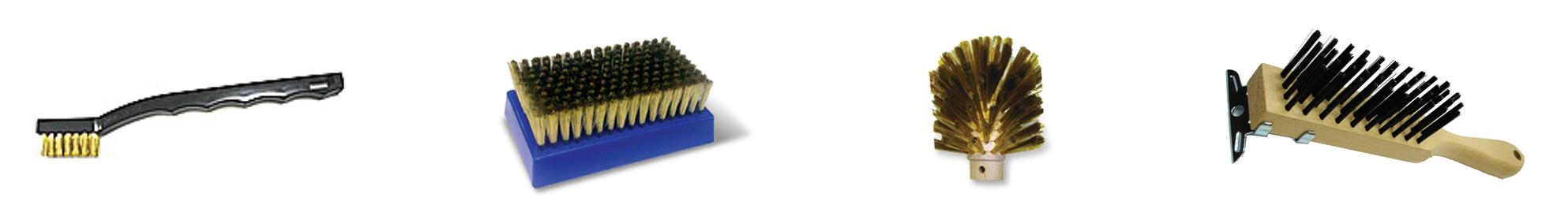

Mill-Rose brushes set the standard for quality and are trusted by more professionals. From surgeons using our medical brushes to machinists using industrial brushes, Mill-Rose brushes perform long after other brushes fail.

We’ve been making brushes since 1919. Millions of them. That’s over a century of brush manufacturing experience!

Mill-Rose makes brushes in every size, shape and material imaginable. From miniature brushes as small as 0.014” in diameter to 48” diameter brushes for industrial applications.

If we don’t have a stock brush for you, we’ll design your brush and make it from any material the job calls for.

Mill-Rose prices typically meet or beat cheaper-quality brushes, but our mission is to always deliver the bestquality brushes. Period.

from

PUBLISHER

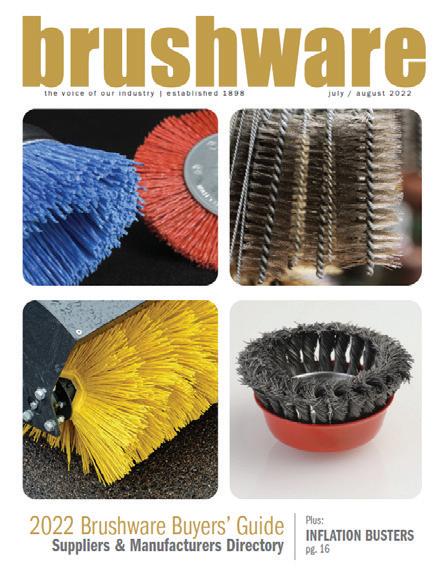

Legacy 2023 Media Kit 125 Year Anniversary 1898-2023

As we enter only our fifth year with the magazine, we certainly say that we are “standing on the shoulders of giants.” With that kind of legacy, we endeavor to continue the drive to make Brushware better every single day — striving to not only make the brand the best in the brush industry but also to make it the best media brand period. The mission for Brushware is not simply to modernize, our aim is to go beyond and forge new paths in the media arena to provide the brush community with a vital resource for connection and information.

Plans to celebrate the 125-year anniversary have been ongoing for more than a year and I am happy to have already made connections with a few key players in the history of Brushware. During those exchanges, I heard a couple of new stories and learned a few bits of history I didn’t know. I am excited to make more connections and follow through on our plan to showcase this milestone year with an article in each issue for 2023.

For part one of this 125-year celebration series, I was able to meet with the previous owner Norman Finegold, who now lives here in my home base of Kansas City. We were able to sit down for a lengthy catch-up and the full interview is available on page 14.

And while we will enjoy looking back, business is always moving forward. We are excited to see that the ABMA and FEIBP have announced Bologna, Italy, as the location for the new World Brush Expo to be held in May 2024. We look forward to promoting, attending and covering the event.

While we are aware that the global economy is facing severe challenges, we do thank all of our readers and advertisers for their support, and we hope our coverage helps provide guidance and inspiration. We are here to help all manufacturers and suppliers achieve success, so as always I welcome your feedback on how Brushware can help the industry move forward. Please enjoy this 125th Anniversary Special edition and have a Happy New Year!

Dylan Goodwin | Publisher

dylan.goodwin@goodwinworldmedia.comBrushware – a bi-monthly publication edited for key personnel in the brush, roller, broom, mop and applicator industry. Published continuously through the years, the one publication that is the spokesman for the brush and allied industries: 1898-1923, called Brooms, Brushes & Handles; 1924-1947, called Brooms, Brushes & Mops, 1948-today, called Brushware

Brushware Magazine Goodwin World Media LLC P.O. Box 7093 Overland Park, KS 66207 Tel: 913-636-7231

GENERAL MANAGER

Susan Goodwin info.brushware@goodwinworldmedia.com

Dylan Goodwin dylan.goodwin@goodwinworldmedia.com

EDITOR Gwyneth Bowen news.brushware@goodwinworldmedia.com

Bob Lawrence Phil Perry Meg Cooper Katharina Goldbeck-Hörz Mark E. Battersby Lisa Anderson

Conor M. Todd

Brushware (ISSN 00072710) (Canadian Sales Agreement Number 0650153) is published bimonthly by Goodwin World Media LLC, P.O. Box 7093, Overland Park, KS 66207 USA. Periodical postage paid at Overland Park, KS 66207 and at additional mailing offices. Printed in the USA. Subscription: $95/year for US, Canada and Mexico. All other countries $210/year.

US Distributor: Brush Fibers Arcola

Please contact us for further information, specifications and offers:

Reinhold Hoerz

Senior Sales Manager, Brush Industry

Phone +41 44 386 7901 Mobile +41 79 785 4657 reinhold.hoerz@dksh.com www.dksh.ch/brush

Think Asia. Think DKSH.

The American Brush Manufacturers Association (ABMA) and the European Brushware Federation (FEIBP) are excited to announce the creation of a new show for the industry: World Brush Expo, which will take place May 22-24, 2024, at the Bologna Exhibition Centre in Bologna, Italy.

Donna Frendt, ABMA Executive Director says, “We have been working on this show since it became apparent at the ABMA meeting last March that Interbrush in Freiburg was untenable. Shortly after the completion of the ABMA convention, ABMA reached out to FEIBP to see if there was interest in putting on an industry show, by and for the industry.”

Since that time, a joint task force from the two associations has been working together to determine a pathway to create and hold an industry show. Fons Ceelaert, FEIBP Managing Director says, “The process to come together has been very good for both associations and we look forward to partnering with ABMA to make World Brush Expo THE show for the industry.”

The task force invited Daniel Strowitzki of FWTM (the owners of Interbrush) to make a presentation to continue the show in Freiburg and to submit a proposal for Salzburg, Austria. The task force and ABMA/FEIBP wish to thank Daniel Strowitzki, FWTM, and the Messe in Freiburg for 45 years of partnership and for the outstanding InterBrossa/Interbrush shows. In addition to the proposals from Freiburg and Salzburg, the task force entertained proposals from Bologna, Modena and Parma, Italy. Eventually, Bologna was selected as the host venue for 2024.

Greg Miller, ABMA President said, “I am very excited to see a new industry show arise from the ashes. It has been since

2016 that the entire industry has been able to get together and I think I speak for everyone when I say that this will be a great event for the industry and I can’t wait for 2024!”

Andrew McIlroy added, “The Bologna venue is world-class and Bologna is a fascinating city and will appeal to attendees from all over the world. In addition, their infrastructure is excellent for our show; attendees and exhibitors alike will enjoy the variety of hotel accommodations and the easy logistics of the Bologna site.”

The Bologna Exhibition Centre covers 375,000 square meters of indoor and external areas. Its exhibition services area covers 36,000 square meters. The venue has 20 halls which are fully wired, air-conditioned and equipped with state-of-the-art IT systems. Multiple events can be held simultaneously thanks to five separate entrances. Flexibility and mobility are ensured by a network of walkways and by a system of carparks for a total of 14,500 covered parking spaces. Vehicle owners can reserve their space in advance. Bologna Fiere is the first exhibition center with its own motorway tollbooth, that provides direct entrance to the venue. A “BolognaFiere” railway station handles special trains for exhibitions with a large number of visitors. A heliport is located on the roof of halls 16-18.

Bologna is one of Italy’s great and historic cities. It has a major airport (BLQ) and supports over 13,000 hotel rooms in the city. The exhibition center is near the city center making for convenient logistics. Bologna is home to the oldest university in Europe and has many nearby attractions for attendees and visitors alike. Visit www.worldbrushexpo.com for updates.

Celanese Corporation (NYSE: CE), a global chemical and specialty materials company, announced on November 1, 2022, that it completed the acquisition of the majority of the Mobility & Materials (M&M) business of DuPont.

“We are excited to welcome the M&M team to Celanese and I want to thank the teams that worked diligently to successfully close this acquisition today,” says Lori Ryerkerk, Chairman and Chief Executive Officer.

“With the addition of M&M’s industry-renowned brands and product portfolios, we have established Celanese as the preeminent global specialty materials company. As one team, we will be better positioned to elevate the growth trajectory of Engineered Materials and to create value for our customers and shareholders.”

The company announced the acquisition of M&M in February 2022. As part of the transaction, Celanese has acquired a broad portfolio of engineered thermoplastics and elastomers, industry-renowned brands and intellectual property, global production assets and a world-class organization.

Celanese Corporation is a global chemical leader in the production of differentiated chemistry solutions and specialty materials used in most major industries and consumer applications. The Celanese portfolio of businesses utilizes the full breadth of Celanese’s global chemistry, technology and commercial expertise to create value for customers, employees, shareholders and the corporation. Celanese partners with customers to solve their most critical business needs and strives to make a positive impact on our communities and the world through The Celanese Foundation. Based in Dallas, Tx., Celanese employs approximately 8,500 employees worldwide and had net sales of $8.5 billion in 2021.

For more information about Celanese Corporation and its product offerings, visit www.celanese.com.

In a year packed with news surrounding tradeshow ups and downs for the brush industry, it was a little surprising that the article on Best Watercolor Brushes for 2022 far outperformed all postings for the year. That probably serves as another reminder as to how important brush industry products are to consumers across the world. Certainly, the controversy around the demise of Interbrush drove readers to the site, but it is heartening to see a lot of the “good news” articles also ranked high with loyal readers. Here are the top-performing news articles for 2022 from the www.brushwaremag.com website:

Brushware presented the best watercolor brushes sourced by top artist brush manufacturers. www.brushwaremag.com//best-watercolor-brushes-2022/

Ken Rakusin offered his perspective on Zahoransky exiting Interbrush. www.brushwaremag.com/gordon-brush-letter-to-zahoransky/

Toredo Fairs and FBMA – INDIA announced the inaugural BrushTech-2022 Exhibition that was held in July in New Delhi.

www.brushwaremag.com/new-brushtech-2022-to-showcase-brush-manufacturers-in-india/

Osborn’s parent company, Jason Industries, announced financial reorganization transitioning the company to private ownership. www.brushwaremag.com/osborn-parent-company-announces-reorganization/

Brushware magazine’s recap of the ABMA’s return to a live convention in 2022 www.brushwaremag.com/2022-abma-convention-notes/

Brush industry machine maker issued a December 2021 press release detailing the decision to exit Interbrush as an exhibitor. www.brushwaremag.com/zahoransky-will-no-longer-exhibit-at-interbrush/

Leading brush industry associations announce the new World Brush Expo just weeks after Interbrush announces the end of its run.

www.brushwaremag.com/abma-feibp-announce-new-brush-industry-trade-show-for-2024/

In February, Perlon announced the acquisition of NOWO Products Sp.z.o.o. in Kluczbork, Poland, a leading European producer of twisted monofilaments for the global paper industry.

www.brushwaremag.com/perlon-takes-over-nowo-products-sp-z-o-o/

Interbrush organizers responded to the loss of Zahoransky as an exhibitor with plans to seek feedback from associations and other top exhibitors on a path forward.

www.brushwaremag.com/interbrush-responds-to-zahoransky-loss/

Hillbrush was featured on an episode of BBC TV’s Inside the Factory about vacuum cleaner manufacturer and Hillbrush customer, Numatic.

www.brushwaremag.com/inside-the-factory-brushes-up-on-hillbrush/

For more than 80 years, DuPont Filaments has been recognized as a leader in innovative synthetic filaments that enable brush manufacturers to address emerging trends and meet evolving consumer expectations.

The most important component of a toothbrush lies in the bristle. With outstanding industry expertise accumulated over the years, coupled with our proven technologies, DuPont Filaments is dedicated to the oral care brush industry with our nylon solutions under the brand names of DuPont™ Tynex®(nylon 612) and DuPont™ Herox®(nylon 610) . Leading toothbrush brands and manufacturers are able to produce very high quality brushes with a balance of consistent quality, wear performance and unmatched productivities in tufting and end-rounding by using DuPont filaments. As consumer trends in toothbrush are increasingly focused on the six major areas of 1) Visual Attractiveness, 2) Interdental Cleaning, 3) Plaque Removal, 4) Gum Comfort, 5) Gingival Cleaning and 6) Anti-microbial within the filaments, DuPont Filaments has been working closely with the leading global brands in oral care as well as toothbrush manufacturers by fulfilling these needs with our broad range of innovative products in the portfolio

DuPont™ Natrafil® filaments, a pioneering filament from DuPont’s unique polyester based material, contain proprietary texturizing additives that create a structured surface that mimics animal hair. Natrafil® filaments offer a synthetic alternative to animal hair in premium cosmetic powder brushes with more consistency in the bristle while maintaining the touch-and-feel of premium animal hair. Studies have shown that brushes made with Natrafil® filaments have equal to superior pickup and release performance versus brushes made with animal hair.

Like most industries, steel manufacturers are always looking for

ways to increase productivity. The emphasis is on getting more square feet of metal through the mill, cleaned and coated faster than ever before. To accomplish this, steel mills are using more aggressive cleaning solutions. The problem is that the cleaning brushes typically used were quickly degrading because many plastics used in the brush filaments can’t handle the solutions of the extremes of the PH scale. The technical resources at DuPont Filaments were able to help solve the problem by adding stabilizers to one of our nylon polymer formulations, effectively extending the pH range that these filaments can be used in. Brushes made with these filaments deliver cleaning performance over an improved service life, helping steel manufactures to achieve higher productivity. Another need voiced by customers is higher aggressiveness in metal finishing applications. DuPont™ Tynex® A filaments, a family of ceramic grit-containing filaments, was developed to meet this need.

When manufacturers began changing their paints to water-based formulations, more people began using paintbrushes made with synthetic bristles because the hog bristles traditionally used in paintbrushes lost stiffness in water-based paints. Synthetics such as DuPont™ Tynex®, DuPont™ Chinex® and DuPont™ Orel® brand filaments quickly became popular choices. As paint manufacturers continue to improve their water-based formulations by reducing volatile organic compound (VOC) content, increasing solid loadings and decreasing drying times, there is an ongoing need for increasingly higher performing brushes. To meet this need, DuPont Filaments continues to innovate and help customize solutions. For example, we developed filaments with stiffer cross-section that can push higher viscosity paints more efficiently. We also changed the shapes of the filaments so that they not only pick up more paint from the can for faster application, but are easier to clean.

Recognition for being the global leader in filaments comes from our customers. You inspire us to make a difference in the world. We will continue to advance our innovations because we believe your BRUSH deserves the best FILAMENTS.

The ABMA’s Webinar Series is scheduled to resume in January with Downtime Tips presented by Adam Moran, Vice President for Sales of Vorne Industries, from 1:00 to 2:00 p.m. EST on Wednesday, January 25, 2023.

Downtime continues to be a huge source of lost productivity for the vast majority of manufacturers, but downtime is also often where the biggest gains can be made. Vorne knows that companies have the resources to improve, but they need the tools to leverage their resources, and this starts with understanding the corporate strategy. Vorne works with leaders at multiple levels of manufacturing companies to implement technology to turbo-charge continuous improvement and change management initiatives.

With more than twenty years of projects across thousands of companies in dozens of countries, Moran has helped companies, analyze, quantify and optimize stalled or failing continuous improvement initiatives through data and process change. Through this ABMA webinar, Moran will present ten simple and practical strategies for reducing downtime to help brush manufacturers regain lost productivity.

Wednesday, January 25, 2023

1:00 p.m. - 2:00 p.m. EST

REGISTRATION

www.abma.org/abmaeducationalinstitute

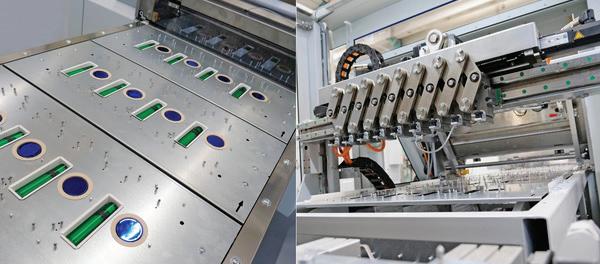

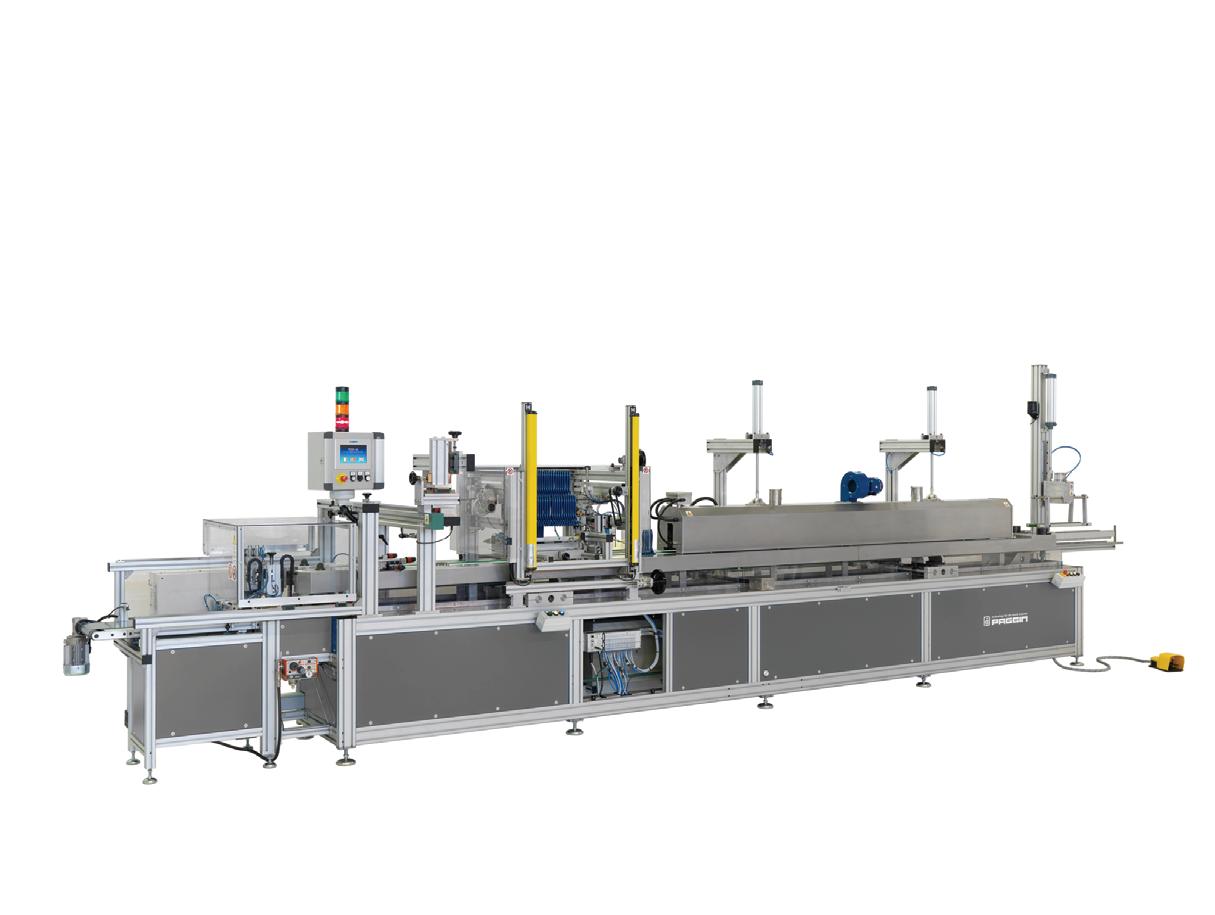

Boucherie’s partner ILLIG has expanded its product portfolio of modern and sustainable packaging solutions with the new HSU 650 — a customizable and modular packaging machine. The machine was designed with a quick and ergonomic change-over in mind, and the user-friendliness was improved with a new HMI. Furthermore, a 30 percent reduction in energy consumption was achieved with a new sealing station that is much more energyefficient. The output is high because of the generous forming and sealing area of 650 x 300 mm combined with a speed of 20 cycles per minute.

• Paper-to-paper blisters

• No glue required

• Side flap sealing

• Inlay as an option

• Automatic infeed available

• Forming/sealing area: 650 x 300 mm

• Speed: Up to 20 cycles per minute

• Blister depth: Up to 80 mm

• Sealing force: Up to 6 tons

For more information, visit www.boucherie.com.

The fourth annual Brushware Digital 40 utilizes statistics from www.brushwaremag.com to rank the top brands and influencers in the brush industry for 2022. We enjoy the opportunity each year to highlight the efforts of companies that are finding new and effective ways to market. Are you looking to make the annual list and get extra exposure for your company? Stay active and engaged with Brushware magazine by sharing press releases with news.brushware@goodwinworldmedia.com. Linkbacks from press releases should be a key part of any brand’s overall marketing and SEO strategy. Get your press releases planned out — we’re already tracking our list for 2023.

01. Interbrush

Industry-leading show ends after 45 years.

02. Zahoransky Machine maker’s exit from Interbrush was a top story.

03. India Brush Expo

New tradeshow was able to launch in May 2022.

04. The Inspired Home Show

The Show returned to action in March with more than 1,000 exhibitors.

05. Ken Rakusin CEO of Gordon Brush.

06. Nextstep Commercial Products

Cleaning products manufacturer with plants in Illinois and Ohio.

07. FEIBP

FEIBP Congress returned with a live event in Prague in September.

08. Nick Mallinger

President and CEO of Tanis Incorporated.

09. Ulrich Zahoransky Managing Director at ZAHORANSKY.

10. Robert Dous

Managing Director of ZAHORANSKY Automation & Molds GmbH and Chief Sales Officer of the ZAHORANSKY GROUP.

11. Loris Maestrutti

CEO of MGG Group.

12. Carlos Petzold

President of Bodam International/Borghi USA and former ABMA president.

13. Interclean

Amsterdam cleaning and hygiene show returned in May.

14. Phillip M. Perry

Brushware’s leading correspondent on economic issues.

15. Hillbrush

UK-based brush manufacturer celebrated 100 years in 2022.

16. Perlon

Filament supplier jumped up from 40th in 2021.

17. Bob Lawrence

Brushware’s senior industry correspondent offered a three-part series on inflation this fall.

18. Bart Boucherie Jr. General Manager for Boucherie.

19. Manfred Roth Owner of Roth Industries.

20. Bart Pelton President of the PelRay International Company.

21. Gordon Brush Brush manufacturer based in the City of Industry, Calif.

22. IHA International Housewares Association.

23. Andrew McIlroy Sales and Marketing Director at Perlon-Hahl and FEIBP President.

24. ABMA American Brush Manufacturers Association.

25. Greg Miller

President of The Mill-Rose Company and ABMA.

26. Global Shop Solutions Leading ERP platform for manufacturers.

27. Lisa Anderson

Brushware’s supply chain and business manufacturing strategy columnist.

28. Matthias Peveling General Manager for Wöhler Brush Tech.

29. Messe Freiburg Organizers of Interbrush.

30. PelRay International Company

Brush industry supplier for natural fibers and more.

31. Boucherie

Full-service manufacturer of brush manufacturing machinery.

32. World Brush Expo

New brush industry tradeshow set to fill the gap left by Interbrush.

33. Borghi USA

Borghi’s USA operation based out of Aberdeen, Md.

34. Fons Ceelaert General Manager for the FEIBP.

35. Wooster Brush Company

One of the oldest manufacturers of paint applicators in the U.S.

36. Coronavirus

Still impacted the industry in 2022.

37. ABMA Annual Convention

Returned with a live event in Bonita Springs, Fla.

38. Jeff Malish President of Malish Corp.

39. John C. Cottam Co-president at the Industrial Brush Corporation.

40. MGG Srl

Brush machine maker had a big presence at the 2022 ABMA Convention.

Hillbrush, the U.K.’s largest manufacturer of brushes and specialist cleaning tools, has rounded off a year of centenary celebrations with the official opening of a new warehouse and planting of a commemorative tree at Wiltshire headquarters. The new environmentally friendly “Centenary Warehouse” was declared officially open by Rt Hon Dr. Andrew Murrison, MP for Southwest Wiltshire, at a special reception held on Friday, November 18, 2022, for Hillbrush customers and suppliers. The celebratory event offered a hog roast, tours of the brush manufacturing facility and a chance to network with colleagues in the brush-making industry.

Hillbrush’s new 1,800 square meter Centenary Warehouse will provide the company with significantly more space to hold product on site and therefore ensure high stock availability to customers. Hillbrush currently manufactures more than 2,000 product lines at Mere. In line with Hillbrush’s focus on building a sustainable and environmentally friendly business, lighting inside the warehouse is movement activated to reduce energy and provide cost efficiency.

Hillbrush’s milestone birthday was also marked by the planting of a Redwood tree at the front of the offices by company Chairman, Philip Coward. Hillbrush was founded in 1922 by Fred and Bill Coward, Philip’s father and uncle. Today, Hillbrush is still independent, familyowned and run with Philip’s

son, Charlie Coward, and nephew, Andy Coward, as current joint managing Directors.

“Who would have thought when Fred and Bill Coward set up the original Hill Brush Company in 1922 to serve the needs of the many farms and agricultural businesses surrounding Mere that we would be celebrating 100 years on,” says Charlie Coward. “Hillbrush is a British manufacturing institution that has stayed true to its family values while innovating and diversifying to stay ahead of the times. It was a delight to celebrate the company’s centenary with our loyal customers and suppliers. We were delighted that our local MP the Rt Hon Dr. Murrison was able to share the day with us and officially open our new warehouse.”

Developing homegrown leaders is one of the most important things companies can do to pave the way for continued success. Global Shop Solutions, a global leader in ERP software for manufacturers, is proud to announce Cynthia Ashby and Ryan Carpenter were identified as Emerging Leaders by the National Tooling and Machining Association (NTMA).

NTMA is a U.S.-based trade association with 1,200 tool and die and precision manufacturing companies representing more than $35 billion in sales. Each year NTMA selects 15 individuals for recognition in the association’s Emerging Leaders Rising program. This program recognizes the hard work and accomplishments of future leaders in manufacturing.

“We’re very proud to have Cynthia and Ryan on our team,” says Dusty Alexander, President and CEO of Global Shop Solutions. “Cynthia attained her current position as Manager of the Financial Data Analysis Team by earning the respect, admiration and trust of senior leaders, supervisors, fellow employees and customers. As an operations consultant on our Continuous Improvement Team, Ryan has greatly impacted our customers by continuously helping them improve their fluency with our software and resolving issues from quote to cash. It’s employees like Cynthia and Ryan that have made Global Shop Solutions great today and into the future.”

Each Emerging Leaders class is profiled in The Record, NTMA’s Monthly Precision Manufacturing Magazine and are invited to attend Manufacturing Engage — the annual precision manufacturing conference — where they are recognized on stage during the awards ceremony. They are also invited to attend the annual Emerging Leaders Conference where they can connect with each other and continue to develop their leadership skills.

“It’s an honor to receive this award, but I wouldn’t be where I am today without the guidance of others,” says Ashby. “Becoming an Emerging Leader has motivated me to work harder and continue growing in my career while helping others succeed.”

“I am honored to be chosen as an Emerging Leader,” says Carpenter. “Every day I do my best to ensure our customers’ needs are met, and I hope to pioneer a path for new hires by demonstrating the effectiveness of young leaders.”

As part of our 125th-anniversary celebration, Brushware is offering an article related to the history of the magazine in each edition for 2023. For our first installment in the series, we present the following interview with the magazine’s previous owner, Norman Finegold.

Age: 74

Current Location: Fairway, Kansas (Kansas City Metro)

Role with Brushware: Owner from 1999 to 2019

When I graduated college, I went to work for Arthur Andersen, which was a big public accounting firm and I hated the life of a public accountant. I then got a job with a company called Cadence Industries as a corporate analyst — going into the divisions and doing internal audits. I was assigned to the publishing divisions and one of their divisions was Marvel Comics. The other company was Magazine Management. They were both in the same building on Madison Avenue in New York City. About two years later, they fired the controller of Marvel and put me in that role. So I was the controller of Marvel Comics for about five years. At the time, they didn’t do anything with movies, but they would produce 60 comic books a month — from Captain America to Hulk to Spiderman. I reported to Stan Lee.

Then, before buying Brushware, I moved around to various other publishing companies. I worked for Worldwide Magazines, which was the biggest exporter of US magazines. I was a controller there for a number of years but I got sick and tired of corporate America.

I married my wife, Karen, in June 1999. She had no experience whatsoever in magazine publishing but was game to learn. So we went out and bought Brushware magazine. Karen was the designer and did everything except, magazine sales, advertising sales and subscriptions. We became a good team and so in 2004, we bought a second trade publication called the American Window Cleaner Magazine

From the day-to-day perspective, what was your favorite part of working on Brushware?

My favorite part was working with the advertisers, they were so nice. I didn’t enjoy the actual travel to conventions, but once I was there I so enjoyed mingling with the advertisers. Yeah, I was there to sell advertising, but it was also wonderful just to BS with them.

From a day-to-day standpoint, it was always a challenge to keep an advertiser in or try to get a new one, and I sort of enjoyed that.

What would you say was the strength of Brushware during your time running the magazine?

Well, we had the highest circulation, so we had the strength of circulation and also the strength of great editorial. We focused on what we thought our advertisers and subscribers wanted to read, and I think that separated us.

Is there anything about the Brushware workflow/process that might come as surprise to readers and advertisers?

There was a lot of conversation and discussion about what articles to run. The editorial calendar took a lot more time than I think any advertiser or reader

would really realize. Bob Lawrence, Mark Battersby and every single writer would contribute ideas for what we should do each August. Karen and I would do that as well. Then Karen and I sat down and looked it all over, and I would ultimately decide which stories we would go with.

What have you been doing since moving on from Brushware?

I got myself involved in umpiring for high school baseball, which I totally love. I started with the lower-grade kids and got frustrated. However, at the same time that I was frustrated, it was imperative I learn the rules better than I knew. When I started, my knowledge of baseball and the rules came from watching the Yankees play baseball on TV, but there were so many more rules that I had to learn. There are so many rules that I probably still don’t know.

Now I’m doing a lot of seventh through 12th-grade baseball games and the higher you go, the more competitive is. It’s just wonderful, I so enjoy it.

I also do volunteer work at the University of Kansas Health System at the Cancer Center on Friday mornings. I have a beverage cart for the patients and families … they’re there for chemo or other treatments. The funniest thing happened to me while I was doing that. When somebody asks me for a cup of coffee, I say, “How do you take it?” Normally, the answer is black or one cream, 2 sugars, Sweet and Low, or something like that. About two months, a guy asked me for a coffee and I said, “How do you take it?” He said, “In a cup.”

I’ve also been going to grandkids’ soccer games and basketball games, watching them grow up. That’s fun. When I grew up, no one played soccer. I grew up in New York City, so … you know, we had beaches and we had other stuff to do. There are no beaches here in Kansas or Missouri, as you know, and the sports here are just amazing. It’s every sport in the world and they play it and everybody plays.

Is there anything about the current Brushware that stands out to you?

I love the publisher’s page. I like the length of it, the detail of it and you know, and I’m enjoying the articles.

What are your thoughts on Brushware celebrating 125 years?

Well, it’s absolutely amazing that the magazine is that old and I’m so happy that I was a part of the history of Brushware. I’m happy that you’re doing well with it and that I passed the baton to somebody who took it and is running with it. Karen and I were happy to be part of the industry and to meet some wonderful, wonderful people.

The supply chain has become an excuse. Although there has certainly been a slew of supply chain challenges that carry on with baby formula shortages, rail backlogs, computer chip issues, hurricane-induced delays, fertilizer scarcity and China’s zero-COVID policy delays, the supply chain should no longer be the excuse. Only the proactive will thrive in the years to come.

Start with the simple. Assess your end-to-end supply chain. Focus on your strengths and identify what must be shored up quickly, or should you completely change your supply chain strategy to better support your target customers’ needs? Why invest money in the bottom 20% of your customers or products that utilize precious resources that should be invested to take market share in what will be the largest opportunity since the Great Depression to solidify your position in your industry?

Instead, identify your target customers and ideal future state customers. Determine which products and services will meet their needs this year, next year and five years from now. Quickly assess a directionally correct path forward, and incorporate these findings into your SIOP (Sales, Inventory, Operations Planning, also known as S&OP) process. Your SIOP process will provide clarity on changes in customer demand patterns, the potential misalignment of demand and supply, decisions required (such as pricing and the reallocation of capacity) and manufacturing and supply chain adjustments needed to support your growth and profitability goals.

If you are heavily reliant on manufacturing in other countries, it is time to reevaluate. How confident are you that you will be able to support your key customers? Most likely, you should assess reshoring, nearshoring, friendly-shoring, expanding capacity or simply finding new partners closer to your customers. You must gain control over your ability to execute to support your customer’s needs.

Collaborate with your supply chain partners. Partner with customers in unique and creative ways for win-win solutions. For example, when working as VP of Operations for a mid-market manufacturer, we partnered with our number two customer to share demand information, coordinate agreements to share warehouse space and build collaborative truckloads. Rethink how to partner with customers and suppliers.

Evaluate your use of technology. Although more than 90 percent of clients can better leverage their ERP system and related technologies to a greater degree to drive customer service, on-time-in-full (OTIF), profitability and working capital improvements, it is no longer enough. Upgrading to a modern ERP system with advanced data analytics and business intelligence capabilities has become the new baseline to automate, digitize, predict and provide a superior customer experience. It is likely you’ll need to think bigger with artificial intelligence (AI), the internet of things (IoT), additive manufacturing and digital twins.

Stop using the supply chain as an excuse and start acting. There is no doubt the world is disrupted and will not realign on its own. Only the resilient and strong will survive, but most importantly, only the proactive and forward-thinking will thrive. Get ahead of the supply chain disruptions, or better yet, be disruptive and solidify your market position and EBITDA strength.

Lisa Anderson is the founder and president of LMA Consulting Group Inc., a consulting firm that specializes in manufacturing strategy and end-to-end supply chain transformation that maximizes the customer experience and enables profitable, scalable, dramatic business growth. She's released several eBooks which can be found at www.lma-consultinggroup.com/lma-books/

COMPANY: Pennelli Cinghiale

LOCATION: Cicognara-Mantova-Italy

TITLE: Managing Director

When did you start working in this industry and how did you get started?

My career started in 2004, but I have practically lived and breathed Pennelli Cinghiale since I was born. Ours is a traditional Italian family-run business that was founded in 1945 with the bold and visionary undertaking of my grandfather.

What aspect of working in the paintbrush industry do you enjoy the most?

The perfect balance between technique and creativity, which has allowed us, through years of experience, to develop a global brand that designs all the products necessary for painting.

What aspect of Pennelli Cinghiale makes you the most proud?

We have been acknowledged as a historic brand of national interest for Italy, and we have created a company museum where our history intertwines with pop art.

What are the main challenges you have faced in recent years and how is Pennelli Cinghiale facing them?

The main and constant challenge is to keep up with the development of paints. Chemical formulas are constantly evolving and we have to design products that are always up-to-date in order to achieve the best performance for their application. A good paint is not enough; you need a suitable tool to achieve perfect results, especially for professionals, who represent our main target group.

Do you foresee any permanent changes for Pennelli Cinghiale and the paintbrush industry in general?

The world of paints is moving more and more towards water-based formulations, requiring increasingly detailed research into synthetic filaments, which are the best to use with this type of formulation, and high-tech materials for a quick and easy application. Another essential aspect is the choice of components: we are now heading towards the use of FSC wood, recyclable plastic and recycled plastic.

Are there any news or initiatives taking place at Pennelli Cinghiale that you would like to share with us?

Over the past few years, we have invested heavily in research into new synthetic filaments which can guarantee the excellent performance of our paintbrushes with new-generation paints. Each filament mixture is produced – and their application is tested – in our laboratories. We are very proud of the results we have obtained, which is why we are very keen to protect our “recipes,” as in the case of Boartex®: a high-performance filament mixture that guarantees extraordinary results with both water and solvent-based paints.

The recruitment of skilled labor in general and young workers has been said to be a concern for the industry. In your opinion, how should this problem be addressed?

We have such a strong connection with our area, which is the industrial paintbrush and brush district, that this problem has never arisen. We have staff from different generations of the same family who have chosen to continue working with us; this is very important as well as significant.

Do you have any key advice in terms of business/leadership for young people whose aim is to reach a leadership role in this industry?

Develop a deep technical knowledge by listening to experience, but be brave enough to dare and innovate. Invest in digital even for a seemingly simple product like a paintbrush. Today’s consumers live in the digital world and they collect information before making any purchase decisions. This is why it is important to create strong cross-selling within the painting industry so that nobody is disappointed by the wrong toolpaint combination.

This year, Pennelli Cinghiale attended the EISENWARENMESSE International Hardware Fair in Cologne, one of the main events for our industry. On this occasion, we presented new products that we have designed according to international building trends and based on the technical requirements of different countries, with a special focus on environmental impact.

What do you like to do when you are not at work?

I am a contemporary art lover, perhaps because art is the most creative and lofty result originating from a paintbrush. I cannot

help but try to imagine the brush stroke and the artist’s gesture lying behind each mark on the canvas.

I love attending live shows and I have missed them a lot over the past two years. I caught up with summer concerts: from Tears for Fears and Ben Harper to Dua Lipa and Lady Gaga. The energy you feel when listening to live music cannot be compared to streaming on Spotify.

My favorite team is our team of Cinghiale professionals. Joking aside, our brand has had strong connections with excellent sports teams, my grandfather being a super fan. Our museum still houses important memorabilia of Inter FC since my grandfather was a huge fan, as well as that of the great cycling champions.

Do you have any advice for business trips?

Yes! Never forget a piece of Parmesan cheese in your luggage for your customer, it is the best gift you can give! Everyone appreciates the real taste of Italy.

Can you tell us one thing about you that people might find surprising?

I am a young woman, isn’t that enough for this industry?

What have you learned in life or in the industry?

People are stronger than products. Creating excellent products designed and manufactured in Italy is what Pennelli Cinghiale has been doing in the factory every day since 1945; but above all, I have learned that being a partner to your customer and not just a supplier makes the real difference.

Is there any question or topic we have not covered that you would like to comment on?

Pennelli Cinghiale can count on a strong heritage thanks to TV advertising, which is still alive in the Italian culture. My grandfather started right after the Second World War and now we are the third generation of a family-run business based on ethics and reliability. Today our goal is to bring the company to the international market with high-quality Made-in-Italy products, 4.0 production technology and digital marketing.

Learn more about Pennelli Cinghiale at www.pennellicinghiale.com.

The economy will slow perceptively in 2023. Less robust activity in sectors such as housing, retailing and manufacturing will put downward pressure on growth and contribute to a deceleration in profits. Companies can prepare for a tougher environment by tracking cash flow closely, investing selectively and hiring prudently.

Businesses are preparing for a more challenging operating environment in 2023. After two years of frenetic commercial activity fueled by a post-pandemic recovery, strengthening headwinds will tap the brakes on a robust economy. Among the culprits: rising inflation, higher interest rates, a softening housing market, continuing supply chain disruptions, declining capital investments and escalating costs for wages and energy.

The loss of some helpful economic initiatives is only adding to the downward pressure. “Government stimulus packages, ultra-low interest rates and strong money supply creation had been helping to compel business activity until mid2022,” says Anirban Basu, Chairman and CEO of Sage Policy Group (www. sagepolicy.com). “All those fundamentals have been inverted.”

Economists are adjusting their forecasts to reflect the new normal. “We project real Gross Domestic Product (GDP) will increase by 1.4% in 2023,” says Bernard Yaros Jr., Assistant Director and Economist at Moody’s Analytics (www.economy.com). “The expectation for 2022 is 1.6%. Both figures represent much slower activity than the 5.7% increase of 2021.” (GDP, the total of the nation’s goods and services, is the most commonly accepted measure of economic growth. “Real” GDP adjusts for inflation.)

All of the above conditions should have a depressing effect on corporate profits, projected by Moody’s Analytics to increase at a 5.2% clip in 2023. That represents a decline from the 7.9% figure anticipated for 2022. Both estimates are much lower than the 25% increase of 2021.

Reports from the field reflect early glimmers of a less robust business environment. “In the first half of 2022 many of our members were still experiencing high demand,” says Tom Palisin, Executive Director of The Manufacturers’ Association, a York, Pa., based regional organization with more than 390 member companies (www.mascpa.org). “But as the year progressed there was a significant slowdown caused by the labor shortage, inflationary issues and global events.”

With its diverse membership in food processing, defense, fabrication and machinery building, Palisin’s association is something of a proxy for all American industry. The good news is that a strong employment environment at the association’s members — as well as at companies elsewhere in the nation — is helping alleviate the negative impact of the economy’s headwinds. Moody’s Analytics expects a continuation of that favorable condition, forecasting an unemployment rate of 4.1% by the end of 2023. That’s not much higher than the 3.7% rate of late 2022. (Many economists peg an unemployment rate of between 3.5% and 4.5% as the “sweet spot” that balances the risks of wage escalation and economic recession).

On the downside, low unemployment usually increases business costs by forcing employers to boost wages to attract scarce workers. Today is no exception. “Our organization surveys members annually on their baseline entry-level hourly wage figure,” says Palisin. “Increases typically run around 2.5% to 3%, but the figure was 8% in 2022.” While Moody’s Analytics forecasts a continuation of labor cost increases, they should moderate to 3.5% in 2023, down from their current 5%. Even so, those increases are expected to affect business profitability.

The tight labor market hits business profitability not only in the form of higher wages but also in a scarcity of the very workers needed to produce goods and services. “Employers will be very focused on labor availability in 2023 as Baby Boomers continue to retire and the supply of immigrant labor has yet to fully recover from severe pandemic-related disruptions,” says Yaros. “Despite a slowing economy, layoffs are low, indicating that businesses are holding onto labor in a reaction to the hiring difficulties they encountered during the pandemic.”

When will workforce availability increase? Not anytime soon, say observers. “The labor market is going to be tight for years to come,” says Bill Conerly, Principal of his own consulting firm in Lake Oswego, Oregon (www.conerlyconsulting.com). “The decade from 2020 to 2030 is expected to have the lowest growth of working age population since the Civil War. One reason is the retirement of the Baby Boomers; another is the low rate of immigration over the last few years.”

Palisin agrees that a labor shortage is going to be a long-term condition and says his members are making moves to lessen the effect. “Employers are trying to be creative in the way they keep and retain workers not only by offering higher salary rates but also by extending benefits and encouraging work flexibility. They are also investing more in automation for labor-intensive tasks.”

The accompanying article suggests an economic slowdown as the likeliest scenario for 2023. But what are the chances of a recession or an actual decline in business activity?

While Moody’s Analytics sets the odds at 50-50, avoiding a recession will require a bit of luck. “The U.S. economy will enter 2023 being vulnerable to anything that might go wrong,” says Bernard Yaros Jr., Assistant Director and Economist at Moody’s Analytics (www.economy.com). He pointed to risks such as a resurgence of the pandemic in China, a worsening of the Ukraine war and another energy supply shock that would hit consumer pocketbooks.

“Avoiding a recession will also depend on a couple of things going right,” adds Yaros. “The ebullient labor market will need to cool down at a pace that softens wage increases without sparking economic turmoil. Most important, the Federal Reserve will need to successfully tame inflation without allowing interest rates to spike the economy.”

Yaros, however, is optimistic. “We think inflation will steadily slow from more than 8% to a pace that is consistent with the central bank’s 2% target by the end of 2023.”

2.3

1.7

Sources:

If high employment levels can stress the bottom lines of many employers, they can also fill workers’ pockets with spendable cash and flush consumers can help drive a robust retail sector, an important slice of the economic pie. “Wage rates, as measured by the Employment Cost Index (ECI), remain very high by the standards of the last couple of decades,” says Scott Hoyt, Senior Director of Consumer Economics for Moody’s Analytics (www.economy.com).

Even so, activity is decelerating at the nation’s stores. “2023 is likely to be a challenging year for retail, with growth only at 2.8%,” says Hoyt. The projected growth is well below the sector’s historic 4.3% average as well as the 8.3% increase expected when 2022 numbers are finally tallied. The recent trend is well below 2021 when a 17.5% increase was fueled by a consumer shift away from services and toward goods.

A slowing economy is contributing to retail’s deceleration, as is a penchant for post-pandemic consumers to shell out less cash on merchandise and more on services such as hotels, travel and restaurants. Any softening of inflation from recent highs should also depress results since retail activity is measured in nominal terms.

Higher wages and scarce workers are not the only forces depressing business profits. Another major factor is a rise in interest rates — the Fed’s favorite tool for fighting inflation. “The purpose of increasing interest rates is to drive down demand,” says Palisin. “So, our members are expecting to see a decrease in new orders that will impact the overall economy. Also, many of our companies have lines

World Bank; projections by Moody’s Analytics.

of credit that rely on floating interest rates. Rising rates will take a hit to the bottom line as companies decide whether to utilize those lines to support their cash flow and investments.”

Adding further downward pressure are disruptions in the delivery of goods that continue to plague companies large and small. “Supply chain problems have improved over the past year, but there hasn’t been the significant resolution we had hoped for,” says Palisin. “Random shortages in materials and deliveries are still plaguing our members and that’s leading to backlogging of orders; companies just can’t get the materials or parts.”

The Russia-Ukraine war has worsened the situation, notes Palisin. “The war has created an energy crunch and a disruption in raw materials from that region that have trickled through the economy to exacerbate the supply chain issues.” Companies are responding by moving to reduce their reliance on China, he adds. “They’re sourcing from additional countries to reduce disruptions.”

Housing, a key driver of the economy, has also entered a period of correction. “The underlying dynamics of the housing market are changing as lower affordability spurred by higher prices and mortgage rates is starting to significantly weigh on demand,” says Yaros.

affordability has sunk to its lowest level since late 2007, the 30-year fixed mortgage rate is within striking distance of its highest level in over a decade, leading to a decline in purchase applications.

A tight housing supply is only adding to upward pricing pressure. The inventory of for-sale homes remains historically low and new ones will be scarce on the ground. “We expect housing starts to fall by 1.8% and 2% in 2022 and 2023 respectively,” says Yaros. “This compares with a 15.1% increase in 2021.”

There’s only so much the industry can do to bolster the housing supply — one big reason being the above-mentioned labor shortage. “The unemployment rate for experienced construction workers is about as low as it’s ever been,” said Yaros. “Capacity limits have delayed housing completions and contributed to a record number of housing units in the pipeline.”

One bright spot in the housing picture: mortgage credit quality has never been better. “The percent of loans delinquent and in foreclosure is at a record low,” says Yaros. “This goes to the stellar underwriting standards since the financial crisis and borrowers’ credit scores are much higher.” While lending standards for mortgage loans are now tightening, the credit spigot is unlikely to seize up as it did during the financial crisis of 2008.

Given the above concerns, it’s little wonder corporate confidence is taking a hit. As the calendar turns to a new year, companies are responding to soaring interest rates and inflation by scaling back the capital investments that help fuel the economy. “Up until the second

half of 2022 most companies were taking advantage of low rates to plan ahead for equipment purchases and expansion opportunities,” says Palisin. “Now, though, many are taking second looks at anything planned for 2023.”

Businesses are also taking steps to increase their liquidity to cushion against tough times. “We are all going to need to watch our cash flow,” says Palisin. “Most of our members anticipate a slowdown in orders; and as a result, they are holding off on some future investments and pulling back in hiring.”

Uncertainty is the name of the game, and that makes planning difficult. “We are faced with a kind of a two-sided coin,” says Palisin. “The positive side represents strong current orders and a continuing need for more workers; while the negative side represents inflationary pressures and global headwinds.”

Which side of the coin will show its face in 2023? Economists advise watching a few key indicators. “In the early part of the year companies should keep an eye on what is happening with the cost of money,” says Basu of Sage Policy Group. “Inflation is the driver of near-andmedium term economic outlooks.” A second vital element, he says, is the employment picture. “Employers should watch for any emerging weakness in the labor market.” Finally, what about consumers? “Any softening of spending would point to a looming recession.”

0502100000 Pigs, Hogs, Boars Bristles & Hair & Waste Thereof (kg)

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

China 4,553,493 131,338 4,753,445 95,486 -4.21 37.55

Germany 3,686 5 -100.00 -100.00

World Total 4,553,493 131,338 4,757,131 95,491 -4.28 37.54

0502900000

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

China 117,846 605 12,335 118 855.38 412.71

New Zealand 5,326 45

United Kingdom 165,381 768

World Total 288,553 1,418 12,335 118 2239.30 1101.69

4417002000

September 2022 YTD September 2021 YTD YTD Growth %

Country Value Qty Value Qty Value Qty

Belgium 46,310 37,800

Brazil 4,150,088 4,917,747 1,997,698 2,076,637 107.74 136.81

Cambodia 166,649 305,695

Canada 2,950 10,000 -100.00 -100.00

China 1,095,950 2,061,779 886,530 1,753,645 23.62 17.57

Colombia 12,098 27,856 4,478 13,020 170.17 113.95

El Salvador 6,948 10,035

Honduras 3,486,275 6,445,805 3,183,554 6,276,831 9.51 2.69

Hong Kong 18,900 100,000 16,154 106,000 17.00 -5.66

India 2,646 668

Indonesia 682,962 778,192 470,548 445,869 45.14 74.53

Japan 3,572 288

Mexico 273,489 468,811 64,720 130,447 322.57 259.39

Pakistan 8,320 18,684 -100.00 -100.00

Sri Lanka 8,260 21,550

Thailand 16,958 39,901

World Total 9,971,105 15,216,127 6,634,952 10,831,133 50.28 40.49

4417004000 Paint Brush And Paint Roller Handles, Of Wood (x)

September 2022 YTD September 2021 YTD YTD Growth% Country Value Qty Value Qty Value Qty

Australia 4,949 49 -100.00 -100.00

Belgium 6,776 1 -100.00 -100.00

China 870,159 238,374 1,233,741 279,868 -29.47 -14.83

Czech Republic 24,328 1,407 -100.00 -100.00

Germany 82,318 7,368 95,476 7,953 -13.78 -7.36

Indonesia 552,416 172,939 561,598 111,616 -1.63 54.94

Italy 11,794,861 677,355 11,706,350 689,769 0.76 -1.80

Kyrgyzstan 18,761 1,882

Poland 1,492,804 164,510 896,444 105,010 66.53 56.66

Sri Lanka 22,106 9,676

Thailand 54,469 4,609 23,562 1,513 131.17 204.63

World Total 14,887,894 1,276,713 14,553,224 1,197,186 2.30 6.64

4417006000

Brush Backs, Of Wood (no)

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Canada 610,793 1,317,946 529,572 1,407,940 15.34 -6.39

China 150,632 516,953 125,727 376,557 19.81 37.28

Indonesia 524,498 1,260,454 377,901 793,951 38.79 58.76

Spain 5,464 116 -100.00 -100.00

Sri Lanka 731,815 1,362,519 535,586 1,037,080 36.64 31.38

World Total 2,017,738 4,457,872 1,574,250 3,615,644 28.17 23.29

4417008010

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Austria 45,635 2,833 -100.00 -100.00

Brazil 336,995 131,594 132,438 78,595 154.45 67.43

Canada 237,670 4,414,486 143,975 1,835,330 65.08 140.53

China 1,388,919 1,284,746 1,288,795 1,487,885 7.77 -13.65

El Salvador 7,554 1,550

Finland 2,034 252

Germany 26,043 1,345 19,240 1,404 35.36 -4.20

Honduras 120,960 58,500 267,201 137,162 -54.73 -57.35

India 135,692 25,228 20,500 5,203 561.91 384.87

Indonesia 44,046 21,671 -100.00 -100.00

Italy 37,657 452,286 60,178 6,124 -37.42 7285.47

Japan 8,186 125

Mexico 1,989,864 513,453 1,895,746 611,126 4.96 -15.98

Netherlands 2,775 136

Spain 136,783 50,130 149,758 48,489 -8.66 3.38

Sri Lanka 18,834 3,840 20,826 15,522 -9.56 -75.26

Sweden 39,700 1,219,961 72,770 2,359 -45.44 51615.18

Switzerland 21,563 799 -100.00 -100.00

Taiwan 192,932 594,078 521,764 59,591 -63.02 896.93

Ukraine 4,590 206 -100.00 -100.00

United Kingdom 4,898 100

Vietnam 68,029 13,575 84,265 10,578 -19.27 28.33

World Total 4,755,525 8,765,385 4,793,290 4,324,877 -0.79 102.67

4417008090 Tools Tool/brush/broom Bodies Shoe Last/tree, Wood (x) September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Australia 8,610 950

Austria 28,541 1,055 17,457 530 63.49 99.06

Brazil 84,385 30,112 35,947 20,063 134.75 50.09

Canada 1,233,341 194,436 523,404 114,955 135.64 69.14

Chile 4,299,337 1,703,557 3,070,040 1,273,134 40.04 33.81

China 6,082,040 1,005,269 5,337,959 1,156,690 13.94 -13.09

Colombia 3,170 1

Croatia 6,968 45 11,151 80 -37.51 -43.75

Czech Republic 19,704 630 40,808 1,566 -51.72 -59.77

Estonia 92,373 810 31,707 423 191.33 91.49

Finland 20,834 1,423 -100.00 -100.00

France 62,847 1,828 14,563 435 331.55 320.23

Germany 120,806 968 141,007 930 -14.33 4.09

Hong Kong 2,050 103 -100.00 -100.00

India 1,517,120 23,316 1,500,013 25,318 1.14 -7.91

Indonesia 83,763 31,829 77,657 28,498 7.86 11.69

Israel 4,828 324 2,639 493 82.95 -34.28

Italy 35,803 1,088 11,709 113 205.77 862.83

Japan 1,558,950 19,728 2,281,694 30,920 -31.68 -36.20

Lithuania 3,269 10 -100.00 -100.00

Malaysia 7,793 69 -100.00 -100.00

Mexico 418,193 83,047 322,805 155,740 29.55 -46.68

Nepal 1,132,072 18,009 452,971 7,209 149.92 149.81

Netherlands 2,301 75

Pakistan 2,425 58 -100.00 -100.00

Philippines 62,375 10,153 8,555 1,296 629.11 683.41

Poland 13,440 244

Spain 44,093 1,563 24,441 432 80.41 261.81

Sri Lanka 539,688 254,155 313,968 200,520 71.89 26.75

Switzerland 5,270 29 12,328 62 -57.25 -53.23

Taiwan 110,629 10,133 109,600 9,012 0.94 12.44

Tanzania 7,165 50

Thailand 3,000 38

Turkey 11,834 16

Ukraine 136,604 4,780 93,563 5,289 46.00 -9.62

United Kingdom 30,475 272 23,959 646 27.20 -57.89

Vietnam 10,389 102 4,132 22 151.43 363.64

World Total 17,770,114 3,398,612 14,500,448 3,036,039 22.55 11.94

9603100500

Wiskbrooms,brm Corn,lt=.96 Ea,lt 61,655 Dz Cal Yr (no)

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

China 19,666 29,500 10,922 14,500 80.06 103.45

Mexico 15,845 23,460 10,680 15,840 48.36 48.11

Vietnam 2,900 5,800

World Total 38,411 58,760 21,602 30,340 77.81 93.67

9603101500

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Australia 3,950 1 -100.00 -100.00

China 57,167 205,256 62,757 231,056 -8.91 -11.17

Colombia 15,636 22,200

Japan 7,471 139 32,660 130,640 -77.12 -99.89

Mexico 4,688 6,250

Vietnam 5,232 9,600 5,191 9,984 0.79 -3.85

World Total 90,194 243,445 104,558 371,681 -13.74 -34.50

9603103500

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

China 104,229 106,604 57,453 54,175 81.42 96.78

Germany 3,764 2,000 -100.00 -100.00

Israel 12,622 775 -100.00 -100.00

Korea, South 7,755 1,704 -100.00 -100.00

Mexico 167,563 168,805 729,549 373,910 -77.03 -54.85

Sweden 2,993 300

Taiwan 3,000 1,000 4,113 356 -27.06 180.90 Thailand 4,600 2,500

Vietnam 5,712 1,200 17,963 18,400 -68.20 -93.48

World Total 288,097 280,409 833,219 451,320 -65.42 -37.87

9603105000 Brooms,of Brm Corn,lt=.96 Ea,gt=121,478 Dz,cal Yr (no)

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

China 10,230 47,000

Mexico 7,526 8,160 2,019 3,300 272.76 147.27 Vietnam 2,390 2,950 -100.00 -100.00

World Total 17,756 55,160 4,409 6,250 302.72 782.56

9603106000 Other Brooms,of Broomcorn,valued Over .96 Each (no)

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

China 18,048 8,460 25,850 15,960 -30.18 -46.99

Latvia 8,230 1,290

Mexico 7,310,210 2,975,326 8,195,048 3,664,168 -10.80 -18.80 World Total 7,336,488 2,985,076 8,220,898 3,680,128 -10.76 -18.89

9603109000 Brooms & Brushes,of Twigs Or Veg Material,nesoi (no)

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Australia 4,704 5 Bangladesh 2,522 50 3,225 55 -21.80 -9.09 Brazil 2,514 1,005

Cambodia 10,493 1,590 Canada 17,784 3,703 China 299,966 320,996 262,600 389,641 14.23 -17.62

Colombia 15,607 29,059 6,116 9,592 155.18 202.95 Denmark 4,883 5 -100.00 -100.00 Germany 19,314 27,290 85,556 40,352 -77.43 -32.37

Guatemala 3,582 2,700

Guyana 2,205 1,000 -100.00 -100.00

India 28,574 17,886 58,264 45,776 -50.96 -60.93

Israel 41,070 47,012 6,690 3,400 513.90 1282.71

Italy 3,881 2,451

Japan 8,181 229 6,951 186 17.70 23.12

Korea, South 33,353 9,760 44,883 83,022 -25.69 -88.24

Lebanon 2,450 98

Mexico 143,076 126,321 30,988 10,881 361.71 1060.93

Netherlands 26,179 31 8,017 12 226.54 158.33

Philippines 87,696 73,544 82,946 55,600 5.73 32.27

Spain 9,702 1,320

Sri Lanka 685,697 565,317 812,829 964,549 -15.64 -41.39

Sweden 10,754 603 2,048 200 425.10 201.50

Switzerland 5,102 40 -100.00 -100.00

Taiwan 16,852 4,432 10,278 606 63.96 631.35

Thailand 81,238 34,073 61,674 51,033 31.72 -33.23

Turkey 7,075 3,500 -100.00 -100.00

Ukraine 20,620 5,313 2,020 450 920.79 1080.67

UAE 7,808 20

United Kingdom 42,695 34,648 2,498 360 1609.17 9524.44

Vietnam 255,370 222,221 179,452 134,981 42.31 64.63

World Total 1,881,682 1,531,677 1,686,300 1,795,241 11.59 -14.68

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Cameroon 3,059 21,528

China 8,399,904 45,504,903 7,680,412 37,672,545 9.37 20.79

Germany 12,698 150,000

Hong Kong 2,880 24,000 -100.00 -100.00

Italy 4,871 710 -100.00 -100.00

Korea, South 12,941 58,828 9,715 44,160 33.21 33.22

Malaysia 240,666 389,656 333,157 703,280 -27.76 -44.59

Mexico 1,518,900 12,001,056 790,377 5,999,712 92.17 100.03

Taiwan 18,750 52,096 -100.00 -100.00

United Kingdom 44,338 218,414 5,508 1,224 704.97 17744.28

Vietnam 2,106 14,040 -100.00 -100.00

World Total 10,232,506 58,344,385 8,847,776 44,511,767 15.65 31.08

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

China 5,211,058 65,832,909 4,823,301 40,336,713 8.04 63.21

France 2,728 12,500 18,167 370,225 -84.98 -96.62

Germany 911,704 5,531,393 337,643 2,154,118 170.02 156.78

Hong Kong 8,226 66,320 6,510 21,000 26.36 215.81

India 23,598 124,200 4,435 201,600 432.09 -38.39

Ireland 36,673 164,889 -100.00 -100.00

Italy 50,485 1,760,406 124,189 2,143,197 -59.35 -17.86

Japan 56,784 153,960 12,062 31,680 370.77 385.98

Korea, South 64,756 395,670 80,139 2,163,785 -19.20 -81.71

Malaysia 19,132 61,726 5,651 1,600,000 238.56 -96.14

Mexico 21,292 262,614

Netherlands 61,767 197,000 -100.00 -100.00

Pakistan 52,149 313,128

Poland 18,013 47,626 -100.00 -100.00

Spain 3,336 2,520 -100.00 -100.00

Taiwan 7,864 164,988 25,161 1,679,020 -68.75 -90.17

Thailand 6,540 200,000 -100.00 -100.00

UAE 4,000 32,000

Vietnam 4,064 10,512

World Total 6,437,840 74,722,326 5,563,587 51,313,373 15.71 45.62

Country Value Qty Value Qty Value Qty

Australia 17,888 4,580 5,884 690 204.01 563.77

Austria 17,336 1,623 33,965 3,293 -48.96 -50.71

Brazil 6,120 1,224 8,138 11,500 -24.80 -89.36

Canada 258,140 90,104 171,716 57,572 50.33 56.51

China 24,463,073 24,103,201 26,774,860 25,601,146 -8.63 -5.85

Colombia 26,405 8,100 16,905 5,370 56.20 50.84

Denmark 2,178 92 22,914 2,315 -90.49 -96.03

Estonia 5,882 503 -100.00 -100.00

France 84,872 8,174 58,818 11,063 44.30 -26.11

Germany 2,311,975 1,056,887 1,412,279 233,342 63.71 352.93

Guinea 3,078 133

Hong Kong 62,480 10,930 30,686 11,856 103.61 -7.81

Hungary 25,546 20,000 -100.00 -100.00

India 7,770 1,416

Ireland 90,391 8,653 -100.00 -100.00

Israel 47,135 10,900 -100.00 -100.00

Italy 262,364 38,280 138,065 16,753 90.03 128.50

Japan 176,309 24,456 289,205 38,608 -39.04 -36.66

Korea, South 549,947 367,835 385,106 429,775 42.80 -14.41

Malaysia 47,072 8,167 22,991 4,124 104.74 98.04

Mexico 62,927 39,371 31,863 3,736 97.49 953.83

Netherlands 105,242 9,192 25,156 7,184 318.36 27.95

Norway 2,113 1,656 -100.00 -100.00

Philippines 23,300 2,532

Portugal 2,071 144

Romania 4,410 615 -100.00 -100.00

Russia 41,844 51,702 6,113 2,050 584.51 2422.05

Singapore 3,500 1,000

Slovenia 3,748 155 -100.00 -100.00

Spain 11,047 3,712 37,183 7,896 -70.29 -52.99

Sri Lanka 140,937 26,446 85,482 10,905 64.87 142.51

Sweden 23,988 2,194 101,372 13,873 -76.34 -84.19

Switzerland 32,943 10,524 60,600 22,386 -45.64 -52.99

Taiwan 289,755 145,776 244,195 124,700 18.66 16.90

Turkey 16,754 4,984 6,314 2,002 165.35 148.95

UAE 90,272 8,777 4,442 1,810 1932.24 384.92

United Kingdom 828,036 119,607 790,641 139,727 4.73 -14.40

Vietnam 31,502 57,332 87,411 51,497 -63.96 11.33

World Total 30,001,125 26,208,495 31,031,529 26,857,655 -3.32 -2.42

9603302000 Artists Brushes,writing Brush,cosmet Br,lt=.05 Ea (no)

September 2022 YTD September 2021 YTD YTD Growth% Country Value Qty Value Qty Value Qty

China 2,137,255 87,062,916 2,948,387 112,362,075 -27.51 -22.52

France 61,122 1,849,962 237,030 5,589,000 -74.21 -66.90

Germany 222,685 8,485,056 55,541 2,852,400 300.94 197.47

India 84,793 5,018,094 119,614 6,239,710 -29.11 -19.58

Italy 1,328,515 88,879,400 1,283,448 83,695,250 3.51 6.19

Japan 50,700 2,150,000 2,250 100,000 2153.33 2050.00

Korea, South 147,733 5,635,000 8,302 265,462 1679.49 2022.71

Mexico 347,033 11,114,732

Taiwan 47,905 1,964,400 68,861 2,688,952 -30.43 -26.95

Thailand 67,931 2,612,731

United Kingdom 3,174 122,077 11,822 454,692 -73.15 -73.15

World Total 4,498,846 214,894,368 4,735,255 214,247,541 -4.99 0.30

9603306000 Artists Brushes,writing Br,cosmetic Br,gt.10 Ea (no)

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Australia 35,087 6,521 6,565 431 434.46 1412.99

Austria 15,474 3,126

Bangladesh 435,976 3,332,771 542,021 3,884,517 -19.56 -14.20

Belgium 19,191 5,040 44,660 110,000 -57.03 -95.42

Burma 8,786 73,764 -100.00 -100.00

Cambodia 27,331 14,152

Canada 49,989 3,898 90,667 4,657 -44.87 -16.30

China 204,488,461 341,738,934 199,401,926 360,818,815 2.55 -5.29

Cyprus 9,774 186 2,551 69 283.14 169.57

Denmark 398,031 32,526 112,915 17,661 252.50 84.17

Dom. Republic 931,405 1,150,195 918,633 1,059,990 1.39 8.51

France 1,170,335 1,316,028 1,472,387 711,915 -20.51 84.86

Germany 3,093,634 1,929,767 4,443,966 5,452,580 -30.39 -64.61

Hong Kong 213,244 179,621 1,325,546 848,508 -83.91 -78.83

India 3,734,951 6,127,449 4,293,863 5,857,735 -13.02 4.60

Indonesia 25,696 69,600 25,582 179,808 0.45 -61.29

Ireland 37,358 36,706 -100.00 -100.00

Israel 19,066 6,498 55,591 31,678 -65.70 -79.49

Italy 1,153,985 388,863 1,100,614 329,025 4.85 18.19

Japan 4,540,298 947,320 4,759,152 1,404,729 -4.60 -32.56

Korea, South 733,265 1,195,546 2,270,346 2,613,253 -67.70 -54.25

Lithuania 27,695 59,737 84,934 266,894 -67.39 -77.62

Malaysia 81,026 73,273 10,781 55,200 651.56 32.74

Mauritius 1,318,754 189,871 923,679 179,214 42.77 5.95

Mexico 23,495,781 133,955,663 17,499,175 109,524,806 34.27 22.31

Montenegro 4,289 1,945 -100.00 -100.00

Netherlands 14,571 1,870 366,274 26,079 -96.02 -92.83

Pakistan 13,500 6,000 3,800 2,000 255.26 200.00

Poland 38,361 4,664 19,025 7,374 101.63 -36.75

Russia 6,906 4,773 57,914 12,642 -88.08 -62.24

Singapore 5,548 752

Spain 317,840 38,811 670,698 389,507 -52.61 -90.04

Sri Lanka 1,288,180 1,560,675 1,434,695 1,087,173 -10.21 43.55

Sweden 2,489 636 12,000 375 -79.26 69.60

Switzerland 2,376 216

Taiwan 1,592,412 2,662,325 516,620 1,464,897 208.24 81.74

Thailand 1,628,387 3,214,367 1,431,922 3,836,297 13.72 -16.21

Turkey 9,025 8,500 -100.00 -100.00

United Kingdom 1,913,815 807,142 1,518,932 481,840 26.00 67.51

Vietnam 630,713 1,404,218 1,023,230 3,321,337 -38.36 -57.72

World Total 253,473,547 502,433,034 246,500,122 504,101,921 2.83 -0.33

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Australia 8,130 1,366

Belgium 45,593 163,702 4,181 38 990.48 430694.74

Brazil 40,257 30,552 113,987 126,276 -64.68 -75.81

Cambodia 3,155,427 6,756,728 3,825,352 7,931,882 -17.51 -14.82

Canada 409,970 230,774 619,972 318,124 -33.87 -27.46

China 19,124,687 47,147,859 20,941,133 48,777,417 -8.67 -3.34

Czech Republic 209,582 1,309,600 418,441 2,637,532 -49.91 -50.35

Germany 227,252 135,138 247,395 48,269 -8.14 179.97

Guatemala 28,833 26,904 -100.00 -100.00

India 27,251 10,344

Indonesia 1,043,300 6,050,712 627,620 3,913,212 66.23 54.62

Italy 193,049 114,194

Japan 249,081 296,479 8,258 4,106 2916.24 7120.63

Korea, South 2,170 40

Country Value Qty Value Qty Value Qty

Bangladesh 466,556 7,025,788 628,766 9,866,800 -25.80 -28.79

China 9,721,903 133,607,160 12,687,640 185,297,479 -23.38 -27.90

France 78,138 1,230,000 77,363 1,141,556 1.00 7.75

Germany 1,438,329 27,264,662 1,340,839 25,626,800 7.27 6.39

Italy 29,275 372,000 -100.00 -100.00

Korea, South 8,925 131,900 45,903 902,300 -80.56 -85.38

Mexico 195,523 2,301,518 948,696 13,558,145 -79.39 -83.02

Taiwan 16,467 191,600 49,972 728,610 -67.05 -73.70

Thailand 4,003 68,727 -100.00 -100.00

Vietnam 28,325 459,162

World Total 11,954,166 172,211,790 15,812,457 237,562,417 -24.40 -27.51

Mexico 1,748,313 2,866,759 1,665,540 3,205,210 4.97 -10.56

Netherlands 7,376 133 2,527 100 191.89 33.00

Poland 8,965 10,120

Sweden 20,189 10,220 24,262 13,120 -16.79 -22.10

Taiwan 33,372 58,282 21,221 26,224 57.26 122.25

Thailand 127,485 34,119 -100.00 -100.00

Turkey 33,715 65,200 18,962 34,850 77.80 87.09

United Kingdom 261,907 412,009 490,288 1,044,309 -46.58 -60.55

Vietnam 23,356 6,457 21,351 13,708 9.39 -52.90

World Total 26,872,942 65,676,668 29,206,808 68,155,400 -7.99 -3.64

Country

China 5,123,882 12,584,109 4,752,696 17,592,606 7.81 -28.47

Mexico 2,200 1,210 4,840 2,640 -54.55 -54.17

Pakistan 22,573 249,800 13,757 151,800 64.08 64.56

Taiwan 122,735 156,480 422,272 891,808 -70.93 -82.45

United Kingdom 237,625 152,200 903,450 1,070,275 -73.70 -85.78

World Total 5,509,015 13,143,799 6,097,015 19,709,129 -9.64 -33.31

9603404040

Natural Bristle Brushes, Exc Subhdg 9603.30 (no)

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Canada 2,242 2,592 82,399 7,608 -97.28 -65.93

China 9,408,121 48,657,678 11,474,859 54,317,644 -18.01 -10.42

Denmark 2,743 1 -100.00 -100.00

France 6,791 621 2,886 500 135.31 24.20

Germany 69,633 4,859 37,139 2,283 87.49 112.83

India 3,400 4,000 54,946 52,502 -93.81 -92.38

Indonesia 4,774,940 25,709,824 3,672,676 22,699,904 30.01 13.26

Italy 144,165 22,771 -100.00 -100.00

Mauritius 91,784 18,418 -100.00 -100.00

Netherlands 74,903 5,838 24,307 2,896 208.15 101.59

Poland 2,656 114

Sri Lanka 18,132 3,061 4,200 700 331.71 337.29

Taiwan 13,150 23,616 26,072 108,360 -49.56 -78.21

Turkey 1,070,532 287,260 1,357,969 349,568 -21.17 -17.82

United Kingdom 9,778 2,831 40,875 6,088 -76.08 -53.50

Vietnam 2,140 320 -100.00 -100.00

World Total 15,454,278 74,702,294 17,019,160 77,589,563 -9.19 -3.72

Paint,distemper/siml Brushes Exc Subhdg 960330,nes (no)

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Australia 2,709 392

Austria 4,604 1 -100.00 -100.00

Bangladesh 39,160 197,376 474,886 2,209,020 -91.75 -91.06

Belgium 7,268 2,138

Brazil 90,175 121,056 332,146 248,508 -72.85 -51.29

Bulgaria 3,605 550 -100.00 -100.00

Canada 135,234 90,000 143,563 51,260 -5.80 75.58

China 60,410,479 199,803,609 68,889,009 233,744,353 -12.31 -14.52

Czech Republic 2,327 4,000 -100.00 -100.00

Dom. Republic 14,240 145,200 -100.00 -100.00

France 4,294 595

Germany 327,670 497,244 366,275 147,219 -10.54 237.76

Guatemala 49,557 40,280 48,302 55,103 2.60 -26.90

Hungary 2,760 800 6,413 1,495 -56.96 -46.49

India 4,296 586 48,131 91,947 -91.07 -99.36

Indonesia 2,560,991 12,102,660 2,385,395 12,310,778 7.36 -1.69

Ireland 6,205 8,808

Israel 9,017 248

Italy 326,658 754,480 536,929 325,684 -39.16 131.66

Japan 92,361 98,227 140,514 196,011 -34.27 -49.89

Korea, South 6,950 160 4,215 2,625 64.89 -93.90

Mexico 101,422 139,899 30,498 56,939 232.55 145.70

Netherlands 58,586 6,707 44,139 4,469 32.73 50.08

Philippines 22,658 81,354 -100.00 -100.00

Poland 41,275 61,764 6,005 220 587.34 27974.55

Romania 2,892 600 2,303 404 25.58 48.51

Singapore 7,800 16,020 -100.00 -100.00

Spain 2,917 666 9,427 1,748 -69.06 -61.90

Sri Lanka 340,533 135,464 193,266 76,968 76.20 76.00

Sweden 116,959 119,299 122,201 82,420 -4.29 44.75

Switzerland 5,629 167 -100.00 -100.00

Taiwan 113,555 458,878 274,911 745,044 -58.69 -38.41

Turkey 228,386 80,340 521,128 809,617 -56.17 -90.08

United Kingdom 104,501 92,228 223,564 395,257 -53.26 -76.67

Vietnam 730,638 1,093,744 616,789 732,283 18.46 49.36

World Total 65,917,448 215,908,248 75,480,872 252,536,664 -12.67 -14.50

Country

Armenia 25,715 395

Australia 504,424 4,432 631,381 3,040 -20.11 45.79

Austria 308,182 422,904 344,863 37,739 -10.64 1020.60

Belgium 100,452 7,763 167,378 4,289 -39.98 81.00

Brazil 18,774 241 25,959 179 -27.68 34.64

Bulgaria 86,699 3,293 2,344 200 3598.76 1546.50

Cambodia 59,588 9,478 -100.00 -100.00

Canada 9,974,283 266,632 7,799,419 613,942 27.88 -56.57

Chile 2,083 90 3,600 80 -42.14 12.50

China 28,195,885 50,421,447 29,393,877 64,274,272 -4.08 -21.55

Czech Republic 282,968 3,407 234,919 862 20.45 295.24

Denmark 202,131 31,537 153,856 26,664 31.38 18.28

Estonia 207,155 23,601 147,470 19,510 40.47 20.97

Finland 227,338 14,826 89,430 5,631 154.21 163.29

France 403,960 13,215 318,416 223,006 26.87 -94.07

Germany 16,376,214 1,974,359 14,708,298 1,426,422 11.34 38.41

Greece 25,220 123 -100.00 -100.00

Hong Kong 26,491 89,200 34,124 10,217 -22.37 773.05

Hungary 27,035 191 51,903 282 -47.91 -32.27

India 37,267 13,380 67,418 119,073 -44.72 -88.76

Indonesia 350,277 92,868 376,202 57,581 -6.89 61.28

Ireland 22,535 4,240 65,036 2,450 -65.35 73.06

Italy 10,276,386 806,078 8,002,267 666,427 28.42 20.96

Japan 6,567,151 149,961 8,413,693 220,461 -21.95 -31.98

Korea, South 1,191,864 267,380 664,449 153,163 79.38 74.57

Lithuania 408,542 3,950

Luxembourg 45,667 26 17,350 8 163.21 225.00

Malaysia 590,384 65,382 1,268,089 310,733 -53.44 -78.96

Mexico 3,590,471 2,289,422 3,584,227 2,382,983 0.17 -3.93

Netherlands 1,407,241 24,276 1,471,398 36,356 -4.36 -33.23

New Zealand 40,200 2,166 -100.00 -100.00

Norway 18,371 1,669 14,380 1,494 27.75 11.71

Poland 231,191 12,651 99,308 25,266 132.80 -49.93

Portugal 333,241 755,485 299,247 4,131 11.36 18188.19

Romania 14,819 1,550 29,016 3,691 -48.93 -58.01

Russia 10,167 3

San Marino 174,358 4,949

Sao Tome & Principe 3,779 560

Serbia

4,774 244 -100.00 -100.00

Singapore 3,260 8 -100.00 -100.00

Slovakia 4,965 900 4,896 4 1.41 22400.00

Slovenia 63,982 10,759 13,330 55 379.98 19461.82

Spain 3,613,619 822,673 3,726,314 997,949 -3.02 -17.56

Sri Lanka 18,107 5,488 16,193 7,668 11.82 -28.43

St Kitts/Nevis 252,207 5,692,764 232,494 4,982,839 8.48 14.25

Sweden 1,160,332 97,755 861,069 85,947 34.75 13.74

Switzerland 1,132,506 80,014 870,991 24,034 30.02 232.92

Taiwan 1,624,295 705,571 1,687,639 1,289,724 -3.75 -45.29

Thailand 89,651 4,155 197,527 222,923 -54.61 -98.14

Turkey 17,500 4,375 41,453 1,113 -57.78 293.08

United Kingdom 1,499,299 196,832 1,411,712 215,246 6.20 -8.55

Vietnam 1,561,442 987,302 2,160,502 1,463,662 -27.73 -32.55

World Total 93,281,405 66,379,951 89,836,479 79,933,335 3.83 -16.96

September 2022 YTD September 2021 YTD YTD Growth%

Country Value Qty Value Qty Value Qty

Canada 920,773 235,745 708,968 191,260 29.88 23.26

China 5,463,024 2,903,759 7,903,997 2,369,180 -30.88 22.56

Germany 75,136 19,722 2,885 4 2504.37 492950.00

Indonesia 67,016 23,920 97,631 27,351 -31.36 -12.54

Israel 87,570 43,522 -100.00 -100.00

Korea, South 2,167 109

Lebanon 98,053 18,371 17,745 3,494 452.57 425.79

Mexico 2,652 82 2,110 1,548 25.69 -94.70