Trust The Leaden lt's no secret why building materials dealers across the counfy are tuming to Eagle LS. It's the lumber industry's business management solution created and backed by Triad, the nation's number one automaton company for your industry. Do you really want to trust your investment to anyone else?

Get The Edge. Triad's taken years of automation expertise combined with feedback ftom over 1,000lumber customers, and packed Eagle LS with everything you need to stay competitive today. How? By heipingyou manage the flow of your business transactions ftom estimating, pick tickets, special orders, mill' work and invoicing to ordering and inventory management.

Total Customer Seryice. Any company can sellyou a computer system, but what happens once it's installed? Ea$e LS is backed by natjonal leadet Triad, which means totai service and educaton is a given, anylvhere in the country. And remember, only Ea$e LS is backed by the speed, power and flexibility of the proven Eagle Series fiom Triad.

Flexibility & Custom SupporU wnatever the size of your busines, Ea$e IS is right for you. For large single store or multiple yard operadons, Triad will work with you on custom data conversions, education and ['aining packages, and software featues. Whatever your business size, Triad offers you the options and flexibilify t0 expand as your business grows. See for yourself

The result-faster hrmaround on quotes, better inventorymanagement,improvedcustomerEAtrI-riil:i:ihT#dealersacrosffi

12

1.37 million starts antinipated-

14 Slouter tempo utith only modcst gtputth

Fewer young adults will requirc ncw lnuses

Retoilcrs could prcfit_ftpm wid.er ueeptutce of EDI

Improued inuentory and, cash nwnagenunt is possible

Enginqgted lumber prduote will grcut 3O% ta I40%

Lack of knowlcdge uill be biggest deterrent to th.eir use

Retoilerc utorned tbt must imptpve technolopy uee Ray Nunn installed as presi.d,ent at 77th annual in-1qns

Soutlern Forcct Ptd.uats Assn.'t ettnttol ncetins

Loute's u.p. focuses on clnrryirry dernographics, spend,{rry

PUBLBIIER thr,tsCltbt EoITOR JuarIhlow8r |SSOC| tEEoTIOB tMtogt Drtncuraq cigs Idomy,Wery Lyncfr ART URECTOR ilantE Enery ST FFARIIST PfFdtl|dof C-nCUL IpX Tr!ry Sbrr|e sugscRlPltolls us.:Ps'o|Dyoac gl'ttoyteB; 155'th.ooyeans. Forelgn om-yoarpaysb lnadusrrco h u.s, fuds: qrte{37, c.n dad ro@ Sr, o0rcotafts8. Arir6.b 3l'f"lf;,1p[tr'ff;*f5*3.m:9:!:p[,"fm-oux*oiirb^ness

CenJaioersr$d'r'*,le;tr;rp&,mraoocalo4coo. dnof,cPR0DucTs0lGEsTbpt6|bh9dmonrilyat|500Crrrgror.'srtoit,irn91eq*r'c.me'0i0-G'r9eo''<iiii'mliilil.riiiEil'ffi :8ffi#jfP*1?:L$f.!g:!gy?l5f:h!3Tq1.sats di'yti-rsriyirftrndsrrsii" c**a'u'roconbnbrDrrpobcbd116

markets in 13 Southern states

Inside this issue some of the top people in our field offer their expert forecast for 1994 and beyond. On this page, we invite everyone to doit-yourself: try your own hand at b'reaching the veil that hides the future from us.

An obvious starting point is to take today's world and extrapolate it into the future. While helpful, this inevitably neglects the interferenoe of outside forces that can radically change the business environment. So the good forecaster ne€ds to consider what likely critical future issues affect him u her and the company and then try to guess what developnents could affect the forecast

Technology plays a big role here. Just as the fax has had a major effect upon business practices, so too will interactive technology, we suspocL As it quickens and expands communication at wort, it's likely to change Oe way America lives at home. And that means what people buy with their disposable income and how they spend their time could drastically change. All this implies Oat strong sellers in today's inventory may well fall from favor.

DAVID CUTLER publisherIn forecasting the next quarter or the next year, spocific goals are achieveable. Beymd tbat tbe forecaster needs to cballenge cmventioal thinking, think the unthinkable, be alert to cultural changes in society that, like int€f,rctive technology, can turn today's situation upside down. Sometines the generalist does bett€r in long range forecasting because of the wide soope of lmowledge and interest brougbt to the puzde. Today's inconsequential frcta can quiclly becme tonarow's major mo{ratqin. Tbe reverse is true and often the change from one to the other is brief. Thongh its effects can linga.

Ask younelf, if I were the orstomer, is th€re any possible reason, no nauer how far-fetche4 why I night in five years change my prcsent pattern of buying? If not" why not? Here's where you need to prod your imagination, intuition, memory and that part of you brain that causes you to hear-hings that go bump in the nigbl

Many make forecasting an ongoing process, continuously monioring edy waming signs. It's one habit that can put money in you po*er

fF YOU are pleased with your Ioverall building materials business perfomunoe for 1993, you could be pleased at this time next year, judging from key economic indicators. Although some of us might experience a sense of "market d€jtr vu" from time to time in 1994, the cmring year will not be an exact carbon copy of 193.

Demand indicators point toward modest grow0 in domestic wood makets. We are looking for a slight uptick of about 3Vo n Lhe national economy with continued-productivity and consumer spending levels that will keep inflation in check. Interest rates might not hold at their surprising current levels, but can be expected to remain stable through the near tenn. For wood mukets, all of this pgins _q!rqq_ hor.rsing sttrts of about 1.4 million unirs, up about lfi),000 from this year. Inoking ahead over a fiveyear period, we see housing starts remaining stable and averaging about 1.4 million.

Repair and renodel and nonresidenrinl ssgmsnts 9f the wood products secttr will show more accelerated growth over the next year or two, each in the range of 10% gains in expendi0res, before slowing somewhat.

The nation's demand for lumber will grow l-2% next year and should average that modest level of increase for the next five-year period. The U.S. appetite for panel products is anticipated to expand ata37o rate annually.

The volatility that has characterized wood pr<iducts prices over the last two years will likely remain in 1994.

Prie forecasts vry dramatically, but we subscribe to pro- jections thaL on the combined average, prlces f6lumber and_plywmd will increase by about4% next yer.

Traditional influences upon price, such as economic indicatms, wealh€r, inventory leveb seasonality, etc., pale in imporunce when compared lo tbe impact oi tog sfrta8es.

In the Northwest, federal government decisions and court i{iunctions t9 halt logging and timber menag€nrent on public forests have pushed timber sales voluies far below the most pessimistic estimates. Fed€ral timber harvests in tbe five-sare rea of tbe Nathwest have dclined by neqtf ttrGrhirds over the past l0 yeas and d€ expocted o drop again !o one-half rbe l992tevel by 1998. In rhe interim, many Northwest mills are being sustained by increased purchases of logs from privatCnon-industri:jl lands. However, the culent rate of harvest on those prop erties cannot be sustained.

Due to tbese rcalities, U.S. lurrber demand will ursrip supply by approximarely 8 bilion board feet within frvb yqn. Smgnryt panel supply will fall2 billion square feet below national needs within that time period-. North American wood producing regions other than the Northwest can take up liule of that slack because they are growing timber near their leral of higbest potential.

Viable sources of offshore timber are Ueing explced and, in time, can make up for an as yet und-etermined amolnt of pending shortfall. We also will be seeing wmd prodrcts taking new fortrB, such as laninated veneer lumber, sherching the available timber resources while p'roviding utility and sfuctural strength.

From all indications, the wood producls sector will &ce familiar narket conditions in 1994 and continuing challenges to resource supplies. Those who best satiify the customers' needs and who operate efficiently will fare besl Never before have we been so challensed.

ket? At the momenl the answer is competition. In recent months headlines have chronicled the growing power of the largest chains. They are expanding beyond metro markets into second-tier cities and moving inland from the Fast and West coasts into the nation's heartland.

As they expan( they face each other in the same markets, where some observers believe they cannot all survive. Some retail companies have left the markeq othen are successfully changing their competitive strategies, finding niches where they can shine against larger competitors.

Yet, as companies expand so does the hardware/home improvement market. There is room for many retail companies in this $113.4 billion market that is growing almost 7Vo alear.

Although the number of store units has essentially stabilized, we still count more than 46,000 home centers, hardware stues and consumer-oriented lumberyards in the primary hardlines channel of distribution.

The market continues to be dominated by independens. The top 25 chains, with approximately 3,000 store units, hold only 3l%o of tfu, toal dollar volume.

The most recent year for which we have statistics, 1992, proved to be a relatively strong one for U.S. hrdware/home improvement re0ailers. Housing starts and new home sales, each up neady 20Vo, generatad hefty sales of lumber and building materials, and sales at home centers and especially lumberyards reflected that demand.

As 1993 draws to a close, all signs point to ano&er strong performance. Despite nronthly ups and downs, the housing market is holding its own. While housing is not the only driver for hardware/home improvement sales, it is a sEong one.

As we look ahead to 1994,we see trends continuing that will benefit the home center market. As they grow into middle age, fanilies tend to settle in. The Baby Boom generation is no different. And when they sede in, they improve and upgrade their homes.

We see a steady trend to more installed sales and demand for professional help with home improvement projects - with consumers calling &e shots about products purchased and where. In our view, the home center industry is healthy. Competition makes it so - it sharpens management, marketing and merchandising skills and enlarges the narket for home improvement goods and services.

EORGIA-PACIFIC will continlJue to be an aggressive competitor in the building products industry. We believe our millwork and specialty centers have tremendous opportunity. Millwork and specialty products, such as moulding, doors, windows and shutters, have grown in popularity with the boom in the

remodeling market and the rebound in housing starts. Housing starts, as reported by the Westem Wood hoducts Association, are expected to be 1.35 million units for 1994, an 9Vo increase from 1993. There will be a growing need for building materials n 1994.

We will continue to introduce new products in 1994 and beyond. As consumer demand for attractive, low-maintenance building materials grows, we see significant increased demand for vinyl products, particulady vinyl siding.

We also see tremendous growti pot€ntial for engineered products, such as oriented strand boar4 laninated veneer lumber and wood I-beam joists. The majority of our new plant facilities on the drawing board will manufacture these types of engineered products. From an expanded wood I-beam manufacturing operation in Ocala, Fl., to a new engineered lumber facility at Roxboro, N.C., and a new oriented strand board plant at Mt. Hope, W.V., G-P is gearing up to be a major supplier of engineered wood products.

In addition to certain structural benefits, these engineered products also conserve our natural resources thmugh complete utilization of all parts of the fee. Wood I-beams, for example, which are used primarily as a structural component in roof and floor systems, use 507o less wood fiber than conventional sawn lumber.

Environmental concems, in fact, will continue to be on the minds of customers. Georgia-Pacific takes its concern for the environment further than just growing superior trees. In addition to producing commercial timber, our lands provide habitat for many species of wildlife and recreation for nearby residents. Our habitat conservation plan for the endangered red-cockaded woodpecker has been recognizedby the U.S. Fish and Wildlife Service as the potential model for corporate forestry.

I believe we will see cooperation like this with government agencies and environmental groups in the years to come. At the same time, our industry is facing everinoeasing environmental scrutiny and regulatory prcssures that are expected to result in increased expenses for protection of endangered species on private timberlands and more strict air and water pollution controls.

EIROM Weyerhaeuser's view- l' point, the past few years have been excellent for the distribution industry and we're looking at 1994 as another positive year.

We have seen some very significant chimges in our building materials distribution business in the '90s. It has experienced a major repositioning the last few years and the business improvement plans laid in place have exceeded our expectations. For exarnple, we streamlined operations and management to make them more responsive to customer needs. In turn, we also reduced overhead and operating costs along with empowering employees to react more quickly and responsively to our customers' needs. Improved customer satisfaction and earnings have followed.

(Please tum to page 14)

OUSING starts in Florida are

since the third quarter of 1992. According to economist Merle F. Dimbalh, pennit values for the first quart€r of 1993 ne up 13% from the year eadier.

This, coupled with a much lower unerployment rate and relatively flat inflation, makes us cautiously optimistic for 1994.

Environmental issues will continue 0o cause concern regarding available lmrber supply, and probably will be a part of our lives forever. The fend to take national forests away ftom the multi-use concept has created mill closings, putring tremendous pressurcs on pricing and supply. The huge swings the market has taken since January have created challenges. Continuing to provide customers with top quallty lumber at competitive prices will be a challenge to all of us fo the foreseeable futrre.

We thirk $nart companies in 1994 will focus their energies on providing the best customer service possible. Slow, steady growth will be our experience, instead of booming markets. Good companies will provide value, convenience and service, and will profit by controlling expenses, to grow and thrive in tle coming years.

we expect 50% of joiss sold and used in this country will be engineered producs. Our third plant is up and running in Nevada and mae plants are on tbe drawing board.

Looking abea( I'm most excited about FiberBond. Its growth will be even greater than we've experienced in OSB. We're just beginning. Initial eceptrnce of underlayment indicates the flmring business has been waiting for an alternative !o lauan plywood- We'rc well equippe0 tro moet fuhrc denands of supply, perfcmance and environmental sensitivity. FiberBond structural exterior sheathing, with the advantage of a fire rating, has just entered the marketplace, and our interior fiber gypsum panels have found a niche wherever superior strength is needed. Nature Guard cellulose insulation, fiber-cement t x9; shekes, a whole family of pr,oducts mnde using oor most plentiful resources - old newspapers, residues of other manufacturing processes and renewable plantation wood - mean fuure oppornmity fa orlomers.

When our new hish friends sent us offrecently with tlre familir blessing, 'may the wind be always at yorn hk," I was reminded of New York Knicks coach Pat Riley's remark to a Itoup of builders last yean 'Winners don't wait for the wind at their backs, but ch€rish tbe challenge of wind in their fa@s."

4% ro 5% growth next year, reaching a total of $125 billion. We expect growth in both oonsumer and professional categories, with consumer sales representing 2R of th total and produa sales to professftnal custmrers tbe otber l/3.

ask, particularly as a new year

lff"AT lies aheali Wherever I 4-nYU go around the giobe. people

approicnes.. Gen6ratiy i leave iore-

casting to the economists, relying

instead on cornmon sense to lead me

in the right direction. I am always

mindful good times are never as

good as they seem andbad times can be filed with winning qportrnities.

By making the best of bad tines, our L-P tean has in the past three years returned 2737o apprc*iation to shareholders. In the fint nine months of '93 we've ex@eded our prior record breaking full year earnings. rily'e've done it by being resourceful ard keeping foremost in mind what our customen are going to need in the funre.

We were looking to the future when we opened our first OSB plant in 1978 with 130 million feet of capacity. We were willing to take what otbers saw as a big risk. Over the past 15 years, thanks to the acceptance of our custometrs, we've creat€d a whole new industry segment to fiil the void created by a diminishing supply of plywood. This year North American OSB production increased to neady 10 billion feet with L-P accounting for A7o of the total volume. And we're still growing. We've announced expansions of Inner-Seal OSB plants into Venezuela and Ireland where government plantations are plentiful and new industry is encouraged.

Consider next tbe fuore for engineered lunber. Today the market for wide dimension lumber is about 5 billion feet with wood l-joists accounting for about lVo. By 2ffi0

While the overall market will grow, increases will not be even throughout the cormtry. 1994 will be a regional versus a national bousing matet with some states showing strong growth. Texas and Colorado will continue to recovar because of pent-up demand after several years of depressed housing. The Soutb, Northwest and Cdifcnia will p'robabty remain slow and higily competitive due 0o the @noentration of military and aviation indusries and job unerainty in those areas.

Our optimism is centered on the fet tbat constsuction of new hmes and aparturents hit a 3-lf2 yat high in the fall. This is prinarily due to mortgage rates being at tbeir lowest level in the last generation. We arc also seeing onsistent monthly increases in building permit applicatinns, which suggests more construction activity in the months abead. The National Association of Home Builders reoently reported Oat over 60% of its members expect sales increases over the next six mmths.

Not all rehilen will increase or even maintain their existing mrket shtre in the years to aqne. In addition to economic frtons, store expansion by several national md regional home improvement retailers has md will continue to ounrip the projected overall home improvement sales increase. Retailers as well as oontrrcttr<rientod btrsine.sses will need !o find ways to improve their efficiency o withstand the aggressive competition moving inio maftets across the United States.

The number one key to future growth is the develry ment of a stnategic plan that focuses on local business conditions including employment levels, competition, areas of

cornpetency, and the needs of the community. Time will be the currency of tbe 1990s and successful retailers must better service the needs of their customer base. This suggests providing a high value equation including a combination of the shopping experierrce, trust and perceived product cosL Those retailers best able to meet these new customer demands will be the winners in the years ahead.

It will be more important than ever that retailers market their store through effective signage, both outside and inside Oe store, making crystal clear statements which communicate the store's position in the market to its customer base. In the end, bigger will not necessarily be better and the retailers who best service their customers' needs will experience higher than average growth and be "the competition" in their markel

Empty buildings are slowly filling. Wrenching changes in corporate America's defense section will allow resources to move to other uses. Transitions while difficult and painful are America's strength - the ability to reorient and change. The risk is policy makers will kill flexibility viaregulatory fiat or bursts of protectionism.

For 1994 a pair of threes would not seem an unreasonable forecast - near 3Vo on both inflation and growth. The interest rate decline is probably history, as they will likely bounce around before short tem rates slowly rise. Modest growth and inflation could be "Geritol" for expansion, allowing it to continue at le:lst through mid-decade.

Excitement in 1994 may well be in the policy arena as efforts to change the medical system continue and tottering progrcss towards additional reductions in global trade barriers hopefully is invigorated.

DONoeRntlG the present upturn

I is in a sense boring. Growth rates of 2Vo to 3Vo are incredible stuff from the perspective of when close to zero was the norm, but insignificant in the context of other postwar business cycles.

Employment numbers have been

IIaOTAL home improvement prod- I ucts sales are projected to increase 6.5Vo lo reach $145.1 billion in 1997, reflecting the improved long-run outlook for interest rates, housing market activity and con-

sumerspending.

Consumer market sales of home improvement products is a distant, politically incorrect memory. The direction,

however, is up.

Beneath slow growth is a seething caldron of activity. Daily we re greeted with headlines of change - downsizing at IBM and Woolworth, closures of miliary bases and curtailments at defense contractors. Less publicized are expansions of Wal-Mart and Dell and rebounding forhrnes for much of the U.S. auto industry. The potential of change in the communications industry is only hinted at when we consider the Bell Atlantic-TCl merger and linkup of ATTandMcCaw.

crawling up from their slide and the American job machine of tb 1980s -

are expected to grow by more than g%o in 1994, outpacing total retail sales growth. A rebound in lawn and garden equipment sales and continued srong growth of lumber and building materials sales will lead the consumer markel With a projected average armual growth of 6.37o over the

next five years, this segment will total $99.3 billion in 1997.

This may be Joseph Schumpeter's process of "creative destruction" personified. That is, it will generate employment and activity in areas not dreaned about.

The ongoing refinancing orgy continues for finns and individuals, with some back the second or third time. This is helping to ease the debt overhang of the 1980s and boost housing affordability to levels not seen in decades.

Inflation, the scourge of the late 1960s and 1970s, has, at least temporarily, been brought down to levels someone who went into a coma in the Eisenhower or Kennedv administrations would be comfortable with upon awakening. (How many of us in the late 1970s would have believed an inflation rate below 3Vo and 30 year mortgages &low 64o?) In a low inflation environmen! born again cost cutters re wmking to boost productivity. Assuming this continues, it will help set the stage for stronger income growth.

Moving into 1994, another year of low inflation and relatively slow growth seems in the cards. Fiscal policy has turned more restrictive with tax increases and slower spending growth. This will danpen growth. Defense cuts are not over, but the four-year decline in interest rates will help support housing, business investment and some consuner durables spending. Low inventories will stimulate production and declines in interest rates overseas suggest 1994 will be bett€r in Western Europe and Japan.

The recovery of the professional remodeler market for home improvement products is expected to accelerate on the strength of lower interest rates that will stimulate greater housing market activity and associated fix-up work. Average growth of 7Vo wrll put the value of the professional market at $45.8 billion in 1997 sales.

- Lower.mortgage rates and a larger stock of existing homes will raise existing home sales to new heights-. Home improvement and repair work, both before and-after sales, will provide a major impetus to the home improvement market through 1995.

As the home owning population ages, single-fanily construction will shift from starter homes to the more lucrative trade-up market. Some of this demand will manifest itself in increased spending for residential improvepg-n-ts. Althgqgh starts will be almost the same in the year 2OO2 as in 1994, real residential consrrucrion wrll & il%o higher.

Hardware and building supply stores, which suffered more than the overall retail sector during the recession, will continue to advance at a brisk 8.9Vo pacn. The gap between the home improvement products consumer martei and total retail sales is expected to widen with total retail sales projected to increase at 5.67o and home improvement products at8.6Vo rn 1994.

^ !_t""dy increases in real disposable income, averaging 2.2Vo over the next five years, will support sales growth of consumer market home improvement products, driven by continued gains in housing market activity and price inflauon.

WSf

single family home market, a rebound in the multifamily sector, and mortgage interest rates lingering at or below 7%,1994 will be a good year for housing.

Although 1993 was weaker than expected, housing starts and new home sales picked up during the second half. We expect that momentum to continue into 1994.

However, we don't expect any strong suge in economic activity. hstea4 the economy will move along at a growth rate of about 2.5% annually for the next couple of years, just enougb to gradudly redrce the nation's unemployment rate. Poor consumer confidence is one factor holding growth back. Indee( the job outlook is foremost on people's minds and, unfortunately, highly publicized plant closings and corporate layoffs continue. This job picture makespeople anxious about their own futures.

Forturately, continued low interest rates will help offset poor consumer confidence and support the economy's interest-sensitive sectors. Rates should stay at or below 79o on 30-year fixed-rate mtrtgages througb 1994.

Low mortgage rates will continue to allow unny people to move out of rental accommodations and into their fint homes. This Eend is one factu that wi[ fuel housing pro-

fT'S that time of year again.

IEveryone looks into that elusive crystal ball and tries to predict the events that await them in the next business year. And every year, it s€ems, the crystal ball gets just a little more cloudy. The variables that could come into play are beginning to overshadow a clear view of the fufire for our industry.

duction next year. We expect housing sttrts to rise in 1994 and again in 195. Our projection is fu 1.37 million strts in 1994, up from 1.253 million in 1993. In 1995, we expect to start 1.41 million new housing units. Singlefamily housing starts will rival levels set duing the bomt years of the 1980s. Single-fmily producrion should reach a peak of 1.165 million in 1994. That's subsuntially mce than the 850,m0 begun in l99l at the depth of the recession, and tbe most since 1986.

Total strts look weak in comparison o histmic numbers because multifnmily production bas fallen to historically low levels, from 669,000 units in l9E5 to about 160,000 this year. The multifamily market has bottmed out, however, and should imp'rove to about 2(D,0(X) rext year and to U1,W in 1995. The inctease can be anrib uted primrily to the recent extension of tbe low-Income Housing Tax Credit, which supports the production of about 60,000 rental units a year.

Tbe remodeling maket is anotber sector of tbe bousing industry that will enjoy finther growth in 1994. Honeowners who have decid€d to stay in their homes raber rhen move are tekinS advantage of today's low interest raes by refinancing 66 rrking out home equity loans to finance improvement projects. The remodeling market should reach a record $120 billion in 1994, up ftm $If 3.9 billion this year. Next year's figure includes $55.9 billion in maintenance and $65 billion in improvements, additions, alterations and major replaoements.

There are m4ior unlrrowns in the picture n€xt year, like the effects of bealth care refam and availability and ftce of lumber. Overall, we expect the housing industry to remain one of the healthiest sectors of Oe economy through 194.

global or domestic economies, our crystal ball time sbould be devoted to market share.

Again, 7% rsvhx many feel the growth rate will be for 1994. What will your market share be? Higber q lower? Tbe forces of competition are sEonger than ever. My point is rhat it is as relevant today o predict bow the pie will be cut up as it is o lmk at the size of the pie.

For example, with the d€mise of Builders Empcium in Southern C:lifornia tbe pre sayed tbe same, but there is now $500,ff)0,000 up for grabs in matet s[ap. $imilarly, other areas of the country could offer martet sbae opportunities for the independenr

Housing strts and forest prcducts reguluions are critical to our industry. No one would argw with tbat But'a plan and an anitude o gain ma*et sbtre is pdt of a winning famula that can make the crystal ball a little cleaer. sumer confidence and govemment regulations. We would also be remiss if we did not take into consideration the regional factor. Certainly areas hard hit by the oconomy, like California have their own idiosyncrasies. Conversely, other regiurs in the country such as the Northeast are ruly on the rise. And how long has it been since we heard

Just a few of these would be environmental issues, con-

about the wes in Texas?

According to Dunn and Bradsreeq only 10% of businesses fail due !o industry wealmess. If you look at the long-teirn projections, our industry will grow in total dollars from $100 billion in 1992 to $171 billion in the year 2000. This is a growth of approximately 79o per year. This along with the potential of low interest rates should offer a solid, but not stellar, 1994.

Now more than ever, however, we need to tqlk about market share. The economic outlook fm 1994 and beyond is strong, but what about the independent hardware or lumber/building material retailer? Baning any catasttophes in

onstruction of single family housing is one of tbe pedicted leaders for 1994. With a strong ilray of positives - geography, stedy demogr4hic support, low mrtgage rates and improving consumer confidence - single family housing will rise 6% n 1994 io 1,050,000 units.

(Please tum to page 14)

pecial Orders Lre Ln important part of your business. Do you know the status of your Special Orders? Can you find them? Does receiving know what to do with them? Do they disappear in inventory only to be found during your physical inventory at year end? Improved inventory control with complete special order tracking is only one of the reasons for you to consider LMAS, the Lumber, Millwork and Accounting System from CAS.

LMAS supports all facets of the building material distributor, including: Integrated POS/Order Entry, Prompted On Line Bill Of Materials, Tally Support, Sectional Orders, solid Accounting, and custom modifications.

LMAS software, coupled with the power and reliability of IBM's AS/40O' hardware, provides an unbeatable solution for yourbusiness needs.

If your computer can't answer your day-today questions, call CAS and let our professionals show you how to get the answers. For further information, please contact Doug Gerstmyer x l-8OO-252-47 15.

FIE economy of 1994 will most likely be mrrch like 193: one of modest growth. Although lower interest rates appear to have finally encouraged a higher level of economic growth in the second half of 1993, the acceleration is unlikely to continue into 1994.

The reasons are many: defense cuts, tax increases for the wealthy, ctrporate resruc0lring, office consfucdon overhang, slow economic growth for some major fueign trading parmers, and concerns over health care restructuring. Together, qhgse danpening forces should hold real GDP growrh to 2.5Vo in1994.

But modest growth is not all that bad. Such growth keeps indusfies from pushing to capacity limits and helps to hold down inflation. In addition to slow growth, current Federal Reserve Board policy and stable curmodity prioes will probably cause inflation to fall from 3.0% in 1993 to 2.57o la 2.8Vo in 1994. In orn, lower inflation should help interest rates fall further. After rising in the last few months of 1993, the yield on the 30-year bond could fall to 5.5Vo in 1994. At the short end of the yield curve, slow economic growth and low inflation provides the ingredients of unchanging Federal Reserve Board policy. Consequently, the prime rate could remain at 6.0% and the 3month Treasury bill could hover from 3.A0% to 3.l5%o over the entire year.

Lower interest rat€s encourage growth in the housing market, but demographics will keep housing from hitting the levels of the 1980s. Specifically, trars factors that bolstered housing growth in the 1980s will not be as strong in the 1990s: the number of new wcking age adults and the participation rate of women in the workforce.

In the 1970s and 1980s, Oe baby boom generation entered the labor force and increased the demand for housrng By contrast" there are fewer young adults today; in 1980 there wqe l2.l million adults age 18-20 and in 1990 that sarne goup totaled 10.8 million. The second factor that &ove labor force growth in the last two decades and also increased the demand for housing was tbe increasing percentage of women in the labor force. The ferrale participuion rate rose from 43.3Vo in 1970 ro 5l.5%o in 1980 and 57.3Vo n 190. However, this rate is expected to increase only to 62Voby the year 2000.

(Continued from page I 2)

In effect, the growth expected during the fint stage of a constmction recovery is being stretched over three years. The regional pattem for 1994 is expected ro be similar to what is taking place this year. The srongest gain will be shown by the South Atlantic, followed by South Crntral, the Northeast and the Midwest. Unfortunately, the West will still be harpered by the disressed Southem California economy.

Strong demographic support is present for the single fanily home market, so some of the deferred deunnd from the 1990-91 downturn and the incomplete recovery in 1992-93 should lead to modest growth in 1994. With inflation low, mortgage rates are expected to remain close

0o current levels at least throrgh mid-194.

Consumer confidence is a bugher ca[ but at least some of tbe uncertainty surrounding tbe Clinon budget package was removed with its passage. The mortgage revenue bond provision of the Clinon program shorild help bring money at below-martet rates to moderate income homebuyers. While the credit cmnci remains an in@iment to developen, a r€oent survey by the Federal Reserve of 60 banks showed thrt some have eased standrds for loans to small businesses - ertainly a hopeful cbange from a year ago.

Th" 35 1e J4-yea-old group is likely to have tbe greareqt impact on home buyng. Because the first balf of tbe 1990s will see this group grow by more tban l0 million persons, tbe demographic fundamenals of tbe single hmily market will stay strong. Furthermore, Oe Census Bureau has raised its population eslimates to take into account greater growth in immigration, boosting projections for housing demand in the yeas ahead.

A toral of 175,000 unirs projected this year will be rhe frst advance since 1986 for the depressed multifamily bousing sector. Gven the new focus of tbe Clinton A0ministration, some support frrom tax sedits for low inme rental housing can be expected. A low 9% incrcase of 190,000 units can be exoected in 194.

Contract value of single family houses to be built in tf!! is projected ro be $116,225 million, up 9% from 193. Muldfamily housing contract value will be $12275 millisl, up 10% ftom 193. Total contrrct value fa residential buildings will be $128,500 miUioq an increase of 9%from1993.

(Continrcdfiompagc 9)

for the upcoming yqrs, we have smre v€ry aggressi\€ and strategic changes planned in the forur of eipan&d orstomer services, new products, new markets and physical and geographical expansion. This type of visionary aproach and initiative will be required in tbe fuurrc of ail disributon if they're to be successfirl.

Alrhoug! we look forward to very pcitive results in the disribution of building materials, wC also soe some very major challenges. Expansion in technology, matets and new products will require disfibutors to look for additirxal gapital to fimd these invesurents. The challenge will be to bdance the invesunent needed to capue growth in menning markets with that needed to improve value-added servioes. To ensure an adequate renlln on their investment, distributors will need to achieve higb€r p'roductivity.

As we look forward, there will be closer wcking relationships between the custmer base and distribution with advancements in technology, electronic data interchange and UPC bar coding. These improvements will provide the entire industry real-time inforrration and cct--savings in tbe future.

-A1ot!gr chalfenge for disributors will be improving relationships with tbeir souoes of suprply. f.or distributtrs that market wood products, closer supplier relationships will be critical to ensure a steady flow of materials. If housing sttrts meet their 1994 projections of 1.3-1.4 nillion units, there will be increased pressure on timber sup plies and wood product availability and pricing *ill again be dramatically affected.

Raw material will continue to affect product availabiliqy. With large log invenlories decreasing, the transition from solid-sawn lunber to engineered prducs is rceler4ing. 4q a result" engineered products are a key emphasis for the'90s in our distribution business.

Interchange, which can whittle a retai ler' s orderin g process down to a few simple procedures, is not in wider use.

Only large retail operations are c ufren tl y using EDI to send purchase orders to wholesalers and receive invoices fron their primary wholesale suppliers,

customer service and costs that hold the line.

Grand Rapids Sash and Door, Grand Rapids, Mi. His company's direct, per transaction costs of EDI versus fonns, postage and handling are a wash. "Basically we break even on EDI," he observes. The cost of EDI is no more than the cost of paper billing, so the benefits of reduced data entry and customer service are a bonus.

In addition to reducing inventory and cutting overhead by shortening the delivery cycle, EDI can benefit a retailer's cash management by eliminating paperwork. Retailers receive invoices directly into their computers, remit via wire transfer and send renittance reports back for cash posting. The wholesaler also benefits with no invoices to handle and no check to get "lost in the mail."

Despite the advantages, a retailer who wants to transact with its although the system can help a retailer to improve inventory management and eliminate unneressary paperwork

Ways rstailers and wholesal€rs can benefit f rom Electonic Data Interchange better Inventory management, improved cash management, elimination of paperwork and redundant data entry. and redundant data entry. However, as a study of the flow charts accompanying this article will show, the system could work for most retailers.

While the retailer benefits the most from EDI, the wholesaler also gains. In the long run, the wholesaler retums these gains to the retailer with better

"An order that took two hours for

us to process now takes 10 minutes," says Alan Kirk, OrePac Building Products, Wilsonville, Or. He feels the faster order entry and proces sing help to reduce the overall cost of servicing a large Lccount.

"We had to implement EDI for one customer, but we'd like to do it for more," says Don Klein,

Receives 7.O.,

fransmtts lnvoice and Receives Remitance Advice.

vendors via EDI may need to force the supplier to provide it. One Southeast distributor says, "We'll go to EDI when the retailers we sell require it."

Clearly EDI is coming. As the building products disribution channel changes and is forced into more efficient operation to offset tightening margins, there is no doubt technologies like EDI will become necessary.

D$trWSBR[trtrS

Builders Square, which is building a relocation store in Pasadena, Tf., with a May I opening targeted, will sponsor the New Year's Eve Alamo Bowl in the Alamodome, San Antonio, Tlr., for the next two years Ktnart Corp., Builders Sqmre parent co., has proposed selling a 25% stake inthechain...

HomeQuarteru opened a new Jackson, Ms., store ... Pelican Building Centers, Conway, S.C., acquired an Aberdeen, N.C., location from Sand Hill Building Supplics end a Rocking[am, N.C., unit ftom Carter Ltmthr ...

Joyner L{trnber Co., Lakeland, Fl., opened a Home Design Center, Tracy Romp, interiordesigner/director Lowe's opened a Jacksonville, N.C., unit, had a grand opening celebration at a Huntsville, Al., superstore and rclocated a Rock Hill, S.C., operation to a new supentore facility

Meeks Building Centers, Sp,ringfield, Mo., acquired land in Bentonville, Ar., to build a 35,000 sq. ft. store due to open in late t994 ...

Home Depot, after estimating its headquarters staff will triple by the end of the decade with stores rcaching 645 during 1997, is shop ping for larger ofrices Lincoln Gardens and Carver City homeowners are objecting to a Homc Depot being relocated to their Thmpa, Fl., neighborhmd ...

Frank Schmidbauer has acquired Grayson Lumber Co., Grayson, Al. ... Smith County Hardware, Taylorsville, Ms., is now owned by Charles R. Connell, Jr., and renamed Smith County Hardware & Supply, Inc. ... T. H. Rogers Lumber Co., Oklalpma City, Ok., broke ground

for new corporate Hq.in Edmon{ ok...

.1. W Porter Innber Co., hrc., DeWitt, Ar., has closed ... Roper Brotlwrs btmber Co., Petersburg, Va., plans to sue the city over a rezoning that keeps them fton rebuilding two Pocahontas Island structures <bsroyed by an August tornado

Builders Warehouse Association Inc., which acquired Heber Springs and Arkadelphia, Ar., stores this year, hopes to acquire four stores next year despite a $1.28 million fiscal 1993loss

Anniversaries: Benjamin Obdylrc Inc., l25th; Delta wocd.working tools, 75th; Dean ltrnber Co., Gilmer, Tir.,55th; Whit Dais Lumber Plzs, Jacksonville, Ar., 40th...

Woodford Plywood, Albany, Ga., flans to open a lVin&r, Gi, distribution oent€r next month Walker-Williams Lumber Co., Harchechubee, Al., began prodrc- tion last month at its new Weswille In., treating plant ...

Georgia-Pacfc acquired majority ownership of G-P Flakeboard Ltd., a company formed with Flalccboard Co.Ird. to purchase assets of CombiBdard Limited P artner ship, B ancroft , Ontario, Canada, production to begin in the spring LouisianaPacific's southern div. will build an OSB plant in Carthage, Tx., next year

BulHlng

Norbord Industies broke ground for an $80 million OSB plant in Tbpelo, Ms. ... Tli-State hmber Co., hrlbn, Ms., installed a new 90 CCA presswe treafing cylinder and an L-M bundle cutting saw at &eir reman facility ...

Southern Sales lh, Marttting Group, Inc., moved to a new Atlanta" Ga., locadon Mcyer U&{, Riviera Beacb, Fl., qeood a branch of Meyer Laninatcs Georyia Inc. in Birminglam, Al., and acquired Deebo Products, Jacksonville, Fl. ...

Knape & Vogt MfS. Co. acquired The Hirsh Co. Arrrrsttar,g, Heritage, Wwaty afr Wilsonart have formed an intcrcompany consortium cdled the Home Tbam to promde oordnatedprodrcts...

ABT BuiWing Pdncts Cor?. e)pects b acquire sbscadally dl the assets of Canadian Prcific Forcst Pduca limited's fur&d Hadbutd Ddy., East Rivcr, ttrovl Scoda, by tbe end of the yeu ...

Hardware Wholesalers Inc., unveiled a new Do-it Express retail design Program unitcd Cmthgs,Inc., was narcd t 193 Vendor of the Year by Moorck Lumber & Building Supplies, nmtoke, Va...

fanplc-Irilord &rc., Diboll, TL, had &ird quarter eunings of 210, per share ... U,SG3 Unitcd Snns Gypsum Co. b tblrd querter net sales rose 12.4% md its L&W Supply Corp.'s, t4.4.h GAF Building Materials Corp. herd $15.1 million third qumer oeersing income ... Universal Forcst Prducu maor- a prblic oftdng of 5,m0,000 shfles

Hortshg st{rlr rcse 2l% b n annually adJusted rete of 1,396,(X)0 in Oct. Catest ffgs.), highest since Feb. 1990 ... stngle family sttrts climbed S.t%i nul'ds Orcpped Wh permits edgprl rp 2.8% ... starts in the South climbed 2.8% ... Davld Sefdcrs, National Association of llomc B_uilders, said, "TIe healthy October gain suggests tb eommy will experience surprisingly good fourth-quarter growttr rates."

You know to rely on the best Southern Pine dimension and outdoor products from New South, Inc. Now with 15 lines and over 50 different products, you can purchase a complete line of specialty products for all your customers' most important projects iust in time for the new season. From fencing and deck components to pattem stock and mailbox kits, the opportunities for creating masterpieces with our expanded product line are limitless.

Produced with great pride at our newly remodeled and expanded remanufacturing facility, our top quality products are ready for you. Please call us for a free copy of our comprehensive and detailed Specialry Products Guide at l-80G3468675 ext. 417

New South, Inc. - we provide the building materials for a strong relationship with you.

Europcen-Amerlcen Hrrdwood Cmvcntton - Dcc. G7, I ^49ham Hilton Hotel, London, England.

Lumbermen's Assoctrrtlon ol Terrs - Dcc. 7, theft prevention seminu, Le Baron Hotel, Ddlas, Tx.

Vlrglntr Bulldbg Meterld Assoc{.tbD - Dcc. t, OSHA sEfety standards seminu, Satrdston, Va

Lumbemen's Club ol Memphls - Jrn. 6, installatioa mcaing, Racquet Club, Memphis, Tn.

Herdwere YYholecelers Inc. - Jen.7{, winEr building Fodwts martet Walt Disney World Dolphin Hotcl, Orlan&, Fl.

Vlrdnh Bulldl'.8 Mrtertrl Assoclrtbn - Jen. ll, sales seminu, Chadottesville; Jen. 12, Wiliamsburg, Va

rQurcr AND eeuRTEous sERvtcE

oRrpttns DQNF RleHT, rHE FtRsT TIME

eQueltrY FRE-owNED FoRKuFrs

eOx UME DEUVERY oF FoRKUFT

rleesrnc & FtxlNclNe sPEclAusrs r 1^z t t.il l{l'!iT=ll r:I ii-'f

Brumgar0 Equ0pmeme Alabama.... ......20*951-1302 Florida....... ......813423$700

ryseer {A@"S@00h Eqottpmts West Tennessee, lfissrbsippi & Arkansas... ........901-79*72@ VanKMLtltrureft

Tu I sa, O K..,.....................,,... 9 t &836485, Oklahoma City, O K.............40il9iln06

S0ourart & 90oucmoom ffiOoffi0 &?mdhg"'

N orth Texas.........................2 I t 43| 42| I

So uth Te x as.........................7 I 3-67 | $90

MBS ho. &eeffi0fthd0ffig Eqo0pmome

C h e s apea ke, V4............................ SOtW 5 -98N

Richmond, VA..............................80+232-78, 6

Roa n o ke, VA..............................70gg2 4972

Wi nchester, VA............................703-66ffi320

Ro cky Mou nt, N C........................9, 94/t&3031 kmmHlkrMilWt

Georgia...... .......401t-987-7666

East Tenn. & No. Carolina..T0tl-588-1300

So uth C a rol in a....................803-796-7300

Ace Herdwerp - Jrn. lll4, lumber & building materials show, Orlando, Fl.

Loubbne BulHlng Metcrlel Deebrs Assodrtl,o - Jeu 1116 annual convention, l:fayette Hilon, Lafayene, k"

Crrollnrs-TennessGe Bultdlng Meterhl Asrocbtbn - Jrn. ltl15, annual convention & buying show, Chubne C-onvention Center, Charlone, N.C.

House-Hesson Herdwere Co. - Jen. 15-16, udnter market, Op,ryland Hotel & Convention Ceotcr, Nashville, Tn.

Cotter & Co. - Jrn. 15-19, winter lrrmb€r martet bs Vegas Hilton, Las Vegas, Nv.

Roof Coedn8s Menufecfirers Assclrtbn -Jen. l$20, annual conference & expo, San Diego, Ca

Nedonrl Houservrres Menufec0rncrc Asoclrtbn - Jrn. tcl9, international housewares show, McCormick Plc, Cbicago, IL

Kentucty Lumbcr & Buldlng Mrferbl Dcebrr AssodrtlonJan. 19-20, annual convention, Galt House, Lonisville, Ky.

Vlrglnle Bulldlng Meterlel Assodetbn - Jen. a), buildiog code seminar, Charlottesville, Va.

Hendy Hardwere Wholcsele - Jn.2l-23, martet, George R. Brown Convention Center. Houston. Tx.

Natlonel Decoredng hoducts fucochdor - Ieo.22, coatings seminr, l-ouisville, Ky.

Mld-Amerlcr Lumbermen's Assoclrtbn - Jen. 24-25, basic material estimating school; Je;n.2f, advanced school, Eureka Springs, Ar.

Scrvl$ar - Jen *25,lumberlrental coovention, Marriott Rivercenter, San Antonio, Tx.

Oklehomr Yonng Lumbcrmen - Ju.274),ducational weekend & mill tour, Glenwood & Nashville, Ar.

Our Orrn Herdwerc - Jem.27-29, building matcrisls expo, Orlando, Fl.

Netlonal Assocletlon ol Wholcseler-Illstrlbutors - Jen. 3lFeb.2, ennud meeting, WashingOn, D.C.

Southern Decontlng hoducts Shor - Fcb. ll-13, Georgia International Convention & Trade Center, Atlaota, G8.

Netbnel VYood Wndow & Iloor Assodedon - Feb. 12-16, annual meeting, PGA National Resort, Palm Berb, Fl.

Home Center Show's Bulldlng, Rcnodclng & Decor hoducts Expo - Feb. 13-15, Dallas Convention Center, Dallas, Tx.

Materlal Handllng, Dellvery & Storage Show - Feb. 13-15, show within BRD Expo, Dallas Convention Center, Dallas, Tx.

THE LUIIBER DEALEB'S UFT TRUCK The newest'OH Reliable' lift tnrck frcm Hyster. The Fl45€5 XM lift truck sedes was crcated witt tp lumberdealer in nind.

The truth is, only the forest products industry relies on a wholly renewable resource -- wood -- to make products. Of course, that renewability depends on responsible forest management. For decades, Willamette lndustries has led the industry in caring for its forests. Reforesting or replanting every harvested acre and never harvesting more than it grows, Willamette's sustained yield will continue to produce wood at or above current levels. Willamette takes great

pains to meet or exceed all environmental requirements, balancing wildlife concerns while assuring renewability. Conservation is further enhanced with Willamette's advanced manufacturing methods which eliminates waste by using every scrap of wood and wood fiber. With Willamette's sound forestry practices, wood will remain a viable resource. So, before you consider the pointedly exaggerated claims of alternative building materials, consider the renewable resource ---wood.

For yeors Weyerhoeuser hos provided you with both visuolly groded ond rnochine stress groded lumber. And now we're obout to introduce o new concept in stress roted lumber. Mechonicolly Evoluoted Lumber. lf meons every boord hos been x+oyed ond put to the test using our polenled odvonced stress groder. So when it comes to stress, there's only one wood fhot con loke it, Weyerhoeuser.

Wood thot fits your needs. Seruice thot fits your expectotions.

"It is very important that you look at these issues not as an issue Oat's taking place somewhere else, because as sq)n as they (environmentalists) get the opportunity, theyre going to move to your tenitory," keynote speaker Lre Roy Jordan warned the 1325 delegates anending the Oct lG18 National Hardwmd Lumber Association convention in Dallas, Tx.

After shaning some insight on his life and good fortune in the sports wodd, Jodan, former Dallas Cowboy linebacker and owner of Lee Roy Jordan Redwood Lumber Co., Dallas and Houslon, challenged his listeners to act now before forest rccess is d€nied.

President Jin C. Hamer announced the NHLA fuing Certification hogram is official, citing reduced hmdling costs, consistent quality, fewer claims, better customer relations and increased prrofits for boh buyers and sellers as benefits. NHLA chief inspecor 3s5 $a[i5tine brbfly outlined the ftmeworkof the pnogram.

A rules committee open forum discussed proposals including revision of kiln dried rule.s. Active members will vote on chrnges in a mail ballot-

Dfuectors elected for three year terms inclu& Catherine Nordine, Nagle Lumber Cr., [.and O hkeg Wi.; Ridard Yormlans, Geugia-Pacific Hardwood Group, Atlenua, Crai Matt Bennett, Emmet Vaughn Lumber Co., Krcxville, Tn; Jerry Lapin, Lane Stanon Vanc€, City of Industry, Ca; Daniel Carriere Crriere Sawmill Co., I-rchute, Qu€bec, CanadA and St€,phen L. Jones, J. W. Jones Lumber Co., Elizabeth City, N.C.

Unadjusted corstruction contract figures fs residential building in the first eight months of 1993 reached $79,813,000, 7% above 192's $74,686,000, aocording to a F. W. Dodgercport.

Dealen can expect an increase in sales of 8d conmm nails and a decrease in the number of 6d common nails sold with the adoption of new nail schedules by the American Plywood Association.

Following field investigations tbat determined inadequate fastening allowed loss of roof sheathing during Hurricane Andrew, three new rmf sheathing nailing schedules that enbance wind resistance have been develo@ by APA.

Soles Center, Hot Springs, Arkonsos t-80G64+I5t5

For most of the country 8d common nails re reconmended for applications where 6d common nails \perc prcviously acceptable. In regions with high wind expcureg such as the Gulf Coast and the F^stem SeaboarG APA rrconunends spacing 8d conmon nails six incbes on cent€r m all roof framing members. Panels over gable ends ue an exception and should be Miled four furches on center on all framing members. Pending changes in wind design rcquirements may lead to use of thicker rcof sbeething in coastal regions, but tbese will be independent of the new nailing recmrmendations.

The recommendations are under consideration in a number of local code jurisdictions.

o No Staining

o No Streaking Highesl quality nails for cedar, redwood and other fine wood malerials.

r Slender shank and blunt diamond point

. Diamond pattern head blends with wood texture. Small head diameter permits tace nailing and blind

nailing o Annular ring threads preclude nail head popping and cupping of siding boards AlSl Grade 304 nickel/chromium allov.

o Self-counter sinking bugle and trim heads o Square drive recess eliminates driver bit cam-out . Sharp point for quick penetration with minimal pressure

o Self-tapping coarse threads o Coated with non-stick, dry lubricating film o Solid nickel/ chrome stainless steel for superior corrosion resistance o 6 lengths: l" through 3"

For additional data and dealer information:

Offu your customers afull line of classic anil period style mouldings. Your Soutlum Ornamentala Mouldings distributor lns tlrc lnrgest selection of decoratioe mouldings in the South. This high quality, htghprofit line is perfect for pro's and D-l-Y'ers.

Mouldings: Dentil, Embossed, Cornice, Chair Rail, Baseboard, Casing (window and door)

Accessories: Pediments, Corner Blocks, Plinth Blocks, Corbels, Medallions

Species:_ Poplar, Red Oak, Special Order woods

aoo-779-1 135

Louisiana: Dyke Industdes, 504-73$8500 gg Lday€ileWoo+Wod6, 318-A$Sa5o

Flodda: Addison Corprdion, Sl$324{161 or Tedr Produds, $G4499245 Alabamr, Georgia & S.C.: Bandall &othes,80G47g4SB

N. Carcllna: Plunkell-Webder, 919362{81 3 Tcnnegsee: l-loHon BuiHers Supply, 80G36641 I Tcrsr: Dalhs Wtnlesale, OOG$+I

Hoover Treated Wood Products announces that a NATIONAL EVALUATION REPORI (NER-4571 has been issued by the National Evaluation Service of ths Council of American Building Officials to confirm that PYRO-GUARD Fire Retardant

Treated Lumber and Plywood meets requirements of the BOCA, UBC, and SBCCI model building codes.

PYRO-GUARD has a degradation-free track record,

a So-year projected useful life, and is the FtBSf Fire Retardant Treated Wood with:

a fhrrd Ptrrty Klln Monltorlng ln oddltlon to U.L. follow-up serwlce

a FRf labor ond moterlols replocement cost waftznly

I Code Complionce P,eport with evslualion of c-levated ]emperurtuto strongth testlng

lor rooJ oppllcatlons

I Hlgh ]empcruturo s]rugth ]es] ru,Euttrt

I New York State Smoke loxlclty test tosults

'

NER reports are subject to rc-examination, ravisions and possible ctosing of fite.

For Technlcol lnformotlon Coll r-800-TEc-wooD

Curtls Turner, v.p., Baton Rouge Lumber Co., Baton Rouge, La., survived the hagic Sept. 22 Amtrak derailing into a marshy south Alabana swamp that killed several passengers.

Israel Redd, formerly with Chesapeake Wood Treating, has joined Tri-State Lumber Co., Fulton, Ms., in sales.

Rlch Gutermuth, director of mktg., Computer System Dynamics (CSD), will also oversee all business functions of CSD's newly acquired ProfitMaster div., Austin, Tx. J. D. Rmey is new to CSD as mktg. coordinator, GarY Brown, director of operations.

Blll Thompson has been p'romoted to gen, mgr. at Foxworth-Galbraitb Lumber Co., Mount Pleasant, Tx. Ken Vessels is now gen. mgr,, Borger, Tx., replacing Kevln Tlllman, who was transferred to Yuma, Az. Bob Stombaugh is now in outside sales in Borger; Mlke Daughertyr inside sales, McKinney, Tx., and Davld HolleY transferred to Carrollton, Tx. Bobby Eldred, Nocona, Tx., recentlY celebrated his 35th anniversary with the co. and 35 years of marriage to his wife, Pearllene

Stephen R. Messana is the new senior v.p.-human resour@s at Home Depot, Atlanta" Ga. Pres. Arthur M. Blank recently received the TBS 17 SuPer Citizen of the Week Award.

Jake Kelly is now co-mgr. at 84 Lumber Co., Fredericksburg, Va. J. R. Justlce is co-mgr. in Pearisburg, Va.

Blll Flelds bas joined Weyerhaeuser's Charlotte, N.C., customer service center as p'roduct mgr.-specialty products. Ed Bullsrd is product mgr.-indushial products, and Beth Llndsey has transferred from Asheville, N.C., to cover western N.C. sales.

James Caudlll is new to Lowe's Cos., North Wilkesboro, N.C., as director of procurement supply distribution. Hope Falrcloth Cofley is management information services/human resornces specialist; Mark T. Nlchols, mgr.-customer relations, and Cathy McKenzle, supervisor-advertising product coordinators, Sterling Advertising div.

Teny Worlh has been promoted to store mgr. at Belleco Home Center, Hattiesburg, Ms.

Llsa Palmer is new to D&I Wood Products, Louisville, Ms., handling sales for a Tylertowq Ms., remfg. PlanL

George Karr, head lumber buyer, Builders Square, San Anlonio, Tx., bas left the co. His responsibilities have been distibuted arnong otber buyers. Greg Siewart is a new sales rep for Conner Distributors, Inc., Fort Worth, Tx., specializing in SYP and hardwoods.

Mfte lVardlow, forrrerly with Boise Cascade, has joined Hunt Plywood Co., Ruston, La., in plywood sales for the Natalbany and Pollock La., plywood plants, according to plywood sales mgr. Terry Clark.

Bllly Plyler, John Plyler Home Center, Glenwood, Ar.; Tony Futrell, corP. sec., E. C. Barton & Co., Jonesboro, Ar., and R. J. Horner, C. J. Homer Co,, Hot Springs, Ar., were named to 8 task force created by the 79tb General Assembly to shtdy state bonding laws. Andy Mann is bandling repairs for Mungus-Fungus Forest hoducts, Climax, Nv., report owners Hugh Mungus and Freddy Fungus.

(Please turn to p. 38)

r-800-443-9003

7:00 AM - 6:00 PM CentrolStondord Tlme

Lumber-Llke You Wont lt When You Wont

DOUGLAS FIR

C & Btr. Boords

C & Btr. 2'

C & Btr. 514 ond AxA

C & Btr. Fingerjoint

SLIM-TRIM

D-Select Fir & Lorch

Select Structurol2x

PONDEROSA PINE

C & Btr. Boords

C & Btr. Fingerjolnt

C & Btr. RWRL 514 - 614 - 814

#2 Shelving

#3 Shelving

WESTERN SPRUCE

D-Select

#2Grode Stompec

#3 Common Potterns, Strips

SOUTHERN PINE

C & Btr. Arkonsos

C & Btr. Southern Yellow

C & Btr, Potterns

#2 Potterns & Boords

Steptreods C,D,#2

CEDAR FINGERJOINT

REDWOOD FINGERJOINT

LP INNERSEAT

PLYWOODS

Hordwood - Birch

Hordwood - Ook

Louon

Cedor Sidings

Sonder Fir

Fir Sidings

MBirminohom

P.O, B6x 2O6f,9

Milton Butler

BRANCHES

Atlonto, GA (CSIS)

Birminohom, AL (BN) Colum-bio, SC (SOUTHERN)

SATES

Nito Weir

Dorlene Dovis

Kevin Weisgerber

Greg Poyne

Bobby Mills

Willie Andrusko

Dwioht Poole

Aor6n Choncey

Steve Blount

Toby Klrklond

Gene Schettgen

Grohom Bishop

Lee Holl

Eric Shirkey

Glulam & LVL In One

Redi-Lan II, a high performance 2,9mF rated engineered timber combining the reliability of standard glulams with the strength of LVL, is new from Rosboro.

Manufactured with a combination of glulam and LVL technologies, the resulting stock beams and headers are as strong as standard LVL (reportedly 20Vo stronler than glularns) but easier to handle and install.

Unlike other laminated timbers, it is made up of two distirrctly different types of wood larninates: a top comprised of laninated dimensiorul lumber (as is found in 2,400F glulans) and a bottom portion of LVL. Code approved and APA-EWS certified, beams come in many standard sizes and stocking lengths of 44 to 50 ft.

on any product in this section is available by writing 4500 Campus Dr., Suite 480, Newport Beach, Ca.92660. Or call (7 74) 852-1,990 or FAX 7 74-852-023 1 Requests will be foru.rarded to the manufacturer. Please list product(s), issue and page number:

CarolinaPine, a new generation of southem pirc poducts designed specifically fq the millwork na*et, has been inroduced by New South Inc.

Tbe products will be used as corestock and cuBtock for windows and doors, fingerjointed mouldings, window frames and door jambs, lineal stock for mouldings and laminated c(mponents and panels.

Tbey are o'rt ta 414, 514, 614 a 8/4" thiclnesses and produced in randorn widths and lengths. They are kiln dried at cmlputer-controlled temperatures to a moisture content of 8-12%.

CarolinaPine is ornently available as 5/4" shop lumber with finished producs to be introduced early next year.

The Bowrench decking tool from CEPCO helps straighten and bold boards in place, leaving lhe user's hands free to nail tbem.

The device consists of a handle, fla cam and b'racka which slips owr

ard self-locks on tbe flocjnisr

It wo(ks with decking, tongue ed groove boards ard tongue and grmve plywood.

Water-repellent dockirng with tection that's built in, not brushed on, is now available ftom Srmbelt Fbrcst Products Corp.

Tropical Decking resiss deterication without costly, time consuming annual trlaintenlnoe. Parallin-based UltraWood water rcpelbnt is injated deep into tbe wood during tbe trcaring process to provide lasting protection against checking, arcking and splitting. Miled ftom #l dense lumber, it features l/2" radius cuts on all four edges and is pressure treated o a .40 retention level.

Decking can be sawn, planed or drilled and still bead water on every surface. It is guaranteed to repel water, termites, rot and decay for 50 years.

Woodtex waterborne urethane wood flooring finish has been introduced by Velco Inc.

The aqueous urethane/acrylic floor finish can cover new or previously nnished wood floors.

The durable, anti-slip finish reportedly is easy to apply, has excellent flow and leveling, is easy to fecoat, requires no sanding between coats and dries fast. Floors may be opened to light raffic within 24 hours.

A n-ew pocket-size, hand-held Moisture Meter from Wagner Electronic Products uses advanced electromagnetic wave technology to accurately measure wood moisture content ftom6%o ta3UVo to adepth of 314".

Featuring an easy-to-read analog meter, the Wood FriendlY L606 model allows checking out boards from top to bottom before buying

The Attractor, a long-handled magnetic retrieval tool that makes cleaning up bits of metal fast and easy, is now available from P.S. Manufacturing.

Designed to find screws, pins, wrenches,nails, bolts, wire and other metal items, the tool features a permanent magnet weighing just 1.5 lbs. and a sturdy 4l in. tall wooden handle for'trostoop lifting" of nearly 20 lbs.

them to avoid later splitting, warpage, delamination and failed glue joina.

It eliminates the need for Pins, which can damage wood and leave unsigbtly holes.

The Bohemia UC (I-joist compatible) glulam beam has been introduced by Willamette Industries in depths that match standard I-joist framing. Used primarily in residential roof and floor framing systems, the cost effective new glulam beam can be framed flush with the I-joist.

Since it is manufacnred with high grade laminations on both the top and bottom face, the zero carnber beam is well suited for multi-span applications, and builders needn't worry about installing it upside down.

Kiln dried soutlern yellow pine provides dimensional stability and high srength.

A miter saw stand that is portable both while fully set up and after folding into a handy cart is new from Trojan Manufacturing. With 10" pneumatic tires, it wheels easily around the job, up stairs and over obstacles. The MS-2000 sets up in less than a minute to provide 13 ft. of overall support

sive chop saw or compound slide saw. The simple stop handles multiple cuts to 9 ft. long.

The new Acclaim line of entrY doors from Challenge Door offers the benefits of steel, low maintenance of fiberglass and beauty of traditional wood paneled doors.

Entries feature a fitted, one-piece high density polystyrene insulating core designed to maintain a constant

energy value over time. An all-wood stile and rail frame provides dimensional stability and a complete thermal break by eliminating metal-tometal thernnl transfer.

Surface panels are made from V$gauge steel, with a 10-mil coating of Iiquid vinyl baked onto exposed surfaces and embossed with a woodgrain pattern.

The line is available in flush, six panel and nine-panel designs, with a variety of insulated decorative glass inserts and matching sidelights. Doors are offered in standard enFance sizes and heights up to 8'. All include Santoprene door sweeps.

The Grow & Tell Children's Gardening Kit, including dl the tools and materials needed for children o design, plant and maintain their very own garden, has been introduced by Aquapore Moisture Systems.

The kit contains a beautifully illustrated, frrll-color activity book, a 4G ft. roll of Moisture Master Soaker Hose, a faucet/hose end connector with flow disc, a hose erd closure, a garden trowel, packets of flower and vegetable seeds, and row markers.

It provides a hands-on way to learn about gardening, while stressing water conservation and environnentally sensitive gardening techniques.

PVC Lumber, said to be a strong, durable, safe and maintenance free new exterior flooring system, has been inroduced by PVC Lumber Co. Reportedly non-loxic, easy to use and environmentally friendly, it comes with a lifetime warnuty ensrning that it will keep its colu, slape andasthetic appearance tbrough yeas of extrcme heatand @ld.

It comes in driftwood gray a white.

stoplock, an innovative super tough window lock, is new from ProblemSaven.

Made of high impact ABS plastic, tbe device is said to securely lock in place vertical and horizontal sliding aluminum windows and doors.

Tbe deadbolt lock feaunes an easy push/pull lever and quick release fcir emergency exit.

a O:i:kly dA nnuuy crry bnd ct ffip-Hre. stlqp. bqnds. seols.

a Frtrm ccntirr.ursty $rin G ${f t|Eo qftr lEor. ltdh lr^r nEinFF cr bdue th€y bqtw q mtru- mlm nrmber d nEving ports. nEfEd qtElfy rEEEls qrd o €.rYEtl op€Etrg.r€g'n tbt fE b6r &r€bp€d thrq.Eh crE 25 l,€c d dtP@l €qgirEirg cnd trsurturilg.

Ast-uslc stg^, }o.t tg.r St,€€d CtEEtrs Gd Scrop Ccr't @r Sygrs ccui pcy tr Ugrrdlc by gMrg.trcu nEag cpa- oarg spce. uEGng fdl.6wy c6 FrcdLErg f€mium.Frrd r€qc+ q&sp.

- Svrlecd ilacnncry, tnc. tumWWnq@pebtudp tnlo Morrdgaable

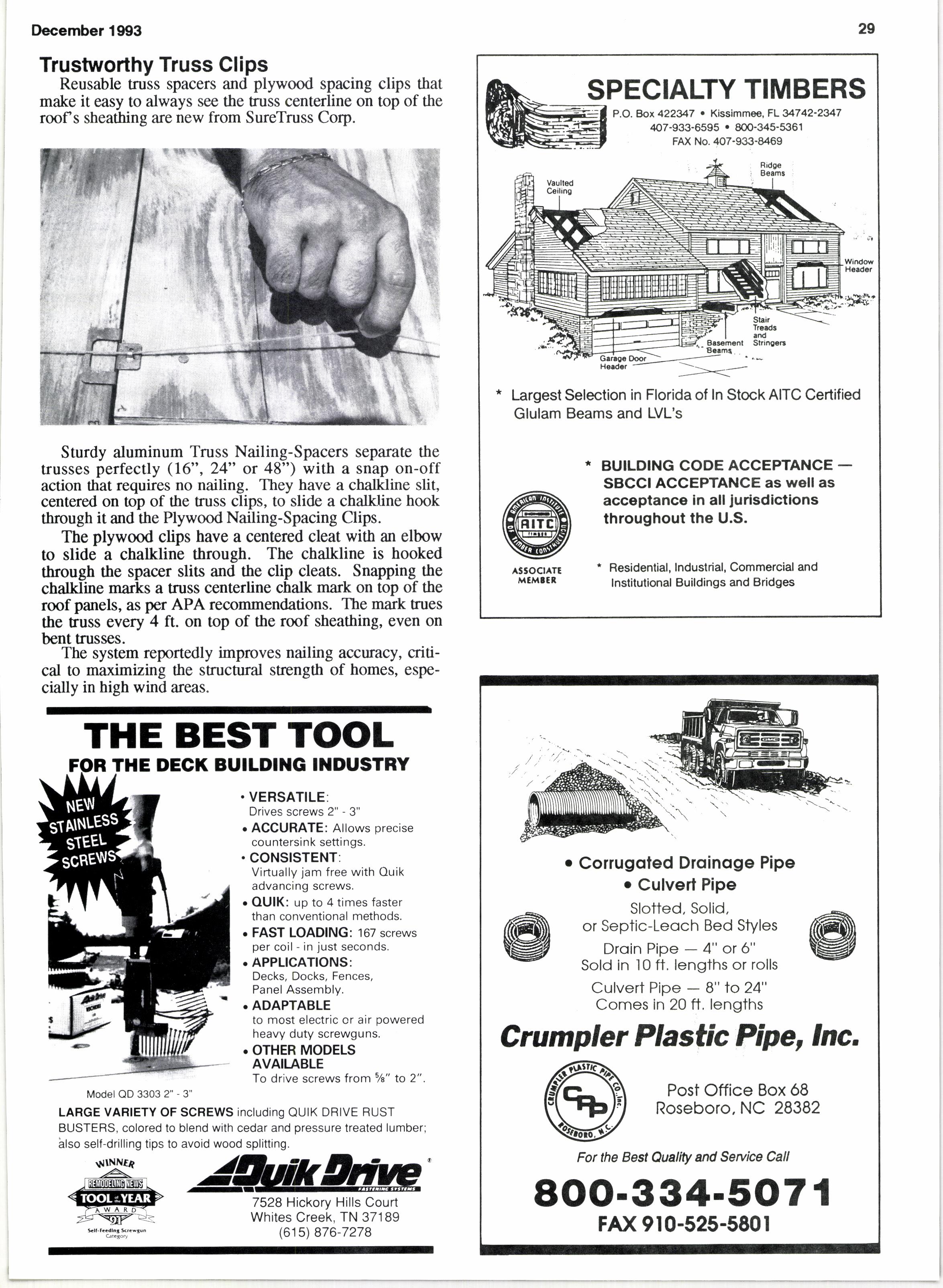

Reusable truss spacers and plywood spacing clips that make it easy to always see the tuss centerline on top of the roof s sheathing are new from SureTruss Corp.

Sturdy aluminum Truss Nailing-Spacers separate the trusses perfectly (16", 24" or 48") with a snap on-off action that requires no nailing. They have a chalkline slit, centered on top of the tuss clips, to slide a chalkline hook through it and the Plywood Nailing-Spacing Clips.

The plywood ctps have a centered cleat with an elbow to slide a chalkline through. The chalkline is hooked through the spacer slits and the clip cleats. Snapping the chalkline marks a truss centedine chalk mark on top of the roof panels, as per APA recommendations. The mark trues the truss every 4 ft. on top of the roof sheathing, even on bent trusses.

The system reportedly improves nailing accuracy, critical to maximizing the structuml sfiength of homes, especially in high wind areas.

VERSATILE:

Drives screws 2" - 3"

. ACCURATE: Allows precise countersink seftings.

CONSISTENT:

Virtually jam free with Ouik advancing screws.

OUIK: uD to 4 times faster than conventional methods.

FAST LOADING: 167 screws per coil - in just seconds.

APPLICATIONS:

Decks, Docks, Fences, Panel Assembly.

. ADAPTABLE to most electric or air powered heavy duty screwguns.

OTHER MODELS

AVAIlABLE

To drive screws from 5/s" to 2"

BUILDING

Model QD 3303 2" - 3"

LARGE VARIETY OF SCREWS including QUIK DRIVE RUST

BUSTERS, colored to blend with cedar and pressure treated lumber; blso self-drilling tips to avoid wood splitting.

7528 Hickory Hills Court

o Hemn"F[n o SFF

o Wesfterm Woods

o Doug0as F0r: [areh aIso

o Fflmger5oflmt tslamks

- e0ear amd kmo@

o Edge G[u@d lPame[s

- e0ear amd kmotty

o B@x S{hook

o lPa00ots

o [Pa00et @tr Sftoek

IIEFYING recession, a weak housUing industry and restrictions on timber harvests, use of engineered lumber poducts continues to grow.

Consumption of laminated veneer Irrmber (LVL) has grown 8% in tbe last two yers; parallel strand lumber (PSL), 4%; wd I-beems, 47%, md parallel chord trusses, 10%, George Carter & Affiliates (GC&A) points out in its latest study of market size and growth for engineered lumber products. Only glulam beams felt tbe re@ssion, falling 19% in usage.

Total consumption is now 690 mil-

Engineered lumber use forecast to grow from 3oolo to ltO% depending on product.

lion linear feet (1-3l4"x12" basis).

since some products arc report€d on a cubic foot basis, figures have been converted to linear feet for direct comparisons. *And remember, this (growth) occurred during a period when housing starts in the United States rose less than l% ard starts in Canada actually fell over llqo,* George M. Carter points ouL

As environmental consciousness increased during the '80s and took off in the '90s, the availability of wood resources, prinarily large dimension, old-growth timber, continued to shrink, forcing wood product manufacturers to examine their manufacnrr-

ing operations. Pressure from the conservation movement bas curtailed the cutting of old-growdh rimber in particular, but 'even wi0out these pressures, Oe supply of standing timber cryable of producing large dimension lrrmber is becoming ever morc scante," the Oradell, NJ., resercher notes.

In the slowly recovering new housing maket and burgeoning repair and remodeling maftet denand for wood keeps growing. Bigger, open, airy rooms with large clear spans are tbe trend in single family construction and will continue into the next oentury, C:rter forecasts.

As the current recovery gains momentum, a stong movement to utilize low interest loms to fix up exising homes is expected to spur the repair and remodeling market. Recovery from Hurricane Andrew, lhe "Noreastet of '92" in tbe Northeast and a varbty of tornadas in tbe South last year will further Oe demand for wood building malerials. Additional ma*et growth also will be redized as rebuilding begins following the ftooding along the Mississippi River and the fires in Califqnia this yejr.

In updating the daabase of tbe ftrst analysis of produoion and use of ELP in the United States and Canada, researchers harn€d many retailers and builden still know little about engineered lumber products.

However, growth hrs occurre4 as shown by the information on the opposite page:

Designed for building materials retailers and whotesalers. thls cpm- plete s-ystem includes point of sale, order proc€ssing, biltng. sophts- ticated priclng (markup, markdown, contiact, quanAty Unelt<s,'etc.) accounts receivable and credit, inventory control, purchase order control, sales analysis, accounts pavable, general ledser.

Easy to_use. completety integrateda-sing;le traniacUon updates all relevant ilata.-Call o-r write:

P.O. Box 1300, Lockeford,CA95237

FAX209-727-3420

(209)727-373r

807o selling LVL, up ftom557o.

87Vo *llng wmd l-beams, up from 587o.

77.34o using engineered lumber products, up from 37.57o.

72.8% using LVL, up from 43.2Vo.

63.97o using wood I-beams, upfrom49.4%o.

15.57o with cost conoerns, down from26.8%,

27.4Vo lack of tnowledge is the biggest deterrent to use of engineered lumber products.

73Vo sper;i$ing LVL, up from 547o.

697o specifying wood [-beams, up from 657o.

Based on about 1.3 million housing starts annually in theU.S. and 155,000 in Canadaby 2000, GC&A predicts:

O LVL use will grow about l37%o ra 285 million linear feet.

O Glulan beam use will rise aboutl0%o to round 150 million linear feet.

o Wood I-beam use will rise nearly 1404o to 530 million linear feet by the year 2000.

O Parallel chord truss use will edge up amodie t32%.

The repct concludes there are tbree deterrents to sales of engineered lumber products: (l) customers not requesting them; (2) lack of lnowledge on the part of retailers, architects and builders, and (3) cosr

4xO - 24x24 8'- 40' S4S, ROUGH DRY, ROUGH GREEN

llEEtlNG the president (1) Frances John, wilh new NLBMDA pre. lqy Nunq. (2)Don A Sy'lvhJohnson, George Swadz. (3) Pam Militrel, Charles Reely, Huck DeVerzio, (a) Bruce Agness, David Dorglas, Regan Agness. (5) Walter Foxwonh, Parker Beebe, Cindy Tooms. (6) Midtael Tonkin, Bob Esposito. (7) Cassitv & Claudette Johes. {81 Dbri Smith, Sr., Donna Swdrtz. (9i David & Esther Still, Leslie & Steve

tbMagistrb. (10) Nancy & l-l€rb Worls. (11) Ia & Matr Bilcr. fl21 John Branscum, David Kennedy. (l3l Di* Walker. James'Benor Walker, GsriJagemon, Kent Brosh.- (1i) Dile lt*ler, Jd Alson. (15)Carl Tindell, Cal Brand. (15) Bob Hanbon, Babara Dorrqlas. fln Jim & Janie Blo0nt, Steve Bolinger, (18) Jim Andrew, LynndMoistirer. (19) Rob Sptinger, Lee & Dean Leaman. i20) Janet & Bill-Trudeau.

tftltlE HAVE not even begun o touch most of the cirUY cus of technology that's out there... and we have paid the price for that," consultant Jack Nunn infomted the National Lumber & Building Material Dealers Association at its 77th annual convention.

Dealers must improve profitability, service and use of technology, said Nunn, Construction Marketing Associ' ates, Ellijay, Ga. He then illustrated how dealers could profit from periodic roundtable discussions with their peers, moderating a sarnple roundtable on wages, salary and benefits by a panel. Attendees then tried the techniques out for themselves.

National association meets to increase members' competitiveness ... compare costs of doing business, discuss rcundta' bles 1994: Maui, Hawaii.

The Oct. 28-30 meeting at the Hyatt Regency Riverwalk, San Antonio, Tx., was opened by John MacKay, The Profit Planning Group, Boulder, Co., who gave an overview of NLBMDA's Cost of Doing Business Survey, explaining how it showed what made the most successful companies successful.

Other speakers included Dr. Roger Blackwell, Ohio State University, on growing profits in a slow growth market; Jim Twining, Enterprise Computer Systems, pricing; Allynn Howe, NLBMDA, legislative strategies; Bob Petow and Shelly Hershberger, Western Wood Products Association, environmentally positive benefits of wood, and political commentator Charles Cook.

The inaugural President's Pathfinder Awards for contributions to the industry and the association were presented to Walter Foxworth, Foxworth-Galbraith Lumber Co., Dallas, Tx., and Joe Arndt, Andersen Windows, Bayport' Mn., whose retirement aftet 37 years with Andersen was armounced.

Ray Nunn, Simms-Moore Lumber & Hardware Co., Frisco, Tx., was installed as president, succeeding Gerald Olrich, Oxford Lumber Co., Oxford, Mi., now chairman of the board. President-elect is B. Harold Smick, Jr., I.S. Smick Lumber, Quinton, N.J.; lst v.p. Roger Scherer, Scherer Bros. Lumber Co., Brooklyn Park, Mn.; 2nd v.p. Joe Orem, Bellingham Sash & Door, Bellingham, Wa.; treas. Jim Wiswell, Barry County Lumber, Hastings, Mi., and exec. v.p./sec. Gary DonnellY.

David Still, Weyerhaeuser Co., Federal Way, Wa., is replacing Dan Russo, Georgia-Pacific, Atlanta, Ga., as head of the Manufacturers & Service Industry Council.

NLBMDA's

Material handling, storage and delivery equipment represent a BIG inveshnent for lumber and building material dealers.

More than $90 million worth of forklifts, tractors and other material handling equipment, for example, are insured by Indiana Lumbermens Mutual Insurance Company.

Big capital investments like these require lots of pre-purchase research to find the right equipment at the right price, research that, up until now, hasn't been easy for most dealers to do.

Now, for the first time, lumber and building material dealers from throughout the United States will have the chance to shop and compare the latest in store and yard equipment, all at the same time and all under one roof.

STORAGE AND DELIVERY SHOW, February 13-15, 7994 at the Dallas Convention Center, Dallas, Texas, is a new "Show-Within-A-Show" at the Home Center Shows' BUILDING, REMODELING & DECOR PRODUCTS