The Marine Insurer

NEWS & ANALYSIS IN THE MARINE MARKETS

Lossprevention remainskeyfocusin marinesector

Geopolitics: The world remains an uncertain place

l Tariffs: Impacting the ability to do business

l Climate change: Marine market adapting to risks

l Middle East: Safe havens emerging

l Sanctions: Difficulties in supporting valid claims

l Piracy: Surge in Asian water attacks

The real cost of tariffs and sanctions

After the best part of a year of fast-moving tariffs and continued sanctions, the true cost of those political decisions is being felt across the world and throughout the marine insurance sector.

Rapidly rising costs and uninsured elements of policies are adding up to a tariff nightmare for many who are faced with enormous price rises to add to an already expensive post-Covid world.

And then there is the human cost – the people whose valid claims are being caught up in sanctions, leaving widows without compensation after the death of husbands on the high seas. From both an ethical and an accounting perspective such stories are costing the industry dearly.

Reputation is a fragile thing and such stories only serve to damage the sector as insureds who thought their claims would be paid in full realise that the tariff element has been excluded, or the widow is left struggling to cope blame the insurance company for their woes.

The marine industry can be slow in reacting to such situations and, as a result, can unfairly take the blame. So, it is good to see more climate change-related legislation coming into force that hopefully will serve to improve the sector’s reputation in one vital area.

Meanwhile, reputations aside the marine insurance industry continues to pay out claims emanating from geopolitical risks, such as the war in Ukraine, the Red Sea and beyond.

They say that “no news is good news” but perhaps it is time for the sector to stand up and start trumpeting its successes, instead of quietly absorbing the criticism?

It’s a really packed issue this month so I hope that you find time to settle back and enjoy the read.

Liz Booth, Editor, The Marine Insurer

Loss prevention must remain key focus in maritime sector

Every year, marine insurer Allianz Commercial produces an analysis of total losses and incidents in shipping in its annual Safety and Shipping Review. Global head of marine risk consulting, Captain Rahul Khanna highlights some of the key insights from the 2025 edition

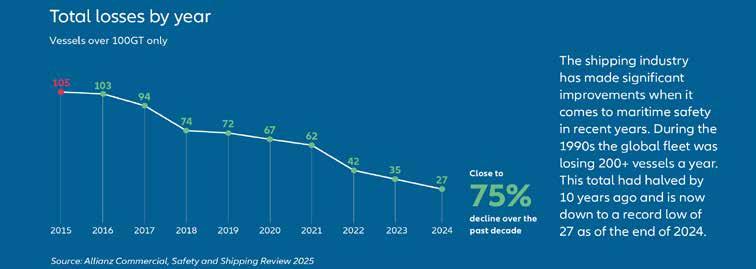

Given that as much as 90% of international trade is transported across oceans, maritime safety is critical, with the shipping industry making significant improvements in recent years. During the 1990s, the global fleet lost 200+ vessels a year. This total had halved by 10 years ago and is now down to a record low of 27 as of the end of 2024.

This compares with 35 a year earlier (vessels over 100 gross tonnage [GT]), down by around 20%, with a 75% decline in total losses reported in the past decade (105 in 2015).

The South China, Indochina, Indonesia and the Philippines region is the main loss hotspot globally in the past year, together with the British Isles and the East Mediterranean and Black Sea (four total losses each), and in the past decade (169).

A huge volume of imports and exports flow through the region, resulting in high levels of shipping traffic, which is reflected in the number of incidents. Overall, the past decade has seen 681 total losses reported across the shipping world.

Fishing vessels accounted for close to 40% of lost vessels during 2024 (10), followed by cargo (6) and chemical/ product vessels (3). Foundered (sunk) was the main cause of total loss across all vessel types (12), accounting for close to 50%. Fire/ explosion ranked second (7), remaining stable with fishing vessels the main casualties. More than 100 total losses of vessels have been caused by fires in the past decade.

The number of reported shipping casualties or incidents around the world actually increased by around 10% during 2024 (3,310 compared to 2,963). The British Isles saw the highest number (799), followed by the East Mediterranean

TOTAL

LOSSES BY YEAR

and Black Sea (694).

The British Isles is also the top location for the most incidents in the past decade (5,613), accounting for 20% of 28,331 reported incidents. Machinery damage/ failure accounted for more than half of all shipping incidents globally (1,860) in 2024, followed by vessel collision (251) and fire/explosion (250).

Despite the ongoing trend for fewer large losses, challenges remain. Shipowners are trying to operate vessels safely within an ever-changing and dynamic regulatory framework and do the right thing, but this is becoming more difficult, given they have to manage a host of complex issues from conflicts, sanctions and tariffs, to the risks posed by the shadow fleet, to the emerging challenges that decarbonisation brings.

The relevance of political risk and conflict as a potential cause of maritime loss is increasing with heightened geopolitical tensions.

Partial and attritional losses remain a major concern and although the industry has made progress on the risks associated with large vessels, this does not mean they are all under control. Fires, collisions and groundings continue to occur due to a lack of mitigation and understanding of risk.

Loss prevention and risk mitigation practices and processes must filter down to the grass roots. Ensuring safety will continue to require a significant effort across the industry.

The annual report identifies loss trends and highlights risk challenges for the maritime sector. Here are four interesting takeaways from the report:

> The industry faces an increasingly volatile and complex operating environment, marked by attacks against shipping, vessel detentions, sanctions, as well as the fall-out from incidents involving damage to critical sub-sea cables. Furthermore, the ripple effect of increasing protectionism and tariffs threatens to remake supply chains and shake up established trade relations;

> While the claims environment was moderate last year, large vessel fires remain a concern. The number of incidents

overall increased during 2024 to a decade high of 250 across all vessel types, our analysis shows, up by 20% year-on-year. Around 30% of these incidents occurred on either container, cargo or roll-on roll-off vessels (ro-ros) (69).

> Allision incidents such as the container ship Dali and the Francis Scott Key Bridge in Baltimore last year, and the incident with a navy vessel and the Brookyln Bridge in May 2025, generated news headlines around the world. Our analysis shows there were close to 200 incidents (184) of vessels hitting port or harbour infrastructure last year, the fifth most frequent cause of shipping incidents around the world, behind machinery damage/failure, collision (involving vessels), fire, explosion and wrecked/stranded (grounded).

> The so-called “shadow fleet”, vessels engaged in illegal oil trades and also linked to sabotage incidents, has grown in size since the war in Ukraine commenced, posing a serious threat to maritime safety. There have already been many fire, collision and oil spill incidents involving these vessels. Clean-up costs for an oil spill could be in excess of US$1bn, depending on location.

“The number of reported shipping casualties or incidents around the world actually increased by around 10% during 2024 (3,310 compared to 2,963). The British Isles saw the highest number (799), followed by the East Mediterranean and Black Sea (694).”

Innovation needed for emerging risks

George Jones, global sales leader, marine, cargo & logistics, Marsh, explains how insurance innovation is unlocking opportunities in marine, cargo

and logistics

Global trade uncertainty and supply chain risk — driven by geopolitical instability, climate change, and shifting trade policies — present challenges to cargo owners and supply chain operators.

According to the Global Risks Report 2025, these challenges are top of mind among decisionmakers given their potential impact on trade, supply chains, product distribution, critical national infrastructure, food and energy security and, ultimately, companies’ sales, reputation, profitability and even survival.

As a critical link in global supply chains, the maritime sector’s response to these challenges is of broad importance.

More recently, tariffs have introduced further complexity to the trade landscape, with significant implications for cargo owners and supply chain operators.

These challenges are forcing the marine insurance industry to refocus on innovation and improve solutions, enabling it to stay ahead of trends, manage risks effectively and seek new opportunities for clients.

TIME IS EVERYTHING

In today’s fast-paced and interconnected economy, timely delivery of goods is essential for operational efficiency.

Delayed cargo shipments - whether due to severe weather events, operational disruptions, or increased tariff or sanctions compliance - can have far-reaching implications on operations, reputations, and finances.

While traditional cargo insurance policies typically cover physical loss or damage to goods, they often exclude expenses directly related to delays.

To address this, cargo owners and supply chain operators are increasingly seeking out innovative insurance products.

One option is parametric insurance, which provides predetermined payouts when specific events occur, such as adverse weather conditions or vessel performance issues.

Despite heavy reliance on key routes for the transportation of goods, limited redundancy exists in the maritime industry.

Many of the world’s busiest ports rely on inland waterway navigation for accessibility, including five of the biggest seaports in Europe.

Inland waterways are particularly vulnerable to the effects of climate change, with the potential for trade to be significantly curtailed if there is insufficient water for the draft of a laden vessel.

When the load factor of multiple vessels is reduced in periods of low water, the costs per ton of transported goods increases. During Europe’s drought in 2022, low water levels in the Rhine River led to a 75% reduction in cargo capacity on some vessels.

Many waterways rely on locks to facilitate the successful passage of vessels. During high water levels, locks may face operational restrictions or closure. During extremely low water levels, there may be limited water available to fill the locks. The Panama Canal has experienced the effects of this, with some vessels reportedly paying $2.4m to skip queues caused by low water levels.

The Mississippi river which is fundamental for ensuring global food accessibility: up to 60% of US grain exports and 78% of the world’s exports of feed grains pass through the river, is only navigable for vessels when water levels exceed nine feet. Extended droughts and flooding can shut down the channel for days or more, leading to delays, loss of perishable goods and disruption.

A parametric policy potentially could be structured around the depth of a river or a canal, triggering a payout if levels drop below or rise above a certain height.

Parametric insurance is gaining traction due to advances in technology and data analytics that enable more precise and rapid

“Parametric insurance is gaining traction due to advances in technology and data analytics that enable more precise and rapid risk underwriting for shipowners, operators and port terminals.”

risk underwriting for shipowners, operators and port terminals. Marsh works with technology providers that can evaluate voyage exposure to delay, which can then support the development of parametric solutions for our clients.

CHARTING NEW COURSES

Economic trade shifts and climate change are forcing (or enabling) many operators to explore alternative shipping routes. This requires adaptations in ports and supply chain infrastructure to support these routes.

For instance, while newer routes, such as the Northern Sea Route, offer potential, they can be hindered by inadequate infrastructure and unsuitable ports.

Increased accumulation in warehouses, ports and distribution centres can create significant bottlenecks that cause disruption. The growing size of vessels and water levels can also heighten the risk of port blockages.

Port landlords typically purchase property insurance, while operators tend to purchase both property and liability coverage. Recent innovations include the introduction of port blockage insurance, which is designed to cover losses from blockages, and port trade disruption insurance, which is designed to address a range of perils that might interrupt cargo flow, such as the impact of geopolitical events or weather-related incidents. These policies are designed specifically for port owners and operators, not cargo owners.

ENHANCING PRODUCT SUITES

Logistics companies generally purchase property and liability insurance to protect against claims made by customers or third

parties regarding lost or damaged cargo.

As these companies expand their service offerings to generate additional revenue streams, they may want to consider shippers’ interest policies to extend cargo coverage to their customers. These products can offer cost-effective cargo coverage for small consignors due to the bulk purchasing of the logistics provider.

Larger cargo-owning companies with extensive transit and storage volumes may prefer to negotiate stock throughput coverage to protect their operations throughout the supply chain.

STRENGTHENING THE SUPPLY CHAIN

Maritime supply chains face other threats — labour strikes, cyberattacks and workforce issues — that can disrupt operations and create ripple effects throughout the global economy.

For example, potential US port fees on China-built ships could limit the availability of ships needed to move agriculture, energy, mining, construction and manufactured goods around the world.

Considering the potential widespread impacts of supply chain disruption, it is important for marine, cargo and logistics operators to understand the challenges they face and identify vulnerabilities in their operations. This understanding can inform a comprehensive risk management and insurance strategy to enhance resilience.

Proprietary systems such as Sentrisk and BrokerSafe can analyse supply chain risks and assess trucking carrier safety records. Sentrisk identifies potential choke points and reputational risks, while BrokerSafe helps cargo owners and freight brokers evaluate carrier safety in trucking fleets. Knowledge and data are powerful enablers that can facilitate better assessment of exposures and risks. These tools are part of Marsh McLennan’s broader effort to provide comprehensive risk management solutions to clients.

MANAGEMENT, MITIGATION, AND INSURANCE

As businesses adapt to shifting trade policies, staying informed about evolving risks and reviewing insurance strategies is becoming increasingly important. Marsh solutions can empower organisations with the knowledge and insights needed to enhance their board-level and real-time decisions.

For instance, Sentrisk, draws on data to help companies proactively manage current and emerging supply chain risks; consulting teams can support companies’ resiliency building and risk mitigation efforts; and brokerage and claims teams transfer risks via insurance and assist in claims recovery in the event of a loss.

Insurance and risk management strategies underpin global supply chains and it is essential that you understand the unique risks you face and the offerings available. Marine, cargo and logistics teams can draw on their expertise and experience to help cargo owners, ports and terminals, shipping and logistics companies adapt and thrive in this evolving landscape.

Coverage clarity is financial clarity

Rob Prichard , claim specialty practice leader-energy/marine IMA Corp, argues that the rise of tariffs has a material impact on cargo insurance and the duties clause becomes a strategic imperative for executives and insurance buyers

In today’s global trade environment, US tariffs have evolved from a policy lever into a material financial exposure. For companies importing goods into the US, duties and tariffs can inflate shipment values by millions of dollars annually. Yet many cargo insurance programmes fail to account for these costs adequately, leaving organisations exposed to unrecoverable losses when claims arise.

At the center of this matter lies a deceptively simple provision: the duties clause in cargo insurance policies. Often overlooked, this clause determines whether duties, tariffs and taxes are included in the insured value of goods.

For CFOs, risk managers and strategic insurance buyers, understanding and negotiating this clause is essential to protecting the balance sheet and ensuring claims recoveries reflect the actual cost of loss.

A DECADE OF DISRUPTION

In the past 10 years, US trade policy has shifted from relative stability to aggressive interventionism. Tariffs, once used primarily for targeted protection, have become central to economic and geopolitical strategy.

From 2015 to 2024, successive administrations imposed a series of tariffs on imports from key trading partners, including China, Mexico, Canada and the European Union. These duties, typically ranging from 10% to 25%, were tied to disputes over intellectual property, trade imbalances and national security.

This trend has accelerated since President Trump returned to office in January 2025. Tariffs are now deployed as strategic tools under the International Emergency Economic Powers Act (IEEPA), with national emergencies declared in response to drug trafficking, illegal immigration and trade deficits.

These declarations have enabled sweeping “Liberation Day” tariffs; blanket levies on nearly all imports, with rates ranging from 10% to 50% depending on origin and product category. The impact has been profound:

•Tariff revenue has surged, with more than $158bn collected since January 2025;

•Importers face rising landed costs, often absorbing duties or passing them on to consumers;

•Inflationary pressures have intensified, particularly in electronics, automotive parts and consumer goods; and,

•Legal challenges are mounting, with a pending Supreme Court case expected to determine the scope of presidential authority under IEEPA.

For insurance buyers, this evolving tariff regime introduces a new layer of complexity. Duties that were once predictable and modest are now volatile, substantial, and politically driven; often representing 20% to 30% of shipment value. Without proactive adjustments to insured values and clear policy language, companies risk significant shortfalls in the event of a cargo loss.

ENTER THE DUTIES CLAUSE

Cargo insurance policies typically include language such as:

“This insurance covers the insured value of goods including freight, duties and taxes, as declared at the time of shipment, unless otherwise excluded.”

However, this clause is not standardised. Key variables include:

• Declared value: Duties must often be explicitly included in the declared value. If omitted, they may not be recoverable even if the clause appears to allow it.

• Policy endorsements: Some insurers require specific endorsements to cover duties and tariffs. Without them, coverage may default to excluding these costs; and,

• Valuation basis: Policies written on CIF (cost, insurance, freight) terms do not automatically include duties unless negotiated.

This ambiguity can lead to disputes during claims, especially when duties represent a substantial portion of the

“Ambiguity can lead to disputes during claims, especially when duties represent a substantial portion of the shipment’s value. In today’s tariff-heavy environment, overlooking this clause can result in significant uninsured losses.”

shipment’s value. In today’s tariff-heavy environment, overlooking this clause can result in significant uninsured losses.

CLAIM SCENARIO: THE COST OF AMBIGUITY

Let’s examine a real-world example:

• A US-based electronics distributor imports $6.5m worth of goods from China;

• $1.5m of that value stems from recently imposed tariffs;

• The cargo policy was bound at $5m, excluding duties;

• During transit, the container is damaged in a port accident and declared a total loss;

• The insurer pays $5m, citing the declared value and policy terms; and,

• The importer absorbs a $1.5m uninsured loss.

This scenario is not hypothetical. It reflects a growing trend in claims disputes in which duties are excluded due to unclear policy language or insufficient declarations.

For executives, this is not just a coverage gap, but a balance sheet event with implications for financial reporting, shareholder value and procurement strategy.

STRATEGIC RECOMMENDATIONS

To mitigate exposure and ensure coverage alignment, marine insurers and buyers should consider the following:

1. Audit cargo policies thoroughly

Review policy language to confirm whether duties and tariffs are covered or excluded. Pay close attention to valuation clauses, declaration requirements and any exclusions that may apply. This audit should be part of the annual renewal process and revisited whenever trade policy shifts.

2. Align insured values with landed costs

Declared values should reflect the full financial exposure, including:

• Base cost of goods;

• Freight charges;

• Duties and tariffs; and,

• Taxes and surcharges.

This alignment is critical to securing full indemnity in the event of loss. Failure to include duties can result in significant underinsurance and unrecoverable costs.

3. Engage brokers and underwriters proactively

Don’t assume coverage. Confirm it. Work with brokers to:

• Negotiate clear policy language;

• Secure endorsements that explicitly include duties; and

• Validate valuation methodology with underwriters.

This proactive engagement can prevent disputes and streamline claims recovery.

4. Monitor trade policy shifts in real time

Establish internal protocols to track tariff changes and adjust insured values accordingly. Treat tariff volatility as a dynamic risk factor requiring ongoing attention. Communicate changes to insurance partners to ensure coverage remains aligned with exposure.

EXECUTIVE CONSIDERATIONS: BEYOND THE POLICY

For senior executives, the duties clause is part of a broader conversation about enterprise risk management. It intersects with:

• Procurement strategy: Tariff exposure may influence sourcing decisions and supplier negotiations;

• Financial planning: Uninsured duties can disrupt cash flow and impact quarterly earnings; and,

• Regulatory compliance: Accurate valuation and documentation are essential for customs and insurance audits.

Treating cargo insurance as a transactional purchase is no longer sufficient. It must be integrated into strategic planning, with clear ownership and accountability across finance, legal and risk functions.

FROM CLAUSE TO COVERAGE STRATEGY

In today’s trade environment, the duties clause is not a footnote; it is a financial safeguard. As tariffs continue to evolve, companies must ensure that their cargo insurance programmes reflect the full scope of their exposure. This means negotiating clear policy language, declaring accurate shipment values and engaging insurance partners with precision and foresight.

For executives and insurance buyers, the takeaway is clear: coverage clarity is financial clarity. By elevating the duties clause from operational detail to strategic priority, organisations can protect their assets, preserve margins and navigate global trade with confidence.

By Joe Kramek , president & CEO,

World Shipping Council, the liner shipping trade association with offices in Brussels, London, Singapore and Washington, D.C.

Shipboard fires remain one of the most significant concerns for both ocean carriers and the marine insurance sector. They are now at their highest level in more than a decade – with liner shipping experiencing a shipboard fire every 60 days. Recent events unfortunately continue to show the deadly and devastating effects of ship fires.

The common thread is mis-declared or undeclared dangerous goods, shipments that enter the supply chain incorrectly documented or concealed, bypassing the safeguards that protect crews and vessels.

Raising the bar on cargo safety: An industry approach to preventing fires

When those containers ignite, the consequences extend well beyond the ship itself, triggering losses that cascade through insurers, reinsurers and P&I Clubs alike.

Inspection data underlines the scale of the problem.

Reporting to the International Maritime Organization by national authorities shows deficiencies in 11% of inspected containers, including incorrect documentation and improper packing. Each of these deficiencies represents a potential spark for disaster.

NO ABSTRACT PROBLEM

For underwriters and reinsurers, this is not an abstract problem. Fires linked to dangerous goods have been behind some of the largest claims in recent memory, spanning hull, cargo, P&I and liability lines simultaneously. The severity of these incidents is precisely what makes them so damaging from an insurance perspective.

The World Shipping Council’s (WSC) new cargo safety programme (CSP) is an industry-led solution to this unacceptable situation. At its core is a digital screening tool, powered by the National Cargo Bureau, that examines container bookings at the time of entry.

Using keyword analysis, trade pattern recognition and machine learning, the system highlights bookings that may represent undeclared or mis-declared dangerous goods. Carriers can then review these alerts, treat them in accordance with their risk assessment policies, and if necessary, escalate them for physical inspection before loading.

What makes this initiative significant is not only the technology, but the scale and standardisation behind it. Carriers representing more than 70% of global container capacity have committed to the programme at launch. That scale allows for shared algorithms, common inspection standards and a feedback system that incorporates lessons from real-world cases. As the system is used, it learns, refines and strengthens.

The launch of the WSC CSP has also drawn support from the wider risk and insurance community. The International Group of P&I Clubs welcomed the initiative as “an important step in enhancing safety in the carriage of containerised cargo by identifying the risks of mis-declared shipments,” recognising its potential to protect vessels, seafarers and the marine environment and supporting its adoption across the sector.

That endorsement matters. It signals recognition that this is not simply a carrier-driven operational measure, but a structural improvement in how risk is managed throughout container shipping.

For insurers, the benefits are clear. Fires caused by misdeclared dangerous goods are high-frequency and highseverity events. Any initiative that intercepts cargo earlier in the chain directly reduces the probability of such incidents.

Common inspection standards reduce variability across carriers, making it easier to assess risk consistently. In time, the feedback loop will generate a deeper dataset on dangerous goods compliance and cargo deficiencies, with the potential to inform both industry practice and underwriting.

ADDITIONAL PROTECTION LAYER

It is important to stress that the WSC CSP does not replace the legal obligation of shippers to declare dangerous goods accurately. That obligation is the cornerstone of safe shipping and is clearly established in international law.

What the programme does is provide an additional layer of protection when that obligation is not met. It is a pragmatic acknowledgement that misdeclaration continues to occur at scale and that the cost of inaction is measured not just in financial losses, but first and foremost in lives.

For seafarers, the stakes are personal and immediate. They are the first and often only responders when a fire breaks out at sea. Too many have lost their lives to fires that began in containers packed far from the vessel, with goods declared in ways that obscured their risks. They should not be exposed to hazards they cannot see and cannot prepare for.

By detecting risks earlier and raising the standard of inspections, the WSC CSP gives crews a chance of avoiding

these situations altogether.

For insurers, the WSC CSP should be seen as a structural improvement in the risk profile of container shipping. It cannot eliminate fire risk and it will not prevent incidents caused by other factors, but it addresses the most persistent and preventable driver of shipboard fires.

The success of this initiative will ultimately be measured in fewer fires, fewer catastrophic losses and stronger compliance with dangerous goods regulations. The data generated through common screening and inspections will, over time, provide a clearer picture of where and how misdeclaration occurs. That insight has the potential to sharpen operational responses, policy discussions, regulatory and enforcement efforts alike.

Maritime risk has always been shared risk and the WSC CSP reflects that reality. Carriers have taken the lead by investing in shared standards and technology. Governments must continue to enforce declaration rules consistently.

Shippers and freight forwarders must fulfil their obligations honestly and accurately. And the insurance industry has an important role to play, in recognising, supporting and reinforcing efforts that demonstrably reduce risk.

Every ship fire avoided is a life protected, a vessel saved, a cargo delivered safely and a major claim that does not materialise. In a sector where the cost of failure is measured in the billions, the launch of the WSC CSP represents a rare and necessary opportunity: a coordinated, scalable and data-driven intervention that directly addresses one of the industry’s most complex issues.

Ship fires will not disappear entirely, but with this programme in place, the industry has a far stronger chance of preventing the next major loss before it begins. That is good news for crews, for carriers, for insurers and for the global economy that depends on all three.

“For seafarers, the stakes are |personal and immediate. They are the first and often only responders when a fire breaks out at sea. Too many have lost their lives to fires that began in containers packed far from the vessel, with goods declared in ways that obscured their risks.”

Navigating climate volatility

Robert Cairoli , (left), vice president, and MK Cheah , senior risk engineer, marine at Liberty Specialty Markets APAC argue that insurers, underwriters and marine engineers must adapt to climate change by embedding climate science into risk models, incentivising resilience and supporting infrastructure upgrades

The Asia Pacific (APAC) region’s maritime sector has been impacted by two growing climate trends: worsening weather disruptions and the lure of Arctic shipping routes.

With densely populated coastlines, vital global trade routes and increasing exposure to extreme weather, the region faces complex and growing risks. For the marine insurance industry, the consequences are already evident: port closures, cargo delays, infrastructure damage and rising claims.

As climate change intensifies, so does the urgency for insurers to reassess traditional models and adopt innovative strategies that can both mitigate losses and build long-term resilience.

OPERATIONAL RISKS

There has been a rise in the frequency and severity of climaterelated disasters impacting APAC, with Asia heating up faster than the global average.

Monsoons, tropical cyclones and heatwaves are only some of the weather events impacting the ports and shipyards in the region, subjecting them to new risks and impacting the protection of machinery and the safety of storage.

Torrential monsoon rains are overwhelming drainage systems at key ports in countries such as India, Bangladesh and China.

These floods have caused widespread equipment failure, downtime and cargo damage.

PROSPECTS AND PERILS

Global warming has caused the Arctic to melt at a rapid pace, allowing the Northern Sea Route (NSR) to become a viable alternative to the Suez Canal, reducing transit distances between Asia and Europe by up to 40%.

NSR traffic reached a record high in 2024, growing to nearly 38 million tonnes, a tenfold increase since 2014.

China is advancing the Polar Silk Road initiative, while Japan, South Korea and Singapore are exploring Arctic shipping viability through separate national and regional efforts.

Despite the rising temperature, significant hazards in the Artic persist. Navigation continues to be challenged by polar storms, floating ice and poor visibility. The route lacks the infrastructure and emergency response capability to handle such risks, while communication blackouts and scarcity of port services can turn minor incidents into crises.

To mitigate such risks, there are safety regulations imposed by the International Maritime Organisation on those using the passage, including mandatory ice-class vessels, significantly raising voyage costs.

As a result, insuring the NSR is complex and leads marine insurers to apply stricter underwriting terms, including higher premiums, ice-class verification and seasonal limits.

MARKET IMPACTS

Natural catastrophe losses globally have surpassed $100bn

annually for the past five years. In the past decade, the APAC region has seen the highest number of marine losses of vessels over 100GT.

Premiums are rising for facilities located in typhoon zones or low-lying floodplains although ports that invest in climate resilience, such as elevated docks or storm gates, may receive adjusted rates. To address these risks, we are shifting from historical loss data to forward-looking risk models, incorporating sea-level projections, storm surge simulations and localised climate scenarios.

Traditional models do not fully incorporate evolving climate patterns, such as rising sea temperatures, shifting storm tracks, or compounding urban vulnerabilities. Moreover, data gaps in Southeast Asia hinder granular risk modelling.

Regulators in Singapore, Hong Kong and Australia now require insurers to integrate climate risks into solvency assessments and board-level reporting, and joint efforts by governments and industry are underway to deploy weather stations and digitise port risk profile. Additionally, industry consortia are supporting knowledge sharing and decarbonisation efforts. We partner with researchers to gather accurate data, refine models and help clients mitigate exposures.

ENGINEERING AND RISK MITIGATION

Ports across APAC are engineering relevant infrastructure to mitigate extreme weather risks. For example, Singapore’s Tuas Port has raised quay walls, retrofit drainage systems

“As climate change intensifies, so does the urgency for insurers to reassess traditional models and adopt innovative strategies that can both mitigate losses and build long-term resilience.”

and relocated critical systems above flood levels. In anticipation of rising sea levels, Singapore’s Terminal 5 airport is being constructed on reclaimed land, elevated up to 5.5 meters above sea level. Additionally, taxiways are designed with a slight slope to aid drainage and the drainage system is engineered to remain effective even as sea levels increase.

As a standard safety measure, most shipyards now implement real-time weather alerts and heat protocols, with hot work rescheduled to cooler periods. Regular safety drills ensure that port staff are prepared for typhoons and flooding events. Additional business continuity planning measures include backup routing, alternative berth arrangements and contingency power solutions.

On-site risk surveys for clients can identify pain points such as exposed control panels or unsecured container stacks. With a global footprint and deep regional insight, we are wellpositioned to support APAC clients navigating both localised weather risks and international shipping challenges.

SHIFTING PARADIGM

As climate volatility continues to impact APAC’s marine industry, marine insurance plays a pivotal role. Traditional models are quickly becoming inadequate to handle the pace and impact of emerging threats.

Insurers, underwriters and marine engineers must adapt by embedding climate science into risk models, incentivising resilience and supporting infrastructure upgrades.

We are committed to supporting the marine industry mitigate the challenges posed by climate volatility head on. In the wake of climate-related disruptions, Our dedicated marine claims team ensures rapid response and recovery support, helping clients resume operations with minimal downtime. With strategic collaboration, sound engineering and agile insurance tools, together we can keep ports operational, cargo protected and trade flowing.

Marine insurance sector supports global maritime industry in tackling climate change

By Sophie Pollard , (left) partner, and Reema Shour , professional support lawyer/legal director, Hill Dickinson

In January 2025, global insurer Allianz published the latest edition of its annual Risk Barometer Report, which provides an overview of the major global risks that are a source of concern for businesses for 2025. The report is based on the outcome of a survey that received feedback from 3,778 respondents.

Cyber incidents, business interruption and natural catastrophes were ranked as the top three concerns for corporates globally. However, climate change achieved its highest ever position in the 14 years of the survey, climbing to number five in the top perceived risks, which is reflective of a new focus on climate change post-Covid-19 challenges.

Climate and nature related risks are on the rise and the financial implications for businesses are becoming more burdensome, whether they are a result of managing climate change transition risk, the increasing costs of regulatory compliance or due to operational disruptions caused by severe weather events and environmental impact.

Managing climate change transition risk through, for example, net zero strategies or decarbonisation, was identified as the key ESG/sustainability risk trend of greatest concern to the survey respondents.

One of the key actions being taken by companies to mitigate the direct impact of climate change is adapting or

increasing insurance cover. The report indicates that insurers are facing increasing global insured losses from extreme events that are occurring more frequently and are causing more severe effects because of climate change.

In the maritime context, the potential exposure of ports to climate related damage, disruptions and delays can have a potentially disastrous effect on global trade-led development. Severe and extreme weather can create hazardous conditions for ships and crew, posing an increased risk to life and property.

By way of example, the grounding of the container vessel, Ever Given, in 2021, which resulted in the obstruction of the Suez Canal, was partly caused by high winds during a sandstorm. It is vital, therefore, for all stakeholders in the international shipping industry to track the effects of climate change, implement best industry practice and comply with all domestic and international climate change regulations.

THE MARITIME REGULATORY LANDSCAPE

The global maritime sector is undergoing the challenging but crucial process of maritime decarbonisation. This is accompanied by an ever more stringent regulatory landscape.

The International Maritime Organisation (IMO) has set the shipping industry the target of reducing its greenhouse gas (GHG) emissions to achieve net-zero by or around 2050. As part of the IMO’s mandatory Net-Zero Framework, approved by the Marine Environment Protection Committee during its 83rd session (MEPC 83) in April 2025, there will be a new global fuel intensity standard and emissions pricing mechanism.

These measures are due to be formally adopted in October 2025 and will then come into force in 2027. They will become mandatory for large ocean-going ships of more than 5,000 gross tons, which emit 85% of the total CO2 emissions from international shipping.

Additionally, the FuelEU Maritime Regulation, which entered into force on 1 January 2025, requires a gradual reduction in the GHG intensity of fuels trading within the EU or European Economic Area (EEA), starting at a –2% reduction in 2025 to reach an 80% reduction by 2050.

Furthermore, since 1 January 2024, the EU Emissions Trading Scheme (EU ETS) extends to maritime transport emissions. Shipping companies must purchase and surrender EU ETS allowance for each ton of reported CO2 emissions in the scope of the system.

These two regulations are part of the European Commission’s Fit for 55 climate package that is aimed at reducing the EU’s GHG emissions by at least 55% by 2030 as compared to 1990 levels.

The UK has its own domestic maritime decarbonisation strategy, which aims for zero fuel lifecycle GHG emissions by 2050, with at least a 30% reduction by 2030 and an 80% reduction by 2040, relative to 2008 levels. The UK’s strategy is aligned with the IMO’s GHG strategy.

“The grounding of the container vessel, Ever Given , in 2021, which resulted in the obstruction of the Suez Canal, was partly caused by high winds during a sandstorm.”

POSEIDON PRINCIPLES FOR MARINE INSURANCE

The Poseidon Principles for Marine Insurance recognise the role that insurers play in the shipping industry and set a benchmark for responsible marine insurers, with guidance on how to achieve this.

Signatories to these Principles include P & I Clubs and other marine insurers. There are also affiliate members, as well as supporting partners (such as the International Union of Marine Insurance).

The Principles are aligned with the IMO’s policies and ambitions with regard to its GHG strategy and net-zero framework and apply globally to all shipping activities where vessels fall under the IMO’s purview.

While the IMO does not require marine insurers to report on the climate impact of their portfolios, the Principles enable insurers to assess and disclose their portfolios so that they promote responsible environmental impacts and incentivise international shipping’s decarbonisation.

The Principles are applicable to marine insurers that provide hull and machinery coverage. There are four key Principles:

(i) Assessment by signatories of the climate alignment of their hull and machinery portfolios;

(ii) Accountability through transparent data collection;

(iii) Enforcement by working with other stakeholders in the industry to meet the IMO goals; and,

(iv) Transparency by publishing the required information in the signatories’ Annual Disclosure Report and their own corporate reports.

The third Annual Disclosure Report was published in March 2025. This Report included contributions from nine signatories (representing 25% of the total deadweight of the world fleet within reporting scope) and nine affiliate members across 10 countries. Those contributing calculated climate alignment scores using vessel data from 2023.

While the results indicated that the climate alignment scores were almost +21% misaligned with the IMO’s minimum ambition in 2023, nonetheless it is anticipated that data-driven insights of this nature produced across the signatories’ H & M portfolios will inform shipowners on how to adapt to new environmental regulations and will support sustainable shipping practices going forward. As methodology improves, so will the accuracy and efficiency of the data provided in future reports.

COMMENT

Tracking emissions is becoming a standard practice in marine insurance. Initiatives of this nature will help marine insurers’ clients to comply with regulatory requirements and reduce their carbon footprint. In turn, it is expected that this will improve internal sustainability practices and contribute to the global reduction of GHG emissions from shipping.

Ethical claims management in a world of sanctions

Iryna Petrenko , manager of claims and P&I department, Nordic Marine Solutions, explains the difficulties and ethical challenges involved with the settlement of personal injury claims in a world riddled with sanctions. She argues that marine insurers must uphold their commitments to seafarers and their families through lawful, ethical and innovative approaches in this challenging environment

The maritime industry’s global nature has always posed unique operational and legal challenges.

However, the introduction of widespread geopolitical sanctions is reshaping how marine insurers manage claims, especially those concerning seafarers and their families.

The imperative to honour legitimate claims clashes with the complexities of sanctions regimes, creating unprecedented hurdles.

To illustrate, consider these recent cases that underscore these challenges.

In 2023, a Latvian seafarer employed on a Latvian-flagged vessel suffered a severe injury in Norwegian waters, losing a leg. His wife, the next of kin, lives in Russia and was to receive compensation related to his injury. Yet sanctions on Russia impede the transfer of funds, blocking payments.

Similarly, in 2025, a captain residing in an EU country died onboard a Liberian-flagged vessel in Sweden. His widow, living in Russia, awaited repatriation of the captain’s body and compensation claims, which sanctions again obstructed.

Further afield, a seafarer working on a Turkish-flagged vessel insured by an IG P&I club was fatally injured off West Africa. His widow resides in Crimea—a region subject to stringent UK, EU and US sanctions—adding layers of complexity to claim settlement.

These cases represent a troubling but real phenomenon: valid claims, grounded in contractual and ethical obligation, are delayed or blocked due to sanction-related constraints.

This situation presents a growing challenge for marine insurers: How to fulfill their commitments while operating legally and ethically in a fractured geopolitical landscape.

OPERATING IN A FRACTURED GLOBAL INDUSTRY

Shipping and marine insurance traditionally thrive on global integration, enabling the free flow of goods, capital and labour.

Today, frameworks of sanctions have fractured this seamless network. more than 30 countries, including key maritime players such as Russia, Iran, North Korea and Venezuela, face comprehensive or targeted sanctions.

These derive from multilateral organisations and unilateral efforts by the US, EU, UK and others. The result is a complex, rapidly evolving regulatory environment with conflicting rules and enforcement.

Shipping companies and insurers must navigate these turbulent waters carefully. Non-compliance risks include severe fines, legal penalties and lasting reputational harm.

The burden of navigating this dynamic landscape requires continuous monitoring, risk assessment and compliance measures built into operational practices.

WHY BUSINESS WITH RUSSIAN SEAFARERS PERSISTS

Despite mounting sanctions, maritime operations involving Russian seafarers continue. Four principal factors contribute:

First, a substantial number of Russian seafarers hold residency abroad and remain active globally.

Second, many seafarers reside outside sanctioned regions but have family in Russia, maintaining operational and financial ties.

Third, global labour shortages drive shipowners to employ Russian seafarers - an experienced and skilled workforce - despite sanctions.

Fourth, legal and contractual complexities, including differing flag state policies and employment agreements, allow Russian seafarers to work on certain vessels legally.

Understanding these realities is critical as marine insurers increasingly confront claims that cross sanctioned borders.

CLAIMS MANAGEMENT STRATEGIES

Claims teams have adopted several compliant strategies: Humanitarian licenses and carve-outs from regulators such as the US Office of Foreign Assets Control (OFAC), His Majesty’s Treasury and the EU authorise exception payments for medical care, repatriation and compensation.

However, the application process demands detailed documentation, legal expertise and can be lengthy. Despite their availability, such licenses remain underused among our clients.

Third-party intermediaries in jurisdictions such as Turkey or the UAE help facilitate payments indirectly in compliance with sanctions. Transparency and due diligence are indispensable to avoid risk.

Escrow or trust accounts in neutral locations serve as secure holding places for funds until sanction restrictions are lifted or appropriate approvals are granted.

Payments in kind or via local partners enable delivery of services such as funeral expenses when direct payments to sanctioned

individuals are barred.

It is important to remember that P&I insurance functions as an indemnity policy. In the context of personal injury claims, the insurer initially indemnifies the member the shipowner or operator—for their incurred losses.

Subsequently, it is the member’s responsibility to address any further rights or pursue recoveries as necessary. This framework places the onus on members to manage claims effectively, while the insurer’s role remains focused on compensating covered losses rather than making direct payments to third parties.

PRACTICAL BARRIERS TO REPATRIATION

Repatriation to sanctioned regions involves more than payments. Delays or blockages in sending vital documents such as death certificates, challenges in arranging transport often requiring cash prepayment, limited transport options and soaring costs collectively complicate timely repatriation.

For example, in Norway, obtaining an original death certificate from the Russian Consulate requires a physical visit by next of kin or an authorized representative. This process is hindered further by sanctions-related travel restrictions and scrutiny.

CLEAR LEGAL GUARDRAILS NEEDED

Claims handlers must observe legal limits rigorously. Willful blindness to sanctioned ownership or efforts to circumvent restrictions through indirect payments are illegal and jeopardise insurers’ standing. Thorough documentation of due diligence is non-negotiable and no payment, however small, can be presumed sanction-safe.

Every action must be defensible under international law to uphold organisational integrity and humanitarian principles.

BEST PRACTICES FOR SANCTIONS-ERA CLAIMS

Forward-looking claims teams invest in sanctions intelligence units that monitor regulatory changes in real time, access expert legal counsel and conduct ethics reviews combining compliance with humanitarian oversight.

Maintaining comprehensive audit trails ensures accountability. Continuous training equips brokers and adjusters to handle these complex claims effectively.

Above all, industry collaboration is crucial. No single insurer, P&I club, or stakeholder can meet these challenges in isolation.

CONCLUSION

The principle remains clear. Legitimate claims know no borders. While sanctions complicate matters, marine insurers must uphold their commitments to seafarers and their families through lawful, ethical and innovative approaches.

The current focus on the Russia-Ukraine conflict may soon expand to other regions, requiring the industry to be agile, prepared and principled.

By embracing transparency, legal rigour, and collective action, the marine insurance sector will continue to safeguard its core purpose - providing support and compensation for those who power global shipping, wherever they may be.

Global labour shortages drive shipowners to employ Russian seafarers - an experienced and skilled workforce - despite sanctions.

AXIS Energy Transition Syndicate 2050

The success of projects striving to deliver net zero rely on stable marine cargo supply chains. We can protect energy transition projects across the globe through our specialist Lloyd’s syndicate.

Marine Cargo activities and assets in scope

The transit, movement and storage of technologies, raw materials and non-fossil fuels required for energy transition projects and activities are all in scope. This includes, but is not limited to:

• Batteries and battery storage systems

• Electric Vehicles

• Solar PV

• Wind turbine components

• Biomass

Click here to find out more

For product and regulatory disclosures, click here.

Navigating an uncertain claims environment

With political tensions in the Red Sea intensifying, insurers are grappling with growing challenges in navigating the resulting uncertainties. Amy Eaves , (left) claims manager – marine, Lancashire Insurance Company & chair of the LMA/IUA Joint Marine Claims Committee, explores the key questions facing the claims market. She engages with Michelle Allingham , (below left) marine claims manager, Brit and Freddie Mehlig , legal director, DWF to examine both the claims market’s response and the legal implications shaping decision-making

Amy: What is the insurer’s role in the immediate aftermath of a major casualty?

Michelle: The most critical part of emergency response is minimising damage at the earliest opportunity, while reducing danger and exposure. Saving lives is always paramount. The insurer’s primary role in emergency response and salvage lies in enabling swift actions that reduce danger to the ship, environment and third parties.

Supporting and assisting the insured and the broker is of the utmost importance for an insurer in the immediate aftermath of a major casualty. Co-ordinating with the many different parties, engaging experts and providing financial support are just some of the actions that can be taken by the insurer.

Amy: How would you say emergency response in war-like scenarios has evolved through time?

Freddie: Each war situation brings about its own challenges. The scenarios are all unique and have to be individually considered. However, technology has advanced to such an extent so as to enable us to gather information quickly. While the ability to gather information and communications promptly is helpful, it must be balanced with prudent fact checking and analysis.

Michelle: When a major event occurs historically, it has often prompted the London market to revise and on occasion update policy wordings. It is essential that policy wordings are continually and thoughtfully reviewed to ensure they remain fit for purpose. For example, clauses developed for one crisis may not be suitable for the complexities of a subsequent crisis or more recent crisis.

Amy: How are insurers currently classifying losses in the Red Sea? As war risks, piracy terrorism or marine perils?

Freddie: The Institute wordings used in the London market invariably refer to the above perils as being “a war, civil war, revolution, rebellion, insurrection, or civil strife arising therefrom, or any hostile act by or against a belligerent power… or any terrorist or any person acting maliciously or from a political motive”.

Whether or not there is a state of war involving the Houthi’s may not be determinative. The war-like acts of firing missiles, use of UAVs or any other weaponry to cause physical damage to a ship and its cargo (or worse, inflict harm to crew) are likely to be captured within the above terms. At the time of writing, the UK has not prescribed the Houthis as a terrorist organisation under the Terrorism Act 2000. That being said, the definition of a terrorist in English law under the Terrorism Act 2000 would seem to cover the Houthis and their actions in the Red Sea to date. On that basis, the Institute wordings are likely to capture such acts by the Houthis.

There may be a more complex issue involving analysis of both the facts of any particular incident and the law of whether the incident was also proximately caused by “war” or “any hostile act by or against a belligerent power”, but it appears likely that this is an academic exercise with the end result being the same for the purposes of policy coverage. To date, however, there are no judgments dealing specifically with the issues arising from the Red Sea crisis and how such acts may be construed in the context of marine insurance under English law.

Amy: If salvage services are engaged during a hostile incident, how are awards likely to be treated?

Michelle: This is likely to depend on the salvage agreement

and whether it is conducted on LOF terms or another contractual framework. Deciding and agreeing on the framework promptly avoids the loss of the “golden hours” of a casualty response and may have a direct impact on the success (or otherwise) of the operation, and in turn the extent of any losses flowing from the casualty. Set terms, such as LOF, are capable of being agreed promptly, whereas bespoke contracts that are not already in place may delay the immediate response.

Amy: In light of the escalating threats to merchant shipping, what strategic considerations should insurers prioritise and what proactive measures are being adopted across the marine industry to mitigate the risks of targeted attacks?

Freddie: There are a wide range of views as to suitable risk mitigation for vessels transiting the Red Sea. The situation is a complicated multi-faceted problem, where the Houthi threat to merchant shipping in the Red Sea is a second or third order consequence of a long-standing geopolitical instability in the Middle East, particularly following the recent Israel/Hamas and Israel/Iran conflicts.

Michelle: There are variables which may well stretch beyond any sensible risk-mitigation that would have any material effect on a potential casualty. If a ship transits via the Red Sea, it does so with an increasingly evident chance that it may be attacked, directly or collaterally, and faces the risk of losses which stem from that approach. However, the total number of casualties and resulting losses from attacks in the Red Sea since late 2023 are dwarfed by the number of vessels which have transited the Red Sea without incident in that period. Losses are often infrequent but severe in nature. Insurers are there to assist in the risk mitigation strategy, while accepting there is a chance the adventure may be attacked, directly or collaterally, and price that risk accordingly.

Freddie: In terms of policy cover, insurers will always need to look carefully at the terms of the cover. For instance, if an insured has breached, and remains in breach, of a warranty at the time of a casualty, then there may be a remedy under Section 10 of the Insurance Act 2015. The days of breach of warranty resulting in covers being rendered void under the Marine Insurance Act 1906 are gone. Insurers need to therefore look carefully at the evolving nature of risks and any warranties and/or subjectivities that may reflect the risk presented to them when providing war risks or breach cover.

Amy: How do you view the importance of co-ordinating and managing the sometimes competing interests during an emergency response?

Michelle: Part of insurers’ role is to assist and guide

“At the time of writing, the UK has not prescribed the Houthis as a terrorist organisation under the Terrorism Act 2000. That being said, the definition of a terrorist in English law under the Terrorism Act 2000 would seem to cover the Houthis and their actions in the Red Sea to date. On that basis, the Institute wordings are likely to capture such acts by the Houthis.”

those affected by the incident in question. That may be challenging, with competing interests across various marine business lines, but good communication goes a long way to bringing those parties together for a common goal.

Amy: You’ve raised some interesting points Michelle. In recent years, the market has strived to enhance communication and co-ordination between hull, war and cargo interests and P & I Clubs. In 2023, the LMA / IUA Joint Marine Claims Committee released the “Guidelines for casualty liaison between the JMCC and the International Group”. This is a great example of promoting timely and

effective engagement, establishing a structured liaison framework and ensuring that delays are avoided where possible.

Amy: How have insurers handled sanctions concerns in the region?

Freddie: The question of sanctions is likely to be a live issue in terms of the response and use of assets in the region. Lead insurers should be aware of a range of aspects, such as the domiciles of followers or the involvement of US persons within their own information chain and what that can mean for sanctions issues. Being alive to it at the earliest opportunity is important in circumstances where financial institutions, with their own responsibilities and obligations, are, by virtue of the insurance cover provided, required to finance costs of an emergency response but are not able to do so without completing the required checks.

Michelle: Those competing points of view do not necessarily facilitate a prompt response operationally. Therefore, it is imperative that insurers are alive to any compliance issues, such as sanctions, so that they can be on the front foot of considering licences and proper notification to any relevant authorities, as well as alerting followers about the position for their own due diligence.

Amy: Could prolonged conflict in the Red Sea trigger a wider reconsideration of standard war clauses in marine contracts?

Michelle: As the geopolitical landscape continues to evolve, it is essential that war clauses adapt accordingly - ensuring that they remain fit for purpose for both the insureds that they protect and the insurers managing these risks. Without such clauses, international trade would face significant disruption. In response to the specific question of whether a conflict during a period of broader peace is covered, the answer is “unlikely on the face of it,” as these clauses are precisely designed to address such scenarios. The clauses have proven effective in situations such as the Red Sea conflict, though it has long been recognised that detention risks have shifted. A working group has been actively reviewing the wording around detention and cancellation.

SUMMARY

While tensions in the Red Sea continue to test the market, the conversations between Amy, Michelle and Freddie make clear that the marine insurance industry is not standing still. By combining commercial insight with technical expertise, insurers are better positioned to navigate uncertainty, strengthen collaboration and build resilience. The challenges may be complex, but they also present an opportunity for the London market to adapt and emerge stronger.

Finally, a recognised port of refuge in the UAE?

Jasmin Fichte , (left) managing partner and Shehab Mamdouh , managing associate, Fichte & Co argue that the UAE is not only reinforcing its status as a major maritime hub in the MENA region but is also setting a global precedent for responsible and strategic maritime governance. With its growing experience, infrastructure, and commitment to international best practices, the UAE is well-positioned to be recognised as a trusted and capable port of refuge in the global maritime community

There has been an alarming increase in ship casualties in recent years, often caused by fire in containers, in holds or in the engine room.

Recent casualties in the MENA region include the Maersk Franksfurt (fire and explosion), the ASL Bauhinia (fire in containers on board) and the Wan Hai 503 (fire and explosions), all of which eventually found a port of refuge in Jebel Ali, Dubai.

The weeks and months that are often passing between the incident and the final arrival in a port of refuge have led to a revived discussion about a recognised and regulated port of refuge in the UAE.

While it remains the liability of the ship operator to find a safe place of refuge for his vessel in distress, we have seen several cases where the refusal by coastal states to accept these vessels in distress has led to significant damage as seen in the X-Press Pearl incident.

In addition to the catastrophic environmental, navigational and commercial consequences resulting from her sinking, the Sri Lankan Court judgment on the X-Press Pearl, ordering a whopping $1bn compensation, following the sinking and environmental damage, is massively increasing the liabilities of the insurance companies and shipowners.

PORT OF REFUGE CONCEPT

A port (or place) of refuge serves as a critical safe haven for

vessels in distress at sea. Whether due to extreme weather, structural failure, mechanical breakdowns, onboard fires, or other emergencies, a ship may need to divert to the nearest safe port.

In such situations, the port of refuge becomes the vessel’s final recourse to seek assistance and mitigate the damages it has sustained as well as reducing risks to navigation and protecting human life and the environment.

In the absence of binding international regulations or conventions obligating coastal states to provide refuge to distressed vessels, the legal framework remains largely discretionary.

Art. 11 of the Salvage Convention (ratified by the UAE in 1993) provides that “a state party shall, whenever regulating or deciding upon matters relating to salvage operations such as admittance to ports of vessels in distress …take into account the need for cooperation between salvors, other interested parties and public authorities to ensure the efficient and successful performance of salvage operations for the purpose of saving life or property in danger as well as preventing damage to the environment in general.”

The United Nations Convention on the Law of the Sea (UNCLOS) would be the most obvious convention to regulate a member state’s obligation regarding a port of refuge, however, there is no mention of a port of refuge concept. Instead, Art. 2

recognises the right of states to regulate entry into their ports and further provisions establish the right of coastal states to take action to protect their coastline.

In general average terms, towing the vessel to a port of refuge is considered an allowable expense under the York-Antwerp Rules, However the Rules do not make any reference to specific regulations for port of refuge.

The Comité Maritime International acknowledged the lack of binding regulations and provided a draft convention to the International Maritime Organisation (IMO), which in turn decided to provide only a guideline (IMO Resolution A. 1184 (33)).

Also the European Maritime Safety Agency issued EU Operational Guidelines on Places of Refuge under the VTMIS Directive (Directive 2002/59/EC as amended).

The above guidelines are non- binding and serve solely as recommendations for for coastal states, shipmasters, salvors and other involved parties to guide their decisions when a vessel in need of assistance seeks a place of refuge.

COMPLEXITIES AND LIABILITIES

While the respective parties for the vessel in distress (and here we speak of the shipowner, operator, insurer, salvor, class, flag state etc) need to decide on a suitable port of refuge, so must the respective state assess the accompanying risks of accepting that specific vessel.

This decision involves significant commercial, environmental, financial and humanitarian risks.

The decision to divert a ship to a port of refuge involves collaboration between three key stakeholders:

1. Flag state: The country of registration assesses regulatory compliance and safety;

2. Port state: The host country evaluates environmental risks, infrastructure capability and overall feasibility; and,

3. Insurance providers & salvors: P&I clubs, underwriters, along with the appointed salvors ensure that all risks are properly assessed, managed, and covered financially.

This tripartite cooperation is crucial to ensure a successful and

legally sound response to maritime emergencies.

SELECTING A PORT OF REFUGE

Determining an appropriate port of refuge involves a multidimensional assessment, often with the salvor who signed the LOF being on the forefront. Key matters include:

• Safety and accessibility: The port must be reachable given the ship’s condition, with adequate depth, manoeuvrability and anchorage;

• Facilities and services: It must offer cargo handling equipment, waste management facilities and secure storage;

• Environmental and security factors: The port must not pose added environmental risks or be located in high-security threat zones; and,

• Regulatory compliance: Authorities must be willing and able to accept the distressed vessel under clear legal frameworks and insurance coverages.

PORT STATE RISK ASSESSMENT

Port states typically impose strict conditions before granting refuge. These are:

• A valid Lloyd’s Open Form (LOF) agreement has to be in place;

• Full P&I (protection & indemnity) and hull & machinery insurance coverages must be confirmed. Will the Club provide an LoI?;

• Appointment of reliable and experienced salvors;

• The port needs to have the experience and the relevant insurance cover; and

• A certified waste management company must be involved to handle any hazardous materials.

Each country has the discretion to set its own internal policies and requirements, which means decisions are often made on a case-by-case basis depending on the nature of the emergency.

There have been high-profile case in which ports denied entry to distressed ships, often due to environmental concerns or political sensitivities.

Notably, the Prestige and X-Press Pearl incidents resulted in catastrophic oil spills and vessel losses after being refused refuge. These tragedies highlight the urgent need for a more unified international approach to handling vessels in distress.

THE UAE’S ROLE

While the absence of binding international regulations makes it difficult to obligate any state to act as a port of refuge, the UAE has proven its capability and willingness to play this vital role Its recent actions underscore the country’s readiness to manage complex salvage operations, coordinate with multiple stakeholders and mitigate potential environmental and commercial risks.

Streamlining the processes by providing a national regulation of a port of refuge and officially recognizing respective UAE ports as such, would certainly provide involved parties with further confidence and we are confident that the UAE maritime administration is already working on respective regulations and will issue a ministerial resolution by the end of this year.

The UAE is not only reinforcing its status as a major maritime hub in the region but is also setting a global precedent for responsible and strategic maritime governance. With its growing experience, infrastructure and commitment to international best practices, the UAE is well-positioned to be recognized as a trusted and capable port of refuge in the global maritime community.

Lessons from recent disputes in cargo and hull

Mohamed El Hawawy , (left) partner and head of Middle East shipping and insurance, and Saif Almobideen , partner of Stephenson Harwood in Dubai, review latest important developments in marine claims and the rising role of the UAE in maritime law

The shipping industry faces constant risks, including physical damage, war, regulatory and environmental threats. Marine insurance, especially cargo and hull cover, remains fundamental to managing these exposures.

As global trade evolves, claims have become more complex, often involving policy interpretation and increased litigation. Staying updated is crucial for legal practitioners and insurers.

While English courts shape much of the legal framework, the UAE’s modernised maritime law has made it an increasingly important forum for casualties and disputes. Understanding both global precedents and UAE court practice is now essential.

SHIFTING RISKS AND LEGAL LESSONS

Cargo insurance has traditionally covered physical loss or damage during transit, however recent disputes reflect a marked shift towards matters such as delay, contamination, regulatory non-compliance and hazardous cargo. Courts are both reaffirming established principles and reassessing the allocation of risk between insurers and assureds.

In the Supreme Court’s decision of Alize 1954 [2021] UKSC 51, it was confirmed that a defective pre-voyage passage plan can render a vessel unseaworthy. As a result, shipowners cannot rely on Article IV HVR, the “error in navigation” defence, for losses arising from poor pre-planning.

This strengthens subrogation prospects for cargo insurers where defective planning links to loss, while requiring shipowners and their insurers to maintain higher standards in planning, updating navigational notices and auditable records.

In Global Process Systems [2011] UKSC 5 the court clarified that “inherent vice” in marine insurance excludes cover only if the loss is solely due to the natural behaviour or internal condition of the cargo, without any external accident or event.

Losses from unexpected or accidental events, even under ‘normal’ sea conditions, may still be insured. This remains influential as insurers often invoke “inherent vice” in structural or cargo failure incidents.

Recently, the allocation of the evidential burden in cargo disputes was reset in Volcafe Ltd [2018] UKSC 61, where the court held that the carrier, as bailee, must prove it took reasonable care of the cargo or that loss was due to an Article IV exemption.

This increases the importance of contemporaneous records for stowage, ventilation and cargo monitoring and has shifted litigation dynamics in favour of cargo insurers, that gain leverage from inadequate documentation.

Hazardous cargo disputes are now a leading concern, with fires, mis-declaration and improper packaging driving claims and prompting stricter warranties and survey requirements. Fraud and misrepresentation remain central.

In Versloot Dredging [2016] UKSC 45, the Court ruled that “collateral lies” do not void an otherwise valid claim. Contrastingly, Suez Fortune [2019] EWHC 2599 (Comm) confirmed that fraudulent claims, where the loss itself is fabricated or caused by the assured, remain irrecoverable. These reaffirm the importance of good faith, while clarifying the line between misrepresentation and outright fraud.

TRADITIONAL PERILS TO MODERN THREATS

Hull insurance, which covers physical damage to vessels, has evolved alongside the increasing complexity of shipping operations and related risks.

Disputes increasingly stem from machinery breakdowns, cyber exposures and the impact of sanctions on claims, though traditional matters such as perils of the sea, latent defects and war risks still dominate litigation.

The interpretation of “perils of the sea” and “latent defect” remains pivotal. In Global Process Systems Inc, the Court clarified that losses from genuine sea perils are covered, while inherent vice and ordinary wear are not. This distinction remains significant, especially where structural failures or machinery damage arise in borderline conditions.

The scope of general average was clarified in Herculito Maritime Ltd [2024] UKSC 2, confirming cargo interests’

“International insurers and shipowners increasingly turn to the UAE as a port of refuge, reflecting trust in its legal system and logistics services.”

liability for ransom payments and highlighting the need for hull policies to align with GA provisions and the York-Antwerp Rules. Similarly, The Renos [2019] UKSC 29 emphasised the importance of timely notices of abandonment and early expert repair estimates.

Cyber risk has further introduced new uncertainties. While traditional hull policies excluded cyber incidents, novel clauses like the CL380 and LMA cyber have narrowed coverage, requiring assureds to understand exclusions and available endorsements. Sanctions-related disputes also expose the need for precise policy drafting and coordination between hull and war risk covers, especially in high-risk regions.

MIDDLE EAST GLIMPSE

There has been a recent rise in marine casualties in the Middle East from fire, war risks to collisions and allisions. The UAE has emerged as a key jurisdiction for marine insurance disputes, with its modernised 2023 maritime law, which offers a clearer framework for casualties, limitation of liability and cargo claims. Crucially, the law now includes a dedicated chapter on marine insurance, distinguishing it from general insurance under the Civil Code. As such, international insurers and shipowners increasingly turn to the UAE as a port of refuge, reflecting trust in its legal system and logistics services.

Despite the pivotal role of Middle Eastern claims experts in investigating incidents and adjusting claims, practical challenges remain, especially in preserving evidence when access to vessels and documents are restricted.

Although some P&I Clubs and insurers have agreements with UAE authorities, delays to ship access can complicate investigations. Rapid mobilisation of surveyors and adjusters is therefore essential. UAE courts also give weight on technical and expert reports, and parties with detailed, contemporaneous records of stowage, navigation, or repairs are more likely to succeed, especially as UAE judges may appoint independent experts whose findings strongly influence outcomes.

TACTICS FOR SUCCESSFUL CLAIMS

A recurring challenge in cargo and hull claims is interpreting policy wordings and exclusions, with courts stressing the need for clarity and construing ambiguities against insurers.

The Insurance Act 2015 and recent case law have raised the bar for disclosure and fair presentation, limiting insurers’ ability to rely on technical breaches and reinforcing the principle of utmost good faith.