_ The International Peanut Family Coming Together in Argentina / 02 _

_ Better Prospects for the World Peanut Supply in 2024 / 08

. With stocks generally very low, all eyes point to Argentina’s harvest

Pablo Rivera (Brazil) _ Joaquin Savala (Nicaragua) _ Zhang Peng (China) _ Tushar Thumar (India) _ Ryan Lepicier (USA) _ Diego Yabes (Argentina)

_ Peanut Butter in High Demand / 24

. In most countries consumers are either maintaining or increasing purchases of peanut products

He Miao (Kobe) (China) _ Marcos Lafuente (Europe) _ Andreas Snyman (South Africa) _ Sergey Khaesh (Russia) _ Anne-Marie DeLorenzo (USA)

_ From the Exhibitors of the World Peanut Meeting / 38

_ Peanut Farming, Argentina Style / 50

. The last day of the World Peanut Meeting was dedicated to the Peanut Circuit, with visits to the production fields and research lots in Southern Cordoba.

_ The Entertainment Side of the WPM / 56

. With typical local food, wine, music, and sports, participants in the event had a chance to taste the culture of the country where the peanuts are grown.

_ Charts & Tables / 65

The first “in-person” World Peanut Meeting took place in Córdoba and in the close-by city of General Deheza in March. It was a challenging event to organize and an enjoyable one to experience, in particular the opportunity to speak face to face with peanut sellers and buyers, surveyors, machinery and services suppliers, farming experts, as well as having the chance to get a taste of Argentina, with tango, folk music, polo games and local delicacies.

This issue of World Peanut Magazine is entirely dedicated to providing a detailed overview of the event: the supply and demand panels with the country presentations conducted by the prestigious speakers who shared their views on the markets; a description of the exhibitors who made the event more interesting with displays of their products and services that are so important to our industry; and the visit to the Peanut Circuit in General Deheza, a great opportunity to see the peanut fields first hand.

Besides the fact that, judging from the success of the event, the members of the peanut family worldwide showed once again that they love new experiences, some points regarding the market trends were rather clear after the event:

_ Peanut-producing countries around the world are working to balance off the current lack of product by increasing peanut production during 2024/2025.

_ Peanut production costs have increased heavily during the last few years..

_ Peanut demand around the world seems to be strong, with many growth opportunities around peanut butter products in Europe, the USA, India, China and South America.

_ European inflation seems to be changing consumers’ behavior by pushing them toward “first price” and private label products, placing extra pressure on prices.

_ All in all, it seems that shellers at origin and manufacturers at consumption markets will have to continue cooperating and try to manage the shrinking margins.

An additional intriguing issue during the World Peanut Meeting was the invitation from the Argentine Peanut Chamber to explore the opportunity to work together with similar organizations in other countries by creating a new organization: “The World Peanut Chamber” . It may be just an idea to challenge our brains around the proposal, or perhaps, it could be the first step toward a new way to address international issues common to all industry professionals by joining forces to defend our peanuts.

Thanks to the World Peanut Meeting attendees for visiting us! And, for the ones who could not make it, we expect you to join us at the next event!.

This section of the wpm deals with the dynamics of the demand and supply of peanuts in the international markets. We will try to keep track of the changes in peanut consumption in the main areas of the world, the factors that can affect production, and the price shifts of the various peanut products.

This area of the magazine focuses on shellers as well as companies transforming peanuts into consumer products. We will focus on current industry standards, quality issues, new technologies and the different industrial solutions adopted by producing countries. A special section will be dedicated to new products and tools for peanut processing developed by the best manufacturers.

The activities of the universities and other research institutes engaged in scientific research on peanuts are of paramount importance for the future of the business. We will follow the main discoveries, from the latest issues concerning peanut genetics to the development of projects on pathogens or the impact of peanut consumption on human health. The consequences of scientific research on the future of the industry are hard to overstate, so we will be putting them in perspective in order to try to understand where the sector is heading in the long term.

The Laws and Regulations section of World Peanut Magazine analyses the impact of new legislation and regulations affecting the production and trade of peanuts. The main issues treated in this section are governmental measures directly affecting international trade (such as the introduction of tariffs or quotas), health safety issues (such as the establishment of Maximum Residue Limits for certain substances) but also legislation impacting distribution, packaging and sales.

This section offers peanut professionals news and insights into the world of peanut consumption and all its aspects. Typical news is related to findings concerning the nutritional values of peanuts, the impact of peanut consumption on human health, and the development of peanut-based food.

The primary production is where the peanut business starts, of course, so we will have a dedicated section for all events, activities, techniques and equipment related to growing peanuts in different parts of the world. The general idea is to bring farming in the producing countries closer to all peanut professionals so that they can have a better grasp of the business from a grower’s perspective and maybe on what the future of peanut farming may look like.

With stocks generally very low, all eyes point to Argentina’s harvest

The hall at the Quinto Centenario Hotel in Cordoba is a lot more crowded that expected on March 19th, when the conference is about to start. The event had been initially intended for 250 participants, but ultimately about 350 peanut professionals joined in and if we consider members of the press, politicians, and officers of the government there are more than 400 people waiting to hear the latest news of the world peanut industry. After the welcoming remarks by Diego Yabes, president of the CAM, it is Pablo Rivera’s turn to open the presentations session with a look at the peanut supply from Brazil.

Pablo Rivera is originally from the peanut producing area of Argentina but has been living in Brazil for many years and currently acts as CEO of Beatrice, one of the largest peanut exporters of the country (it accounts for 20% of overall exports, and 40% of the peanuts sold in EU countries). Pablo has a moment of hesitation when the moderator, Diego Bracco, asks him how many world cups he has (the soccer rivalry between Argentina and Brazil is well known) but he quickly recovers from the tease: he claims eight, three from Argentina, his home country, and five from Brazil, where he works. But it is time to talk about peanuts.

Most of the Brazilian peanuts are grown in Sao Paulo. However, due to the increasing cost of the lots (the lease has increased by 150% in the last three years) part of the area is moving to other states: Minas Gerais, Paraná, Mato Grosso and Mato Grosso do Sul. “The crop in 2024 will not be as good as previous years”, Pablo says, “…because the country has experienced one of the worst droughts of the last decades. Surely the planted area will be reduced this year, due to the competition from other crops (especially sugar cane and soybeans) and rising costs: last year the production cost of one hectare was 2,200 US$; this year, according to estimates, it will be around 2,400 US$.”

As far as figures are concerned, there is a certain degree of uncertainty: according to CONAB (the Companhia Nacional de Abastecimento, or National Supply Company) the total production in 2023 has been around 900 thousand tons, but according to the Brazilian Peanut Chamber it was well over 1 million tons. Pablo explains that the Chamber is most likely closer to the real figure: according to separate research, the average consumption of peanuts in Brazil is about 1.1 kilos per person per year, that means over 200.000 tons per year. If you add exports, oil production and other uses to that number, the figure estimated by CONAB does not seem to add up. It is important, Pablo says, to rely on better quality statistics,

so “we are working to make it happen and the new association we are promoting among farmers, shellers, exporters and manufacturers will lead to more accurate figures in the near future.”

The exports estimate for 2024 is 280.000 tons, less than hoped for, again, due to the drought.

Pablo is very proud of the accomplishments of the Brazilian industry in terms of sustainability initiatives: “Embrapa, the state agricultural research agency, has measured the carbon footprints of peanuts and with 616 kilos per MT, they resulted lower than the average in peanut producing countries.” Another notable achievement, Pablo explains, is the percentage of biological control operated by the Brazilian agribusiness, 55%, much higher than Europe and other areas (the average in the world, Pablo says, is 14%).

Pablo Rivera has worked as a CEO at Beatrice Peanuts since 2015. He was born in General Cabrera, Cordoba, Argentina, but has lived in Brazil since 2005 when JLA Brasil Laboratories was founded and where he worked as an Administrative Manager until 2015. He currently holds the position of Alternate Representative of the Peanut Chamber of the State of Sao Paulo, is a member of the Management Committee of Brasil Sweets and Snacks Project of Abicab and Apex-Brasil and is Vice President of the Association of Peanut Farmers, Shellers, Exporters and Industries

“Nicaragua has an agriculture-led economy and peanuts are an important part of it, as one of the significant export crops alongside sugar cane and coffee,” says Joaquin Savala, General Manager of Comasa, one of the largest peanut companies in the country. Joaquin participated in both online versions of the World Peanut Meeting in 2020 and 2021 during the Covid pandemic and reminds us how nice it feels to be able to participate in person today.

The industry in Nicaragua is set up in a fashion similar to Brazil, with specialized roles for farmers, shellers and exporters, unlike, for example, Argentina, where the peanut sector is more vertically integrated. Climate conditions are obviously very important and though the land in Nicaragua gets a lot of water, certainly more than Argentina, the average temperature is very high, so the amount of rain is critical. “El niño years tend to be tough. Sometimes in the last few years the rain distribution has been rather abnormal. While historically September and October see an abundance of water, which is fundamental given the life cycle of the peanut plant, in the last period we have seen less water, with immediate impact on yields.” In 2023 the yield has been 3.84 tons per hectare, which is much lower than the average (4.45 since 2010 in non-el niño years).

In the last few years Nicaragua has reached a total production in the 200-220 thousand range, of which 150-175 thousand are exported and the rest used for crushing and seeds. The most important market is the European Union, particularly Italy, Spain, the Netherland and Poland. However, Mexico and other Latin American countries are also significant customers.

Joaquin is aware, of course, of the need to work more on sustainability, but he also reminds us “that it is still important that farmers make a profit when they plant peanuts… having said that we all have to join efforts and work together on these issues, that is also why it is important to have forums like this one…”

Joaquín Zavala. Over 25 years experience in the peanut business. Has been General Manager at Comasa since 2016, previously help positions in the commercial, operations and finance areas. Has a Bachelor Degree in Industrial Engineering from Texas A&M University (1994) and a Master in Business Administration from Carnegie Mellon University (1998). Happily married since 2002 and father of three.

Zhang Peng is the founder and chair of JLA China, as well as a peanut consultant for the China Chamber of Commerce for Export and Import of Foodstuffs.

Going from China to Argentina is one of the longest journeys, as Zhang says: “It took me about 40 hours to get here and I only have about 15 minutes for my presentation so I will try to make it worthwhile, not just show some data, but also my personal insights and hopefully this will help you to better interpret the Chinese peanut market.”

One of Zhang’s slides displays two supply/demand tables of peanuts, one with official data from the government and one prepared by industry actors. “The difference can be quite big. In some cases, it reaches 6 million tons or so, and that represents the whole production of the second world producer, India.”

“The central government obtains the data from the local governments,” Zhang explains. “But you should not think that the local government checks every producer in order to estimate the production. There are just too many, millions in fact. Nobody could to that. So, they run estimates, often there are errors, which quickly sum up when the data are consolidated at national level. The result is the big differences we see…”

“But the data from the industry is not completely reliable either. What they do is take a sample of maybe 100 farmers, make some assumptions, and try to infer the total production. An additional factor is that companies that deal with futures may attempt to influence the data depending on their specific objectives. This is why it is difficult for us, as speakers, to provide some reliable numbers.”

“You get a good example if you notice the big difference in the line “other uses” on the slide: about 3 million for the industry, almost nothing for

the official data. You have to consider that there are many small farmers, each one of them produces, say, one ton of peanuts inshell and puts it in their small warehouse, maybe in the kitchen. Then the producer must decide whether to sell it, or maybe make oil with it, or just consume it with his relatives. No one knows if those peanuts will ever go to the market. Now consider that there are millions of these small producers.”

“Which data set is better? Personally, I trust neither of them… so, it is complicated in China…”

What about the future? It is early to talk about the next season, Zhang says, but the key, looking at the long term, is consumption. Everything changed after the pandemic, consumption started to decline. Long term cultural trends matter too. Many people from later generations traditionally like to eat fried peanuts while drinking liquor. “But young people do not find this fashionable at all. Maybe that could change with the proper marketing strategy.”

Zhang Peng, Research Fellow, is the senior consultant of China Chamber of Commerce for the Import and Export of Foodstuffs, Native Produce and Animal By-products (CFNA), senior consultant of the Chinese Academy of Inspection and Quarantine, Secretary General of Qingdao Peanut Import and Export Association (QPA), and Founder/Chairman of JLA China.

Engaged in food safety and technical consulting for more than 20 years, Mr. Zhang has worked on supervision and inspection of import and export food in Shandong Entry-Exit Inspection and Quarantine Bureau and other food inspection authorities. He has represented the Chinese peanut industry to participate in World Customs Organization (WTO) conferences and numerous international and domestic peanut industry conferences, and is committed to providing technical support for food safety management for the global food industry.

Tushar Thumar is the head of Khedut Feeds & Foods PVT of India. Unfortunately, he had a bureaucratic problem completing the visa process and couldn’t make it to Cordoba. Instead, he recorded a video with his presentation about the peanut supply from his country. By way of introduction, he used a beautiful line, “The word is my family”, which adapts quite well to the whole WPM event as for a few days the world peanut family gathered in Cordoba.

Tushar underscored the importance of a single Indian state for peanut production, Gujarat, where 45% of the Indian peanuts are grown. As most agriculture professionals know, there are two crop seasons in India: Kharif (summer in the northern hemisphere, from June-July to September-October), which accounts for about 85% of peanut production, and Rabi (from October-November to JanuaryFebruary). “Besides being the second largest peanut producer, India is also a very significant exporter: even though only 8 to 10% of the peanut supply is exported, this amounts, depending on the season, to more than 600,000 metric tons that go into the international markets, mostly in Asian countries such as Indonesia, Vietnam, the Philippines, Malaya and Thailand.” A challenge for Indian peanuts that Tushar underscores is its small role in the European market (about 1 %), where the high compulsory controls, set at 50% for India, constitute a major obstacle.

Of course, most of the peanuts India produces are consumed in the internal market and the demand is rising very quickly, at a 3 to 4% pace, as Tushar explains, with a growth particularly significant for peanut butter and peanut oil, as people become more attracted to healthy food choices. If the trend continues, as was the case with China a few years ago, India may soon switch from net exporter to importer.

Tushar highlights the important role of the government in the peanut industry. For starters, the public sector is working to foster

the consumption, especially of oil. But the intervention of the government is particularly important through programs that provide good quality seeds and fertilizers at subsidized rates, and even more with the Minimum Support Price, which guarantees producers with a level of income: in 2023 the government paid 64 Rp. per Kilo (775 USD per MT).

Tushar Thumar, is the Director at Khedut Feeds and Foods Pvt. Ltd., a leading Agro processing owned company of India established in 1967. He oversees Procurement, Framing Initiatives, Quality & Process control. His dedication to quality and sustainability has led the company to adopt advanced technologies for processing and establishing a sustainable, integrated groundnut supply chain. He successfully initiated an now leads the program “Project Saurashtra Peanuts†or PSP wich works along nearly 25,000 Indian farmers to implement scientific agricultural practices in peanut cultivation.

With a focus on innovation, ethical values, and sustainability, Tushar continues to drive de company towards greater heights, shaping the futuro of the peanut-processing industry of India.

Ryan Lepicier is the president and CEO of the National Peanut Board. He ascended to this position just a few months ago, after the former president (and speaker in the first online version of the WPM in 2020), Bob Parker, retired at the end of 2023.

Ryan starts his presentation with an overview of the 2023 crop. In terms of peanut variety, of course, Runner is the number one, with 78% of the total. After all it is the favorite type for peanut butter producers, which is where most of the US peanuts end up. The remaining three varieties are Virginia, Spanish and Valencia.

The figures are the ones we know: 1,574,000 acres (about 637,000 hectares) of planted area for a production of 5,890 million pounds (2.284 million tons), which results in a yield of 3,742 pounds per acre (4.19 MT per hectare).

“The crop has been a mixed bag: better in some states and worse in others,” Ryan says, “…but on average the quality has not been as good as the previous years. Altogether, it has been an expensive crop for shellers to handle, with buyers having to be flexible in terms of specs, especially for premium peanuts. The export increase contributed to a tightening of the supply, particularly for blanched peanuts.”

“The perspectives for 2024 are rather good. Peanuts seem to be a better option for farmers than corn, cotton and soybeans. A recent survey on peanut acreage done by peanut specialists showed an increase of the planted area of about 5.4%. Other estimates point to a 5 to 8% increase. We think that the market right now needs about a 5% increase. But on

March 28th we will have the USDA official forecast available.” By the time we write this summary we can check the USDA figure, which presents planting intentions in line with 2023 (an increase in Georgia is offset by a reduction in Texas, the second largest producing state).

Ryan Lepicier, with a passion for fueling peanut demand and consumption, Ryan Lepicier serves as President and CEO of the National Peanut Board. Ryan and his team are working to make peanuts the most relevant nut among consumers by ensuring people are thinking about peanuts differently, talking about peanuts positively, engaging with peanuts more often, and ultimately buying more peanuts.

The last presentation of the supply panel is performed by the host of the event, Diego Yabes, GM of Olega and president of the Argentina Peanut Chamber.

“From a geographic standpoint Cordoba is the main province for growing peanuts in Argentina. But the contribution from other provinces, such as Buenos Aires, La Pampa, San Luis, Santa Fe and others is significant,” Diego explains, as he lays out the results of a survey conducted by the Chamber just a few days back: “…while the actual numbers will be available in July-August, we estimate that the province of Cordoba will maintain about 75% of the area. We can see that through the years the big increase has been with the province of Buenos Aires, now accounting for close to 14% of the total peanut area, while the other provinces are rather stable. Santa Fe could increase in the future…” The total area estimated for the 2023-24 crop is 405,000 hectares, an increase of approximately 8% compared to the previous season. “The weather was completely different from the previous crop obviously. We had good water accumulation, and “el niño” brought fairly good rain. The temperatures were a little lower than 2023, but still in line with the values we need for peanuts.”

“According to our survey the crop looks in a very good shape. Of course, the survey was conducted before digging, so it is a first estimation, but the resulting yield is very close to 2.5 tons per hectare, leading to a total production of 1,430,000 metric tons.”

As far as exports are concerned the estimate for the current sales season is set at 507,000 against more than 700,000 in the previous two periods, which means a reduction of almost 30%. But the reduction will be particularly marked in the first third of 2024; in March and April the reduction will be close to 50%.

“If we look at exports’ destinations,” Diego adds, “the EU, of course, is still the most important area. In 2023 it decreased a little in percentage, from 67 to 62%, since, given the bad crop, the amount of quality peanut was a little lower than the previous years. Observing from the perspective of EU imports, Argentina is still the biggest player. Last year we exported 38,000 metric tons less, which were supplied by the USA as Ryan said.”

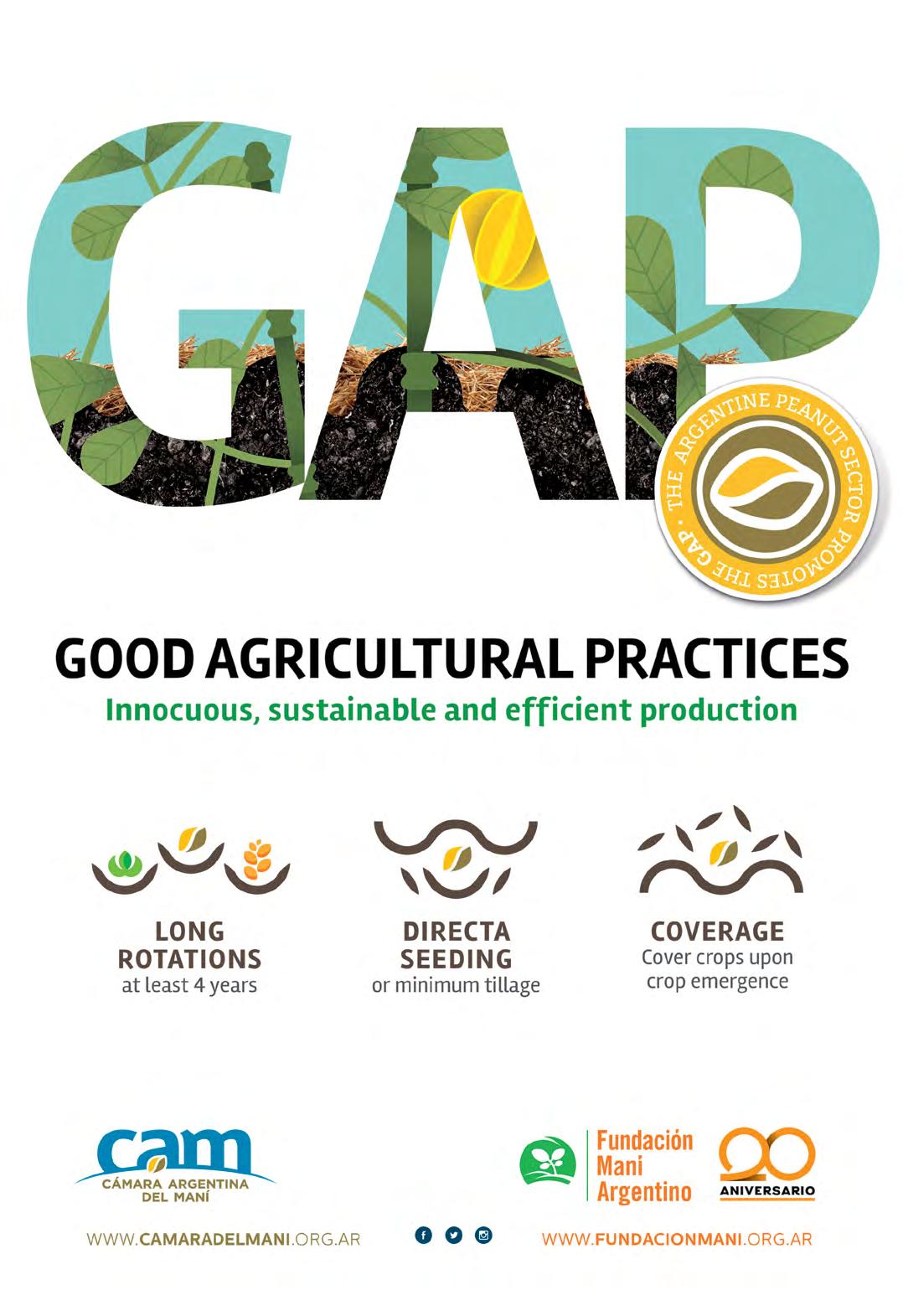

Diego dedicates a significant part of his presentation to the sustainability initiatives of the Argentine peanut sector: “Since the beginning of 2000 we have been adopting direct seeding, which today accounts for more than 90% of the planted area, while 100% of the soil subject to erosion is treated with cover crops as a prevention tool. We have no deforestation in the area, no artificial irrigation, no artificial fertilization, and we routinely practice a rotation of at least 4 years. The shells are recycled and used for energy production. Two years back we started working to certify the FSA sustainability program and now we are looking at carbon footprint and regenerative agriculture. One big advantage in Argentina in terms of footprints is the recycling of the shell to produce energy. I believe we need a common way to measure, a standard for the peanut industry. We also work to create and maintain the institutions that will work on sustainability in the future: the Argentina Peanut Foundation, the Peanut Science and Technology Network, with the support of the government and the universities of the area, and the Peanut Institute, founded during the presidency of Ivana Cavigliasso, that will work on training our human resources.”

Diego concludes his remarks by summarizing the supply situation: “Argentina will have a volume similar to the seasons prior to 2022-23, the quality looks good, though, of course, much will depend on the weather conditions during harvest. It is still not certain which origins will replace Argentina’s reduced exports in the next few months before our crop is ready. We foresee a strong demand in the coming months as stocks in Europe are low. We need to assess the quality of the crops in Brazil and the US and their suitability to supply the EU markets as well as other destinations with high quality standards. The political and economic situation in Argentina could be a disrupting factor, especially the increase of costs in dollar terms; today we have the highest inflation in the world, while rising production costs affect many origins.”

Diego Yabes, President of the Argentina Peanut Chamber. MBA from CEMA university and Industrial engineer dregree from Universidad de Buenos Aires, has been working in Olega since 1991. Throughout the years he has held different positions in the company and built up a wide expierience in the peanut industry. Today he is the General Manager of the company focusing his work in the production, logistics and trading of peanuts.

In most countries consumers are either maintaining or increasing purchases of peanut products

On March 20th, after a night with good cuisine and a show of tango, the participants of the World Peanut Meeting are back in the main hall of the Quinto Centenario Hotel for the second part of the conference, the demand presentations.

The first speaker is another veteran of the WPM online. Kobe is a senior director at China Metaintl Corporation. A big player in the edible oil market, the company imports about 500,000 metric tons of oil per year.

Before getting into the details of the Chinese market, Kobe proposes a longterm overview of the major peanut international trade flows: “Ten years ago China and India were the two main world exporters, with Argentina following behind. But then Argentina became the number one while some countries, like Sudan, show sharp rises and falls, due to internal instability. Brazil gradually increases its share of world exports. As far as peanut oil is concerned, of course, we know that Brazil has passed Argentina a few years back.”

With consumption increasing China became a net importer and is now not only the main producer but also the biggest importer in the world. “We still export peanuts, though,” Kobe says, “and it is interesting to see how export performance varies during the year: from May through September, the off season, due to the summer high temperatures, it is difficult to ensure proper storage and transportation while maintaining the necessary quality standards. As a consequence, monthly exports remain close to 25,000 metric tons. However, from October to April, when the new crop becomes available, the conditions are much more favorable and exports go up to 30,000, even 40,000 tons. February is an exception as the spring festivals cause a drop in exports.”

It is interesting to see where China gets the peanuts it needs. While the country buys a significant amount of inshell peanuts from the US (about 120,000 tons in 2023), the great source of shelled peanuts are the African countries of Sudan and Senegal, which together have been exporting more than 600,000 tons every year since 2020, with a decrease in 2023, probably due to the war in Sudan. “African countries do not pay duties when exporting to China and

they can provide high-oleic peanuts. As far as oil is concerned, the champion has been Brazil, while India and Argentina are also important providers.”

Kobe shows how the peanuts are consumed in China. More than half go to crushing for oil production, though there has been a reduction from 2022 (60% of the total) to 2023 (52%). The rest go to food use (37% in 2023), seeds (10%) and exports (1%). “Food use” includes a wide variety of products: snacks, peanut butter, beverages, protein products, etc. “The crushing operations are rather concentrated in a few big companies: Luhua, Cofco, Wilmar, but then many small producers do some small-scale crushing, mostly for self-consumption as Zhang mentioned yesterday.”

Most of the peanut oil consumption is rather concentrated in the big cities, such as Beijing, Tinjin and Shenzhen. “In recent years, with the promotion and marketing efforts of many brands, the consumption area is expanding.” It is interesting to note that while the total edible oil consumption has almost doubled in China in the last ten years or so (from 23.49 million tons in 2009-10 to 41.70 million tons in 2020-21), the percentage of peanut oil has remained the same: 8% of the total.

“As for general trends, healthy products are in good demand, as are high end, quality items that explore more segmentation and different consumption scenarios. We expect that peanut from the US, Argentina and Brazil may play an important role as import complements.” In the next period peanut imports are expected to decline due to the civil war in Sudan, while providers may become more diversified with a bigger role for India, Brazil, Argentina.

“How good will the domestic peanut production in 2024 be in reality? Of course, that will affect imports. Among bearish factors I would mention the fact that the current oil demand will not support high prices like in the past and, in general, in the post-pandemic China expectations are not as optimistic as in the past.”

He Miao, obtained a Master's degree from the University of London in 2012. Currently the Senior Director of China Metaintl Corporation, He worked as the Ediable Oil and Grain Department Manager for a state-owned Enterprise, and has been deeply involved in the peanut industry for more than 8 years. He has extensive knowledge and rich experience of peanut and peanut oil international trade operations in countries such as India, Argentina, Brazil, USA, Senegal, Sudan, Ethiopia etc., specializing in domestic and global peanut supply and demand analysis. He also has served as the speaker at many variety of domestic and international peanut industry forums and industry conferences.

Marcos is from Argentina but has worked for the European snack giant Intersnack for 15 years. Europe is one of the most important markets, especially for origins such as Argentina, Brazil, Nicaragua and the US, so expectations are big for Marco’s presentation.

“We have to keep in mind that the world trade of peanuts represents only a small part of the overall production; about 54 million tons are produced in the world and the internal consumption is almost 50, so…” Marcos continues, “of course, when Argentina has a good crop, they can supply very well Europe. In 2023 the gap of availability from Argentina was covered by the US. But although the gap was not reduced by a lot, the quality was different. The problem may start now, we will see during these months the problem caused by the Argentina drought.”

In general, Marcos explains, the savory snack market is a category that is growing all over the world, there is no country where it is not growing. “But Europe lately has quite an issue with inflation, we had it for the last two years and it will continue to affect consumers for another two years, though it is in a downward trend. Compared to Argentina the extent of European inflation is “peanuts” but for countries that for 40 or 50 years had no inflation, it is tough, and it has changed people’s behavior in food buying. When you go to a supermarket you have branded products and private labels and what consumers are doing is choosing the cheaper products. They are trying private label products. The second factor is that instead of going to the regular supermarket, they are going to the discount supermarket where you only get private labels.”

“For peanuts, in some countries, almost 90% of sales are private labels: the distinction of quality is very small, it is mostly the price! The Argentina supply during the June-December period of last year was not dramatically reduced, but the sizes were smaller, the quality was lower,

and it was difficult to establish a difference between branded and private label.”

Marcos continues by describing the snack market in Europe: “On average 5kg per year of snacks are consumed. The income per capita plays an important role on the quantity consumed, but also habits: it is always interesting to see different trends of snack consumption in different countries. Some, like the Netherlands, the UK and Spain tend to consume more, others may have more growth potential. The UK, Germany, France and Spain account for half of the snack consumption in the area.”

Nuts and seeds are not gaining a lot of share within snacks. They account for about 26% of the total snacks and increased by only 3% in the last period. Before 2021 sales of what are sometimes called “noble nuts”, almonds, pistachios, etc, were growing at two-digit speed. “After 2021, those sales stabilized, and we see record low prices. Consumption of peanuts is more stable, but there are certain peanut products that are growing; the main one by far is peanut butter. It is a very hot segment in Europe, all over the place. In the Netherlands and the UK peanut butter is well established in the daily diets, those are mature markets. But when you see the other countries, Germany, France, Italy, with huge populations, there is a lot of potential there. The health claim is important for replacing other products such as marmalade. Why are sales not growing more? We are using all the production capacity.”

Marcos talks about the requirement that the European Unión imposed on food imports: “We know that doing business with Europe is difficult. Imports come with important requirements. In the past they were very focused on food safety, and to some degree with social considerations (labor, etc.). But now we have the green deal. It will be the focus in the next 10 years. There are carbon emission reduction targets, and each company must meet certain objectives. In the case of Intersnack, we have to reduce 30% of emissions by 2032. This will be a key point for the future.”

Marcos then wraps up on a positive note, reminding everyone how lucky peanut professionals are in a way: “We are in an industry where people gather to eat, they share a moment, maybe with a beer, and we are in that moment. It is a good moment to be in!”

Marcos Lafuente, has 15 years experience in Peanut markets from Latin America. Marcos has gained a vast experience in world trade, and he is passionate about the peanut industry and its value chain. His aim is to generate long-lasting relationships that strengthen the business and consolidate a sustainable future.

Andreas is an agronomist and currently works in the peanut division of the company GWK Limited. “It is nice to be part of the peanut family…” he starts. “South Africans like to win, and currently we are rugby world champions… for the fourth time. When we talk to our children, we tell them they must use the head, not for thinking, but as a weapon. For those who do not know rugby, it is probably the closest you can get to war without weapons, it is really tough… I think it speaks about the resilience of the South Africans: the economy has been difficult, the government has been doing not so well, and it is difficult to do business, but, on the other hand, agriculture is performing really well, exports are increasing, especially in the fruit business. Many are working hard, head down, to make it work in our country and it will be a challenge to improve our government in the future…”

South Africa is both a producing country and a market for peanut exporters such as Brazil and Argentina. Andreas starts talking about the varieties grown in the country: “The reason we use the Spanish type is that we grow peanuts with just 500 millimeters of rain and currently about 90% of our production is dry land production; we need rain for that. We used to have more irrigation for peanuts and it could probably come back, the problem is we have lost a lot of soil to pecan nuts and crops like maize and alfalfa over the past few years, that is the challenge. This season we planted more than 41,000 hectares (an increase of about 30% compared to the previous one) and we thought we were going to have a good crop, but the rain is not coming…” As far as consumption is concerned, Andreas explains that about 90,000 metric tons are sold in South Africa. However, there is a significant informal market, and there are informal imports from other African countries which add to that number.

“Kernel-based the yield has been between 1 and 1.8 tons per hectare,” Andreas says. “It is low because of the dry land. But I want to underscore the

up and down trend. Mostly due to drought. In South Africa we know that in El niño years we get drought, while with la niña we get rain. The next problem is that we need new varieties. The governmental program came to a stop and now we are working on it with the private companies, some new varieties are coming out now. We need them also to convince farmers to plant more peanut and make production stable.”

“Our imports are becoming more important over time while exports have been going down.” A total of 70%, sometimes 80%, comes from Brazil and Argentina, the rest is coming from Africa. Last year most of the imports came from Brazil due to changes in the sanitary rules for peanut imports, because of smut. “But after a few meetings with the government and the people from the Argentina Chamber we were able to change the rules again, in the same way Australia did a few years back. So it will be possible also for Argentina to export to South Africa this year.”

The quantities exported are destined for niche markets such as Japan (which represents about 31% of the total) and the Netherlands. “In the Netherlands they like to eat South African peanuts,” Andreas says proudly, “because they are the best tasting in the world. They are more expensive, though we cannot achieve the yield that other countries get with the runner types.”

The South African peanut market has been shocked in the last few months by a security failure: “There is something I must mention, we had to remove products from the shelves, and it was really bad for the industry. A small peanut butter producer imported peanuts from Africa with aflatoxin contamination and it was bad… all because of a player not doing his job properly. We will see the level of damage in the future.” Most of the peanuts imported are used for peanut butter as South Africans are great consumers of it: about 35,000 tons (that is more than 50% of the peanut usage).

Andreas concludes with a note concerning the next crop: “By Feb 10th the crop looked very good, but then it stopped raining and this caused a lot of damage. We can only guess the extent of it. We will need to import at least 10 to 15 thousand tons to fill the gap with the internal demand.”

Andreas Snyman. grew up on a farm in the Northern Cape province of South Africa. He completed an BSc. Agric. Honors degree in Soil Science, Agronomy, and Irrigation design at the University of the Free State. In 1994 he started working at GWK Limited as an agronomist, working with irrigation farmers. Since 1996 Andreas has been involved in the production, processing, marketing, and management of GWK’s peanut business. Over the years he has been responsible for the processing, marketing, and business management of various agricultural commodities, such as maize, wheat, barley, alfalfa, and cotton. Currently Andreas is based in Douglas in the Northern Cape Province and is Head of GWK International, which focuses on the international trading of commodities including pecan nuts and peanuts.

Sergey Khaesh is the founder and general manager of Agroimpex, Russia’s greatest player in the peanut distribution sector.

“Russia is the fifth largest importer of peanuts: the peak has been in 2019, with 153,000 tons imported. After the pandemic and other events, the number decreased a bit and in 2023 we imported 143,000 tons. However, there is a long-term positive trend toward an increasing consumption of nuts, which are perceived as healthy, and we believe this trend will push peanuts as well.”

In terms of origins, Russia is very price sensitive, Sergey says. “Argentina used to be the largest supplier, but since 2018 she was replaced by Brazil. But we also import from Nicaragua and India, which is the cheapest option. I think in 2024 we will have huge numbers from India. More specifically, in 2023 Brazil accounted for 63% of the total, Argentina 20%, India 10% and the rest from Nicaragua and China.”

In Russia the market is rather concentrated: 15 companies represent about 80% of the sales. Another characteristic of the market is that 85% of imports are performed by traders, mainly due to complex regulations and customs formalities. Logistics is also a challenge given the size of the country.

How are peanuts consumed in Russia? There is practically no oil crushing and most of the product, 64%, is used in the confectionery industry (chocolate, biscuits, wafers, etc.). The rest is used for snacks (33%) and peanut butter (3%). A significant percentage of the confectionery is then exported, especially to neighboring countries such as China, the Middle East, and some African countries.

“As with Europe, we also have strong requirements in terms of quality, though the specifications can be different from those of Europe. Do not consider Russia a country with low quality standards. Among the requirements

I should mention moisture levels, and uniformity. I always recommend to suppliers to be careful about insects, especially from Brazil. In general, my advice is to talk a lot with Russian customers and agree upon definitions, which might not be the same in Russia and Europe or other countries. You should also avoid the mistake of thinking that, because it is not in the EU the limit for aflatoxin can be any level: we have 5ppb for B1 and 10 ppb for total.”

Among recent market trends, Sergey mentions ecommerce, which is growing by double digits, and the increase of peanut butter consumption. Lately the sector had a few challenges as well – very strict controls at entry, as every container is sampled and analyzed, and new traceability regulations: the information system “Zerno” is creating a lot of headaches. In practice, all peanut lots coming in must be registered and all transaction among companies recorded. In this way it is possible to trace peanuts bought in the supermarket. An additional problem, Sergey adds, “is the conflict, of course. We have a difficult situation.”

Sergey Khaesh. Founder and General Manager of AGROIMPEX Co. the largest Russian importer and processor of peanuts. He has 30 years of experience in Agriculture Commodity trading, farming and processing. He has done Mechanical Engineering from ITMO University St. Petersburg and did his EMBA from Graduate School of Management St. Petersburg State University

Anne-Marie is the senior strategic sourcing manager for peanuts at Mars Wrigley, where she has worked for over 33 years.

“We work in the best industry in the world,” Anne-Marie tells the audience. “Peanuts are not only healthy for us, they are really tasty… and I am so honored to be able to work in this industry and to be here, with so many friends and family… I can’t wait to go and see the crop in the next couple of days.”

In the US, per capita yearly peanut consumption is now about 7.7 pounds (approximately 3.5 kilos). There has been a bounce during covid, the sales kept up and we are still growing. Consumption is really driven by peanut butter, which accounts for 57% of the total in the US, that is about 4.4 pounds (2 kilos); then you have peanut candy and peanut snacks, 35%.

“In the US, how you drive brands is putting out new innovations, new products, not only to draw consumers to the new products but also to highlight your own brand. For example, Mars launched the Snickers Hi-Protein bar, that will also push regular Snickers consumption. I have brought a couple of bars here… I can give them out if someone answers this question: which is the best-selling chocolate bar in the world? Yes, Snickers… some people answered quickly!...Brand extension is a good way to go, it gives consumers a new way to try the product.”

The next product Anne-Marie shows is the new M&Ms, mini and mega, introduced in the last quarter of 2023, they are peanut butter M&M: “We could not keep up with the demand and had to double the capacity.” Among other product categories that are hot AnneMarie mentions “nostalgia” peanut butter and jelly items, sauces with peanuts, some of them spicy, peanut products with world flavors such as African style potato chips with peanuts, and peanut noodles.

The next part of Anne-Marie’s presentation is dedicated to world trade and disputes. “We have a truce over EU imposed retaliatory tariffs on peanuts. Trade relations with China are relatively stable right now… But much depends on the next elections in November: a Trump administration or a Republican Congress will likely lead to trade wars. Other disputes may have to do with the EU’s farm-to-fork policy which affects our peanut exports. While another issue could be India’s market price support program.”

Before closing, Anne-Marie says she “gets to have a little fun with Diego: in America we have the best football, the only football, American football! And this year is the year of the peanut butter, and Mars is highly focused on that. The Superbowl is not only about football but also about commercials, so 40% of the people watch it for the commercials and the rest for the game. So here is our commercial!” and there goes the “M&M’s Almost Champions Ring of Comfort” ad.

Anne-Marie DeLorenzo serves as Senior Strategic Sourcing Manager - Peanuts for Mars Wrigley. In this role, Anne-Marie has responsibility for sourcing Peanuts from the US, Argentina, Brazil and Nicaragua for use globally. Anne-Marie’s responsibilities include driving the initiatives that will ensure long term viability of Mars brands.

In her 33+ years with Mars, Inc., Anne-Marie has held a variety of positions within Procurement including responsibility for Dairy, Sugar, Cereal Grains, Fruits, Flavors, Colors and sales support. Anne-Marie has been recognized as Mars’ Sustainability Champion in 2013, received Regional Make the Difference awards in 2011, 2013 and 2018 and the Global Make A Difference in 2019 - one of the highest honors bestowed on a Mars Associate. The award recognizes outstanding individual or team contributions of living Mars’ Five Principles. In 2017, Anne-Marie won the Global Procurement Leaders Award for External Collaboration.

Anne-Marie resides in Wilmington, North Carolina and has two daughters, Joanne & Jessica and three beautiful grandchildren, Elliott, Gray and Lila. Anne-Marie is very involved in community service working in area soup kitchens, helping woman in need, fund raising chairwoman of Habitat for Humanity and Big Sister & Brothers.

We asked the companies that participated in the event with a stand or a tabletop to send us a few words about their products and their experience at the WPM in Cordoba.

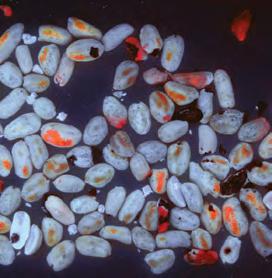

By leading the optical sorting technology since 1947, Bühler Sortex has positioned itself through the years as a pioneer and an absolute leader within the industry, thanks to its recognized reliability, technical excellence, product innovation and engineering leadership.

As representatives for the Southern Cone since 1989, today we are positioned as market leaders with a strong presence in the peanut sector, with more than 150 units installed, thanks to an unconditional commitment to help our customers ensure the quality and security of their products within the different production stages.

Today we provide not only first-rate equipment, but also the guarantee that the products acquired will always be backed by an excellent post-sale service, with the necessary resources, and the spare parts required to avoid problems and delays in the production process.

The AmSpec Group has been relied upon in the testing, inspection and certification (TIC) sector for several decades.

With hundreds of locations all over the world, AmSpec is highly capable of providing leading testing, inspection and certification services for a wide range of industries and products.

Product experience is key to our strategy of serving our customers by adding in-depth knowledge of the peanut market, its specificity, and its quality requirements. Our peanuts division assists you in your daily challenges, such

as logistics, qualities and contract specifications. AmSpec Agri brings you solutions to anticipate potential concerns and will enable you to maximize the outcome of your business.

At AmSpec, our ultimate goal is to make food and feed safety simple for every company, and their end consumers. Our cutting-edge international network of offices and laboratories offer all of the services required to ensure the safety of your agricultural products through testing, inspections and certifications.

We would like to thank the organizers of WPM 2024 for such a first-class event. It was a very positive experience, and we hope to continue to promote and help the improvement of the Argentine peanut industry.

Nolin Steel is a 50-year-old, third-generation equipment manufacturer. Proglobal is a 40-year-old, second-generation business serving the Mercosur markets. Together, we offer an integral solution for the peanut processing industry.

The World Peanut Meeting gave Nolin Steel and our partner Proglobal a chance to learn more about the global peanut industry and the latest trends and information in the market. The opportunity to meet new friends and customers, networking and establishing relationships, was simply fantastic! It was a short but very enjoyable three days. There will always be challenges in any industry, so it’s important to come together and create a sense of community and see that all of us, from all over the world, have many things in common.

Kudos to the organization. Thank you to all the attendees for such a nice welcome! We are looking forward to meeting everyone again at the next World Peanut Meeting.

Bag Bio’s technology was developed in order to guarantee optimal storing, conservation and transport conditions through the application of modified atmosphere with gas injections and vacuum specific for each product.

The packaging system is innovative and employs clean, high quality and sustainable technologies. In addition, our software records all packaging information and generates the traceability of the units.

Our system prepares the product in big bags (from 700 to 1250 kilos) allowing its organoleptic properties to remain 100% unaltered until the opening.

The benefits include:

• Avoids oxidation and color shift.

• Maintains the moisture level.

• Prevents insects, molds and fungi.

• Does not require the use of chemicals –especially important for organic products.

• Reduces the need to condition the containers for sea freight.

• Avoids recall of the payload at destination.

• Maintains organoleptic properties intact until arrival.

• Increases storing time, thus enhancing sales prospects.

• Makes refrigeration unnecessary.

Our participation at the WPM was very positive and gratifying. We have been participating in peanut conferences outside of Argentina for ten years and being able to participate as “locals” in our province allowed us to show our products and equipment in a much better way.

It has been very satisfying to meet local and foreign clients with whom we have been working for years and be able to show them the benefits of our technology. We congratulate the CAM for the organization of this event!!

We are a service company with more than 30 years of experience in the market, with offices in Argentina and Brazil; we provide multiple solutions for industrial processes focused in value-added products and care for quality. We are a strategic partner for our customers and assist them in achieving their goals with the highest standards of quality.

We can count on an experienced team of professionals capable of supporting the investments of our customers with engineering projects for the processing of peanuts, grains, legumes, nuts and seeds in all relevant areas. We develop projects in the areas of mechanical, civil and electrical engineering, automation, industrial design; all under the BIM format in order to reduce to a minimum the problems related to interference during construction and to minimize the costs.

We complement our innovation in construction with our innovative management services. Alongside our sales representatives we offer different solutions for the agricultural sector: grain and seed processing including bagging and palletizing, packaging, case packers, checkweighers, metal detection and much more.

Lope de Vega 60, Villa Carlos Paz, Argentina Rua sete de setembro 590, Ribeirão Preto, Brasil ventas@grupodaq.com +5493513126474

At our stand we offered peanuts in all versions: hps, blanched – split and whole, in both food and feed grade.

The idea has been to start with the positioning of the brand with the main international prospects and to take advantage of the space to maintain meetings.

The experience has been highly positive, during the morning we could participate in the supply and demand panels while we organized meetings in the afternoon.

The organization of the event has been extraordinary, and its level matched the prestige of the international participants and speakers. The comments received from other participants were in line with our own experience. The event has been a success!

At the WPM we had the opportunity to talk about peanut quality with companies from all over the world, to meet new actors in the supply chain, and to listen to valuable insights. A couple of weeks after our participation as sponsors and exhibitors, we can say that it outreached our expectations.

At JLA we are committed to food safety. Through our three business units, we provide services to assure quality, achieve accuracy and boost innovation in our clients, addressing real problems and getting involved in the execution of the solutions.

As a certification body, we work closely with international companies focused on quality, aiming to assist them from the origin as peers. The goal of our certification is to reduce the claims risk to negligible levels.

But it is not only through certification that we interact with peanuts; the lab and the farm were also present at our stand: R&D projects, pesticide monitoring, environmental swabbing, field studies, and workshops at our experimental farm.

We are passionate about peanuts, and look forward to sharing some of our expertise with you.

VIS Consul, the official representative of LMC in the area, received the team from LMC, the supplier of equipment for the mechanical sorting of peanuts.

Ignacio Pittaro, General Manager of VIS, said: “We have worked hard to be able to match the level of the WPM. From the very start it exceeded our expectations. We want to use this opportunity to show our appreciation to the Camara de Mani for inviting us to the event. We will certainly be back!”

Myles Mosely, vice president of LMC, who participated in the event, stated: “It is an honor for LMC to be a Gold Sponsor at an event in which we can meet our most important customers, seeking to bring value to the industry.” He added: “Over three days we had the opportunity to meet with people from 25 different countries, all of them with a lot to share. It has been a really incredible experience for LMC and all our team.”

The first World Peanut Meeting has been an event that has marked an inflection point in the industry. VIS and LMC were a part of it. It is the first step of a great road we can walk together!

MSC, shipping peanuts worldwide. Every season, MSC becomes your best logistics partner for shipping peanuts around the world.

Every single journey we organize for our customers’ cargoes receives the highest level of attention and expertise.

Our highly-experienced teams take huge pride in supporting each step of the export process, from guiding customers through specific procedures, to helpfully advising on shipment preparation.

Our global sea and inland networks connect exporters to the world’s most important trade centers. Through our extensive inland transportation network under MSC Inland Solutions, we also offer customized end-to-end solutions that can be adapted according to your needs. The result: a flexible and reliable service, all year round.

Peanuts require meticulous care to preserve their freshness, taste and texture. MSC’s green, modern and efficient container fleet enables us to safely handle, stow and transport a range of dry and food-grade cargo to keep your shipment in perfect condition throughout its entire journey.

Our presence at the World Peanut Meeting was proof of our strong commitment to our valued customers in the peanut market. Certainly, in the future, you will hear more from us.

Tracestory is a platform for cooperative traceability and data integration for the agro-food supply chains with the objective of making the data available through a digital passport and assisting in intelligent decision-making with its dash board.

There are manifold rewards from the availability and unification of the data, both within and outside the supply chain.

Quality control and process provides a precise knowledge of what is happening in the different production lines; it helps to make products more homogeneous and detects anomalies in the process.

Product differentiation provides additional information on the products and allows an understanding of what makes them unique, generating trust in what we consume.

Sustainability support provides the opportunity to demonstrate sustainable actions with specific data from the production lots, reinforces the value of good practices, and highlights those who use greenwashing as a marketing tool.

Supplier development, knowledge of production from its origin helps unify efforts toward achieving a better product, reducing frictions in the relationships, and anticipating decision time.

As CEO Dario Baudino said, “At Tracestory we believe in enhancing the value of the products through the integration of data in the supply chain. We find value in good practices, organic productions, lower carbon emissions, areas without deforestation… In this sense, we believe that technology can play a major role in helping these sectors generate more transparency and at the same time use the data for decision making.”

The experience at the WPM was most positive; it allowed Tracestory to present its product with both the demand and the supply and get in contact, within the same place, with some of its current customers.

IFE Servicio Técnico S.A.: Leading Comprehensive Solutions for Peanut Paste and Butter Production

IFE Servicio Técnico S.A. stands out in offering comprehensive solutions for the production of peanut paste and butter.

Our focus lies in quality and efficiency, utilizing state-of-the-art and highly efficient equipment, while providing customized services for each client. From design to implementation, we specialize in developing turnkey modular plants that adapt to the specific production needs of each company.

In addition to offering cutting-edge, high-performance equipment, we excel in providing complementary services. From optimizing existing processes to the installation, commissioning and maintenance of plants, our expert team is dedicated to ensuring maximum efficiency and reliability at every stage of the process.

IFE is distinguished by its comprehensive approach to engineering projects, encompassing the integration of equipment and control systems to optimize production. Whether you’re looking to improve your current processes or implement a new plant from scratch, IFE will be there to provide reliable and high-quality solutions.

We recently had the privilege of participating in WPM 2024, where we showcased our innovative solutions and established numerous contacts spanning not only Latin America but also the rest of the world. It was an immensely enriching experience that has allowed us to establish new relationships, strengthen existing ones, and continue to solidify our position as leaders in the industry.

Georgalos Peanut World provides services of business intelligence through our Argentine and International Peanut Market Reports, available through individual subscription per company.

The Argentine & World Peanut Report is issued weekly every Monday.

The International Peanut Market Report is issued weekly every Tuesday, and deals extensively with the origins of the United States, China, India, Brazil, South Africa and others, as well as the market for crude peanut oil.

It is the part of our organization that provides the most intelligence.

This process is very critical in making sure that business is done transparently, informing our clients and subscribers about the market situation, thereby making our clients more powerful and well informed in making the right business decisions. “It is how GPW service information makes peanut operators stronger.”

Procurement services and positioning help you make the right and timely business decisions.

The global peanut market in the 2024/2025 marketing year has its challenges and opportunities.

Each origin faces its unique set of circumstances, making it crucial for your company’s general management, business management and CEO to stay updated and adapt their business strategies and positioning accordingly.

Georgalos Peanut World team offers robust business intelligence and unmatched expertise in advising on peanut business complexities in the world peanut market.

The last day of the World Peanut Meeting was dedicated to the Peanut Circuit, with visits to the production fields and research lots in Southern Cordoba

Sergio Morichetti is one of the organizers of the Peanut Circuit, the event that took place in General Deheza on March 20 th and 21st. He is the professional who welcomed the group from the World Peanut Meeting and took the guests for a tour of the lots. We had a chat with him concerning what the international crowd saw during the visit.

Sergio, I understand that the Circuit was at its tenth edition this year?

That is right. The Peanut Circuit is organized every two years by the National Institute of Agricultural Technology (INTA is the Spanish acronym) and the Agronomist Association of General Cabrera (CIA), the city close to Deheza which is at the center of the peanut area in Argentina. This year the Circuit was especially successful: we had 1800 professionals participating. In addition, on March 21st we had the visit of the group from the WPM, with people coming from many different parts of the world. My colleague Franco Vos and I had the opportunity to show them various peanut plots where we ran the trials.

Great, tell me about what you showed them

During the first presentation we explained to the group the different methods we employ to control weeds, which is a major

challenge with peanuts, as the plant is known for its slow initial growth and the wide space in between rows (to allow for adequate digging and inversion), which makes it less competitive against many weeds. We saw various control options with different herbicides underscoring the need to identify distinct sites of action to slow down the rise of resistant weeds.

following stop?

We took a close look at the growth regulator trial. This is a technique that helps facilitate digging and inversion for the tallest varieties. With the application of this product, given the prevailing conditions in Argentina, we can achieve a reduction of 20 to 35% of the plant’s height, depending on rate. We explained to our guests that this product is still in a trial phase in Argentina and we hope we can have it registered in the near future.

I am sure you talked about diseases at some point?

For sure. We started with the Leaf Spot disease, which has been causing some concern in the last few years from the resistance standpoint. It was difficult to show big performance differences with the products employed because it is still a little early for the development of the fungus, but we discussed the importance of using multi-site fungicides to protect those that are active in just one place. It is an effective way to reduce or delay the resistance. Leaf Spot is a very important foliar disease to control because it causes significant defoliation and serious problems for the adequate digging and inversion of peanut plants. We also mentioned some precautions to take into account at the time of mixing grass control herbicides plus crop oil, as they can cause injury and necrosis on the leaves when mixed with some fungicides.

I understand that one of the stations was dedicated to seed quality?

Yes, we discussed the damage that seeds may cause due to the specific features of this crop. We sometimes find mechanical damages due to the shelling process in the plants, but also damages coming from improper storing, others caused by drying, etc. More than 90% of the peanuts produced in Argentina are planted in soil conditions that are rather cold if compared with most other peanut areas of the world. About 50% of the peanuts are planted with surface residues without tilling (no-till) and the rest with no significant soil disturbance, implying that the soil has below optimal temperatures. If we add to this the fact that seeds often have some kind of damage, the result is a certain degree of plant failures. Seed damage causes abnormal plants that show little development, are prone to suffer harm from the application of herbicides and have low productivity.

Many of the visitors do not get so many chances to see the crops firsthand. I bet there were a lot of questions asked?

Yes, there were for sure. I believe there was a lot of curiosity from many of the guests, especially those peanut professionals who perhaps are more dedicated to the commercial side of the business and do not see the fields very often. We tried to provide a good overview of the crops and the solutions we employ, to satisfy their curiosity.

Maximize food safety and ensure the removal of allergens, aflatoxin, foreign material, and frost damage while minimizing food loss. Every Resource Counts™

TOMRA 5C

LEARN MORE

TOMRA 5C

LEARN MORE

With typical local food, wine, music and sports, participants at the event had a chance to taste the culture of the country where the peanuts are grown.

While sipping some good Argentine wines or Fernet with Coke, the typical Cordobese cocktail, the group listened to the welcome speeches. First the words of Diego Yabes, President of the Argentina Peanut Chamber and host of the event, and then the address by Pablo De Chiara, President of ProCordoba, representing the local government..

It was an unusually hot night for the season in the classic building of Cordoba’s Court House, an excellent reason to have a cold beer to bring the temperature down while enjoying the food and the tango show.

After watching the polo game and a windy welcome to the hall of the estancia, the group of international peanut professionals could taste one of the specialties of the local cuisine, the asado. Besides the great music and the show, a great success of the night was the poncho, the simple, sleeveless traditional garment that came in a variety of colors.

exports of brazil (tm 1202.42 + 2008.11) &

peanut exports of argentina - kernels (mt)

eu 27 imports, mt (shelled hs 1202.42)

china future prices (settle value - rbm)

eu (27) imports (prepared 2008.11) mt

mintec benchmark prices for peanuts delivered to rotterdam. Courtesy of Mintec Global

This issue of the World Peanut Magazine has been completed thanks to the efforts of:

Tracy Grondine

USA

American Peanut Council

Jane Zheng, China

Qingdao Shengde Foods Co.

LTD

Kishore Tanna

India

IOPEPC

Sergio Morichetti and Claudio Irazoqui

Argentina

Agronomists Center of General Cabrera

Joaquin Zavala

Nicaragua Comasa

Ryan Lepicier

USA

National Peanut Board

Diego Yabes

Argentina

Argentina Peanut Chamber

Tushar Thumar

India

Khedut Feeds and Foods

Zhang Peng

China

JLA

Pablo Rivera

Brazil

Beatrice

Sergey Khaesh

Russia

Agroimpex

Graphic Design and illustrations. ese-estudio.com.ar · @ese.estudio.ok

Typography. Journalist by Sergio Rodriguez / Work Sans by Wei Huang / Noto Sans /

Marcos Lafuente

Europe Intersnack

Anne-Marie Delorenzo

USA

Mars and Wrigley

Andreas Snyman

South Africa

GWK

He Miao

China

China Metaintl Corporation

Gabriela Alcorta

Soledad Bossio

Diego Yabes

Javier Martinetto

Edoardo Fracanzani

Sebastián Della Giustina

Argentina

cam (Argentina Peanut Chamber)

Cámara Argentina del Maní 20 de Septiembre 855 “A”.

(X5809AJI) General Cabrera · Córdoba, Argentina Tel +54 358 4933118

cam@camaradelmani.org.ar www.camaradelmani.org.ar