Q2 2025

CBRE’S QUARTERLY CAPITAL MARKETS MAGAZINE, PROVIDING INSIGHTS

ACROSS ALL MAJOR SECTORS.

Q2 2025

CBRE’S QUARTERLY CAPITAL MARKETS MAGAZINE, PROVIDING INSIGHTS

ACROSS ALL MAJOR SECTORS.

Sector spotlights on Industrial & Logistics, Office and Capital Advisory

From Racing Cars to Renewables: Lee Holdsworth’s Journey into Commercial Real Estate

Sydney’s Industrial & Logistics Market: A Beacon of Growth & Opportunity

Investing in the Land of the Long White Cloud

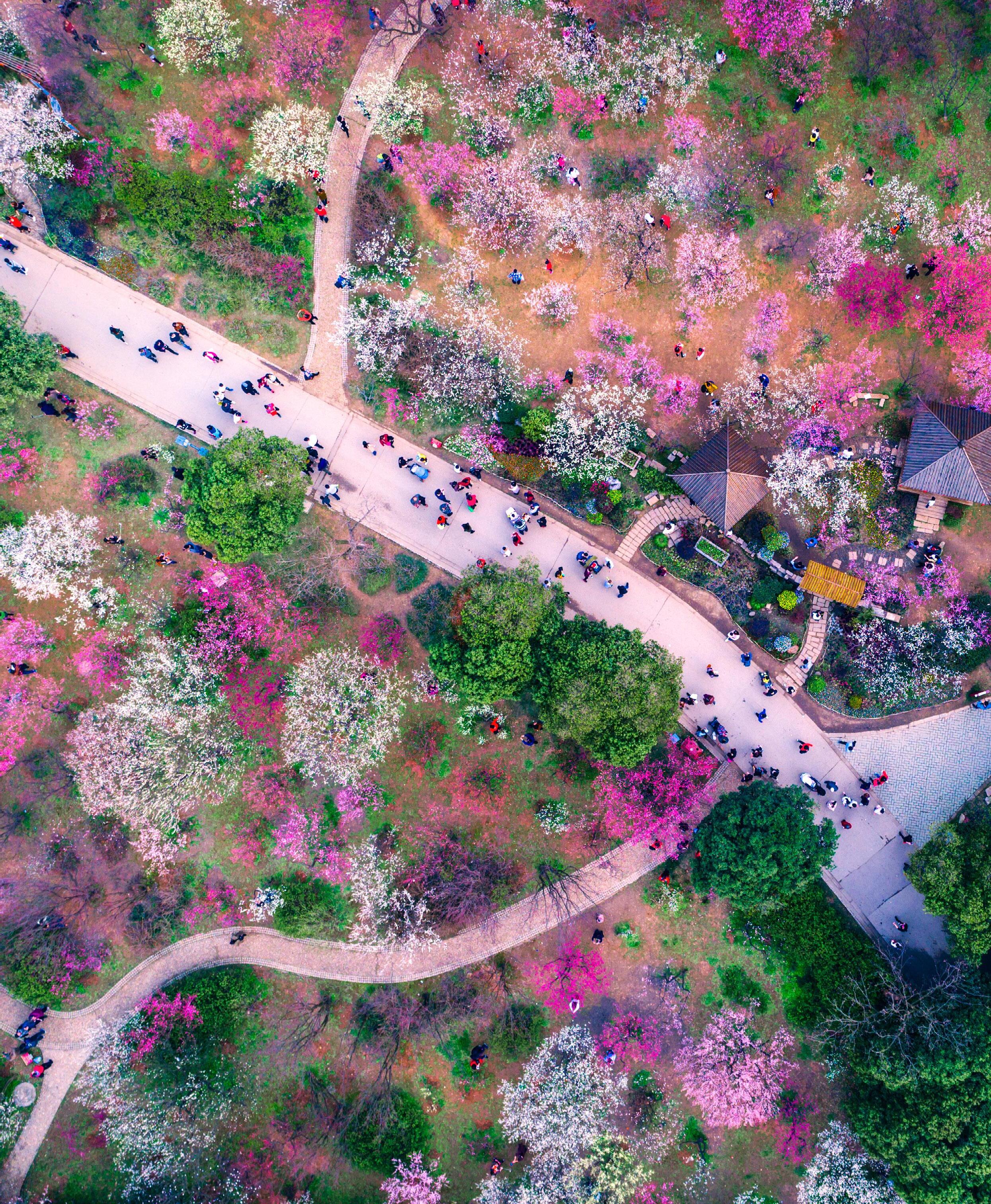

Population Growth & Its Impact on Australian Property

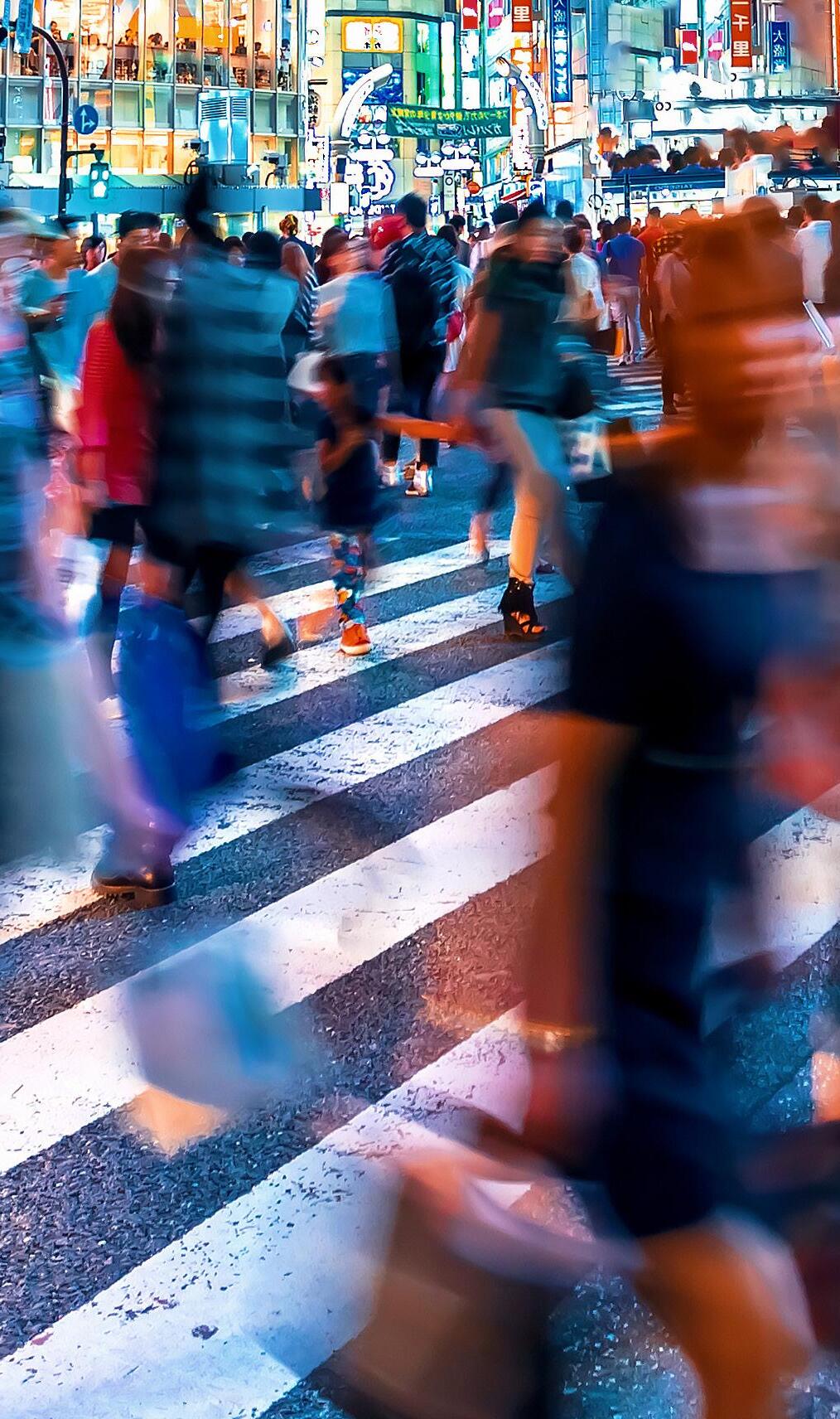

CBRE’s Yuko Toda & the Surge of Japanese Capital in the Pacific

Answering the most Important Capital Markets Questions for 2025

on the state of play

With the arrival of 2025 came the expectation of a more “stable” year under the backdrop of increasing volumes and a recovering market. The volatility of recent weeks reminds us that instability is never too far away. In recent times volatility has been a constant whether it be war, pandemic, share markets, interest rates, inflation and now tariffs. The ructions of recent weeks are nothing new and neither is the revelation that with adversity comes opportunity.

The tariff war will no doubt have varying positive and negative impacts on our industry through construction costs, occupier demand, retail spend, capital demand and of course cost of debt. We see minimal direct economic impact for the Pacific and expect that the accelerated interest rate reduction cycle will be a significant net benefit for the market. For Investors who can see through the chaos the fundamentals of high replacement values, positive demand and shrinking supply continue to provide strong prospects for rent growth.

In this edition of Capital Edge, our Sector Spotlights on the Industrial & Logistics market, where key trends are shaping the landscape. Melbourne has seen a decline in transaction volumes but an increasing number of curious buyers seeking value, while Sydney remains a high-demand market with the prospect of compressing yields.

We also explore the Office market, which has undergone significant repricing and now presents attractive relative value. Trends from overseas are influencing the market, with increasing investor support for office leading to a significant rise in transactions of scale across the region.

Insights from our Capital Advisory business highlight improved private capital market conditions and investor sentiment, with Australia screening as an attractive destination for investors.

Our 2025 Asia Pacific Investor Intentions Survey reveals a promising outlook for real estate investment across the region. With over half of the respondents indicating a preference to increase their real estate allocations, the survey highlights a significant improvement in buying intentions compared to previous years.

We hope you find this issue of Capital Edge both informative and insightful. Our commitment to providing the latest market intelligence and expert advice remains steadfast. By staying informed and adaptable, we can navigate this dynamic environment and achieve sustained success together.

Flint Davidson Head of Capital Markets, Pacific

+61 411 183 061 flint.davidson@cbre.com.au

The 2025 Asia Pacific Investor Intentions Survey by CBRE reveals a promising outlook for real estate investment across the region. With over half of the respondents indicating a preference to increase their real estate allocations, the survey highlights a significant improvement in buying intentions compared to previous years.

The survey, conducted in late 2024, shows that the ongoing interest rate cut cycle in most markets is a key driver behind the increased investment activity anticipated for 2025. However, the extent of this activity will vary across different markets. Australia, Korea, Singapore, and Hong Kong SAR are expected to see notable gains in transaction activity, while Japan and India are poised for robust purchasing activity, driven by core/core-plus and opportunistic strategies, respectively.

Australia is set to benefit from its stable economic environment and favourable interest rates, attracting both domestic and international investors. Korea’s market is expected to see increased activity due to its strategic location and growing demand for high-quality assets. Singapore’s well-established financial sector and transparent regulatory framework make it a prime destination for investors seeking stability and growth. Hong Kong SAR, despite recent challenges, remains a key market due to its strategic importance in the region.

Japan’s real estate market is anticipated to experience strong purchasing activity, particularly in the core/core-plus segment. Investors are drawn to Japan’s stable economic conditions and attractive pricing. India, on the other hand, is expected to see a surge in opportunistic investments, driven by its rapidly growing economy and increasing demand for modern infrastructure.

Investors are showing a renewed interest in core-plus and value-added investment strategies, aiming to achieve target returns and acquire core assets at attractive pricing. Offices and data centres have seen the biggest uptick in investor preference, with the former attracting core and core-plus investors and the latter appealing to those seeking opportunistic pricing, particularly in Southeast Asia.

The office sector is experiencing a resurgence as companies adapt to hybrid work models and seek high-quality spaces that cater to evolving employee needs. Prime office locations in major cities are particularly attractive to investors looking for stable returns. Data centres, driven by the increasing demand for digital infrastructure, are becoming a focal point for opportunistic investors. Southeast Asia, with its growing digital economy, presents significant opportunities for data center investments.

Industrial properties remain the top choice for core investors, while the living sector continues to attract interest despite limited investable stock outside of Japan, Australia, and mainland China. The industrial sector’s resilience and strong demand for logistics and warehousing facilities make it a preferred investment option. The living sector, including multifamily and student housing, is gaining traction as investors seek to capitalise on demographic trends and urbanisation.

Healthcare assets and data centers are also gaining traction as alternative investments. The healthcare sector, driven by aging populations and increasing healthcare needs, offers stable and long-term investment opportunities. Data centers, essential for supporting the digital economy, are becoming increasingly attractive to investors looking for high-growth potential.

Despite the positive sentiment, investors remain cautious about the extent of rate cuts in 2025, which could impact investment sentiment throughout the year. The uncertainty surrounding interest rate policies and economic conditions may lead to cautious investment strategies. However, the overall investment sentiment has improved, with net buying intentions rising from 5% in 2024 to 13% in 2025.

Investors are also mindful of geopolitical risks and regulatory changes that could affect market dynamics. The ongoing trade tensions and political uncertainties in some regions may pose challenges to investment strategies. Nonetheless, the optimism reflected in the survey indicates a strong belief in the long-term potential of the Asia Pacific real estate market.

The 2025 Asia Pacific Investor Intentions Survey underscores a year of optimism and strategic shifts in the real estate investment landscape. As investors navigate the evolving market dynamics, their focus on core-plus, value-added, and opportunistic strategies will shape the investment trends and opportunities in the region. The survey highlights the importance of adapting to changing economic conditions and leveraging strategic insights to make informed investment decisions.

With a diverse range of investment opportunities across various sectors and markets, the Asia Pacific region continues to be a key destination for real estate investors. The positive sentiment and strategic shifts observed in the survey indicate a promising outlook for 2025, as investors seek to capitalise on favorable market conditions and achieve their investment goals.

The current market ructions caused by tariff uncertainty are very topical with real estate investors. We see minimal direct economic impact for the Pacific, other than wealth effect of lower equity values. There might be a pause in certain pockets of offshore capital as they focus on more immediate domestic requirements. The fundamentals of high replacement values, positive demand and shrinking supply provide a good backdrop for rising rents. Near-term there is greater scope for interest rate cuts and heightened leasing activity in logistics. Leasing velocity may slow in some other sectors, including office and luxury retail.

As the demand for quality education continues to rise globally, the student accommodation sector has emerged as a compelling investment opportunity. Melbourne, Australia’s largest student market, is at the forefront of this growth, offering investors a unique chance to capitalise on the burgeoning need for purpose-built student accommodation (PBSA).

Australia’s education sector is a significant contributor to the national economy, adding approximately $50 billion annually, second only to the mining sector. With over 250,000 full-time domestic and international students, Melbourne stands as the country’s premier student city, ranking fifth globally in the QS Best Student Cities 2025.

Despite this, the supply of PBSA in Australia lags behind global peers, with a penetration rate of just 6% compared to 29% in the US and 33% in the UK. This gap presents a substantial opportunity for investors to meet the growing demand for high-quality student housing.

Located at 145 Berkeley Street, Melbourne - Yugo is a 335-bed PBSA asset that exemplifies the potential of student accommodation investments. Since its opening in May 2019, the property has maintained high occupancy rates, with over 97% of beds leased as of March 2025. The asset has achieved a 13% compound annual growth rate (CAGR) in average rents per bed between 2022 and 2025, reflecting its strong demand and operational success.

Melbourne’s student accommodation market is characterised by high economic rents, which constrain future supply and make development unviable at current market rates. This scarcity drives rent growth and ensures that existing assets, like Yugo Berkeley Street, remain highly sought after. The city’s prime location, opposite the University of Melbourne and within close proximity to RMIT and other top universities, further enhances its appeal.

Over 80% of Yugo Berkeley Street’s residents attend the nearby University of Melbourne, underscoring the property’s strategic positioning.

Andrew Purdon, Regional Director of Living Sectors at CBRE, highlights the growing attractiveness of PBSA as an asset class: “Purpose-built student accommodation is becoming an increasingly attractive asset class for international investors. The strong demand for quality education in Australia, coupled with the limited supply of student housing, creates a compelling investment opportunity. Melbourne, in particular, stands out as a prime market due to its large student population and world-class universities.”

Investors are increasingly prioritising sustainability and ESG principles, and Yugo Berkeley Street is committed to achieving net zero by 2040. The property features extensive submetering systems for energy and water consumption, universal access, and a range of shared spaces promoting well-being and community interaction.

The growth in student accommodation presents a compelling investment opportunity for local and offshore investors. Yugo Berkeley Street, with its prime location, proven performance, and commitment to sustainability, stands as a testament to the potential of this sector. As the demand for quality education and student housing continues to rise, investing in PBSA assets like Yugo Berkeley Street offers a chance to contribute to the future of education while achieving strong returns.

alex.shaw@cbre.com

From Chris O’Brien

Head of Industrial & Logistics

+61 407 664 233 chris.obrien@cbre.com.au

“Shifting investor preferences and new economic realities.”

• Melbourne’s transaction volumes are down due to the Foreign Owners Land Tax.

• Adelaide and Perth are moving from mining boom hype to industrial land values, reflecting diversification.

• Investors are increasingly seeking long WALE properties for stable, long-term income streams.

The current economic landscape presents a complex environment for the industrial and logistics market. Key trends and shifts are shaping the market, and it is essential to understand these dynamics.

Melbourne has experienced a notable decline in transaction volumes, primarily driven by the impact of the Foreign Owners Land Tax. This tax has started to significantly affect the market, leading to reduced activity from foreign investors. Across all major markets, rent growth has shown signs of deceleration, indicative of a broader economic slowdown and increased caution among tenants.

Sydney continues to be a high-demand market, with yields compressing despite expectations of a short-term rise. Brisbane’s industrial and logistics market is performing well as increased capital pivots to this market, bolstered by strategic location and infrastructure investments. The data centre sector is continuing to experience strong investor appetite with data centre sites extracting a premium above industrial land values.

Adelaide continues to demonstrate strong performance despite lower investor interest. Both Adelaide and Perth are experiencing a shift from the mining boom hype towards more industrial land values. This transition reflects a broader trend of diversification within these markets, as investors seek opportunities beyond the traditional mining sector.

We have observed an increase in corporates looking to monetise their real estate assets. This trend is driven by the need to optimise balance sheets and unlock capital for core business activities. Corporates are exploring various strategies, including sale-and-leaseback arrangements, to capitalise on the strong demand for industrial and logistics properties. Premium pricing for largescale assets has not yet returned to the market. Transactions below $100 million are generally extracting the strongest pricing, reflecting investor caution and a preference for smaller, more manageable investments.

Offshore and domestic investors are closely monitoring the impact of recent tariff increases and geopolitical instability, which are disrupting supply chains and affecting market confidence. Despite these challenges, the sector’s strong fundamentals, such as high replacement values, increasing demand, and limited supply, remain attractive.

Anticipated interest rate cuts could further boost domestic activity, though investors must stay adaptable and resilient to navigate ongoing economic and political fluctuations. There is a growing appetite for long WALE properties, with investors increasingly prioritising tenant strength and security to ensure stable, long-term income streams. This shift towards long WALE assets reflects a more conservative investment approach, aimed at mitigating risks and ensuring sustainable returns.

Blackstone has successfully acquired the Arcadia Industrial Estate, located on Boundary Road in Coopers Plains, Brisbane, marking a significant transaction in the industrial and logistics sector.

Arcadia Industrial Estate is strategically positioned between Brisbane’s major arterial roads and rail yard, including the Logan and Ipswich Motorways. The estate offers dual street access and a variety of warehouse and office spaces, catering to diverse warehouse and distribution needs.

The estate comprises nine single-level buildings, generating a net income of approximately $5 million per annum at an average lease rate of $126 per sqm.

The Weighted Average Lease Expiry (WALE) is 3.8 years, ensuring a stable and reliable income stream for the new owner, Blackstone.

The sale was finalised in March 2025, with an initial yield of 5.55%. Blackstone acquired the property for $91 million. The estate features a GLA of 40,110sqm and a site area of 80,025sqm. Sitting tenants include Market Direct Group, Nippon Food Supplies, Toyo Tyres, Guest Group, and GPC Asia Pacific.

The Brisbane market has seen significant growth, with investment sale transactions totalling $333 million in the first quarter of 2025, representing a 36% increase compared to the same period last year.

CBRE’s Head of Queensland Industrial & Logistics, Matthew Frazer-Ryan said, “This highlights the strength and resilience of the industrial and logistics sector in Brisbane. The strategic location and highquality tenant mix make Arcadia Industrial Estate a valuable addition to Blackstone’s portfolio.”

BADGERYS CREEK

235 Martin Road, Badgerys Creek, offers a generational opportunity to secure the last gateway site of scale within the Western Sydney Aerotropolis precinct. This 196-hectare land parcel is adjacent to the Western Sydney International Airport and is poised to become one of Australia’s largest logistics estates, with over 703,007 sqm of GLA, subject to council approval.

Strategically located approximately 48 kilometres west of Sydney’s CBD, the site benefits from excellent connectivity to major arterials and infrastructure, including the M12 Motorway, Elizabeth Drive, and the Northern Road. The Western Sydney Aerotropolis is set to evolve into a world-class precinct, focusing on industries such as advanced manufacturing, technology, research, training and education, freight and logistics, agribusiness, and mixed-use development.

Cameron Grier

+61 415 666 444 cameron.grier@cbre.com.au

Jason Edge

+61 410 687 866 jason.edge@cbre.com.au

Sydney’s industrial market faces a severe supply shortage, with vacancy rates as low as 2.1%, among the lowest globally. This site represents the last chance to secure genuine scale within the precinct, making it a prime investment opportunity.

Significant infrastructure investments are underway, including the $1.8 billion M12 Motorway, $600 million Elizabeth Drive Upgrade, $1 billion Fifteenth Avenue Upgrade, $11 billion Metro Rail Line, and the $6 billion Western Sydney Airport. These projects will enhance connectivity, reduce travel times, and support the region’s growth.

The property is offered for sale via International Expressions of Interest, closing Thursday, 10th April 2025.

Chris O’Brien

+61 407 664 233 chris.obrien@cbre.com.au

In the latest episode of CBRE’s “Talking Property” podcast, we delve into the fascinating career transition of Lee Holdsworth, a Bathurst 1000 Supercars winner who has shifted gears from the racetrack to the renewable energy sector. Holdsworth, now a commercial real estate expert at CBRE, focuses on alternative investment assets, particularly in the renewables space.

A WINNING MINDSET

Holdsworth’s journey from racing cars to renewables is marked by his winner’s mindset, which he attributes to his success both on and off the track. With 21 Bathurst 1000 starts and a top spot on the Mount Panorama podium three years ago, Holdsworth has demonstrated the importance of resilience, teamwork, and strategic thinking—qualities that have seamlessly translated into his role at CBRE.

NAVIGATING THE ENERGY TRANSITION

As Australia makes strides towards a net-zero future, Holdsworth sees significant property opportunities in the renewable energy sector. He emphasises the importance of finding the right capital partners to leverage growth in this space. His insights into the sector reveal a promising landscape for investors looking to diversify their portfolios with alternative investments.

INNOVATIONS & OPPORTUNITIES

Holdsworth highlights several innovations to watch out for in the renewables sector, including advancements in solar and wind energy technologies. He believes that these innovations, coupled with strategic investments, can drive substantial returns for investors. His expertise in the sector is a testament to the growing importance of renewable energy in the commercial real estate market.

PETROL TO NET ZERO

The inherent irony in Holdsworth’s career transition—from a petrol-guzzling profession to one geared towards sustainability—underscores the dynamic nature of the energy sector. His story is a compelling example of how professionals can pivot their careers to align with global sustainability goals, contributing to a greener future.

Lee Holdsworth’s journey from racing cars to renewables is not just a personal success story but also a reflection of the broader trends in the commercial real estate market. As Australia continues its energy transition, the renewables sector offers untapped opportunities for investors. Holdsworth’s insights and expertise provide a valuable roadmap for navigating this evolving landscape.

LISTEN NOW

Scan for the full Talking Property podcast.

Sydney’s industrial and logistics sector is undergoing a transformative period, characterised by significant growth and innovation. As we progress through 2025, this sector is not only a cornerstone of the city’s economic infrastructure but also a focal point for investment and technological advancements. Several key trends and developments are shaping Sydney’s industrial and logistics market, highlighting the opportunities and challenges that lie ahead.

E-COMMERCE BOOM: FUELLING UNPRECEDENTED DEMAND

The surge in e-commerce has been a pivotal factor for Sydney’s industrial and logistics market. The demand for efficient supply chain solutions and advanced logistics facilities has escalated, driven by the necessity to meet the expectations of a burgeoning online consumer base. This trend shows no signs of abating, with e-commerce projected to continue its upward trajectory in the forthcoming years.

E-commerce growth has led to a significant increase in the need for last-mile delivery hubs and urban logistics centres. These facilities are crucial for ensuring timely deliveries and maintaining customer satisfaction in a highly competitive market.

INVESTMENT SURGE: BUILDING THE FUTURE

Investors are increasingly recognising the potential of Sydney’s industrial and logistics sector. Significant capital is being channelled into the development of stateof-the-art warehouses and distribution centres. These investments are not only enhancing the region’s infrastructure but also contributing to its economic growth.

Sydney’s strategic location, with its proximity to major transport hubs and ports, renders it an attractive destination for both domestic and international investors.

Recent investments have focused on developing high-tech facilities equipped with automation and robotics. These advancements are aimed at improving operational efficiency and reducing costs, making Sydney a competitive player in the global logistics market.

The development of the Western Sydney Airport is set to be a game-changer for the region’s industrial and logistics sector. This major infrastructure project is expected to significantly boost the area’s connectivity and accessibility, making it an attractive

hub for logistics operations. The airport’s strategic location will facilitate faster and more efficient movement of goods, both domestically and internationally.

Sass Jalili, CBRE’s Head of Industrial & Logistics, Data Centre Research Australia and Director of NSW Research, emphasises the importance of this development: “Our assessment of Western Sydney’s land supply marks a significant milestone, providing unprecedented insights and setting a new benchmark in research capabilities within the sector.”

The airport is anticipated to attract substantial investment in surrounding industrial precincts, driving demand for land and development opportunities. This influx of investment will likely lead to the creation of new jobs and further economic growth in the region.

LAND SUPPLY: THE CRITICAL FACTOR

One of the most pressing issues in Sydney’s industrial and logistics market is the availability of land. As demand for industrial space continues to rise, the scarcity of suitable land has become a significant challenge. Developers are increasingly looking towards brownfield sites and urban infill opportunities to meet the growing need for industrial space. The competition for land is intense, driving up prices and necessitating innovative solutions to maximise the use of available space.

Western Sydney Airport’s development is expected to unlock new industrial precincts, providing much-needed space for logistics operations. This initiative is crucial in mitigating the land scarcity issue and supporting the sector’s growth.

Government initiatives aimed at rezoning and developing industrial land are essential for meeting future demand. These initiatives include the identification of new industrial zones and the redevelopment of underutilised areas.

The integration of technology is revolutionising the industrial and logistics sector. Automation, robotics, and data analytics are being leveraged to optimise processes, reduce costs, and improve efficiency. Smart warehouses equipped with advanced tracking systems and automated machinery are becoming the norm, enabling businesses to meet the high expectations of modern consumers.

Technological advancements are enhancing supply chain visibility and enabling real-time tracking of goods. This increased transparency is vital for improving operational efficiency and reducing delays.

GREEN INITIATIVES: LEADING THE WAY IN SUSTAINABILITY

Sustainability is at the forefront of the industrial and logistics sector in Sydney. Developers and operators are increasingly adopting green building practices and energy-efficient technologies to minimise environmental impact. This push towards sustainability is driven not only by regulatory requirements but also by a growing awareness among businesses and consumers about the importance of environmental stewardship.

Several case studies highlight industrial facilities that have implemented sustainable practices, such as solar power installations and rainwater harvesting systems. These initiatives are not only reducing the environmental footprint but also lowering operational costs.

BRIGHT FUTURE: POSITIVE MARKET OUTLOOK

The outlook for Sydney’s industrial and logistics market remains positive. With continued demand from e-commerce, strategic investments, technological advancements, and a focus on sustainability, the sector is well-positioned for sustained growth. However, challenges such as rising construction costs, supply chain disruptions, and land scarcity need to be managed effectively to maintain this momentum.

Collaboration between the public and private sectors is essential in addressing these challenges. By working together, stakeholders can develop innovative solutions that support long-term growth and stability in the market.

Sydney’s industrial and logistics market is a beacon of growth and opportunity. As the sector continues to evolve, it presents numerous opportunities for investors, developers, and businesses to capitalise on the burgeoning demand and technological advancements. By staying ahead of the trends and embracing innovation, stakeholders can ensure long-term success in this dynamic market.

READ NOW

Scan for the full ‘Sydney Industrial & Logistics Land Supply 2025’ report.

As we navigate through 2025, New Zealand’s commercial property market presents an evolving landscape for investors. CBRE’s recent market outlook highlights several key trends and opportunities that are shaping the investment environment, driven by economic factors, sector-specific dynamics, and shifting investor preferences.

ECONOMIC

The Reserve Bank of New Zealand (RBNZ) has adopted a more accommodative monetary policy stance, with significant interest rate cuts expected throughout 2025. This approach has already started to stimulate economic activity, with consumer spending anticipated to continue to lead the initial rebound. Business investment, particularly in productive capacity such as commercial spaces, is projected to pick up more substantially in 2026 as the economy absorbs existing excess capacity.

Brent McGregor, CBRE New Zealand’s Executive Chairman, notes, “The RBNZ’s February monetary policy review not only delivered another 50bps reduction to the cash rate but also strongly signalled an ongoing commitment to lowering short-term interest rates in contrast to some other central banks”. This positive economic outlook sets the stage for a favourable investment environment in the commercial property market.

SECTOR-SPECIFIC INSIGHTS

The office market is witnessing a small bump in investor preference after a period of subdued interest. This renewed interest is largely driven by the sector’s value proposition at current yield levels plus a big delta between A-grade rentals and economic rents for new development. Hybrid working remains a key feature, but its impact on reducing office footprints has worked itself through. Occupier sentiment surveys indicate that consolidation pressures are easing, suggesting a stabilising demand for office spaces.

Brent McGregor comments, “Groups wanting to look at NZ Office opportunities, still have time; the rebound won’t be fast. Quality assets are in the cross hairs for a few investors who haven’t managed to pick up Sydney assets over the past 18 months, and NZ is increasing becoming appealing relative to the Australian states which have introduced fresh property taxes.

Although retail has been out of favour in recent years, there is a noticeable positive shift in investor sentiment. Our investor survey shows that the proportion of investors targeting retail has more than doubled since 2023 and we see this investment sector being poised for recovery as supply peaks and occupancy rates improve over the next 18-24 months.

The industrial sector continues to attract strong investor right across the board. Vacancies have increased but are still negligible and although cap rates have expanded out, market rental increases have offset most of the impact. This sector has been the bright spot over recent years and is set to continue to make up a large slice of the transaction volumes chart.

In 2025, yield movements are expected to contribute positively to investment returns. The lack of rental growth in 2024 limited capital and income-based returns, but historical cycles suggest that a slowdown in rental growth often precedes a recovery. By 2026, both rents and yields are forecast to contribute positively to capital returns, with total returns potentially reaching double digits.

Brent McGregor explains, “We forecast yields firming moderately in 2025 as investor confidence and liquidity lift, and interest rate falls filter through”. This scenario is encouraging for investors looking to capitalise on the evolving market dynamics. This doesn’t mean that we’ll see valuations increase however, as on average there still remains a decent gap between valuations and bid pricing across most assets.

Existing quality assets offer significant potential for capital growth, particularly those where replacement costs would demand rents substantially higher than that indicated for the built stock. Proactive asset management and well-judged capital expenditures are proving effective in enhancing occupancy and rental performance.

Location remains a critical factor in attracting lessee and buyer interest. Proximity to public transport, broader amenities, and appealing streetscapes remain key.

Developers are increasingly focusing on boutique prime-grade residential projects, targeting discerning buyers less affected by economic cycles. This niche market offers opportunities for high-quality developments that cater to lifestyle and life stage preferences.

New Zealand’s commercial property market in 2025 offers a compelling landscape for intelligent investment. With accommodative monetary policies, sector-specific opportunities, and a positive outlook for yield movements, investors can navigate this market with confidence. By focusing on strategic asset management, prime locations, and emerging residential opportunities, investors can position themselves to capitalise on the evolving dynamics of New Zealand’s commercial property market.

Brent McGregor summarises, “We’ve been through the trough now and all signs are pointing towards an improved environment for asset funding, construction and rental growth. We’re starting to see international investors engaging again and CBRE is anticipating a year-on-year 50% bump in transaction volumes during 2025.”

READ MORE

Scan for the full ‘2025 New Zealand Real Estate Market Outlook’.

From James Parry

Head of Office

+61 408 553 000

james.parry@cbre.com

“Office

• Flight-to-quality driving the Australian and New Zealand office markets.

• Sydney’s office sector is leading the investor resurgence, with seven significant transactions in the last nine months.

• Recent global changes, including US tariffs, are creating volatility, but the office sector’s re-rating over the last three years should provide insulation.

The market has become increasingly bifurcated due to the global phenomenon of tenant flight-to-quality, based on both the quality of buildings and locations.

Sydney is experiencing a resurgence, with premium office rents soaring by circa 30% since the peak of the investment cycle in 2022. This growth has been driven by a significant tightening in vacancy rates due to the flight-to-quality. Premium direct vacancy rates in the Sydney CBD Core have plummeted to 5.4%, making the city’s office market the standout asset class both domestically and compared to major markets globally.

Sydney CBD rents are forecast for growth throughout the balance of the decade. CBD replacement costs are approximately 20% above current rents, and circa 60% in metropolitan markets, effectively making new construction unviable. The time required for developing new office premises will present a lag of any new supply in the short to mid-term.

The significant trading activity in Sydney’s CBD recently and the expectation of solid rent growth in the coming years have resulted in limited opportunities to invest in the city, with yields firming for CBD assets as investors seek to invest at this point in the cycle. This has led to renewed interest in alternative locations.

In terms of timing the market, 2024 was the year to buy Sydney CBD as clear signs of price increases have emerged. However, outside of Sydney’s CBD, excellent investment opportunities remain at prices deeply discounted from the peaks in 2022.

Brisbane is experiencing stronger investor intentions driven by the resurgence in the current leasing market, which has contracted from 16.3% to 8.3% for prime-

grade assets over the past three years. Brisbane has also witnessed the strongest net effective growth in Asia (13.8% YoY), and the vacancy rate is forecast to decline to 6.3% by 2032. Investors have primarily been attracted to the long-term spread between Sydney and Brisbane office yields (50-150 bps) and the infrastructure pipeline being undertaken in the lead-up to the 2032 Olympics.

Of all national markets, Melbourne’s recovery has been more gradual, impacted by tax regime changes and a sluggish return to office dynamic, tempering investor confidence. Material asset repricing and a strong correction in occupier activity (led by near nonexistent new supply) has combined to bring a noticeable uplift in demand however, as investors look to capitalise on the counter cyclical nature of the current buying window. With net effective rent growth being recorded in Q4 2024 across the eastern (4.8%) and western core precincts (5.6%), investors have gravitated to quality assets in these markets as the flight-to-quality thematic again prevails. With vacancy peaking, the rate cut cycle accelerating and with limited activity in NSW, we expect to see a noticeable uptick in transaction activity over the balance of 2025 in Australia’s second gateway city.

What remains to be seen are the global economic impacts of the recent tariff volatility. While Australia appears to have escaped on a relative basis, given these disruptions, there are sure to be knock-on impacts to the domestic economy. Increased volatility across the business landscape could potentially see occupier and investor decisions become cautious with a wait-and-see mindset, but for now, it appears both leasing and investor activity is increasing.

Green Square North Tower in Fortitude Valley, Brisbane, is a premier mixed-use development offering both commercial and residential spaces. Situated at 515 St Pauls Terrace, it enjoys excellent connectivity to Brisbane’s CBD and public transport options.

The property features modern facilities such as high-speed elevators, advanced security systems, and ample parking. The commercial spaces are designed to accommodate a variety of businesses, providing flexible leasing options and contemporary amenities. The residential units offer luxurious living spaces with stunning city views, blending work and lifestyle seamlessly.

Sustainability is a key focus, with eco-friendly design elements like solar panels, rainwater harvesting, and energy-efficient lighting integrated throughout the building. The development also includes thoughtfully designed communal areas, landscaped gardens, recreational facilities, and retail spaces, enhancing the overall lifestyle experience for residents and tenants.

Green Square North Tower represents a prime investment opportunity in one of Brisbane’s most sought-after locations. Its exceptional facilities, strategic location, and commitment to sustainability make it highly attractive to both commercial and residential sectors.

How an additional 340,000 migrants will transform these Australian property sectors.

Australia is on the brink of a population boom, with projections indicating the population will reach 31.3 million by 2034. By June 2025 alone, an additional 340,000 people are expected to call Australia home. This surge in population is poised to reshape the property landscape, presenting both challenges and opportunities for investors, occupiers, and developers.

The residential sector is set to face significant pressure due to the ongoing housing crisis, which will be further exacerbated by population growth. Despite the public sector’s ambitious target of delivering 240,000 homes per annum through to 2029, supply pipelines remain constrained. This persistent imbalance between supply and demand is likely to drive the evolution of living sector alternatives. Build-to-rent (BTR) developments, single-family rentals, purpose-built student accommodation (PBSA), retirement communities, and land lease communities are expected to gain traction as viable solutions to meet the growing housing needs.

The retail landscape in Australia will undergo a dramatic transformation as the population increases. Investors, occupiers, and developers must adapt to the changing demands and capitalise on emerging opportunities. The influx of new residents will drive demand for diverse retail offerings, from everyday necessities to luxury goods. Retail spaces will need to evolve to cater to the preferences of a larger and more diverse consumer base, potentially leading to the development of mixed-use spaces that combine retail, residential, and recreational facilities.

OFFICE SECTOR

Population growth will also have a profound impact on the office sector. As the workforce expands, the demand for office spaces will rise. Targeting markets with lower vacancy rates, such as Brisbane, can provide optimistic pathways for

investment. Additionally, the shift towards hybrid work models will necessitate flexible office solutions that can accommodate varying needs. Developers and investors will need to focus on creating adaptable workspaces that foster collaboration and innovation while meeting the demands of a growing workforce.

Australia’s population growth presents a unique opportunity for the property sector. By identifying and leveraging growth potential in residential, retail, and office sectors, stakeholders can navigate challenges and capitalise on emerging opportunities. The key to success lies in adaptability and innovation, ensuring that the property market evolves to meet the needs of a burgeoning population. As Australia continues to grow, the property sector must remain agile and forwardthinking to thrive in this dynamic environment.

READ MORE

Scan for the full ‘Australian Population Growth’ article.

Yuko Toda is a seasoned professional in the commercial real estate sector, currently contributing her expertise at CBRE since 2024, joining as Director in 2024, based in CBRE’s Tokyo office. Her career is marked by significant roles and accomplishments across various organisations.

At CBRE, Yuko’s current role involves overseeing strategic initiatives and managing key client relationships. She is responsible for driving growth in the commercial real estate sector, leveraging her extensive experience and deep understanding of market dynamics. Her leadership and vision are crucial in navigating the complexities of the industry and ensuring the successful execution of projects.

One of the key areas Yuko focuses on is the influx of Japanese capital into the Pacific real estate markets. Japanese investment in these regions has surged in recent years, driven by the stable business environment and growth potential. According to the “2025 Asia Pacific Investor Intentions Survey: Japan Results” report, Japanese investors maintain a robust appetite for real estate investments, with 90% planning to purchase more or the same volume of real estate as last year.

Sydney and Melbourne are among the top investment destinations for Japanese investors in the Asia Pacific region, ranking third and seventh respectively. This highlights the attractiveness of the Australian market for Japanese capital. Japanese firms such as Mitsubishi Estate, Mitsui Fudosan, Daiwa House, and Sekisui House have expanded their presence in Australia, engaging in major transactions and joint ventures. The build-to-rent sector, in particular, has seen substantial Japanese investment due to the ongoing housing shortage and the familiarity of Japanese investors with this model.

Japanese investors are increasingly interested in value-add investments. This strategy is preferred across various asset types, including office, industrial, retail, residential, and hotels. Residential properties remain the most popular investment type among Japanese investors, followed by logistics. The interest in logistics has risen due to the potential tightening of the supply-demand balance as rising construction costs deter new construction.

Despite the strong investment appetite, Japanese investors are aware of several challenges, including rising labour and construction costs, uncertain geopolitical landscapes, and higher interest rates. These factors could impact their investment decisions and strategies. However, there is a growing willingness among Japanese investors to pay a price premium for properties that meet sustainability standards, reflecting the increasing importance of environmental, social, and governance (ESG) factors in investment decisions.

With her extensive background in finance and real estate, Yuko is well-positioned to facilitate Japanese investments and strengthen relationships between Japanese investors and the Australian and New Zealand markets. Her role is pivotal in navigating these trends and ensuring successful transactions in the dynamic world of commercial real estate.

Yuko Toda

Director, Capital Markets

CBRE Japan +81 70 502 371 74 yuko.toda@cbre.com

Our leading capital markets experts provide exclusive insight on what to expect in specific commercial sectors this year.

VIEW NOW Scan for to view the full ‘Big Questions’ video series.

2025 is bringing renewed investment opportunities for commercial property in the Pacific. The key to capitalising on this relies heavily on understanding the dynamics of the current capital markets space.

Flint Davidson, CBRE’s Head of Capital Markets in the Pacific, explains how 2024 was a clear precursor that demonstrated early signs of a recovery led by a rebound in transaction volumes. “This was seen across most of the sectors, with office volumes up a staggering 70% from the lows of 2023.”

Pricing didn’t follow the trend, with the broader market experiencing further price softening. This resulted in sectors like retail and office experiencing peak-to-trough value declines of more than 30%.

“This was enough for the value-add and core-plus buyers to re-enter the market while the core money was slow to return,” says Flint.

Other observations revealed that high-quality real estate outperformed all else from both a tenant and capital markets perspective.

So, what’s expected for the capital markets in 2025?

BIGGEST CHALLENGE OF 2025

“The biggest challenge in 2025 is really to find product where investors are looking to deploy,” says Paul Ryan, CBRE’s Pacific Head of Capital Advisors. “Some of the sectors are purpose-built student accommodation (PBSA), self-storage, data centres and manufacturing housing.”

BIGGEST OPPORTUNITY IN 2025

“We’re about to enter into an interest rate easing cycle,” says Michael Simpson, CBRE’s Pacific Head of Hotels. “That will have a compressing impact on capitalisation rates. It’s going to have a stimulatory impact on corporate travel budgets and leisure travel budgets. We’ll see cap rates going down and income going up. It’s the perfect storm for investors provided that those investors get into the market and get set now.”

WHERE CAPITAL IS COMING FROM

“The capital this year will continue to be supported from the domestic banks, which have been very strong in 2024, that will continue in 25 and 26,” explains Andrew McCasker, CBRE’s Pacific Head of Debt & Structured Finance. “The offshore and domestic banks really like the Australian market as do the offshore pension funds, mutual funds and superannuation funds. We’ve also got a large amount of capital coming into private credit funds out of sovereign wealth funds and United Arab Emirates.”

The expert outlook is that Melbourne will continue to struggle with pricing while Sydney will fair much better. “There’s so much capital going into Sydney,” says Chris O’Brien, CBRE’s Pacific Head of Industrial & Logistics. “There is no longer a premium for scale. From a pricing perspective, anything above $100 million is going to struggle, while anything under $100 million is going to do well. Brisbane is going to move a little better this year as well.”

When it comes to stand out sectors in commercial property, CBRE’s Pacific Head of Alternatives, Mark Granter, highlights strength in three key property types. “The outperforming sectors in 2025 will be data centres, student accommodation, and retirement and senior living,” he says.

Adding to that is James Parry, CBRE’s Pacific Head of Office, who is equally excited about the opportunity for office. “It’s been repriced, and it looks like good value. Trends from overseas are really increasing and we’re seeing large-scale transactions starting to happen there and we anticipate that will also become the flavour here.”

From Paul Ryan

Head of Capital Advisory

+61 402 503 755 paul.ryan@cbre.com

• Improved conditions: Australia’s market conditions and sentiment are better in Q1 2025.

• International investment: Investment from abroad rose 37% in 2024.

• Recent trade war escalations are increasing volatility and uncertainty in markets globally.

Private capital market conditions and investor sentiment has improved materially as we round out Q1 2025 when compared with 2024.

Within Asia Pacific, investors are focused on developed Asia, with Australia and Japan the most favoured markets. With inflation in Japan running at circa 3.7%, and a cash rate of 0.5%, there continues to be uncertainty regarding when inflation will be tamed and where interest rates will stabilise. Our experience in Australia through 2023 and 2024 is that whilst this dynamic prevails, investors are reluctant to deploy in scale. With interest rates falling and asset pricing broadly seen to have bottomed, we believe that Australia will disproportionately benefit in terms of deployment as liquidity continues to improve in the region.

International investment increased 37% in 2024 vs 2023 and represented 28% of total transaction volumes. The US was the leading source market, contributing $3.6 billion in property transactions, double that of 2023. Japanese investment continued to remain strong, with nearly $2 billion of investment, in line with 2023. We have seen a meaningful uptick in engagement from Singaporean and Canadian investors, resulting in strong demand from all major foreign jurisdictions. NSW remains the preferred market for international investors as foreign tax surcharges in VIC and QLD negatively impact returns and sentiment.

Whilst core plus/value-add capital remains the most liquid risk strategy, we are starting to see a resurgence in the availability of core capital. This is being underpinned by recycling as asset pricing has stabilised, fresh allocations for 2025 and fund inflows. As interest rates fall, core capital that was favouring private credit opportunities is returning focus to equity. There has been a marked increase in preference for distribution yields contributing more meaningfully to total returns, with income support measures increasingly being explored.

Beds and sheds remain the top sectors of interest for both domestic and international investors. The alternative sectors such as data centres, PBSA, manufactured housing and self-storage remain highly sought; however, investment opportunities of scale remain scarce.

With retail asset pricing having reset, occupiers being in much better health, a positive carry to debt and effectively zero supply, retail is well and truly back on the radar after several years on the sidelines. We believe this could be quite opportune timing as core capital returns to the market, particularly for non-discretionary anchored neighbourhood centres.

Private capital raising activity picked up materially in late 2024 and this momentum has continued into 2025. With liquidity improving, investors

are being presented with a significant number of opportunities. From an issuer’s perspective, bringing the right product to market in terms of risk/return profile, structure and governance has never been more important. JV and Club deals remain the preferred structures and liquidity and decision making are front of mind for both managers and investors. With liquidity and sentiment improving, we have seen a commensurate increase in transaction size, with immediate scale being sought and a greater willingness for investors to commit growth capital to fund pipeline opportunities and growth strategies. Preference remains for sector-specific vehicles with a core plus return profile, noting this can be achieved through portfolio construction with a portion of stabilised, value-add and development assets.

KEY TRANSACTIONS

• Stockland M&G Asia Property Trust: 50/50 open-ended core partnership with M&G Real Estate, seeded by one Sydney logistics asset – gross asset value: circa $415 million.

• Stockland Logistics Partnership Trust – 70/30 open-ended core-plus partnership with KKR (70%) seeded with three Sydney logistics assets – initial portfolio gross asset value: circa $388 million.

• MA Financial Group / Warburg Pincus: $1 billion+ Real Estate Credit Vehicle established to lend to high-quality developers across Australia’s undersupplied residential market.

STRONG TAILWINDS WITH NEAR-TERM VOLATILITY

Recent trade war escalations are increasing volatility and uncertainty in markets globally. With interest rates falling, cap rate compression expected and liquidity improving, 2025 has the potential to be a good vintage for Australian real estate, particularly for investors who look through the noise and take a longer-term view.

A selection of recent needle-moving transactions from CBRE.

Purchase Price: $385,000,000

Vendor: GPT Wholesale Shopping Centre Fund (GWSCF)

Purchaser: Nikos Property Group

Nikos Property Group has acquired a 50% interest in Northland Shopping Centre for $385 million, marking the largest sale for a Victorian shopping centre since 2018.

The opportunity to secure a 50% interest in a major, Melbourne metropolitan regional shopping centre 13km north-west of the CBD, positioned on a prominent 19.04-ha site, and strong turnover performance generated considerable domestic and offshore investor interest.

The transaction highlights the resurgence of investor interest in large regional and sub regional shopping centre stakes, with 15 part-share deals totalling $3.5 billion having been completed since the start of 2024.

Purchase Price: Confidential

Vendor: 233 Victoria Square Hotel Pty Ltd

Purchaser: Amora Hotels & Resorts

Amora Hotels & Resorts has acquired the iconic Hilton Adelaide following a competitive on-market campaign. This acquisition marks a significant milestone for Amora Hotels & Resorts, expanding their presence in key Australian cities.

Located at Victoria Square, Hilton Adelaide is a five-star hotel featuring 377 guest rooms, 20 conference and meeting rooms, and high-quality food and beverage offerings. The hotel is situated in the heart of Adelaide’s entertainment, dining, shopping, and business precincts, close to major attractions like Adelaide Central Market and Chinatown.

The sale reflects strong interest from both domestic and international investors, highlighting the importance of Adelaide’s vibrant tourism and business landscape.

Purchase Price: $460,000,000 gross

Vendor: Brookfield

Purchaser: UOL and Singapore Land

Brookfield has sold its 50% stake in the 29-storey A-grade office tower at 388 George Street to UOL and Singapore Land for $460 million. This transaction comes amid a broader softening of cap rates of around 170 basis points from peak market pricing in 2022, reflecting the recent softening of the office market.

388 George Street, home to Cartier Oceania’s flagship boutique, spans 38,935 sqm of office space and includes a recently completed 2,163 sqm luxury retail pavilion. The asset was fully leased at the time of sale to an array of national and international tenants including QBE, Aware Super, PVH Brands and The Commons. The sale highlights rising international interest in Australian assets, and in Sydney CBD in particular, with prime office values showing signs of stabilising at circa 6-6.50% in Sydney.

OFFICE

Institutional and middle markets

CAPITAL ADVISORS

Equity and capital advisory services

DEBT & STRUCTURED FINANCE

Origination and loan services

LIVING

BTR, purpose built student accom, co-living and affordable housing

RETAIL

Institutional and middle markets

HOTELS

Accommodation, pubs and tourism

INDUSTRIAL & LOGISTICS

Institutional and Middle markets

Our trusted, tenured experts seamlessly collaborate to help clients connect to global capital and opportunities through a cohesive, cross-disciplinary service offering.

DEVELOPMENT

METROPOLITAN INVESTMENTS Commercial

DATA CENTRES

Data centres and digital infrastructure

INFRASTRUCTURE

Airports, roads and ports

ENERGY & RENEWABLES

Energy, oil, gas, mining and renewables

AGRIBUSINESS

Grazing, cropping, horticulture, viticulture, water licenses and carbon offsets

HEALTHCARE & SOCIAL

INFRASTRUCTURE

Childcare, medical, aged care, education, recreation and life sciences

connect with Capital Markets

Flint Davidson

Head of Capital Markets & Office, Pacific flint.davidson@cbre.com.au

Mark Granter

Head of Alternatives mark.granter@cbre.com.au

John Harrison

Head of Agribusiness john.harrison@cbre.com

Trent Hobart

Head of Development trent.hobart@cbre.com

Chris O’Brien

Head of Industrial & Logistics chris.obrien@cbre.com.au

Andrew Purdon

Head of Living Sectors andrew.purdon@cbre.com

Simon Rooney

Head of Retail Investments simon.rooney@cbre.com

Adrian Sacco

Head of Metropolitan Investments adrian.sacco@cbre.com.au

Michael Simpson

Head of Hotels michaelj.simpson@cbre.com

Hugh McDonald

Head of Capital Advisors, APAC hugh.mcdonald@cbre.com CAPITAL ADVISORS

Paul Ryan

Head of Capital Advisors, Pacific paul.ryan@cbre.com

DEBT & STRUCTURED FINANCE

Andrew McCasker

Head of Debt & Structured Finance andrew.mccasker@cbre.com

Brent McGregor

Head of New Zealand Capital Markets brent.mcgregor@cbre.co.nz NEW ZEALAND