As we transition into the year’s final quarter, the momentum from the midyear transactional window continues to drive market activity. Sales volumes have shown a robust increase, and pricing data points have stabilised for good quality real estate. This is now reflecting what appears to be the bottom of the cycle and the early signs of a shift away from a buyers market. For secondary assets and locations however, the pain is not over yet with both occupier markets and capital markets showing limited support suggesting further valuation declines are likely. The bifurcation between the best and the rest continues to play out.

This issue explores the pivotal factors influencing the current market dynamics. This year has seen a 9.3% surge in investment volumes, reaching $13.6 billion. This growth is primarily driven by the Office and Industrial & Logistics sectors, with notable contributions from offshore investors.

The sustainability revolution is increasingly vital in the property sector. This issue explores how green practices enhance property design, construction, and management, boosting asset value and attracting investors. We also examine the evolving regulatory landscape, which encourages developers to adopt sustainable practices.

In our Sector Spotlights, we take a close look into the Hotels market, where our visitor economy is robust, with international arrivals at 85% of pre-pandemic levels, driven by significant growth from China, while domestic demand faces some dilution from increased outbound travel, hotel occupancy rates are improving.

We look closely at the Purpose-Built-Student-Accommodation scene, which presents an exciting opportunity for developers and investors, with Australia ranking among the top international education destinations.

We also examine the state of the Industrial & Logistics market, where we are seeing overall signs of stabilisation, with the yield cycle reaching its lowest point and construction costs beginning to settle, encouraging new development projects.

We hope you find this issue of Capital Edge both informative and insightful. As always, we are committed to providing you with the latest market intelligence and expert advice to help you make informed investment decisions. Here’s to a successful and prosperous quarter ahead.

Flint Davidson

Head of Capital Markets, Pacific +61 411 183 061 flint.davidson@cbre.com.au

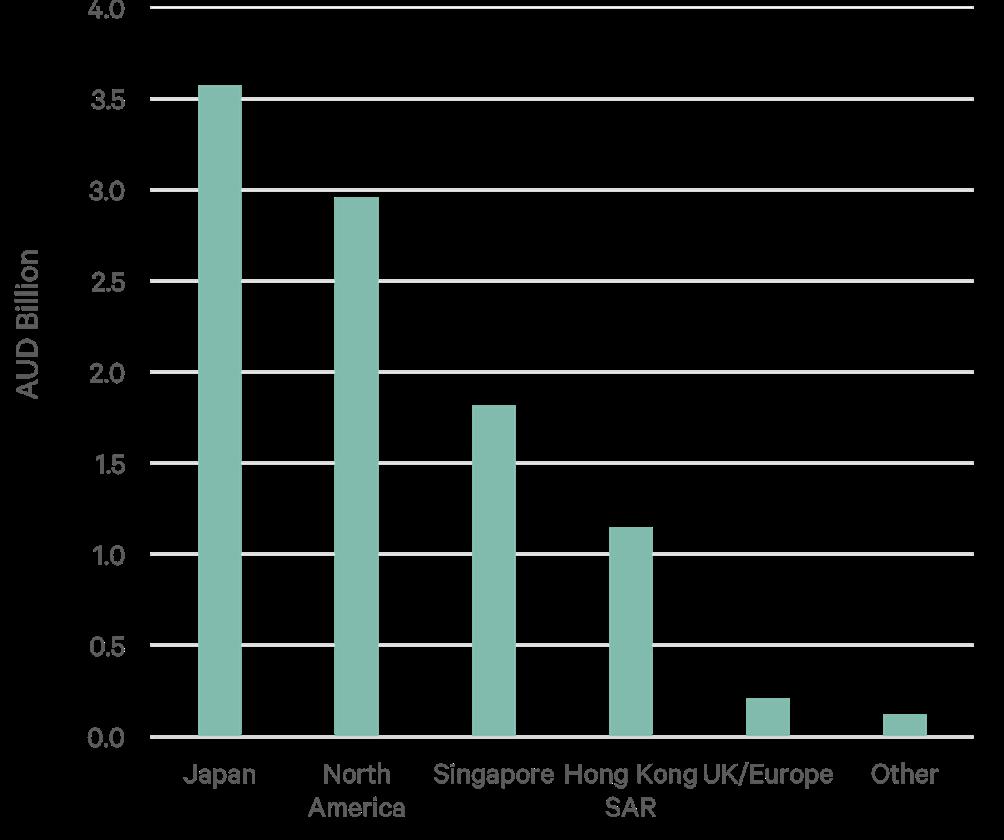

The ‘H1 2024 Australian Capital Flows Report’ revealed a dynamic and resilient real estate market in Australia, with total investment volumes surging by 9.3% to $13.6 billion in the first half of 2024. This growth is spearheaded by robust activity in the office and Industrial & Logistics sectors. Offshore investors, particularly from Japan and North America, have significantly contributed, making up 27% of total purchases. The report underscores the attractiveness of current pricing and the stability of interest rates, alongside the impact of high population growth and limited supply in driving investments, especially in the living sector.

AUSTRALIAN INVESTMENT VOLUMES

Download the full H1 2024 Australian Capital Flow Report DOWNLOAD NOW

Sales activity improved across Australia in the first half of 2024, with total volumes reaching $13.6 billion. This represents a 9.3% increase compared to the same period in 2023, indicating a positive trend in the market.

The office sector led the way in terms of sales volumes, with a total of $4.2 billion invested in H1 2024. The Industrial and Logistics (I&L) sector followed closely behind, with a total volume of $3.6 billion.

Offshore investors played a significant role accounting for 27% of purchases in H1 2024, up from 25% in the previous year. This indicates a growing interest from international investors given the stability, transparency and relative value that Australia offers.

The improved sales activity can be attributed to the more attractive pricing across sectors, with valuations that reflect new benchmarks more accurately. In addition, investors are relatively confident that interest rates are at or close to their peak in Australia.

In 2024, offshore investment into Australian commercial property made up 27% of total volumes in H1 2024. Japanese investors have remained the most active, investing a significant $1.5 billion year to date. The Bank of Japan has recently increased interest rates for the second time in 2024, with more rate hikes expected. This may cause outflows into markets like Australia to moderate as Japanese investors face headwinds domestically.

Investment from the United States has also been solid, reaching $1.3 billion in the first half of 2024. American investors have shown particular interest in the Living and Industrial sectors of the Australian market.

However, investment from Singapore and Hong Kong has slowed in recent times. These source markets have typically been the most active in Australia.

Overall, offshore investors have favoured the office and living sectors over the past 18 months. Office values have declined to a level that are starting to look attractive while the fundamentals of the leasing markets have improved. Meanwhile, the high population growth in Australia, combined with restrictive supply is encouraging investment into the living sector.

One of Adelaide’s most famous luxury hotels, the Hilton Adelaide, has been listed for sale for the first time in more than 30 years by private local owners, 233 Victoria Square Hotel Pty Ltd.

CBRE’s Michael Simpson, Vasso Zographou, Tom Gibson and Nick Hill are managing the sale via an International Expressions of Interest campaign.

“This is a rare opportunity to acquire a flagship five-star asset in one of Australia’s most resilient investment markets,” Michael said.

“As the capital of South Australia, Adelaide is the backbone to the state’s economy serving as a multifaceted hub to its manufacturing, financial services, health, education and government industries worth a combined $100+ billion to the national economy.

“The city has designed a new economic future with its competitive cost base and significant investments, notably the $438 billion investment in the Osborne Naval Shipyard, the $1 billion Adelaide Airport Expansion and the $1 billion Festival Tower mixed-use development.”

Located at 233 Victoria Square, the hotel occupies a 3,556sqm site with 377 guest rooms, 20 conference and meeting rooms, a business lounge, tennis court, gymnasium and swimming pool. The hotel features high-quality food and beverage offerings COAL Cellar + Grill and The Collins Bar.

The property is subject to a management agreement with Hilton Hotels of Australia Pty Ltd, with vacant possession available from 1st July 2026.

Vasso added, “We expect this campaign to generate significant interest from a broad range of domestic and international investors given the hotel’s extensive size, value-add opportunities and its central CBD location. The hotel is perfectly situated to provide guests with easy access to some of the city’s largest office towers, including Westpac House, ANZ House, and Grenfell Centre, as well as cultural and entertainment demand drivers such as the Adelaide Central Market and the Adelaide Oval.

“From 1st July 2026, the hotel will be afforded with vacant possession, supporting a range of future ownership strategies including re-engagement with Hilton, selfmanagement or engaging an alternative third-party operator to drive performance.”

Michael Simpson

+61 431 649 724 michaelj.simpson@cbre.com

Vasso Zographou

+61 449 979 039

vasso.zograpou@cbre.com

Tom Gibson

+61 437 538 888 tom.gibson@cbre.com

Nick Hill

+61 487 394 282 nick.hill1@cbre.com

From

Michael Simpson

Head of Hotels

+61 431 649 724

michaelj.simpson@cbre.com

“Australia’s

• Arrivals from China have surged by 231%, making it the second largest source of overseas demand for Australia.

• Perth, Sydney, and Brisbane lead ADR growth, reaching new RevPAR highs.

• Despite heightened debt costs and inflationary pressures, transaction volumes remain robust with significant equity capital ready to be deployed.

Australia’s visitor economy has sustained strong performance over the past year, driven by the growth in international arrivals, which are approaching full recovery at 85% of 2019 levels. While New Zealand remains our primary source market, arrivals from China have surged by 231%. Although they still lag 44% behind pre-pandemic figures, this makes China the second-largest source of overseas demand for Australia.

Australian travellers venturing abroad are also on the rise, approaching pre-pandemic levels. This trend is diluting the effects of international arrivals to Australia and domestic demand. Nevertheless, overnight domestic trips continue to grow, showing moderate increases throughout the year and remaining above pre-pandemic levels in most states.

A robust visitor economy has resulted in consistent year-on-year hotel demand. Nationally, all key performance indicators have improved compared to the same period in 2023, although growth has moderated from the rapid pace achieved in 2022.

Most markets continue to post occupancy gains with Perth, Sydney and Brisbane leading ADR growth and reaching new RevPAR highs. In contrast, Melbourne, Adelaide, and Hobart have recorded rate softening; Melbourne’s situation is largely due to a surge in new supply, while Adelaide and Hobart have faced weakened demand for domestic leisure travel.

The new supply pipeline is expected to contract materially over the coming years due to borrowing costs, lender caution and increased construction costs. There are currently over 5,000 new rooms

under construction with the bulk to be delivered in 2024 and 2025. Most new stock will be at the premium end, with limited mid-range and economy projects. Melbourne has the most hotel rooms coming online; however, occupancy levels have been strong in the face of new supply which is expected to remain the case given the city’s diverse range of demand generators.

From an investment perspective, as a result of the headwinds of heightened debt costs and inflationary pressures, transaction volumes have remained robust. Continued growth in occupancies and ADR conditions and the likelihood of interest rate reductions in late 2024 and 2025 should see capital markets benefit from improving investor certainty. A significant level of high-conviction equity capital remains on the sidelines waiting to be deployed in the sector.

Over the next 12 months, CBRE expects pent-up outbound travel to moderate while the ongoing recovery in inbound travel will stimulate demand, particularly in major gateway markets of Sydney and Melbourne. This trend is likely to lead to further occupancy gains in 2025. Most markets are projected to see ADR growth, led by Sydney and Brisbane; however, the pace of growth may slow as achieving higher rate profiles becomes more challenging, especially with easing inflation.

The investor syndicate made up of Mervyn Basserabie, Allen Linz and Eduard Litver has acquired one of Sydney’s most famous hotels – The InterContinental Sydney Double Bay for $204.5 million. CBRE Hotels, along with Colliers, negotiated the sale of the 140-key hotel on behalf of Piety Group and Fridcorp.

Built in 1991 and originally launched as The Ritz-Carlton, the Bates Smart-designed hotel has been managed by IHG Hotels & Resorts for the past eight years was offered to the market with the potential of vacant possession.

Embodying the essence of Sydney’s affluent east, InterContinental Sydney Double Bay features stunning harbour views and is positioned on the doorstep of a vibrant cosmopolitan village with access to some of the best restaurants, bars, cafes and designer retail in Australia.

As Australia’s most resilient and tightly held investment market, this sale received significant domestic and offshore interest from a range of hotel, mixed-use and residential developers. The successful purchasers have plans to reposition the property into a mixeduse precinct combining luxury apartments with high-end retail.

In conjunction with Colliers

Cosgrove Group’s recent purchase of the iconic Esplanade Hotel Fremantle signifies the continued strength of Perth’s hotel market with the sale representing the second largest hotel transaction ever in Western Australia, for $116.5 million. CBRE exclusively negotiated the sale of the 4.5-star 300 key hotel on behalf of Centuria Capital who absorbed the asset through the merger of Primewest in late 2022.

Positioned on the corner of Marine Terrace and Essex Street the hotel which is described as true trophy asset in the heart of Fremantle provides a unique offering with conferencing facilities accommodating up to 1,000 patrons. Beyond the hotels striking heritage façade and impressive offerings, Fremantle has seen unprecedented levels of private and public investment completely repositioning the city centre. One of Western Australia’s most visited destinations, Fremantle continues to grow its status as a true gateway for domestic and international travel.

CBRE WA Head of Capital Markets Aaron Desange noted that the depth of private and institutional capital for value-add opportunities across Perth has been a key drawcard for groups chasing higher yielding returns. “Trophy assets like the Esplanade Fremantle are rarely traded assets and are increasingly difficult to unlock, this underscored with the trading performance of the hotel shows why there was significant interest generated throughout the campaign”.

+61 431 649 724 michaelj.simpson@cbre.com

+61 438 911 186 charlie.james@cbre.com

The Shakespeare Group’s acquisition of The Woolstore 1888 by Ovolo signifies a strategic move by the Prime Value group, acquiring the stunning hotel, one of 21 original wool stores in Sydney. CBRE exclusively negotiated the sale of the 90-room heritage-listed hotel, with the asset going into a single-asset unlisted trust seeking a 16% total return.

Acquired with vacant possession, The Shakespeare Group has identified operational value-add opportunities through its selection of Accor as operator under their new boutique handwritten collection brand.

CBRE Hotels Managing Director Michael Simpson noted that the hotel’s location in the flourishing entertainment hub of Darling Harbour is set to benefit from Mirvac’s $2 billion harbourside redevelopment in addition to the government’s investment into surrounding infrastructure. “Quality freehold hotels in Sydney rarely come to market, and the quality of this asset coupled with its prime location and surrounding demand drivers generated significant domestic and offshore interest throughout the campaign.”

Michael Simpson

+61 431 649 724

michaelj.simpson@cbre.com

Steve Carroll

+65 91 791 439

steve.carroll@cbre.com

Wayne Bunz

+61 431 649 724

wayne.bunz@cbre.com

DARWIN CONVENTION CENTRE HOTEL

A new hotel planned for the Darwin Waterfront Precinct has reached a major milestone, with Singaporean-based SingHaiyi Group having been selected to develop, own and operate the Darwin Convention Centre Hotel following a competitive expression of interest process.

The hotel is a key part of the masterplan to redevelop Darwin’s waterfront into one of Australia’s leading integrated lifestyle and tourism destinations. The Darwin Convention Centre Hotel will offer 236 rooms and provide new, upscale accommodation options for corporate and leisure visitors. The hotel will be operated under the group’s own brand, Momentus Hotels & Resorts, and is expected to open in late 2026.

CBRE Hotel’s Senior Director, Tom Gibson managed the process which attracted widespread domestic and international interest. “The nature of the offering to deliver a world-class hotel facility attached to a state-of-the-art CBD convention centre drew significant appeal from the market, especially with the support of the NT Government who contributed the land”.

Tom Gibson

+61 437 538 888

tom.gibson@cbre.com

Hotel sustainability is on the rise and Dr. Jerry Schwartz is one person who knows why when it comes to business ROI and social responsibility.

While many around the world reassess their spending habits during times of increased cost of living, the one industry that is seemingly going against the trend is travel and accommodation.

It’s a result forecasted by CBRE’s hotels report from earlier this year which found that surging inbound tourism is set to boost Australia’s hotel occupancy levels in the next two years. In the global gateway states of New South Wales and Victoria, domestic travel nights were up 5% and 13% respectively on the year prior.

One person who has reaped the full benefits of this market is Dr. Jerry Schwartz, one of Australia’s most successful, self-made hotel magnates.

Schwartz currently owns 15 hotels across the country, including the landmark Sofitel Sydney at Darling Harbour, a Hunter Valley brewery, an events centre, a charter and training airline called Blue Sky, and Sydney Seaplanes. He’s also finished construction on his second $10 million solar farm in the Hunter Valley.

The latter is one of his portfolio’s more interesting investments as it places a fresh spotlight on a rapidly expanding space in the commercial property sector –sustainability.

Sustainability in hotels has been on the rise in recent years. Beyond its regulatory push from the government, Schwartz personally sees real opportunities for ROI on the business front, as explored in CBRE’s recent Talking Property episode.

Here’s why one of the country’s most successful private hoteliers has been directing his business interests towards sustainability.

AUSTRALIA’S PROMISING HOTEL

Despite the current cost of living pressures and high-interest rate environment, the local hotels sector continues to surprise many by displaying resilience amongst investors. According to CBRE’s senior experts, it was a market that recorded strong capital markets activity in Australia in 2023.

“As investors got better clarity on the fundamentals, domestic visitor nights in 2023 were about 7% ahead of 2019 levels, which is quite remarkable,” says Phil Rowland, CBRE’s Pacific Advisory Services CEO.

International visitation to Australia has been rebounding, with New Zealand, the U.S. and the UK emerging as the top three source markets. This resurgence in tourism can be attributed to several factors. According to Sameer Chopra, CBRE’s Pacific Head of Research, population growth plays a significant role in this trend.

“It has a dramatic impact on hotels. For every one million new Australians that we have, we need 11,000 more hotel beds. That’s about 20 new hotels that need to be built. The way we’re seeing forward supply, there’s only about 5,000 hotel beds at best in the supply pipeline, and it’s very skewed towards luxury. Supply is half of demand very much at the premium end of town. Last year, we traded almost $2.5 billion of stock, which brought hotel investment activity back to its 2015 levels. Hotels look and feel a lot like residential.”

Wayne Bunz, CBRE’s National Director, Capital Markets, Hotels, agrees that the hotels industry has seen a strong bounce back in post-pandemic times.

“It shifted and refocused back into Australian leisure. While the CBD corporate hotels went quiet, the leisure destinations probably had the best 12 to 18-month trading period in the last decade. The hotels industry has seen so many year-on-year capital gains and if you look back through time, it’s rare that you will see a hotel get into financial difficulty unless it’s been over-geared or built in a rather remote location.”

Schwartz adds that it’s not only today’s high replacement cost of hotels, but also the challenging building process that’s aiding the performance of existing hotels.

“Part of building a hotel is the application to the council and the number of years that it would take for a new hotel to be built. It’s the hassle factor which is being diminished by the fact that you can just buy a second-hand hotel and improve on it. This is really why hotel values have just kept shooting up.”

While NABERS ratings are common across many of today’s office buildings, its appeal amongst hotels has only begun seeing substantial growth in recent years.

According to the latest NABERS report findings, 49 hotels were rated in 2023 compared to 32 from the previous year - a 53.1% increase. Part of this can be attributed to the Australian Government’s push towards getting more commercial buildings towards net zero.

One current initiative sees the Government considering changes to the Commercial Building Disclosure (CBD) Program. Successive reviews of the CBD Program suggest that its expansion to cover new building and ownership types will reduce energy consumption, reduce energy bills, and lower greenhouse gas emissions. Notably, hotels have been categorised as Group 2 buildings preceded by office buildings in Group 1.

If these proposed changes pass, it could mandate NABERS energy ratings and disclosure for large hotels by 2027 or 2028.

It’s a move that comes alongside the government’s use of its procurement power to further drive decarbonisation in the hotel sector. From July 2024, all travelling government officials must consider the environment when booking their accommodation. To drive a greater part of their business towards hotels taking meaningful action to decarbonise, NABERS Energy ratings for hotels will be included in the booking system used by officials.

For seasoned hoteliers like Schwartz, this trend needs little external motivation. “Sustainability allows you to do two things: It allows you to do the right thing, and it allows you to save money.

“When I first started in the sustainability space, it was all about changing light bulbs and making them more efficient. It was cutting down on electricity and adding variable drives to pumps; adding energy management systems so that you wouldn’t use energy when you didn’t need to.

“I established my own full-time Sustainability Officer to implement sustainability measures and it’s since grown. We’ve put solar panels on most of our hotels. I’ve built two 5 megawatt solar farms with plans for a third megawatt solar farm to make us totally sustainable. We’ll be producing all the energy that we require for all 15 of my hotels.”

Schwartz’s investment in sustainability comes at an ideal time when the Government is similarly prioritising NABERS ratings.

“We were one of the first hotel chains to introduce NABERS ratings for both power and water. And not only did that manifest the fact that you were saving money, but it also manifested the fact that you’re doing the right thing. A lot of government agencies look at that and I think it’s part and parcel in the world today that you need to do the right thing.”

On another front, investors are similarly factoring in sustainability when it comes to making hotel investment decisions.

“Two of the biggest challenges we have with inflation are energy and insurance costs. We don’t have much control over the latter, but we certainly do in energy costs,” says Wayne.

“When you’re buying a lot of older hotels, the cost of making those large hotels more energy efficient is a lot more challenging. But the more energy you can save, the better the bottom line, the sharper the yield, and the higher price per key.”

UNDERSTANDING NABERS FOR YOUR HOTEL

Someone who has first-hand experience with NABERS for hotels is Sachith Alwis, CBRE’s Sustainability Engineer. He knows that environmental credentials can attract government and corporate bookings and investors, alongside operational cost savings over the years.

“Hotels are rated from 0 to 6 stars based on their energy intensity compared to industry benchmarks. A NABERS hotel rating combines 12 months of operational data of the hotel’s guest rooms, on-site amenities and back-of-house facilities to determine the star rating. NABERS ratings also adjust for differences between hotel quality, so it’s always a fair comparison,” says Sachith.

The process is similar to the rating process for offices, with different inputs required for the area and amenities of the hotel.

One of the most common challenges to date involves securing sufficient data to conduct the rating. This is often encountered when it’s the first time a hotel is sourcing this type of information. Subsequent ratings after the first report tends to get easier as the hotel aligns itself to the process and keeps track of the data.

NABERS ratings are an effective tool to benchmark performance against industry standards, and it is the first step to becoming carbon neutral.

Scan for more insights and to listen to the full ‘Talking Property’ podcast episode featuring Jerry Schwartz

LISTEN NOW

Regional Director, Living Sectors +61 483 282 583

andrew.purdon@cbre.com

“Australia is a top four market for international education.”

• Australia is a leading destination for international education, with eight universities ranked in the top 100 globally.

• There is a significant under supply of PBSA in Australia across all markets with Top 100 globally ranked Universities.

• A new government policy aims to limit overseas student enrollments to manage educational quality, migration, and housing. The impact on demand in the shortterm will be clear in January 2025.

Australia is a top four market for international education and competes with the US, UK and Canada for students. We currently have eight universities ranked in the top hundred globally by QS University Rankings 2025. These universities are distributed across five cities (Sydney, Melbourne, Brisbane, Canberra, Perth and Adelaide), and therefore, the demand drivers from students also go beyond the gateway cities.

In 2024, Australia had approximately 1.6 million undergraduates, with an international student ratio of 31% (circa 500,000). It is estimated that only around 2.5% of domestic students live in Purpose-Built Student Accommodation (PBSA), but nonetheless, the undersupply of accommodation for international students demonstrates a very clear capacity for market growth across many markets, particularly where there is a globally recognised university. Despite growing rapidly since 2010, Australia has only 49,000 PBSA beds completed and forecast to be delivered by 2025.

It has been a dynamic few months for PBSA, with a lot of interest in a new policy announcement from the Australian Government in May 2024, releasing a new bill designed to limit the number of overseas students. The policy intent appears to focus on three objectives:

1. Ensure educational quality outcomes

2. Attract legitimate students (rather than working visa)

3. Manage migration and housing

Senior leaders within the Universities and PBSA industry reacted to the policy as a knee-jerk reaction to the housing shortage and rent escalation in the inner city apartment markets and observed that limiting overseas students is seen as a lower political risk approach for the Government than restricting other forms of migration. Student housing demand only affects a small geographic area immediately around the relevant University and therefore, is not a major contributor to the housing shortage at a macro level. The Government has also been widely criticised as potentially disrupting Australia’s globally recognised higher education sector which is the country’s fourth largest export.

In response to the Government policy announcement, some investors are hesitant to invest until 2025 demand is clearer. The reality of short-term international student demand will become clearer during December 2024 and January 2025 as the providers re-lease their properties. Many investors are not overly concerned by the government policy because the market is undersupplied across all cities.

CBRE estimates that there is 15-20,000 of unmet demand for PBSA in Melbourne City / Inner North Melbourne. Similarly, our estimate is 25-30,000 of unmet demand for PBSA in Central / Inner-West Sydney. Outside the gateway markets, we estimate circa 25-30,000 thousand unmet demand in Central Perth.

Universities are expressing frustration and concern about the impact on their funding model. Six of the Group of Eight Universities rely on overseas student tuition fee revenue for more than 25% of their annual revenue. CBRE is seeing clear signs that universities are taking a new and dynamic approach to PBSA as they need the accommodation provided by a suitable manager in order to attract students in the future and also ensure they are resilient to further government policies insisting upon direct linkage between international student numbers and beds.

Investment sales of institutional-quality PBSA are very rare at this stage of market evolution in Australia. To gain exposure to PBSA income, investors can co-invest in an existing fund or club with a specialist manager. This is the approach adopted by Scape, which owns and manages the largest portfolio of PBSA in the country. For those investors seeking 100% ownership in real estate as opposed to co-investment, the route to market is typically via ground-up development or fund through.

It is an exciting time for developers and investors in PBSA. Income-producing assets are largely controlled by the existing platforms, and the supply/demand fundamentals are compelling despite recent policy announcements. CBRE is confident that investors will continue to focus on the top hundred global universities as they define their investment allocations into 2025. Whilst the three East Coast markets (Sydney, Melbourne, Brisbane) will continue to be top of investor priorities, smaller cities (Perth, Adelaide, Canberra) also have exceptionally strong supply/demand fundamentals as they have less existing PBSA and tighter vacancy rates in the private rental market (under 1.0%).

The Australian student accommodation sector is set for notable growth and transformation, as highlighted in CBRE’s Australian Student Accommodation 2024 report.

The Australian student accommodation market presents lucrative opportunities for investors, with increasing demand, robust rental growth, and supportive government policies paving the way for future growth. For a detailed analysis and insights, scan the QR code to download the full report.

The penetration of student accommodation in Australia is ~6% or one bed per 15 higher education students. While some students live at home, those that opt for student accommodation, typically prefer to live within walking distance or shortcommute of Universities. Our micro-analysis of catchments suggests:

• There is an unmet demand 25,000-30,000 PBSA beds in Central/ Inner-West Sydney to support students at University of Sydney/UTS

• There is an unmet demand 15,000-20,000 PBSA beds in Melbourne CBD/ Inner-North to support students at University of Melbourne/RMIT

CBRE estimates 19,000 beds of new supply (Australia-wide) over 2024 to 2027, which represents 18% uplift to current volumes.

Median rents for student accommodation studios grew at CAGR 6% over 2018 to 2024 across Melbourne and Sydney markets. CBRE forecasts rent growth in inner city living sectors will continue to outperform inflation, with private rental market vacancy likely to remain sub 2%.

The Australian Government announced an intention to regulate the international student market. Our view is that the Government is seeking to curb the growth of non-genuine students. Re-balancing student migration to genuine students, who are also more likely to reside in PBSA during the early part of their Australian studies, is likely to be constructive for the PBSA sector, in our view.

Capital continues to pursue development as there are few opportunities to purchase stabilised operational stock in Australia. The sector has remained exceptionally resilient to the rise in bond yields.

Download the full Australian Student Accommodation Report 2024. DOWNLOAD NOW

From Chris O’Brien

Executive Director, APAC

Industrial & Logistics

+61 407 644 233

chris.obrien@cbre.com.au

• Yield cycle appears to be approaching the bottom across most key markets, with limited further expansion of capitalisation rates expected.

• Stabilised construction costs encourage development projects, enhancing financial predictability for developers.

• Investor focus shifting from Melbourne to Brisbane, while Sydney shows improvements in pricing and transaction volumes.

Whilst the current market is navigating through a period of significant shifts and trends, one of the most notable developments recently is the general acceptance that the yield cycle has ceased further expansion across most key markets.

This stabilisation suggests a more predictable market going forward, which will likely result in an increase in transaction volumes.

Construction costs, which have been a source of volatility, are now beginning to settle. This newfound stability is likely to encourage more development projects as financial predictability improves, making it easier for developers to plan and execute new ventures.

In the rental market, growth is slowing but remains positive. This is underpinned by exceptionally low vacancy rates compared to global standards, indicating strong demand for rental properties despite the deceleration in growth. Investors and landlords can still find opportunities in this resilient segment of the market.

Melbourne, however, is experiencing a downturn in both pricing and transaction volumes, largely due to Foreign Owners Land Tax implications. This has resulted in a shift of investor focus away from Melbourne, with capital attention increasingly directed towards Brisbane. Sydney presents a contrasting picture with improvements, in some cases, in both pricing and transaction volumes, particularly in unencumbered sales (i.e. 100% freehold). This suggests a healthier market dynamic

in Sydney, attracting more investor interest and activity.

The logistics market is witnessing a resurgence of the focus on quality and income security. Properties with long Weighted Average Lease Expiry (WALE) are gaining attention again, reflecting a preference for stable, long-term investments. This trend underscores the importance of reliable income streams in the logistics sector.

Owner-occupiers and Privates are dominating transactions in the sub-$50 million space, indicating active participation from smaller investors. This trend suggests that these investors are keen to capitalise on current market conditions, seeking opportunities that align with their financial capabilities.

Lastly, data centre groups remain very active in Melbourne and Sydney, helping to sustain land values in key markets. This ongoing activity highlights the critical role of data infrastructure in these cities, supporting the overall stability and growth of the real estate market.

Overall, the market is showing signs of stabilisation, with certain regions and sectors outperforming others. Investors are adjusting their strategies to align with these emerging trends, focusing on areas with strong growth potential and stable returns.

One of Australia’s premier logistics estates, the Wacol Logistics Hub, has officially hit the market. This state-of-theart estate, completed in Q4 2023, is strategically located with direct access to the Ipswich and Logan Motorways, making it a prime location for logistics and distribution.

Wacol Logistics Hub boasts a total Gross Lettable Area (GLA) of 99,291 sqm, across six tenancies. The estate is fully leased to multiple tenants, including prominent names such as Winning Appliances, Fantastic Furniture, and Myer. The estate’s significant scale, covering a site area of 182,100 sqm, positions it as a key player in a land-constrained market.

Key investment highlights include:

• Newly developed and completed in Q4 2023

• Impeccable location with exposure and direct access to both Ipswich and Logan Motorways

• Continued infrastructure spending in Brisbane will

support sector fundamentals long term

• 100% leased (prior to completion) to predominantly national tenants

• WALE of 6.5 years (as at 1 Jan 2025) with strong annual escalations

• Secure Net Passing Income of $12,446,197 pa ($125/ sqm)

• Approximately 20% rental uplift with an assessed Net Market Income of $14,873,505 pa ($150/sqm)

Wacol Logistics Hub represents a rare opportunity for investors to acquire a premier logistics asset in one of Brisbane’s most sought-after locations. With its impeccable location, significant scale, and strong tenant mix, the estate is poised to deliver robust returns for its new owners.

The estate is offered for sale via an Expressions of Interest campaign closing 17 October 2024.

Growthpoint Properties Australia (Growthpoint) (ASX:GOZ) entered into an agreement to form the Growthpoint Australia Logistics Partnership (GALP) with TPG Angelo Gordon, a diversified credit and real estate investing platform within TPG Inc. (NASDAQ:TPG).

TPG Angelo Gordon acquired a circa 80% interest in six existing Growthpoint industrial assets in line with the assets 30 June 2024 book values of approximately $198,000,000, Growthpoint entities will hold the remaining circa 20% interest and will be the investment and property manager.

The Portfolio includes:

• 6-7 John Morphett Place, Erskine Park NSW1

• 81 Derby Street, Silverwater NSW1

• 6 Kingston Park Court, Knoxfield, VIC2

• 19 Southern Court, Keysborough VIC2

• 20 Southern Court, Keysborough VIC2

• 13 Business Street, Yatala QLD2

In a recent episode of CBRE’s Talking Property podcast, industry experts delved into the transformative potential of sustainability within the property sector. As the world grapples with climate change, the property industry stands at a pivotal juncture, with sustainability emerging as a critical driver of innovation and growth.

The podcast highlighted how sustainability is no longer a mere buzzword but a fundamental shift in how properties are designed, built, and managed. The discussion underscored the importance of integrating green practices to reduce environmental impact, enhance asset value, and attract discerning investors.

SUSTAINABLE DESIGN AND CONSTRUCTION

The experts emphasised the need for eco-friendly materials and energy-efficient designs. Sustainable buildings are becoming the norm rather than the exception, driven by both regulatory pressures and market demand for greener, healthier living and working spaces. The use of renewable materials, such as recycled steel and lowcarbon concrete, is gaining traction. Additionally, incorporating features like green roofs, solar panels, and rainwater harvesting systems is becoming standard practice.

OPERATIONAL EFFICIENCY

The conversation also touched on the role of technology in improving the operational efficiency of buildings. Smart systems that monitor and optimise energy use can significantly reduce a building’s carbon footprint while lowering operational costs. Innovations such as automated lighting, HVAC systems, and energy management software are enabling property managers to achieve substantial energy savings. These technologies not only contribute to sustainability goals but also enhance the comfort and well-being of occupants.

INVESTOR APPEAL

Sustainability is increasingly influencing investment decisions. Properties with strong environmental credentials are more attractive to investors who are keen to align their portfolios with ESG (Environmental, Social, and Governance) principles. This trend is expected to grow, making sustainability a critical factor in property valuation. Investors are recognising that sustainable properties often have lower

operating costs, higher occupancy rates, and greater long-term value. This shift is driving a surge in green financing options, such as green bonds and sustainabilitylinked loans, which provide favourable terms for projects with strong environmental performance.

The podcast discussed the evolving regulatory landscape, with governments around the world implementing stricter environmental standards. Compliance with these regulations not only mitigates risk but also positions properties as forward-thinking and responsible investments. In Australia, for example, the National Construction Code is being updated to include more stringent energy efficiency requirements. These changes are prompting developers to adopt best practices in sustainable design and construction, ensuring that new buildings meet high environmental standards.

As the property industry continues to evolve, sustainability will play an increasingly central role. The insights from CBRE’s podcast make it clear that embracing green practices is beneficial not only for the environment but also for the bottom line. By prioritising sustainability, the property sector can lead the way towards a more resilient and prosperous future. The integration of sustainable practices is not only a response to regulatory demands but also a proactive strategy to future-proof assets against the impacts of climate change.

Scan for more insights and to listen to the full podcast

LISTEN NOW

Henry Chin has been appointed as Chief Operating Officer of Global Research. He will relocate to the global headquarters in Dallas and begin his new responsibilities in September, reporting to Richard Barkham, Global Chief Economist and Global Head of Research.

In this new position, Dr. Chin will oversee the operation of CBRE’s research platform globally. He will be responsible for optimising the Research function with a focus on operational excellence, further differentiating CBRE’s research from competitors, aligning with business plans, and collaborating with executives across the globe. He will retain his duties as Global Head of Investor Research and oversee Field Research and Econometric Advisors.

Dr. Chin joined CBRE in 2014 after serving in leadership roles for research, analysis and strategy in Asia Pacific and Europe for Prudential Financial Inc. and, Deutsche Bank Group. For the past decade, he has held various leadership roles in CBRE, including as Head of Research in EMEA from 2019-2020.

“CBRE has a fine track record in the delivery of world-class real estate data insights and analytics. Through close collaboration with CBRE’s digital and marketing teams, Henry will ensure our global research team is ever equipped to provide integrated market intelligence to our professionals and clients,” said Dr. Barkham.

Ada Choi has been appointed as Head of Research, Asia Pacific, effective 2 September 2024, and will report to Dr. Chin. Ms. Choi joined CBRE in 2005 and has served in various research leadership roles in Asia Pacific, including Head of Capital Markets Research for Asia Pacific and Head of Research for Greater China, with her most recent role as the Head of Occupier Research and Head of Data Intelligence and Management.

“Ada’s wealth of experience puts her in a great position to take on this new responsibility. I am confident that under her leadership, the Asia Pacific Research team will enhance its capabilities, maintain close partnerships with the business, and provide our clients with timely insights and strategies,” Dr. Chin said.

Listen to the full episode of The House view, plus more episodes of Talking Property.

LISTEN NOW

As 2024 draws to a close, the Australian property market is navigating a landscape shaped by evolving social infrastructure needs, global interest rate trends, and significant shifts in economic rents and replacement costs. Phil Rowland, CEO of CBRE’s Pacific business, and Sameer Chopra, Head of Research discussed this and more in the latest episode of The House View.

The critical role of social infrastructure in shaping Australia’s future cannot be overstated. With a growing and aging population, sectors such as healthcare, retirement living, and childcare are becoming increasingly vital. The demand for these services is driven by compelling demographic trends, including the projected increase in the population aged 65 and above from 4.75 million to nearly 7 million by 2040.

Phil highlights, “The demographic fundamentals for healthcare, retirement living, and childcare are compelling. We have this enormous supply side challenge.”

Despite regulatory challenges, investment activity in these sectors remains robust. The resilience of these markets is underpinned by strong fundamentals supporting continued growth. For instance, the childcare sector has seen a significant increase in demand, with an additional 100,000 children aged 0-5 entering childcare over the past eight years.

GLOBAL PERSPECTIVE

As global interest rates begin to ease, the implications for Australia’s property market are significant. The synchronised rate cuts in the US, Europe, Canada, the UK, and New Zealand set the stage for potential rate reductions by the Reserve Bank of Australia (RBA). This shift could lead to increased deal activity and capital market reactions, particularly benefiting high-quality assets in prime locations.

Sameer notes, “The highest quality assets, such as CBD prime office spaces and super prime industrial properties, are likely to see initial cap rate compression.”

The significant gap between current average values and replacement costs across various property sectors underscores the need for higher economic rents to justify new developments. For example, economic face rents for new office constructions in Sydney CBD have increased by 42% since 2020, driven by factors such as cap

Phil Rowland CEO, Australia & New Zealand phil.rowland@cbre.com

rate expansion, construction cost inflation, and higher incentives.

In the logistics sector, economic rents for new developments in Sydney have doubled over the past five years, reflecting similar pressures. This trend highlights the importance of understanding target occupier segments and their willingness to pay higher rents or prices.

Phil explains, “There’s this sizable gap between current average value and replacement costs across almost every aspect of Australian real estate. In most cases, the gap is around 30 to 40%.”

GLOBAL INSIGHTS: DIVERGING TRENDS AND OPPORTUNITIES

A global perspective reveals contrasting trends in different markets. In Asia, there’s a notable divergence between strong office take-up in India and weaker absorption in China. Meanwhile, in the US, office net absorption has turned positive for the first time since 2019, signalling a potential recovery.

In London, larger office floor plates are leasing better than smaller ones, reflecting a preference for high-quality, centrally located spaces. This trend is echoed in the residential market, where safety has emerged as the top factor influencing housing choices, ahead of affordability and proximity to public transport.

As we move into 2025, key risks and opportunities in the property sector are identified. Rising property taxes and elevated costs remain significant concerns. However, the replacement cost argument presents compelling opportunities, particularly in sectors with supply constraints. Sameer Chopra highlights regional shopping centres, residential build-to-sell, and student accommodation as his top investment picks.

Sameer adds, “The replacement cost argument is very compelling, particularly in sectors with supply constraints. My favourite three sectors right now are regional shopping centres, residential build-to-sell, and student accommodation.”

Head of Research, Pacific & ESG, Asia Pacific sameer.chopra@cbre.com

OFFICE

Institutional and middle markets

CAPITAL ADVISORS

Equity and capital advisory services

DEBT & STRUCTURED FINANCE

Origination and loan services

LIVING

BTR, purpose built student accom, co-living and affordable housing

RETAIL

Institutional and middle markets

HOTELS

Accommodation, pubs and tourism

INDUSTRIAL & LOGISTICS

Institutional and Middle markets

Our trusted, tenured experts seamlessly collaborate to help clients connect to global capital and opportunities through a cohesive, cross-disciplinary service offering.

DEVELOPMENT

METROPOLITAN INVESTMENTS Commercial

DATA CENTRES

Data centres and digital infrastructure

INFRASTRUCTURE

Airports, roads and ports

ENERGY & RENEWABLES

Energy, oil, gas, mining and renewables

AGRIBUSINESS

Grazing, cropping, horticulture, viticulture, water licenses and carbon offsets

HEALTHCARE & SOCIAL

INFRASTRUCTURE

Childcare, medical, aged care, education, recreation and life sciences

connect with Capital Markets

Flint Davidson

Head of Capital Markets & Office, Pacific flint.davidson@cbre.com.au

Mark Granter

Head of Alternatives mark.granter@cbre.com.au

John Harrison

Head of Agribusiness john.harrison@cbre.com

Trent Hobart

Head of Development trent.hobart@cbre.com

Mark Lafferty

Head of Metropolitan Investments mark.lafferty@cbre.com.au

Chris O’Brien

Head of Industrial & Logistics chris.obrien@cbre.com.au

Andrew Purdon

Head of Living Sectors andrew.purdon@cbre.com

Simon Rooney

Head of Retail Investments simon.rooney@cbre.com

Michael Simpson

Head of Hotels michaelj.simpson@cbre.com

Stuart McCann

Head of Capital Advisors, APAC stuart.mccann@cbre.com CAPITAL ADVISORS

Paul Ryan

Head of Capital Advisors, Pacific paul.ryan@cbre.com

Andrew McCasker

Head of Debt & Structured Finance andrew.mccasker@cbre.com DEBT & STRUCTURED FINANCE

Brent McGregor

Head of New Zealand Capital Markets brent.mcgregor@cbre.co.nz NEW ZEALAND