FY 2025-26

Operating Budget

Capital Improvement Program

FY 2025-26

Operating Budget

Capital Improvement Program

Budget preparation team

Finance team

Zach Korach, Finance Director

Brigid Drury, Finance Manager

Jeremy Bates, Senior Management Analyst

Bridget Desmarais, Management Analyst

Leadership team

Geoff Patnoe, City Manager

Cindie McMahon, City Attorney

Sheila Cobian, Assistant City Manager

Gary Barberio, Deputy City Manager, Community Services

Paz Gomez, Deputy City Manager, Public Works

Laura Rocha, Deputy City Manager, Administrative Services

Christie Calderwood, Chief, Police Department

Mike Calderwood, Chief, Fire Department

Maria Callander, Director, Information Technology

Amanda Flesse, Director, Utilities

Tom Frank, Director, Transportation

Jason Haber, Director, Intergovernmental Affairs

Zach Korach, Director, Finance

Kyle Lancaster, Director, Parks & Recreation

Faviola Medina, Director, Constituent & Clerk Services

Mandy Mills, Director, Housing & Homeless Services

Jeff Murphy, Director, Community Development

Matt Sanford, Director, Economic Development

Darrin Schwabe, Director, Human Resources

Suzanne Smithson, Director, Library & Cultural Arts

Amy Ventetuolo, Director, Communication & Engagement

James Wood, Jr., Director, Environmental Sustainability

Department budget preparers & advisors

Shoshana Aguilar, Utilities

Conrad Avila, Finance

Mariel Cairns, Transportation

Fiona Everett, Library & Cultural Arts

Brent Gerber, Information Technology

Lindsey Hansen, Communication & Engagement

Chad Kantner, Parks & Recreation

John Maashoff, Fleet & Facilities

Rachel Maltz, Economic Development

Debbie Jo McCool, Library & Cultural Arts

Bradley Northup, Fleet & Facilities

Debbie Porter, Human Resources

Sarah Reiswig, Risk Management

Laureen Ryan, Community Development

Amanda Simpson, Police Department

Flora Waite, Office of the City Attorney

Rosario Aranda, Environmental Sustainability

Deborah Baird, Fire Department

Pat Downie, Office of the City Clerk

Shawn Gaskari, Fleet & Facilities

Kayla Hanner, Finance

Emily Hasegawa, Construction Mgmt. & Inspection

Sarah Lemons, Communication & Engagement

Lovelynne Magalued, Transportation

Jennie Marinov, Fire Department

Roxanne Muhlmeister, Finance

Robin Nuschy, Office of the City Attorney

Megan Powers, Public Works Administration

Kim Riboni, Finance

Katie Schroeder, Office of the City Treasurer

Leah Sorensen, Housing & Homeless Services

Marsha Weeks, Parks & Recreation

Dear City Council:

Carlsbad is starting the new fiscal year with a budget that invests in the community’s highest priorities, sets aside money for future infrastructure needs and grows the city’s cash reserves – all while supporting the continued delivery of top-quality day-to-day services our community expects.

This year’s budget reflects a long-standing commitment to fiscal responsibility and strategic planning. Despite economic uncertainty nationwide, Carlsbad remains in a strong financial position, with a AAA credit rating, strong reserves and among the lowest pension debts in the region.

In recent years, we’ve prioritized investments in core infrastructure and returned our focus to the basics – making sure essential services our community depends on remain strong. Thanks to this solid foundation, we’re able to invest in key projects and initiatives that support the City Council’s 5-Year Strategic Plan goals, while projecting a balanced budget through fiscal year 2031.

Following three years of reductions in both the operating budget and staffing, this year’s budget process focused on meaningful conversations with staff across departments to better understand what’s working well and where pressure points remain in delivering highquality services. Based on that input, the budget includes three new full-time positions in Finance, Human Resources and Fleet maintenance to address operational needs.

Even with these additions, the General Fund budget reflects only a modest increase of 1.7% – less than half the regional inflation rate of 3.8%. And we’re accomplishing this while continuing to grow our General Fund reserves during a time of immense economic uncertainty.

Investing in what matters most

This year’s budget directs resources to key projects and initiatives that support the City Council’s 5-Year Strategic Plan goals, which focus on the issues most important to the community.

Key investments include:

Public safety

• Increasing the Fire Department’s service capacity through the purchase of a new aerial ladder fire truck

• Reclassifying six EMTs to firefighters this year as part of a multi-year effort to enhance emergency response

• Additional funding for brush and vegetation management to reduce wildfire risk across city preserves and strengthen hazard reduction within the city-owned urban forests, such as Hosp Grove

• Six additional Police Department positions to improve response times, assist with traffic mitigation for special events, enhance digital forensics services and assist in resolving internet crimes against children

Sustainability

• Advancing initiatives in the City Council’s adopted Climate Action Plan, including switching all energy use at city government facilities to 100% renewable through the Clean Energy Alliance

• Accelerating the replacement of the city’s vehicle fleet with 14 electric and 15 hybrid vehicles

Community character & connection

• Construction of Veterans Memorial Park, which is expected to begin in late 2025. The 93.7-acre park will honor veterans, offer places for quiet contemplation as well as active uses like the city’s first bike park and nature-inspired playground, and maintain over half the land as natural habitat

• Ongoing support to keep the city’s Georgina Cole Library and Carlsbad City Library on Dove Lane open on Sundays, restoring seven-day-a-week community access to library services for the first time in five years

• Expanding support of programming and services at the newly upgraded Schulman Auditorium at Dove Library

The City of Carlsbad’s Capital Improvement Program reflects the city’s ongoing commitment to maintaining the highest standards of quality facilities for our community today and in the future.

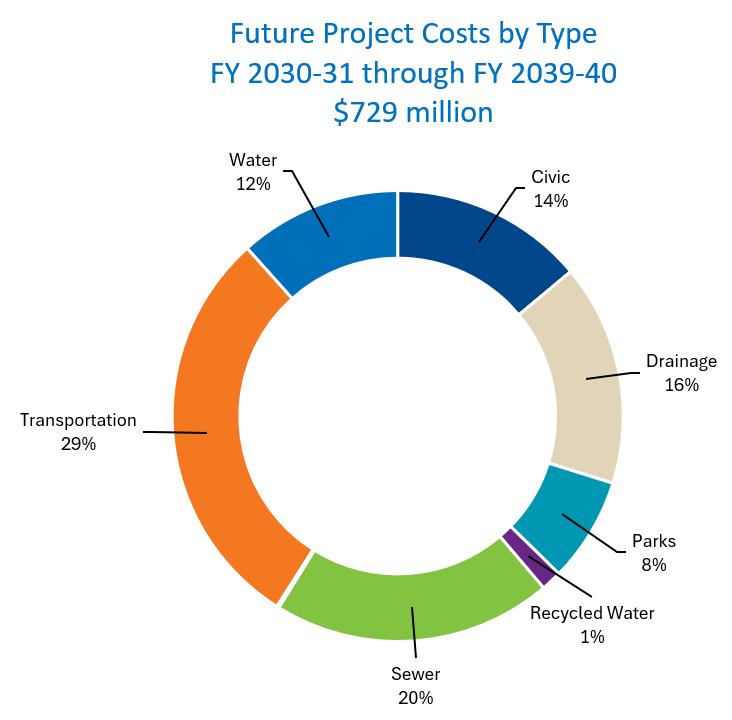

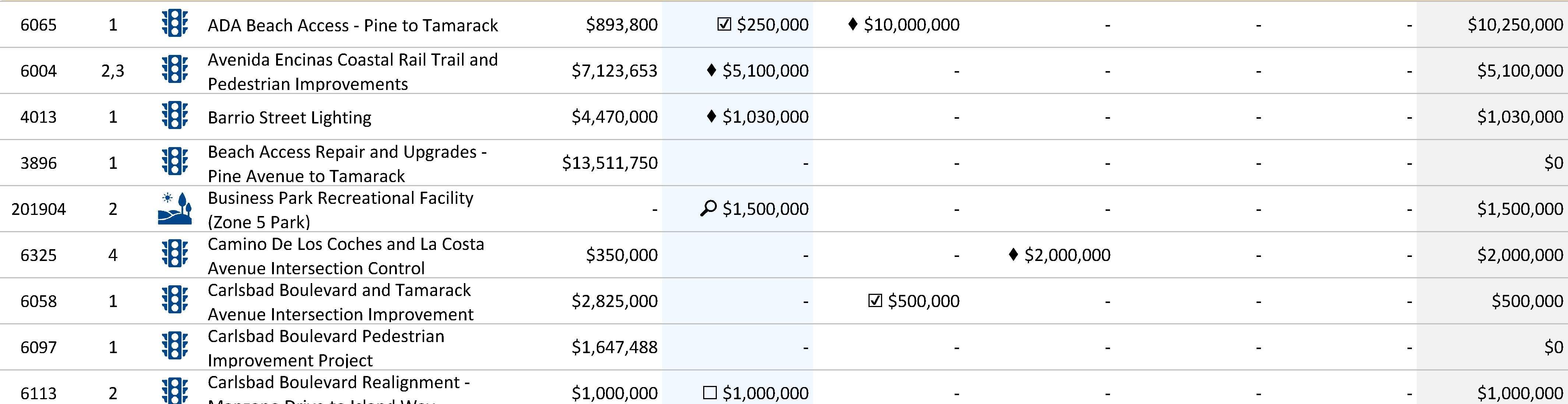

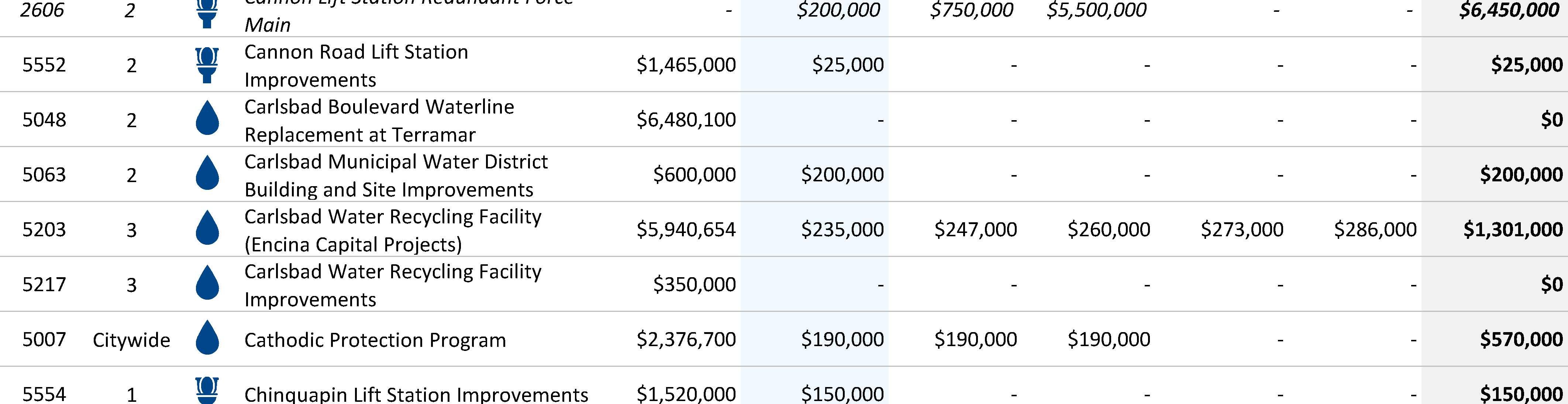

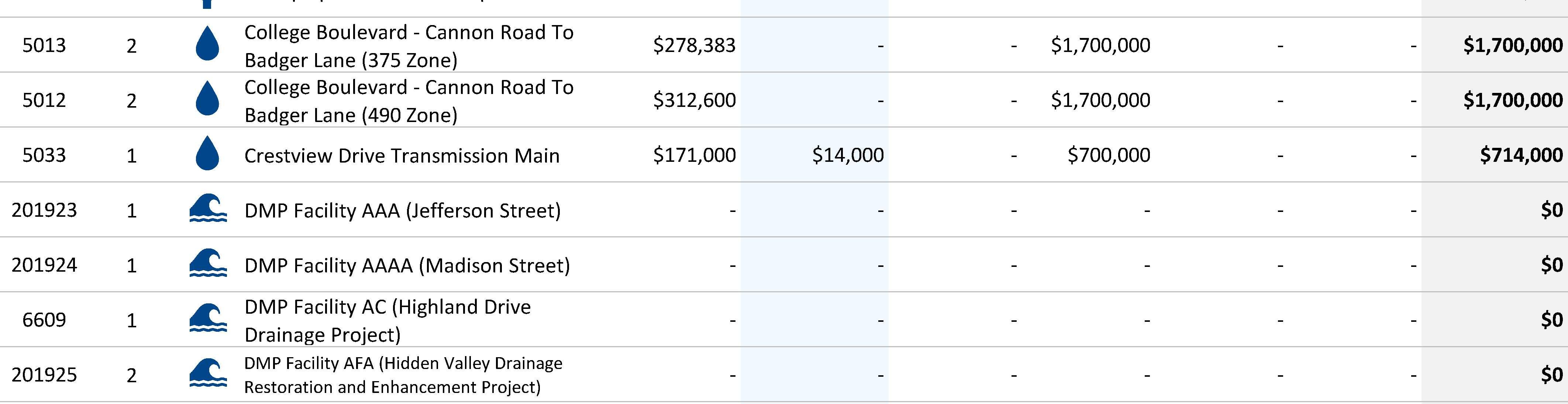

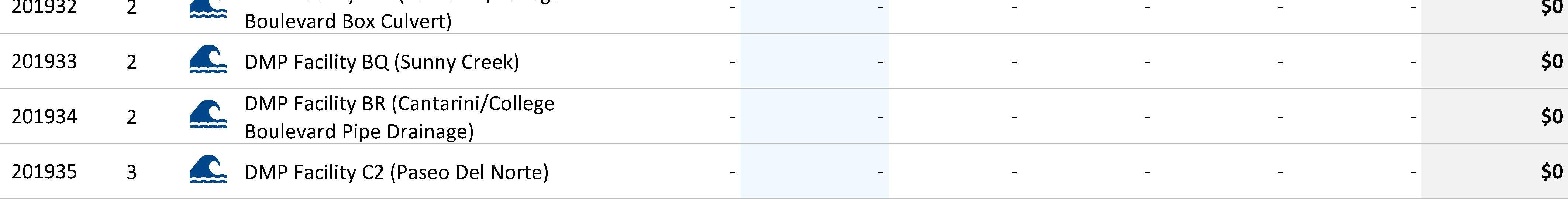

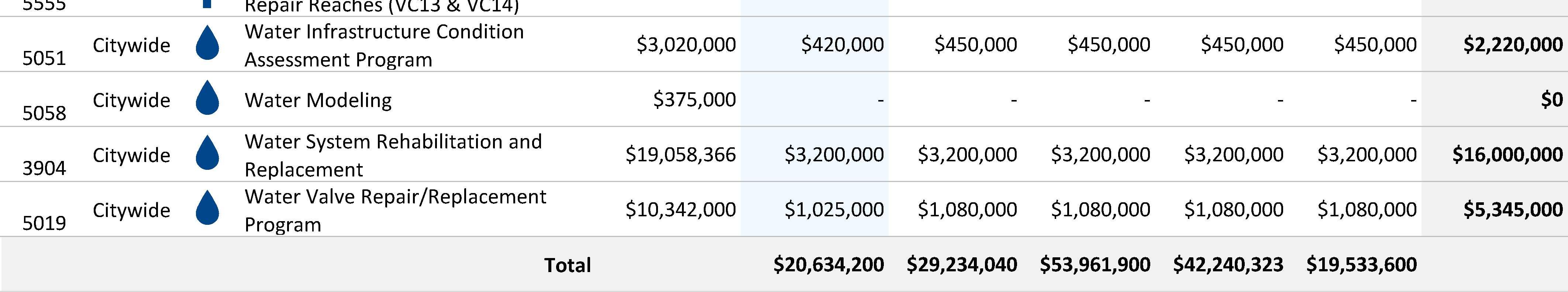

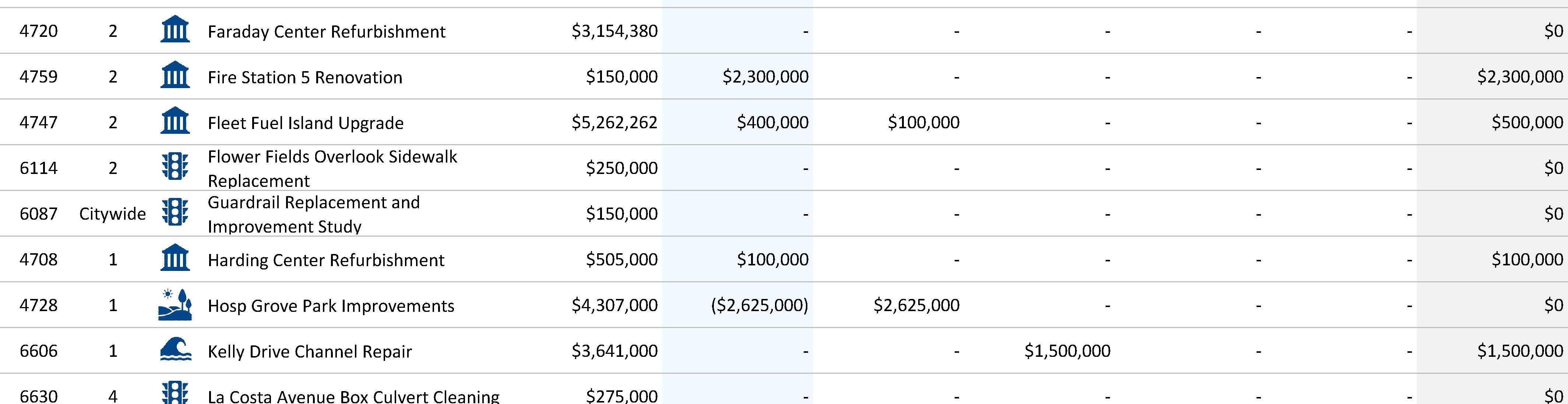

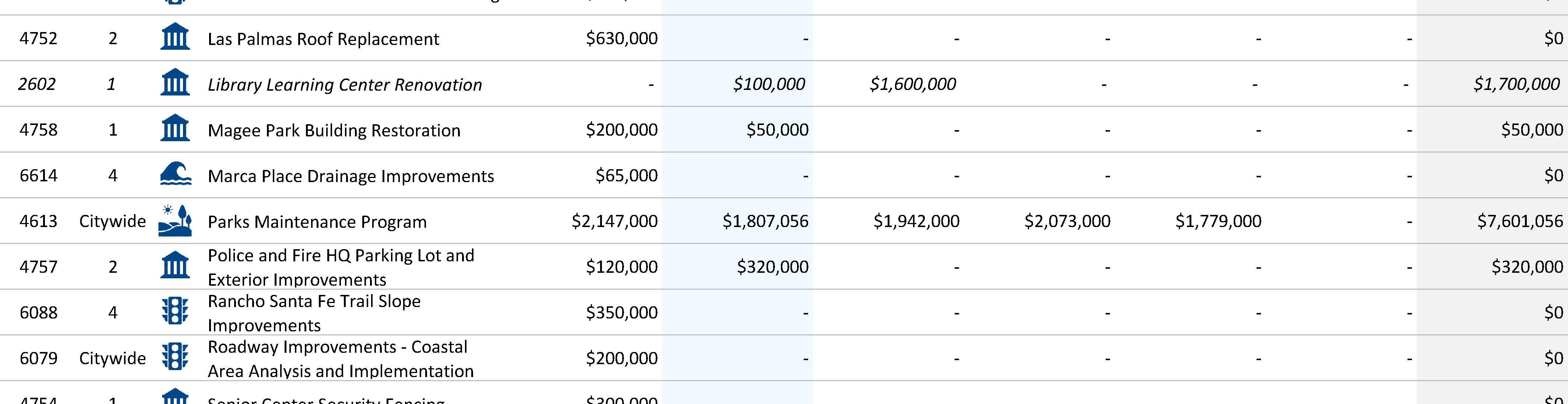

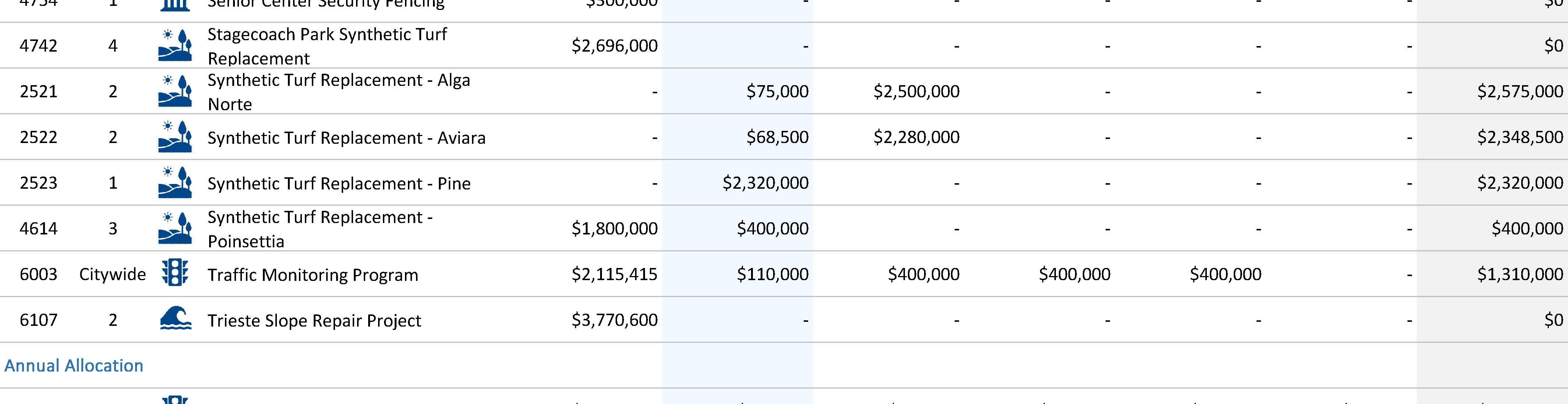

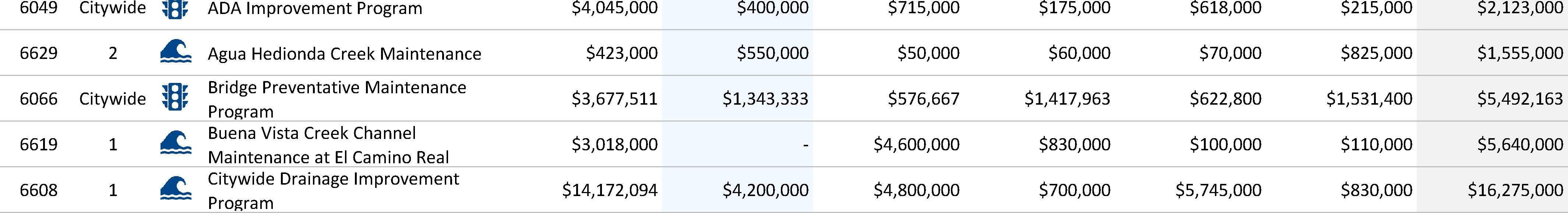

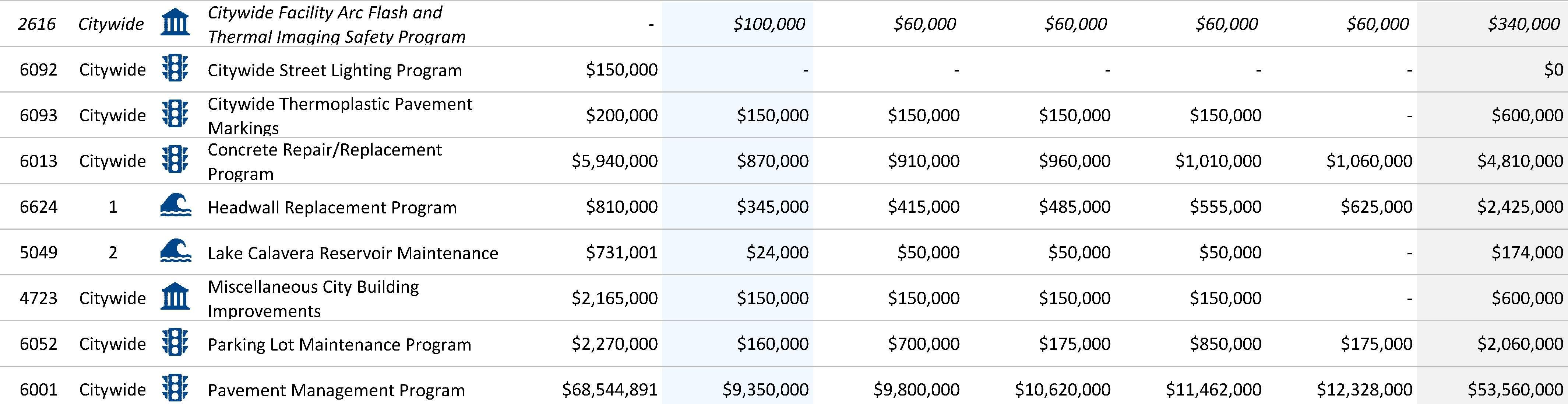

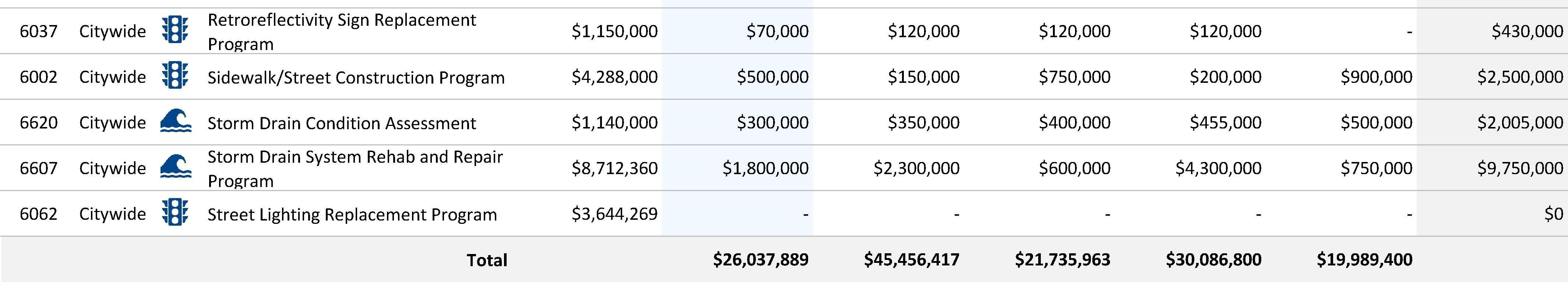

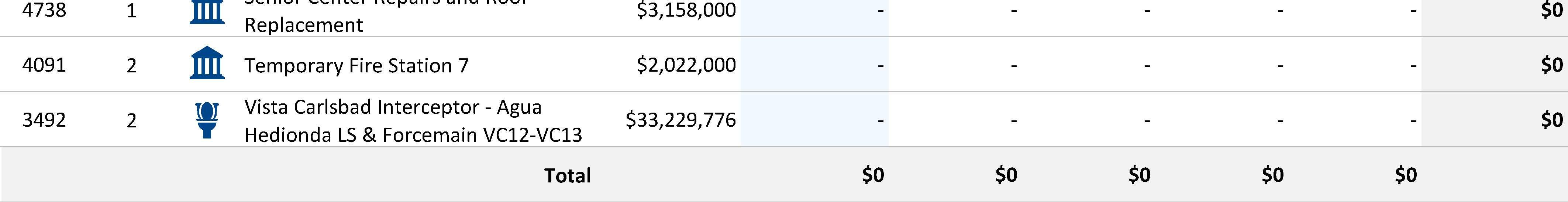

The fiscal year 2025-26 Capital Improvement Program focuses on 194 projects planned over the next five years. Approximately $47 million in new appropriations fund the continuation of existing projects as well as a limited number of new projects.

To deliver on our commitments to residents, this year’s budget emphasizes completing projects already underway. As a result, only 14 carefully selected new projects were added, ensuring resources are concentrated where they will have the greatest impact.

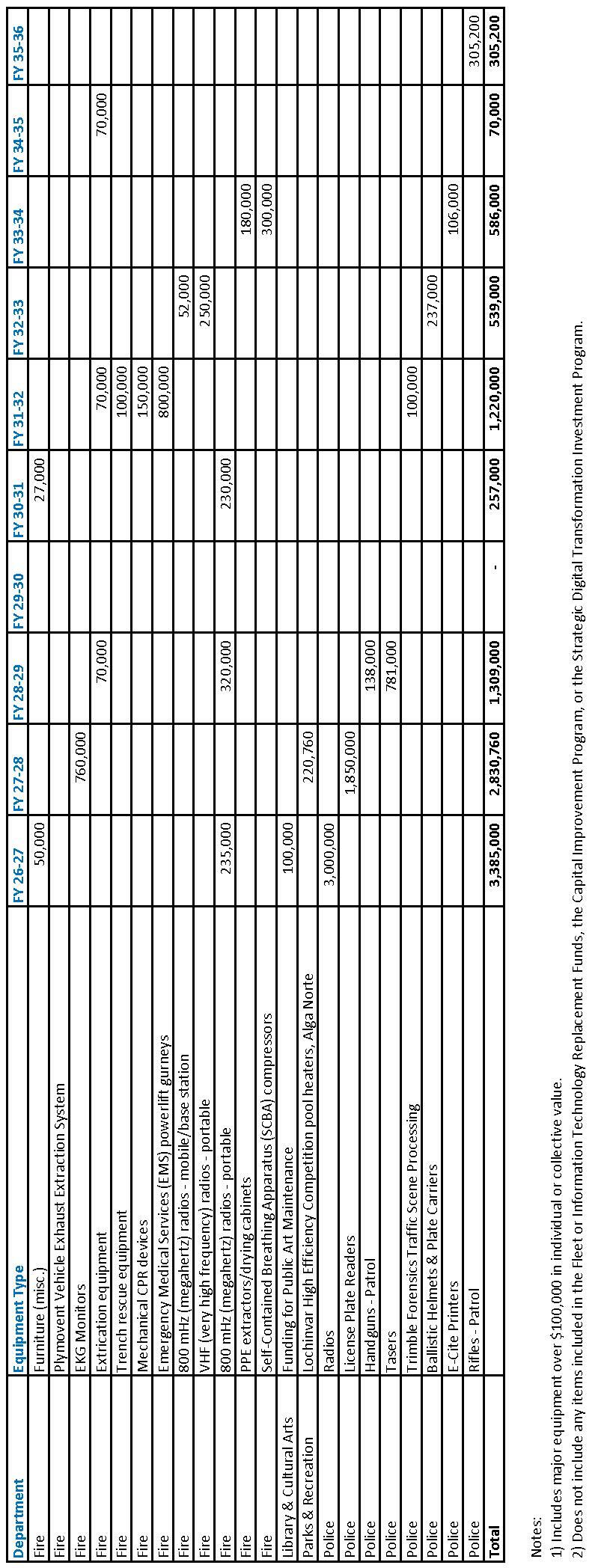

Just as the city plans ahead for major Capital Improvement Projects, last fiscal year the City Council approved a new General Fund asset replacement reserve. This reserve continues to manage and fund the replacement of the city’s large machinery and equipment separately from the General Fund reserve.

Staff projects about $10.5 million will be needed to cover replacement costs in the next 10 years. The reserve helps the city prioritize and strategically plan for these costs without affecting the General Fund reserve or annual budget surpluses.

Over the years, the city’s use of technology has become as critical to city operations as traditional infrastructure. The city’s Strategic Digital Transformation Investment Program increases efficiencies, security, transparency and data-driven decision making through investments in the city’s digital infrastructure.

In total, 40 continuing and new projects are planned over the next five years, with $5.4 million appropriated for fiscal year 2025-26

One key effort is the Core Systems Modernization Project, which will upgrade the city's technology by consolidating seven separate systems into a single, centralized platform. This major initiative will increase efficiency, enhance security and create a more user-friendly experience for staff and residents. Thanks to funding set aside over several years — and in this year's budget — the project is now underway.

The City Council has a policy to maintain the equivalent of 40% of the annual General Fund operating budget in a reserve account. This helps ensure that during emergencies and economic downturns the city can continue to meet the community’s needs. In June 2026, the city is projected to have $147.8 million in reserves, or 61% of the annual General Fund operating budget.

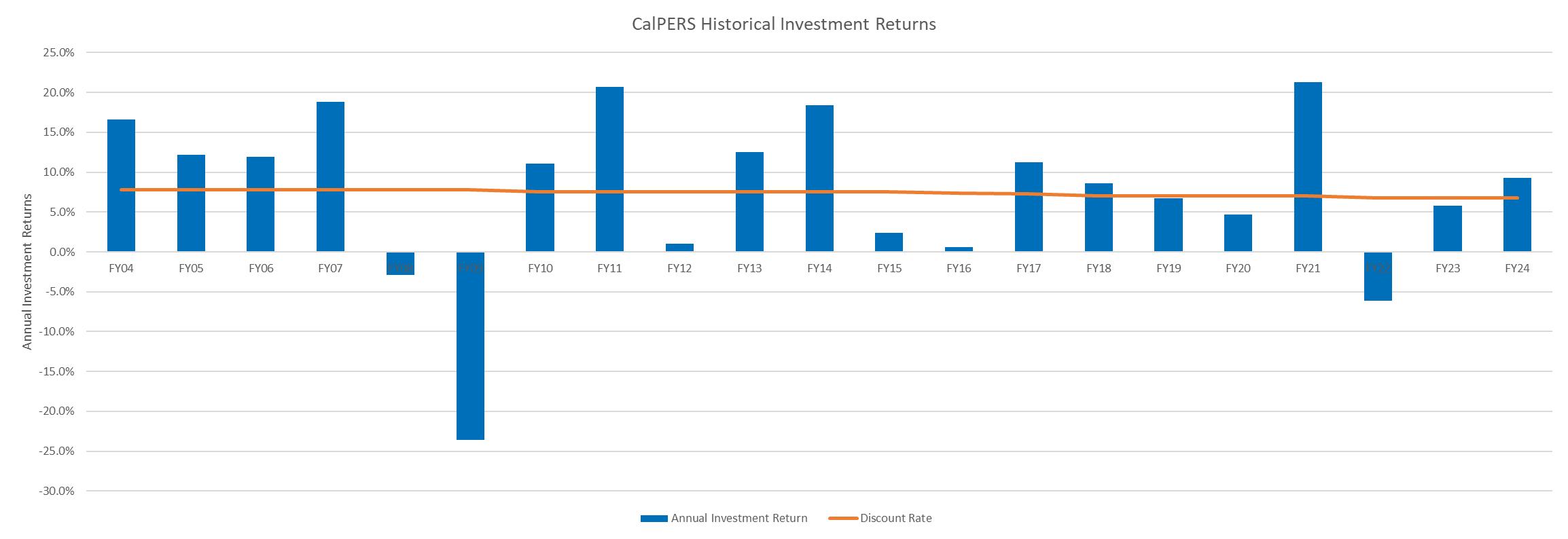

At a time when cities throughout California continue to be challenged by increasing payments into the California Public Employees' Retirement System, the City of Carlsbad has achieved one of the lowest pension debts in the San Diego region. This is due to strong funding through both CalPERS and the city’s separate Section 115 pension trust account, where the city manages how funds are invested. Carlsbad’s pension is funded at 77% and remains on track to reach the City Council’s target of 80% by fiscal year 2028-29.

However, continued vigilance is needed, as CalPERS investment returns, which help fund pension benefits, remain vulnerable to market volatility.

While the broader economy continues to present challenges, Carlsbad is well-positioned to adapt. This is a focused, responsible and responsive budget – one that addresses both internal and community priorities and sustains high-quality services without accelerating any projected financial deficit over the next five years.

Thank you to the City Council for your continued leadership and commitment to responsible financial stewardship. With this budget, Carlsbad is taking another important step toward achieving the community’s long-term goals while continuing to deliver top quality day-today services that enhance the lives of all who live, work and play in our city.

Sincerely,

Geoff Patnoe City Manager

The annual budget is the most significant expression of how City Council policies are translated into daily operations. In this document, you will see where the city gets the money it uses to carry out its mission and how that money will be spent during the fiscal year that begins July 1, 2025

More than a spending plan, the annual budget is also intended to provide a window into the complex and dynamic economic environment within which your local government operates. As such, this document reviews local, state and national trends affecting city finances, as well as demographic information, regulations and policies that affect how, when and where the city invests resources.

Some of the information included in this budget document is required by state law. Other details are provided for context and transparency. More than anything, city staff have prepared this budget to serve as a practical guide and tool for ensuring the City of Carlsbad lives up to its standard of being the best run government, period.

The following information is included in the four main sections of the budget:

Introduction

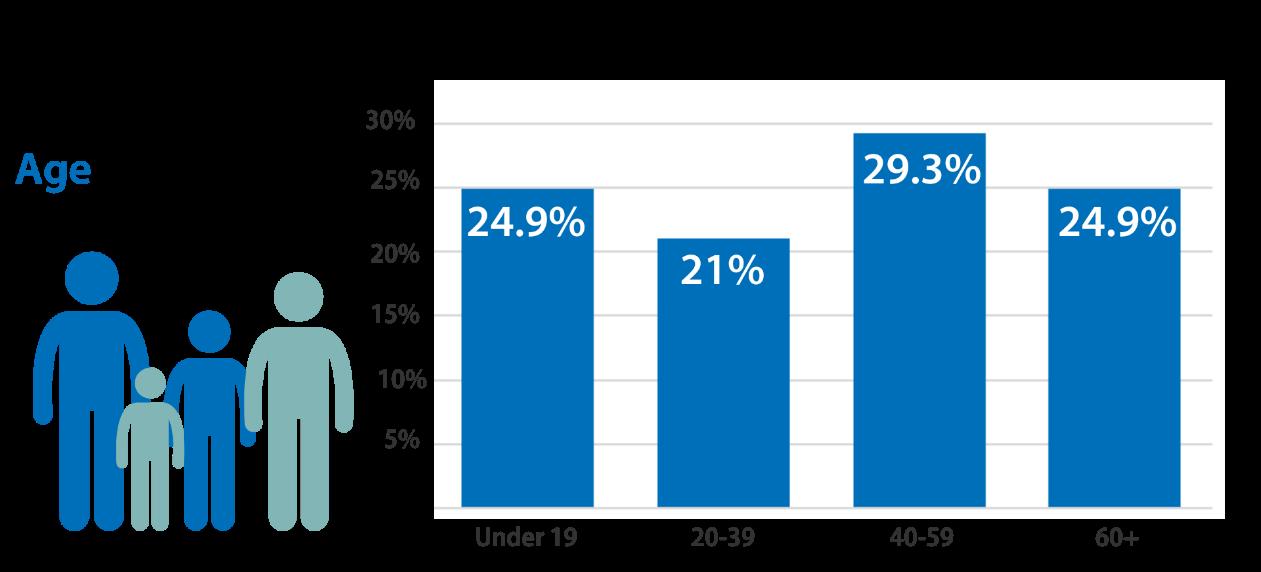

• Information about the city, its size, its demographics, the city government structure and other background

• How the budget is prepared and approved

• Input city staff received from the public and how it has been incorporated into city spending priorities

• The economic and fiscal issues facing the city

• Financial management policies

Operating Budget

• An overview of where the city gets the money (“revenue”) to fund daily operations

• A big picture summary of city staffing levels, spending broken out into different categories and other aggregate information

• Detailed budgets for all city functional areas

Strategic Digital Transformation Investment Program

• Major city digital transformation projects (online permitting, records management system, police computer aided dispatch system, hardware and software, security strategy, etc.) included in this year’s budget

• How projects are identified and prioritized

• Sources of funding and long-term plan

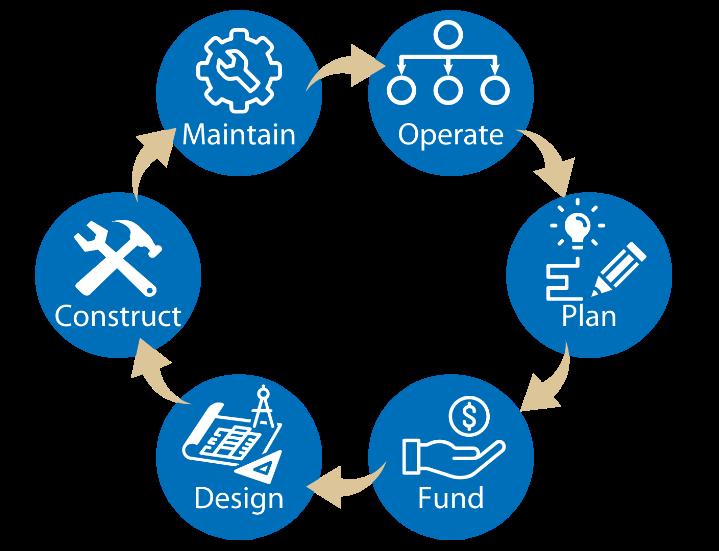

• Major city construction projects (roads, water and wastewater systems, parks, etc.) included in this year’s budget

• How projects are identified and prioritized

• Sources of funding and long-term plan

The City Council sets the overall policy direction for the City of Carlsbad and helps staff prioritize programs, projects and services to support that direction. Public input plays a critical role in setting both the long-range policy direction of the city and decisions about day-to-day spending. The city operates on a fiscal year that begins July 1. City staff in all departments prepare individual budgets for their functional areas. These budgets are then combined into an overall city budget that is presented to the City Council each spring for review and input.

The City Council has the authority to approve the annual budget and may amend it during the year if needed. The legal level of budgetary control is at the fund level, which means spending in each different type of fund may not exceed the budgeted amount without City Council approval. Additional information regarding the budgetary controls can be found in the resolution approving the annual operating budget in the appendices.

Finance Department staff hold meetings with departments to discuss budget goals and timelines for the upcoming fiscal year. Finance Department staff also prepare base budgets for each department during this time based on prior fiscal year appropriations

City staff hold a budget kick-off meeting to discuss priorities for the upcoming budget cycle, any changes to the budget process compared to last fiscal year and the calendar for submission of required budget forms. Departments begin developing their budget submissions based on the base budgets provided by the Finance Department and their needs and budget guidelines for the new fiscal year

Departments provide their budget submissions to the Finance Department. These submissions include any requests departments make to amend their budgets, along with general information about existing personnel allocations and budget for professional and outside services. Finance Department staff review submissions, analyze requested budgets and work with departments to make any necessary changes.

Departments present their budgets, including significant changes and requests for new funding, to the City Manager. Departments submit estimates for current fiscal year-end revenues and expenditures to Finance.

Based on meetings with individual departments, the City Manager decides the budget that will move forward for City Council consideration. Finance Department staff prepare the preliminary budget document.

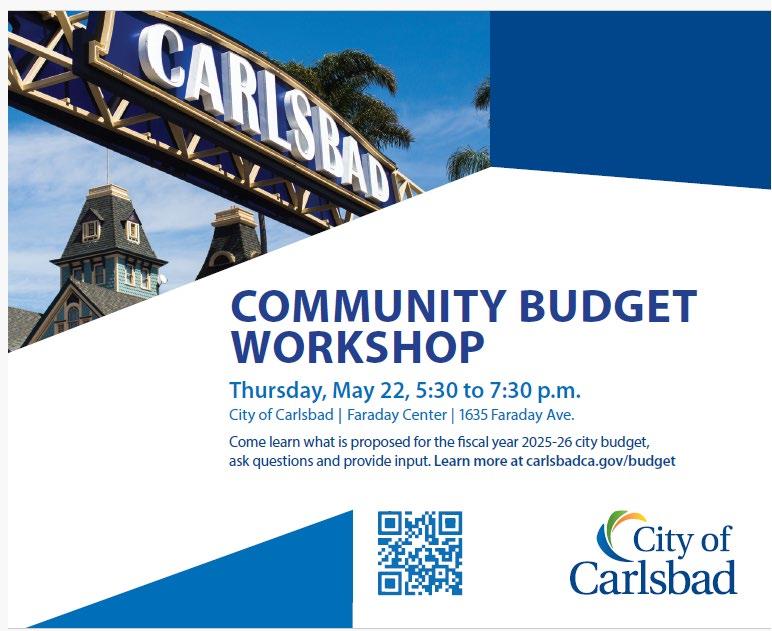

Staff present the preliminary budget to the City Council for consideration. After this public meeting, staff amends the preliminary budget document for any City Council-directed changes. City staff also hold a public budget workshop to discuss the preliminary budget with the community and answer questions about it.

At a public hearing, staff present the final proposed budget to the City Council for consideration and adoption.

The City of Carlsbad is guided by a 5-Year Strategic Plan, which was adopted by the City Council in 2022. The plan serves as a road map during the budget process by identifying specific, measurable objectives to be achieved during the five-year timeframe.

The plan was developed by working closely with the community to identify a vision for the Carlsbad community, strategic plan goals and project priorities. The community will continue to be engaged in refining specific projects and initiatives within the strategic plan as it is implemented. This input is also incorporated into the annual budget process.

The 5-Year Strategic Plan includes high level goals, objectives, projects and service commitments that support the Carlsbad Community Vision.

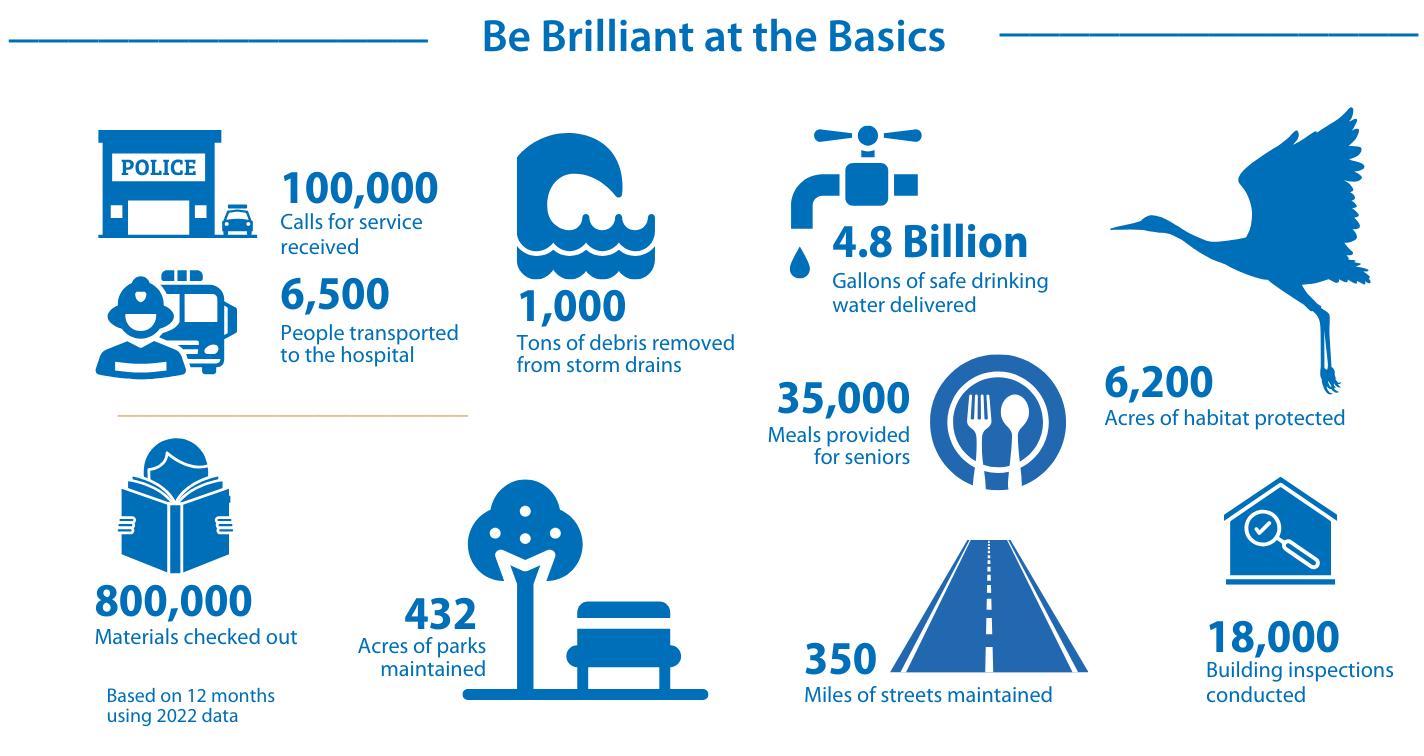

The city fulfills its purpose and supports the 5-Year Strategic Plan goals every day by providing core services and functions of municipal government at a very high level of quality. From a resource perspective, these ongoing services represent the vast majority of the city’s annual budget.

Specific work plans and resource allocations to support the 5-Year Strategic Plan are developed each year and included in each department’s budget. Some of the key initiatives, projects and services that support strategic plan goals in the fiscal year 2025-26 budget include:

• Continue work on an updated growth management plan

• Invest in projects that make the Village and Barrio more walkable

• Construction of Veterans Memorial Park. The 93.7-acre site will honor veterans for their service, celebrate the site’s natural beauty and views, and feature family-oriented amenities, while minimizing environmental impacts by maintaining over half the land as protected habitat

• Pursue grant funding with SANDAG and NCTD to further the design of a project to lower the railroad tracks between Agua Hedionda and Buena Vista lagoons

• Complete construction of the Monroe Street Pool renovations

• Provide high quality library services, programs and events – including expanded support of programs at the newly upgraded Schulman Auditorium at the Carlsbad City Library on Dove Lane – that bring people together and support lifelong learning

• Maintain the return of Sunday hours at the city’s Georgina Cole Library and Carlsbad City Library on Dove Lane

• Continue traffic safety improvements citywide

• Implement the city’s Homelessness Action Plan to help address homelessness in Carlsbad and its effects on the community

• Continue a high level of public safety services including a full-service Police Department, fire and emergency medical services, a park ranger program and city lifeguards

• Seek property for permanent Fire Station 7

• Continue to foster strong relationships between community members and the Police Department through the Community-Police Engagement Commission

• Increase Fire Department service capacity through the purchase of a new aerial ladder fire truck

• Reclassify six EMTs to paramedic firefighters in a multi-year effort to enhance emergency response

• Fire mitigation and preparedness efforts for brush and vegetation management across the city’s 6,500 acres of preserves and hazard reduction within the city-owned urban forests such as Hosp Grove

• Continue funding six positions added to the Police Department to improve response times, assist with traffic mitigation particularly for special events, enhance digital forensics services and assist in resolving internet crimes against children

• Advance initiatives in the city’s adopted Climate Action Plan to meet council-directed sustainability goals, including switching all of the energy used to power city government buildings, facilities and operations to the Clean Energy Alliance’s 100% renewable energy option

• Accelerate the replacement of the city’s combustion engine fleet with the purchase of 14 electric and 15 hybrid vehicles

• Build additional EV charging stations in the Village

• Manage the city’s 6,200 acres of habitat preserves

• Continue to implement new sustainable materials management programs, including organics recycling and reducing use of single use plastics

• Continue a cybersecurity awareness program for businesses

• Continue the Life in Action recruiter program to help streamline the connection between employers and qualified candidates

• Provide resources to grow and support key industries in Carlsbad’s economy

• Support the long-term viability of small businesses, startups and entrepreneurs in partnership with local and regional collaborators

• Support workforce development by collaborating with the San Diego North Economic Development Council and California State University San Marcos to expand an intern housing program

• Streamline operations by consolidating the city’s core IT systems to improve efficiency associated with operating many different systems with different vendors

• Expand the software platform for managing affordable housing, handling records, automating business processes and conducting data analytics

• Continue modernization of IT infrastructure to improve cybersecurity and data analytics

• Foster a culture of continuous improvement that equips the organization to deliver excellent service to the community

• Attract and retain a talented, diverse and engaged workforce

• Maintain CalPERS funded status of 80% or greater (Council Policy No. 86)

• Continue design of the Orion Center (centralized public works yard) and Public Works storage facility and evidence storage building for the Police Department

• Implement a cutting-edge Computer Aided Dispatch system with a real-time crime center

• Install public wireless internet access at Alga Norte Park

• Upgrade library Radio Frequency Identification system for automated checkouts/returns

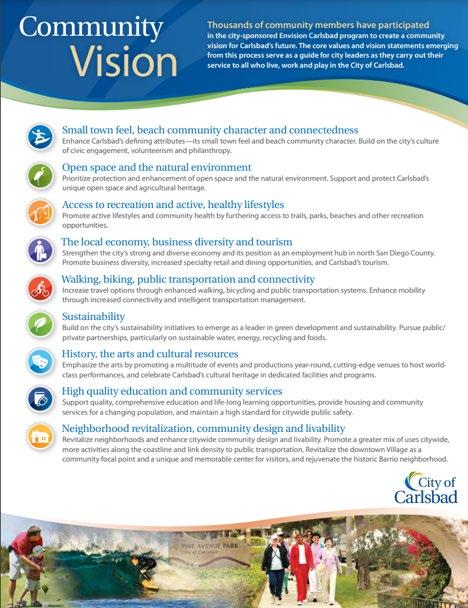

The City of Carlsbad is guided by two documents built on extensive feedback from the community:

• Carlsbad Community Vision

• City Council 5-Year Strategic Plan

The Carlsbad Community Vision was first developed over 10 years ago through an 18-month public engagement process. Since that time, the city has checked in with the community every few years to validate the nine core values that make up the community’s vision for the future.

While areas of emphasis have shifted based on current events, the economy and other factors, the values have stood the test of time.

In 2021, the City Council decided to develop a 5-Year Strategic Plan to focus on building momentum on its highest priority goals. Previously, the City Council developed goals annually, often causing new goals to be added to the list before the previous year’s goals could be completed. As a result, progress could be slowed as staff’s efforts were spread among too many competing priorities.

The City Council chose five main areas of focus within the Community Vision, based on input received from the community. Then, the public was invited to share their ideas and priorities within each area. This public engagement process yielded the largest amount of community input since the city launched a formal community engagement program in the early 2000s.

The fiscal year 2025-26 budget represents the work plan and resource allocation for year four of the strategic plan’s implementation.

The city continues to engage the community on specific projects and initiatives within the strategic plan. Input gathered during fiscal year 2024-25 that helped shape decisions reflected in the fiscal year 2025-26 budget included:

• Hundreds of comments emailed from community members.

• Over 210 participants at public workshops and meetings.

• Over 750 surveys completed by community members.

• Public workshops, online surveys and other engagement for specific projects:

o Barrio public art traffic circle

o Barrio lighting project

o Carlsbad Boulevard and Tamarack Avenue intersection improvements

o Carlsbad Reads Together

o Climate Action Plan

o Safe Routes to School

o Tyler Street complete streets improvements

o Veterans Memorial Park public art

o Chestnut I-5 underpass public art

o Water, recycled water and sewer rates

o Drive-thru regulations

o Garfield street parking

Finally, the city also sought input on the budget itself through a public workshop, public meetings, social media and other channels. A list of these efforts can be found in the appendices.

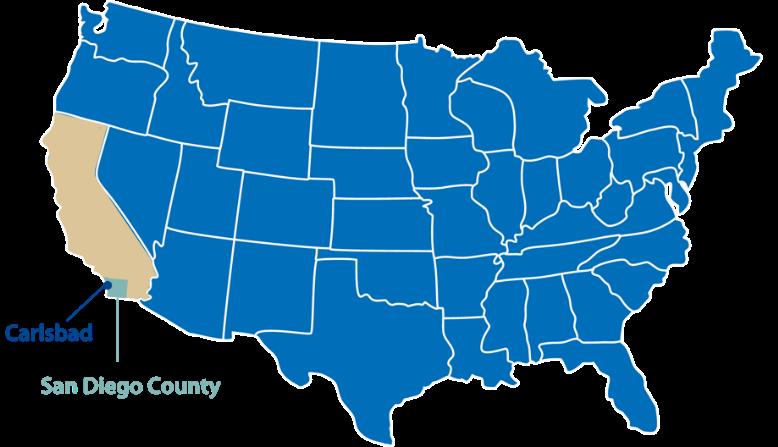

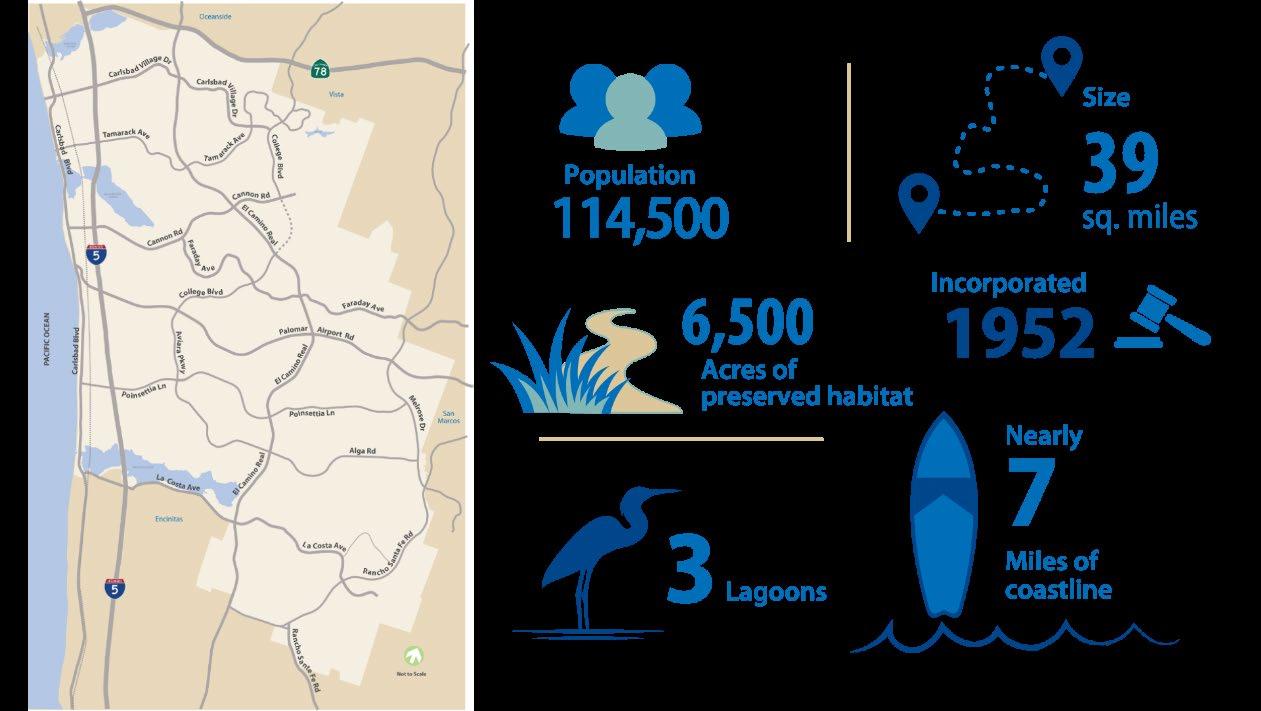

The City of Carlsbad is situated in north San Diego County where a great climate, beautiful beaches and lagoons, and abundant natural open space combine with world class resorts, family attractions, wellplanned neighborhoods, a diverse business sector and a charming village atmosphere to create the ideal California experience.

Named for a famed 19th Century European spa whose mineral springs were found to be remarkably similar to those found here, the City of Carlsbad’s history reflects the heritage of many cultures. The shoreline of the city’s Agua Hedionda Lagoon was home to the indigenous Luiseño and Diegueños Indians for centuries before the arrival of the Spaniards. The area known today as Carlsbad was once a territory of Spain and then Mexico. The City of Carlsbad was incorporated in 1952 and today is home to more than 100,000 people. Guided by an award-winning growth management plan approved by voters in 1986, the City of Carlsbad has matured into a well-rounded community where parks, roads and other infrastructure have kept pace with development. Now that the period of rapid growth is coming to an end, the city is focused on sustaining an excellent quality of life for residents and continuing to foster a strong sense of community.

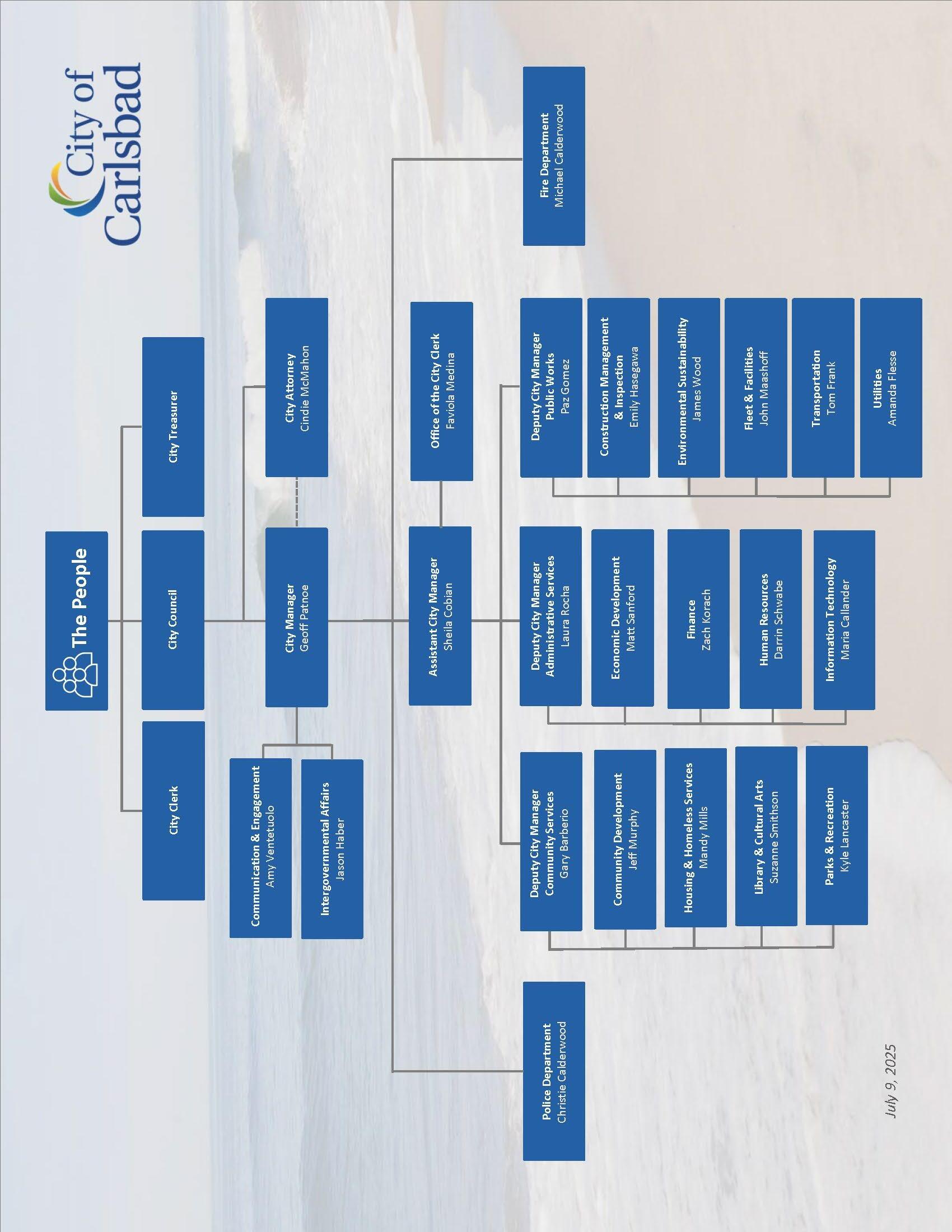

The City of Carlsbad is a municipal corporation following the council-manager form of government. The City Council, the city’s legislative body, defines the policy direction of the city. The City Manager oversees the day-to-day operations of the city. The City of Carlsbad also has an elected City Clerk and City Treasurer

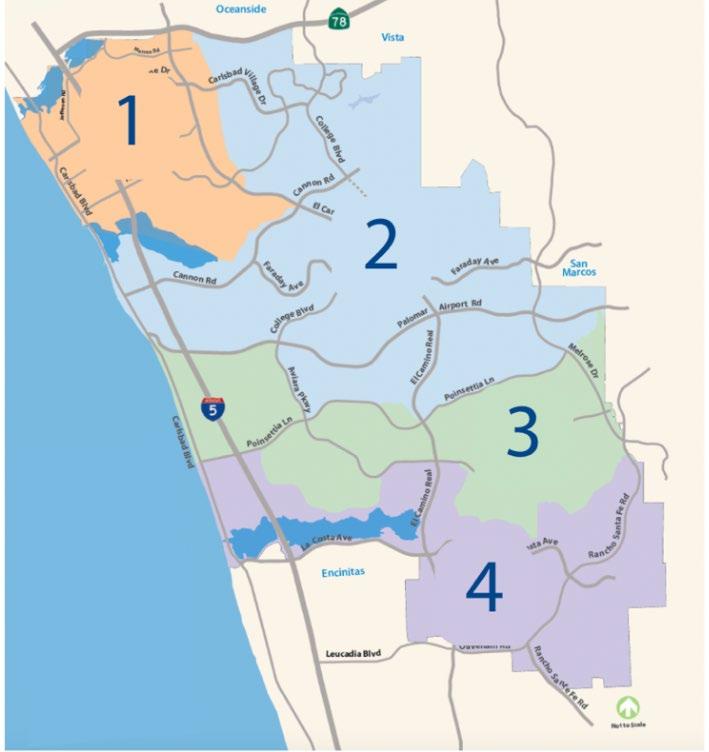

The City Council consists of an elected Mayor and four elected council members. Each serves a four-year term. In 2017, the city switched to a system where City Council members are elected by district instead of at large or citywide. District boundaries were updated following the 2020 Census.

There are two types of cities in California: charter and general law. Charter cities follow the laws set forth in the state’s constitution along with their own adopted “charter” document. General law cities follow the laws set forth by the state legislature.

In 2008, City of Carlsbad residents voted to approve the charter city measure, Proposition D, by 82%.

The charter gives the City of Carlsbad more flexibility on such issues as purchasing and contracting, because the process mandated by the state can be expensive and cumbersome, causing project delays. Certain affairs, such as traffic and vehicle regulation, open and public meetings laws, some planning and environmental laws, and eminent domain, remain matters of state authority even as a charter city.

The City Council appoints members to a variety of boards and commissions, which provide opportunities for community engagement and recommendations to the City Council.

Agricultural Conversion Mitigation Fee Committee

Arts Commission

Community-Police Engagement Commission

Environmental Sustainability Commission

Golf Lodging Business Improvement District

Historic Preservation Commission

Housing Commission

Investment Review Board

Library Board of Trustees

Parks & Recreation Commission

Planning Commission

Senior Commission

Tourism Business Improvement District

Traffic Safety & Mobility Commission

Education Median income Homeownership

46% HIGHER Households with a bachelor’s degree or higher compared to San Diego County $139,326 36% Higher than San Diego County Higher than U S 77% 16% 12% Higher than county average Higher than state average 63%

Apple Stores Ken Grody Dixon Ford

Autonation Chrysler/Dodge/Jeep/Ram Carlsbad Legoland California

Autonation Hyundai Carlsbad Lexus Carlsbad

Autonation Mazda Carlsbad Lowe’s Home Centers

Autonation Subaru Carlsbad

BMW of Carlsbad

Costco Wholesale

Fashionphile

Financial Services Vehicle Trust

Hoehn Honda Certified Used Cars

Omni La Costa Resort & Spa

Park Hyatt Aviara

Premier Cadillac/Buick/GMC of Carlsbad

Premier Chevrolet of Carlsbad

Premier Kia of Carlsbad

Tesla Motors

Hoehn Mercedes Toyota Carlsbad

Invitrogen

Jaguar/Land Rover Carlsbad

Vons Grocery Company

*Alphabetical order

The table below shows General Fund revenue comparisons with neighboring jurisdictions for fiscal year 2025-26 adopted budgets. Population estimates for 2025 and total General Fund budgets are included for additional context.

At the time of developing the Fiscal Year 2025-26 Proposed Budget, much of the lingering effects of the unprecedented inflationary levels experienced since 2021 have diminished The Federal Reserve’s swift action to combat the rise in inflation by increasing interest rate targets which has stabilized inflationary levels; however, new trade and administrative policies have created new challenges not only for general consumers but for business sectors such as life sciences that depend on federal grant funding. Fiscal year 2024-25 began to experience year-over-year decreases in gross sales tax activities which indicates a drop in consumer confidence as well as the impacts of sustained levels of inflation in recent years. Although inflation has cooled, we have yet to see inflation levels return to more historically normal levels. As the city moves forward, monitoring trade and economic policies from the federal administration will be paramount.

Prior to the pandemic, the city boasted a low unemployment rate of 2.9%. At the height of the pandemic, unemployment spiked to 13.8%. With the pandemic’s economic impacts behind us, unemployment rates have dropped dramatically The March 2025 unemployment rate of 4.1% in Carlsbad represented an increase compared to the prior year’s unemployment rate of 3.5%. The unemployment rate for the County of San Diego was 4.2% in March 2025 and the State of California was 5.3%. Within the city, many employers are citing difficulty in finding and retaining workers. Macroeconomic trends in the tech industry have been pushing unemployment up nationally, but the labor market is still considered to be very tight.

At the end of March 2025, the two-year Treasury yield was 70 basis points lower, and the 10-year Treasury yield was about 11 basis points lower, year-over-year. The inversion between the two-year and 10-year Treasury yield increased about 10 basis points to 0.34 over the previous month-end. The average historical spread since 2003 is about +130 basis points. The yield curve, inverted for a period of over two years, became positive in September 2024 and has slowly increased month over month. The Federal Reserve’s interest rate targets are currently at 4.25%-4.50%, and inflation has decreased but not to desired levels of 2%.

Maintaining good fiscal health must remain a top priority. Meeting this objective preserves the city’s ability to continue providing important programs and services to the community. Past economic challenges and prudent financial planning have provided opportunities for developing solutions to address lost revenues while preserving vital services. The positive effect of inflation on some of the city’s revenue sources have been significant but is considered one-time and something to be very closely monitored moving forward. As inflation is likely to decline in the future, so will revenue growth. Disciplined spending and long-term financial planning remain critical to ensuring the future sustainability of important city programs and services.

Strategic planning begins with determining the city's fiscal capacity based upon long-term financial forecasts of recurring available revenues and future financial obligations. Prior to the adoption of the annual budget, the finance department will prepare a Ten -Year Financial Forecast (Forecast) that evaluates known internal and external issues impacting the city's financial condition. The methodology for preparing the Forecast can be found in the appendices of this document. The Forecast is intended to help the city:

• Attain and maintain financial sustainability,

• Have sufficient long-term information to guide financial decisions,

• Have sufficient resources to provide programs and services for the stakeholders,

• Identify potential risks to on-going operations in the long-term financial planning process and communicate these risks on an annual basis,

• Establish mechanisms to identify early warning indicators, and

• Identify changes in expenditure or revenue structures needed to deliver services or to meet the goals adopted by the City Council.

It is important to stress that the Forecast is not a budget. The Forecast does not dictate expenditure decisions, but rather highlights the need to prioritize the allocation of the city’s limited resources to ensure the continuation of core city services. The purpose of the plan is to provide the City Council, key stakeholders and the public an overview of the city’s fiscal health based on various financial and service level assumptions over the next ten years. It also allows for the discussion of necessary steps to be initiated during the development and implementation of future budgets. The Forecast is intended to look beyond the annual budget cycle and serve as a planning tool to bring a long-term perspective to the budget process. The Forecast also takes into consideration City Council policies that need to be met on an annual basis including General Fund reserve guidelines, pension funding guidelines, etc. Should projected expenditures exceed projected revenues in any given year, the City Manager will need to identify steps to mitigate the shortfalls prior to presenting a balanced budget to the City Council for consideration during the annual budget development process.

It should be noted that the Forecast is a snapshot in time and will change as additional information is made available and incorporated into the fiscal projections. Inflation and the uncertainty associated with the economy has increased the volatility of projecting future revenues.

The city prepares a long-term financial model for both capital and operating needs. It is imperative that the city plan for the impacts of development, the construction and operation of new public facilities, and planning resources needed to build them. Th e city prepares a ten-year operating forecast for the General Fund, a five-year Strategic Digital Transformation Investment Program, and a fifteen-year Capital Improvement Program. As part of the new Strategic Digital Transformation Investment Program and the Capital Improvement Program, the city annually calculates the amounts needed to pay for the projects and anticipated operating budget impacts. In this way, the city can anticipate the effects of development from both a capital and an operating perspective.

One important initiative the city has undertaken to ensure its financial health is the development of an Infrastructure Replacement Fund. With this fund, the city sets aside a portion of General Fund revenues on an annual basis for major maintenance and replacement of its infrastructure. Much of the city’s infrastructure is relatively new; thus, the city is just now experiencing the impact of

maintenance requirements. By setting aside funds now, the city’s residents can be assured that the proper maintenance and replacement will be performed, as needed, on streets, parks and many facilities for which the city is responsible.

Employee retirement costs continue to require ongoing prudent fiscal management. The City Council issued a pension funding policy to codify its commitment to ensure that resources will be available to fulfill the city’s contractual retirement promises to its employees, and to minimize the chance that the funding of these benefits will interfere with providing essential services to the community. The policy outlines a funding discipline to ensure that adequate resources will be accumulated in a systematic and disciplined manner to fund the long-term cost of benefits to the plan participants and annuitants. Overall funding levels of the city’s plans are reviewed annually to ensure the city’s funding level remains at least 80% – the city’s minimum targeted level. While this enhances the city’s funding position, risks remain in the system. Required employer contributions will continue to increase over the next few years and actual contribution increases could exceed expectations if future investment return rates or other factors are unfavorable.

The city’s Forecast considers the annual growth of all currently known elements of city revenues and expenditures. Projecting revenues is particularly difficult when considering rising inflation and impacts to consumer demand. When forecasting expenditures, some of the major factors considered are rising healthcare and workers’ compensation costs, underperforming pension programs, and general inflation in both personnel and operating expenditures. Currently, the city projects expenditure growth will outpace revenue growth in the near future. To support the increase in ongoing costs, the city will need to consider alternative options, such as ways to increase economic activity that will drive sustainable increases in the city’s current revenue base, an expansion of the city’s revenue base, or a reduction of the city’s current service offerings and associated costs.

The development and maintenance of balanced and reliable revenue streams will be the primary revenue objective of the city. Efforts will be directed to optimize existing revenue sources while periodically reviewing potential new revenue sources. One method to maximize existing revenue sources is to promote a healthy business climate. Revenue estimates will be prepared on an annual basis during the preparation of the budget and major revenue categories will be projected on a tenyear basis. Revenues will be estimated conservatively using accepted standards and estimates provided by the state and other governmental agencies. Alternative revenue sources will be periodically evaluated to determine their applicability to meet identified city needs. Sources of revenue will be evaluated and modified as necessary to assure a diversified and growing revenue base that improves the city’s ability to handle fluctuations in individual revenue sources.

Revenues from “one-time” or limited duration revenue sources will not be used for ongoing operating expenses. Fees and charges for services will be evaluated and, if necessary, adjusted annually to ensure that they generate sufficient revenues to meet service delivery costs. The city will establish user charges at a level generally related to the full cost (operating, direct, indirect and

capital costs) of providing the service, unless the City Council determines that a subsidy from the General Fund is in the public interest, in accordance with City Council Policy 95, Cost Recovery Policy for Fees and Charges for Services. The city will also consider market rates and charges levied by other municipalities of similar size for like services in establishing rates, fees and charges. Enterprise and internal service funds will aim to be self-supporting.

Major expenditure categories will be projected on a ten-year basis. The city will operate on a current funding basis. Expenditures will be budgeted and controlled so as not to exceed current revenues plus the planned use of any accumulated fund balances. Annual budgeted operating expenditures shall not exceed annual operating revenues, including budgeted use of reserves, unless directed by the City Council.

The City Manager shall prepare and submit to the City Council annually a proposed operating, strategic digital transformation investment program and capital improvement program budget and the budgets will be adopted by June 30 of each year. Budget status reports are prepared quarterly and posted on the city’s website. Because the budget is based on estimates, from time to time, it is necessary to make adjustments to finetune the line items within it. Various levels of administrative control are utilized to maintain the budget’s integrity. Program managers are accountable for the line-item level of control of their individual program budgets. Department heads are accountable for the fund level of control for funds within their departments. The City Manager is accountable for the fund level of control across departments, up to $100,000. The Finance Department oversees the general level of accountability related to budgetary integrity through systematic checks and balances and various internal controls.

City Council Policy 87, General Fund Surplus Policy outlines the use of surplus funds resulting from unrestricted General Fund actual revenues exceeding total actual expenditures, encumbrances, and commitments for a given fiscal year. It is the intent of the city to use all surplus funds generated to meet reserve policies, and the reduction or avoidance of long term liabilities. The city will not use year-end surplus funds to fund ongoing operations unless otherwise approved by the City Council.

The city will use surplus funds to replenish any General Fund deficiencies, up to the minimum level as set forth in City Council Policy 74, General Fund Reserve Policy and then any pension liability deficiencies, as defined in City Council Policy 86, Pension Funding Policy.

The City Manager is authorized to approve the carryforward of any unencumbered and unspent budget for a particular item equal to or less than $100,000 into the following fiscal year. These items will be one-time expenditures and not for ongoing services, programs or personnel. Any remaining surplus funds in excess of reserve and pension liability deficiencies and items equal to or greater than $100,000 will be brought forward for City Council approval.

The city adheres to long-range financial planning, which forecasts revenues and expenditures over a long-term period, using assumptions about economic conditions, future spending scenarios and other salient variables. Financial planning allows the city to execute overall strategies to support the process of aligning financial capacity with long-term service objectives. Financial forecasts are updated at least once a year, or more often if unexpected changes in economic conditions or other unforeseen circumstances exist. Any significant changes will be reported to the City Manager and the

City Council. Otherwise, these financial forecasts will be used as a tool during the development of the annual budget process and to set utility rates as needed.

The city formally mandates the levels at which reserves shall be maintained for the General Fund and utilities funds and informally sets minimum target levels for the internal service funds.

City Council Policy 74, General Fund Reserve Policy was most recently updated and approved by the City Council in June 2019. The purpose of the policy is to establish a target minimum level of designated reserves in the General Fund to:

• Reduce the risk of financial impacts resulting from a natural disaster or other catastrophic events;

• Respond to the challenges of a changing economic environment, including prolonged downturns in the local, state or national economy; and

• Demonstrate continued prudent fiscal management and creditworthiness.

The city commits to maintaining General Fund reserves (the term reserve refers to any unassigned fund balance) at a target of 40% of General Fund annual operating expenditures. The total reserve level will be calculated using the prior year’s adopted General Fund budgeted expenditures.

At the discretion of the City Council, reserve levels in excess of the 40% target requirement may be used for one-time opportunity cost purposes. Reserve funds will not be spent for any function other than the specific direction in the annual budget or by a separate City Council action.

As a general budget principle concerning the use of reserves, the City Council decides whether to appropriate funds from reserves. Reserve funds will not be spent for any function other than the specific purpose of the reserve account from which they are drawn without specific direction in the annual budget or by a separate City Council action.

The City Council approved City Council Policy 96, Utilities Reserve Policy in March 2023 to establish guidelines to ensure the fiscal stability of the potable water, recycled water and wastewater funds and provide guidance to staff in the management of each utility’s finances. These funds will target a reserve funding level of 100% of annual debt service costs, 120 days of operating costs, and 1% of system replacement value in emergency capital. The Wastewater Fund will target a reserve funding level of 50% of the five-year rolling average of annual spending on capital improvement projects while the Potable and Recycled Water funds will target 100% of this average. Also, the Wastewater Fund will target a reserve of 10% of rate revenues while the Potable and Recycled Water funds will target a reserve of 20% of rate revenues to provide a source of funds to smooth rates or avoid rate increases in the event of short- or mid-term disruption to revenues such as drought-related demand reductions. The city or the Carlsbad Municipal Water District’s potable water, recycled water and wastewater utilities will treat minimum reserve levels as practical reserve floors and allow reserves to increase or decrease as necessary within the minimum and target levels prescribed above.

The city’s Workers’ Compensation and Risk Management (General Liability) funds will maintain minimum reserves equal to the estimated outstanding claims as calculated by a third-party administrator. Additional reserve amounts may be set aside as deemed appropriate based on thirdparty actuarial studies completed at two-year intervals. During the annual budget process, the target

confidence level will be compared with the projected fund balance of each fund, and if the projected fund balance is greater than or lesser than the target, a plan to adjust the fund balance will be considered, using either or both increasing revenues through interdepartmental charges and onetime cash contributions from those funds contributing to the shortfall.

The Information Technology Asset Replacement and Vehicle Asset Replacement funds shall maintain minimum reserve levels defined as the amount of accumulated depreciation of capitalized assets based on the original cost of each capitalized asset and up to a maximum reserve level defined as the accumulated depreciation based on the estimated replacement cost of each capitalized asset.

The city has established a formal Investment Policy. It is the policy of the City of Carlsbad to invest public funds not required for immediate day-to-day operations in safe, liquid and medium-term investments that shall yield an acceptable return while conforming to all California statutes. It is intended that the policy cover the investment activities of all contingency reserves and inactive cash under the direct authority of the city. Investments of the city and its component units will be made on a pooled basis; however, investments of bond proceeds will be held separately if required

The city’s City Council Policy 86, Pension Funding Policy embodies funding and accounting principles to ensure that resources will be available to fulfill the city’s contractual promises to its employees. The policy objectives include using actuarially determined contributions, or ADC, provided by CalPERS to fund the full amount of the ADC each year, maintaining no less than a combined minimum 80% funded ratio, and demonstrating accountability and transparency by communicating all information necessary for assessing the city’s progress toward meeting its pension funding objectives.

In the event the city is unable to meet the minimum combined pension funded ratio of 80% with current resources (i.e., without borrowing or using reserves), the Finance Director will identify a reasonable period to return to a minimum 80% funded ratio status.

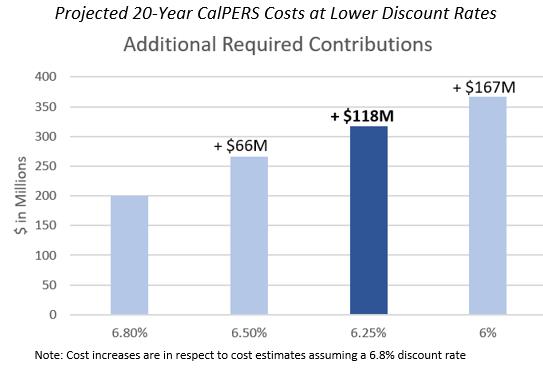

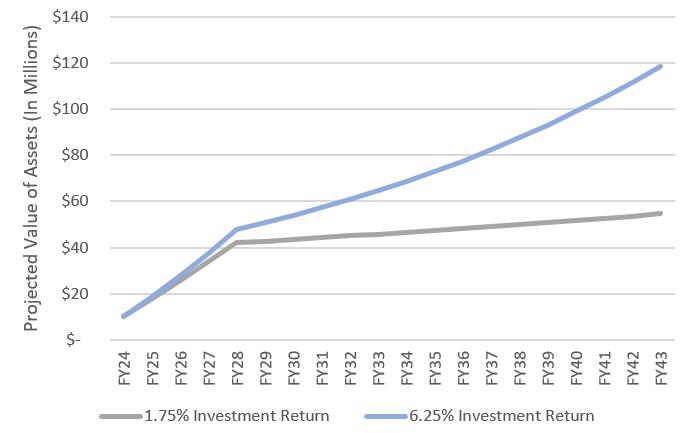

In an effort to mitigate pension rate volatility, manage the city’s funded status and enhance local control of city funds, the city established a Section 115 Pension Trust. The city’s Section 115 Pension Trust is a tax-exempt investment tool that allows local governments to pre-fund pension and retiree health costs. Once contributions are placed into the trust, assets from the trust can only be used for retirement plan purposes. Withdrawals may be made to either reimburse the city for retirement system contributions or to directly pay CalPERS. Benefits of the trust include (1) local control over assets, (2) pension rate stabilization, (3) potential for higher investment return than General Fund, and (4) diversification from CalPERS’ investments. Contributions from the General Fund are invested in accordance with City Council Policy 98, Pension Trust Investment Policy. In an effort to maintain a combined funded status of 80% and to fund the costs associated with a potential reduction in CalPERS’ discount rate, the trust is scheduled to receive a total of $40 million in principal contributions over five fiscal years, and assuming an annual rate of return of 6.25%, the trust is projected to accumulate sufficient assets to fund a potential discount rate reduction from the current 6.8% to 6.25%.

The city’s City Council Policy 91, Long Term General Fund Capital Funding Policy ensures the needs of the city are met and demonstrates continued prudent fiscal management by providing a funding source for long-term, large value capital purchases. Many city assets demand large capital expenditures, examples include roads, building, parks and information technology infrastructure. The city funds the General Fund portion of these necessary investments by adopting an annual budget that includes a transfer from the General Fund to one or more of the city’s long-term capital funds. These long-term capital funds include the General Capital Construction Fund, the Infrastructure Replacement Fund and the Technology Investment Capital Fund. The city commits to targeting a transfer to the city’s long-term capital funds of 6% of budgeted General Fund revenues. The transfers are proposed during the annual budget process or on an as needed basis for the City Council’s consideration.

Full versions of these policies and other City Council policies are available on the city’s website at www.carlsbadca.gov/city-hall/laws-policies/council-policies.

The appropriations limitation imposed by the state, otherwise known as the Gann limit, creates a restriction on the amount of revenue that can be appropriated in any fiscal year. The basis for calculating the limit began in fiscal year 1978-79 and is increased based on population growth and inflation. The appropriation limit applies only to those revenues defined as proceeds of taxes.

• Population growth of Carlsbad, OR

• Population growth within San Diego County, AND

• Growth in California per capita income, OR

• Growth in non-residential assessed valuation due to new construction in the city.

The factors used to calculate the fiscal year 2025-26 limit were:

• Population growth within San Diego County AND

• Growth in California per capita income.

The formula is outlined below:

year 2024-25 expenditure limit $630,004,237

Fiscal year 2025-26 limit (2024-25 limit x factor)

$673,537,530

Current appropriation of proceeds of taxes (Subject to the limit) $204,034,005

Gann Appropriation Limit

Appropriations Subject to Limit

The City of Carlsbad’s appropriation limit is currently over three times its annual appropriations. With such a large margin, it is unlikely that the city will reach the appropriation limit in the foreseeable future.

The City of Carlsbad has a AAA credit rating and is widely acknowledged for its financial stability and responsible management of resources. The use of debt has always been a primary issue in the development of the Capital Improvement Program and the policies put in place to implement the city’s Growth Management Program. Over the years, the city has issued millions of dollars of bonds and Certificates of Participation to fund streets, buildings, sewer and water facilities, open space acquisitions, and other infrastructure projects. The city is continually evaluating its outstanding debt as well as potential future issues to ensure that interest costs are kept at a minimum and the use of the bond funds is appropriate.

The Government Code of the State of California has established maximum general obligation debt limits for local governments within the state. The city’s outstanding general obligation debt should not exceed 15% (as adjusted by 25% per the law) of total assessed property value. As of June 30, 2025, the city’s calculated debt limit for general obligation debt was $1.7 billion.

The city currently has approximately $41.4 million debt outstanding as of June 30, 2025. Of that $41.4 million, $12.5 million is water construction loans and the remainder is debt of financing districts. Outstanding debt obligations of financing districts (special districts and/or assessment districts) within the city do not obligate the City of Carlsbad and are not paid from the city’s General Fund.

1. The final principal payment for the 2005 Construction loan was paid in fiscal year 2024-25.

2 The 2023 construction loan reflects total draws through fiscal year 2024–25 from the original loan amount of $4,601,000 Repayment is estimated to begin in fiscal year 2026–27

The city budgets on a modified accrual basis for all funds except for its enterprise and internal service funds, which are budgeted on a full accrual basis. This is consistent with the city’s basis of accounting as reported in its Annual Comprehensive Financial Report.

The city's Governmental fund budgets consist of:

• The General Fund

• Special revenue funds

• Capital project funds

To summarize, under this basis, revenues are estimated for the fiscal year if they are susceptible to accrual, e.g., amounts can be determined and will be collected within the current period. Principal and interest on general long-term debt are budgeted as expenditures when due, whereas other expenditures are budgeted for liabilities expected to be incurred during the current period or shortly thereafter to pay current liabilities.

Proprietary fund budgets are adopted using the full accrual basis of accounting whereby revenue projections are developed recognizing revenues expected to be earned in the period, and expenditure estimates are developed for all expenses anticipated to be incurred during the fiscal year. The city's proprietary fund types consist of enterprise and internal service funds because the city has municipally owned utilities or other enterprise activities.

Fiduciary funds are used if the city has a fiduciary or custodial responsibility for assets. The city currently budgets for one fiduciary fund, the Successor Agency to the former Carlsbad Redevelopment Agency.

The legal level of Budgetary Control is the fund level and expenditures should not exceed budgeted amounts at the fund level. Budgetary control is maintained through the city’s accounting system, as well as through monthly reporting on all revenue and expenditure accounts and other special reports summarizing the financial position of the city. The City Council adopts the formal budget for all funds prior to the beginning of each fiscal year and may amend the budget as necessary by City Council action throughout the year. All unencumbered, unspent appropriations expire at yearend unless specifically carried into the new fiscal year in accordance with City Council Policy 87, General Fund Surplus Policy.

Internal Controls exist within the accounting system to ensure safety of assets from misappropriation or unauthorized use or disposition and to maintain the accuracy of financial record keeping. These internal controls must be established consistent with the sound management practices based on the cost and benefit of the controls imposed. The cost of a control should not be excessive in relation to its benefit as viewed by city management. The internal controls in existence within the city’s system are sufficient to ensure, in all material aspects, both the safety of the city’s assets and the accuracy of the financial record keeping system.

Controls on the use and transfers of budget funds are outlined in the adopted budget resolution in the appendices of this document.

The budget of the city is organized based on funds, each of which is considered to be a separate accounting entity. The operations of each fund are accounted for by providing a separate set of selfbalancing accounts that comprise its assets, liabilities, fund equity, revenues and expenditures.

Detailed descriptions of each fund and a department/fund budget relationship matrix can be found in the appendices of this document. The various funds are grouped as follows:

• Affordable Housing

• Agricultural Mitigation Fee

• Buena Vista Channel Maintenance District

• Citizens’ Option for Public Safety (COPS)

• Community Activity Grants

• Community Development Block Grant

• Continuum of Care

• Cultural Arts Donations

• Encampment Resolution Fund

• Habitat Mitigation Fee

• Library and Arts Endowments

• Library Gifts and Bequests

• Lighting and Landscaping District 2

• Local Cable Infrastructure

• Median Maintenance District

• Opioid Settlement Fund

• Parking in-Lieu Fees

• Permanent Local Housing Allocation

• Police Asset Forfeiture

• Public Safety Grants

• Recreation Donations

• Rental Assistance/Section 8 Program

• Senior Program Donations

• Street Lighting Maintenance District

• Street Tree Maintenance District

• Tyler Court Apartments

• College Boulevard – Reach A

• Community Facilities District 1

• Gas Tax

• Gas Tax-Road Maintenance and Rehabilitation

• General Capital Construction (GCC)

• Grants-Federal

• Grants-State

• Infrastructure Replacement (IRF)

• Park in-Lieu Fees (PIL)

• Planned Local Drainage Area Fees (PLD)

• Public Facilities Fees (PFF)

• Technology Investment Capital

• Transportation Development Act (TDA)

• Traffic Impact Fees (TIF)

• TransNet

Internal Service Funds

• Workers’ Compensation

• Risk Management

• Vehicle Maintenance

• Vehicle Replacement

• Information Technology Operations

• Information Technology Replacement

Enterprise Funds

• Potable Water Operations

• Potable Water Connection

• Potable Water Replacement

• Recycled Water Operations

• Recycled Water Connection

• Recycled Water Replacement

• Wastewater Operations

• Wastewater Connection

• Wastewater Replacement

• Solid Waste Management

• Storm Water Protection

• Watershed Protection

• The Crossings Golf Course

Private Purpose Trust Fund

• Successor Agency to the Redevelopment Agency

The California Society of Municipal Finance Officers, or CSMFO, recognizes those entities with highly professional budget documents with two levels of certificates. The first level is the “Meritorious Budget Award,” which requires the entity to meet a very specific list of criteria defined by CSMFO. The second level is the “Operating Budget Excellence Award,” which requires that the organization meet even higher criteria which effectively enhances the usability of the document.

In preparing the budget for fiscal year 2025-26, the city has once again followed CSMFO’s award criteria. This budget document will be submitted to CSMFO for the fiscal year 2025-26 budget award program.

Government Finance Officers Association of the United States and Canada, or GFOA, presented a Distinguished Budget Presentation Award to City of Carlsbad, California, for its Annual Budget for the fiscal year beginning July 1, 2024. To receive this award, a governmental unit must publish a budget document that meets program criteria as a policy document, as a financial plan, as an operations guide and as a communications device.

This award is valid for a period of one year only. In preparing the budget for fiscal year 2025-26, the city has once again followed GFOA’s award criteria. This budget document will be submitted to GFOA for the fiscal year 2025-26 budget award program.

This section includes a summary of the revenues and expenditures included in the fiscal year 2025-26 operating budget. Spending is presented by funding source, department and type, such as personnel or maintenance and operations. For context, previous years’ spending levels are often presented alongside this information. Financial tables are presented to the nearest hundred thousand; rounding differences may exist.

Detailed summaries of department services and expenditures are included within the five main sections of the operating budget following this overview. The five city branches include:

• Public Safety

• Public Works

• Community Services

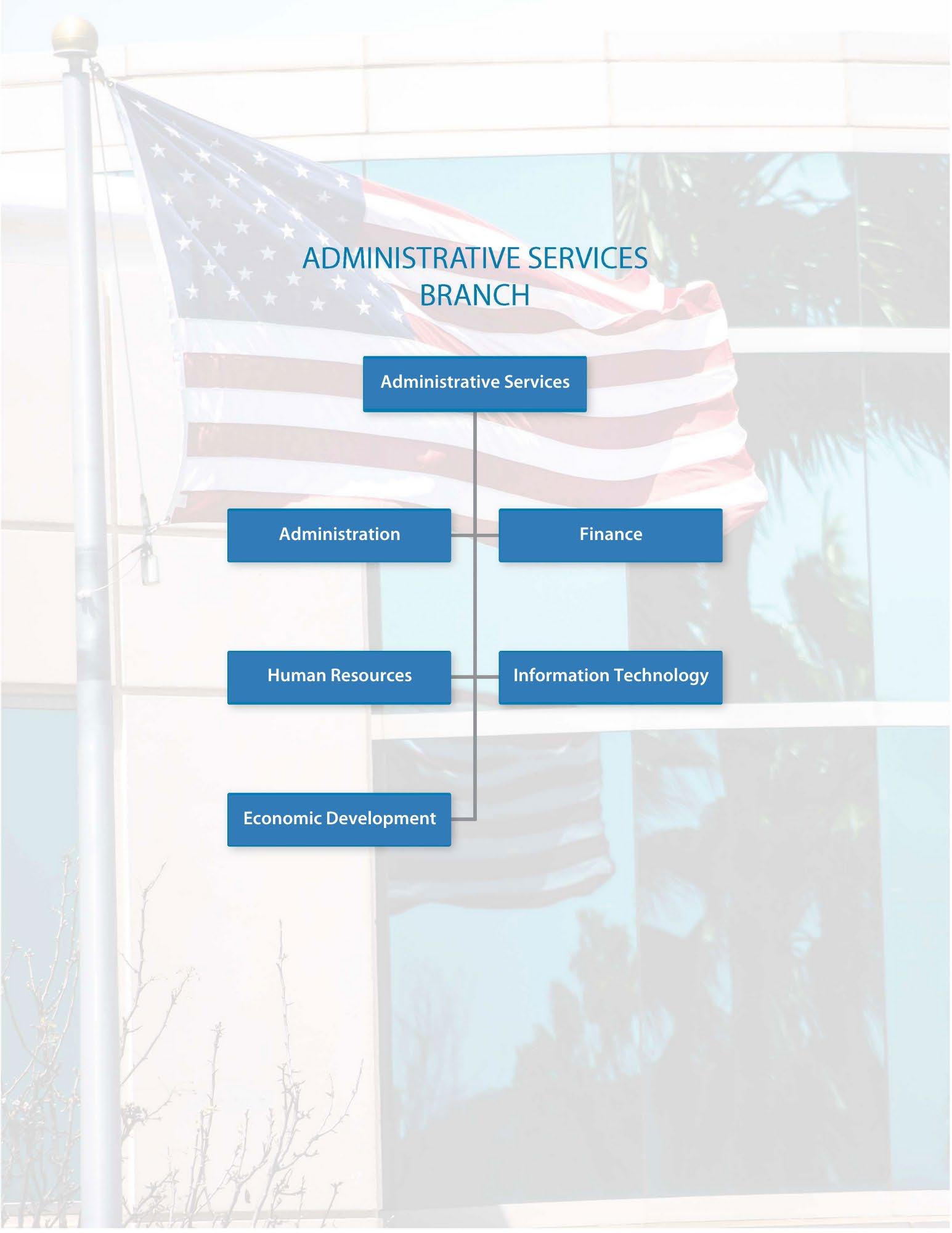

• Administrative Services

• Policy & Leadership

Information about the city’s approach to planning for and funding digital transformation efforts throughout the city is included in the Strategic Digital Transformation Investment Program section.

Information about capital projects, such as construction of roads and pipelines, the development of parks and construction and maintenance of city facilities, is included in the Capital Improvement Program section.

The Operating Budget for fiscal year 2025-26 totals $458.6 million, with revenues for the year estimated at $441.1 million. General Fund revenues are estimated at $243.3 million and General Fund budgeted expenditures are $242.4 million, which includes an additional $5.6 million in one-time transfers to the General Capital Construction Fund and Infrastructure Replacement Fund and $2.0 million to the Storm Water Fund Excluding the one-time uses of General Fund surplus, the General Fund budgeted operating expenditures are $234.8 million.

Revenue estimates for the Operating Budget indicate the city will receive a total of $441.1 million in fiscal year 2025-26, a change of 1.1% or $4.9 million above the estimated fiscal year 2024-25 revenues. General Fund revenues are expected to increase by $4.3 million or 1.8% compared to the prior year’s adopted revenues and $2.7 million or 1.1% compared to fiscal year 2024-25 estimates. Special Revenue funds are projected to decrease by 28.8% or $10.1 million over fiscal year 2024-25 estimates driven by one-time Encampment Resolution funding received in fiscal year 2024-25 Enterprise Fund revenues are projected to increase by 17% or $18.1 million in the upcoming fiscal year. Internal Service Fund revenues are decreasing over the prior year’s adopted budget and to fiscal year 2024-25 estimates. This is primarily driven by one-time transfers in from the General Fund to fund Workers’ Compensation in fiscal year 2024-25. The Successor Agency Housing Trust is no longer receiving any material revenue as the loan owed to the General Fund has now been fully repaid More detailed information on the city’s revenue sources is provided in the following discussion.

The following table shows the total operating revenues anticipated to be received by the city for fiscal year 2024-25, as well as those budgeted for fiscal year 2025-26

General Fund revenues provide a representative picture of the local economy. These revenues are of particular interest as they fund basic city services such as Police, Fire, Library & Cultural Arts, Street and Park Maintenance and Recreation programs. The table below provides a summarized outlook of the General Fund revenues.

Sustained by pent-up demand following the COVID-19 pandemic and accumulated savings, the inflationary spike between March of 2021 and November of 2023 served as a boost for the city’s revenue sources like sales tax and transient occupancy tax. While these revenue sources sustained strong performance in fiscal year 2023-24, we began seeing customer demand decline in response to the sustained inflationary levels and diminishing levels of personal savings, despite the Federal Reserve’s attempt to slow inflation by increasing rates as high as 5.25% - 5.50%. This trend continued throughout fiscal year 2024-25 and was only exacerbated by the new federal administration’s policy changes, notably the implementation of tariffs on foreign goods. Recent trade policy changes including fluctuating tariff levels on imports from China, Canada, and Mexico have affected input costs and supply chains across the United States, with potential downstream impacts on Carlsbad’s manufacturing and clean tech sectors. Nationally, GDP contracted by 0.3% in the first quarter of 2025, largely due to import surges ahead of tariff implementation. In addition, proposed reductions to federal research grants and travel restrictions for federal agency staff could disproportionately impact Carlsbad’s life sciences and healthcare industries, which rely heavily on federal funding and collaboration.

There is still much uncertainty surrounding tariffs and their macro- and micro -economic impacts on the nation; however, even in recent months, there has been extreme market volatility and further consumer demand pullback with the risk of recession greatly looming.

Nearly 80% of General Fund revenues are derived from three sources: property tax, sales tax, and transient occupancy tax, or TOT. Sales tax and TOT revenues tend to be much more sensitive to changes in economic conditions, unlike property tax revenues, which remain relatively stable because of the mitigating effect of Proposition 13, which limits annual growth in assessed values.

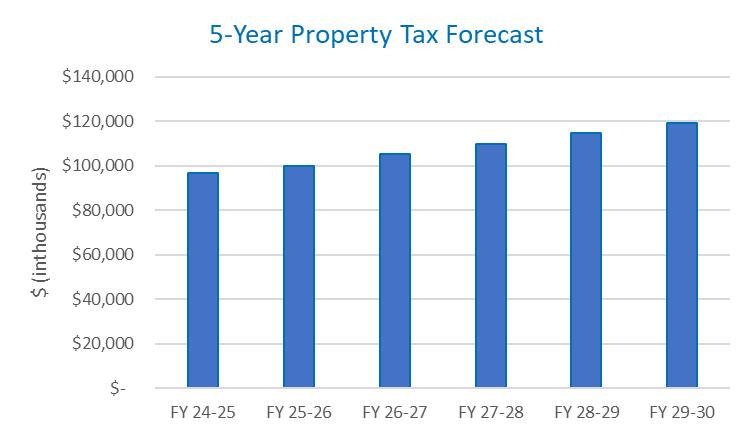

Property tax, the largest source of General Fund revenues, is expected to grow by $3.2 million, or 3.3%, over the previous year’s estimates Despite the extended rise and recent reduction in interest

rates from the Federal Reserve, Carlsbad’s residential real estate market has seen positive year-overyear growth, increasing by 4.3% to a $1.54 million median price as of March 2025 The new federal administration’s implementation of tariffs has intensified uncertainty in the markets. Future growth is expected to remain relatively flat although strong and continued demand for relatively limited supply may stabilize any adverse factors. Commercial property assessed values are expected to remain relatively flat given current interest rates coupled with the tariff implementation In response to the unprecedented inflationary increases experienced over the last three years, the Federal Reserve’s interest rate hikes have made purchasing a home more difficult for borrowers. Inflation has cooled off and the Federal Reserve has begun reducing target rates; however, with the implementation of tariffs, it is not yet known which direction interest rates and home values will trend throughout the upcoming fiscal year. Proposition 8 allows owners to have their property temporarily revalued if market value is lower than the factored base year value, posing a risk that commercial property values could temporarily decrease.

Assessed values on the residential real estate side are expected to grow modestly, capped by California’s Proposition 13. Adopted in 1978, Proposition 13 limits the annual increase in assessed values for property. Under this proposition, assessed values (and the related property tax) can grow by no more than 2% per year. The value upon which the tax is based is only increased to the full market value upon the sale of a property. In recent years, residential activity has been driven by low interest rates on mortgages, pent-up demand that built during the shutdown and an increase in the ability to work remotely. Now, increased rates, tariff implementation, and market uncertainty will likely have adverse impacts compared to prior periods.

Changes in property tax revenues lag behind changes in the housing market, as the tax revenue for the upcoming fiscal year is based on assessed values from the previous January. Thus, the taxes to be received for fiscal year 2025-26 are based on assessed values as of January 1, 2025

Property taxes tend to grow slowly unless there is a significant amount of development-related activity. In past decades the city has seen robust growth in property tax revenue due to new development, high turnover of existing homes and double-digit growth in housing prices. However, as opportunities for new development and growth lessen, development-related revenues have slowed.

In addition to current interest rates levels and the implementation of tariffs, slower development combined with minimal commercial property transactions creates more uncertainty regarding future growth.

Sales Tax by Category Third Quarter 2024

State & County Pools, 19%

Restaurants & Hotels, 14%

General Consumer Goods, 17%

Fuel & Service Stations, 3%

Autos & Transportation, 32%

Building & Construction, 2%

Business & Industry, 11%

Food & Drugs, 2%

Sales Tax revenues generally move in step with economic conditions but overall, Carlsbad’s economy has absorbed the inflationary increases experienced since 2021. With the pandemic and its fiscal impacts behind us, new uncertainty stems from the new federal administration and the implementation of tariffs. Consumer demand has been diminishing as a result of the sustained levels of inflation; however, as inflation continues to cool off, impacts from tariffs are not yet quantifiable.

The onset of the pandemic in March 2020 resulted in swift reductions in sales tax revenues. During fiscal year 2020-21, sales tax levels generally correlated with shelter-in-place mandates. As restrictions were lifted, the city’s sales tax levels recovered. While the city ended fiscal year 2019-20 with $38 million in sales tax revenues, that figure increased in 2020-21 to $44 million in sales tax revenues. Fiscal year 2021-22 experienced the most accelerated recovery, ending the year at a historic high of $51.2 million in sales tax revenues. The fiscal year 2022-23 and 2023-24 sales tax estimates reflected uncertainty surrounding market and economic conditions like inflation and impacts to disposable income. Despite the levels of inflation, growth has been positive over this period; however, fiscal year 2024-25 indicated a slowdown in consumer demand as a result of the sustained levels of inflation and the uncertainty regarding tariffs. Although we are seeing an overall increase in sales tax revenues year over year, taxable receipts have declined by approximately 5% compared to the previous year after factoring for one-time adjustments. As a result, staff have proposed a conservative estimate of $57.8 million in budgeted revenue for fiscal year 2025-26 which represents a decrease of $1.5 million, or 2.6%, over fiscal year 2024-25 estimates.

As indicated in the chart on the previous page, the city’s sales tax base is heavily weighted in the transportation (comprised heavily of new auto sales) and general retail sectors, which combined account for over half of the taxable sales in Carlsbad. New auto sales are highly elastic or responsive to changes in price in comparison to economic trends, and tax revenues from new auto sales fell precipitously during the recession, from $6.7 million in 2007 to $4.4 million in 2009. Since that dip, auto sales tax revenues have grown steadily, reaching a high of $19.8 million for the four quarters ended June 30, 2024 Much of the positive performance in fiscal year 2023-24 was due to a correction of an error made by one particular auto dealer in how they were reporting and remitting their taxable receipts. Projections in fiscal year 2024-25 are estimated at $18.6 million, representing a $1.2 million or 6% decline, indicating a reduction in consumer demand resulting from sustained inflationary levels coupled with uncertainty surrounding the implementation and impacts of tariffs. Similar trends are expected across multiple industry groups including business and industry, fuel and service stations, and general consumer goods.

Sales tax revenues include those received under Proposition 72, a 0.5 cent increase in California sales tax for the funding of local public safety services.

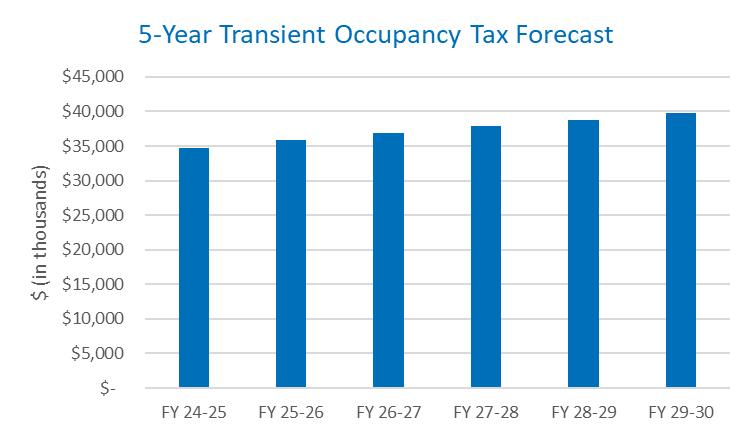

The third highest General Fund revenue source is Transient Occupancy Tax, also known as TOT or hotel tax. TOT was the revenue category most adversely impacted by COVID-19. From historic highs of $26 million in fiscal year 2018-19, the city experienced year-over-year decreases of 27% and 16%. Recovery from the pandemic was estimated conservatively; however, fiscal year 2021-22 TOT revenues proved otherwise, reaching a historic high of $32.4 million driven by the easing of restrictions, pent-up demand and an increase in average daily room rates. This trend continued in fiscal year 2022-23, whereby actual revenues exceeded conservative estimates that were applied to account for sustained levels of unprecedented inflation. Although fiscal year 2023-24 reported an overall revenue slowdown, likely driven by sustained inflationary levels, fiscal year 2024-25 is projected to result in a $1.0 million or 3.0% increase year over year. Although there is much economic uncertainty, mainly around tariffs, it is not anticipated TOT will experience as much adverse impact as

other revenue sources like sales tax. The fiscal year 2025-26 budget estimates TOT to increase by $1.0 million or 3.0% compared to the previous year.

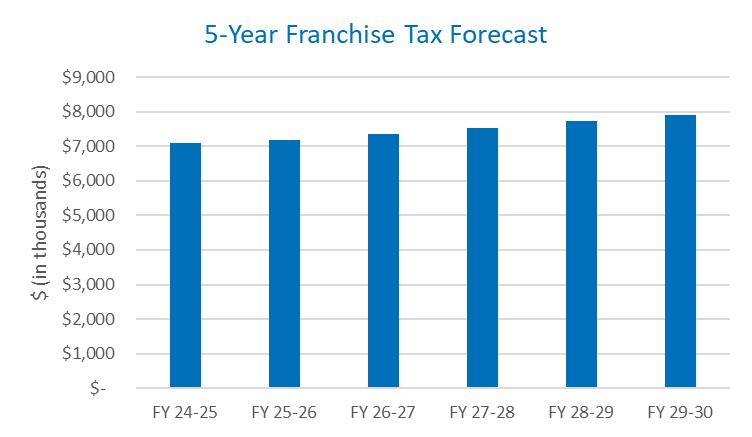

Franchise Tax revenue has experienced volatility in recent years and is projected at $7.2 million in fiscal year 2025-26. Franchise taxes are paid by certain industries that use the city’s right-of-way to conduct their business. The city currently has franchise agreements for cable TV service, solid waste services, cell sites, fiber optic antenna systems and gas and electric services. The solid waste franchise fee has experienced minor revenue increases that mirror growth in population and changes in rate structures. Cable TV franchise revenue is expected to slightly decrease from $1.26 million in fiscal year 2024-25 to $1.2 million in fiscal year 2025-26. This revenue source will most likely remain stable or decline in future years as more subscribers cut cable services and move to online streaming services.

In April 2021, a new franchise agreement for solid waste was approved with Republic Services of San Diego. The city receives 7.5% of revenue collected as well as an annual payment of $0.9 million in support of AB 939 and a $1.4 million storm water fee. Fiscal year 2024-25 solid waste franchise tax revenue is projected to end the year with $2.47 million and fiscal year 2025-26 is projected to slightly increase to $2.53 million.

San Diego Gas & Electric pays franchise taxes for the use of the public land over which they transport gas and electricity. The city also receives an “in-lieu” franchise tax based on the value of gas and electricity transported on SDG&E lines but purchased from another source. The “in-lieu” tax captures the franchise taxes on gas and electricity that is transported using public lands, which would not otherwise be included in the calculations for franchise taxes due to deregulation of the power industry. Fiscal years 2022-23 and 2023-24 experienced strong increases as a result of increased rates on both the gas and electric sides; however, fiscal year 2024-25 experienced rate declines of approximately 20%. As a result, SDG&E franchise tax revenues decreased from $4.5 million in fiscal year 2023-24 to $3.3 million in fiscal year 2024-25. Based on preliminary projections from SDG&E, fiscal year 2025-26 is expected to remain relatively flat compared to the previous year.

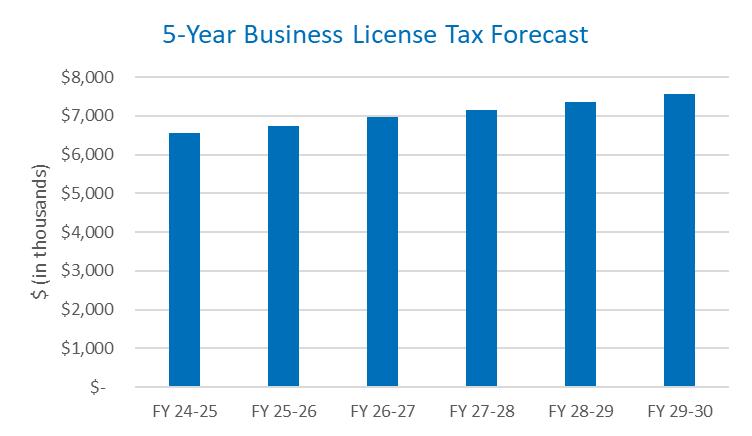

Business license taxes are closely tied to the health of the local economy and are projected to increase to $6.8 million in fiscal year 2025-26. This represents growth of $0.2 million or 3% when compared to last year’s current estimates Increases in business license taxes tend to correlate with sales tax revenue increases as businesses either pay taxes based on the amount of their gross receipts or based on set fees. There are currently about 10,043 licensed businesses in the City of Carlsbad, 592 more than in the prior year with 6,744 of them located in the city

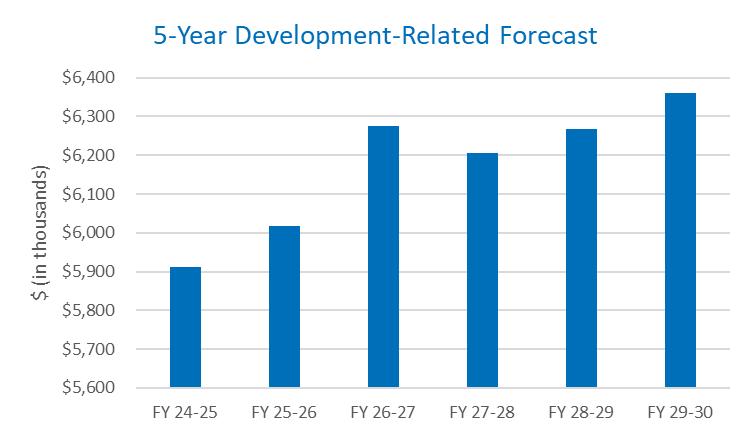

Development-related revenues are derived from fees for planning, engineering and building permits, and fees paid by developers to cover the cost of reviewing and monitoring development activities, such as plan checks and inspections. These revenues are difficult to predict as many of the planning and engineering activities occur months or years before any actual development.

Over the last 10 years development-related revenues have fluctuated in line with increases and decreases in residential, commercial and industrial development. In fiscal year 2025-26 the city expects a 4.2% increase in development related revenues to approximately $4.8 million. This follows a 16% increase between fiscal year 2023-24 and 2024-25 The projected increase in development -related revenues is tied to the volume and type of development projected to be permitted, multi-family versus single-family, and the revenues derived from building fees which occur in the early stages of development. Increases applied to these charges for services are made in accordance with City Council Policy 95, Cost Recovery.

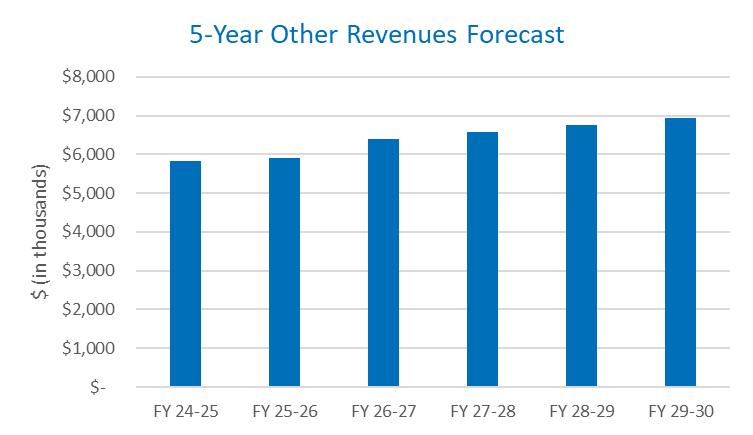

The All other revenue category comprises all other sources of revenue in the General Fund other than those mentioned above and are projected to decrease by $0.5 million in fiscal year 2025-26 representing a 1.7% change from fiscal year 2024-25 estimates. The main revenue sources contributing to this category are described in more detail below.

Interdepartmental charges are generated through engineering services charged to capital projects, reimbursed work from other funds and miscellaneous interdepartmental expenses charged to funds outside the General Fund for services performed by departments within the General Fund. General Fund miscellaneous interdepartmental charges are expected to increase by 2.5% compared to the prior year’s adopted budget, based on the inflationary index applied to the chargeback in offcycle years in which an updated cost allocation plan is not completed.