Asia Pacific Investor Intentions Survey 2024: Unveiling a Cautious Yet Shifting Real Estate Landscape Sector spotlights on Hotels, Alternatives with a focus on Childcare, and Debt & Structured Finance Intelligent Investment: Show Me the Money: Capital Flow into Australia’s Commercial Real Estate Sector Future Cities: Residential Airspace: Australia’s Untapped Multi-Billion Dollar Opportunity Evolving Workforces: Why More Employees are Returning to the Office in 2024 CAPITALedge ISSUE #3 34 Q2 2024 CBRE’S QUARTERLY CAPITAL MARKETS MAGAZINE, PROVIDING INSIGHTS ACROSS ALL MAJOR SECTORS. Transaction Insights Inside

Flint Davidson

of

Trading flat but value appears.

The frantic optimism that followed the summer break appears to have dissipated, revealing similar market conditions to those we left in 2023. There are only a few real sellers and limited buyers willing to take advantage of the once-in-a-cycle pricing.

However, there is now a greater level of clarity in the market compared to the confusion that overwhelmed the market last year. Despite delays to the rate reduction cycle, most commentators believe rates have peaked. Buyers are also more comfortable with their terminal yield assumptions, and the market has re-rated, showing real value.

This value is particularly evident in existing modern assets when compared to the cost of developing new ones. This value proposition applies to all sectors, but what does it mean for the market?

Firstly, supply of new development is likely to be constrained across all sectors as projects simply don’t stack up. For those coming out of the ground, the required rents are at record highs.

As a result, rents for existing modern assets are grossly undervalued when compared to new economic rents, and this gap will eventually close. Expect a combination of limited supply and economic rents to drive serious growth in the next tier of modern assets over the next few years.

Similarly, we anticipate this trend to impact values. Savvy buyers are taking advantage of the opportunity to acquire modern assets at nearly half the replacement cost in sectors like office and retail.

Sale volumes in Q1 remained flat, but it’s only a matter of time before buyers recognise the serious mispricing in modern existing assets. This recognition will be one of the catalysts for a return in volumes.

Flint Davidson

Head of Capital Markets, Pacific +61 411 183 061

flint.davidson@cbre.com.au

on the state

play Welcome to the third edition of Capital Edge.

top stories across the sectors Asia Pacific Investor Survey 2024 Unveiling a Cautious Yet Shifting Real Estate Landscape 04 Q-on-Q Pacific Barometer Q1 2024 08 Sector Spotlight on Hotels Michael Simpson 12 Capital Spotlight Plans Progress for Sydney’s Iconic Manly Wharf as New Owners Move In 10 Sector Spotlight on Alternatives - Childcare Mark Granter 18 Sector Spotlight on Debt & Structured Finance Daniel Sollorz 22 Intelligent Investment Show Me the Money: Capital Flow into Australia’s Commercial Real Estate Sector 25 Evolving Workforces Why More Employees are Returning to the Office in 2024 28 One Capital Markets Team Your Strategic Partner Across the Entire Investment Lifecycle 30 Future Cities Residential Airspace: Australia’s Untapped Multi-Billion Dollar Opportunity 26 3 © 2024 CBRE INC.

CBRE Asia Pacific Investor Intentions Survey 2024: Unveiling a Cautious Yet Shifting Real Estate Landscape

The CBRE Asia Pacific Investor Intentions Survey 2024 paints a picture of a real estate investment environment marked by both caution and subtle transformation.

Overall buying intentions remain subdued, reflecting a reluctance to deploy capital until investors gain a clearer understanding of the market’s direction.

This cautiousness is mirrored in the record-high selling intentions reported in the survey, suggesting a strategic offloading of assets to generate returns and manage debt.

4 CAPITAL EDGE | ISSUE #3

PURCHASING & SELLING INTENTIONS BY INVESTOR ORIGIN

However, beneath the surface of this cautious approach lies a current of optimism. The anticipation of interest rate cuts in the latter half of 2024, coupled with projections of economic recovery, is fueling expectations of a more active investment environment later in the year. High-net-worth individuals and private investors are already taking advantage of the situation, capitalising on price adjustments and emerging as the most active buyers in the current market. As property funds approach the end of their investment cycles, they are also expected to become more prominent participants, potentially injecting fresh capital into the market.

The survey also unveils a shift in preferred investment strategies. Value-added approaches are taking centre stage as investors seek to generate target returns in markets experiencing negative carry. This situation arises when holding costs exceed income generated from the asset, essentially creating a scenario where an investment loses money over time. Residential assets, particularly multifamily and build-torent options, are gaining traction due to the sector’s resilience in the face of economic uncertainty. While industrial and office properties remain the top choices for core investors focused on stable income streams, their appeal has waned compared to previous years. This suggests a potential recalibration of risk tolerance among investors, with some seeking higher potential

returns through value-added strategies while others prioritise the stability of core assets.

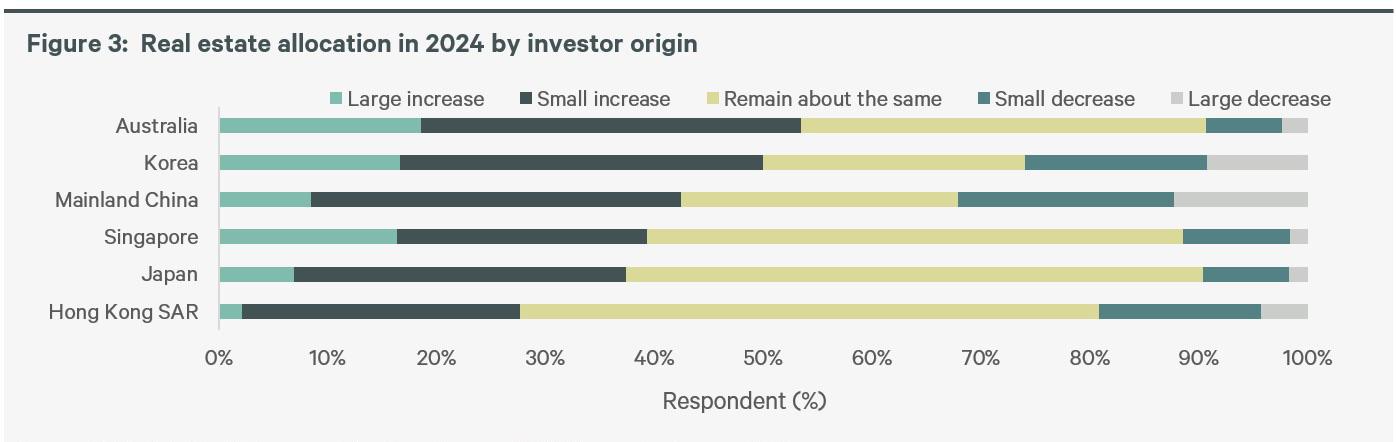

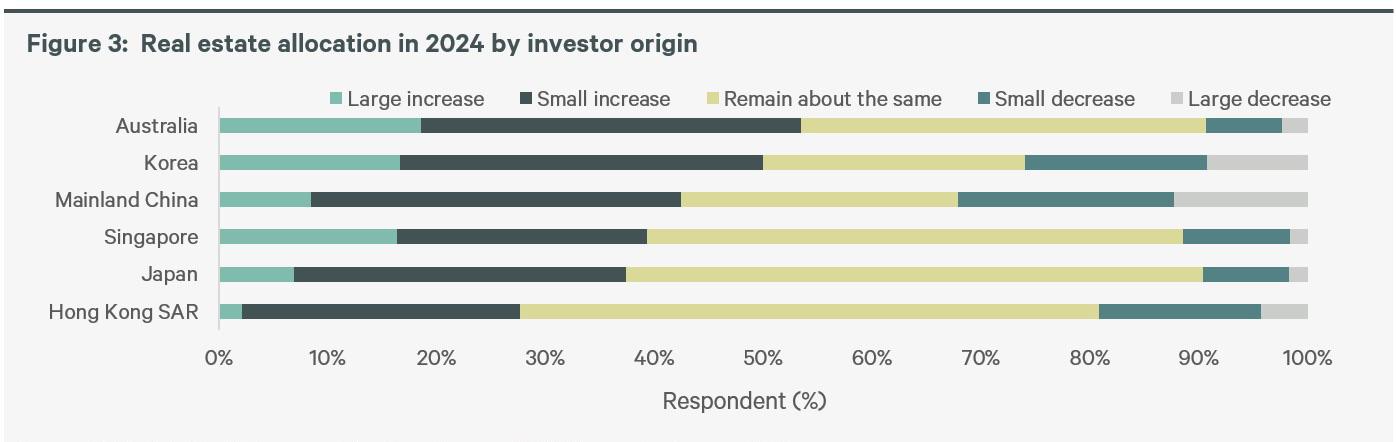

From a regional perspective, the survey reveals a nuanced picture across Asia Pacific. Japan continues to reign supreme as the most favoured destination for cross-border investment, followed by Singapore and Australia. Investors are drawn to these markets by their stable income streams and highly liquid nature, meaning they can easily buy and sell assets. However, the report also highlights contrasting situations in other parts of the region. Hong Kong investors, burdened by high financing costs and negative carry, exhibit the weakest buying intentions. Nevertheless, a potential economic recovery in mainland China, a critical trading partner, could breathe new life into the Hong Kong market. Mainland Chinese investors themselves remain cautious despite government efforts to support the property sector, suggesting a wait-and-see approach as they assess the effectiveness of these interventions. Conversely, Korean investors stand out with the strongest buying intentions, targeting core office assets that offer the potential for steady rental income. Australian and Korean investors, anticipating further price adjustments, are planning to increase their real estate allocations. This signals confidence in the long-term prospects of the asset class, but also a willingness to capitalise on potential bargains in the current market.

5 © 2024 CBRE INC.

The report also identifies key challenges that investors need to navigate. Central bank policy rates and economic uncertainty, though less worrisome than in the previous year, remain significant concerns. The persistent mismatch between buyer and seller price expectations continues to act as a hurdle to investment activity. Rising construction and labour costs pose additional challenges, particularly in Japan where rapid cost increases can erode potential returns. Loan-to-Value ratios and credit spreads are areas of close scrutiny for investors, as they determine the amount of leverage they can employ and the risk associated with their investments. The tightening of lending criteria and increasing interest expenses are putting pressure on refinancing, potentially forcing some investors to hold

onto assets they might otherwise sell. Additionally, with the exception of mainland China, limited rate cuts are anticipated across the region, meaning investors may not see the significant decrease in borrowing costs they are hoping for.

Looking ahead, the survey suggests that value-added and distressed assets, along with debt solutions, are likely to capture significant investor attention. These strategies offer the potential for higher returns but also carry greater risk. Investors with strong risk management capabilities and the ability to identify undervalued opportunities are likely to be well-positioned to succeed in this space. The living sector, particularly build-to-rent and build-to-sell models, is poised for increased investment activity as

INVESTORS’ PREFERRED SECTOR FOR INVESTMENT IN 2024

6

CAPITAL EDGE | ISSUE #3 REAL ESTATE ALLOCATION IN 2024 BY INVESTOR ORIGIN

demographic trends and urbanisation continue to drive demand for rental housing. This segment presents a compelling opportunity for investors seeking stable returns and the potential for long-term growth. High-quality prime office assets in central business districts will continue to be sought after by corporations seeking to attract and retain talent in a post-pandemic workplace environment. Here, the focus will likely be on properties that offer amenities and features that cater to the evolving needs of a mobile and tech-savvy workforce. On the other hand, shopping malls are expected to undergo further repricing to attract investors, as changing consumer habits and the rise of e-commerce continue to impact this retail segment. Investors venturing into this space will need to be innovative and identify ways to revitalise shopping malls and create experiences that entice.

The CBRE Asia Pacific Investor Intentions Survey 2024 offers valuable insights into a dynamic real estate landscape. While caution prevails in the near term, a shift towards value-added strategies and an increased focus on the living sector point towards a market with evolving opportunities. Investors who can navigate the challenges of rising costs, mismatched pricing expectations, and a changing economic environment will be best positioned to capitalise on these opportunities. The success of future investments will hinge on a combination of strategic risk management, the ability to identify undervalued assets, and a keen understanding of emerging trends in tenant demand and consumer behaviour. As Asia Pacific continues to evolve, the real estate market will undoubtedly adapt alongside it, presenting both risks and rewards for investors with a long-term perspective.¬¬¬

Download the full 2024 Asia Pacific Investor Intentions Survey & Report

MAJOR CHALLENGES FOR REAL ESTATE INVESTMENT

DOWNLOAD NOW

7 © 2024 CBRE INC.

LIVING / BUILD-TO-RENT 4.25% Cap Rates 16.2% Rents Y-o-Y $0.1b Sales Volumes 1.1% Vacancy INDUSTRIAL & LOGISTICS 5.82% Cap Rates 13.8% Net Eff. Rents Y-o-Y $1.4b Sales Volumes 1.1% Vacancy RETAIL 6.06% Cap Rates 4.1% Net Eff. Rents Y-o-Y $1.4b Sales Volumes 12.7% Vacancy OFFICE 6.20% Cap Rates 2.7% Net Eff. Rents Y-o-Y $1.2b Sales Volumes 13.5% Vacancy HOTELS 12.9% RevPAR Y-o-Y 4.6% Daily Rates Y-o-Y $0.2b Sales Volumes 73.5% Occupancy DEBT 4.35% Cash Rate 1.50x Interest Cover Ratios Stable Domestic Lending Appetite 50% Loan to Value Ratio (LVR) Q1 Q-on-Q Pacific Barometer CAPITAL EDGE | ISSUE #3 8

9 © 2024 CBRE INC.

Capital Spotlight

MANLY WHARF

Plans Progress for Sydney’s Iconic Manly Wharf as New Owners Move In

Simon Rooney

+61 418 284 680

simon.rooney@cbre.com

James Douglas

+61 419 973 245

james.douglas@cbre.com

Artemus Group has officially been handed the keys to Sydney’s Manly Wharf after settling on the landmark purchase. The group, which is renowned for setting new worldclass standards for Australian real estate and hospitality destinations, is also the owner of Brisbane’s iconic Howard Smith Wharves (HSW).

CBRE’s Simon Rooney and James Douglas negotiated the deal in 2023 on behalf of Robert Magid’s TMG Developments (TMG). Artemus Group also acquired the Manly Wharf Hotel, with the combined deal valued at $110 million.

Following this week’s settlement, Artemus Group founders and directors Adam Flaskas and Paul Henry and CEO Luke Fraser have committed to working with the community in Manly on plans to elevate the Wharf.

“With an ever-expanding portfolio of restaurants, bars and real estate, we are specialists at revitalising waterfront precincts and transforming them into thriving community and cultural hubs. We champion local quality and a pioneering spirit and are proud to be building a legacy for future generations to enjoy,” Mr Flaskas said.

“Manly Wharf represents an incredible opportunity for the group - we want to bring our energy, community focus and vision to Manly. We will be making some initial improvements while we continue to operate business as usual.”

Mr Henry added, “Our focus is on engaging with the community, so we’d encourage you to come down, say hello and share your stories with us. We’re grateful for the warm welcome we’ve received so far and are extremely proud to join such a vibrant community.”

The heritage listed Manly Wharf was originally constructed in 1855 as a passenger terminal for the Sydney to Manly Ferry. It has since been transformed into a hospitality destination, which is home to an array of venues including Queen Chow, Hugos and Manly Wharf Hotel.

Now home to approximately 20 specialty tenancies, the premium harbourfront site is a recognised international landmark which serves as the highly patronised gateway to Manly and Sydney’s northern beaches, providing a captive customer audience, generated by the approximately 2.5 million commuters and day trippers who passed through the adjoining ferry and bus terminals each year.

CBRE’s Mr Rooney noted that the value-add opportunities for both income and asset value growth at Manly Wharf, complemented by a high-earning residential catchment, had been key drawcards for domestic and offshore buyers during the sale campaign. “Trophy retail properties such as Manly Wharf are historically tightly held, rarely traded, and highly sought after. This underpinned significant interest in the sale, as did the site’s iconic harbourfront location, high profile tenant offering and robust trading performance,” Mr Rooney said.

Mr Magid noted, “We’ve had a transformational focus on Manly Wharf, which was rundown when we acquired it. Our repositioning strategies have had a significant impact and we look forward to seeing how this iconic asset continues to evolve under new ownership.”

11 © 2024 CBRE INC.

Hotels

From Michael Simpson

Managing Director, Hotels, Capital Markets, Pacific

From Michael Simpson

Managing Director, Hotels, Capital Markets, Pacific

+61 431 649 724

michaelj.simpson@cbre.com

“Australian Hotel Market Rebound Continues”

• Market makes record-breaking comeback signalling investor confidence

• Adjusting room rate pricing to market fluctuations proves attractive

• Stability & high occupancy make attractive investment environment

Investors strongly supported the Australian hotel sector in 2023 with c. $2.5 billion in accommodation hotel sales.

Sydney/NSW accounted for over half of sales which included the forward sale of Waldorf Astoria in Sydney’s Circular Quay to Fiveight which is owned by Nicola and Andrew Forrest. The project will be delivered by Lendlease. CBRE was involved in this transaction.

High-net-worth and institutional investors were the dominant buyers collectively representing over 75% of all transactions and driving all hotel sales over $100 million.

Sector Spotlight

Over half of sales represented hotels which exceed a “ticket price” greater than $150 million, which augers well for investor support for the hotel property class. Investors recognise the ability for this asset class to “mark to market” on a daily basis. This has been demonstrated in the current high inflationary environment, with average daily rates for hotel rooms exceeding operating cost inflation, supporting strong income growth.

Luxury and upper upscale hotels accounted for 60% of sales, reflecting the high calibre of hotels which were brought to market in 2023. This included Sofitel Adelaide, Sofitel Brisbane Central, Sheraton Grande Mirage Resort Gold Coast and the Waldorf Astoria SydneyCBRE was involved in transacting each of the properties.

MSCI Real Assets, a global commercial real estate research and analytics firm, ranked CBRE #1 Hotel Advisor in the Pacific region, as well as in Asia and the Americas for

2023, reflecting CBRE’s global connectivity, collaboration and deep investor relationships.

The healthy sales volume achieved in 2023, highlights Australia’s hotel investment market is sought after by both domestic and international investors due its status as a “safe haven” stemming from:

• A stable political system

• Legal and financial transparency

• The hotel sector having matured to deliver consistently high occupancy levels which in turn drives higher room rates culminating in healthy returns to owners.

The expectation that the US Federal Reserve and the Reserve Bank of Australia will commence reducing interest rates in 2024, will start to reduce the cost of credit for hotel investment. This will further support investor sentiment to acquire hotels. As we approach the inflection point of the rising interest rate cycle, astute investors will recognise value buying in 2024 before yield compression and increased investor competition for assets drives values higher.

2024 is already shaping up to be another active year in the hotel sector with $1.5+ billion worth of property circulating in the market either through public campaigns or targeted off market offerings.

CAPITAL EDGE | ISSUE #3 12

NSW ARLC Secures Financial Future with Hotel Acquisition

QUEST WOOLOOWARE BAY

The Australian Rugby League Commission’s (ARLC) recent purchase of the Quest Woolooware Bay hotel signifies a prudent and strategic move for the governing body. This investment strengthens the ARLC’s financial position, fostering long-term stability and reinvestment opportunities within the game.

The ARLC’s focus on a diversified revenue stream is commendable. By entering the property market, the commission secures a reliable income source alongside traditional NRL revenue. This financial foresight ensures the game’s future by mitigating the impact of potential economic fluctuations.

The location of the hotel further amplifies the strategic merit of this acquisition. Its proximity to PointsBet Stadium, home of the CronullaSutherland Sharks, positions the Quest Woolooware Bay to capitalise

on the loyal rugby league fan base. However, the hotel’s appeal extends beyond match days. The idyllic location near Cronulla beach attracts leisure and corporate travellers, maximising occupancy rates.

This well-considered purchase, as Michael Simpson, Director at CBRE, noted, “represents an astute purchase by the Australian Rugby League Commission as it continues to grow its property portfolio.” The hotel’s modern amenities, including conference facilities and a gym, cater to a diverse clientele, further solidifying the investment’s potential for longterm growth and strong returns.

Michael Simpson

+61 431 649 724

michaelj.simpson@cbre.com

Vasso Zographou

+61 449 979 039

vasso.zographou@cbre.com

13

© 2024 CBRE INC.

SA Sofitel Adelaide Sets a New Benchmark

SOFITEL ADELAIDE HOTEL

Michael Simpson

+61 431 649 724

michaelj.simpson@cbre.com

+61 449 979 039

Tom Gibson

+61 437 538 888

tom.gibson@cbre.com

Salter Brothers, one of the region’s most active hotel investors, has acquired the multi-award winning Sofitel Adelaide Hotel for approximately $154 million. CBRE Hotels together with Savills negotiated the sale of the 251-key hotel on behalf of one of South Australia’s most respected development and construction firms Palumbo Group. Salter Brothers Managing Director Paul Salter said, “We are extremely pleased to acquire this quality institutional luxury hotel asset in one of Australia’s most robust markets.”

Located at 108 Currie Street in the heart of the CBD, Sofitel Adelaide is the first internationally branded five-star hotel to be built in Adelaide in 30 years, forming part of a 32-storey mixed use tower with two flexible retail tenancies included.

CBRE Hotels Managing Director Michael Simpson noted, “The sale of the Sofitel Adelaide represents Adelaide’s most significant single asset hotel transaction. The developers, who were the vendors in this transaction, literally poured their heart and soul into delivering what is arguably the best internationally branded luxury hotel in Adelaide. We are privileged to have had the opportunity to work with the vendors to negotiate this transaction. The sale of the Sofitel Adelaide has reset the benchmark for the Adelaide luxury hotel market with a record price per key achieved for a CBD asset.”

In conjunction with Savills Vasso Zographou

vasso.zographou@cbre.com

The acquisition will allow Salter Brothers to capitalise on the significant public and private investment that is currently being undertaken throughout the city. Mr Simpson said, “We have seen considerable investment activity for the first half of 2023, with the Sofitel Adelaide sale joining a raft of other major institutional transactions we have been involved in, including the Waldorf Astoria Sydney, Novotel & Ibis Melbourne Central and the Sofitel Brisbane, which together exceed $1.2 billion.”

CAPITAL EDGE | ISSUE #3 14

QLD Sofitel Sale Ignites Investor Confidence

SOFITEL BRISBANE CENTRAL

Brisbane’s hotel market reached a new height in 2023 with the Sofitel Brisbane Central’s record-breaking sale for $190 million. Facilitated by CBRE and McVay Real Estate, this Singapore-bound deal underscores Brisbane’s growing allure as a prime investment destination within the Asia-Pacific region.

The crown jewel of this transaction is the Sofitel itself. This 416-room icon boasts a proven track record of exceptional service and luxurious accommodations. Beyond its impressive offerings, the Sofitel’s strategic location in the heart of Brisbane’s central business district adds another layer of value. Here, guests have unmatched convenience with close proximity to key business areas, cultural attractions, and entertainment venues.

Michael Simpson

+61 431 649 724

michaelj.simpson@cbre.com

Tom Gibson

+61 437 538 888

tom.gibson@cbre.com

Brisbane’s hospitality sector has displayed remarkable resilience, even in the face of recent global challenges. This bodes well for the future, especially with the upcoming 2032 Olympic Games expected to draw a surge of international visitors. Furthermore, Brisbane’s robust infrastructure pipeline and flourishing business environment solidify the city’s position as a compelling investment opportunity. The hotel sector is well-positioned to capitalise on these positive trends, furthering Brisbane’s place as a leading hospitality destination in Australia and the Asia-Pacific region.

Wayne Bunz

+61 419 698 640

wayne.bunz@cbre.com

In conjunction with McVay Real Estate

© 2024 CBRE INC. 15

* The above includes all 2023 market transactions over $20 million to the best of CBRE’s knowledge.

Property City State Sale Price Stars Category Waldorf Astoria Sydney NSW Confidential 5.0 Luxury Stamford Sydney Sydney NSW $210,500,000 5.0 Upper Upscale Sheraton Grand Mirage Resort Gold Coast QLD $192,000,000 5.0 Upper Upscale Sofitel Brisbane Central Brisbane QLD $178,000,000 5.0 Upper Upscale Sofitel Adelaide Adelaide SA $154,000,000 5.0 Upper Upscale The Old Clare Hotel Sydney NSW $61,800,000 5.0 Luxury Lilianfels - escarp Katoomba NSW Confidential 5.0 Upper Upscale Hydro - escarp Medlow Bath NSW Confidential 5.0 Upscale Adelphi Hotel Melbourne VIC $25,000,000 5.0 Luxury Incholm Hotel Brisbane QLD $24,800,000 5.0 Luxury Milton Park Country House & Spa Bowral NSW $21,500,000 5.0 Upscale Mercure Kawana Waters Sunshine Coast QLD $21,250,000 4.5 Upper Upscale Novotel Ibis Hotel Central Melbourne Melbourne VIC $170,000,000 3.0 Midscale Proposed Hotel Sydney NSW $106,000,000 4.0 Upscale 350 William St Serviced Apartment Hotel Melbourne VIC $67,000,000 4.0 Upscale Courtyard by Marriott North Ryde Sydney NSW $55,200,000 4.0 Upscale Novotel Sydney Parramatta Sydney NSW $53,800,000 4.0 Upscale Abode Hotel Woden Canberra ACT $41,500,000 4.0 Upscale Quest Fremantle Fremantle WA $38,000,000 4.0 Upscale Gibraltar Hotel Bowral Bowral NSW $30,000,000 4.0 Luxury Hotel Vali Byron Byron Bay NSW $29,120,000 4.0 Upscale Quest Midland Perth WA $28,000,000 4.0 Upscale Angourie Resort and Spa Yamba NSW $25,200,000 4.0 Upscale Quest Woolooware Bay Sydney NSW $21,860,000 4.0 Upscale Kingsford The Barossa Kingsford SA $21,000,000 4.0 Upscale Great Eastern Motor Lodge Perth WA $40,000,000 3.5 Upper Midscale Ibis Hotel Central Melbourne Melbourne VIC $70,000,000 3.0 Midscale The Lodge Motel & South Headland Motel South Headland WA $27,000,000 3.0 Midscale

2023 MARKET TRANSACTIONS *

CAPITAL EDGE | ISSUE #3 16

Strong Demand for International Travel but Airline Capacity Continues to Lag

The staggered re-opening of Asia Pacific markets’ borders, combined with shortages of planes and crew, has seen airlines in the region continue to operate below pre-pandemic capacity.

According to the Official Airline Guide (OAG) 1, total available aircraft seats (when comparing December 2019 to December 2023) remain at a deficit in Asia Pacific due to airlines’ inability to bring back staff as well as a shortage of aircraft for both domestic and international flights.

However, when comparing the performance of major airlines in Asia Pacific in H1 2019 and H1 2023, most airlines have registered an increase in passenger load factor. Overall load factor in Asia Pacific has risen by 6.7% y-o-y so far this year and is above what was measured in 2019.

Although further growth in international travel is expected over the next 12 months, the challenging economic environment could weigh on the recovery. Persistently high inflation has exerted pressure on transport and accommodation costs for tourists. Slower economic growth typically correlates with a slowdown in international departures, meaning that markets that are slated to experience below trend growth will most likely see international departures lose momentum over the next six months.

Despite this, air passenger forecasts in the region are positive. According to the International Air Transport Association’s (IATA) December 2023 forecast 2 , passenger through-flow for airports in Asia Pacific is set to surpass 2019 levels during 2024, with growth in air passengers to be more positive in Asia Pacific than what is expected in both Europe and North America.

1 OAG Airline Frequency and Capacity Trend Statistics Report: November 2023

2 IATA Global Outlook for Air Transport: December 2023

ASIA PACIFIC NEWS

CBRE’s Asia Pacific Market Outlook 2024 provides insights across all major sectors. READ MORE 17 © 2024 CBRE INC.

Alternatives Focus on Childcare

From Mark Granter

Executive Managing Director, Alternatives

From Mark Granter

Executive Managing Director, Alternatives

+61 439 035 433

mark.granter@cbre.com.au

“Australia’s Childcare Boom a Win for Families & Investors”

• Government support for affordable childcare & increased workforce

• Demand for childcare services outpacing development

• Parents becoming more cost and education-focused, demanding high-quality childcare

Australia’s childcare sector is undergoing a remarkable transformation. Once a niche player in commercial real estate, it’s now rapidly approaching the established dominance of healthcare. This surge is driven by a confluence of factors, creating a win-win situation for both families and investors.

At the heart of this growth lies the Australian government’s unwavering support for childcare as an essential service. Increased funding and subsidies have made childcare more accessible for families, particularly those struggling with rising living costs. This translates to a more engaged workforce, with parents, especially mothers, empowered to participate more fully. The government’s commitment to “equitable and affordable childcare” further underscores its dedication to this critical sector.

Sector Spotlight

But affordability is just one piece of the puzzle. The surge in demand for childcare has outpaced the development of new facilities. Rising construction costs are squeezing the pipeline of new centers, creating a situation of limited supply chasing ever-increasing demand. This scarcity is a boon for investors, who are witnessing stable yields despite recent interest rate hikes. The sector’s resilience during the pandemic has only bolstered investor confidence, making childcare a highly attractive asset class.

Looking ahead, the future of childcare appears bright. The limited supply of childcare centers presents a unique opportunity for investors seeking secure, long-term assets. With fewer properties on the market, competition for highquality childcare investments is fierce. Astute

investors anticipate this trend to continue, with declining supply potentially driving prices upwards in the medium to long term. This creates a compelling window of opportunity for those who get in on the ground floor.

However, it’s not just about profits. Consumer preferences are also evolving. Today’s parents are far more discerning. Cost and educational outcomes are equally important considerations. This shift may lead to a rise in demand for flexible childcare options, catering to families seeking a balance between affordability and quality education.

“It’s no surprise to our team that childcare investments are highly sought after. We have also witnessed first-hand significant growth in the childcare leasing market. As childcare centre and operator profits continue to go from strength-to-strength, despite a challenging economic backdrop, investor and leasing demand continues to grow.” Marcello CaspaniMuto, Associate Director, Australian Healthcare & Social Infrastructure.

The undeniable truth is that Australia needs more high-quality childcare centers. The growing demand for these services necessitates an expansion of facilities to meet the needs of families across the country. As consumer preferences continue to evolve and the need for childcare grows, the Australian childcare sector is poised for a future marked by both innovation and adaptation. This growth will not only benefit families seeking quality care for their children, but also create a thriving investment landscape, solidifying childcare’s position as a pillar of Australian commercial real estate.

18 CAPITAL EDGE | ISSUE #3

Local Investor Snaps up Childcare Centre for $17.5 Million

46 DENDY STREET, BRIGHTON

Sandro Peluso

+61 418 389 757

sandro.peluso@cbre.com.au

Marcello Caspani-Muto

+61 417 065 777

marcello.caspanimuto@cbre.com.au

Jimmy Tat 毕家辉

+61 439 399 118

jimmy.tat@cbre.com

A prominent Brighton childcare centre has been acquired by a local Victorian investor for $17.5 million, signifying the burgeoning investor interest in childcare facilities as an asset class.

The 2019-built facility boasts a license for 171 children and operates under the Learning Sanctuary banner of ASX-listed G8 Education. This expansive property generates a net operating income exceeding $910,000 annually.

CBRE’s Australian Healthcare and Social Infrastructure team, led by Sandro Peluso, Jimmy Tat, and Marcello Caspani-Muto, facilitated the sale through an international campaign. The team has solidified its market leadership, having brokered four out of the five largest childcare centre transactions in Australia since April 2022.

“Private capital is demonstrably leading the charge in transactions within the $15-$50 million range,” remarked Jimmy Tat, highlighting the surge in investor activity. The sale attracted bids from international groups in Singapore and Taiwan, further underscoring the global appeal of these assets.

Industry experts, however, caution of a potential shift in investor focus. Sandro Peluso, a member of the CBRE team, observes a transition from yield-based investment strategies to an emphasis on replacement costs. “Savvy investors recognise this as a temporary trend, with rising interest rates likely to compress yields in the near future,” he explained. Mr. Peluso further emphasises the economic advantage of existing facilities. “The current cost of acquiring land and constructing a new childcare centre often results in yields on par with, or even lower than, those achievable by purchasing a well-maintained facility on prime land,” he concluded.

VIC

19 © 2024 CBRE INC.

$12.8 Million Sale Highlights Booming Childcare Market

SPRINGVALE ROAD, DONVALE

Victoria’s childcare market continues to sizzle, with another major sale following on the heels of a near-$18 million Brighton centre acquisition (previous page). This time, a Nunawading childcare centre has been snapped up for a cool $12.8 million, reflecting a 5.3% yield.

The property, located at 86 Springvale Road, is one of the state’s largest centres, consistently operating with 154 children. Tenanted by Explorers Early Learning on a long-term lease, the sale highlights the strong appeal of childcare facilities as investments.

“Buyers are coming to terms with the current interest rate landscape,” said Sandro Peluso, Senior Director, Australian Healthcare & Social Infrastructure. “This is evident in recent sales totalling nearly $30 million, all with a 5% yield. It suggests a shift in focus from chasing the highest possible yields to securing stable assets with long-term potential.”

Analysts point to a more sophisticated approach by investors. Beyond immediate returns, they are conducting a more comprehensive analysis that factors in depreciation, replacement costs, and potential returns compared to traditional banking options.

Jimmy Tat, Director, Australian Healthcare & Social Infrastructure, added “The volume of private international capital in the marketplace continues to surprise both buyers and agents alike. The money is there but it’s more challenging to engage buyers to act and overcome much the negative commentary they see in the media then it has ever been. It’s about understanding the personal requirements of each investors in detail and doing the work to get them answers/solutions based on the data. If this involves the engagement third party experts and completion of associated reports this is what we will do.”

This robust childcare centre market presents a compelling opportunity for investors seeking strong returns. The potential for significant gains, exceeding traditional investment options, coupled with the stability of the sector, makes childcare centres an attractive proposition.

Sandro Peluso

+61 418 389 757

sandro.peluso@cbre.com.au

Jimmy Tat 毕家辉

+61 439 399 118

jimmy.tat@cbre.com

Marcello Caspani-Muto

+61 417 065 777

marcello.caspanimuto@cbre.com.au

VIC

20 CAPITAL EDGE | ISSUE #2

CBRE’s Healthcare & Social Infrastructure Team Making History with Record-Breaking Childcare Transactions

CBRE’s Healthcare & Social Infrastructure Team has established itself as a preeminent force in the Australian childcare investment landscape. Through a series of record-breaking transactions, they have redefined the sector and become the trusted advisor for investors seeking entry into this burgeoning market.

Their impressive streak began in June 2023 with the sale of a Victorian centre for a record-breaking $20.5 million. This was followed by a $17.5 million Brighton acquisition and most recently, a $12.8 million Nunawading deal.

“Established locations with high land values, coupled with rising construction costs, make existing centres attractive,” explains Sandro Peluso, Senior Director, “These factors, along with yields between 4.5%-5%, are pushing transactions closer to replacement costs.”

Peluso’s insight highlights the reasons behind these record sales. Existing centres, with their prime locations, offer compelling investment opportunities even at high purchase prices.

CBRE’s expertise and proven ability to secure exceptional deals make them the undisputed leader in childcare centre transactions. Their success story is likely to continue with strong investor interest in this sector.

DOWNLOAD EDITION #6 OF THE CHILDCARE REPORT NOW 21 © 2024 CBRE INC.

Debt & Structured Finance

From Daniel Sollorz Senior Director

From Daniel Sollorz Senior Director

Debt & Structured Finance

+61 414 498 546

daniel.sollorz@cbre.com

“Borrowers See Openings as Rate Cuts Expected”

• Next rate move expected to be a cut in either late 2024 or early 2025

• Lower rates make borrowing attractive

• Lenders shifting focus to alternates due to strong performance

The interest rate environment in Australia has shifted from a tightening bias to an expectation of rate decreases at some future point. The apparent stickiness of core inflation is shifting views on when Overnight Cash Rate (OCR) decreases might occur with market pundits increasingly expecting this to occur more so in 2025 than the current calendar year. The consensus view is for the next RBA move to be a downward move will be down, the question is more about timing.

This move in rate expectations has seen 3-5 yr swap rates find levels at 0.3-0.4% below the current cash rate. In some recent instances this has seen borrowers, for new debt transactions and refinancing, once again avail of interest rate swaps as a means of achieving required Interest Cover Ratio (ICR) tests.

Sector Spotlight

Stability in interest costs causes a direct reduction in debt servicing risk During the course of the recent rate increase cycle, lenders and borrowers alike were unsure on when stable ground would be achieved. Therefore, forecast debt servicing models all included some form of sensitivity. Each sensitivity scenario invariably led to a reduced volume of debt available in a transaction. With the return of rate stability, and indeed the expectation of OCR reductions at some point, we are seeing lenders exhibit improved appetite for new transactions and also refinancing transactions where leasing and income risk is sufficiently managed. This is particularly the case for assets providing an inflation hedge (such as hotels) and sectors

with a Life Sciences or Social Infrastructure overlay.

Further supporting lender demand for the alternate asset sectors is a strategic decision of where to judiciously apply capital. While occupier demand and valuations find a firmer footing in the office sector, lenders are exhibiting heightened demand for the alternate sectors. This is being exhibited through a combination of the loan structuring metrics (primarily ICR thresholds) and debt capital pricing. Loan to Value Ratios (LVR) remain relatively static across most asset classes (except for highly specialised assets whereby LVR requirements are somewhat reduced).

Our most recent Lender Sentiment Survey (H2 2023) evidenced this trend of alternates and hotels attracting lender interest. This survey showed the continued status of the industrial sector as the most attractive segment for the lenders driven by the lowest vacancy level globally and strong rental growth. However, alternates showed the largest half-on-half increase of any sector.

Finally, the lender support we are seeing is relatively broad spread and evidenced in our discussions with a broad range of debt capital providers – whether local banks, domestic private credit, international banks or global funds.

22 CAPITAL EDGE | ISSUE #3

$400m across 8 hotels

ACCOMMODATION HOTELS

CBRE worked with an APAC Real Estate Fund, arranging a senior debt facility, overall consolidating multiple bi-lateral facilities into a single multi-currency senior structure.

A Clear & Strategic Shift Towards Alternatives

CBRE’s Debt & Structured Finance team has been engaged recently to secure funding for a number of non-traditional and alternative assets.

$55m across multiple centres

CHILDCARE CENTRES

CBRE has been engaged by private developers and investors to secure competitive financing for the development, acquisition, and refinance of childcare assets. The assets are spread across multiple jurisdictions including NSW, ACT, QLD and VIC.

The opportunities are either owner operated or third party leased and have delivered competitive debt terms on development and acquisition. The refinances have permitted strong debt renewal terms and capital release for further projects.

$27m across 7 pubs

PUBS & HOTELS

CBRE arranged debt terms for seven hotel assets across regional NSW. The transaction allowed for a significant equity release for the client along with additional funding for capital works, overall enhancing the offerings for our client’s patrons and business performance.

23 © 2024 CBRE INC.

Head of Development Appointment to Further Boost Capital Markets Offering

CBRE has appointed Trent Hobart as Head of Development within the Capital Markets Pacific team.

Based in Melbourne, Trent will be responsible for leading the restructured Pacific Development Team and brings with him 18+ years of experience in the industry. Over the past five years, he has transacted more than half of the major development sites across Melbourne’s CBD and city fringe in addition to his involvement in deals across the nation.

As a response to the needs of clients, the Capital Markets Development team will be focusing on high-end land and development site sales with a particular emphasis on residential developments. In New South Wales, Ben Wicks, Ben Hunter and Alex Mirzaian will be operating exclusively in this space. This capability is further extended across the eastern seaboard, with Will Carman in Queensland and David Minty in Victoria providing local market specialisation.

“We recently boosted CBRE’s capability around Capital Markets living sectors in response to the increasing activity from our clients in this evolving sector. In doing so, we have seen the need to provide our clients with a more sophisticated level of service in development. Trent will lead a team of dedicated specialists across the country providing opportunities, advice and capital solutions in this space,” said Flint Davidson, CBRE’s Pacific Head of Capital Markets.

“In securing Trent as the Head of Development, we have a market leader who will also assist us in our growth aspirations across this evolving sector.”

INTELLIGENT INVESTMENT

Show Me the Money

The capital flowing into Australia’s commercial real estate sector dipped significantly in 2023, as local and offshore investors sat on the sidelines. But are there signs of a market shift?

CBRE’s capital markets experts, Stuart McCann and Tom Broderick, shed light on the evolving landscape of commercial real estate investment in Australia.

OFFSHORE CAPITAL FLOWS

Offshore investment mirrored the decline in total volume, dropping to $6 billion or 25% of the market share. Notably, Japanese capital bucked the trend, becoming the most active source with over $2 billion invested. The living sector emerged as the most attractive to offshore investors, followed by office properties.

A GLIMMER OF OPTIMISM

Despite the decline, a sense of growing optimism is emerging among global capital. This can be attributed to several factors, including signs of inflation being brought under control in Australia and the potential for future interest rate cuts. Additionally, recent market repricing has created attractive cap rates, enticing investors.

LIQUIDITY AND INVESTOR DIVERSITY

Liquidity remains patchy, with large private equity groups and capital from North Asia showing strong activity. However, European and US limited partners (LPs) are currently looking to sell assets to rebalance their portfolios, impacting overall liquidity.

SHIFTING SECTORAL FOCUS

The office sector, once facing challenges, is attracting renewed interest. Improved performance in core markets and attractive cap rates compared to other sectors are key drivers. The living sector continues to be a favorite, fueled by institutionalisation, government migration policies, and a chronic supply shortage leading to strong rental growth. Value-add opportunities are also garnering attention, although vendors are becoming less receptive to aggressive pricing strategies.

MARKET OUTLOOK AND CAPITAL DEPLOYMENT

CBRE predicts a gradual increase in transaction activity in 2024, potentially leading to a significant upswing in 2025 if interest rates become more favorable. Domestic investors, particularly super funds, are expected to re-enter the market, focusing on logistics assets and various segments within the living sector, such as affordable housing, social housing, and build-to-rent strategies. Strategic partnerships between global investors and local developers/fund managers are also gaining traction, offering a path to securing scale and achieving investment goals.

The Australian commercial property market is in a state of flux. While offshore investment has declined, there’s a growing optimism fueled by specific market conditions. The focus is shifting towards sectors with strong fundamentals and opportunistic plays, with capital flowing in from a diverse range of investors seeking strategic partnerships for their deployments. The coming year is poised for a gradual increase in activity, with the potential for a significant surge in 2025 if interest rates follow a downward trajectory.

Stuart McCann

Head of International Capital & Capital Advisors

+65 9824 5834

stuart.mccann@cbre.com

Tom Broderick

Head of Office & Capital Markets Research

+61 430 405 910

tom.broderick@cbre.com.au

LISTEN NOW

You

25 © 2024 CBRE INC.

can listen to more insights about capital flow in episode of this Talking Property with CBRE.

FUTURE CITIES

Residential Airspace: Australia’s Untapped Multi-Billion Dollar Opportunity

Airspace development is close to a $86 billion industry in the UK. Could Australia see the same investment opportunities? We spoke to the industry experts to find out.

Australia’s housing shortage crisis won’t see relief anytime soon. It’s a collective view shared by CBRE’s leading experts, which paints a challenging environment for those looking for a place to call home and significant opportunities for investors looking for promising returns.

“We’ve got four years of worsening supply situations,” said David Milton, CBRE’s Managing Director of Residential Projects in Australia, “That’s four years of decreasing supply and increasing demand. And then there’ll be a four to five year lag period before we catch up. We’re going to be in one of the most difficult markets for people who are looking for a home. The pressure that this demand is going to put on rents will bring a lot of investors back into the market, particularly with talk around interest rates coming back down.”

So, could building new rooftop homes in the air space above older style apartments be one of the potential solutions to the nation’s predicament?

It’s a question we posed to Warren Livesey, the founder of Buy Airspace and founder of the Association of Rooftop & Airspace Development, in our latest Talking Property podcast episode. The conversation also features insights from Toby Silk, a director in CBRE’s Metropolitan Investments team.

WHAT IS RESIDENTIAL AIRSPACE?

“Typically, airspace is anything above a property,” explains Livesey. “When you buy a property, you own the airspace all the way to heaven and hypothetically, all the way down to hell. It’s just the actual council that restricts you from putting anything over and above what is actually required.”

While the emphasis is on residential airspace, the same rule can also apply to commercial real estate across office blocks and shop tops.

“There’s a big focus on strata property at the moment because it has the largest amount of airspace available to build new rooftop homes that isn’t being used when compared to commercial airspaces.”

CAN IT WORK IN AUSTRALIA?

Residential airspace may be a relatively new concept to Australia, but in countries such as Europe and the US, the question of high-density living has long been at the forefront of residential planning.

“Airspace development is close to a $86 billion industry in just the UK,” says Livesey. “They’ve approved 180,000 airspace homes in and around hospitals and transportation hubs.”

He sees the opportunity in Australia to construct up to 250,000 new rooftop homes, with significant potential in New South Wales, which has approximately 90,000 strata apartments or blocks.

“Of those apartments, your average strata block is about an eight-to12-unit scheme. It is generally a three storey walk-up with about 300 square metres of roof space which isn’t being used. Multiply that figure by 90,000 and that equates to 27 million square metres of roof space.

26 CAPITAL EDGE | ISSUE #3

Multiply that to an average of 10,000 to 12,000 or 15,000 a square metre for sale value, and you’re actually looking close onto $400 billion.

“In Australia, we can also build close to 100,000 new airspace homes in around our hospitals for essential workers. Nothing needs to be knocked down and replaced, and the key aspect of airspace development is that it’s the greenest housing solution available.”

Despite all the potential opportunities, residential airspace doesn’t come without some challenges. Livesey says that the real testing part in Australia comes from the fact that strata owners aren’t typically trained in this area, they don’t normally have the funds, or may not always get along with their neighbours.

“The best way to adapt or unlock that airspace is by negotiating or tendering out the space to an airspace developer and doing a joint venture contract with an experienced expert in the field. These experts have the finances involved and they will look after the whole project from start to finish.”

WHAT ARE THE BENEFITS?

Residential airspace has the potential to provide a host of benefits for investors and strata property owners. The opportunity to capitalise on the current rental growth trend is the most evident, according to Silk, who highlights a 35 percent increase in residential rental growth for apartments in 2022.

“Just last year we saw them grow by 16.5 percent and this year it’s expected to moderate to somewhere around 10 percent. We are seeing huge amounts of properties coming to market alongside many buyers. 2024 should be an exciting time for us with strong growth to be had in that sector.

“Other opportunities that apartment blocks can provide investors is if it is on one title,” he adds. “You can strata title the apartment block and you can apply for a residential loan as opposed to a commercial loan. This allows you to unlock some more equity which you can then use to invest into another asset, or you could sell down the apartments individually. There are opportunities there to take a few different angles for an investor and diversify their risk.”

Beyond this broader investor lens, leveraging residential airspace could also help Australia’s aging population and downsizers find a suitable home. “This group wants something that’s a bit more conveniently located to amenities as well as requiring less maintenance than a house.

“A lot of the apartment blocks that are currently out there, especially the aged ones, don’t facilitate what downsizers are after and don’t have the right infrastructure in them. They’ll need lifts and similar features since these owners want to ensure that they’re future proofing their properties to accommodate as their forever home. They don’t see themselves moving out of this property, so ensuring it has high-end luxury features and ticks all their boxes is a priority.

Where Livesey’s airspace concept can be most attractive is for the apartment blocks located in prime locations with views.

Even if these owners were to sell out to a developer, the chances of them being able to buy an apartment within that same location on the money that they’ve been offered is next to nothing

Toby Silk

Director, Metropolitan Investments

+61 422 143 813 toby.silk@cbre.com.au

“Even if these owners were to sell out to a developer, the chances of them being able to buy an apartment within that same location on the money that they’ve been offered is next to nothing,” says Silk.

“They want to stay in that same location, but the block generally has some issues like not having a lift. What they’ll need to do is talk to someone who can potentially activate the roof space and use that to convert into more apartments. And then they can use that money to upgrade their building and make sure that they future proof their position in that property.

“It’s definitely a niche within the market and there’s a lot of people that I think could find huge advantage in what Warren is proposing.”

You can listen to more insights about the potential airspace opportunity in this episode of Talking Property with CBRE.

27 © 2024 CBRE INC.

EVOLVING WORKFORCES

Why More Employees are Returning to the Office in 2024

CBRE’s latest research is forecasting a strong return to office in Australia and our experts analyse why.

What began as a global push to keep businesses open during the height of a pandemic is now one of the most debated topics in the modern employment landscape: hybrid work.

While the hybrid work model sits high on the priority list of employee workplace benefits, it’s a more diplomatic setting with options rather than strict return to office mandates.

What have leading researchers discovered regarding the latest office trends right now?

The return to office in Australia will continue gathering pace after reaching 71 percent of 2019 levels in 2023, well above the 54 percent recorded in the prior period.

WHAT’S BRINGING PEOPLE BACK INTO THE OFFICE

The concept of a quality work environment continues to evolve alongside the return to office trend.

CBRE’s findings indicate a clear trend of tenants looking to upgrade their premises.

Almost three quarters of the office re-location decisions in major city CBDs have involved premises which commanded the same or higher market rents. For these re-locations, the median net face rent is an additional 10 percent ($/sqm), when compared to what may have been payable if the occupier remained in the same premises.

This trend is attributed to drivers such as office location, commute time and access to public transport.

What’s more interesting though is the renewed appreciation for workplace design and office technology. Environmental features like natural light and better air quality now rank highly, alongside dedicated spaces for individual online meetings and focused work.

Attracting Gen Z and Millennials into the office needs even more creativity from building occupiers, with considerations for parking, food and beverage options, and apps which inform when colleagues will be in the office.

“Great experiences, social interaction and human connection are going to draw more workers into offices,” says Jenny Liu, Director of Workplace Consulting at CBRE. “Workplace experience is key to enticing people back to the office and these strategies fall under the key categories of people, place and technology.

A workplace experience isn’t just environment, cool furniture and tech anymore. It’s the culture, ways of working, leadership, and how vibrancy is created. This is crucial because people are your most valuable asset, not your real estate footprint and office space.”

There’s also the importance of leaders’ responsibilities to act as “magnets” for employees who want to learn from them and experience how they deal with clients.

“They want to grow their profiles and meet other people in the business. How do you curate those moments where people stay? You can’t. You need leaders there to create the opportunities and connections.”

CBRE Research Manager Thomas Biglands says that face-to-face interaction and collaboration are key to driving more employees back into the office, experiences that aren’t possible via remote work.

“It’s important to achieve a critical mass of visitation so that employees come in and feel as though the office is vibrant and full. It’s also important that enough coworkers and managers are in the office so that they see value from coming in. It defeats the purpose if workers show up to the office and end up being on Zoom calls all day.”

The significance of focusing on workplace

28 CAPITAL EDGE | ISSUE #3

vibrancy also doesn’t escape Biglands, who says that ground levels and areas surrounding the building need to be amenity-rich and busy in order to create excitement around return to office.

“Landlords, local businesses, and even government bodies play an important role in enticing employees back. Building activations and community events are key to enhancing the value proposition of any office tenancy.”

PREMIUM OFFICES ARE IN DEMAND

The pursuit of more people in offices has allowed premium office spaces to thrive in recent times.

Based on data tracked by CBRE, over 90 percent of office occupiers looking for space in 2023 indicated they wanted prime space (an average of Premium and A-Grade assets) while 45 percent indicated a preference for premium space. This has put pressure on landlords to uplift B-Grade assets.

“Premium offices offer a high level of amenities and high ESG credentials,” explains Liu, “Think retail offerings, community events and yoga classes. A lot more tenants are focused on delivering the offerings from the broader precinct. If a property management team can create great events, the desire to leave decreases.”

Liu knows this for a fact from her interactions with premium office clients in the field. “They do see the value in it. Most of the clients who engage us value their employees and the employee experience. They’re willing to move into premium assets with great amenity, invest in their people and ensure they know how to use their space and adopt the technology to work more effectively.

“Higher levels of amenities paired with potentially smaller tenancy footprints are making premium assets a more viable choice for companies who might not have previously considered them. They’ll go to places that have great amenities because they care about that and are happy to pay the rents.”

While client testimonials can help sway occupier business decisions, verifying the cost-benefit ratio is crucial. Biglands says that the best way to determine whether leasing premium office space is beneficial is to simply look at the decisions being made by other occupiers.

“Occupiers have the best visibility into the contentment, performance and efficiency of their own workforces. The high demand for premium space and out-performance from a real estate perspective (vacancy rates, rental rate growth) shows that firms believe there is a benefit to leasing premium space.

“They have made the internal decision that the marginally higher real estate costs add value to their operations and that this type of space makes their workforce happier and more effective.”

THE FUTURE OF WORK FROM OFFICE

Occupier demand for premium space isn’t showing any signs of slowing to date.

“As the market continues to recover from the pandemic, leasing conditions will only tighten, and we’d expect rental rates to continue accelerating,” says Biglands, “Minimal new supply coming over the next three to four years will limit availability of space even further. I don’t think premium space is going to get any cheaper over the near term and there are likely more options now than there will be going forward.”

And while there could be some growth in peak day visitation across Australian cities, it’ll never reach the levels of the pre-pandemic five-day weeks in Liu’s opinion.

“We will always have to offer some form of hybrid. It is an employee value proposition, and the next generation will expect some level of it. However, as occupiers look to better utilise and manage space, there could be more flattening of the peaks to spread out office use and ensure teams are coming in together for anchor days.”

29 © 2024 CBRE INC.

Capital Markets Team ONE

RETAIL

Institutional and middle markets

OFFICE

Institutional and middle markets

HOTELS

Accommodation, pubs and tourism

INDUSTRIAL & LOGISTICS

Institutional and Middle markets

DEBT & STRUCTURED FINANCE

Origination and loan services CAPITAL ADVISORS

Equity and capital advisory services

LIVING

BTR, purpose built student accom, co-living and affordable housing

1ONE CAPITAL MARKETS TEAM

DATA CENTRES

Data centres and digital infrastructure

Our trusted, tenured experts seamlessly collaborate to help clients connect to global capital and opportunities through a cohesive, cross-disciplinary service offering.

DEVELOPMENT

Residential & commercial developments sites >$20 million

METROPOLITAN INVESTMENTS

Commercial property <$35 million

INFRASTRUCTURE

Airports, roads and ports

ENERGY & RENEWABLES

Energy, oil, gas, mining and renewables

AGRIBUSINESS

Grazing, cropping, horticulture, viticulture, water licenses and carbon offsets

HEALTHCARE & SOCIAL INFRASTRUCTURE

Childcare, medical, aged care, education, recreation and life sciences

30 CAPITAL EDGE | ISSUE #3

connect with Capital Markets

INVESTMENT PROPERTIES

Flint Davidson

Head of Capital Markets & Office flint.davidson@cbre.com.au

Mark Granter

Head of Alternatives mark.granter@cbre.com.au

John Harrison

Head of Agribusiness john.harrison@cbre.com

Trent Hobart

Head of Development trent.hobart@cbre.com

Mark Lafferty

Head of Metropolitan Investments mark.lafferty@cbre.com.au

Chris O’Brien

Head of Industrial & Logistics chris.obrien@cbre.com.au

Andrew Purdon

Head of Living Sectors andrew.purdon@cbre.com

Simon Rooney

Head of Retail Investments simon.rooney@cbre.com

Michael Simpson

Head of Hotels

michaelj.simpson@cbre.com

CAPITAL ADVISORS

Stuart McCann

Head of Capital Advisors, APAC stuart.mccann@cbre.com

Paul Ryan

Head of Capital Advisors, Pacific paul.ryan@cbre.com

DEBT & STRUCTURED FINANCE

Andrew McCasker

Head of Debt & Structured Finance andrew.mccasker@cbre.com

31 © 2024 CBRE INC.

FIND OUT MORE © 2024 CBRE, Inc. All rights reserved. This information has been obtained from sources believed reliable but has not been verified for accuracy or completeness. CBRE makes no guarantee, representation or warranty and accepts no responsibility or liability as to the accuracy, completeness, or reliability of the information contained herein. You should conduct a careful, independent investigation of the property and verify all information. Any reliance on this information is solely at your own risk.

From Michael Simpson

Managing Director, Hotels, Capital Markets, Pacific

From Michael Simpson

Managing Director, Hotels, Capital Markets, Pacific

From Mark Granter

Executive Managing Director, Alternatives

From Mark Granter

Executive Managing Director, Alternatives

From Daniel Sollorz Senior Director

From Daniel Sollorz Senior Director