roofs using standing seam technology, they miss the fact that it blocks skylights, increasing electricity bills. There are newer techniques now where you can integrate skylights with standing seam roofing and align aisles to maximize natural light. But these decisions must be made during the warehouse design phase, not retrofitted later.

We’ve also used heat maps to analyze forklift movement and product picking patterns. By repositioning frequently picked SKUs closer to access points, we’ve reduced forklift count—directly contributing to lower emissions and costs.

Moreover, sustainability isn’t just about solar panels or EVs. It’s about understanding your energy footprint, knowing your processing area needs (especially in verticals like apparel where tagging and scanning are critical), and optimizing from within before making external investments. In short, we’ve stopped talking about ROI in isolation. The landscape is evolving too quickly. The real metric today is business continuity and resilience. ROI, if it comes, is now a long-term outcome—not a prerequisite for action.

How can organizations balance short-term cost pressures with long-term investments in sustainable infrastructure?

Ashish Bhatnagar, Director & Head – Procurement, Bimbo Bakeries:

Sustainable infrastructure currently has high initial cost – be it solar park, electrification, EVs, etc., and often these costs are invisible in the supply chain and cannot be passed on to the consumers due to limited tangible benefits. Organizations are often under a dilemma to invest upfront which impacts their current performance, which is against the stakeholder requirements, and hence it is very important to find out ways to eliminate this dilemma. One of the ways is partnerships with suppliers, another is government push through subsidies or reduction in technology cost.

Technology cost and usage are like a chicken and egg story since technology will not get cheaper till it attains a scale and scale cannot be reached till technology becomes viable and hence such programs has to be driven at top level summits / cross country summits like G-20 and be funded keeping in view its impact on the climate change and then percolated downstream by way of subsidy or some other means.

Some organizations are already working on models eg: Solar Opex instead of Capex to help organizations avoid upfront costs but still these are long term 15-25 years contracts which limits the organizations to make decisions. However, there is a significant movement in investments driven by many MNCs and Indian giants committing to GHG goals wherein infrastructure improvement w.r.t. environmental goals is the first priority.

By harnessing breakthrough technologies and fostering deep collaboration across partners, industries are slashing delays, cutting carbon footprints, and future-proofing supply chains against growing uncertainties. This isn’t just progress—it’s a paradigm shift where co-creation turns complexity into opportunity, and sustainability becomes a powerful catalyst for competitive advantage.

Can you share a real-world example where innovative infrastructure significantly improved value chain resilience or reduced environmental impact?

Anirban Sanyal: A notable example is the Port of Rotterdam’s digital transformation. By integrating IoT sensors, AI, and blockchain, the port optimized cargo handling and vessel traffic, significantly reducing wait times and emissions. The “PortXchange” platform enables real-time data sharing among shipping lines, terminals, and service providers, enhancing decisionmaking and operational efficiency. This innovation improved the resilience of the supply chain by reducing delays and disruptions while lowering CO₂ emissions, contributing to a greener, more reliable logistics ecosystem. It’s a leading model of how smart infrastructure can drive both environmental and value chain benefits in global trade.

Ashish Bhatnagar: Organizations are increasingly adopting green energy sources, electrification, and equipment efficiency improvements to reduce power and fuel consumption. Examples include switching from grid power to solar or wind energy and transitioning from Light Diesel Oil (LDO) to Piped Natural Gas (PNG), all aimed at lowering greenhouse gas (GHG) emissions and minimizing environmental impact. Some organizations have also set ambitious targets to adopt electric vehicles (EVs) for their transportation needs, including EV scooters for last-mile connectivity, further contributing to sustainability goals.

A notable example of innovative

infrastructure in India that has enhanced value chain resilience while reducing environmental impact is the development of Multi-Modal Logistics Parks (MMLPs). Spearheaded by the Government of India through the Ministry of Road Transport and Highways (MoRTH) and the National Highways Authority of India (NHAI), these parks are being developed under the Logistics Efficiency Enhancement Program (LEEP). MMLPs are designed to integrate multiple modes of transport—road, rail, air, and sea— within a single facility. If successfully implemented, these parks will offer comprehensive infrastructure including mechanized warehousing, cold storage, and multimodal connectivity. This will not only streamline freight movement but also significantly reduce emissions, minimize food waste, and improve overall resource efficiency, thereby contributing to a lower environmental footprint.

How do you work with clients to co-develop tailored, innovative infrastructure solutions that address specific client challenges, particularly in complex or emerging sectors like renewable energy logistics?

Ishant Agarwal, President, CJ Darcl Logistics Ltd.: CJ Darcl is a recognised player in the industry for its customerspecific solutions that cater to all kinds of logistics requirements across a multitude of sectors from construction to energy. Sectors like renewable energy have specific requirements such as movement of large components like wind turbine blades or solar panels and liquid fuels that are transported in large tankers. With our diverse range of containers

such as open top, flat bed, end open, dwarf height etc, we cater to the unique requirements of our client’s basis the shape and size of their goods.

At CJ Darcl, we work in close tandem with the clients’ team to provide them fair understanding of the processes involved from securing permits to route surveys that we conduct before the actual journey begins to map the obstacles and be prepared with preventive measures to eliminate their impact. We also guide them about the optimal combination of road, rail, air, and sea transport to create efficient and cost-effective infrastructure solutions tailored to their project specific demands. Moreover, with an expert team of experienced professionals, we meticulously plan the entire journey to minimize delays and ensure cargo safety at every step in the way, underscoring CJ Darcl's dedication to delivering innovative infrastructure solutions that precisely address the unique challenges in even the most complex sectors.

In the face of cost pressures, low consumer willingness to pay, and the evolving nature of green technologies, how can companies collaborate across their value chain—including suppliers, customers, and even competitors—to drive innovation and make sustainability viable?

Anirban Sanyal: To address cost pressures and limited consumer willingness to pay, companies can collaborate across the value chain by sharing resources, risks, and innovations. Joint investments in green technologies with suppliers can reduce costs through scale. Engaging customers through co-

The evolution of warehousing and supply chains over the past two decades has been nothing short of transformative. What once were simple storage spaces have evolved into sophisticated, highly automated, and data-driven networks. This shift has been driven by the need for greater efficiency, scalability, and the ability to serve multiple sales channels—from traditional retail to rapid e-commerce fulfillment. As we look to the future, the challenge isn’t just about solving current logistics problems—it’s about anticipating future demands and investing wisely in innovations that will keep supply chains agile and competitive. The key lies in balancing immediate operational needs with strategic foresight to build resilient, adaptable, and technology-enabled infrastructure that can meet the evolving expectations of customers and markets.

created sustainable solutions increases acceptance. Competitors can form pre-competitive alliances to develop industry standards, share best practices, and lobby for supportive regulations. Transparent data sharing and aligned incentives promote trust and efficiency. By building ecosystems of collaboration, companies can accelerate innovation, reduce duplication, and make sustainability more economically viable while reinforcing collective resilience and long-term competitiveness.

Shammi Dua: We are at an inflection point where certain technologies and practices can no longer be assessed purely through conventional ROI frameworks. Just as ERP, automation, and AI/ML have become foundational to operational excellence, sustainability enablers—like clean energy integration, green logistics, and circular supply chains—must be seen as strategic capabilities.

Companies that are serious about making sustainability viable must break down the silos. Collaboration is the force multiplier. Whether it's co-investing with suppliers in renewable energy infrastructure, pooling demand to scale green raw materials, or jointly developing circular packaging with competitors, the future is about ecosystem-wide innovation. We’re already seeing this in practice:

◊ Shared infrastructure models—like

Multi-Modal Logistics Parks— are being co-developed to reduce environmental impact across industries.

◊ Digital supply chains are enabling real-time data sharing with suppliers and partners, reducing waste, emissions, and inefficiencies.

◊ AI-driven demand sensing allows for smarter planning across the chain, which not only reduces working capital but also minimizes environmental footprint. The shift we’re seeing is from scattered green initiatives to integrated sustainability platforms. Rather than each company piloting its own isolated energy optimization system, for example, leading players are co-building interoperable platforms that benefit the entire value chain—suppliers, partners, and even competitors. This mindset shift—from sustainability as a compliance cost to sustainability as a source of shared value—requires transparency, trust, and technological alignment.

Ultimately, sustainability, like technology, must be embedded into the operating model. It’s not just about installing solar panels or switching to EVs—it’s about rethinking the entire value chain with agility, resilience, and environmental responsibility at its core.

And just like you wouldn’t ask for the ROI of cybersecurity or cloud

computing today, in a few years, you won’t ask about the ROI of decarbonized transport or regenerative sourcing. These will be the baseline expectations— built collaboratively and sustained collectively.

Prof. Jitender Madaan: For sustainability to be truly viable, companies must move beyond isolated efforts and embrace integrated, systemwide collaboration across their entire value chain. This involves aligning manufacturers, suppliers, logistics partners, and customers around common goals rather than operating in silos.

A practical way to achieve this is by hybridizing supply and warehousing networks—balancing centralized efficiency with decentralized agility based on product value density and demand patterns. This approach optimizes costs while enhancing service levels and sustainability outcomes.

In international logistics, intermodal transportation highlights the power of collaborative planning. Coordinated use of sea, rail, and road transport across partners can significantly reduce environmental impact without sacrificing service quality. Although these models require deep data sharing and long-term commitment, they yield substantial improvements in efficiency, resilience, and sustainability that no single player can achieve alone.

Sustainability cannot be achieved in silos. Whether it’s energy, mobility, or packaging, we need to pool investments through consortia models; optimize asset usage across customers, suppliers, and even sectors; and drive demand aggregation to bring down costs and improve supplier economics. Early adopters will, as always, enjoy the first-mover advantage. But collaboration is the multiplier that will make sustainability scalable and commercially viable.

Effective risk management is another area where collaboration is critical. Organizations should build strong partnerships with suppliers at all tiers and adopt a mix of global and regional sourcing strategies to mitigate disruptions. Cultivating a risk-aware culture that spans internal functions and external partners is essential to managing complexity.

Ultimately, sustainability and resilience become achievable when leadership champions a collaborative mindset, embedding it into supply chain strategy. By fostering strong crosscompany partnerships, organizations can share resources, reduce costs, innovate collectively, and deliver sustainable value—even amid cost pressures and consumer reluctance to pay premiums.

Ashish Bhatnagar: To answer this, let me start with why sustainability has become non-negotiable—especially for those of us in the food sector. Climate volatility is already disrupting agricultural output. For instance, the IMD has predicted that March temperatures this year will be 2°C above normal. That may sound small, but it significantly impacts wheat yields in India, where production barely meets consumption. Even a slight dip in output triggers imports, inflation, and supply risks. This isn’t unique to India—it’s a global issue, and food companies are among the first to feel its effects.

At the same time, while consumers, NGOs, and regulators increasingly expect sustainable practices, there’s still limited consumer willingness to pay a premium. Label a product ‘green’ and raise the price—even marginally—and you’ll see pushback. This disconnect between

intent and market behaviour creates real pressure. On one end, suppliers charge a green premium; on the other, customers resist higher prices.

This is where collaboration becomes critical—within and beyond the value chain. Take solar energy. Rather than each company making individual investments, open access solar allows multiple companies to co-invest—say 25% each—in a shared generation facility. Whether your plants are co-located or spread across regions, everyone benefits from pooled access to renewable energy. It reduces cost and accelerates adoption.

The same logic applies to logistics. Everyone wants to shift to EVs to cut emissions, but the upfront cost is high. Yet EVs run at just ₹1–1.5 per km, compared to ₹10 for diesel. The challenge is utilization. If a logistics partner runs an EV for our deliveries from 4 am to 10 am, it often sits idle the rest of the day. So why not use that same EV for another customer or sector in the afternoon?

This kind of cross-company, crosssector collaboration is key. Dark stores operated by quick commerce platforms, for example, also need regular deliveries. If we can share assets, routes, and time slots, we can jointly improve ROI and speed up the shift to cleaner transport. Over time, as usage rises and scale improves, the cost curve will flatten. We’re already seeing that with EVs— thanks to government incentives, import duty relaxations, and improved financing. What’s encouraging is that policymakers, including the Prime Minister, are now openly discussing Scope 1, 2, and 3 emissions. That’s a clear signal that sustainability is no longer niche—it’s entering the mainstream.

Ishant Agarwal: At CJ Darcl, we deeply foster an ecosystem with long-term partnerships and a mutually aligned vision toward adoption of greener technologies, embedding sustainability throughout the supply chain. We collaborate with our clients to offer them a sustainability-as-a-service platform that calculates carbon emissions of their shipment transportation along with customized actionable strategies to reduce the same. This not just helps us to reduce our carbon emissions but enables our customers to meet their sustainability targets by choosing carbon friendlier options. With this initiative, we have set a benchmark in the industry to encourage more players to offer alternative solutions to heavy carbon emitting solutions.

We are also expanding our railway operations to reduce carbon emissions via road transport and offer multimodal transportation solutions comprising of a mix of road, rail, coastal and air transportation. By embracing an encouraging environment with positive collaborative spirit toward large scale adoption of sustainable options, CJ Darcl aims to drive meaningful innovation and make sustainability not just an option, but an integral part of every supply chain we touch.

True resilience in infrastructure isn’t about patching vulnerabilities—it’s about reimagining systems as agile, interconnected networks built to adapt and thrive amid complexity. Sustainable innovation must go beyond isolated projects to transform the very backbone of logistics, energy, and supply chains. This means embracing circular models, smart technologies, and cross-sector collaboration to future-proof infrastructure that drives economic growth while safeguarding the environment and society.

With all the work being done in innovation, efficiency, and sustainability—especially in the wake of the COVID-19 crisis—are we, as a supply chain ecosystem, becoming more resilient?

Prof. Jitender Madaan: Yes, but with caveats. The supply chain ecosystem is indeed becoming more resilient— but only where innovation, efficiency, and sustainability are treated as strategic imperatives, not side projects. Sustainability, often misunderstood as purely environmental, must be framed through the triple bottom line: environmental, economic, and social. When these elements align, they create systemic resilience.

Technology adoption—from AI and IoT to EVs and digital twins—initially meets resistance, but as regulations tighten and climate risks grow, these tools become non-negotiable. They’re not just about compliance—they enhance agility, reduce waste, and improve responsiveness. Crucially, overlooked areas like packaging—which directly impact cost, carbon footprint, and product integrity—must be prioritized. India still lacks formal education in this space, which hampers next-gen supply chain capabilities.

Post-COVID, resilience must be redefined—not just as the ability to recover, but as the capacity to adapt and future-proof operations. Organizations that integrate sustainability deeply into their design—across Scope 1, 2, and 3— are building a competitive edge, not just

ticking ESG boxes. Sustainability, done right, is resilience.

Ishant Agarwal: At CJ Darcl, our journey toward resilience didn’t begin with the pandemic—but it was certainly tested by it. Long before COVID-19, we recognized that technology and sustainability were essential to operational continuity and agility. As early as 2011, we implemented a centralized ERP system, digitally connecting all our branch offices. This foresight gave us a robust digital backbone that proved critical during the pandemic.

When disruption hit, we didn’t just react—we evolved. We diversified into air cargo and third-party logistics (3PL), expanding beyond road freight. This shift wasn’t merely about survival; it was a strategic pivot that enhanced our ability to serve customers under volatile conditions. These investments in infrastructure, digitalization, and service diversification weren’t just about efficiency—they were resilience in action.

Looking back, our sustained focus on innovation, backed by a culture of continuous improvement, has allowed CJ Darcl to remain agile and adaptive in the face of systemic shocks. Resilience, in our view, is not a one-time response—it’s an embedded capability. Our experience shows that investing in efficiency and sustainability before a crisis pays off during one. And that is the clearest evidence that the supply chain ecosystem, when proactive, can absolutely become more resilient.

As sustainability becomes a central focus, how do you view the role of Scope 1 emissions in logistics, and how can supply chain leaders make a meaningful difference in this area?

Ashish Bhatnagar: From my perspective, sustainability is no longer a mere trend—it’s a fundamental responsibility for everyone in supply chain and procurement. In the logistics domain, Scope 1 presents significant opportunities for impactful change. This is where companies can directly influence their carbon footprint by adopting cleaner energy sources and optimizing energy consumption. For instance, the carbon emission intensity of grid-based power is approximately 1,000 grams of CO2 per kilowatt-hour, while solar power can range from 20 to 70 grams per kilowatt-hour, depending on the type of solar cells used. The carbon savings from transitioning to solar energy are profound, and companies are increasingly investing in this shift to reduce their overall emissions.

Moreover, Scope 1 also encompasses fuel usage, with diesel having an emission factor of about 2.6, and natural gas emitting around 2 grams per kilowatthour. By transitioning to cleaner fuels and integrating fuel-efficient technologies, organizations can further reduce their carbon emissions and enhance their sustainability efforts.

For supply chain leaders, there are multiple avenues to address Scope 1 emissions effectively. In addition to

adopting cleaner energy, optimizing energy efficiency across operations is equally crucial. Installing fuel-saving technologies on production lines, automating systems to minimize energy consumption, and improving overall operational efficiency can significantly reduce emissions. Many companies today have set ambitious Net Zero goals, with some striving for negative emissions. Achieving these goals will require a comprehensive strategy that not only

embraces sustainable energy but also prioritizes efficiency in every facet of the supply chain.

As leaders in logistics and supply chain management, it’s imperative that we embrace these opportunities to lead by example. The future of sustainable logistics lies in our ability to integrate cleaner energy solutions and adopt innovative practices that drive both operational efficiency and environmental responsibility. By focusing on Scope 1

emissions, we can make a meaningful contribution to a more sustainable and resilient supply chain.

What policy or cross-sector collaboration do you believe is most urgently needed to scale sustainable infrastructure across industries?

Anirban Sanyal: The most urgent need is for a unified public-private partnership framework that incentivizes sustainable infrastructure through aligned policies, financing, and standards. Governments should implement carbon pricing, green procurement mandates, and tax incentives for sustainable projects. Simultaneously, cross-sector collaboration—between energy, transport, tech, and construction—must establish interoperable standards, datasharing protocols, and pooled investment funds. This integrated approach ensures scalability, de-risks innovation, and drives systemic change by aligning economic viability with environmental goals across industries.

How do you view the current state of infrastructure logistics, and what does the future hold?

Prof. Jitender Madaan: From my perspective, the supply chain sector is undergoing a profound transformation driven by increasing complexity. This

At CJ Darcl, we promote a ‘technology-first’ culture to scale our operations while managing them with precision. Our fleet is equipped with Intelligent Fleet Management System that predicts vehicle maintenance requirements and avoids breakdowns during the journey. It is also supported by a smart Driver Fatigue Management System (DFMS) that monitors the behaviour of our drivers while driving. Designed to reduce the number of road accidents of fleet, this cutting-edge technology keeps a check on the driver’s driving pattern and suggests trainings basis the analysis of that data. We have IoT devices equipped with smart sensors that help in streamlining our operations such as maintenance of temperature and humidity levels inside our warehouses. We also have state-of-the-art TES (Technology, Engineering, Systems and Solutions), a patented technology developed by CJ Logistics Korea, which helps in automation of several processes including digital picking/sorting, smart packaging, and various other automations.

Sustainable infrastructure is no longer a differentiator—it is fast becoming a prerequisite. As expectations rise, companies must build logistics and warehousing systems that are not only operationally agile but also environmentally accountable. The future belongs to infrastructure that is digitally integrated, resource-conscious, and resilient in the face of both market volatility and climate change. This moment calls for bold transformation: a reengineering of the supply chain that balances speed, flexibility, and sustainability—seamlessly and credibly.

complexity stems from a variety of factors, including evolving consumer demands, the expansion of new retail channels like quick commerce, and the accelerating pace of technological advancements. Yet, one of the most significant challenges still facing the industry is the lack of standardization across operations. While the need for standardized systems, processes, and technologies has been long recognized, the absence of a unified approach continues to be a major hurdle to optimizing supply chains.

Turning to innovation, artificial intelligence (AI), particularly generative AI, stands out as a gamechanger. There has been an extraordinary surge in investment in AI, estimated at $10 to $15 trillion, with a substantial 60% of this funding directed toward marketing and supply chain management (SCM). This underscores the critical role AI is poised to play in the future of logistics. From predictive analytics and route optimization to automation and demand forecasting, AI will redefine the way supply chains operate. The ability to harness AI for real-time decision-making and operational efficiency will become a key differentiator for companies aiming to stay ahead in an increasingly competitive market.

As AI continues to advance, its impact on supply chain operations will be far-reaching. The integration of data analytics will enable businesses to predict market trends, optimize inventories, and make smarter decisions. Automation will streamline manual processes, reducing errors and costs while boosting productivity. However, AI’s role isn’t limited to efficiency alone—it will fundamentally shift how companies

approach logistics by providing deeper insights that enable them to anticipate customer needs and deliver more personalized services.

While AI may be garnering the most attention, another crucial force shaping the future of supply chains is the transition to clean energy. Despite receiving less fanfare than AI, clean energy and mobility innovations are receiving substantial investments. These investments will have a transformative impact on logistics, particularly in terms of energy consumption, fuel alternatives, and sustainability. As businesses strive to meet environmental goals and reduce their carbon footprints, clean energy solutions will become an integral part of the supply chain infrastructure.

The adoption of clean energy and mobility will affect various facets of supply chain management, from the energy used in warehouses and distribution centers to the fuel powering transportation fleets. It will drive the shift toward greener solutions, enhancing sustainability while maintaining operational efficiency. Moreover, the increasing regulatory focus on environmental standards will compel businesses to integrate clean energy into their logistics operations, both as a strategic advantage and a compliance necessity.

The future of infrastructure logistics will be defined by a convergence of AIdriven innovation and clean energy integration. The successful companies of tomorrow will be those that can effectively embrace these technological advancements, navigate the challenges of standardization, and adapt to the evolving demands of the marketplace, all while contributing to a more sustainable

and responsible supply chain ecosystem.

Ishant Agarwal: The Government of India has been making significant efforts toward enhancing the logistics infrastructure of India with the development of Dedicated Freight Corridors which have expedited cargo movement by rail, Multimodal Logistics Parks that are serving as transhipment hubs for multiple modes of transportation and possess warehousing abilities followed by better road connectivity which has led the way for seamless logistics. These developments, today, play a pivotal role in supply chain management by supporting efficient transportation and storage of goods and CJ Darcl is at the forefront to leverage these developments and better serve the evolving requirements of its clients.

To prepare for positive developments and changes in the future, CJ Darcl is strategically focusing on sustainability by transitioning from BS IV vehicles to BS VI vehicles and exploring the use of alternate fuels to reduce its carbon emissions. On the technology front, we provide our clients with the best global practices leveraging the patented technologies by CJ Logistics and we remain open to new technology-based solutions that can further optimise our supply chains and enhance our customer experience. To meet the increasing demand for faster deliveries, CJ Darcl leverages its pan-India network of fleet supported by its strategically located warehouses across the nation.

Maritime logistics, long defined by tradition and steady rhythms, now finds itself on the cusp of meaningful change. For years, ocean carriers have navigated paper-based maps in a world fast turning digital—relying on manual processes and fragmented systems. But the winds are shifting. In an era where Agility, Visibility, and Precision define competitive strength, the call for digital transformation grows louder. This is not just about adopting new tools—it’s about reimagining how the industry operates at its very core. From smart bookings and intelligent vessels to predictive maintenance and customer-centric platforms, digitalization promises to turn complexity into clarity and challenge into opportunity, writes Pradeep Chaudhary, Senior Domain Consultant, Tata Consultancy Services. What lies ahead is a journey of intent—one that demands vision, adaptability, and bold execution. The course is set. The tools are at hand. Now is the time to embrace the digital horizon.

OVER the past two decades, the digital revolution has significantly altered the competitive landscape across multiple sectors—banking, media, telecom, retail, manufacturing, and logistics among them. However, despite its central role in facilitating global and regional trade, the maritime logistics industry has lagged in adopting digital transformation at scale. Except for a few major players, the sector has been notably conservative in integrating digital technologies across core operations.

In today’s rapidly evolving supply chain environment, this cautious approach is no longer sustainable. To remain competitive, improve operational efficiency, and respond to the increasingly sophisticated expectations of shippers and supply chain stakeholders, ocean carriers must accelerate their digital transformation journey. The imperative is clear: digitalization is no longer a strategic advantage—it is a necessity for survival and growth in the maritime logistics sector.

Despite its critical role in global trade, the maritime logistics industry remains entrenched in outdated, paperbased processes. Manual data entry, fragmented communication via emails and phone calls, and siloed workflows persist across commercial operations, planning, ship management, and support functions. These legacy practices introduce inefficiencies, delays, and errors—ultimately driving up costs and diminishing competitiveness.

A recent survey by Container xChange, encompassing over 1,000 logistics professionals, highlights the magnitude of the issue: 93% of respondents reported spending nearly half their workday addressing problems stemming from the absence of appropriate digital tools. Frequent challenges include inaccurate documentation, miscommunication, payment delays, and undetected cargo damage—all of which could be mitigated through end-to-end digital integration.

Pradeep Chaudhary has more than 25 years’ experience in Logistics and Information Technology. An MBA in Operations management from Mumbai University, he currently works as Senior Domain Consultant in the Strategic Initiatives Group of Tata Consultancy Services Ltd., focusing on clients in the Logistics and Shipping vertical.

Consider the Bill of Lading—a critical shipping document. While the air cargo industry has digitised its equivalent, the Air Waybill, with over 80% compliance, ocean shipping lags far behind. Electronic Bills of Lading (eBLs) account for a mere 5% of total issuance, revealing a stark technological gap between industries.