4 UPFRONT

6 POWER LIST INTERVIEW

Economic development leader Christopher Chung discusses how North Carolina aims to remain the envy of its peers.

A Greenville gaming entrepreneur cashes in; Duke Health picks up its pace; A fourth-generation CEO steps up at Carolina Cat; It may be Bad Company’s time; Turning a party into a business; Stephen Curry plots a Davidson rebound.

Baseball’s storied history in the Tar Heel state takes a corporate turn with investment groups taking unprecedented stakes in teams and stadiums, with support from local governments and taxpayers.

BY TUCKER MITCHELL

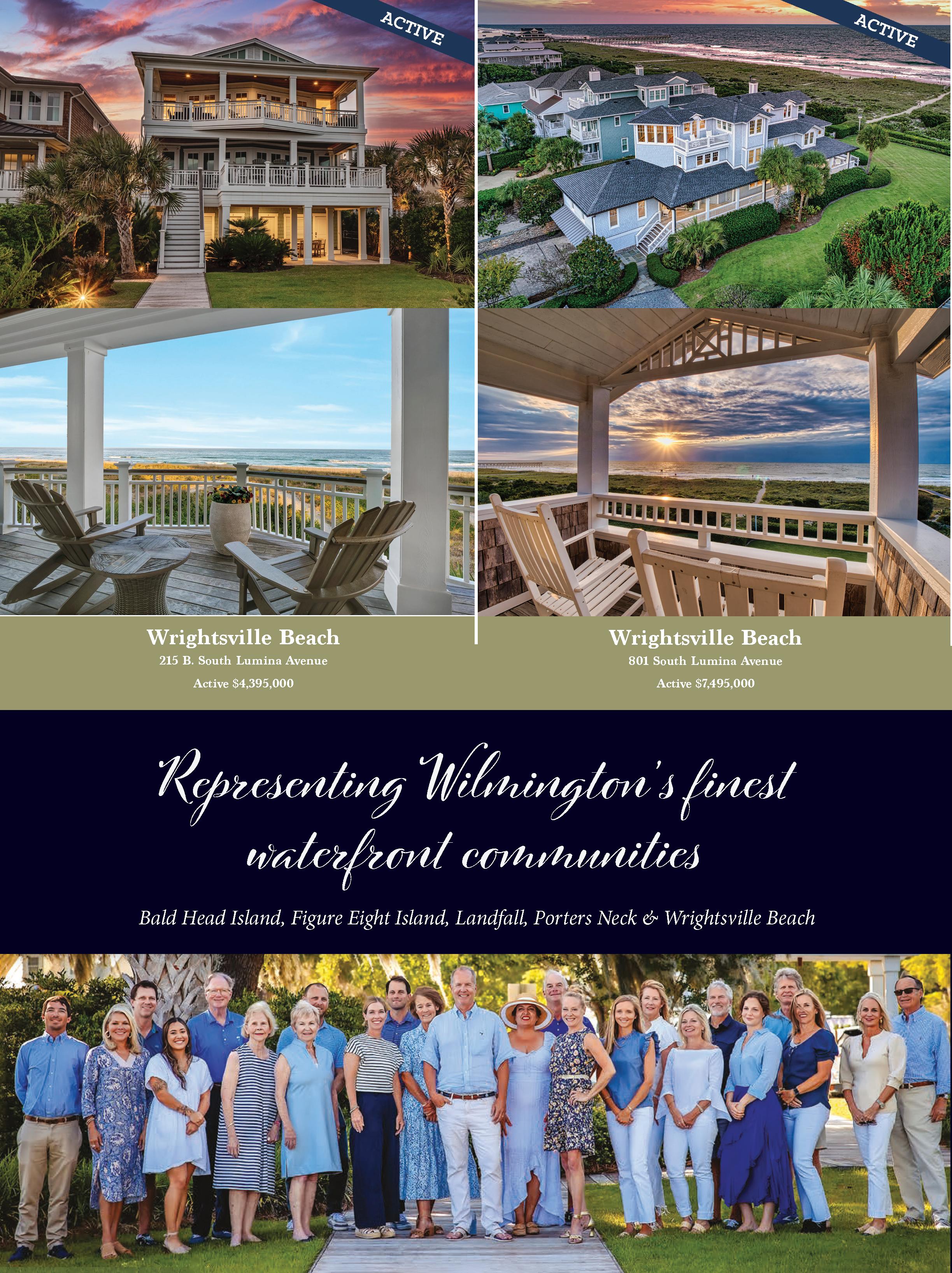

32 COMMUNITY CLOSE-UP: BRUNSWICK, NEW HANOVER, PENDER

People arriving at these three southeastern counties are finding vibrant communities filled with new opportunities.

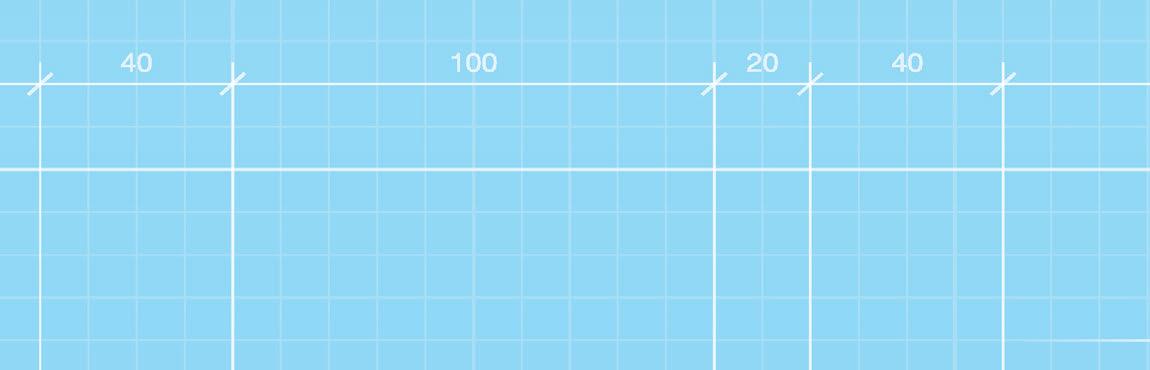

42 ROUND TABLE: TRANSPORTATION

Six experts discuss planes, trains, automobiles, trucks and ports and the strategies to keep North Carolina moving.

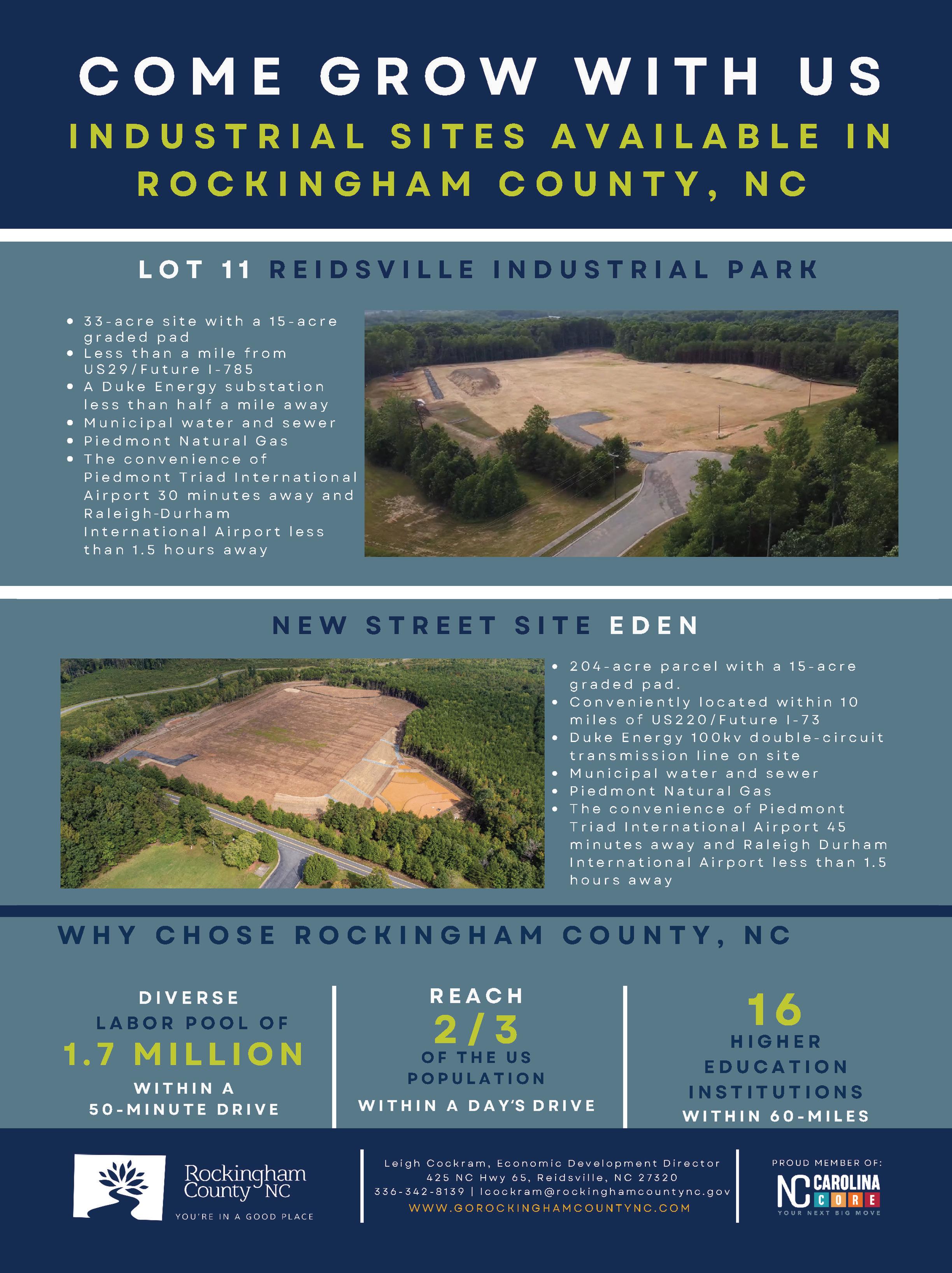

80 INDUSTRIAL PARKS

Years of effective local planning have allowed communities to reinvent themselves and offer space for commercial growth.

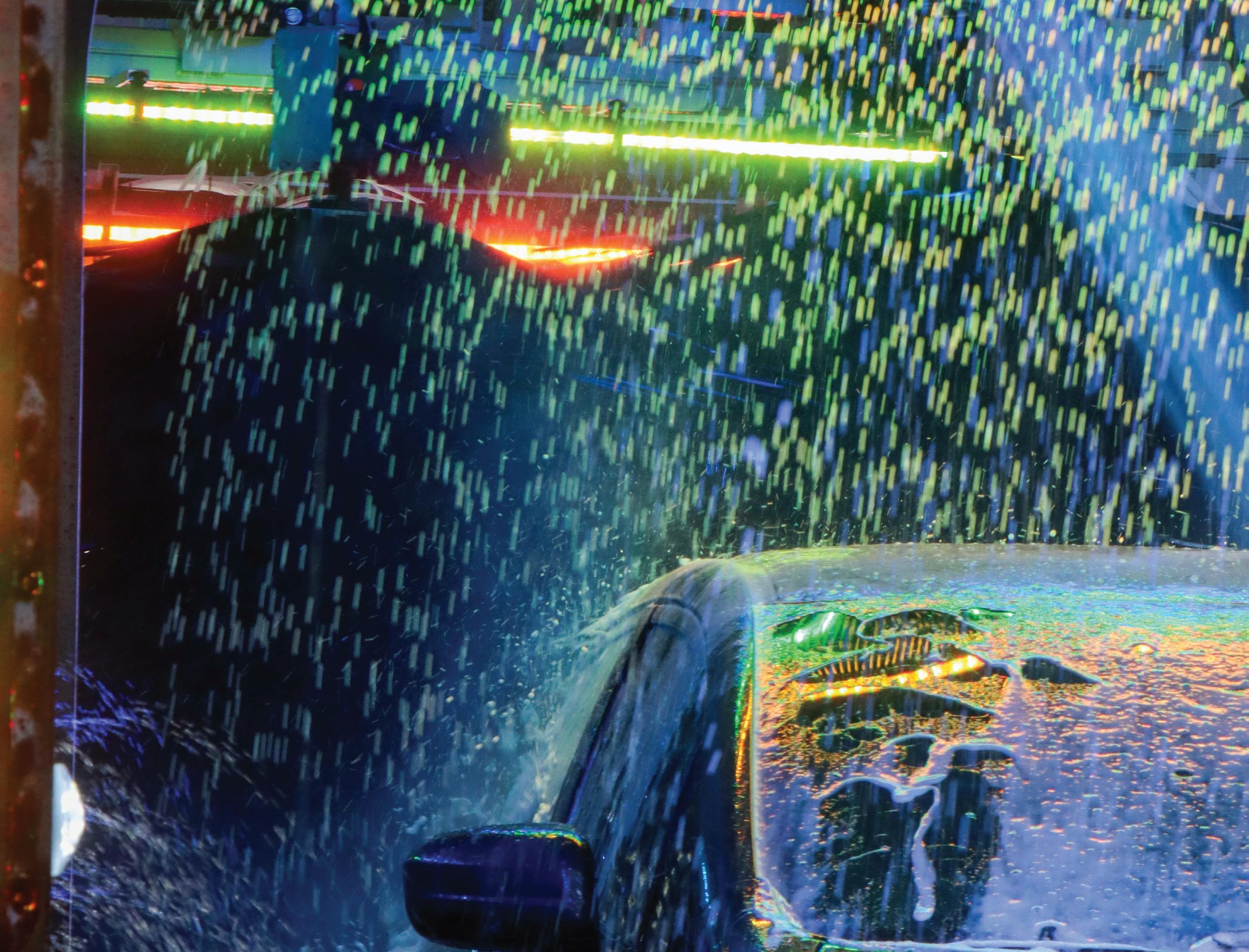

A pending deal has Jose Costa and Whistle Express poised to be the captains of car washing.

BY DAVID MILDENBERG

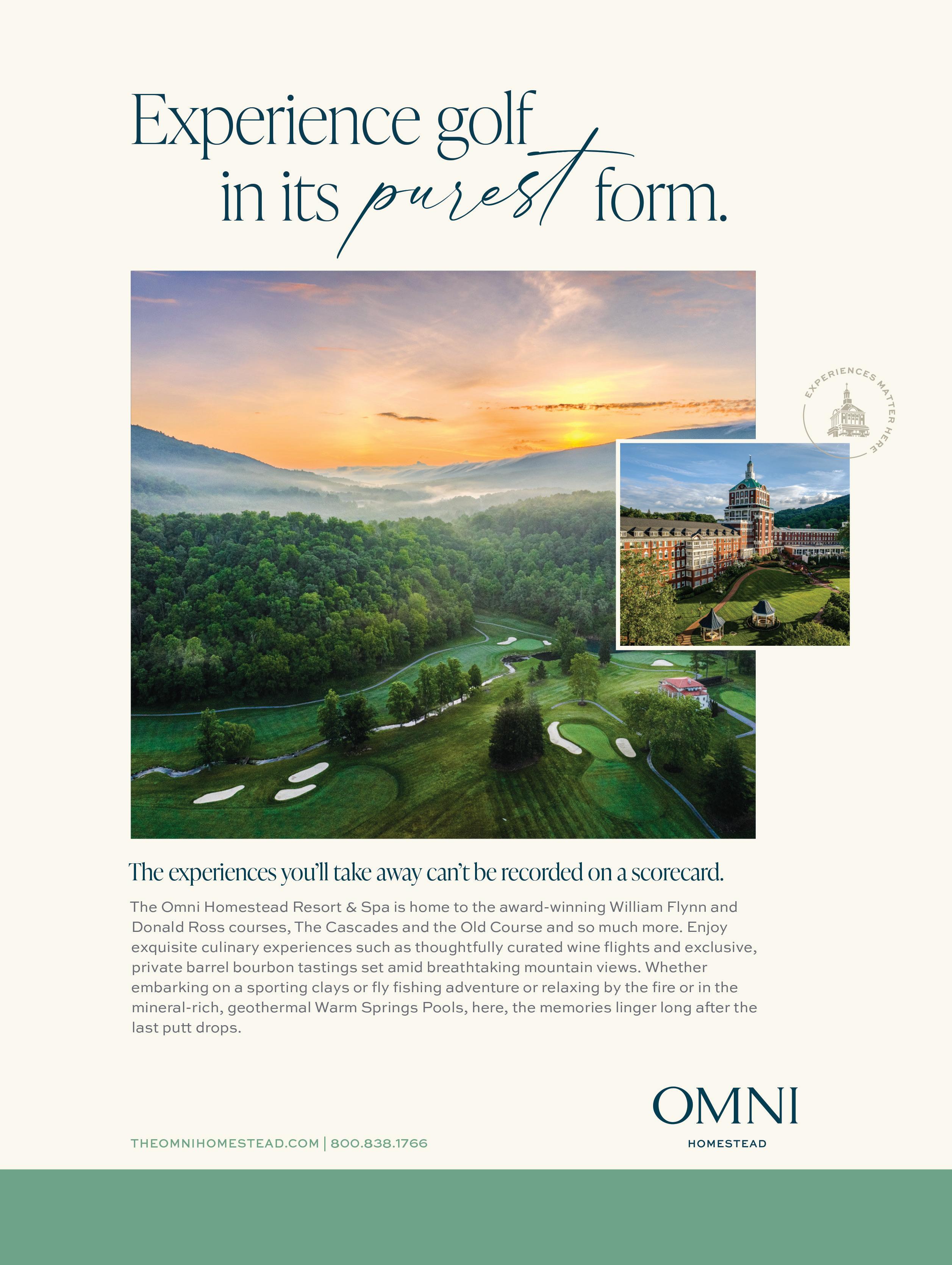

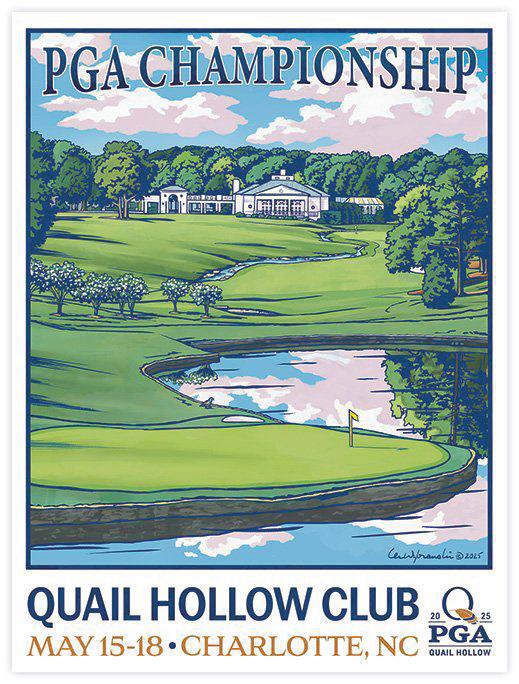

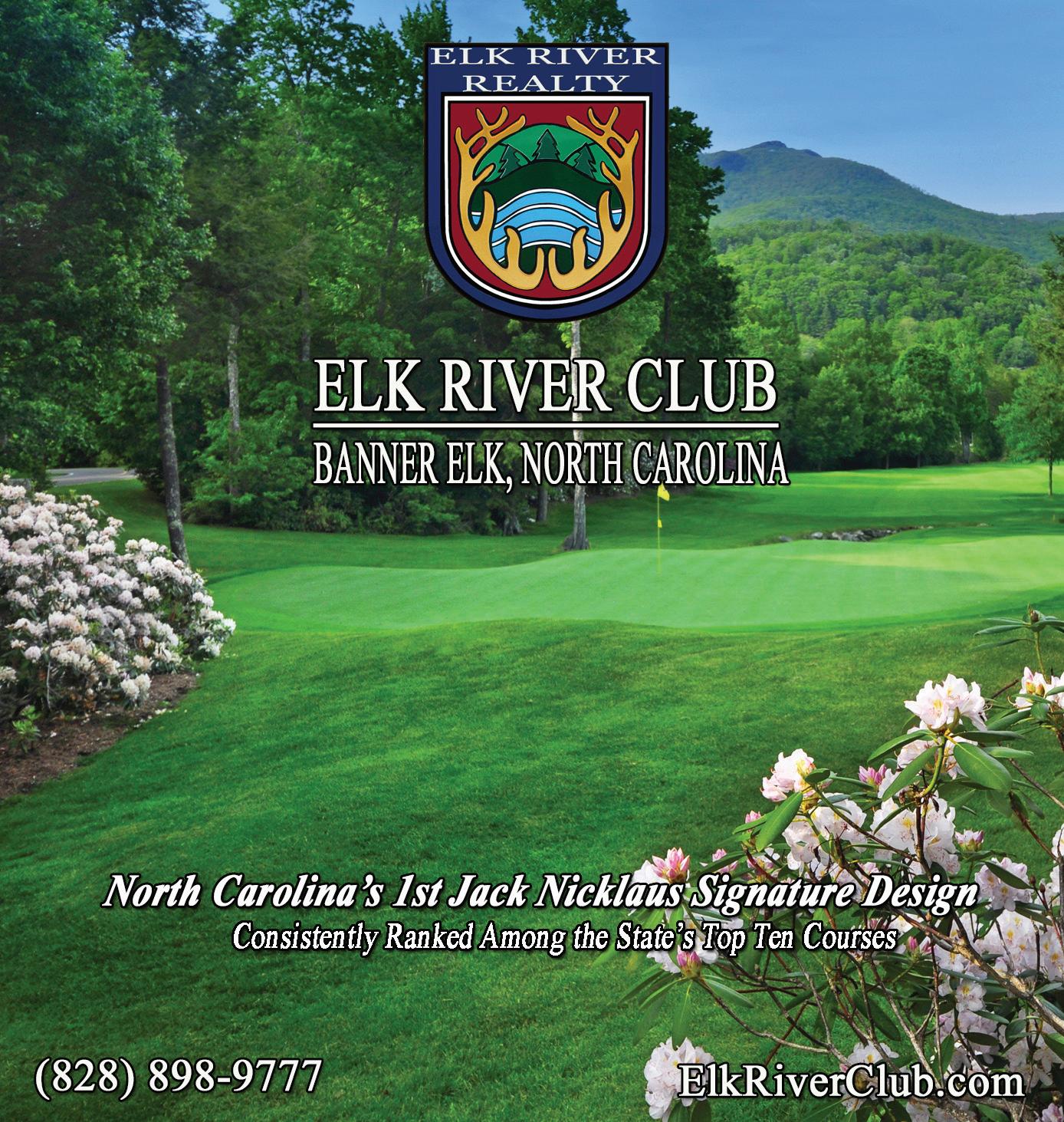

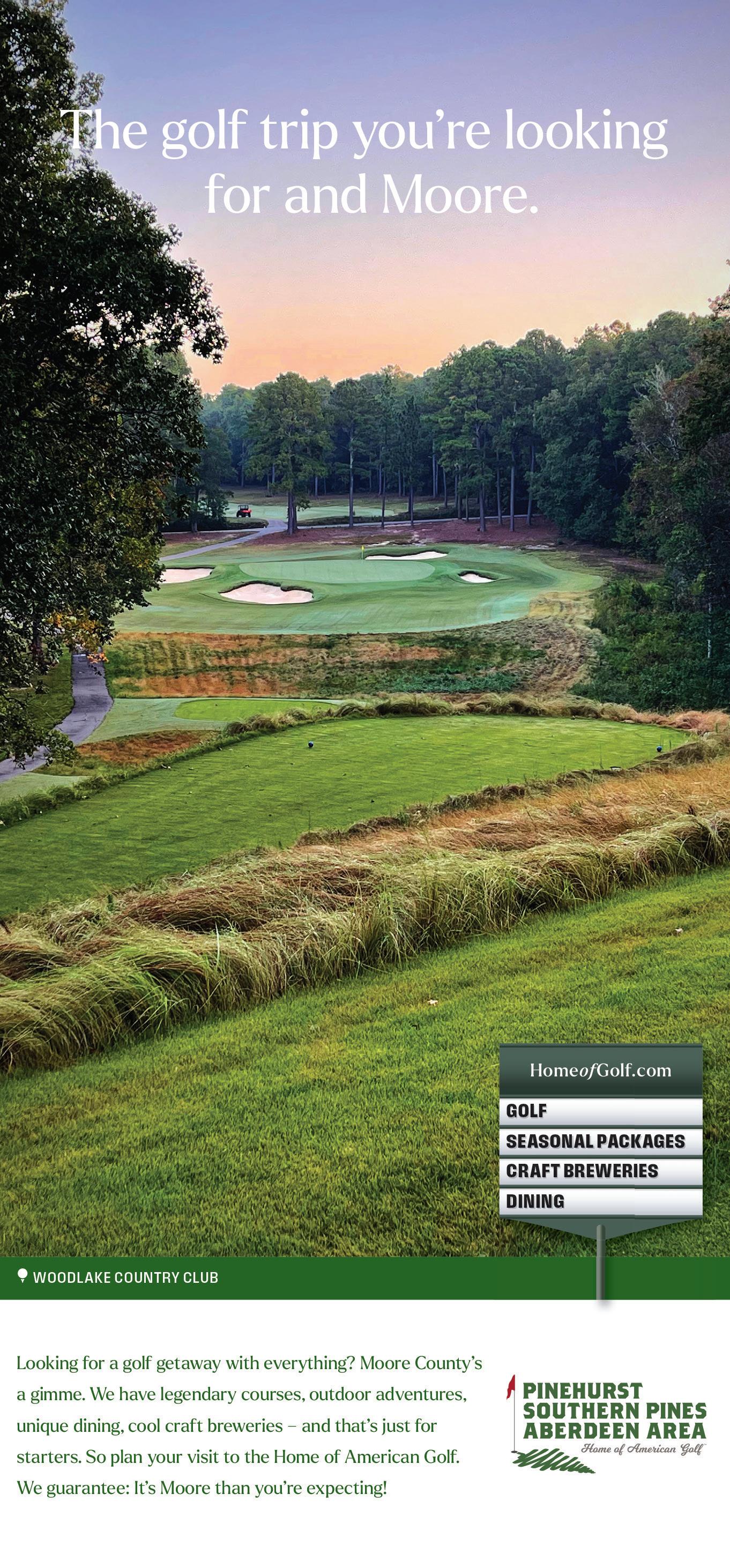

The world’s best golfers head to Charlotte ; The N.C. Golf Panel presents the state’s best courses; Hurricane Helene’s toll. BY BRAD KING, TRENT BOUTS

The state’s new Commerce secretary brings rural roots, lobbying experience and bipartisan instincts.

BY RAY GRONBERG

It strikes me that change is inevitable and that North Carolina is getting better all the time. It’s easy to long for the good old days, even if they weren’t all that good, while appreciating enduring values that make for long-term progress.

The thought, and more specifically how Raleigh has changed, was sparked by a chat with Brad Hurley, who with John Vick has run the 42nd Street Oyster Bar restaurant in downtown Raleigh since 1987. They succeeded partner Thad Eure Jr., who envisioned the addition to his hugely successful Angus Barn in west Raleigh. Sadly, he died of pancreatic cancer at age 56 a year after the Oyster Bar’s debut.

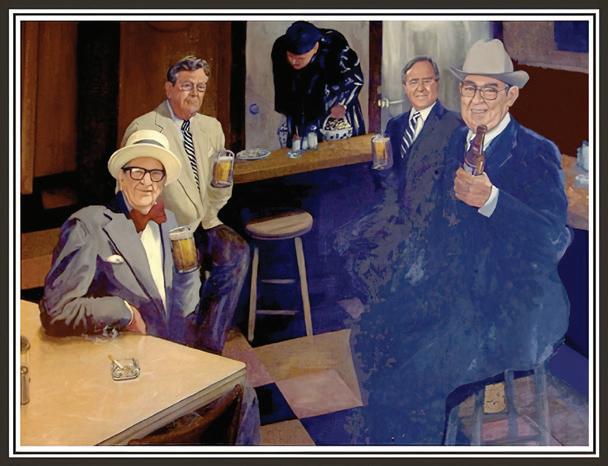

The restaurant is famous as the site where many key decisions were hammered out by lobbyists, politicians and Raleigh influencers. An iconic mural at the restaurant shows former Gov. Bob Scott; Eure’s father Thad Sr., who was N.C. secretary of state for 52 years; 36-year Agriculture Commissioner Jim Graham and developer Willie York, who created the Cameron Village shopping center.

“People have said the big, bad landlord wins again, but that isn’t right,” Hurley says. “We had a good run and we chose not to sell the restaurant.”

Yes, change is inevitable and often positive when insightful folks are steering the ship. Many examples of changemakers are evident in this edition.

Christopher Chung’s name pops up a lot this month. State leaders recruited him from Missouri a decade ago to lead the state’s industry recruitment. He’s handled the pressure with aplomb, letting the politicians strut while gaining the confidence of both sides in a highly partisan environment.

Hurley is an East Carolina University grad who in the 1970s joined the upstart Darryl’s chain, formed by the younger Eure and Charlie Winston. He learned the spirits business at the company’s Lexington, Kentucky, restaurant, in preparation for the legalization of mixed drinks in parts of the state in 1978. Darryl’s sent bar trainers from Kentucky to its N.C. restaurants, which benefited from liquor by the drink.

Eure saw the opportunity for a classy, clubby watering hole near the state Capitol when lobbyists could buy dinners and drinks with limited oversight. At its peak, the 240-seat restaurant employed 120 people.

T hirty-eight years later, Hurley and Vick are in their 70s and not ready to commit to another lease with the longtime property owners, the Hobby family. A late March closing was planned. Hurley and Vick didn't want to see the restaurant's reputation decline. While there’s more competition for diners now, the restaurant is doing fine, he says.

Charlotte kingpin Johnny Harris gets a mention in our section focusing on the state’s golf business. His longstanding promotion of the sport's economic impact in North Carolina has led to global broadcasts of Charlotte’s major golf tournaments. That’s made the Queen City more inviting to CEOs, whose relocation decisions have changed the state. Bobby Long in Greensboro and Robert Dedman and Tom Pashley in Pinehurst have played similar roles with their events.

In the Statewide report, we note Kevin Howell’s selection as chancellor at NC State University in May. He has to sustain momentum from Randy Woodson’s 15-year tenure at the campus. Lacking the Ph.D. pedigree of most university chiefs, Howell is among the state’s most well-liked leaders after two decades of key roles at the Raleigh campus and UNC System.

Vision also can lead to personal fortune. Gambling industry entrepreneur Garrett Blackwelder hit the jackpot in February, selling about half of his Greenville-based Grover Gaming for $1 billion. (See Page 8.) Perhaps more effectively than anyone in state history, he figured out how to tap into the insatiable national obsession for betting.

That vision thing is a pretty rare, unpredictable and amazing beast, don’t you think?

Contact David Mildenberg at dmildenberg@businessnc.com.

VOLUME 45, NO. 4

PUBLISHER

Ben Kinney bkinney@businessnc.com

EDITOR

David Mildenberg dmildenberg@businessnc.com

MANAGING EDITOR Kevin Ellis kellis@businessnc.com

ASSOCIATE EDITORS

Ray Gronberg rgronberg@businessnc.com

Cathy Martin cmartin@businessnc.com

EDITORIAL INTERN

Natalie Bradin

CONTRIBUTING WRITERS

Pete M. Anderson, Dan Barkin, Chris Burritt, Trent Bouts, Brad King, Tucker Mitchell

CREATIVE DIRECTOR

Cathy Swaney cswaney@businessnc.com

GRAPHIC DESIGNER

Lauren Ellis

M ARKETING COORDINATOR

Jennifer Ware jware@businessnc.com

EVENT DIRECTOR

Norwood Teague nteague@businessnc.com

ADVERTISING SALES

ACCOUNT DIRECTOR

Melanie Weaver Lynch, eastern N.C. 919-855-9380 mweaver@businessnc.com

ACCOUNT MANAGER

Anne Brundage, western N.C. abrundage@businessnc.com

CIRCULATION: 818-286-3106

EDITORIAL: 704-523-6987

REPRINTS: circulation@businessnc.com

OWNERS

Jack Andrews, Frank Daniels III, David Woronoff, in memoriam Frank Daniels Jr.

PUBLISHED BY Old North State Magazines LLC

PRESIDENT David Woronoff

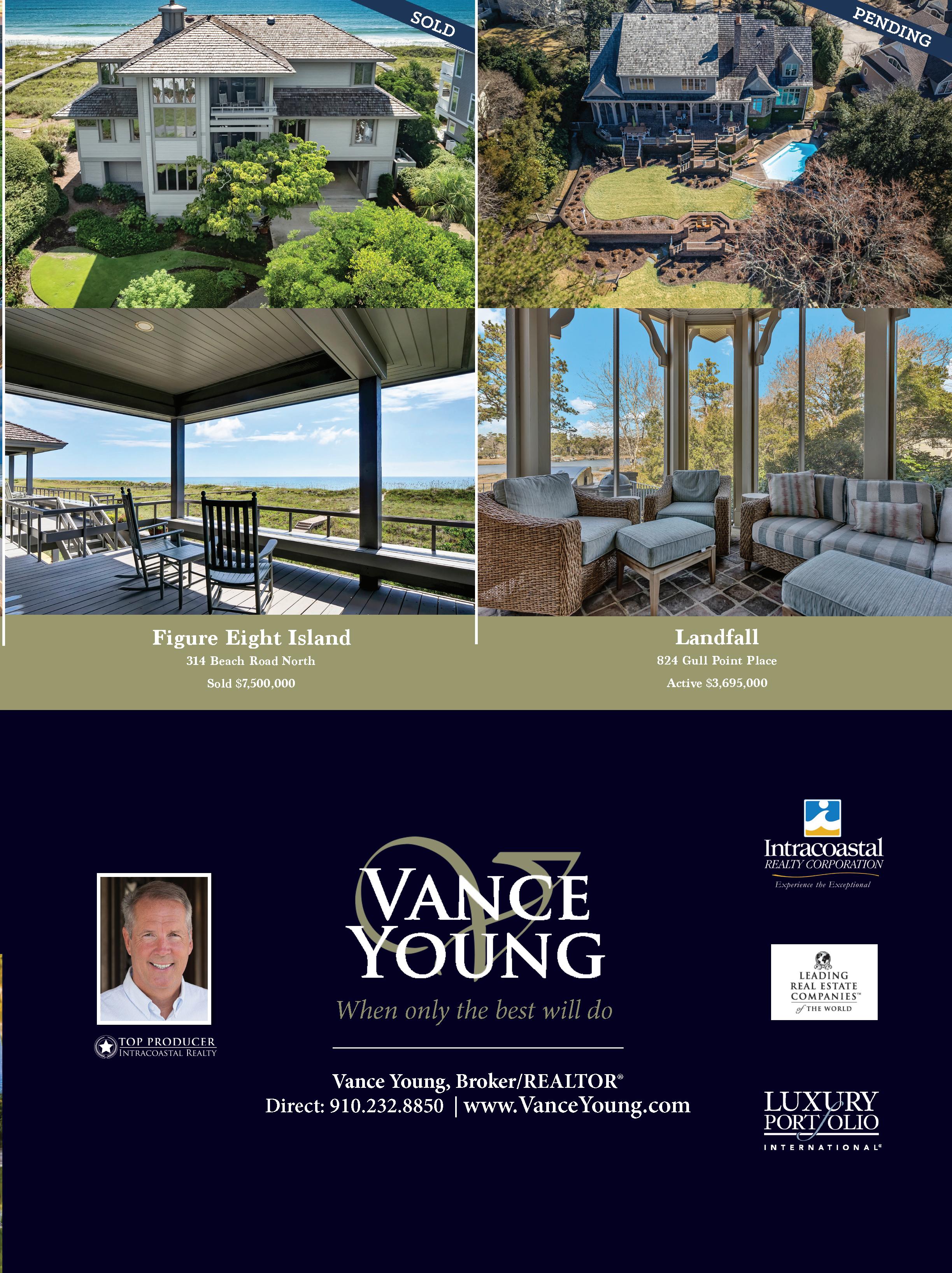

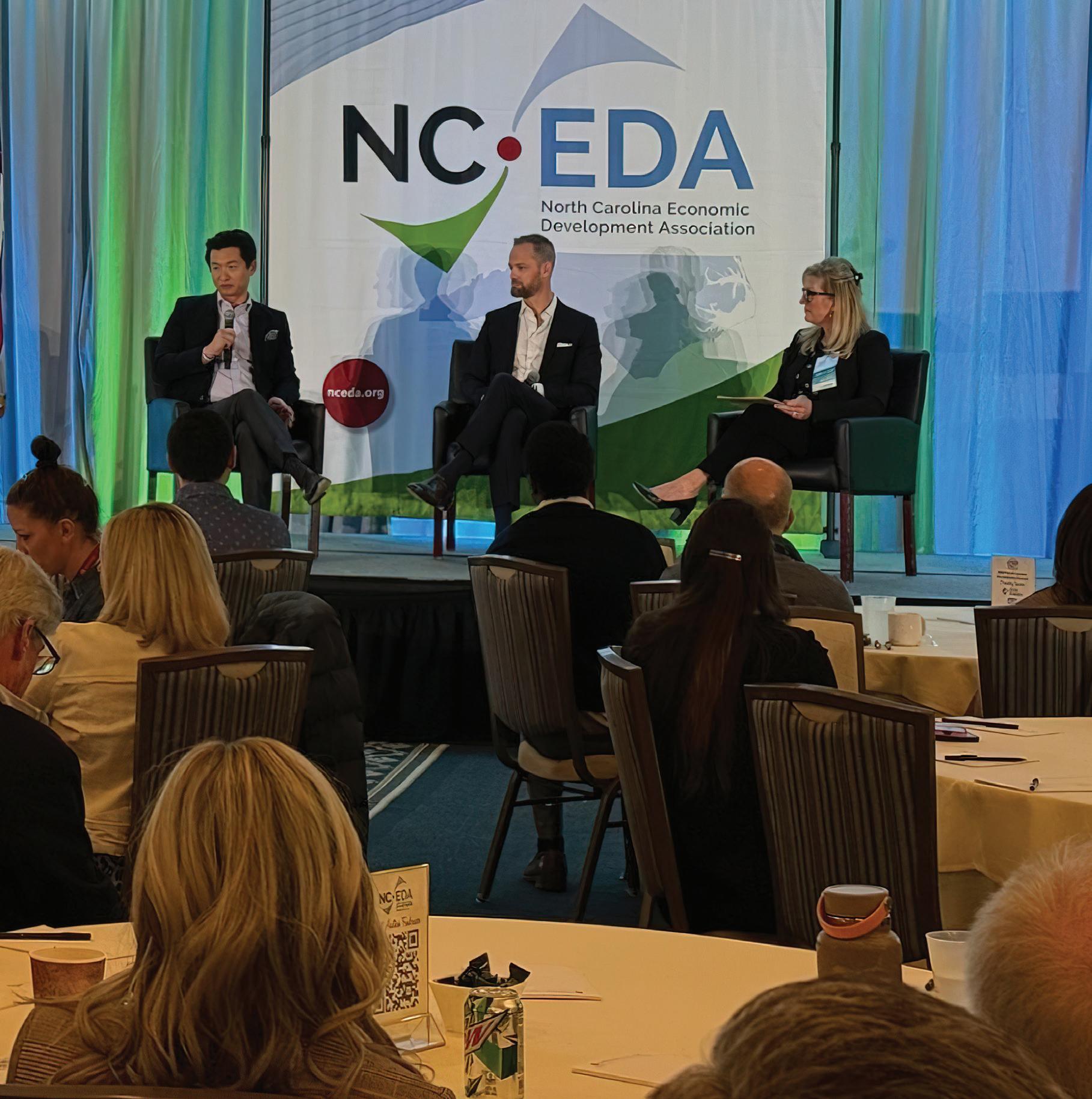

Christopher Chung, CEO of the Economic Development Partnership of North Carolina, joined High Point University President Nido Qubein in the Power List interview, a partnership for discussions with influential leaders. The interview was edited for clarity.

Why did you major in Japanese?

In my formative younger years, Japan was really in economic ascendancy. You will remember in the 1980s, our automotive industry here in the United States and other industries in the country were worried about Japanese prominence, much in the same way that today we see that same concern about China.

I grew up in a suburb of Columbus, Ohio, that was home to a lot of Japanese family transplants who worked at the major

Christopher Chung defers to the politicians at ribbon cuttings, but insiders know he’s a key force in state industry recruitment after a decade leading the 70-employee Economic Development Partnership of North Carolina. The son of Taiwanese immigrants earned a dual-major bachelor’s degree in Japanese and economics at Ohio State University, then worked in industry hunting jobs in Ohio and Missouri before moving to Raleigh in 2015. EDPNC was started under the tenure of former Gov. Pat McCrory, a Republican who favored a split from the N.C. Department of Commerce. Since then, Chung has cultivated bipartisan support for the partnership, which works on deals before getting final financial approval from the state agency and elected officials. He and his wife, Emily, have two daughters.

Honda factory on the outskirts of Columbus. I got to know a lot of these kids personally, but also saw that there was probably a good professional reason long-term to study this language.

I developed an interest in the food and the culture, all those things that when you’re 11 or 12 years old, they might drive your interest in learning a new language.

My parents had quite a bit of exposure to Japanese culture because Japan governed Taiwan from about 1895 to the end of World War II.

It ended up being a great decision, personally, because it led me into the career path that I’m in right now.

The Economic Development Partnership of North Carolina is a vital, vibrant organization in our state. You have been a champion in attracting so much business to our state, highlighted by Toyota Battery, Boom Supersonic, Apple, and so on. What attracts people to the Tar Heel state?

The number one draw by far is the access to human capital. If you’re a company, whatever industry you are, you need people to be successful. It doesn’t matter if you’re in manufacturing or technology or life sciences, you depend on the access to that skilled talent to be the number one company in your particular industry.

When companies look here in North Carolina, they’re really floored by the workforce story, both in terms of what we’re producing through fine institutions like High Point University and all our private and public schools across the state, as well as our two-year community colleges.

We have a lot of people who are leaving military service from right here in North Carolina re-entering civilian life. And then add that people who continue to migrate in from the Northeast, the Midwest, California, other parts of the South.

We continue to be a magnet for people moving here who bring not only their educational abilities, but their skills, their experiences, their connections, and all of that creates a really attractive talent picture.

You and your staff have done a fantastic job in attracting something like 70,000 new jobs in our state, which, of course, contributes measurably to economic impact, tax base and housing starts. Do we have capacity to keep growing?

Well, I would rather be answering that question, than other states that may be wondering, “Well, what does it take to emulate the kind of success North Carolina has?”

I’ll be very clear. We are part of a broader team of partners doing this type of work all across the state that involve the public sector, the private sector, the nonprofit sector. We get to be the tip of the spear in a lot of these conversations with companies.

By no means does that credit fall solely to our organization. We have so many local, regional, private sector partners that we all call in when we get these opportunities.

But where is that equilibrium? At some point are we going to be taking jobs from this company, or do we really have a supply of workforce that we can promote?

That’s really going to be the key to North Carolina’s longterm, sustained success in economic development. Can we keep up with the challenges of growth? I think any state would much rather have to deal with the challenges of growth.

That’s where we depend on our state policymakers, and our local government officials, to make sure that we’re investing in things like educational capacity, infrastructure, housing availability.

If not properly managed, we might see growth start to have some really negative consequences.

But, yes, I believe that North Carolina will continue to have plenty of room to grow as long as we’re smart about planning our investments in the future so that that growth never becomes a liability or compromises the quality of life that has drawn people here for decades.

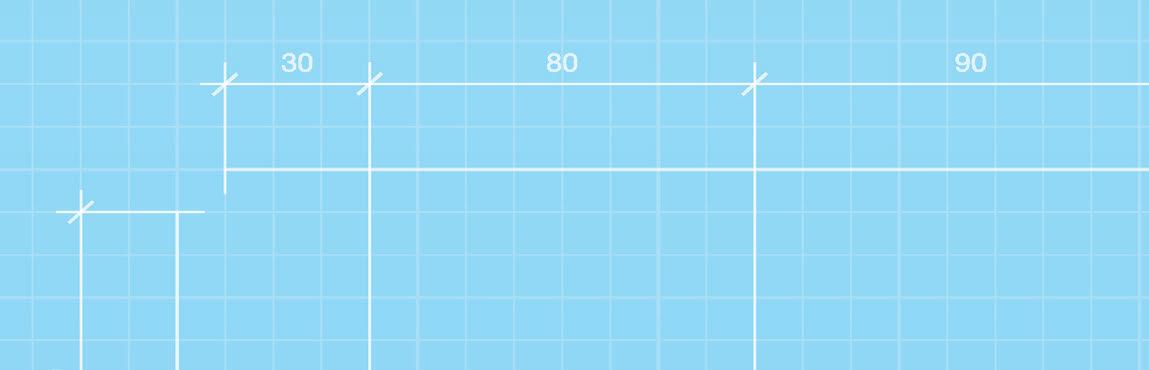

What do you mean by improved infrastructure? Does that mean highways, airports, ports?

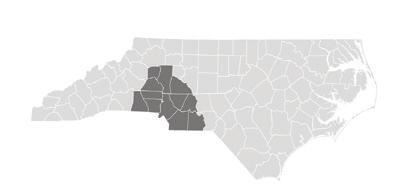

One thing that people notice in a high-growth area can be traffic congestion. That starts to really erode into quality of life. Here in the Piedmont Triad region of Greensboro, Winston-Salem and High Point, the road system is very well planned and built out. There is a tremendous amount of excess highway capacity right now that really sets this region up well for the future. We want to make sure that continues to be the case in places like Charlotte, the Triangle, Asheville, Wilmington and other high-growth markets in the state.

We’ve also really seen in the past few years, across the whole country, as well as here in North Carolina, housing has gotten to be really expensive and really hard for people to get into.

If they’re not making a certain amount of money, they really have to look very far away, and commute a much greater distance to get to the jobs that are being created in the center parts of these growing markets.

These are challenges of growth. We’d much rather have them, but that doesn’t make them any easier of a challenge to try to address.

Sometimes we lose a deal, right? They go down to South Carolina and part of that is often money that some of these companies are looking for.

Much as I hate to admit it, yes, sometimes that does happen. Part of that is often money. As a state, we’ve made a lot more progress. I think roughly 10 years ago when I started in this role,

I would say incentives were much more of a frequent reason as to why we would lose, especially the really big transformative deals.

A deal like what Toyota is doing here in Greensboro, that would’ve been one we would be vulnerable to losing based on incentives a decade ago. We didn’t quite have the mindset that we had to be very, very competitive.

I would say that that’s come a long way because of the governor and the General Assembly working closely together to figure out how we incent these deals responsibly, but in a way that’s going to allow us to emerge tops in the competition.

Today, we actually lose deals much earlier in the process when we do lose, because we lack the kinds of industrial real estate necessary to attract some of these very large advanced manufacturing facilities.

Those parcels of land are getting increasingly in short supply, partly because we’ve been successful in filling those types of sites with major users.

We have to make sure that inventory doesn’t get so low that we start being unable to compete for a lot of these big projects.

What is your biggest challenge?

We want to make sure that when companies continue to look in North Carolina, we can answer their concerns about long-term workforce availability.

Talent is the big reason that we wore the crown for two years in a row for being the top state for business, according to CNBC. We want to make sure that from a workforce and talent standpoint, we continue to be the superlative choice across all 50 states.

That isn’t something that will just happen. That is my concern because it’s going to take very deliberate, intentional policy and strategy for us as a state to stay top of the country, top of the game in this regard. If we do that, I think the future is in very, very good hands.

We know that artificial intelligence and technology is going to evolve. How do you see that as affecting workforce preparedness?

No one is going to be able to predict where technology takes us in the next five or 10 years. Of course, there are futurists and people who think they know, but the reality is that’s a big question mark.

That further underscores the importance of life skills. Things like critical thinking, lifelong learning. These are skills that will serve anybody well, regardless of where technology takes our industries.

For any of us to guess what industry is going to look like, there’s probably going to be more of us who are wrong than right.

But let’s imbue our students and our graduates with the skills that will enable them to be prosperous and successful, whatever the economy looks like in a decade from now.

Unlike when I first moved here nine years ago, I have two kids now who were born in North Carolina, two little girls who are 3 and 1.

That probably subconsciously gives the work a new meaning. People in economic development often talk about the fact that if they’re successful doing their work, maybe that means their kids won’t have to move far away for a job.

I don’t worry about North Carolina being a great economy by the time my kids are working age, if I can do my part in this role in the brief time that I’m in it, maybe that just increases those chances that our girls will stay close by and we’ll continue to be closer. ■

Designing and servicing electronic games at fraternal lodges proves to be lucrative work for Greenville entrepreneur Garrett Blackwelder.

By Chris Burritt

The gambling industry is famously profitable, as visitors to elaborate casinos can attest. But there’s also plenty of opportunity in the lesser-known business of charitable gaming, in which much of the revenue is funneled to local organizations such as Veterans of Foreign Wars and Elks Clubs.

That was evident when Greenville’s Grover Gaming agreed to sell its charitable gambling division to slot machine manufacturer Light & Wonder for as much as $1.05 billion. That includes $850 million in cash upon the deal’s closing, and potentially $200 million more if certain financial targets are achieved through 2028.

Garrett Blackwelder founded Grover in 2013 after earning a bachelor’s degree at East Carolina University in 2000. He now employs more than 400 people and develops software for games such as Peggy’s Big Break; video lottery terminals; and gaming systems for tribal casinos and charitable gaming sites.

It has more than 10,000 leased electronic pull-tab units in North Dakota, Ohio, Virginia, Kentucky and New Hampshire, which operate under a recurring revenue model that leads to predictable cash flows. Electronic pull-tab devices combine bingo and scratch-off lottery tickets, allowing players to win money if they get the right combination of numbers or symbols. They are legal in 11 states, including the five where Grover now operates with service technicians and relationship managers keeping customers happy.

The billion-dollar sale only includes Grover’s charitable gaming business, which officials say makes up about half of its total operation. The remaining business is an independent entity owned by Blackwelder, who agreed to work with Light & Wonder for at least three years.

Grover had revenue of $135 million last year, while its profit before interest, taxes, depreciation and amortization was about $111 million, reflecting a margin of more than 80%.

Light & Wonder is the second-largest slot machine maker after International Game Technology. It agreed to pay about 7.7 times the adjusted earnings, according to Bloomberg News.

Light & Wonder CEO Matt Wilson told analysts in February that he expects more states to permit charitable gaming, which is part of the rationale for buying Grover. The business “is generally seen as a more palatable form of expansion in states that are traditionally opposed to gaming,” according to a February report in gamingbusiness.com, a trade publication.

Grover has 1,500 customers in the business in five states, versus Light & Wonder’s 700 customers across North America, Wilson noted. “We could’ve built it organically, but it could’ve taken us five, six, seven years to get to this level of scale,” he says. “We get to buy 10,000 units immediately and then layer in our content.”

Light & Wonder expects the transaction to close by June 30. It was formerly known as Scientific Games before rebranding in 2022 and had a market cap of about $8.7 billion mid-March.

Grover Gaming employs people in nine states, including a design studio in Wilmington and a software development center in Chicago.

Blackwelder called Light & Wonder “an ideal partner for us, given our similar company cultures and dedication to innovation and customer service.’’

Grover Chief Development Officer Kevin Morse added, “The real winners are the charities and fraternals in these markets, because of the exciting game content L&W brings to the table. We are excited to see charitable gaming taken to a new level.”

In 2021, Grover said it had raised more than $200 million for charitable organizations. While the machines are mostly in lodges of fraternal groups, some states allow them in bars and restaurants. ■

“Grover Gaming is a leading player in charitable gaming, a category that has experienced significant growth in recent years,” Light & Wonder CEO Matt Wilson says.

“This transaction complements our position as the leading cross-platform global games company by adding another compelling regulated adjacency to our profile.”

Duke University drives to become a bigger healthcare force in North Carolina.

By David Mildenberg

It hasn’t attracted attention like Blue Devil basketball phenom Cooper Flagg, but the pace of change at Duke University’s healthcare operation has accelerated dramatically.

In December, Duke Health said it would invest $280 million to buy Lake Norman Regional Medical Center and related businesses in Mooresville in Iredell County. It marks the Durham-based system’s first entry into the Charlotte metropolitan area, pending regulatory approval.

In January, Duke Health said it would partner with UNC Health to build a proposed $2 billion pediatric hospital on an undisclosed site in the Triangle. The state-owned, Chapel Hillbased system announced the freestanding 500-bed children’s hospital in September 2023. Beyond its globally respected medical pedigree, Duke is providing fundraising muscle needed to execute the project, a first of its type in the state.

In March, Duke Health announced a partnership with Novant Health to develop locations across the state to improve health outcomes. No specific projects or financial details were

provided by the state’s second-largest hospital operator (Novant had about $10 billion in annual revenue last year) and third-biggest (Duke had $6.8 billion of revenue in fiscal 2024.)

The organizations said construction of the first sites would begin this summer, with the facilities opening about 18 months later.

Duke Health officials decline to discuss what is sparking the ambitious moves. But consolidation is a major trend in the healthcare industry because of increasing costs of remaining competitive and perceived advantages from economies of scale. Hospital system executives say they need to achieve a significant size to better negotiate contracts with insurance companies and invest in talent, technology and real estate.

Novant Health, which owns hospitals in the Charlotte, Winston-Salem and Wilmington areas, has said it wants to triple its annual revenue to the $30 billion range over the next few years.

That followed a similarly aggressive expansion effort at Atrium Health sparked after the 2016 hiring of CEO Eugene Woods. The Charlotte-based institution now dwarfs its North Carolina peers, with annual revenue topping $32 billion and operations in six states.

Duke Health’s moves follow a restructuring of leadership after the June 2023 retirement of Eugene Washington as the university’s chancellor for health affairs. He had held the post since 2015.

Upon Washington’s departure, Duke Health created two positions. Dr. Craig Albanese became CEO, overseeing the clinical enterprise, and Dr. Mary Klotman was named executive vice president for health affairs. The dean of Duke School of Medicine since 2017, she would “oversee Duke Health’s academic mission,” university President Vincent Price said in a June 2023 release.

Albanese came to Duke in January 2022 from New York-Presbyterian Hospital, where he had been group senior vice president and chief medical officer of the $9.2 billion, 10-hospital academic health system. He is a surgeon who

previously had senior leadership jobs at Stanford University and its healthcare business.

Money won’t be a problem at Duke. The university reported an endowment of $11.9 billion last year and has an alumni roster that includes billionaires such as Apple CEO Tim Cook and Carlyle Group co-founder David Rubenstein.

In December, an anonymous donor gave $50 million to the proton beam therapy center, which is scheduled to open in 2029. It is expected to provide fewer side effects than traditional radiation therapy.

“Hospital affiliations are the new merger,” says Barak Richman, a law professor at George Washington University, referring to the Novant agreement. He is an expert on N.C. healthcare after previously working at Duke. “The idea is you secure patient flows, and you lock up different parts of the market. And, sometimes, that requires less regulatory scrutiny or oversight.”

Duke operates its internationally recognized flagship hospital and a smaller regional one in Durham, plus a third hospital in Raleigh that was acquired in 1998. Since 2011, it has been a partner with Brentwood, Tennessee-based LifePoint Health in the ownership of smaller community hospitals, including nine in North Carolina.

“We recognize the healthcare landscape is changing,” Albanese said about the Iredell County expansion. “While we continue to expand access to care within the communities we serve, it’s also time to do more and deliver care to more people — in more communities.” ■

Keeping growth humming challenges a fourth-generation boss at one of the state’s biggest private enterprises.

By David Mildenberg

Amanda Weisiger Cornelson knows better than anyone that she has big shoes to fill after becoming a fourthgeneration CEO at Charlotte-based Weisiger Group.

Her father, Ed Weisiger Jr., took over as the family businesses’s leader in 1991, when Carolina Tractor and Equipment had annual revenue of $75 million and 175 employees in four offices. The company, which was renamed CTE then Weisiger Group, was founded in 1926.

Thirty-four years later, the business has annual revenue of $1.3 billion, 2,300 employees and 30 branches in five states. “My father has done an astronomical job,” says Cornelson, who became CEO and president in February. “I can’t overstate the high bar he has set.”

Some of that growth reflects the company’s diversification into various businesses. But the main affiliation remains as a dealer for Caterpillar, Hyster-Yale Materials Handling and other equipment manufacturers.

The formal succession process for Cornelson started 2½ years ago when the business promoted Matt Nazarro to the chief operating officer role to help bridge the gap between generations. He had joined the business in 2016 as chief financial officer. Irving, Texasbased Caterpillar is serious about maintaining strong management amid generational change at its franchises.

Cornelson says her path to the CEO job started as a teenager, when she enjoyed hanging around her father and learning about the family business. The company bylaws required that family members work at other companies to “get perspective outside of our bubble,” she says.

So after graduating from Vanderbilt University in 2012, she worked for several e-commerce companies in New York and Nashville, Tennessee, and started her own online retail company that was acquired in 2018.

She then joined Carolina Cat intending to become the leader. “I started earning my stripes, and we were thoughtful as I was having increased responsibilities for [profit and loss],” she says. Working through a variety of departments would help her win “hearts and minds” of colleagues and engage with the community, she adds. “It’s been a special experience in which I’ve done a little bit of everything.”

Those assignments included learning to pull parts to fill customer orders; assist technicians and field service coordinators; run a rental store in south Charlotte; work on the finance team; and most recently, lead the sales organization. Those experiences “make a big impact when problems bubble up,” she says. “Having that foundation gives me a lot of confidence.”

And, she’s learned how to juggle business and family obligations. She and her husband, Shaw, are parents of a 3-year-old son and 1-year-old daughter.

Cornelson’s father remains chair of Weisiger Group’s board. He is also chair of the NC State University board of trustees and co-founder of Charlotte-based Beacon Partners, one of North Carolina’s largest commercial real estate companies. “My dad has been my biggest role model,” she says, including encouraging her to work outside the family business. “I wanted to put in my time

to explore my own interests, and that was great for me. I learned to succeed and fail on my own without the microscope.”

Cornelson’s two sisters, Marshall Weisiger Rodman and Grace Weisiger, share in the company ownership and will rotate as board members.

While

construction equipment may have once ranked as among the most male-dominated businesses, Cornelson notes that women now lead Caterpillar franchises in Alabama, Tennessee, Texas and other regions. “You couldn’t say the same thing 10 years ago,” she says.

The CEO shift occurs with the construction business on a roll in Carolina Cat’s markets, bolstered by population and economic growth and the response to Hurricane Helene. “There is an enormous amount of cleanup needed in western North Carolina. Countless dealers have helped us on [the Helene response],” she says. “It’s been amazing to see how resilient those folks have been because the region has been incredibly devastated.”

Research shows about one in 200 businesses survive into a fourth generation of family ownership, and Cornelson says she’s committed to sustaining the tradition. “We realize how rare that is,” she says. “We will embrace a lot of change in the digital space, and we are very dialed into our service offerings in addition to our `big iron’ business. We’re extremely committed to Cat and Hyster and that won’t change.” ■

Nominees for this year’s Rock & Roll Hall of Fame class are an impressive list. The Black Crowes, Joy Division/ New Order, Mariah Carey and Cyndi Lauper are included among 14 nominees. One band stands out to me: Bad Company made the list for the first time. That’s both awesome, but also incredibly sad to report. The British band formed in 1973, debuted “Feel Like Makin’ Love” in 1975, and was a powerhouse before initially disbanding in 1983. It reunited for tours over the next three decades.

We reached out to North Carolina marketing executive Rick French, chair and CEO of Raleigh-based communications firm French/West/Vaughan, about the nominations. He’s a big Bad Company fan and a Rock Hall board of trustees member. Here’s what he had to say before inductees are announced in late April:

What is your role with the HOF?

I was elected to the board of trustees in 2006 and have spent the past two decades supporting our unique mission to engage, teach and inspire through the power of rock ‘n’ roll.

How do bands get nominated?

A nominating committee comprised of rock ‘n’ roll historians, board members, current living inductees and music-industry executives painstakingly research, debate and ultimately put forward a slate of nominees for consideration by the full voting membership, which is made up of 1,200 artists, historians and music-industry professionals worldwide, the majority of whom are living inductees. So to actually get voted in, the artist really needs the support of a jury of their peers. There is often a misperception that the Rock Hall as an institution or our board puts artists in, or keeps artists out, and nothing could be further from the truth. We work to create a diverse slate and then let the votes fall as they may.

In any given year, five to seven artists are elected, depending on the size of the slate. This year, we have 14 nominees so I expect seven to be elected, but that isn’t assured.

What pushed Bad Company over the top this year?

A board contingent pushed the nominating committee hard for the band’s inclusion on this year’s ballot. And several high-profile inductees threw their considerable weight behind a nomination. I don’t want to name names, but if you follow the connective tissue of Paul Rodgers’ career to other bands or shared labels he was a part of, you might be able to make a pretty educated guess. Note: Rodgers was the vocalist for Bad Company, as well as Free and The Firm.

Why do you think Bad Company deserves a shot?

I’m biased because Bad Company drummer Simon Kirke is a friend. I would have liked for this to be a Free/Bad Company nomination in the same way we nominated Joy Division/New Order and how we inducted The Faces/Small Faces previously.

Plus, Simon allowed me to join some of Broadway’s biggest stars on stage to sing the Free classic, “All Right Now” at Sony Hall in New York City a few years ago, and that song alone should get Free a nomination.

Nonetheless, Paul is one of the greatest rock ‘n’ roll vocalists of all time, and Simon is one of its greatest drummers. Bad Company was a supergroup by anyone’s definition, considering it also included Mott the Hoople guitarist Mick Ralphs and former King Crimson bassist and vocalist Boz Burrell. It delivered one rock anthem after another, from “Feel Like Makin’ Love” to “Bad Company” to “Rock ‘n’ Roll Fantasy.” And if you were in high school in the late ’70s like I was, you couldn’t walk the halls without seeing someone wearing one of those iconic tumbling dice concert T-shirts from the band’s “Straight Shooter” album.

Paul probably didn’t do himself or the band any favors by being so dismissive of the Rock Hall in the past. He has definitely changed his tune, as did Cher last year and Dolly Parton a couple of years ago. It’s hard to push for anyone’s inclusion if it’s a club they say they don’t want to belong to. Are you listening, Oasis? ■

By Natalie Bradin

Everyone loves throwing a fabulous party, though at times it can be tough on the bank account. But a Charlotte couple has found a way to turn their love of event planning and community building into a solid business.

In 2021, Monica and David Hickman cofounded SocialHub, a Charlotte-based event service that provides gatherings for apartment complexes wanting to impress their residents and create a community feeling. By hosting espresso martini bars, crafting sessions and other get-togethers, SocialHub turns a profit while helping the properties retain residents and free their staff for other customer service duties.

SocialHub was born out of the couple’s love of fostering community. They noticed that event planning for multifamily properties usually relies on leasing agents and other staffers, who juggle multiple duties. SocialHub fills the need for community-building events without burdening on-site management.

The Hickmans describe themselves as “two of the most normal people” you’ll ever meet. The couple, who have been married for more than 20 years, met at Montreat College near Asheville, where they were student-athletes. Monica played volleyball and softball, and David was on the baseball team.

After graduating, Monica became an elementary school teacher, while David pursued a degree in theology, then led a couple of nonprofit groups.

“In terms of your average, typical idea of entrepreneurs, we don’t have that background, but we both come from very good, honest, hardworking families,” David says.

While lacking formal business training, their ability to connect with the community and identify areas for improvement have helped them become successful entrepreneurs.

“We’re scrappy, we’re idealistic, but at the same time, we are captured with just a really deep appreciation and love for people,” he says.

During the pandemic, the pair started having conversations with multifamily property management companies, including Charleston, South Carolina-based Greystar, the world’s largest apartment operator. It has multiple properties in the Charlotte and Triangle areas.

With Monica as CEO and David as president, the business raised $125,000 from friends and family. Within 18 months, the business was turning a profit and they have not sought additional outside investment. Revenue reached $1.2 million in SocialHub’s second full year and topped $1.5 million in 2024.

The couple held their first event in Charlotte at a Greystar complex in southwest Charlotte. After receiving positive feedback, they realized the concept would work in other cities with lots of new apartments opening.

Starting in Charlotte, SocialHub has expanded to the Raleigh and Charleston areas, and now works with more than 120 complexes, having added about 30 in the past year. About 25 people work for the business.

“SocialHub is exactly what the multifamily industry has needed,” says Nataile Roman, a portfolio manager with Alpharetta, Georgiabased Pegasus Realty, another large apartment operator.

“Monica and David plan, set up, help host and clean up, allowing the onsite teams to truly connect and be present with their residents,” Roman says. “The residents all love participating in their events, and we have seen an increase in resident turnout and involvement event after event.”

With event services costing from $750 to $1,000, SocialHub has created a consistent revenue stream, opening up opportunities for expansion.

“We have carved pumpkins, made candles, planted herbs for cooking, learned how to arrange flowers, taken a painting class, enjoyed music bingo and picked vegetables from the farmers market,” says Jill Rackley, a Charlotte apartment resident who has participated in SocialHub events.

Apartment vacancy rates have ticked up and record construction in most markets over the past decade. In response, many property managers are offering incentives to fill their units, with some cutting their marketing budgets and others doubling down to retain their lessees. “It’s easy to leave an apartment, but it’s harder to leave a community of friends,” David says.

The Hickmans have a 10-year goal of operating in the largest city in every Southern state and a 25-year goal of having a presence in the largest city in all 50 states.

The company is also considering expanding its offerings, such as assisting apartment managers with broader marketing programs. “We’ve got several different irons in the fire,” David adds. ■

`Chef Curry’ cooks up a plan to revive a storied North Carolina basketball program.

By David Mildenberg

Following recently mediocre results on the court, Davidson College is starting a $10 million-plus fund for its basketball programs..

Initial support for the fund comes from NBA superstar Stephen Curry, his wife Ayesha, and college supporters Don, Matt and Erica Berman. Curry, 37, starred for three years at Davidson, from 2006-09, and has since become an international celebrity because of his unprecedented long-distance scoring for the Golden State Warriors.

Known for generations as an elite, academicoriented school that prepares future lawyers, doctors and preachers, the north Mecklenburg County college became nationally competitive on the court during the 33-year tenure of men’s coach Bob McKillop. His son, Matt, succeeded his father as basketball coach in 2022.

The men’s team has lost about as many games as they’ve won over the past three years, so Davidson is looking for a fresh start. The team ranked 144th nationally at the end of the 2024 regular season, according to basketball analyst Ken Pomeroy.

Meanwhile, the Wildcat women’s team has had five winning seasons since joining the Atlantic 10 Conference in 2014.

Curry and his former Davidson teammate Matt Berman will be assistant general managers, acting as advisers to invest time and experience with both men’s and women’s teams, the college said in mid-March.

Berman’s father, Don, started Cardworks, a consumer finance company based in Woodbury, New York. In January, Cardworks bought a $2.3 billion credit-card portfolio from Charlotte-based Ally Financial. The companies had announced a similar sale in 2020, but the deal was canceled because of the pandemic.

Curry is the first active player in U.S. major professional sports to take an administrative job with an NCAA team. He is earning $55.7 million this year to play for Golden State. He has received $357.8 million from the team in his prior seasons, according to basketball-reference.com.

“I had the opportunity to play basketball at the highest level, got a great education, an amazing network through the Davidson alumni

and continue to wave the Davidson flag,” Curry said via a news release.

“I want very talented, high character studentathletes to have that same experience.”

The new fund could presumably help Davidson become more competitive in offering name, image and likeness contracts to talented basketball players. Details on NIL deals tend to be confidential, but the most elite players are receiving annual compensation of more than $1 million.

“When our basketball programs are successful, they provide much-needed revenue and exposure to support all our athletics programs and raise the overall visibility of the college,” Athletics Director Chris Clunie says.

Davidson President Doug Hicks and Clunie have emphasized that the college is committed to upholding its

commitment to academics and integrity amid major changes in the sports world. They noted that the college’s athletes have traditionally outperformed the overall student body in grade point averages and graduation rates.

Davidson College had an endowment of $1.4 billion as of June 30. The private college has about 2,000 undergraduate students. By comparison, Wake Forest University in WinstonSalem has an endowment of about $2 billion, and enrollment of more than 9,000 students.

To lead the effort, Davidson named Austin Buntz as general manager and assistant athletic director for basketball development. He has helped raise money for athletics at Davidson since 2021. ■

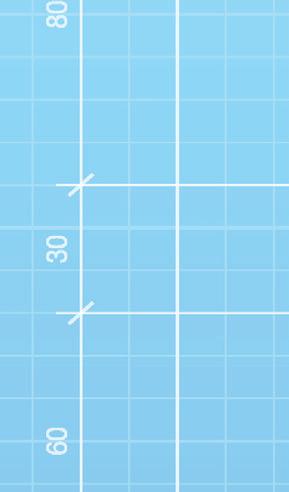

When PNC Bank’s Kyle Huber contemplates the future of North Carolina’s business landscape, he points to robust population growth as one of the state’s most compelling opportunities – and one of its most complex challenges.

There is little question that North Carolina’s growing population, which is estimated to reach 11.7 million by 2030 and 15.4 million by 2060, will fuel continued economic success and innovation. At the same time, sustaining this transformational growth will require significant investment in the state’s infrastructure and public facilities.

Raleigh-based Huber is motivated by the business imperative to build, expand and improve the public institutions that serve the people of North Carolina – from roads and schools to water and wastewater services to nonprofits and higher education institutions. As senior vice president and relationship manager for PNC’s Public Finance group, he helps bring capital projects to life by providing local governments with access to PNC’s resources and capabilities, including traditional bank products through PNC Bank, National Association and capital markets solutions through PNC Capital Markets LLC.

“The strength of our state’s infrastructure is an important factor for economic development initiatives,” says Huber. “Additionally, the local infrastructure contributes to the quality of life that makes North Carolina such an attractive place to live and work. That’s why PNC is committed to helping communities move forward with projects that deliver on this dual objective.”

Never far from Huber’s mind is the responsibility that accompanies the financing of assets and resources that meet the needs of North Carolinians. “As a state resident and taxpayer, I want to see public resources stewarded

responsibly and deployed as strategically as possible,” he says. “As a banker, I help PNC’s Public Finance clients structure deals while navigating shifting markets and external factors of varying levels of complexity, in collaboration with colleagues and local decision makers. One of the most fulfilling aspects of financing a capital project, which can take several years to bring to fruition, is the opportunity to work closely with N.C. government finance officers who put great diligence into managing public interests.”

Among the projects for which Huber and his colleagues are helping lead financing is the expansion of a regional water treatment facility that underpins the surrounding biotechnology industry. For Huber, this project, a joint effort between multiple municipalities, is reflective of the N.C. public sector’s collaboration, master planning, oversight and vision that have catapulted the state to global prominence in multiple industries.

“When you think about some of the municipalities around the Triangle, for example, there are places that have more than doubled their populations over the past 15 years,” says Huber. “Today they are home to campuses of major corporations and thriving communities. This growth has ushered in a new host of demands, so the challenge becomes understanding when and how capital can most efficiently be deployed to meet the goals unique to each community.”

As Huber explains, financing solutions for these projects are dynamic, often including a mix of bank financing and publicly issued bonds. PNC’s Public Finance group offers both, with PNC Capital Markets LLC serving as one of the most active firms in the state by helping local governments access the capital markets for long-term, fixed-rate taxexempt bonds.

communities, and my hope is that this deal can serve as a model that could be implemented elsewhere.”

Additionally, Huber is proud of PNC’s work in financing rural capital projects, which often replace community facilities that are in desperate need of repairs or rebuilding. Projects of this nature may include several sources of funding, including bank credit, grants and, potentially, equity.

Meanwhile, in the Outer Banks, Huber is embarking on a water-related project of an entirely different sort: providing a loan to finance the development of housing for ocean rescue staff, including seasonal employees.

“What excites me most about this new workforce housing project is that it will provide a necessary resource for the individuals who make it possible for residents and visitors to safely enjoy the beaches,” says Huber, who in recent years has also helped finance beach nourishment projects to shore up the state’s coastal communities and economies. “Housing supply can be a challenge for many North Carolina

Beyond the deal-making aspects of public finance, Huber believes the continued adoption of treasury management solutions among public sector entities will be critical to their resilience and productivity as organizations protect themselves against cyber threats and streamline processes through automation and digital transformation.

“Each transaction represents a journey for the community,” says Huber. “Each project creates its own set of ripple effects, and I am humbled to play a role in financing infrastructure assets that will support North Carolina’s brilliant future.”

Pamlico Capital closed its sixth fund at $1.75 billion, exceeding its $1.5 billion goal amid strong investor demand. The firm, focused on lower- to middle-market growth equity and buyouts, has raised more than $6.5 billion since 2002, backing companies in tech, healthcare IT and communications.

Charlotte-based Capitala Group, the business investment company led by Joe Alala III, raised more than $1 billion in capital commitments. Since its formation in 1998, Capitala has invested more than $3.2 billion. It focuses on companies with less than $100 million of annual revenue.

Clemson University and Florida State University resolved their legal issues with the Atlantic Coast Conference after a year of lawsuits over how revenue is shared. The two traditional football powers expect to receive more than $60 million annually from the ACC under the new revenue plan.

Coca‑Cola Consolidated’s board approved a 10-for-1 split of the company’s common and Class B shares. Pending shareholder approval, stockholders of record as of May 16 will receive nine additional shares for each share held.

Package-delivery company UPS will lay off 99 mostly part-time workers at a sorting hub on May 2. It laid off 75 workers at the same facility in 2024.

IperionX Limited secured a U.S. Department of Defense contract worth as much as $47.1 million to enhance the U.S. titanium supply chain. The two-year partnership would involve IperionX investing $23.6 million, for a total investment of $70.7 million.

Barings, a global asset manager, agreed to buy Washington, D.C.-based Artemis Real Estate Partners. The real estate investment firm manages more than $11 billion in assets.

Capital One Financial will open its first Charlotte office, leasing a floor at The Line in South End. The bank filed $4 million in renovation permits for the 34,500-squarefoot space. Capital One does not have branches here.

The Consumer Financial Protection Bureau dismissed its lawsuit against Zelle’s operator, Early Warning Services, and its owner banks, including Bank of America, JPMorgan Chase and Wells Fargo. The suit accused the banks of failing to investigate fraud complaints. The case was dropped with prejudice, preventing future refiling.

Odyssey Logistics moved its headquarters here from Danbury, Connecticut. The office includes its executive team and 80 employees.

Bill Thierfelder plans to retire as president of Belmont Abbey College in August, take a year off and then come back to teach at the private Catholic college. The former Olympian high jumper came to Belmont Abbey in 2004 when the school had about 500 students. It now has about 1,600. A relationship with CaroMont Health has led to the opening of a hospital near campus in January and a new nursing program.

Some Lowe’s employees will be getting a bonus of as much as $10,000 after “betterthan-expected” earnings despite “a difficult

home improvement macro environment,” says CEO Marvin Ellison. About $80 million is planned for the bonuses.

Barrier Fencing Supply, which sells aluminum and vinyl fences nationally, plans to invest $15 million and create 151 jobs by establishing a headquarters and manufacturing center here. The move will relocate manufacturing to the U.S. from Asia, officials said.

Information technology outsourcing firm Provalus plans a $6.48 million investment here that’s expected to create 61 jobs. Based in Brewton, Alabama, Provalus has operations in Whiteville and plans to open a site in North Wilkesboro.

Former Army Master Sgt. Chad McKeown is expanding his Kraken Skulls brand with Kraken Customs, a new car body shop. The shop will specialize in fabrication, performance upgrades, and restorations. McKeown who built a 12-business enterprise, has also pitched a Netflix show on the shop.

A $7.5 million grant from the New Hanover Community Endowment moves the N.C. Aquarium closer to its $56 million expansion, which includes a 350,000-gallon tank, new educational spaces and a 4,000-square-foot rooftop deck. The upgrades aim to enhance marine education, tourism and economic impact in the region.

Chatsworth Products will invest $11 million in an expansion here that’s expected to add about 45 jobs to its 220-member workforce. The Simi Valley, California-based company manufactures infrastructure hardware and equipment for the information and communication technology industries.

Pennsylvania Transformer Technology, also known as PTT, will invest $102.5 million and create 217 jobs in an expansion of its manufacturing facility. The company employs about 77 workers at a factory it has operated here for almost 30 years. PTT makes products for electric utility, municipal power, renewable energy and industrial markets.

First Carolina Bank acquired Pennsylvania-based BM Technologies for $66 million. BMTX and First Carolina forged a five-year partnership in 2023 that brought the fintech almost $450 million in deposits under the bank’s umbrella.

E-commerce giant Amazon said it will create more than 1,000 jobs at a 600,000-square-foot robotics fulfillment center under construction in Wilmington. The project was announced last year, though the number of jobs wasn’t disclosed until a groundbreaking event in March.

Canadian-based manufacturer Advanced Glazings will open a sales office here and plans for a future manufacturing facility. The expansion is expected to create about 50 jobs. The company specializes in glass insulation and light diffusion and is known for its Solera products.

Global aerospace manufacturer Protocase and its subsidiary 45Drives are launching production at a 12,000-square-foot building. Initially projected for 2029, the Canada-based company plans to scale up to full production for both companies within the next year. The facility will produce custom computer parts and is expected to create around 400 jobs.

GE Aerospace is investing nearly $52 million in its Wilmington facility as part of a $1 billion nationwide expansion. The funds will enhance manufacturing capacity, upgrade facilities, and improve efficiency. The site produces components for commercial and military aircraft engines, strengthening North Carolina’s aerospace sector.

Kontoor Brands, which owns the iconic Wrangler and Lee jeans brands, agreed to buy Norwegian outdoor and workwear brand Helly Hansen in a deal valued at about $900 million. The seller is Canadian Tire, a Toronto-based retail company that has owned the Oslo, Norway-based company since 2018.

UNC Greensboro launched the BRIGHT Institute, which aims to train students for careers in the region’s growing battery sector, bolstered by Toyota’s Liberty plant. Vice Chancellor Sherine Obare says the institute will leverage UNCG’s strengths to position

students for jobs in battery technology and next-generation energy industries.

Seattle-based Amazon.com Services paid $12.07 million for an undeveloped 85.25-acre tract in south Greensboro, near Interstate 85 and South Elm/Eugene streets. The seller is Williams Development Group. Amazon.com had no immediate comment.

Master Plumbers Heating and Cooling, founded in 2000, was bought by Leap Partners of Nashville, Tennessee. Terms were not disclosed. Leap Partners said the purchase is part of an expansion into North Carolina, following the 2023 purchase of Whittier-based Premier Indoor Comfort Systems, which serves western North Carolina.

Syntec Precision Technology, a Chinabased company, will create 34 jobs with

its first North American production and warehouse facility. Syntech produces parts for the hydraulic, life sciences, and transportation industries. The Vance County plant will make parts for medical devices, diagnostic equipment and orthopedic products.

Commercial furniture manufacturer Beaufurn is pledging to create and relocate a combined 57 full-time jobs to an existing plant here with a $929,000 capital investment.

Former HanesBrands executive Jay Turner acquired Excalibur Direct Marketing, which describes itself as the state’s oldest firm of its type. Janie and J.D. Wilson founded the business in 1972. Excalibur has 26 employees with an average tenure of 18

years. President George Newstedt and Vice President of Client Services Ryan Talbert will remain in place.

Quality Oil Company, a familyowned business that employs about 1,500 people at stores and hotels, named Don McIver president and CEO, following the retirement of Graham Bennett. He’s the first person outside of the Bennett family to lead the company, which has 140 convenience stores in four states and about eight hotels. The Glenn and Bennett families have owned the business since 1930.

Friendly Barber Shop on East Main Street is closing in April after 64 years. Russ Sturdivant has owned the shop for three decades, after his father, Grady, opened it in 1961. Instead of mirrors and

televisions, the shop’s back wall hosts Tar Heel paraphernalia, newspaper clippings and framed family photos.

Drug developer Chimerix’s history as a promising North Carolina biotech is shifting gears after the company agreed to sell to Dublin-based Jazz Pharmaceuticals for about $935 million. The transaction is expected to close in the second quarter. Chimerix was formed in 2000. Its lead asset is dordaviprone, a small molecule treatment in development for a rare brain tumor that mostly affects children and young adults.

RTI International is cutting 150 jobs, including 80 in North Carolina, following 226 temporary layoffs in February. The nonprofit has relied on funding from the National Institute of Health and U.S. Agency for International Development, which face cutbacks under the Trump administration. It has employed 6,000 people globally and is a leading employer at Research Triangle Park.

Veteran Raleigh lobbyist Kevin Howell was named NC State University chancellor, succeeding Randy Woodson later this spring. It follows a national search after Woodson said he would retire after 15 years, during which he gained national acclaim for boosting the profile of the state’s largest university, with enrollment of 39,000. Howell is a former vice chancellor at NC State who joined UNC Health in 2024 as chief external affairs officer.

Duke University’s 6,500 undergraduate students learned that the total cost of attending for the 2025-26 academic year would top $92,000, versus about $41,000 in 2005. In February, Duke’s board approved a 5.9% increase. Many students pay less than the full cost because of scholarships and grants. Duke’s admission rate has been less than 10% of applicants in recent years.

Digital health firm Lumata Health raised $23 million to double its workforce to 400 employees. The company partners with ophthalmology practices to help patients adhere to treatment plans. Investors included LRVHealth, McKesson Ventures, and Cencora Ventures, with money to be used for care coaching, data, and technology teams. Lumata serves about 3,000 to 4,000 new patients monthly.

Access Newswire, which was called Issuer Direct until January, agreed to sell its compliance business to New York Citybased Equiniti Trust for $12.5 million. Access says it will use $12 million to pay down debt. The sale includes the transfer of the 11-employee compliance team, client contracts, intellectual property and other related assets. Access is focusing on its communications subscription business.

Ralliant Corp., spun off from Everett, Washington-based Fortive in February, will invest $2.1 million and create 180 jobs that pay more than $189,400 on average, more than twice the current average wage ($76,643) in Wake County. Ralliant was formed from Fortive’s Precision Technologies segment and is built on industry-leading brands with approximately $2 billion in revenue.

A settlement between the State Insurance Department and the insurance industry will result in an average increase of about 15% in home insurance premium base rates by mid-2026. The industry’s N.C. Rate Bureau had sought a 42% average increase. The rate hikes will be implemented in two stages.

North Carolinians wagered more than $6.1 billion in real money bets in the first year of legal sports betting, with operators earning $713 million in gross revenue. The state collected $128 million in taxes, which mainly funds UNC System athletics and gambling addiction programs.

Captrust Financial Advisors acquired Charlotte’s Carolinas Investment Consulting, which oversees about $1.4 billion in assets. The 20-member firm will be Captrust’s second location in Charlotte. It also has offices in Greensboro, Raleigh, Sanford and Wilmington as part of a national network of more than 80 locations.

Raleigh Golf Association, the city’s oldest public course, is set for a $3.5 million renovation by McConnell Golf, including a new 60-bay, lit driving range. Course architect Kris Spence of Greensboro will lead upgrades, while rezoning plans could turn the north side into residential development, preserving affordable public golf on the city’s south side.

North Carolina state employees and retirees may see their health insurance premiums increase. The state insurance plan is projected to have a $500 miillion shortfall in 2016 and $800 million in 2027, State Treasurer Brad Briner told state leaders.. The plans have about 750,000 enrolled.

42nd Street Oyster Bar, a staple with state government officials and lobbyists since 1931, was expected to close March 30. Originally a fish market offering oysters and craft beer, it became a bar in 1987 and was a favored seafood spot.

After two decades of development, a new lightweight metallic material created by NC State University engineering professor Afsaneh Rabiei and her Raleighbased company, Advanced Materials Manufacturing, launched a commercial product. The company claims the material is “as strong as steel yet as lightweight as aluminum,” likening it to a metal bubble wrap.

Raleigh-based Golden Corral’s spinoff chain Homeward Kitchen will be replaced by the rebranded Golden Corral Favorites. The venture aims to serve the brand’s signature comfort foods in a smaller format. Homeward Kitchen launched here in late 2023.

FirstCarolinaCare will no longer offer insurance plans past 2025, with the exception of Medicare Advantage. The organization cited medical inflation, rising prescription drug costs, higher volumes of chronic conditions and rising technology costs as factors. FirstHealth of the Carolinas started the insurer, which has been majorityowned by Urbana, Illinois-based Carle Health since 2020.

Asheville-based Aeroflow Health recently hit its 1,000th employee milestone and moved into a new 51,000-squarefoot fulfillment center that is expected

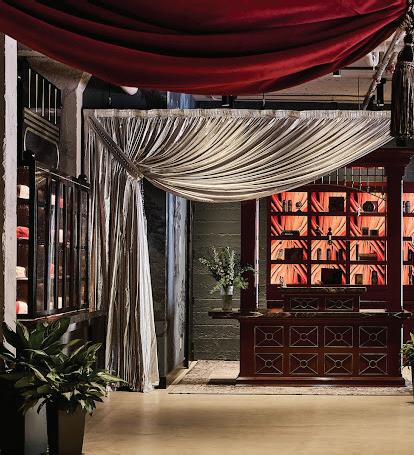

Time included The Radical boutique hotel in its annual World’s Greatest Places List. It’s the only Tar Heel site on the list, which includes places to stay or visit. In November, Business North Carolina selected The Radical as its “hospitality category winner” in our 11th annual feature on the most important new buildings that opened across the state in the past year.

to process 17,000 orders per day for customers nationally. It will start with 65 employees. The company had 1.4 million customers in 2024 and distributes breast pumps, glucose monitors, diapers, CPAP machines and other products. It expects to fulfill 3 million orders in 2025.

The UNC System didn’t travel far in its search for a new chancellor at Appalachian State University. Heather Hulburt Norris had been the interim chancellor since April 2024 after succeeding Sheri Everts, who stepped down after 10 years due to “significant health challenges.” Norris has been at the university for more than 20 years.

North Canton, Ohio-based Timken is closing the Alexander County manufacturing facility it acquired two years ago, resulting in the loss of 58 jobs. The manufacturer of bearings and power transmission products says the first layoff s will occur July 31 and continue through the end of the year. Timken bought the assets of American Roller Bearing in February 2023. ■

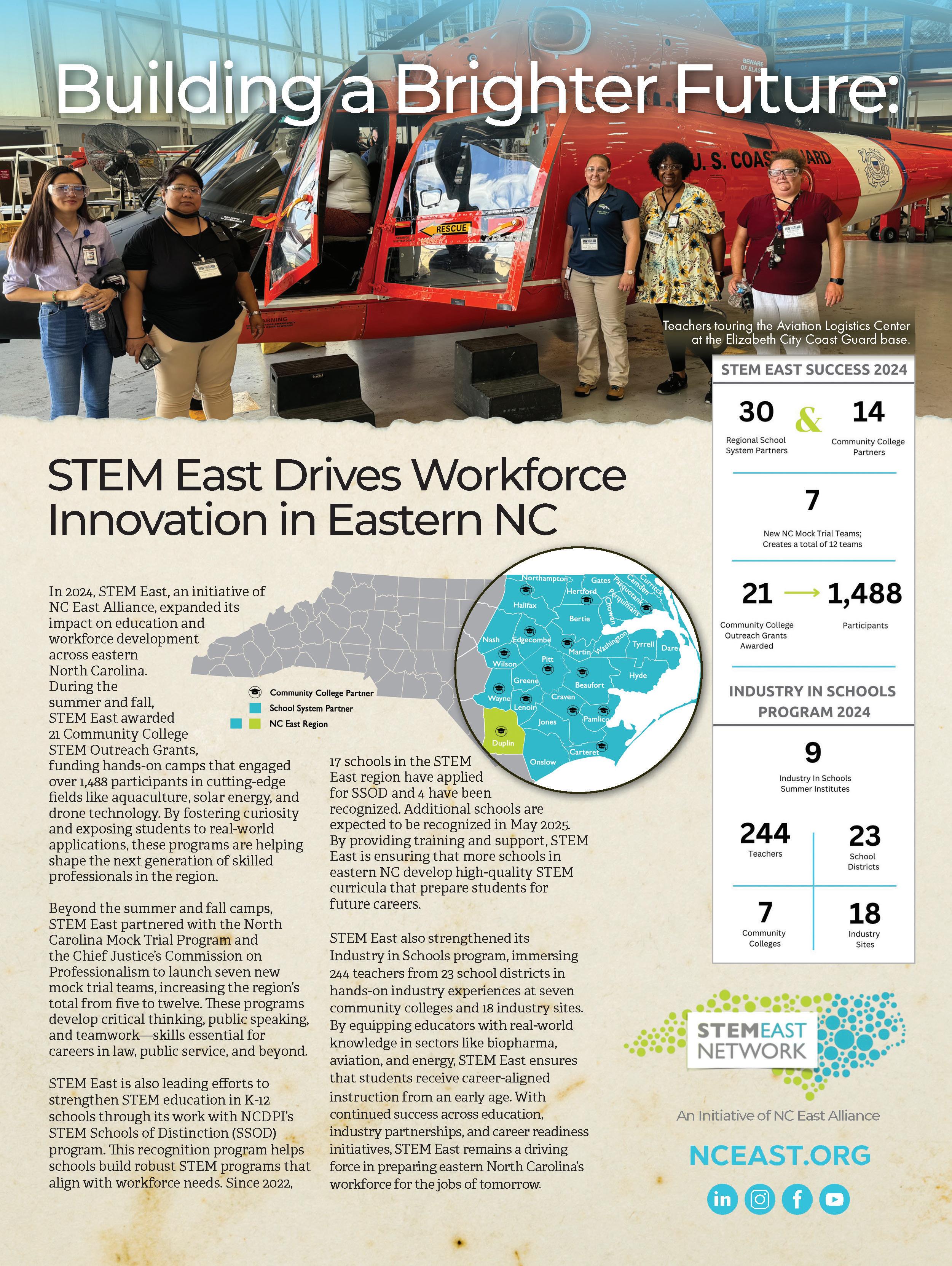

Education programs demonstrate careers in rural areas can provide bright futures.

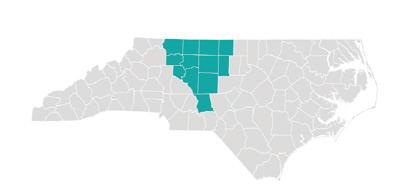

NC State’s Rural Works! program places engineering students in summer internships with manufacturers in rural counties. The basic gist is that employers gain talented summer help, while students receive practical experience.

The bigger idea is to help rural counties struggling with population losses show these students engineering opportunities. They might come back after graduation.

North Carolina is a mostly rural state with its prosperous urban areas of Charlotte and Raleigh showing a lot of population growth. Outside of the metros, it is a different story. In this decade, 20 of the state’s 100 counties will lose population, according to projections. Another 10 will grow 1% or less.

There are a bunch of historic reasons. Many small manufacturing plants that used to make textiles, apparel and wood furniture have closed. Foreign competition and automation took a lot of these jobs away.

A lot of kids from rural areas go off to college and don’t come back because of opportunities in the cities. Some research shows that only around a quarter of college students from rural areas returned to their home county after graduation.

Rural Works! splits the cost of the internship. Employers pay $15 an hour and NC State’s College of Engineering pays $10. So the student gets $25 an hour. It is run by NC State’s Industry Expansion Solutions, the manufacturing extension arm of the university, in coordination with the Career Development Center and the engineering college. Anna Mangum, an IES regional manager, recruits and works with manufacturers, Career Development and the college to promote the program among students.

Since starting with four students in 2019, the program has placed 600 engineering students in internships. Last summer, 147 students worked at 83 companies, spread across 39 counties.

The program’s budget caps out at 150 students. In midJanuary, 103 positions had been posted. “There are 1,852 applicants from our students against those 103 jobs,” says Mangum. She had a client who was slightly overwhelmed because he had 100 applicants of students wanting to gain experience in his machine shop.

Nathan Kiger of Nash County had an internship last summer and is returning this to the same employer, Evans Machinery of Wilson.

Kiger, who grew up on a sweetpotato farm, is a junior majoring in biological and agricultural engineering. He was steering tractors in the field when he was 4, sitting in granddad’s lap. By 13, he was driving the tractor by himself.

He grew up fascinated by agriculture and by all the mechanical stuff on the farm. That was the story of agriculture in the second half of the 20th century, the spread of tractors and other equipment.

Evans is a nearly 50-year-old family business that manufactures and repairs complex tobacco processing and other agricultural equipment commonly found on eastern North Carolina farms. This was a good place for Kiger to intern.

“I used a lot of my classes very quickly,” he says. Evans put him to work on real projects. We discussed tender trailers, the kind of thing used to haul fertilizer from a distributor to the farm, where the stuff would be dumped into a spreader. There are a lot of hydraulics needed to push out the fertilizer. Kiger had to size the hydraulic lines.

“In fluid mechanics, you don’t exactly learn how to size a hydraulic line,” he says. But he had experienced folks around him at Evans who helped him.

He worked on the redesign of a fertilizer bucket elevator, which is used to move the fertilizer to another stage in processing. He went out to help with installations, and saw the difference between designs on a computer and what equipment looks liked in a customer’s building. Subtle things that he would use to tweak his designs.

Next summer, he will be on the road as the engineering guy on sales calls and going out on more installations. It will be more of a customer-facing role, and he’s looking forward to another summer with Evans.

And Evans is looking forward to another summer, and, they hope, longer with Kiger. “He’s a smart guy,” says Amanda Barnes, president of the company. She’s the daughter of Donald Evans, one of three brothers who founded the business. (Bobby and Tony were the others.) “He’s friendly. He’s knowledgeable, well-mannered, so we really want to try to hang on to him.”

Evans has an innovative culture. Kiger was encouraged to try new designs, new features, not just follow what had been done before. He fits the culture.

“He was willing to get in there,” says Barnes, “and say, ‘Yeah, we got it this way, but, hey, let’s see what it’ll look like if we tried it this way. Move this on this drawing and change it up a little bit.’ Lots of time, that’s what we all need, which is fresh eyes to look at something.”

At the same time the Evans brothers were launching their company in 1979, my wife and I got married in southwest Virginia, where we had both started working after college.

My wife grew up on a Sampson County tobacco farm in eastern North Carolina, and I can remember 40 years ago meeting people on our visits to see her family in Clinton who would tell me their kid had gone off to college and was now living in Cary.

Cary, just west of Raleigh, had grown from 7,700 residents in 1970 to nearly 22,000 in 1980, the result of RTP’s growth and the arrival of the up-and-coming software company SAS, which spun out of NC State. Today, Cary has a population of more than 180,000. Many residents are from other states and countries, but more than a quarter are from North Carolina. Some are Cary natives, but not all.

In the old days, most of the kids from rural counties would come back from college to learn how to run a factory, work in the bank, or, like my father-in-law, to run the family farm. Then Raleigh, Charlotte, Durham and Cary and other cities became powerful draws, pulling a lot of talent out of the rural areas.

There are good ideas to build up the rural talent pool, such as Rural Works! NCEast Alliance has a program to show students career possibilities around them in 29 eastern counties. Also promising are the community college training programs for the expanding biomanufacturing sector in the region. I have written about the expanding aviation and aeronautics sector that has found a hub at the NC Global TransPark in Kinston.

This is a slog, economic development in rural counties. To a large extent, it is a talent recruitment/retention project. Wins are hard-earned, and we need to celebrate them one engineering student at a time. ■

Veteran journalist Dan Barkin writes the NC Military Report newsletter for Business NC. Originally from Newton, Massachusetts, Dan moved to the South for college before settling in North Carolina in 1996. He can be reached at dbarkin53@gmail.com.

by Allen N. Trask III and Amy H. Wooten

We are attorneys and don't sell or broker insurance. Yet, we're writing to alert business owners of a direct threat posed by a "set it and forget it" approach to insurance coverage. Why? Because we see firsthand the damage this approach can cause as we litigate claims that business owners bring and defend against their insurers.

During the last five years, government shutdowns, supply chain disruptions, material price increases, and substantial and costly property losses resulting from natural disasters like Hurricanes Florence, Dorian, Isaias, and, most recently, Helene have highlighted for business owners the importance of making it a routine business practice to take stock of the types and extent of insurance coverages their businesses have in place.

The hot topic during the height of COVID-19, and for quite some time thereafter, was how businesses could recoup their losses when mandatory government shutdowns required them to shutter their doors for a period of time.

Business owners also sought possible relief through insurance as business income/interruption loss claims. A valuable lesson coming out of COVID for any business that owns property is the importance of how market and supply chain disruptions impact pricing relevant to

commercial property insurance policies, particularly those with replacement cost coverages and those with co-insurance penalties.

Increased market costs for labor and material translate to increased repair and rebuild costs, which may mean your once appropriately insured-to-value commercial property is now underinsured.

This isn't just an important consideration for your business, though; it should also factor into your thought process when considering businesses you are contracting with and how, through contract terms, you can further protect and mitigate risks for your company.

Turning back to the search for a way to recoup the losses that many businesses sustained during the suspension of operations due to government orders during COVID, there was a wave of claims and litigation across the country sorting through whether such orders and their resulting impact were covered losses.

These issues were still on our courts' dockets even late last year. The North Carolina Supreme Court took up and issued opinions in two cases last December.

In one case, the Court determined that the language of the policy at issue was not clear in defining "direct physical loss"

to exclude circumstances in which the insureds could not use their insured property due to government orders or threatened viral contamination.

In a companion case, the Court determined that there was no coverage where the policy at issue expressly excluded viral contamination as a covered cause of loss.

Both of these cases illustrate the importance ascribed by North Carolina's courts to the language in insurance contracts and, for business owners, the value that can come from having a basic understanding of how the courts read and apply those contracts to reach an answer.

We read insurance contracts not to sell them but to help business owners fully understand both the risks mitigated by and left unattended to in their current coverage portfolios. In the event of a significant loss, that type of counsel can be tremendously helpful and can be the difference between receiving the claimed benefit or being left holding the bill.

Insurance is not a risk management tool that North Carolina business owners can afford to relegate to the bottom shelf...

Another lesson, and for a significant portion of the State, a heartbreaking one, came last September when Hurricane Helene exposed a significant gap in insurance, impacting many businesses. These businesses either did not have any flood insurance, perhaps because they were not in an area mapped as a flood zone, or the coverage they carried through the National Flood Insurance Program (NFIP) was insufficient to cover the extent of their losses. Currently, NFIP commercial policy limits are capped at $500,000 for buildings and $500,000 for contents.

Hurricane Helene proved to be a stark reminder that even areas in the State thought to be unlikely to or not prone to flooding are not immune from the dangers and damage of flood waters. It confirmed for all businesses having commercial properties the importance of giving due

consideration to whether they need flood insurance and, if so, whether the NFIP's offerings are likely to prove sufficient in the event a flood loss occurs.

Suffice it to say, insurance is not a risk management tool that North Carolina business owners can afford to relegate to the bottom shelf only to be pulled out when the need to use it arises. Thankfully, failing to take a policy and terms inventory on a routine basis is a mistake that all businesses can easily avoid.

Keep in mind, though, that regularly assessing your business's insurance portfolio is the bare minimum a company should undertake in this area of its risk management efforts. Further assessments are warranted when changes occur to or within the business or when new risks in the market and industry are reasonably expected to impact the business.

For additional information on mitigating insurance business risks or litigating on behalf of commercial policyholders, please get in touch with us.

Allen

N. Trask III Litigation Attorney ant@wardandsmith.com

Amy H. Wooten

Litigation Attorney

ahwooten@wardandsmith.com

wardandsmith.com

This article is not intended to give, and should not be relied upon for, legal advice in any particular circumstance or fact situation. No action should be taken in reliance upon the information contained in this article without obtaining the advice of an attorney.

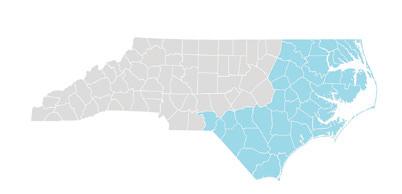

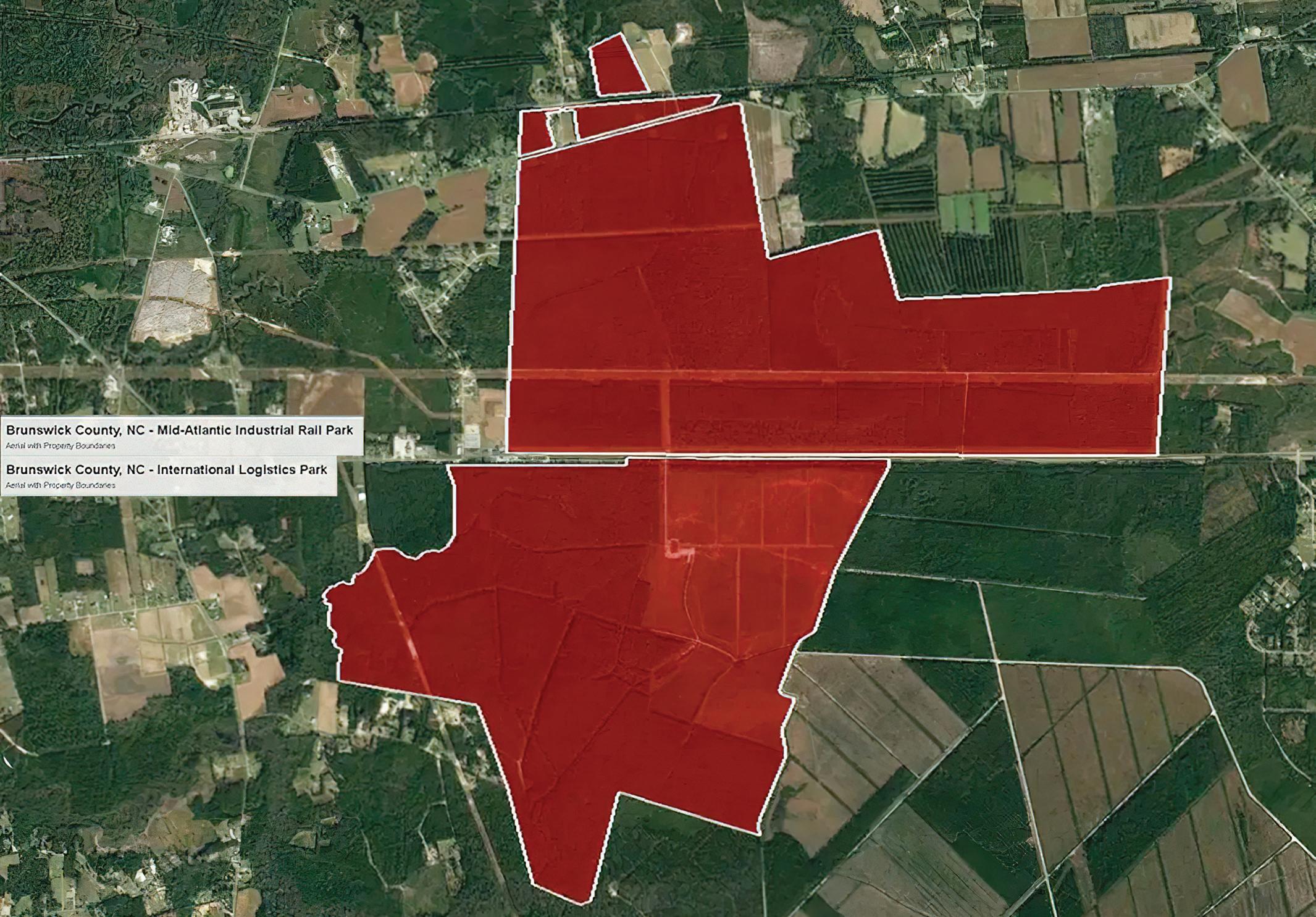

People and businesses are flocking to southeastern North Carolina. Brunswick, New Hanover and Pender counties are working to ensure they have what they need to live and work.

Southeastern North Carolina is home to the state’s fifth- and sixthlargest counties by area — Pender and Brunswick — and its second-smallest, New Hanover. Its 328 square miles is about the size of Charlotte, the state’s most-populous city. Together they form the Wilmington Metropolitan Statistical Area. With a population nearing 500,000, it’s one of the nation’s fastestgrowing regions.

Wilmington topped United Van Lines’ 2024 National Movers Study, which found 83% of household moves there were inbound. The New Hanover County seat’s population was nearly124,000 in 2023, according to N.C. Office of State Budget and Management estimates, nearly 10,000 more than in 2020. That growth has been spurred by a blossoming job market, attractive beachfront communities and relatively

low cost of living. Some people are here for an education. “We talk a lot about the film industry, our port, our restaurant scene and so many other key economic drivers,” says New Hanover County Manager Chris Coudriet. “But we are also a very big college town. Combined, [UNC Wilmington] and Cape Fear Community College have nearly 50,000 students taking part in classes. That’s a tremendous amount of people in various stages of their educational journeys in our community.”

Coudriet says the county has a broad makeup. “A lot of people are here for a lot of different reasons, and that’s something we really embrace,” he says. “Obviously, we have a thriving tourism industry driven by our proximity to water. We also have become a destination for folks later in their lives or careers who are looking to settle down.”

The region attracts commerce, too. “Our location between both the Wilmington and Myrtle Beach MSAs makes it a competitive and viable area for business and industry development opportunities, as well as its vibrant beach towns and growing municipalities,” says Brunswick County Manager Steve Stone. “Brunswick has a long and fascinating history dating back to before the American Revolution, and its proximity to Wilmington and the Atlantic Ocean, along with its low tax rate, has made it one of the most desirable places to live, visit or start a business.”

A growing population and economy are good problems to have. But they still create challenges. Each of the three counties are meeting them by developing and enacting proactive strategies.