Create a lasting legacy with tax efficiency through strategic charitable giving.

Commerce Trust can help to ensure your assets are strategically allocated to minimize tax liabilities while protecting what you pass on to your philanthropic beneficiaries.

Our tailored approach ensures we can assess how different charitable giving strategies may benefit you situation, including donating directly, contributing to a donor-advised fund, establishing a private foundation, and making qualified charitable distributions.

Our holistic, team-based approach to servicing clients means your team of estate and tax planning, investment management, and trust administration professionals will work collaboratively with your estate attorney and tax advisor to craft a plan tailored to your personal and family goals.

Let us assist you with navigating the complexities and opportunities of strategic charitable giving and estate planning. Contact Lyle Johnson, your dedicated Market Executive for Commerce Trust, at (573) 886-5324 or lyle.johnson@commercebank.com to secure your legacy.

By Scott LaPresta, CTFA, Senior Vice President, Director of Private Client Advisors, Commerce Trust, and Amy Stiglic, CTFA, Senior Vice President, Market Executive, Kansas City, Commerce Trust

Strategically donating assets to charity can help you support philanthropic causes while leading to potential tax savings for high-net-worth donors and their families. Maximizing the financial benefits of your donations can help to ensure a lasting and impactful legacy of generosity through charitable donations.

Donating directly to a charitable organization

Charitable contributions to a qualified organization can provide an income tax deduction between 20% and 60% of the donor’s adjusted gross income (AGI) depending on the asset and to which type of organization it is given. Generally, donors of long-term appreciated assets (assets held for more than one year) are not obligated to pay capital gains taxes and can deduct the fair market value of these assets up to 30% of their adjusted gross income.

Donating directly to charitable organizations may also provide a way to lower your taxable estate since contributions to qualified organizations are not included in the donor’s estate for estate tax purposes.

Contributing to a donor-advised fund

Donor-advised funds (DAFs) are held at a DAF-sponsoring organization and may ultimately lower the donor’s income, capital gains, and federal estate taxes.

Assets contributed to the fund can typically be invested for potential growth tax-free before they are distributed to qualified charities of the donor’s choosing.

Donors who itemize their deductions are generally eligible for an income tax deduction of up to 60% of their AGI for cash and up to 30% for long-term capital gains assets. Donors may also forgo paying capital gains taxes on long-term capital gains assets.

Assets contributed to a DAF are irrevocable and excluded from the donor’s taxable estate, potentially reducing federal estate tax liability.

Forming, and donating to, a private foundation may lower your income, capital gains, and estate taxes.

Those who form a private foundation can leverage various tax benefits depending on how the foundation is structured and the nature of its charitable activities. For example, if the foundation qualifies for 501(c)(3) status as a tax-exempt organization, it will generally not have to pay federal tax on its income. Contributions to a private foundation typically qualify for an income tax deduction up to 30% of their AGI for cash and up to 20% for long-term capital gains property.

Donors can potentially eliminate the capital gains tax on appreciated assets by donating them to a private foundation.

more individuals for a set period. Then, the remaining assets are distributed to one or more charitable organizations. A charitable lead trust first distributes assets to charitable organizations and then transfers the remaining assets to one or more individual beneficiaries.

The tax benefits of each depend on the trust’s structure but may include lowering income taxes through charitable deductions, mitigating capital gains taxes, or decreasing the value of your taxable estate to minimize estate taxes.

Assessing how various charitable giving vehicles can facilitate your philanthropic goals while providing tax benefits requires a specialized understanding of estate planning, tax management,* and trust administration.

Contact Commerce Trust today at www.commercetrustcompany.com/estateplanning to learn more about charitable gifting strategies that fit your family’s wealth plan.

*Commerce Trust does not provide tax advice to customers unless engaged to do so. The opinions and other information in the commentary are provided as of January 16, 2025. This summary is intended to provide general information only, and may be of value to the reader and audience.

This material is not a recommendation of any particular investment or insurance strategy, is not based on any particular financial situation or need, and is not intended to replace the advice of a qualified tax advisor or investment professional. While Commerce may provide information or express opinions from time to time, such information or opinions are subject to change, are not offered as professional tax, insurance or legal advice, and may not be relied on as such.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Commerce Trust is a division of Commerce Bank.

Investment Products: Not FDIC Insured | May Lose Value | No Bank Guarantee

PUBLISHING

David Nivens, Publisher david@comocompanies.com

Chris Harrison, Associate Publisher chris@comocompanies.com

EDITORIAL

Jodie Jackson Jr, Editor jodie@comocompanies.com

Kelsey Winkeljohn, Associate Editor kelsey@comocompanies.com

Karen Pasley, Contributing Copyeditor

DESIGN

Jordan Watts, Senior Designer jordan@comocompanies.com

MARKETING

Charles Bruce, Director of Client Relations charles@comocompanies.com

Kerrie Bloss, Account Executive kerrie@comocompanies.com

CONTRIBUTING PHOTOGRAPHERS

Keith Borgmeyer, Sunitha Bosecker, Lana Eklund, Hoss Koetting, Jodie Jackson Jr, Brandon Knight

CONTRIBUTING WRITERS

Sunitha Bosecker, Beth Bramstedt, Barbara Bu aloe, Hoss Koetting, Jodie Jackson Jr, Brandon Knight, Madeleine Leroux, Natasha Myrick, Michelle Terhune, Kelsey Winkeljohn

SUBSCRIPTIONS

Magazines are $5 an issue. Subscription rate is $54 for 12 issues for one year or $89 for 24 issues for two years. Subscribe at comomag.com or by phone. COMO Magazine is published monthly by e COMO Companies.

OUR MISSION STATEMENT

COMO Magazine and comomag.com strive to inspire, educate, and entertain the citizens of Columbia with quality, relevant content that re ects Columbia’s business environment, lifestyle, and community spirit.

Copyright e COMO Companies, 2025

All rights reserved. Reproduction or use of any editorial or graphic content without the express written permission of the publisher is prohibited.

FEEDBACK

Have a story idea, feedback, or a general inquiry? Email our editor at Jodie@comocompanies.com.

CONTACT e COMO Companies | 404 Portland, Columbia, MO 65201 573-577-1965 | comomag.com | comobusinesstimes.com

That’s probably something you grew up hearing. Let’s be very clear, though. Money does solve a lot of problems. Currency is the blood of our existence, keeping us alive and moving forward. Without it, we don’t have anything. No house. No car. No health care. De nitely no vacations. Not even the little things that bring us joy, like a massive tub of cookies ‘n’ cream ice cream.

On the ip side, as we all know, money can’t buy us everything. When you have all the money in the world, everything loses its value, its meaning. What once felt special can quickly become ordinary when it’s always within reach.

But money isn’t the only thing that brings “wealth” into our lives. When I think back to the times that have brought me the most joy, they rarely involve actively swiping a credit card. Game nights with friends. Sitting out on the balcony during a rainstorm. Opening a book and learning something new. ose are the moments that make my life feel rich.

Of course, that doesn’t mean money doesn’t matter. Financial security creates a foundation for stability, health, and opportunity. It pays the bills, keeps the lights on, and allows us to plan for our futures. Still, it’s important to remember that true wealth is layered. It’s not just the dollars and cents, but relationships, meaning, and the ways we choose to give back.

Here in Columbia, we see examples of that layered wealth every day. Our city is lled with people investing, nancially and personally, in the city we all call home. Neighbors show up for one another when times are hard. Small businesses pour their hearts into their work, enriching the local economy while also strengthening the culture of our community. Volunteers dedicate hours of their time to causes that matter, often without recognition, but always with impact. ese contributions don’t appear on a bank statement, but they are powerful forms of currency in their own right.

at’s why this issue is dedicated to wealth in its many forms. You’ll nd stories that explore the Voluntary Action Center’s upcoming Opportunity Campus, which will empower our unhoused neighbors, how the Community Foundation of Central Missouri helps people turn their assets into valuable local investments, and, on the CBT side, planning for early inheritance.

e healthiest version of wealth is balanced. We need enough money to meet our needs, but we also need the things money can’t buy: connection, joy, creativity, and purpose.

KELSEY WINKELJOHN ASSOCIATE EDITOR kelsey@comocompanies.com

We take pride in representing our community well, and we couldn’t do what we do without our COMO Magazine advisory board. Thank You!

Beth Bramstedt

Church Life Pastor, Christian Fellowship Church

Heather Brown

Strategic Partnership Officer, Harry S Truman VA Hospital

Emily Dunlap Burnham

Principal Investigator and Owner, Missouri Investigative Group

Tootie Burns

Artist and Treasurer, North Village Art District

Chris Horn

Principal Treaty Reinsurance Underwriter, American Family Insurance

Jeremiah Hunter

Assistant Police Chief, Columbia Police Department

Kris Husted

Investigative Editor, NPR Midwest Newsroom

Laura Johnson Writer

Laura Schemel

Director of Marketing and Communications, MU Health Care

Art Smith

Author & Musician, Almost Retired

Megan Steen

Chief Operating Officer, Central Region, Burrell Behavioral Health

Nathan Todd

Business Services Officer, First State Community Bank

Casey Twidwell

Community Engagement Manager, Heart of Missouri CASA

Wende Wagner Development Manager, DeafLEAD

Have a story idea, feedback, or a general inquiry? Email Jodie@comocompanies.com.

BY MADELEINE LEROUX

Every family leaves a legacy, whether through heirlooms, land, or the values passed on to children. e Community Foundation of Central Missouri exists to make sure part of that legacy can also strengthen local nonpro ts and communities.

As billions of dollars shift from one generation to the next, the foundation is working to ensure more of that wealth stays local and that every gift, big or small, has the power to make a lasting di erence.

CFCM is one of eight community foundations in the state, and it serves a ten-county region, not just Columbia. Its role is to connect local generosity with local needs and steward those dollars so they make a di erence for years to come. at can mean a grant to a food pantry, a scholarship for a rst-generation student, or an endowment that reliably supports an arts program every year.

CFCM serves as a transitional steward, helping donors create meaningful community support from their assets. at might mean cash, stocks, real estate, or more unusual contributions.

“If it’s legal, we’ll take it,” says Executive Director Eric Sappington.

He jokes that if someone wanted to donate an elephant, CFCM would nd a way to make it work. In reality, most noncash gifts are liquidated so their value can ow to a nonpro t cause. e point, Sappington says, is that the foundation’s role is to ensure donations are handled properly, donor intent is respected, and the end result is charitable dollars at work in mid-Missouri.

“We’re the gatekeepers,” he says. “We make sure the process is followed, and the money goes where it’s supposed to.” at process is designed to be straightforward for donors and airtight behind the scenes. A typical pathway starts when a family reaches out with a question regarding anything from stock to rental property. CFCM talks through goals, timing, and bene ciaries, then coordinates with the donor’s attorney or tax professional. Assets are reviewed, appraised when needed, and, if accepted, converted into charitable dollars that ow to the nonpro t the donor designates or into a fund for ongoing support. e family gets the tax documentation they need, and the community gets the bene t.

America is in the midst of the largest wealth transfer in history, as Baby Boomers and older generations pass on trillions in assets. In Missouri, a study commissioned by the Alliance of Missouri Community Foundations projects a $153 billion transfer over the next ten years. Central Missouri’s share is estimated at $8.29 billion by 2032. If just 5 percent of that were directed to philanthropy, the region could generate more than $414 million for local causes, producing about $20 million annually if endowed.

“ is is really about making sure those dollars stay here,” Sappington says. “We don’t want to see wealth leave Missouri when families move, or children inherit and take it elsewhere. Our job is to keep as much of it as possible in Central Missouri to bene t the community at large.”

Most mid-Missourians know CFCM through CoMoGives, the high-pro le online campaign each December that raised nearly $2 million in 2024 alone. It remains the foundation’s “largest and loudest” effort, Sappington says, but it does not tell the whole story.

While CoMoGives can feel Columbiacentered, part of Sappington’s role is to remind donors and nonpro ts across the region that they are just as central to the foundation’s mission.

And the year-end campaign is only one piece of CFCM’s work. Year-round, the organization o ers tools that help families and businesses give in ways that t their lives.

The Community Foundation of Central Missouri helps fund — through donations — the Columbia Arts Fund, which recently gave an award to Violet VonderHaar and unveiled the 2025 commemorative poster. The winning poster is Craig Miles’ oil painting Rhythm-N-Yellow.

Donor-advised funds, sometimes described as philanthropic checking accounts, let people contribute when it makes sense, take an immediate tax deduction, and recommend grants over time.

Endowment funds are built for the long haul, providing nonpro ts with reliable income year after year. One prominent example is the Columbia Arts Fund, a permanent endowment created in partnership with the city’s O ce of Cultural A airs to provide long-term support for local arts.

Each year, it underwrites projects from festivals and concerts to visual art exhibitions and educational programming. In September, the city highlighted several local artists whose work had been supported through Columbia Arts Fund grants, underscoring how a single endowed fund can ripple outward, nurturing creativity, building community identity, and giving residents more opportunities to connect through the arts.

Scholarship funds let donors name a fund and direct it to the school of their choice in honor of a loved one, often giving families more exibility than a college or university can o er. At the University of Missouri, for example, creating a named scholarship requires either a $5,000 annual contribution or a $50,000 endowed fund, and any naming opportunities must be approved by the university. By contrast, CFCM can start a scholarship with any amount, making the idea of a family scholarship realistic instead of out of reach.

If foundation giving still sounds like something reserved for the wealthy, Sappington is quick to push back.

“ ere’s no minimum,” he says. “ is isn’t just for millionaires. Anyone can open a fund here.”

In practice, that might mean a teacher who wants to remember a parent with a modest memorial scholarship, a small business that wants to give back each year as it grows, or a family who donates part of the proceeds when they sell a piece of land. Whatever the size or source, the foundation’s role is to ensure those gifts are handled responsibly. Donors want to know their gifts are managed with professionalism and transparency. Nonpro ts rely on the consistency that comes with a partner focused on long-term stewardship. Communities bene t from the multiplier e ect that happens when even modest gifts are

pooled and invested carefully, then granted out to address local priorities. In rural counties where population is at or declining, that kind of reliable philanthropy can be the di erence between scaling a program and shuttering it.

e 5 percent idea puts the opportunity in plain view. If every family in Central Missouri left just 5 percent of their estate to local philanthropy, the impact would be permanent. Accomplishing this does not require a complicated estate plan. It can start with a single conversation and a simple fund.

As Sappington puts it, “ e donor gets the tax break, the nonpro ts get funding, and the community bene ts long-term.” at “win all around” mentality is the foundation’s North Star. It is also why CFCM keeps saying yes: to the routine gifts and the unusual ones, to the check mailed in December and the appreciated stock transferred in April, to the family farm set aside for a future sale and the modest scholarship in honor of a grandfather who taught his grandkids to read.

Whatever the size or class of a donated asset, the Community Foundation of Central Missouri exists to ensure that the transfer of wealth strengthens the region for decades to come.

And if a legacy idea happens to be a little unconventional, they are ready for that too — as long as it helps neighbors and keeps more of our shared future right here at home.

your

Health primary care provider to schedule an appointment. Go to Boone.Health and click on “primary care” to find a clinic near you. If your business is interested in on-site flu shots, email Jenny.Workman@Boone.Health or use the QR code below!

The Larry Gross Lewy Body Awareness Foundation brings clarity, resources, and hope to families.

BY KELSEY WINKELJOHN

Imagine watching someone you love slip away — not because of age alone, but because of a disease doctors sometimes have trouble naming correctly.

Lewy Body Dementia (LBD) steals more than memories. It steals identities. It’s one of more than 100 known forms of dementia and the second most common after Alzheimer’s. Yet despite its prevalence, LBD is also one of the most misdiagnosed. In its early stages, the disease often presents like Alzheimer’s or Parkinson’s, with overlapping symptoms that include changes in memory, movement, mood, and even language.

ough research on LBD has improved in recent years, families still struggle to get clear answers. at’s why advocates persistently work to raise awareness in hospitals, memory care facilities, and living rooms across the country.

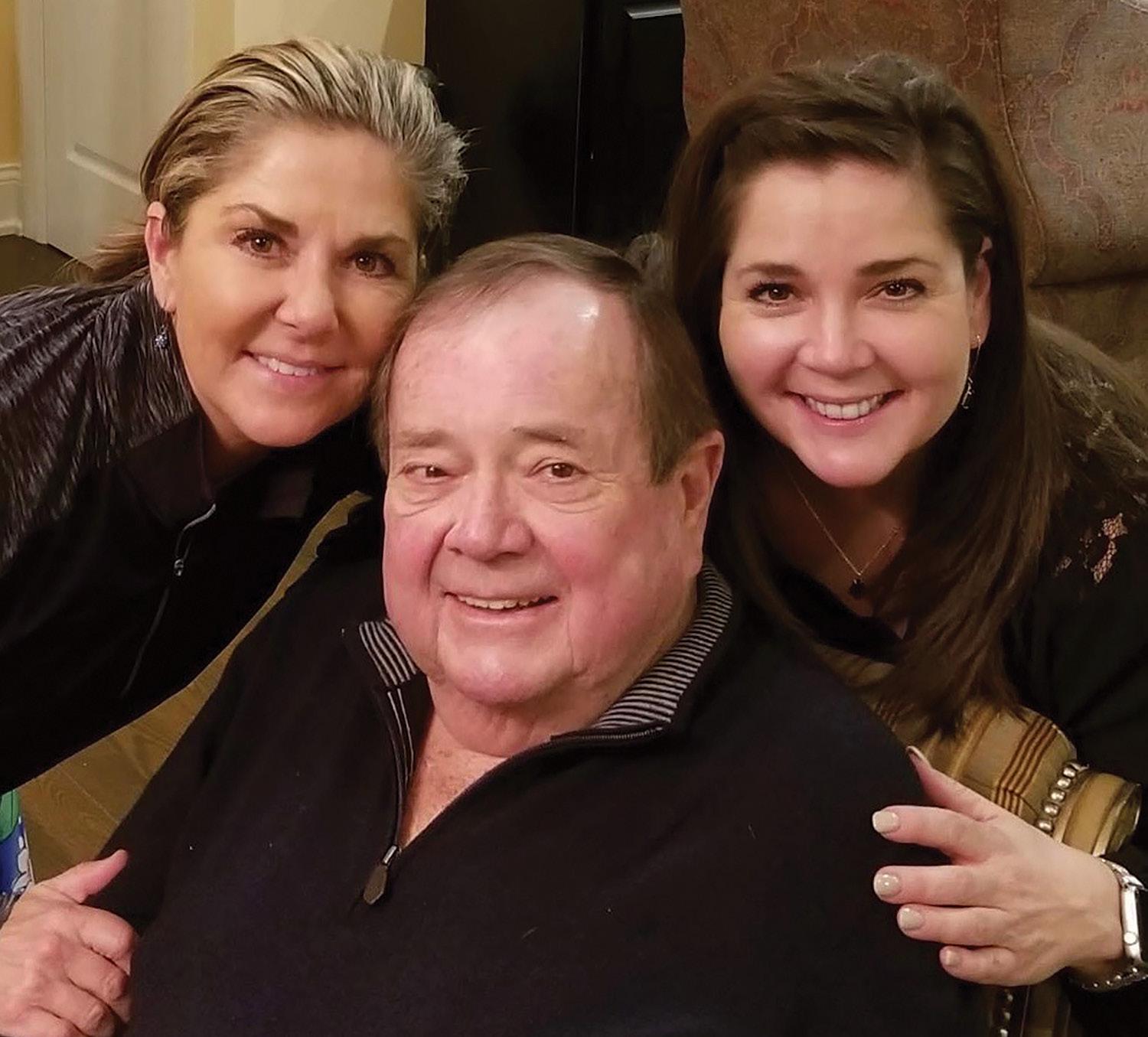

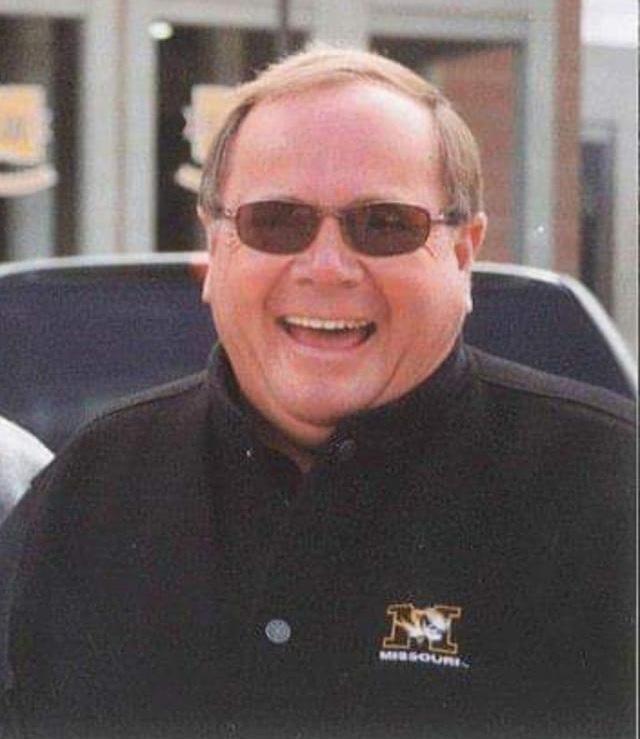

Locally, the Larry Gross Lewy Body Awareness Foundation is doing just that. e nonpro t was cofounded by sisters Rebecca Gross-Highland and Amy Gross Greenwood following the death of their father in 2021. e foundation became an o cial 501(c)(3) nonpro t in 2023.

To understand why the Larry Gross Lewy Body Awareness Foundation exists, it helps to know Larry’s story.

LARRY’S STORY

Lawrence “Larry” Gross was always a numbers guy. Business, sales, strategy — it all came naturally. In the 1960s, he even lived what his daughters jokingly call a “Bionic Man” life, selling cutting-edge knee replacements after leaving behind a successful pharmaceutical career. To his daughters, Amy and Rebecca, he was “a brilliant mind.”

It was that brilliance that made his cognitive decline impossible to ignore.

In 2013, when subtle changes in their father’s processing abilities began to surface, Rebecca and Amy encouraged their parents, Larry and Anna, to see a general practitioner.

“ e doctor basically said, ‘It’s probably Alzheimer’s, here’s some Aricept, bye,’” Amy recalls.

“Alzheimer’s was the catch-all,” Rebecca adds.

ey weren’t alone in their frustration. According to the Lewy Body Dementia Association, only about 30 percent of people with LBD receive the correct diagnosis during their lifetime, with Alzheimer’s being the most common misdiagnosis. For years, Larry was among those misdiagnosed.

Over the next two years, Larry’s decline became more pronounced. In 2015, he visited a neurologist but once again received an incorrect diagnosis. Although he had experienced REM

sleep disturbances for years, no one recognized them as early indicators of Lewy body dementia. Without a full understanding of the disease’s complex symptoms, key signs continued to go unnoticed.

Four years later, Larry nally received the correct diagnosis, though there was some initial confusion. Because Lewy Body Dementia shares many features with Parkinson’s disease, it was rst described to the family as a Parkinsonian disorder. is led to some misunderstanding about what the diagnosis truly meant — a mix-up that’s not uncommon given the overlapping symptoms of these conditions. In 2020, just two weeks before a devastating hemorrhagic stroke, his diagnosis of LBD was clari ed and con rmed.

But when he was transferred to another hospital, his LBD record didn’t follow. After the attack, hallucinations and delusions — already a challenge — intensi ed.

“He had all this pressure in his brain, which was making him act weird,” says Amy. “And they kept giving him drugs you cannot give a patient with Lewy Body, one of those being Haldol, which is probably the worst one.”

Haldol, an antipsychotic often prescribed for schizophrenia, delirium, or agitation, can have the reverse e ect on someone with LBD, amplifying confusion and aggression rather than calming it.

e hallucinations and delusions soon became a de ning part of Larry’s life. Amy explains, in layman’s terms, that hallucinations are “seeing something a little weird,” while delusions are “completely immersive.”

Among the many lessons Amy and Rebecca learned while caring for their dad, one stood out: Sometimes compassion means playing along. In their guide to Lewy Body, they explain that sometimes it’s better to lie — not to deceive, but to relieve.

With help from a team of caregivers, Amy and Rebecca continued caring for Larry until 2021. Along the way, they gained a deeper understanding of the insidious disease that had reshaped their father’s life.

During his illness, the sisters pored over books and online resources and joined support groups, trying to make sense of his symptoms and help their parents navigate the confusing and painful journey. After Larry’s death, Amy and Rebecca decided to gather everything they had learned into one accessible resource for families like theirs.

e foundation’s mission re ects this: to educate families of loved ones diagnosed with LBD, as well as the wider community, healthcare providers, social services, and long- and short-term memory care facilities. To do so, Amy and Rebecca raised funds through di erent events to create informative care packages for families who have a diagnosed loved one.

Care packages include a folder of information packets, from symptoms to look for to ways you can help care for your loved one through advocacy, as well as a children’s book (Grandpa & Lewy) and an adult’s book (A Caregiver’s Guide to Lewy

Body Dementia), explaining the disease at the respective level needed.

As of January 2025, the Larry Gross Lewy Body Awareness Foundation had assembled more than 1,500 resources to distribute to those in need, sending resources around the country and to places like New Zealand, Canada, and Uganda. e sisters also continually attend conferences, such as the Alzheimer’s Association International Conference, to get the word out.

To raise funds, the foundation accepts donations via its website, hosts golf tournaments, and participates in group fundraising. Its fourth annual golf tournament took place in June and featured eighteen holes of golf, contests, ra es, and community events. Coming up, the nonpro t will be a part of the Tigers on the Prowl collaborative fundraising event on October 17, along with Woodhaven, Love Co ee, Grant Us Grace, and Safe Families for Children.

For now, the sisters’ main priority is to keep educating and equipping families with the resources they need. Looking ahead, they hope to one day award scholarships to neurology students or establish a dedicated caregivers’ clinic to provide respite for those carrying the heavy emotional weight of dementia care. Every event, every resource, and every goal is another way of honoring Larry’s life and of ensuring that other families navigating Lewy Body Dementia don’t have to walk the path alone.

The LGLBAF was founded by Rebecca Highland and Amy Greenwood, Larry’s daughters, so other families don’t have to go through what our family went though when our dad was diagnosed with Lewy Body Dementia.

We provide support, education, and resources to those affected by Lewy Body Dementia while cultivating relationships with healthcare professionals to foster early diagnosis and treatment.

DO YOU KNOW THE SYMPTOMS?

• Hallucinations

• REM Sleep Disorder

• Delusions

• Paranoia

Larry Gross Lewy Body Awareness Foundation

lewybodyawareness.org larrygrosslbaf@gmail.com (573) 673-4349

Instagram: @lewybodyawarenessfnd

Facebook: Larry Gross Lewy Body Awareness Foundation

• Anxiety

• Poor regulation of bodily functions

• Shuffling walk

For more information on LBD and the resources available, scan the QR code or visit LewyBodyAwareness.org.

LarryGrosslbaf@gmail.com • 573-673-4349 FOLLOW OUR FACEBOOK PAGE: Larry Gross Lewy Body Awareness Foundation

God’s promise when grief is overwhelming.

BY BETH BRAMSTEDT

“ is is the word of the God of Israel — e jar of our will not run out, and the bottle of oil will not become empty ...”

1 Kings 17:14

Almost ten years ago, I traveled over spring break to visit a friend. We spent the weekend having fun, staying up late, eating rich foods, and trying to maximize the most of our sightseeing experience. By Sunday night, I wasn’t feeling well, hadn’t slept much, and had a long drive home ahead.

I woke up Monday morning and saw the light on my cell phone blinking. e text sent me into a tailspin. One of my team members had fallen o a balcony and cracked his skull. His brain was bleeding, he wasn’t breathing on his own, and they were rushing him into surgery.

I sat down on the bed, stunned. Paralyzed. en I cried. Exhaustion washed over me — physically, spiritually, and emotionally. It was a feeling I will never forget. Somehow, I managed to get in the car and head home, only to pull o the road just outside Kirksville to throw up. I ended up at home on the couch, unable to do anything for several days.

I soon realized I was experiencing grief — and more intensely than I ever had before. e life-threatening accident brought back all the feelings of relational loss I had experienced over the previous several years. Honestly, I was mad at God. How did he expect me to live life with people only for them to leave in some way? In that overwhelming moment, I truly wondered if God were asking too much.

As I’ve found myself having similar feelings of relational tension and loss this past year, it’s been comforting to

think of the widow in 1 Kings. She is living in a time of drought. She is a single mom. She barely has enough food for one last meal. Yet the prophet Elijah shows up in town and asks her for something to eat. She explains her predicament. She’s gathering rewood to make one last loaf of bread for her and her son before they die. ey have nothing left to give.

Yet God makes a promise through Elijah. “Don’t worry about a thing,” he says, “Your jar of our will not run out, and your bottle of oil will not run dry.” In her grief, her pain, God promises just enough to sustain her. And he does. Day by day, he provides exactly what she needs.

I want to trust God like that.

Would you like to trust God like that?

What is your jar of our today? What in your life needs lling up? Will you let go and trust God to provide for your needs today?

Beth Bramstedt is the Church Life Pastor at Christian Fellowship.

BY SUNITHA BOSECKER

We’re currently in the midst of what former U.S. Surgeon General Vivek Murthy declared a “loneliness epidemic.” at might sound like an exaggeration until you consider how many of us feel disconnected, despite full calendars, active group chats, and endless digital interactions. Loneliness doesn’t care about your income, your travel log, or how many people like your photos. It doesn’t discriminate. ere are important factors that have contributed to the loneliness epidemic, including high levels of life transitions, individualism, and technology.

A friend recently shared a story that keeps me feeling hopeful. Before leaving town, she arranged with her neighbor’s son to mow her lawn while she was away. When she returned, her lawn was perfectly cared for. Wanting to keep up her end of the agreement, she stopped by to pay the boy, but only his father was home. He declined the payment, saying, “I want to teach my son the importance of community. We do things to help our neighbors.”

at moment was bigger than a menial household chore; it was about reciprocity, showing what it means to be part of something larger than yourself.

at kind of mindset is increasingly rare in a culture that rewards individual hustle and constant productivity. Reciprocity is about mutual commitment, not about one’s ever-changing mood.

Here’s a truth we don’t talk about enough: We need each other. Not just for practical survival, but for the richness, depth, and emotional color that relationships bring to life. A healthy community, whether it’s your friend circle, neighborhood, workplace, or chosen family, functions on acts of mutual care. Nor do those acts always require grand gestures. Often, they’re small, quiet, and consistent.

A few months ago, after a long trip, I noticed a friend wasn’t quite herself.

It was a rainy day, and I almost continued with work as usual. But something nudged me to text her. When she said she was working from home, I picked up a warm chai and drove over. She opened the door, we embraced, and she felt emotional. Two hours passed in conversation I didn’t plan for. She needed that connection — and so did I. at’s community.

In a world that often praises self-reliance and overbooked schedules, showing up can feel like a radical act. I’ll admit, there are times I don’t have the bandwidth. ere have been times I said no because I was exhausted or talked myself out of a check-in because I thought it wouldn’t matter. Still, I’m trying to be more intentional. Because the truth is, we owe each other.

Yes, we’re busy. However, we are the product of others’ generosity. People have shared their time, guidance, energy, or quiet presence when we needed it most. It’s our turn to give back. at could mean checking in with someone who’s been quiet, splitting leftovers, running errands together, o ering to walk a dog, sharing homegrown tomatoes, or simply sitting beside someone who’s overwhelmed.

Loneliness thrives when we believe our desire for connection will not be met. Yet most of us are quietly yearning to be

witnessed, to be thought of, to be celebrated for simply existing. It’s OK to have this desire, and it’s also OK to ask for it.

Let’s reframe loneliness not as something shameful, but as a signal. Consider it a moment of re ection on how we’re relating to ourselves and others. Ask yourself, “Am I showing up for people I care about? Am I being honest about my own needs? Am I demonstrating mutual support or just checking boxes?”

Meaningful relationships are gifts. And like any gift, they come with responsibility. at means o ering our time, attention, purpose, skills, and, sometimes, just our stillness. It means giving what you can and taking what you need, not out of obligation, but out of love.

e next time someone crosses your mind, then, don’t wait for the perfect moment to get in touch. Text them. Stop by. Lend a hand. Make the call. Show up. Because on the other side of loneliness is connection, and it requires all of us to take turns doing our part. We need each other.

BY HOSS KOETTING

Well, we’re about to transition to fall. Temperatures are dropping, days are getting shorter, and my garden is putting out its last gasps of life for the season. Yes, it is actually still producing some tomatoes and peppers!

It’s been quite a season for Hoss’s Acres (or a fraction of an acre), as we’ve had an absolute ton of cherry tomatoes and a pretty good harvest of slicers. e green bell peppers did fairly well, as did the jalapeños, but I was vetoed on growing my favorite — habaneros — because we still have a pretty good quantity of them in the freezer. I love growing them not only for the heat and avor they impart to recipes, but because there is something fun about the way they change color from the green of immaturity to the orange of ripeness. e nice thing about the habaneros is that they can be frozen in a zip-close bag and then used as needed in whatever recipe you are making.

Another harbinger of fall is the intrinsic desire to get the oven cranked up for a hearty meal be tting a crisp fall day, and if you can use the bounty from the garden, so much the better! is recipe calls for bonein country-style ribs, but make sure they are from the loin and not the shoulder. You can also substitute pork rib chops if desired.

Jim “Hoss” Koetting is a retired restaurateur/chef who enjoys gardening, good food, good bourbon, and good friends.

RIB INGREDIENTS

• 2 lb. bone-in, country-style pork ribs

• 2 cups diced fresh tomatoes (or, if unavailable, canned stewed tomatoes)

• 1 cup diced yellow onion

• 2 tbsp. minced fresh garlic

• 12 fresh, whole jalapeños

• 3 cups pork or chicken stock

• 2 tbsp. Hoss’s Italian seasoning

• Salt and pepper to taste

ORZO INGREDIENTS

• 1-1/2 cups dried orzo

• Vegetables and cooking liquid from the pork

• Grated Parmigiano Reggiano, for serving

1. Preheat the oven to 350 degrees.

2. Season the pork with salt and pepper, brown in a heavy-bottomed skillet, then remove from heat.

3. Add the tomatoes, onion, and garlic and saute for about 5 to10 minutes.

4. Add the jalapeños, stock, and seasoning, then place the pork ribs on top of the tomato mixture and place in oven.

5. Roast for 15 to 20 minutes until the interior temperature of the pork is 145 degrees; remove from oven.

6. Place the orzo in a pot and barely cover with a combination of the tomato mixture and water.

7. Bring to a boil, stir, then reduce the heat to a simmer, stirring the orzo every minute or two and adding liquid as necessary. e orzo will become creamy, like risotto, as it gets done.

8. Use any leftover cooking veggies for sauce and top liberally with grated Parmigiano Reggiano!

From intimate dinners to elaborate celebrations, a great caterer makes the meal as memorable as the moment.

BY SUNITHA BOSECKER

What begins with the promise of an intimate gathering, perhaps a quiet dinner among friends, can blossom into a full-blown celebration complete with carefully curated menus, local avors, and unforgettable moments. Two powerhouse culinary artisans, Kimber Dean of Happy Food Meals and Happy Foods Catering and Rachel Hershberger of Honey Puddle Food & Farm, demonstrate how that journey unfolds with intention, passion, and purpose.

Dean’s origin story begins with a vision of food inclusivity and joy. In 2014, frustrated by the lack of allergy-friendly yet delicious fare in Columbia, she merged her training as a holistic chef, cookbook author, and farm steward into Happy Food. Her mission: feeding happiness from within. Dean creates meals that are clean, nourishing, allergy-friendly, and undeniably joyful. ey’re an invitation to savor health without sacri ce.

Meanwhile, Hershberger’s Honey Puddle Food & Farm was born from a mother’s devotion. Her children inspired a quest for healthful, thoughtful food not just for nourishment, but for life-long well-being.

“I wanted to ensure that they were fed healthy ingredients and teach them best practices of knowing what they were

eating and why,” she says. Over time, these habits became life-changing routines for the entire family.

ese two women share more than culinary creativity; they share a commitment to making the act of eating both meaningful and accessible.

At Happy Food, gluten- and dairy-free fare feels indulgent, not engineered. Staple hits include Brownie Energy Bites, which provide high-protein, plant-based, freezer-friendly fuel. Dean’s gluten-free chicken tenders with an almondour crust arrive baked and golden, while her Heart Health Salad and Diabetic Bowl are gut-friendly, nutrient-dense, superfood-forward meals that heal in savory fashion.

Dean's creativity starts with her choice of healthy ingredients. Imagine classic lasagna reimagined in glutenand dairy-free form with zucchini or brown-rice noodles, cashew cheese, and house-made marinara.

At Honey Puddle, the vision is elegantly simple: to help make healthy daily choices e ortless, not exhausting, for busy families. Hershberger notes that healthy food “is time-consuming and requires consistency.” e beauty of Honey Puddle lies in its commitment to ease, o ering tried-and-tasty family entrées, to-go lunches, and seasonal sweets that satisfy.

Signature favorites include protein-rich lunch boxes that combine fresh, seasonal fruit with healthy fats to create a balanced meal. On the dessert front, there’s the gluten-free peach pie, consisting of homemade peach purée and a pecan-walnut crust with just the right touch of buttery sweetness. Lemon cheesecake comes crowned with homemade lemon curd over a crushed cookie crust. Each treat embodies that sense of abundance that characterizes Hershberger’s business: “If there are puddles of honey, there is an abundance of sweet goodness.”

Whether you’re organizing a small home gathering or a grand a air, Honey Puddle and Happy Food both o er a seamless path from initial vision to nal execution.

At Happy Food, Dean consults with clients to understand guest lists, dietary needs, and event styles. en she delivers a custom menu, handles local sourcing, and orchestrates every detail so the host can enjoy the evening without worrying about behind-the-scenes stress. From intimate two-person dinners to events for 500 or more people, Happy Food accommodates a wide range of event sizes and budgets, charging around $100 per person for private dinners and $25-$40 per plate for larger gatherings.

When brainstorming delicious catering items, Dean was struck over the years by the educational component of serving clients. Many are unaware of the complexity behind allergy-friendly, locally sourced menus. It’s not just about cooking — it requires attention to logistics (ingredient sourcing, supplier coordination, timing, sta ng, plate service) and making it all feel e ortless for the client.

At Honey Puddle, prospective clients visit the website and then enjoy a planning conversation that Hershberger says is “just as much fun as sitting down to eat.” Together, client and caterer co-create menus that are unique, delicious, and rmly grounded in what works beautifully.

From these stellar women’s kitchens to the broader landscape of local cooks, Columbia’s catering scene is lled with personal touches and community-minded professionals. Here are a few local catering favorites:

• Peachtree Catering is deeply embedded in the Columbia community. For 26 years, it has operated as a small family business that listens, tailoring each event’s menu from scratch. at means no cookie-cutter options. e folks at Peachtree source produce and meats from local farmers and delight in sharing the stories behind the squash, the pork, and the people. eir focus is on genuine relationships and real food.

• Eclipse Catering and Events o ers “catering that just makes sense,” a blend of familiar avors, fresh seasonal ingredients, and a ordable pricing. Beyond food, Eclipse delivers professional service, personal touches, and an approachable, on-point experience. “ ey just knocked it out of the park,” says one enthusiastic client.

• Sara Fougere Catering brings 20+ years of experience, specializing in upscale corporate and in-home events. Each menu is uniquely crafted to suit the individual event — a testament to design, customization, and thoughtful presentation.

• e Old Neighborhood Cafe, a scratch-kitchen newcomer rooted in family tradition, sources ingredients locally and honors heritage recipes. It caters everything from business lunches and bridal showers to charcuterie boards and grazing tables — tailored, thoughtful, and handcrafted.

THE

ARC OF THE EVENT: FROM MERE “DINNER” TO A CELEBRATION

Tracing the arc of how hosting evolves, through the lens of these caterers:

1. Inception: A host envisions a gathering, maybe a Valentine’s dinner, a family reunion, or a summer garden party.

2. Connection: ey contact a caterer. e pros at Honey Puddle and Happy Food consider that conversation half the joy. e goal is to nd dietary harmony and align expectations on avors and a vision of the event.

3. Collaboration: With Peachtree, Eclipse, Sara Fougere, or Old Neighborhood, each host engages in co-creating the event. Some seek a custom farm-fresh feast, while others crave familiarity with a creative twist.

4. Production: Behind the scenes, caterers assemble menus, source ingredients, prepare dishes, and manage logistics. It’s a symphony of recipe execution, timing, sta ng, and presentation.

5. Revelation: e event arrives. What was once “just a dinner” becomes an unforgettable experience.

6. Satisfaction: Guests leave nourished, both physically and emotionally, as part of a community that cares about what we eat and how we gather.

A small dinner party is just as important as a grand celebration, thanks to the intent behind each ingredient, the care in planning, and the generosity of those who cook from the heart.

Whether you’re planning a family dinner, gearing up for an engagement party, or imagining a wedding reception, you’ll nd excellent catering options throughout Columbia.

Rachel is an administrative assistant in our Trust department! She is a joy to work with, always having a positive attitude that brightens the whole office. She consistently goes above and beyond for both colleagues and clients. She approaches every challenge with optimism and shows great initiative and follow-through. We are very lucky to have her on our team!

YOUR

573-874-8100 • centralbank.net/boonebank

Where the st ies of Boone County come alive.

Upcoming Community Events:

October 15:

October 24:

Things That Matter Speaker Series: I-70/63 Interchange MoDOT update

Blind Boone Piano Concert Series: Tom Andes Trio

Call us at 573-443-8936 or scan the QR code to learn more.

STORY AND PHOTOS BY JODIE JACKSON JR

Where can you go to see whimsical splashes of color that expertly blend in with re hydrants, tra c lights, and asphalt and concrete? In downtown Columbia, you can go to the bank. More speci cally, Commerce Bank, Simmons Bank, and Central Bank.

In addition to mosaic benches that display milkweed, canna lilies, petunias, and coleus, among other bright annuals and perennials, Simmons Bank at 801 E. Broadway also has a cozy pocket park and the stunning Suspended Globe sculpture. e twenty-foot-tall structure imbues strength and resolve, casting re ections that meld with busy street scenes.

One block down at 901 E. Broadway, the botanical selections outside Commerce Bank also include petunias, lilies, zinnias, coleus, and milkweed — the only plant where monarch butter ies lay their eggs. Across the street at 720 E. Broadway, Central Bank’s sky-reaching windows perfectly re ect Columbia City Hall. e exterior colors come from garden mums, black-eyed Susan, taro, wax begonias, hydrangeas, coleus, a neatly trimmed evergreen, and more.

As autumn sets in, and the leaves change to spectacular colors, don’t forget about the downtown spots that display color year-round. And be sure to pause long enough to re ect on the re ections.

(Re)Discover COMO is a monthly feature sponsored by the Columbia Convention and Visitors Bureau highlighting places, events, and historical connections that new residents and visitors can discover, and not-sonewcomers and long-time residents can ... rediscover.

ere’s a place located smack dab downtown that is a destination for slowing down, reconnecting with others, and appreciating the simple joys of life. at place is Wynnsome, where locals and visitors can sip on a wide variety of artisanal teas or locally roasted co ee while enjoying a slice of handcrafted cake.

Wynnsome is at 1020 E. Broadway, Suite G. e shop is open from noon to 8 p.m. on Wednesday and ursday, and from 10 a.m. to 8 p.m. Friday and Saturday.

Owner and baker Emma Briner says hospitality is at the core of her shop. Her brother crafted the tables, her curtains, and menus, and other décor items are handmade gifts from creative friends.

While the usual co ee beverages like cappuccinos and cortados are available, Briner urges patrons to trust her team to deliver a cup of tea even tea haters will love.

You can nd all your favorite autumn plants and décor just south of Columbia at Strawberry Hill Farms, located at 3770 E. Highway 163. Mums, pumpkins, gourds, fall annuals, and more await now that fall hours have begun. e farm is open from 9 a.m. to 6 p.m. Monday through Saturday, and from 11 a.m. to 5 p.m. Sunday.

Strawberry Hill Farms, established in 1980, specializes in providing a variety of quality garden bedding plants, including annuals, perennials, shrubs, fruits, and vegetables. Strawberry Hill o ers a range of gardening resources such as growing guides and deer-safe plants to support local gardening enthusiasts.

Grab on, get a good foothold … and climb! CoMo Rocks at 205 E. Nifong, Suite 120, is growing the local climbing community by making the sport accessible and welcoming to people of all ages, races, genders, and ability levels, and by reducing the socioeconomic barriers in the sport of climbing.

CoMo Rocks is a state-of-the-art indoor rock climbing and training facility with thousands of square feet of climbing where people of all ages and abilities can challenge themselves and have fun. e unique Columbia destination o ers limited roped climbing, bouldering, kilter board, 9,400 square feet of terrain, and a gear shop.

CoMo Rocks is also an ideal venue for corporate retreats, youth groups, church groups, school groups, Scouts, and parties, with certi ed and trained sta available.

Anyone is welcome to climb, and membership is not required. And climbers of all ages are also welcome. You can be any age to boulder and use the auto-belays, but climbers must be 13 years or older to top rope belay. Climbing and yoga classes are also available to non-members.

Non-members pay $20 for a day pass for ages 13 and up, ages 5 through 12 are admitted for $16, and ages 3 and under are free. Rope climbing 101 is available for $30 per class. Yoga class is free for members and $15 per class for non-members.

CoMo Rocks is open from noon to 9 p.m. on Monday, Wednesday, and Friday, from 6:30 a.m. to 9 p.m. Tuesday and ursday, from 10 a.m. to 7 p.m. Saturday, and from noon to 7 p.m. Sunday.

By Mike Messer MMesser@ShelterInsurance.com

You are a genuinely good person. You have no desire to hurt others, and you would likely never do anything on purpose to harm someone. Still, situations can arise, and we are part of a litigious culture where individuals can—and will— sue. Fortunately, you can help protect your assets and the life you've worked so hard to build with umbrella insurance.

Imagine these scenarios:

• Your neighbor's kids come over to play on the trampoline with your kids. One falls off and tragically breaks his back. His parents sue, and the judge awards them $250,000 in damages.

• You are driving down a street in a neighborhood and a child rides her bike out in front of you. You have no time to stop and you hit her. She hits your bumper and windshield before landing on the pavement. Because she is not wearing a helmet, she suffers serious head injuries. Some witnesses say she did not look before riding her bike into traffic and support the fact that you had no time to stop, but the family is awarded $500,000 in damages.

In some instances, umbrella insurance can help provide coverage above what your underlying liability limits on your auto or homeowners policies provide. In the first scenario, if your liability limit on your homeowners policy is $100,000, you may have to come up with the remaining $150,000. Similarly, in the second scenario, if your auto liability limit for bodily injury

is only $250,000 and it provides that coverage, you may owe $250,000. If you purchase umbrella insurance, some, or maybe even all or the remaining amount could be covered. Some umbrella policies will even help cover your legal fees.

Of course, as with any kind of insurance, the amount of coverage your umbrella policy provides depends on the facts of the claim and the details of your policy.

MIKE MESSER AIC, LUTCFSHELTER INSURANCE ® ®

With over two decades in the insurance industry, Mike Messer has served as a claims adjuster, supervisor, and underwriter, giving him a well-rounded understanding of how policies work when it matters most — before and after a loss. He prioritizes building relationships based on trust and personalized service, recognizing that every client’s needs are unique. Through annual policy reviews, he helps ensure clients stay informed, confident, and properly covered, providing them with peace of mind and financial security.

to good people, and court and settlement costs can be astronomical.

Shelter Insurance® offers an umbrella policy that could provide you with $1 million in coverage or more, which is much higher than the usual limits of your home and auto policies. You might be wondering why you would need a million dollars or more in liability coverage. Higher coverage limits can ease your mind when you've been served with a lawsuit that looks like it could break your bank. The truth is that big accidents happen, even

If you don't want to face the possibility of having to deal with the above scenarios, consider talking to local Shelter Insurance® agent Mike Messer about umbrella coverage. Hopefully nothing like this will ever happen to you, but wouldn't it be good to have the peace of mind umbrella coverage can help provide if it does?

Shelter Life Insurance Company, 1817 West Broadway, Columbia, MO 65218

By Kelly McBride Find more

The world of Hydrangeas may seem overwhelming but really, there are just 4 common types of Hydrangea. Each one has specific pruning, watering, and sun requirements and have varieties that come in a range of sizes and colors.

Big Leaf Hydrangea

• High water requirements

• Full shade with no afternoon sun.

• In late Spring or early Summer, you’ll have big, round mophead blooms in pink, blue, purple or white. Fun Fact: PH levels of the soil determine the bloom color, so keep that in mind that it might change once you plant it in your soil. There are fertilizers that add acidity to the soil so you can control it fairly easily. This is unique to the Big Leaf Hydrangea.

• These bloom on old wood, meaning they set their buds on last year’s growth in the Fall. Because we don’t want to trim off any of those potential flower buds, Big Leaf Hydrangeas shouldn’t be pruned until after they have filled out with new growth in late Spring. Then you’ll only need to trim out any Winter dieback.

Oakleaf Hydrangea

These Hydrangeas get their name from the oak-shaped leaf which turns a stunning color in the Fall.

• Normal watering requirements

• They have branchy structure with flakey bark which can give some nice Winter interest.

• Cone-shaped blooms appear in late Spring and come in pink or white.

• Oakleaf Hydrangeas bloom on old wood, so similarly to the Big Leaf Hydrangea, you’ll just let these leaf out in the Spring, and then trim back any Winter dieback.

• Feel free to trim off any wild hairs through the rest of the year.

Smooth Hydrangea

Smooth Hydrangea gets confused for Big Leaf Hydrangea a lot but they are so much easier and you will get a show of blooms!

• Part shade to full sun (with a little protection)

• Part shade to full sun (with a little protection)

• Normal watering needs

• They will bloom in early Summer with large round blooms that come in pink or white.

• The big difference is that these bloom

Kelly McBride grew up in Columbia just down the road from Rost Inc., and she's happy to still call Columbia home. She has a degree in plant science and landscape design from MU and was hired as Rost’s landscape maintenance manager after graduation. Her love for plants makes this job very enjoyable when assisting clients with their outdoor tasks. Outside of work, you can find her cooking, gardening, sewing, or doing other outdoor activities.

(573) 445-4465 ROSTLANDSCAPING.COM

on NEW wood. They set their buds in the Spring, so the late frosts won’t change the amount of blooms you get.

• Because of this their pruning is also very easy! You just trim them down to around 6” to 1’ in late Fall or early Spring and move on.

Panicle Hydrangea

These Hydrangeas have exploded with new varieties in the last 10 years.

Part sun to full sun Hydrangea with no protection needed

• Do not require extra watering while in the full sun

• All through Summer and into Fall they will flower with large cone shaped blooms. These will all come out white, and some will fade to pink in late Summer or as we go into Fall.

• Panicle Hydrangeas also bloom on new wood, so they can be trimmed in late Fall or early Spring without affecting the amount of blooms you get.

• Some leave their spent blooms on for Winter interest.

Aging Best helps the 65 and older population navigate the challenges of aging.

BY ROGER M C KINNEY | PHOTOS BY RONEISHA DUKE

Pamela Hildebrand and Anita Nugent feel as close as any family members to one another.

“Pam is the sister I never had,” Nugent said.

“She’s the sister I always wanted,” Hildebrand said of Nugent.

Both are residents of the same senior housing apartments in Columbia, and they’re enthusiastic clients of Aging Best, the area agency on aging.

According to the National Council on Aging, more than 17 million adults aged 65 and older are economically insecure, a reality that a ects minority seniors at a higher rate. Hildebrand agreed that today’s seniors face many challenges.

“It’s scary as hell to be a senior,” Hildebrand said. “ ere’s a lot of seniors that lay awake at night worrying about how they are going to make it through. And if it wasn’t for Aging Best, I couldn’t manage.”

Aging Best is one the area agencies on aging that sprouted from the Older Americans Act of 1965, part of President Lyndon Johnson’s War on Poverty and Great Society programs. e law created the Administration on Aging; the area agencies on aging are part of its network.

Overseen by the Missouri Department of Health and Senior Services, there are ten of the agencies in Missouri. Aging Best covers nineteen counties in mid-Missouri with approximately nintey full-time employees.

“When people nd Aging Best, they generally nd us because of nutrition,” noted Candi Bockenstedt, the agency’s director of special programs. “ ey come into one of the [nutrition activity] centers, or they are requesting home-delivered meals. We deliver meals in all 19 counties and to anyone that is homebound.”

Hildebrand and Nugent are among the agency’s grateful meal recipients. “Aging Best provides me food,” Hildebrand said. “And it’s good food. It’s healthy food. One of the hardest things as a senior is food, because it’s so expensive to buy fresh foods for one person.”

e cost of food and other essentials has certainly shot up, and Bockenstedt and her sta are sensitive to their clients’ budgetary dilemmas. “Our client care specialists answer the phone and help kind of triage di erent people’s needs and try to gure out if they’re eligible for things” she said. at includes such services as farmers market vouchers and help with Medicare enrollment.

“Our client care specialists can help with any kind of application assistance, whether it’s Medicaid or food stamps or help with enrolling for Medicare or picking a new plan,” she said. eir expertise extends to navigating the changes to Medicare’s Part D plan for prescriptions as well. “We’ve been known to save people $800 a month in pharmacy expenses,” Bockenstedt commented. “And that’s not just a one-time thing. at happens all the time that we’re able to help people.”

“It’s scary as hell to be a senior. There’s a lot of seniors that lay awake at night worrying about how they are going to make it through. And if it wasn’t for Aging Best, I couldn’t manage.”

— PAMELA HILDEBRAND

It may be that Aging Best is so good at dealing with its clients’ economic stresses because the agency faces nancial challenges of its own.

“We’re struggling, like all the nonpro ts,” Bockenstedt said. “We have cut sta . We haven’t cut programs. We see the need, and we ll the need.”

One way Aging Best does that is by bringing together the services of other agencies. For example, it partners with existing transportation services to match people with them. Bockenstedt recalled one typical case in which Aging Best was able to nd a way to get a client in Columbia to a doctor’s appointment in Sedalia and back home. Medical transportation can be arranged for Aging Best clients to anywhere in the state, she said.

Bockenstedt noted that Aging Best lls gaps when other nonpro ts aren’t able to. Among its gap- lling e orts, Aging Best:

• Replaces air conditioners for seniors

• Finds cleaning services for their homes or apartments

• Provides seniors with hospice services

A more yawning gap is housing, which Bockenstedt said is too expensive and hard for many seniors to nd. At a recent conference, she learned that people over the age of 60 will be the largest unhoused population by 2030, a statistic that astounded her. To help prevent that prediction from coming true in this neck of the woods, Aging Best helps individuals nd housing, too.

Of course, while many seniors experience nancial di culties, not all of them do. In fact, recent data from the U.S. Federal Reserve places the median net worth of seniors aged 65 to 74 at $409,900 and their average net worth at $1.8 million. at compares favorably to the 45-54 age group, which has a median net worth of $247,200 and an average net worth of $975,800.

None of the services Aging Best provides are income-based. ey’re available to anyone 60 or older and for grandparents caring for grandchildren 55 and older, Bockenstedt said.

She highlighted Give 5, “which is a program for anyone who has retired, to match them with nonpro ts in their community, to be able to reconnect.”

“We nd that after you retire, you kind of lose your identity a little bit and sometimes you feel disengaged from your community,” Bockenstedt observed. By connecting seniors with local nonpro ts, “it’s kind of peeling back the curtain, kind of a Wizard of Oz-type deal, because you get to see how your community runs from behind the scenes,” she said of the program.

Currently available only in Columbia, Je erson City, and Lake of the Ozarks, Give 5 will be expanding into the entire Aging Best area in the fall. “So that’s a really good program for anyone who’s retired to nd a place, to nd their tribe,” Bockenstedt said.

“We find that after you retire, you kind of lose your identity a little bit and sometimes you feel disengaged from your community.”

— CANDI BOCKENSTEDT

Speaking of tribes, while the seniors in the apartment complex where Hildebrand and Nugent live appreciate the services Aging Best o ers, that doesn’t mean they don’t take the initiative in their own lives.

“We call and check on each other,” said Hildebrand, who has diabetes and gets around in a motorized wheelchair. “We do welfare checks.”

From 3 to 5 each afternoon, many of the residents gather in the building’s community room.

“We all sit there and solve the world’s problems,” Hildebrand said. “I call it an extended family.”

“It’s keeping us all a little active,” added Nugent.

at self-help ethos is also evident in Hildebrand’s work with the Silver Haired Legislature, of which she is the current chair.

e advocacy group develops proposals to bene t seniors and lobbies the legislature for their enactment. “How do you get the resources to the people in need?” asked Hildebrand. “ ose things are crucial to me.”

Missouri is currently in the process of developing a new Master Plan on Aging. A draft master plan is to be developed by the end of 2025. e goal is a ten-year framework to empower older adults and individuals with disabilities and support senior communities. Another goal is to allow individuals to live safely and independently in the environment they choose.

ough she has a disability, Hildebrand isn’t nished with her advocacy work.

“My journey’s not done,” she said. “If I’m going to be here, I’m going to be active and I’m going to be busy.”

“It has been a pleasure working with everyone at Garrett Painting. I cannot complement their work enough! Very professional and great communication.”

Jennifer F., Google Review, June 2025

By bringing community partners under one roof, Columbia’s Opportunity Campus is creating pathways from survival to stability.

BY MICHELLE TERHUNE

Opportunity is a gift when it comes calling. But for some, opportunity never comes knocking because they have no door. ey also don’t have walls, a roof, or windows.

at’s the reality for the hundreds of people in Columbia who have no place to live. e annual Point-in-Time Count in 2024 found 323 sheltered and unsheltered homeless. ese are folks in emergency shelters, safe havens, and transitional housing, as well as those living on the street, in their cars, or in other locations un t for human habitation.

e reasons why people experience homelessness are as numerous as the head count. eir numbers are growing, as are the e orts to care for those who have no place to go.

In 2021, the city of Columbia issued a request for proposals for a Comprehensive Homeless Services Center Plan designed to address the issue.

e Voluntary Action Center, which provides an array of services to the homeless and near-homeless, also refers clients to several other agencies and organizations. at way, clients know what services are available and who provides them, even if VAC doesn’t.

“Folks typically leave our o ce with the services they came in for,” said Ed Stansberry, VAC executive director. As noted, however, some of those services are referrals to other providers.

It isn’t always easy for someone who’s homeless to get to a shelter or a hot meal. VAC saw the RFP as a way to formalize provider relationships and bring more services under one roof — or rather, two — to better serve the unhoused population. And that’s how the Opportunity Campus came about.

e groundbreaking for the campus took place in 2024. Today, it is taking shape where there was once empty ground on I-70 Business Loop East. e project’s architect and general contractors are hometown companies, PWArchitects, Inc., and Little Dixie Construction.

Stansberry said construction is on track for the Cindy Mustard Resource Center, named in honor of Mustard, VAC’s rst executive director and a long-time Columbia volunteer leader. at building, which will house service providers like VAC and the medical clinic, is slated to open in March 2026.

e shelter should open two to three months later, due to a delay in the delivery of steel early on. Stansberry con rmed that naming rights for the Opportunity Campus shelter facility are still up for grabs.

Strength in Numbers

e campus will provide a long-term home for many of the organizations whose mission is to serve the unhoused. For example, Room at the Inn (RATI) has provided overnight shelter services in Columbia for more than fteen years. But it operated only seasonally and relied on various churches for space to house people. For the past two years, it has operated continuously in the city-owned Ashley Street Center.

RATI routinely lls the ninety-bed facility every night, said John Trapp, RATI’s executive director. e shelter at the Opportunity Campus will have 150 beds served by RATI sta , although the nonpro t will be absorbed by VAC. VAC recently hired Jessica McNear from Rape and Abuse Crisis Service in Je erson City as shelter director.

“RATI will cease to exist as a separate organization when the OC opens,” Trapp said. “We believe that having the shelter run by VAC will o er bene ts of scale, particularly when it comes to employee bene ts and attracting and retaining quality sta . RATI brings trained sta and knowledge of the population that we serve to VAC. is will lessen the learning curve and allow VAC to hit the ground running.”

Loaves and Fishes, which used to provide meals at Wilkes Boulevard United Methodist Church, now serves meals at the RATI location. While that eliminated the need to shuttle people between meals and overnight shelter, sharing the current space is tricky. Guests must wait outside while the room is converted from dining to sleeping and back again. e Opportunity Campus has space for both functions — and more — to coexist.

e Resource Center will be the new home for VAC, which owns the campus. Turning Point, another nonpro t serving the unhoused, will also move operations there.

“Turning Point's mission and role will not change,” said Darren Morton, the organization’s executive director. “We will continue to focus on providing hope and restoring dignity to persons experiencing homelessness. We will simply be renting space at the Opportunity Campus instead of Wilkes Boulevard UMC.”

Other organizations, such as Loaves and Fishes, will also call the campus home, and many more will provide services there.

“We have letters of intent from twelve to fteen community partners to provide services at the campus,” Stansberry said. “We’ll be transitioning those letters of intent to memoranda of understanding over the next six months or so to really de ne what that looks like.”

“We are already paying for it with the burden on law enforcement, the judicial system, and unreimbursed medical expenses

These are cycles we believe we can interrupt.”

For example, Job Point will provide employment counseling. Central Missouri Humane Society and the Mizzou vet school will help with pets. Central Missouri Community Action will provide services such as life coaching and budgeting skills training. Columbia Center for Urban Agriculture will help develop a community garden.

“We believe that our community's support for the unhoused works because di erent agencies collaborate so closely with one another,” Morton said. “ ese collaborations are essential to our success. But at the same time, we also need to respect each other’s di erences, since we each have our own role to play.”

Another key feature of the campus will be the medical clinic, which will be housed in the Resource Center. Clarity Health/Compass Healthcare and Burrell Behavioral Health will be providing mental health, substance abuse, and primary care services. Stansberry said those services will be applying for status as a Federally Quali ed Health Center, which means the clinic won’t just serve those struggling with homelessness, but the Columbia community at large.

Meanwhile, the shelter, as a low-barrier facility, will also accommodate its guests’ pets.

“One of the reasons that a lot of people don’t use shelters is because they don’t accept pets,” Stansberry said. “We are currently working with an organization called RedRover and the MU vet school to help educate us on best practices for our guests and their pets.”

e vet school helped VAC obtain a $60,000 grant from RedRover and will be instrumental to sta ng veterinary services once the campus opens. ere will be an exam room, washing station, runs, and kennels. And pets will be allowed in the shelter with their owners unless they’re disruptive.

Stansberry reported that total construction costs for the Opportunity Campus should be roughly $18.6 million. So far, $15.2 million has been raised from a variety of sources, including American Rescue Plan Act (ARPA) funds from the state of Missouri ($6 million), city of Columbia ($3.133 million), and Boone County Commission ($350,000). Each of these entities has appropriated funding. Neighborhood Assistance Program tax credits, foundation grants, and donations from businesses and individuals have also added to the total.

Stansberry hopes another $3 million will come from some of the $4.7 million grant proposals VAC has submitted and from ongoing donations and three-year pledges made through the Opportunity Campus website. VAC’s goal is to accumulate a $2 million endowment for the facility, the interest of which can be tapped in the event of a lean year of operations.

Given an annual operating budget of $1.2 to $1.5 million for the Opportunity Campus, some question this major investment in the homeless population.

“We are already paying for it with the burden on law enforcement, the judicial system, and unreimbursed medical expenses,” Stansberry said in response to such doubts. “ ese are cycles we believe we can interrupt.”

While some Columbians fear the campus will attract more homeless people to the area, Stansberry said research tells another story.

“National studies have shown that 70 percent or more of the homeless population is homeless in the community in which they became homeless,” he said. “It is reasonable to say that this is a population with limited resources. In other words, they typically do not own vehicles to drive to the newest homeless center, nor can they a ord the cost of transportation.”

Step One of Making Home Ha en

e goal of the Opportunity Campus is to “make home happen” for an estimated 10,000 people every year and to expand if the need grows. But it’s only the rst step. Naturally, the end of someone’s homelessness is having a home. Whether that’s an a ordable rental or home ownership, people will have that door for opportunity to come knocking.

“Homeless shelters are not a solution to homelessness,” Trapp said. “ ey are a stopgap to lessen the damage done by homelessness.” In Trapp’s view, solving the homelessness problem requires increasing the supply of available housing, especially on the a ordable end of the spectrum.

“While getting individuals o the street and into shelter where services can be provided is a step in the right direction, without an adequate housing supply, we are still facing a continued rise in homelessness,” Trapp said. “Increasing services does not increase homelessness. Rather, services are expanding to meet the growing need.”

The emergency shelter now under construction at the Opportunity Campus on Business Loop I-70 East will participate in the Campus Companions program, which will help keep pets with homeless individuals staying at and receiving services at the facility.

To make that program a reality, the national nonpro t RedRover has awarded a $60,000 Safe Housing grant to the Voluntary Action Center, which is spearheading construction of the Opportunity Campus project and will take charge of its subsequent operation. A news release from RedRover said the Opportunity Campus expects to serve an estimated seventy- ve animals annually.

is funding will enable VAC to:

• Build a 547-square-foot kennel at the shelter to include two rooms with space for pet housing, bathing, and basic medical care

• Furnish the kennel with the appropriate and needed equipment, furniture, and startup supplies

• Provide pet enrichment supplies

• Financially support veterinary care for pets residing at the shelter

Ed Stansberry, VAC executive director, expressed gratitude for the RedRover grant, adding that the Campus Companions program “will greatly bene t from RedRover’s shared knowledge and expertise on kennel best practices.”

Katie Campbell, president and CEO of RedRover, explained, “Pets can be the lifeline for people who are su ering from hardship. Keeping people and their pets under the safety of a shelter can bring hope and relief when not much else can.”

VAC will partner with the University of Missouri College of Veterinary Medicine to implement the Campus Companions program and provide needed veterinary care. e partnership will bene t each organization, as well as the animals in their care, Campbell said.

Dr. Carolyn Henry, professor and director of CVM’s Research Center for Human-Animal Interaction, echoed that conclusion. “At the Mizzou College of Veterinary Medicine, we understand the power of the human-animal bond,” she said, adding that the partnership will give Mizzou veterinary students “real-world experience, meeting people where they are and providing compassionate veterinary care to their pets.”

“By helping people and pets remain safely together, we can preserve that vital connection while strengthening the health and well-being of our community," Henry noted. And there’s evidence that protecting such connections can enable the unhoused to access the services they need. One study found that 93 percent of men and 96 percent of women said that they would not stay at a homeless shelter if pets were not allowed.

e National Coalition for the Homeless estimates that has many as 3.5 million people experience homelessness each year, and up to 25 percent of them have pets. RedRover’s website and mission statement noted that non-pet-friendly shelters may force people to choose between their pets and supportive services.

Founded in 1987, the Sacramento, California-based RedRover focuses on bringing animals out of crisis and strengthening the human-animal bond through emergency sheltering, disaster relief services, nancial assistance, and education. Since 2012, RedRover has awarded 255 grants to shelters in forty-eight states, totaling more than $6 million. In addition, its Safe Housing grants have created the rst petfriendly domestic violence shelters in ten states.

The Tuning SPOT offers affordable alternative to auto repair.

STORY AND PHOTOS

BY BRANDON KNIGHT

Among car enthusiasts in Columbia, it’s common to hear e Tuning SPOT as a recommended automotive shop. e main reason is that it’s

uniquely a do-it-yourself shop. It enables customers to work on their vehicles with tools and equipment the shop provides. Today, not many DIY car repair shops exist in Missouri. While some have been successful, others have started and perished. However, e Tuning SPOT has now been a part of Columbia’s automotive scene for nearly fourteen years.

e shop was the brainchild of Stuart Cunningham, who launched the business in December 2011. Cunningham

had long been interested in working on cars, but not for a dealership or traditional service station. at led him to start his own shop with a new mission: empowering people to maintain their own vehicles.

“My friends would just be frustrated about how limiting it is to try and do it yourself, like in your own garage, you know, on jackstands or what have you, and I said ‘ ere's gotta be a better way,’” Cunningham said. “It didn't occur to me that they didn't really exist.”

At the time, customers were limited to taking their cars to traditional auto repair shops or a dealership for repairs. Cunningham was looking to ll the gap between the driveway and expensive dealership prices. He hoped he could save his customers money while giving them back some freedom.

e shop originally opened on Burlington Street, but Cunningham quickly outgrew that location and moved the business to 1305 Olympic Boulevard.

e 2,000-square-foot shop allowed for more lifts, which meant more space for customers to work on their vehicles.

“When he moved to this location, he re ned what worked. I just continued that vision, helping people work on their own cars with the right tools and guidance,” said James McNamer, the shop’s current owner.

McNamer was a Tuning SPOT customer before he heard the business was for sale. Once he was able to a ord it, he seized the opportunity to buy it. Now, McNamer and Cunningham have become friends.

“I de nitely got a good man out of it, and I'm super happy that he's the one that took it over because when you start something like that from scratch, it's kind of your baby,” Cunningham said.

“Even though I would sell it and was ready to move on, I wanted to make sure it was gonna go to someone who

was gonna treat my customers well and run it properly.”