NOTE

Festive Cheer–India’s Growth Story Shines

Dear Readers,

This Diwali brought a wave of optimism across India’s business landscape. According to the Confederation of All India Traders (CAIT), Diwali 2025 sales touched a record ₹6.05 trillion (US$68.77 billion) — ₹5.40 trillion in goods and ₹65,000 crore in services. The surge was driven by reduced GST rates, with 72% of traders attributing stronger sales to lower taxes on essential items. Prime Minister Narendra Modi’s call for a “Vocal for Local” and “Swadeshi Diwali” deeply resonated with consumers — 87% opted for Indian-made products, leading to a 25% jump in domestic goods sales and a steep drop in demand for Chinese items.

Confidence across the ecosystem remains upbeat, with the Trader Confidence Index at 8.6/10 and the Consumer Confidence Index at 8.4/10. The festive boom also generated nearly five million temporary jobs across logistics, packaging, retail, and transport — underscoring India’s growing consumption economy.

Against this buoyant backdrop, we’re delighted to bring you the 73 rd issue of Supply Chain Tribe. Our Cover Story dives into Procurement as a Strategic Enabler, showcasing how the function has evolved from transactional to transformational — unlocking value and resilience. Our Special Report explores how Carbon is emerging as the new currency, with Scope 3 emissions shaping the language of growth in a decarbonized decade.

We also feature an exclusive interview with Varun Gupta, Supply Chain Director, Nestlé South Asia Region, detailing Nestlé’s playbook for building a resilient, future-ready network — plus thoughtprovoking pieces on India’s energy policy and the role of space technology in strengthening on-ground operations.

Happy reading,

Charulata Bansal Publisher Charulata.bansal@celerityin.com

www.supplychaintribe.com

Published by: Charulata Bansal on behalf of Celerity India Marketing Services

Edited by: Prerna Lodaya e-mail: prerna.lodaya@celerityin.com

Designed by: Lakshminarayanan G e-mail: lakshdesign@gmail.com

Logistics Partner: Blue Dart Express Limited

CONTENTS

18 COVER STORY

Procurement’s Next Act: From Saving Costs to Shaping Strategy

“Procurement’s true power lies not in what it saves—but in what it enables.” Once confined to the margins of cost control, procurement has stepped into the spotlight as a catalyst for enterprise transformation. Today’s procurement leaders aren’t just negotiating better deals; they’re shaping how value is created, how risks are shared, and how business priorities are reimagined for the long game. This Cover Story explores how procurement is transforming from a transactional necessity into a strategic powerhouse—one that wields influence not through budgets, but through vision, insight, and impact.

4 | LEADERSHIP

Digitally Driven, Locally Tuned: Nestlé Supply Chain Edge

In this exclusive interview, Varun Gupta, Supply Chain Director, Nestlé South Asia Region, shares how the company is balancing global standards with hyperlocal execution—leveraging digitization, automation, and sustainability to build a Resilient, Responsive, and FutureReady Supply Network.

8 | SPECIAL REPORT

Carbon as Currency: The New Language of Competitive Supply Chains

“You can’t manage what you don’t measure—and you can’t compete on what you don’t connect.” This Special Report explores how Scope 3 is becoming the language of growth, efficiency, and leadership in the decarbonized decade ahead.

FOCUS

29 | Beyond Barrels: India’s Blueprint for Energy Resilience

India stands at a defining crossroads in its energy journey — where the race for growth meets the responsibility of sustainability. Sanjay Desai, Independent Board Advisor / Mentor, traces this pivotal transformation — where hydrocarbons sustain the present, ethanol bridges the transition, and electric mobility powered by renewables builds the future.

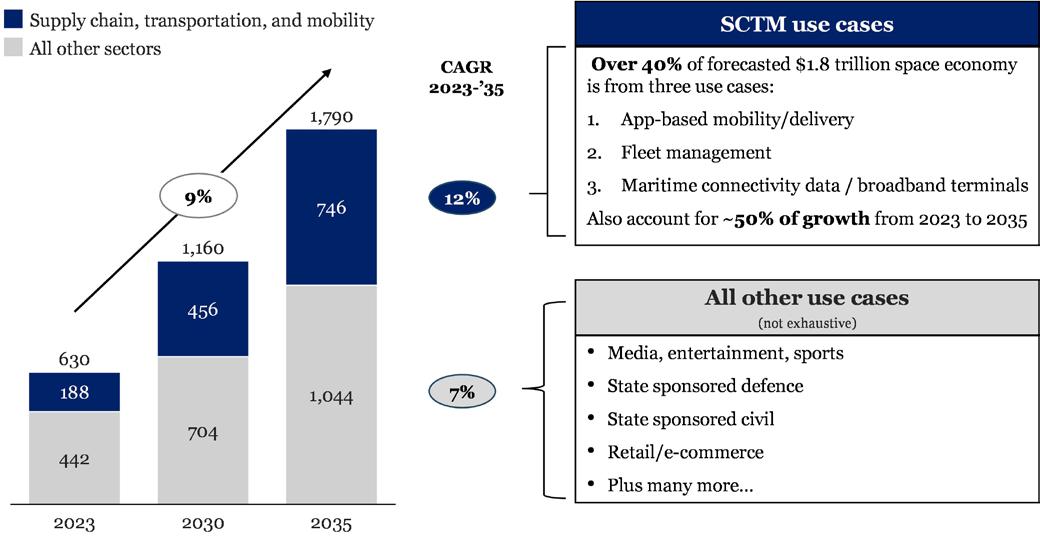

32 | From Orbit to Aisle: Space Tech Supercharging Supply Chains and Mobility

Space technology is no longer just about rockets and exploration—it’s transforming the way goods move, and businesses operate here on Earth. The fastest-growing segment of the space economy is now focused on downstream applications in supply chain, transportation, and mobility (SCTM). New research by the World Economic Forum and McKinsey reveals how this high-altitude innovation is reshaping the very foundation of global logistics.

DIGITALLY DRIVEN, LOCALLY TUNED:

In a region defined by logistical complexity and regulatory diversity, Nestlé South Asia is rewriting the playbook for supply chain excellence. In this exclusive interview, Varun Gupta, Supply Chain Director, Nestlé South Asia Region, shares how the company is balancing global standards with hyper-local execution—leveraging digitization, automation, and sustainability to build a Resilient, Responsive, and Future-Ready Supply Network. From predictive dashboards and AI-led forecasting to green logistics and ethical sourcing, he outlines the strategic pillars that are transforming Nestlé supply chain into a competitive advantage across South Asia’s dynamic markets.

How do you align Nestlé South Asia’s supply chain strategy across diverse markets with unique logistical and regulatory challenges?

Nestlé South Asia’s supply chain strategy balances global consistency with local adaptability. Core principles like safety, sustainability, and service remain central, but execution is tailored to each market’s logistical realities and regulatory frameworks. This includes deploying energy-efficient, digitally enabled warehouses and optimizing transport modes—such as electric vehicles and LNG—to suit regional infrastructure and environmental goals.

To ensure compliance and agility, Nestlé uses localized frameworks aligned with both internal standards and external regulations. End-toend digital visibility through smart dashboards enables predictive planning and faster decision-making, helping reduce stockouts and improve service levels. This approach allows Nestlé to stay responsive to evolving market needs while maintaining operational excellence across diverse geographies.

What are the key pillars of your strategy to balance efficiency, agility, and cost competitiveness in the region?

Our strategy rests on 3 pillars:

Digitization: We harness advanced digital tools and analytics to enable realtime visibility across our supply chain. This includes smart dashboards that integrate data from sales, warehousing, and transport, allowing predictive alerts and faster decision-making. These capabilities help reduce stockouts, improve replenishment accuracy, and enhance responsiveness to market shifts. Additionally, we use AI-led demand forecasting, automated storage systems, and digital twins to simulate warehouse operations and anticipate demand fluctuations.

Network Optimization: Our logistics and distribution networks are continuously refined to reduce lead times and operational costs. This involves optimizing route planning, leveraging alternate transport modes like rail and sea, and adopting green logistics solutions such as electric vehicles and LNG. These efforts not only improve service delivery but also contribute to sustainability goals. The use of cost models and solvers in concurrent planning further enhances our ability to prioritize demand and manage inventory efficiently.

People’s Capability: We invest in building a resilient and innovative workforce by promoting a culture of continuous learning and adaptability. Through capability-building sessions, digital onboarding, and supplier engagement platforms like Business Partner Meets, we empower employees and partners to drive transformation. This pillar ensures that our teams are equipped to embrace change, foster innovation, and sustain improvements across the supply chain.

What role does end-to-end digital visibility play in enabling smarter, faster decisions—and can you share a recent example where it delivered measurable impact? End-to-end digital visibility plays a transformative role in enhancing decision-

We’re building a pipeline of leaders who are agile, tech-savvy, and purpose-driven. Through mentorship, exposure to innovation projects, and global collaboration, we’re preparing them to lead in a world where supply chains are not just efficient—but ethical and responsive. We run structured learning academies, cross-functional rotations, and digital bootcamps. These programs equip our teams with the skills to lead in a tech-enabled, customer-centric environment.

making across Nestlé South Asia’s supply chain. By integrating data streams from sales, warehousing, and transport into a unified smart dashboard—powered by Power BI—we’ve created a real-time control tower that enables predictive alerts and rapid response capabilities. This visibility allows teams to anticipate disruptions, optimize inventory levels, and align replenishment cycles with actual demand patterns. It also supports cross-functional collaboration by making performance metrics accessible and actionable across departments.

A recent example of its impact is the rollout of Power BI dashboards across our distribution centers. These dashboards were designed to reduce stockouts and improve replenishment accuracy. By leveraging real-time data, we achieved a measurable improvement of 100 basis points in stock availability and a 5% reduction in secondary dispatch delays. Additionally, factory and branchlevel DI dashboards have enabled granular tracking of movement and contribution across regions and business units, further strengthening our ability to make smarter, faster decisions.

How is Nestlé applying automation, AI, or advanced analytics to enhance planning, forecasting, and distribution across South Asia?

Nestlé South Asia is applying automation, AI, and advanced analytics to enhance planning, forecasting, and distribution through a suite of integrated technologies. AI-led demand forecasting helps us anticipate market

shifts with greater precision, reducing inventory imbalances and improving service levels. We use digital twins to simulate warehouse operations, allowing us to test layouts, workflows, and throughput strategies virtually before implementing them physically resulting in better space utilization and operational efficiency.

A key enabler in this transformation is the Drishti Command Hub, which acts as a centralized control tower for realtime monitoring and decision-making. It integrates data from multiple supply chain nodes—factories, warehouses, and transport—providing predictive insights and actionable alerts. This visibility supports concurrent planning, route optimization, and waste reduction, especially critical in South Asia’s dynamic and diverse markets. Together, these tools empower our teams to respond faster, plan smarter, and deliver more reliably.

How do you encourage innovation and digital maturity among suppliers to build more resilient, responsive supply chains?

We treat suppliers not just as vendors, but as strategic partners in transformation. Our approach begins with digital onboarding, ensuring that suppliers are equipped with intuitive tools and platforms that align with our operational standards. This is followed by joint capability-building sessions, where we co-develop skills and share best practices in areas like safety, sustainability, and digital operations. These sessions foster a shared understanding of

Supply chain professionals will need data literacy, systems thinking, sustainability awareness, and cross-functional collaboration to thrive in the next decade. The ability to translate insights into action will be a key differentiator.

business goals and encourage suppliers to innovate within their own ecosystems. A key initiative is our Business Partner Meets, which serve as collaborative platforms for suppliers to showcase their own digital and safety innovations. These events—like the one held in May 2024 in Gurgaon, May 2025 in Haridwar—create space for dialogue, recognition, and alignment on future priorities. Through these engagements, we promote a culture of continuous improvement and digital maturity, helping suppliers become more agile, transparent, and resilient. This ecosystem-wide uplift strengthens our supply chain’s ability to respond to disruptions and deliver consistent value.

What are Nestlé South Asia’s top priorities for building a sustainable supply chain, particularly in logistics and packaging?

Nestlé South Asia’s sustainable supply chain strategy is anchored on three core pillars: green logistics, eco-packaging, and carbon reduction. In green logistics, the focus is on transitioning to alternate fuels such as LNG and CNG and increasing

the use of rail and sea transport to reduce road dependency and emissions. These efforts are supported by route optimization tools that help minimize fuel consumption and improve delivery efficiency. In packaging, Nestlé is actively reducing plastic usage and increasing the share of recyclable and reusable materials. This includes innovations in lightweight packaging and the use of mono-materials that simplify recycling processes.

The third pillar—carbon reduction—is driven by initiatives like solar-powered warehouses, which are being integrated into planning and infrastructure upgrades. These facilities not only reduce grid dependency but also contribute to Nestlé’s broader climate goals. All these efforts are aligned with Nestlé’s global commitments under SBTi (Science Based Targets initiative) and FLAG (Forests, Land, and Agriculture). SBTi provides a science-based framework for setting greenhouse gas (GHG) reduction targets, while FLAG addresses emissions from land-based sectors, which account for nearly 25% of global emissions. These frameworks are backed by global collaborations including CDP, UN Global

Compact, WRI, and WWF, ensuring that Nestlé’s sustainability actions are both credible and impactful.

How do you ensure compliance with ESG standards across your supplier network, especially in areas like ethical sourcing and emissions reduction?

We follow a structured and aligned framework, leveraging supplier scorecards and traceability tools. For example, the Nestlé Cocoa Plan is designed to build a more sustainable supply chain. By collaborating with farmers, communities, and organizations, we aim not only to reduce our carbon footprint but also to support cocoa-farming communities and improve their livelihoods. The plan, recognized as an income accelerator, currently reaches over 150k farmers worldwide and offers full traceability.

To ensure compliance and ethical sourcing, our supply partners adhere to robust governance across four pillars: labor standards, health & safety, environmental stewardship, and business ethics—validated by thirdparty audits via SEDEX or Supplier

Ethical Data Exchange, that enables ethical sourcing, risk management, and supplier transparency by centralizing data on labor, safety, environment, and business practices, additionally ensuring compliance and building responsible supply networks. I would like to point out that our sustainably sourced crops contribute to reduced GHG emissions.

What steps is Nestlé taking to strengthen and future-proof its local supplier ecosystems in South Asia?

We foster long-term supplier partnerships through strategic relationship meetings, innovation meets, and shared objectives. Our focus includes building a bestin-class supplier portal for agility and transparency, promoting digital literacy, and supporting financial inclusion via supplier financing programs. We also consistently invest in MSMEs to help suppliers scale sustainably and navigate market challenges.

What are the key supply chain drivers that enable Nestlé India to balance efficiency, resilience, and sustainability while ensuring products reach consumers across both urban and rural markets?

At Nestlé India, supply chain resilience is not just about efficiency, but also about responsibility towards the people and partners who make it possible. Truck drivers are the backbone of our logistics network, and with India’s logistics sector facing both acute driver shortages and high accident risks, we have made road safety a key driver of our supply chain strategy.

Through our initiative ‘Safety Every Second – Engage Heart and Mind’, we are working to reduce accidents and promote safer driving practices across our ecosystem. This includes training over 10,000 drivers in defensive driving, conducting regular health and eye camps in partnership with organizations like Sightsavers India, and ensuring only compliant and roadworthy vehicles are engaged for our deliveries. We are also leveraging technology such as GPS, AIenabled cameras, ADAS, real-time alerts, and in-transit visibility to drive digitalenabled safety and efficiency.

Equally important, we engage over

At Nestlé India, supply chain resilience is not just about efficiency, but also about responsibility towards the people and partners who make it possible. Truck drivers are the backbone of our logistics network, and with India’s logistics sector facing both acute driver shortages and high accident risks, we have made road safety a key driver of our supply chain strategy.

150+ business partners through regular governance and collaboration, ensuring safety becomes a shared priority across the value chain. By embedding safety, compliance, and technology into our logistics operations, we not only strengthen the resilience and reliability of our supply chain, but also build a culture of care and responsibility for the people who keep it moving.

What leadership qualities are most critical to leading complex, future-ready supply chains in today’s dynamic environment?

In today’s dynamic and rapidly evolving environment, leading a future-ready supply chain requires a unique blend of strategic foresight, technological agility, and people-centric leadership. At Nestlé India, we believe that the most critical leadership qualities include the ability to anticipate market shifts and align supply chain operations with long-term business goals. Embracing digital transformation—through AI, automation, and predictive analytics— is essential to driving efficiency and responsiveness across the value chain. Equally important is collaborative leadership that fosters cross-functional alignment and innovation at scale. Resilience and risk management are vital in navigating disruptions while maintaining continuity and compliance. As sustainability becomes central to supply chain strategy, leaders must champion ethical sourcing, circularity, and low-carbon logistics. Above all, empowering teams and nurturing a culture of ownership and capabilitybuilding ensures operational excellence. These qualities are key to delivering on Nestlé’s purpose of ‘Good Food, Good

Life’—responsibly, efficiently, and with lasting impact.

What is the biggest talent challenges you face in supply chain roles across South Asia, and how are you addressing them?

We noticed a gap in digital readiness among frontline teams. To address this, we launched targeted training programs and introduced digital tools with intuitive interfaces. As a result, adoption rates improved by 40% and error rates dropped significantly.

If you could implement one gamechanging innovation across all Nestlé South Asia supply chains tomorrow, what would it be—and why?

A unified AI-powered control tower that integrates demand sensing, inventory, logistics efficiencies, optimized transport, and ESG metrics. It would enable real-time decisions, reduce waste, and elevate both efficiency and responsibility.

Carbon as Currency: The New Language of Competitive Supply Chains

“Youcan’tmanagewhatyoudon’tmeasure—andyoucan’tcompeteonwhatyoudon’t connect.”That realization is redefining how global supply chains see Scope 3. The conversation has moved beyond compliance and carbon counting to something far more strategic: Value Translation. Emissions data is emerging as a new form of currency—one that determines access to capital, shapes supplier choices, and signals credibility in low-carbon markets. What was once a sustainability ledger is becoming a balance sheet of competitiveness, where every tonne reduced strengthens operational and financial performance. In this new equation, carbon intelligence is not just an ethical commitment— it’s a business advantage, reshaping how companies Buy, Build, and Lead in the Next Economy. This Special Report explores how Scope 3 is becoming the language of growth, efficiency, and leadership in the decarbonized decade ahead.

IF carbon is now the currency of competitive supply chains, then Scope 3 data is the new design code. The world’s most forward-looking companies are no longer treating emissions as an externality—they’re engineering them into the DNA of how performance is measured, decisions are made, and value is created. This marks a profound evolution: sustainability metrics are no longer adjuncts to business KPIs but integral levers of operational and strategic excellence.

By embedding emissions directly into core KPIs, organizations are translating climate ambition into everyday accountability. Cost, Speed, and Reliability still matter—but now they coexist with carbon impact as a defining measure of success. This integration is revealing unexpected synergies: efficiency gains that lower

emissions, digital tools that turn carbon visibility into real-time decision power, and supplier collaborations that yield both resilience and reduction.

The shift is not just operational— it’s architectural. Companies are beginning to use Scope 3 insights as design inputs, reconfiguring supply networks, product lifecycles, and sourcing ecosystems. What began as compliance-driven reporting is evolving into a systems-level redesign of enterprise performance. Emissions intelligence is no longer a sustainability function—it is becoming a strategic capability that informs how capital is allocated, how risk is managed, and how competitiveness is defined in the low-carbon economy.

As this transformation accelerates, the question is no longer whether to manage Scope 3—but how deeply to embed it into the organization’s

design logic. The firms that master this integration will not just meet regulatory thresholds; they will set new performance benchmarks for Efficiency, Transparency, and Innovation.

Industry leaders now share how they are operationalizing this shift—turning Scope 3 insights into a Blueprint for Competitive, LowCarbon Enterprise Design.

Embedding Emissions into Core KPIs

Forward-looking organizations are now tracking emissions alongside cost, lead time, and service—reshaping how decisions are made and trade-offs evaluated.

FOR years, sustainability metrics lived outside the operational scorecard—tracked annually, reported externally, and rarely influencing daily business choices. That boundary is rapidly dissolving. As Scope 3 data gains granularity and credibility, organizations are beginning to integrate emissions metrics into the same dashboards that guide cost, quality, and delivery. The shift is subtle but significant: carbon is no longer a separate concern—it’s a performance variable.

Forward-looking enterprises are realizing that true efficiency cannot be achieved without accounting for emissions intensity. Procurement teams are factoring carbon cost into sourcing models; logistics leaders are using emissions data to optimize routes and modes; and finance functions are beginning to align budgets with carbon budgets. This integration is creating a new language of trade-offs—where reducing emissions can enhance resilience, supplier reliability, and even profitability. The result is a more transparent, datadriven culture—one where sustainability is not an agenda item but a measurable outcome of smarter operations.

Swaroop Banerjee, VP – Corporate Sustainability, JSW Group: Traditionally, supplier and logistics performance has been evaluated based on cost, lead time, and service levels. However, recognising the growing importance of climate resilience and low-carbon transition, companies are now aligning these KPIs with their longterm sustainability goals. Companies have initiated efforts to include carbon intensity as a measurable parameter within their supplier assessment and onboarding processes, especially for high-emission categories such as raw materials, freight, and packaging. This is complemented by the progressive application of lifecycle-based assessments. This integrated approach is already influencing decision-making across our sourcing and logistics functions. Low-emission alternatives such as rail-

based freight over road or sourcing from suppliers powered by renewable energy are being prioritised where feasible. These shifts not only support the climate objectives but also enhance supply chain resilience in a future where emissionsbased regulatory and market pressures are expected to increase. By aligning emissions performance with traditional KPIs, we are building a supply chain that is both operationally efficient and aligned to Net Zero ambition.

Bipin Odhekar, Head – Sustainability,

EHS & Operations Excellence, Marico

India Ltd.: At Marico, we are integrating emissions metrics directly into core supply chain KPIs—alongside cost, lead time, and service performance— positioning carbon intensity as a critical lever in operational decision-making.

Procurement decisions are no longer based solely on price and delivery timelines. Suppliers are now evaluated on their emissions footprint, particularly in high-impact categories such as packaging and raw materials. Vendors offering lowcarbon, recyclable, or circular solutions are prioritized—not just for compliance, but for their ability to reduce long-term risks and create shared value.

Similarly, logistics strategies are being redefined through a dual lens of efficiency and emissions reduction. Our data architecture is designed to integrate carbon data with cost and service performance, enabling smarter trade-offs in transportation modes, route optimization, and warehouse locations. For instance, insights from upstream transportation emissions led us to redesign our distribution network, reducing both freight emissions and operating costs without compromising service levels.

We’ve also embedded emissions metrics into internal performance scorecards, making sustainability a shared accountability across functions. Decisions that were previously driven purely by cost are now scrutinized through a climate lens, ensuring that any short-term savings do not undermine

long-term resilience.

This integration of carbon data into everyday supply chain management is shifting the focus from short-term optimization to sustainable value creation—building a more agile, lowcarbon, and future-ready supply chain that balances profitability with climate responsibility.

Vishal Bhavsar, Head ESG, Multiples

Alternate Asset Management: There’s a growing shift in how procurement functions operate—moving beyond cost optimization to embrace carbon reduction as a core supply chain KPI. Chief Procurement Officers (CPOs) are playing a pivotal role in embedding emissions metrics into procurement strategies, aligning their teams with broader corporate climate goals. As supply chains often account for the majority of a company’s carbon footprint, emissions data is now being tracked alongside traditional metrics like cost, lead time, and service reliability.

For companies with significant Scope 3 emissions, this integration is reshaping decision-making. Procurement teams are now evaluating suppliers not just on price and delivery, but also on CO₂ per unit sourced, climate resilience, and sustainability practices. This shift enables organizations to unlock efficiencies, reduce risk, and improve margins— while advancing toward net-zero targets.

Tata Motors exemplifies this approach. Recognizing that over 80% of upstream emissions lie beyond Tier 1 suppliers, the company launched a Supplier Sustainability Assessment Programme. Emissions metrics are embedded into procurement scorecards, directly influencing supplier selection and contract renewals. This has helped Tata Motors prioritize low-carbon sourcing and improve supply chain transparency.

Mahindra Logistics has gone a step further by embedding Scope 3 emissions into operational KPIs. Their Green Logistics Ecosystem includes carbonneutral warehousing, EV fleets, and alternate fuels like LNG and hydrogen.

Traditional KPIs like cost, lead time, and service levels remain important—but companies are increasingly introducing parallel ‘green’ KPIs, such as Green Cost, Green Lead Time, and Green Service Levels. These KPIs weigh environmental performance alongside operational metrics, providing a holistic view of supply chain health.

These initiatives are measured not just by cost and delivery speed, but also by carbon intensity per shipment.

For example, Mahindra Logistics uses a centralized SaaS dashboard to monitor emissions per delivery route, integrating this data with service performance metrics like on-time delivery and fill rate. This enables route optimization that balances speed, cost, and sustainability— making emissions a core part of service quality evaluation.

Jaswinder Saini, Vice President, Tata Play Ltd.: At Tata Play, we’re beginning to weave environmental performance into our traditional procurement KPIs. While cost, lead time, and serviceability remain critical, we’re now adding ESG weightage where relevant. For example, we replaced PVC flex with eco-friendly, non-PVC fabric in our non-lit branding boards, significantly reducing plastic waste. These sustainable choices are now factored into supplier evaluations, helping us make procurement decisions that balance commercial and environmental outcomes.

Smitha Shetty, Regional Director – APAC, Achilles Information Ltd.: In recent years, ESG considerations have gained significant ground within procurement functions. What was once viewed as a parallel track is now fully embedded in supplier evaluation frameworks. As a result, emissions metrics are being integrated more systematically into the core set of supply chain performance indicators, alongside cost, lead time, quality, and service levels.

Procurement teams are increasingly measuring carbon intensity per product, per transaction, or across supplier categories. This data is no longer collected solely for sustainability reporting. It is being used to inform sourcing strategies, supplier negotiations, and contract decisions.

This shift is also influencing how trade-offs are evaluated. In the past, procurement decisions often defaulted to the lowest cost or fastest delivery.

Today, emissions criteria are playing an equally important role in supplier selection. This change is prompting more holistic supplier assessments, deeper engagement on improvement plans, and a stronger focus on long-term value creation.

As emissions metrics become part of the standard decision-making process, organizations are better positioned to align operational goals with climate commitments. It also supports greater resilience by anticipating regulatory shifts, investor scrutiny, and evolving customer expectations. In this way, emissions integration is not just improving environmental outcomes—it is strengthening the overall quality and accountability of supply chain decisions.

Veeshwass Kulkarni, General

Manager

–

Procurement,

Legrand: Emissions metrics have moved from being separate sustainability reports into the heart of operational dashboards. We’ve developed life cycle cost models that track CO₂ per INR spent, carbon intensity per product unit, and emissions per shipment—displayed alongside classic KPIs like cost, lead time, and service level. This visibility fundamentally changes decision-making. For example, when comparing suppliers with similar prices and service reliability, we now prioritize those with lower carbon footprints. Likewise, decisions about shifting transport modes—such as from air freight to sea or rail—are no longer evaluated purely on cost and speed, but also on their carbon impact. Beyond tracking, we set explicit carbon reduction targets for procurement categories, like cost-saving targets, making carbon management an operational objective rather than an afterthought. This integrated approach ensures sustainability is embedded in the supply chain’s daily rhythm, strengthening resilience and future readiness.

Dipanjan Banerjee, Chief Commercial Officer, Blue Dart: We’ve integrated

emissions as a core KPI alongside cost and lead time. At Blue Dart, we now evaluate trade-offs with a triple-bottom-line view. For example, a slightly longer delivery time might be acceptable if it drastically cuts emissions and costs. This holistic view is enabling more responsible supply chain choices—and our customers are increasingly requesting data that reflect this integrated perspective.

Sandeep Chatterjee, Growth Leader – Digital Business Solutions, Supply Chain and Sustainability Pillar, INFOLOB: Traditional KPIs like cost, lead time, and service levels remain important—but companies are increasingly introducing parallel ‘green’ KPIs, such as Green Cost, Green Lead Time, and Green Service Levels. These KPIs weigh environmental performance alongside operational metrics, providing a holistic view of supply chain health. By doing this, organizations can make trade-offs transparent understanding, for example, when a slightly higher cost or longer lead time is justified by a significant emissions reduction. This shift from purely financial KPIs to blended metrics aligns supply chain decisions more closely with corporate sustainability targets and stakeholder expectations.

Varun Chopra, Executive Chairman, GEAR: The Market regulator Sebi's board approved a balanced framework for ESG disclosures, ratings and investing. In a board meeting, the regulator said, to enhance the reliability of ESG disclosures, the BRSR (Business Responsibility and Sustainability Report) Core has been introduced. For this, the regulator prescribed a glide path for top 500 listed firms in terms of market share from FY25-26. Thus, now there is a compliance requirement to introduce supply chain emissions (Scope 1, Scope 2 and Scope 3) for organisations and these are now being embedded into organization KPIs across functions.

Turning Scope 3 Data into Competitive Wins

By acting on surprising emissions insights, some companies are redesigning supply chains in ways that lower carbon footprints and unlock cost savings.

THE real breakthrough with Scope 3 isn’t just Measurement—it’s Momentum. As organizations begin to interpret and act on emissions data, many are discovering that the path to decarbonization often mirrors the path to greater efficiency. What started as an exercise in transparency is now driving tangible competitive advantage. By tracing carbon across suppliers, processes, and logistics networks, companies are uncovering inefficiencies that traditional performance metrics often miss—duplicate transport legs, high-emission materials, and underutilized assets. The insights are leading to smarter sourcing decisions, streamlined distribution models, and innovative collaborations with suppliers who share the same climate goals.

For some, the gains are dual: measurable carbon reduction and substantial cost savings. For others, it’s about strengthening resilience and meeting customer expectations for low-carbon products. Either way, Scope 3 data is proving its worth—not as a reporting requirement, but as a catalyst for reinvention. These success stories spotlight how leading companies are translating emissions insight into operational excellence and long-term value creation.

Swaroop Banerjee: An illustrative example of Scope 3 insights influencing strategic decision-making at JSW Steel comes from our logistics optimization efforts. Traditional cost-focused analysis had favoured conventional diesel transport for raw material movement due to its perceived cost efficiency. However, a detailed Scope 3 assessment revealed that certain long-haul routes had disproportionately high emissions intensity, exacerbated by idling, congestion, and fuel inefficiencies. Leveraging this insight, JSW Steel piloted a transition to electric vehicles (EVs)

for intra-plant and short-haul logistics, coupled with route re-mapping and supplier collaboration. Contrary to initial assumptions, the shift not only reduced emissions substantially but also lowered operating costs over time due to reduced fuel dependency, fewer maintenance needs, and regulatory incentives. This counterintuitive shift driven by Scope 3 visibility demonstrates how emissions data can challenge legacy practices and deliver dual value in environmental and financial performance.

Bipin Odhekar: Yes, one such counterintuitive yet impactful decision emerged from our Scope 3 emission analysis, particularly within the category of Upstream Transportation and Logistics. While conventional thinking might suggest that faster, direct shipping methods are more efficient, network optimization tools revealed that distributed manufacturing footprint will help is reducing overall material movement.

By leveraging insights from realtime route tracking and transportation pattern analysis, we identified opportunities in our network design. Instead of increasing delivery frequency, we adopted a strategy of modal shift and shipment consolidation, complemented by the establishment of strategically located regional distribution centres. This not only enhanced vehicle fill rates and reduced empty return miles but also enabled us to shift a portion of our logistics from high-emission road transport to lower-emission rail networks wherever feasible.

This approach yielded tangible outcomes: In FY25 alone, our upstream transportation and logistics emissions intensity reduced by approximately 8%, forming a substantial portion of our Scope 3 profile. Through network reconfiguration, route optimisation, and supplier engagement for fuel efficiency

improvements, we saw measurable reductions in emissions intensity. Simultaneously, the shift reduced overall logistics costs by lowering fuel consumption, minimising idle time, and streamlining scheduling inefficiencies.

Vishal Bhavsar: Scope 3 insights often reveal that the biggest emissions—and opportunities—lie in unexpected corners of the value chain. For instance, Hindustan Unilever (HUL) discovered through emissions mapping that packaging and logistics were major contributors to its Scope 3 footprint. Instead of focusing solely on manufacturing upgrades, HUL made a counterintuitive pivot: it redesigned packaging to be lighter and more recyclable, and collaborated with suppliers to optimize transport routes. These changes not only reduced emissions but also cut material costs and improved delivery efficiency—boosting margins while enhancing brand equity.

Another compelling example is Novelis’ partnership with Jaguar Land Rover (JLR). Rather than sourcing new low-carbon aluminum, Novelis increased the recycled content in its supply to JLR—a move that seemed risky given concerns about material quality. However, this shift enabled a closedloop recycling system, where scrap from JLR’s production was returned to Novelis for reuse. The result: significant reductions in Scope 3 emissions and lower procurement costs for JLR, all while maintaining product integrity and advancing its net-zero goals.

These cases show that Scope 3 data can challenge conventional wisdom— leading companies to rethink sourcing, packaging, and supplier relationships in ways that deliver both climate and commercial wins.

Jaswinder Saini: One such example is our adoption of green electricity sourced through Waste-to-Energy initiatives for

Hindustan Unilever (HUL) discovered through emissions mapping that packaging and logistics were major contributors to its Scope 3 footprint. Instead of focusing solely on manufacturing upgrades, HUL made a counterintuitive pivot: it redesigned packaging to be lighter and more recyclable, and collaborated with suppliers to optimize transport routes. These changes not only reduced emissions but also cut material costs and improved delivery efficiency—boosting margins while enhancing brand equity.

our office locations—an unconventional shift from traditional fuel-based sources. Similarly, the deployment of electric vehicles for employee commutes and last-mile material transport seemed operationally challenging at first. However, both moves proved to be not only environmentally sustainable but also cost-effective over time, offering dual benefits of emissions reduction and long-term savings.

Smitha Shetty: One of the most compelling examples we have seen involves a large utility organization that adopted a data-driven approach to Scope 3 emissions reduction across its supply chain. Initially, the company's focus was on direct emissions, but through a structured supplier engagement program and adoption of the CEMARS (Certified Emissions Measurement and Reduction Scheme) certification, the business began collecting verified emissions data from its suppliers.

This revealed that a significant share of the organization’s carbon footprint came from indirect sources within the supply chain, particularly in areas that had not been previously prioritized. Rather than pursuing cost-driven decisions alone, the company worked collaboratively with its suppliers to measure emissions and identify operational changes that could reduce their carbon impact.

In several instances, suppliers adjusted materials used, changed processes, or optimized logistics in ways that not only lowered emissions but also delivered cost savings. What made this approach effective was that the company did not rely on assumptions or generic benchmarks. Instead, it used verified, activity-based data to guide its decisions. This shifted the conversation from compliance to continuous improvement and helped build a stronger, more sustainable supplier base.

This example reinforces the idea that

real Scope 3 impact comes not from topdown directives, but from equipping suppliers with the tools, incentives, and shared responsibility to innovate. It also highlights how emissions data, when verified and supplier-specific, can lead to better commercial outcomes in addition to environmental benefits.

Veeshwass Kulkarni: One illustrative example involves a product family that was historically produced at a supplier in western India, then transported to our national warehouse—also in the west— before being distributed across the country. Scope 3 analysis revealed that around 70% of demand for this product came from southern India. Recognizing this, we explored and qualified a supplier in the south, whose facility operated with solar power, modern automation, and higher energy efficiency. This change not only cut transport distances and reduced logistics emissions but also lowered overall production and logistics costs by approximately 15%.

Another case came from reevaluating packaging. Our Scope 3 study examined how effectively we were using truck capacity—specifically CBM utilization and per-unit transport emissions. Crossfunctional workshops revealed that by adjusting box orientation during loading, optimizing product mixes, and redesigning or eliminating some packaging layers, we could transport more products per trip. These changes reduced logistics costs by 7–8% while cutting emissions significantly. Such examples show how Scope 3 insights can drive decisions that simultaneously improve sustainability and financial performance.

Dipanjan Banerjee: One such instance involved a client who routinely shipped via air for speed. Our delivery modelling revealed that switching to a multi-modal solution which includes

shifting consignment from air to road cut carbon emissions significantly without impacting the final delivery timeline due to smart hub placement. As expected, it also lowered total costs. Scope 3 data gave us the confidence to recommend a solution that went against conventional assumptions but delivered both environmental and economic gains.

Sandeep Chatterjee: A major automobile manufacturer discovered that chassis production from one of its suppliers had unusually high emissions based on the supplier’s Scope 1 and Scope 2 data. Instead of switching suppliers, the company collaborated closely with them to reengineer the manufacturing process, introducing energy-efficient techniques and better resource utilization. Surprisingly, this reduced not only the emissions footprint but also operating costs, thanks to lower energy consumption and reduced waste. The result was a win-win: improved sustainability metrics and direct cost savings.

Varun Chopra: I can share an example from the Material Handling Equipment (MHE i.e. Forklifts) industry, where my organisation, GEAR has been a pioneer in deploying Zero Emission MHEs in the last couple of years. Since rented assets (including MHEs) come under Scope 3 Emissions, with our customers, we demonstrated that when one transitions from lead acid powered Forklifts to lithium-ion Forklifts, there is ~30% OpEx saving due to reduced electricity consumption and zero maintenance, and all this without any compromise on performance. Thus, customers could save cost via lower OpEx and deliver the same to higher level of performance with these Zero Emission Forklifts – this really helped accelerate the transition to Zero Emission MHEs across industries in India.

Scope 3 as a Design Input—

What’s Next?

As emissions data becomes integral to supply chain design, leaders are asking what comes after compliance: dynamic, data-driven networks built for resilience and agility.

SUPPLY chains are entering a phase where carbon isn’t just measured—it’s designed for. The ability to model emissions early in the planning cycle is changing how products are developed, how suppliers are chosen, and how networks are built. What once came at the end of a reporting process is now informing the first line of a design brief.

This shift marks a decisive evolution from reactive compliance to proactive innovation. Companies are beginning to treat carbon data as a creative input— using digital simulations, predictive analytics, and supplier co-design to balance performance with sustainability from the start. The goal is no longer to offset emissions after production, but to eliminate them through smarter choices at the blueprint stage. In this emerging landscape, Scope 3 becomes both a design principle and a competitive differentiator—reshaping the architecture of supply chains built for a low-carbon future.

Swaroop Banerjee: Scope 3 emissions are increasingly emerging as a critical parameter in future-oriented supply chain design. As stakeholder expectations, global regulations, and climate commitments continue to evolve, there is a clear shift towards integrating emissions data into strategic procurement and logistics decisions alongside conventional factors such as cost, speed, and reliability.

Decarbonising the value chain is not only essential for achieving Net Zero ambition, but also a lever for longterm business resilience. In this context, companies are working and adopting to embed Scope 3 considerations into their supplier evaluation frameworks, raw material sourcing strategies, and freight optimisation models.

Looking ahead, the next frontier will involve the convergence of digital technologies and sustainability data.

We foresee greater adoption of real-time emissions modelling, AI-enabled scenario analysis, and collaborative digital platforms that enhance transparency across multi-tier supplier networks. These innovations will enable the creation of adaptive, low-carbon supply chains that are agile, cost-efficient, and aligned with global climate goals.

Bipin Odhekar: Increasingly, Scope 3 emissions are no longer peripheral, they are foundational to reimagining supply chains for a carbon-constrained world. Historically, supply chain design has been governed by the holy trinity of cost, speed, and reliability. But climate intelligence is now emerging as the fourth axis of supply chain value creation and Scope 3 sits at its core.

The next frontier isn’t just digital— it’s ecosystemic. Shared data standards, sectoral alliances, co-developed supplier scorecards—these will be key in enabling full-spectrum visibility and coordinated decarbonization across complex, multitier value chains. So yes, Scope 3 will soon be a standard input. But more importantly, it will become a strategic lens for designing supply chains that are not only lean and agile—but also just, regenerative, and future-fit.

Vishal Bhavsar: Absolutely—it’s no longer a choice but the new norm in supply chain design. Scope 3 emissions are rapidly becoming just as critical as cost, speed, and quality, as businesses realize that climate performance is deeply entwined with operational resilience and value creation. We’re seeing early gains where companies leverage digital platforms and data intelligence to reduce emissions, drive efficiencies, and strengthen supplier partnerships.

But this is only the beginning. The journey to full decarbonization will demand large-scale, cross-industry collaboration—moving beyond isolated sustainability efforts toward

ecosystem-wide transformation. While decarbonization, circularity, and transition funds have gained traction, the next frontier lies in the emergence of dedicated supply chain climate finance mechanisms—solutions that unlock investment for emissions reduction across upstream and downstream tiers.

Technology will be a decisive enabler in this shift. Real impact will come when digital tools reach deep into Tier 2 and Tier 3 supplier networks—generating insights, guiding investments, and powering collective progress. In the future, we won't just ask “how fast and how cheaply can we deliver?”—we’ll ask “how sustainably can we operate at scale?” Scope 3 will be the compass, and supply chain leaders will be the trailblazers.

Smitha Shetty: Yes, Scope 3 is becoming a critical input in supply chain design, especially in sectors where it accounts for the majority of total emissions. In industries like manufacturing, retail, Oil & Gas, consumer goods where complex supply chains dominate, emissions from suppliers and logistics can represent over 70 to 95 percent of the total footprint. As the ESG regulatory landscape continues to evolve, organizations are under growing pressure to demonstrate compliance. One of the most immediate and effective ways to do this is by tracking, managing, and monitoring Scope 3 emissions across the value chain.

This shift is pushing companies to rethink procurement and logistics strategies with emissions performance in mind. Cost and speed remain important, but they are now evaluated alongside environmental impact. The next step is full integration of emissions data into digital supply chain tools, enabling realtime analysis, carbon budgeting, and more informed sourcing decisions. Scope 3 is no longer just a reporting requirement. It is becoming a foundational element in building supply chains that are not only

The next frontier will involve the convergence of digital technologies and sustainability data. We foresee greater adoption of real-time emissions modelling, AI-enabled scenario analysis, and collaborative digital platforms that enhance transparency across multi-tier supplier networks. These innovations will enable the creation of adaptive, low-carbon supply chains that are agile, cost-efficient, and aligned with global climate goals.

efficient, but also resilient, transparent, and aligned with long-term sustainability goals.

Veeshwass Kulkarni: Without a doubt… Scope 3 emissions data is already starting to influence supply chain design decisions at the earliest stages—whether it’s supplier selection, transport mode choice, or packaging design. Rather than treating emissions as a constraint checked at the end of planning, it’s becoming a standard input from the outset.

The next frontier lies in AI-powered digital twins of the entire supply chain. These models will continuously optimize trade-offs among cost, service level, and emissions, adapting in real time to shifts in energy markets, supplier performance, and regulatory changes. Over time, Scope 3 data won’t just guide operational decisions but will influence capital allocation and supplier development strategies. Suppliers who

demonstrate lower carbon footprints and provide transparent data will gain competitive advantages through longer contracts and deeper collaboration.

In essence, Scope 3 is transitioning from a backward-looking compliance number to a forward-looking strategic lever for resilience, efficiency, and market leadership. Companies that act early and embed carbon intelligence into their supply chains will define the next era of sustainable value creation.

Sandeep Chatterjee: Scope 3 is definitely gaining traction as an integral design parameter—but full adoption depends on meaningful incentives and clear business value. No CEO is going to sacrifice profitability purely for sustainability unless there’s either regulatory pressure, market demand, or financial upside. The real opportunity lies in designing new supply chains from the ground up that optimize both costs

and emissions, rather than retrofitting existing networks. While redesigning legacy supply chains can be costly and complex, new supply chains increasingly factor in carbon intensity, renewable energy availability, and circularity as key criteria. The next frontier is fully integrating emissions data into digital twins and AI-driven supply chain design tools—so sustainability, cost, and speed are balanced by design rather than by afterthought.

Varun Chopra: My belief is that Scope 3 Emissions will become a source of competitive advantage for organizations that track and measure it well. In fact, going forward the carbon credit mechanism which will most likely gain pace in 2026-27 will further stimulate sophistication in tracking of Scope 1, 2 & 3 Emissions across organisations.

Swaroop Banerjee, VP – Corporate Sustainability, JSW Group

Scope 3 emissions are fast becoming a defining parameter in futureready supply chains. As global regulations evolve and stakeholder scrutiny intensifies, emissions data now sits beside cost and reliability in procurement and logistics decisions. Decarbonising the value chain is no longer an ESG agenda—it’s a resilience strategy. The real transformation will come from convergence: when real-time emissions modelling, AI-driven scenario planning, and digital collaboration platforms unite to make multi-tier supplier networks transparent and adaptive. That’s when low-carbon supply chains will become the new benchmark for efficiency, agility, and climate alignment.

Bipin Odhekar, Head – Sustainability, EHS & Operations Excellence, Marico India Ltd.

Scope 3 emissions are moving from the margins to the core of supplychain design. The old trinity of Cost, Speed, and Reliability now has a fourth axis—Climate Intelligence. Tomorrow’s supply chains will be built not just on data, but on shared purpose. Common data standards, co-created scorecards, and cross-sector alliances will redefine what visibility truly means. Scope 3 will soon be more than a metric—it will be the strategic lens for designing value chains that are not only efficient but equitable, regenerative, and future-fit. This is how businesses will thrive in a carbon-constrained world.

Vishal Bhavsar, Head ESG, Multiples Alternate Asset Management

Scope 3 is no longer a choice—it’s the new norm in supply-chain design. Climate performance is now inseparable from operational resilience and long-term value creation. Companies are already leveraging digital intelligence to cut emissions, boost efficiency, and strengthen supplier ecosystems. Yet, the next leap will come from climate-finance mechanisms that fund decarbonization across the entire value chain. When digital tools reach deep into Tier 2 and Tier 3 networks, we’ll see real impact—insights, investments, and innovation converging for collective progress. Soon, success won’t be measured only by speed or cost, but by how sustainably we operate at scale.

Smitha Shetty, Regional Director – APAC, Achilles Information Ltd.

In many industries, Scope 3 accounts for over 70% of total emissions— making it an essential input in supply-chain design. Regulatory expectations are pushing companies to monitor, manage, and mitigate emissions across every tier of the value chain. Procurement and logistics strategies are now being recalibrated with carbon impact in mind. The future lies in fully integrated digital tools that bring emissions data into real-time sourcing and planning decisions. Scope 3 is no longer a reporting exercise—it’s the foundation for building supply chains that are resilient, transparent, and aligned with long-term sustainability goals.

Veeshwass Kulkarni, General Manager –Procurement, Legrand

Scope 3 is transforming from a compliance metric to a design driver. Companies are embedding emissions data at the earliest stages— whether choosing suppliers, transport modes, or packaging. The next leap will come from AI-powered digital twins that balance cost, service, and emissions dynamically as markets shift. Over time, carbon data will shape capital allocation and supplier-development priorities, rewarding transparency and low-carbon innovation. Scope 3 intelligence will become a strategic lever—delivering resilience, efficiency, and market leadership for those who act early and design sustainability into their DNA.

Sandeep Chatterjee, Growth Leader – Digital Business Solutions, Supply Chain and Sustainability Pillar, INFOLOB

Scope 3 integration is accelerating, but widespread adoption will hinge on clear business value and the right incentives. Sustainability must coexist with profitability to drive real change. The opportunity lies in designing new supply chains that optimise both emissions and cost from day one—rather than retrofitting legacy systems. Increasingly, carbon intensity, renewable access, and circularity are part of the design brief. The next frontier is full digital integration—AI-driven twins that balance sustainability, cost, and speed by design, not by afterthought. That’s when decarbonization becomes not a constraint, but a competitive advantage.

Dipanjan Banerjee, Chief Commercial Officer, Blue Dart

At Blue Dart, emissions are no longer a side metric—they’re a core KPI, evaluated alongside cost and lead time. We’ve moved to a triple-bottom-line view, where every decision considers financial performance, service efficiency, and environmental impact in equal measure. Sometimes, a marginally longer delivery time is a smarter choice if it significantly reduces emissions and costs. This integrated approach is shaping more responsible, data-driven supply chain decisions. What’s encouraging is that our customers increasingly seek this transparency—demanding insights that reflect not just how fast we deliver, but how sustainably we operate.

Varun Chopra, Executive Chairman, GEAR

Scope 3 emissions will soon move from being a compliance metric to a competitive differentiator. Organizations that can accurately measure, track, and act on their value-chain emissions will gain a distinct edge—both in reputation and resilience. As carbon credit mechanisms mature—particularly with expected acceleration around 2026–27—we’ll see a far greater emphasis on integrated emissions accounting across Scope 1, 2, and 3. This will not only sharpen sustainability performance but also unlock new financial and operational opportunities. In the future, carbon intelligence will sit alongside cost and efficiency as a core driver of business advantage.

Procurement’s Next Act: FROM SAVING COSTS TO SHAPING STRATEGY

“Procurement’s true power lies not in what it saves—but in what it enables.” Once confined to the margins of cost control, procurement has stepped into the spotlight as a catalyst for enterprise transformation. It now defines how organizations think about resilience, innovation, and purpose in an increasingly volatile world. In just a few years, the function has evolved from managing contracts to curating ecosystems—where data informs decisions, relationships drive innovation, and sustainability becomes a measurable advantage. Today’s procurement leaders aren’t just negotiating better deals; they’re shaping how value is created, how risks are shared, and how business priorities are reimagined for the long game. This Cover Story explores how procurement is transforming from a transactional necessity into a strategic powerhouse—one that wields influence not through budgets, but through vision, insight, and impact.

PROCUREMENT has come a long way from being a silent enabler in the corporate machinery to becoming one of its most dynamic strategic engines. The forces reshaping the function are clear — geopolitical flux, supply chain shocks, digital acceleration, and the climate agenda have all converged to redefine what value means. The modern procurement leader is no longer measured by how much they save, but by how fast they can pivot, how effectively they can collaborate, and how deeply they can align decisions with business purpose.

Over the past five years, the procurement playbook has expanded dramatically. AI, predictive analytics, and blockchain are enabling unprecedented visibility and control across supplier networks. Supplier diversity and ESG metrics have become central to sourcing decisions, reflecting a deeper accountability to society and stakeholders alike. And as organizations move from linear to networked supply chains, procurement is emerging as the orchestrator of trust and transparency— bridging innovation, sustainability, and strategic growth.

In this environment, leadership itself is being redefined. The new procurement professional must be part technologist, part strategist, and part diplomat— balancing data with discernment and relationships with resilience. The question is no longer whether procurement can add value, but how it can multiply

it—by driving competitive advantage, unlocking innovation, and shaping the organization’s future readiness.

This conversation with leading procurement voices explores that evolution in action—how the function is shifting from cost to capability, and what it truly takes to lead in this new era of intelligent, purpose-driven procurement.

Over the last five years, how have you seen procurement evolve, and what have been the biggest changes from your industry perspective?

The past five years have marked a defining inflection point for procurement. What was once a cost-control discipline has matured into a strategic nerve center driving resilience, innovation, and stakeholder value. The focus has shifted from transactional efficiency to ecosystem intelligence—where supplier partnerships, risk visibility, and datadriven decisions have become core differentiators. This evolution has not only elevated procurement’s seat at the leadership table but also redefined how industries measure value and performance.

Amol Polke, Global Head Procurement, Piramal Pharma

Solutions: If I look back at the past five years, procurement has gone through nothing short of a transformation— particularly in the pharma sector, where the stakes are higher given our direct connection to human health. Having worked across major pharma organizations for over two decades, I can

say with conviction that the procurement function today is almost unrecognizable compared to the pre-COVID era.

Before the pandemic, procurement was largely synonymous with purchasing. The focus was transactional—getting the right product at the lowest price. Savings were the dominant metric. But the pandemic exposed the limitations of that approach. Suddenly, it wasn’t just about cost—it was about resilience.

During COVID, our over-dependence on single sources of supply became painfully clear. We faced situations where material availability was uncertain, logistics were disrupted, and production continuity was at risk. This forced us—and the entire industry—to think differently. We had to take quick, decisive calls on alternate sourcing, diversify our supplier base, and actively evaluate make-versus-buy strategies. Outsourcing models were re-examined, not only from a cost perspective but also for their ability to enhance resilience.

Another defining shift was digitalization. The pandemic era made remote work unavoidable, but paradoxically, it brought the world closer. Suddenly, procurement leaders were managing global supplier relationships, negotiations, and strategy reviews entirely through digital platforms— Zoom, Teams, and beyond. This accelerated the adoption of digital procurement tools and created a culture where data and connectivity became central to decision-making.

For pharma specifically, the rise of analytics and market intelligence platforms has been a true game changer.

Pharma Solutions

Future leaders must be co-owners across functions, working hand-in-hand with finance, business, and project teams. The pace of technological change demands direction, alignment, and commitment (DAC) from leaders—without this, organizations will struggle to adapt. True leadership lies in balancing polarities: digital platforms must be harnessed, but not at the cost of human judgment; cost efficiency must coexist with sustainability. Empowering teams is central—leaders cannot be everywhere, and learning often comes through trial and failure. Procurement leadership will increasingly be defined by its ability to harmonize opposites while guiding organizations through relentless change.

AI, analytics, and automation are rewriting procurement’s DNA. What was once reactive and process-heavy is now proactive and insight-led. Predictive tools flag risks before they surface, digital twins simulate supply scenarios, and intelligent workflows accelerate decisions across functions. But technology alone isn’t the story—it’s the mindset shift it inspires. The best procurement leaders see digital not as a destination but as an amplifier of human judgment, using it to combine precision with purpose, and data with discernment.

Earlier, decisions were often driven by experience and cost benchmarks. Today, advanced analytics provide visibility into supply risks, market trends, price volatility, and supplier performance. This shift from intuition-driven to datadriven procurement has elevated the function to a far more strategic role.

So, if I were to distil the biggest changes:

From cost savings to resilience: Procurement is now about ensuring business continuity and supply security.

From transactional to strategic: Sourcing decisions today involve broader considerations such as risk diversification, sustainability, and innovation.

From traditional to digitalfirst: Technology has redefined how procurement operates, from collaboration to analytics.

In many ways, procurement has moved from being a support function to being a value creator. For the pharma sector, where supply chains are complex and global, this evolution has been critical to keeping us agile, future-ready, and resilient against disruptions.

Nikhil Puri, Sr VP – Direct Purchase, Yokohama ATG: When COVID struck, the world came to a standstill. None of us knew when or how the crisis would end. As operations gradually resumed and people started returning to offices, one realization became clear: there was

no such thing as post-COVID. We had to learn to operate with COVID—to accept uncertainty as a constant and build systems that could thrive within it.

That mindset shift was fundamental. We went back to the basics of supply chain triangle – Cost, Service and Cash Flow. These levers have always defined procurement, but the pandemic forced us to integrate them more thoughtfully, balancing at least two at any given time rather than focusing on one in isolation.

On the cost front, the real breakthrough came from redefining globalization. For us, globalization wasn’t about chasing the lowest cost in one region—it meant true diversification. We segmented the world into regions—China, Southeast Asia, Europe, the Americas, and the Middle East—and built supply bases in each. For every major commodity, we now have multi-regional sourcing options. This transformation didn’t happen overnight; it took extensive stakeholder alignment and months of groundwork. But today, unlike in the pre-COVID era, our sourcing is genuinely global. If disruption strikes one geography, we can seamlessly pivot to another, without jeopardizing continuity.

On serviceability, we reframed the role of inventory. Traditionally, inventory was seen as a necessary evil—an added cost. But in volatile times, it became a strategic shield. We created a three-tier inventory model:

Inventory in hand at our warehouses,

Inventory in transit, and

Inventory at the supplier’s end.

This model gave us built-in elasticity, allowing supply cycles to flex from 45 days to 90 or even 120 days depending on the situation. That flexibility turned inventory from a burden into a strategic advantage.

On the delivery side, we brought agility closer to our plants. By creating near-hubs and stocking points across India—through vendor-managed models as well as our own facilities— we ensured faster responsiveness and minimized production risk, even amid global transport bottlenecks.

The cumulative impact of these changes is profound. Today, geopolitical tensions or trade disruptions do not trigger panic—they’re simply part of the landscape. In fact, within our teams, such events are often discussed as routine business scenarios, not crises. That confidence comes from the resilience and flexibility we have embedded into our procurement systems.

In essence, procurement has evolved from being reactive and costdriven to being proactive, resilient, and strategically global. It’s no longer about responding to disruptions; it’s about being ready for them before they arrive.

Subodh Nagarsekar, VPProcurement & Supply Chain, Rentokil PCI: The pandemic has been a turning point for procurement and supply chain management. For years, procurement was viewed primarily through the narrow lens of the golden triangle: revenue, profitability, and sustainability. But before COVID, the emphasis was overwhelmingly on the

Subodh Nagarsekar, VP – Procurement & Supply Chain, Rentokil PCI

Leadership today rests on three principles—Communicate, Delegate, Collaborate. Strong internal and external stakeholder connect is the foundation for success; unless leaders understand the realities faced by suppliers and customers, half the work remains incomplete. Delegation empowers teams, while collaboration across functions, with suppliers, and with customers builds trust and resilience. In a volatile environment, purchase intelligence becomes indispensable. Every day presents new risks, so strategies must embed risk mitigation at their core. Tomorrow’s leaders will be measured not only by efficiency, but by how well they anticipate and prepare for disruption.

first two vertices—growth and margins. Post-COVID, the focus has expanded to include the third, equally critical element—sustainability.

And I use “sustainability” in a broader sense than just ESG. It is about building operational sustainability—ensuring that systems, processes, and ways of working are resilient, adaptable, and future-proof. If organizations can’t build operational continuity into their procurement and supply chain structures, even the most profitable strategies won’t last in the face of disruption.

At Rentokil PCI, we approached this transformation through a three-pillar framework:

Suppliers as partners, not vendors: For any procurement leader, suppliers are one of the two most important levers of success. Pre-COVID, relationships often stayed transactional—based on price, margins, or immediate needs. But in the last five to six years, we’ve consciously moved beyond that. Today, every supplier we work with is treated as a strategic partner. In fact, we don’t even use the word “supplier” anymore— they are business partners who share our vision. Unless we are aligned on longterm purpose, culture, and standards, collaboration has little value.

This shift has made us more resilient because we co-create solutions with our partners. It is no longer about pushing terms or negotiating harder—it’s about building trust, sharing risks, and innovating together.

Building and upskilling the team: The second lever is the team itself. Historically, supply chain was seen

as a fallback function—roles people entered not always by choice but by compulsion. This perception has changed dramatically. Today, supply chain is viewed as a strategic growth driver, with global trends showing more CEOs emerging from procurement and supply chain backgrounds.

Within my team, I see it as my responsibility to elevate their skills and perspectives. Technology cycles are shortening—what was relevant yesterday becomes outdated today and tomorrow demands something entirely new. Digitization, data-driven decisionmaking, and automation are already shaping the future of procurement. I am investing heavily in upskilling our people so that they can not only cope with this change but also lead it. A capable, futureready team is the biggest differentiator in ensuring supply chain resilience.

Visibility and customer-centricity: The third pillar is visibility across the value chain. Procurement is positioned right between suppliers and customers—it is the bridge that connects production to demand. If we don’t bring transparency, speed, and responsiveness into that bridge, we fail both ends.

By embedding customer-centricity into every process, procurement can move beyond being a support function. It becomes a value creator—delivering not just efficiency but measurable business outcomes. At Rentokil PCI, our aim is to transform procurement into a profit centre by aligning everything we do with customer satisfaction and long-term business value.

In essence, the last five years have

repositioned procurement from being a transactional cost-control function to being a strategic, sustainable, and customer-centric enabler of business growth. It is no longer about negotiating better—it’s about building ecosystems that are resilient, people-powered, and innovation-driven.

Vikrant Srivastava, Associate Director – Supply Chain, Yum Restaurants India Pvt. Ltd.: I would divide the answer into two distinct phases—pre-COVID and postCOVID—because the expectations from procurement and supply chain functions have transformed dramatically during this period.

Pre-COVID, procurement’s focus was almost singular: cost optimization. Whether negotiating contracts, onboarding suppliers, or managing supply lines, the guiding principle was “are we getting it cheaper, and are we protecting margins?” Procurement was viewed largely as a cost-control function, working behind the scenes to ensure profitability.

Post-COVID, that narrow lens has given way to a far more strategic outlook, shaped by resilience, agility, and value creation. Several shifts have been particularly important:

Resilience through diversification: The pandemic, coupled with global disruptions such as the Suez Canal blockage and ongoing Red Sea crises, exposed how vulnerable supply chains were when overly dependent on a single source or geography. We learned that resilience matters as much as efficiency.

For us, this meant rethinking sourcing strategies—building multi-supplier ecosystems, regional supply bases, and even localized sourcing models where possible. The idea is simple: supply chains must be designed to withstand shocks and guarantee availability at all times, regardless of what is happening globally.

Suppliers as strategic partners:

Another major shift is in how we engage with suppliers. Earlier, suppliers were treated transactionally—as vendors who provided inputs at the lowest possible cost. Today, they are viewed as strategic partners and collaborators in value engineering.

In the QSR space, we understand our consumer, our brand, and our operational requirements deeply. But our suppliers— because they often work with multiple industries such as pharma, automotive, and retail—bring cross-sectoral insights that we can leverage. When we co-create with them, the conversation shifts from price negotiation to innovation, efficiency, and new forms of value creation. Interestingly, when you focus on joint problem-solving, cost optimization happens naturally as a by-product.

Sustainability as a defining filter:

Sustainability has become a nonnegotiable pillar of procurement strategy. This goes well beyond environmental or ESG mandates. It’s also about ensuring that suppliers themselves are sustainable—financially, operationally, and ethically. If a supplier lacks resilience or cannot adapt to the future, our own

business continuity is at stake. Therefore, procurement leaders must now evaluate suppliers not just on quality and price, but also on their ability to thrive over the next decade. This long-term thinking is a fundamental change in how supply ecosystems are built.

Procurement’s elevated role within the enterprise: Perhaps the most profound change is the elevation of procurement and supply chain to a boardroom-level function. Pre-COVID, procurement was often seen as a support function—important, but largely transactional. Post-COVID, the function is deeply embedded in strategic decisionmaking.

Today, business leaders across departments—whether general managers, CFOs, or even CEOs— regularly seek supply chain’s input before finalizing decisions. Procurement teams are called on to validate supplier choices, assess cost structures, and ensure long-term value creation. This increased visibility has transformed supply chain into a core strategic pillar of the organization.

To sum it up, the role of procurement has evolved from being transactional and cost-driven to being strategic, resilient, and future-oriented. It is about creating supply ecosystems that can withstand disruptions, nurturing supplier partnerships that drive innovation, embedding sustainability into every decision, and ensuring procurement is a genuine enabler of business growth—not just a cost gatekeeper.