In & Out Australia H1 23: Inbound & Outbound Investment Trends Sector spotlights on Industrial & Logistics, Debt and Build-to-Rent The ESG future for Australia’s Industrial & Logistics sector ISSUE #1 26 Q4 2023 CBRE’S QUARTERLY CAPITAL MARKETS MAGAZINE, PROVIDING INSIGHTS ACROSS ALL MAJOR SECTORS. Transaction Insights Inside CAPITALedge

Flint Davidson

on the state of play Welcome to the first edition of Capital Edge.

This magazine is your quarterly go-to source for critical insights, data points, trends and transactions in all sectors across Capital Markets in commercial property.

In each addition we will focus on particular sectors and in this quarter’s edition we take a closer look at the performance of the Industrial & Logistics and Living sectors together with insights into the debt markets.

We will also drill down into capital flows which will show Investment volumes across Australia have dropped by 50% in H1 2023 across all sectors but most notably in Office (-67%) which continues to be plagued by concerns over “the future of Office”. Hotels have proven to be the most resilient asset class supported by strong occupancy and revenues.

Volumes during the balance of the year are unlikely to show any great resurgence with multiple factors affecting the market. The movement in the cost of debt has been the major contributor to reduced trading with valuations lagging the market by as little as 5% for prime Industrial & Logistics and as much as 30% in secondary Office.

Asset classes including Living, Life Sciences and Industrial & Logistics remain of most interest to capital.

As the valuation cycle catches up to the market we do expect volumes to steadily increase. In particular we anticipate foreign capital to be most active with Australia remaining one of the most favoured investment destinations both regionally and globally.

We hope you enjoy this first edition of Capital Edge. We look forward to bringing you more news and analysis in the coming months.

Flint Davidson

Head of Capital Markets, Pacific

+61 411 183 061

flint.davidson@cbre.com.au

top stories across the sectors In & Out Australia H1 2023 Inbound and Outbound Investment Trends 04 Pacific Barometer Q3 2023 06 Sector Spotlight: Industrial & Logistics Chris O’Brien 10 Capital Spotlight Largest Single Asset Hotel Sale in Australia’s History 08 Sector Spotlight: Debt & Structured Finance Andrew McCasker 14 Sector Spotlight: Living Sectors Andrew Purdon 16 Creating Resilience Identifying the opportunities in Australia’s Build-to-Rent sector 21 Intelligent Investment What’s Influencing Investor Decisions in 2023 18 Future Cities The ESG Future for Australia’s Industrial & Logistics Sector 20 One Capital Markets Team Your Strategic Partner Across the Entire Investment Lifecycle 22 3 © 2023 CBRE INC.

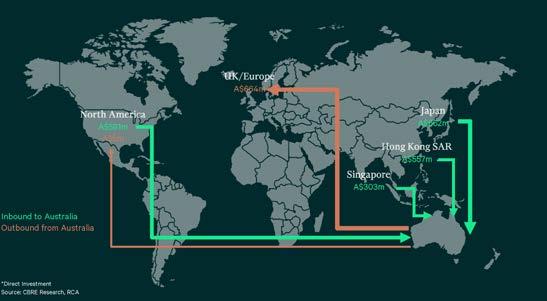

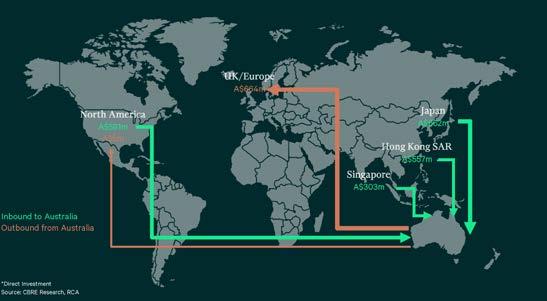

Inbound & Outbound Investment Trends In & Out Australia H1 2023

TRANSACTION ACTIVITY SLOWS IN H1 2023

Total investment volumes across Australia dropped by 50% in H1 2023 to $8.8 billion, compared to the same period in 2022. This figure includes approximately $2.3 billion worth of deals that are yet to settle, with a number subject to a capital raise.

Of the settled deals, Office saw the highest volumes at $1.89 billion, followed by Retail at $1.83 billion. All sectors observed a decline in volumes apart from Hotels which have remained buoyant off the back of strong occupancy and room rates.

SMALLER TRANSACTIONS LESS IMPACTED DUE TO DOMESTIC PRIVATE BUYER DEPTH

While deal volumes across the board have dropped, smaller transactions have been more resilient, dropping by 36% in H1 2023 compared to the same time last year. This is largely off the back of solid private buyer depth in the market. Private investors have seen the current environment as an opportunity to buy assets with larger institutional domestic and offshore groups largely on the sidelines. Transaction volumes for assets worth >$100m have dropped by 58% y-o-y, partly due to fewer foreign investors looking to deploy at present.

OFFSHORE INVESTMENT DROPS IN H1 2023

Capital inflows slowed from offshore in H1 2023, accounting for just 24% of total volumes, from 44% over the same period in 2022. Total offshore volumes dropped to $2.1 billion, down 73% y-o-y.

A noticeable increase of purchases by Japanese investors occurred during early 2023, with interest rates remaining low in that country, giving those buyers a competitive advantage in the market.

Office assets were favoured by foreign investors in H1 2023, accounting for 52% of total inflows. The most significant deal was PAG out of Hong Kong purchasing 44 Market Street for $393 million.

OUTBOUND CAPITAL DROPS IN EARLY 2023

Outbound direct investment declined considerably in H1 2023 to $669 million, down 87% compared to the same period last year.

Explore Insights & Research 4 CAPITAL EDGE | Q4 2023

Domestic groups, particularly large institutional investors have become cautious about buying real assets directly as pricing recalibrates around the world.

The lack of investment into Asia-Pacific was a key theme from Australian based investors after an increase over the past few years.

EUROPE FAVOURED BY AUSTRALIAN INVESTORS

Europe was the key destination for Australian capital in H1 2023. Netherlands was the most favoured, accounting for 36% of total outward investment in H1 2023. Investors largely targeted Industrial & Logistics assets.

Australian investors continued to target the UK, which has been a trend in recent years. Transactions in H1 2023 in the UK were a combination of Office and I&L assets.

While deal volumes across the board have dropped, smaller transactions have been more resilient, dropping by 36% in H1 2023 compared to the same time last year. Capital inflows slowed from offshore in H1 2023, accounting for just 24% of total volumes, from 44% over the same period in 2022.

Stuart McCann Head of International Capital & Capital Advisors

Stuart McCann Head of International Capital & Capital Advisors

+65 9824 5834

stuart.mccann@cbre.com

International Capital Update

5 © 2023 CBRE INC.

LIVING / BUILD-TO-RENT 4.25% Cap Rates 13.1% Rents Y-o-Y $0.6b Sales Volumes 1.1% Vacancy INDUSTRIAL & LOGISTICS 5.49% Cap Rates 24.0% Net Eff. Rents Y-o-Y $1.9b Sales Volumes 0.6% Vacancy RETAIL 5.80% Cap Rates 2.4% Net Eff. Rents Y-o-Y $1.2b Sales Volumes 15.0% Vacancy OFFICE 5.84% Cap Rates 2.0% Net Eff. Rents Y-o-Y $1.4b Sales Volumes 12.8% Vacancy HOTELS 12.4% RevPAR Y-o-Y 4.6% Daily Rates Y-o-Y $0.4b Sales Volumes 70.7% Occupancy DEBT 4.10% Cash Rate 1.50x Interest Cover Ratios Stable Domestic Lending Appetite 50% Loan to Value Ratio (LVR)

Barometer 6 CAPITAL EDGE | Q4 2023

Q3 Pacific

7 © 2023 CBRE INC.

Capital Spotlight

Largest Single Asset Hotel Sale in Australia’s History

WALDORF ASTORIA, SYDNEY NSW

CBRE Hotels was engaged to conduct an offmarket campaign for the sale of the Waldorf Astoria Sydney on behalf of the joint venture owners Mitsubishi Estate Asia and Lendlease.

The 220-room luxury hotel is due for completion in 2026 and forms part of the 1 Circular Quay development, comprising a 59-level residential tower with 466sqm of ground floor retail on the corner of George, Alfred and Pitt Streets.

Transacted at over half a billion dollars (AUD), the sale represents the highest price per room in a capital city and the largest ever singleasset hotel transaction in Australia’s history. The Waldorf Astoria Sydney will redefine luxury hotel accommodation in Sydney and deliver Australia’s most iconic hotel view.

The hotel is expected to attract both domestic and international visitors, including high-networth individuals, business travellers and leisure tourists. It will be a significant addition to Sydney’s hotel landscape and will help to further enhance the city’s reputation as a global destination.

Vendor

JV – Mitsubishi Estate Asia & Lendlease

Purchaser Fiveight

Tenure Freehold

Stabilised Yield 4.14%

Total Rooms 220

Site Area 2,400sqm

Please contact your agent for more information

Michael Simpson

+61 431 649 724 michaelj.simpson@cbre.com

Tom Gibson

+61 437 538 888 tom.gibson@cbre.com

Vasso Zographou

+61 449 979 039 vasso.zographou@cbre.com

In conjunction with McVay Real Estate.

9

© 2023 CBRE INC.

From Chris O’Brien

Head of Industrial & Logistics

From Chris O’Brien

Head of Industrial & Logistics

+61 407 644 233 chris.obrien@cbre.com.au

“Sheds resilient despite moderating growth”

• Occupier depth slowing

• Sub-1% vacancy

• Melbourne and Sydney in demand

The Industrial & Logistics sector has been one of the most resilient asset classes in the last decade, but even it is starting to show some minor signs of cooling as demand moderates from its pandemicera highs.

Regional rents displayed resilience in the first half of 2023, with performance bifurcating between tightly supplied markets across Australia and New Zealand. This trend is likely to continue in the second half of the year, with rental growth in markets with a supply shortage losing momentum as demand tapers off. In saying this, the growth was much faster than all indicators expected, hence this has been generally predictable.

Despite the cooling market, I&L remains the most preferred asset class for investors. This is due to a number of factors, including:

Sector Spotlight

• Strong long-term fundamentals, driven by e-commerce growth and the ongoing shift to online shopping.

• A shortage of supply in key markets, which is underpinning rental growth.

• Government support for the sector, including tax breaks and incentives for investment.

However, there are also some headwinds that investors need to be aware of, including:

• Rising interest rates, which are increasing the cost of capital and making it more expensive to develop new assets.

• A potential demand-supply imbalance in some markets, which could slow the rent growth story.

• Negative carry, which is the situation where the income yield on an asset is lower than the cost of financing it.

In light of these headwinds, investors should carefully consider their investment strategy and focus on investing in high-quality assets in tightly supplied markets.

Owners of I&L assets are also ramping up the implementation of rooftop solar photovoltaic systems to generate clean energy on-site. Despite requiring significant upfront investment, financial benefits such as savings on electricity costs and government incentives make such initiatives attractive.

However, on-site clean energy is nevertheless insufficient to support a warehouse’s daily operations. GLP data show that the energy generated from their on-site solar panels was equivalent to just 12.9% of total energy consumption in 2021 in Australia, however New Zealand leads the region at 40.2%*. Despite this, the adoption of clean energy initiatives is expected to accelerate in the coming years, as investors and tenants become more focused on sustainability.

The logistics sector is facing some headwinds in the short term, but the long-term fundamentals remain very strong. Investors should carefully consider their investment strategy and focus on investing in high-quality assets in tightly supplied markets. The adoption of clean energy initiatives will be a key trend in the coming years. Investors should look for assets that have the potential to be converted to renewable energy and that are located in areas with good access to public transportation.

Logistics * Source: Our World in Data based in BP Statistical Review of World Energy, 2022

Industrial &

10 CAPITAL EDGE | Q4 2023

Off-Market in Mascot

10-122 KENT ROAD, MASCOT

Prime industrial warehouse and office building, purchased off-market by Goodman as a sale and leaseback to Eaton, a global leader in power management.

The property has significant prospects, with a potential gross floor area (GFA) of 44,790sqm* and a floor space ratio (FSR) of 3:1. This makes it ideal for future commercial or mixed development.

The new M8 Motorway provides immediate access from Mascot to Sydney’s orbital network arterials, Mascot is also a rapidly gentrifying hot spot within the Sydney Employment Zone, further enhancing the property’s long term potential. Tenant

Eaton Net Income $3,410,000pa / $389 per sqm Lease Term 5

Initial Yield 4.49% GLA / $ per sqm 8,762sqm / $8,674 per sqm Site Area / $ per sqm 14,930sqm / $5,090 per sqm Sale Price $76,000,000 Sale Date July 2023 Chris O’Brien +61 407 644 233 chris.obrien@cbre.com.au Jason Edge +61 410 687 866 jason.edge@cbre.com.au NSW * Approximate 11 © 2023 CBRE INC.

years plus 3 year option

Land Rich Value-add Play

GILBERTSON & PIPE ROAD, LAVERTON NORTH

The portfolio comprised two estates with a combined site area of 9.42 hectares situated across 8 separate titles providing ultimate flexibility. Located in the highly sought after core Industrial & Logistics suburb of Laverton North delivering significant rental reversion and repositioning opportunities.

Underpinned by short term income to multiple tenants with immediate rental reversion across the estates. The offering provided defensive cash flow prospects strengthened by significant land parcels in a key logistics location. The Inner West Estates were fully leased generating an approximate Net Passing Income of $3,941,183 per annum.

Andrew Bell

+61 456 810 999

andrew.bell@cbre.com

Tom Hayes

+61 413 997 703 tom.hayes@cbre.com.au

Tom Murphy

+61 434 414 901

tom.murphy@cbre.com.au

Tenant Multi tenanted

Net Income $3,941,183 pa / $ per sqm

WALE 1.4 years

Initial Yield 5.54%

GLA / $ per sqm 56,462sqm / $1,259 per sqm

Site Area / $ per sqm 94,213sqm / $755 per sqm

Sale Price $71,100,000

Sale Date July 2023

VIC

12 CAPITAL EDGE | Q4 2023

Q3 MARKET TRANSACTIONS * Property State/Region Sale Price GLA (sqm) Rate (per sqm) Land Area (sqm) Rate (per sqm) Initial Yield NPS Portfolio 20 Assets 50% Interest VIC & NSW $560,000,000 341,765 $3,277 774,000 $1,477 4.40% RF Corval Portfolio 11 Assets 100% Interest NZ $151,400,000 145,513 $1,040 6,640,000 $2390-118 Bolinda Road Campbellfield Forward Fund VIC $104,100,000 47,709 $2,182 41,870 $1,998114-120 Old Pittwater Road Brookvale Multi-Tenanted Investment NSW $83,640,000 29,607 $2,825 41,870 $1,998 6.16% 115-121 Jedda Road Prestons Tenanted Investment NSW $79,000,000 15,030 $5,256 53,260 $1,483 5.43% 15 Britton Street Wetherill Park Tenanted Investment NSW $47,050,000 12,797 $3,677 32,480 $1,449 3.34% Inner West Estate Portfolio 3 Assets, Laverton North 100% Interest VIC $39,400,000 32,335 $1,218 50,653 $778 5.82% 18 Litoria Court Epping Tenanted Investment NSW $37,600,000 16,078 $2,339 24,400 $1,541 5.56% 23 Davis Road Wetherill Park Tenanted Investment NSW $25,000,000 2,015 $12,407 20,280 $1,233 4.06% Homebush West Portfolio 3 Assets Homebush West NSW $24,500,000 8,095 $3,027 10,474 $2,339 1.77% 10-16 Swettenham Road Minto Development Site NSW $20,100,000 1,806 $11,130 15,392 $1,30615-21 Enterprise Drive Rowville Tenanted Investment VIC $19,000,000 6,555 $2,899 15,330 $1,239 5.11% Unit 1, 19 Chifley Street Fairfield Vacant Possession NSW $17,700,000 7,236 $1,960 27,001 $65643-55 Mark Anthony Drive Dandenong South Tenanted Investment VIC $16,500,000 8,420 $1,960 17,184 $960 4.61% 28 Brookhollow Avenue Baulkham Hills Tenanted Investment NSW $16,100,000 2,424 $6,642 7,249 $2,221 3.88% 48-54 Burns Road Altona Tenanted Investment VIC $14,600,000 6,733 $2,168 11,571 $1,262 4.84% 57 Trade Street Lytton Tenanted Investment QLD $13,500,000 5,933 $2,275 10,800 $1,250 5.54% 27 Technology Drive Augustine Heights Vacant Possession QLD $10,370,000 5,083 $2,040 7,000 $1,481 -

The above include all Q3 2023 market transactions to the best of CBRE’s knowledge. 13 © 2023 CBRE INC.

*

From

Andrew McCasker

Head of Debt & Structured Finance

From

Andrew McCasker

Head of Debt & Structured Finance

+61 438 947 780 andrew.mccasker@cbre.com.au

“Topping out but no certainty around easing”

• OCR increases to 4.10%

• Lenders indicating nearing top of OCR

• Strong appetite for Hotel and Retail sectors

The Australian debt market has experienced unprecedented movement in the Official Cash Rate (OCR) moving 12 consecutive times in 13 months resulting in the OCR increasing 400bps to its current rate of 4.10%

The velocity of the move caught many borrowers unprepared impacting significantly affordability rates for residential borrowers and Interest Cover Ratios (ICR) for commercial property investors. The latter now becoming the benchmark for debt sizing and affordability rather than utilising Lending Value Ratios (LVR) risk parameters as the affordable benchmark for loan sizing.

Sector Spotlight

There is consistent commentary regarding the OCR from all major lenders indicating we are either at the top or 1-2 movements away from the top. Where we are seeing differing opinions from economic commentators is when does, if at all, the OCR start to reduce and what is considered the stabilised OCR position. These forecast indicate potential rate easing stating from 1st quarter 2024 through to last quarter 2024 with target OCR landing between 2.80% - 3.20%, unfortunately there is no time certainty to this result.

As a result of the fast moving OCR the prevailing BBSY and forward fixed yield curve has increased significantly forcing banks to react with reducing ICR covenant testing which now in the main sits around 1.5 times as the default testing regime. Throughout 2023 lenders have been taking a conservative approach to Office, having concern around softening yield, impact on increased interest rates and what this all means to valuations. The lack of sales

evidence in the market has delayed any data demonstrating softening of yield and until the banks have certainty as to the impact on values they will continue to have a conservative view on this sector.

We have seen a strong resurgence in appetite for Hotels and Retail with lenders seeing the impact of COVID unwinding from these assets and investors seeing positive value to debt costs allowing leverage to improve total returns to transactions. BTR has been an evolving market darling with all domestic banks now having strong appetite for this asset class, this coupled with the offshore debt capital demand means the BTR sector is well supported. The only caveat which is consistent on all asset classes is the underlying stabilised ICR being evident.

Finally to the Industrial & Logistics market, which continues to be well supported by a majority of lenders understanding the rental reversion story across the sector.

When reflecting across the debt market for US, UK and EU, the Australian banks are well placed with reportable relatively clean loan books as a result of measured lending through the past 5 years. This is a great positive for the Australian property market having a robust financial platform to support the industry throughout the coming years.

& Structured

Debt

Finance

14 CAPITAL EDGE | Q4 2023

Funding Early I&L Development Works in Yatala, QLD

CBRE assisted our private client to acquire a debt facility to fund the acquisition and early works for Logistx Business Park in the Yatala Enterprise Area, South East Queensland’s fastest growing corridor. The 23 hectare estate will house multiple lots zoned Medium Impact Industry ranging in size from circa 4,000sqm to over 25,000sqm.

Build-to-Rent Capital Raise in South Yarra, VIC

CBRE worked with Greystar, arranging a senior debt facility to fund construction of their second Australian BTR project in South Yarra. On completion the project will deliver 617 apartments across two buildings with 2,061sqm of commercial, 459sqm of retail and over 3,578sqm of shared resident amenity space.

Private Investment Firm Acquire Domain House, NSW

CBRE worked a private investment firm, arranging a senior debt facility to fund the acquisition of Domain House, located on Macquarie Street in Sydney’s CBD. The 14-storey tower is in an exclusive and rarely traded part of the city, with views across the Royal Botanic Gardens and Sydney Harbour.

$74m FUNDING

23 HECTARES

$235m FUNDING

617 UNITS

$60m FUNDING

5,776

15 © 2023 CBRE INC.

SQM

Living Sectors

From Andrew Purdon

Head of Living Sectors

+61 483 282 583 andrew.purdon@cbre.com

“Living Sectors continue to captivate

investors”

• Demand for rental housing is outstripping supply

• Significant increase in investment over the next few years

• Long wait for those who expect completed investment opportunities

Australia’s living sectors, particularly build-to-rent (BTR), student accommodation, and affordable housing, continue to captivate investors, with the big three east coast cities being the primary targets for capital. This is due to several factors.

Australia has one of the fastest-growing populations in the developed world, and demand for rental housing is outstripping supply. This is particularly true in the inner cities, where vacancy rates are at record lows.

The COVID-19 pandemic had a significant impact on the international student market, but this is now rebounding strongly. This is putting additional pressure on the urban rental markets, as international students are typically renters.

Sector Spotlight

Rental growth has been dramatic in the inner-city apartment markets of the major capital cities in recent years, with some areas experiencing growth of over 15% per annum. This is making rental housing an increasingly attractive investment proposition.

The Australian government has proposed equalisation of MIT Withholding Tax with other real estate asset classes, creating a level playing field for institutional investors accessing the sector.

However, there are also some headwinds which are impairing current investment volumes:

• Accessing the BTR market is almost entirely reliant on developing from the ground up. Many investors require a specialist delivery partner to provide the requisite skills to deliver a development and it takes time and alignment of interests to form these relationships;

• Construction cost inflation across all locations has negatively impacted investment returns although rental growth has mitigated this to an extent;

• There is some pressure on cap rates due to interest rates and softening in other asset classes. BTR globally has shown less cap rate expansion than other asset classes and the most active investors understand that rental housing is less volatile and demonstrates resilient cash flow characteristics which are different to other real estate investments;

• Land prices and planning certainty remain a barrier to growth in Sydney.

Despite these headwinds, the outlook for living sectors growth looks bright. All subsectors of rental housing are undersupplied, and investor confidence will grow as more assets are completed. Several platform co-investments are available, and we expect to see more fund through transactions offered by specialist developer/ contractors in 2024.

It will be a long wait for those investors who expect their entry point into rental housing in Australia to be via completed investment sales. This is evidenced by the lack of trading activity in PBSA which is a more mature market but tightly controlled by a small number of investors.

The living sectors in Australia are some of the most attractive investment opportunities in the world. The fundamentals are strong, and the government is supportive of investment in this sector. However, it is important to be patient and to partner with experienced professionals to navigate the market.

16 CAPITAL EDGE | Q4 2023

Mirvac $1.8bn BTR Capital Raise

The largest build-to-rent transaction in Australia’s history, securing two major investors into Mirvac’s $1.8bn seed portfolio.

The venture includes Mirvac’s operational build to rent assets, as well as its build to rent pipeline assets. Mirvac will retain a 44% interest in the venture, with the remaining 56% held by cornerstone investors, including the Clean Energy Finance Corporation (CEFC).

CBRE’s international Capital Markets team, led by Stuart McCann, and Andrew Purdon, advised on the transaction.

The new venture will allow Mirvac to increase its exposure to the build to rent sector and grow its portfolio to at least 5,000 apartments in the medium term. It will also help to address the housing and rental shortfall in Australia.

LIV Indigo Sydney 316 units Stabilised Investment LIV Munro Melbourne 490 units Leasing Up LIV Anura Brisbane 396 units Under Construction LIV Aston Melbourne 474 units Under Construction LIV Albert Fields Melbourne 498 units Pre-Construction Andrew Purdon +61 483 282 583 andrew.purdon@cbre.com Stuart McCann +65 9824 5834 stuart.mccann@cbre.com 17 © 2023 CBRE INC.

Propelling our Capital Advisors Business with New Appointment

CBRE has appointed former senior Goldman Sachs real estate investment banker Paul Ryan to further propel the growth of its Capital Advisors investment banking business in Australia and New Zealand.

Mr Ryan brings nearly two decades of investment banking experience during which he has advised on over AUD$75 billion in transactions.

In his new Sydney-based role, Mr Ryan will work closely with Stuart McCann, the Head of Capital Advisors – Pacific and Southeast Asia (SEA), to further support the growth of CBRE’s capital raising and corporate advisory / M&A services for clients in the Pacific region.

Flint Davidson, CBRE’s Pacific Head of Capital Markets, noted, “Through our Singapore-based Capital Advisors team, we’ve raised over AUD$4.2 billion in equity to facilitate AUD$9 billion in Australian transactions across multiple sectors since 2021. Having Paul based in Sydney will allow us to build on that momentum as our clients increasingly look to us to not only provide real estate expertise but capital raising and corporate advisory services.”

Mr Ryan said he was looking forward to utilising his real estate investment banking experience to provide a differentiated offering for CBRE’s clients across Asia Pacific.

“Real estate markets have entered a new era with significant variability in the underlying drivers and expected returns across traditional and alternate real estate sub sectors. Against this backdrop, a nuanced and flexible approach considering real time data to provide the right advice to clients has never been more important,” Mr Ryan noted, “CBRE’s market leading global real estate platform uniquely positions it to assist clients in navigating changing market conditions to achieve superior outcomes across all real estate sub sectors and investment banking products, including raising debt and equity capital and corporate advisory / M&A.”

INTELLIGENT INVESTMENT

What’s Influencing Investor Decisions in 2023

While some specific sectors are performing better than others, investors need to understand which ones are remaining resilient against those that are experiencing market headwinds.

CBRE’s recent In and Out report (page 4) reveals Australia’s latest inbound and outbound investment trends. While it highlights a challenging first half of the year with a 50% dip in the total value of deals across the Office, Industrial & Logistics, Retail, and Hotel sectors when compared to 2022, it’s not all bad news. Some sectors remain buoyant while several Asian countries and the US see the Australian market as a prime offshore investment opportunity. And of course, there’s also speculation around the rapidly maturing BTR sector which is primed to become a key pillar to offshore capital’s portfolio construction across the country.

DISCOVER CBRE’S CAPITAL ADVISORS TEAM 18 CAPITAL EDGE | Q4 2023

In a recent episode of CBRE’s Talking Property Podcast, we examine the current debt landscape and the drivers that will shape the market and influence investor decision making this year. CBRE’s Communications Director, Kathryn House, presents the topic’s key insights from three of CBRE’s leading market experts, Stuart McCann, Head of International Capital for Pacific and Southeast Asia, Andrew McCasker our Pacific Managing Director of Debt and Structured Finance, and Tom Broderick, CBRE’s Australian Head of Capital Markets Research.

This important episode will examine the current debt landscape and the drivers that will shape the market and influence investor decision making this year. CBRE’s Communications Director, Kathryn House, will present the topic’s key insights from three of CBRE’s leading market experts, Stuart McCann, Head of International Capital for Pacific and Southeast Asia, Andrew McCasker our Pacific Managing Director of Debt and Structured Finance, and Tom Broderick, CBRE’s Australian Head of Capital Markets Research.

Andrew McCasker

Pacific Managing Director of Debt and Structured Finance andrew.mccasker@cbre.com.au

Stuart McCann

Head of International Capital for Pacific and Southeast Asia stuart.mccann@cbre.com

If you have any questions from this episode or property topics that you’d like CBRE to answer in future episodes, please email us at: talkingproperty@cbre.com.

property

continues to be a fluid affair in 2023.

Tom Broderick

Australian Head of Capital Markets Research

tom.broderick@cbre.com

Kathryn House

Pacific Communications Director

kathryn.house@cbre.com

Investment activity across

commercial

Step

the world

commercial

and join

LISTEN

the

spectrum

into

of

real estate

us for Talking Property with CBRE.

NOW

19 © 2023 CBRE INC.

The ESG Future for Australia’s Industrial & Logistics Sector

While Office, Residential and Retail spaces were the first property types to experience the real benefits of ESG (Environmental, Social and Governance) and placemaking initiatives, the industrial & logistics space is now a major investment grade asset class which is also beginning to inherit the same sustainability criteria. It’s a strong indication that industrial property has changed and is no longer just about employees arriving to work in a shed and then clocking off.

In our latest ESG in Conversation series, CBRE’s Pacific Head of ESG, Su-Fern Tan, talks exclusively to Andrew Thai, National Sustainability Manager for Frasers Property Industrial, and Tamara Williams, Head of ESG for Altis. In this insightful talk, the trio explore the real-time sustainability strategies being used by today’s leading developers to help future proof their portfolios while showcasing the unique ROI opportunities that innovation in this space can bring.

With analysis based around The YARDS project, the first industrial estate to ever achieve a Green Star Communities rating from the Green Building Council of Australia, the experts will specifically look at:

What this industrial project did to earn this rating

The challenges of pursuing the maximum Green Star rating for industrial assets

The hidden benefits of providing workers with amenities and a sense of community

Identifying the value of this rating system and the value of social impact for industrial assets

Which stakeholders are demanding this radical shift in industrial assets

Is it possible to create an industrial workplace that workers want to be in?

If you have any questions from this episode or property topics that you’d like CBRE to answer in future episodes, please email us at: talkingproperty@cbre.com.

Step into the world of commercial real estate and join us for Talking Property with CBRE.

LISTEN NOW

CAPITAL EDGE | Q4 2023 FUTURE

20

CITIES

Identifying the opportunities in Australia’s build-to-rent sector

In Australia’s 2023 May budget, the government announced 1.5 million in net migration for the country over five years to help revive a stalling economy. CBRE’s May budget analysis highlighted this particular figure as a huge number of people to accommodate.

As an emerging asset class, BTR has been attracting significant interest from both local and offshore investors as well as garnering plenty of industry attention as one part of a bigger solution to alleviating the country’s housing and rental crisis.

With 30,000 apartments operating or in the pipeline across the country, there’s big potential with forecasts the BTR sector could grow to as many as 150,000 apartments within 10 years.

To understand the diversity of benefits, challenges and future market outlook for BTR in Australia, CBRE’s Pacific Communications Director, Kathryn House, spoke exclusively to Mirvac’s Fund Manager and BTR Sector Lead, Angela Buckley, alongside CBRE Pacific’s Head of Living Sectors business, Andrew Purdon in a recent Talking Property, CBRE’s in-house produced podcast series.

If you have any questions from this episode or property topics that you’d like CBRE to answer in future episodes, please email us at: talkingproperty@cbre.com.

Step into the world of commercial real estate and join us for Talking Property with CBRE.

LISTEN NOW

21 © 2023 CBRE INC.

CREATING RESILIENCE

Capital Markets Team ONE

CAPITAL ADVISORY

Equity and capital advisory services

DEBT & STRUCTURED FINANCE

Origination and loan services

OFFICE

Institutional and middle markets

LIVING

BTR, purpose built student accom, co-living and affordable housing

RETAIL Institutional and middle markets

HOTELS

Accommodation, pubs and tourism

INDUSTRIAL & LOGISTICS

Institutional and Middle markets

1ONE CAPITAL MARKETS TEAM

DATA CENTRES

Data centres and digital infrastructure

Our trusted, tenured experts seamlessly collaborate to help clients connect to global capital and opportunities through a cohesive, cross-disciplinary service offering.

DEVELOPMENT

Residenital & commercial developments sites >$20 million

METROPOLITAN INVESTMENTS

Commercial property <$35 million

INFRASTRUCTURE

Airports, roads and ports

ENERGY & RENEWABLES

Energy, oil, gas, mining and renewables

AGRIBUSINESS

Grazing, cropping, horticulture, viticulture, water licenses and carbon offsets

HEALTHCARE & SOCIAL INFRASTRUCTURE

Childcare, medical, aged care, education, recreation and life sciences

22 CAPITAL EDGE | Q4 2023

CBRE Capital Markets is the #1 ranked brokerage firm globally with 23.4% market share*. We provide proactive insights and executable strategies to unlock hidden value, drive returns and enhance outcomes for our clients’ real estate investments.

We unlock hidden value, drive returns and enhance outcomes for your real estate investments, in all geographies and across all asset classes, including:

Office

Retail

Hotels

Metropolitan Investments

Development

Industrial & Logistics

Energy & Renewables

Infrastructure

Data Centres

Healthcare & Social Infrastructure

Living Sectors

Agribusiness

Debt & Structured

Finance

Capital Advisory

Connect with Capital Markets

Flint Davidson

Head of Capital Markets & Office flint.davidson@cbre.com.au

Simon Rooney

Head of Retail Investments simon.rooney@cbre.com

Micheal Simpson

Head of Hotels michaelj.simpson@cbre.com

Mark Lafferty

Head of Metropolitan Investments mark.lafferty@cbre.com.au

Chris O’Brien

Head of Industrial & Logistics chris.obrien@cbre.com.au

Sandro Peluso

Head of Healthcare & Social Infrastructure sandro.peluso@cbre.com.au

Andrew Purdon

Head of Living Sectors andrew.purdon@cbre.com

John Harrison

Head of Agribusiness john.harrison@cbre.com

Andrew McCasker

Head of Debt & Structured Finance andrew.mccasker@cbre.com

Stuart McCann

Head of International Capital & Capital Advisors stuart.mccann@cbre.com

* Source: MSCI Real Assets 23 © 2023 CBRE INC.

FIND OUT MORE © 2023 CBRE, Inc. All rights reserved. This information has been obtained from sources believed reliable but has not been verified for accuracy or completeness. CBRE makes no guarantee, representation or warranty and accepts no responsibility or liability as to the accuracy, completeness, or reliability of the information contained herein. You should conduct a careful, independent investigation of the property and verify all information. Any reliance on this information is solely at your own risk.

Stuart McCann Head of International Capital & Capital Advisors

Stuart McCann Head of International Capital & Capital Advisors

From Chris O’Brien

Head of Industrial & Logistics

From Chris O’Brien

Head of Industrial & Logistics

From

Andrew McCasker

Head of Debt & Structured Finance

From

Andrew McCasker

Head of Debt & Structured Finance