A Columbia Institution Celebrates

50 Years

THE FINANCE ISSUE

OCTOBER 2023 | THE FINANCE ISSUE | A PUBLICATION OF THE COMO COMPANIES

now open

Columbia’s newest gathering place for business professionals looking for a stylish space to unwind.

Book YouR Holiday Party with us!

>> Elevated Cocktail Menu

>> Upscale Setting

Reserve one of our exclusive rooms for your upcoming party, business gathering, meeting, or intimate event for a night to remember. harposcomo.com/contact

>> Menu Available

27 South 10th Street Downtown Columbia

An El evated Harpo’s experience

COMMERCE TRUST WELCOMES NEW TEAM MEMBERS

Commerce Trust is pleased to introduce the newest members of our Columbia-based team. Steven Jeffrey, Sarah Hanneken, Keith Schawo, and Greg Jones collectively bring nearly 90 years of financial planning, wealth and asset management experience, adding considerable depth to our team servicing clientele throughout Central Missouri.

Commerce Trust has been a leading provider of investment management, financial planning, trust and private banking services for individuals and institutions for more than 100 years. Our clients benefit from the insight gained by our experience administering more than $63 billion in assets through all market cycles.1 Today, Commerce Trust, a division of Commerce Bank, ranks 20th in the U.S. among bank-managed trust companies based on assets under management.2

CONTACT A COMMERCE TRUST ADVISOR

1 Based on assets under administration (AUA) as of June 30, 2023. 2 Earnings Highlights, 2nd Quarter, 2023. Investment Products: NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE Commerce Trust is a division of Commerce Bank. commercetrustcompany.com

AT 573-886-5275

Upscale comfort in the heart of downtown

Modern comfort meets historic charm at voco The Tiger Hotel, a beloved Columbia landmark that captures the magic of the Roaring Twenties. You’ll find us below our famous neon Tiger sign in the heart of downtown, well placed for boutique shopping and right next to the University of Missouri.

Modern, southern comfort food.

All Missouri-made BBQ, beer, spirits, and wine.

Cool and casual lounge with award-winning cocktails.

A-1 Foundation Solutions offers several foundation repair solutions in Columbia and the surrounding areas. We are your local foundation experts. As a locally owned family business with over 25 years of experience, we offer a wide range of foundation services which include waterproofing, foundation repair, crawl space repair, drain installation, and concrete lifting. No job is too tough for us! When it’s too tough for everyone else, it’s just right for us. Our goal is to work together to find the right foundation repair solution for your home. Waterproofing & Foundation Experts in Mid-Missouri phone : 573-240-2038 | email : info@a1foundationsolutions.com a1foundationsolutions.com Genuine Family Owned Quality Work Licensed & Insured Foundation Repair Crawl Space Repair Concrete Lifting Waterproofing Solutions Drain Installation Scan the code to fill out the form on our website for a FREE Estimate.

LET US HELP YOU SMILE CONFIDENTLY.

At Cherry Hill Dental, we pride ourselves on providing exceptional dental care for your entire family, offering a wide range of personalized services. Our state-of-the-art technology and experienced team ensure the best care available.

Book your appointment today and discover a stress-free and comfortable dental experience.

COLUMBIA 220 Diego Court Columbia, MO 65203 (573) 446-0880 JEFFERSON CITY 923 S Country Club Dr Jefferson City, MO 65109 (573) 556-8500 FULTON 1500 N Bluff St Fulton, MO 65251 (573) 826-2968 VISIT OUR WEBSITE: CherryHillDentalOnline.com | FOLLOW US ON SOCIAL Cosmetic Dentistry Dental Implants Invisalign* Comprehensive Care *The dentists in this office are not specialists in the advertised dental specialty of orthodontics.

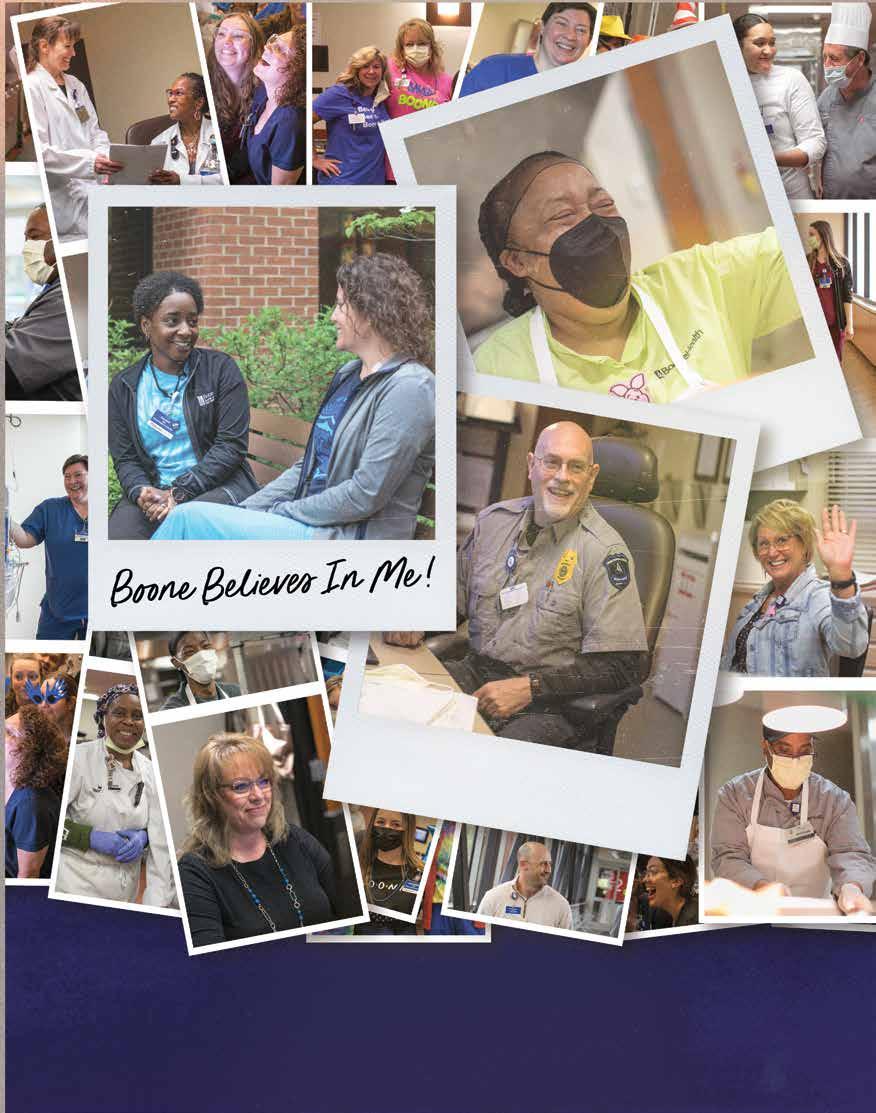

Thank You, Columbia! Special thanks to our sponsors: 2023 Presenting Sponsor SILVER SPONSORS • Automotive Specialists • Islamic Center of Central Missouri • Cripps & Simmons, LLC. • LaBrunerie Financial Services • Crockett Engineering • Cedarhurst Senior Living • Anderson Homes BRONZE SPONSORS • Assured Partners • Commerce Bank • Hawthorn Bank • Angelo’s Pizza & Steak • Fast Yowi • Booth • Truman VA Hospital • Champion • Sumits Hot Yoga • Boone Electric Coop. • First Mid Bank & Trust • Jim Butler Auto Group Gold Sponsors Platinum Sponsor FOR SUPPORTING THE FIGHT TO END ALZHEIMER’S.

THANK YOU TO OUR 2023 COLUMBIA GO RED FOR WOMEN® EXECUTIVE LEADERSHIP TEAM Columbia Go Red For Women Chair Brook Berkey Central Bank of Boone County Amy Begemann MU Health Care Brian Burks Emery Sapp & Sons Susan Hart Reinhardt Construction Dena Kartheiser Shelter Insurance Madison Loethen Boone Health Michelle McCaulley Williams Keepers Monica Smith Boone Health © Copyright 2023 American Heart Association, Inc., a 501(c)(3) not-for-profit. All rights reserved. Go Red for Women is a registered trademark of the Association. The Red Dress Design is a trademark of U.S. DHHS. Unauthorized use prohibited. Nationally sponsored by Locally sponsored by

What’s your CoMo?

Mizzou events and our son’s events.

What do you think is Columbia’s best kept secret?

Shelter Gardens.

How would you describe Columbia in one word?

Inviting.

VisitColumbiaMO.com @VisitColumbiaMO Eric Morrison is the President of Sundvold Financial and an Investment Advisor Representative. No matter who you are, how long you have lived here, or what you do for fun, everyone has their own CoMo. This year, we’re featuring local residents and asking them what makes their CoMo. From favorite places to grab dinner to our best-kept secrets for visitors to explore, they will be sharing what makes our city extraordinary to them. Because, in the end, it’s those memorable places and experiences that make it your CoMo.

to

a visitor

What is your go

place to take

in Columbia? The Columns. What’s your fave pastime in Columbia?

ERIC MORRISON

CALL TODAY 800-479-2091 *2022 Mediacom Executive Summary Reliability Report. © 2023 Mediacom Communications Corporation. All Rights Reserved. Mediacom Business Internet is now more powerful. Including Advanced Data Security, an A.I.-driven first line of defense against malicious cyber threats, plus Business Wi-Fi with separate connections for customers and employees. Experience high-capacity broadband with no data caps on a network with over 99.99%* reliability. It’s the connectivity your business needs right now. WITH EMBEDDED DATA SECURITY AND BUSINESS WI-FI POWERFUL BUSINESS CONNECTIVITY

Locate Us | Event & Wedding Studio 1-31 Agriculture Building Columbia, MO 65201 Affordable Petals, Always Worth The Priceless Smiles

President Erica Pefferman | Erica@comocompanies.com

EDITORIAL

Publisher | Erica Pefferman Erica@comocompanies.com

Editor-in-Chief | Kim Ambra Kim@comocompanies.com

Digital Editor | Jodie Jackson Jr Jodie@comocompanies.com

DESIGN

Creative Director | Kate Morrow Kate@comocompanies.com

Senior Designer | Jordan Watts Jordan@comocompanies.com

MARKETING

Director of Account Services

Amanda Melton Amanda@comocompanies.com

Marketing Representative Sarah Hempelmann Shempelmann@comocompanies.com

Marketing Representative Becky Roberts Becky@comocompanies.com

CONTRIBUTING PHOTOGRAPHERS

Charles Bruce III, Madison Green

Anthony Jinson

MARKETING

Director of Sales | Charles Bruce Charles@comocompanies.com

OUR MISSION

To inspire, educate, and entertain the citizens of Columbia with quality, relevant content that reflects Columbia’s business environment, lifestyle, and community spirit.

CONTACT

The COMO Companies 404 Portland, Columbia, MO 65201 (573) 499-1830 | comomag.com @wearecomomag

SUBSCRIPTIONS

Magazines are $5.95 an issue. Subscription rate is $54 for 12 issues for one year or $89 for 24 issues for two years. Subscribe at comomag.com or by phone.

CONTRIBUTING WRITERS

Candice Ball, Christina Beals, Alicia Belmore, Barbara Buffaloe, Lauren Sable Freiman, Jodie Jackson Jr, Hoss Koetting, Amanda Long, Amy Pletz, De’Carlon Seewood, Michelle Terhune, Dr. Brian Yearwood

16 THE FINANCE ISSUE 2023 Adjusting your health in the right direction.

Jennifer Sutherland DC, FASA, Webster Certified Dr. Ashley Emel DC, CACCP, Webster Certified 2516 Forum Blvd. #102 (573) 445-4444 compass-chiropractic.com

Dr.

COMO Magazine is published every month by The COMO Companies. Copyright The COMO Companies 2023. All rights reserved. Reproduction or use of any editorial or graphic content without the express written permission of the publisher is prohibited. KEEP AN EYE OUT FOR RECENT ISSUES AT LOCAL STOCKISTS AROUND

TOWN!

The Chronicles of My Financial Misadventures

Ah, finances –

the word that strikes fear into the hearts of budgeting-challenged individuals like me. I’ve danced with budgets, tiptoed through spreadsheets, and tried to make sense of investment jargon, all while feeling like I stumbled into a calculus class with a crayon in hand. Allow me to share a few of my nancial ascos.

BUDGETING? WHAT’S THAT?

Attempting to stick to a budget is like trying to herd cats. e moment I set a budget, it is as if the universe conspires against me to make it disappear. at meticulously planned grocery list? Mysteriously transformed into a cart over owing with gourmet cheese and exotic fruits, all of which I convince myself are essential for my survival. Who doesn’t love a good charcuterie board ... Amirite?! Budget? What budget? I’m single-handedly keeping the local cheese counter in business!

THE GREAT RECEIPT REBELLION

I decided to become a responsible adult I needed to save all my receipts so I could track my spending. Little did I know my wallet wasn’t prepared for the rebellion that followed. e ever-growing stack of crumpled paper waged a war against me. I had receipts everywhere ... literally falling out of my opened car door. I quickly realized that merely saving the receipts did not really get you anywhere unless you were doing something with said receipts. Which I was not — so that war was quickly over. But an “A” for e ort.

INVESTING: LOST IN TRANSLATION is part ends quickly, so don’t blink here. ere were a few days in my life that I thought I would investigate investing. I felt like “stock” was a word that I should be introducing into

my adult language. When I realized that I was close to purchasing stock solely because it had a cute logo and a catchy name ... I realized maybe that’s not for everyone.

CREDIT CARD CAPERS

Credit cards, those plastic temptresses! ey lull you into a false sense of nancial security with their shiny veneer and cashback rewards. For emergencies only. at is what I was told. It’s all fun and games until you nd yourself explaining how a new winter coat was an emergency. In my defense, it was winter and very cold. at was my rst and last credit card.

In conclusion, my nancial journey has de nitely been an adventure! I’ve come to embrace the comedy of it all. Life’s too short to fret over every penny. So, if you nd yourself in the same budgeting boat, remember to laugh at your nancial foibles, learn from your mistakes, and keep your sense of humor intact. At the end of the day the bills are paid, and I live an incredible life.

All jokes aside, we have some incredible resources in our community available to help you with whatever side of the budgeting world you live in. I admire you planners and savers! But if anyone wants to book a trip tonight, with a ight that leaves tomorrow, and we gure out the rest of it when we get there — call me!

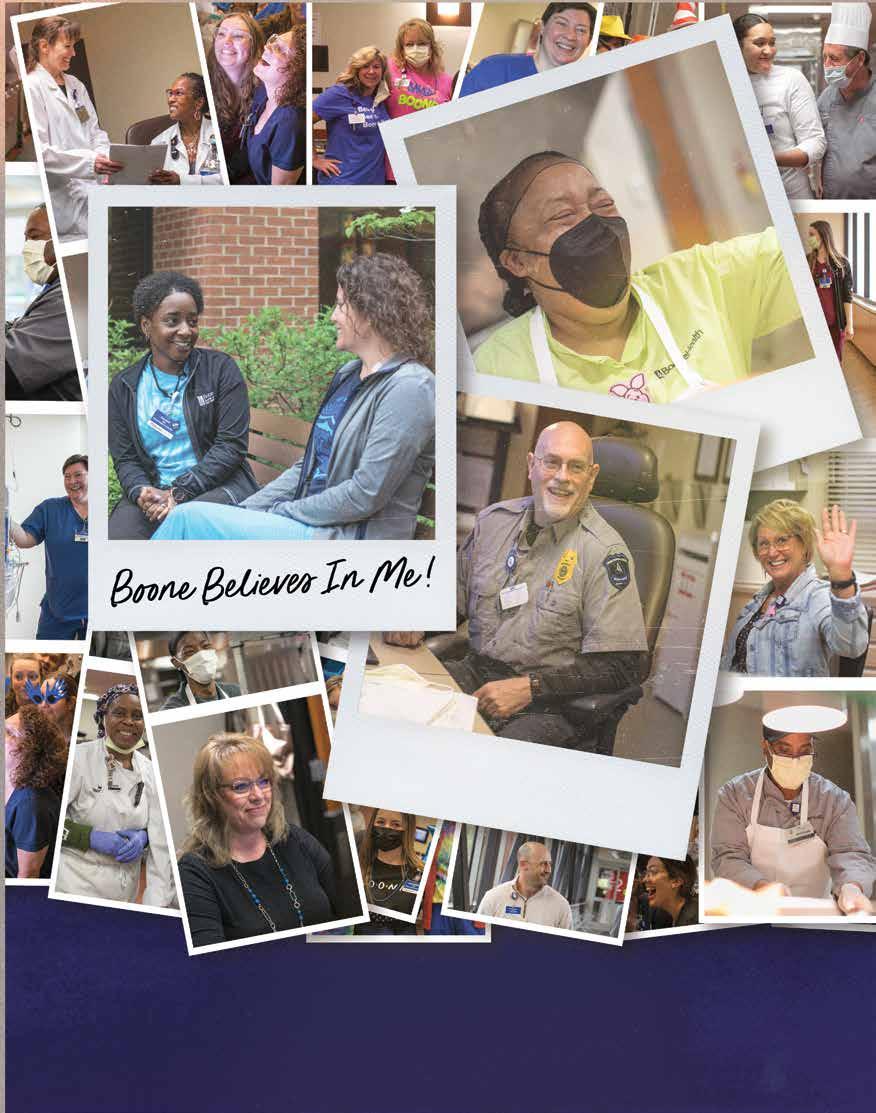

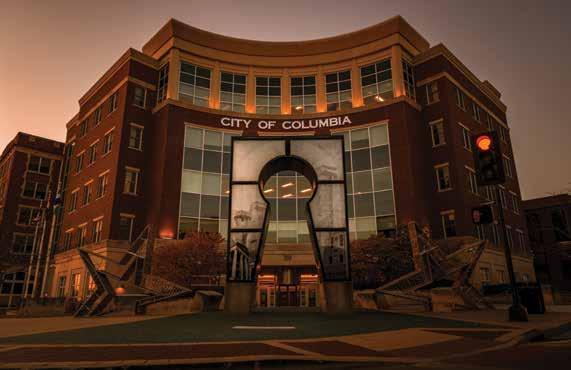

Nationally recognized Shakespeare’s Pizza celebrates 50 years in business.

COMOMAG.COM 17

Letter from the Editor

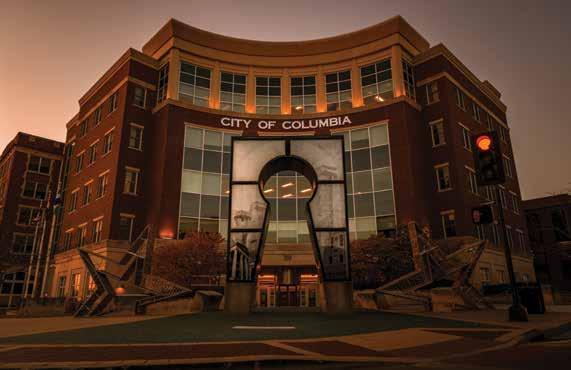

KIM AMBRA , EDITOR-IN-CHIEF XO, OCTOBER 2023 THE FINANCE ISSUE A PUBLICATION OF THE COMO COMPANIES THE FINANCE ISSUE 50 Years A Columbia Institution Celebrates ON THE COVER

Photo by Anthony Jinson

Representing Voices from All Different Walks of Life.

We take pride in representing our community well and we couldn’t do what we do without our COMO Magazine advisory board. Thank You!

Beth Bramstedt

Associate Pastor Christian Fellowship Church

Kris Husted

Senior Content Editor

NPR Midwest Newsroom

Heather Brown Strategic Partnership Officer

Harry S Truman VA Hospital

Chris Cottle Walk Manager

Alzheimer’s Association Greater Missouri Chapter

Sam Fleury

Assistant Vice President, Strategic Communications, Columbia College

Alex George Owner

Skylark Bookshop Executive Director Unbound Book Festival Author

Chris Horn

Sr. Reinsurance Manager American Family Insurance

Jeremiah Hunter

Assistant Police Chief Commander Investigations Bureau Columbia Police Department

Amanda Jacobs Owner Jacobs Property Management

Darren Morton Program Director Turning Point

Megan Steen

Chief Operating Officer, Central Region Burrell Behavioral Health

Nathan Todd Business Services Specialist First State Community Bank

Wende Wagner

Director of Philanthropy The Missouri Symphony

18 THE FINANCE ISSUE 2023 Advisory Board

30 NONPROFIT SPOTLIGHT Loving People Forward

54 IT'S THE THIRD ACT, NOT THE CURTAIN CALL Retirement can be your best act yet. Just make sure you’re prepared to deliver your lines.

60

BOONE COUNTY AWARDS

COMOMAG.COM 19 COMO MAGAZINE THE FINANCE ISSUE | OCTOBER 2023 17 EDITOR’S LETTER 18 MEET OUR ADVISORY BOARD 22 ART & CULTURE Supporting Art and Artists 25 COMO CREATURES Barking up the Right Tree 27 WELLNESS An Easy Pill to Swallow 28 GUEST VOICES Dr. Brian Yearwood 39 GOURMET Two Degrees of Shakespeare's 45 GUEST VOICES Cookin' with Hoss 47 FAVORITE FINDS Invest in Yourself 49 FRIENDS & FAMILY Dollars and Sense 53 GUEST VOICES D'Carlon Seewood

GUEST VOICES Barbara Buffaloe

64

66 THE LAST WORD

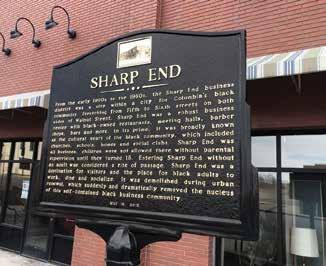

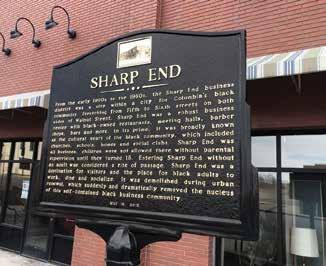

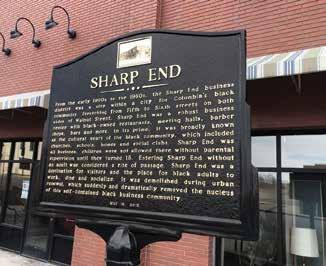

$12 MILLION IN ARPA 26 organizations receive money for an array of social projects.

Photo by Madison Green

20 THE FINANCE ISSUE 2023 Protect what is important. Allstate Insurance Agent — Bradley Young, Columbia, MO (573) 514-6407 2500 W ASH ST COLUMBIA, MO Walk-ins welcome, or request an appointment! Get fresh, seasonal flowers straight from the farm to your home every week with easy delivery or pickup. For 20 weeks during the summer growing season, you can have a one of a kind bouquet made just for you! Flowers are harvested multiple times per week and then arranged into beautiful bouquets. We grow a wide variety of ornamental cut flowers throughout the year. Everyone loves a fresh bouquet of flowers! Order your bouquet online or visit our booth at the Columbia Farmers Market, Saturdays from 8am-12pm! Medium Bouquet - $22/week | Deluxe Bouquet - $30/week Delivery - $8/week *There is no fee for pickup

1111 E. BROADWAY, COLUMBIA • (573) 875-7000 • THEBROADWAYCOLUMBIA.COM FOOD, DRINKS, AND LODGING — we have it all! BOOK YOUR HOLIDAY PARTY WITH US!

Supporting Art and Artists

Columbia Art League is a canvas for artists to exhibit — and sell — their creations.

BY CHRISTINA BEALS

The Columbia Art League, founded in 1959, is a nonpro t organization that provides support and resources to local artists. Founders Betty Robins and her team of fellow artists established CAL to promote local artists’ work, while encouraging a stronger appreciation for art within the community. rough the league, artists have access to workshops, classes, events, and six exhibitions every year.

By purchasing art through CAL, art lovers and collectors can help support the Columbia arts scene, while also supporting the artists. Executive Director Kelsey Hammond says CAL receives a 35 percent commission on all work sold in the members’ gallery, and artists receive the rest of the pro t. Artists are paid their share at the beginning of the month for the previous month’s sales.

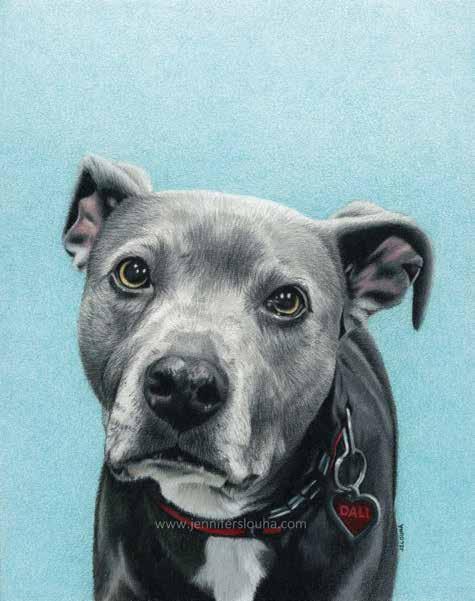

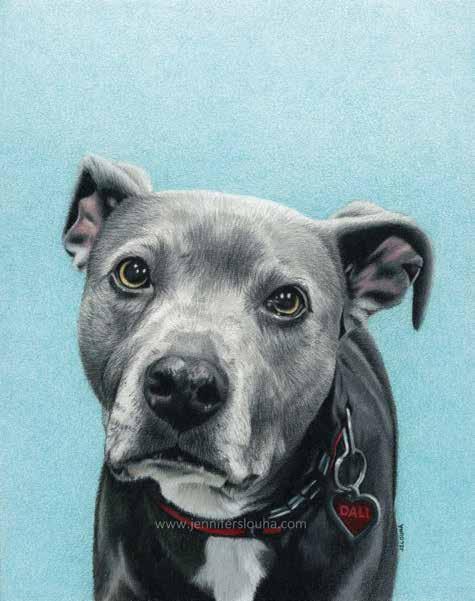

JENNIFER SLOUHA

Hand-Drawn

Photorealism

Jennifer Slouha’s unique approach to her art starts with how she creates it: with professional-grade colored pencil. ough she also works with several types of mediums, like graphite pencil and acrylic paint, Slouha uses colored pencil to best capture her signature

photo-realistic style, while still upholding the color vibrancy she strives for.

“With colored pencil, you can create something highly realistic and something that retains all the details that I am looking to include,” she says. “I like to promote that, like acrylic or oil paints, art created by colored pencil can be purchased and hung up on your walls and won’t fade or degrade in any way.”

Jennifer specializes in commissioned art, speci cally pet portraits and automotive drawings. Her hand-drawn

22 THE FINANCE ISSUE 2023

ART & CULTURE COMO

“Dali” by Jennifer Slouha; 8x10 inches; colored pencil Commissioned pet portrait

art can take anywhere between 30 and 100 hours to complete, all starting with a ne line drawing of the image. From there, Jennifer builds upon its depth until the drawing takes form.

Commissioned pieces ramped up for Jennifer in 2013, which she says is when she started to hone in her artistic skill sets and strengthen them. From there, her work started to gain more attention and commission than before. at same year, Jennifer became a part of the Columbia Art League as an artist looking to further connect with her community. Alongside her exhibited work, Jennifer has sold other original works, prints, and her popular colored pencil earrings displayed through the CAL gift gallery. ey are hand-drawn, like “Shrinky Dink earrings from the ‘90s. I draw each one individually, so it’s like wearable artwork,” she says.

Since joining CAL, not a year has gone by when Jennifer has not had her work featured in at least one exhibit with the organization.

“I personally don’t like to go too long without creating art because you almost feel like you have to restart,” Jennifer says. “It’s good to consistently maintain creating something on a regular basis.”

Website: jenniferslouha.com

Facebook: /JSlouhaFineArt

Instagram: @jslouha

Whimsical Illustrations

Creating under the name “Art Chica,” Michelle Marcum’s digital artwork stems from retracing her steps back to her adolescence, when her love for cartoon illustration and character design were rst born.

But before that, Michelle took on a di erent form of artistry behind the counter of a local Subway.

“I was a sandwich artist, but that’s not exactly what I meant when I said I wanted to grow up and be an artist,” she says.

In 2007, Michelle went back to school to study digital design online through the Art Institute of Pittsburgh, then pursued her degree at Moberly Area Community College before transferring to Stephen’s College in 2012. While pursuing her Graphic Design degree there, Michelle’s involvement with CAL started to take form.

Since her CAL involvement began in 2010, Michelle served on its Board of Directors for three years before transitioning to selling her artwork through its gallery.

Among the several CAL exhibits that have displayed her art, one of Michelle’s favorites was Let em Eat Art, where two of her digital prints received significant attention.

“I sold both my sushi mermaid and strawberry octopus prints through Let em Eat Art, and not only were both of them picked by chefs to be featured in the exhibit, but they both sold. ey also received honorable mentions,” Michelle shares.

Along with her prints, stickers, and greeting cards for sale, Michelle’s whimsical creations displayed in the gift gallery extend beyond the realm of digital illustrations, to her notably popular ceramics.

Every year, she sets up shop at several local events like e Zipper Fest, Mid-Missouri Pride Fest, and Art in the Park. Pop-ups unlocked a tidal wave of opportunities for Michelle. In January, she set up a tiered Patreon account for her art, where patrons can choose from tiers that vary in pricing, depending on what is included in each.

Michelle also conducts polls with her patrons, which helps her decide her own upcoming monthly themes for content. Among other sources, like Pinterest and fellow illustrators through social media, the input she receives through Patreon has helped Michelle inspire her art and better cater her content to clientele.

Website: artchicamarcum.com

Etsy: etsy.com/shop/artchicastudios

Patreon: patreon.com/artchicamarcum

Instagram: @artchicamarcum

There’s more to the story! Read more about CAL and the artists it supports in our online exclusive extended edition.

COMOMAG.COM 23 ART & CULTURE COMO

MICHELLE MARCUM

24 THE FINANCE ISSUE 2023 MOVE BETTER. FEEL BETTER. SIMPLY LIVE BETTER! WILSONSFITNESS.COM 2902 FORUM BLVD. (573) 446-3232 l 2601 RANGELINE (573) 443-4242 GROUP FITNESS INDOOR POOL HOT STUDIO PERSONAL COACHING + ENDLESS AMENITIES RECEIVE A FREE PERSONALIZED GUIDE TO MOVE PAIN FREE! www.mathnasium.com This moment is brought to you by Mathnasium A child who continues to develop their math skills can feel confident that they’re on track for a successful school year. Mathnasium gives students the instruction they need to reinforce what they’re learning in school, work on concepts that may pose a challenge, and take their math knowledge to a new level. In other words, we got this. Contact Us for a Free Assessment Mathnasium of Columbia MO (573) 445-7040 columbiamo@mathnasium.com 3906 Peachtree Dr, Suite E, Columbia

Barking Up the Right Tree

Revenue from pet licenses supports multiple departments.

BY ALICIA BELMORE

BY ALICIA BELMORE

Columbia dog and cat owners will pay about $50,000 in the next year to make sure their furry friends are properly licensed with the city.

e scal year 2024 budget (October 1, 2023, to September 30, 2024) anticipates animal licensing revenue of $49,716, an increase of some $4,800 from the previous year. e license fees go into the city's general fund, which allocates money to a variety of city departments, including police, re, and animal control, among others.

Molly Aust, animal control supervisor, says the city's animal licensing ordinance requires all dogs and cats over three months of age to be licensed and vaccinated against rabies. e de ning factor isn't whether someone considers their dog or cat to be a pet. e ordinance stipulates that any animal over three months of age that is owned, kept, harbored, or permitted to be or remain on the premises must be licensed.

COUNTY REQUIREMENTS

Di ering from the city, the Boone County animal control ordinance does not require licensing pets, but owners are required to vaccinate their dogs and cats against rabies.

Dogs and cats that are spayed or neutered can be licensed for $5 per year, or $15 per year if they are not spayed or neutered. Pet licenses can be purchased for up to three years at a time.

As a part of the Columbia/Boone County Department of Public Health and Human Services, Aust's animal control sta also enforces city ordinances on dogs running loose and dog bites, responds to county-wide calls about wildlife that might get into a residence, and investigates reports of animal cruelty in both the city and county.

e FY2024 budget that was approved on September 18 by the Columbia City Council calls for $876,730 in spending for animal control, an 11 percent increase from FY2023. e animal control budget accounts for 0.0007 percent of the overall general fund. About 63 percent of the animal control budget is dedicated to salaries, bene ts, and other personnel services.

Other revenue streams for the animal control division include some $23,000 in animal control fees and $30,000 from a state grant. Revenue from fees that the municipal court levies and collects regarding animal licensing violations and other animal-related citations goes into the general fund.

Animal control also contracts for services with the Central Missouri Humane Society, which is the de facto “pound” for animals impounded by animal control. Central Missouri Humane Society provides “limited veterinary care to animals in need,” Aust said in an email interview. ere is also a free spay and neuter program available to the public through the Humane Society.

HOW TO GET YOUR PET LICENSED

Pet owners can get rabies tags or certicates and licensing for pets through a veterinarian. Animal control provides those forms to the veterinarians. Dog or cat licenses are also available at the health department at 1005 W. Worley St., and the pet owner must provide proof of vaccination. Pet licenses are issued by the city's

business license o ce. Animal control keeps track of the licenses in its database. A rabies shot is required even for dogs or cats that stay indoors. Rabies vaccinations can be for one to three years in duration. e pet licensing requirement does not apply to certi ed working dogs trained to assist individuals with disabilities.

Pet owners can also purchase the required license when picking up their pet after being impounded by animal control. To claim a pet from impoundment, the owner must pay $20 per day or part of a day in addition to a $35 impoundment fee. A microchip implantation fee of $15 is added for pet owners who want that service when claiming an animal.

In addition to licensing regulations, the city's animal control ordinance requires that pet owners clean up any waste left by their pets on public or private property that is not the pet owner's property. Violations of the animal control ordinance are, in most cases, misdemeanors that are handled via citations to the pet owner or a summons to appear in municipal court.

COMOMAG.COM 25 COMO CREATURES COMO

Life’s moments and milestones are worth remembering, celebrating, and capturing.

26 THE FINANCE ISSUE 2023 INVEST IN YOUR SKIN. FOLLOW US: alanaharperesthetics.com • @alanaharperesthetics 20% off 20% off DERMAPLANING SERVICES FOR COMO READERS! OFFER VALID THROUGH NOVEMBER 30, 2023

An Easy Pill to Swallow

Next RX offers affordable options compared to traditional pharmacies.

BY CANDICE BALL

PHOTO BY SADIE THIBODEAUX

Erica Crane, pharmacist in charge and co-owner of Next RX, has always had a passion for helping others.

“When I got into pharmacy school, I’d been a bio-chem major, and I thought to myself, ‘I don’t want to be a doctor, but I want to help people,’” Crane explains, noting that her career began in Columbia with a 15-year stint at D&H Drugstore as a student, then pharmacist, and then pharmacist in charge. Crane also was involved with the Missouri Pharmacy Association and was president of the association in 2014.

Her resume includes involvement in other grassroots movements and talking with legislators about laws that a ect her profession.

Crane tried di erent roles and positions at other pharmacies, but ultimately knew she wanted to set up her own shop to serve the community she comes from.

“I thought, ‘I can do this now. I’ve been out in the eld’ — sometimes you just need to take a leap, take a jump,” she adds. And she did. Next RX provides access to providers and cash-only a ordable generic prescriptions.

“A lot of independent pharmacies are closing left and right” in the wake of COVID, Crane says. “A lot of them [closed] because they can’t keep their doors open with the current reimbursement models. At the end of the day, pharmacies are still a business, and someone has to pay for the medication, and if your insurance isn’t going to do it, then who is?”

Next RX o ers answers to those questions. e pharmacy provides access to online, drive-through, and retail services.

e team works to nd the best deals for their customers, often saving customers as much as 80 percent o the retail price of generic medications. Via the Next Rx website, customers can search for specific medications and nd out the pricing Next RX o ers.

Crane is eager to point out the way Next RX o ers a ordable options to patients who may not understand how their prescription insurance, or how medi-

cal insurance and co-pays a ect what they pay out of pocket. She stresses that name-brand prescriptions can be pricey and problematic when it comes to billing.

“People with plans with high deductibles are often way, way over-charged. Nobody sees anything behind the scenes, in terms of what’s actually being billed to your insurance,” Crane says. “A medication could cost about three dollars a bottle, but then you have this thing called AWP – actual wholesale price – and that is what insurance is billed on. It could be ve hundred dollars for the same bottle, and that’s what’s getting hit on someone’s insurance. at’s when I have people come to me and ask me what their medicine actually costs, and they give me this ‘too good to be true’ response. And I tell them, ‘ ere’s no reason you should be paying that much.’”

Crane says the team members at Next RX likes to think of themselves as an “altruistic pharmacy,” which makes her proud. “We ll a need that people don’t always know they need.”

COMOMAG.COM 27

RX 2909 Falling Leaf Lane, Suite A info@nextrx.com nextrx.com 573-545-5278

NEXT

WELLNESS COMO

From left to right: Debbie Head, Neal Head, Erica Crane, Cole George

A Glimpse into Columbia Public Schools’ Budget Development Process

BY DR. BRIAN YEARWOOD

The Board of Education and Columbia Public Schools are committed to being good stewards of taxpayer dollars.

e process used to develop the school district’s budget requires a great deal of analysis. e decisions made in the short term need to be sustainable in the long term.

Columbia Public Schools works collaboratively with schools, district programs, and district administration to develop strategies and align resources in a manner that re ects our vision, mission, and values. We believe that budget development is the foundation of meeting our district’s vision and mission to be the best district in our state.

Additionally, committees established by the Board of Education for long-range nancial and facility planning help guide the development of the budget and the district’s long-range facility and nancial plans.

e school district’s budget development process begins in early winter each year with revenue projections derived from student enrollment, preliminary assessed valuations, and other factors.

Beginning in December and continuing through February, the nance committee and the board review and establish budget parameters and timelines. Also, during the winter months, the administration compiles needs based on budget requests received from building and department leaders for personnel, services and supplies, and capital items. During this same period, the nance committee and the board gather information on employee bene t recommendations and requests.

roughout the spring months, the board has monthly budget discussions, including public work sessions, to discuss and prioritize budget needs. An annual budget hearing for the public is also held each year.

As required by statute, by June 30 a nal budget for the coming year is adopted.

Managing expenditures requires checks and balances. roughout the year, departmental and building budgets are managed using a purchase order system that is budget-restricted. Purchase orders are part of a purchase approval process and prevent an overcommitment of funds.

Revenue budgets are reviewed and updated on a regular basis and discussed with the board as a part of the district's ve-year projection model. Budget amendments may be made as additional information becomes available, particularly relating to federal program funds, assessed valuation, and student count data. Any additions to or redirections from the approved budget that require additional sta ng or could result in

spending beyond what has been authorized by the board requires approval by the board. Additionally, the board has nal approval of the original budget and budget adjustments made throughout the year. In a spirit of transparency and clarity, the board approves full-time equivalent (FTE) budgets, salary schedules, rates of pay, and work calendars as a part of the budget process. ese items are included in the nal board-approved budget document. Changes during the

28 THE FINANCE ISSUE 2023 VOICES COMO

The district’s Annual Comprehensive Financial Report has earned the Government Finance Officers Association Certificate of Achievement for Excellence in Financial Reporting and the Association of School Business Officials Certificate

of Excellence in

Financial Reporting for more than 35 years.

year to these schedules, rates of pay, or FTE needs are brought to the board for consideration.

Columbia Public Schools continues to rely upon and receive the support of local taxpayers to fund the operating budget. Approximately 60 percent of the district’s operating budget comes from local tax dollars. e remaining funds come from state, federal, and other revenue sources such as grants. In 2016, voters approved a tax levy increase to address continued growth and the need to keep salaries competitive to recruit and retain high-quality employees. Each year, as required by law, the district sets the annual tax rate within the threshold approved by voters and based on current assessed valuation as well as other required nancial considerations.

e district is in stable nancial condition due to support from the community and continued prudent nancial management. is in turn has allowed the district to maintain a very strong Aa1 bond rating. Bonds are used by government entities for

new construction projects. By law, bond funds cannot be used for salaries, materials, or supplies. e district’s strongnancial position has resulted in positive bond sales with considerable premiums and low interest rates.

e district’s e orts to remain transparent and provide understandable nancial reporting for the public have resulted in national and international recognition. For more than 35 years, the district’s Annual Comprehensive Financial Report has earned both the Government Finance Ofcers Association Certi cate of Achievement for Excellence in Financial Reporting and the Association of School Business O cials Certi cate of Excellence in Financial Reporting.

ese awards are granted only to governmental entities that publish an annual comprehensive nancial report, which is easily readable, e ciently organized, and conforms to program standards. Such reports must satisfy both generally accepted accounting principles and applicable legal requirements.

For the past ve years, the district’s budget has been recognized by the Association of School Business O cials for excellence in budget presentation with the Meritorious Budget Award (MBA). Participants submit their budget documents to a panel of school nancial professionals who review the materials for compliance with the MBA criteria checklist and other requirements and provide expert feedback that districts can use to improve their budget documents. By participating in the program, the district demonstrates its commitment to upholding nationally recognized budget presentation standards which includes the development of a high-quality, easy-to-understand budget to share the district’s goals and objectives internally and with the community.

e district’s 2023-24 budget is focused on putting scholars rst so they graduate college-, career-, and life-ready. e decisions we’ve made support our mission to provide every child with an excellent education. We appreciate the continued support of our taxpayers.

Strong public schools mean a strong and thriving community. e district is committed to providing nancial transparency and will continue to prudently allocate the funds entrusted to us.

VOICES COMO

Dr. Brian Yearwood is the Superintendent of Columbia Public Schools.

The district’s budget has been recognized by the Association of School Business Officials for excellence in budget presentation with the Meritorious Budget Award for the past five years.

Loving People Forward

Financial

BY AMY PLETZ PHOTOS BY CHARLES BRUCE III

In the heart of downtown Columbia, one faith-based nonpro t is going the extra mile to transform the city one personal budget, one personal dream at a time.

Love Columbia, an organization founded in 2008 for the purpose of neighbors helping neighbors, has a mission to seek out the most vulnerable and disadvantaged and lift them up.

Executive Director Jane Williams passionately explains, “We come alongside our neighbors who are struggling to provide for their basic needs or create a path forward in life and provide a range of services that includes life skills coaching and nancial and practical assistance.”

Founded during e Great Recession, a time of historic economic downturn, Love Columbia quickly realized thatnances, and the need to understand and not fear money in everyday living, was a much-needed service. Today, the economy is pressing upon Americans yet again with in ation and rapidly rising prices of just about everything.

As a nancial coach and Housing and Urban Development (HUD) counselor, Sherry Wyss understands the economic climate and nancial hardships that area residents are experiencing.

30 THE FINANCE ISSUE 2023 NONPROFIT SPOTLIGHT COMO

coaching, community support, and a joyous journey to success.

Sherry Wyss, Extra Mile Coaching Specialist/HUD Counselor at Love Columbia

Love Columbia

FOUNDED

2008

MISSION

To connect community relationships and resources to love people forward.

VISION

To see individual lives and the community transformed through neighbors helping neighbors. We believe this is best done through a “wholistic” approach where we serve the whole person and engage the whole community. We are motivated and inspired by the extravagant love and selfless service of Jesus who sought out the most vulnerable and disadvantaged and lifted them up.

BOARD OF DIRECTORS

• Carson Coffman, President President and COO, Socket Telecom, LLC

• Brent Beshore, Vice-President

CEO of Permanent Equity

• Ryan Lidolph, Treasurer Permanent Equity

• Melissa Murphy, Secretary Owner of Johnston Paint

“It’s tough with this housing market, but by connecting people with resources and support, they’re still qualifying for home loans,” she says.

Love Columbia o ers a range ofnancial programs in response to existing and emerging community needs that “meet people where they are,” Williams adds. She applauds Love Columbia’s clients “for having the courage to share their nancial situation and seek coaching.”

Williams continues, “We recognize that many people were not taught money management skills as they grew up and need a supportive environment to learn as adults.”

Wyss describes a unique tradition Love Columbia has in the “Joy Bell,” a handbell that is rung to celebrate victories small and large alike. She laughs when telling how people can even be seen, and heard, shouting and dancing down the hallway while ringing the bell. Williams reiterated that joy.

“Every day, we see one person’s contribution, whether it is what they enjoy doing or an unneeded item they have, change the life of a neighbor and add joy to their own life as they give,” she says. “Every day we see lives and family trajectories changed and stress relieved through our coaching programs.”

Love Columbia o ers nance-speci c programs including Credit Score Building, Basic Budgeting, Extra Mile Financial Coaching, First Time Homebuyer Workshops, and Pre-Homeownership Housing Classes. ese classes are o ered in one-on-one and smallgroup settings. e classes are individualized and supportive.

Most classes are free to attend, with scholarships available to those who cannot a ord to pay for classes with fees. Love Columbia opens its doors to all Columbians seeking a healthy relationship with personal nances and nancial freedom. Financial coaches, like Wyss, consider the potential anx-

COMOMAG.COM 31 NONPROFIT SPOTLIGHT COMO

Jacob Garrett, Senior Mortgage Loan Officer at Bell Bank Mortgage

iety and fears participants may carry as personal baggage, things that are often barriers to seeking help in the rst place.

Love Columbia’s website shares the testimony of one client, who said, “You believed in me until I could believe in myself.”

“As with other skills, money management is best learned through a combination of education and opportunity to practice,” Williams says. “Having the support of a coach who also serves as an accountability partner makes all the difference. We come alongside our neighbors who are struggling to provide for their basic needs or create a path forward in life and provide a range of services that includes life skills coaching and nancial and practical assistance.”

Williams has been with the nonpro t from the beginning, as one of the organization’s founders. Fifteen years ago, when a small group of people coordinated the e orts of about a dozen churches and a few passionate volunteers to help neighbors in need, Williams emerged as an advocate and community organizer and has since led Love Columbia’s response team to a network of over 80 churches, dozens of business partners, and hundreds of volunteers, with more than 30 sta members.

In 2021, the nonpro t, originally founded as Love Inc., o cially became Love Columbia and moved its core ser-

vices to 1209 E. Walnut St., a move that greatly increased accessibility and capacity to serve more people and engage even more volunteers.

“Love Columbia connects relationships and resources to love people forward,” Williams says, repeating the organization’s mission statement.

e impact translates to Love Columbia serving 2,100 households last year, and by mid-2023, some 1,500 households had already been served. Wyss beamed, “ is is the most rewarding work I’ve ever done. I love connecting people with resources and seeing people become rst-time homebuyers. I love giving people hope and seeing hope on their faces.”

Having the right people in the right positions has been key to the organization’s success.

“Our team includes sta with nancial expertise and trained community volunteers, some of whom are nancial professionals and others are just caring people who understand the importance of nancial education and learning sound practices,” Williams explains. “Several of our coaches have been through our program themselves and want to help others in the same way they were helped.”

ere are currently 64 individuals in Extra Mile, a one-on-one, 16-week money management coaching program that

started in 2012. is unique program operates on a point and incentive system where participants can earn weekly, mid-program, and end-of-program nancial rewards. Additionally, participants gain peace of mind, improved money management skills, a larger support network, and improved relationships, in addition to access to a pay day relief loan after four weeks in the program.

Wyss, who came to Love Columbia with more than 20 years of banking experience, sees herself as a mentor and cheerleader, someone who’s there to faithfully extend support and reassurance.

Extra Mile is designed for individuals who are motivated to learn how to better manage their nances, desire change, have a stable income, and are willing to be open about their nances.

Wyss adds that Love Columbia is a HUD-certi ed agency and the only place in Columbia that o ers a rst-time homebuyers class, a program that connects potential homebuyers with funding assistance through a city grant.

Love Columbia o ers other services like rent, housing and utility assistance, career coaching, and personal development, in addition to operating a furniture bank and resale store. e nonpro t also o ers a robust online information library that’s free for all to access with topics ranging from basic needs, health and wellness, nance, and career resources, to a wide array of situation-speci c topics. e online library also maintains a local available housing list, equipped with an interactive map.

Williams says the organization needs more volunteers to coach or teach classes, adding, “We match the time, skills, and resources of people who want to help with the needs, hopes, and dreams of their neighbors.”

e nonpro t relies on the generous support of partnering agencies, local businesses, and the general public to go the extra mile for local residents struggling to meet a variety of challenges.

32 THE FINANCE ISSUE 2023 NONPROFIT SPOTLIGHT COMO

LOVE COLUMBIA 1209 E. Walnut 573-256-7662

lovecolumbia.org finance@lovecolumbia.org

Justina Dial, Mortgage Loan Officer at Central Bank

WHAT THE HOME PROS KNOW

JACLYN

JAKE BAUMGARTNER BAUMGARTNER’S FURNITURE

ROGERS AI PAINTING PLUS

SHAUN HENRY

ATKINS CHET KENT C OMO PREMIUM EXTERIORS

SHADE TREES FOR FALL COLOR

By Jacob Porter

As we get requests to create planting designs for clients, adding color through the seasons is high on many priority lists. When adding color, most people are focused on the flowering color that various trees and shrubs can provide. While that is the most common way to add color to the landscape, we cannot forget about foliage and the colors leaves can provide throughout the year. The color shade trees provide in fall make it one of the most beautiful times of the year. There are trees that show varying shades of red, orange, and yellow and even a few with purple leaves. This article highlights a few of the options available in those colors. Several of the trees mentioned can show shades of multiple colors in addition to the color they are listed under. Keep in mind, these are just shade tree options. Ornamental trees and shrubs also can provide excellent seasonal foliage color.

Red

Red maples tend to be the most used tree to incorporate red autumn colors. Red maples grow large and provide good shade and visual coverage in addition to the foliage color. A couple of great varieties to choose from would be Red Pointe and Sun Valley red maples.

Frontier elms are another great shade tree that has a darker red fall color. These elms are smaller than other elms, which make them good to use in urban landscapes where planting area may be limited.

Yellow

When yellow is the desired color for fall, a Ginkgo is one of the best options to choose. Their fan-like leaves are oneof-a-kind and provide plenty of shade throughout most of the year and have

JACOB PORTER ROST LANDSCAPING

WHAT THE HOME PROS KNOW

Jacob comes from the small town of California, Missouri. With his plant science degree from MU and six years with Rost, he enjoys creating exciting outdoor spaces for his clients. Watching these creations come to life is only one highlight of being a designer for Rost. When he is not designing, he loves spending time with his wife and kids, tournament bass fishing, and doing a little bit of woodworking.

(573) 445-4465

ROSTLANDSCAPING.COM

outstanding gold foliage in autumn.

Opposite of the Frontier elm, Princeton and Triumph elms are larger varieties that turn shades of yellow later in the year.

River birch also provide great yellow fall color in addition to the exfoliating bark that they display all year. River birch can also be planted in wet areas if that’s something you have to consider.

Orange

‘Fall Fiesta’ sugar maples provide some of the best orange fall color in our opinion. They do have shades of red and yellow, but the orange stands out the most. Be sure to carefully consider when planting these trees though. Sugar maples tend to do better in areas that are not heavily irrigated or compacted.

Purple

There are not many shade trees that stand out with purple as the dominant Fall color. Black gum and sweetgum trees are a couple types that display multiple colors,

but also have some purple come through in autumn. These can help give a variety of colors in one tree. If you’re hesitant when we mention sweetgum, we understand. However, there are many varieties that have been bred to be seedless.

Landscape designers will always consider shade trees and incorporate them into your design. And if you’re looking to DIY, hopefully this gives you some inspiration. Remember, now is a great time to plant trees!

Find more at rostlandscaping.com

SPONSORED CONTENT

PESTS GOT YOU DOWN?

By Shaun Henry Find more at AtkinsInc.com

Building, buying, and keeping up a home in Columbia can be the single biggest investment for most people. While in college, my wife and I started off buying a quaint little mobile home in Woodstock Mobile Home Park, then moved to a lease-option for our first house on the north side. After a few years in that little blue house, we bought some land and built our first house. Nerve racking, but worth it.

We did all we could to protect our investment. We pre-treated for termites to keep them at bay; we took special care of the lawn, landscape, and the home itself so it would last us forever. We did wind up selling that house 17 years later so we could purchase our current property where we are working hard to continue to protect our investment. It’s gotta last us forever! There are a few pests that can bring a home’s value down:

Termites

• Termites in Missouri are subterranean - they live in the soil and wood that is touching the soil. Missouri isn’t the worst of the states when it comes to termite damage, but the threat is still classified as “modest” to “heavy” for homeowners.

• It’s reported that termites cause upwards of $2 billion in damages each year across the U.S.

• On top of the worker termites consuming wood 24/7 to feed the soldier, young, and reproductive termites in the colony, a termite queen can lay up to 30,000 eggs per day. Colonies can expand and can destroy a portion of your home without you even knowing they are there.

SHAUN HENRY ATKINS

A Columbia native, Shaun Henry found a home at Atkins in 2000 when he started his career as a turf technician. Shaun holds a commercial applicator’s license through the Missouri Department of Agriculture and is a member of the National Association of Landscape Professionals, the Mid-America Green Industry Council, and the Missouri Green Industry Alliance. Shaun strongly believes in the importance of a great customer experience where the Atkins staff knows their clients and anticipates their needs accordingly.

Shaun is an MU alumnus and has a degree in plant science.

573-874-5100

Mice

• From in and around your home or out on the farm, mice are troublesome rodents. Like all rodents, mice have front incisors that continually grow their entire lives, so they must constantly chew on things to help keep their teeth from growing to be too large. Unfortunately, they sometimes turn their attention to chewing things inside your house.

• They can cause damage to the structure of your home, like chewing on electrical wires and components, and damage furniture, drywall, and wall coverings.

• They also damage the insulation inside the walls, floors, and attics with their nesting habits, plus with their urine and fecal matter left behind. Odors and parasites (fleas, ticks and mites) will be left behind as well.

• A mouse only needs a dime-sized hole to squeeze into the house. Once inside, they find the warmth, food, and security they’re looking for.

So, what do you do?

• For termites, eliminate any wood debris left behind from construction and make sure the area around your home’s

foundation is well-drained and the soil is dry. Even if you do everything right, an infestation of termites can still occur. If you don’t currently have termites, a barrier treatment or a baiting system can help keep them away. Contact our team for an evaluation, termite inspection, and best recommendation for your situation.

• For mice, you’ll want to seal cracks in the foundation, fill holes in the siding where utility lines come into the house, repair damaged vents (dryer vents or vents for crawlspaces and others), make sure your seals around your doors (exterior house doors and garage doors) don’t let light out and fill any other gaps in the roof where it meets the gutters.

• Once mice are in your house, they can be difficult to get rid of. There are a variety of traps available, but mice are smart and can quickly learn to avoid them. You may need an Atkins Pest expert’s help to get rid of your infestation.

We hope that you enjoy the fall season as much as we do and remember, we’re here to answer questions you might have about your property. That’s what friends and neighbors do! Thank you for your continued trust in our team.

WHAT THE

PROS

HOME

KNOW

ATKINSINC.COM

SPONSORED CONTENT

PUMPKIN SPICE AND EVERYTHING NICE: THE SEASON OF COLOR

By Jake Baumgartner Find more at baumgartners.com

October brings a sense of anticipation and a sort of calm: The biggest holidays are just around the corner, but for now you’re catching your breath from the back-to-school season that has settled down by now. While you’re catching your breath and relaxing in your most comfortable space — your living room, bedroom, or dining room — why not take stock of the feeling that your guests and other family members experience?

The best place to start that mental checklist is considering the color schemes of furniture, accessories, floor coverings, lighting, and bedding. How well do those schemes match the wall colors? Maybe it occurs to you that a color change here, a new piece of furniture there could actually make your space feel more open and welcoming or, perhaps, cozier and more welcoming. You can take some clues from Mother Nature and the incredible splashes of color on the autumn landscape. It just all “fits,” doesn’t it? What would Mother Nature do to coordinate the colors in your living space? Here are some tips.

• Before getting into the nitty gritty of design trends, new styles, or changing anything even a little, first identify what your furniture, bedding, and accessories are meant to do: They are an extension of you, your style, and you and your family’s personality. Does the color, the furniture sets and arrangements, and transition from one room to another work for YOU?

• Are you a fabric, leather, or faux covering furniture owner? What colors are most natural for your style? (If you love bold color and patterns, fabric generally has more options.)

JAKE BAUMGARTNER

BAUMGARTNER’S FURNITURE

WHAT THE HOME PROS KNOW

Jake essentially grew up in the furniture industry, as he is the fourth generation involved in Baumgartner’s Furniture. Working very closely with his father, Alan, Jake has been devoted to the stores full-time since 2004. His greatest enjoyment, however, still comes from working closely with the customers. He is married to Sarah, and they have two active boys, Noah and Laine. Jake received his degree in finance from Saint Louis University.

(573) 256-6288

BAUMGARTNERS.COM

• Open spaces can be a canvas for experimenting with different color schemes and styles, or you can go with simple, so-called “safe” colors that elicit a calming effect. What are “safe” colors? Black, white, gray, and brown. These colors typically mesh well with a vast majority of décor styles and are not easily altered by trends. These colors help make furniture feel timeless. Black accents dark and dramatic spaces and fits with most color palettes. White is light and airy and matches with anything. Gray has a crisp, fresh, contemporary feel. Brown has a rich and earthy aura, a classic that has proven timeless.

• As a good rule of thumb, select one color to be your “neutral” color then add on from there. If it’s a cool color, warm accents are good accessories. If you’re using blue and white, take care not to make them look too cold. (A darker shade slipcover or throw pillow can easily “warm” things up.

• You’re looking for balance but avoid having equal concentrations of three colors. You’ve probably stepped into a room and wondered why it feels a bit

cluttered, even though there’s no clutter to be seen. It’s probably because of the array of colors that don’t complement each other or your furnishing.

• Don’t let the pressure of trendy colors and décor styles throw you off. Remember: The color in your home reflects your style and your family’s personality.

Finally, when you’re considering a new piece of furniture or set, be careful not to get so caught up in color schemes that you look past the craftsmanship. Whether Mid-Century Modern, rustic Americana, or minimalistic comfort, quality craftsmanship and materials will assure that your furniture is built to last.

SPONSORED CONTENT

PAINT YOUR KITCHEN CABINETS FOR A FRESH, NEW LOOK

By Jaclyn Rogers Find more at aipaintingplus.com

Kitchen cabinets can dramatically transform the look and feel of your kitchen space. If you have good quality kitchen cabinets, but ones that have seen better days, re-painting is a great option to give your space a new look at an affordable price and in half the time it takes to replace them. (And at far less cost.)

You already know that the pros at Ai Painting Plus are champions for DIY’ers, and painting your cabinets is a task you can take on yourself. Here’s a brief review of things to consider and pitfalls to avoid if that’s the route you take.

What is your budget? Yes, generally painting your cabinets is more costeffective than replacing them. If you have to remove the cabinet doors, drawers, hinges, and hardware, take care that they will still fit and aren’t damaged or discolored. (Fixing those “oops” can be very expensive.)

What material are your cabinets made from? There are different paint application procedures and supplies for solid wood, stainless steel (plain or powder-coated), or engineered wood. Test in an inconspicuous spot to be sure the paint won’t easily flake or chip. This is especially vital for kitchen durability and use.

What is the finish on your cabinets? Most stains and polyurethane finishes can be covered over but you may run into issues if you’re going from a painted finish to a stain. To remove latex paint,

JACLYN ROGERS

SALES REPRESENTATIVE

WHAT THE HOME PROS KNOW

Jaclyn Rogers, sales representative at Ai Painting Plus, sees paint as more valuable than simply being an accent in a home. “We are painting joy into people’s homes,” she says. Jaclyn is certified as a Psychological Color Expert, which means she has demonstrated mastery in specifying interior paint in residential applications.

you will need to sand the cupboards first. If that’s the case, refacing the cabinets with new doors might be a better option.

It’s much easier to darken a light finish than it is to lighten up a dark paint or stain without primer.

What’s your kitchen Plan B? Your cabinet painting DIY project will take time and will likely make the kitchen off-limits or simply limited for a few days. If you’re painting the inside of the cupboards, that means moving your dishes and utensils to another room.

Just be sure you’re dedicating enough time to this cool project. (This isn’t something to take on the day before the family and guests arrive for Thanksgiving dinner.)

Painting kitchen cabinets is a great solution for anyone who’s interested in a cosmetic update.

Take no shortcuts. Be sure to use high-quality paint, properly clean and prime the cabinets, and follow the best painting techniques for a professionallooking finish that you’ll love just much a year from now as you love it today. Your time and money spent will be a great investment if you avoid taking shortcuts.

On second thought … Instead of the DIY option, consider the benefits of hiring a professional painting company instead. For that decision, make sure to cover these bases.

• Expertise and experience. Is this a project the company has done and can show results for?

• Time and efficiency. You already know this may be time-consuming and you’d rather not try to fit it into your schedule or be without a usable kitchen any longer than necessary. How much time will it take?

• Attention to detail. You want a smooth, flawless finish, which requires not just expertise but also the right tools and techniques to achieve high-quality results.

• Proper preparation. Professionals know how to prep the cabinets, which includes cleaning, sanding, and priming to create the smooth surface and finish that you desire.

• Insurance and warranty. Reputable painting contractors have liability insurance and may offer warranties on workmanship. Insist on that peace-of-mind factor from your pro.

Quality workmanship, quality products, experience, and expertise are the essential qualities you’ll find with Ai Painting Plus. Contact us today to schedule your free, in-home consultation.

573-639-2343 AIPAINTINGPLUS.COM

SPONSORED CONTENT

WHAT ARE THE QUALITIES OF A GOOD SIDING CONTRACTOR?

By Chet Kent

Find more at comoexteriors.com

By Chet Kent

Find more at comoexteriors.com

F or homeowners who are considering beginning an exterior siding remodeling project, finding a high-quality siding contractor is one of the most critical aspects of the project’s success. We’re going to look at some of the most essential qualities of a good contractor, and how those qualities can help ensure a smooth, professional installation process that meets manufacturer requirements.

When ready to start looking for a good siding contractor, you need to evaluate several conditions before making a decision. Remember, this is going to be someone working on the primary line of defense for your home against the elements. Here are 5 of the biggest factors you should look at.

1. Creating A Detailed Proposal: A detailed proposal is one of the biggest indicators of a siding contractor’s commitment to professionalism and quality results. It should include a written description of the work to be performed, the product manufacturers and colors selected to be installed, and easy to understand contract language. A solid proposal will help to eliminate many potential disputes later on.

2. Educated on the Best Siding Materials: You may not be able to investigate this factor until you pick your material, but your contractor should be intimately familiar with the siding material that you decide on. Whether you select vinyl, James Hardie fiber cement, or LP SmartSide, your contractor

With over 20 years in the construction field, Chet’s experience ranges from running operations for a local garage door company to managing large scale remodeling projects for a local contractor. Chet began his career with CoMo Premium Exteriors as a Sales Rep, then moved to Sales Manager, and now serves as our General Manager. With almost 20 years in the Army National Guard, Chet has superb organizational ability and is responsible for the dayto-day management of the company.

should be able to demonstrate their expertise with the material and provide you with the pros and cons of each. This will ultimately help ensure that it can be installed properly and without making an abundance of mistakes, while also helping you to make the best decision for your goals and budget.

3. They Set Appropriate Expectations: Any good siding contractor will take the time and make the effort to set appropriate expectations with their clients. They should set expectations regarding the project’s anticipated direction, forecasted or potential problems, and the costs of the project. Experienced siding sales people should be knowledgeable and able to explain the installation process step-by-step.

4. Warranty Knowledge: Understanding the warranty options that are available for your siding project can have a significant effect on the product you ultimately choose. Any contractor that isn’t familiar with their products’ warranties will generally tell you it will “last forever” or something similar, but nothing lasts forever, which is important to remember when choosing products based on warranty coverage.

5. Excellent Communication:

Communication is essential in any home improvement project, and a good siding company will help keep you informed through every step of the process. There will be times when you have questions about your project, or simply want an update on the day’s process, and your contractor should be ready to help keep you updated. Good siding companies will notify you immediately of issues and let you know the proposed solution as well.

CoMo Premium Exteriors has an entire team of highly-experienced, skilled siding professionals that put the customer’s satisfaction first. We’ll make sure you have a detailed, transparent proposal, and help you determine what siding options are ideal for your home.

Experience the difference in working with an exceptional siding contractor, and let CoMo Premium Exteriors show you how our team can put the highest industry standards to work on your project. Reach out to make an appointment for an estimate from the leading siding contractor in Columbia, Jefferson City, and surrounding areas.

38 THE FINANCE ISSUE 2023

WHAT

THE HOME PROS KNOW

(573) 424-9008 COMOEXTERIORS.COM

SPONSORED CONTENT

Six Degrees of Kevin Bacon TWO SHAKESPEARE’S

BY AMANDA LONG | PHOTOS BY ANTHONY JINSON

O ver the past ve decades, Shakespeare’s Pizza has undergone some big transformations in location and service while keeping things endearingly the same. And now it’s time to celebrate.

“ e menu hasn’t really changed much over the years,” says Kurt Mirtsching, general manager and Shakespeare’s employee since 1978. “Anytime we try to add something new, our customers say, ‘Oh, that’s awesome!’ then order their usual. At some point we realized if it ain’t broke ...” e humble, oft-told origin story of the nationally recognized pizza

GOURMET COMO

The team that leads Shakespeare’s.

“We were in our twenties and had no experience in the restaurant industry,” says Jay’s wife and Shakespeaker’s co-owner, Nancy Lewis. “Jay had good work ethic and he needed somewhere to work.”

“A guy walked into a bar — and walked out owning a pizza restaurant,” Mirtsching laughs, recounting when Jay purchased Shakespeare’s from Bill Hahn in 1976.

“Jay always used to say, ‘It’s just pizza’ which is a sarcastic, funny way to look at what we do here,” Mirtsching says. “It’s the running joke that we’re throwing a big party, but that is what we really are doing. We work hard, but we don’t take it too seriously.”

e way Mirtsching sees it, consistency has been vital to Shakespeare’s success throughout its 50-year history. e strong brand survived the demolition and rebuilding of the original downtown location in May 2015, the expansion to two additional Columbia locations in 2003 and 2012, and the establishment of a ourishing line of frozen pizzas.

Patrons can be assured that the fresh pizza dough baked several times daily, the robust tomato sauce, and the thickly sliced meats and vegetables are the same no matter when, where, or from whom they are ordered — and it keeps them coming back for more.

But it’s not just the pizza. e establishment has cultivated a nearly tangible devotion over the decades, that has been passed down generationally and intertwines employees and customers into the Shakespeare’s culture.

e Hands at Prepared It

Shakespeare’s has employed thousands of people through the years. Dozens have stayed for more than 10 years, are legacies (their parents worked there), or are still employed, and the business takes credit for countless marriages and relationships.

“And maybe a few divorces,” Nancy chimes in.

Mirtsching laughs, adding, “In Columbia, it’s not six degrees of Kevin Bacon, it’s two degrees of Shakespeare’s. Everyone knows someone who knows someone who has worked here.”

As to why that is, Mirtsching says, “Our employees do the work — clean bathrooms, cook, serve, but they also want to be themselves and we give them the space to do that — it’s authentic respect. If you

COMOMAG.COM 41

GOURMET COMO

run your business right and have respect for your workforce, it grants you the success to have the resources to give back to employees and the community.”

Toby Epstein, manager and employee since 2005, says his long tenure at Shakespeare’s is a result of the family-owned aspect and owners treat their employees like family.

“ ere’s a lot of camaraderie in the industry. Working for a restaurant is hard work and requires people with good work ethic,” Epstein explains. “ ose that don’t have it get spit out rather quickly. ose that do have it become friends. And as stressful and as busy as this restaurant can be, you get to work with your friends, and that can make it all mean a bit more than just work.”

e Mouths at Ate It

Mirtsching says Shakespeare’s customers are often celebrati ng when they come in, creating their own good memories and that lters into the atmosphere.

“Important memories like rst birthdays, baby showers, engagements, rehearsal dinners and even a few weddings and receptions — it’s kind of cheesy,” he says, smiling.

Columbia native and Mizzou alumna Katie Burnham Wilkins has a long history of vivid, priceless memories with Shakespeare’s connection.

“Shakespeare’s was cool before restaurants were cool — the quirky artwork, old signs and photos, bikes on the wall. When I was a child, it was the one place we all agreed on for family dinners,” Wilkins says, adding that she now

42 THE FINANCE ISSUE 2023

“In Columbia, it’s not six degrees of Kevin Bacon, it’s two degrees of Shakespeare’s,” laughs Kurt.

GOURMET COMO

“Everyone knows someone who knows someone who has worked here.”

shares that tradition with her husband, Marcus, and daughter, Harper. “And although he technically proposed to me at

e Pasta Factory where we worked and met in college, it was during one of our Sunday dinners at Shake’s he told me he wanted to go ring shopping.”

Turning the Big 5-0

To commemorate such an epic milestone, the Shakespeare’s team started planning the 50th anniversary celebration more than two years prior. ey wanted to hold a separate event at each of the three locations but were unsure how to make that happen.

e team joined forces with Samantha Boisclair of Party Perfectly, a local event planning and supply company that helped guide and execute the celebrations.

In February 2023, the Shakespeare’s team held a 50th birthday kick-o celebration at Shakespeare’s West. Shakespeare’s lovers from near and far were invited to bring their memorabilia, including shirts and pictures, as well as their favorite stories to share and reminisce.

e second installment, Shake’s Recess, was a family-friendly event held in June at Shakespeare’s South, where attendees played a variety of recess games, including a speed pizza eating contest, tricycle pizza delivery challenge, a rock, paper, scissors tournament, and a T-shirt unfreeze race.

“It was so much fun. We even had a ‘Shake’s Cup Cup’ trophy made from Shakespeare’s cups,” says Alysia Lewis, Nancy and Jay’s daughter and the eatery’s director of operations. Entry fees were donated to Shakespeare’s nonpro t partners.

e team chose six nonpro ts for donations and to showcase throughout the festivities: Rainbow House, Missouri River Relief, RagTag Film Society, Special Olympics Missouri, Unchained Melodies, and Welcome Home.

“ ere are so many worthwhile nonpro ts in Columbia, it was really dicult to narrow it down to just six,” Nancy Lewis says.

On September 23, prior to the Big Bash, Shakespeare’s hosted a private employee alumni event, to which all past and current employees were invited, and all three locations closed.

e nal celebration, the Big Bash, was held on September 23 at the downtown location on Ninth Street. Working with the city of Columbia and e Blue Note, the street was closed for a free concert featuring musical performances by STRFKR, Liz Cooper, Bad Bad Hats, and local band Tri-County Liquidators on a stage in front of the Missouri eatre. Free Shakespeare’s pizza was available as well as Bud’s BBQ and Munchi’s Fish & Chicc’n.

Other local collaborations to commemorate the monumental milestone available at the Big Bash included Logboat Brewing Company’s Golden Nugget Golden Ale and 4 Hand Brewing Company’s Mango Lemonade Seltzer, both specially created for the celebration.

“It has really been a big learning curve for all of us, but you only turn 50 once,” Alysia Lewis says.

“We all felt it was important that the community knew that the 50th celebration was a big thank you to Columbia for supporting us. We brought a lot of resources to these events because we wanted to give back to our customers and employees,” Mirtsching adds. “Without them there would have been a lot of cold pizza sitting around.”

In the restaurant business, 50 years is a long time, and generational restaurants, like Shakespeare’s, can bring time-specific, cherished memories ooding back.

“One of the things that ew under the radar in the demo of the original building was someone wrote on the wall, ‘When the dust settles, all that will be left is memories,’” recalls Matt Turner, a Shakepeare’s employee from 2003 to 2010. “I think that’s what Shakespeare’s is for everyone. You wouldn’t think so much could happen under one roof, but it did.”

COMOMAG.COM 43 GOURMET COMO

Above: Toby Epstein, Shakespeare’s manager and employee since 2005 serves up pizza by the slice. Opposite page: Owner, Nancy Lewis sits with her daugher and director of operations, Alysia Lewis, across from Kurt Mirtsching, general manager and Shakespeare’s employee since 1978.

task.

Let us assist you with your will or trust and powers of attorney. By getting these documents in place, you will:

• Ensure your assets pass to the people of your choosing

• If you have minor children, exercise your right to name their guardian if something happens to you

• Avoid probate and its expensive and unnecessary costs

• Have peace of mind knowing your family and assets are protected.

Our seasoned team of Wedding Specialists craft magical moments tailored just for you. Every detail, every wish, meticulously brought to life. From planning to decor, photography to 360 video booths, Bilingual DJ/MC to Atmospheric FX, video and more, we have it all. Say “I Do” to elevated experiences with Blue Diamond Events.

44 THE FINANCE ISSUE 2023 2412 Forum Blvd, Suite 101, Columbia | 573-874-1122 | Fax: 573-340-1465 | JandULaw.com The choice of a lawyer is an important decision and should not be based solely upon advertisements. WILLS & TRUSTS PERSONAL INJURY WORKERS’ COMP BUSINESS LAW FAMILY LAW

Rob

CALL NOW TO SCHEDULE YOUR COMPLIMENTARY PLANNING MEETING. BLUEDIAMOND-EVENTS.COM • FOLLOW US:

We know planning your estate can be a daunting

Temple Attorney Nathan Jones Partner

PLANNING + DESIGN + COORDINATION | LIGHTING + ATMOSPHERIC FX | PHOTOGRAPHY VIDEOGRAPHY | CUSTOM DECOR INSTALLATIONS | DJS/MCS | PHOTO + VIDEO BOOTH RENTALS TRANSFORM DREAMS INTO

COOKIN' WITH HOSS

BY HOSS KOETTING

Iguess we’re in the thick of the “Pumpkin Spice” season, where everything from lattes to fancy candles is tagged with that ubiquitous moniker. I wonder if the person who rst came up with that avor knew what a cultural phenomenon they created? Oh well, I digress.

is is my favorite time of year, not because of the pumpkin spice, but because of the weather — a chill in the morning, crisp afternoons, and the aromas of simmering soups and hearty entrees wafting through the house. Whereas in the summer you would be hesitant to crank up the oven so as not to heat up the house, this time of year it makes sense because, with the windows open, a hot stove adds just the right amount of warmth to your home.

One of my favorite meals to make in the fall is braised beef short ribs, which were once relatively inexpensive but have gotten ridiculously priced since they’ve become more popular with the culinary community. However, beef chuck is a good substitute for short ribs and is, relatively speaking, more reasonably priced.

ere are several keys to preparing a delicious meal of braised beef.

• Make sure to deeply brown the beef.

• Use a rich stock, either homemade or a good quality commercial soup base such as Minor’s.

• Make sure you braise (a method of cooking using moist heat) long enough to make the beef fall apart tender. Here’s a tasty version you can try that has a little kick to it!

SOUTHWESTERN BRAISED SHORT RIBS

INGREDIENTS

• ½ lb. roasted poblanos

• ¼ c. minced fresh jalapenos

• 4-5 lbs. beef short ribs, cut in 4-5” portions, or 2-3 lbs. beef chuck

• 2 c. diced yellow onion

• ⅛ c. minced fresh garlic

• 2 lbs. diced fresh tomatoes

• 2 c. rich beef stock

• 1 c. cerveza (beer)

• 1 sprig epazote (in some Hispanic markets), or 1 tbsp. dried Mexican oregano

DIRECTIONS

• Sprinkle the short ribs with salt.

• Brown the short ribs well in a Dutch oven or heavy pan over medium-high heat.

• Remove ribs, add onions, sauté until slightly caramelized.

• Add garlic, sauté for a couple of minutes.

• Add tomatoes and the rest of the ingredients; stir and add ribs.

Jim “Hoss” Koetting is a retired restaurateur/chef who enjoys gardening, good food, good bourbon, and good friends.

• 1 tbsp. Hoss’s Southwest seasoning

• Salt to taste

• Oil for browning

• Cover the pot and simmer or roast in a 300-degree oven for approximately 2 hours, or until the meat falls o the bone.

• Skim grease o the top; serve tomato sauce with ribs.

COMOMAG.COM 45

VOICES COMO

46 THE FINANCE ISSUE 2023 47 DUAL CREDITS AVAILABLE STUDENTS LEARN BUDGETING THROUGH DAVE RAMSEY PROGRAM. KNOWLEDGE. FAITH. CHARACTER. CFSKNIGHTS.ORG STUDENTS RECEIVE HANDS ON LEARNING ABOUT FINANCES THROUGH B iz Town PROGRAM. Polished in CoMo to help distinguish from other Polished nail salons! polishedincomo.com BY APPOINTMENT ONLY*