VINFAST’S EARLY RIDE NOT ALWAYS SMOOTH

GROWING WITH HAPPY DIRT | BLUM BUILDS ON ITS 100-YEAR REPUTATION | HEALTHIER PANCAKES

VINFAST’S EARLY RIDE NOT ALWAYS SMOOTH

GROWING WITH HAPPY DIRT | BLUM BUILDS ON ITS 100-YEAR REPUTATION | HEALTHIER PANCAKES

Our annual Building N.C. feature spotlights new structures shaping the state, including Western Carolina University residence halls.

Global TransPark fulfilling promise of becoming aviation and aeronautics hub.

8

CEO Joseph Budd tells how he keeps employees engaged while they perform in a tough job.

10 ENERGIZERS

Store sells not only coffee but offers differently abled workers dignity.

BNC’s annual CEO Summit honored leaders of thriving Tar Heel businesses; Making pancakes healthier is company’s recipe for success; Will park changes leave city’s history behind; High Point’s efforts to remain vibrant year-round; The year’s coolest products made in North Carolina.

88 GREEN SHOOTS

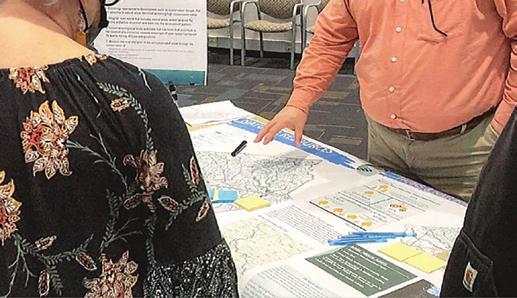

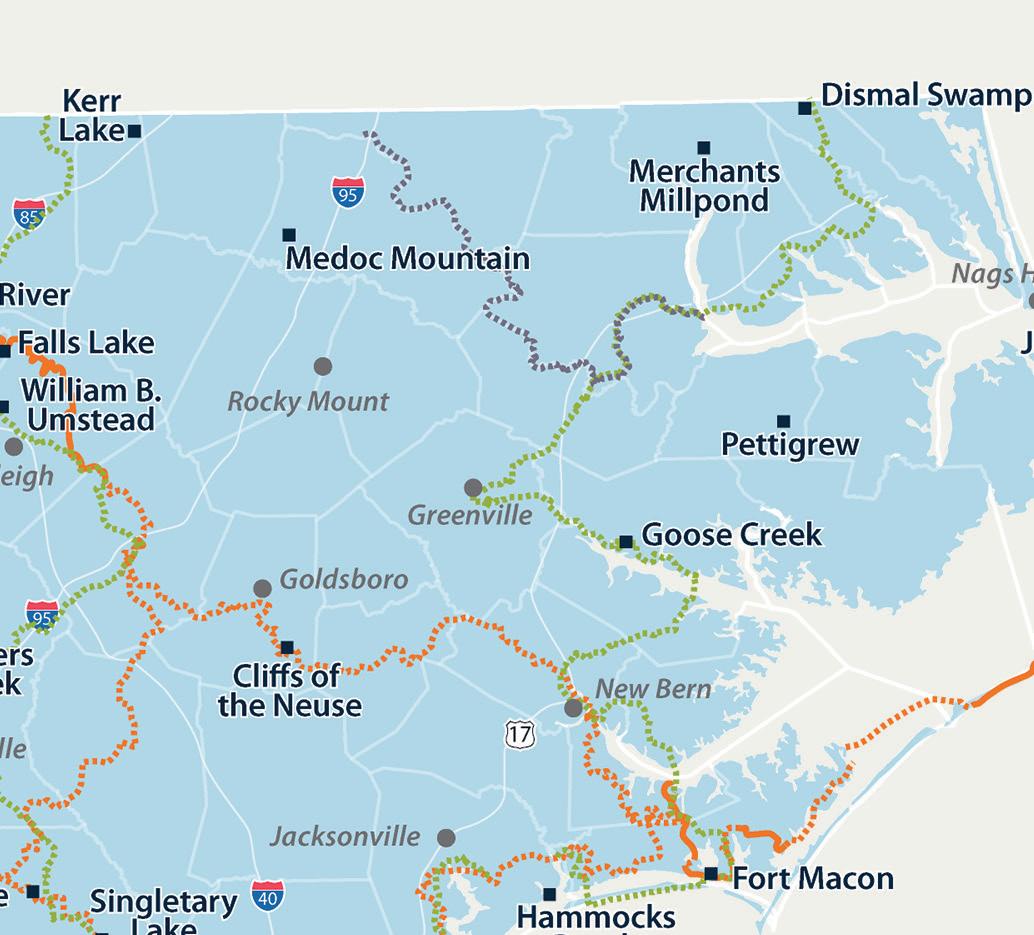

State lawmakers put $54.9 million into building trails in mostly rural communities.

30 MID-MARKET

A diverse array of firms top the rankings of the state’s fastestgrowing mid-size enterprises.

64 ROUND TABLE: EMPLOYMENT

Remote work, labor shortages and employee safety are just a few of the challenges businesses are facing since the pandemic.

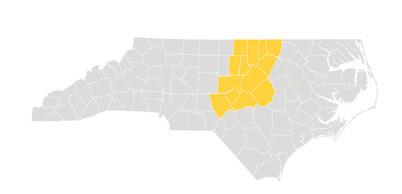

76 COMMUNITY CLOSE UP: JOHNSTON COUNTY

A diverse economy keeps the state’s 11th largest county growing at a fast pace.

The 10th annual look at the best new and rehabbed structures that opened in the last year.

BY KEVIN ELLIS

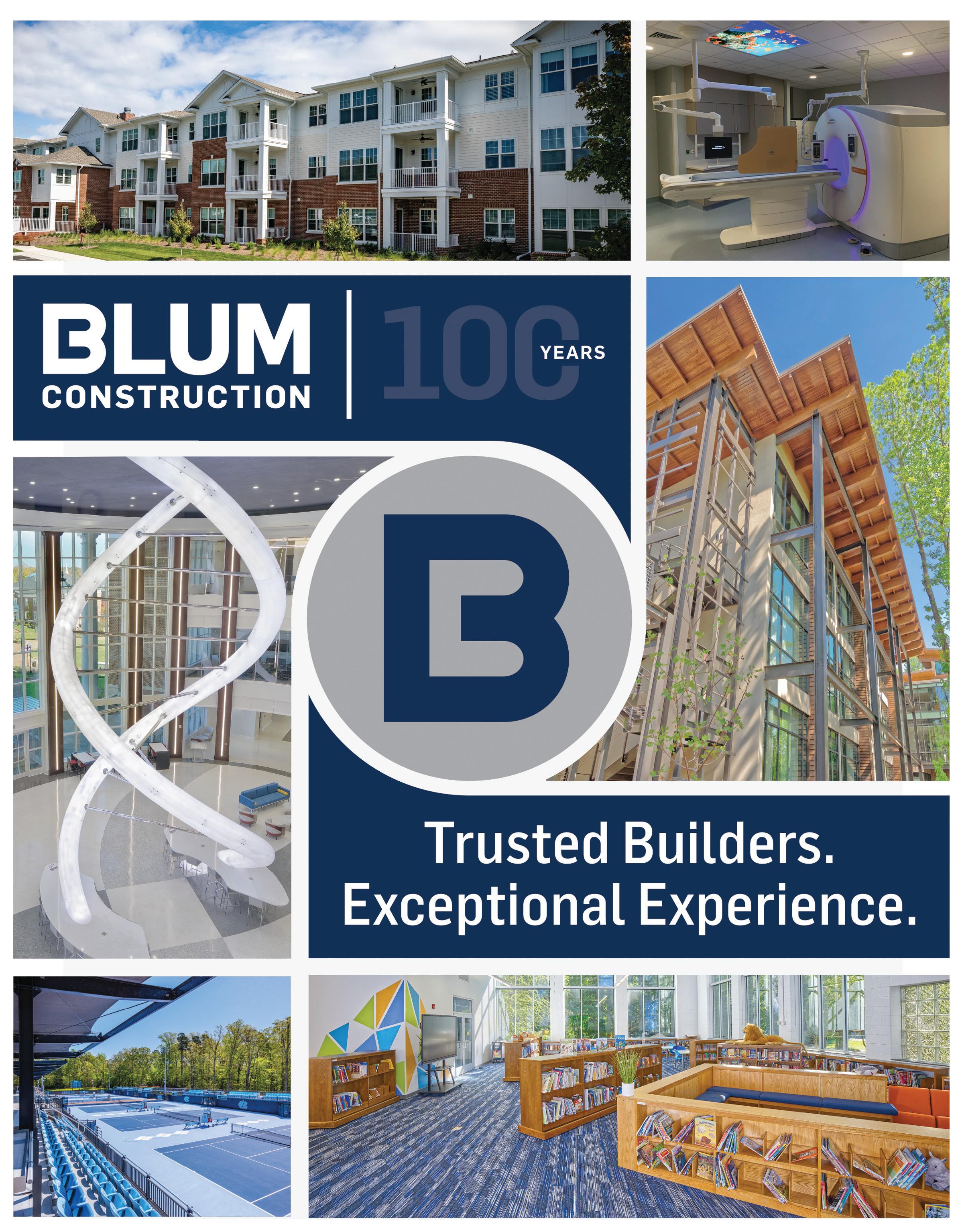

Century-old Winston-Salem contractor builds business on its portfolio of work.

BY TUCKER MITCHELL

VinFast’s path to ride EV market to transform N.C.’s economy not always smooth.

BY MIKE MACMILLAN

Happy Dirt helps organic farmers get their produce to grocers and restaurants.

BY CHRIS ROUSH

The North Carolina Music Hall of Fame 2023 inductions were made last month and Charlotte’s own Fetchin Bones were one of the N.C. music legends honored this year. Back in the ’80s, this band was a force of nature, opening for acts such as R.E.M., the B-52s and the Red Hot Chili Peppers — not that they didn’t have a strong following of their own. I always considered their sound kind of country-punk with a bit of funk. The band, led by vocalist Hope Nicholls, is well-deserving of the recognition.

Reading about this reminded me of a time when I was in high school in 1987, when Fetchin Bones was in its heyday. My high school buddy had an incredible cherry-red 1962 Buick Electra 225. We drove that thing everywhere — in fact, we took our dates to our prom in it. As I recall, when it broke down for the umpteenth time, he didn’t have the bread to pay for repairs, so he had to put it up for sale. The first takers were the band. My friend was (and still is) a music connoisseur, and was well aware of Fetchin Bones’ notoriety. Having them as the buyer was an added value to the price they paid for the car. They painted it purple, and rumor had it the car became their touring vehicle for some time. Every time we cranked up their hit “Stray” at a bonfire at the end of a cul-de-sac in a soon-to-be developed neighborhood on a Friday night, we told the story to anyone who would listen. Good times.

Contact Ben Kinney at bkinney@businessnc.com.

PUBLISHER Ben Kinney bkinney@businessnc.com

EDITOR David Mildenberg dmildenberg@businessnc.com

MANAGING EDITOR Kevin Ellis kellis@businessnc.com

EXECUTIVE EDITOR, DIGITAL Chris Roush croush@businessnc.com

ASSOCIATE EDITORS

Ray Gronberg rgronberg@businessnc.com

Cathy Martin cmartin@businessnc.com

SENIOR CONTRIBUTING EDITOR Edward Martin emartin@businessnc.com

SPECIAL PROJECTS EDITOR Katherine Snow Smith

CONTRIBUTING WRITERS

Dan Barkin, Uma Bhat, Audrey Knaack, Mike MacMillan, Tucker Mitchell

CREATIVE DIRECTOR Peggy Knaack pknaack@businessnc.com

GRAPHIC DESIGNER Cathy Swaney cswaney@businessnc.com

MARKETING COORDINATOR Jennifer Ware jware@businessnc.com

ADVERTISING SALES

ACCOUNT DIRECTOR

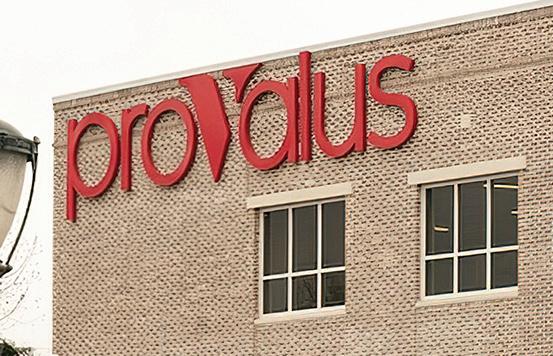

Melanie Weaver Lynch, eastern N.C. 919-855-9380 mweaver@businessnc.com

ACCOUNT MANAGER AND AUDIENCE DEVELOPMENT SPECIALIST Scott Leonard, western N.C. 704-996-6426 sleonard@businessnc.com

CIRCULATION: 818-286-3106

EDITORIAL: 704-523-6987

REPRINTS: circulation@businessnc.com

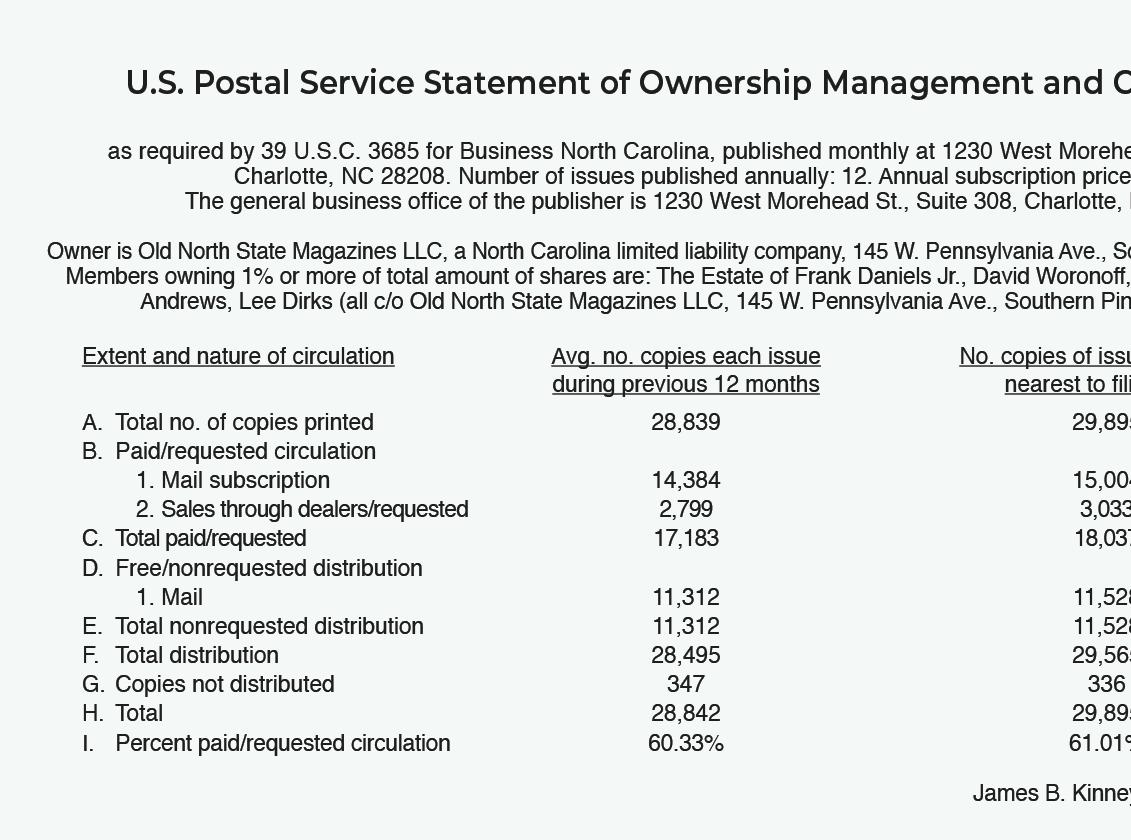

OWNERS

Jack Andrews, Frank Daniels III, Lee Dirks, David Woronoff, in memoriam Frank Daniels Jr.

PUBLISHED BY Old North State Magazines LLC

PRESIDENT David Woronoff BUSINESSNC.COM

Hopes to fulfill the Global TransPark’s promise are looking brighter.

When I came to North Carolina in the mid-1990s, the Global TransPark in Lenoir County was an experiment. e thinking was that manufacturing companies would come to the old Kinston airport and product would be own out. at happened somewhat.

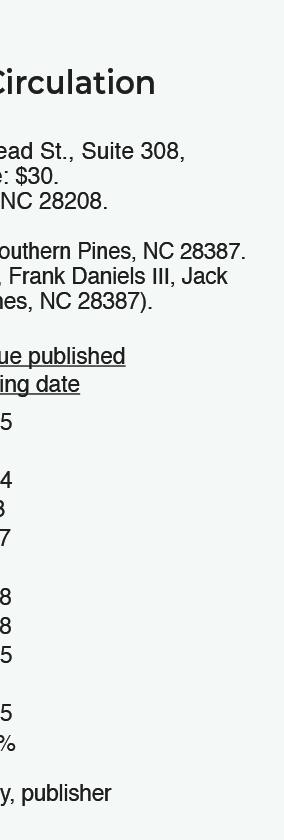

But a bunch of other things have happened. Steadily, the TransPark has become an aviation and aeronautics hub. e pieces are falling into place to make it what it was supposed to be, an engine of economic growth for rural eastern North Carolina.

At one end of the runway, Spirit AeroSystems is manufacturing components for Airbus. At another end, a military contractor, Draken, ies exercises against Air Force and Marine pilots. Another area is dominated by yExclusive, a large charter-jet company. e Navy is overhauling helicopters, and much more work could be coming. Lenoir Community College, which already has a building at the site, is getting ready to build a $25 million aviation training facility.

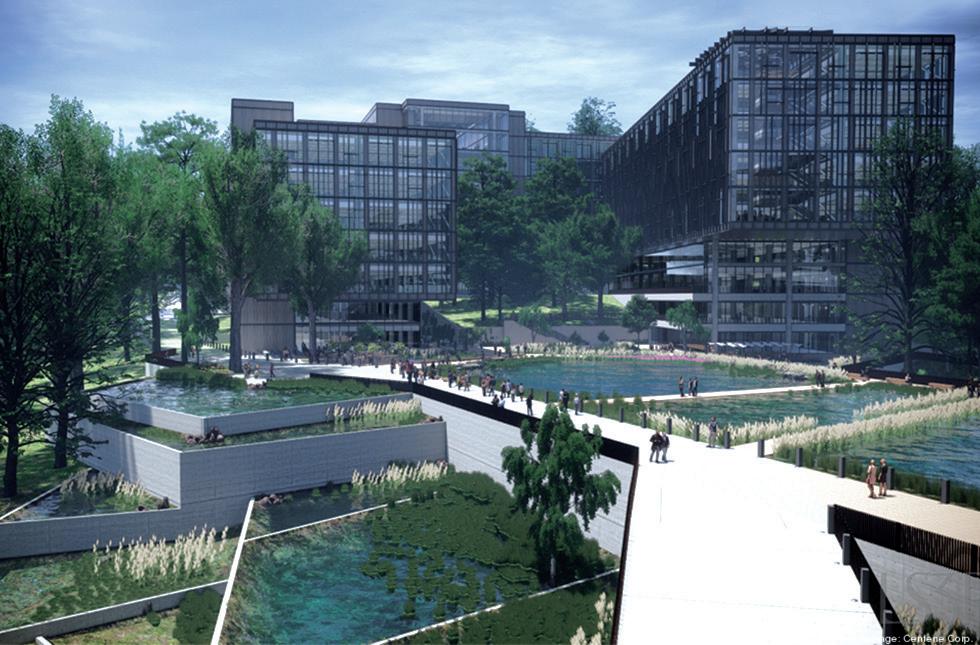

Many N.C. economic development sites aren’t much more than vacant land. at isn’t the TransPark, which is part of the N.C. Department of Transportation. It has one of the longest runways on the East Coast. It has utilities and roads. It has workforce training in place, growing tenants and solid leadership. And it has a plan for a big chunk — around 500 of its 2,500 acres — on the mostly undeveloped north side of its 11,500-foot runway. at plan got my attention.

Mark Pope is the president of the N.C. Global TransPark Economic Development Region. He leads the team for the TransPark as well as surrounding Lenoir, Wayne and Greene counties. Some of the hard work in economic development is marketing, but a lot is having readyto-build-on, fully permitted sites to show CEOs. It is also about identifying gaps or problems.

e TransPark had done a good job of lling up the south side of the runway, with yExclusive, Spirit and the community college. e opportunity is in the mostly undeveloped north side. Pope needed a

plan for that area, particularly an objective assessment to show national consultants and N.C. o cials.

GTP got a grant from Duke Energy to hire a South Carolina rm, Global Location Strategies, to perform a site assessment. Duke is a leading player in the state’s economic development ecosystem. e study was conducted last summer. “When they came in, we gave them a little shock and awe,” says Pope. “I talked to them for about 45 minutes. Here’s where we’re coming from, here’s where we are and here’s where we want to go. And you can see what they put together. I think it is spot on.”

GLS observed that overall, the TransPark has some signi cant advantages: A er due diligence studies were completed, “no environmental conditions have been identi ed.” ere’s a strong existing utility capacity for “certain types of projects” and the TransPark understands what improvements are needed for larger projects. And there’s access to a skilled, specialized manufacturing workforce.

But GLS also pointed out some fairly obvious needs. e 500-acre site needs better road access that would link up with existing roads on the perimeter of the TransPark. A gas line extension and some water and wastewater improvements could also be needed. None of this was surprising.

Neither was the GLS observation about a problem that the TransPark has little control over — the future Interstate 42.

It is better known as U.S. 70, and it runs through the stoplights of Kinston, a few miles from the TransPark, on its way from Raleigh to the port in Morehead City. Slowly, the state has been working on road improvements intended to turn the highway into an interstate, including bypasses around Clayton and Goldsboro. Major work is being done in New Bern and Havelock.

It is a big deal when a highway like U.S. 70 becomes an interstate. A lot of companies looking to open new plants only want to look at sites with interstate access.

e $700 million Kinston bypass is one of the last big projects needed for U.S. 70 to become a full- edged interstate corridor in eastern North Carolina. But it isn’t scheduled for construction yet.

e GLS study noted this. “While the site is near the future I-42, it is currently not within proximity of an interstate and the timeline for completion of the interstate access is unknown. e proximity to interstate access may be a deterrent and/or perceived as a weakness by some investment projects that rely on large truck volumes for transporting inbound raw materials and outbound nished product.

Sometimes, road projects like the Kinston Bypass can get on a faster track with a few breaks. at is where the Navy comes in.

e Navy’s Fleet Readiness Center East is in Havelock at Marine Corps Air Station Cherry Point, about an hour down U.S. 70 from the TransPark. Around 4,000 artisans and engineers overhaul military jets and helicopters at FRC East. It is one of the largest industrial operations in the state. It is also tight on space with the new F-35 next-generation jets arriving.

Two years ago, FRC East moved repairs for the UH-1 helicopter to the TransPark, into a renovated 20-year-old building. e success of that move led to more conversations.

FRC East was also looking to bring in work on the military’s large C-130 planes from a depot in Utah, and looked again to GTP for the space.

Now it looks like that will happen. e state budget includes $350 million to build hangars for the project at GTP and lease them to the Navy as a way to recover the investment. C-130s could arrive in 2026. is would be on GTP acreage near the 500 acres that GLS studied. “ ere’s 600 acres just on that side of the air eld,” says Pope. e C-130 project is “not included in the 500 acres. at’s additional, probably another hundred acres over there, C-130s, where that can be located.” is may lead to hundreds of additional skilled artisan and engineering jobs at the TransPark. For Lenoir Community College

advanced manufacturing and aeronautics students, it would provide another career destination, in addition to the sprawling yExclusive maintenance and repair facilities, Spirit and Draken. It would make the TransPark an increasingly attractive location for suppliers. Pope has plenty of acreage for them, too, on both sides of the runway.

In September, Pope and I rode around the TransPark in a pickup truck driven by Rick Barkes, the airport director. It was drizzling and gusty. We started at the old passenger terminal, where the TransPark has its o ces and could become a small business incubator.

As we drove along Taxiway Alpha next to the runway, Barkes was in constant contact with the FAA folks in the tower, letting them know what he was up to. e runway is busy, with Draken and yExclusive jets, and FedEx planes taking o a er maintenance at Mountain Air Cargo. It isn’t uncommon for a huge Antonov cargo plane to arrive to pick up Spirit components destined for an Airbus assembly plant in France.

“ ey’ve been here a couple hundred times over the last three or four years,” says Barkes. “ e cockpit is six stories o the ground.”

We stopped at Draken, in the North Cargo building that was extensively remodeled into a facility suitable for aircra maintenance and repair. Parked outside were A-4s and French Mirages. e nearly two dozen jets are own by retired military ghter pilots against pilots at Seymour Johnson Air Force Base in Goldsboro, MCAS Cherry Point, Shaw Air Force Base in South Carolina and Langley Air Force Base in Virginia. Draken technicians bring aging jets back to life.

Scott Hauber, the lead production supervisor, pointed to a disassembled A-4. “We bought that from a museum in New Zealand. Here’s the back half and here’s the front. e wings are in that crate right there.”

We drove back to the south side of the runway, to the fuel farm construction site, where new tanks will hold 500,000 gallons. e new farm will be able to handle military fueling. Given the TransPark’s mid-East Coast location, its runway and FAA tower make it a convenient place to refuel.

We nished the tour at the community college’s Aerospace and Advanced Manufacturing Center, lled with computer-integrated machines, robot arms, 3-D printers and high tech labs. e new Aviation Center of Excellence should be completed by 2026. Of all the elements at GTP that create a good economic development story to tell, workforce training has the most potential. It also got $30 million from the new state budget for a pilot training center and yExclusive’s headquarters.

For now, Pope faces the challenge of getting the word out. He has sent the GLS report to site consultants nationally, the Economic Development Partnership of North Carolina and the N.C. Department of Commerce. He is talking up the Kinston Bypass and Interstate 42 whenever there’s a forum.

My idea would be to bring as many decision-makers as possible down to Kinston and put them in the front seat of Rick Barkes’ truck, with Pope in the back. Give them the tour. ■

Veteran journalist Dan Barkin went to high school in Newton, Massachusetts, arrived in the South for college in 1971 and moved to North Carolina in 1996. He can be reached at dbarkin53@gmail.com.

Budd Group CEO Joseph Budd joined High Point University President Nido Qubein in the Power List interview, a partnership for discussions with influential leaders. Interview videos are available at www.businessnc.com.

This year marks the 60th anniversary of The Budd Group. Joe Budd leads a familyowned janitorial business in Winston-Salem with 5,000 employees and more than 1,000 clients in 12 states, stretching from Pennsylvania to Georgia. Budd has a bachelor’s degree from High Point University and an MBA from Wake Forest University. An avid pilot, he is board chair of the Corporate Aircraft Association, a trade group promoting general aviation. His company also sponsors Nido Qubein’s show on PBS NC.

This story includes excerpts from Budd’s interview and was edited for clarity.

How did the business start? Was it your dad who started the business?

I’m generation two. My father, Richard Budd, started the company in 1963 after graduating from High Point College back in the day. He started it when I was 1 year old.

What was the business at that time?

In the early 60s, it was selling cleaning supplies and equipment just across North Carolina to schools, colleges, industrial plants, the tobacco industry, hospitals and medical facilities. Now, we do janitorial services, landscaping. We do landscaping maintenance and installation, irrigation. We also do maintenance. And we have a growing business we call “specialty services” which is disinfection, air quality and really anything that our clients want us to do.

I like to say anybody with a large facility. So, industrial, manufacturing, hospitals, schools, colleges, K-12 schools, high-rise office buildings, business parks, homeowners associations, large real estate complexes, corporate campuses.

What is your biggest challenge?

Labor. It’s also our biggest opportunity. We have about 5,000 employees and we are very front-line focused. We have more turnover than a lot of businesses but we have turnover of about 50%, which is about half of our industry standard of 100%.

I don’t know how you sleep well at night?

It’s a big challenge but we really work on our culture. We work on making The Budd Group a great place to work for people who like to serve. We have mobile vans that are wrapped in our logo, and they go out after hours. They go to churches, community events, baseball games, set up the mobile vans and we do recruiting. We are recruiting almost 24/7.

You pay more than minimum wage, right?

We haven’t paid minimum wage in probably 20 years. Our starting pay is about twice minimum wage in most places.

It’s got to be very expensive to constantly be in a cycle of replacing current employees?

Every team call that we have starts with a safety moment, and then we talk about retention. We have every leader in our company engaged in how do we retain great employees. We have an app, the Bee Hive, that everybody who has a smartphone can come into contact with me and any leader in our company, and access to safety and training data and anything they want.

Do they call to say, “I love you,” or, “You’ve got to pay me more, dude!”?

I get very few messages about paying me more. What they want is recognition. They want to be a part of a team, and so when they put a picture on the Bee Hive about a front lawn that has been striped and really looks nice, they can put before and after pictures. The power of a “like’’ on our internal social media from me and my leadership team goes a long way to increasing retention

What percent of your overall expenses is related to payroll?

Approximately 80%.

Why has employee turnover become so prevalent?

That’s a really good question. We study our demographics. We have a lot of data in our human capital management system. I think people are transient. Fortunately for North Carolina, we see a lot of people moving in, which has been really great for our economy. And there’s been a little bit of “unsettledness,” whether you work in a facility or work at home and the hybrid models are still being tested.

Do you have to teach your employees what you want them to do?

I have seen over the course of my career that the front-line employees in landscaping, janitorial maintenance are becoming more skilled. The equipment is becoming more technical. They require more training and the burden of that training is on us as the employer. Our clients like Toyota or a medical facility want us to be safe and they want us to be efficient and know our craft at a high level. We can’t just take an employee and put them in there without training. So, we have a large training department that does on-the-job training.

Has your growth been mostly organic or M&A?

The first 20 years were organic. The next 20 had a lot of acquisitions when we were growing outside of the Triad. The last 20 years have been primarily organic.

Why did you stop M&A?

We were pretty good at selling our services ourselves, and we believed that the business that we can develop on our own stays longer than the business we would buy. We have a very high client retention rate and we believe that we can only grow as fast as our leadership, and we like to develop our leaders from within.

What is happening in terms of government regulation affecting your business?

The biggest thing that the government could do for our industry is fix immigration. We need legal immigration. And if our government would tackle that issue in a bipartisan way, and even just go after the low-hanging fruit, it would be a game changer for our economy. It would help control inflation, and it would create opportunities for a lot of people in our country.

What would you say about this to your brother, U.S. Sen. Ted Budd?

What I would say to Ted is, fix DACA, that’s the dreamers. We have a lot of wonderful young people that were brought into this country. That’s a layup. Fix that. And then, also, look at what President Reagan did in the mid-80s. He granted immunity to a lot of the immigrants that were here in our country, and he did it in a way that was a win/win for our country. We need to find a bipartisan way to fix immigration.

Also, our K-12 education system has issues. When you look at the third-grade reading and math scores, that is a real problem in our country. We have to fix reading and math because if you don’t get it by the third grade, it’s really hard to catch up.

Does Ted agree with you?

I think Ted sees these issues. There’s a lot to do.

Let’s go back to your business. Where are your efficiencies of scale?

We do it with training, leadership, equipment and supplies. When my father started this business, we were cleaning at a rate of about 2,000 feet an hour. Today, we clean at rates approaching 8,000 feet an hour. Most facilities are non-smoking today and so that speeds things up. Robotics speeds things up. The way buildings are designed also helps.

What is the hardest building to keep up?

A middle school restroom is probably the hardest to clean.

What about in industry?

Industrial facilities where you have forklifts moving back and forth. You have to be very careful in those. And sites where there’s a lot of dust. That can be carbon in the air. You have to have to be really careful in industrial facilities.

I understand you are a pilot with 9,000 hours, and you fly to visit your facilities.

It’s been a great business tool. It’s quite the time machine. It allows me and our leadership to get to our different offices. Today, we have a plane in Nashville. Tomorrow, there will be one in Indiana and maybe Ohio.

Is business going to be tougher over the next three years?

I think we will have good organic growth. We have a great pipeline of opportunity. The key is to keep your existing business, and so we have to really work hard at that, and continue to focus on our frontline workers, and continue to develop strong leaders. It’s been a great recipe for success.

What is your biggest worry today?

It is probably continuing to recruit, train and retain. And then I worry about the polarization of our politics. It’s unfortunate. There’s a lot we can do together.

I have a great belief in the notion that somebody can come up with an idea, work very hard, take appropriate risks and realign as necessary, deal with various economic conditions, and yet have the grit and the faith and the courage and the tenacity to continue to do that. You and your family have exemplified that to a very high level of excellence. Thank you. ■

By Uma Bhat

Lindsay Wrege didn’t even drink coffee when she opened a coffee shop with fellow N.C. State University student Michael Evans her freshman year in 2017.

Technically, the “shop” was a folding table they’d rented from the student union. The coffee — which was “sold” to students for free — was brewed in a coffee maker bought from Target.

But it was a start, and coffee was a viable product for Wrege’s ultimate vision: a store that employed individuals with disabilities.

Growing up, many of Wrege’s closest friends at Green Hope Elementary in Cary had disabilities. By the time Wrege was inching toward high school graduation, she began to see a difference in her life trajectory and her friends.

“I got to think about college, and I got to tour N.C. State and I got to think about studying abroad, and do you want a summer internship and all of these next potential steps,” Wrege, 24, says. “But for my friends that had disabilities, that was not their reality.”

One of her friends with a disability had a job in high school. When Wrege offered her kudos, the friend’s response proved memorable: “Thanks, but all they let me do is clean bathrooms.”

The comment showed Wrege that “not only is it really hard for people with disabilities to get jobs, but the jobs that they were sometimes getting weren’t meaningful.”

That was an impetus for what became 321 Coffee, which now

has four Triangle locations and more than 60 employees, most of whom have disabilities. The name represents the third copy of the 21st chromosome of individuals with Down syndrome.

Wrege began studying at N.C. State as a pre-med student. But as the folding table pop-up shop began building traction with the help of Wolfpack alumni, professors and fellowship programs, she began to envision a different future.

“I want to turn this into something, and I want this to be where I really focus my time and attention,” she recalls thinking.

Now, 321 has two more locations on the way — and a 321 storefront that will open on N.C. State’s Centennial Campus early next year marks a full circle for Wrege, Evans and the brand. 321 also has business-to-business partnerships, including a café at Pendo’s Raleigh office.

“I’m just so impressed by how many steps our team has taken and how we have navigated growth,” Wrege says. “We’re still not yet at the scale of Starbucks or Port City Java, but we’re not in the dorm rooms anymore.”

The company started as a nonprofit but re-launched as a for-profit company in 2021, raising $350,000 from friends and family.

Wrege wants 321 to succeed not just as a business, but by showing off the capabilities of employees with disabilities. In 2022, the unemployment rate for persons with a disability was about twice as high as the rate for persons without a disability nationally,

according to the Bureau of Labor Statistics, and the employment rate for individuals with a disability that year was 21%, versus 19% in 2021.

Coffee is central to 321’s mission because the industry is based around community and conversation. “You never know who’s going to walk in that is a hiring manager at another food or beverage concept or retail space or really any industry,” Wrege says. “I want people to understand why it matters that we employ people with disabilities.”

She also wants people to understand the importance of supply chains and strong ethics, too, and why a cup of coffee might be priced at $3, $4 or even $5.

“Yes, you can get a cup of coffee that’s $1 or $2 some places,” Wrege says. “There’s reasons for [321 Coffee products] being more expensive — part of it is quality, but another part of it is making sure that people throughout your supply chain are paid a strong and fair livable wage.”

Recruiting, training and performance evaluation at 321 also emphasize accessibility, Wrege says. The team has designed job applications to make sure no one feels ineligible for a certain role.

“A lot of times job descriptions ask for a certain number of years of industry experience,” she says. “Is that really necessary? For us, it’s not — I want someone who wants to learn and wants to grow.”

321 Coffee asks applicants about their preferred method of communication, which recognizes that traditional verbal interviews may not work for everyone.

The team also knows that not all employees learn the same way. They created training videos on how to brew espresso, for example, which enables employees to learn at home without distractions. “We want to set our people up to be successful,” Wrege says.

Other businesses can become more mission-driven, she says, by

considering team representation, embracing supplier diversity and making decisions that impact social good.

“Individuals want to be part of a team that matters, and they want to work for a company that isn’t just out here to print money,” Wrege says. “So I think it’s time now for companies — if they want to have top talent — to do right by their people and also show that they are taking care of the world.”

That’s something consumers also look for when choosing where to spend their money, says Ken Bernhardt, who taught marketing at Georgia State University for more than 20 years. The internet and social media have made it easier for consumers to understand how businesses treat their employees, communities and the environment. That’s particularly true for younger consumers who are “forming their buying loyalties” and “taking this kind of information into account,” says Bernhardt.

Wrege has seen that at 321. “So much of our growth and success is credited to the fact that we are mission-driven because it resonates with people, and it brings people together and it makes people want to help.” ■

A gathering of top state executives enabled sharing of wisdom and some tributes.

By David Mildenberg

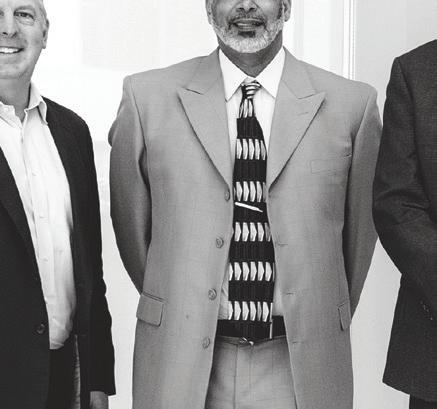

Business North Carolina’s annual CEO Summit in October honored three leaders of thriving Tar Heel businesses, while providing an informal forum for top executives to share insights with their peers.

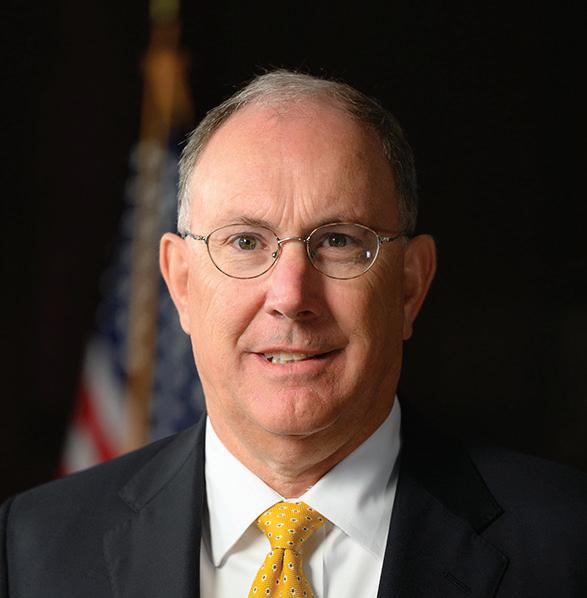

In the Enterprise Division, Frank Holding Jr. was named CEO of the Year for his leadership at First Citizens Bancshares. Over the past two years, the Raleigh-based bank has nearly quadrupled in size through the acquisition of CIT Group and the assets and liabilities of the failed Silicon Valley Bank. The deals have helped send First Citizens’ shares soaring during a difficult year for most U.S. banks.

Holding is a third-generation leader of the largest U.S. familyowned U.S. bank. He’s been CEO since 2008 and is a trustee and former chair of Blue Cross Blue Shield of North Carolina.

In the Middle Market Division, Paul Evans of Durham-based Velocity Clinical Research was named CEO of Year. Since leaving

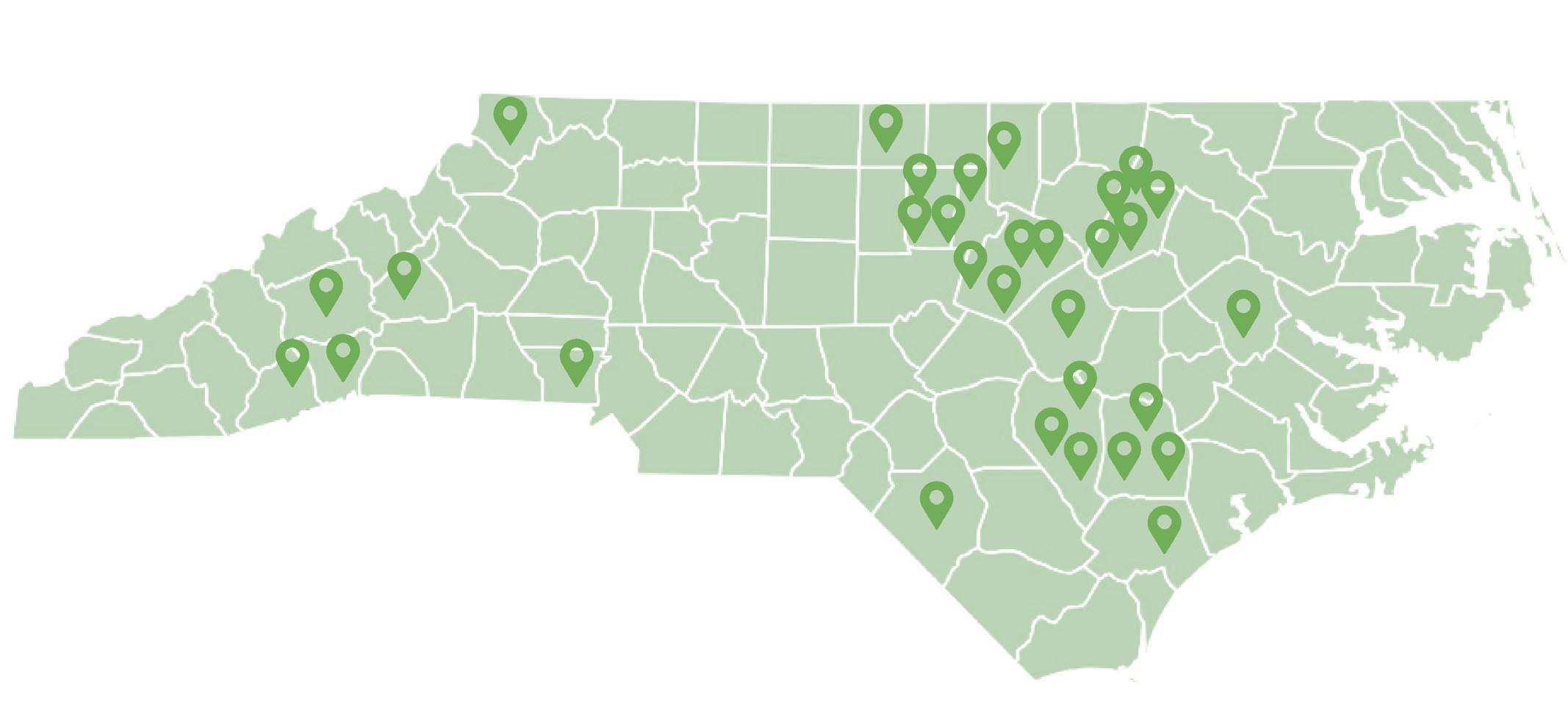

industry giant Parexel’s London office in 2018 to move to North Carolina, Evans has led dramatic growth at the clinical trials company, which works with pharma and biotech companies to research new drugs and devices. Velocity ranked No. 543 on the Inc. 5000 list of fastest-growing U.S. private companies. About 60 of the company’s 1,700 employees work in the Triangle.

In the Growth Division, judges selected Scott Hoots, the CEO of Charlotte-based QC Kinetix, which is among the nation’s fastest-growing franchise businesses. The company’s 170-plus offices serve people suffering pain by offering alternatives to surgery and medications. A family tragedy during his college days prompted him to start delivering pizzas at Domino’s; he became a regional vice president overseeing 1,500 franchise stores, and later worked for other franchising systems. He joined QC Kinetix in 2020 and has led rapid growth.

During panel discussions, executives shared strategies that had helped propel success. Eric Hobbs, the CEO of Raleigh-based

Technology Associates, explained how he shifted the company’s compensation philosophy in the past few years, implementing profit sharing and a flexible pay structure. The move has reduced turnover and boosted recruiting, he says.

At Raleigh-based Bobbitt Construction, CEO Brian Denisar described how the company has held “signing days” for its interns and new hires. Each is given a jersey from their university, with the pictures posted on social media. The program has raised Bobbitt’s profile among college students interested in construction careers.

Other CEOs who discussed their trials and successes included Charlotte developer David Ravin of Northwood Ravin; Brian DuMont of Raleigh-based YardNique, one of the fastest-growing U.S. landscape services companies; and Van Isley, who built Raleigh-based Professional Builders Supply into a $700 million business before its sale to U.S. LBM in 2021.

The conference also included comments from Jonathan Kozy, a senior macro strategy analyst at Bank of America, who predicted that current interest rate levels may last longer than expected, partly because of a continued strong labor market. Most executives with whom Kozy has conversed say their biggest issue is not finding workers for jobs, “It’s finding good workers who want to show up and work.”

The conference at Pinehurst Resort was sponsored by Bank of America, Brooks Pierce, Catapult Employers Association, FlyExclusive, Rocky Mount Event Center and Ward and Smith. ■

Blanket aims to make eating pancakes a healthier choice.

By Chris Roush

When Marquita Carter was pregnant in 2012 with her second son, Isaiah, she had health complications that caused her to change her diet. She and her husband, Deven, started looking at ingredients in the food they were consuming. “Everything we were choosing was just for taste,” she says. “We didn’t see the things we could eat” on the labels.

So the couple began making their own food, starting with syrup that didn’t have high-fructose corn syrup or sugar. Pancake batter came next, and they started sharing their concoctions with family members and selling products at Charlotte-area farmers markets in 2017. Customers gobbled them up.

Now, the Carters’ Blanket brand pancake mixes and syrups are for sale in 2,000 stores, including Walmart and Food Lion. Their Charlotte business, Home Food LLC, also makes private-label products for other retailers. Revenue has reached seven figures, and the Carters say the business is profitable.

They’re evaluating additional pancake flavors, as well as a line of protein-based and gluten-free foods. “We want Blanket to be a household name,” Deven says.

Getting their product onto grocery shelves wasn’t easy. Deven worked full time at insurer Allstate while earning an MBA at Wake Forest University. He attended classes on Saturdays while Marquita set up displays at The Market at 7th Street in Charlotte. “It was a scary time,” says Marquita, a former special education teacher. “We didn’t know a lot about the pancake and syrup industry. We just wanted to make good products.”

The couple also had trouble convincing lenders to fund their business. They cashed out a 401(k) plan and a pension for about $30,000 to get the operation up and running. “We had the business plan and forecasts, and we’d exceeded expectations,” she says. “But we couldn’t find a line of credit anywhere.”

By late 2019, Blanket was in a half-dozen local stores. Then COVID hit in early 2020, prompting the closing of farmers markets. The Carters converted their dining room into a studio and started

posting online cooking demonstrations on social media, which led to sales through their website. The online presence caught the attention of Salisbury-based Food Lion, which placed Blanket mixes and syrups into 500 stores.

Deven quit his Allstate job in November 2020 to focus on the startup. “It was a bit of a gamble, but it was a calculated risk,” he says. “I felt competent in our abilities to manage our growth.” Deven is chief operating officer and oversees distribution. Marquita is the CEO and leads product development. They both share the taste testing.

The honey butter pancake mix is the top-selling flavor, followed by buttermilk pancakes and vanilla bean syrup. Other pancake

flavors include sweet potato and chocolate chip, and there’s a vegan version. A three-pack of Blanket flavors costs $21.75 on Amazon. com. Others selling pancake mix in resealable packets include General Mills’ Betty Crocker brand; Tukwila, Wash.-based Krusteaz, a family business; and Park City, Utah-based Kodiak, which is owned by a private-equity company.

The Carters say they’re working on a protein pancake, as well as ready-made batter in a cup. “Our pillars are about nutrition and accessibility,” says Deven.

The company’s growth means more staff is needed. They’d like to hire a chief financial officer, a head of distribution and leaders of other departments. They’re also seeking investors, after relying on organic growth since their launch.

“In the next five years, you’re going to see more flavors and a variety of products,” says Deven. “Blanket is just one of our product lines.” ■

Charlotte plots a $10 million tribute to its most famous modern leader, erasing an earlier design.

By Audrey Knaack and David Mildenberg

In a year or two, Charlotte’s famed Trade and Tryon street intersection is likely to sport a tribute to Charlotte banker Hugh McColl Jr., directly across from towers where he worked decades building what became the second-largest U.S. bank.

The park’s design is a work in progress, backed by $10 million from individuals and groups. It’s unclear if it will become a glitzy attraction or a tranquil site. It replaces Thomas Polk Park, which opened in 1991 and was demolished this summer at the City Council’s direction. It featured a large waterfall and a tribute to the Revolutionary War-era man most associated with Charlotte’s founding.

A city press release cited the park as “obsolete, with limited gathering space, poor lighting, outdated landscaping, and a hard-to-maintain fountain.” To a degree, Polk Park’s decline mirrors the center city, which has more homeless people, an office vacancy rate topping 20% and increasing crime fears.

McColl Park is a partial response and in line with how Charlotte prizes the new over the historic. This change is fine with Dan Morrill, the city’s best-known preservationist. “History is about today. I have no problem with them renaming the park,” he says.

The retired UNC Charlotte professor never liked Polk Park’s design, despite his esteem for Polk’s importance. The waterfall was too big for the small parcel, and it was bracketed by walls of two imposing towers, he says. “One of those buildings needed to have an opening so you could walk through the park. It just didn’t work.”

Other historians disagree, contending the park deserved better care and historic designation. Charles Birnbaum, CEO of the Washington, D.C.-based Cultural Landscape Foundation, protested the change to city officials, with no apparent impact. “Polk Park was a rare and important public work in Charlotte by a woman artist. (Bulgarianborn landscape architect Angela Danadjieva). The city did a poor job of maintaining Polk Park,” he says. “Even worse was the absence of an honest public review process.”

There was no such process before the city spent $350,000 to eliminate the park, adds Sarah Hardinger, president of the Mecklenburg Historical Association. Local history buffs had no input before Polk Park was eliminated, and she blames the city for not maintaining the park and allowing homeless people to gather there frequently.

Center City Partners, the downtown booster group that McColl, 88, helped organize decades ago, has been mulling how to honor the banker at the site since 2021.

Michael Smith, who leads the partnership, is raising $10 million for the project. Fundraising “is going extremely well. I can’t say more than that,” says Moira Quinn, the group’s spokesperson.

In September, Smith organized a community meeting to introduce McColl Park’s design team and take initial input. Charlotte native Walter Hood, a landscape architecture professor at the University of California, Berkeley, and civil engineers Bolton & Menk, which bought Charlotte’s ColeJenest & Stone firm in 2021, will oversee the project. Hood’s past projects include a garden at the International African American Museum in Charleston, South Carolina, and the Peter Oliver Gallery Memorial in Winston-Salem.

“We believe that community input is crucial in creating an inspired public space that responds to the aspirations of our residents,” Smith said in a release. The city is losing “an architectural treasure,” Hardinger says. “In my 30 years in Charlotte, I don’t recall them tearing down a public site like this without any public input.”

The committee will make the design decisions on the city-owned site with input from Assistant City Manager Phil Reiger, Quinn says. Members include civic leaders and longtime McColl friends, including former Mayor Harvey Gantt, civic leader Cyndee Patterson and Michael Marsicano, the retired CEO of the Foundation For The Carolinas.

Morrill says it’s smart to honor McColl, who he deems as probably the second-most important figure in Charlotte history behind industrialist D.A. Tompkins, who pioneered the region’s textile industry in the late 19th century. While building the megabank, McColl also led many civic initiatives, including developing Charlotte’s robust center city.

Still, Morrill hopes the new park will include at least a minor tribute to Polk, whose detachment helped protect the Liberty Bell in Philadelphia during the Revolutionary War. ■

A mayor, backed by a family foundation and a university chief, ignites a new design for High Point.

By Tucker Mitchell

When Jay Wagner steps down as mayor of High Point this winter, constituents won’t have to think hard to identify his legacy. He started the ball rolling on his hometown’s brand-new uptown.

As mayor since 2017, Wagner presided over construction of Truist Point, the city’s new multi-use ballpark, and the privately funded Congdon Yards development next door. The city pumped almost $70 million into the area, while the Congdon family and other private investors added more than $65 million to the project, called Catalyst.

They dream of a city center filled with small businesses, restaurants, and an assortment of housing and entertainment options. The goal is to provide a memorable downtown gathering place for the growing city of 112,000.

High Point’s downtown is unique, given now that it is swallowed by 11.5 million square feet of furniture showrooms. Many spaces are palatial and breathtaking, but they aren’t very busy outside of two weeks each fall and spring amid the famed furniture markets that attract an estimated 75,000 visitors annually. The rest of the year, downtown is largely somnambulant.

“[The market] put this city on the map,” says Wagner, 56. “But it never made sense that for 48 weeks of the year, we have to wait for the other four. You can have a great place for the people who live and work here, and you can have the market, too. It can be our Super Bowl. It can be the cherry on top.”

The Catalyst project aims to transform High Point’s future. The city’s leaders are “pulling in the same direction,” Wagner says. That hasn’t been the case, historically.

High Point attorney Aaron Clinard, a former law partner of Wagner who helped keep the downtown revitalization drive alive for decades, says the key deterrent to change downtown was city government. Afraid of upsetting furniture market leaders, or the status quo, City Council wouldn’t support changes to spur alternative developments, he says.

That changed 10 years ago when famed urban planner Andres Duany of Miami whipped up interest with a revitalization plan commissioned by city business leaders. Named “Ignite High Point,” Duany’s typically outrageous plan raised the temperature. A key moment came when the council refused to pass a zoning plan that banned new showrooms in the area north of the historic downtown, which was targeted for the Catalyst effort.

Not passing the measure

“really ticked off the people who had contributed some fairly big bucks to bring in Duany, and who saw the importance of creating some kind of a downtown,” says Clinard. “It became obvious to all, right then, that we had to get a new mayor, a new council.”

They got one, with help from a new political action committee driven by Patrick Chapin, the CEO of Business High Point, the city’s chamber of commerce. The pro-growth High Point Political Alliance raised more than $100,000 for the 2017 city races, and backed the winner in every council race. Their favorite, Wagner, won the mayor’s race by 53 votes over Bruce Davis.

The new council promptly created the new zoning district and started efforts for a baseball stadium. High Point University President Nido Qubein agreed to lead a private campaign to raise dollars for amenities associated with the proposed new downtown, then stunned even his biggest admirers by raising the $32 million goal in three weeks. (Since taking his post in 2005, Qubein has overseen the multibillion expansion of his university, building enrollment from 1,400 to 6,000.)

Some of that money went to the Nido and Mariana Qubein Children’s Museum, which is not part of the Catalyst project. But most went for stadium-related projects. Either way, it accelerated the building momentum.

Then, the Congdons entered the picture. David Congdon, who was then CEO of Old Dominion Freight Line, chaired the chamber’s board at the time. He was also looking for how the new Earl and Kitty Congdon Family Foundation, honoring his parents, could make a splash. When Business High Point landed a $1.5 million grant to create a business incubator, he found a cause.

The incubator needed 10,000 square feet. The Catalyst needed more than a ballpark. The Congdons combined the two projects by buying and refurbishing the old 200,000-square Adams Millis hosiery mill next door to the stadium. The foundation’s investment totals nearly $50 million.

Congdon Yards houses business tenants, meeting space, an art gallery, and a 13,000-square foot coffee shop and public meeting space. The Congdon foundation leases the property to Business High Point for $1 a year. Business High Point holds the leases and uses the rental income to fund the entrepreneur center and building operations. The project had positive cash flow in its second year, says Rachel Collins, who succeeded Chapin as the chamber’s CEO in February.

The Congdons have been active in High Point since the early 1960s, notes Megan Oglesby, David Congdon’s niece and the executive director of the foundation. “Our long-standing philanthropic focus is to invest in education, critical community needs and economic development to support stabilization.”

She’s heading up an investor group that is bringing an MLS Next Pro team to High Point. The Carolina Core FC and High Point Rockers baseball team will share the stadium, which is undergoing a $7 million, city-funded upgrade. Truist Point is expected to host about 200 events next year.

“The stadium was never about going crazy over a baseball team,” Wagner says. “It’s about bringing people to an area. It’s about economic development.”

Among the many faces behind the Catalyst, most point to Wagner as the critical piece. He’s a graduate of UNC Chapel Hill with a law degree from N.C. Central University. He was a banker and teacher before he practiced law.

“You’d never have brought all this together, or kept it moving, with sharp elbows,” says Collins. “I think the mayor has used his elbows the right way. He has an uncanny ability to listen to people and say the right thing at the right time, and really is quite a visionary. And then when dollars are involved you have to be pragmatic, and he is that, too. It’s fair to say the Catalyst wouldn’t be here without him.”

The city of High Point’s spending on the downtown project, including repaying a stadium construction loan, is largely funded through a 490-acre special financing district, created in 2016. Since then, the district’s tax value has increased by 37%, or $250 million, to $934 million.

That growth exceeded an expected $100 million gain in 10 years.

“So, half the time, more than twice the amount,” says Chapin, the former Business High Point leader.

Continued growth seems likely. High Point-based Peters Development has assembled 14 parcels with a tax value of $8.3 million within a few blocks of the stadium, Congdon Yards and the Atrium Health Wake Forest Baptist’s 351-bed High Point Medical Center. Peters CEO Dr. Lenny Peters is founder of Bethany Medical, a chain of physician practices in the Triad.

City leaders say developers from Charlotte and Raleigh have made inquiries in recent months. For now, the city is under contract with Maryland-based Elliot Sidewalk, as the project’s master developer. Elliott developed the Stock & Grain Food Hall, an entertainment/food court just outside of the stadium.

The city’s role will grow, too. The City Council recently authorized the purchase of a nearby building on a 1-acre lot, where it may build a new city hall and a parking deck. That would add several hundred employees and 10,000 monthly visitors to the area.

Wagner expects his successor to help continue the momentum. Among the four mayoral candidates, city council members Victor Jones and Cyril Jefferson are the clear favorites. Both have been solid Catalyst supporters.

“I don’t see a push to undo anything we’re doing,” says Wagner, who announced in October that he will run for Congress. “The momentum is on our side. Now, this isn’t going to happen tomorrow. This kind of thing takes 20 years, maybe more. But you can see now it’s going to happen. I’m looking forward to living to see it.” ■

By Kevin Ellis

he NC Chamber’s annual quest to find the “Coolest Thing Made in North Carolina” concluded with two winners: a product that can make the difference between life or death and another that assists manufacturers of everything from plastic chairs to race car molds.

More than 45,000 votes were tabulated in the annual contest, which drew 130 nominations. The winning companies were Troutman-based C.R. Onsrud, which has about 200 employees; and Burlington’s Fjord, which employs seven.

Fjord’s Static Rope Edge Protectors, also known as STREP, keeps static lines from chafing on sharp edges or abrasive surfaces. Think about first responders working on a rope rescue team, technicians who use rope to access their work or rock climbers.

“STREP products are ‘cool’ in that they protect more than just rope, they keep the rope from chafing, thus keeping people using them safe where a cut rope means certain death,” Fjord President Michael Ratigan says.

Fjord’s primary product is Chafe-Pro, which was designed primarily for the U.S. Coast Guard and Navy more than 20 years ago to protect mooring and towing lines from chafe abrasion. Private boaters, supertankers and aircraft carriers now use Chafe-Pro. Offerings of STREP include wraparound style rope protection and mats that are laid down over an edge.

STREP has products to protect tightrope walkers at the Eiffel Tower and contestants on TV shows like “Amazing Race” and “Running Wild with Bear Grylls.” The products are also used to protect centuries-old facades throughout Europe as workers hang from ropes to do repairs or cleanings. Chafe-Pro was invented in 1991, while STREP was launched in the fall of 2021.

C.R. Onsrud’s Q-Series 5-Axis computer-controlled machine – also known as the Qube – helps manufacturers including Boeing, Goodyear and Steinway & Son with high-speed machining of advanced materials.

Computer controls direct the industrial machine to cut, drill, mill and saw materials for manufacturers who then make everything from race car molds to complex satellite components to foam Statues of Liberty. As a five-axis machine, it can cut plastic, carbon fiber, aluminum, woods and other materials from all directions without repositioning.

“These machines can create patterns that are so intricate and require such precision that they cannot even be created manually,” says Jennifer Kaufman, a technical writer for C.R. Onsrud. “Because of this, and their amazingly high speeds, manufacturers are pretty much only limited by their imagination.”

Oscar Onsrud founded his Onsrud Machine Works company in Chicago in 1915, making routers that were widely used in aviation, defense, furniture and many other industries. Onsrud’s grandson, Charles, established C.R. Onsrud in Iredell County in 1976 to be closer to the furniture industry. The company started making CNC machines in 1994, and they continue to be designed, fabricated, assembled and shipped from Troutman. Family members continue to lead the business.

The NC Chamber launched its “coolest thing” competition in 2020 to honor North Carolina manufacturers and highlight industry careers. The state’s manufacturing industry is the largest in the Southeast with about 475,000 workers.

Deerfield, Ill.-based Baxter is the presenting sponsor of the online competition, and Business North Carolina is media partner. The Fortune 500 company has a plant in Marion that produces intravenous and peritoneal dialysis solutions, empty containers and parts for other Baxter facilities. ■

Je Brown, CEO of Detroit-based Ally Financial since 2015, plans to leave in January to become president of Hendrick Automotive Group. Hendrick is owned by Rick Hendrick and is the largest privately held U.S. automotive retail group with nearly 11,000 employees and 131 retail franchises in 13 states. Annual revenues top $11 billion.

Duke Energy Progress implemented rate increases for N.C. customers. With the new rates, which have been approved by the N.C. Utilities Commission, the typical residential customer using 1,000 kilowatthours per month will see an increase of $8.04, from $144.12 to $152.16 per month, followed by additional increases.

More than 2,100 volunteers took part in the weeklong Jimmy and Rosalynn Carter Work Project for Habitat for Humanity. e workers worked on 23 homes in a west Charlotte area with a homeownership rate of 26%, less than half the rate of Mecklenburg County. Country music superstars Garth Brooks and Trisha Yearwood spent the week at the project.

Elon University plans to open a part-time law school for about 35 students at its new regional education center. e Alamance County-based university awaits formal accreditation from the American Bar Association, but has operated a law school in Greensboro since 2006 that now has more than 400 students. Law classes in Charlotte will take place at night.

chemicals manufacturing company for violations of the Foreign Corrupt Practices Act. Albemarle self-reported the misconduct.

Smith eld Foods plans to close its porkprocessing plant Dec. 8 and lay o 107 people. e Virginia-based company will transfer production to its Bladen County facility. Smith eld employs more than 10,000 people in North Carolina.

Feastables, the snack company created by YouTube star MrBeast, will be the o cial jersey patch partner of the Charlotte Hornets. Feastables’ logo will appear on Hornets uniforms, including its sister G League team, the Greensboro Swarm. MrBeast, whose formal name is Jimmy Donaldson, 25, is a Greenville native.

Meridian Waste Florida, a business unit of Meridian Waste, started residential collection for the city of Jacksonville, Florida. e contract represents the rst time the city has granted two residential contracts to one single hauler. e rm says 116 new employees were hired.

ousands of Bank of America workers received a pay raise when the banking giant

Albemarle agreed to pay $218 million to resolve federal investigations into allegations it bribed government o cials in multiple foreign countries. e U.S. Department of Justice and the Securities and Exchange Commission were investigating the specialty

raised its hourly minimum wage for U.S. workers to $23. e move is part of its plan to pay its U.S. employees at least $25 an hour by 2025. e bank has increased its minimum hourly wage by almost $14 per hour since 2010.

A federal grand jury indicted a Charlotte behavioral health services provider on 16 Medicaid and COVID-19 fraud charges. e indictment alleges Ashley Nicole Cross used her company, Odyssey Health Group, to commit health care fraud and collect Paycheck Protection Program money using false claims.

Palmetto, a tech company that connects homeowners with roo op solar installers, relocated its headquarters from Charleston, South Carolina, to a 200-person o ce here.

Shoe Show founder Robert Tucker, who opened his rst store in 1960 in Kannapolis, died at age 86. Shoe Show is a $1 billion-plus business with more than 1,100 stores in 47 states. His daughter, Lisa, has led the company since 2018.

Krispy Kreme named Josh Charlesworth as CEO, succeeding Michael Tatters eld, who has held the role since 2017. e company has seen annual revenue growth from $550 million in 2016 to an expected $1.6 billion this year. Tatters eld moved the company’s headquarters from Winston-Salem to Charlotte four years ago, and will remain a director and senior adviser.

Alicia Paxson, the widow of a man who died a er driving his car o a collapsed bridge in Catawba County, led a lawsuit in Wake County that names Google, its parent company, Alphabet, and others as defendants. e lawsuit alleges Philip Paxson was following directions from Google Maps when his Jeep Gladiator plunged into a creek, leading to his death in September 2022. e bridge had collapsed nine years prior, but was never repaired despite requests from multiple people.

Atlanta-based Chick- l-A will invest $58 million in a new distribution center that will employ 85 workers. e 120,000-square-foot distribution center will serve about 100 restaurants in the Charlotte region and will open in the third quarter next year. It’s being built at the former site of the Kannapolis minor league baseball team, which now plays at a downtown stadium.

House Speaker Tim Moore, who said over the summer that he won’t run for another term as speaker, isn’t running for another term in the state House, either. e Republican speaker said that he will nish his term through the end of 2024.

Charlotte-based Albemarle and Caterpillar signed an agreement to work together at the lithium mine site that is expected to be reopened as early as late 2026. In September, the Department of Defense awarded the Charlotte company $90 million to support expansion of domestic mining of lithium, a key source for the battery supply chain.

Charlotte-based Coats American is laying o 51 workers. e layo s are expected to occur in late November and will be permanent. e parent Coats Group, which makes yarns, threads and zippers, is based in Great Britain. e company cut 41 jobs at its McAdenville facility in Gaston County earlier this year. In November 2022, the manufacturer cut 51 jobs, shuttering its Hendersonville plant.

Gildan Yarns is laying o 258 workers and closing a plant in Salisbury on Dec. 8. Employees are being o ered the opportunity to transfer to other area operations in Salisbury and Mocksville. e company has 550 workers in the county. Last year, the Montreal-based company closed its distribution center in Mebane and laid o 128 employees.

Brunswick County plans to buy 539 acres in the county’s northwestern corner. e land, which is expected to draw new employers, will cost the county about $35,000 per acre, or about $18.8 million. e county hopes the land will draw new companies and jobs.

e Pender County Board of Commissioners transferred ownership of Pender Medical Center to Novant Health. In lieu of a cash payment, Novant has agreed to spend $50 million on improvements to the facility over the next decade.

Kayser-Roth will lay o 126 workers at a plant that makes pantyhose and tights, citing increased costs and fewer women wearing pantyhose and tights. KayserRoth has owned the manufacturing plant since the late 1970s, producing No Nonsense and Hue brands. A distribution center will remain at the site.

e Methodist University Cape Fear Valley Health School of Medicine received a $1 million gi from longtime donor and Fayetteville auto dealer Norwood Bryan Jr. e school expects to have its rst class of students in 2026.

IT services company Provalus will invest $500,000 to create 92 jobs in Columbus County. The company will work out of a 20,000-square-foot downtown building.

Pfizer restarted the majority of its manufacturing lines two months after its facility was damaged by a July 19 tornado. Full production is expected by the end of the year. Established in 1968, the site has more than 3,000 full-time employees and contractors and produces almost 50 medicines, about 25% of Pfizer’s injectables used in U.S. hospitals.

The EUE/Screen Gems Studios complex in Wilmington, a hub of film and television production for nearly four decades, was sold to Cinespace Studios. Cinespace also acquired the EUE/Screen Gems complex in Atlanta. Terms weren’t disclosed. The studios were built by film producer Dino DeLaurentiis in 1984.

PolyQuest acquired Lake City, South Carolina-based Baker Transportation. The new entity will be named Baker Transportation. PolyQuest is a privately held resin distributor that also has facilities in Darlington and Florence in South Carolina; and Farmingdale, New York.

Chancellor Harold Martin Sr., 71, of North Carolina A&T State University will retire in June. He is the first alum to lead NC A&T and has served as chancellor for the past 14 years. He previously led WinstonSalem State University and held key UNC System posts.

Apexanalytix, a Greensboro provider of supply chain risk management software and services, acquired Darkbeam, a Londonbased cybersecurity business. Terms were not disclosed. Apexanalytix is also known by the Apex brand.

Steel producer Nucor is partnering with Helion to develop a 500-megawatt nuclear fusion power plant. Nucor committed to investing $35 million in Helion to accelerate fusion deployment. The two companies aim to begin operations here by 2030.

Jolo Brands, which operates Jolo Winery and Vineyards, agreed to buy the RayLen Vineyards and Winery properties in Mocksville. A late November closing is expected. Jolo is keeping the RayLen brand name and will manage operations.

John-Richard, a luxury home furnishings and décor supplier, is relocating the company’s corporate headquarters and centralized distribution facility to a new 236,000-square-foot facility. The company has operated in Mississippi since 1980.

Majority ownership of Cook & Boardman Group, a distributor of doors, frames and security systems, is being sold to Los Angeles private equity company Platinum Equity. Terms were not disclosed. Cook & Boardman employs 1,400 people.

Novant Health reduced its workforce by 160 positions, mainly administrators and managers. The healthcare company employs 36,000.

A federal lawsuit that alleged T.W. Garner Food Co. deliberately deceives consumers because its Texas Pete products are not made in the Lone Star state was dismissed. Texas Pete products have been made here since 1929.

Epic Games, which operates the Fortnite franchise, is laying off 16% of its workforce, or more than 800 people. The company also said it would divest Bandcamp, which is joining Songtradr, a music marketplace company supporting artists.

Dr. Shelly Earp will step down next June as director of the UNC Lineberger Comprehensive Cancer Center. Earp has served as UNC Lineberger’s director since 2018. She had also led the center from 1997-2014. She will remain a professor of cancer research, medicine and pharmacology.

UNC Health plans to build a $2 billionplus children’s hospital in the Triangle area within the next decade that will have hundreds of beds and employ thousands of workers. A child and adolescent psychiatric hospital, including at least 100 beds, would be included in the project.

City employees will receive bonuses ranging from $500 to $5,000, following a strike by sanitation workers. Employees who make less than $42,480 will receive $5,000. Others will receive $3,750, $2,500, $2,000 and $500 bonuses, depending on their salaries. Part-time employees will receive $1,000.

Rho, a contract research organization for the pharmaceutical industry, cut jobs, the company confirmed to the Triangle Business Journal. Rho declined to comment on the layoffs, but said it has 450 full-time employees globally.

Syneos was acquired by Elliott Investment Management, Patient Square Capital and Veritas Capital for about $7.1 billion, including outstanding debt. The company offers clinical and commercial services and has 29,000 employees globally. Michelle Keefe, who had been CEO for 18 months, was replaced by Colin Shannon, the former CEO of Raleigh-based PRA Health Sciences.

North Carolina Healthcare Association CEO Stephen Lawler will retire at the end of 2024. He has been the association’s leader since July 2017 and is only the fourth professional CEO in the group’s history. A national search committee will work to attract his successor.

North Carolina’s Education Lottery exceeded $1 billion in annual net earnings for the first time, buoyed by record sales from multistate jackpot drawings. Net proceeds fund school construction and repairs, the N.C. Pre-K Program, college scholarships and salaries for noninstructional support personnel and school transportation.

The Fresh International Market opened. There are nine locations of the Asian grocery store group nationally. Bowen Kou founded the business in Michigan in 2011.

Members of the State Employees’ Credit Union of North Carolina elected dissident members to the board of directors at the annual meeting. The vote ousts three current SECU directors from the 11-member board of the second-largest credit union in the U.S. They are: Michael Clements, Barbara Perkins and Chuck Stone. The three defeated directors were veteran state government officials Alice Garland, Jo Anne Sanford and Thomas Parrish.

Omni Hotels and Resorts plans a 27-story, 550-room hotel downtown near the convention center. The hotel, expected to open in 2027, will occupy a square city block.

Captrust Financial Advisors received an undisclosed investment from private-equity firm Carlyle Group. The transaction valued Captrust at $3.7 billion, which is about triple the amount from 2020 when Chicagobased GTCR bought a 25% stake. It has $832 billion of assets under management and 1,500 employees and 85 offices.

Popular hummus brand Roots began selling its equipment and leasing its plant as part of its closing. Roots and its owner, James Matthew Parris, were ordered in June to pay a creditor more than $2.6 million for uncollected debt.

Synth giant Moog Music laid off 30 workers at its headquarters just months after it was acquired by the audio

equipment company inMusic. Bob Moog founded the business almost 50 years ago, with its equipment used by the Rolling Stones, the Beatles and others.

Ten doctors and physicians’ assistants with Carolina Spine and Neurosurgery Center have rejoined Mission Health after their practice was acquired by another healthcare group. They remained active at Mission Hospital, and are now affiliated with the HCA Healthcare-owned system, says Carolina Spine President Dr. Richard Lytle.

Mission Hospital’s application for a $29 million standing emergency room near Candler was approved by the N.C. Department of Health and Human Services. This is the second time a Certificate of Need for the Candler ER has been approved, after being rejected previously.

The Appalachian Regional Commission awarded a $10 million grant to The Industrial Commons, a nonprofit in western North Carolina, to build a 40,000-square-foot textile manufacturing center in Burke County. This project is a collaboration between North Carolina, South Carolina and Tennessee for economic development in southern Appalachia. The project will include $60 million in private investment and is expected to create 85 jobs, including 31 in North Carolina

The NASCAR Cup Series All-Star Race will remain at North Wilkesboro Speedway in 2024 after this year’s event attracted a capacity crowd. The exhibition race is planned for May 19, one week before the Coca-Cola 600 at Charlotte Motor Speedway. The historic Wilkes County venue hosted more than 90 Cup races before it closed in 1996. ■

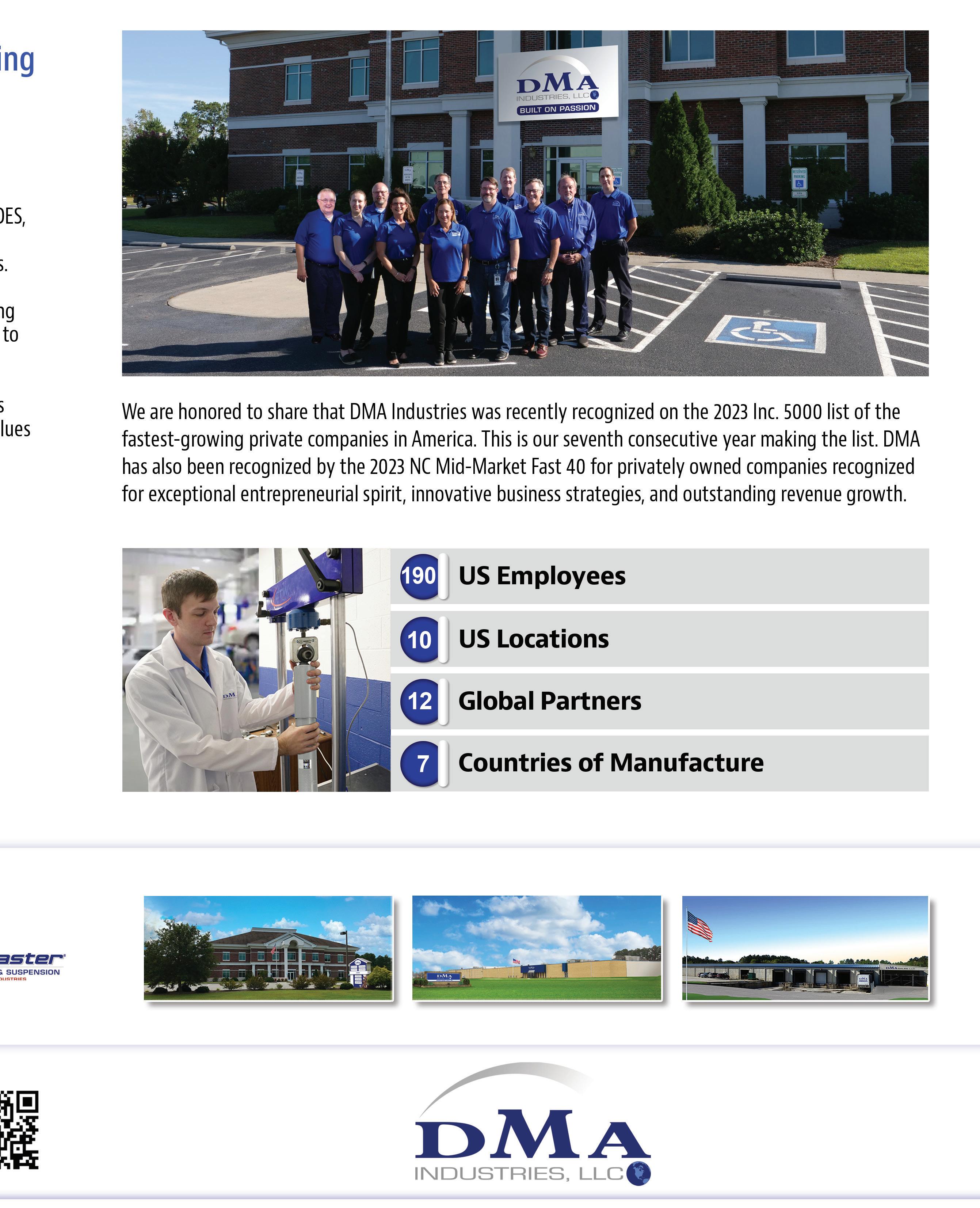

Forty fast-growing North Carolina middle-market companies were celebrated for their entrepreneurial spirit and strong revenue growth. The 2023 North Carolina Mid-Market Fast 40 is sponsored by Business North Carolina, Cherry Bekaert, Regions Bank and Ward and Smith. The 13th annual Fast 40 program honored representatives of the companies at the Grandover Resort in Greensboro.

MID-MARKET FAST 40 ROUND TABLE

Earning a spot on the North Carolina Mid-Market Fast 40 list takes hard work, especially during challenging economic times. Leaders of four representative companies gathered recently at High Point University to discuss their growth and some critical challenges. ey were joined by veteran N.C. banker ad Walton and Raleigh attorney Lee Hodge.

Photography by John Gessner

The following round table discussion was moderated by Business North Carolina editor Dave Mildenberg. It was edited for brevity and clarity.

Geoff Foster

CEO & president

Core Technology Molding

Lee Hodge

attorney Ward & Smith P.A.

Zeb Hadley

CEO & president National Coatings.

Robert Scott vice president

Atlantic Forklift Services

Fred Snow

chief operating officer

DMA Industries

Thad Walton senior vice president commercial banking leader Regions Bank

CONGRATULATIONS FOR BEING A PART OF THE FAST 40. LET’S START WITH INTRODUCTIONS OF YOURSELF AND YOUR COMPANY.

FOSTER: I’m Geoff Foster, CEO at Core Technology Molding. This is our 18th year in business. We do plastic injection molding in Greensboro. We’re 65% biological/ pharmaceutical with Merck, Pfizer and Eli Lilly on the vaccine side. In the automotive sector, we’re Tier One (level of supplying OEMs) with BMW, Volvo, and Mack Trucks. We just got awarded a contract with Toyota last week. We operate 24 hours a day, seven days a week. Last year we worked 356 days. It’s actually not enough. So we’re in an expansion project right now. We’re building and adding on to the building.

WALTON: I’m Thad Walton with Regions Bank. I lead our commercial banking teams. We have seven bankers in Charlotte and two in Raleigh, and then a host of teams around them in both of those cities.

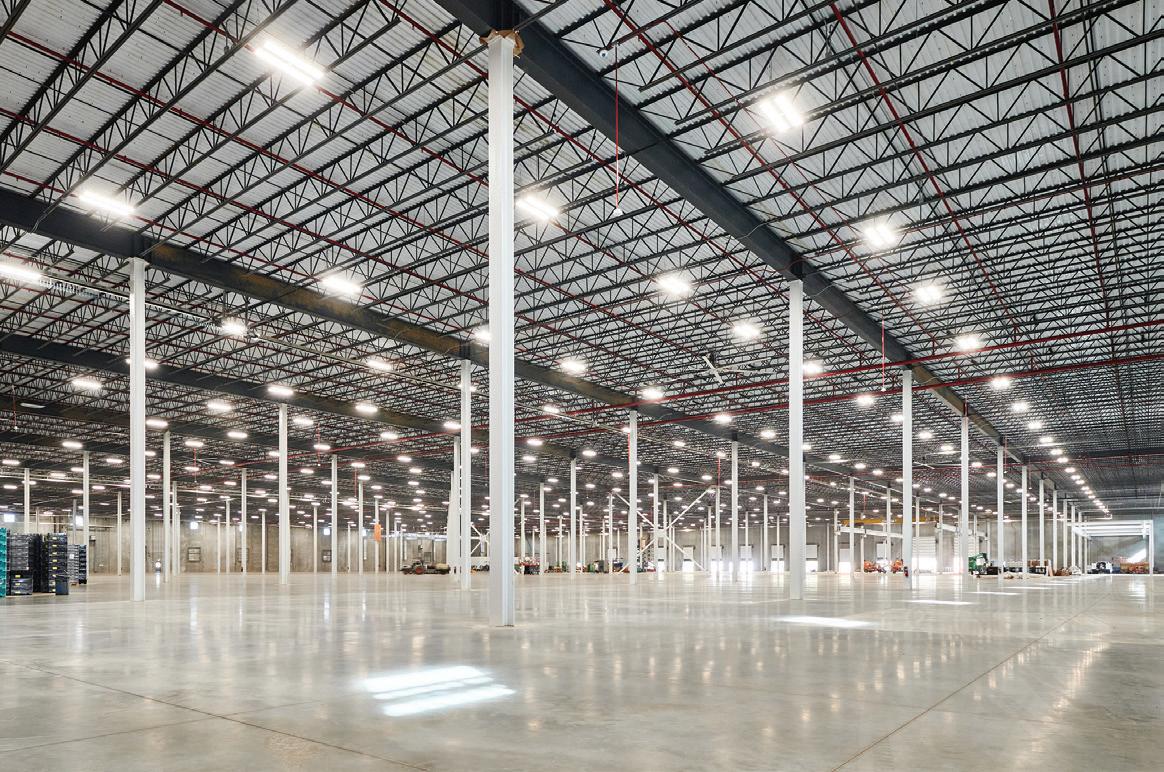

SNOW: I’m Fred Snow, chief operating officer at DMA. We’re an automotive business as well, mainly focused on the aftermarket, where our main product categories are shocks and struts and complete strut assemblies. Our main customers are O’Reilly Auto Parts, AutoZone, big box retailers, and others players in that industry who sell to mechanics to fix cars. We’re located in the Tabor City area, right on the North Carolina-South Carolina border, down by the beach. We have nine warehouses and a lot of auto parts that we supply around the country.

SCOTT: I’m Robert Scott, vice president and part- owner of Atlantic Forklift Services. We started the company in 2013. I have a tale of two careers. I spent 10 years in educational software, and then started a forklift company. We’ve grown considerably and just celebrated our 10-year anniversary. We have three locations in North and South Carolina, and I hope we’ll have three more locations within the next 18 months.

HADLEY: I’m Zeb Hadley. I attended N.C. State University and started a power washing and painting business back in my junior year of college. I went door to door. From that we’ve

transformed into a multi-state commercial and industrial painting company. e corporate headquarters is in Raleigh. We’ve got o ces in Boise, Idaho; Denver, Colorado; and believe it or not, Big Sky, Montana. We’re nationwide. I think we just led taxes in 38 states. We’ve taken the small town approach. We go from market to market, usually on the coattails of a general contractor. As they grow, we grow with them.

HADLEY: ere’s a [Colorado Springs, Colorado-based] construction company called G.E. Johnson that went to Big Sky in 2016 to build condos. Since then we’ve done every major project in Yellowstone Club, Spanish Peaks, and the Big Sky Resort along with Moonlight Basin. It has really spread our wings. Condos are about $1 million per square foot, so a 2,400 square foot condo is $24 million. We thrive in niche markets when people don’t want to (work) in certain places. We’ve bought houses and rented houses and transferred and relocated people. It’s a hard project because of the constraints to get there. Our guys drive about an hour each way to work and back home.

HODGE: I’m Lee Hodge, an attorney with Ward & Smith. We have ve o ces across North Carolina, from Wilmington to Asheville. We’re a midsized, full-service law rm. I’m a corporate and M&A attorney. ings have been rockin’ and rollin’ even though the national news you hear is that the M&A world is slow. Well, it’s slow compared to last year when it was red-hot.

THAD, PLEASE SHARE YOUR VIEWS ON BUSINESS CONDITIONS SINCE YOU HAVE A BROAD VIEW MANY INDUSTRIES.

WALTON: In the news, you hear how in ation is trending and interest rates are signi cantly higher than they were 24 months ago. But if you look at the historical interest rate map, we’re about where interest rates have been for many, many years. We had a 10-year low when money was cheap. e money that came into the system and into the market covered a lot of ine ciencies. Now money is getting to be as expensive as it has historically been. People are looking

to be more e cient and they’re cleaning up some of those excesses a little bit. Our job in banking is to try to use the past to predict the future from a risk and return standpoint. Certainly there are some unknowns out there, but I think in North Carolina speci cally, and a lot of the Southeast, we’re really insulated from a lot of the issues. In the Northeast and some places out West, you’re seeing more challenges in the o ce real estate market and they’re having broader economic challenges as well.

SCOTT: I also think we’re pretty insulated from a lot of things here, too. e projections in North Carolina for us this year indicate it’s going to be a record year. Our market is one of the top ve in the nation. ere’s a lot of building here and a lot of major accounts. I don’t see any slowing down right now. Our company has tried to be a whole warehouse solution provider. We service docks and doors, forkli s, sweepers, scrubbers, scissor li s, any type of material handling equipment.

HADLEY: We quantify our future work based on the backlog of what we have. Right now, in North Carolina, our backlog is about $11 million. e next largest, believe it or not, is Big Sky at about $8 million. Denver is about $6 million. We’ve seen explosive growth in North Carolina. I think our average backlog is around $4 million to $5 million. I really don’t see anything slowing down. Apple’s campus is coming and the Toyota battery plant. We just nished up the world headquarters for Bandwidth in Raleigh. It seems like this year is on turbo-speed, but I think next year we’re going to see a decline. Not us (speci cally), we’re typically 12 months out, but we’re seeing lower opportunities for middle market construction projects with costs from $20 million to $150 million. ose are getting pushed down the road, but these large projects, they’re going to continue on for us. I think we’re going to have a strong ‘24, and probably a little bit of a dip in ‘25, ‘26.

LET’S HIT OUR AUTO EXPERTS HERE. GEOFF, HOW DO YOU VIEW THE MARKET?

FOSTER: We are intentionally 30% automotive and I don’t want to go above that, but it’s getting hard not to with so many opportunities. I call North Carolina the Detroit of the South. I get calls all day about taking work from a Detroit molder whose business is 95% with the Big ree in Detroit, (who were facing a United Auto Workers strike at press time.) Volvo, BMW, Mercedes want their [mold work] done here.

I feel very insulated here in North Carolina on the automotive side. But the even bigger industry here is the biological pharmaceuticals with Merck, P zer and Eli Lilly. Lilly is building a multibillion dollar plant in Concord. Merck has been a customer in Durham and Wilson. P zer is in Rocky Mount. e 300% growth we’re seeing is for vaccines. We’re not even doing COVID. [Core Technology’s injection molding is used for] products used to treat the chicken pox, measles, mumps, rubella. I do feel like it’s recession proof. e HPV vaccine, none of us probably took that, but our kids or grandkids take it. We’re doing HPV every day and now we’re sending it to other countries. We ship to 150 countries. We have two clean rooms. So the type of manufacturing we saw or our parents saw, that’s not what we’re doing. We’re able to hire young people who don’t want to get dirty. ey want to be in a clean room. ey want to have the air blowing on them and not get dirty or sweat. With that controlled environment, it’s easier for us to get good employees.

SNOW: Our growth has more than doubled in the last ve years. It’s growing more than 20% annually right now. In my short nine months here, we’ve added over 40 people, and we’re looking for about a dozen right now. We’re in an area where people want to move to. We just onboarded a new product manager moving from Detroit. It was very tough (to hire) warehouse workers and production line workers but in the last three or four months, we’re getting a lot more resumes.

SNOW: e cost is going up exponentially, partially because of in ation but also because of the amount of technology in cars. ere are more and more electronics. [DMA CEO] John Treece and I were in D.C. last week lobbying for a bill that came to committee yesterday. We’re focusing on "the right to repair." As cars get more complex, there’s also more data your car generates. Technicians need that information to properly x them, but the OEMs are holding on to that info. It makes it harder and harder for independent shops to repair those cars. Dealers usually cost 36% more for a repair than the a ermarket. In some of the rural areas, you don’t have a dealership close by, so this creates an accessibility factor and a cost factor. If you’re lower income and rural, it takes away your choice. If the OEMs have their way and continue to restrict access to that information. at’s going to drive up the cost of car ownership even more.

HODGE: From a macro perspective, North Carolina is just a great place to do business. We’ve got a great regulatory climate, a great tax climate. You can see the bar graphs on the national news about the population in ows across the Southeast, and North Carolina has been a big bene ciary of that. It’s feeding the labor pool. Our clients are able to attract people with great skill sets who are looking to move from New York, D.C., New Jersey (and other areas) down to a much cheaper cost of living and better quality of life. North Carolina has always had a strong education system, so we’re turning out our own citizens and people who are coming to the state for education.

HODGE: Hammer is a strong word, but you’ve de nitely seen a tick down in valuations. Private equity has plenty of cash on the sidelines. Now, their deals are going to be leveraged, so the cost of capital is impacting valuation. eir models are getting

a little tighter. But there’s still a lot of activity, and still plenty of cash they want to put to work. I think, to Thad’s point, people are adjusting to this new normal where money’s not free anymore. But the deal is still worth doing. We’re still seeing plenty of deals that are getting done.