The Marine Insurer

MarineSanctions:insurers inaregulatory storm

l Natural catastrophes: Topping the risk list

l Standing firm? Is it time for the market to keep its discipline?

l Recruitment: Need for specialists highlighted

l Ship recycling: Turkey set for boom

l Complex claims: How to navigate a complex claim

04 Electronic trading

New model terms for electronic bills of lading have been launched in a major fillip in the development of electronic trading

08 Market outlook

Why specialist expertise and discipline matter most in volatile times

10 Marine market conditions

Marine insurance market must stand firm in the face of rising competitive pressures

12 Risk outlook

Nat cats and political risk top agenda for marine and shipping in 2025

16 When risks are special

Expert knowledge and skills are needed more than ever as risks become ever more complex and non-standard

19 Liability claims

The complex and tragic case of the MSC Flaminia shows how challenging and personal such a claim can be

24 Sanctions at sea

Shifting political alliances and new technology will continue to shape the maritime sector and role of marine insurance in the era of sanctions

28 EV fire risk

The burning question: Are car carriers prepared for the electric vehicle revolution?

30 Know your limits

The implications of Réseau de Transport d’Électricité v. Costain Limited & Others [2025] EWHC 73 (Admiralty) and the use of the Limitation Convention

32 Insurance Act 2015

Analysng the implications of a recent UK Court of Appeal decision on the application of the Insurance Act 2015

36 Scrap metal fires

Does the IMSBC code adequately address the risks in the case of scrap metal fires that continue to grab the headlines?

40 Ship recycling

Looking at Turkiye’s ship recycling industry, examining its economic importance and the environmental challenges it faces

44 Alternative fuels

Why existing liability regimes may not be fit for purpose in shipping’s energy transition

48 Crop transit

Explaining the complexities of identifying causes of spoilage in fresh produce transit

2025 is shaping up to be another extremely uncertain year. President Trump has just released a wave of global tariffs –something that will impact the marine trade very directly as economies look to reshape their trade patterns in response. Of course, we have no idea how long or how deep these impacts will be but, for now, it means greater uncertainty for the year ahead. So no wonder that the marine insurance world is looking for dedicated specialists to power their portfolios. That drive for specialists is essential as the sector looks to handle increasingly complex claims. While our example in this issue looks back to the Flaminia, there are plenty of lessons for more recent cases too which, as we have seen, are increasingly complex and require innovation and fresh thinking.

Innovation is also a crucial part of the latest technological advancements. For the marine world, that is about changing centuries of trading practices. Most notable is in the world of bills of lading. Electronic bills of lading (eBLs) have existed for decades however trust in the systems has been slow to build and there have been barriers with, for example, platforms unable to “talk” to each other.

Now the Singapore government is looking to drive through change with new Models Terms and its TradeTrust platform, both of which should give much needed impetus for the wider adoption of eBLs.

Environmental concerns are another area of continual change. This year will see the adoption of new recycling rules globally and Turkey, for one, is excited about the new opportunities those new rules might provide.

However, as Gard explores in this issue, there are also added risks – another opportunity for insurers but also risks that must be factored into pricing, which brings us in a neat circle back to the subject of maintaining market discipline.

Only time will tell what happens to the marine insurance market through the course of 2025 but what is clear a few months in is that we face many of the same challenges but also have plenty of opportunities to grasp.

Enjoy the read!

Liz Booth, Editor, The Marine Insurer

New model terms for electronic bills of lading have been launched in a major fillip to the development of electronic trading, as Liz Booth reports

Bills of lading have been an essential tool in the shipping industry for centuries, enabling global trade to function. However, cumbersome paper-based systems have slowed the process down in a technological age.

The introduction of electronic bills of lading (eBLs) has been met with scepticism by many and they are still far from widely accepted. This is reflected in the results of a survey carried out last year by the Future of International Trade (FIT) Alliance, which found that despite widespread awareness of eBLs, only 21% of bank respondents currently accept them.

The FIT Alliance pointed to a lack of interoperability as causing hesitancy around adoption and further engagement is needed to address those concerns. In recent years the Singapore government has been encouraging the sector to adopt eBLs, culminating in the development of the

TradeTrust framework.

Now, providing a new impetus for eBLs, the launch of TradeTrust’s Model Terms is designed to promote global adoption of the technology, enabling more trade to be managed electronically.

The Model Terms were launched in March, at the Marine Insurance Asia conference, as Singapore’s Infocomm Media Development Authority (IMDA), looks to encourage commercial interests worldwide to embrace new technology to digitalise transferable instruments in an open and interoperable manner.

IMDA has been at the forefront of technical innovation and driving change to electronic form. Among its developments is the TradeTrust framework, which standardises digital trade with enhanced security and legal certainty for the international trade ecosystem. It allows trading partners to create, exchange, verify digitised

documents and transfer ownership for title documents across different digital platforms seamlessly and without a handover point, which solves issues around liability.

The result is that TradeTrust eBLs can operate across multiple systems. It achieves this by using blockchain and cryptographic technologies, adhering to global standards and legal requirements to enable trusted portability of electronic trade documents across digital platforms. IMDA has now added to this proposition by incorporating legal interoperability into the TradeTrust framework.

Electronic documents issued this way can be trusted, interoperable and legally effective across different systems, thereby streamlining and enhancing overall operational efficiency for businesses and governments.

Offered as a digital utility (similar to digital public infrastructure), TradeTrust is open-sourced so that all parties can freely adopt and build on it to benefit their business ecosystem.

The aim is to provide users with both a free tool and the supporting legal structure, to turn your documents into smart electronic documents that are portable across your trading partners, with enhanced security features, all while meeting international standards and legal requirements. By adopting TradeTrust, users can independently:

• issue and revoke electronic documents

• verify documents’ proof of source and authenticity

• transfer performance obligations of transferable documents

TradeTrust eBLs differ from those provided by centralised systems and are aligned with requirements laid out in the Model Law on Electronic Transferable Records (MLETR). This alignment enables legal recognition across different jurisdictions, benefiting trade participants such as

“The Model Terms were launched in March, at the Marine Insurance Asia conference, as Singapore’s Infocomm Media Development Authority (IMDA), looks to encourage commercial interests worldwide to embrace new technology to digitalise transferable instruments in an open and interoperable manner.”

corporates, banks and carriers by improving efficiency and enhancing trust in electronic trade documentation.

Loh Sin Yong, senior principal consultant at the IMDA, stresses that the TradeTrust system does not replace existing platforms but works with them to provide synergy.

“It is a digital public good,” he stresses, “and is designed to eventuate a decentralised system. Key for encouraging global trade is the built-in interoperability, via an immutable public blockchain and free open-source software.”

Providing an example, he said “if you are operating in Singapore and shipping your goods to the UK, you need your e-bills of lading to work in both Singapore and in the UK. However, most platforms are closed networks, making it difficult to operate when just across two closed platforms. With TradeTrust, this challenge is eliminated. Not only is cross-system operation possible – it’s seamless. The receiving platform in the UK can easily accept and process the eBL via the TradeTrust components integrated within it’s own system, with most of the groundwork pre-supplied.

Designed to complement TradeTrust’s open-source software components, IMDA has now launched these Model Terms to provide a mechanism for legal alignment among TradeTrust adopters. This is crucial in a fast changing legal environment where there is an increasing number of jurisdictions aligning themselves to the MLETR. For example, in April 2021 the G7 (including Canada, France Germany, Italy, Japan, the UK and the US) agreed a framework to promote the use of electronic transferable records through adoption of the MLETR.

In October 2021 the G7 Trade Ministers’ Digital Trade Principles were published, which included a statement that “…governments and industry should drive forward the digitisation of trade-related documents”. To date the MLETR has been adopted by only a handful of countries, including Singapore, Abu Dhabi and Bahrain. Loh Sin Yong also referred to Singapore Electronic Transactions (Amendment) Act 2021 and the more recent UK’s Electronic Trade Documents Act 2023 as legislative steps supporting the broader adoption of electronic instruments. Interest is growing, for example with the French National Assembly adopted MLETR on 5 June 2024, adding France to the list of countries/jurisdictions to adopt this model law.

Another essential consideration in the launch of Model Terms and eBLs, is the approval of the International Group of P&I Clubs (IG) and symmetry with their rules. As the key functions of bills of lading relate to the receipt, transfer of title and evidence of contractual terms for the carriage of cargo by ocean-going vessels, these documents are central to risk management of potential carrier liability to third parties for loss or damage to cargo. Carriers insure this risk through P&I, through membership of P&I Clubs, who are part of the IG. Between the 12 P&I Clubs which comprise the IG, they

“if you are operating in Singapore and shipping your goods to the UK, you need your e-bills of lading to work in both Singapore and in the UK. However, most platforms are closed networks, making it difficult to operate when just across two closed platforms. With TradeTrust, this challenge is eliminated. Not only is cross-system operation possible –it’s seamless. ”

Loh Sin Yong IMDA

provide P&I coverage for approximately 90% of all global ocean-going tonnage.

As independent, not-for-profit, mutual insurance associations, each will sign up to “Club Rules” sharing large loss exposures. Club Rules for liability with respect to cargo include requirements for all bills of lading issued by members to contain certain legal exclusions from and limitations of

liability and other provisions which mitigate risks of claims by, and liability to, third party claimants for loss or damage to cargo.

The IG supports the transition from paper bills of lading to eBLs and sees many benefits. However, such systems have been required to undergo an IG approval process. To gain that approval, eBL systems must

o Comply with laws recognizing eBLs as equivalent to paper bills.

o Provide evidence of contract of carriage terms.

o Have system functionality for transfer rejections and accomplishment.

o Have system provider’s liability coverage for failures.

“Just as the TradeTrust framework provides a technical solution to interoperability through its technology components, the Model Terms provide a legal solution to interoperability,” Loh Sin Yong said. “The Model Terms establish a clear legal foundation that facilitate TradeTrust eBLs to be supported by IG P&I insurance cover and are legally transferable across jurisdictions. This combined technical and legal approach strengthens confidence and reliability in the use of electronic trade documents.”

There are three constituent parts to the Model Terms:

• Part A – Definitions

• Part B – User Agreement Terms and Conditions

• Part C TradeTrust eBL provisions

Looking in more detail at each of the parts:

Part A – Definitions

Definitions for the key parties involved in the eBL/traditional BL lifecycle, including the carrier, consignee and shipper.

Other important definitions:

i. “TradeTrust eBL” – ensures that the TradeTrust eBL captures the mandatory user agreement clauses from Part B of the Model Terms.

ii. “TradeTrust Enabled eBL System” – affirms the integration of TradeTrust software and incorporation of the Model User Agreement and eBL Terms.

iii. “TradeTrust Software” – makes clear that the TradeTrust software developed by IMDA is free and opensource and is made openly available to the public via the TradeTrust website.

Part B – User agreement terms

eBL CLAUSING: protection for carrier

REJECTION OF THE eBL: International Group requirement, commercial reality

SWITCH TO PAPER: eBL made inoperative and ceases to have any effect or validity

SURRENDER, DELIVERY AND ACCOMPLISHMENT: surrender vs accomplishment

LIABILITY : criteria (e) of IG streamlined approval process

DISPUTE RESOLUTION: SIAC (Singapore International Arbitration Centre) and SCMA (Singapore Chamber of Maritime Arbitration).

Part C – eBL terms

NOTICE: compliance with the MLETR

CARRIER’S RIGHT TO RECEIVE BACK: protection for carrier;

SWITCH TO PAPER: paper bl to contain same rights and legal effect as precedent TradeTrust e-BL;

SURRENDER, DELIVERY AND ACCOMPLISHMENT: carrier’s right to request identification; and DISPUTE RESOLUTION.

Though the eBL remains IMDA’s primary focus, the principles outlined in the Model Terms could also be adapted for other types of electronic transferable records (ETRs) recognised by law, such as electronic promissory notes, bills of exchange, warehouse receipts and any future MLETR-aligned instruments. The Model Terms are intended to serve as a baseline reference and not meant as a comprehensive set of terms set out for service providers/ systems.

Loh Sin Yong concluded “These Model Terms will help in overcoming existing concerns relating to the interoperability of different platforms in decentralised ETR systems. It also leads to simplifying technical (and legal) concepts and should help drive change towards mass adoption of ETRs.”

Helen Steadman , global head of cargo, AXIS, explains why

specialist expertise and discipline matter most in volatile times

In a dynamic risk environment in which many newsworthy events have a marine cargo ‘angle’—whether it is a warehouse engulfed in wildfire, Middle East conflict, a terror attack, or a sinking ship—our instinct as underwriters when a new headline appears is to reach for our laptops and hammer the details into our systems.

Through information garnered from our data, or a switchedon claims colleague or broker partner, within minutes, we start the complex process of identifying affected parties and overlaying this with our own portfolio, to determine whether we are on risk or to what extent.

Summarising this vital information in a single sentence, ready to relay almost instantaneously, is par for the course for the marine underwriter who needs to act with speed, ready to address enquiries and pre-empt the call from above and that inevitable question: Is it one of ours?

Sitting at your box at Lloyd’s or, more often the familiar surroundings of the open-plan office or desk at home, it is possible to appear insulated from the world’s crises even as they lap shores increasingly close to home.

However, for London cargo underwriters, myself included, mapping the effects of turbulent geopolitics and disruptions to global trade, and working with market peers to create responsive, flexible solutions, is built into our working lives.

We read and absorb risk reports and work closely with our claims specialists who, through their daily conversations, are closely tuned into the realities outside.

As underwriters, our discussions with brokers and insureds on the fresh challenges they are navigating every day help us to hone our appetites, pricing and terms nd conditions to meet increasing or decreasing levels of risk as we see it and elevate the solutions we deliver.

Site visits in our line of work are as valuable in building a picture of the evolving risk landscape as the data at our fingertips. Access to useful data is improving all the time— helping to monitor accumulation risk, while recognising the complexities involved with tracking goods in transit.

As we remind colleagues in adjacent lines of insurance business, storage units, also covered by cargo, are inherently easier to trace than their contents, which, as soon as it is on the move, may encounter myriad risks along their trade routes, from war and terror acts to new tariffs or sanctions, to weather-related diversions.

For the seasoned cargo underwriter, today’s disruptions are truly unprecedented, even five years on from a pandemic that triggered a near total shutdown in global trade. How else do you describe the current unpredictable world defined by economic instability, climate change, and the erosion of decades of geopolitical norms? We are all operating under the assumption that normality may not resume any time soon—we know this and our underwriting ought to reflect this.

The challenges in the market arrive thick and fast. It remains as important as ever that, as a market, we continue ‘pricing in’ the unpredictability of the geopolitical and economic climate to our underwriting decisions. As a specialty market, we excel in providing solutions in volatile times and this responsiveness is key to our success.

There is no cause to relax on rate or terms and conditions

“For the seasoned cargo underwriter, today’s disruptions are truly unprecedented— even five years on from a pandemic that triggered a near total shutdown in global trade. How else do you describe the current unpredictable world defined by economic instability, climate change and the erosion of decades of geopolitical norms?”

because the cargo market has been relatively cushioned from the impacts of the volatile environment. Unlike when the giant curveball of Covid-19 changed our market, there is no let-up in activity and therefore claims amid today’s uncertainty.

It is not so long ago that the London market experienced the Decile-10 years, a process under which all syndicates had to identify their poorest performing portfolios of business (the Decile 10) and demonstrate plans to return the portfolio to profit. It is questionable whether any underwriter would risk stepping back to those ill-disciplined times and undo the gains enjoyed by the marine market in particular from that process.

Following a sustained period of rate resiliency post-Decile 10, we are seeing single-digit rate deterioration in 2025. As new capacity continues to flow in and the market’s bifurcation into lead versus follow continues, market incumbents need to lead by example in showing discipline and foresight to ensure these signs of softening do not lead us into escalating unprofitability and weakening terms and conditions.

We believe there is a fine line that we ourselves are treading between necessary market modernisation through increased portfolio underwriting and facilitisation that add value and efficiency for all and investing in maintaining strong and differentiated leaders in the open market.

We cannot stop the major losses—fires, trade wars, terror attacks—that we are here to respond to. But we are capable through discipline and foresight of minimising the selfinflicted wounds caused by a race to the bottom on rate and terms. And if a stick were needed, Lloyd’s has made it clear in recent statements that it will not tolerate a slide backwards in underwriting standards that would risk dragging a market segment back into unprofitability.

Another piece of the puzzle in building a sustainable cargo market that is future proofed against the next twists and turns of global trade and geopolitics is investing in our people. With 25-plus years’ experience, I have worked through previous market cycles and developed a long-term view of how the cargo market responds to and withstands world events. It is incumbent on experienced underwriters to take the training and development of newer underwriters seriously.

We are cognisant of the deep competition for talent in the London market and, as line sizes increase, cargo teams need to attract and retain engaged, up-and-coming underwriters who can ensure the market retains its edge as a home for challenging, complex and specialty risks. Curiosity and passion cannot be taught but a disciplined, flexible, informed approach to specialty underwriting can be modelled and learned.

Our purpose in developing elevated, specialty solutions to meet the evolving needs of customers is best fulfilled when we work together in our common interest. This must be founded on price adequacy, fairness and service for customers and informed underwriting to build a strong, sustainable market in which we learn from the past and prepare for a turbulent future.

Mike

Burle , head of marine

and

deputy

active underwriter, Liberty Specialty Markets, argues that the marine insurance market must stand firm in the face of rising competitive pressures in what remains a highly volatile market

The last seven years has been a period of remediation for the marine insurance market. Efforts market-wide gradually restored books to profitability, which was a considerable task for most and a real struggle for many.

Yet the marine market pulled together and, certainly in London, Lloyd’s Decile 10 project launched in 2018 to bring underperforming syndicates and classes of business back to profitability, helped accelerate this process, instilling the discipline required to create portfolios that consistently perform well across the cycle.

These efforts eventually yielded results not seen in the marine market for more than a decade. In March 2024 Lloyd’s results revealed just how good a position the market was in, with other markets also performing strongly.

However, despite this, or some may argue because of it, recent renewal cycles suggest marine rates are once again starting to soften.

While the triggers, context and circumstances are different for every soft market, there are usually some fundamental similarities. This time, however, is arguably different for several notable reasons, not least the precarious geopolitical situation and ongoing global economic fragmentation.

The increase in natural catastrophe exposures, such as earthquake, windstorm and flood – even tornados and wildfires – are happening in places, at times and on a scale insurers were not expecting.

This is also a period of market bifurcation, where certain placements are placed through market facilities, with marine an already fairly facilitized market. There has also been the emergence of auto-follow facilities, with a whole array of new propositions dominating headlines in recent times. These, among many other factors, are putting pressure on every risk that insurers see in the market.

Following several consecutive years of rate increases, client fatigue is a further factor, with discounts now being sought placing extra pressure on insurance renewals. The profitability of Lloyd’s and other markets has been cited by brokers when seeking client discounts.

While some may argue we’ve got it too good, this overlooks the fact that any market is only ever one or two losses away from a dramatic change of fortune. Any insurer should be able to command a fair return for the risks it accepts to ensure that it is economically sustainable and can continue to meet client needs.

Also, while the marine market may be profitable right now, this is finely balanced. In some areas margins appear slim, such as marine hull, which as a standalone class of business has struggled for consistent returns. The last 12 months have also seen significant losses affect the market, with the Baltimore bridge allision a further stark reminder of the potential for outsized marine losses. This was followed more recently by the collision between MV Solong, the Portuguese-flagged cargo vessel, and MV Stena Immaculate, a tanker transporting jet fuel for the US military, in the North Sea an incident that analysts estimate would cost the marine insurance market up to $300m at the time of writing.

Due to the ongoing geopolitical situation, ship operators continue to face a broad range of challenges across vast areas. In the Red Sea, the threat of vessels being attacked by Yemen’s Houthi rebels remains very real.

Media coverage of these attacks has declined significantly over the past six months yet, paradoxically, Houthi activity in the Red Sea actually intensified over that period. With more than 100 Houthi attacks in the region since November

2023, many vessels now routinely take the route around the Cape of Good Hope; a lengthy detour of around 3,500 nautical miles.

In addition, the Black Sea remains a militarized zone, given the ongoing Russia-Ukraine conflict, with naval blockades, missile strikes and drone attacks posing a serious threat. Both countries have deployed naval mines, some of which have become unanchored and drifted, creating a further hazard for vessels.

In the Persian Gulf, ongoing tensions between Iran, the US and Gulf States brings the heightened risk of naval confrontations, missile attacks and military escalations. Iran has previously seized or harassed commercial vessels, particularly in the chokepoint of the Strait of Hormuz.

Simultaneously, in the US Midwest, the footprint of “tornado alley” is consistently growing, with losses already

“Any market is only ever one or two losses away from a dramatic change of fortune. Any insurer should be able to command a fair return for the risks it accepts to ensure that it is economically sustainable and can continue to meet client needs.”

incurred relating to tornados and storms affecting large US warehouses and distribution centres.

All of these examples highlight the imminent possibility of a tectonic occurrence in the marine market. Preserving both a sufficient pool of premium and underwriting discipline is essential to its sustainability and ability to protect clients for the long term despite heightened volatility.

In 2015/16, a series of large losses occurred at a time of excess capacity and low rates, with a number of organisations aggressively looking to grow, creating the perfect storm. Those who remember that period have no desire to relive what was necessary to correct the marine market after it was allowed to drift so dramatically off course.

This remediation work and the lessons learned from that time helped create the disciplined, profitable and robust marine market of today. This hard-won position not only deserves to be preserved but built on requiring collaboration at an industry level and some restructuring at an individual business level.

For example, silos still exist within many insurance companies, hampering interaction and collaboration between departments. Given the risks and uncertainties facing clients, fostering greater organisation-wide collaboration, through closer stakeholder alignment and integration of business units, is one of the most important steps insurers can take to support clients in meeting these challenges.

At Liberty, underwriters, risk engineers and claims specialists sit and work together on a weekly basis, ensuring much greater knowledge sharing and therefore better risk mitigation. It has helped produce more insightful terms and conditions, coverage and a better product for the client. Additionally in claims, the ingenuity generated by closely collaborating, multidisciplined teams has enabled clients to achieve satisfactory outcomes far faster.

This is therefore a pivotal moment for the marine market, which begs an important question: Will insurers, through initiatives such as these, continue to build, become more sophisticated and resilient, or will the opportunity to avoid a race to the bottom be squandered? My hope is the market will prove itself better than that and, remembering the lessons of the recent past, hold its nerve and press ahead in its pursuit of excellence.

Capt. Randall Lund , MBA, NAMSCMS, senior maarine risk consultant, Allianz Commercial reports on the findings of the insurer’s latest Risk Barometer and evolving risk perception among professionals within the maritime sector

Cyber incidents such as data breaches, ransomware attacks, and IT disruptions are the biggest business risks for companies globally in 2025, according to the latest Allianz Risk Barometer. Business interruption ranks as the second top concern for companies of all sizes followed by natural catastrophes.

Now in its 14th year, the Risk Barometer is an annual business risk ranking incorporating the views of 3,778 risk management experts in 106 countries and territories including CEOs, risk managers, brokers and insurance experts.

The Risk Barometer also surveyed marine and shipping risk experts to identify the threats keeping them up at night. Following is a review of the top industry risks for 2025, as voted for by the respondents.

Tied for first place by marine and shipping respondents are natural catastrophe activity and political risks. Some 29% of industry respondents cited these risks as their top concern for 2025, with natural catastrophes up from the second spot last year.

Natural catastrophes were the fifth biggest cause of marine insurance claims, by frequency and severity for a five-year period analysed by Allianz Commercial.

Extreme weather and natural hazards have contributed to a number of large losses in the past, with the loss of vessels and damage to cargos. Extreme weather was a contributing factor in around a third of the total vessel losses reported in 2023 alone, while drought in Europe and the Americas has caused major disruption to shipping and supply chains in recent years.

While political risks and violence surprisingly declined in the latest overall global rankings of the Allianz Risk Barometer across all industries, it rises from the third spot in 2024 among marine and shipping respondents.

Recent incidents, such as in the wake of the conflict in Gaza, have demonstrated the increasing vulnerability of global shipping to proxy wars, disputes and geopolitical events, with many ships having been targeted in the Red Sea and elsewhere by Houthi militants in response

“According to Allianz’s 2024 Safety and Shipping Review, there were more than 200 fire incidents (205) reported on board vessels over 100 gross tonnage (GT) during 2023, the second year in a row that this total has been exceeded – after a decade high of 211 in 2022.”

to the conflict.

Disruption to shipping in and around the region has persisted. Both the war in Ukraine and the Red Sea attacks have also revealed the increasing threat to commercial shipping posed by new technology, such as drones, which are relatively cheap and easy to make and difficult to defend against without a large naval presence.

Looking to the future, more technologically driven attacks against shipping and ports are also a distinct possibility. Reports of vessels experiencing GPS interference have also increased particularly in the Strait of Hormuz, the Mediterranean and the Black Sea.

A new entry to the marine and shipping risk rankings yearon-year is theft, fraud and corruption with 26% of industry respondents ranking this a top concern in 2025.

Allianz Commercial has seen an uptick in cargo theft incidents in recent years, particularly in transportation and logistics. In North America, the number of theft claims has increased in recent years, with a 20% increase reported in 2022.

The current economic environment, and cost of living crisis, means there is a much greater incentive to steal. While theft of high value cargo has increased, more and more goods are becoming attractive to criminals that were not before, such as food and household goods.

At the same time criminals are using more organized methods to gain access to cargo, often employing technology. For example, thieves exploit cyber security weaknesses to impersonate a trusted supplier or gain access to systems to facilitate theft or divert shipments. Criminals may also use jammers to interfere with cargo GPS tracking devices and mobile telephone signals, making it harder to recover stolen goods.

Another major risk that was identified is climate change, including physical, operational and financial risks as a result of global warming. 2024 was another year of extreme weather and new climate records. Last year was the hottest year on record. It was also the fifth year in a row in which insured losses from natural disasters worldwide exceeded

the $100bn mark. It is little surprise then that climate change delivers a standout result in 2025.

Shipping contributes around 3% of global emissions caused by human activities, and the industry has committed to tough targets to cut these. Reaching these targets requires a mix of strategies, including measures to improve energy efficiency, the adoption of alternative fuels, innovative ship design and methods of propulsion.

Top 5 risks in Marine and shipping

Source: Allianz Commercial

Figures

Decarbonisation presents various challenges for an industry that is juggling new technologies alongside existing ways of working. For example, the industry will need to develop infrastructure to support vessels using alternative fuels, such as bunkering and maintenance, while at the same time phasing out fossil fuels. There are also potential safety issues with terminal operators and vessels’ crew handling alternative fuels that can be toxic or highly explosive.

Respondents: 86

Figures don’t add up to 100% as up to three risks could be selected NEW New entry in the top 5 risks

There has been a renewed focus on climate change risk management post-Covid-19 after this peril dropped down the ranking during the pandemic years as companies dealt with more immediate challenges.

The top three actions that companies are taking to mitigate the direct impact of climate change according to respondents are: Adapting or increasing insurance protection (including alternative risk transfer); Adopting carbonreducing business models (eg recycling and reducing waste, encouraging sustainable travel, developing more sustainable supply chains); and creating contingency plans for climaterelated eventualities (eg response and recovery, assessing critical systems and resources).

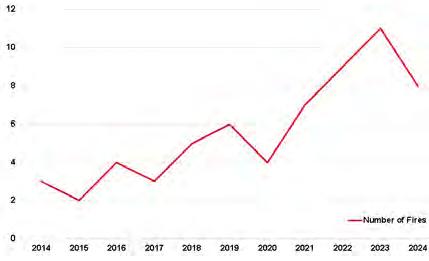

Fire and explosion risk dropped from its number one spot last year for the industry to tie in fourth place with climate change at 22% of marine industry respondents.

According to Allianz’s 2024 Safety and Shipping Review, there were more than 200 fire incidents (205) reported on board vessels of more than 100 gross tonnage (GT) during 2023, the second year in a row that this total has been

Political risks and violence (eg political instability, war, terrorism, coup d'état, civil unrest, strikes, riots, looting)

Figures represent how often a risk was selected as a percentage of all responses for that industry sector Respondents: 86

Figures don’t add up to 100% as up to three risks could be selected NEW New entry in the top 5 risks

Source: Allianz Commercial

exceeded – after a decade high of 211 in 2022.

Fire remains a major cause of loss for large vessels and recent years have seen several major fires involving Roll On-Roll Off (Ro-Ro) vessels and car carriers.

Ro Ros can be more exposed to fire and stability issues than other vessels due to the nature of their cargo and their design. Incidents have coincided with the ongoing debate about the fire risks of transporting electric vehicles (EVs) powered by lithium ion batteries.

Several Ro Ro ferry and car carrier operators have taken a cautious approach to transporting EVs while insurers have highlighted additional risks associated with lithium ion batteries, as well as the need to upgrade firefighting capabilities of Ro Ros accordingly.

The transportation of consumer goods, such as e scooters, that contain lithium-ion batteries is still not as good as it needs to be. Employees need to be trained to recognise possibly damaged, or suspect batteries.

“Allianz Commercial has seen an uptick in cargo theft incidents in recent years, particularly in transportation and logistics. In North America, the number of theft claims has increased in recent years, with a 20% increase reported in 2022.”

In addition, all parties (suppliers, shippers, third party transporters, carriers, vessel crews and port and terminal workforces) must also be trained and drilled in the protocols that their employer should develop in the case of an incident or the discovery of a suspect battery.

As industry and regulatory standards continue to evolve and be implemented, and technical solutions that could reduce the impact of any fire emerge, there is a benefit in supply chain transporters being proactive in this way, even though it may not yet be required by the various governing regulations. The cost of training will be infinitesimal compared to the cost of any major incident involving lithium ion batteries.

To read the full 2025 Allianz Risk Barometer, please visit: https://commercial.allianz.com/news-and-insights/reports/ allianz-risk-barometer.html

The Hiscox London Market Marine, Energy and Specialty division blends Hiscox’s underwriting expertise and heritage with our Lloyd’s roots stretching back to 1901.

Alongside the ability to underwrite traditional risks, our empowered teams of underwriters, claims and policy wordings specialists also welcome the opportunity to look at new risks and develop innovative products where we feel we can offer a genuine difference for our clients as long-term, trusted partners in risk.

Find out more at hiscoxlondonmarket.com.

Alberto Comitardi (head of special risks) and Gian Piero Priano (right)(global head of claims) at Cambiaso Risso Marine explain why expert knowledge and skills are needed more than ever as risks become ever more complex and non-standard

What does “special” mean? In the world of insurance, the term “special risks” refers to unique and often complex risks that do not fall under standard insurance categories. These risks require specialised knowledge and tailored solutions to ensure adequate coverage and protection.

Special risks encompass a broad spectrum of scenarios that are not typically covered by conventional insurance policies. These risks can arise from various sources, including natural disasters, political instability, cyber threats and new maritime operations never insured before (eg carbon capture and transportation, desalination activities, hydrogen propulsion performance).

When speaking about events such as earthquakes, hurricanes, floods and wildfires, from a marine perspective we are mainly speaking about ports and terminals.

Ports are often exposed to events that can cause damage to properties and infrastructures on a vast scale, leading to substantial financial losses. Insurers must assess the likelihood and potential impact of such events to provide appropriate coverage.

Even if not of a natural origin, political instability, including acts of terrorism, war and civil unrest, pose significant challenges for businesses operating in volatile regions and expose them to large-scale losses over a vast region.

As we are living in a time of uncertainty, it is no surprise that, cyber insurance excepted, in recent times one of the most called on special risks insurance in the shipping industry is “marine trade disruption”.

This cover is designed to protect a company’s earnings against events that affect the entire supply chain. Unlike standard loss of hire insurance, which covers marine perils and loss due to physical damage to the vessel and the earnings of a single vessel, trade disruption insurance extends to many other external sources of interruption that are outside the control of the ship manager.

It is possible to combine trade disruption insurance with the loss of hire and delay cover for maximum protection. Earnings protection supports payment of loan interests and increases the ability of a company to attract finance.

Further, the increasing reliance on digital technologies has made cyber threats a major concern for any business. Cyber risk insurance covers losses resulting from the inability to operate data, be it from cyber-attacks or other digital threats. Companies operating on a liner basis, be it a container or cruise ships, are among the most exposed. These companies deal with millions of pieces of information and can conduct business solely relying on digital tools. Any situation that deprives them of access to their data causes immediate disruption and data breach exposes them to costly investigations by regulators.

Bearing that in mind, it is pivotal to be aware of which insurers have more experience and appetite to insure business interruption losses affecting the supply chain (container lines) compared to those insurers that have built a reputation in handling GDPR (General Data Protection

“The evaluation of special risks calls for extensive data analysis from the very start. Insurers rely on advanced modelling techniques, historical data, and expert analysis to evaluate these risks effectively. Implementing proactive measures to reduce the likelihood and impact of special risks is the differentiating factor.”

Regulation) and privacy breach exposures and regulatory claims (cruise lines).

Among the most innovative solutions, we can then consider forms of “technology performance insurance” in respect of new propulsion systems. New technologies, such as hydrogen marine propulsion systems, may simply not work as expected but there is no associated physical loss to compensate. Technology performance insurance can protect against financial losses suffered when the technology fails to meet performance standards.

The evaluation of special risks calls for extensive data analysis from the very start. Insurers rely on advanced modelling techniques, historical data and expert analysis to evaluate these risks effectively. Implementing proactive measures to reduce the likelihood and impact of special risks is the differentiating factor.

Measures include advanced security systems, diversifying the supply chains and developing comprehensive disaster recovery plans. Coordination with risk engineers and continuous monitoring of risk factors becomes essential to keep potential threats under control and maintain insurability at competitive rates.

A further challenge is the customisation of insurance policies to address the specific needs and exposures of each client. This requires a deep understanding of the client’s operations and the risks that they face. Therefore, only insurers that are willing to work closely with their clients can understand their unique exposures and be willing to design policies that provide the relevant, comprehensive coverage.

On 19 July 2024, a single content update from CrowdStrike, a cyber security software company, caused more than 8.5 million systems to crash. The disruptive effect extended to thousands of organisations worldwide resulting in losses estimated to be more than $5bn, possibly approaching $10bn.

Air transportation, railways and mass transportation systems were the most affected in the transport industry with old fashioned shipping showing some natural resilience, mostly due to the way bulk shipping is traded. Insured losses amounted primarily to lost revenues insured under the business interruption section of the cover and associated costs, either as additional working costs or data restoration costs.

The disruption did not originate from a hacker attacking the system. It was a pure system failure experienced by a new version release of the CrowdStrike software. As the CrowdStrike software is one that protects against attacks, the software is authorised to access and block the systems that it protects. And that is essentially what happened, with the IT of companies scrambling to regain the operativity of their networks to prevent disruption to the business and revenues.

“On 19 July 2024, a single content update from CrowdStrike, a cyber security software company, caused more than 8.5 million systems to crash. The disruptive effect extended to thousands of organisations worldwide.”

The result was a recovery of the operativity of the affected networks in less than 24 hours, without triggering significant actual losses.

Cyber insurance currently protects against cyber risks at large be it originating from a cyber-attack or “natural” system error. Further, cyber insurance is essentially a business interruption insurance.

What however is not always clear is whether the wording of any given cyber insurance includes, as a trigger, the inability of a key vendor to operate. That is generally defined as a form of contingent or dependent business insurance.

That trigger of cover is not always included, it may refer only to cyber-attacks and may have to be negotiated with the insurer. Outages of a third-party vendor, such as CrowdStrike, could have resulted in a dangerous gap in cover. Ensuring that risks are appropriately insured under appropriate wording is a challenging task that we face every day.

Special risks represent a significant challenge that requires specialised knowledge and tailored solutions. By understanding the nature of these risks, assessing their impact and implementing effective risk management strategies, companies can protect themselves against potential losses and ensure business continuity. As the world continues to evolve, staying vigilant and proactive is essential for long-term success.

The success of projects striving to deliver net zero rely on stable marine cargo supply chains. We can protect energy transition projects across the globe through our specialist Lloyd’s syndicate.

The transit, movement and storage of technologies, raw materials and non-fossil fuels required for energy transition projects and activities are all in scope. This includes, but is not limited to:

• Batteries and battery storage systems

• Electric Vehicles

• Solar PV

• Wind turbine components

• Biomass

Click here to find out more

For product and regulatory disclosures, click here.

Sean Maloney , CEO of Elaborate Communications, reviews the complex and tragic case of the MSC Flaminia showing how challenging and personal such a claim can be

On 14 July 2012, a violent explosion onboard the 6,732 teu MSC Flaminia in the middle of the Atlantic Ocean, caused the death of three crew members and created one of the most protracted court cases in maritime history.

And while the legal remnants of the case still linger on today with the Supreme Court in London now being asked by MSC to rule on a bid to limit liability for firefighting and clean-up costs, the case is significant in that both the owner of the vessel, Conti Reederei, and the ship manager, NSB, were found by a US judge, earlier in the proceedings, to bear zero liability for the incident.

This was an outcome that was as much to do with the detailed and chronicled management procedures of the manager as it was with the very strong working relationship between the manager and the vessel’s insurer The Swedish Club.

“At the end of the day, the Swedish Club is the insurer and when you have an accident, an insurer is normally never your friend. In business, it’s all about money and not about giving gifts. But it is different with the Swedish Club I can vouch for that.”

The explosion occurred shortly after 08:00 hours on 14 July, after white “smoke” had been reported escaping from one of the cargo holds of the 300 metre long container ship, around two hours earlier.

Three crew sustained fatal injuries in the explosion and a further two were injured. At the time of the explosion, the vessel was in the middle of the Atlantic Ocean, having loaded containers in the Gulf ports of the US and Mexico and was crossing to Europe.

Stolt Tank Containers had 29 containers aboard the ship. Three of the Stolt containers were stowed in cargo hold number four, which was alleged to have caused the fire aboard the vessel. It was also alleged that the Stolt tank containers did not provide adequate information about the hazardous nature of the cargo.

Intensive investigations of the casualty identified that the explosion originated from the three 20 foot ISO tanks containing a hazardous chemical called Di-Vinyl Benzene (DVB) – a monomer used in industry to make polymer plastic.

According to an account of the investigation by consultant scientists and engineers Burgoynes: “The chemical analyses carried out on the retained exhibits indicated that the DVB had polymerised and decomposed, resulting in flammable decomposition products being expelled into the cargo hold at high temperature through the anticipated operation of pressure relief valves on the ISO tanks. It was those decomposition products that was the fuel for the explosion.”

Sanne Hauschildt, currently managing director of NSB Claim Solutions but head of the manager’s insurance and claims teams investigating the casualty as part of the expanded emergency response team at the time of the accident, is still affected by the impact such a casualty,

especially one involving loss of life, had on her and the team members at the time.

“After initially working on the case for 16 months, I had to leave for a time out of five months, because I was done in by the stress. This also applied to other colleagues in the team. However, there had been many more hard-working colleagues at NSB who kept fighting and did an excellent job. But looking back, the Flaminia case simply took too long and it was not necessary to lose lives as we did,” she said.

“When you follow cases in the US courts, you never find a judge who awards someone zero liability. It is the first time I had heard of it happening,” added Sanne.

But it was the special relationship that she, as the manager, and the Swedish Club, as the insurer, had built up that contributed significantly to the successful outcome of the case.

“There’s a long relationship between NSB and the Swedish Club. At the end of the day, the Swedish Club is the insurer and when you have an accident, an insurer is normally never your friend. In business, it’s all about money and not about giving gifts. But it is different with the Swedish Club I can vouch for that. The very strong relationship and friendship we had was very different than I had experienced with any of the other clubs. The team at the Swedish Club, fronted by an amazing claims handler Benny Johansson, helped to guide us and the shipowner throughout the entire case, not only by their expertise, but financially,” she said.

Referring to Benny as ‘the Brain’, Sanne said the Swedish Club team went above and beyond what was expected, even down to the number of times the team travelled to Wilhelmshaven or Romania as part of their investigations.

“When you are faced with a casualty, you are obliged to call

the insurer in the first instance. That is what we did and there were no long discussions; we were all on the same page and it was clear that The Swedish Club was there to help us,” she added. “Apart from Benny, we also had a very good broker who worked with us for all these years.

“At the time of the explosion, the vessel was in the middle of the Atlantic Ocean, having loaded containers in the Gulf ports of the US and Mexico. Stolt Tank Containers had 29 containers aboard the ship. Three of the Stolt containers were stowed in cargo hold number four, which was alleged to have caused the fire aboard the vessel.”

“What I found amazing about Benny was that he remembered everything When I was struggling to find a document or piece of communication, he knew where it was.”

But when questioned further, Sanne pointed to the hurdles they faced in actually dealing with the casualty.

“The first problem we had to deal with after two months of negotiating with all available coastal states in finding a port of refuge, was handling the contractual relationships between the various parties. The case brought together a variety of interests such as the ship owner, the charterer, the cargo owner of the DVB, all other cargo owners, and there was even a family that was relocating from Charleston to Switzerland, who were waiting for their container with all their family furniture in. There were so many single tragic stories.

“We had the cargo manufacturer, the manager which was us - NSB, the crew manager, the insurer, and not only the Swedish Club, but many other insurers for other cargo owners. And everyone had an interest. And everyone was of

course eager to protect their assets. Everyone had to follow their own protocols and everyone had an insurer behind them, so there were many cooks ready to spoil the broth.

“And of course, in the beginning it was deemed to be nobody else’s fault apart from ours. When you think about the cause of the explosion, everyone had their own opinion. Newspapers made-up their own stories.”

Another major hurdle was finding the right experts who had knowledge about the cargo, “because we could not ask the manufacturer of the affected cargo, of course. All of a sudden, the people that you were supposed to ask when investigating a casualty, were off limits. So we had to bring in all these experts to gain knowledge about the things that we simply couldn’t ask anyone else about.

“Given the multiple contracts in place, we also had several applicable jurisdictions to deal with. The charter party was under English law; the cargo came from the US; the ship was flying the German flag; the ship owner and the manager were German; the port of refuge was Wilhelmshaven in Germany and we had to deal with repair yards and waste disposal in Denmark and Romania.

“Most importantly, I should mention that the necessary changes until today, in finding a port of refuge or carrying hazardous material on board, are not enough to sufficiently protect our crew,” she added.

“When you have a major incident, you have to get on and deal with it. And immediately, the practical thing is to get the ship to a port, in this case it was Wilhelmshaven, and then to repair. Because there are so many different things going on at the same time, you have to work with one box at a time. When you close one box you go to the next one and so on,” said Benny Johansson.

“Of course, we are there to get any monies owed to the ship owner or the manager,” he added.

Benny again: “We could quickly see in the beginning that the hull insurers would not cover all of the expenses that would accrue through the course of the casualty.”

And according to Benny, P&I had its work cut out following the casualty, dealing not only with the crew deaths, but dealing with the air and the cargo pollution.

“The financial strain on the shipowner was such that we had to assist them if we were to have any chance of getting the ship out of the port and into repair. We had no option but to assist the owner financially, there was no question about that, otherwise the ship would have stayed in Wilhelmshaven,” he said.

When you have a major casualty there is a tendency to see claims coming in from all directions, something which happened with the Flaminia. “A lot of people, and I am talking about a lot of people, see money coming in and they inflate everything. So, I stopped paying the port and they threatened to arrest us and then we had to negotiate. Things were happening continuously. We went to arbitration over the port costs, to finalise the matter and the port costs were reduced by more than €5m. And this was because we went to court.

“It was the same with the British authorities because the ship was in the English Channel, they said they had a lot of costs here and demanded £1m, we ended up paying £200,000. The French authorities asked for more than €10m, but we manged to get the cost down to €450,000. There was a hurdle everywhere,” he said

“The whole thing is about money. Life doesn’t matter. It is about money.”

One of the aspects that came out of the case was that the owners and the managers were not liable. Was this down to the hard work of the shipowner and the manager?

“We had to show, of course, that the crew was competent and had all the right certificates, and that the ship was in shipshape condition. We had to show the courts that the vessel was in good condition which we did. Of course, the manager had to prove that it had all the right certificates and paperwork and the way they worked. When you are dealing with a competent manager, it is not difficult to do this. We should mention the support we had from all our very competent lawyers in Germany (Ahlers and Vogel), France (HFW), UK (HFW) and US (MMWR and Phelps),” concluded Benny.

13 & 14 May 2025, Athens

DAY TWO - 14th May 2025

09.55-10.00 Welcome Address: George Tsavliris, Non-Executive Chairman, OneGlobal Greece & Cyprus

10.00-10.20

Keynote Address: Topic TBC

Presenter: Matthew Lodge, His Majesty’s Ambassador to the Hellenic Republic, Greece

10.20-10.40 Keynote Address: Topic TBC

Presenter: Invited Minister of Shipping and Island Policy Vasilis Kikilias

10.40-11.20 Panel Discussion: Integrated Waste Management Services After a Fire on Board a Container Vessel

Moderator: Stavriana Asprogiannidou

Panellists: Gianluca Rol , Master Mariner and Marine Consultant, Minton, Treharne & Davies Group, Athanasios Polychronopoulos, Chief Executive O cer and Managing Director, Polygreen, Martin Bjerregaard, Director, D3 Consulting, Afroditi Karava, Senior Claims Manager & Solicitor, The London P&I Club

11.20-12.00 Panel Discussion: Sanctions in Practice

Moderator: Dimitri Vassos, Partner, HFW

Panellists: E e Koureta, P&I Claims Director, NorthStandard, Danae Pispini, Lawyer, Gard, Dmitry Vavilov, Managing Director, Maritime Risk Management, Joanna Pavlidis, Associate Director, The London P&I Club

12.30-12.50 Interactive Session: The Recurring Risk of Stowaways

Presenters: Aliki Gotsi, Senior Claims Manager, West of England P&I Club

Ian Clarke, Chief Executive O cer (Hellas), West of England P&I Club

12.50-13.10

Presentation: Trends in War Risk Claims

Presenter: Dimitris Exarchou, Partner, HFW

13.10-13.30 Fireside Chat: Time for the End of Billable Hours for Maritime Lawyers?

13.30-13.45

Participant: Alexandra Davison, Head of FDD Claims – Greece, NorthStandard

Presentation: A Heavy Price for Small Misdemeanours?

Presenter: Turker Yildrim, Partner, Esenyel Partners

DAY ONE - 13th May 2025

10.00-10.15 Co ee breaks: 11.40-12.10 & 16.05-16.25 Lunch: 13.40-14.30

09.55-10.00 Welcome Address: Yannis Triphyllis, Board Member, Hellenic Chamber of Shipping

Keynote Address: The Future Looks Bright – Shipping Remains a Global Force

Presenter: George Alexandratos, Chairman, Hellenic Chamber of Shipping

10.15-10.30 Keynote Address: Bringing a New Balance to the Marine Insurance Sector

Presenter: Vivi Kolliopoulou, President, WISTA Hellas - Insurance Manager, Angelicoussis Group

10.30-11.20 Panel Discussion: The Big Picture – Does Marine Insurance Remain Fit for Purpose?

Moderator: Ilias Tsakiris, Chair, Ocean Hull Committee, International Union of Marine Insurance

Panellists: Manos Lorentzos, Executive Director, Seascope Europe S.A. and Chairman, Hellenic Committee of Lloyd’s Brokers, Haris Lagios, Head of Marine, Aon Greece, Davinia Melachrinos, Partner – Marine, McGill and Partners

11.20-11.40 Presentation: Are Marine Claims Being Redefined?

Presenter: George Margetis, Chief Executive O cer, Margetis Maritime

12.10-13.00 Panel Discussion: Debating The Hot Topics – LOF

Moderator: Martin Hall, Partner, Hill Dickinson

Panellists: George Tsavliris, Non-Executive Chairman, OneGlobal Greece & Cyprus, Elias Psyllos, Vice President, T&T Salvage, Mark Beare, Regional Claims Director, UK P&I Club, Arabella Ramage, Legal and Regulatory Director, Lloyd’s Market Association, Andrew Dyer, Regional Claims Director EMEA-SVP, Shipowners claims Bureau Hellas, Kiran Khosla, Principal Director (Legal), International Chamber of Shipping

13.00-13.40 Panel Discussion: The Red Sea

Moderator: Nicholas Berketis, Manager, J.Kouroutis & Co. Ltd. Insurance and Reinsurance Brokers

Panellists: Spyros Vlassopoulos, Managing Director, IONIC Shipping, Despina Kalfa, General Manager, Senior Broker, Aries Marine Insurance Brokers Ltd, Damian Bischiniotis, Marine Broker, Blueaigaion, Dr. Apostolos Papachristos, Risk Manager, Ydrogios Insurance and Reinsurance S.A.

14.30-14.50 Case Study: Years of Wrangling Ahead? The Dali

Presenter: Dimitris Theodorou, Director, Emergency Response, Resolve Marine

14.50-15.10 Presentation: End of Life Care Needs Attention

Presenter: Maria Moisidou, Partner, Hill Dickinson

15.10-15.30 Presentation: Fire at Sea – Navigating the Complexities of Marine Fire Investigations

Presenter: Tom Peat, Forensic Investigator, Hawkins & Associates

15.30-16.05 Panel Discussion: The Human Element – Managing Crew

Moderator: Ioanna Topaloglou, General Manager, Orion Brokers

Panellists: Alexandra Chatzimichailoglou, Senior Claims Adviser, Lawyer, Gard, David Nichol, Senior Advisor Loss Prevention & Claims, The Swedish Club

16.25-16.40 Presentation: What Does the Philippines’ Magna Carta Mean for the Shipping Sector?

Presenter: Holly Hughes, P&I Senior Claims Executive, NorthStandard

16.40-17.15 Panel Discussion: The Trump E ect

Moderator: Yannis Triphyllis, Board Member, Hellenic Chamber of Shipping

Panellists: Ino Afendouli, Director, Institute of International Relations (IDIS), Athanasios Platias, Prof. International Relations, University of Piraeus, Department of International and European Studies, Maria Gavouneli, Director General, ELIAMEP; Professor, Faculty of Law, National and Kapodistrian, University of Athens

17.15-17.35 Presentation: Fuel EU Maritime Regulation

Presenter: Eleni Antoniadou, Lawyer, Gard

20.00 - LATEPolygreen are proud to sponsor the Marine Insurance Greece Party 2025, which will be held at Barbarossa, Athens. All delegates are warmly invited to attend.

Jean-Charles Gordon , Kpler’s director of ship tracking, explains how tighter regulations, shifting political alliances and new technological capabilities will continue to shape the maritime sector and role of marine insurance in global trade in the era of sanctions

A confluence of new sanctions, evolving regulations and escalating geopolitical tensions has placed marine insurers squarely in the spotlight. At a time when maritime trade is striving to recover from global disruptions, underwriters are confronted with an unprecedented maze of rules designed to curtail the flow of sanctioned oil and other commodities.

From the UK’s Office of Financial Sanctions Implementation (OFSI) to the European Union’s frameworks and the US Office of Foreign Assets Control (OFAC), regulators are tightening their grip on the shipping sector. Additional measures—such as the oil price cap championed by Western alliances—have intensified the industry’s compliance burden, compelling insurers and protection and indemnity (P&I) clubs to enhance their investigative capabilities.

This expanded regulatory reach has thrust the marine insurance world into unfamiliar territory. Operators linked to blacklisted regimes are deploying intricate methods to evade sanctions, using deceptive shipping practices and elaborate ownership structures to obscure true beneficiaries.

Meanwhile, insurers face the twin risks of severe financial penalties and reputational damage should they inadvertently provide cover to prohibited activities. Addressing this challenge demands a more forensic approach to underwriting and claims scrutiny, underpinned by real-time data, comprehensive vessel tracking and close collaboration with international watchdogs.

Historically, sanctions in maritime activities targeted a limited number of jurisdictions. Today, however, they are increasingly tailored to specific commodities, shipping corridors and even types of financial transactions. Insurers must now determine not only the lawfulness of a vessel or its cargo but also whether its trading falls below an imposed price ceiling—as is the case with recent oil price cap regulations.

Gone are the days when a simple blacklist sufficed. Modern underwriters must scrutinise trade documentation, shipping logs and beneficial ownership records in evergreater detail.

The situation is further complicated by the rapidity with which regulators act. New restrictions may be announced at short notice, or existing lists may be updated with revised identifiers for flagged vessels. Consequently, insurers are required to maintain up-to-date internal watchlists and be prepared to deny or adjust cover swiftly if a client or cargo becomes associated with a newly sanctioned entity. This constant state of vigilance, though undoubtedly onerous, is fast becoming an integral element of modern underwriting.

Market observers note that this shift underscores the strategic importance of maritime transport in advancing foreign policy. With global energy and commodity flows forming the lifeblood of many national economies, targeting shipping has become a potent means of exerting pressure on sanctioned regimes. Yet this policy also places a considerable burden on insurers and their compliance teams, who now effectively serve as frontline enforcers—or risk incurring severe penalties themselves.

Caught in this tightened regulatory net, operators linked to restricted regimes have become ever more inventive in their strategies for dodging scrutiny. Among the most prevalent tactics are:

l AIS manipulation

AIS (automatic identification system) signals allow market

participants and regulators to track vessel movements. In an effort to conceal their true routes, some ships resort to “spoofing,” broadcasting false coordinates that place them in one part of the world while they are, in fact, loading or unloading cargo elsewhere. Others may switch off their AIS transponders entirely—a phenomenon known as “going dark”—to obscure port calls in sanctioned regions or illicit ship-to-ship (STS) transfers.

l Dark ship-to-ship transfers

STS operations are a regular fixture in the tanker sector, but the recent rise of “dark” transfers has troubled compliance teams. Vessels may meet clandestinely in remote waters, disabling transponders to avoid creating a digital record of their rendezvous. The cargo is then offloaded onto another tanker, ready to be shipped on to a port that, on paper, appears legitimate. By the time these ships reappear on AIS, any evidence of a mid-voyage transfer may be difficult to trace.

l Opaque ownership webs

While legitimate shipping often involves complex ownership structures, sanctions have given rise to a new wave of shell companies. These entities are registered in jurisdictions with minimal disclosure requirements, making it difficult to identify the ultimate beneficiaries. In certain cases, the vessel’s name, flag and nominal owner may shift repeatedly over a short period—colloquially known as “flag hopping”— further complicating due diligence for underwriters.

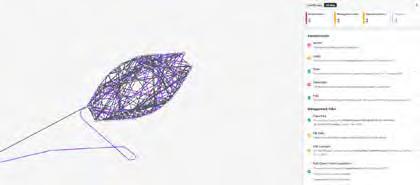

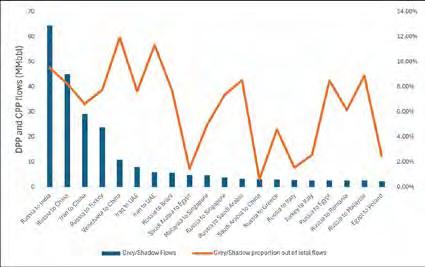

Between January 2022 and January 2025, maritime deception tactics have evolved markedly. Dark STS transfers surged from fewer than 10 incidents per month in early 2022 to a consistent range of 90–130 monthly cases by 2024—an increase of more than 1,200%. This escalation coincided with intensified sanctions following regulatory actions in early 2024 targeting high-risk maritime corridors.

In contrast, AIS spoofing incidents, which averaged 5–10 events per month, experienced a sudden spike to around 160 cases in May 2024—a 1,500% increase—before rapidly declining as advanced detection technologies and enforcement measures were deployed. These trends underscore that, while digital deception such as AIS spoofing can be swiftly mitigated, physical evasion tactics like dark STS transfers remain resilient.

For insurers, the consequences of underwriting a sanctioned vessel or cargo are stark. Regulatory bodies demand strict adherence to sanctions laws and any suggestion that an insurer has extended cover without meticulous checks can result in heavy fines, licence revocations and significant reputational damage. Moreover, the forced mid-year withdrawal of coverage on detecting a breach can disrupt forecast premium revenue, further straining financial projections and market positioning.

P&I clubs, operating on a mutual basis, are equally exposed. A single large claim involving a sanctioned vessel could tarnish the entire club’s reputation and drive up costs

3-month rolling average trends in AIS spoofing and dark STS transfers (January 2022 – December 2024) - Kpler data

for all members. The claims process itself poses additional challenges. Should a vessel found to be in breach of sanctions suffer a casualty, insurers may be thrust into a complex legal and regulatory battle to defend the validity of their cover. Even if a claim is ultimately repudiated on the grounds of sanctions violations, the associated legal fees and administrative burdens can be immense.

Reinsurers are increasingly demanding robust evidence that front-line insurers have exercised due diligence—often requiring continuous monitoring of vessels rather than a one-off check at the inception of the policy period. In response, many insurers and P&I clubs are recalibrating their risk appetites. Some are narrowing the regions or cargo types they cover, while others are investing heavily in compliance infrastructure and thirdparty data tools. A growing trend is the integration of internal processes with external intelligence platforms capable of tracking vessels in near real-time, generating alerts for unusual activity and mapping historical associations with restricted parties.

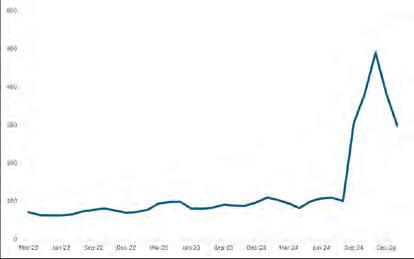

Between January 2022 and January 2025, vessel management risks were highly volatile. Incidents—including improper classification, missing P&I insurance, unknown ISM managers, and PSC detentions—averaged 60 to 120 per month in 2022 and 2023. Then, starting in September 2024, incidents surged to more than 750 per month—a jump of more than 500%. This

spike was driven by the enforcement of sanctions, which led to more than 350 vessels and numerous companies being added to sanction lists between September 2024 and January 2025. In response, classification societies and P&I clubs severed ties with these entities, leaving vessels unclassed, uninsured and in some cases managed by unknown ISM providers—or with no ISM at all.

l Bolstering investigations

With sanctions evolving rapidly, marine insurers recognise that reactive strategies are no longer sufficient. The focus has shifted to proactive investigation, enabled by live data analytics and a broader spectrum of maritime intelligence.

Many insurers now rely on multi-source platforms that amalgamate satellite imagery, port call records and global commercial data into cohesive dashboards. Such systems reveal vessel behaviours that standard AIS tracking might overlook.

l Vessel profiling

A vessel’s flag state, age, ownership history and port calls can collectively illuminate its risk profile. By consolidating these data points, underwriters can assess whether a vessel is linked to sanctioned regions. Repeated calls at restricted ports or sudden changes in ownership are immediate red flags, particularly when viewed in a longitudinal context.

l Cargo visibility

Recent price cap regulations have heightened the need to verify cargo origins and valuations. Should the declared price of oil or refined products deviate from global benchmarks or recognised regional differentials, insurers may request supplementary evidence. Cross-referencing cargo documentation against shipping manifests and customs data can expose attempts to disguise a sanctioned route.

l Real-time alerts

Continuous monitoring is now indispensable for preventing regulatory breaches. Alert systems can flag abrupt route

deviations, significant AIS signal gaps or STS events in waters known for illicit transhipments. Prompt investigation of such alerts enables insurers to cancel or adjust cover before a more serious incident arises, contrasting sharply with earlier models that assessed risk only at policy inception and renewal.

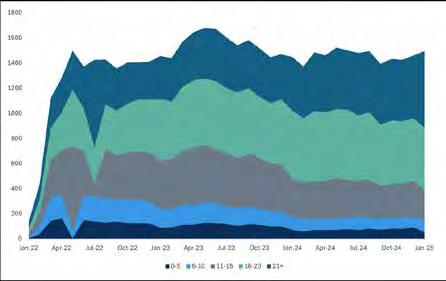

The period from January 2022 to January 2025 reveals clear trends in the age profile of vessels implicated in the transport of sanctioned cargo. At the beginning of 2022, incidents were minimal, but by April 2022, the number of implicated vessels had surged past 1,400—a response likely triggered by new sanctions regimes following major geopolitical events.

Vessels aged 21 years and older consistently account for the largest share, representing more than 40% of cases at peak times. This trend underscores a preference for older, less scrutinised tonnage in sanctions evasion networks, where opaque ownership and weaker compliance oversight are common. Vessels in the 16–20-year bracket also play a significant role, contributing roughly 30–35% of cases during the peak years of 2023 and 2024. By contrast, newer vessels (0–5 years) consistently form the smallest proportion—rarely exceeding 10% of the total. This pattern reflects not only the effect of stricter financing and insurance requirements but also the fact that these high-value, early-life assets carry a higher opportunity cost if they are subject to sanctions.

Overall, the number of cases involving sanctioned cargo remained elevated through 2023, peaking again in mid-2024 before showing a slight decline towards early 2025. This evolution highlights the persistent reliance on older fleets in high-risk operations and underlines the importance of targeted monitoring strategies based on vessel age profiles.

In 2024, the grey or shadow fleet played a significant role in facilitating DPP (dirty petroleum products) and CPP (clean petroleum products) flows along key global trade routes. Notably, the largest volume of grey fleet activity was observed between Russia and India, where 9.5% of total flows—exceeding 64 million tonnes—reflected India’s burgeoning energy demand. Trade between Russia and China

followed closely at 8.3%, reinforcing China’s ongoing energy diversification strategies.

Meanwhile, routes such as Venezuela to China (11.9%) and Iran to the UAE (11.3%) exhibited some of the highest proportions of grey fleet involvement, signalling a heavy reliance on shadow fleets in regions affected by sanctions and geopolitical tensions. Other notable flows, including Russia to Saudi Arabia (8.5%) and Russia to Turkey (7.8%), underscore shifting trade dynamics as traditional supply chains adapt to global sanctions and regulatory pressures. This data highlights the increasingly central role of grey fleets in enabling energy trade in politically sensitive and high-risk regions.

Marine insurers are increasingly realising the value of open communication with regulators and industry bodies. In the UK, for example, OFSI actively encourages businesses to report suspicious findings—a collaborative stance that can ultimately guide enforcement efforts.

Industry groups, ranging from broker associations to leading P&I clubs, have stepped up intelligence-sharing initiatives, exchanging anonymised data on illicit STS locations or frequently flagged vessels. This collective effort, supported by classification societies, port authorities and, where appropriate, enforcement agencies, helps distribute the compliance burden and promotes consistent standards across the sector.

Reinsurance markets, too, have become more active in demanding transparency. Keen to avoid the repercussions of sanctions risk, reinsurers may now require detailed risk reporting throughout the policy lifecycle, further embedding robust compliance practices within underwriting teams.

As western governments continue to refine and expand their sanctions regimes, marine insurers must brace for further

constraints. Simultaneously, illicit operators are likely to adopt even more sophisticated methods to conceal their activities, particularly as technologies for AIS spoofing and other forms of digital manipulation become more accessible. Against this backdrop, the industry is witnessing a boom in advanced data analytics—often combining machine learning with satellite networks—to detect deceptive patterns more effectively.