Major Transportation Corridors

Situated along Highways 401 and 402, covering over 1,080 square miles.

Proximity to Key Locations

Adjacent to London International Airport, with six universities and four colleges within 62 miles.

Strong Advanced Manufacturing

Nestled in the heart of Southwestern Ontario, Middlesex County offers a blend of urban and rural advantages. Surrounding the City of London and located just two hours from Toronto and Detroit, Middlesex County consists of eight municipalities, each presenting unique investment opportunities.

An extensive ecosystem of manufacturers in motor vehicle parts, agri-food processing, and pharmaceuticals, supported by a solid base of trucking and logistics services.

Easy access to Canadian and crossborder markets, making it a popular choice for both commercial and industrial development. Market Access

ILLINOIS: OPEN FOR BUSINESS

INDUSTRY OUTLOOK: Managing Shipping Uncertainties Is Better With Foreign Trade Zones

Tariffs and other changes in importing and exporting can be strategically addressed through FTZs

By David Hodes

INNOVATION AND STRATEGIES: Opportunity

Zones Still Finding Footing in Economic Development Efforts

Incentive rules and regulations are still being ironed, while developers hesitate to jump in

By David Hodes

INDUSTRY INSIGHT: Still-Struggling

Commercial Development Seeing Light at the End of the Tunnel

The effects of the pandemic are fading fast, making room for commercial real estate transactions —with the hospitality sector leading the charge

By David Hodes

MISSOURI: The Perfect Location to Thrive

ASSOCIATE PUBLISHER

Alan Reyes-Guerra areyes@bxjmag.com 205-862-5175

FEATURES EDITOR

David Hodes

CREATIVE DIRECTOR

Clint Cabiness

clint@dialedinmediagroup.com 205-613-5910

EDITORIAL OFFICE

King Publishing, Inc. 1000 Stafford Court Birmingham, Alabama 35242 Tel: 205-862-5175

ONLINE MEDIA ASSISTANT Nick Boliek nick@dialedinmediagroup.com

SUBSCRIPTION CHANGES & REQUESTS 205-862-5175 or www.bxjmag.com

King Publishing, Inc., 1000 Stafford Court, Birmingham, AL 35242; www.bxjmag.com. Advertising rates are furnished upon request. Subscriptions are free to those who qualify. Non-qualified subscriptions are $69 in the U.S.; $89 in Canada and Mexico; elsewhere outside the U.S. is $99 for 10 issues. Back issue rate is $6 when available. Payment must accompany order. The views expressed in all articles and advertisements appearing in the Business Xpansion Journal magazine are solely those of the author and advertiser, respectively.

© Copyright 2025, King Publishing, Inc. All rights reserved. No partof this publication may be reproduced without written permission from the publisher.

POSTMASTER: Send change of address notification to Business Xpansion Journal, 1000 Stafford Court, Birmingham, AL 35242. Subscribers can make address changes by calling 205-862-5175 or by e-mail at www.bxjmag.com.

1000 Stafford Court, BIRMINGHAM, AL 35242

TEL: 205-862-5175 Printed in the U.S.A. 2001

BY: DAVID HODES

Tariffs and other changes in importing and exporting can be strategically addressed through FTZs

There are many benefits of foreign trade zones (FTZ), a method of managing importing and exporting that was created by Congress with the Foreign Trade Zones Act of 1934.

But today, tariff uncertainties are playing a larger role in utilizing the true benefits of FTZs. Certain new strategies with FTZs are being explored in response.

For example, an article by tax and accounting organization Thomson Reuters reports that FTZs allow businesses to lock in tariff rates at the point where goods enter the FTZ, or at the time they leave it, enabling them to pay whichever rate is lower.

Here is a deeper dive into the basics of what an FTZ offers, according to the National Association of Foreign Trade Zones (NAFTZ):

• Duty exemption: No duties or quota charges on re-exports. No duty is paid on goods destroyed in the zone, which can benefit a company with fragile imports or with manufacturing processes that result in large amounts of scrap.

• Duty deferral: Customs duties and federal excise tax are deferred on imports until they leave the zone and enter the U.S. Customs territory.

• Duty reduction (Inverted Tariff): Where zone manufacturing results in a finished product that has a lower U.S. tariff rate than the rates on foreign inputs, the finished product may be entered into the U.S. Customs territory at the duty rate that applies to its finished condition.

• Merchandise processing fee (MPF) reduction: MPF is only paid on goods entering the U.S. customs territory. Zone users can file a single entry for all goods shipped from a zone in a consecutive seven-day period instead of one entry file for each shipment.

• Streamlined logistics: Upon approval from Customs, imports may be directly delivered to the zone.

A 2024 report to Congress about foreign trade zones defines them as secure areas under supervision of U.S. Customs and Border Protection (CBP) that are considered outside the customs territory of the United States for the purposes of duty payment.

Generally located in or near customs ports of entry, FTZs are the U.S. version of what are known internationally as free trade zones. The value of shipments into zones totaled nearly $949 billion in 2023, compared with just over a trillion in 2022, according to the U.S. Department of Commerce.

An FTZ is created when a local organization, such as a city, county, or port authority, applies to the FTZ board for a grant to establish and operate a zone to serve a specifically defined geographic area. Upon approval of the zone by the FTZ board, the organization becomes known as the FTZ “grantee”.

Grantees are then able to submit applications to the FTZ board to establish FTZ sites or subzones for use by companies in that area.

According to the report, there were 200 FTZs active during the year, with a total of 374 active production operations. Over 550,000 were employed within 1,300 active FTZ operations during the year.

The top 5 states for merchandise received FTZ activity are Texas, Louisiana, California, Illinois and South Carolina. The top five for FTZ export activity are nearly the same except that Florida replaces Illinois in that list.

There are 20 FTZs in Florida—three in and around the Port of Miami—second in number

The Port of Albany, 200 miles from the Atlantic seaboard, has one of the few inland FTZs. It serves a 10-county region. The facility has recently completed nearly $100 million in maritime upgrades. Picture courtesy Port of Albany

only to Texas, where there are 35 FTZs with eight located at various seaports.

Most FTZs are clustered around seaports on both the east and west coast.

The largest FTZ for total merchandise received is the 4,000-acre FTZ #84 at Port Houston. The port’s economic activity totaled $439 billion in 2024—nearly 20 percent of Texas’ total gross domestic product.

All major ports on both coasts have multiple FTZ sites throughout their states. For example, California’s Port of Los Angeles and its FTZ number 202 site on 5,400 acres has 39 activated sites in Los Angeles, Orange, and San Bernardino counties, including the 704-acre Laxfuel, a jet fuel storage company; and the FTZ number 49 site on 350 acres at the Port of New York and New Jersey has 23 activated sites, including the 123-acre Port Newark/ Elizabeth Port Authority Marine Terminal and the 107-acre Sunoco site.

National Association of Foreign Trade Zones (NAFTZ) has created the Trade and Tariffs Rapid Response Team (TRRT), a cross-functional group focused on efficiently addressing trade and tariff developments, with the goals of tracking customs, tariff policy, and regulatory changes; evaluating risks and effects on the FTZ program; bringing in external insights when needed; providing a rapid, organized response to developments; and exploring strategies to mitigate tariff impacts.

Melissa Irmen, the director of Advocacy and Strategic Relations for the NAFTZ, told BXJ that their biggest challenge is the current executive orders on tariffs and the restrictions placed on FTZs in those orders. “Those have come as a surprise to our members and to U.S. foreign trade zones,” she said. “So we’re trying to help educate both the

The Port of Long Beach is unleashing the power of data sharing through the Supply Chain Information Highway, a digital tool designed to maximize cargo visibility, velocity and value.

By merging technology and collaboration, the Supply Chain Information Highway delivers a virtual onramp to partners seeking improved planning, scheduling and tracking of cargo across the goods movement industry.

The Port of Long Beach developed the Supply Chain Information Highway in collaboration with goods movement and transportation partners to aggregate that will allow them to predict and prepare for container movements.

The latest Supply Chain Information Highway features include:

Public Port Container Track and Trace, allowing users to locate containers throughout the Port’s six container terminals. polb.com/ publictrackandtrace

Port Operations Dashboard, displaying Port operations metrics. polb. com/operations

Beneficial Cargo Owner (BCO) Dashboard, which allows registered users a more in-depth view and access to data related to the movement of cargo. polb.com/BCOdashboard

The Port of Long Beach partnered with St. Louis-based UNCOMN to create the Supply Chain Information Highway in response to lessons learned during the pandemic and the heightened need for improved cargo visibility.

The free, online system enables authorized users to access data and determine the status of cargo containers from the point of origin to destination, leading to increased timeliness, accuracy and a smoother flow of goods across the supply chain.

The Supply Chain Information Highway is built to be compatible with similar port community data systems within the maritime logistics industry, with a goal of using the tool at other U.S. seaports.

Several partners collaborate with the Port of Long Beach in the project, including the Port of Oakland, the Northwest Seaport Alliance, the Utah Inland Port Authority, PortMiami, the South Carolina Ports Authority, the Port Authority of New York and New Jersey, the Port of Hueneme, Union

Pacific and BNSF. Additional seaports are expected to join in the future. By increasing cargo visibility, the Supply Chain Information Highway delivers a record of the most recent container movements through the ports complex, helps mitigate delays and aids the entire goods movement industry from end to end and coast to coast.

Users can securely access and customize data, offering optimal flexibility. Proprietary and sensitive data are removed from data transactions prior to viewing.

The Supply Chain Information Highway speeds the delivery of data exchange and increases efficiency several ways:

• Real-time data enables users to make immediate decisions for planning, scheduling and tracking cargo.

• Information aggregated by the Supply Chain Information Highway enhances the ability to predict and prepare for container movements.

• Digital visibility reduces costs, saves time, increases supply chain performance and builds resiliency.

The Governor’s Office of Business and Economic Development –known as GO-Biz – awarded a $7.875 million grant in 2024 to help build additional functions, including:

• Unified Truck Appointment System, allowing trucking companies to make appointments through a single system for all six Port of Long Beach container terminals. A planned connection to terminals at the neighboring Port of Los Angeles will create an even more cohesive system to speed goods through the San Pedro Bay ports complex.

• Heighten the visibility of export and rail cargo processed at marine terminals, along with recognizing containers moved with zero-emissions trucks and equipment.

• Non-Container Digital Visibility, adding breakbulk, roll-on/roll-off and other non-containerized cargo to the digital platform.

The Port of Long Beach is one of the world’s premier seaports, a gateway for trans-Pacific trade and a trailblazer in goods movement and environmental stewardship. The Port handles $300 billion in cargo annually and supports 2.7 million trade-related jobs across the nation.

Trade moving through the Port of Long Beach reaches every state and supports 2.7 million jobs throughout the U.S. We move goods to market with world-class customer service and operational excellence.

At Port Tampa Bay (PTB), logistics meets opportunity. Companies looking to optimize their supply chains and expand their commercial footprint turn to the PTB’s Foreign Trade Zone (FTZ) operation for a measurable competitive advantage.

Located on Florida’s west coast, Port Tampa Bay is the state’s largest port by acreage (5,000 acres) and tonnage (35 million tons annually), handling containers, breakbulk, bulk, and roll on-roll off (RoRo) cargo. Port Tampa Bay offers direct transportation services from major international shipping lanes, including weekly sailings from Asia, Central America, and South America, ensuring faster and reliable connections to global suppliers and customers. Port Tampa Bay’s central location in the state, which includes the I-4 Corridor that connects Tampa and Orlando, offers streamlined access to the largest concentration of distribution centers that encompasses over 550 million square feet of distribution space.

As a market, Florida is now the third-largest state in the United States with more than 23 million residents. The state also welcomes nearly 143 million annual tourists. This ranks Florida among the fastestgrowing economies, offering companies expanding their logistics and commercial footprint a gateway to high-demand markets with sustained growth potential.

To meet market demands, the port makes meaningful investments to improve its infrastructure, which has included the purchase of four post-Panamax cranes, expansion to 97-acres of paved container yard, upgrade of the container yard’s gates, construction of a 135,000-square-foot cold storage facility, and reinforcement of a growing intermodal network. Planned terminal expansion projects include additional berth space and the installation of new post-Panamax cranes, reflecting Port Tampa Bay’s commitment to growing with its partners and staying ahead of evolving supply chain demands.

In addition to its physical infrastructure, Port Tampa Bay offers strategic operational advantages through its FTZ program. As part of

the national FTZ system, PTB’s FTZ operation is designed to incentivize companies to optimize their supply chains, enhance the competitiveness of their U.S. based operations, and encourage companies to retain, if not increase, the level of operational participation in the US.

PTB’s FTZ program is structured to align with and enhance the supply chain strategies of its partners, enabling businesses to take full advantage of the port’s facilities while optimizing their global logistics and operational goals. As an example, PTB’s global connectivity supports a range of business models. For companies with importfor-export strategies, the port’s FTZ operation enables value-added activities like inspection, assembly, or customization before re-export. For those importing raw materials or finished goods for domestic use, it streamlines market access and reduces landed costs. For manufacturers exporting from the U.S., Port Tampa Bay offers fast, cost-effective routes to key markets in Central and South America.

With world-class facilities, efficient customs clearance, and FTZ advantages, Port Tampa Bay is a growing strategic exit and entry point both for domestic and international goods, which presents opportunities to reduce logistical costs, shorten transit times, and expand market access across Florida and beyond.

Beyond cargo movement, Port Tampa Bay continues to contribute to local job creation by supporting advanced manufacturing, distribution, and logistics industries in Florida, helping companies strengthen their domestic footprint while remaining globally competitive.

Companies ready to reroute their thinking and reimagine their supply chains can receive significant financial and operational rewards by utilizing Port Tampa Bay’s FTZ operation.

Discover how Port Tampa Bay’s FTZ can strengthen your competitive edge. Visit https://www.porttb.com/foreign-trade-zone-79 to learn more and connect with their business development team today.

• Strategically located at the crossroads of the growing Tampa/Orlando Corridor

• More than 550 million square feet of distribution center space along I-4 and I-75

• E-commerce, consumer goods, perishables and building materials

• The fastest growing region in the fastest growing state

• Recently expanded terminal capacity and plenty of room for growth

• Capable of multiple round-trip truck deliveries per day from Port to distribution centers

• Weekly direct sailings from Asia and Latin America including Mexico

administration and Congress on the impact and the loss of benefits and the business impact of that. It’s definitely one of our primary focuses, particularly because regardless of what changes happen, unless these restrictions are removed, U.S. foreign trade zones are going to be overly impacted. So even if they start increasing or decreasing, either way, our members, particularly those that are manufacturing, are especially hard hit.”

The focus of the Obama administration was to help U.S. exports and make it easier to increase exports. That was also a primary objective of the FTZ program, which was to help U.S. companies compete globally. “Over time, we’ve seen a trend in increased interest and participation in the program. U.S. manufacturing has increased in the program,” Irmen said. The tariffs have put U.S. companies at a disadvantage. “They’re losing their ability to remain competitive.”

According to an NAFTZ study, FTZs have a positive local impact. Communities that have an FTZ have a slight advantage from an economic development impact, Irmen said. “But even more so, we start seeing a trend of increased manufacturing, increased overall salary of the community. The interesting thing is that it’s not just having an FTZ and the businesses that are directly attracted to that. It’s all the support and ancillary services around that. So if you attract a manufacturing plant to your location because of the FTZ, not only do you get the manufacturing jobs, but you get all of the supply chain logistics support

An example of a sign outside of an FTZ. Picture courtesy Melissa Irmen

people, you get the restaurants and the services that support that company,” she said. “It definitely is an overall positive impact on a community.”

The Capital District’s Port of Albany on the Hudson River is home to FTZ number 121, one of just a handful of inland FTZ sites (the Atlantic Ocean is 200 miles away from this port), servicing Albany, Columbia, Fulton, Greene, Montgomery, Rensselaer, Saratoga, Schenectady, Warren, and Washington counties.

Kate Maynard, the director of planning and economic development for the district, told BXJ what she has noted in the past six months, since the new administration, is “definitely a lot of kicking the tires” in terms of the FTZ program, to see if it would really provide benefits in relation to issues being perceived from the current administration.

“We have had a lot of interest, a lot of questions, a lot of worried businesses who are assessing the potential impacts as they continue to evolve related to tariffs and international supply chain and what our regional businesses need to really know in terms of certainty,” Maynard said. “We know that businesses do not like uncertainty. But it’s quite important to be able to plan for your current operations and your future strategies.”

According to a report on FTZs by the U.S. International Trade Commission, in 2013, the FTZ Board issued a comprehensive revision of its regulations concerning the authorization and regulation of FTZs and zone activity in the United States. The changes simplify many procedures, including streamlining the application process for subzones. The new rules improve access for U.S. manufacturing operations, safeguard against negative consequences from certain FTZ activities, and establish a definition of “production” that combines the definitions of “manufacturing” and “processing” as defined in the 1991 regulations.

The NAFTZ reports that the Automated Commercial Environment (ACE), which is a U.S. Customs and Border Protection (CBP) system that streamlines the process of reporting imports and exports, is still active in the NAFTZ Automation Committee but has never been completed. A

number of other ACE programming issues remain up for consideration. Due to limited amount of funding for ACE development, focus on the ACE programming specific to FTZs has been put on hold.

Irmen said that FTZs have always been subject to extra CBP oversight, so the focus of the NAFTZ has been to help their members be compliant because they do have an extra layer of regulatory requirements on top of

their importing responsibilities. “We work very closely with CBP,” Irmen said. “We’re always interested in opportunities to help educate ports and port officers as they rotate in and out of FTZ responsibilities. We’ve been working for years now to help try to get directed funding for CBP to focus on FTZ, and we continue to work on that with Congress. Appropriations now is a little bit more challenging than it has been in the past, so it’s still an item on our agenda. We’re still working hard to try to get that FTZ directed funding to help support the program.” X

Quonset Business Park’s Port of Davisville supports nearly 1,700 jobs and $374.3 million in economic activity for Rhode Island annually. In the last 20 years, the Port has increased its annual imports by 745% and is home to one of the largest auto importers in North America.

To accommodate even more growth, Quonset has embarked on the Port of Davisville Master Plan, a $234 million development project that will provide a new 50-year service life to the port’s infrastructure.

At Pier 1, Quonset is replacing thousands of wooden pilings with concrete and steel pilings to strengthen the pier’s foundation. Construction at Pier 2 was completed in 2022 and extended the pier by 232 ft., creating an additional berthing space to accommodate larger ships, including roll-on/ roll-off (RO/RO) carrier ships delivering automobiles.

Quonset is also offloading non-auto cargo, including lumber, project cargo and offshore wind components. Construction is nearly complete on the Port’s new Terminal 5 Pier — the first new pier built at Quonset in nearly 70 years. These specialized berthing spaces will accommodate a variety of offshore wind vessels and other cargoes, including the short-term docking needs of small businesses, emerging companies and research and development organizations.

The bottom line is that the Port of Davisville is booming. Quonset’s guiding philosophy is that opportunity plus preparedness equals success. With the implementation of the Port Master Plan well underway, Quonset is well-prepared to continue to grow.

BY: DAVID HODES

Incentive rules and regulations are still being ironed, while developers hesitate to jump in

The Opportunity Zones (OZ) tax incentive, created by the Tax Cuts and Jobs Act of December, 2017, was touted as a new economic development tool that allows people to invest in developing economically distressed areas. Since their implementation, OZs have spurred over $89 billion in investment across thousands of communities.

.........................................................................................................

But using the incentive as an economic development tool has become a bit of a mixed bag. Documenting and measuring success can be difficult, and the structure of the incentive has been an obstacle for investors.

A Housing and Urban Development (HUD) report emphasized that OZs should involve measuring investment and outcomes related to economic growth and poverty, including the unemployment rate, the poverty rate, household income, housing supply, and job creation.

An assessment of OZs by the Urban Institute found that while OZs are “helping spur the evolution of a new community development ecosystem, engaging both project developers and investors who have limited historical engagement in community development work,” there are many “mission-oriented actors” struggling to access capital. “Many project sponsors

are struggling to access the class of investors—wealthy individuals and corporations with capital gains—for whom the OZ incentives are tailored. As OZ incentives are not structured to encourage resident or community engagement, mission-oriented projects struggle to compete for attention with higher-return projects—for which OZs provide much larger subsidies because of the design of the incentives.”

The vast majority of OZ capital appears to be flowing into real estate, not into operating businesses, because of various program design constraints and the undesirability of selling equity from both the business owners’ and the investors’ perspective, according to the assessment.

“Ultimately, most developers and investors view OZ incentives as providing a relatively small boost to overall returns.”

As of 2018, the most recent listing of OZs for all 50 states, shows that

A OZ fund helped finance construction of a 77-unit mixedincome apartment complex in Springdale, Arkansas. 30 units will be permanently reserved for low income households. Picture courtesy Downtown Springdale Alliance.

One80 Place, a homeless shelter in Charleston, South Carolina, is a six-story $44 million OZ development under construction. It is expected to open in 2026. Picture courtesy HUD.

most states have around 50. But there are 155 OZs in Alabama; 167 in Arizona; 512 in New York; 426 in Florida; and 878 in California.

A Housing and Urban Development report to the White House found that, on average, the median family income in an OZ is 37 percent below the state median; more than one in five OZs have a poverty rate higher than 40 percent; 71 percent meet the U.S. Department of the Treasury’s definition of “severely distressed”; 22 percent of adults in OZs have not attained a high school diploma, compared to 13 percent nationally; and life expectancy for OZ residents is on average three years shorter than it is nationally.

The first set of qualified OZ designations, covering parts of 18 states, were initiated on April 9, 2018.

During 2018, the chief executive officer of each state was required to

submit their nominations to the Treasury Department, which then certified the nominations and designated the state’s census tracts as OZs for 10 years.

The ideal standard census tract has a population of 4,000 residents. Census tracts with over 8,000 residents can be split into two or more tracts. Census tracts with fewer than 1,200 residents may be merged with an adjacent tract located within the same county.

Of the 8,688 OZ census tracts identified by 2021, 1,332 (15.3%) were split into two or more tracts; 3,769 (43.4%) tracts had no change in their geographic area; 1,815 (20.9%) tracts increased in geographic size; 1,772 (20.4%) tracts decreased in geographic size.

The OZ Working Group, founded in 2017 to identify and address technical and administrative issues that arise under the federal OZ incentive, has sought to have the IRS “issue clear guidance in the form of a notice or revenue ruling that addresses the extent to which modifications to census tract boundaries as a result of the 2020 Census affect OZs.”

The group is looking for major tax legislation to be introduced in 2025 that will likely include language to extend, modernize, expand and/or renew the OZ incentive, commonly referred to as OZ 2.0.

Early academic research on OZs demonstrates a mix of results, such as this article from Real Estate Economics by researchers at Tulane University: “Overall, our results suggest that OZ designation has not had a substantial impact on residential and commercial parcel sales prices or on the volume of real estate transactions. In some of our simpler specifications (mainly those without many control variables), our estimation results suggest

that OZs may have had a small positive effect on non-vacant residential property values.

“What might explain these results? An obvious one is that the program is simply ineffective in achieving its stated aims, a conclusion that characterizes many if not all place-based initiatives. Another, more positive explanation is that the OZ program is still in its infancy, so it may not have had sufficient time to achieve its intended effects.”

Ben Glasner is an economist and one of the authors of a recent working paper by the Economic Innovation Group (EIG), a bipartisan public policy organization, “The Impact of Opportunity Zones on Housing Supply.” The study found that the OZ incentive has roughly doubled the number of new housing units in these distressed economic areas, generating more than 313,000 new residential addresses between 2019 and 2024.

“First and foremost, we didn’t even see an effect on residential addresses or housing units as a result of OZ designation,” he told BXJ “Because that was actually kind of a big gap in the literature so far as an understanding of if it’s happening at all, and if so, where that is occurring. We are able to show with our data, using addresses which are accounts from the USPS, just how many addresses are in a particular spot at a track at a given time. We’re able to show not only that the effective OZ designation was large and positive, but it was something that was growing over time, which has been missed by a lot of previous studies.”

Things such as creating residential addresses take time, he said, even though the incentive had already gone into place. “It takes a long time for building permits to be acquired, for construction costs to be

realized, for all these things to kind of fall into place. And early studies of the effect of OZs seem to miss the fact that this is going to be a long running trend as the initial foundation was being formed. We’re starting to see the payoff of that right now.”

He said EIG was able to demonstrate in the descriptive statistics at the start just how quickly OZ designated tracks are growing relative to non-OZ designated tracks. “They’ve already superseded the growth rate, which is a first time that we can see that within the data that we have on hand,” Glasner said. “Not only that, but the share of new addresses is also growing, and we are seeing an actual inflection in growth rates within these types of tracks, and what looks to be a really substantial change, particularly for these low income and high poverty areas.”

He said that they are finding “real, legitimate causal effects” that show positive investment and positive construction for residential addresses that are not what would have happened without OZs. “So we’re pretty happy seeing that effect, simply because we know that we’re in a housing shortage. Anything that’s moving the needle of getting more homes in places where people want them to be seems to be something we’re celebrating.”

According to the HUD report, the wide geographic scope of opportunity zones and the diversity of investment encouraged will generate rich evidence on the effects of a place-based investment incentive. “Identifying the places and the ways in which the incentive has met its

intended goals can inform future efforts to expand opportunities for distressed areas. Doing so, however, depends on rigorous, high-quality evidence that can credibly uncover the actual effects of the incentive, as opposed to spurious ones stemming from other sources such as pre-existing trends.”

The Tulane University article also supports more time to measure the success of OZs, adding that “other measures of economic opportunity should be used in future empirical work,” and that effects in other states should be considered. “We anticipate over the next several years that more comprehensive publicly available data covering a longer time period and additional states will bring clarity to the impacts of the OZ program.”

“I think it’s worth keeping in mind the fact that this is really a novel capital gains tax incentive,” Glasner said. “This is something we haven’t tried before at the federal or local level. We’re in the early stages of understanding both what it can and can’t do, and how the design of it changes, and where those investment dollars might be headed.

“But the early signs seem to be this has at least been a very effective way, as written, to motivate more investment in residential real estate, which is a key component for neighborhood revitalization. I’m really hopeful that we’re going to see the neighborhood revitalization on the housing side spill over into benefits, both for legacy residents and new residents in those areas, seeing higher levels of employment, lower levels of poverty, and general revitalization for places that have been left behind.” X

BY: DAVID HODES

The effects of the pandemic are fading fast, making room for commercial real estate transactions —with the hospitality sector leading the charge

The commercial real estate market is still trudging back from the damage of the pandemic, according to industry experts, with a strong light at the end of the tunnel that developers hope will spell true and sustained recovery.

...............................................................................................................................

According to a quick look at results in the 2025 market monitor from the Commercial Real Estate Development Association (formerly the National Association of Industry and Office Properties, or NAIOP), office markets in southeastern states attracted a growing share of office transaction volume; relative office transaction volume fell in several northern and inland markets in California, but ticked up in the state’s southern coastal markets; several industrial markets

underwent large changes in volatility, and there was a notable increase in the number of industrial markets that experienced a substantial swing in volume; and relative volatility declined across several industrial markets in the Pacific and Mountain West and in the Southeast, but rose in several Midwestern markets.

Total transaction volume among the second-largest 51 office markets has nearly recovered from pre-pandemic levels, according to the monitor, down only 11.9% from the first quarter of 2019. But it remains depressed among the largest 51 office markets, with total volume down 56.4% over the same period.

That sort of good-news-bad-news posture is evident in recent space demand forecasts. The office market performed worse in

the first quarter of 2024 than previously forecast, with national office net absorption totaling a negative 13.4 million square feet, according to a space demand forecast by the NAIOP.

Elevated interest rates are affecting corporate earnings and firms’ ability to expand their operations, which appears likely to continue, at least in the near term.

The National Association of Realtors (NAR) noted that Class A prime location offices maintained positive annual absorption but saw vacancies rise to 20.3%. Class B offices, older than Class A but with good value and location, performed relatively better, with slower vacancy growth and stronger rent gains at 1.3%. Class C, which are older buildings in less desirable neighborhoods,

Steps from the nation’s capital, Montgomery County, Maryland, is home to a thriving business ecosystem, top-tier academic institutions, and a robust talent pipeline.

Anchored by a variety of commercial developments in life sciences and technology, the county offers companies modern, transit-connected office space, state-of-the-art lab facilities, and vibrant mixed-use communities designed to attract and retain talent. More than 350 life sciences firms specializing in gene and cell therapies, vaccines, pharmaceuticals, and advanced manufacturing already call Montgomery County home. With a diverse economy that also spans cybersecurity, quantum computing, hospitality, and nonprofits, Montgomery County is a launchpad for growth; whether companies are starting off or are well-established. Supported by a rich culture, and a highly educated and diverse population, the county offers an unmatched quality of life.

Recent development opportunities are primed to accelerate Montgomery County’s continued growth as an epicenter for innovation. The transformative Viva White Oak project, also the county’s first-ever Tax Incremental Funding (TIF) proposal, offers 280 acres that are ready for development. Located adjacent to the FDA headquarters and near Adventist HealthCare White Oak Medical Center, Viva White Oak

continued to struggle.

One significant sign of recovery comes from the hospitality sector.

As of April, 2025, hotel occupancy was at 63.1%, which is still 2.9% below pre-pandemic levels, occurring largely due to the prevalence of remote work, according to the NAR commercial real estate market insights.

Profitability has rebounded, with average daily rates up 22% to $160 compared to April 2019.

There is expected adjustment underway. Hotel acquisitions have dipped slightly over the past year. As of April, 2025, the 12-month sales volume had declined to $20.5 billion, down from $23.6 billion the previous year. STR, a hospitality data company, reported that 61 of 172 U.S. markets are seeing a raise in June hospitality demand gains, led by five markets: Chicago, Nashville, Oklahoma area, Orlando, and St. Louis.

A global hotel investment 2025 report by real estate and investment management company JLL echoes this sentiment about hospitality. “Though there is uncertainty about the magnitude and pace of forthcoming interest rate cuts, there seems to be clarity that rates are indeed heading in a downward trajectory over the next 12 months,” the report concluded. “JLL expects global hotel investment volume to accelerate in 2025, likely exceeding 2024 by 15% to 25%. Look for the Americas to see

is approved for more than 12 million square feet of mixed-use development. The Viva White Oak site is a $2.8B investment featuring more than 3 million square feet of lab space, office/medical office, retail, and up to 5,000 quality residences.

With a strategic focus on the life sciences and biohealth industries, Viva White Oak, stands out with the promise to be another major life sciences hub in the region, anticipating at least 9,000 jobs created.

Montgomery County is Maryland’s largest, wealthiest, and most diverse county—with a third of its adult population (age 25 or older) holding an advanced degree (master’s or higher). Access to a highly skilled and educated workforce is a key driver for new developments in the county. From the Dickerson Plant, a 710-acre heavy industrial redevelopment opportunity to the 140,000 square feet build-to-suit Hughes Network Systems project, as well as the 44-acre White Flint Mall property and the 204-acre COMSAT property, home to the former COMSAT research facility, these sites present an opportunity for developers and site selectors to shape Montgomery County’s next chapter of growth and deliver state-of-the-art facilities that have the potential to be truly transformative mixed-use communities.

the largest growth.”

Overall, a realistic sort of cautious optimism about commercial real estate prevails, as noted by Bryan Reid, executive director of MSCI research, a business data analytics company. “No one knows for sure, but recent interest rate cuts by central banks in Canada and Europe may have given investors some hope that a turning point in U.S. monetary policy is approaching,” he wrote in a blog post. “It is also worth noting that rate cuts alone will not solve all the challenges real-estate investors face, with many markets still working through post-pandemic challenges, most notably the central business district office market where demand has been reshaped by remote work.”

Further, he wrote, there may be an element of “be careful what you wish for,” as there are potential downside growth risks to consider, such as a recession or banking crisis, noting that high borrowing costs “have been a pain point for real-estate investors. It’s made deal financing more of a challenge and put pressure on asset values.”

With all the continued uncertainty about the commercial real estate business in general, there are some bright spots among developers.

One example: Midwest commercial real estate developer, Block and Company, rated by the Kansas City Business Journal as the largest commercial real estate developer in the city ranked by

At the heart of the Capital Region, discover a unique synergy of location, talent and infrastructure.

The Viva White Oak site is a $2.8B investment featuring more than 3m sq. ft of lab space, office/medical office, retail, and up to 5,000 quality residences.

Acres

Million square feet of mixed-use development

square feet of commercial space developed or redeveloped from 2019-2024, and the most-active commercial real estate firm in the Kansas City area in 2024.

David Block, company principal who runs the retail, restaurant, and hospitality divisions doing commercial brokerage services, development, construction management, asset/property management, tenant representation, and corporate real estate services, has been doing commercial real estate development for 50 years now. “I’ve seen a lot of cycles,” he told BXJ. “Kansas City real estate is a very good, solid, stable market, and it always has been, for the time that I’ve been in this industry, even when rates and things get difficult in other parts of the country.”

Block and Company has an estimated retail sector inventory of 118 million square feet as of 2024, with average vacancy rate of 3.6 percent; and an office sector inventory of nearly 130 million square feet, with an average vacancy rate of 8.8 percent.

One of the largest developments that Block has managed since 2009 is The Plaza at the Kansas Speedway, an 850,000 square foot retail shopping center in western Kansas City, Kansas. Speedway tenants include Walmart Supercenter (co-anchor tenant), Best Buy (original co-anchor tenant, and the first tenant to open for business at The Plaza. It was sold in September, 2024).

Other tenants include Taco Bell, Olive Garden, Red Lobster, Chick-fil-A, and Wendy’s, among others.

Block said that the company is now in phase five of the Plaza development. “We’ve got a couple of deals working for another couple of 100,000 square feet to finish off that development, to end up, in total, 500,000 square feet or 600,000, somewhere in that range, when it’s done,” he said. “Then we are always doing stuff up in Liberty and Lee Summit and the major suburbs of greater Kansas City, like Overland Park, Kansas.”

When he is looking for new areas to develop a retail business operation, Block likes to go where the area has an existing, growing, and stable residential community, with schools that are coming or have been built and are well-occupied with students. “I’m always looking for a good bedroom community in the suburbs of greater Kansas City,” Block said. “Someplace that has a good, strong population base around a strong traffic intersection. I’m usually looking for intersections that have two major arteries, one in front and one on the side.”

He said that he does spec work, where he will find a good bedroom community and build in extra square footage for projected users in shopping centers that have small and medium sized shops. Some of the shops may not even have tenants. “I knew that if I built it in the right location, it would fill up,” he said. “I could sit here and tell you every area of town where we’ve added a lot of spec space that we built up. But normally we will have at least one or two anchor tenants that would go there, even if it’s a smaller strip shopping area.”

Block said that retail commercial development is a lot easier if a developer has relationships with city council people or the mayor, especially if that involves contact with certain people

on the staff in whatever city the development is happening. “If you’re going to develop something, you got to go to the staff,” he said. “Staff will work with you. And then once you come up with a plan, the council will either say we’re going to back it or not back it. Either way, you typically are going to a planning commission, where they’re going to ask you a whole lot of questions, and then you’re going to go to the city council, and the mayor,” he said. “That’s the way most of these suburban markets around big cities are operated.

“In our business, timing is everything, and time is money,” Block said. “Many cities have a difficult time understanding the cost the developer pays just to hold something while they make these decisions. So it’s pretty important that we try and do the deal as quickly as possible.”

It can take about a year from start to finish to complete a deal, he said. “You go in and you put it under contract, and then you

work with an architect, work with a contractor, put your costs together, take your plans in, and you maybe get tenants,” Block said. “You have to get those tenant leases inked up. And then you have to go to the city, to the staff, and meet with that person and their departments, all the utilities and all of that, all the different trades. Then you work up all your costs while you’re going into the city to get approval for what you want to do. And that, many times, will take six months, just that portion of it.

“When you’re in the commercial development business, you are in the gambling business,” Block said. “You may not go to Vegas, you may not go to a casino, but you are gambling that what you’re going to do will be successful when you’re ready for it to come to market. I enjoy seeing things come up from dirt to being a completed project. That’s always fun, to see a new building done. I enjoy following the construction as it goes along.” X

Illinois is a premier destination for business growth and investment boasting a diverse economy, highly-skilled workforce, unparalleled infrastructure, and strategic location. ........................................

Companies looking to grow or relocate would be in good company. For three years running, Illinois has held the #2 spot in the nation for corporate expansions and relocations.

Illinois boasts the fifth-highest GDP in the nation, making it one of only five states with a GDP over $1.1 trillion. Globally, it ranks as a top-20 largest economy. This economic stability is reflected in Illinois’ nine credit upgrades since 2021. The state is also a major hub for global

corporations, as the home of 30+ Fortune 500 companies. Last year, Illinois was best in the Midwest for new business creation.

The state's labor force is a significant asset, with a workforce of over 6.5 million people (the largest in the Midwest). Over 3.2 million Illinoisans hold a bachelor's degree or higher, which is over 2% greater than the national average. The state is home to over 240 higher education institutions, including two of the top-5 business schools (the University of Chicago and Northwestern University). Further underscoring our top-tier talent, the University of Illinois graduates

One hour east of St. Louis on 1-70 at Exit 61

Up to 115 Shovel-Ready Acres available in Vandalia Industrial Park Area

Up to 120 Shovel-Ready Acres

Geotechnical and Environmental Surveys Complete

Logistics = Excellent Midwest Access to 1-70, 1-55, 1-57, 1- 64, US 51, SR 40, 140 & 185

Main Rail Served by CSX - Short Line Served by Patriot Rail Company

TIF Benefits Tax Reimbursements through 2027

Enterprise Zone through 2034

Kaskaskia Community College and Okaw Area

Vocational Center workforce training resources

more engineers each year than MIT, Stanford, and Caltechcombined. Illinois also has a robust network of workforce development programs, including manufacturing training academies focused on emerging fields like EV production.

Unmatched Infrastructure and Central Location

Illinois’ central location and extensive infrastructure provide a competitive advantage. CNBC’s Top States for Business rankings place Illinois #8, due to assets like the nation’s third-largest interstate highway network and the nation’s #1 most-connected airport (O’Hare). More than 80% of the U.S. continental population is within a two-day drive.

Editorial credit: Flystock / Shutterstock.com

Leading High-Growth Industries

Illinois is a leader in several high-growth industries, including:

• Life Sciences: Illinois is home to more than 15,500 life sciences firms and leading companies like AbbVie and Baxter. It is a top-5 state for producing life sciences talent.

• Quantum Computing, AI, and Microelectronics: Illinois is leading in quantum innovation, with the Illinois Quantum and Microelectronics Park (IQMP)—a first-of-its-kind campus for quantum tech scale-up and R&D. Illinois also hosts four of the ten national quantum research centers (the most of any U.S. state).

• Clean Energy: As a leader in sustainable development, Illinois is the first in the Midwest to set an aggressive goal to reach 100% renewable energy by 2050. The state's nuclear power plants produce over an eighth of all U.S. nuclear power generation.

• Advanced Manufacturing: The state's total manufacturing sector generates over $130 billion in annual economic output. The total manufacturing workforce is over 500,000 people, and the state is home to companies like John Deere and Rivian.

• Next Generation Agriculture, Agtech, and Food Processing: Illinois is #1 in the U.S. for agricultural feedstock and industrial biosciences employment and has over 2,100 food manufacturing locations.

• Transportation, Distribution, and Logistics (TDL): With a GRP

of $49.3 billion, Illinois’ central location and infrastructure provide unique access to air, digital, port, rail, and roads. Chicago is home to the second-largest TDL workforce in the nation.

Editorial credit: IQMP.org

The Illinois Economic Development Corporation, a publicprivate partnership, plays a vital role in showcasing these strengths to domestic and international companies. The organization provides data, location assistance, and connections to simplify the site selection process and has helped create over 21,000 jobs and generate nearly $12 billion in investment over the last eight years. Illinois EDC’s efforts highlight why Illinois is the preeminent place to do business and thrive.

Interested in doing business in Illinois? Contact them at illinoisedc.org today.

Vandalia, Illinois (pop. 7,460) is centrally located in Southern Illinois on Interstate 70, Exits 61 & 63, between St. Louis, MO and Terre Haute, IN. Rich in history, Vandalia was the 2nd State Capitol of Illinois, serving as capitol from 1819-1839. It is where Abraham Lincoln begain his political and legal career. The building he last served in, the Vandalia Statehouse, remains standing today in Historic Downtown Vandalia, averaging 20,000 visitors a year. Vandalia is a community with a hometown feel, a great school system with a Vocational Education center, as well as a community college, Kaskaskia College extension center to serve the residents in their secondary education pursuits. Many of the businesses in Vandalia have been ran by people born and raised here and of recent, younger residents and people within Fayette County (pop. 21,492) are interested in starting their business ventures because of the local support received and because of Vandalia’s location, serving as county seat.

Workforce Development is one of the highest priorities for the City of Vandalia, Illinois. Many of our established manufacturers, distribution centers, small businesses and service industries are wanting to grow and expand. To meet this challenge, in collaboration with Kaskaskia College, the City has brought industries together to understand their needs and identify the skills required of an expanded workforce and will begin marketing these opportunities to job seekers.

The OKAW Vocational Center, located in Vandalia, works with

12 area high schools, located in four counties to train students in a variety of trades, such as: Auto Body, Auto Mechanics, Building Trades, Computer Aided Drafting (CAD), Computer Technology and Networking, Culinary Arts & Food Service, Foundations of Education, Graphic Design/Commercial Arts, Health Occupations, Office Technology/Business Entrepreneur, Power Mechanics/ Power Sports, Welding/Metal Fabrication. The program is venturing towards grants to build a new 40,000 sf facility in the Vandali Industrial Park. With Kaskaskia College Vandalia campus only .8 miles away, it is prime for working together to get people to work!

These collaborations position Vandalia, Illinois for growth, not only for those who currently reside and have businesses here, but also for those who are looking for an opportunity to relocate or expand. We have a wide variety of available buildings and sites for both lease and for sale with City incentives including TIF, Opporunity Zone and Enterprise Zone. Specifically, the City of Vandalia, Illinois has 120 acres available for development within their Industrial Park, located not even a .5 mile from Interstate 70.

If you are interested in learning more about the opportunities that exist and the success that you can realize in Vandalia, Illinois, reach out to LaTisha Paslay, City Administrator and Interim Economic Development DIrtector at vandaliaed@ vandaliaillinois.com.

Southern Illinois is rapidly gaining recognition as a pivotal logistics and manufacturing center in the Midwest, thanks to its strategic location and comprehensive transportation network. Situated at the convergence of major interstates—I-57, I-64, and I-24—the region offers seamless access to major cities like Chicago, St. Louis, Nashville, and Memphis. With eight metropolitan areas reachable within five hours, businesses benefit from reduced shipping times and lower distribution costs.

The region’s economic development is championed by Southern Illinois Now (SI Now), a coalition representing 17 counties. SI Now promotes the area’s unique “R4 Advantage”— rivers, rail, roads, and runways—which collectively provide unmatched connectivity. Southern Illinois is served by five Class I railroads, including Union Pacific and BNSF, and is located near the Mississippi and Ohio Rivers, which handle the majority of inland barge traffic in the U.S., making it ideal for bulk shipping and international commerce.

Air transportation includes Veterans Airport of Southern Illinois with daily jet service to Chicago O’Hare, while Southern Illinois Airport is home to Southern Illinois University Carbondale’s acclaimed aviation and automotive programs. The presence of

nearly two dozen aviation-related companies and eight general aviation airports further enhances the region’s appeal for aerospace and logistics companies.

This infrastructure has drawn substantial investment from global firms such as Continental Tire, AISIN, and Prysmian, along with newer arrivals like Texas-based Manner Polymers and AECI Schirm. These companies cite the region’s central location, skilled labor pool, and multimodal access as key factors in their decision to expand operations in Southern Illinois.

The region’s growth aligns with the Illinois Economic Growth Plan, which targets transportation, logistics, and advanced manufacturing as priority sectors. Illinois supports these industries through investments in infrastructure, workforce development, and innovation. With the third-largest interstate system and all seven Class I railroads, Illinois is among the most connected states in the nation.

Southern Illinois plays a vital role in this statewide strategy by unifying the region, promoting site readiness, and supporting workforce training to build resilient communities and broaden economic opportunities.

Once overlooked in favor of larger cities, Southern Illinois is now emerging as a key player in America’s supply chain. Its combination of location, infrastructure, workforce, and quality of life—including a low cost of living and abundant outdoor recreation—makes it an ideal destination for business growth and innovation.

Explore more at Southern Illinois Now by visiting southernillinoisnow.org

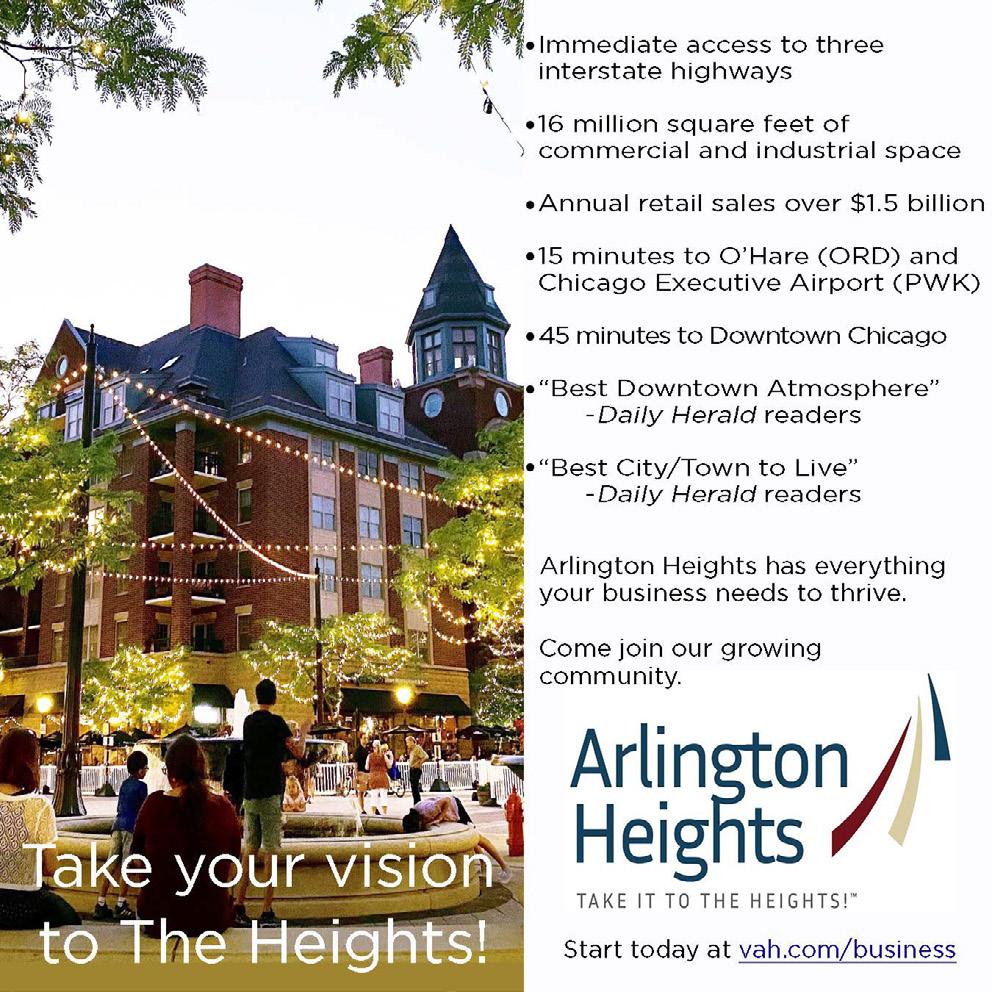

– Take Your Vision to The Heights!

With over 75,000 residents and a median annual household income of over $100,000, Arlington Heights continues to grow and thrive. As one of the largest business communities in Chicagoland, Arlington Heights is the home of more than 3,000 businesses. Arlington Heights also boasts an educated workforce with 60% of adult residents having earned a bachelor’s degree or higher. A corporate destination as well, Arlington Heights has numerous major companies that have invested in operations within our community, including Amazon, United Airlines, Frito-Lay (PepsiCo), GE Healthcare, Red Bull, and Northwest Community Healthcare.

Location is one of the community’s key assets, offering incomparable positioning within the region. Arlington Heights is served by two Metra rail stations, connecting to the Chicago Loop in under 45 minutes. Arlington Heights also provides immediate access to three interstate highways and is conveniently located just 15 minutes from both O’Hare International Airport (ORD) and Chicago Executive Airport (PWK).

Downtown Arlington Heights has become one of the region’s top destinations to visit, presenting a unique, eclectic experience with an enticing urban lifestyle. Shoppers can find one-of-a-kind gifts and products at more than 30 shops and boutiques. Cuisine is a key ingredient to Downtown’s success, showcasing a diverse collection of nearly 40 different restaurants and casual eateries. Arlington Alfresco, one of the Chicago region’s premier outdoor dining experiences, brings over 200,000 visitors to Downtown from May to September.

Downtown Arlington Heights is also a Chicagoland destination for entertainment, hosting outdoor concerts and annual events, and is home to live music venues such as Hey Nonny and Big Shot Piano Lounge. Meanwhile, the Metropolis Performing Arts Centre features live comedy, theatre, and music. Downtown development continues with over 400 new multi-family residential units approved or under construction, further validating Arlington Heights as a key location for investment.

Business thrives throughout Arlington Heights as well. In 2023, Arlington Heights businesses conducted over $1.5 billion in retail sales. Mitsuwa Marketplace, the largest Japanese grocery store in the Midwest, serves as a cultural and culinary destination for patrons from throughout the region. Arlington Heights is

also a major manufacturing, warehousing, and distribution hub. The community has over 5.5 million square feet of industrial space, including the recently completed Northwest Gateway Center, which offers over 500,000 square feet of versatile warehouse and manufacturing space with immediate access to I-90, I-290, and I-355 via IL-53.

Arlington Heights also remains the target of significant development. The 27-acre Arlington Downs development continues to take shape with more than 500 luxury residential units, in addition to current and planned commercial development, and interstate highway access nearby. Additionally, the first phase of the Arlington Gateway project is approved to begin construction on 300 new residential units, and 25,000 square feet of commercial space, immediately off of I-90. And Hickory/Kensington, just east of Downtown Arlington Heights, features the recently-completed FourNorth development offering 76 new multi-family residential units and ground floor commercial space. This area is supported by a TIF district, and additional development proposals are currently under consideration.

Quality of life is exceptional in Arlington Heights, with many of its students attending some of the Chicago area’s best elementary schools and high schools. In the past ten years, six Arlington Heights schools have received the prestigious “Blue Ribbon” designation from the U.S. Department of Education. Also, the Arlington Heights Memorial Library is regularly ranked among the nation’s best public libraries for its size and is an 11-time recipient of a “Five Star” designation by Library Journal, the publication’s highest rating. The community is also served by the Arlington Heights Park District with more than 50 public parks and facilities. Health care rates highly as well thanks to Northwest Community Hospital, ranked one of the 20 best hospitals in Illinois by U.S. News & World Report.

With an exceptional quality of life, a wealth of amenities, and unparalleled access within the Chicago metro area, Arlington Heights is positioned to continue to grow and thrive. To learn more about business and development opportunities in Arlington Heights, please visit VAH.com/business, or contact the Department of Planning & Community Development at planningmail@vah.com or at (847) 368-5200. X

From startup firms to global corporations, Missouri’s pro-business climate continues to offer a perfect location for all industries to thrive. The Show Me State offers a low tax rate, reduced red tape and business friendly regulations. Your business in Missouri will also benefit from the low utility rates, central location and cutting-edge workforce training solutions.

.........................................................................................

Whether you are here to grow your business, find a career, raise a family, produce a film, or take a family vacation, you will feel right at home in Missouri. Located in the heart of the country, their work ethic is second to none, their products are as diverse as the industries and customers they serve, and their culture continues to inspire and innovate.

Missouri has the 4th most diverse economy in the nation. From

IT to advanced manufacturing, to bioscience and everything in between, they have the tools needed to succeed.

From the largest river system in the nation to 19 freight railroads and more than 99 airports, to 7th ranked highway system, Missouri can help you connect quickly with your customers.

Their certified sites have been pre-qualified through a standardization process to meet the requirements of industry.

Development and business prospects can review sites for compatibility with their development needs.

Businesses locating or expanding in designated certified geographical areas may access local incentives through local real property abatement for improvements made to an existing facility or for the construction of a new facility.

For more information on Missouri, please contact the Missouri Dept. of Economic Development at 573-751-4962 or visit www.ded.mo.gov

In the fast-paced world of business expansion, readiness, reliability, and return on investment are paramount. That’s why Moberly, Missouri is catching the eye of forward-thinking companies and site selectors across the region.

Recently spotlighted through the Missouri Partnership’s Raise the Bar – Assess program, Moberly earned high marks for site readiness, workforce capabilities, and community support. The review, led by national site selection experts at Quest Site Solutions, noted that “Moberly is a hidden gem” with a “special sense of community,” a strong record of follow-through, and a pro-business attitude that sets it apart.

companies looking to scale quickly and strategically.

Looking for a community where you’re more than just a project on a map?

Let’s build something in Moberly.

Visit moberly-edc.com or call (660) 263-8811. X

At the heart of Moberly’s offering is the Moberly Area Industrial Park, a Missouri Certified Site with robust infrastructure, local control, and a track record of success. It’s already home to established manufacturers like JBS Foods and MFA Oil, and ready to accommodate a range of project sizes. The City of Moberly’s ownership of the park is a significant advantage for businesses seeking streamlined development without unnecessary red tape.

Moberly also boasts key sector strengths in food processing, electrical components, machinery, and metals, all backed by deep workforce roots. In fact, electrical equipment manufacturing in the region has a location quotient of 3.49, signaling a concentration more than three times the national average. Local wages in the sector are competitive, averaging nearly $64,000, and job growth is projected at 2.1% over the next five years.

With a low cost of doing business, strong institutional partners like Moberly Area Community College, and regional connectivity just 30 minutes from Columbia and 2 hours from St. Louis and Kansas City, Moberly is ideally positioned for

30 MINUTES NORTH OF COLUMBIA

2 HOURS FROM ST. LOUIS & KANSAS CITY DIRECT CONNECTION TO US-HWY 63 MISSOURI CERTIFIED SITE

ATLANTA, GA — Governor Brian P. Kemp announced that familyowned, Hawaii-inspired food company King’s Hawaiian® will invest approximately $54 million in expanding its Oakwood facility, creating more than 135 new jobs.

“For nearly 15 years, King’s Hawaiian has proven to be an incredible partner in creating quality jobs in northeast Georgia, and we look forward to even more years of great success for them in Hall County,” said Governor Brian Kemp. “Expansions like these are an important part of our economic development work, helping create further opportunities in growing communities.”

King’s Hawaiian was founded in 1950 by the Taira family in Hilo, Hawaii. Since establishing a presence in Georgia in 2010, the company’s footprint has grown to support more than 800 jobs in the state.

“This expansion represents a major milestone in our journey, and we’re thrilled to continue growing our ohana in Hall County,” said Mark Taira, CEO of King’s Hawaiian. “For 15 years, Georgia has been an essential part of our success. The support from Lanier Technical College, Georgia Quick Start, and the Greater Hall Chamber of Commerce has been instrumental in helping us train and develop talent to grow our business.”

The expansion will add a new production line at the 150,000-square-foot King’s Hawaiian facility located in the Oakwood South Industrial Park. Start-up of the new line is expected in the second quarter of 2026, producing additional flavors of King’s Hawaiian Pretzel Bites. The company will be hiring for positions in management, maintenance, food safety, and quality control. Interested individuals can learn more and apply at kingshawaiian.com/careers.

LEHIGH VALLEY, PA — Governor Josh Stein announced that Amazon is planning to invest $10 billion to launch a new high-tech cloud computing and artificial intelligence (AI) innovation campus in Richmond County, creating at least 500 new high-paying, high-tech jobs.

“Artificial intelligence is changing the way we work and innovate, and I am pleased that North Carolina will stay at the forefront of all that’s ahead as we continue to attract top technology companies like Amazon,” said Governor Josh Stein. “Amazon’s investment is among the largest in state history and will bring hundreds of good-paying jobs and an economic boost to Richmond County.”

Amazon Web Services (AWS) is the world’s most comprehensive and broadly adopted cloud computing solution, and its data centers enable customers of all sizes and across all industries, such as automotive, health care, manufacturing, financial services, public sector, and more, to transform their businesses. The new data centers will contain computer servers, data storage drives, networking equipment, and other forms of technology infrastructure used to power cloud computing capabilities and generative AI technologies. North Carolina’s business-friendly environment, abundance of infrastructure resources, availability of skilled labor, and growing technology sectors made it a natural hub for building world-class data center infrastructure.

“Amazon’s $10 billion investment in North Carolina underscores our commitment to driving innovation and advancing the future of cloud

“King’s Hawaiian has become a cornerstone of our regional economy and a shining example of a company that invests in both business and community,” said Tim Evans, President and CEO of the Greater Hall Chamber of Commerce. “This sixth major expansion since 2010 is a testament to the company’s deep roots in Hall County. We are especially proud of their ongoing support for youth and community programs, including the University of North Georgia’s First Generation Scholars, Junior Achievement, and Youth Leadership Hall. We look forward to continuing this remarkable partnership.”

Regional Project Manager Brandon Lounsbury represented the Georgia Department of Economic Development’s (GDEcD) Global Commerce team on this competitive project in partnership with the Greater Hall Chamber of Commerce and Georgia EMC.

“King’s Hawaiian has been a cornerstone employer in northeast Georgia and a valued partner of Georgia Quick Start for more than a decade,” said GDEcD Commissioner Pat Wilson. “By continuing to invest in people and innovation – and by working closely with the Technical College System of Georgia – King’s Hawaiian is helping build the skilled workforce that drives its success. Congratulations to Hall County on another exciting chapter in this thriving partnership.”

Founded more than 70 years ago in Hilo, Hawaii, by Robert R. Taira, KING’S HAWAIIAN is a family-owned business that has been dedicated to providing Hawaii-inspired foods made with original recipes and Aloha Spirit for three generations. For more information, visit the company’s website at www.KingsHawaiian.com, or find KING’S HAWAIIAN on Facebook, Instagram, and X (formerly Twitter).

computing and AI technologies,” said David Zapolsky, Amazon’s Chief Global Affairs and Legal Officer. “This investment will position North Carolina as a hub for cutting-edge technology, create hundreds of high-skilled jobs, and drive significant economic growth. We look forward to partnering with state and local leaders, local suppliers, and educational institutions to nurture the next generation of talent.”

“I am excited for Amazon’s $10 billion investment in our community,” said Senator David Craven. “This project will bring hundreds of good-paying jobs and significant investment to our area for many years to come.”

“Richmond County is delighted to welcome Amazon to our community,” said Representative Ben Moss. “The new jobs created by this facility will change hundreds of lives for the better. Rural communities like ours can lead the way in technology advancements, including artificial intelligence, which is an ever-increasing presence in the world.”

“The Richmond County, NC Board of County Commissioners, is pleased to announce and welcome Amazon as our newest corporate partner,” said Richmond County Board of Commissioners Chairman Rick Watkins. “Their selection of the Energy Way Industrial Park represents the largest Cap-ex investment in the history of North Carolina and will serve as a catalyst to transform the local economy, provide high paying jobs for citizens, and improve the quality of life for all residents. We stand ready to work together with Amazon as they continue to build capacity and innovate their cloud computing platform. Working together, our possibilities are limitless!

Company signs lease with U.S. Department of Energy for what will be biggest economic development project in Western Kentucky history

PADUCAH, KY — Kentucky Gov. Andy Beshear announced a major milestone for an economic development project in McCracken County that will include a nearly $1.5 billion investment and create 140 well-paying jobs. The Governor joined other elected officials and leaders from General Matter, an American uranium enrichment company, to recognize the company’s signing a lease with the U.S. Department of Energy (DOE) for the former Paducah Gaseous Diffusion Plant.

The signing of the lease paves the way for future milestones, including permitting, licensing and contractual terms with the DOE that will move the project moving forward. When completed, the facility will represent the largest economic development project in Western Kentucky history.

“I want to congratulate the team at General Matter on this major step toward what will be the largest economic investment ever for Western Kentucky,” Gov. Beshear said. “This lease reflects Kentucky’s leadership in nuclear energy and our strong partnerships at the federal and local levels, as well as in the private sector. I am looking forward to being back in Paducah soon to celebrate the next key milestone for this exciting and historic project.”

PHILADELPHIA, PA — A major $100 million investment by Rhoads Industries, in partnership with Pennsylvania Governor Josh Shapiro’s administration, is set to make Philadelphia’s Navy Yard a national hub for submarine manufacturing. Select Greater Philadelphia welcomes this investment news as this expansion is expected to exponentially grow Greater Philadelphia’s manufacturing sector and become an anchor that strengthens our region’s middle market.

The project includes building a new 95,000-square-foot fabrication facility designed for large-scale submarine production and barge shipping operations. This state-of-the-art expansion will double Rhoads’s capacity to support the U.S. Navy’s submarine industrial base, including advanced welding, machining, and logistics services.

“The future of shipbuilding runs through Philadelphia — and just like generations before us, it’s Pennsylvania workers who will build what keeps our nation safe. We’re investing in that future because it’s good for our economy, our communities, and for the people of Pennsylvania.” said Governor Shapiro at the announcement.

This investment serves as a catalyst for accelerating economic opportunities for Greater Philadelphia’s residents. This project will create 450 new full-time jobs while retaining 541 existing jobs

General Matter collaborated with state and local leaders and the DOE for the plan to build a commercial uranium enrichment facility at the Paducah site that served as the first location in the United States for industrialized enrichment technology. Plans for the facility include production of fuel needed for the next generation of nuclear energy, which are vital for future growth of manufacturing, artificial intelligence and other key industries.

“Seventy-five years ago, the U.S. Atomic Energy Commission selected Paducah to help lead the nation’s original enrichment efforts,” said General Matter CEO Scott Nolan. “We are proud to return to and reactivate this historic site to power a new era of American energy independence, and we thank our partners in Kentucky and at the DOE’s Office of Environmental Management and the Office of Nuclear Energy for supporting us in this landmark investment in American nuclear infrastructure.”

General Matter is a privately funded American company focused on development of uranium enrichment technology to reshore domestic nuclear fuel capacity and power American energy production. The company’s team includes experts and engineers with backgrounds in nuclear, tech and government. The company was selected by the DOE as an awardee in both its low enriched uranium (LEU) and high-assay low enriched uranium (HALEU) enrichment acquisition programs and plans to enrich uranium at the Paducah site by 2030.

General Matter’s investment and job creation will build on the best five-year period for economic growth in state history. For more information on General Matter visit generalmatter.com.

at the Navy Yard, which should result in a projected $44 million in annual payroll entering the local economy. To help clear a pathway for tomorrow’s workforce, Rhoads operates a state-accredited, three-year apprenticeship program in collaboration with Boilermakers Local 19, training high school graduates in welding, machining, and submarine fabrication.

A major win for the region, this expansion reflects that Greater Philadelphia is a thriving economic hub that is connected, collaborative, and accessible to the world.

LITTLE ROCK, AR — As part of its continued investment in Arkansas, Amazon broke ground on a more than 930,000-square-foot logistics facility in Little Rock that will create more than 1,000 full- and part-time jobs once fully operational. This new investment will help improve delivery speeds for customers and boost local economic growth. The facility is expected to be operational by 2027.

“I’m excited to see companies like Amazon choosing the Port of Little Rock – an area where river, rail, road, and runway all connect – to expand their business,” said Arkansas Governor Sarah Huckabee Sanders. “This strategic location in the heart of the heartland streamlines logistics processes and offers businesses easy access to critical transportation corridors. Areas like this are just one reason why Central Arkansas is a great place to do business.”

“We’re proud to continue investing in Arkansas and Little Rock with this

ROWAN COUNTY, NC — Governor Josh Stein announced Jabil Inc., a leader in engineering, supply chain, and manufacturing solutions, expects to create 1,181 new jobs in Rowan County. The company says it will invest approximately $500 million over several years to establish a manufacturing facility to support cloud and AI data center customers.

“Companies that are already operating in North Carolina know the value of doing business in our state better than anyone,” said Governor Josh Stein. “We welcome Jabil’s expansion, and we are committed to further developing the largest manufacturing workforce in the southeast and the business-friendly climate they need for this next phase of growth.”

Headquartered in St. Petersburg, Florida, Jabil has a global footprint