General contractor Swinerton is among the 49 North Carolina companies honored for their inspired workplaces.

4 UP FRONT

6 POWER LIST INTERVIEW

UNC Wilmington Chancellor Aswani Volety discusses his journey from India to leading a growing public university that is focused on its coastal region.

8 POINT TAKEN

Architects from Clark Nexsen’s Raleigh office complete an unusual project at the Air Force Academy in Colorado.

10 NC TREND

Odyssey Logistics opts for a Southern HQ; PSA Airlines moves its base closer to where most of its workers call home; VP Nursing aims to empower healthcare workers.

24 ROUND TABLE: BANKING

Six industry experts discuss North Carolina’s competitive financial services sector and pending economic challenges.

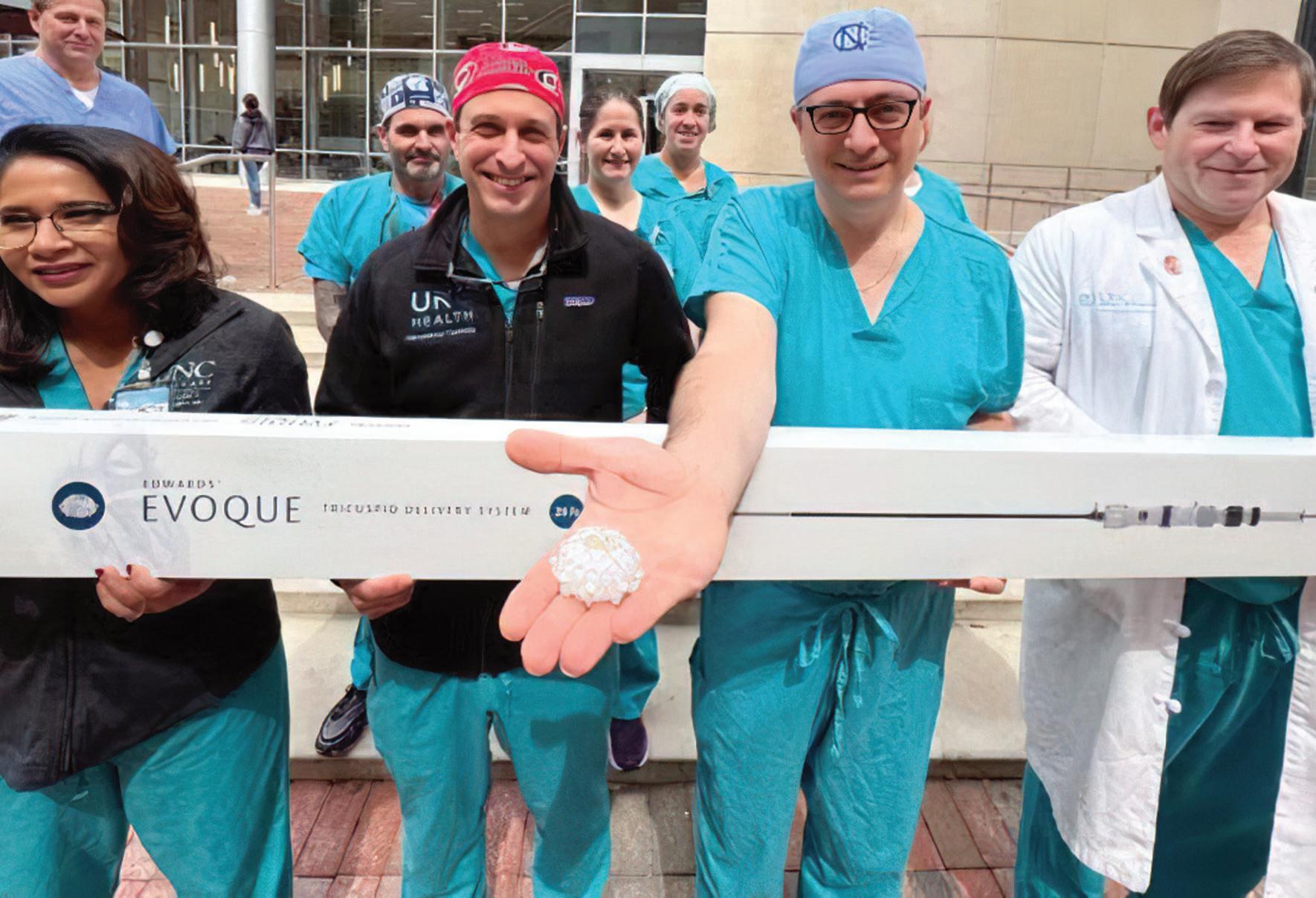

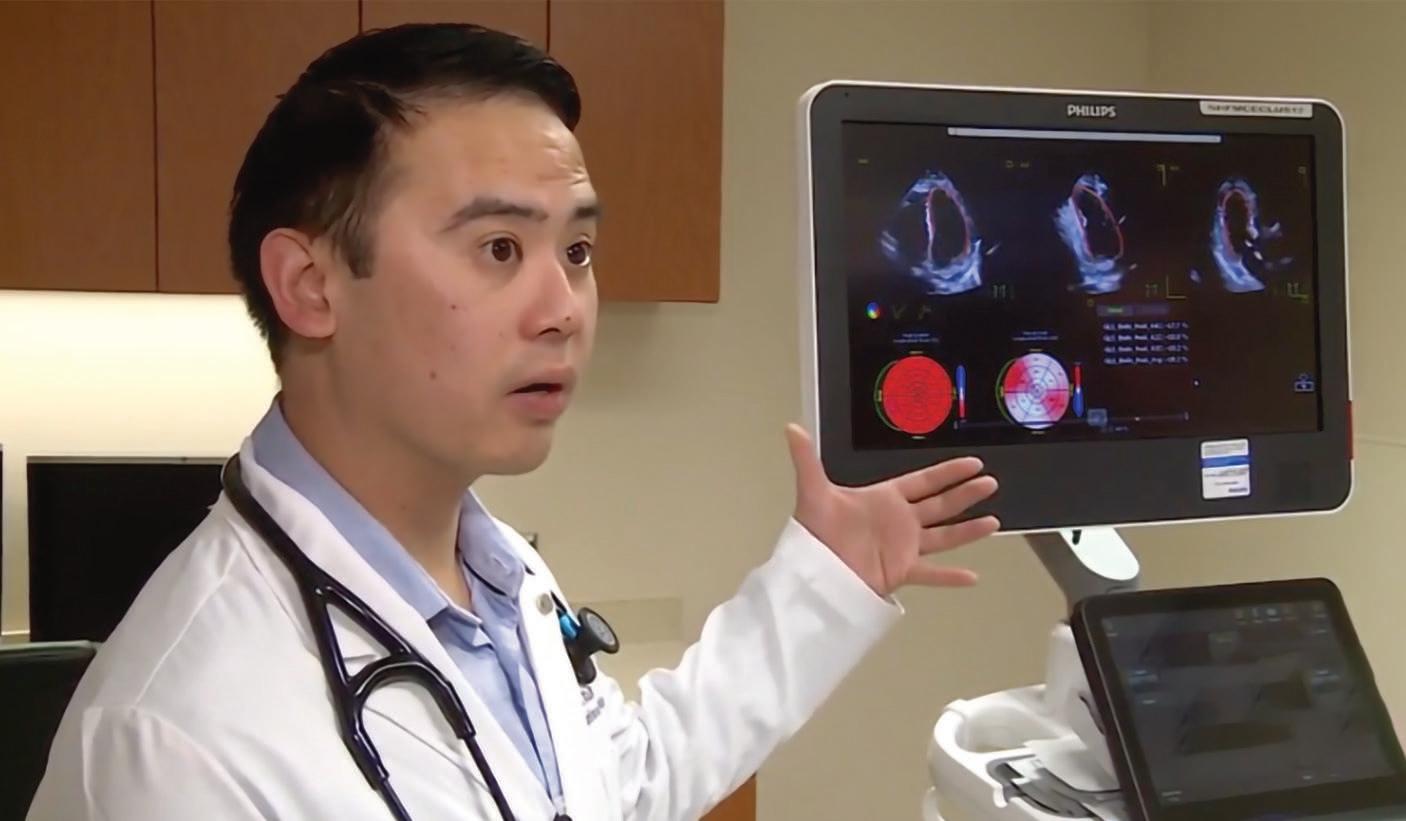

34 MEDICAL: HEART HEALTH

Technological advances are detecting problems sooner and allowing doctors to treat patients less invasively, which is leading to better outcomes.

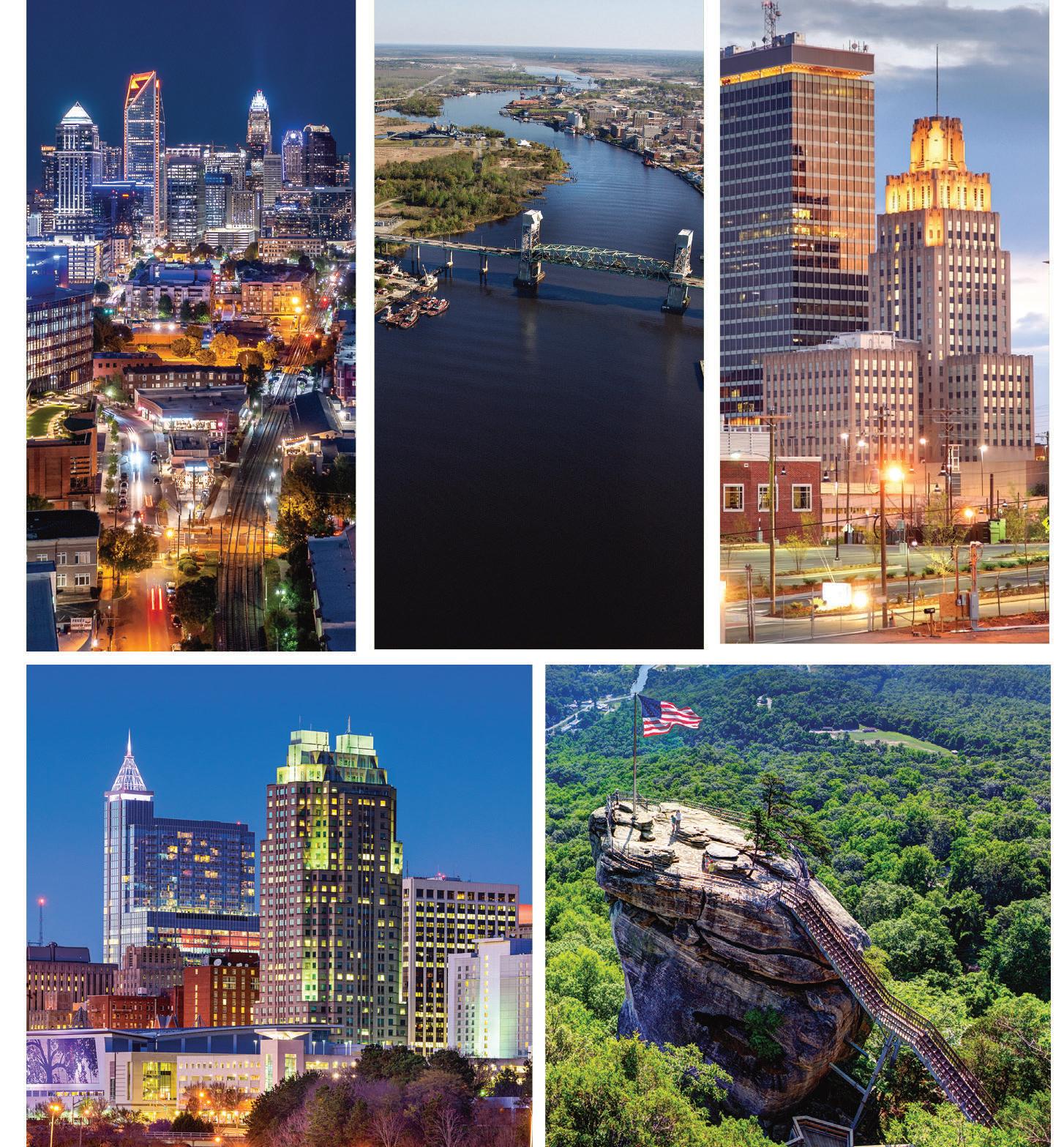

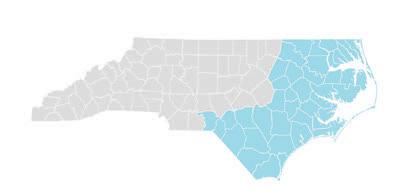

84 COMMUNITY CLOSE UP:

CORE

Twelve counties, 1.7 million residents and 21 colleges and universities find strength in the diversity of the region’s mix of rural and urban entrepreneurship.

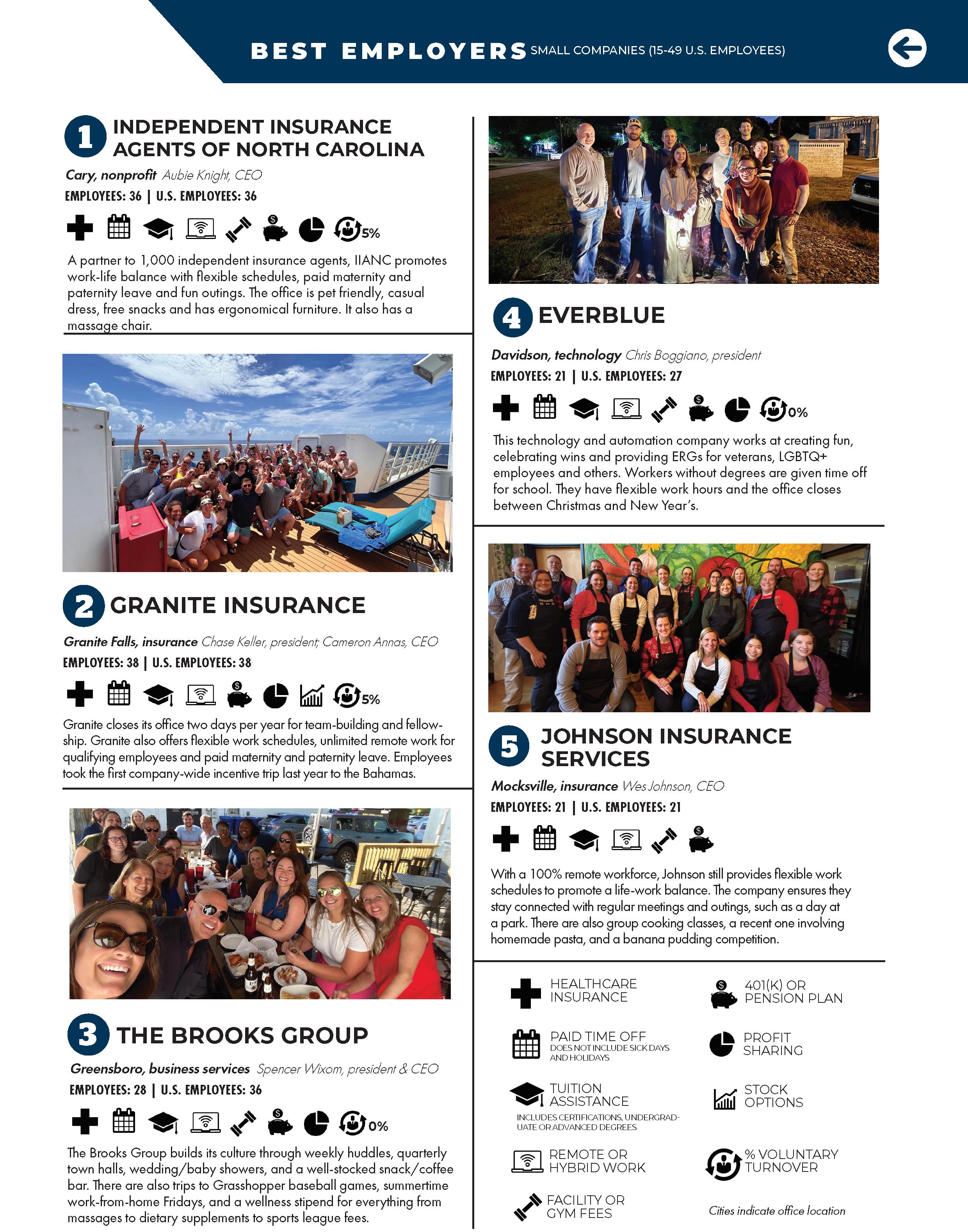

COVER STORY

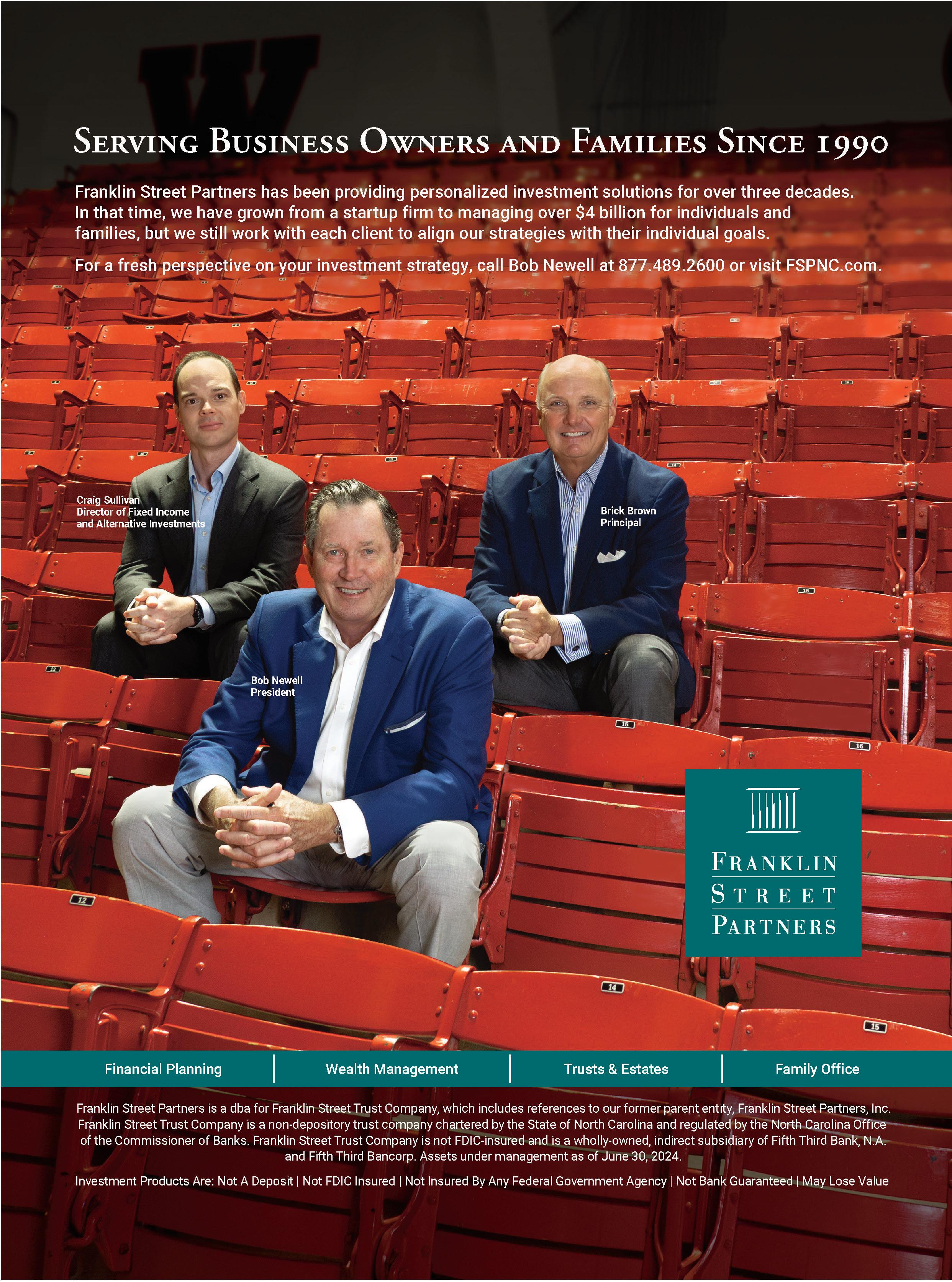

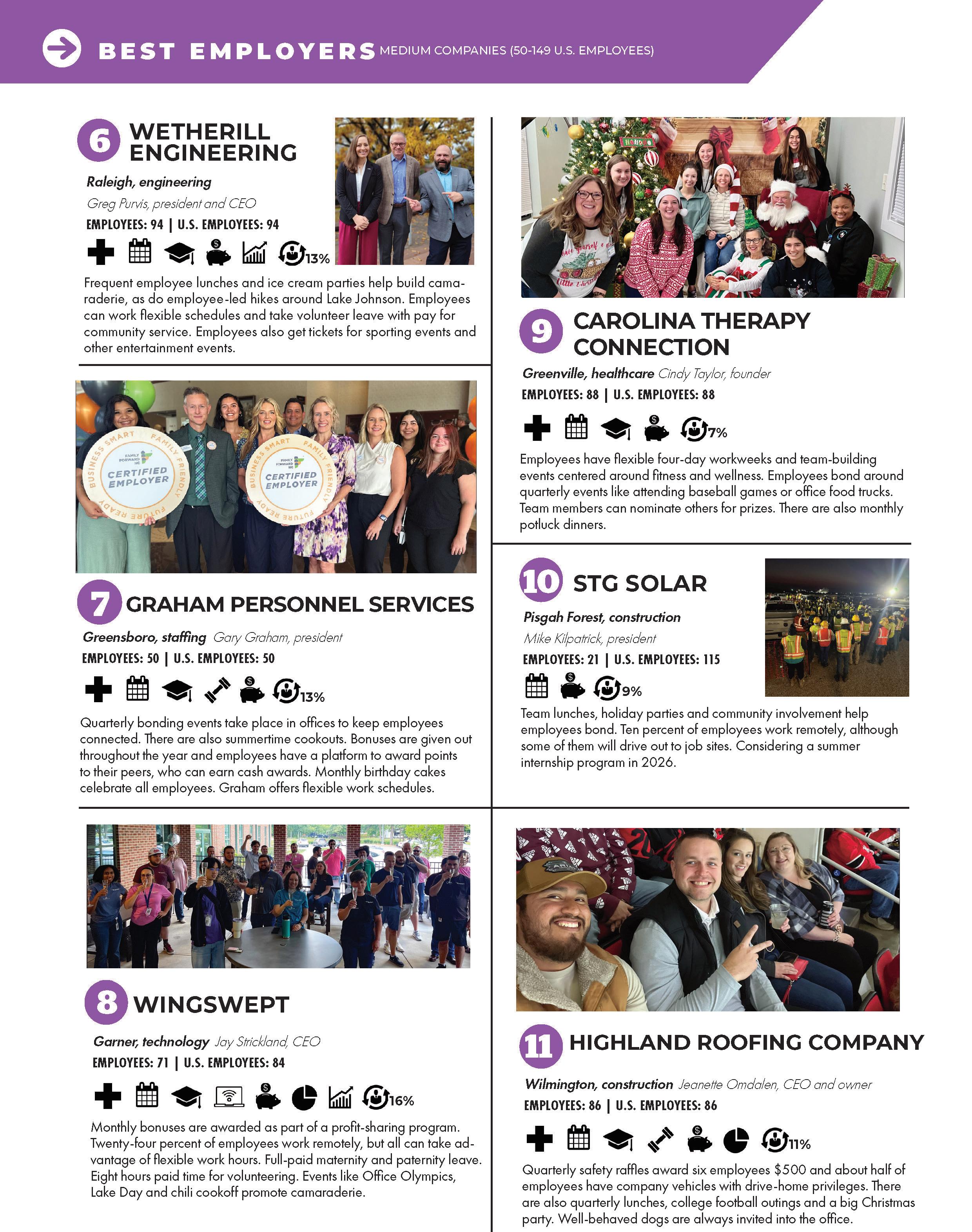

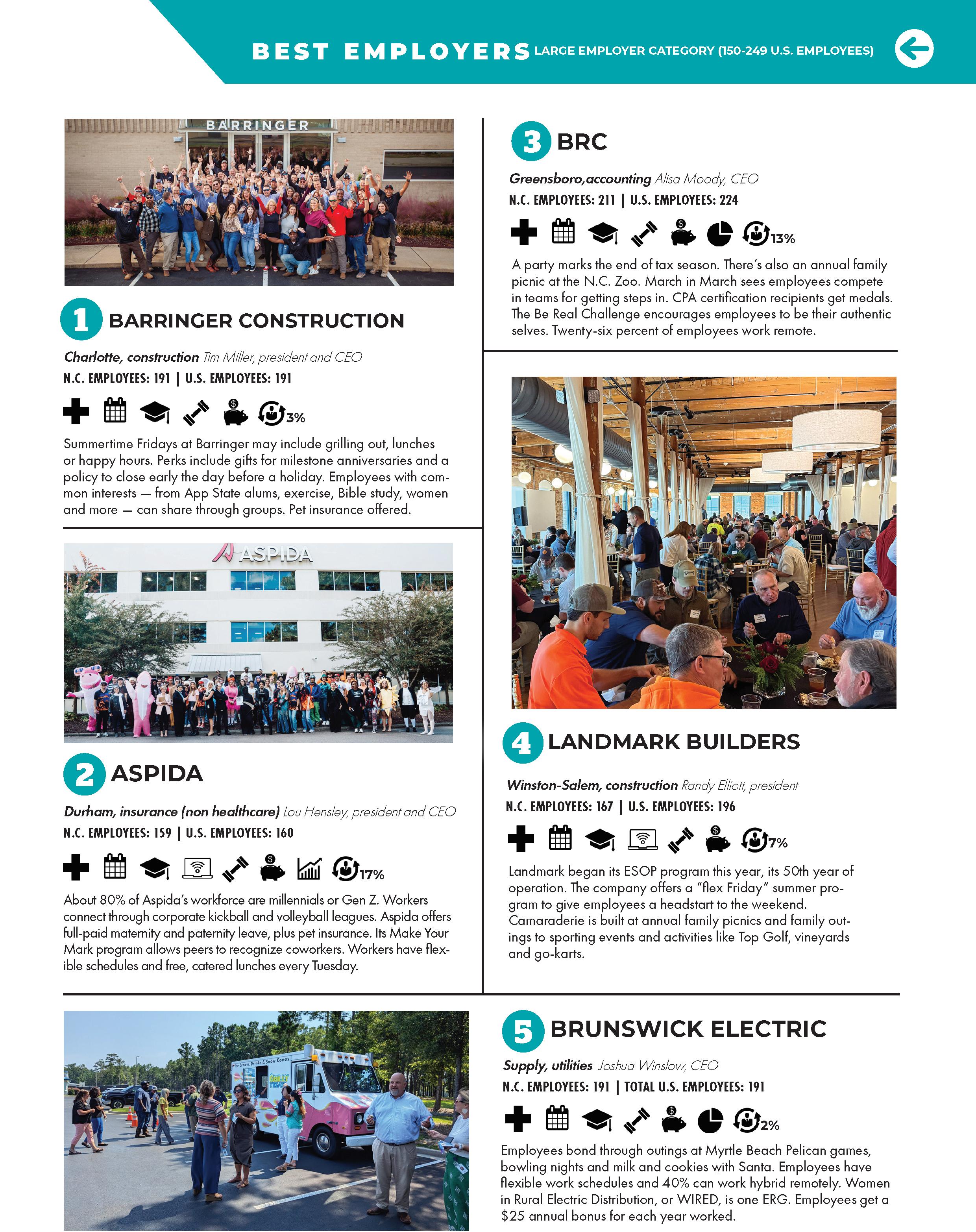

Business North Carolina’s annual look at the businesses taking the extra steps to recruit and retain workers.

BY KEVIN ELLIS

After figuring out a winning strategy in insurance networking, Doug Witcher says God’s plan calls for him to share his wealth widely.

BY TUCKER MITCHELL

Ranking the state’s biggest financial institutions and money management firms.

BY DAVID MILDENBERG AND WIL SPEIR

More than 400,000 former Local Government Federal Credit Union members will transition to Civic, cutting historic ties with the state’s dominant credit union.

BY CHRIS BURRITT

Meet the top professionals making a difference at global firms, agencies and small enterprises.

BY KEVIN ELLIS

We’ve been working on some other ways to provide North Carolina’s decision-makers content in a variety of ways. One of these is a new monthly video series we are pretty excited about.

Business North Carolina and Bclip Productions, Inc. are proud to present "On the Ground: The Grit That Drives Carolina Business," a behind-the-scenes video series filmed on location with the entrepreneurs, risk-takers, and innovators shaping North Carolina's economy. Each episode offers an unfiltered look at the bold decisions and daily grit required to build impactful businesses.

Over the past few months, we’ve covered two impressive innovators. Riverbend Malt House is a Buncombe County-based business that has been serving the craft beer industry since 2011. Durham-based custom carwash services group Spiffy has transformed traditional car care in more than 30 cities with a fleet of mobile technicians, backed by custom-built vans and powerful cloud-based technology.

We’ll be uploading a video each month on our YouTube Channel. You can scan the QR code and check out these cool companies, with more to come.

PUBLISHER

Ben Kinney bkinney@businessnc.com

EDITOR

David Mildenberg dmildenberg@businessnc.com

MANAGING EDITOR Kevin Ellis kellis@businessnc.com

ASSOCIATE EDITORS

Ray Gronberg rgronberg@businessnc.com

Cathy Martin cmartin@businessnc.com

EDITORIAL INTERN

Natalie Bradin, Wil Speir

CONTRIBUTING WRITERS

Pete M. Anderson, Dan Barkin, Chris Burritt, Tucker Mitchell

CREATIVE DIRECTOR

Cathy Swaney cswaney@businessnc.com

GRAPHIC DESIGNER

Lauren Ellis

MARKETING COORDINATOR

Jennifer Ware jware@businessnc.com

EVENT DIRECTOR Norwood Teague nteague@businessnc.com

ADVERTISING SALES

ACCOUNT DIRECTOR

Melanie Weaver Lynch, eastern N.C. 919-855-9380 mweaver@businessnc.com

ACCOUNT MANAGER

Anne Brundage, western N.C. abrundage@businessnc.com

CIRCULATION: 818-286-3106

EDITORIAL: 704-523-6987

REPRINTS: circulation@businessnc.com

OWNERS

Jack Andrews, Frank Daniels III, David Woronoff, in memoriam Frank Daniels Jr.

PUBLISHED BY Old North State Magazines LLC

PRESIDENT David Woronoff

Aswani Volety, chancellor of UNC Wilmington, joined High Point University President Nido Qubein in the Power List interview, a partnership for discussions with influential leaders. The interview was edited for clarity.

Chancellor Volety, your story is amazing. You started school at age 2 and graduated high school at age 15. That makes me feel like a total failure. Tell me, how does someone start school at age 2?

My mom tells me I was getting in trouble with all my cousins. I grew up in a large extended family, I was reading and writing.

Aswani Volety grew up in a one-room home in India and started school before turning 3. He graduated from high school at age 15. He then earned a bachelor’s degree from Andhra University, followed by a master of science in zoology at the same school in 1990. It is a coastal campus, on India’s south coast.

In 1990, he entered a doctoral program at the College of William and Mary in Virginia, where he earned a Ph.D. in marine science in 1995. He later moved to Florida Golf Coast University as a professor and later interim dean for the college of arts and sciences.

He joined UNC Wilmington in 2014 as dean of the College of Arts and Sciences, helping implement new programs and attract a $5 million corporate donation that was a record at the time. In 2019, he moved to Elon University as provost, and vice president of academic affairs.

Three years later, he was selected after a national search to become chancellor of UNC Wilmington. Since July 2022, he has helped the campus expand various academic opportunities and its student support services.

The university completed a $131 million fundraising campaign. It enrolled 18,848 students last fall, about 3,500 more than a decade earlier. They came from about 45 states and 50 nations.

He and his wife, Ai Ning Loh, have two children. Loh is an associate professor of Earth and Ocean Sciences at UNCW.

She said, “You’re better o going to school and learning something than getting in trouble at home.” So she sent me o .

Kidding aside, I had some amazing mentors. I had a very caring family who helped provide some great opportunities. I was the rst in my family to go to college.

And you came to America in 1990 to do your best at William and Mary?

Yes, I did. A er graduation, I worked at William and Mary for a couple of years on a post-doctral fellowship. en I had a National Academy of Sciences fellowship. It was a fairly prestigious fellowship to work in a federal lab.

A er that, I went to Florida Gulf Coast University, which was a brand-new university in the state system of Florida. It was on the coast, enabling the kind of marine work I was doing. at was a great location for me. I worked on projects such as Everglades restoration and Deepwater Horizon oil spill work.

Why did you leave Florida Gulf Coast after 15 years? e Wilmington opportunity was similar, with both programs focused on students. UNCW has a very large marine science program. And that’s what attracted me to Wilmington as the dean of the college of arts and sciences and then as chancellor.

How does an immigrant, who grew up with a lot of adversity, manage to focus so directly, so positively and with such determination?

I want to say it’s because of my hard work, and I’m smart, but that’s not true. ere are a lot of very hard-working, very smart people who are smarter than I am who don’t have the opportunities that I have. I’ve always said the three things that made a di erence in my life are, education, mentors and the opportunities this great country a ords.

Without mentors and the opportunities that this great country a orded me, I wouldn’t be where I am. at’s what I tell myself every day. I want to make sure that every student that comes to UNCW has experiences similar to mine that made a di erence in my life, and I want them to be even more successful than I am.

Why is educational attainment so strong in many Asian nations?

That is true. The family unit is very strong. The focus on education has always been a primary force in Asian cultures. In India, perhaps education has been one way to get ahead economically and financially, and to help your family progress.

There is so much discussion that is not very respectful about higher education. People are talking about the value in going to college, and does it really pay to do that? That must not resonate well with you?

That shouldn’t be a conversation, yet It is. Studies have shown that an individual with a college degree makes over $1 million more than what a high school graduate makes. With the graduate programs, it’s even more when it comes to professional programs.

It’s somewhere in the range of $3 million to $5 million. Yet, somehow, we talk about the false narrative. There are individuals who didn’t have a college degree that are very successful, and individuals who have college degrees who aren’t as successful as measured by economic terms. I think as an industry, higher education hasn’t done a good job of communicating the value of education.

And it is for the long run. As you know, the technologies are evolving. People are living longer. The skill sets that employers are looking for are changing very quickly. Unless you are training students to learn how to learn, adapt and acquire the next set of skills, they probably won’t be employed in the long run.

Especially these days with the advent of artificial intelligence, it is mind blowing how quickly things are changing. You may have a job today as a high school graduate. But the question one should be asking is, are they prepared to adapt and evolve and be in the next job with the right skill sets with a high school degree?

It’s the long run where higher education provides the opportunity for individuals to be successful in what’s coming next.

What doctoral programs does UNCW offer?

We have doctoral programs in marine biology, psychology, nursing practice, education and pharmaceutical chemistry. And our most recent program, a doctorate in applied coastal ocean sciences.

Let’s talk about marine science for a moment. How do you define it?

Marine science is the study of the oceans and how the oceans impact us. It involves biology, physics, geology and chemistry. But more importantly, it also involves modeling and resource economics. What is the value of a certain fishery? What is the value of tourism? What is the value of all the economics of recreational activities? All these things are broadly defined as marine science. It’s a very broad area.

How important is it that UNCW is located next to an ocean?

UNCW is the only UNC System university that is on the coast, and we have a very large marine science program. In all the areas that I talked about, the researchers investigate the deepest parts of the ocean and the organisms that live there, collecting samples from the deepest oceans. They actually send remotely operated vehicles, all the way to the deepest parts.

Tell me what that looks like.

Imagine a robot with propellers and arms that can collect samples. They’re all geo-referenced. In other words, you know exactly the point, relative to Earth, where you picked up the samples, literally sending a machine to the deepest parts of the ocean, and you’re controlling it remotely.

Our sediment samples are first samples or anything else from the deepest oceans that are brought to the surface.

Our researchers are also using nanosatellites. Imagine a satellite that is the size of a loaf of bread when it goes up into space and then opens up. The satellite is taking very high resolution images of the coastal areas from the air. That is used to look at how much food is present in the sea surface or how much sediment is being pushed out into the open ocean or the coastal areas. That impacts how much seagrasses will grow or not.

So UNCW researchers cover anywhere from space all the way to the deepest parts of the ocean and anywhere in between.

More than 70% of the world’s population lives less than 100 miles from the coast. So whether we are relying on the coastal areas and the oceans for food, recreation, pharmaceutical applications, etc., we know that humans have traditionally had a very close relationship with water.

All civilizations revolve around water, including oceans and rivers. There is also fun, transportation and fishing. When you think about oceans, a good amount of seafood for human consumption comes from the ocean. In addition to wild fisheries, you’re also farming the ocean. What is happening in the coastal areas is also a precursor of what is likely to happen to us.

The pollution going into coastal areas, whether it is rivers, estuaries, oceans, if the animals are not doing well and we are closely interacting with that environment or consuming those organisms, sooner or later, it’s also going to impact our health.

So looking at the health of these coastal areas is also a preview of what is likely to come and how it’s going to affect us as humans interact with this environment very closely.

Therefore, every day you’re discovering new species and you’re figuring out, how do these animals live? Under very stressful conditions. No light. Not a lot of food. Very cold temperatures. Very, very high pressure. How are they managing those things? And we are also looking at how they’re adapting and saying, can we use some of those molecular tools to better survive or modify the organisms. Agriculture is a good example of that.

I can remember when I would swim in the ocean with my children with zero worry about dangers like sharks. All of a sudden, we have concerns about that. What happened environmentally to cause that?

I think you’re more aware of those things. When you look at the number of incidents relative to the number of people going to any coastal or any beach, you have a higher likelihood of something happening when you’re driving on the road than something happening in the water, whether it is drowning, whether the shark bites, that is a minuscule percentage. But it attracts news.

If you’re building more bridges and jetties and other structures, they attract other fish. And with more recreational fishing, you’re putting more food in the water. That attracts the sharks. But sharks don’t come to humans, and try to eat them. It’s a case of mistaken identity.

It is our strategic plan or a roadmap for the next 10 years. That is the title of our strategic plan.

It’s not just a tagline, but that is how we think in terms of doing better every day, and making sure our students are soaring higher, accomplishing greater things.

I hope to see through it and do many more, just like my predecessors have done. They’ve left me with an amazing institution, with very strong foundations. Hopefully, sometime in the very far future, when I leave, I hope to leave the institution in a much better place than I found it. ■

Iwrite about the military and some of this involves military construction, or MILCON, as it is called. The military has spent billions of MILCON dollars here, particularly at Camp Lejeune and other eastern North Carolina installations on Marine Corps projects over the past five years. The Navy is building a big C-130 hangar complex in Kinston, at the Global TransPark. The Army is always building at Fort Bragg.

So I write a lot about military construction projects, when contracts are bid and awarded, when ground is broken and ribbons cut.

This is a different tale altogether, about a military construction project that is in Colorado, at the Air Force Academy, in the foothills of the Rocky Mountains. It is notable for us because it has been designed by architects in Raleigh, trained at NC State. They work for Clark Nexsen, an architectural and engineering firm with roots in Virginia and nine offices and 400 employees in the Southeast. And it is also notable because the focus of the building is to train Air Force cyberwarriors and to develop new ways to wage the new kind of cyberwar.

The building is the Madera Cyber Innovation Center, a nearly 50,000-square-foot, $50 million structure.

The firm that is now Clark Nexsen was founded by architect Pendleton Clark, in Lynchburg, Virginia, after his service as a naval officer in World War I. As the firm grew and Clark took on new partners, it specialized in higher education and military buildings, two growth areas. College buildings all over Virginia were designed by the firm, beginning in the 1920s and 1930s. That higher education work is also evident throughout North Carolina, including the engineering building, Fitts-Woolard Hall, on NC State’s Centennial Campus, which opened in 2020.

Over the decades, it has designed hundreds of buildings for

the military, including facilities at Fort Bragg and Marine Corps Base Camp Pendleton in California, as well as hundreds of overseas installations. Since 2008, Clark Nexsen has gotten nearly $270 million in federal work as a prime contractor, mostly for the Department of Defense, according to USASpending.gov.

In May, Clark Nexsen announced it is merging with a larger Maryland firm - Johnson, Mirmiran & Thompson.

The new building, officially opened in April, is really a symbol of changes that have been happening in the military over the past decade to spur innovation. In addition to being an academic building, it is the home of AF CyberWorx. There are many similar innovation hubs around the military. That is why an outfit called NavalX has something called the Eastern North Carolina Tech Bridge next to the airport in New Bern. It was why the Defense Innovation Unit was created, and the Silicon Valley Innovation Program in the Department of Homeland Security. This goes in cycles, incidentally. After Russia launched Sputnik in 1957 the government created DARPA, which gave us the Internet.

In 2015, the concept of AF CyberWorx was presented to some senior Air Force leaders, with the idea of housing it at the academy. The Air Force Academy committed to temporary space. Congress authorized $30 million for a building in the 2018 National

Defense Authorization Act, and they were in business. The project became bigger than originally scoped because it attracted private donations from academy alumni, like Paul Madera, who graduated in 1978, served as a fighter pilot, and then got a Stanford MBA and became a technology venture capitalist. He was an early investor in Facebook and Salesforce.

The project was put out for bid by Air Force CyberWorx in mid-April 2020, a month after lots of us started working from home. That is why Jennifer Heintz of Clark Nexsen was on calls about the building design at her dining room table. Heintz, a Statesville native and 1998 graduate of NC State’s College of Design, was the senior project architect on the job for Clark Nexsen, which had been hired by Bryan Construction, a Colorado contractor. This was a challenging building to design, with an exterior that was almost all glass and a multi-story spiral-ish staircase. It’s the spiral-ish part of this that makes architecture hard and interesting.

The academy’s McDermott Library has a spiral staircase, and the desire was to put one in the Madera building.

“When we got the project,” says Heintz, “it was an option to do a spiral staircase in the middle of the building. But at the time they accepted that option, we were too far down in the design, and the space allowed for it did not allow for a true spiral. So that’s when we engaged Ryan.”

Ryan Johnson is a computational designer in the Raleigh office.

“A spiral stair is a literal circle. It just wouldn’t fit in the rectangular opening,” says Johnson, a Winston-Salem native who went to App State as an undergraduate before getting his master’s in architecture at NC State. “What I’ve been calling it, it’s like a free-

form spiral stair. So, if you look up it’s kind of crossing over itself. It looks like it’s crossing over itself, moving in and out. As opposed to just a pure geometric circle form.”

Another challenge was designing the glass safety rails up the staircase. “You can bend glass but if you do, there’s lots of rules around bending glass, so that you can actually bend it correctly and not have it break and explode,” says Johnson.

“We came up with an idea that we liked architecturally and visually. And that’s where the computation comes in. We basically write a script that rationalizes that geometry in a way that can be built by the glass.

“And then the script works its way back and does the rest. Validates that it works, and then we can draw the treads and risers and that ultimately works back to the structural concrete. It’s a structural concrete stair. There’s no columns bracing. It only touches the ground at the bottom and then the two landings. Three floors plus a mezzanine.”

What has happened over the past quarter century with architecture is what has happened everywhere, with ever more powerful computers and software. Digital visualization tools like Rhino have gotten more powerful.

“We provided the actual geometry in 3D for the fabricator to make the formwork from, and then they poured all that formwork which was coordinated and designed pretty heavily by the engineers,” says Johnson.

The engineers used laser scanning to check and recheck the stairs during the phases of construction. “It required precision. More than a typical building.”

“Ryan and I, we’ve done extensive work on NC State, Duke, Chapel Hill, Wake Tech, UNC Charlotte,” says Heintz. “This was just a great opportunity for us to really elevate each other within our office, as well as give ourselves new experience. I have been at this for 26 years. I like learning new things and this building, with some of its more innovative ideas, allowed me to do things I have never done.” ■

Veteran journalist Dan Barkin writes the NC Military Report newsletter for Business NC. He can be reached at dbarkin53@gmail.com.

One of Charlotte’s new corporate headquarters companies sees golden opportunities in the logistics sector.

By David Mildenberg

It only took Odyssey Logistics 22 years to realize that Charlotte was the best place for its headquarters.

Now that CEO Hans Stig Moller has put a stake in the Queen City, the diversi ed transportation company is excited about its potential growth.

Odyssey Logistics was formed in 2002 by former Union Carbide executive Bob Shellman a er Dow Chemical acquired the company a year earlier for more than $10 billion. e logistics business stemmed from Union Carbide’s $650 million budget for managing and transporting chemicals and other raw materials and nished goods. Union Carbide was a pioneering chemical company whose products included Energizer batteries, Glad bags and Prestone antifreeze.

Since then, independently owned Odyssey has stitched together 17 acquisitions to create a $1 billion-plus revenue, 2,000-employee business that is now centered on four main divisions. One unit involving managed services has been based in Charlotte since 2003, giving the company a long history with North Carolina.

▲Hans Stig Moller

e same can be said for Moller, who came to Charlotte himself in 2003 as an executive for Maersk, the Denmark-based shipping organization that bought Sea-Land Service in 1999. From 2008-13, he led Maersk’s Bridge Terminal Transport unit, which was sold to a private equity company and then XPO Logistics. A er that, he worked for XPO and later, in consulting posts.

In 2023, Odyssey hired Moller as CEO with the option of staying in Charlotte, rather than move to the company headquarters in Danbury, Connecticut. at’s where Union Carbide had been based since 1983.

One of Moller’s tasks included building a strong executive team. As he and HR colleagues recruited for dozens of key jobs, he quickly realized that logistics executives liked living and working in Charlotte. He mostly credits the cost of living and the city’s convenient, robust airport.

“As we looked at the C-suite positions, we came to nd out that the talent pool was signi cant in Charlotte,” he says. “We posted roles for both Charlotte and Danbury and a lot of them were being lled in Charlotte. So it was kind of a natural migration of movement of talent, from Danbury to Charlotte.’

Earlier this year, Odyssey moved into a 23,390-square-foot space at Whitehall Corporate Center in southwest Charlotte.

e o ces house more than 80 employees involved in IT, human resources, procurement, sales support, marketing and commercial operations. e 60-employee Managed Services division has a separate o ce, also in southwest Charlotte.

Odyssey’s other three divisions cover marine logistics, transport and warehousing, and intermodal services.

While its most recent acquisition was in December, the overriding focus is internal growth more than additional deals, Moller says. Each division has growth potential, he adds, though the most mature division is marine logistics, which mainly involves providing logistic services to companies serving Alaska, Hawaii, Guam, and Puerto Rico under Jones Act rules. e federal law essentially mandates that goods shipped between U.S. points must be transported on American- agged ships.

e transport and warehousing business is based in Chesterton, Indiana, and it specializes in the movement of large steel coils and

paper rolls. Because of the requirements of moving such large products, Odyssey owns a fleet of trucks needed to transport pieces.

But those trucks and other capital equipment make it distinct from most of Odyssey’s business, which is considered “asset light” in the industry jargon. The focus is more on consulting and brokerage services rather than the actual movement of goods, which is handled by other companies.

“Logistics is really becoming a technology differentiator more than anything else,” Moller says. “If you don’t have good technology, you really don’t have a strong value proposition to sell your customers.”

That’s why a key hire was Chief Information Officer Maneet Singh, who is responsible for Odyssey’s technology and cybersecurity strategy and leads major IT transformation to foster growth. He had previous management jobs at Snap One, XPO Logistics and other companies, “Since I’ve joined Odyssey, I have been working on getting the systems connected and getting all the data in one place so we can make decisions based on key performance indicators,” he says. “You’ve also got to make sure it is secure, so cybersecurity is essential.”

Moller is a native of Denmark and like several of his top associates, he has spent much of his career on global activities.

But he emphasizes that while many customers are global-minded, Odyssey is very domestic and niche-oriented. It does not seek to compete in international markets against much larger rivals.

Since its split from Union Carbide, Odyssey has largely been owned by private equity companies. Since 2017, the principal owner is the Jordan Group, a New York firm that is also the majority owner of Charlotte’s Bojangles’ fast food chain and Greensboro’s Camco RV parts manufacturer.

Jordan also owns six other logistics companies and has significant expertise in the industry, which Moller calls an advantage for Odyssey. “There’s nothing worse than having bosses who don’t understand your business,” he says, and that is not the case with Jordan.

“What I remain focused on is how do we build the best business and the owners will eventually decide when they’re going to sell the business,” Moller says. “We know that private equity companies are in the business to sell their companies. That’s what they do for a living. My role is to position the business in the best possible way for the current holder and also for a future owner.”

From the new/old perch in Charlotte, Moller is content. “I can tell you, we’re very pleased to be here and it’s worked out great.” ■

By Kevin Ellis

ASmaller-jet operator PSA relocates its base to Charlotte, adding to its owners’ prominence.

bout 70% of PSA Airline’s employees spend 200 work days a year in the sky, carrying passengers to di erent destinations. About half of its 3,600 pilots and ight attendants call Charlotte home.

By January, the subsidiary of American Airlines will call Charlotte home, too. PSA is moving its headquarters from Dayton, Ohio, to the Queen City, a logical decision given that almost half of its 750 daily ights occur at Charlotte Douglas International Airport. It’s the world’s sixth-busiest because of American’s big hub.

e headquarters move involves adding about 350 workers to the 50 management and support sta already in Charlotte, putting its total around 2,200 workers living in the region. e PSA expansion is expected is expected to support more than $228 million in economic output in North Carolina and $10 million in state and local tax revenue, according to a study by NC State.

“ is is our epicenter,” says PSA CEO Dion Flannery, “and that’s principally the reason for our move. More and more of our ights, and more and more of our activity, is here in Charlotte and we were feeling further removed from our employees.”

Flannery spoke from the American Airlines Flight Training Center, which is about a mile from Charlotte Douglas International Airport and two miles from the ve-story, 80,000-square-foot building PSA will use as its headquarters in southwest Charlotte. Soon, says Flannery, he’ll be able to have a meeting in his o ce there, and then be at the airport talking to a crewmember or in the ight training center talking to a pilot within a few minutes.

“It’s as close to a single campus as we can get and that’s what we’re striving for,” he says. Moving from Ohio to Charlotte had been discussed for several years, but the pandemic put the plan on hold. Once airlines began to recover, discussions returned in earnest. Flannery says the airline put in 18 months of work before making the announcement.

e move is a testament to the importance of Charlotte to PSA, says Flannery, adding that those changes occurred gradually over time as the Queen Center became its main crew base. e airline also serves American hubs in Dayton, Dallas, Philadelphia and Washington, D.C., and has maintenance facilities at 10 sites, including Charlotte.

“All the hiring and training that had taken place in Dayton,

About four hours after PSA Airlines announced it was moving its headquarters to Charlotte on Jan. 29, tragedy struck. A PSA flight, on a Bombardier CRJ700 jet, with 60 passengers and the four crew members, collided midair with a U.S. Army Sikorsky H-60 helicopter, upon the jet’s approach to Reagan Washington National Airport. The PSA jet and helicopter crashed into the Potomac River, killing all 67 on the two aircraft. It was the first fatal crash involving American Airlines since 2001. The cause remains under investigation.

5,200 PSA employees, which includes 1,954 pilots, 1,640 flight attendants and 777 mechanics.

750 Approximate number of PSA flights daily, making it the secondlargest airline flying the American Eagle brand for American Airlines based on departures. Envoy Air is slightly larger.

360 PSA daily departures and arrivals from Charlotte Douglas International Airport

21,000 PSA’s daily number of customers served at CLT.

15,500 American Airlines’s employees in Charlotte (18,800 statewide).

gradually those roles moved to Charlotte,” says Flannery. “As we grew the airline and as we grew in Charlotte, some of those roles and opportunities came here.”

For example, American Airlines’ Flight Training Center has six full-motion simulators, which train PSA workers, says Flannery. All PSA pilots and ight attendants will begin their careers with the airline training in Charlotte and return periodically for new training.

PSA says construction at its building is ahead of schedule and should be ready to occupy in January. PSA had a higher-thanexpected relocation acceptance rate, but still expects to ll at

Dion Flannery joined PSA as president in 2014, when the airline had 49 planes, and was promoted to CEO in 2022. PSA now has 140 planes, and is awaiting delivery of 14 used Bombardier CRJ900s that parent American Airlines bought in 2024 and will lease to its wholly owned subsidiary. It takes about six months to finish maintenance and other work to make a plane conform to the existing fleet, he says.

Flannery joined the former Continental Airlines as a director, analyzing pricing and revenue for trans-Atlantic flights, in 1993, after earning an MBA from the University of Houston. He has a bachelor’s degree in advertising from the University of Texas.

He spent more than nine years with Continental before moving to America West Airlines and then to US Airways. He spent nine years there and was part of US Airways when it merged with American Airlines in 2013. As president of US Airways Express, he led PSA, Piedmont Airlines and seven regional affiliates.

1,850 Number of PSA employees based in Charlotte, mostly flight attendants and pilots, along with about 50 support personnel.

350 Number of PSA hires in Charlotte related to location of its headquarters here in January.

least 200 of the 350 jobs locally. PSA is happy with that number because it allows for business continuity, while also giving the company an infusion of new ideas, Flannery says.

PSA received more than 6,000 applications for those new management and support sta positions, showing a tremendous amount of interest in PSA, he adds.

e airline hires about 1,200 workers a year, which comes with being a regional airline, as pilots, ight attendants and mechanics o en move to the larger planes at the major airlines where they can make more money, says Flannery.

PSA Airlines ies the American Eagle-branded jets, which are the 75-seat CRJ 900s and the 65-seat CRJ 600s. American Airlines handles reservations and bookings, and the goal is for passengers not to notice a di erence. When reservations are made, passengers will see that an American Eagle ight is being handled by either PSA or its two other companies, Envoy Air or Piedmont Airlines, which are based in Irving, Texas, and Salisbury, Maryland, respectively.

Independently owned Republic Airways and Sky West Airlines also y American Eagle jets under contract with American Airlines.

In 2022, American raised pilot pay at its three wholly-owned a liates to nearly match compensation earned by its own pilots. e move doubled the cost of regional operations, which had long been a lower-cost option to serve small cities, according to Airline Weekly Rival commuter airlines have mostly matched American’s move.

Passengers entering a plane from the sky bridge can look down and to the le to observe the marking of the carrier. Frequent business travelers may grow more familiar with PSA workers because of the relatively small size of the company compared with the 130,000 who work for American Airlines.

PSA’s growth depends on American Airlines, which is adding 14 jets to its eet. He says Charlotte will also be a part of PSA’s story.

“Charlotte is a growing community, a business-minded community, and it’s where a vast majority of our crew members come and go on a daily basis,” he says. “We need to look at Charlotte as our long-term home.” ■

By Natalie Bradin

SA veteran North Carolina nurse trains her peers to seek new opportunities.

everal years ago, Viola Pierce found herself in a state similar to many nursing peers: emotionally drained and overwhelmed by too much work. But the native of tiny Hollister in Halifax County doesn’t like to sit still or feel defeated.

Instead, she founded Viola Pierce Nursing, or VP Nursing, in 2018 to empower other nurses to utilize their skills to launch consulting and coaching businesses. Attending an industry conference a decade ago shi ed her career perspective and ultimately shaped the birth of her company.

“I saw that nurses were doing other things, and I loved speaking from stage and really transforming people’s lives,” Pierce says. “ at’s how my life got transformed.”

e pressure that many nurses face in their demanding industry is evident in high turnover rates and constant hiring campaigns by most of the state’s healthcare industry. Board meetings at some organizations routinely include reports on hirings, vacancies and reliance on traveling-nurse programs needed to ll shortages.

“ e message I want to share is straightforward: Nurses serve as problem solvers and innovators and educators and leaders, rather than only caregivers,” Pierce says. “ e ability to make a di erence does not require additional educational degrees. e solutions that healthcare needs already exist within our knowledge.”

Pierce has deep roots in nursing. Her mother and sister worked as nursing assistants. Pierce earned an LPN degree in 2002 at Nash Community College. She added a bachelor’s in nursing from Winston-Salem State University in 2014, and a doctorate from Grand Canyon University in 2019.

Most of her career was spent at hospitals in Rocky Mount, now UNC Nash Healthcare, and Tarboro’s Heritage Hospital, which is now ECU Health.

VP Nursing’s business model includes a variety of options aimed at motivating nurses. For $149 a month, Pierce provides

coaching services to her members, along with access to events and workshops that support a community of healthcare workers looking to build their own enterprises.

e company presents the annual Millionaire CEO Nurse Conference, which Pierce hosted in February at 1 Word Plaza in Rocky Mount. e venue is part of Word Tabernacle Church, an evangelical Christian megachurch that has long promoted Black entrepreneurship.

Pierce is author of “ e Audacity of Execution — Nurse to Entrepreneurs: Turn Your Knowledge into Wealth.” e book describes her story and career passion. Some clients that have found success through her coaching appear on e VP Nursing Podcast, in which nurse entrepreneurs pay $50 to share their stories and build their brands.

“My biggest success is seeing other nurses being successful,” Pierce says. “For me, it is not about me at all. It is about them changing their lives.”

Effective nurses have to combine empathetic leadership and clear communication skills, which Pierce notes can help them be good speakers and life coaches. “Nurses use their high emotional intelligence and problem-solving abilities under pressure together with their deep sense of purpose to connect with people emotionally while delivering practical solutions,” she says.

VP Nursing had its first client hit the 7-figure annual revenue earlier this year. “For me, that is my win,” Pierce says. “I love to see that because I want nurses to be able to transform the edge of their knowledge into something tangible, so that they can live their best lives.”

Most of Pierce’s clients continue as nurses. “Our team demonstrates how nurses can use their days off to develop their business operations instead of only recovering from work,” she says. The goal is to “exit with confidence and not chaos.”

Pierce offers two pieces of advice for women leaders: Be unapologetically yourself, and invest in coaching. “I believe that coaches need a coach,” Pierce says. “I’m a firm believer that you should invest in your personal and professional development.”

Asked where she sees VP Nursing in 10 years, Pierce had a quick response: “I want us to be valued as a $10 million company at the minimum.” ■

A federal judge ordered Bank of America to pay $540 million to the FDIC, resolving a long-running lawsuit over alleged underpayment of deposit insurance assessments from 2013 to 2014. The FDIC’s broader $1.1 billion claim was partially dismissed due to timing. BofA says it has already set aside reserves. The nation’s second-largest bank also announced a $5 billion expansion to add 150 branches across 60 U.S. markets by 2027.

Advocate Health named Steve Smoot as division president for North Carolina and Georgia, effective June 2. He succeeds Ken Haynes, the newly named chief enterprise services officer for Advocate. Atrium Health is the group’s brand name in the south, while it uses Advocate or Aurora in its Illinois and Wisconsin markets.

Berlin-based Trench Group will open its first U.S. plant here, investing $50 million and creating 74 jobs by early 2026. HSP US will produce high-voltage transformer bushings, offering an average wage of $77,315.

A city councilmember said the city is paying Police Chief Johnny Jennings $300,000 after he considered suing over threatening texts from former council member Tariq Bokhari. The city has declined to confirm details. Bokhari resigned in April after being appointed to a transit job in the Trump administration.

AvidXchange is being acquired by TPG, a Fort Worth, Texas-based global alternative asset management firm in partnership with Corpay, a leader in corporate payments. TPG and Corpay will acquire AvidXchange for $10 per share, which values the accounts payable automation software provider at $2.2 billion. AvidXchange shares closed at $8.20 on the day the acquisition was announced.

Hendrick Automotive, the largest U.S. privately held automotive retailer, added two Columbia, South Carolina, dealerships to its roster. Hendrick acquired Love Chevrolet and Love GMC, and now has 13 dealerships in the Palmetto State and almost 100 across 11 states.

The Leon Levine Foundation donated $24.9 million to UNC Charlotte to extend its Levine Scholars Program through 203233. The merit-based scholarship supports top students focused on leadership and service. With this gift, the foundation’s total giving to the university nears $53 million.

Tennessee real estate firm Highland Ventures acquired a 19-story, 409,000-square-foot property at 525 N. Tryon St. for $24 million from New York Life Real Estate Investors. The property has a tax value of $97.2 million. New York Life paid $60 million for the property in 2014.

The Lone Star legend — Whataburger opened its first North Carolina restaurant here, with plans to open eight more in the Tar Heel state this year, including one in Hickory this month. Based in San Antonio, Whataburger began in Corpus Christi, Texas, in 1950, and now has more than 1,100 restaurants. North Carolina is its 17th state, and it opened several restaurants in South Carolina last year.

Cape Fear Commercial brokered the $28 million sale of a 17-acre industrial property occupied by John Deere. Hank Miller and Paul Loukas represented the sellers, MT96 Crosspoint and AHG Crosspoint. New York-based Bluerock bought the site, which includes a 327,000-square-foot building.

Istanbul-based Pelsan Tekstil aims to invest $82 million in a breathable film manufacturing plant here, creating 200plus jobs. The plant will support hygiene, medical, and insulation industries.

Prolec-GE Waukesha, a company with 374 employees already in Wayne County, plans to add 330 jobs with a $140 million investment to build a second manufacturing facility for power transformers. The new jobs for the Wisconsin-based company will pay an average salary of $71,912, well above the current Wayne County average of $46,211

Boviet Solar’s solar module factory has opened. The $294 million investment is expected to create 900 jobs. The company makes solar panels and photovoltaic cells. It has commercial, industrial and residential customers in the United States.

East Carolina University Chancellor Philip Rogers filled two leadership positions by removing interim titles. Meagan Kiser was appointed general counsel and vice chancellor for legal affairs and J. Christopher Buddo was appointed provost and vice chancellor. Both had been filling the roles as interim since October.

Big Lots is about to open 132 stores it had closed last year due to its bankruptcy filing, the chain’s new owners, Variety Wholesalers, announced. The shuttered stores will reopen in 14 states, mostly in the south, including 27 in North Carolina. Big Lots closed about 1,000 stores after filing for bankruptcy in September. Variety Wholesalers acquired the business in January.

The North Carolina Aquarium at Fort Fisher will launch a $65 million renovation and expansion later this year, its first major upgrade in more than 20 years. Plans include the state’s largest shark habitat, a rooftop sky deck, and immersive education and conservation spaces.

Washington Regional Medical Center, the only hospital serving Washington County’s 10,713 residents, hopes to emerge from bankruptcy by late May. Rural hospitals not tied to major systems face steep financial challenges. Nearby Martin General closed in 2023 and 13 other northeastern North Carolina counties have no hospitals.

The N.C. Coastal Land Trust purchased 150 oceanfront acres in an area known as The Point, one of the last undeveloped tracts on North Carolina’s barrier islands. The $8 million acquisition ensures permanent conservation and protection of rare habitat and wildlife.

Asheville-based FedUp Foods launched operations at its new 130,000-square-foot facility, formerly home to TRU Colors Brewing. The kombucha and cold brew maker will distribute from this site across North America. The company now runs three East Coast facilities and plans to employ 100 here.

Plans for the first RV park within city limits are advancing after a pause. The project, called Studio Park RV, is proposed on an undeveloped 18-acre tract at 2231 One Tree Hill Way and would include a 50-pad RV park that would cater to travelers wanting a luxury RV experience. Site plans include three buildings and a kayak launch on Smith Creek. Construction could begin in 2026.

Pinehurst Resort will build Course No. 11 at its Sandmines site — its second full-scale course in two years. Designed by Bill Coore and Ben Crenshaw, the course will contrast with Tom Doak’s No. 10. The project taps into the site’s mining history and natural ridges, aiming for a 2027 debut.

Chestertown, Maryland-based Gillespie Precast plans a $10 million concrete manufacturing plant here that will create 39 jobs. Gillespie produces manholes, catch basins and other custom structures made from precast concrete. Once cured, the products are transported to construction sites for drainage and other uses.

Blue Cross Blue Shield NC is asking for sanctions against LifeBrite Community Hospital of Stokes, alleging it submitted over $76 million in false lab claims. The dispute, ongoing since 2018, includes accusations of billing for tests never performed and misrepresenting services as in-network.

Cone Health acquired Novant Health’s stake in HealthTeam Advantage, making it the sole owner of the Medicare Advantage plan with 22,000 members. The plan, launched in 2016, expanded significantly while Novant was a coowner. Cone Health also opened a $100 million, five-story, 156,000-square-foot comprehensive heart and vascular center that will serve about 120,000 patients next to its Moses Cone Hospital.

Amazon received a permit to build a 192,026-square-foot, $24.4 million facility at Ritters Logistics Center. The move follows its February land purchase and continues Amazon’s rapid Triad expansion, which includes major sites in Kernersville, Whitsett and Colfax.

Tanger’s board authorized a $200 million share repurchase program, replacing a $100 million plan set to expire May 31. Considering Tanger shares have traded between $25.94 and $37.57 in the past year, the company could buy back between 7.7 million and 5.3 million shares.

New Piedmont Triad International Airport Authority Chair Graham Bennett says its terminal may need a full rebuild due to worn-out utilities. A redesign could reduce gate count while enhancing traveler comfort. Early-stage planning is underway, with construction possibly starting within a few years.

Ziggy’s, a live music venue from longtime Triad promoter Jay Stephens, opened on South Elm Street. With deep roots in Winston-Salem and High Point, Ziggy’s aims to foster local talent and build community through intimate shows and a $200,000 investment.

Quebec-based Opsun Corp. will invest $9.3 million to create a manufacturing site for solar panels that’s expected to create 20 jobs. It will be the Canadian company’s first U.S. production facility. Average annual wages for the positions will be $63,015, exceeding Guilford County’s average of $60,195.

Blue Ridge Cos. has hired Dallas firm Willow Bridge to manage daily operations at its 10,000-unit apartment portfolio. The company will retain ownership while shifting its focus to development and construction. It still manages commercial assets like Palladium shopping center here.

Culp sold its Quebec mattress fabrics plant for $6.2 million. The company received $1.4 million upfront, with the remainder due over six to 12 months. It projects net proceeds of up to $3.5 million from the sale.

Atrium Health Wake Forest Baptist opened its $78.4 million outpatient surgery center on its Ardmore campus. The 55,000-square-foot facility includes 12 surgical suites and a robotic surgery training room. Plans date back to 2010.

Polyvlies USA will invest $31 million to expand its factory and create 28 new jobs. The nonwoven textiles manufacturer makes fabrics from natural and synthetic fibers. The project follows approval of performance-based incentives from both the city and county.

Bob’s Discount Furniture will enter the Southeast with six new stores in North Carolina this year, part of a 20-store U.S. expansion. The Connecticut-based retailer will mark its 200th store with a location here, with other N.C. openings set for Durham, Fayetteville, Wilmington, Jacksonville and Winston-Salem.

Well, a company that promotes health engagement, attracted $30 million in funding, bringing its cumulative capital raising to more than $150 million. The company now employs more than 250 and promotes its use of artificial intelligence to help predict and address health risks within employee populations. The company could reach profitability next year, says co-founder and President David Werry.

Deutsche Bank’s office here has grown to 1,100 employees — its largest ever — with plans to reach 1,300. The site serves as a U.S. and global tech hub, with 100 positions currently open. Renovations and continued hiring reflect its long-term Triangle commitment.

Town Council approved Hillside Trace, a 190-unit affordable housing community on Martin Luther King Jr. Boulevard. Developed by Taft Mills Group, the project will serve households earning 60% of area median income and marks the town’s largest single-site affordable development.

The Emmy Award-winning series My Home, NC returns for a tenth heartwarming season. Join host Heather Burgiss as she visits the people and places that make NC so inviting, from a James Beard Award-nominated chef and an artist forging a new path in printmaking to a vibrant community rebuilding after Hurricane Helene.

Thursday nights on PBS NC

Duke University began offering voluntary buyouts as part of efforts to cut $350 million in expenses as it faces possible federal funding cuts. The school has frozen hiring, suspended capital projects and may revise employee benefits. Officials warn layoffs may still be necessary.

Fortrea Holdings CEO Thomas Pike is stepping down and will resign as a member of the company’s board of directors. He has been its CEO since its spinoff from Burlington-based Labcorp in June 2023. Fortrea’s board named Peter Neupert, a director on the board, to succeed Pike as interim CEO.

Duck-Rabbit Craft Brewery shut down after more than two decades. The brewery, known for its milk stout and decorated history, filed for Chapter 7 bankruptcy, joining a growing list of N.C. breweries facing industry headwinds.

Ahead of its scheduled opening later this year, Fujifilm Diosynth Biotechnologies manufacturing plant has secured a 10year agreement worth $3 billion to make medicines for the New York drugmaker Regeneron. Fujifilm’s other major customers at the site includeJohnson & Johnson and TG Therapeutics.

Carolina Hurricanes owner Tom Dundon received a rezoning request that will allow him to move forward with a $1 billion sports and entertainment district around the Lenovo Center. The plan allows up to 40-story buildings, 1,450 housing units, 1.8 million square feet of non-residential space and a 4,000-seat concert venue. Construction could begin this year and take a decade or more to build out.

California-based Genentech, a subsidiary of Switzerland-based Roche Holdings, plans a $700 million investment that will create 420 jobs at a 700,000-square-foot manufacturing facility. Genentech creates medicines for seriously ill patients. Its fill-finish operation will be its first on the East Coast.

Building a 46-bed hospital here has two different suitors. Cone Health and a joint venture by Duke Health and Novant Health both filed Certificate of Need requests with state regulators to build a hospital in Alamance County at a cost of $250 million and $225 million, respectively. State regulators aren’t expected to make a decision for several months on which plan to accept, if either.

City Council endorsed tolling a 10-mile stretch of U.S. 1 between Interstate 540 and Purnell Road. The move would fund conversion to a six-lane expressway, replacing traffic lights with interchanges. NCDOT estimates tolls could generate $800 million.

Lee and Associates Property Management merged with Lundy Management Group. The combined company of 50 professionals will operate under the Lee and Associates brand and manage more than 13 million square

feet of space, and become the largest locally owned property and management company in the Triangle.

UNC Health Chatham added maternity care to its 25-bed hospital. Over the last decade, 10 North Carolina hospitals have shut down maternity units.

The historic Green Park Inn, built in 1891 and host to presidents, Annie Oakley, and Gone with the Wind author Margaret Mitchell, is being torn down. Town officials say the new owner plans to build condos and a 40-room hotel on the site.

Spirtas Worldwide, which purchased Canton’s 185-acre former mill site last fall, plans to release its master plan within six months. Owner Eric Spirtas says the plan includes economic, residential, commercial and environmental components. Spirtas continues to cover wastewater treatment costs as discussions with the town continue.

NASCAR’s Cup Series brought its All-Star race back to the historic speedway here for the third consecutive year, attracting approximately 80,000 visitors to the four days of racing.

Pittsburgh-based PPG Industries will invest $380 million to establish a manufacturing center for its aerospace coatings and sealants that’s expected to employ 110 workers. Production is expected to begin by the first half of 2027. PPG first established a Cleveland County operation in the 1950s, but sold its fiberglass unit in 2017 to Nippon Electric Glass, which still has operations there. ■

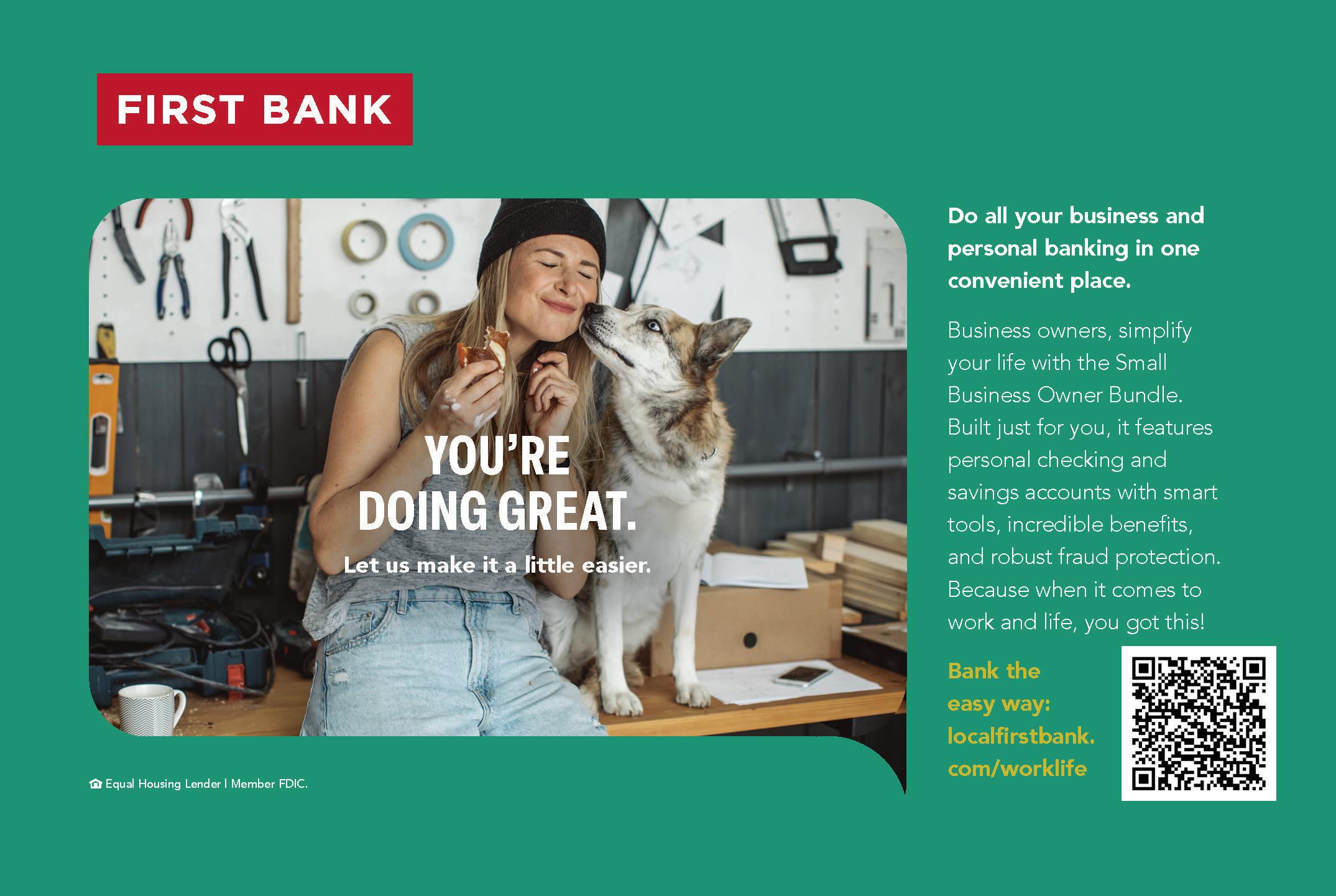

North Carolina’s banking industry, from Charlotte headquarters to small town branches, has been a strong part of the state’s economy for decades. But forces beyond its direct control are reshaping its present and future. Fewer federal regulations, are welcome relief, but tariffs, interest rates and other issues are causing concern and uncertainty. To better understand what’s happening, Business North Carolina gathered industry experts to take stock of the industry, explain its current position and describe possible paths forward. Their conversation was moderated by Editor David Mildenberg. The transcript was edited for brevity and clarity.

The discussion was sponsored by:

•North Carolina Bankers Association

•Pinnacle Financial Partners

•PNC

•Robeson Community College

•TowneBank North Carolina

Adam Currie CEO

First

Bank

CURRIE: North Carolina continues to be a fantastic growth story. Jobs, residents and opportunities are increasing statewide. Urban and rural regions are growing. That isn’t happening at the same level nationally as it is here. That will continue to be a tailwind for the state’s financial industry.

Current banking trends support efficiency. Consumers and businesses demand faster and easier ways to do business, such as payments, loan applications and deposit-account openings. But that pursuit has been at the expense of the personal relationship. Banking will always be a relationship business.

GWALTNEY: Uncertainty is a common theme in my conversations with bankers. There’s uncertainty about tariffs, changes in government agencies, interest rates and inflation. All dampen the economy, which affects banks through slower loan and deposit growth. When driving through heavy rain or thick fog, rather than continuing, it’s safer to pull over and wait for the weather to clear. Many businesses are choosing that approach. It’s less risky. Changes underway in federal regulatory agencies are directly affecting the industry.

It’s an understatement to say those changes are dramatic. Beyond the largescale downsizing in staffing and changing leadership, many of the regulations issued during previous administrations have been withdrawn. We’re relieved and pleased with much of what we’re seeing. But we’re unsure where it all will land. That makes planning difficult.

ANDRESS: The industry loves the additional flexibility that comes with less regulatory burden, including stress tests and other requirements put in place, at least for the largest banks, after the Great Recession. Those regulations, maybe at some point, were a step too far. I’m not suggesting that there wasn’t a good reason for them, but maybe it’s time for more flexibility.

There’s a broader range of economic outcomes today than maybe ever, so we don’t know where we’re headed. But the additional regulations have put the entire banking industry in a good position. We can all feel good, whether or not we like some of those regulations.

ALLEN: This year began with a strong sense of optimism. People were expected to be active, deploying capital and engaging more. We started to see that, but people

Matt Davis president, regional banking director

North Carolina

have become more cautious. There’s uncertainty about the long-term impacts to suppliers. Projects in place are moving forward. But there is a sense of pause, waiting 60 or 90 days for better clarity.

DAVIS: Bankers always take a cautious approach, slowing or waiting until there’s a better feel for which way things will settle. Uncertainty enhances risk. It’s important to understand your operating environment before doing anything too bold. Optimistic but cautious is the overriding theme that we hear from our customers and peers.

ALLEN: Business news channel CNBC named North Carolina the second-best state for business in 2024 and first in 2022 and 2023. It was for good reason. It’s a strong banking state. Many banks are headquartered in Charlotte, which has been a key player in the industry for years.

ANDRESS: North Carolina is the first destination of many recent college graduates, whether they studied here or elsewhere. That is incredibly beneficial to our economic growth.

Peter Gwaltney president and CEO North Carolina Bankers Association

DAVIS: Beyond a strong foundation, other aspects of the state’s economy are positives for financial institutions. There’s a strong digital technology focus. The industry must continue investing in data analytics, cloud integration and other technology to be competitive. The university system is robust and focused on technology and business. As current economic uncertainties settle the industry can leverage and catapult to success from that foundation.

CURRIE: Banks and financial firms are catalysts for economic development. A strong banking presence makes any community economically stronger over time. North Carolina is home to some great homegrown financial institutions. It seems like every bank from the Northeast and Midwest has North Carolina in its strategic plan. That creates great opportunity for North Carolinians and keeps the job market vibrant.

ALLEN: It’s rapid. As new technology is introduced, banks follow, ensuring they all have the same bells and whistles. While technology is integral to what we do, we can’t completely embrace artificial intelligence. The human component is vital to our industry. We must complement technology with talented people who understand the industry and our clients.

DAVIS: Everybody gets enamored with new technology; I’m no exception. But banks are in the people business. I read that technology will never do some things, including engaging and empathizing with a human being. Technology does many things, especially data and quantitative efforts, better than us. So, we should focus on the qualitative aspects of life and relationships.

AI is a positive. Properly utilized, it forces us to do what we do best, which isn’t punching numbers into a spreadsheet. But it does take a person to interpret that data and discuss its implications with a

customer. Our customers entrust us with a lot of important data. We need to use technology wisely. That’s the key.

ANDRESS: About five years ago, fintechs were supposedly going to replace the banking industry. Banks are as strong as ever. Fintech’s inventions have accelerated the industry’s growth. In some cases, banks have co-opted their technology. In other cases, acquisitions were made. It comes down to fitting together technology and people. The two go hand in hand. Our CEO says it’s not your father’s banking business anymore. The technology-oriented discussion at internal meetings today is very different than years ago.

ALLEN: The talent pipeline has shrunk. There are fewer bank-run training programs. Pinnacle Financial Partners doesn’t have one. We recruit bankers from other banks; that’s our model. I’d like universities to become more engaged, offering a banking career path.

NCBA under Peter’s leadership has been more involved with them. Graduates need analytical skills. That’s not beyond the typical finance and accounting degrees. But that knowledge needs to be applied to what we do and how we do it. Soft skills are important, but we can develop those better than the more technical and analytical skills.

Pinnacle’s Bankers in Schools program puts our bankers in middle and high

schools, where they talk to students about careers in the industry. They’re more than loan transactions and financial management. It’s information technology, cybersecurity, administrative and more.

DAVIS: TowneBank recently began a training program, because there aren’t many available. It’s common practice to let somebody else train workers. Bankers move around. That’s the way it happens. We’re still in our infancy, but we’re establishing relationships with major universities. We recruit at them. I’m scheduled to sit on an upcoming panel, interviewing and hiring recent graduates, who will enter a formal training program. The industry needs more of that.

PATE: Our accounting and finance program blends traditional fundamentals with modern technology. It has many fintech elements such as blockchain analytics and digital banking. Handson experience is emphasized through industry partnerships and internships. Simulation software creates practical scenarios for our students.

Our faculty maintains close working relationships with banking and financial professionals. They’re invited into our classrooms on a regular basis to discuss current trends, needs and opportunities in the industry. What they share shapes our curriculum. Everything is data driven and evidence based now, so we need to teach those skills and impart that way of thinking to students.

We’ve added a course, Data Analysis and Decision-making, to our accounting

and finance degree and business administration degree. Students learn to collect and analyze data, visualize information, assess risk, make predictions and navigate decision-making processes effectively. We teach the theoretical part in the classroom, putting them in position to apply their knowledge in the job market. We’ve added a one year 12-hour certificate program called Bookkeeping and Data Management. It provides fundamental accounting skills focused on financial decision-making through data organization and analysis.

We added a work-based learning option to our curriculum. Students earn course credit. It’s seen statewide through the apprenticeship program and work-based learning programs in general. We’re giving students an option, allowing them to choose an apprenticeship or internship or a traditional classroom course for the credit they need.

A few years ago, we changed our Customer Service course to Customer Experience. That broadened its classroom work to include understanding complex customer requirements and handling stressful situations. We aligned our goal with what we’re doing in the classroom and the customer service skills that are required today.

The job market for accounting and finance students is promising. There’s strong demand for entry level accounting, bookkeeping, financial assistance and similar positions. Our local banks and credit unions consistently seek our graduates. Their technical knowledge and understanding of the local economic landscape are valued by small businesses. Remote work opportunities have opened doors to larger firms and jobs in urban centers.

CURRIE: The two banking jobs that are most in demand are bankers and technologists. The industry needs

commercial and retail bankers with deep relationships in their communities and experts who can translate technology to business leaders.

ALLEN: The real tell is the state’s successes. The state’s three largest metros — Charlotte, Raleigh and the Triad — rarely go a week or two without welcoming a business relocation or expansion. They’re figuring out how to be competitive at the state level to attract companies.

GWALTNEY: I recently spoke to a company that’s considering an expansion into a Tier 1 county — one of the state’s less economically advantaged counties. There are state incentives to make those moves more possible. That’s something the state has been smart about. It certainly can do more, but it does some things well.

North Carolina has an extraordinary business climate. It’s one of the top three fastest growing states in terms of population. Shortly after I moved here, the General Assembly was considering the Job Development Investment Grant program. NCBA typically stays in its lane, but under the leadership of Bob Hatley, its chair at the time, it weighed in on that. The math made sense, because there was accountability if the business didn’t create the promised number of jobs with the incentives it received. It has worked, and other states do it, too. It’s a game that we must play to be in play for businesses to come here and create jobs. That makes the state better.

GWALTNEY: The U.S. Census Bureau defines banking deserts as places that

lack a bank branch. Their minimum size is determined by their location: 2-mile radius for urban communities, 5-mile radius for suburban communities and 10-mile radius for rural communities. North Carolina has a handful in sparsely populated regions such as the Great Dismal Swamp and Great Smoky and Blue Ridge mountains.

A bank branch needs a certain level of deposits and loan activity to be viable. Short of that, it can’t be staffed, insured or operated. No one wants to be the last bank to leave a community. A lot of angst is spent over that decision. And when that bank decides to leave, extraordinary things are done to serve those residents.

There are about 2,000 bank branches across North Carolina. About a quarter of them are in Tier 1 counties. A large number are in Tier 2 counties, then there are a number in Tier 3 counties, which are the most economically advantaged.

PATE: Rural North Carolina students bring a unique perspective. They’ve been shaped by the transition to an economy dominated by service industries, such as banking and finance, from agriculture and manufacturing. They demonstrate remarkable resourcefulness and practical financial literacy. They learned it out of necessity.

Our students value developing portable skills, which are applicable locally or within other markets. They recognize that financial expertise is particularly valuable in rural communities, which often have limited access to financial services. Robeson County is rural. While we acknowledge that there is a wage disparity between rural and urban workers, our students appreciate the lower cost of living and strong community connections that we have here. Many students want to contribute locally rather than automatically pursuing opportunities in large cities.

ALLEN: Interest-rate commentary for a bank can go many directions. Like other industries, we like stability. Banks tend to do better in lower interest-rate environments, though zero is tough. That’s typically where our clients become more active. Activity tends to decrease as rates rise. I’m not advocating where rates should be, but a lower environment is usually better for banks.

DAVIS: It’s better when rates change slowly rather than quickly. The industry is adaptable, just as the country and economy. But that adaption can take time. It’s hard to predict the ideal interest-rate environment. A bit lower than where it’s now is probably better. But everything is relative. When I had an 8.25% fixed rate on my first house, I thought I hung the moon. But my children say they could never buy a house at that rate.

ANDRESS: We started this conversation discussing the range of potential outcomes for the economy. The same could be said for today’s interest-rate environment. We could argue for wide interest-rate swings in either direction. That’s why it’s important for banks to be well capitalized and positioned for the foreseeable future.

GWALTNEY: The Fed Funds Rate was 4.3% on April 24. The average Fed Funds Rate is 4.6% over the past five decades. So, we’re in a good place, though recent history would say it’s too high.

CURRIE: The banking industry has faced three major economic crises in five years. We experienced the pandemic, the failure of Silicon Valley Bank and the bank liquidity crisis in 2023, and now the tariff tantrum. Banks are generally well capitalized, well reserved and have plenty of liquidity. An economic downturn is never fun, but I do feel we are prepared this time around. Market fluctuations are part of business, and as leaders, we have to prepare our company

as well as we can for the inevitable tough times. Hopefully, we will avert a serious downturn this time around, but we are prepared if that is not the case.

ALLEN: We change lives. It’s special when you can put someone in a home, help start a business, or help someone retire or accomplish goals. Our clients become friends. It’s rewarding to see that happen.

We work in the community. We teach financial literacy classes at schools and churches. We support nonprofits. Our workforce volunteers. We do it as a team, as a family. All of my colleagues do these things in their markets. The day-to-day is great, but that allows us to do the big things.

DAVIS: Banking has always played an integral part in the community. It’s great to help others achieve everything that they want to do. That’s rewarding.

ANDRESS: PNC’s Grow Up Great program focuses on early childhood education. If a child doesn’t get a good start, then the chances of catching up educationally and otherwise are long. When I was introduced to it 13 years ago, when I started working for PNC, I envisioned reading books to young children. We’ve done some of that, and it’s a joy. But it has been a privilege to see the work that supports these young children and their families. PNC supports the arts community. If you’re going to have a vibrant economy, then you need a strong arts community.

GWALTNEY: I have a front row seat to all of this. There are 100,000 bankers statewide. They’re great people doing great work. They’re doing large company lending and financial literacy. They were handing out piggy banks to children on National Teach Children to Save Day in April. They do many other things. It’s often said that if something good happens in a community, it usually starts at the local bank. It’s so true. ■

This is the thirty-seventh in a series of informative monthly articles for North Carolina businesses from PNC in collaboration with BUSINESS NORTH

Finance and technology executive Ned Carroll is unable to recall a time when he wasn’t fascinated with the premise of how well-managed data can be used.

His love of data has lineage dating back generations. As a child, Carroll spent his weekends with his grandfather at the Port of Baltimore calculating ship turnaround time, berth productivity, dwell time and other metrics used to assess productivity of port operations.

While in high school, he learned of his family’s history leveraging data to impact world events. His great-grandfather served in World War II as a researcher and epidemiologist for the War Office on Malaria, the predecessor to the Centers for Disease Control, to help battle the No. 1 killer of U.S. troops in the Pacific Theater: tropical disease.

Fast forward to today, and Charlotte-based Carroll is using this background context of how powerful data can be to understand the world around us and help formulate solutions to advance automation in banking.

This, together with 30 years of industry experience, provides Carroll the inspiration and capacity necessary to address the seemingly paradoxical challenge of harnessing the power of advances in Artificial Intelligence (AI) within the responsibly regulated framework of the financial services industry.

“AI is not new,” says Carroll. “As a student at Davidson College, I did AI. The difference now is that the availability of data, compute and tools makes it easier, faster and cheaper to access.”

As executive vice president and head of Enterprise Data and Automation at PNC Bank, Carroll is accountable for driving the application of AI for all bank stakeholders and delivering solutions that drive efficiency, while upholding the responsibility that accompanies a financial institution’s stewardship of data. It’s a delicate balance he refers to as prudent innovation.

Fortunately, the same types of skills required to manage AI responsibly have been used to manage models that impact the safety and soundness of the financial system, so the financial services industry is well positioned to deploy AI responsibly.

“As an enterprise, we are always seeking new ways to work smarter and create greater efficiencies while delivering the best customer experiences possible,” says Carroll. “PNC has been using AI for years to drive efficiencies and will continue to do so in a strategic and thoughtful way that optimizes return on investment, minimizes risk and prioritizes our customers’ best interests.”

Carroll frequently shares his insights with executives throughout the country. And while AI use cases and particulars can vary widely across industries, the same fundamentals apply.

As interest in AI continues to grow and it becomes increasingly more accessible to organizations, Carroll cautions against viewing AI as a silver bullet for addressing business and operational challenges. He emphasizes that AI should be recognized for what it truly is: a way to extract value from data. And it takes a lot of data to operationalize AI.

“Data and AI are often approached as two independent conversations, when in fact the connections and interdependencies between the two cannot be ignored,” he says.

Bad data can plague a model with flawed results and can create ripple effects. As the saying goes, “garbage in, garbage out,” so any AI strategy must be built atop a strong data strategy.

“I analogize the connection between data and AI models with food and how we nourish our bodies,” says Carroll. “Consuming junk food with little nutritional value is akin to feeding models low-quality data. A model is only as good as the data that fuels it.”

Beyond the data-quality imperative, there are several considerations organizations should evaluate when contemplating AI implementation, including viability, risk and cost, says Carroll. For PNC, applying AI involves a thoughtful approach and emphasis on demonstrable value.

“Before even considering leveraging AI as a tool, organizations should ask themselves, ‘What are we trying to solve for?’” he says.

In some instances, the most immediate or cost-effective solution may be an old-fashioned process improvement.

And while the potential for AI is exciting, organizations need to think beyond how they can leverage it – and focus on how to control it in a way that is reliable and trustworthy, understanding the risks and building guardrails to help mitigate risk.

“In some ways, AI can be viewed as a high-performance car,” says Carroll. “Engineering for speed and power may be the objective, but the importance of safety mechanisms cannot be overstated. Additionally, it’s not always needed. For example, I don’t necessarily need a Ferrari to drive to the grocery store.”

Additionally, organizations should be mindful of potential cybersecurity or privacy risks and how to safeguard the vast volume of data that informs AI models. Privacy and protection of customers is paramount.

“The cost of introducing AI into a business’s operations extends beyond the initial investment in the tech and upskilling for employees. The true cost over the long term — beyond the initial capital investment — should be part of the decision calculus,” Carroll says.

When it comes to PNC’s prudent approach to innovation and AI, Carroll leans into the enterprise’s core messaging of brilliant and boring. “While AI may not seem boring at face value, our priorities are intentionally focused on responsibility, security, quality and driving efficiencies,” he says. “Our human-in-the-loop approach means our employees continue to play a critical role in managing data and automation technologies and strive for the highest level of quality. It’s important that we consistently demonstrate our commitment to responsible AI to our customers, shareholders and employees.”